Insurance TPA Market by Type (Health Insurance, Property and Casualty Insurance, Workers' Compensation Insurance, Disability Insurance, Personal Accident Insurance, Travel Insurance, Cyber insurance, Gadgets and Personal Belongings Insurance, and Others), by Services (Claims Management and Risk Control Management), and by End User (Healthcare, Construction, Real Estate and Hospitality, Transportation, Staffing, and Other End User) – Global Opportunity Analysis and Industry Forecast, 2024–2030

Industry: BFSI | Publish Date: 15-Oct-2025 | No of Pages: 432 | No. of Tables: 290 | No. of Figures: 235 | Format: PDF | Report Code : BF597

Insurance TPA Market Overview

The global Insurance TPA Market size was valued USD 399.71 billion in 2024, and it is projected to reach USD 575.15 billion by 2030, with a CAGR of 5.4% from 2025-2030.

The insurance third-party administrator (TPA) market involves companies that manage administrative services for insurance providers. TPAs act as intermediaries, handling claims processing, policy management, and customer support, that allows insurers to focus on their main business activities.

Using specialized software and skilled teams, TPAs streamline claims and data management, especially in sectors such as health, property & casualty (P&C), workers' compensation and many more, where high volumes of claims need to be managed efficiently.

By taking on these tasks, TPAs help insurers save on costs, increase efficiency, and reduce administrative work. Their expertise and technology improve accuracy, speed up claims processing, and boost overall productivity, enabling insurers to use their resources more effectively. This ultimately benefits policyholders with faster service and higher-quality support, making TPAs essential to the insurance industry.

The Rising Healthcare Costs Drives the Demand for TPAs

Increasing healthcare costs, driven by rising medical prices, advanced technology, the prevalence of chronic diseases, and escalating drug expenses, place significant financial strain on insurers and complicate claims management. As a result, insurers often outsource administrative tasks to TPAs for claims processing and risk management. TPAs offer the expertise and systems needed for efficient claims handling, enabling insurers to reduce costs and concentrate on their core operations, thereby enhancing overall efficiency.

According to the latest report published by the World Bank Group, healthcare expenditure in the U.S. reached USD 12,474 per capita in 2022, up from USD 9,849 in 2015, reflecting a growth of approximately 26.2% from 2015 to 2022.Similarly, Australia's healthcare expenditure accounted for USD 6,372 billion in 2022, compared to USD 5,322 billion in 2015, reflecting a growth of 19.68% from 2015-2022. Additionally, TPAs leverage advanced technology and skilled personnel to expedite claims processing and enhance service quality, meeting consumer demand for prompt settlements. This partnership not only boosts customer satisfaction through faster processing times but also contributes to higher retention rates for insurers.

Rapidly Rising Gross Written Premiums (GWP) Influence the Demand for TPAs

The swiftly rising gross written premiums (GWP) is increasing demand for TPAs as insurers look to manage the growing volume of claims effectively. As GWP rises, insurers encounter greater administrative challenges and more complex claims processing. TPAs assist in streamlining operations, cutting costs, and ensuring service quality, making them a valuable solution for insurers.

According to the latest data published by the Organization for Economic Cooperation and Development (OECD), the total gross written premium of the U.S. stood for USD 35,01,194 million in 2022 compared to that of 2020 it recorded for USD 29,34,828 million, representing a growth of 19.3%. On the other hand, the total gross written premium of the UK recorded for USD 4,46,337 million in 2022 compared to that of 2020 it stood for USD 3,80,954 million, with a growth of 17.16%. This favorable environment positions TPAs as essential partners in effective claims management and enhances the overall insurance experience, ultimately fostering growth and innovation in the sector.

The Adoption of Digitalization is Boosting the Growth of Insurance TPA Industry

The widespread adoption of digitalization is significantly boosting the insurance TPA industry by streamlining claims processing, enhancing data analytics, and improving customer service. Digital tools and automation enable TPAs to process claims faster, reduce errors, and offer better transparency, making them essential for insurers aiming to enhance operational efficiency and meet rising customer expectations. According to the International Data Corporation (IDC), digital transformation (DX) is a top priority for businesses, with global spending expected to reach USD 3.9 trillion by 2027, growing with a five-year compound annual growth rate (CAGR) of 16.1%. In 2023, the U.S. accounts for 35.8% of DX spending, closely followed by Asia-Pacific at 33.5%, while EMEA contributes 26.8%.

Growing Data Security Concerns Hinders Insurance TPA Industry

Data security concerns are a major obstacle for the growth of the insurance TPA market. As it handles sensitive personal and financial data which makes TPAs vulnerable to breaches, leading to legal issues and reputational damage. This risk causes insurers to hesitate in outsourcing claims management. Strict data privacy regulations add further compliance costs, limiting service expansion and innovation. For instance, in May 2024, WebTPA faced a data breach that exposed the personal information of 2.4 million individuals, including Social Security numbers. As a result, TPAs face barriers to innovation and expansion, while incidents including the WebTPA breach highlight the ongoing vulnerabilities in the industry.

