India Green Hydrogen Market By Plant Capacity (Pilot, Small, Medium, and Large), By Production Technology (Alkaline Electrolysers, Proton Exchange Membrane, and Others), By Renewable Power Source (Solar PV-Driven, Onshore Wind-Driven, and Others), By Project Maturity Stage (Concept & Feasibility, Under Construction, and Others), By End-User (Chemicals & Fertilisers, Refining & Petrochemicals, Steel & Heavy Industry, and Others) – India Analysis & Forecast, 2025–2030

Industry: Energy & Power | Publish Date: 18-Oct-2025 | No of Pages: N/A | No. of Tables: N/A | No. of Figures: N/A | Format: PDF | Report Code : EP3620

Industry Outlook

The India Green Hydrogen Market size was valued at USD 2,500.1 million in 2024, and is expected to be valued at USD 3,250.3 million by the end of 2025. The industry is projected to grow, hitting USD 11,500.7 million by 2030, with a CAGR of 29.7% between 2025 and 2030.

The India green hydrogen market is experiencing steady and significant growth, driven by abundant renewable energy resources, advancements in electrolyser technology, and strong government support under initiatives such as the National Green Hydrogen Mission. Rising adoption across industrial and commercial sectors, including transportation, power generation, and heavy industries like steel manufacturing, is accelerating demand, as hydrogen increasingly serves as a clean and sustainable energy source. The industry is evolving with a focus on cost-efficient production, domestic electrolyser manufacturing, and large-scale infrastructure development, enabling greater scalability and integration of green hydrogen into India’s energy ecosystem.

Innovation is also advancing across hydrogen storage, fuel cell technology, and clean mobility solutions, enhancing the practicality and economic viability of green hydrogen applications. Policy frameworks, state-level initiatives, and international collaborations are shaping the India green hydrogen market, ensuring that production and utilization meet stringent sustainability, efficiency, and reliability benchmarks. As investments continue and technologies mature, India is positioning itself to become a global leader in green hydrogen, driving decarbonization and supporting the country’s broader energy transition objectives.

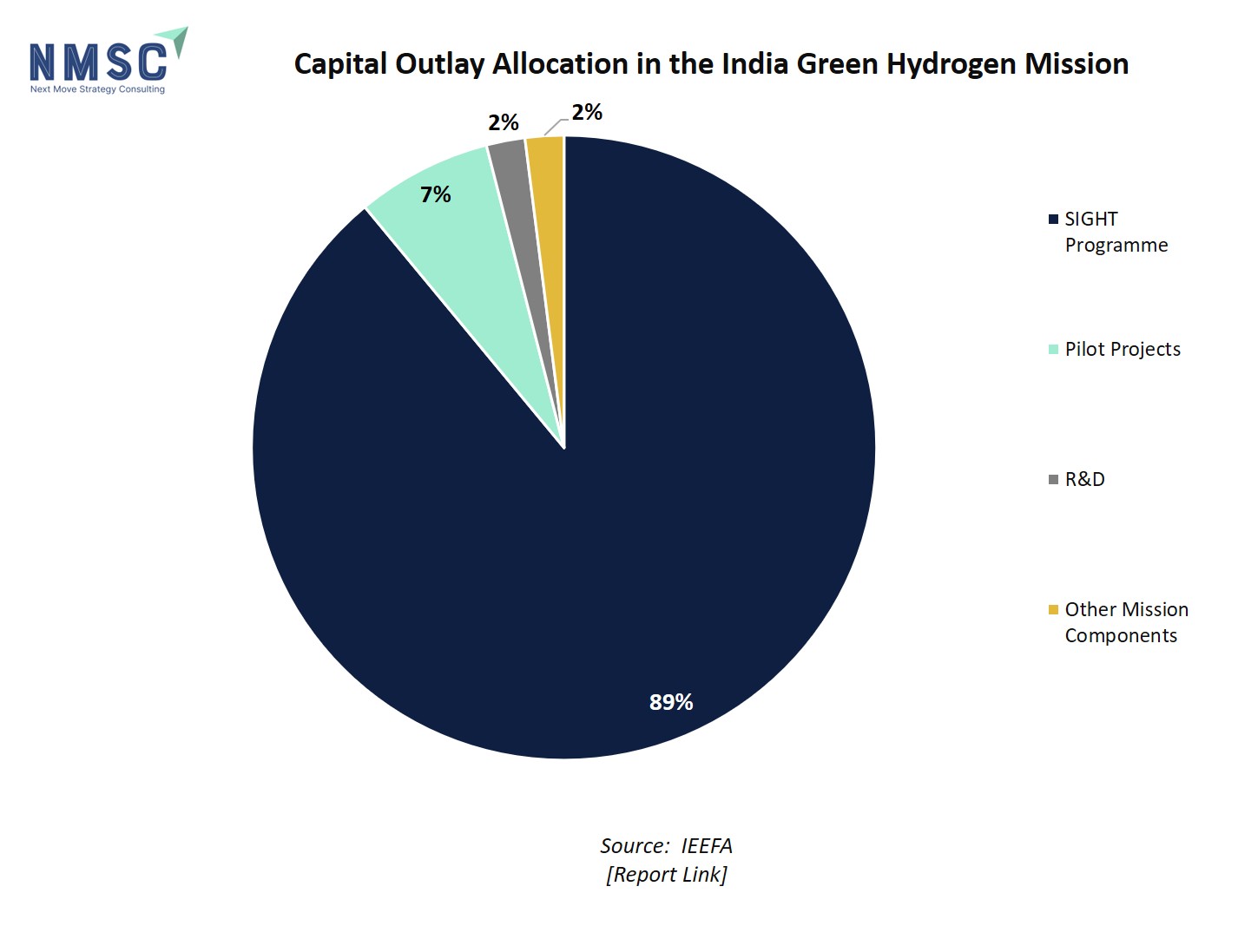

The above chart depicts the capital outlay allocation in India's Green Hydrogen Mission, highlighting that a dominant 89% of funding is directed toward the SIGHT Programme, which is focused on incentivizing the production of green hydrogen and its critical inputs. Pilot Projects account for 7% of the budget, reflecting India's commitment to demonstration and early deployment of green hydrogen technologies. Only 2% each is earmarked for R&D and other mission components, indicating that while research remains important, the primary emphasis is on immediate large-scale implementation and market creation under this ambitious national mission.

What is the Key India Green Hydrogen Industry Trends?

How is India Green Hydrogen Market Transforming Industrial Decarbonization?

India's green hydrogen sector is rapidly evolving, with significant strides in industrial decarbonization. The National Green Hydrogen Mission, aims to produce 5 million metric tons of green hydrogen annually by 2030, supported by an investment of approximately USD 2.4 billion. This initiative is expected to reduce the levelized cost of green hydrogen to INR 260–310/kg (USD 3–3.7/kg) by 2030, enhancing its competitiveness against conventional fuels. Industries such as steel, refining, and fertilizers are increasingly adopting green hydrogen to meet sustainability goals and comply with stringent emissions regulations. For companies in these sectors, investing in green hydrogen infrastructure and technology is becoming imperative. Collaborations with state governments offering capital subsidies and tax incentives can further accelerate adoption. Additionally, aligning with India's decarbonization targets can enhance corporate reputation and open avenues for international partnerships, especially with nations like Japan and South Korea, which are key importers of green hydrogen.

What Role Do State-Level Initiatives Play in Scaling Green Hydrogen?

State governments are playing a pivotal role in scaling India's green hydrogen market. For instance, Haryana has set ambitious targets to produce 250 KTPA (kilotons per annum) of green hydrogen and develop 2 GW of electrolyser capacity by 2030. Similarly, Uttar Pradesh is positioning itself as a hub for green aviation fuel, focusing on converting agricultural residues into bio-jet fuel. These state-led initiatives are complemented by national policies that provide capital subsidies, tax waivers, and priority access to infrastructure, creating a conducive environment for investment. For businesses, engaging with state governments to tap into these incentives can significantly reduce capital expenditure and accelerate project timelines. Establishing operations in states with robust green hydrogen policies can also provide access to a skilled workforce and proximity to renewable energy sources, further enhancing project feasibility and sustainability.

State-Level Initiatives in Scaling Green Hydrogen Market:

|

Initiatives |

Focus Area |

|

Maharashtra |

Maharashtra Harit Hydrogen Policy |

|

Andhra Pradesh |

Andhra Pradesh Green Hydrogen and Green Ammonia Policy |

|

Uttar Pradesh |

Uttar Pradesh Green Hydrogen Policy |

|

Odisha |

Odisha Hydrogen Policy |

|

West Bengal |

West Bengal Green Hydrogen Policy |

Source: Ministry of New and Renewable Energy

How are Technological Innovations Enhancing Green Hydrogen Production?

Technological advancements are central to reducing the cost and increasing the efficiency of green hydrogen production. Innovations in electrolyser technology, such as the development of alkaline and proton exchange membrane (PEM) electrolysers, are improving hydrogen yield and energy efficiency. Additionally, advancements in renewable energy integration and hydrogen storage solutions are addressing intermittency issues and enhancing the reliability of green hydrogen supply. For companies, investing in cutting-edge technologies and forming partnerships with research institutions can provide a competitive edge. Adopting state-of-the-art electrolyser systems and storage solutions can lead to significant cost savings and improved operational efficiency, aligning with both economic and environmental objectives.

What are the Export Opportunities for India's Green Hydrogen?

India is positioning itself as a significant player in the global green hydrogen market. The country aims to capture nearly 10% of the global green hydrogen demand, which is expected to exceed 100 million metric tonnes by 2030. With ongoing investments in infrastructure and technology, India is set to become a key exporter of green hydrogen and its derivatives, such as green methanol and sustainable aviation fuel, to markets in the European Union, Japan, and South Korea. Engaging in international collaborations and adhering to global standards can facilitate entry into foreign markets and enhance competitiveness. Additionally, aligning with international demand can drive innovation and operational excellence, positioning companies as leaders in the global green hydrogen economy.

What are the Key Market Drivers, Breakthroughs, and Investment Opportunities that will Shape the India Green Hydrogen Industry in the Next Decade?

India's green hydrogen market is entering a transformative phase, underpinned by strong government commitment, rapid technological progress, and rising demand for decarbonization across industries. The launch of the National Green Hydrogen Mission, with a planned investment of USD 2.4 billion, sets a clear roadmap for producing 5 million metric tons annually by 2030, signaling the seriousness of India’s clean energy transition. This momentum is further supported by India’s net-zero target by 2070 and increasing global interest in hydrogen as a sustainable fuel. Heavy industries such as steel, refining, and fertilizers are exploring hydrogen adoption to replace fossil fuels, while clean mobility and power generation are emerging use cases.

At the same time, challenges remain in scaling the sector, including high production costs, lack of large-scale infrastructure, and regulatory gaps. However, opportunities in electrolyser manufacturing, renewable integration, and export partnerships are creating strong prospects for investment. With sustained policy support and industry collaboration, India has the potential to position itself as a leading global hub for green hydrogen, contributing both to domestic decarbonization and international clean energy supply chains.

Growth Drivers:

What Role Do Government Policies Play in Accelerating Green Hydrogen Adoption?

Government support is one of the most powerful catalysts driving the adoption of green hydrogen in India. The National Green Hydrogen Mission not only targets 5 MMT annual production by 2030 but also integrates policies that encourage domestic manufacturing of electrolysers, subsidies for early-stage projects, and frameworks for pilot hydrogen corridors in heavy mobility. According to the Ministry of New and Renewable Energy, this initiative is expected to cut 50 MMT of annual carbon dioxide emissions by 2030. Such clear policy direction is significantly reducing investment risks while attracting global partnerships, particularly with the EU and Japan, which see India as a future supplier. For businesses, aligning projects with these policies offers tangible benefits access to subsidies, priority grid connections, and reduced project financing costs. Proactive engagement with central and state governments can further enhance competitive advantage, making policy-driven alignment not only a compliance step but a strategic growth enabler.

How are Technological Advancements Enhancing Green Hydrogen Production?

Technological innovation is reshaping the economics of green hydrogen production in India, making it progressively more competitive with fossil-based alternatives. Electrolyser efficiency is improving rapidly, with Proton Exchange Membrane (PEM) and Solid Oxide Electrolyser Cells (SOECs) offering higher yields and lower electricity requirements compared to older technologies. Reports suggest that production costs, currently around USD 4.65/kg, could fall to USD 2–2.5/kg by 2030 as renewable energy prices continue to decline and electrolyser scaling improves. Beyond production, advances in storage, such as compressed hydrogen and liquid organic carriers are tackling the challenge of intermittency and long-distance transport. Moreover, integrating AI-driven predictive maintenance into electrolyser systems can improve reliability and lower lifecycle costs, offering both efficiency gains and a competitive market edge.

Growth Inhibitors:

What Cost and Infrastructure Challenges are Slowing the India Green Hydrogen Market?

Despite its potential, India’s green hydrogen market faces structural and economic challenges that must be addressed for widespread adoption. The foremost barrier is cost competitiveness; green hydrogen is still nearly twice as expensive as grey hydrogen derived from natural gas. Coupled with this is the lack of a dedicated hydrogen transportation and storage network, which constrains scalability. A recent analysis highlights that without long-term contracts, offtake certainty remains low, deterring large-scale private investments. Furthermore, there is currently no standardized certification mechanism in India to differentiate green hydrogen from other hydrogen variants, which complicates international trade prospects.

Why are Electrolysers, Green Ammonia, and Export Markets the Next Big Opportunities in India’s Green Hydrogen Sector?

The Indian green hydrogen market is brimming with investment opportunities across the value chain, particularly as domestic and global demand scales rapidly. According to EY, areas like electrolyser manufacturing, green ammonia and methanol production, and hydrogen fueling infrastructure represent the most attractive segments for investors. Export-oriented opportunities are also emerging, with India aiming to meet 10% of global green hydrogen demand by 2030, valued at over USD 200 billion. For investors, forming joint ventures with established renewable players in India, such as NTPC or Adani Green, offers a pathway to de-risk entry while leveraging large-scale renewable assets. Additionally, building capabilities in derivative fuels like green aviation fuel or shipping-grade ammonia can tap into early-mover advantage in global supply chains. Targeted investments aligned with decarbonization goals not only ensure profitability but also future-proof portfolios in the evolving clean energy economy.

How India Green Hydrogen market is Segmented in this Report, and What are the Key Insights from the Segmentation Analysis?

By Plant Capacity (MW) Insights

How Is the India Green Hydrogen Market Share Segmented by Plant Capacity?

On the basis of plant capacity (MW), the India green hydrogen market is segmented into pilot (< 1 MW), small (1–10 MW), medium (10–50 MW) and large (> 50 MW).

The pilot segment (<1 MW) primarily includes demonstration and R&D projects. These small-scale plants allow technology validation, process optimization, and operational learning before large-scale deployment. For example, GAIL and NTPC have commissioned pilot electrolyser facilities to test PEM and alkaline technologies under Indian conditions. Small-scale plants (1–10 MW) are bridging the gap between pilot demonstrations and medium-scale commercial deployments. These plants cater to industrial clusters, such as refineries, steel mini-plants, and fertilizer units, where localized hydrogen supply reduces dependency on fossil-based hydrogen.

Medium-scale plants (10–50 MW) serve as backbone hydrogen hubs for multiple industrial consumers. These projects integrate renewable energy generation, electrolysers, and storage to optimize operational efficiency. For instance, NTPC is developing medium-scale facilities to supply hydrogen to steel and chemical industries. The segment emphasizes scalable, cost-efficient operations and represents a critical step toward commercial profitability. Large-scale green hydrogen projects (>50 MW) are positioned to lead the next wave of market expansion, targeting industrial offtake, blending applications, and export markets.

By Production Technology Insights

Which Electrolyser Technologies are Driving the India Green Hydrogen Market Growth?

Based on production technology, the India green hydrogen market is segmented into alkaline electrolysers (AEL), proton exchange membrane (PEM), anion exchange membrane (AEM), solid oxide electrolysers (SOEC) and others.

