Lipstick Market By Product Type (Traditional Lipstick, Liquid Lipstick, Lip Crayon and Others), By Formulation (Standard, Organic, Cruelty-Free and Others), By Coverage (Sheer, Medium, Full), By Colour (Red, Pink, Nude and Others), By Age Group (Under 20, 20 to 30 and Others), By Distribution Channel (Online Retail and Offline Retail), By Application (Daily Wear, Occasional Use, Professional Use) – Global Analysis & Forecast, 2025–2030

Lipstick Industry Outlook

The global lipstick market size was valued at USD 14.59 billion in 2024, and is expected to be valued at USD 15.50 billion by the end of 2025. The industry is projected to grow, hitting USD 20.93 billion by 2030, with a CAGR of 6.2% between 2025 and 2030.

The market is undergoing a transformation driven by consumer demand for safer, sustainable, and high-quality products. Consumers are increasingly seeking lip products free from harmful chemicals and produced using eco-friendly practices, prompting brands to reformulate offerings to exclude potentially harmful ingredients.

Regulatory measures, such as initiatives to control lead levels in cosmetics, are reinforcing compliance while encouraging brands to cater to the growing segment of eco-conscious consumers. This shift is influencing product development, packaging innovation, and marketing strategies, as companies aim to differentiate themselves in a highly competitive market and align with evolving consumer expectations.

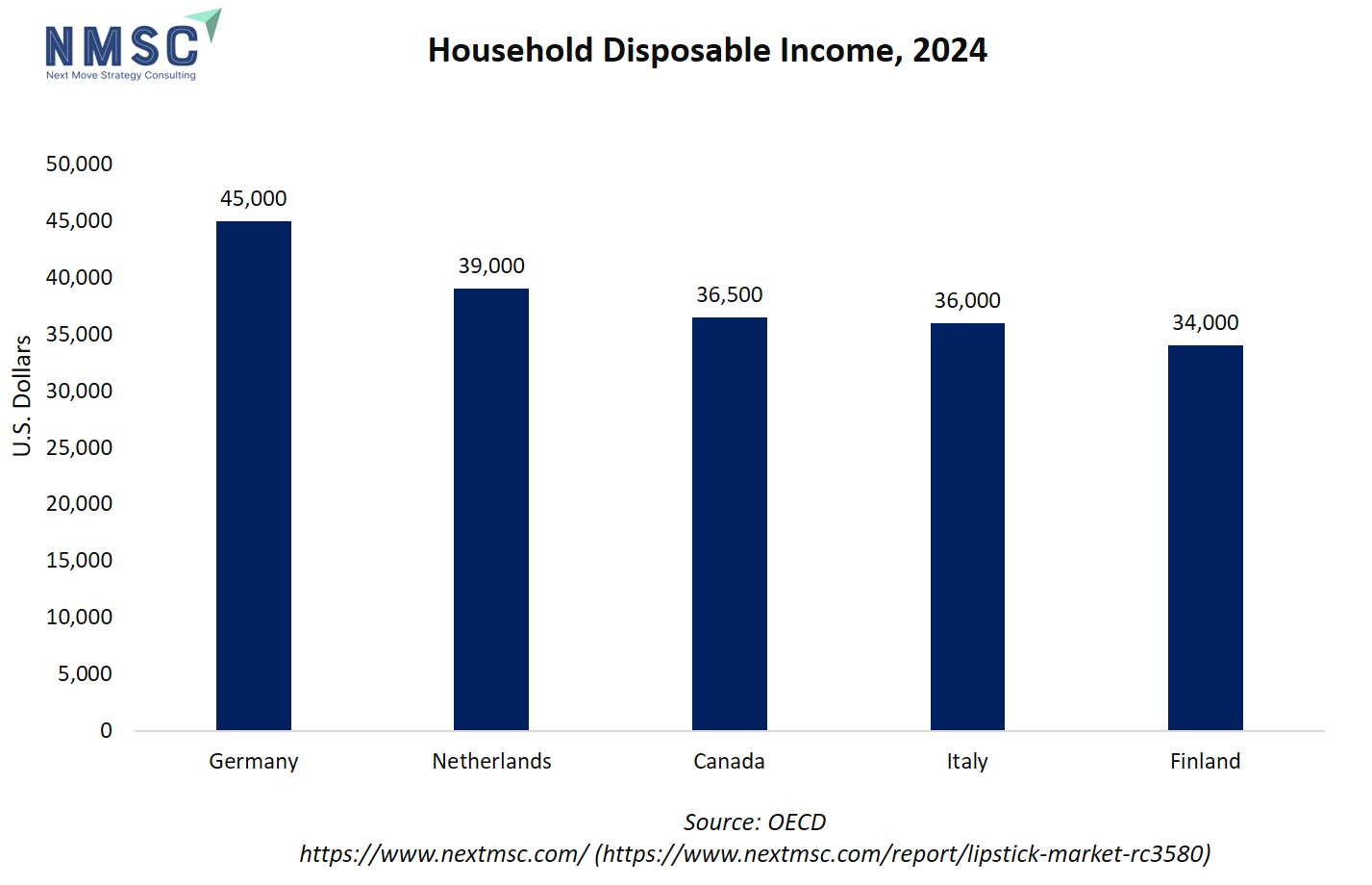

Rising household disposable income further fuels demand for lipstick, enabling consumers to invest in premium, diverse, and personalized products that enhance appearance and self-expression. Alongside consumer interest in sustainable products, these dynamics encourage brands to innovate, expand product lines, and adopt eco-friendly practices, supporting market growth, product diversification, and competitive differentiation across both established and emerging markets.

