U.S. Electric Shaver Market By Type (Rotary Shavers, Foil Shavers, Clippers & Trimmers [Beard Trimmers, Body Trimmers, and Others]), By Power Source (Battery Powered, Rechargeable/Cordless), By Usage (Dry Electric Shavers, Wet & Dry Electric Shavers), By Distribution Channel (Online, Health & Beauty Stores, Electronic Stores, Supermarkets, Hypermarkets), and By End-User (Men, Women) – Global Opportunity Analysis and Industry Forecast, 2025–2030..

Industry: Retail and Consumer | Publish Date: 10-Oct-2025 | No of Pages: 171 | No. of Tables: 134 | No. of Figures: 79 | Format: PDF | Report Code : RC1999

Industry Outlook

The U.S. Electric Shaver Market size was valued at USD 4.62 billion in 2024 and is expected to reach USD 5.23 billion by the end of 2025. The industry is projected to grow, hitting USD 7.87 million by 2030 with a CAGR of 8.52%. Additionally, in terms of volume, the market size was 402,93 thousand units in 2024 and is projected to reach 46755 thousand units by 2025. Additionally, the industry is expected to continue its growth trajectory, reaching 78210 thousand units by 2030, with a CAGR of 10.8% between 2025 and 2030.

The U.S. Electric Shaver market is undergoing consistent growth, largely fuelled by rising disposable income, e-commerce influence, and evolving consumer preferences. The market is characterized by a growing consumer base focused on self-care, with electric shavers becoming a common household grooming tool.

The industry is experiencing growth and innovation, driven by rising consumer demand for customization, longer battery life, and eco-friendly options. There's a growing shift towards smart shavers and devices designed for sensitive skin, reflecting a shift toward more personalized and specialized grooming solutions.

What are the Key Trends in the U.S. Electric Shaver Industry?

How is the U.S. Electric Shaver Market Evolving with Sustainable Consumer Demand?

The U.S. Electric Shaver market is experiencing a significant shift toward sustainability, driven by eco-conscious consumers seeking environmentally friendly products. A 2024 report from the NACS shows that 38% of U.S. consumers are willing to pay a premium for eco-friendly personal care items. This is prompting manufacturers to invest in sustainable materials, such as recyclable plastics and biodegradable packaging, while reducing carbon footprints in the production process. Companies like Philips and P&G are leading the charge with products that emphasize sustainable design without compromising performance.

As the sustainability trend continues to grow, companies that prioritize eco-friendly initiatives expect a competitive edge. For instance, offering long-lasting, rechargeable products made from recycled materials appeal to a broader, environmentally conscious consumer base, increasing brand loyalty and market share.

How are Technological Advancements Reshaping the U.S. Electric Shaver Market trends?

Technological innovations in electric shavers are reshaping the grooming experience by boosting comfort, efficiency, and performance. Advances like integrated sensors that adjust shaving speed based on hair density and personalized settings are increasingly common. By incorporating such technologies, companies attract tech-savvy consumers seeking precision and convenience in their grooming routines. Manufacturers who embrace innovations such as AI-powered skin adaptation features are poised to see higher demand, particularly from younger consumers.

What are the Key Market Drivers, Breakthroughs, and Investment Opportunities that will Shape the Industry in the Next Decade?

The U.S. electric shaver market growth is driven by a combination of consumer-driven factors and technological advancements. Rising disposable income is enabling consumers to prioritize high-quality, efficient grooming solutions, with many opting for premium electric shavers that offer convenience and improved functionality. The increase in personal consumption expenditures (PCE) directly correlates to greater adoption of electric shavers, particularly among professionals and dual-income households. Additionally, the expansion of e-commerce has made these products more accessible, with online platforms offering competitive pricing, enhanced shopping experiences, and a broad selection of options, further accelerating growth.

However, challenges such as the high upfront costs of electric shavers and the continued popularity of low-cost alternatives, such as manual razors, limit market growth. For many consumers, the affordability and simplicity of manual razors remain appealing, especially in lower-income brackets. Despite these hurdles, breakthroughs in AI-powered technology, such as adaptive shaving sensors and personalized grooming features, are creating substantial growth opportunities. AI-driven innovations are attracting tech-savvy consumers and enhancing product differentiation, opening new pathways for industry expansion.

Growth Drivers:

How Does Rising Disposable Income Impact the Electric Shaver Market in the U.S.?

The U.S. electric shaver market is experiencing significant growth, largely driven by the rising disposable income among consumers. As individuals increasingly prioritize convenience and personal grooming, electric shavers, known for their efficiency, skin-friendly features, and user-friendliness, have gained popularity. According to the U.S. Bureau of Economic Analysis, disposable personal income (DPI) grew by USD 61.0 billion (0.3%) in 2025, while personal consumption expenditures (PCE) rose by USD 69.9 billion (0.3%). This growth in consumer spending indicates that Americans are not only earning more, but also spending more on advanced grooming tools. Higher disposable incomes, especially among working professionals and dual-income households, have resulted in a shift toward premium grooming devices, reinforcing income growth as a pivotal factor driving the market expansion.

How Is E-Commerce Driving the Growth of the U.S. Electric Shaver Market?

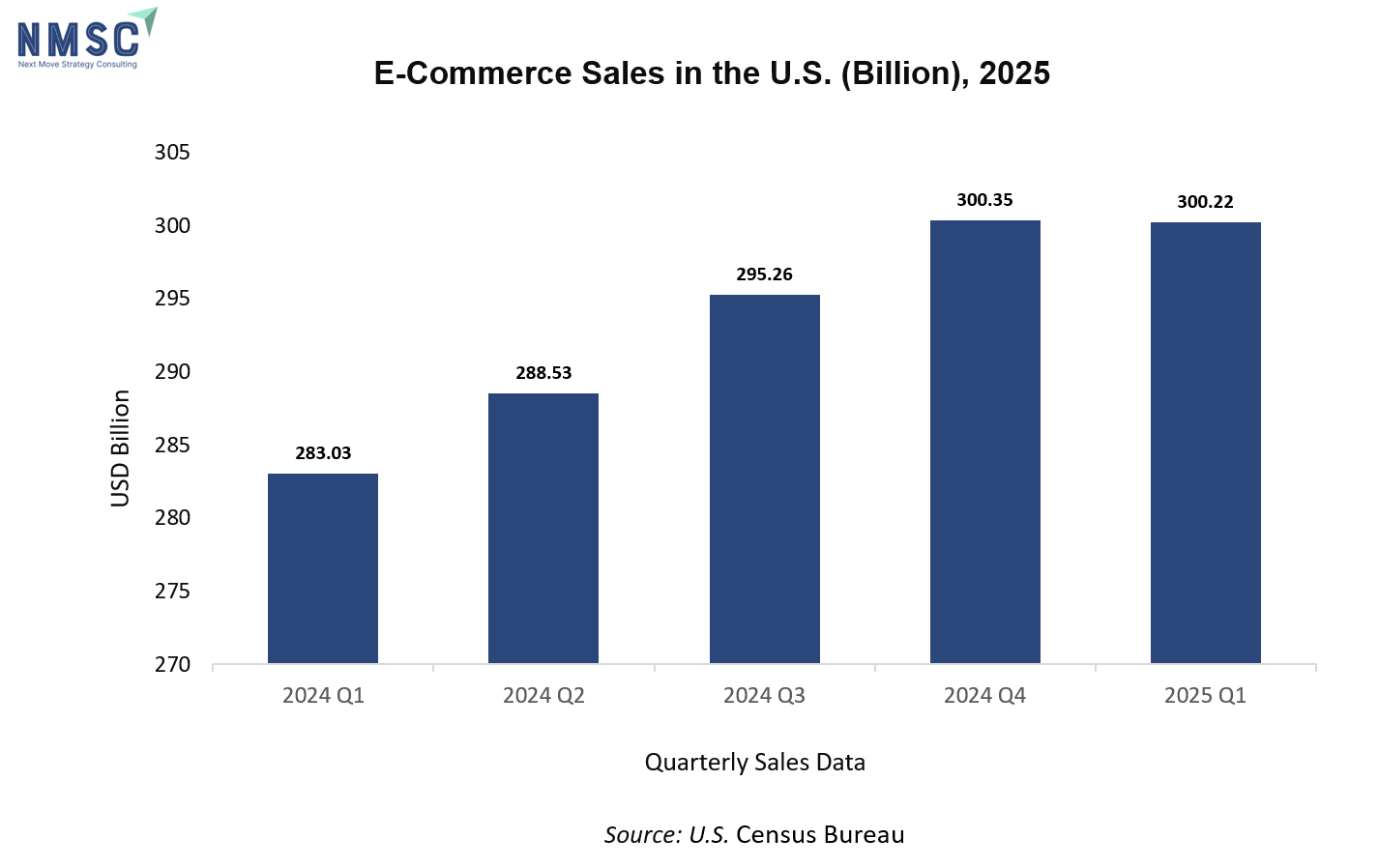

E-commerce is playing a crucial role in the growth of the market, with digital platforms increasingly influencing consumer buying behaviour. According to the U.S. Census Bureau, e-commerce sales saw a 6.1% increase in Q1 of 2025 compared to the previous year, signaling a significant shift toward online shopping. This trend has made electric shavers more accessible by providing consumers with a wide array of options, competitive pricing, and the convenience of home delivery. Online shopping experiences, such as detailed product descriptions, customer reviews, virtual try-ons, and exclusive deals, are encouraging consumers to invest in higher-end grooming devices. Furthermore, the rise of direct-to-consumer channels and subscription services is enhancing brand loyalty, especially among younger, tech-savvy consumers. As e-commerce continues to grow, it is playing an essential role in boosting demand and reshaping the future of the electric shaver market in the U.S.

Growth Inhibitors:

What Are the Barriers Hindering the Growth of the U.S. Electric Shaver Market?

While electric shavers are gaining popularity, their high upfront costs and the continued availability of affordable traditional alternatives are hindering market growth. For price-sensitive consumers, especially those in lower-income brackets, the initial expense of an electric shaver is a significant deterrent, especially when manual razors remain a cheap and easily accessible option. Moreover, traditional razors are favoured for their simplicity, convenience (no charging required), and easy availability in supermarkets and convenience stores. This price-performance gap limits electric shaver adoption, particularly among occasional users or individuals who are not specifically seeking advanced grooming products. Consequently, the high cost and the enduring presence of low-cost manual razors act as major obstacles to the widespread growth of the electric shaver market in the U.S.

How Are AI-Driven Innovations Creating Growth Opportunities for the U.S. Electric Shaver Market?

The rapid advancement of artificial intelligence (AI) is unlocking exciting new growth opportunities in the market. According to a 2025 report by the U.S. Government Accountability Office, AI use cases across federal agencies nearly doubled from 571 to 1,110 in 2024, with generative AI use cases skyrocketing from 32 to 282. This growing adoption of intelligent technologies is also influencing the personal care industry, where AI-powered features like adaptive shaving sensors, skin-type recognition, and customized grooming modes are transforming electric shavers into smart, high-performance devices. These technological innovations not only elevate the shaving experience but also appeal to consumers looking for advanced, tech-driven grooming solutions. As AI continues to advance across various sectors, its integration into electric shavers presents significant opportunities for market growth, product differentiation, and enhanced consumer engagement.

How is the U.S. Electric Shaver Market Segmented in this Report, and what are the Key insights from the Segmentation Analysis?

By Type Insights

Are Rotary and Foil Shavers Dominating the U.S. Market in 2025?

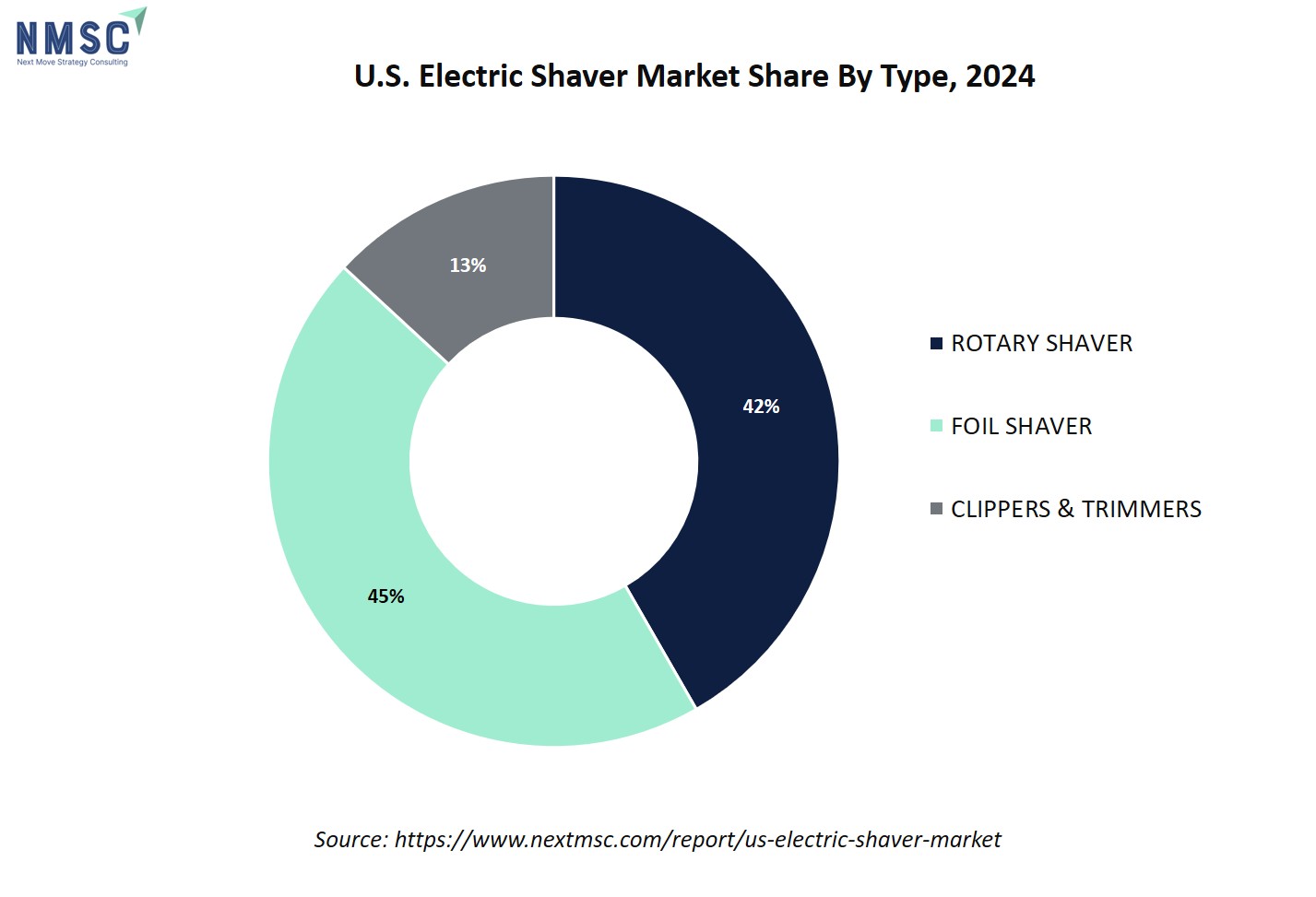

Based on Usage, the market is categorized into rotary shaver, foil shaver, clippers and trimmers (beard trimmers, body trimmer & others).

The U.S. electric shaver market is primarily segmented into rotary shavers, foil shavers, and clippers and trimmers. Rotary shavers are favoured for their ability to adapt to facial contours, making them ideal for consumers with thicker or coarser hair. Foil shavers, on the other hand, are preferred by those who seek a closer, smoother shave, especially for sensitive skin. Meanwhile, clippers and trimmers have seen a rise, especially among male consumers for beard and body grooming. As grooming routines evolve, the demand for multi-functional trimmers is expected to grow, offering versatility for both facial and body hair care.

By Power Source Insights

Is Rechargeable/Cordless Technology Outpacing Battery-Powered Models?

Based on Usage, the market is categorized into battery-powered and rechargeable/cordless.

Rechargeable and cordless electric shavers are rapidly outpacing battery-powered models in the U.S. market. The convenience, longer battery life, and portability of rechargeable models make them highly appealing to consumers, particularly those with busy lifestyles. As manufacturers focus on improving battery efficiency and reducing charging times, rechargeable and cordless shavers are becoming the go-to choice, with consumers increasingly seeking flexibility and ease of use in their grooming routines.

By Usage Insights

Are Wet and Dry Electric Shavers Gaining Preference Among Consumers?

Based on Usage, the market is categorized into dry electric shavers and wet and dry electric shavers.

Wet and dry electric shavers are increasingly popular due to their versatility and convenience. Consumers appreciate the option to use them in the shower or for dry shaving, providing a more personalized grooming experience. These shavers are particularly favoured for their ability to offer smoother results while minimizing skin irritation. This trend is expected to continue, especially with increasing demand from younger, more discerning consumers who value convenience and skin-friendly features.

By Distribution Channel Insights

Is E-Commerce Taking Over the Electric Shaver Market?

Based on the Distribution Channel, the market is categorised into online, health and beauty store, electronic store, supermarkets & hypermarkets.

E-commerce continues to dominate as the primary distribution channel for electric shavers. Online shopping platforms offer a vast selection of electric shavers, allowing consumers to compare features, prices, and customer reviews. The rise of direct-to-consumer brands and subscription-based services also plays a significant role in expanding market reach. While brick-and-mortar stores such as health and beauty stores and electronic retailers remain important, the convenience of online shopping is likely to continue shaping the market landscape in the coming years.

By End User Insights

Is the Electric Shaver Market Expanding Beyond Men’s Grooming?

Based on End User, the market is categorised into men & women.

The U.S. electric shaver market is seeing a shift as products are increasingly marketed towards women. Women’s electric shavers, particularly those designed for leg and underarm hair, are gaining traction, representing a growing portion of the market. As grooming habits evolve, women are seeking more efficient and comfortable alternatives to manual shaving, driving the demand for electric shavers tailored to their needs. This trend suggests significant growth potential for companies that cater to both male and female consumers, focusing on versatile and ergonomic product designs.

Competitive Landscape

What are the Top Companies in the U.S. Electric Shaver Industry, and How are they Competing Against One Another?

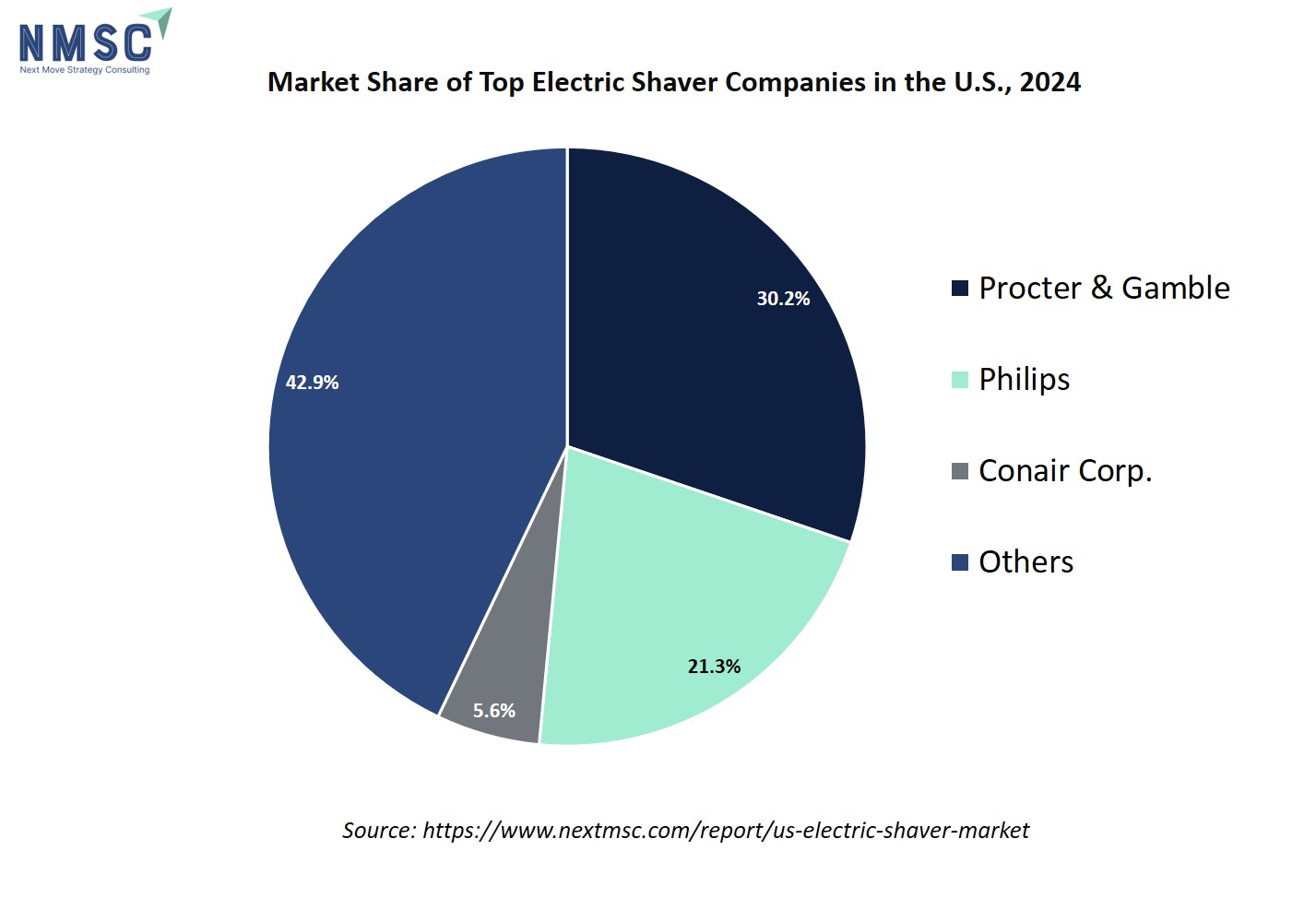

The electric shaver industry in the U.S. is dominated by leading companies such as Procter & Gamble, Philips, Conair Corporation, Panasonic, Spectrum Brands Inc., Wahl Clipper Corporation, Andis, Manscaped, Dollar Shave Club Inc., Meridian Grooming, and others.

In the U.S. Electric Shaver market, companies like Philips, P&G, and Panasonic dominate, each bringing innovation and expertise to the table. Philips, for instance, leverages its expertise in consumer electronics to integrate cutting-edge technology, while P&G focuses on premium, user-friendly products. The competition between these giants is fierce, with each continuously evolving its product line to stay ahead in both performance and design.

Innovation and Adaptability Drive Market Success

In the U.S. electric shaver market, success hinges on a combination of technological innovation, consumer responsiveness, and market adaptability. Leading brands such as Philips, P&G, and Panasonic must continually invest in R&D for new shaving technologies, ergonomic designs, and features that enhance user comfort. This includes advancements like AI-driven shaving sensors, smart features, and multi-functional trimmers that cater to a diverse consumer base. Companies are also focused on sustainability, integrating eco-friendly materials and improving energy efficiency in their products.

Additionally, manufacturers are strengthening their retail and e-commerce partnerships to meet growing consumer demand for convenience and accessibility. As more consumers shop online, especially younger tech-savvy users, brands must ensure seamless digital experiences, from virtual try-ons to competitive pricing and fast delivery. For emerging brands, carving out niche markets through innovative product features, personalization, and premium offerings presents significant opportunities to disrupt the market and cater to the evolving grooming needs of U.S. consumers.

However, challenges such as price sensitivity and competition from manual razors remain. Nevertheless, the increasing demand for high-performance, eco-friendly, and smart electric shavers creates a pathway for brands to expand their presence and build loyalty with discerning consumers.

Market Players to Opt for Merger & Acquisition Strategies to Expand their Presence

In the U.S. electric shaver market, established companies are increasingly leveraging mergers, acquisitions, and strategic partnerships to strengthen their competitive positions and diversify their product portfolios. Major players like Philips and P&G are focused on acquiring or partnering with firms that specialize in smart technology, AI integration, and sustainable innovations. These collaborations allow larger players to combine their established manufacturing capabilities with new-age digital expertise and eco-conscious solutions, ensuring they remain competitive in a fast-evolving market.

This strategy enables companies to accelerate product development and expand into niche segments such as women’s grooming or environmentally sustainable products. By acquiring smaller, innovative brands, they quickly adapt to new consumer preferences and enhance their presence across different pricing tiers, from value to premium electric shavers.

Moreover, partnerships with tech startups or digital influencers provide the agility needed to remain ahead in a market that demands constant innovation and brand adaptability. These mergers and acquisitions are crucial for maintaining growth and gaining a competitive edge in a crowded marketplace.

List of Key U.S. Electric Shaver Companies

-

Conair Corporation

-

Panasonic Corporation

-

Spectrum Brands, Inc. (Remington)

-

Wahl Clipper Corporation

-

Andis Company

-

Manscaped

-

Dollar Shave Club Inc

-

Meridian Grooming

-

Freebird Shaver

-

Skull Shaver

-

JML Direct

-

TPOB

-

Shanghai Flyco Electric Co., Ltd.

What Are the Latest Key Industry Developments?

-

June 2025 – Braun (P&G) introduced the updated Series 9 Pro+, which highlights the brand's dedication to premium grooming, featuring enhanced performance and design upgrades for a superior shaving experience.

-

May 2025 – Philips Norelco launched their i9000 Prestige Ultra Shaver, powered by AI, which offers superior comfort, precision, and personalization, meeting the growing demand for smart, high-performance grooming devices in the U.S. market.

-

January 2024 – To strengthen its presence in the market, Panasonic introduced the Palm Shaver (ES-PV6A-W), a compact, five-blade shaver designed for a close, smooth shave. Featuring advanced sensing technology and a linear motor, it adapts to facial contours for a customized grooming experience.

-

February 2024 – Andis Company introduced the eMERGE Clipper, a heavy-duty tool tailored for barbers. With a powerful motor and detachable blades compatible with Andis' ultraEDGE and ceramicEDGE systems, it promises exceptional versatility and precision, catering to the diverse needs of professionals in the U.S. electric shaver market.

-

September 2024 – MANSCAPED launched the Chairman Pro Electric Foil Shaver and Premium Face Shaving Kit. The new products aim to elevate the shaving experience with high-performance features, offering precision and comfort for grooming enthusiasts in the U.S. electric shaver market.

What are the Key Factors Influencing Investment Analysis & Opportunities in U.S. Market for Electric Shaver?

The U.S. electric shaver market offers strong investment opportunities, fuelled by rising disposable incomes, evolving consumer preferences, and rapid technological advancements. As consumers increasingly prioritize premium, tech-driven grooming solutions, demand for electric shavers with smart features, longer battery life, and eco-friendly designs is growing. E-commerce plays a pivotal role in enabling brands to scale efficiently and reach a broader, tech-savvy audience. The market is also expanding with innovations such as AI-powered shavers and multi-functional grooming devices, which attract a growing number of consumers seeking customized, convenient solutions.

At the same time, there are significant challenges and opportunities related to sustainability, including rising regulatory pressures surrounding packaging and the impact on product life cycles. Companies investing in eco-conscious, energy-efficient designs are well-positioned to lead the market. Additionally, expanding premium product lines and tapping into underserved segments, such as women’s grooming, along with leveraging direct-to-consumer (DTC) models and rural market penetration, could drive future growth. Strategic partnerships with tech firms to integrate IoT features further enhance product differentiation, offering new opportunities to boost consumer loyalty and market share.

Key Benefits for Stakeholders:

Next Move Strategy Consulting (NMSC) presents a comprehensive analysis of the U.S. Electric Shaver market, covering historical trends from 2020 through 2024 and offering detailed forecasts through 2030. Our study examines the market at global, regional, and country levels, providing quantitative projections and insights into key growth drivers, challenges, and investment opportunities across all major electric shaver segments.

Report Scope:

|

Parameters |

Details |

|

Market Size in 2025 |

USD 5,233.01 million |

|

Revenue Forecast in 2030 |

USD 7,875.21 million |

|

Growth Rate |

CAGR of 8.5% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Million (USD) |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 analyst-working hours) after purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

|

Approach |

In-depth primary and secondary research; proprietary databases; rigorous quality control and validation measures. |

|

Analytical Tools |

Porter's Five Forces, SWOT, value chain, and Harvey ball analysis to assess competitive intensity, stakeholder roles, and relative impact of key factors. |

Key Market Segments

By Type

-

Rotary Shaver

-

Foil Shaver

-

Clippers and Trimmers

-

Beard Trimmers

-

Body Trimmer

-

Others

-

By Power Source

-

Battery Powered

-

Rechargeable/Cordless

By Usage

-

Dry Electric Shavers

-

Wet and Dry Electric Shavers

By Distribution Channel

-

Online

-

Health and Beauty Store

-

Electronic Store

-

Supermarkets

-

Hypermarkets

By End-User

-

Men

-

Women

Conclusion & Recommendations

Our report equips stakeholders, industry participants, investors, policy makers, and consultants with actionable intelligence to capitalize on the dynamic growth of the U.S. electric shaver market. By combining comprehensive, data driven analysis with strategic insights and market frameworks, NMSC’s U.S. Electric Shaver Market Report serves as an indispensable resource for navigating evolving consumer preferences, regulatory shifts, and competitive dynamics.

Speak to Our Analyst

Speak to Our Analyst