Alkaline electrolysis remains the most mature and widely deployed technology for high-capacity projects globally and in India because of its relative cost-competitiveness and long operational history. The IEA notes that alkaline and PEM systems can have comparable efficiencies but alkaline systems are typically favoured where low capital cost per kW and large, steady operation matter.

PEM electrolysers, on the other hand, are the technology of choice for projects requiring high-purity hydrogen, fast ramping with variable renewables, and compact plant footprint. India has seen concrete PEM deployments, such as GAIL’s 10 MW PEM plant at Vijaipur (producing ~4.3 tpd) demonstrates PEM’s commercial pilot maturity under Indian conditions. AEM seeks to combine the low-cost materials of alkaline with the dynamic performance of PEM. NTPC’s commissioning of an AEM pilot at Dadri (Nov 2023) and recent commercial activity around AEM stacks indicate India is actively testing this technology under local conditions. Beyond the main families, emerging or hybrid approaches (membrane innovations, pressurised modules, coupled chemical carriers) are being trialled to address storage, transport, and integration pain points.

By Renewable Power Source Insights

Which Renewable Energy Sources are Powering the Growth of India Green Hydrogen Market Demand?

Based on renewable power source, the India green hydrogen market is divided into solar PV-driven, onshore wind-driven, offshore wind-driven, hydro / biomass / geothermal and others.

Solar PV is the dominant renewable source for green hydrogen production in India, thanks to the country’s high solar irradiance and falling solar tariffs. As of 2024, India had installed 97.86 GW of solar capacity, with an additional 232.88 GW in the pipeline. Many pilot and commercial electrolyser projects co-locate with solar farms to achieve lower levelized cost of hydrogen (LCOH). For example, Adani Green Energy is integrating large-scale PV with electrolysers in Gujarat and Andhra Pradesh. This segment highlights the market’s focus on cost-competitive, scalable renewable integration.

Onshore wind farms are increasingly paired with electrolysers, especially in Gujarat, Tamil Nadu, and Maharashtra, where wind resources are abundant. Wind energy is a crucial contributor to green hydrogen production in India. By December 2024, India had installed 48.16 GW of wind capacity, with 74.96 GW in the pipeline. Onshore wind-driven hydrogen production allows industrial clusters and export hubs to benefit from predictable renewable supply. While hydro, biomass, and geothermal energy sources contribute to India's renewable energy mix, their role in green hydrogen production is currently limited. Hydropower, for example, accounted for a smaller share compared to wind and solar energy in recent installations.

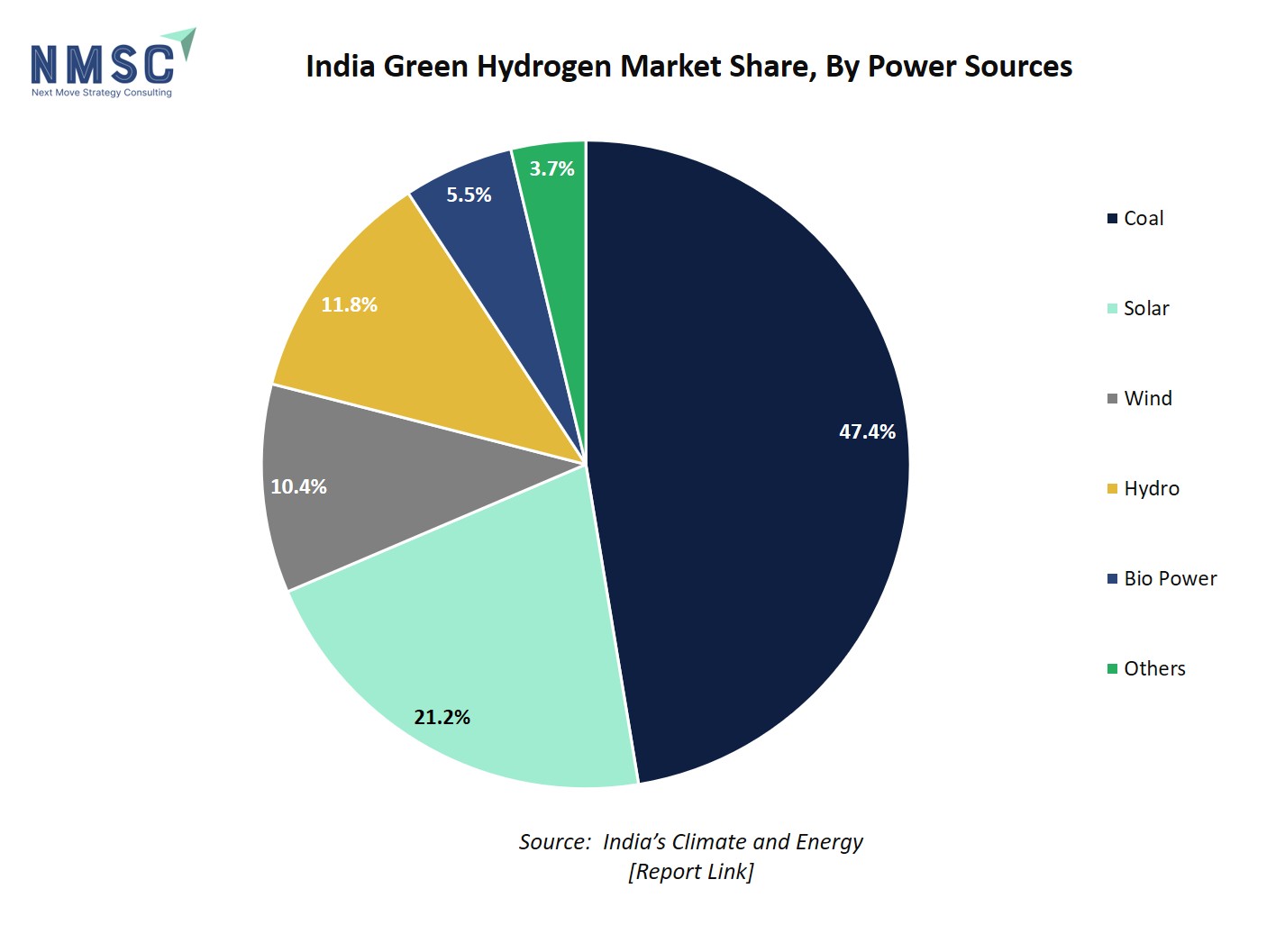

The chart showing India's power sources demonstrates that coal dominates the nation's energy mix at 47.4%, while renewable sources such as solar (21.18%), wind (10.42%), hydro (10.17%), and bio power (5.50%) collectively make up a significant portion of generation. This strong growth in renewables, especially solar and wind, provides the necessary clean electricity backbone required for large-scale green hydrogen production, as green hydrogen relies on abundant, low-carbon electricity for cost-effective electrolysis. As renewables continue to expand their share and fossil dependence declines, India is better positioned to achieve both its decarbonization targets and accelerate the commercial viability and competitiveness of green hydrogen as part of its energy transition strategy.

By System Ownership Model Insights

Which System Ownership Models are Shaping India’s Green Hydrogen Market in 2025?

Based on system ownership model, the India green hydrogen market is divided into captive (single-user industrial), merchant hubs (dedicated export/hub) and public-private partnerships (large-scale export).

Captive green hydrogen plants are owned and operated by a single industrial user, such as steel, refining, or fertilizer units. These plants focus on decarbonizing internal processes and reducing dependency on grey hydrogen.

Merchant hubs are dedicated hydrogen production facilities supplying multiple industrial consumers or export markets. These hubs leverage scale economies and co-located renewable energy to supply regional clusters or international buyers. States like Gujarat and Andhra Pradesh are developing export-oriented hydrogen hubs with private sector participation. For example, Gujarat's ports can serve as important hubs for the export of green hydrogen, contributing to India's export potential.

Similarly, PPP models are being implemented for giga-scale green hydrogen projects aimed at domestic and international markets. These models combine government incentives, policy support, and private sector efficiency to establish large-scale hubs. For example, NTPC’s Pudimadaka Green Hydrogen Hub aligns with this model, integrating solar/wind generation, electrolysers, and storage for industrial and export-ready hydrogen.

By Project Maturity Stage Insights

How are Concept, FID, Construction, and Operational Projects Driving India’s Green Hydrogen Market?

Based on project maturity stage, the India green hydrogen market is segmented into concept & feasibility, final investment decision (FID), under construction and operational.

Concept and feasibility-stage projects represent the earliest planning phase of green hydrogen plants. These projects focus on site selection, technology assessment, and techno-economic modelling. For example, various state renewable energy agencies and MNRE-supported programs are funding feasibility studies for hydrogen hubs in Gujarat, Andhra Pradesh, and Maharashtra. FID-stage projects indicate that technical, financial, and regulatory approvals have been secured, and project execution is imminent. Several green hydrogen hubs in India, such as the NTPC Pudimadaka Hub, have reached FID, combining renewable power, electrolysers, and storage for domestic and export purposes.

Projects under construction are actively installing electrolysers, renewable power capacity, and storage systems. This stage reflects significant capital deployment and policy alignment. Operational projects represent commissioned green hydrogen plants delivering hydrogen to industrial or mobility applications. They provide validated performance data, real-world costs, and market adoption insights.

By Delivery & Distribution Insights

How are Different Delivery and Distribution Methods Driving India’s Green Hydrogen Market?

Based on delivery & distribution, the India green hydrogen market is segmented into on-site captive, merchant / third-party offtake, pipeline transport, compressed-gas tube trailers and liquefied-hydrogen shipping.

On-site captive delivery involves producing and using hydrogen at the same facility, eliminating transport needs and ensuring a stable supply. Industries such as steel, refining, and fertilizer units are adopting on-site hydrogen production to decarbonize processes efficiently. Merchant or third-party offtake involves producing hydrogen at a central hub and supplying multiple industrial or commercial users. This model allows economies of scale and regional distribution. States like Gujarat and Andhra Pradesh are developing export-oriented hubs with merchant offtake strategies.

Pipeline transport connects production hubs to nearby industrial clusters, reducing reliance on trucked hydrogen and improving supply stability. For example, industrial corridors in Gujarat are evaluating dedicated hydrogen pipelines for steel and chemical units. While, compressed hydrogen in high-pressure cylinders or tube trailers enables flexible, small-scale delivery to customers not near production hubs. This method suits refineries, laboratories, and pilot mobility applications.

By End-User Sector Insights

How do Chemicals, Steel, Mobility, and Power Drive India’s Green Hydrogen Market Demand?

Based on end-user sector, the India green hydrogen market is bifurcated into chemicals & fertilisers (e.g. ammonia, methanol), refining & petrochemicals, steel & heavy industry (DRI), mobility (road, rail, maritime, aviation), and power & utilities (grid services, peaking, storage).

The chemicals and fertiliser sector remains the largest early adopter of green hydrogen, primarily for ammonia and methanol production. India’s push to decarbonize nitrogenous fertiliser production, combined with pilot projects integrating electrolysers with renewable power, positions this sector as a key driver. Similarly, Green hydrogen is increasingly used in refineries and petrochemical complexes for hydrogenation and fuel processing. Indian Oil, Bharat Petroleum, and Hindustan Petroleum are exploring green hydrogen for blending and process decarbonization.

The mobility applications include road, rail, maritime, and aviation sectors. Trials are underway for hydrogen fuel-cell buses, trucks, and port logistics vehicles. Power generation and utility applications use hydrogen for grid balancing, peaking, and long-duration energy storage. Hydrogen-to-power projects help integrate variable renewables into the grid, improve system reliability, and provide backup power.

Competitive Landscape

Which Companies Dominate the India Green Hydrogen Market and How do they Compete?

India’s green hydrogen space is spearheaded by a handful of industrial and energy giants with diverse approaches to the value chain. NTPC, as the country’s largest power producer, is leveraging its renewable portfolio to build integrated hydrogen hubs and pilot projects in Ladakh and Gujarat. Adani Group is using its solar and wind assets to design co-located hydrogen production facilities that minimize costs. Reliance Industries is positioning itself as a value-chain leader, developing India’s largest new energy complex in Jamnagar. On the downstream side, Indian Oil and GAIL are piloting hydrogen production to replace fossil-based feedstocks in refineries, while Tata Group explores advanced material solutions for hydrogen storage. Together, these companies set the pace of competition, using scale, renewable energy integration, and early adoption of electrolyser technology to secure market dominance in India’s emerging green hydrogen sector.

Companies’ growing inclination towards renewable energy is significantly boosting the green hydrogen market. By investing in renewable-powered hydrogen production, firms reduce carbon footprints and contribute to sustainable energy goals. This shift encourages innovation in electrolysis technology and storage solutions, enhancing efficiency and lowering costs.

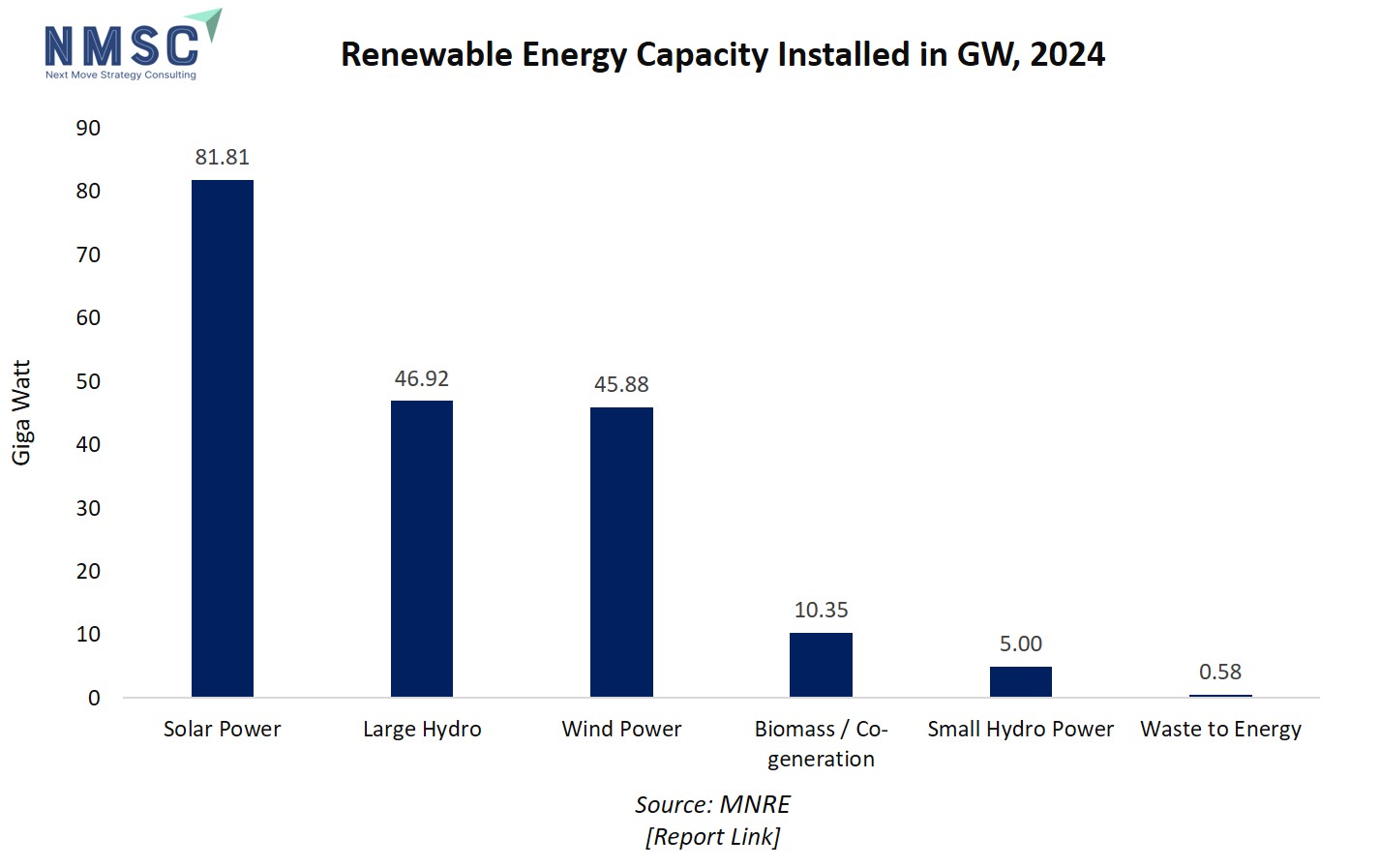

The above chart shows India's renewable energy capacity installed in 2024, highlighting solar power (82 GW), large hydro (47 GW), and wind power (46 GW) as the dominant contributors, with smaller shares from biomass/co-generation (10 GW), small hydro (5 GW), and waste-to-energy (1 GW). This robust and diverse portfolio of renewables provides a strong foundation for green hydrogen production, since large-scale and reliable green hydrogen projects require access to abundant, low-carbon electricity, especially from solar and wind. As solar and wind capacity continue to increase, India’s ability to produce competitive green hydrogen improves, accelerating the country’s clean energy transition and supporting decarbonization. This level of renewable capacity directly benefits the growth of India's green hydrogen market, because green hydrogen requires significant amounts of low-carbon electricity for electrolysis.

Market Dominated by India Green Hydrogen Giants and Specialists

The competitive landscape is being shaped by geography, state incentives, and industrial niches. Gujarat and Rajasthan, with high solar and wind potential, have become hotspots for mega-project announcements from NTPC, Reliance, and Adani. Coastal states such as Andhra Pradesh and Tamil Nadu are attracting interest for export-oriented hydrogen hubs due to their port infrastructure. At the same time, industry-specific specialists are carving out captive use cases. Indian Oil is deploying hydrogen to decarbonize refining processes, while JSW Steel explores hydrogen-based steelmaking pilots. States are also offering unique fiscal incentives, including land allocations, renewable power banking, and capital subsidies, prompting companies to strategically align projects with local strengths. This creates a dynamic environment where large players pursue scale across states, while niche specialists’ experiment with hydrogen use in hard-to-abate sectors, ensuring a diverse and competitive market evolution.

Innovation and Adaptability Drive Market Success

India’s leading hydrogen players are prioritizing technology adoption and innovation as differentiators. Reliance Industries is working on vertical integration by manufacturing electrolysers and fuel cells domestically, reducing import reliance and creating economies of scale. GAIL and Indian Oil are experimenting with PEM and alkaline electrolysers in pilot projects, while also testing hydrogen blending in pipelines and city gas distribution networks. NTPC is using hybrid renewable plants with hydrogen storage to explore round-the-clock clean energy supply. Tata Group is advancing R&D in storage and transport technologies, crucial for scaling hydrogen mobility solutions. Companies are also deploying digital twins, AI-driven predictive maintenance, and smart monitoring to enhance plant efficiency. By focusing on operational adaptability and innovation, firms are not only lowering the cost of hydrogen production but also positioning themselves for leadership in global technology collaborations and long-term competitiveness.

Market Players to Opt for Merger & Acquisition Strategies to Expand Their Presence

Mergers, acquisitions, and partnerships are becoming essential to India’s hydrogen growth story, as companies seek to scale faster and fill capability gaps. Reliance Industries has signed licensing deals with international electrolyser technology firms, bringing advanced know-how into India. NTPC has entered into MOUs with several state governments to establish green hydrogen hubs, anchoring policy support with industrial deployment. Indian Oil has tied up with private companies to establish hydrogen refueling stations integrated into the existing city gas infrastructure. Meanwhile, JSW Neo Energy’s bid for Statkraft’s hydro portfolio illustrates the appetite for acquiring renewable assets that could support large-scale hydrogen production. These partnerships and acquisitions reflect a clear trend: companies are no longer just competing individually but collaborating strategically, using alliances, technology access, and asset acquisitions to secure leadership across production, storage, and export-oriented green hydrogen markets.

List of Key India Green Hydrogen Companies

-

Indian Oil Corporation Ltd.

-

GAIL (India) Ltd.

-

Adani Group

-

Suzlon Energy

-

Bharat Petroleum Corp. Ltd.

-

Hindustan Petroleum Corp. Ltd.

-

Greenko Energy Holdings Pvt Ltd.

-

ACME Grouphydrogen

-

Inox Air Products

-

Oil & Natural Gas Corporation Ltd. (ONGC)

-

Oil India Ltd.

-

JSW Energy Ltd.

-

Jindal India Power Ltd.

What are the Latest Key Industry Developments?

-

June 2025- Adani New Industries announced a 5 MW solar + BESS driven off-grid electrolyser in Kutch, proving decentralized, grid-independent hydrogen production for coastal/industrial clusters and strengthening Mundra green-hub plans.

-

April 2025- BPCL and Sembcorp formed a joint venture targeting large-scale renewables and green hydrogen projects (including green ammonia/bunkering), reflecting oil-majors’ strategic pivot to integrated renewables + hydrogen value chains.

-

January 2024- NTPC’s green hydrogen hub foundation stone at Pudimadaka (large-scale integrated hub) formalizes government-aligned capacity build-out, combining renewables, electrolysers, and storage to enable industrial offtakes and export-ready volumes.

-

May 2024- Hindustan Petroleum announced a solid-oxide electrolyser at an R&D/demo facility to produce green H2 with higher thermal integration potential, signaling refiners’ shift to advanced electrolyser tech to lower LCOH and refinery decarbonization risks.

-

May 2024- GAIL commissioned a 4.3 TPD PEM electrolyser-based 10 MW pilot facility in Madhya Pradesh to validate on-site green H₂ production for industrial feedstock and pipeline blending. This pilot accelerates technology learning and offtake readiness for scale-up.

What are the Key Factors Influencing Investment Analysis & Opportunities in the India Green Hydrogen Market?

India's green hydrogen sector is experiencing a surge in investment, driven by favorable policies, infrastructure development, and international partnerships. The National Green Hydrogen Mission, launched with an investment of approximately USD 2.4 billion, aims to produce 5 million metric tons of green hydrogen annually by 2030, positioning India as a global leader in the industry.

Key investment hotspots include Gujarat, Andhra Pradesh, and Haryana. Gujarat's Vibrant Gujarat Global Summit 2024 attracted over approximately USD 87 billion in investment commitments, with significant focus on renewable energy and green hydrogen projects. Andhra Pradesh is developing a USD 1.3 billion green hydrogen and ammonia facility near Mulapeta port, aiming for export markets. Similarly, Haryana plans to implement decentralized renewable energy solutions across its villages, with a target to produce 250 KTPA of green hydrogen and develop 2 GW of electrolyser capacity by 2030. These developments underscore India's strategic focus on green hydrogen as a cornerstone of its clean energy transition, attracting both domestic and international investments.

Key Benefits for Stakeholders:

Next Move Strategy Consulting (NMSC) presents a comprehensive analysis of the India green hydrogen market, covering historical trends from 2020 through 2024 and offering detailed forecasts through 2030. Our study examines the market at country levels, providing quantitative projections and insights into key growth drivers, challenges, and investment opportunities across all major India green hydrogen segments.

The India green hydrogen market offers significant value to a wide array of stakeholders. Investors benefit from early-mover opportunities in electrolyser manufacturing, green ammonia production, and export-oriented hydrogen hubs, capturing high-growth returns as global demand surges. Policymakers leverage the sector to meet India’s net-zero 2070 commitment, advance renewable energy targets, and stimulate regional economic development through state-level incentives and infrastructure expansion. While customers, including industrial end-users in steel, refining, fertilizers, and mobility sectors, gain access to cleaner, cost-competitive hydrogen that helps reduce carbon emissions and comply with regulatory mandates. Collectively, these stakeholders drive a synergistic ecosystem where investment inflows, policy support, and industrial adoption accelerate technological innovation, scale, and international competitiveness, positioning India as a global hub for sustainable hydrogen solutions while fostering economic, environmental, and strategic gains.

Report Scope:

|

Parameters |

Details |

|

Market Size in 2025 |

USD 3,250.3 Million |

|

Revenue Forecast in 2030 |

USD 11,500.7 Million |

|

Growth Rate |

CAGR of 29.7% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Million (USD) |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent to up to 80 analyst-working hours) after purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

|

Approach |

In-depth primary and secondary research; proprietary databases; rigorous quality control and validation measures. |

|

Analytical Tools |

Porter's Five Forces, SWOT, value chain, and Harvey ball analysis to assess competitive intensity, stakeholder roles, and relative impact of key factors. |

Key Market Segments

By Plant Capacity (MW)

-

Pilot (< 1 MW)

-

Small (1–10 MW)

-

Medium (10–50 MW)

-

Large (> 50 MW)

By Production Technology

-

Alkaline Electrolysers (AEL)

-

Proton Exchange Membrane (PEM)

-

Anion Exchange Membrane (AEM)

-

Solid Oxide Electrolysers (SOEC)

-

Other

By Renewable Power Source

-

Solar PV-Driven

-

Onshore Wind-Driven

-

Offshore Wind-Driven

-

Hydro / Biomass / Geothermal

-

Other

By System Ownership Model

-

Captive (single-user industrial)

-

Merchant Hubs (dedicated export/hub)

-

Public-Private Partnerships (large-scale export)

By Project Maturity Stage

-

Concept & Feasibility

-

Final Investment Decision (FID)

-

Under Construction

-

Operational

By Delivery & Distribution

-

On-Site Captive

-

Merchant / Third-Party Offtake

-

Pipeline Transport

-

Compressed-Gas Tube Trailers

-

Liquefied-H₂ Shipping

By End Use Sector

-

Chemicals & Fertilisers (e.g. ammonia, methanol)

-

Refining & Petrochemicals

-

Steel & Heavy Industry (DRI)

-

Mobility (road, rail, maritime, aviation)

-

Power & Utilities (grid services, peaking, storage)

Conclusion & Recommendations

Our report equips stakeholders, industry participants, investors, policy-makers, and consultants with actionable intelligence to capitalize on India green hydrogen’ transformative potential. By combining robust data-driven analysis with strategic frameworks, NMSC’s India green hydrogen market report serves as an indispensable resource for navigating the evolving landscape.

The India green hydrogen market is set for transformative growth, driven by strong government support, technological innovation, and expanding industrial adoption. Strategic takeaways include the critical importance of aligning with state and central policies, investing in advanced electrolyser and storage technologies, and exploring partnerships or M&A to secure scale and market access. Investors and companies that focus on both domestic demand and export potential are likely to capture early-mover advantages.

Looking ahead, the India green hydrogen market is expected to benefit from declining production costs, increasing integration with renewable energy infrastructure, and rising global demand for low-carbon hydrogen. By leveraging innovation, strategic collaborations, and policy incentives, stakeholders can position themselves to lead India’s transition toward a sustainable hydrogen economy, shaping both national energy security and the global green hydrogen landscape.

Speak to Our Analyst

Speak to Our Analyst