Organic Soda Market by Product Type (Organic Soda Pops, Organic Sparkling Water, Organic Functional Soft Drinks, Organic Concentrates), by Sweetener Profile (Zero Sugar, Low or Reduced Sugar, Full Sugar), by Packaging (Plastic Bottles, Glass Bottles, Metal Cans, Paperboard or Carton), by Distribution Channel (Supermarkets and Hypermarkets, Convenience and Local Retail Stores, Online and Direct to Consumer, Food Service) – Global Analysis & Forecast, 2025–2030

Industry Outlook

The global Organic Soda Market size was valued at USD 8.13 billion in 2024, and is expected to be valued at USD 8.62 billion by the end of 2025. The industry is projected to grow, hitting USD 11.50 billion by 2030, with a CAGR of 5.94% between 2025 and 2030.

The market is experiencing significant growth, driven by urbanization, rising disposable incomes, increasing health awareness, and growing demand for natural and premium beverage options. Globally, consumers are increasingly seeking safe, chemical-free, and eco-friendly sodas, fueling expansion in retail chains, e-commerce platforms, cafes, and health-focused outlets. Growth in online grocery platforms, subscription beverage services, and smart retail solutions is further accelerating the need for innovative flavors, formulations, and packaging designs. Advancements in organic ingredients, low-sugar or sugar-free formulations, functional benefits (such as added vitamins or probiotics), and sustainable packaging are transforming product offerings, enhancing consumer satisfaction, and fostering strong brand loyalty.

What are the key trends in Organic Soda Market?

What major technological advancements are influencing the organic soda market?

Technological innovation is significantly transforming the market. Cold-pressed and natural fruit/vegetable extracts, plant-based sweeteners, and organic carbonation methods are improving product quality, safety, and taste. Functional enhancements, such as vitamin- and probiotic-enriched formulations, provide added health benefits, while automated production lines ensure consistency, efficiency, and scalability.

AI-driven consumer insights are enabling personalized flavor offerings and product recommendations based on lifestyle, taste preferences, and health considerations. Additionally, sustainable technologies, including biodegradable bottles, refillable packaging, and energy-efficient production processes, are gaining traction as brands focus on eco-conscious practices.

How is demographic change impacting the organic soda market?

Demographic shifts are driving demand for diverse organic soda products. Rising disposable incomes, urbanization, and growing health awareness in emerging markets are increasing consumption of both mainstream and premium organic sodas.

Younger, health- and trend-conscious consumers are gravitating toward flavored, low-sugar, and functional beverages, while older populations in developed economies prefer natural, sugar-free, and nutrient-enhanced options. This demographic evolution is pushing brands to offer tailored, multifunctional product portfolios catering to different age groups and lifestyle preferences.

What role does government regulation and support play in the organic soda sector?

Government policies and regulations play a critical role in shaping the organic soda market. Strict guidelines on food safety, labeling, chemical additives, and organic certification ensure product credibility and consumer trust. Eco-friendly packaging mandates and sustainability initiatives encourage brands to adopt greener production and distribution practices. Additionally, incentives for domestic manufacturing, MSME participation, and organic certification programs enhance competitiveness and innovation in the market.

How are consumer preferences changing in the organic soda market?

Consumer preferences are shifting toward organic, healthy, and customized soda options. Shoppers increasingly favor beverages that align with wellness, sustainability, and lifestyle values, such as low-sugar, plant-based, and eco-friendly products. Demand is moving away from conventional sodas toward offerings that provide functional benefits like added vitamins, probiotics, or antioxidant properties. This change reflects a broader emphasis on health-conscious, environmentally aware, and experience-driven consumption, driving brands toward innovation-focused and consumer-centric growth.

What are the Key Market Drivers, Breakthroughs, And Investment Opportunities that will Shape the Organic Soda Industry in Next Decade?

The global organic soda market is witnessing robust growth, driven by urbanization, rising disposable incomes, and evolving consumer lifestyles. Urban consumers increasingly prefer multifunctional, branded, and premium organic sodas that combine natural ingredients with unique flavors and functional benefits.

The rapid expansion of e-commerce and online retail platforms further accelerates market growth by offering convenience, personalized recommendations, and broader accessibility across geographies. However, the market faces challenges from high competition and limited availability of certified organic ingredients, leading to pricing pressures and the need for product differentiation.

Meanwhile, the growing demand for natural, low-sugar, functional, and sustainably packaged sodas presents significant opportunities for innovation, premiumization, and long-term brand loyalty.

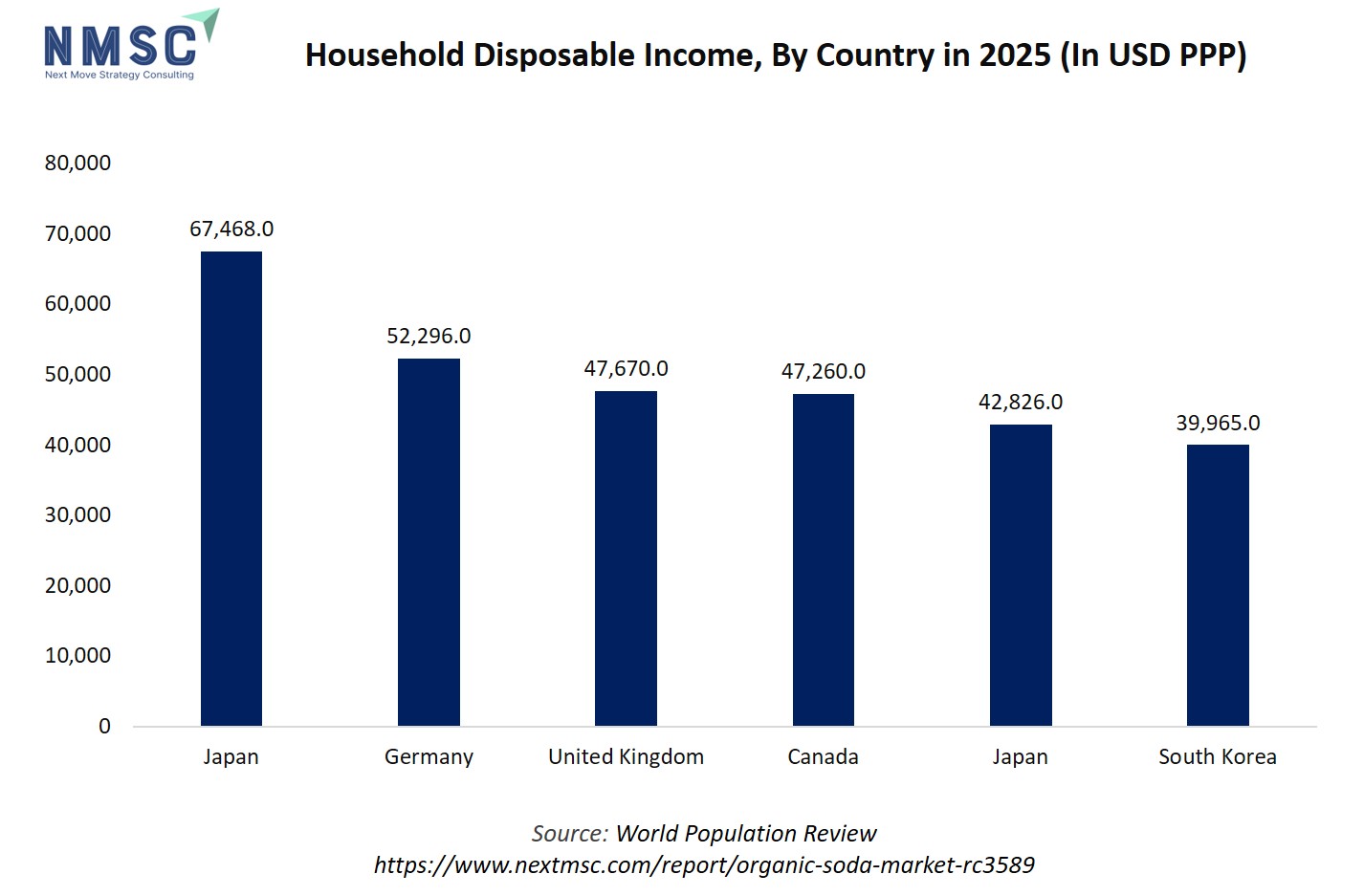

The bar chart highlights household disposable income in USD PPP for selected countries in 2024–2025. Higher disposable income levels correlate strongly with the demand for premium and multifunctional organic soda products, as consumers in affluent markets are more likely to spend on natural, organic, and health-focused beverages. For instance, Japan, with the highest per capita disposable income at USD 67,468, is likely to see strong consumption of premium organic sodas, flavored sparkling water, and functional beverages, while countries like Germany (USD 52,296) and the United Kingdom (USD 47,670) also represent lucrative markets for branded and specialty organic soda offerings.

Even markets with comparatively lower disposable incomes, such as South Korea (USD 39,965), are witnessing increasing adoption of innovative and naturally formulated sodas, reflecting rising health and wellness consciousness. Overall, higher disposable income directly drives market growth, encouraging both premiumization and diversification of natural soft drink offerings, including zero-sugar variants, functional beverages, and unique flavor profiles targeted at discerning consumers.

Growth Drivers:

How is Urbanization & Rising Disposable Incomes Driving the Organic Soda Market Demand?

Growing disposable incomes, particularly in emerging economies, are enabling consumers to spend more on premium and specialty beverages, including organic sodas. Urban populations, concentrated in cities, such as 66% of China’s population and 84% of the U.S. population according to the World Bank, are increasingly exposed to modern lifestyles, health trends, and global consumption patterns. As urbanization accelerates, demand rises for organic sodas that combine natural ingredients with unique flavors and functional benefits. Urban consumers are more likely to seek branded, innovative, and health-oriented beverages that reflect their lifestyle and wellness aspirations. This trend is expanding the customer base and driving premiumization, as consumers shift from conventional sodas to value-added, organic, and artisanal drink options.

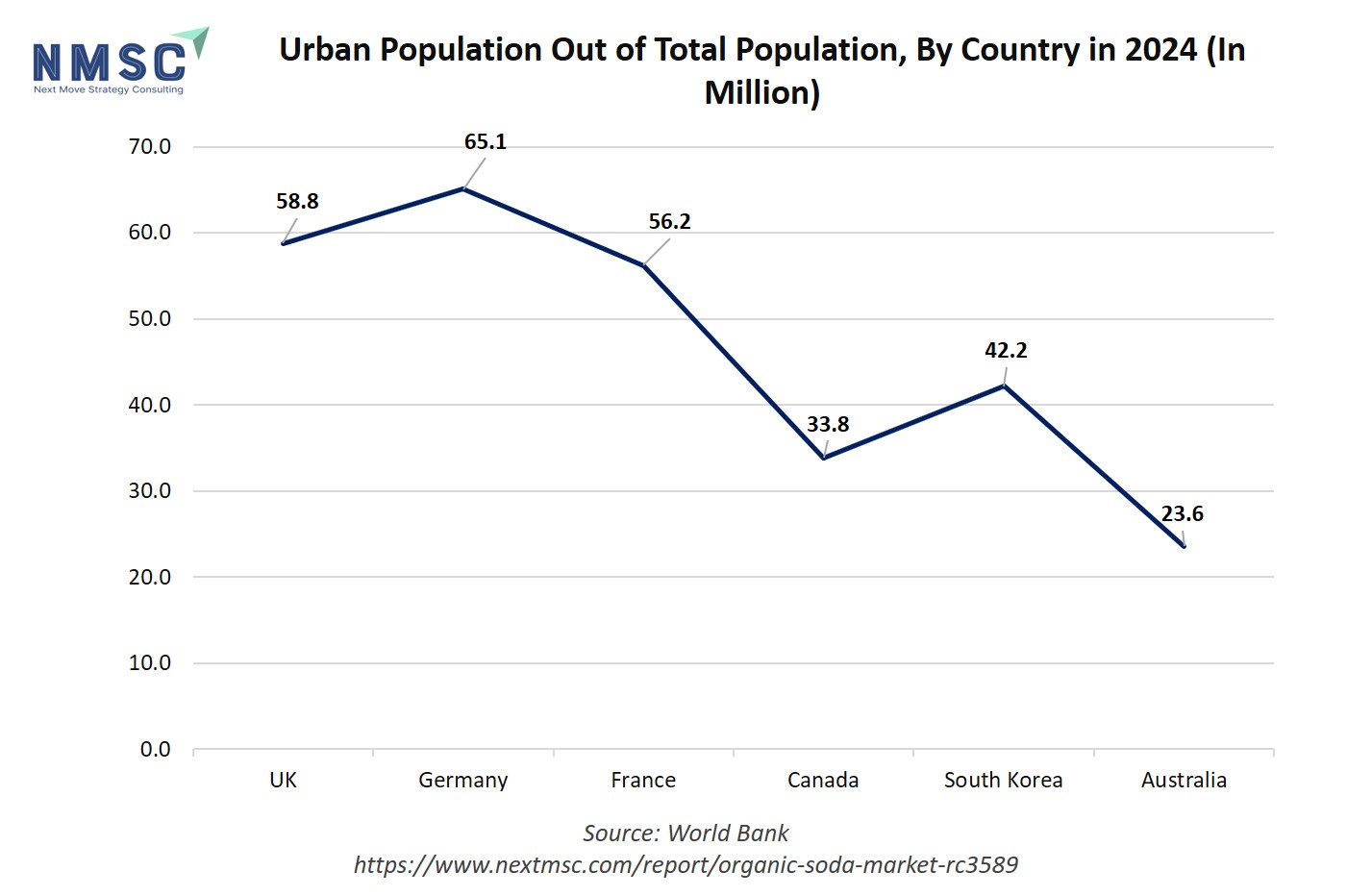

The chart shows the size of the urban population across selected countries in 2024, which directly indicates the potential consumer base for Organic Soda products. For example, Germany (65.1 million), the UK (58.8 million), and France (56.2 million) have large urban populations, suggesting a significant pool of consumers who are more likely to purchase organic sodas due to higher exposure to modern retail outlets, lifestyle trends, and disposable incomes.

Countries with smaller urban populations, such as Australia (23.60 million), Canada (33.8 million), and South Korea (42.2 million), represent comparatively smaller markets. However, urban centers in these countries still be attractive for targeted product launches, premium offerings, and functional beverages. In essence, larger urban populations indicate a bigger potential market for Organic Soda products, as urban consumers tend to drive demand for natural, premium, and innovative soda formulations.

Is Rising Health Awareness Accelerating the Organic Soda Market Growth?

Increasing consumer focus on health and wellness is a key driver of the organic soda market trends. Modern consumers are more conscious about sugar intake, artificial additives, and chemical preservatives in beverages. This shift has led to higher demand for natural, organic, and low-sugar carbonated drinks that offer better nutritional value without compromising taste. People are also seeking functional benefits such as vitamins, probiotics, or antioxidant-enriched sodas. As health consciousness grows globally, especially among millennials and urban populations, the preference for organic and clean-label beverages is driving market expansion and encouraging brands to innovate with healthier, guilt-free alternatives.

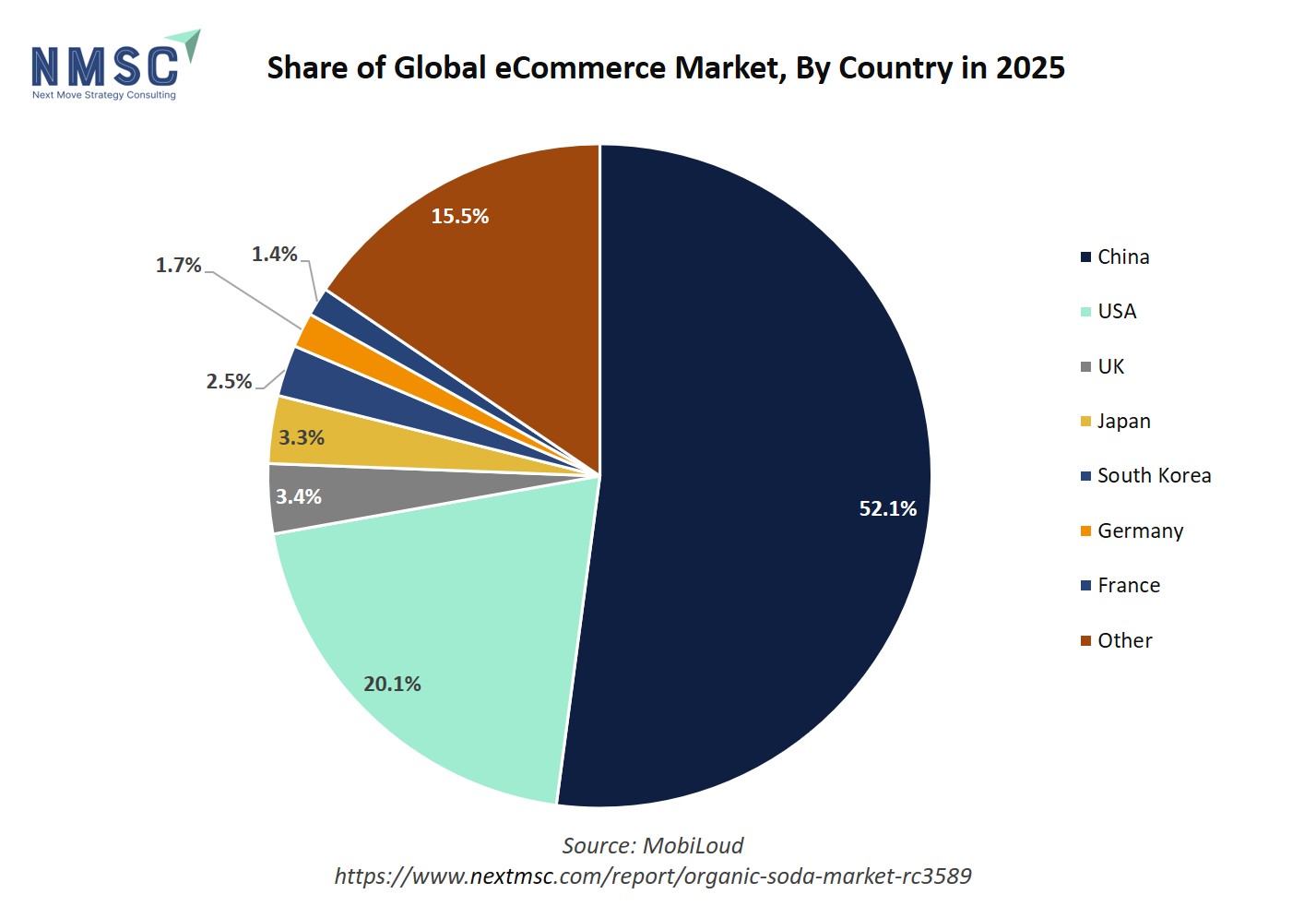

The pie chart showing global e-commerce market share in 2025 highlights the significant role of online channels in shaping consumer markets, including Organic Soda. China, with a dominant 52.1% share of global e-commerce, represents a massive opportunity for Organic Soda brands to reach millions of digitally active consumers. The USA, contributing 20.1%, also offers a strong online market for premium, natural, and innovative functional soda products.

Smaller markets like the UK (3.4%), Japan (3.3%), South Korea (2.5%), Germany (1.7%), and France (1.4%) indicate that while their online retail activity is lower in global terms, urbanized populations in these countries are still highly receptive to e-commerce, making them target markets for specialized or niche organic soda offerings. The “Other” category (15.5%) points to emerging e-commerce markets where growing internet penetration and smartphone adoption are likely to increase access to organic soda products, driving market expansion. In essence, the dominance of e-commerce, particularly in China and the U.S., is a strong driver for the global Organic Soda Market, enabling brands to reach wider audiences, introduce diverse product lines, and leverage digital marketing for growth.

Growth Inhibitors:

How Does High Production Costs Limit the Growth of the Organic Soda Market?

Organic sodas rely on premium, certified organic ingredients, natural sweeteners, and eco-friendly packaging, which significantly increase production costs compared to conventional carbonated beverages. This led to higher retail prices, limiting affordability and adoption, particularly in price-sensitive markets. Additionally, sourcing organic ingredients consistently be challenging, further constraining large-scale production and supply chain efficiency.

How is Rising Demand for Functional and Innovative Beverages Creating Opportunity for the Market?

There is a growing consumer preference for beverages that provide added health benefits beyond basic refreshment, such as vitamin enrichment, probiotics, antioxidants, or plant-based ingredients. This creates a strong opportunity for brands to develop innovative organic sodas that combine unique flavors with functional benefits. Expanding into niche segments like low-sugar, sugar-free, or immunity-boosting drinks allows companies to differentiate themselves, attract health-conscious consumers, and drive market growth globally.

How Organic Soda Market is segmented in this report, and what are the key insights from the segmentation analysis?

By Product Type Insights

Which Product Type Is Expected to Drive the Organic Soda Market in 2025?

On the basis of product type, the market is segmented into Organic Soda Pops, Organic Sparkling Water, Organic Functional Soft Drinks, and Organic Concentrates. The organic soda market in 2025 is expected to be primarily driven by Organic Soda Pops. These products remain the most preferred format due to their wide variety of flavors, nostalgic appeal, and ability to cater to both mainstream and niche consumer preferences. Their accessibility across multiple retail formats and alignment with the growing demand for clean-label, natural, and refreshing beverages further strengthen their dominance.

While other segments such as Organic Sparkling Water, Organic Functional Soft Drinks, and Organic Concentrates are gaining momentum due to health-focused innovation, wellness benefits, and sustainable consumption trends, Organic Soda Pops continue to capture the largest share. Additionally, the Organic Functional Soft Drinks segment is emerging as a high-potential category, fueled by rising consumer interest in beverages that provide added benefits such as energy, immunity, and digestive health, positioning it as a strong growth driver alongside traditional soda offerings.

By Sweetener Profile Insights

How Is the Sweetener Profile Shaping Consumer Preferences in the Organic Soda Market in 2025?

On the basis of sweetener profile, the market is segmented into Zero Sugar, Low or Reduced Sugar, and Full Sugar. In 2025, the market is expected to be primarily driven by Zero Sugar variants. Growing health awareness, rising prevalence of diabetes and obesity, and a global shift toward low-calorie beverages have made sugar-free options increasingly popular. These products appeal to fitness-conscious consumers and align with regulatory pushes for healthier formulations.

Low or Reduced Sugar sodas are also experiencing strong traction, as they strike a balance between taste and health. They are particularly appealing to consumers who seek reduced calorie intake but still want some sweetness. This segment is positioned as a transitional choice for customers shifting away from traditional sodas toward healthier options. Full Sugar sodas, while declining in growth compared to other profiles, continue to hold a loyal consumer base, especially among younger demographics and in markets where indulgence and taste preference remain strong drivers. However, their share is expected to gradually shrink as Zero Sugar and Reduced Sugar alternatives expand globally.

By Packaging Insights

Which Packaging Formats Are Driving Growth in the Organic Soda Market in 2025?

On the basis of packaging, the market is segmented into Plastic Bottles, Glass Bottles, Metal Cans, and Paperboard or Carton. The market in 2025 is expected to be primarily driven by Glass Bottles and Metal Cans. Glass bottles are preferred by eco-conscious and premium consumers due to better taste retention, perceived quality, and sustainability. Metal cans are popular for their portability, convenience, and recyclability, appealing to younger and on-the-go consumers.

Plastic Bottles continue to hold a significant share because of their affordability, durability, and widespread availability across retail channels, especially in developing markets. However, environmental concerns are expected to gradually reduce their market share. Paperboard or Carton packaging is emerging as a high-potential segment, driven by consumer demand for biodegradable, eco-friendly solutions and innovations in sustainable packaging design.

By Distribution Channel Insights

Which Distribution Channel Is Expected to Drive the Organic Soda Market in 2025?

On the basis of distribution channel, the market is segmented into Supermarkets and Hypermarkets, Convenience and Local Retail Stores, Online and Direct to Consumer, Specialty Organic and Health Food Stores, and Food Service.

The market in 2025 is expected to be primarily driven by Supermarkets and Hypermarkets, which provide wide product availability, competitive pricing, and convenient access for consumers across all demographics. These channels benefit from high footfall, frequent promotions, and strong brand visibility, making them the preferred choice for daily beverage purchases. Other channels such as Convenience and Local Retail Stores, Online and Direct to Consumer, and Specialty Organic and Health Food Stores are gaining traction due to convenience, niche offerings, and specialty product availability. Online and Direct to Consumer channels are emerging as a high-potential segment, fueled by the growth of e-commerce, smartphone usage, and preference for doorstep delivery, especially among younger consumers and urban populations. Food Service outlets and specialty channels are also expanding, catering to organic, premium, and wellness-focused beverages, supporting innovation and wider market reach.

Regional Outlook

The market is geographically studied across North America, Europe, Asia Pacific, and the Middle East & Africa, and each region is further studied across countries.

Organic Soda Market in North America

The North American market is being driven by growing consumer awareness of health and wellness, rising disposable incomes, and increasing demand for premium and natural beverage options. Expanding retail networks, including supermarkets, specialty stores, and e-commerce platforms, are enhancing product accessibility and visibility. Urban consumers are seeking organic sodas with unique flavors, functional benefits, and natural ingredients, while the trend toward low-sugar, chemical-free, and sustainably packaged beverages is creating additional growth opportunities for manufacturers across the region.

Organic Soda Market in the United States

In the U.S., the market growth is primarily fueled by the rising adoption of natural, organic, and premium sodas. Health-conscious and wellness-oriented consumers are increasingly seeking products with functional benefits, such as added vitamins, probiotics, or antioxidant properties. The expansion of organized retail and online channels allows brands to reach diverse consumer segments, while innovative flavors, low-sugar formulations, and eco-friendly packaging are enabling differentiation and building brand loyalty.

Organic Soda Market in Canada

In Canada, demand for organic sodas is being driven by urbanization, higher disposable incomes, and increasing awareness of natural, clean-label, and environmentally friendly products. Consumers are showing a preference for beverages that offer added health benefits, unique flavors, or functional ingredients. E-commerce and modern retail channels are expanding market reach, while growing interest in sustainability encourages manufacturers to innovate in both product formulations and packaging.

Organic Soda Market in Europe

The European market is supported by a strong focus on health, wellness, and eco-conscious lifestyles. Consumers are increasingly adopting premium, organic, and functional sodas with natural ingredients and nutritional benefits. Retail modernization, the growth of online shopping, and sustainability trends are enhancing product visibility and accessibility. The market is also witnessing innovation in low-sugar, flavored, and functional beverages, providing opportunities for brands to cater to diverse consumer preferences across different countries.

Organic Soda Market in the United Kingdom

In the U.K., the market is primarily driven by growing consumer focus on health, wellness, and premium beverage options. Urban populations and rising disposable incomes are boosting demand for flavored, functional, and specialty organic sodas, while increasing awareness of natural, organic, and eco-friendly ingredients is shaping purchasing preferences. The expansion of modern retail chains, supermarkets, and e-commerce platforms is improving product accessibility and visibility, enabling consumers to explore a wider variety of organic beverage offerings. Additionally, government initiatives promoting health, sustainability, and eco-conscious consumption further support consistent market growth across the country.

Organic Soda Market in Germany

Germany’s market is primarily driven by consumer preference for premium, natural, and health-oriented beverages, alongside strong awareness of wellness and healthy lifestyles. Urban populations with higher disposable incomes are increasingly seeking organic sodas with unique flavors, functional benefits, and low-sugar or sugar-free formulations. The expansion of modern retail outlets, supermarkets, and e-commerce platforms enhances accessibility, while sustainability trends encourage the adoption of eco-friendly and chemical-free packaging, supporting steady market growth.

Organic Soda Market in France

In France, market growth is fueled by urbanization and rising health consciousness. Consumers are increasingly adopting natural, organic, and functional sodas with added vitamins, probiotics, or antioxidants. Modern retail channels, including supermarkets, specialty stores, and online platforms, are improving product visibility and availability. The demand for premium and wellness-oriented organic sodas is further supported by growing awareness of healthy lifestyles and eco-friendly consumption practices.

Organic Soda Market in Spain

Spain’s market is significantly influenced by urbanization and growing disposable incomes, which are expanding access to modern retail and online shopping platforms. Urban consumers are showing strong preference for premium, natural, and functional sodas, creating opportunities for brands to innovate in flavors, formulations, and sustainable packaging. Rising interest in eco-conscious and chemical-free beverages is also driving market growth.

Organic Soda Market in Italy

Italy’s market is being driven by increasing health and wellness awareness, along with strong demand for premium and natural beverages. Consumers are increasingly seeking organic sodas with functional benefits, such as hydration, low sugar, vitamins, or probiotics, supported by urbanization and rising disposable incomes. The expansion of modern retail and e-commerce channels enhances product accessibility, while growing interest in sustainable, eco-friendly, and chemical-free formulations provides opportunities for differentiation and long-term brand loyalty.

Organic Soda Market in the Nordics

In the Nordic countries, the market is primarily driven by high consumer awareness of health, wellness, and natural products. Urban populations with higher disposable incomes are seeking premium, functional, and flavorful organic sodas. The market is also influenced by strong trends toward sustainable, eco-friendly, and chemical-free beverages, while modern retail chains and e-commerce platforms provide greater accessibility and visibility. Consumers increasingly prefer products that combine health benefits, unique flavors, and environmentally responsible formulations, supporting steady market growth.

Organic Soda Market in Asia Pacific

The market in Asia Pacific is fueled by rapid urbanization, rising disposable incomes, and growing health and wellness awareness. Countries such as India, China, South Korea, Japan, and Australia are witnessing strong demand for premium, natural, and functional sodas driven by expanding urban populations and evolving lifestyle preferences. The growth of modern retail outlets and online shopping platforms is increasing product accessibility, while consumers are increasingly opting for low-sugar, eco-friendly, and chemical-free formulations. Rising awareness of health, wellness trends, and sustainability considerations is creating significant opportunities for product innovation and market expansion.

Organic Soda Market in China

China’s market growth is primarily driven by urbanization, rising disposable incomes, and increasing demand for premium and natural beverages. Consumers are seeking functional, flavorful, and natural sodas that offer added health benefits, supported by strong awareness of wellness and healthy lifestyles. The expansion of e-commerce platforms and modern retail chains enhances product availability, while growing interest in eco-friendly and sustainable beverages fosters brand differentiation and market development.

Organic Soda Market in Japan

Japan’s market is influenced by aging populations, high health consciousness, and premiumization of beverage consumption. Consumers increasingly prefer natural, low-sugar, functional, and nutrient-enriched sodas that cater to wellness needs and dietary preferences. Availability through supermarkets, specialty stores, and online platforms supports product accessibility, while sustainability trends and natural ingredient formulations encourage innovation and differentiation, strengthening brand loyalty.

Organic Soda Market in India

In India, the market is being significantly driven by rapid urbanization, rising disposable incomes, and increasing health awareness. According to the World Bank, India’s urban population is approximately 534.91 million, highlighting the concentration of consumers in cities. This demographic shift, combined with growing preference for healthier lifestyles, is boosting demand for premium, natural, and functional sodas. Expansion of modern retail outlets and e-commerce platforms, along with increasing focus on eco-friendly and chemical-free formulations, is creating strong opportunities for product innovation and market growth across urban centers.

Organic Soda Market in South Korea

In South Korea, the market is primarily driven by urbanization, rising disposable incomes, and increasing health and wellness awareness. Urban populations are increasingly seeking premium, natural, and functional sodas with added health benefits. Growing demand for eco-friendly and chemical-free beverages, along with widespread availability through modern retail chains and e-commerce platforms, supports consistent market growth and encourages innovation in product formulations, flavors, and sustainable packaging.

Organic Soda Market in Taiwan

Taiwan’s market growth is fueled by health-conscious and wellness-oriented consumers who prefer premium, natural, and functional beverages. Expansion of urban areas, higher disposable incomes, and exposure to global health and lifestyle trends are driving adoption of chemical-free, eco-friendly, and nutrient-enriched sodas. Retail modernization and online shopping platforms improve product accessibility, while trends toward sustainable packaging create opportunities for differentiation and innovation.

Organic Soda Market in Indonesia

In Indonesia, the market is being driven by rapid urbanization, growing middle-class populations, and increasing health awareness. Consumers are demanding functional, flavored, and natural sodas, while e-commerce and modern retail channels improve accessibility and variety. Rising interest in eco-friendly and chemical-free formulations encourages brands to innovate in ingredients, flavors, and sustainable packaging, creating strong growth prospects across urban and semi-urban markets.

Organic Soda Market in Australia

Australia’s market is supported by urbanization, rising disposable incomes, and growing preference for premium and natural beverages. Urban consumers increasingly seek herbal, nutrient-enriched, and functional sodas that offer health and wellness benefits. The expansion of modern retail outlets and online platforms enhances product visibility, while sustainability trends and eco-conscious purchasing behavior drive demand for chemical-free, biodegradable, and environmentally responsible products, fostering innovation and market growth across the country.

Organic Soda Market in Latin America

In Latin America, the market is primarily driven by rapid urbanization, rising disposable incomes, and increasing health consciousness. Growing urban populations are fuelling demand for premium, natural, and functional sodas. Expansion of modern retail outlets and e-commerce platforms enhances product accessibility and visibility, while consumer preference for eco-friendly, low-sugar, and nutrient-enriched formulations encourages innovation and market growth across metropolitan and semi-urban areas.

Organic Soda Market in the Middle East & Africa

In the Middle East and Africa, the market growth is supported by urbanization, rising health awareness, and increasing adoption of functional beverages. Consumers are seeking premium, nutrient-enriched, and natural sodas, with a growing focus on chemical-free, eco-friendly, and sustainable ingredients. Expansion of retail channels, including supermarkets, specialty stores, and online platforms, improves product availability, while the demand for environmentally responsible and health-focused beverages presents opportunities for differentiation and innovation, driving steady growth across the region.

Competitive Landscape

Which Companies Dominate the Organic Soda Industry and How Do They Compete?

The global industry is dominated by established multinational and regional players such as Zevia, LLC, Olipop (Olipop, Inc.), Organic Soda Pops, Good Sodas (Denmark), Bec Soda Inc., Phoenix Organics (NZ), Soda Press Co, Sati Soda, Indi Essences (Organic Kola Soda), Cool Mountain Beverages, Inc., Nixie Beverage Company, Maine Root Beverage Corporation, Boylan Bottling Co., Tractor Beverage Corp., and Bionade GmbH. These companies compete by offering a wide range of organic sodas across mass-market, premium, functional, and niche segments, catering to diverse consumer preferences worldwide.

Market leaders differentiate themselves through innovative flavors and formulations, functional benefits such as prebiotics or natural sweeteners, eco-friendly and sustainable ingredients, and premium packaging. Their strategies also focus on expanding regional and global distribution networks, brand recognition, marketing campaigns, and product diversification.

Regional specialists and niche brands compete by offering artisanal, wellness-focused, or locally inspired sodas, targeting specific consumer demographics and markets. As demand continues to grow for natural, organic, low-sugar, and functional beverages, companies that combine product innovation, sustainability practices, and operational efficiency are capturing market share and establishing strong brand loyalty in the market.

Market dominated by Organic Soda Market Giants and Specialists

The organic soda market share is divided between large multinational manufacturers and regional or niche players. Large companies compete on scale, brand recognition, extensive distribution networks, and broad product portfolios, offering a wide range of sodas from mass-market to premium and specialty variants. Smaller or specialist providers focus on organic, natural, low-sugar, or functional formulations, catering to specific consumer preferences, local markets, or premium segments. This creates a dual market structure where consumers either choose well-established brands for reliability and variety or opt for specialized products that meet unique taste, health, or wellness requirements.

Innovation and Adaptability Drive Market Success

Market leaders are investing in innovative formulations, natural and sustainable ingredients, and advanced production technologies to enhance product quality, functionality, and consumer appeal. Companies are developing flavored, low-sugar, vitamin- or probiotic-enriched sodas, alongside eco-friendly and recyclable packaging to meet evolving consumer preferences. Brands that adapt to trends like personalization, functional beverages, and wellness-oriented offerings are securing stronger market presence and loyalty. Continuous innovation in flavor, carbonation, packaging, and functional benefits is key to maintaining competitive advantage in the sector.

Market Players to Opt for Merger & Acquisition Strategies to Expand Their Presence

Mergers and acquisitions have become a key strategy for Organic Soda companies to expand product portfolios, enter new geographic markets, and acquire specialized formulations or production capabilities. Leading manufacturers are acquiring regional or niche organic soda brands to strengthen market share, diversify offerings, and integrate advanced production technologies. These M&A activities enable companies to reach new consumer segments, scale operations, and respond effectively to growing demand for premium, natural, functional, and eco-friendly sodas, while enhancing their competitive positioning in both mass-market and specialty categories.

List of Key Organic Soda Companies

-

Zevia, LLC

-

Organic Soda Pops

-

Good Sodas (Denmark)

-

Bec Soda Inc.

-

Phoenix Organics (NZ)

-

Soda Press Co

-

Sati Soda

-

Indi Essences (Organic Kola Soda)

-

Nixie Beverage Company

-

Maine Root Beverage Corporation

-

Tractor Beverage Corp.

-

Bionade GmbH

What are the Latest Key Industry Developments?

-

August 2025 - Phoenix Organics is undergoing a brand revitalization with the help of New Zealand-based creative agency Marx, aiming to return to its previous status in the market.

-

February 2025 - Sati Slim, a new line of organic, sugar-free energy drinks, was launched in December 2024, offering naturally sweetened, zero-calorie beverages with clean ingredients.

-

February 2025 - Olipop achieved a USD 1.85 billion valuation after raising USD 50 million in a Series C funding round led by J.P. Morgan Private Capital. The brand turned profitable in 2024, with sales doubling to USD 400 million.

-

January 2025 - Good Sodas® participated in the Mandatory event in Copenhagen, showcasing their organic fermented sodas alongside Danish and international fashion and lifestyle brands.

What are the Key Factors Influencing Investment Analysis & Opportunities In The Organic Sodamarket?

The organic soda market is attracting growing investor attention as global demand rises for premium, natural, and functional beverages. Companies offering innovative formulations, sustainable and eco-friendly ingredients, and differentiated packaging are particularly appealing, with investments focused on scalable production, product innovation, and functional beverage development. Market activity is strong in North America, Europe, and Asia-Pacific, where urbanization, rising disposable incomes, health consciousness, and wellness trends are driving rapid adoption of high-quality organic sodas. Strategic mergers, acquisitions, and partnerships by leading manufacturers highlight consolidation as a key growth strategy. For investors, the most promising opportunities lie in companies that combine diverse product portfolios, technological and formulation innovation, operational efficiency, and the ability to cater to evolving consumer preferences across mass-market, premium, and niche segments, including low-sug

Key Benefits for Stakeholders:

Next Move Strategy Consulting (NMSC) presents a comprehensive analysis of the organic soda market, covering historical trends from 2020 through 2024 and offering detailed forecasts through 2030. Our study examines the market at global, regional, and country levels, providing quantitative projections and insights into key growth drivers, challenges, and investment opportunities across all major market segments.

Report Scope

|

Parameters |

Details |

|

Market Size in 2025 |

USD 8.62 Billion |

|

Revenue Forecast in 2030 |

USD 11.50 Billion |

|

Growth Rate |

CAGR of 5.94% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Countries Covered |

28 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent to up to 80 analyst-working hours) after purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

|

Approach |

In-depth primary and secondary research; proprietary databases; rigorous quality control and validation measures. |

|

Analytical Tools |

Porter's Five Forces, SWOT, value chain, and Harvey ball analysis to assess competitive intensity, stakeholder roles, and relative impact of key factors. |

Key Market Segments

By Product Type

-

Organic Soda Pops

-

Cola flavor

-

Citrus flavor

-

Ginger or Spiced flavor

-

Other flavors

-

-

Organic Sparkling Water

-

Organic Functional Soft Drinks

-

Organic Concentrates

By Sweetener Profile

-

Zero Sugar

-

Low or Reduced Sugar

-

Full Sugar

-

By Packaging

-

Plastic Bottles

-

Glass Bottles

-

Metal Cans

-

Paperboard or Carton

By Distribution Channel

-

Supermarkets / Hypermarkets

-

Convenience & Local Retail Stores

-

Online & Direct to Consumer

-

Specialty Organic & Health Food Stores

-

Food Service

Geographical Breakdown

North America: U.S., Canada, and Mexico.

Europe: U.K., Germany, France, Italy, Spain, Sweden, Denmark, Finland, Netherlands, and rest of Europe.

Asia Pacific: China, India, Japan, South Korea, Taiwan, Indonesia, Vietnam, Australia, Philippines, and rest of APAC.

Middle East & Africa (MENA): Saudi Arabia, UAE, Egypt, Israel, Turkey, Nigeria, South Africa, and rest of MENA.

Latin America: Brazil, Argentina, Chile, Colombia, and rest of LATAM

Conclusion & Recommendations

Our report equips stakeholders, industry participants, investors, policy-makers, and consultants with actionable intelligence to capitalize on the market’s transformative potential. By combining robust data-driven analysis with strategic frameworks, NMSC’s Organic Soda Market Report serves as an indispensable resource for navigating the evolving landscape.

Speak to Our Analyst

Speak to Our Analyst