Advent of Advanced Technologies Creates Future Opportunity for the Market

The adoption of advanced technologies such as artificial intelligence (AI) and automation is transforming the insurance industry to create significant market opportunities for TPAs in the coming years. These technologies help TPAs streamline claims processing, reduce operational costs, and enhance efficiency by automating routine tasks. This shift presents opportunities to improve service delivery, minimize errors, and drive growth in the market. As an example, Healthcare Management Administrators (HMA) partnered with Priority Health to launch a flexible TPA solution for Michigan employers with 100 or more employees, set to begin on January 1, 2025. This innovative self-funded health plan aims to provide customized, cost-effective options while addressing the healthcare needs of employees. The collaboration combines HMA's expertise in self-funding with Priority Health's extensive local network and support, enhancing operational efficiency and employee satisfaction for Michigan businesses.

By Type, Health Insurance Holds Dominant Share in the Insurance TPA Market

Health insurance holds the dominating share of the market compared to property and casualty insurance due to the increasing demand for TPAs to manage complex healthcare claims, policy administration, and member services. The rising prevalence of chronic diseases, expanding health coverage, and growing awareness about the benefits of health insurance amplified the need for efficient claims processing and customer support.

TPAs play a critical role in streamlining these operations, ensuring faster reimbursements, reducing administrative burdens for insurers, and enhancing customer satisfaction, thereby driving the dominance of the health insurance segment in the insurance TPA market. Health insurance is further bifurcated into disease insurance and medical insurance.

By End User, Real Estate and Hospitality Witness the Fastest Growth in the Insurance TPA Market

Real estate and hospitality exhibit the highest CAGR in the end user segment due to the rising adoption of specialized insurance products to address risks associated with property management, operational continuity, and guest safety. The growing prevalence of high-value assets, combined with the demand for customized coverage in areas such as liability, property damage, and business interruption, spurred significant growth in insurance adoption. Furthermore, the expansion of luxury accommodations and real estate developments, coupled with rising awareness of risk management solutions, contributes to the rapid uptake of insurance policies in this dynamic sector.

North America Holds the Dominants the Insurance TPA Market Share and Expected to Show Steady Growth

Rising healthcare expenditures lead to increased pressure on insurance companies to manage claim payouts effectively. This financial strain prompts insurers to rely on TPAs for streamlined claims processing and improved operational efficiency.

According to the latest report published by the World Bank Group, healthcare expenditure in the U.S. reached USD 12,474 per capita in 2022, up from USD 9,849 in 2015, reflecting a growth of approximately 26.2% from 2015 to 2022. Thus, the demand for TPA grows exponentially due to their essential role in enhancing service delivery and maintaining profitability in the face of rising healthcare costs.

Moreover, the growing digitalization of the insurance industry is enhancing the acceptance of evolving technologies such as AI, automation and data analytics. These technologies enhance efficiency, streamline claims processing, and reduce costs for TPAs. As a result, the growing reliance on digital tools is fueling the insurance TPA market growth, as insurers seek more efficient and cost-effective solutions.

According to the Global Digitalization Index (GDI) 2024, Canada ranked 17th in global digitalization index with a score of 61.3 and it shares the 2nd highest rank across the region after the U.S. in terms of digitalization.

Asia-Pacific is Expected to Witness the Highest Growth During the Forecast Period

Increasing disposable income enhances consumers' capacity to access insurance services, leading to higher demand for policies. This results in more claims and administrative tasks, creating a greater demand for TPAs to efficiently manage and process these services thus, driving overall market growth.

As per the U.S. Energy Information Administration latest report, the disposable income per capita of China recorded for USD 10,529 in 2022 and it is projected to surge to USD 19,156 by 2035, it is estimated to increase by 81.94% within the span of 13 years.

Moreover, the growing penetration of insurance leads to more individuals and businesses obtaining coverage, resulting in a larger and more diverse market for TPAs. With a larger customer base and increased claims, TPAs see higher demand for their services, such as claims management, policy administration, and customer support.

As per the latest data published by the Organization for Economic Cooperation and Development (OECD), the total gross premium in the India reached USD 1,10,394 million in 2022, as compared to that of 2019 it accounted for USD 1,07,817 million, reflecting a steady growth of approximately 2.4% in the sector in just 3 years.

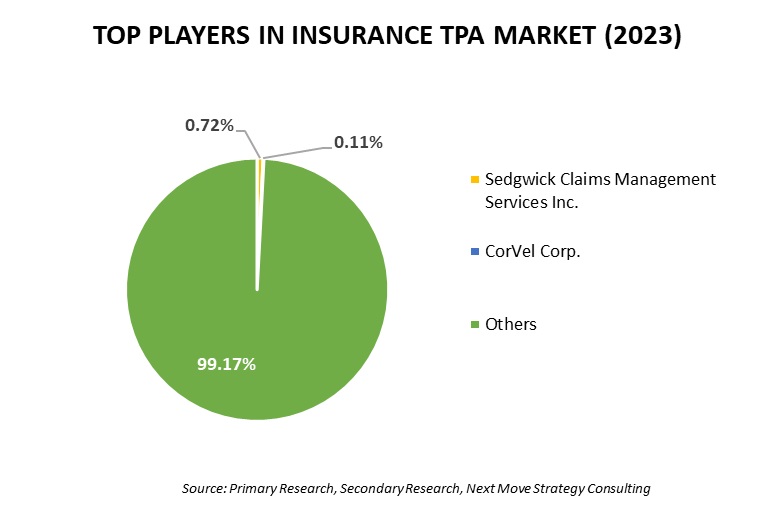

Competitive Landscape

The insurance TPA industry comprises various key players such as Sedgwick Claims Management Services Inc., Arthur J. Gallagher & Co., Cannon Cochran Management Services Inc.,dba CCMSI, ESIS Inc., Crawford & Co., Meritain Health, Charles Taylor, CorVel Corp., United HealthCare Services (UMR) Inc., Trustmark Health Benefits Inc., AP Companies Group, McLarens, Fusion CX, Healix, Pinnacle Claims Management Inc. and others.

For the latest market share of top 10 players, order the full report at: Access the Full Report

These market players are adopting various strategies including investment, acquisition and product launch across various regions to maintain their dominance in insurance TPA industry.

|

DATE |

COMPANY |

RECENT DEVELOPMENTS |

|

|

Nov-24 |

Sedgwick |

Sedgwick completed a minority investment led by Altas Partners, with support from Carlyle and Stone Point Capital, boosting its capabilities in claims management and technology solutions. With an enterprise value of USD 13.2 billion to expand services and continue delivering excellence in claims handling. |

|

|

Oct-24 |

Arthur J. Gallagher |

Arthur J. Gallagher & Co. acquired Risk International, a risk management and insurance services firm based in Columbus, Ohio. This acquisition enhances Gallagher's capabilities in providing comprehensive risk management solutions and strengthens its position in the insurance market. The existing Risk International team will continue to operate under Gallagher’s leadership, ensuring a seamless transition for clients. |

|

|

Oct-24 |

Crawford |

Crawford & Company launched Turvi, a new insurtech offering software-as-a-service (SaaS) solutions aimed at enhancing the property and casualty claims process through AI and automation. It will provide innovative tools to address industry challenges and improve the policyholder experience. |

|

|

Oct-24 |

Meritain |

Meritain subsidiary of Aetna launched SimplePay Health, a new offering designed to simplify healthcare coverage, with Meritain Health serving as the third-party administrator (TPA) for self-insured clients. This initiative aims to provide members with clear insights into costs and provider quality, enabling informed healthcare decisions while offering convenient payment options. |

|

Insurance TPA Market Key Segment

By Type

-

Health Insurance

-

Disease Insurance

-

Medical Insurance

-

Senior Citizens

-

Adults

-

Minors

-

-

-

Property and Casualty Insurance

-

Homeowners Insurance

-

Car Insurance

-

-

Workers' Compensation Insurance

-

Disability Insurance

-

Personal Accident Insurance

-

Death and Permanent Disability

-

Medical Expenses

-

-

Travel Insurance

-

Medical Coverage

-

Trip Cancellation Coverage

-

Baggage and Personal Belongings Coverage

-

Accidental Death and Dismemberment (AD&D) Coverage

-

-

Cyber insurance

-

Gadgets and Personal Belongings Insurance

-

Mobile Phone

-

Laptop

-

-

Others

By Services

-

Claims Management

-

Risk Control Management

By End User

-

Healthcare

-

Construction

-

Real Estate and Hospitality

-

Transportation

-

Staffing

-

Banking

-

Travel and Tourism

-

Telecommunication

-

Other End User

Key Players

-

Sedgwick Claims Management Services Inc.

-

Arthur J. Gallagher & Co.

-

Cannon Cochran Management Services Inc., dba CCMSI

-

ESIS Inc.

-

Crawford & Co.

-

Meritain Health

-

Charles Taylor

-

CorVel Corp.

-

United HealthCare Services (UMR) Inc.

-

Trustmark Health Benefits Inc.

-

AP Companies Group

-

McLarens

-

Fusion CX

-

Healix

-

Pinnacle Claims Management Inc.

Report Scope and Segmentation

|

Parameters |

Details |

|

Market Size in 2024 |

USD 399.71 Billion |

|

Revenue Forecast in 2030 |

USD 575.15 Billion |

|

Growth Rate |

CAGR of 5.4% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst