HUL, P&G, Nirma Drive India’s $9.36B Fabric Care Boom

Published: 2025-11-01

As per the NMSC analysis, India’s fabric care industry is set to maintain strong growth momentum, with market size expected to reach around USD 9.36 billion by 2030. The market was valued at USD 6.49 billion in 2024 and is projected to rise to USD 7.15 billion by 2025, marking a solid CAGR of 5.51%. This growth is being propelled by rapid expansion of e-commerce, and rising disposable incomes among the population. evolving urban lifestyles.

Additionally, the surge in on-demand, high-efficiency laundering solutions across homes, apartment complexes and commercial laundries is transforming India’s fabric care scene—unlocking fresh growth opportunities in urban residential projects, hospitality chains, healthcare facilities and retail networks.

INDUSTRY OVERVIEW

India’s fabric care market is entering a dynamic new phase, propelled by heightened environmental awareness, stringent water‐use regulations, and a growing preference for specialized fabric treatments. As consumers seek solutions that conserve water and reduce microplastic release, brands are innovating with concentrated, low-water formulations and microplastic-free polymers. The rise of performance textiles activewear, technical fabrics, and heritage weaves has spurred demand for targeted care products that preserve stretch, breathability, and colour intensity.

At the same time, the proliferation of organized retail chains and omni-channel platforms is making premium, niche fabric care more accessible beyond metro hubs. Government incentives for water-efficient appliances and eco-friendly chemicals are further accelerating uptake, while social-media–driven “care hacks” and influencer partnerships are educating shoppers on advanced laundry routines.

With legacy FMCG giants and agile start-ups alike embracing bio-enzymes, biodegradable surfactants, and refill-on-demand models, India’s fabric care sector is poised to transform everyday laundering into a sustainable, high-performance ritual.

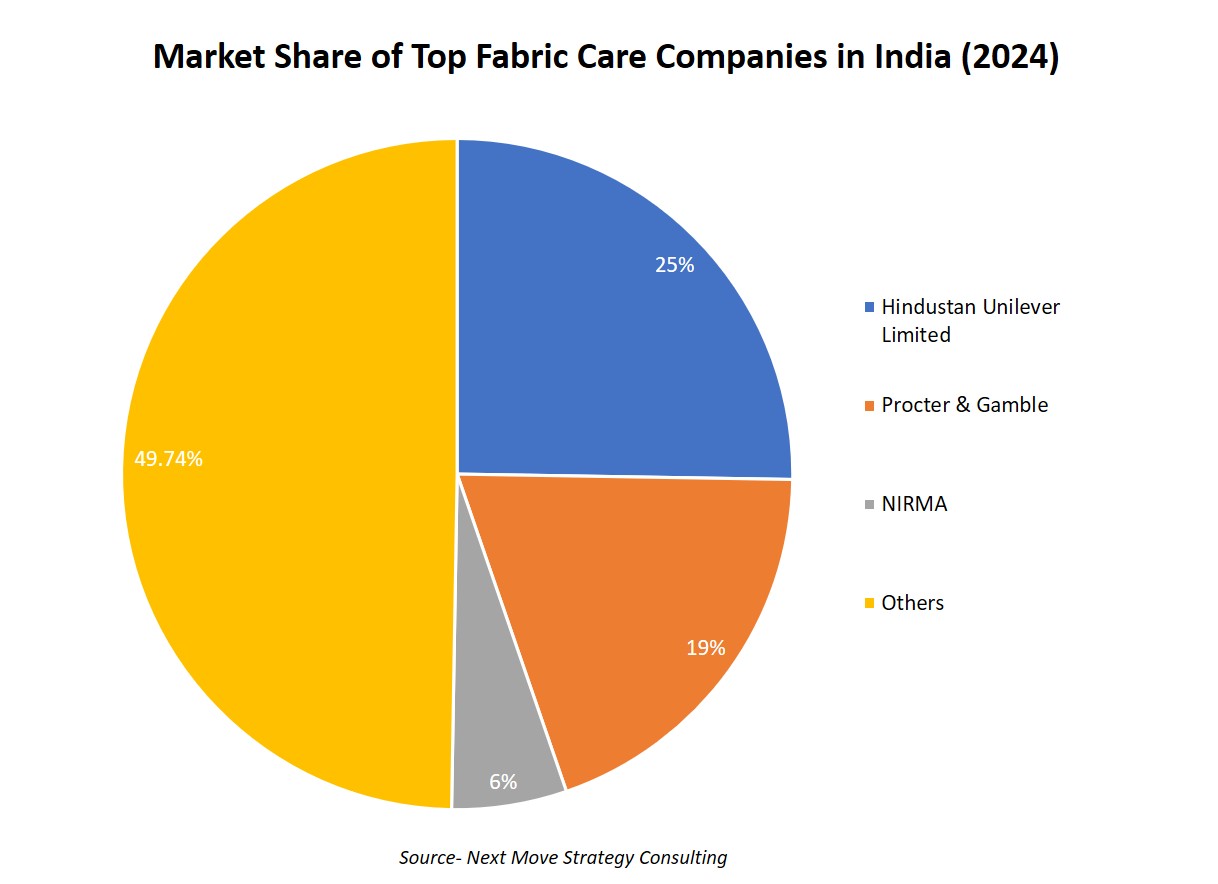

Several major companies dominating the India fabric care industry include Hindustan Unilever Limited, Procter & Gamble, Nirma Limited, RSPL Group, Jyothy Laboratories Ltd., Reckitt Benckiser India, Fena Private Limited (India), and The Clorox Company, among others. These companies are driving innovation in the sector by developing eco-friendly formulations, AI-powered detergents, and sustainable packaging solutions tailored to India’s evolving consumer preferences.

With a sharp focus on green chemistry, enzyme-based stain removal, and smart delivery models like subscription refills and solid-format detergents, these players are reshaping the modern laundry experience. Their continued investments in R&D, combined with an emphasis on affordability and performance across urban and rural markets, position them as key enablers of the next phase in India’s fabric care revolution.

For the in-depth analysis of India Fabric Care industry, buy the latest report

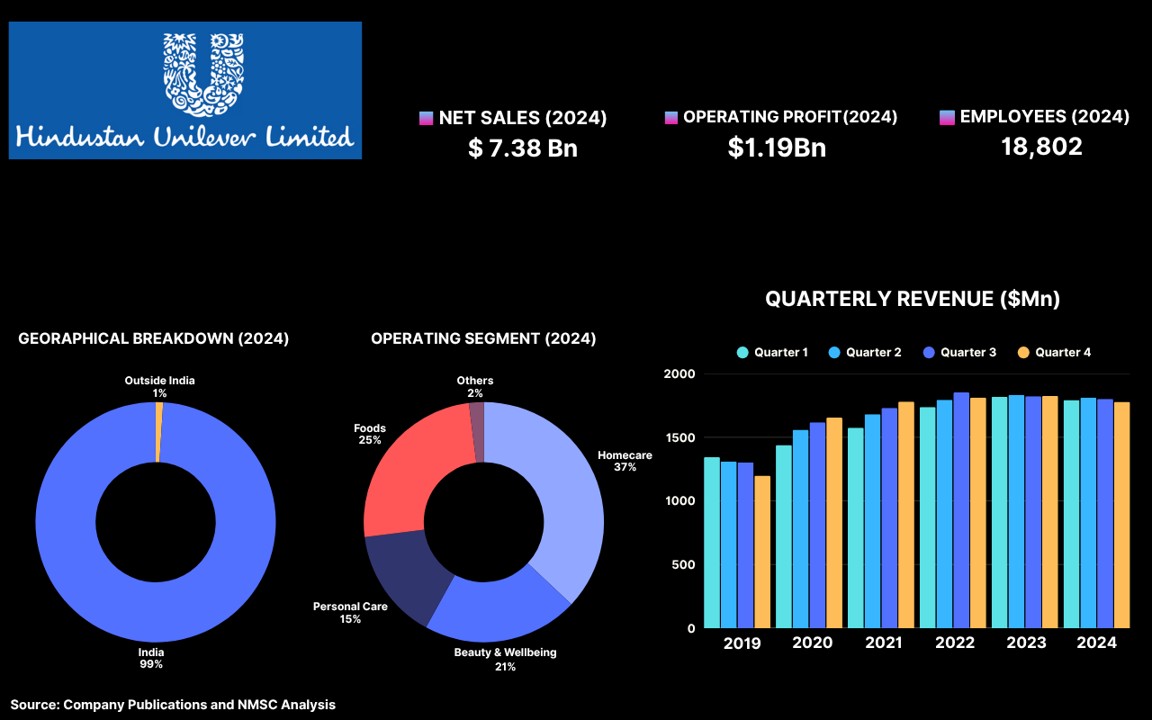

HIGHLIGHTS OF HINDUSTAN UNILEVER LIMITED

Hindustan Unilever Limited (HUL), headquartered in Mumbai, is India's largest fast-moving consumer goods (FMCG) company and a subsidiary of the Anglo-Dutch multinational Unilever PLC. With over 90 years of presence in India since its inception as Sunlight Soap in 1888, HUL has evolved into a market leader with substantial influence across India's fabric care segment, touching the lives of two out of three Indians through its comprehensive portfolio of home and personal care products.

In 2024 and early 2025, Hindustan Unilever Limited reinforced its leadership in India’s fabric care market through three major product innovations Surf Excel Matic Express, a premium 15-minute wash solution featuring AI-driven formulation and endorsed by Jasprit Bumrah; in March 2025, Hindustan Unilever unveiled the all-new Surf Excel Smart Shots, boasting an advanced formula and enhanced benefits to elevate its premium fabric care offering.

Earlier, in December 2024, the iconic Rin detergent bar made a grand return with cutting-edge polymer technology, while Comfort fabric conditioner received a comprehensive makeover to further reinforce its market-leading position. Going back to June 2024, HUL joined forces with Whirlpool of India for an innovative campaign that paired Surf Excel Matic Liquid with Whirlpool’s state-of-the-art washing machines, marrying mechanical, thermal, and chemical cleaning powers to deliver unrivalled stain-removal performance.

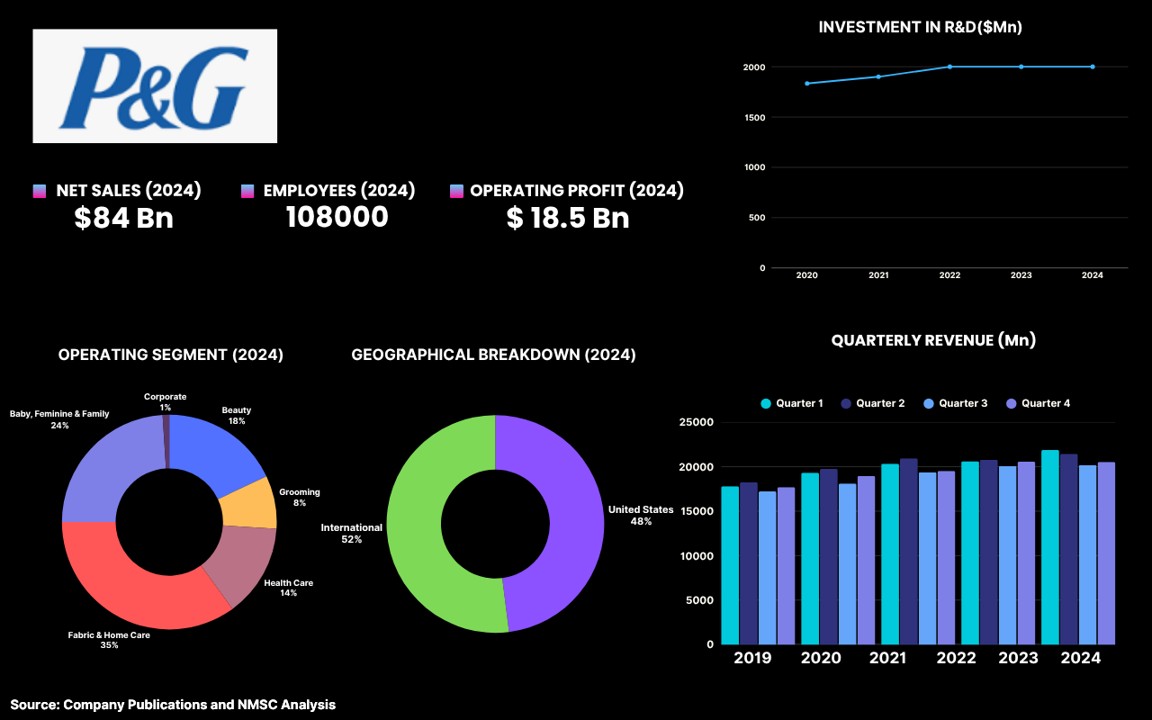

HIGHLIGHTS OF PROCTER & GAMBLE

Procter & Gamble (P&G), headquartered in Cincinnati, Ohio, is a global leader in consumer goods with over 180 years of heritage and operations in more than 70 countries. In India, P&G established its presence in 1964 and has since become one of the foremost players in the fabric care segment, offering innovative products, strong brand equity, and a robust distribution network that spans both urban and rural markets.

P&G’s fabric care portfolio in India is anchored by its flagship brand Ariel, which commands a premium position through superior stain-removal technology and detergent formulations. Complementing Ariel are Tide and Tide Plus, targeted at value-conscious consumers and tailored to deliver reliable cleaning performance in hard-water conditions. Together, these brands hold approximately 31% of India’s organized detergent market, making P&G the second-largest player after Hindustan Unilever.

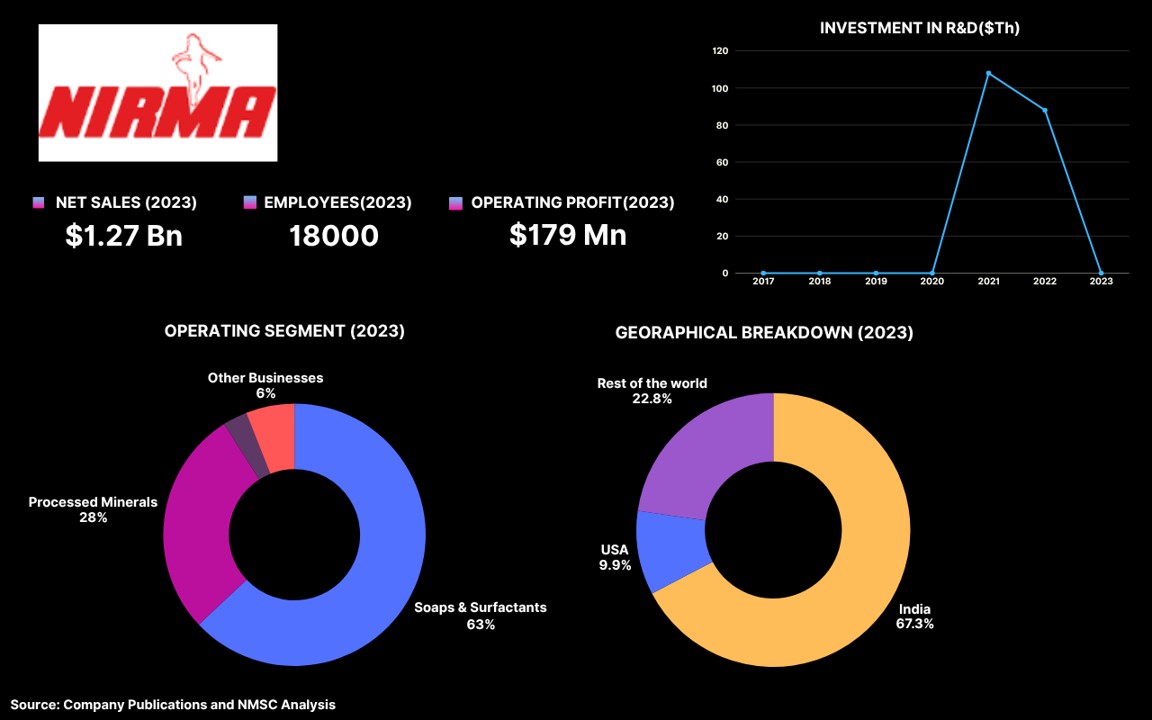

HIGHLIGHTS OF NIRMA

Nirma, founded in 1969 by Karsanbhai Patel, is one of India’s most iconic homegrown fast-moving consumer goods companies, best known for democratizing fabric care with its affordable detergent powders. Headquartered in Ahmedabad, Gujarat, Nirma disrupted the market in the 1980s by offering high-quality washing powder at a fraction of prevailing prices, rapidly capturing rural and price-sensitive urban segments. Today, Nirma continues to command a significant presence in India’s fabric care sector through a diverse range of products, including Nirma Detergent Washing Powder, Nirma Advance, Nirma Ultra, Nirma Excel Liquid Detergent, and Excel Fabric Conditioner.

Nirma has long been synonymous with affordable, high-quality fabric care across India, commanding a robust market presence that resonates from bustling metropolises to remote villages. Leveraging its pioneering cost‐leadership model and extensive manufacturing footprint in Gujarat, Odisha, and Tamil Nadu, Nirma ensures consistent supply and competitive pricing for its economy and premium detergent powders and liquids. Its deep rural distribution network coupled with targeted innovations like enzyme‐based cold‐wash powders and plant‐based liquid detergents, has enabled the company to capture roughly 9% of the fabric care market.

By continuously modernizing legacy brands such as Nirma Detergent Washing Powder, while expanding its Excel Liquid and Excel Fabric Conditioner lines for aspirational consumers, Nirma maintains unparalleled brand loyalty, especially among price‐sensitive segments, solidifying its position as a formidable leader in India’s dynamic fabric care landscape.

HIGHLIGHTS OF RSPL GROUP

RSPL Group, headquartered in Kanpur, is one of India’s premier FMCG conglomerates with a legacy spanning over three decades. Founded in 1988 by Shri Murali Dhar Gyanchandani and Shri Bimal Kumar Gyanchandani, the Group began its journey with Ghadi Detergent and has since diversified into personal care, home care, dairy, renewable energy, real estate, and footwear. In the fabric care segment, RSPL commands approximately 7% market share in India’s highly competitive fabric care market, driven by superior formulation, value-for-money positioning, and extensive distribution across 21 manufacturing units in Uttar Pradesh, Madhya Pradesh, Rajasthan, Uttarakhand, Jharkhand, Karnataka, Bihar, Chhattisgarh, and Maharashtra.

RSPL Group has firmly established itself as a powerhouse in India’s fabric care market, with its flagship Ghadi detergent brand commanding approximately 20 percent market share and reaching millions of households nationwide. Its expansive distribution network of over 3,300 exclusive distributors and seamless penetration into both urban and rural retail outlets underpins its ability to cater to diverse consumer segments with value-for-money and performance-driven products. Continuous product innovation such as the Ghadi TOUGH stain-removal variants and eco-friendly formulations further cements RSPL’s reputation for quality and affordability in India’s fiercely competitive laundry care landscape.

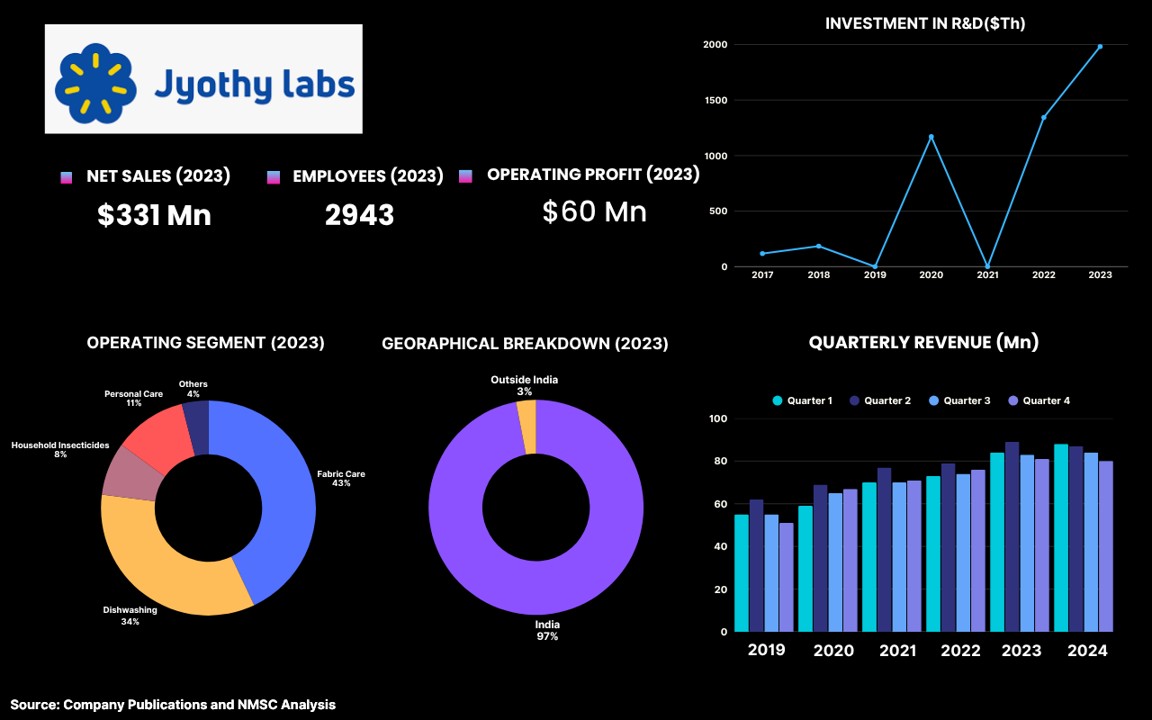

HIGHLIGHTS OF JYOTHY LABORATORIES LTD.

Jyothy Laboratories Limited (JLL), founded in 1983 by M.P. Ramachandran and headquartered in Mumbai, has emerged as a leading player in India’s fabric care segment. The company pioneered the liquid fabric whitener category with the launch of Ujala Supreme in the 1980s and today commands over 3% market share in the fabric whitener space by value, making Ujala India’s definitive white-care brand. Building on this heritage, JLL has expanded its fabric care portfolio with brands such as Henko, Mr White, and More Light, catering to diverse consumer needs across price points and performance requirements.

Jyothy Labs Limited’s launch of Ujala Young & Fresh in March 2025 underscores the company’s ongoing innovation and premiumization in India’s fabric care market, particularly in the post-wash segment where its Ujala franchise has long been a household name. The new variant features SmartBurst French Perfume capsules that release 12-fold long-lasting fragrance, catering to consumers’ growing desire for enhanced sensory experiences in laundry care. By expanding its portfolio with such differentiated offerings, Jyothy Labs continues to reinforce its leadership and meet evolving fabric care needs across Indian households.

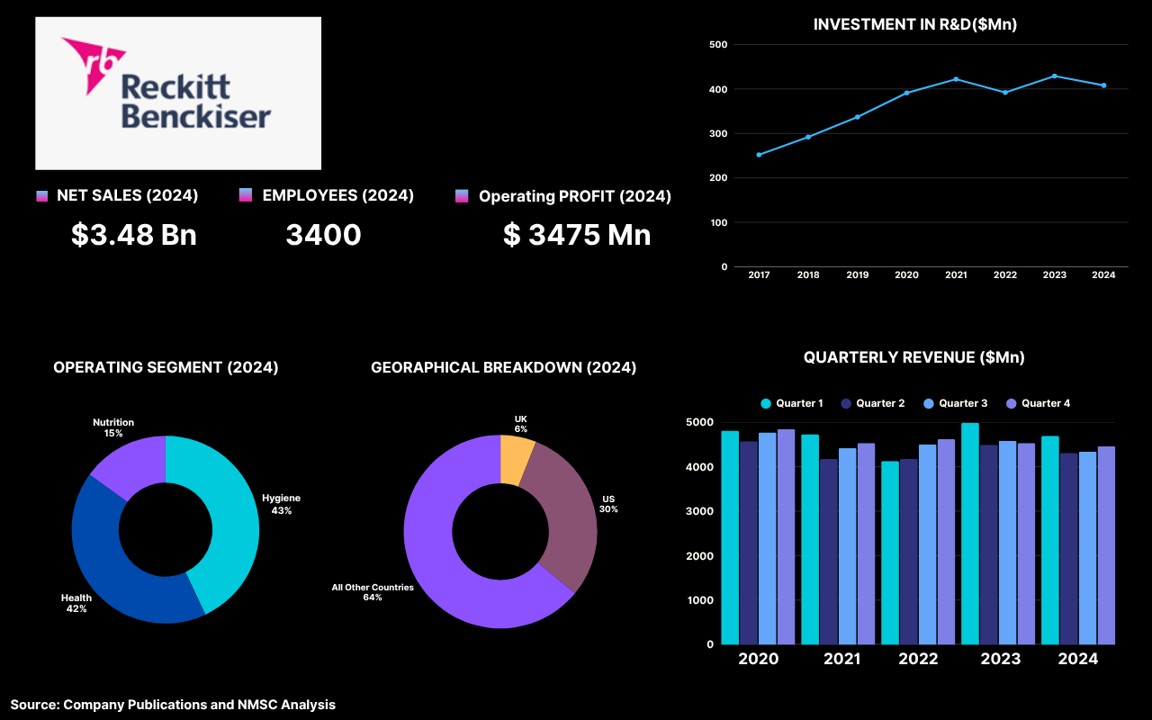

HIGHLIGHTS OF RECKITT BENCKISER INDIA

Reckitt Benckiser India, headquartered in Gurgaon, Haryana, has established an unassailable leadership in India’s fabric care segment through its flagship stain-removal brand Vanish, which commands the number-one position in the lucrative fabric-treatment category and continues to outpace both home-care and laundry detergents in premiumization and growth.

By repositioning Vanish Oxi-Action with an advanced formula tailored to Indian consumers’ needs for colour safety, brightening, and deep stain removal, RB India has transformed a niche additive into a mass-market powerhouse available in powder, liquid, and gel formats.

The company has further reinforced its fabric-care dominance by introducing complementary global innovations—such as Woolite for delicate and dark garments—and by investing in targeted marketing campaigns and omnichannel partnerships that deepen consumer engagement and drive year-on-year volume and value share gains in India’s rapidly expanding fabric-treatment market.

Reckitt Benckiser India has solidified its status as a one of the dominant forces in the Indian fabric care market by consistently innovating and expanding its product range to meet diverse consumer needs. With Vanish at the forefront, the company has effectively positioned itself as the go-to brand for advanced stain removal solutions, combining scientific expertise with localized understanding of fabric care challenges unique to Indian households.

Its strategic focus on product versatility, offering powders, liquids, and gels, along with newer additions like Woolite, enables Reckitt to cater to various fabric types and washing habits. The company's proactive engagement through dynamic marketing strategies and digital transformation initiatives has strengthened its connection with consumers, allowing it to capture growth opportunities in both urban and semi-urban markets, thereby reinforcing its leadership in India’s burgeoning fabric-treatment category.

Summary of the India Fabric Care Market

India’s fabric care market is undergoing significant transformation, driven by evolving consumer preferences and lifestyle changes that emphasize hygiene, convenience, and premium experiences. The shift from traditional fabric care products toward innovative formats like liquids, pods, and conditioners reflects a broader trend toward advanced, multi-functional solutions that cater to diverse fabric needs.

Technological advancements in formulation and distribution, combined with the expansion of modern retail and digital channels, are reshaping how products reach consumers across urban and rural areas. There is a growing emphasis on sustainability and enhanced sensory attributes such as fragrance, as well as a rising consciousness around eco-friendly and hygienic fabric care. Urban centers continue to be key consumption hubs, while the market overall is becoming more dynamic and consumer-centric, poised for continued innovation and expansion.

About the Author

Jayanta Das is a dedicated and enthusiastic research associate with expertise in deep analysis and problem-solving. He provides valuable insights across various industries and enjoys sharing his perspectives through writing. Outside of work, he loves solo traveling, reading, and engaging in meaningful conversations.

Jayanta Das is a dedicated and enthusiastic research associate with expertise in deep analysis and problem-solving. He provides valuable insights across various industries and enjoys sharing his perspectives through writing. Outside of work, he loves solo traveling, reading, and engaging in meaningful conversations.

About the Reviewer

Sanyukta Deb is a seasoned Content Writer and Team Leader in Digital Marketing, known for her expertise in crafting online visibility strategies and navigating the dynamic digital landscape. With a flair for developing data-driven campaigns and producing compelling, audience-focused content, she helps brands elevate their presence and deepen user engagement. Beyond her professional endeavors, Sanyukta finds inspiration in creative projects and design pursuits.

Sanyukta Deb is a seasoned Content Writer and Team Leader in Digital Marketing, known for her expertise in crafting online visibility strategies and navigating the dynamic digital landscape. With a flair for developing data-driven campaigns and producing compelling, audience-focused content, she helps brands elevate their presence and deepen user engagement. Beyond her professional endeavors, Sanyukta finds inspiration in creative projects and design pursuits.

Add Comment