The chart showing household disposable income by country in 2024 is highly indicative, as higher disposable income strongly correlates with increased spending on premium and lifestyle products, including cosmetics and lipsticks. Countries like Germany, the Netherlands, and Canada, which have higher household disposable incomes, represent attractive markets for lipstick brands, as consumers in these regions are more likely to invest in premium, innovative, and high-quality makeup products that meet evolving trends and preferences.

What are the key trends in the lipstick industry?

How are digital innovation reshaping consumer experiences in the lipstick sector?

Digital innovation is reshaping the industry by enhancing consumer engagement and streamlining purchases. Brands are increasingly using augmented reality (AR) and virtual try-ons, allowing customers to test shades and finishes before buying. This not only boosts satisfaction but also reduces returns. Social media and influencer marketing further amplify brand visibility, especially among younger consumers.

Products like Revlon’s Super Lustrous Glass Shine Balm and Dior Rouge Dior on Stage have been celebrated for performance and inclusivity, earning recognition in the 2025 Allure Best of Beauty Awards. The trend underscores growing consumer demand for personalized, immersive shopping experiences, encouraging companies to invest in AR and AI technologies to remain competitive.

How are health and safety regulations influencing lipstick formulations and consumer choices?

Health and safety regulations are significantly shaping the industry, influencing both product formulations and consumer purchasing decisions. The U.S. Food and Drug Administration (FDA) plays a crucial role in overseeing the safety of cosmetics, including lip products. The FDA monitors the use of colour additives in cosmetics, ensuring they are approved for use and do not pose health risks to consumers. For instance, certain color additives used in lipsticks are subject to FDA scrutiny to ensure they meet safety standards. This regulatory oversight helps maintain consumer confidence in the safety of cosmetic products.

How are sustainability and eco-friendly packaging reshaping lipstick consumer behaviour?

Sustainability is increasingly influencing consumer choices in the lipstick market demand, with a growing demand for eco-friendly packaging and formulations. According to the U.S. Federal Trade Commission's Green Guides, companies making environmental claims about their products must ensure those claims are truthful and substantiated. This regulatory framework encourages brands to adopt sustainable practices, such as using recyclable materials and reducing plastic usage in packaging. The European Union's Cosmetics Regulation also emphasizes the importance of environmental safety, requiring cosmetic products to be manufactured in a way that minimizes their impact on the environment.

What are the key market drivers, breakthroughs, and investment opportunities that will shape the industry in next decade?

The lipstick industry is evolving rapidly in response to shifting consumer expectations, regulatory developments, and rising disposable incomes. Consumers increasingly demand lip products free from harmful chemicals and produced through sustainable practices, prompting brands to reformulate products to exclude substances like lead and PFAS, which are under regulatory scrutiny.

For example, Washington State’s Toxic-Free Cosmetics Act encourages brands to align with legal standards while appealing to eco-conscious consumers. At the same time, rising household disposable income fuels demand for personal care and beauty products, enabling consumers to invest in premium, diverse, and personalized lipstick offerings. OECD data indicates a positive trend in real household income per capita in 2024, highlighting increased purchasing power and reinforcing demand, even during economic fluctuations through the “lipstick effect”.

Regulatory frameworks such as the Modernization of Cosmetics Regulation Act (MoCRA) pose operational challenges by requiring facility registration and detailed ingredient disclosure, which can increase compliance costs and slow product launches, particularly for smaller brands.

Meanwhile, the growing interest in refillable and biodegradable packaging offers new opportunities for brands to meet sustainability goals and reduce plastic waste. Companies investing in eco-friendly formulations and innovative packaging solutions can gain a competitive edge, driving market growth, technological advancement, and expansion in an increasingly conscious and digitally engaged consumer base.

Growth Drivers:

How is the demand for sustainable and clean beauty products influencing lipstick formulations?

Consumers are increasingly seeking lip products that are free from harmful chemicals and are produced using sustainable practices. This shift is prompting brands to reformulate products to exclude ingredients like lead and per- and polyfluoroalkyl substances (PFAS), which are under scrutiny for their potential health risks. For instance, Washington State's Toxic-Free Cosmetics Act aims to regulate lead levels in cosmetics to ensure consumer safety. Brands aligning with these regulations not only comply with legal standards but also cater to the growing segment of eco-conscious consumers.

How Does Rising Household Disposable Income Influence Lipstick Demand?

Rising household disposable income is a key driver of the lipstick market growth, as it directly influences consumers’ ability to spend on non-essential items like cosmetics. When disposable income increases, individuals are more likely to invest in personal care and beauty products, including lipsticks, to enhance their appearance and express personal style.

According to OECD data, real household income per capita in OECD countries showed a positive growth trend in 2024, reflecting increased consumer spending capacity. This trend, combined with the “lipstick effect” where consumers continue to purchase affordable luxuries even during economic downturns, highlights how fluctuations in disposable income significantly shape demand in the market.

Growth Inhibitors:

How are stringent regulatory requirements impacting lipstick product development?

The implementation of the Modernization of Cosmetics Regulation Act (MoCRA) has emerged as a significant restraint for the lipstick market. As of July 2024, the U.S. Food and Drug Administration (FDA) mandates that all cosmetic product facilities register with the agency, and each marketed cosmetic product must be listed with detailed ingredient information.

Compliance with these requirements necessitates considerable adjustments in product development and manufacturing processes, leading to increased operational costs and longer time-to-market. By July2025, there were 12,049 unique, active facility registrations and 784,270 unique, active product listings under MoCRA. These regulatory burdens can slow product launches, particularly affecting smaller brands, thereby acting as a key market restraint.

How is the rise of refillable and eco-friendly lipstick packaging creating new market opportunities?

As consumers become more environmentally conscious, there is a growing demand for refillable and sustainable lipstick packaging. Brands are responding by introducing refillable lipstick cases and biodegradable packaging options, aligning with sustainability goals and reducing plastic waste. This trend presents an opportunity for investment in innovative packaging solutions that meet consumer preferences for eco-friendly products. Companies that invest in sustainable packaging technologies are likely to gain a competitive edge in the evolving beauty market.

How is the lipstick market is segmented in this report, and what are the key insights from segmentation analysis?

By Type Insights

How is the Lipstick Market Shaped by Traditional, Liquid, Lip Crayon, Lip Stain and Lip Gloss?

Based on product type, the market is segmented into traditional, liquid, lip crayon, lip stain and lip gloss.

Traditional lipsticks remain popular due to their ease of application, portability, and classic appeal. Stick lipsticks provide a solid, precise application, pencils allow for defined lip lines, and palettes offer multiple shades in a single product, catering to versatile looks. These products continue to attract consumers who value familiarity and convenience, making them a stable segment in the market.

Liquid lipsticks are gaining traction for their long-lasting wear and high pigment intensity. Matte finishes dominate for durability, glossy options provide shine, satin balances colour and sheen, and metallic finishes appeal to trend-conscious consumers. This segment is growing rapidly, driven by social media influence and demand for vibrant, photogenic colours.

Lip crayons combine the ease of pencils with the coverage of stick lipsticks, offering portable, creamy application. They are popular among younger consumers and those seeking quick, everyday makeup solutions. This segment benefits from the increasing demand for multitasking, convenient products.

Lip stains are valued for their lightweight feel and long-lasting colour that adheres directly to the lips. Consumers favour lip stains for a natural, “no-touch-up-needed” look, particularly in professional or active lifestyles. Their growth reflects a trend toward minimal, long-lasting makeup solutions.

Lip glosses remain essential for adding shine, hydration, and a plumping effect. They are often layered over other lipstick types or worn alone for a casual look. The segment appeals to younger demographics and those preferring a subtle, fresh appearance.

By Formulation Insights

Which formulation is emerging as the most flexible in the lipstick market?

Based on formulation, the market is segmented into Standard, Organic, Cruelty Free, Vegan, with SPF, Hydrating, Long-Wearing and Transfer Resistant.

Standard lipsticks remain a staple in the market, offering a wide variety of shades and finishes at affordable prices. They appeal to mass-market consumers who prioritize accessibility and cost-effectiveness over specialized claims. Despite the rise of clean beauty, this segment continues to dominate in terms of volume sales.

Organic lipsticks are growing in demand as consumers increasingly prefer products free from synthetic chemicals and pesticides. This trend is supported by regulatory encouragement for safer cosmetic ingredients and growing awareness of environmental sustainability. Organic formulations align with a shift toward “clean beauty” lifestyles.

Cruelty-free lipsticks those not tested on animals are gaining traction, driven by consumer activism and stricter regulatory frameworks in regions like the EU, which bans animal testing in cosmetics. This segment benefits from strong consumer sentiment, particularly among Millennials and Gen Z.

Vegan lipsticks, formulated without any animal-derived ingredients, are experiencing robust growth. The demand reflects ethical consumerism, with buyers seeking inclusivity and sustainability. This trend mirrors broader growth in the vegan lifestyle, supported by rising global advocacy for plant-based alternatives.

SPF-infused lipsticks are becoming more popular as consumers seek products that combine beauty with protection. These formulations not only provide colour and style but also help shield the lips from sun damage, making them a practical choice for daily wear. By blending cosmetic appeal with functional care, SPF lipsticks cater to the growing preference for multi-purpose products that support both appearance and long-term wellness.

Hydrating lipsticks infused with moisturizing agents like shea butter, hyaluronic acid, or natural oils appeal to consumers combating dryness. Demand for this formulation is high in colder climates and among consumers seeking comfort alongside colour payoff.

Long-wear lipsticks are popular for their ability to last throughout the day without frequent reapplication. They are especially favoured for professional and social occasions, offering convenience and durability. This segment overlaps with busy urban lifestyles.

Transfer resistant lipsticks, designed to stay intact even during eating or drinking, have surged in popularity post-pandemic as mask-wearing accelerated demand for smudge-proof solutions. This innovation continues to gain favour as consumers prioritize performance and practicality.

By Coverage Insights

How is the Lipstick Market Shaped by Coverage Segmentation?

Based on coverage, the market is segmented into Sheer, Medium, Full.

Sheer lipsticks are favoured for their light, natural finish, often chosen by consumers seeking a subtle look suitable for everyday wear. They provide a soft tint with added hydration, appealing particularly to younger demographics and those preferring minimal makeup. This segment reflects the rising popularity of “no-makeup makeup” trends.

Medium coverage lipsticks balance between subtlety and boldness, offering buildable colour suitable for both casual and professional settings. They attract consumers who value versatility, as these products can be worn lightly during the day and layered for stronger evening looks. This adaptability ensures medium coverage remains a steady performer in the market.

Full coverage lipsticks deliver intense pigmentation and bold statements, often chosen for formal, festive, or high-impact occasions. They resonate strongly with consumers who want long-lasting, standout appearances. Their popularity is reinforced by fashion and beauty influencers who highlight bold shades and dramatic looks on social media platforms

By Colour Insights

How Colours are Driving the Lipstick Market?

Based on colours, the market is segmented into classic, warm and trendy colours.

Classic shades like red, pink, and nude remain the backbone of the lipstick market report, driving steady demand due to their universal appeal and timeless popularity. They attract a broad consumer base across age groups and geographies, supporting consistent sales for both mass-market and premium brands. Their versatility for everyday wear, professional settings, and gifting occasions ensures that they continue to be a reliable revenue driver.

Warm shades, including browns, corals, and burgundies, are fueling market growth by catering to evolving consumer preferences for bold yet wearable colors. These shades enhance skin warmth and are often linked to seasonal collections, festivals, and fashion trends, prompting repeat purchases and seasonal promotions. Their appeal to consumers seeking expressive but practical shades strengthens brand differentiation and boosts market share.

Trendy and bold colors, such multi-colour and specialty finishes like metallics and ombre, are expanding the market by attracting younger, fashion-conscious, and experimental consumers. They drive incremental sales by tapping into the growing demand for self-expression, social media driven trends, and limited-edition collections. This segment supports innovation, encourages trial, and positions brands as trendsetters, fueling overall market dynamism.

By Distribution Channel Insights

How are Online and Offline Retail Driving the Lipstick Market?

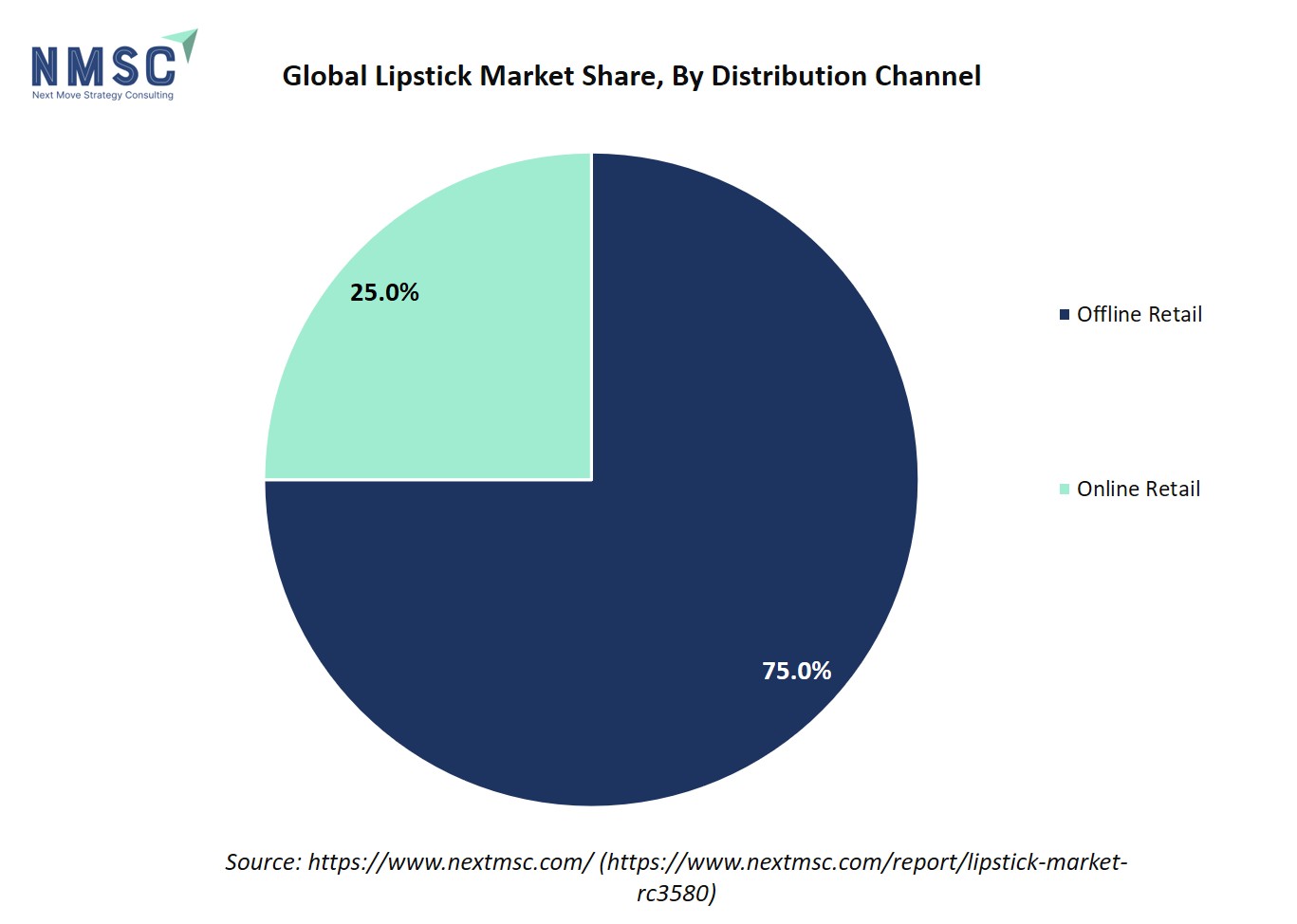

Based on distribution channel, the market is segmented into online retail and offline retail.

Online channels, including e-commerce platforms and brand websites, have become increasingly significant as digital adoption accelerates. They offer consumers convenience, wider product variety, and personalized recommendations. Online retail is especially favoured by younger demographics who rely on reviews, social media, and virtual try-on tools to guide purchases. The growing popularity of direct-to-consumer (D2C) strategies has further strengthened this channel.

Offline retail continues to hold a dominant role, as many consumers prefer in-store experiences to test shades and textures before purchase. Supermarkets and pharmacies offer accessibility and affordability, while specialty and department stores provide premium shopping experiences. Physical retail remains crucial for building brand trust, offering instant product availability, and creating immersive experiences through beauty counters and consultations.

The chart shows the lipstick market share by distribution channel, with Offline Retail leading at 75%, followed by Online Retail at 25%. This distribution highlights that the largest sales occur through offline channels, including specialty stores, department stores, supermarkets, and pharmacies, where consumers can experience products firsthand, test shades, and receive personalized service, driving significant revenue for traditional retail outlets. The substantial share held by online retail indicates strong growth potential fueled by e-commerce platforms, social media influence, and digital marketing strategies, which make it convenient for consumers to explore a wide range of products and trends. Consequently, this varied distribution channel mix supports the broad adoption of lipstick products, underpinned by evolving consumer preferences and increasing digital engagement across markets

Regional Outlook

The market is geographically studied across North America, Europe, Asia Pacific, Latin America and the Middle East & Africa and each region is further studied across countries.

Lipstick Market in North America

In North America, sustainability and eco-conscious purchasing are shaping the lipstick market trends as consumers seek products that align with broader environmental goals. Increasing awareness of plastic waste has pushed brands to adopt recyclable or refillable packaging, a shift consistent with U.S. and Canadian policy efforts to reduce single-use plastics. For example, Canada’s federal government is implementing a ban on harmful single-use plastics to cut plastic pollution. This creates strong momentum for refillable lipstick cases and biodegradable packaging, giving innovative brands a competitive edge.

Lipstick Market in the United States

The U.S. market is poised for steady growth through 2025, reflecting the broader resilience of the cosmetics industry. According to the Personal Care Products Council, the sector continues to adapt to evolving consumer preferences, demonstrating strong innovation and responsiveness. This adaptability allows brands to remain relevant while meeting demand for new formulations, shades, and product experiences. Overall, the market’s economic contribution and projected growth underscore its vitality and the ongoing opportunities for development within the lipstick segment.

Lipstick Market in Canada

Canada’s Cosmetics Regulations and Health Canada guidance emphasize safety, labelling and industry responsibility strengthening consumer trust in domestic and imported brands. Regulatory clarity around ingredient lists and labelling supports growth for products marketed on safety/clean credentials, while government guidance helps smaller manufacturers scale responsibly. Online retail and cross-border shopping mean Canadian demand follows U.S. trends but with a particular sensitivity to safety and bilingual labelling requirements; as a result, mid-to-premium lipsticks with clear ingredient transparency perform well.

Lipstick Market in Europe

According to the European Union, the unified Cosmetics Regulation (EC 1223/2009) fosters a high-trust market by ensuring safety, restricting banned ingredients, and requiring mandatory product information files, which collectively boost consumer confidence. This regulatory framework encourages innovation in sustainable packaging, “clean” formulations, and non-animal testing alternatives, as compliance is essential for market entry across member states.

Lipstick Market in the United Kingdom

According to the UK government’s Product Safety Database report for 2024-2025, cosmetics accounted for 12% of all product safety notifications, making them the third most reported category after electrical appliances and toys. This indicates heightened scrutiny and regulatory attention on cosmetic products, including lipsticks. The prevalence of safety-related notifications underscores the importance of compliance with UK regulations, influencing brands to prioritize product safety and quality. This trend reflects a consumer-driven demand for safer, more reliable cosmetic products in the UK market

Lipstick Market in Germany

Post-Brexit the U.K. has retained rigorous cosmetics safety rules while adding national enforcement mechanisms; guidance from UK authorities supports product notification and compliance. Consumers continue to demand transparency, cruelty-free claims and sustainability; brands that maintain clear product information and fast online fulfilment capture urban and younger shoppers. The U.K.’s strong beauty-retail ecosystem keeps demand for both prestige and mass lipsticks robust, with regulation ensuring comparable safety expectations to the EU.

Lipstick Market in France

French consumers have a strong preference for premium, high-quality cosmetics, including lipsticks. This drives brands to focus on superior formulations, innovative textures, and elegant packaging to meet expectations. The emphasis on quality and luxury encourages continuous product innovation, enhances brand differentiation, and strengthens consumer loyalty, making high-performance and aesthetically appealing lipsticks a key growth segment in the French market.

Lipstick Market in Spain

Spain’s regulator (AEMPS) conducts active market surveillance and enforces cosmetic safety standards, which raises consumer confidence and helps legitimize new ingredient claims. Spanish consumers follow Mediterranean beauty trend nudes, long-wear and sun-protective formulations are popular, while regulatory actions demonstrate enforcement that protects reputable brands. These regulatory controls encourage brands to prioritize microbiological safety and correct labelling, which in turn supports growth in trusted mass-market and premium lipstick segments.

Lipstick Market in Italy

Italy follows EU law but adds national in-market checks and labelling specifics, which supports consumer trust and export readiness for Italian brands. The Ministry of Health and national sanitary processes mean manufacturers and importers must comply with high-quality labelling and safety checks; this reassures buyers and supports demand for both mass and artisanal lipstick ranges. Italian fashion cycles and strong domestic designer brands also push seasonal and limited-edition lipstick sales.

Lipstick Market in Asia Pacific

According to the National Medical Products Administration (NMPA) of China, updates to the Inventory of existing cosmetic ingredients encourage the use of new, safe, and innovative raw materials. For the lipstick market, this regulatory support enables brands to develop advanced formulations with enhanced hydration, long-lasting colour, and added skincare benefits. By facilitating the introduction of novel ingredients, the NMPA helps manufacturers meet evolving consumer preferences for high-performance and multifunctional lipsticks, driving growth in the Asia-Pacific market.

Lipstick Market in China

According to the State Council Information Office of China, consumer spending on cosmetics, including personal care and beauty products, continues to grow steadily, reflecting rising disposable incomes and increased urban consumption. This growing confidence encourages consumers to explore premium and innovative products, including lipsticks. As a result, brands are investing in diverse shades, advanced formulations, and multifunctional lipsticks to meet evolving consumer preferences, driving overall growth in the Chinese lipstick market.

Lipstick Market in Japan

A significant driver contributing to the growth of Japan's lipstick market between 2024 and 2025 is the expansion of e-commerce, particularly through omnichannel shopping strategies. According to a report by Japan Up Close, the swift expansion of e-commerce in Japan has given rise to new consumer patterns, extending beyond mere transactions to multifaceted avenues that cater to diverse consumer preferences.

Lipstick Market in India

India’s Cosmetics Rules, enforced by the Central Drugs Standard Control Organization (CDSCO), mandate registration for imports and set safety standards for domestic production, enhancing product safety and traceability. Rapid urbanization, growing disposable incomes, and the surge in e-commerce are driving demand for both mass-market and premium lipsticks. Social media trends and influencer marketing are further accelerating adoption among younger consumers.

Lipstick Market in South Korea

South Korea’s Ministry of Food and Drug Safety (MFDS) provides robust regulatory oversight, which has supported the global rise of K-beauty. Strict safety standards for functional cosmetics, coupled with proactive enforcement updates, enable rapid innovation in lip products. Trend-conscious consumers readily adopt novel textures, finishes, and formulations, including lip tints and cushion lipsticks. The combination of strong domestic regulation and agile product development fuels both local demand and international exports, driving growth and positioning the South Korean lipstick market as a hub for innovative, high-quality products.

Lipstick Market in Australia

In Australia, cosmetics are regulated through the Australian Industrial Chemicals Introduction Scheme (AICIS) and, where relevant, the Therapeutic Goods Administration (TGA), providing clear rules that ensure consumer safety. Australian consumers prioritize sun protection and natural ingredients, driving demand for hydrating and SPF-infused lipsticks. Strong online retail adoption alongside traditional beauty stores supports both mass-market and premium sales. Regulatory clarity around ingredients and advertising allows trusted brands to expand domestically and export across the APAC region, fostering growth in the Australian lipstick market.

Lipstick Market in Latin America

Latin America is emerging as a key growth region for lipsticks, driven by a rising middle class and a strong cultural emphasis on beauty. Active regulatory oversight, such as Brazil’s ANVISA, ensures product safety through pre-market notification and registration, encouraging global brand participation. Rapid urban e-commerce growth is enabling consumers to trade up to performance and premium lipsticks. Local brands that comply with regulatory standards can scale across the region, while ongoing efforts toward regulatory harmonization within Mercosur and the broader Americas further support the lipstick market expansion.

Lipstick Market in the Middle East & Africa

The Middle East is experiencing a significant shift towards ethical consumerism, with a growing preference for vegan and cruelty-free beauty products. This trend is particularly evident in the cosmetics sector, including lipsticks, where consumers are increasingly opting for products that align with their ethical beliefs. The rise in demand for vegan cosmetics is driven by factors such as increased awareness of animal welfare, environmental concerns, and a desire for products that reflect personal values. This cultural shift is fostering a more sustainable and ethical beauty industry in the region, influencing both consumer choices and market offerings.

Competitive Landscape

Who are the Leading Companies in the Lipstick Industry and How are they Competing?

Global lipstick competition is shaped by a mix of legacy multinationals and emerging digital-first brands. Established players like Revlon, Shiseido, Avon, and Mary Kay dominate through their vast distribution networks, global brand recognition, and long-standing customer bases. These companies leverage economies of scale, strong R&D capabilities, and trusted reputations to maintain relevance in both mass-market and premium categories. Their ability to adapt to shifting consumer trends, such as clean beauty formulations and sustainable packaging helps them secure consistent market share while appealing to evolving consumer preferences.

On the other hand, prestige and digital-native challengers such as Sephora, Charlotte Tilbury, Pat McGrath, Huda Beauty, Anastasia Beverly Hills, Glossier, ColourPop, KIKO Milano, Inglot, Barry M, and Etude compete by focusing on innovation, influencer-driven marketing, and rapid product rollouts. These brands thrive on creating buzz through limited-edition collections, collaborations with celebrities or creators, and social media campaigns that resonate strongly with younger audiences. Their agility in responding to trends, coupled with direct-to-consumer strategies, allows them to carve out niche loyalty while putting pressure on legacy giants to stay competitive.

Market Dominated by Lipstick Giants and Specialists

Large corporate groups control global logistics, brand visibility, and extensive product portfolios, while specialists and indie digital-native brands capture younger, trend-driven consumers through influencer-led launches and rapid product iteration. Regional players such as KIKO Milano, Etude, Inglot, and Barry M leverage strong local distribution and cultural relevance to secure loyal customer bases, while prestige houses focus on exclusivity and higher margins. At the same time, direct-to-consumer brands compete through affordability and viral marketing strategies, creating a multi-speed competitive landscape where scale, luxury positioning, and trend responsiveness each define how companies strengthen their foothold across geographies and niches.

Innovation and Adaptability Drive Market Success

Innovation is a critical differentiator in the lipstick market, as consumers demand cleaner formulations, sustainable packaging, and trend-driven shades. Revlon launched its ColorStay Limitless Matte Liquid Lipstick in 2024, offering up to 24-hour wear, a non-tightening formula, and a patented lip-hugging applicator, while incorporating vegan ingredients like triple hyaluronic acid and upcycled cranberry extract for added lip care.

Similarly, ColourPop introduced its So Juicy Plumping Gloss Balm and matching Plumping Lip Liners in early 2024, combining gloss, balm, and plumping benefits with vegan formulations enriched with hyaluronic acid and peptides. These launches demonstrate how brands are responding to consumer demand for long-lasting, multifunctional, and clean formulations, while differentiating themselves through texture, performance, and ingredient innovation to capture attention in a crowded market.

Market Players to Opt for Merger & Acquisition Strategies to Expand their Presence

Mergers and acquisitions are playing a key role in shaping competition across the lipstick landscape. Shiseido has been actively restructuring its brand portfolio to strengthen its position in the global cosmetics and lipstick market. In May 2025, the company announced a simplified absorption-type merger with its subsidiary, Shiseido Japan, which became effective on July 1, 2025. This strategic move is part of Shiseido's broader "Action Plan 2025-2026," designed to streamline operations, reinforce key brand foundations, and rebuild a more profitable structure.

For the lipstick segment specifically, this restructuring allows Shiseido to focus resources on innovation, product development, and marketing of high-demand lipstick lines, ensuring faster response to consumer trends such as long-lasting formulations, eco-friendly packaging, and vibrant color offerings. By consolidating operations, Shiseido aims to enhance its competitiveness against both legacy multinational brands and emerging digital-first challengers, securing greater market share in a crowded and fast-evolving sector.

List of Key Lipstick Companies

-

MARY KAY

-

AVON

-

INGLOT

-

SHISEIDO

-

KIKO MILANO

-

CHARLOTTE TILBURY UK

-

ANASTASIAA BEVERLY HILLS

-

GLOSSIER

-

SEPHORA

-

ETUDE BEAUTY

-

PAT McGRATH LIPSTICK

-

REVLON .CO

-

HUDA BEAUTY

What are the Latest Key Industry Developments?

-

September 2025 - Revlon's Super Lustrous Glass Shine Balm was honoured as the Best Sheer Lipstick in Allure's 2025 Best of Beauty Awards. The award underscores the product's exceptional performance, comfort, and inclusivity, solidifying Revlon's position in the competitive lipstick market.

-

June 2025 – Mary Kay was recognized as the leading direct-selling brand of skin care and color cosmetics globally for three consecutive years. This achievement underscores the company's strong market presence and consumer trust in its product offerings.

What are the Key Factors Influencing Investment Analysis & Opportunities in Lipstick Market?

The lipstick market is attracting considerable investment interest due to its dynamic growth and evolving consumer preferences. Funding trends indicate increasing capital inflows into brands that emphasize innovation, sustainability, and digital engagement, reflecting investor confidence in products that align with modern beauty standards. Valuations are influenced by brand strength, product differentiation, and market positioning, with premium and niche segments often commanding higher multiples.

Investment hotspots are emerging in regions where beauty consumption is expanding rapidly, driven by rising disposable incomes and social media influence. Companies introducing eco-friendly formulations, personalized offerings, or technologically enhanced products are particularly appealing, creating opportunities for both strategic partnerships and venture funding. Overall, the market presents attractive prospects for investors seeking exposure to a sector combining creativity, consumer engagement, and sustainable growth.

Key Benefits for Stakeholders:

Next Move Strategy Consulting (NMSC) presents a comprehensive analysis of the global lipstick market, covering historical trends from 2020 through 2024 and offering detailed forecasts through 2030. Our study examines the market at global, regional, and country levels, providing quantitative projections and insights into key growth drivers, challenges, and investment opportunities across all major lipstick segments.

The lipstick industry generates value for a wide range of stakeholders. Investors benefit from strong growth potential and high returns driven by evolving consumer trends and premium product segments. Policymakers gain from increased tax revenues, job creation, and the promotion of local manufacturing and export opportunities.

Customers enjoy a diverse array of products that cater to personal style, ethical preferences, and wellness considerations, including eco-friendly and innovative formulations. By addressing the needs of these groups simultaneously, the industry fosters economic growth, social engagement, and consumer satisfaction, creating a mutually beneficial ecosystem.

Report Scope:

|

Parameters |

Details |

|

Market Size in 2025 |

USD 15.50 Billion |

|

Revenue Forecast in 2030 |

USD 20.93 Billion |

|

Growth Rate |

CAGR of 6.2% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

28 |

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 analyst-working hours) after purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

|

Approach |

In-depth primary and secondary research; proprietary databases; rigorous quality control and validation measures. |

|

Analytical Tools |

Porter's Five Forces, SWOT, value chain, and Harvey ball analysis to assess competitive intensity, stakeholder roles, and relative impact of key factors. |

Key Market Segments

By Product Type

-

Traditional Lipstick

-

Stick

-

Pencil

-

Palette

-

-

Liquid Lipstick

-

Matte

-

Glossy

-

Satin

-

Metallic

-

-

Lip Crayon

-

Lip Stain

-

Lip Gloss

By Formulation

-

Standard

-

Organic

-

Cruelty-Free

-

Vegan

-

With SPF

-

Hydrating

-

Long-Wearing

-

Transfer-Resistant

-

Others

By Coverage

-

Sheer

-

Medium

-

Full

By Colour

-

Classic

-

Red

-

Pink

-

Nude

-

Others

-

-

Warm

-

Orange

-

Brown

-

Maroon

-

Others

-

-

Trendy

-

Multi-Colour

-

Specialty Finishes

-

-

Others

By Age Group

-

Under 20

-

20 to 30

-

31 to 50

-

Over 50

By Price Tier

-

Mass Market

-

Premium

-

Luxury

By Distribution Channel

-

Online Retail

-

E-commerce Platforms

-

Brand Websites

-

-

Offline Retail

-

Supermarkets

-

Specialty Stores

-

Department Stores

-

Pharmacies

-

Geographical Breakdown

-

North America: U.S., Canada, and Mexico.

-

Europe: U.K., Germany, France, Italy, Spain, Sweden, Denmark, Finland, Netherlands, and rest of Europe.

-

Asia Pacific: China, India, Japan, South Korea, Taiwan, Indonesia, Vietnam, Australia, Philippines, and rest of APAC.

-

Middle East & Africa (MENA): Saudi Arabia, UAE, Egypt, Israel, Turkey, Nigeria, South Africa, and rest of MENA.

-

Latin America: Brazil, Argentina, Chile, Colombia, and rest of LATAM.

Conclusion & Recommendations

The future of the lipstick market depends on its ability to blend innovation, sustainability, and consumer personalization while capturing rising global demand for diverse and ethical beauty products. Strategic moves such as expanding into emerging regions, adopting eco-friendly formulations, and leveraging digital and AI-driven customization will shape the next phase of market leadership.

For investors, the lipstick industry offers attractive growth potential and brand-value appreciation, while policymakers can support the industry through regulations that encourage safety, sustainability, and local manufacturing. Executives, meanwhile, must prioritize product innovation, strategic partnerships, and digital engagement to maintain competitiveness in an evolving and increasingly discerning market.

Speak to Our Analyst

Speak to Our Analyst