Military Ethernet Switches Market by Product Type (MIL-STD Package Solutions and Board-Level Ruggedized Configurations), by Port Speed (100 MBPS, 1 GBPS, 2.5 GBPS, 5 GBPS, 10 GBPS, 25 GBPS, and 50 GBPS), by Network Management (Managed and Unmanaged), by Application (Unmanned Vehicles, Battlefield Communication C4isr, Avionic & Shipboard System, Data Acquisition & Transmission, Rugged Networks, Combat Vehicles, and Others) – Global Opportunity Analysis and Industry Forecast, 2025–2030

Industry: Aerospace & Defense | Publish Date: 11-Sep-2025 | No of Pages: 287 | No. of Tables: 202 | No. of Figures: 175 | Format: PDF | Report Code : AD409

Military Ethernet Switches Market Overview

The global Military Ethernet Switches Market size was valued at USD 358.7 million in 2024 and is predicted to reach USD 555.6 million by 2030, with a CAGR of 7.5% from 2025 to 2030.

The factors such as increasing military expenditure, rising government initiatives along with growing reliance on secure and efficient communication networks accelerates the market growth at global level. However, high costs associated with the development and deployment of military ethernet switches restrain the overall market growth. On the contrary, the integration of artificial intelligence into ethernet switches offers lucrative opportunity growth for market growth by improving efficiency and user experience.

Moreover, the key players such as Cisco Systems, Amphenol Corporation, Curtiss-Wrights and others are taking key initiatives including product launches to maintain their competitive position in the market. These initiatives are fueling the growth of the market by ensuring safety, reliability, and compliance with industry standards. As defense system across various nations is rapidly growing, the demand for military ethernet switches also increases.

Rise in Military Expenditure Globally is Driving the Military Ethernet Switches Market

The growing government investment in advanced technologies including advanced weaponry and communication systems in the military and defense sector boost the market growth. This trend includes a rise in interconnected platforms such as drones, fighter jets, and armored vehicles, which require robust and secure data networks. Thus, there is an increased demand for advanced military ethernet switches that has the capacity to handle high levels of data traffic while also functioning in extreme environments.

Recent data from the Stockholm International Peace Research Institute states that the global military expenditure has reached USD 2.443 trillion by 2023, experiencing a 6.8% incline in 2022. With the expansion of the defense budget, the demand for advanced secure and reliable networks within military systems is expected to surge.

The Rising Arms Export Globally is Significantly Boosting the Growth of the Market

The worldwide rising arms export is another factor driving the military ethernet switches market. As countries increase their arms exports and invest in modern military technology, there is a growing demand for advanced communication systems that ensure secure and efficient data transmission. Military ethernet switches are indispensable for these systems, forming a solid network backbone for several defense applications.

According to the Chicago Policy Review, the U.S. accounts for over 40% of global weapons exports, it has since made up somewhere between USD 100 billion and USD 200 billion per annum from arms sales, and this number is increasing every year without exception. This surge in arms exports around the world will positively stimulate the demand for advanced Ethernet switches, thereby boosting military operational capabilities and technological improvement.

The Growing Reliance on Secure and Efficient Communication Networks Propels the Market Growth

The military ethernet switches market report will benefit from building secure reliable communication networks. Increasingly, modern military operations depend upon reliable data connectivity. According to arXiv, a curated research-sharing platform, the global defense communication system market is expected to grow from USD 46.7 billion in 2023 to USD 120.62 billion by 2033. Enhanced communication networks facilitate real-time information sharing, communication, and decision-making from different parts of a compound, ambient environment.

Military ethernet switch designs deliver the durability, security, and performance required to support these critical activities by ensuring uninterrupted data flow and integrity of networks even in heavily austere environments. This rising military ethernet switches market demand for advanced communication infrastructure will lead to the increased adoption of military-grade ethernet switches, in turn, largely driving growth and innovation for secure networking solutions.

High Costs Associated with the Development and Deployment of Military Ethernet Switches Restrains the Market Growth

The high costs associated with developing and deploying military ethernet switches hinder market growth by constraining budgets for procurement and modernization of communication infrastructure. These specialized devices necessitate extensive research and development to meet stringent military standards for durability, security, and performance, resulting in higher production expenses.

Furthermore, the costs of rigorous testing, certification, and integration with existing systems further increase the financial burden. Thus, military agencies and organizations generally slow down the introduction and expansion of military ethernet switches by offering sub superior needs in place of enhancing communication networks.

Integration of Artificial Intelligence and the Internet of Things in Military Applications Creates Opportunity

Rapid integration of advanced technologies like Artificial Intelligence and the Internet of Things in military applications will propel growth opportunities for the market over the forecast period. Other innovations in AI and ML concerning autonomous systems, threat detection, and decision-making processes push up the need for higher speed, lower-latency networking solutions.

IoT integration will broaden the scope by connecting numerous sensors and devices, demanding advanced ethernet switches to manage the increased data load and ensure interoperability. These technological advancements will drive the demand for sophisticated military ethernet switches capable of supporting complex, data-intensive operations, thus enhancing future growth opportunities.

North America Dominates the Military Ethernet Switches Market

The region's developed defense sector, along with ongoing modernization efforts, has heightened the emphasis on advanced communication technologies within military infrastructure, driving the market growth. In 2023, North America's military expenditure reached USD 943 billion, a 2.4% increase compared to the previous year and an 11% increase compared to 2014.

Further, the evolving shape of security threats requires the capability for secure and trusted transmission of data in support of the mission critical operations. Military ethernet switches capable of ruggedization and enhanced security features are critical for ensuring smooth connectivity and interoperability among various military systems.

Also, the advanced defense systems in the region heavily rely on interconnected networks to facilitate communication, data exchange, and control operations that propels the demand for military ethernet switch. Military ethernet switches play a pivotal role in supporting the network-centric defense system by ensuring seamless connectivity, interoperability, and secure data transmission across diverse platforms and environments.

According to the latest report of U.S. Department of State report, in 2023 U.S. exported around USD 62.25 billion in arms export that represents an increase of around 55.9% from USD 51.9 billion in 2022. The escalating volume of the regions arms exports is driving the demand for military ethernet switches, as these essential networking components are indispensable to the functioning of the exported advanced defense systems.

Asia-Pacific is Expected to Show Steady Growth in the Military Ethernet Switches Market

The strategic expansion in arms exports by countries such as China and Japan, driven by their growing defense capabilities and international partnerships, is fueling the demand for advanced communication systems, including military ethernet switches. With an increasing focus on global military cooperation and defense equipment exports, these countries aim to enhance their influence in the international defense market.

This emphasis on arms exports creates a heightened demand for military ethernet switches, essential components of modern communication networks in defense systems. China, in particular, is investing significantly in its defense sector, with military arms and equipment exports reaching approximately USD 2,017 million in 2022. This substantial contribution to the global arms trade, underscores the strategic aims of regional countries for improving defenses, creating international networks, and therefore demanding the need for military Ethernet switches.

In addition, increased spending on defense by China, Japan, and India is expected to shape the further growth of the market in the region. Military Ethernet switches provide the invaluable service of transmitting data throughout military networks, which enables seamless communication of various units and personnel.

According to the Stockholm International Peace Research Institute (SIPRI), Japan adopted a military budget of USD 50.2 billion in 2023, representing an 11 percent increase from that of 2022 and a 31 percent increase compared to the 2014 budget trend; moreover, the country plans USD 310 billion on developing military capabilities by 2027, which will result in an average annual military budget of USD 62 billion over that exact period. These substantial investments highlight the region's commitment in boosting defense capabilities and modernizing armed forces.

Competitive Landscape

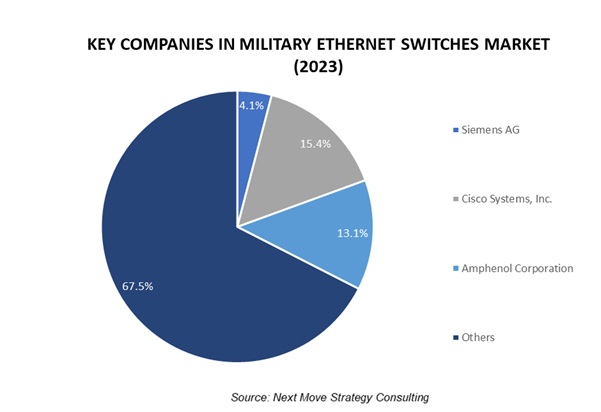

The military ethernet switches industry comprises various key players, such as Siemens AG, Cisco Systems, Inc., Microsemi, Curtiss-Wrights, Extreme Networks Inc, Amphenol Corporation, Moog Inc., Aeronix, Inc, Ontime Networks, Llc, Enercon Technologies (Techaya), MilDef Group AB, AMETEK, Inc. (Abaco Systems), HMS Networks (Red Lion Controls, Inc), North Atlantic Industries, Diamond Systems and others.

These companies are adopting various strategies including product launches and collaborations across various regions to maintain their dominance in military ethernet switches industry. By continuously innovating and launching new offerings, they aim to meet the evolving demands of customers and also enables them to capture new opportunities and expand their military ethernet switches market share.

|

DATE |

COMPANY |

RECENT DEVELOPMENTS |

|

|

April 2024 |

Abaco Systems |

Abaco Systems collaborated with TTTech Aerospace to deliver Time-Sensitive Networking (TSN) solutions. This partnership aimed to enhance the performance and reliability of aerospace and defense communications by integrating TTTech’s TSN technology with Abaco’s rugged computing platforms. |

|

|

February 2024 |

MilDef Group AB |

MilDef collaborated with BAE Systems Bofors by signing a ten-year framework agreement for the supply of ruggedized hardware, including computers, network equipment, and displays, to support the Archer artillery system. The agreement signifies a deeper collaboration, with an initial order worth USD 6.58 million placed in early 2023 |

|

|

January 2024 |

Extreme Networks |

Extreme Networks launched Wi-Fi 7-capable access point (AP5020) and a cloud-managed 4000 Switch Series that prioritize ease of deployment, cloud-based management, and built-in security through Extreme's Universal ZTNA. The AP5020 features a dedicated 2x2 security radio that can be paired with Extreme AirDefense for wireless intrusion prevention. |

|

|

October 2023 |

Cisco and Custiss-Wright |

Cisco partnered with Curtiss-Wright to launch a new OpenVPX network switch tailored for rugged military and aerospace environments. Built upon the VITA 65 (OpenVPX) standard, the switch offered advanced networking capabilities while meeting stringent requirements for resilience against harsh conditions such as shock, vibration, and extreme temperatures. |

|

|

December 2023 |

HMS Network |

HMS Networks acquired Red Lion Controls, significantly expanding its presence in North America. This acquisition aims to enhance HMS Networks' product portfolio and market reach in industrial automation and communication solutions. |

|

|

March 2023 |

Amphenol Corporation |

Amphenol Corporation partnered with Apollo Aerospace to distribute Amphenol's products, including connectors and other interconnect solutions, to its customers in the aerospace and defense industries. |

|

|

September 2022 |

North Atlantic Industries (NAI) |

North Atlantic Industries (NAI) introduced the NIU3E, a rugged, SWaP-optimized nano interface unit for Mil-Aero applications. It features processing, ethernet switching, and multifunction I/O, including MIL-STD-1553, ARINC 429/575, CAN bus, and programmable Discrete I/O. The NIU3E offers advanced processing and reliability for critical applications across industries. |

|

Military Ethernet Switches Market Key Segments

By Product Type

-

MIL-STD Packaged Solutions

-

Board-Level Ruggedized Configurations

By Port Speed

-

100 MBPS

-

1 GBPS

-

2.5 GBPS

-

5 GBPS

-

10 GBPS

-

25 GBPS

-

50 GBPS

By Network Management

-

Managed

-

Unmanaged

By Application

-

Unmanned Vehicles

-

Battlefield Communication C4isr

-

Avionic & Shipboard System

-

Data Acquisition & Transmission

-

Rugged Networks

-

Combat Vehicles

-

Others

Key Players

-

Siemens AG

-

Cisco Systems, Inc.

-

Microsemi

-

Curtiss-Wrights

-

Extreme Networks Inc.

-

Amphenol Corporation

-

Moog Inc.

-

Aeronix, Inc.

-

Ontime Networks, LLC

-

Enercon Technologies (Techaya)

-

MilDef Group AB

-

AMETEK, Inc. (Abaco Systems)

-

HMS Networks (Red Lion Controls, Inc)

-

North Atlantic Industries

-

Diamond Systems

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2024 |

USD 358.7 Million |

|

Revenue Forecast in 2030 |

USD 555.6 Million |

|

Growth Rate |

CAGR of 7.5% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2024–2030 |

|

Market Size Estimation |

Million (USD) |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst