Russia Warehouse Robotics Market by Types (Automated Guided Vehicles, Autonomous Mobile Robots, Articulated Robots, Collaborative Robots (Cobot), Scara Robots and Cylindrical Robot, and Others), by Offerings (Hardware, Software, and Services), by Payload Capacity (≤ 100 KG, 101-200 KG, and Others), by Application (Palletizing and depalletizing, Sorting and Packaging, and Others), and by End User (E-commerce, Automotive, and Others) – Opportunity Analysis and Industry Forecast, 2025–2030

Industry: Semiconductor & Electronics | Publish Date: 29-Aug-2025 | No of Pages: 202 | No. of Tables: 162 | No. of Figures: 119 | Format: PDF | Report Code : SE3165

Russia Warehouse Robotics Market Overview

The Russia Warehouse Robotics Market size was valued at USD 120.0 million in 2024, and is predicted to reach USD 250.8 million by 2030, at a CAGR of 12.0% from 2025 to 2030. In terms of volume, the market size was 3.63 thousand units in 2024 and is projected to reach 8.09 thousand units by 2030, with a CAGR of 13.0% from 2025 to 2030.

Rising investments in the semiconductor industry of Russia is likely to have an important impact on the adoption of warehouse robotics in the country. However, the current geopolitical tensions and global sanctions in Russia, restrains the market growth. On the contrary, introduction of artificial intelligence in the smart warehouse technology creates future options for the market.

Government-led Industrial Modernization Initiatives Accelerate Robotics Adoption in Russian Warehousing

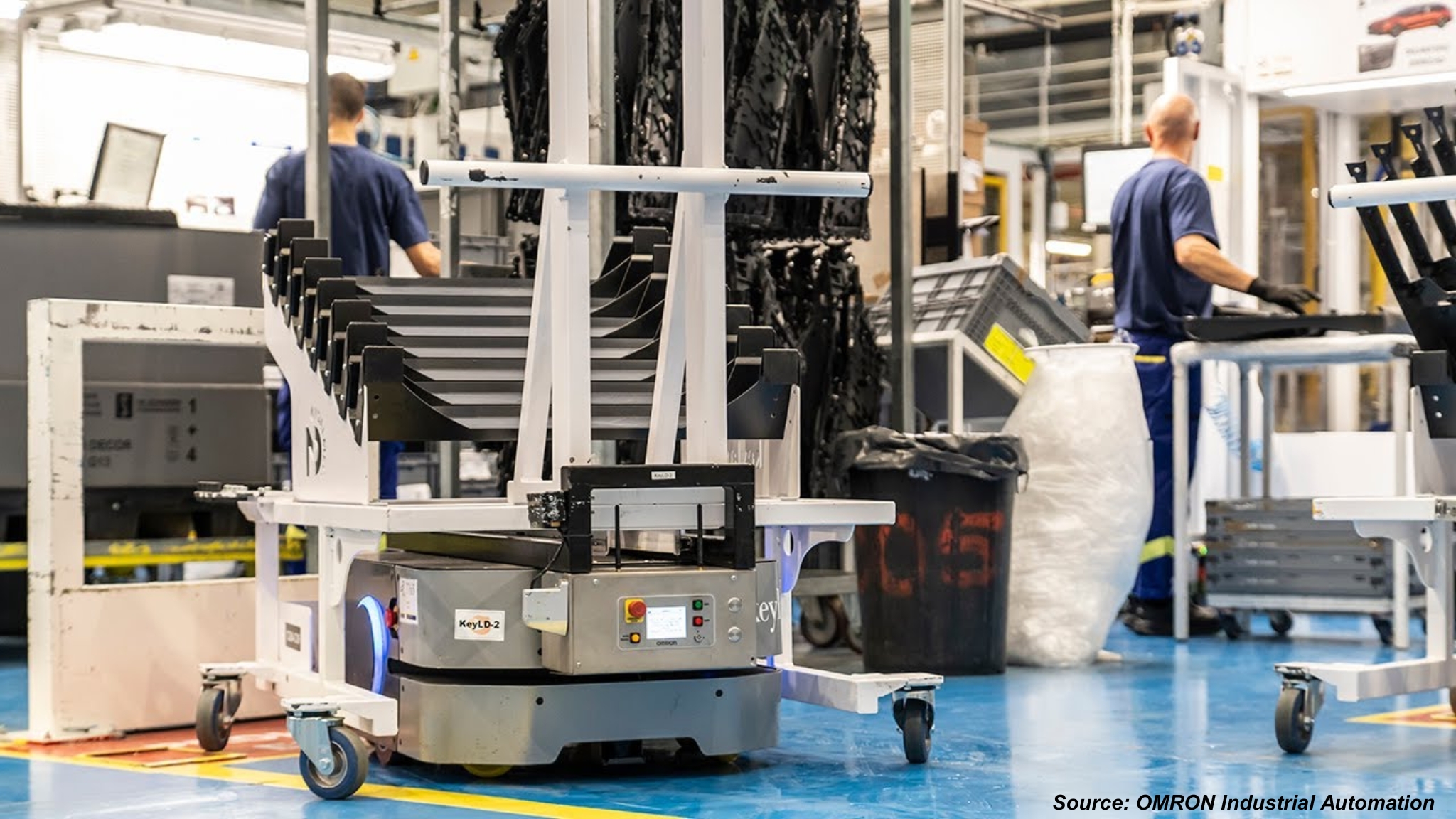

Russia’s push toward industrial modernization and technological sovereignty is fueling the adoption of robotics in warehousing. Policy emphasis on reducing dependency on imported systems has encouraged the integration of domestically developed automation technologies. Government-backed programs supporting digital transformation across logistics and manufacturing are also incentivizing companies to adopt robotics as part of broader Industry 4.0 strategies.

