Health and Wellness Foods Market by Product (Functional Foods, Fortified & Healthy Bakery Products, Healthy Snacks & Beverages, Organic Foods, BFY Foods, Other Products), By Ingredient (Animal-Based Ingredients, Plant-Based Ingredients), By Calorie Content (No-Calorie and Others), By Nature (Non-GMO, GMO), By Distribution Channels (Supermarket & Hypermarket, Convenience Stores, Specialty Stores, Online Retailers) — Global Analysis & Forecast, 2025–2030

Industry Outlook

The global Health and Wellness Foods Market size was valued at USD 1055.5 billion in 2024, and is expected to be valued at USD 1147.85 billion by the end of 2025. The industry is projected to grow, hitting USD 1746.17 billion by 2030, with a CAGR of 8.64% between 2025 and 2030.

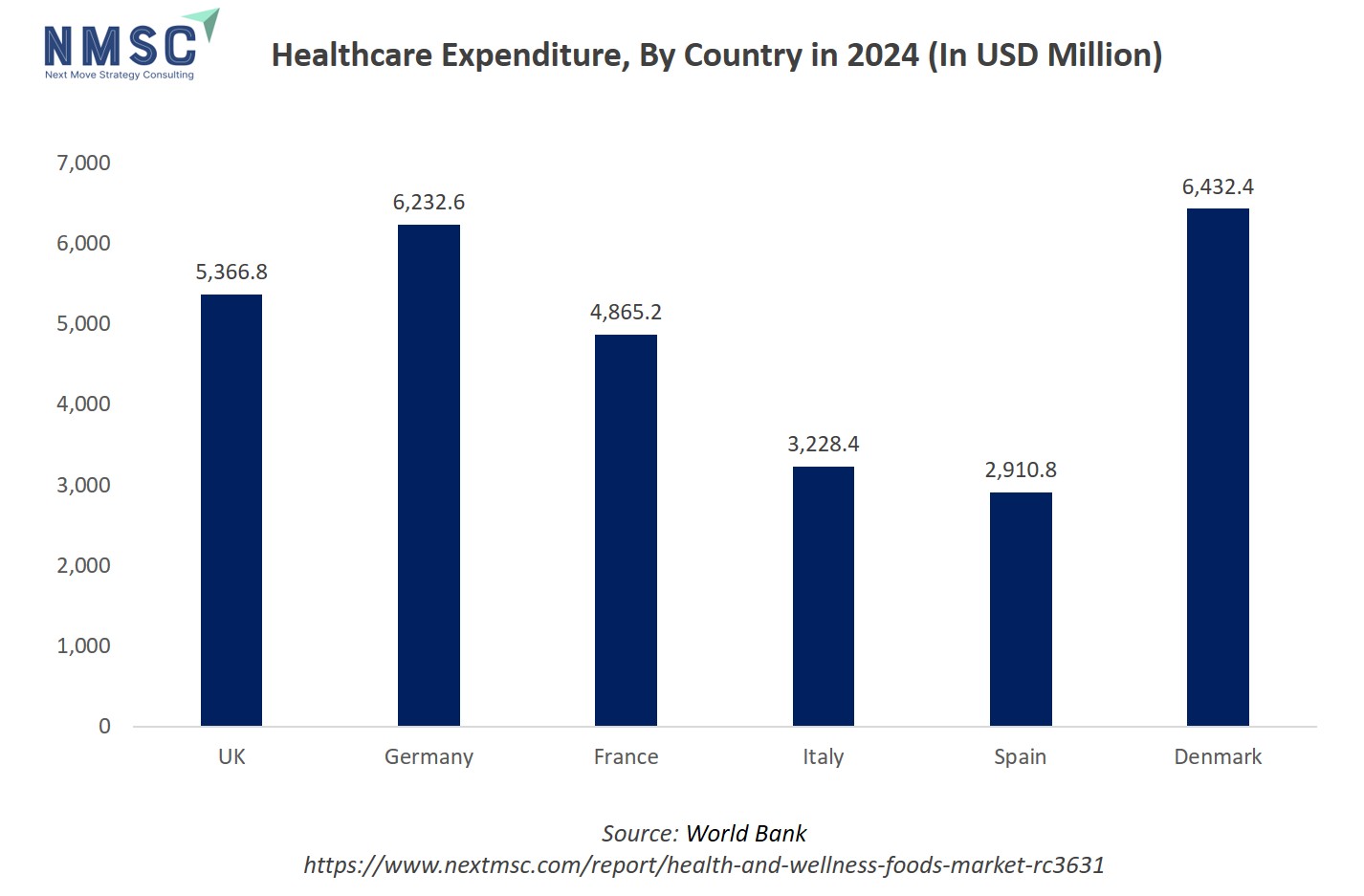

Rising healthcare expenditure is a major driver of the health and wellness foods market growth, as increased investment in health, such as the 8.2% growth in US health spending in 2024—boosts consumer focus on preventive nutrition and wellness. This trend fuels demand for functional foods and beverages enriched with vitamins, probiotics, omega-3s, and plant-based proteins, supporting gut health, heart wellness, and overall wellbeing. Consumers in health-conscious markets like Denmark, Germany, and the UK increasingly prioritize nutritional value, ingredient transparency, and quality, encouraging growth in premium and fortified product segments.

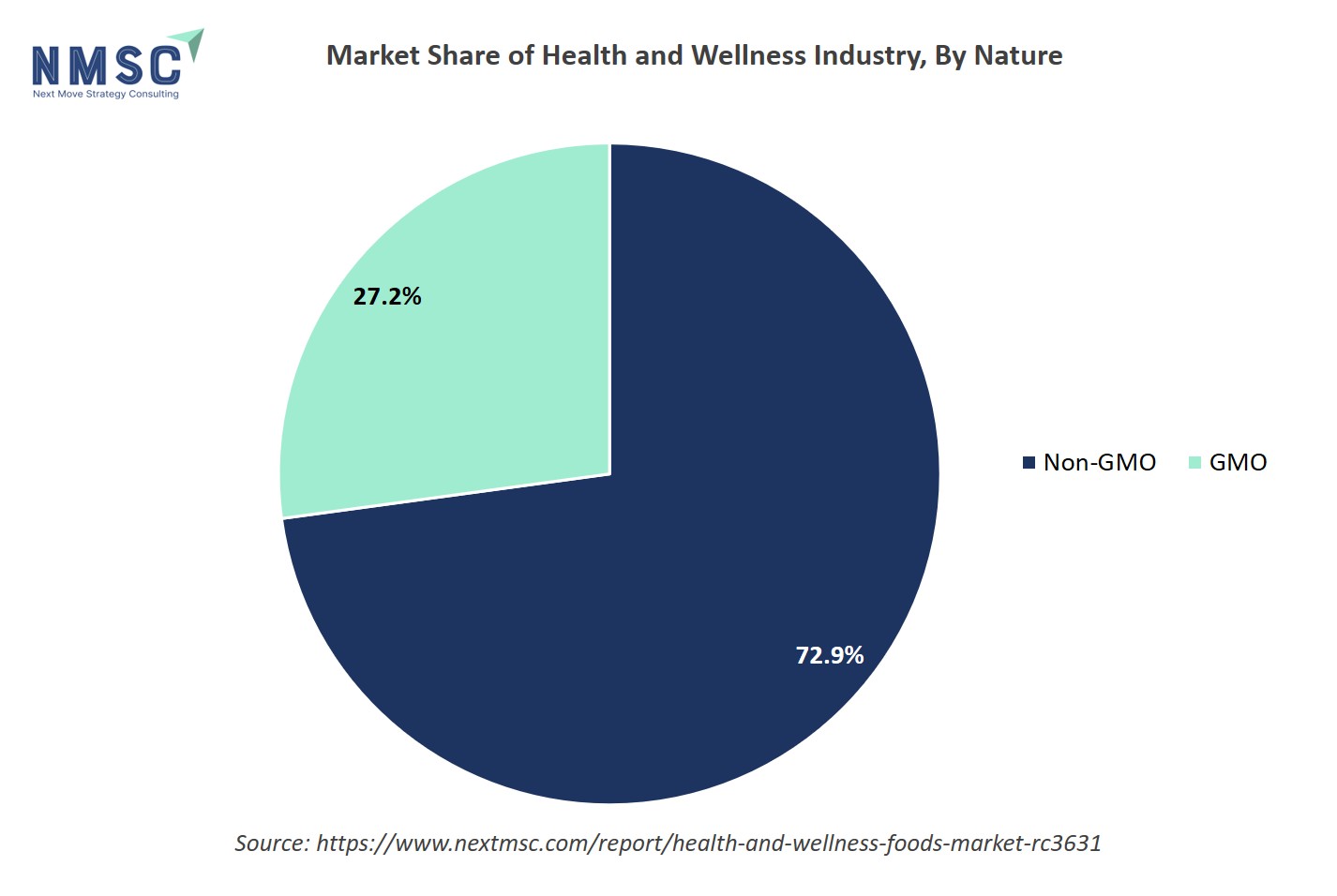

Plant-based ingredients are becoming central to food innovation, with brands introducing vegan and flexitarian options such as pea protein, oat milk, and dairy alternatives to meet ethical, environmental, and health-conscious consumer demand. Similarly, the rise of clean-label products and transparency emphasizing non-GMO, organic, and chemical-free attributes is shaping purchase decisions, compelling manufacturers to focus on simple, recognizable, and natural ingredients. Together, these trends highlight how health awareness, sustainability, and product transparency are reshaping consumer behavior and driving market expansion in the Health and Wellness Foods sector

What are the key trends in health and wellness foods industry?

How Is Rising Health Expenditure Driving Demand for Functional Foods?

The strong growth in national health expenditures particularly in US, which increased by 8.2% in 2024, nearly 3 percentage points faster than GDP growth (5.3%) and exceeding USD 5 trillion reflects a rising focus on health and wellness. This trend is driving demand for functional foods and beverages enriched with vitamins, probiotics, omega-3 fatty acids, and plant-based proteins, which support gut health, heart wellness, and overall well-being. Companies are investing in nutrient-dense and fortified formulations, catering to consumers who increasingly prioritize preventive health and proactive nutrition.

Healthcare expenditure significantly influences the health and wellness foods market trends, as higher investments in healthcare coincide with increased consumer awareness about nutrition, preventive health, and overall wellbeing. In countries with elevated healthcare spending, consumers tend to make more health-conscious dietary choices, favoring products that support long-term wellness, such as functional foods, organic products, and fortified snacks. The chart above highlights nations like Denmark, Germany, and the UK, where substantial health-related resources indicate a strong emphasis on preventive care and healthy living. In these markets, consumers are more attentive to nutritional value, ingredient transparency, and product quality, driving growth in premium and health-focused food segments.

Are Plant-Based Ingredients Becoming the New Normal in Food Innovation?

Yes, plant-based ingredients are reshaping the health and wellness food landscape. Consumers are turning to plant-derived proteins, dairy alternatives, and natural sweeteners due to ethical, environmental, and health concerns. The rising popularity of vegan and flexitarian lifestyles is pushing brands to innovate with ingredients like pea protein, oat milk, and coconut oil, replacing traditional animal-based sources. This shift aligns with sustainability goals and clean-label product expectations.

For example, in 2024, Kraft Heinz, in collaboration with NotCo, launched a plant-based version of their iconic boxed macaroni and cheese. This move highlights how companies are responding to growing consumer demand for plant-based and healthier alternatives, a key driver in the sector. By expanding their plant-based product offerings, including dairy and meat alternatives, Kraft Heinz demonstrates that consumer preference for ethical, sustainable, and health-focused ingredients is directly shaping food innovation and market growth.

How is the Rise of Clean Label and Transparency Influencing Consumer Choices?

Transparency has become a deciding factor for purchase decisions. Today’s consumers scrutinize ingredient lists, sourcing origins, and nutritional claims before buying. Brands emphasizing non-GMO, organic, and chemical-free attributes enjoy stronger trust and loyalty. The clean-label movement is also compelling manufacturers to minimize artificial additives and focus on simple, recognizable ingredients, aligning with global trends toward natural and authentic food product.

What are the key market drivers, breakthroughs, and investment opportunities that will shape the Health and Wellness Foods industry in next decade?

The health and wellness foods market is being driven by the rapid growth of e-commerce and direct-to-consumer channels, which enhance accessibility, offer personalized recommendations, and allow brands to quickly introduce innovative products. Rising awareness of lifestyle-related health issues, such as obesity, diabetes, and cardiovascular diseases, is further boosting demand for low-calorie, nutrient-enriched, and functional foods. At the same time, regulatory complexity around health claims, labeling, and ingredient safety poses challenges, particularly for smaller players and cross-border expansion. Meanwhile, the rise of personalized nutrition leveraging AI, digital health tracking, and genetic insights—is creating new opportunities for tailored dietary solutions, premium product offerings, and subscription-based business models, supporting continued market growth globally.

Growth Drivers:

How Is the Growth of Online Retail and Direct-to-Consumer Channels Driving the Health and Wellness Foods Market Demand?

The rapid expansion of e-commerce, online grocery platforms, and subscription-based delivery models is significantly enhancing the accessibility of health and wellness foods. These digital channels enable companies to directly reach health-conscious consumers, provide personalized product recommendations, and introduce innovative offerings quickly. As a result, brands expand their market presence globally, increase consumer engagement, and capture a larger share of the growing demand for functional, fortified, and plant-based food products.

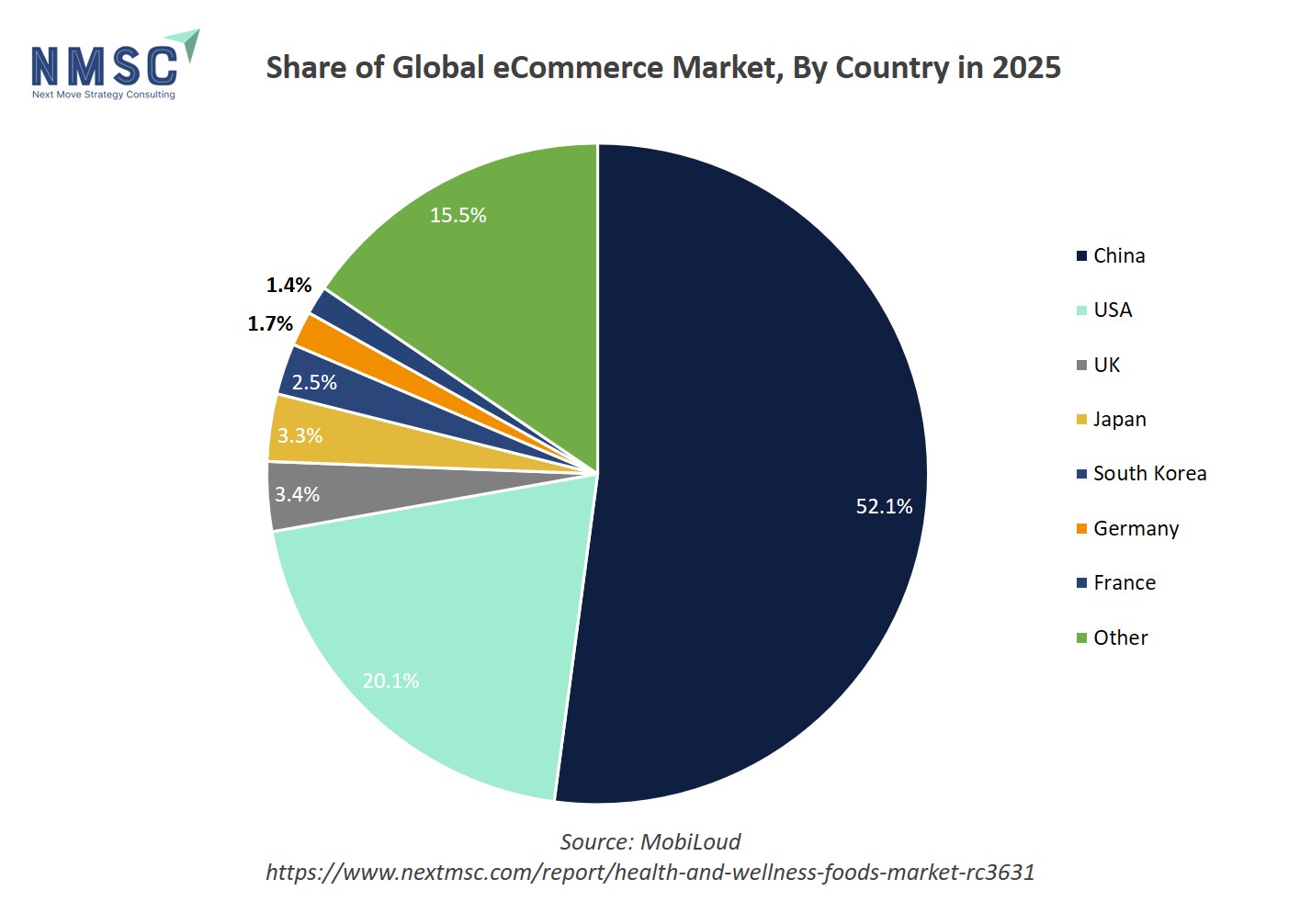

The rise of e-commerce is transforming the market, providing consumers with easier access to a wide range of health-focused products. Online platforms enable shoppers to compare nutritional information, read reviews, and explore specialty or niche wellness foods that are not be available in physical stores. As shown in the chart above, the growing share of online retail highlights how convenience, wider product selection, and personalized recommendations are driving the adoption of functional foods, organic products, and other wellness-oriented offerings in digitally savvy markets

How Is Rising Awareness of Lifestyle-Related Health Issues Driving the Health and Wellness Foods Market?

The global rise in obesity, diabetes, and cardiovascular diseases is prompting consumers to prioritize healthier diets and functional foods. In response, manufacturers are increasingly developing low-calorie, sugar-reduced, and nutrient-enriched products designed to address lifestyle-related health risks. This shift in consumer behavior is expanding demand for health-focused food offerings, creating new opportunities for product innovation and market growth in the health and wellness foods sector.

Growth Inhibitors:

How Are Regulatory Complexity and Compliance Challenges Limiting the Health and Wellness Foods Market Expansion?

The health and wellness foods market is subject to stringent regulations related to health claims, labeling standards, ingredient safety, and fortification levels across various regions. For example, claims such as “immune-boosting” or “heart-healthy” require scientific validation and approval from regulatory authorities like the FDA in the U.S., EFSA in Europe, and FSSAI in India. Navigating these complex regulations increases research and testing costs, extends the time-to-market, and delay product launches. Smaller players and startups face higher barriers due to limited resources, making it challenging to compete with larger brands. Additionally, differences in regulatory frameworks across countries restrict cross-border trade, complicating global expansion strategies. These factors collectively constrain growth and innovation, particularly in emerging markets where compliance infrastructure is still developing.

How Is the Rise of Personalized Nutrition Creating Growth Opportunities in the Health and Wellness Foods Market?

The growing focus on personalized nutrition represents a transformative opportunity for the health and wellness foods industry. By integrating AI, digital health tracking, genetic testing, and microbiome analysis, companies develop customized dietary solutions tailored to individual health needs, preferences, and lifestyle goals. This trend enables brands to create targeted functional foods, beverages, and supplements, enhancing efficacy and consumer satisfaction. With consumers increasingly seeking preventive healthcare and wellness optimization, personalized nutrition is expected to drive premium product demand, higher engagement, and recurring sales. Moreover, partnerships between food manufacturers, health tech companies, and wellness platforms are creating new business models, subscription services, and D2C offerings, expanding market penetration in both developed and emerging economies over the next decade.

How is the Health and Wellness Foods Market is segmented in this report, and what are the key insights from segmentation analysis?

By Product Type Insights

How is the Health and Wellness Foods Market Shaped by Product Type?

Based on product type, the market is segmented into Functional Foods, Fortified & Healthy Bakery Products, Healthy Snacks & Beverages, Organic Foods, BFY Foods, and Other Products.

The Functional Foods segment caters to consumers seeking products enriched with vitamins, minerals, probiotics, and omega-3s to support immunity, digestive health, and overall wellness. Fortified and healthy bakery products provide nutrient-enriched breads, cookies, and baked snacks that combine indulgence with health benefits. The Healthy Snacks & Beverages segment focuses on low-calorie, low-sugar, and natural ingredient options, appealing to on-the-go health-conscious consumers. organic foods attract consumers preferring non-GMO, chemical-free, and sustainably sourced products. The BFY (Better-for-You) Foods segment emphasizes reduced sugar, fat, and calorie content without compromising taste, while Other Products include functional supplements, meal replacements, and niche wellness offerings.

By Nature Insights

Which Type Dominates the Health and Wellness Foods Market?

Based on product nature, the market is segmented into Non-GMO and GMO foods.

The Non-GMO segment holds a significant share of the health and wellness foods market, driven by rising consumer preference for natural, clean-label, and health-focused products. Non-GMO foods are perceived as safer and healthier, aligning with increasing awareness of dietary quality, sustainability, and preventive health. Consumers are actively seeking products labeled non-GMO across categories such as functional foods, fortified snacks, beverages, and plant-based alternatives. Leading brands, including Nestlé, Danone, and General Mills, are expanding their non-GMO offerings to meet the growing demand for transparency, authenticity, and nutrient-rich formulations.

The GMO segment, while smaller in market share, continues to serve consumers seeking fortified or high-yield food products at competitive prices. GMO foods provide enhanced nutritional content, extended shelf life, and cost-effective production advantages. In some regions, particularly in North America and Asia, GMO-based functional foods and ingredients are incorporated into fortified snacks, beverages, and supplements to meet large-scale consumer demand. Companies are increasingly labeling GMO products clearly to maintain transparency and address consumer concerns, balancing affordability with innovation in the health and wellness segment

By Ingredient Insights

How Is the Market Influenced by Ingredient Type?

Based on ingredient type, the market is segmented into Animal-Based Ingredients and Plant-Based Ingredients.

The Animal-Based Ingredients segment includes dairy proteins, eggs, fish oils, collagen, and whey protein, which are widely used in functional foods, fortified bakery items, and protein supplements. These ingredients are rich sources of essential amino acids, omega-3 fatty acids, and bioactive compounds that support muscle growth, heart health, and immunity. Dairy-derived proteins, such as whey and casein, continue to dominate sports nutrition and recovery products due to their high digestibility and complete amino acid profile. Furthermore, the increasing demand for fortified dairy beverages and yogurts in developed regions such as North America and Europe continues to sustain this segment’s growth. However, the segment faces challenges from rising lactose intolerance, animal welfare concerns, and environmental sustainability issues, which are encouraging a gradual shift toward plant-based alternatives.

On the other hand, the Plant-Based Ingredients segment is experiencing exponential growth, driven by the global adoption of vegan, vegetarian, and flexitarian lifestyles. Ingredients such as pea protein, soy, almond, oat, rice, and coconut are being extensively used in snacks, beverages, dairy alternatives, bakery, and ready-to-eat meals. Pea protein, in particular, has gained traction due to its neutral taste, high protein content, and allergen-free profile, making it suitable for both beverages and meat alternatives. Similarly, the growing demand for oat milk and almond-based products is transforming the dairy alternatives market.

Thus, the shift from animal-based to plant-based ingredients reflects the industry’s evolution toward healthier, more sustainable, and inclusive food systems, positioning plant-derived components as a cornerstone of future innovation in the market.

By Distribution Channel Insights

Which Distribution Channel Dominates the Health and Wellness Foods Market Share?

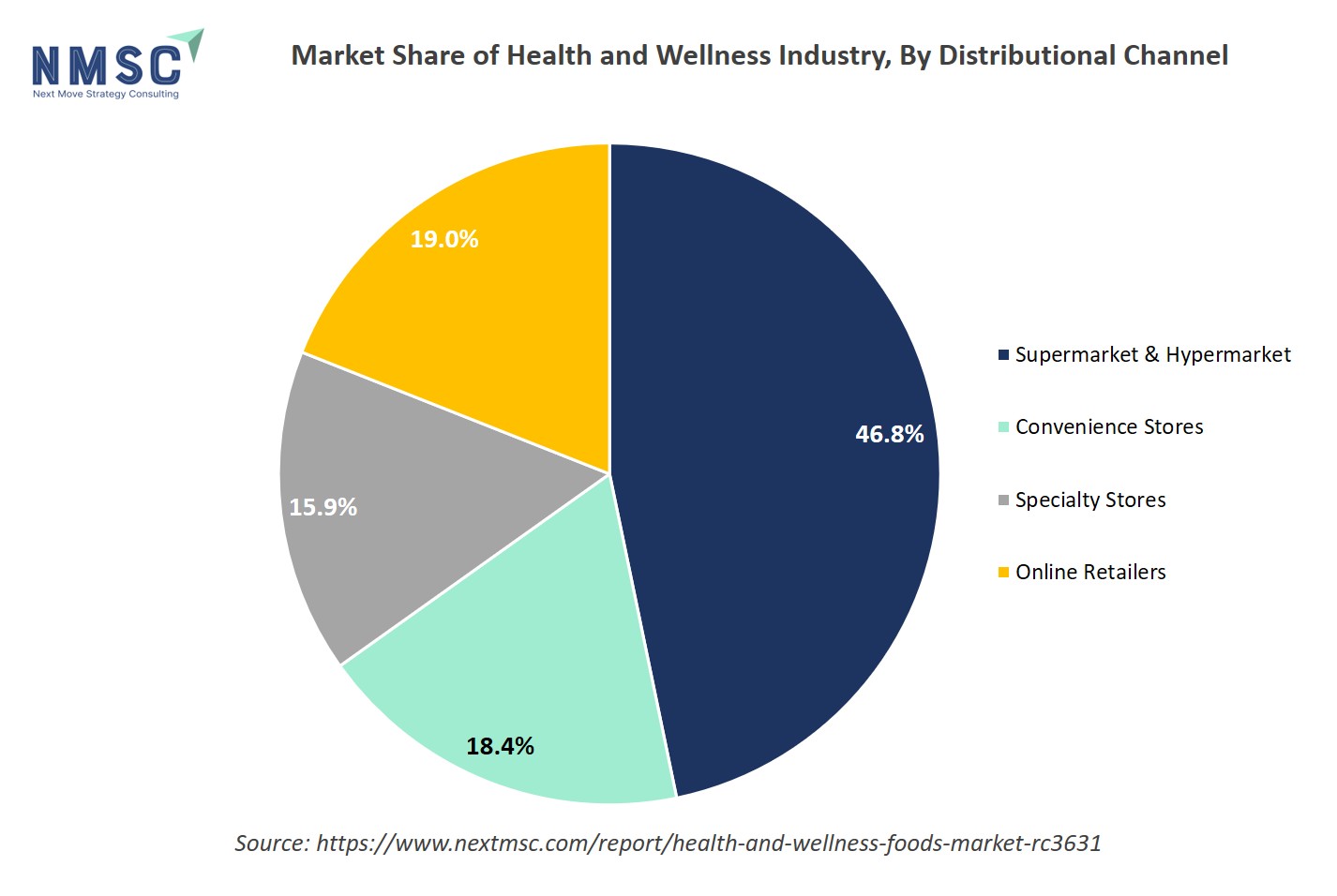

Based on distribution channel, the market is segmented into Supermarkets & Hypermarkets, Convenience Stores, Specialty Stores, and Online Retailers.

The Supermarkets & Hypermarkets segment holds a significant share of the market, owing to the wide product variety, strong brand visibility, and consumer trust associated with organized retail. These outlets offer a comprehensive range of functional foods, dietary supplements, organic snacks, and fortified beverages, allowing consumers to compare labels and explore new product categories under one roof. Major retail chains such as Walmart, Carrefour, Tesco, and Target are expanding their health-focused sections and private-label offerings to cater to the growing demand for clean-label and natural foods. The strategic placement of health and wellness food aisles and promotional bundling with fitness products further enhance product accessibility and consumer engagement.

Convenience Stores are gaining traction due to the rise in on-the-go consumption and impulse buying. With busier lifestyles, consumers are increasingly opting for ready-to-eat protein bars, fortified drinks, and probiotic yogurts available at nearby stores. The segment benefits from urbanization, particularly in Asian markets like Japan and South Korea, where convenience stores serve as key points for daily grocery and health food purchases.

The Specialty Stores segment caters to a niche but rapidly expanding consumer base seeking premium, organic, gluten-free, or allergen-free products. These stores stock exclusive brands focusing on nutrition-specific needs, such as keto-friendly, vegan, or immunity-boosting formulations. Retailers like Whole Foods Market and The Vitamin Shoppe have become global leaders in promoting health-centric brands and educating consumers on functional ingredients through personalized recommendations and in-store experiences.

Meanwhile, the Online Retailers segment is emerging as the fastest-growing channel, fueled by the rise of e-commerce platforms, health-focused apps, and D2C (Direct-to-Consumer) models. The convenience of doorstep delivery, subscription plans, and access to product reviews have made digital platforms a preferred choice for purchasing superfoods, supplements, and organic products. Leading platforms such as Amazon, iHerb, and Thrive Market, along with brand-owned e-stores like Nestlé’s Garden of Life and Herbalife Nutrition, are reshaping consumer buying patterns by offering personalized recommendations and loyalty programs.

Overall, the distribution landscape of the health and wellness foods market is evolving rapidly, with online retail and specialty channels witnessing robust growth, while supermarkets and hypermarkets continue to dominate in terms of total sales volume due to their extensive reach and product diversity.

Regional Outlook

The market is geographically studied across North America, Europe, Asia Pacific, Latin America and the Middle East & Africa and each region is further studied across countries.

Health and Wellness Foods Market in North America

North America dominates the global health and wellness foods market, driven by rising health consciousness, preventive healthcare adoption, and strong innovation in functional and plant-based food segments. In 2024, the U.S. Department of Health & Human Services reported that national health expenditures grew by 8.2%, outpacing GDP growth and highlighting the rising focus on long-term wellness. This trend is propelling demand for functional foods, protein-rich snacks, and clean-label beverages that promote immunity and heart health. Additionally, government initiatives promoting nutrition labeling and sugar reduction are pushing manufacturers to reformulate products with natural ingredients. Major brands like Kraft Heinz, Nestlé, and General Mills are expanding their wellness portfolios, while digital grocery platforms such as Amazon Fresh and Walmart+ are making healthier options more accessible.

Health and Wellness Foods Market in the United States

The U.S. health and wellness foods market is witnessing strong growth driven by the increasing prevalence of chronic conditions such as obesity, diabetes, and cardiovascular diseases, which are profoundly shaping consumer dietary preferences. Heart disease remains the leading cause of death for men, women, and people across most racial and ethnic groups in the United States. Alarming statistics reveal that one person dies every 34 seconds from cardiovascular disease, and in 2023 alone, 919,032 people lost their lives to it — accounting for one in every three deaths nationwide.

This growing health burden is fueling consumer demand for plant-based, low-sugar, and nutrient-dense food products that promote heart health and preventive wellness. Furthermore, the expansion of direct-to-consumer (D2C) platforms is enhancing access to personalized nutrition and subscription-based healthy meal options. With an advanced retail infrastructure, a strong focus on clean-label formulations, and a health-aware population, the U.S. continues to dominate global innovation in wellness-oriented food solutions.

Health and Wellness Foods Market in Canada

In Canada, the market is driven by government-led health campaigns and a growing shift toward organic and functional food products. The Canadian government’s “Healthy Eating Strategy” promotes front-of-pack nutrition labeling and limits on trans fats, encouraging manufacturers to reformulate with cleaner, nutrient-rich ingredients. Consumers, especially millennials, are adopting plant-based proteins, dairy alternatives, and fortified foods as part of a sustainable lifestyle. The rise of specialty retailers like Nature’s Fare Markets and Goodness Me!, along with the availability of local organic brands, has accelerated market penetration. With an emphasis on transparency, quality, and ethical sourcing, Canada’s health and wellness food sector continues to mature rapidly.

Health and Wellness Foods Market in Europe

Europe is one of the most established regions for health and wellness foods, supported by strict nutritional regulations and strong demand for natural, sustainable, and organic products. Between 2019 and 2024, the European Food Safety Authority (EFSA) approved numerous functional ingredients for use in fortified foods, accelerating innovation in probiotics, vitamins, and omega-3-enriched products. Consumers in the region prioritize clean-label and ethically sourced foods, with growing awareness of the link between diet and long-term well-being. Additionally, the European Union’s “Farm to Fork” strategy is pushing brands toward environmentally sustainable food production, aligning with the rising adoption of plant-based and low-carbon diets.

Health and Wellness Foods Market in the United Kingdom

The UK market is expanding due to strong consumer awareness of lifestyle-related diseases and the government’s sugar reduction initiatives. The “HFSS (High Fat, Sugar, Salt)” regulations are prompting manufacturers to develop reformulated, nutrient-dense products that align with public health objectives. UK consumers are increasingly opting for functional beverages, fortified snacks, and probiotic yogurts, while e-commerce and health-food chains like Holland & Barrett are boosting accessibility. With growing vegan and flexitarian populations, the UK remains a leader in plant-based food innovation, creating a dynamic ecosystem for both established brands and startups.

Health and Wellness Foods Market in Germany

Germany is a major hub for organic and functional foods, supported by one of Europe’s most health-conscious populations. German consumers prefer locally sourced, sustainable, and additive-free food products, leading to rapid growth in organic supermarkets such as Alnatura and Denn’s Biomarkt. The market is also benefiting from the country’s robust sports nutrition culture, where high-protein and performance-based foods are gaining traction. Furthermore, Germany’s regulatory emphasis on product traceability and ingredient transparency fosters consumer trust and encourages continuous innovation in the wellness segment.

Health and Wellness Foods Market in France

France’s health and wellness foods market is influenced by the growing interest in natural diets and functional beverages. The French population’s increasing focus on digestive health, immunity, and beauty-from-within trends is boosting demand for probiotic drinks, collagen-enriched foods, and antioxidant-rich snacks. Companies are responding by expanding their portfolios of clean-label and reduced-sugar products, while local startups are innovating in vegan dairy and plant-based desserts. Government initiatives promoting healthy school meals and reduced processed food consumption further reinforce the country’s focus on wellness-driven food habits.

Health and Wellness Foods Market in Spain

Spain is experiencing robust market growth due to the rising adoption of the Mediterranean diet, which naturally aligns with health and wellness principles. Consumers are increasingly choosing foods rich in olive oil, legumes, whole grains, and plant proteins, while demand for functional beverages and fortified snacks is on the rise. The presence of global brands and local producers focusing on natural ingredients has strengthened Spain’s market position. Additionally, the growing tourism and hospitality sectors are expanding opportunities for health-focused food innovations in restaurants and retail chains.

Health and Wellness Foods Market in Asia Pacific

The Asia-Pacific region is witnessing explosive growth, driven by urbanization, rising disposable incomes, and greater awareness of preventive healthcare. Consumers across China, India, Japan, and South Korea are shifting from traditional diets to functional, protein-enriched, and fortified food products that support immunity and energy. Increasing investments by global brands and local startups are accelerating innovation in superfoods, nutraceutical beverages, and fortified convenience foods. Additionally, digitalization and e-commerce are key enablers, with platforms like Tmall, BigBasket, and Rakuten expanding access to wellness-oriented foods across the region.

Health and Wellness Foods Market in China

In 2024, China’s per capita disposable income reached 41,314 yuan, reflecting a nominal rise of 5.3% and a real growth of 5.1% after adjusting for inflation. This increasing purchasing power is fueling the expansion of the country’s health and wellness foods market, as more consumers prioritize nutrition and diet-related health. Rising awareness of lifestyle diseases is driving demand for low-fat, probiotic, and vitamin-fortified products. Both domestic and international players are capitalizing on this trend by expanding offerings in functional dairy, plant-based alternatives, and products inspired by traditional Chinese medicine. The market is further boosted by a strong online retail ecosystem and targeted digital marketing on platforms such as Douyin (TikTok China) and JD.com, making China a central engine for growth in Asia’s wellness food sector.

Health and Wellness Foods Market in Japan

Japan’s market is characterized by an aging population and a deeply ingrained culture of preventive healthcare. Consumers prefer functional foods enriched with collagen, fiber, and probiotics, targeting digestive and joint health. The government’s FOSHU (Foods for Specified Health Uses) certification supports innovation and consumer confidence in the segment. Companies like Yakult, Meiji, and Morinaga continue to lead with probiotic and fortified offerings. Additionally, the trend of convenience-focused, portion-controlled wellness foods fits perfectly with Japan’s fast-paced yet health-conscious lifestyle.

Health and Wellness Foods Market in India

India’s market is growing rapidly, driven by rising disposable incomes, fitness awareness, and lifestyle-related health concerns. Consumers are increasingly opting for millets, fortified cereals, herbal supplements, and plant-based dairy alternatives. The government’s “Eat Right India” initiative promotes balanced diets and cleaner nutrition labeling, supporting the shift toward low-sugar and preservative-free products. Major FMCG brands like ITC, Dabur, and Tata Consumer Products are launching wellness-focused food lines, while online retailers like HealthKart and BigBasket are expanding access to nutritious food products nationwide.

Health and Wellness Foods Market in South Korea

South Korea’s market is being shaped by high digital connectivity and a strong beauty and wellness culture. Consumers prefer functional foods that enhance skin health, metabolism, and immunity, incorporating ginseng, collagen, and green tea extracts. The popularity of K-beauty-inspired edible wellness and the rise of functional beverages have driven product innovation. Additionally, the e-commerce boom, led by platforms such as Coupang and Naver Shopping, is fueling rapid market expansion, especially among young, tech-savvy consumers seeking convenient and health-oriented food options.

Health and Wellness Foods Market in Australia

Australia’s market is driven by rising awareness of clean eating, sustainability, and sports nutrition. Consumers increasingly seek organic, gluten-free, and high-protein products, while the country’s strong fitness culture supports the adoption of nutrient-dense snacks and fortified drinks. Government-backed initiatives encouraging healthy food labeling and reduced sodium intake have also contributed to market growth. Local brands like Freedom Foods and Sanitarium are expanding their health food offerings, and the growing export potential to Asia further strengthens Australia’s position in the global wellness food ecosystem.

Health and Wellness Foods Market in Latin America

Latin America is emerging as a rapidly growing market for health and wellness foods, driven by rising health awareness, increasing disposable incomes, and the adoption of preventive healthcare practices. Countries such as Brazil, Mexico, and Argentina are witnessing strong demand for functional foods, fortified beverages, and plant-based products, as consumers seek solutions to address obesity, diabetes, and cardiovascular health concerns. The expansion of modern retail channels, including supermarkets, specialty stores, and online platforms, is further enhancing product accessibility across urban and semi-urban areas. Additionally, collaborations between local manufacturers and global wellness brands are driving innovation in fortified snacks, organic products, and clean-label offerings. With growing consumer interest in nutrition-focused lifestyles and natural ingredients, Latin America represents a significant growth opportunity for health and wellness foods in the coming decade.

Health and Wellness Foods Market in the Middle East & Africa

The health and wellness foods market in the Middle East and Africa is being shaped by increasing urbanization, a youthful population, and rising awareness of lifestyle-related health issues. Countries such as Saudi Arabia, the UAE, South Africa, and Egypt are experiencing growing demand for functional foods, fortified beverages, organic snacks, and plant-based alternatives. Consumers are particularly focused on products that support weight management, immunity, and overall wellness. The market is also benefiting from modern retail expansion and e-commerce adoption, which provide convenient access to health and wellness products. Furthermore, government initiatives promoting healthier diets and food labeling regulations are encouraging manufacturers to introduce fortified, nutrient-enriched, and low-sugar options. As awareness of preventive healthcare and clean-label products rises, the Middle East & Africa is emerging as a high-potential region for innovation, investment, and market expansion in Health and Wellness Foods.

Competitive Landscape

Who Are the Leading Companies in the Health and Wellness Foods Market and How Are They Competing?

The global health and wellness foods market is increasingly shaped by both established multinational giants and innovative niche players, including Nestlé S.A., PepsiCo Inc., General Mills Inc., Kellogg Company, Kraft Heinz Company, Abbott Laboratories, and Others. These companies compete through product innovation, expanding portfolios with functional foods, plant-based alternatives, vitamin-fortified items, and traditional medicine-inspired nutrition. Health-focused reformulation is a key strategy, exemplified by PepsiCo, which surpassed its 2025 goals ahead of schedule, with 81% of its convenient foods containing no more than 1.1 grams of saturated fat per 100 calories and 67% of its beverages under 100 calories from added sugars per 12 oz serving. Brands are also leveraging digital marketing and e-commerce platforms like Douyin and JD.com to engage consumers, while emphasizing clean labeling, sustainability, and regional customization to capture emerging markets and meet the growing demand for healthier, functional food products.

Innovation and Adaptability Drive Market Success

In the health and wellness foods market, innovation and adaptability remain key drivers of growth, shaping competitive dynamics and allowing companies to stand out in a rapidly evolving landscape. Leading U.S. cereal makers, including Kellogg and General Mills, have committed to eliminating artificial dyes, with General Mills later joining Kraft Heinz, Nestlé, Smucker’s, and other manufacturers in setting target dates for completing this transition. These moves highlight how top players are responding to shifting consumer demand for cleaner, healthier products while using innovation as a strategic advantage. Globally, companies are adopting similar approaches developing reformulated products, investing in functional and plant-based alternatives, and leveraging digital marketing to stay competitive and capture growth in the expanding health and wellness foods sector.

Market Players to Opt for Partnership & Acquisition Strategies to Expand their Presence

Leading companies in the health and wellness foods industry are increasingly pursuing partnerships and acquisitions to strengthen their market position and capitalize on emerging trends. In a notable example, PepsiCo struck a USD 2 billion deal to acquire Poppi, a prebiotic beverage brand founded by entrepreneurs who initially raised funding through the television show Shark Tank. Poppi’s drinks, which combine juice, vinegar, and prebiotics, claim to promote gut health while containing less sugar than conventional soft drinks. The brand’s rapid popularity has been driven in part by viral marketing on TikTok and other social media platforms, highlighting how strategic acquisitions and digital engagement are enabling established players like PepsiCo to expand their presence in the growing functional beverages segment.

List of Key Health and Wellness Foods in Healthcare Companies

-

PepsiCo Inc.

-

General Mills Inc.

-

Kellogg Company

-

Kraft Heinz Company

-

Herbalife Nutrition Ltd.

-

Archer Daniels Midland Company

-

Clif Bar & Company

-

Glanbia PLC

-

Kashi LLC

-

The Quaker Oats Company

-

Mars, Incorporated

-

The Simply Good Foods Company

-

Hindustan Uniliver

What Are The Latest Key Industry Developments?

-

In October 2024, Nestlé S.A. has expanded its Cerelac range in India to include 21 variants, with 14 now free from refined sugar. This move follows previous concerns over added sugars in its baby food products and aims to align with growing consumer demand for healthier options.

-

In April 2024, Hindustan Unilever Ltd (HUL), owner of Horlicks and Boost, repositioned its ‘Health Food Drinks’ portfolio as ‘Functional Nutrition Drinks’. This move reflects a broader market trend in the health and wellness foods sector, where rising regulatory scrutiny and growing consumer demand for transparency are pushing companies to focus on nutrient-rich, low-sugar, and functional formulations to meet evolving wellness-focused dietary preferences.

-

In January 2024, WK Kellogg Co launched a new cereal brand, Eat Your Mouth Off, targeting millennials and Gen Z with Fruity and Chocolate flavors, each offering 22 grams of protein and zero grams of sugar per bowl. The launch reflects a growing trend in the health and wellness foods market, where companies are diversifying portfolios to meet rising consumer demand for high-protein, low-sugar, and functional breakfast options aligned with healthier lifestyles.

-

In January 2024, Kellogg Co, the maker of Pringles, Special K, Frosties, and Corn Flakes, launched a new line of organic crackers enriched with Vitamin D, a first for the company. Each serving provides 10% of the daily value of Vitamin D from mushroom powder, addressing widespread deficiency concerns among Americans. This launch reflects a broader trend in the health and wellness foods market, where fortified and nutrient-enhanced snacks are gaining popularity as consumers increasingly seek products that support overall wellness and preventive health.

What Are The Key Factors Influencing Investment Analysis & Opportunities In Health And Wellness Foods Market?

The health and wellness foods market is attracting strong investor interest, driven by rising consumer awareness of nutrition and lifestyle-related health risks, increasing disposable incomes, and growing demand for functional, clean-label, and plant-based products. Investment trends show a mix of venture capital, private equity, and strategic partnerships, supporting both innovative startups and established players in expanding product portfolios, enhancing technology-driven manufacturing, and entering new geographic markets. High valuations for well-positioned companies reflect confidence in the sector’s resilience and long-term growth potential. Key investment hotspots include North America, Europe, and select Asia-Pacific markets, where urbanization, health-conscious consumers, and digital adoption are creating strong demand for wellness-focused foods. Investors are increasingly targeting companies that combine operational expertise with innovation in product formulation, sustainable sourcing, and digital marketing, creating opportunities for portfolio diversification, higher returns, and sustained growth in the global market.

Key Benefits for Stakeholders:

Next Move Strategy Consulting (NMSC) provides a comprehensive analysis of the health and wellness foods market, covering historical trends from 2020 through 2024 and delivering detailed forecasts through 2030. Our study offers global, regional, and country-level insights, including quantitative projections, key growth drivers, challenges, and investment opportunities across all major segments of the market.

Report Scope:

|

Parameters |

Details |

|

Market Size in 2025 |

USD 1147.85 Billion |

|

Revenue Forecast in 2030 |

USD 1746.17 Billion |

|

Growth Rate |

CAGR of 8.64% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

Growing Online Retail and Direct-to-Consumer Channels Driving the health and wellness foods market. Rising Awareness of Lifestyle-Related Health Issues Driving the health and wellness foods market |

|

Countries Covered |

33 |

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 analyst-working hours) after purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

|

Approach |

In-depth primary and secondary research; proprietary databases; rigorous quality control and validation measures. |

|

Analytical Tools |

Porter's Five Forces, SWOT, value chain, and Harvey ball analysis to assess competitive intensity, stakeholder roles, and relative impact of key factors. |

Key Market Segments

By Product

-

Functional Foods

-

Fortified and Healthy Bakery Products

-

Healthy Snacks & Beverages

-

Organic Foods

-

BFY Foods

-

Other Products

By Ingredient

-

Animal-Based Ingredients

-

Plant-Based Ingredients

-

By Calorie Content

-

No-Calorie

-

Low Calories

-

Reduced-Calorie

By Nature

-

Non-GMO

-

GMO

By Type

-

Conventional

-

Organic

By Free From Category

-

Gluten-Free

-

Dairy-Free

-

Soy-Free

-

Nut-Free

-

Lactose-Free

-

Artificial Flavor-Free

-

Artificial Color-Free

-

Others

By Distribution Channels

-

Supermarket & Hypermarket

-

Convenience Stores

-

Specialty Stores

-

Online Retailers

Geographical Breakdown

-

North America: U.S., Canada, and Mexico.

-

Europe: U.K., Germany, France, Italy, Spain, Sweden, Denmark, Finland, Netherlands, and rest of Europe.

-

Asia Pacific: China, India, Japan, South Korea, Taiwan, Indonesia, Vietnam, Australia, Philippines, Malaysia and rest of APAC.

-

Middle East & Africa (MEA): Saudi Arabia, UAE, Egypt, Israel, Turkey, Nigeria, South Africa, and rest of MEA.

-

Latin America: Brazil, Argentina, Chile, Colombia, and rest of LATAM.

Conclusion & Recommendations

Our report equips stakeholders, industry participants, investors, policy-makers, and consultants with actionable intelligence to capitalize on market transformative potential. By combining robust data-driven analysis with strategic frameworks, NMSC’s Health and Wellness Foods Market Report serves as an indispensable resource for navigating the evolving landscape.

Speak to Our Analyst

Speak to Our Analyst