Warehousing facilities, especially those tied to strategic sectors such as manufacturing, automotive, and logistics, are increasingly investing in autonomous systems to ensure efficiency, precision, and resilience against labor shortages. This policy-driven ecosystem is creating a favorable environment for warehouse robotics growth, while also strengthening Russia’s position in global supply chain competitiveness.

Rising Pressure from E-commerce Logistics Demand Drives Rapid Robotics Deployment

The surge in Russia’s e-commerce market, driven by changing consumer behavior and increasing digital penetration, is reshaping warehouse requirements. Logistics operators are under mounting pressure to meet faster delivery timelines, manage high seasonal demand, and process complex order flows. Warehouse robotics—including autonomous mobile robots (AMRs), robotic picking systems, and AI-based inventory management solutions—are being deployed to meet these demands with greater accuracy and speed.

The strong shift toward omni-channel fulfillment has also intensified the role of robotics in bridging online and offline inventory management. By reducing reliance on manual labor and enabling scalable operations, robotics solutions are becoming indispensable for retailers and logistics providers aiming to stay competitive in Russia’s fast-growing digital economy.

Geopolitical Trade Restrictions and Technology Access Limitations Slow Market Expansion

One of the key challenges in the Russia warehouse robotics market is restricted access to advanced robotics technologies and components due to international trade sanctions and export controls. Critical hardware such as high-performance chips, AI processors, and specialized sensors often face sourcing difficulties, leading to delays in system deployment and increased procurement costs.

These constraints are particularly limiting for small- and medium-sized logistics providers that lack the resources to absorb high costs or secure alternative supply channels. The resulting technological gap hinders broad-based adoption, creating a divide between large enterprises that can afford customized solutions and smaller players struggling to modernize operations.

Ai-enabled Robotics and Advanced Analytics Create Next-gen Smart Warehouse Ecosystems in Russia

The growing integration of artificial intelligence, machine learning, and predictive analytics into robotics systems is opening new growth opportunities for warehouse automation in Russia. AI-driven robotics can optimize picking accuracy, predict inventory movements, and adapt dynamically to fluctuations in order volumes—capabilities that are increasingly valuable for e-commerce and logistics operators.

By combining robotics with advanced data analytics, warehouses are transitioning into smart ecosystems capable of self-learning and autonomous decision-making. This shift not only enhances operational efficiency but also provides businesses with real-time visibility and control over supply chain processes, making Russia a strong contender in the global smart warehouse transformation.

Competitive Landscape

The Russia warehouse robotics market comprises of various market players such as Dematic GmbH, Geek+ Technology Co., Ltd., COMITAS, Valday Robots, Ronavi Robotics, RoboCV, Aripix Robotics, Robotech, Unique Robotics, AVTOMAKON, Promobot, YaCu Robotics and others. These players are taking various initiatives to remain dominant in the Russia warehouse robotics market.

Russia Warehouse Robotics Market Key Segments

By Types

-

Automated Guided Vehicles (AGVs)

-

Laser Guidance

-

Magnetic Guidance

-

Optical Tape Guidance

-

Vision Guidance

-

Others

-

-

Autonomous Mobile Robots (AMRs)

-

Tow Vehicle

-

Tug Vehicle

-

Unit Load Vehicle

-

Pallet Truck

-

Forklift Vehicle

-

Other Type

-

-

Articulated Robots

-

Collaborative Robots (Cobot)

-

Scara Robots and Cylindrical Robot

-

Others

By Offerings

-

Hardware

-

Software

-

Warehouse Management System (WMS)

-

Warehouse Execution System (WES)

-

Warehouse Control System (WCS)

-

-

Services

By Payload Capacity

-

≤ 100 KG

-

101-200 KG

-

201-500 KG

-

501-1000 KG

-

1001-2000 KG

-

2001-5000KG

By Application

-

Palletizing and depalletizing

-

Sorting and Packaging

-

Picking and Placing

-

Transportation

By End User

-

E-commerce

-

Automotive

-

Food & Beverages

-

Pharmaceutical

-

Chemical and Materials

-

Semiconductor and Electronics

-

Others

Key Players

-

Dematic GmbH

-

Geek+ Technology Co., Ltd.

-

COMITAS

-

Valday Robots

-

Ronavi Robotics

-

RoboCV

-

Aripix Robotics

-

Robotech

-

Unique Robotics

-

AVTOMAKON

-

Promobot

-

YaCu Robotics

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size Value in 2024 |

USD 120 million |

|

Revenue Forecast in 2030 |

USD 250.8 million |

|

Value Growth Rate |

CAGR of 12% from 2025 to 2030 |

|

Market Volume in 2024 |

3.63 thousand units |

|

Unit Forecast in 2030 |

8.09 thousand units |

|

Volume Growth Rate |

CAGR of 13.0% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Million (USD) |

|

Market Volume Estimation |

Thousand units |

|

Growth Factors |

|

|

Companies Profiled |

12 |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst