India Fabric Care Market by Product Type (Detergents – General, Baby, Delicate; Softeners; Stain Removers/Bleach; Sanitizers; Others), Form (Liquid; Powder; Pods/Sachets; Sheets & Wipes; Spray), Nature (Conventional; Eco‑Friendly), Channel (Online – Marketplaces, Brand e‑com, Quick Commerce; Offline – Supermarkets, Hypermarkets, Dept. Stores, Independent), Price Tier (Value; Mid‑Range; Premium), End User (Residential; Commercial; Others) – India Analysis & Forecast, 2025–2030

Industry: Materials and Chemical | Publish Date: 22-Oct-2025 | No of Pages: 260 | No. of Tables: 195 | No. of Figures: 140 | Format: PDF | Report Code : MC3433

Industry Overview

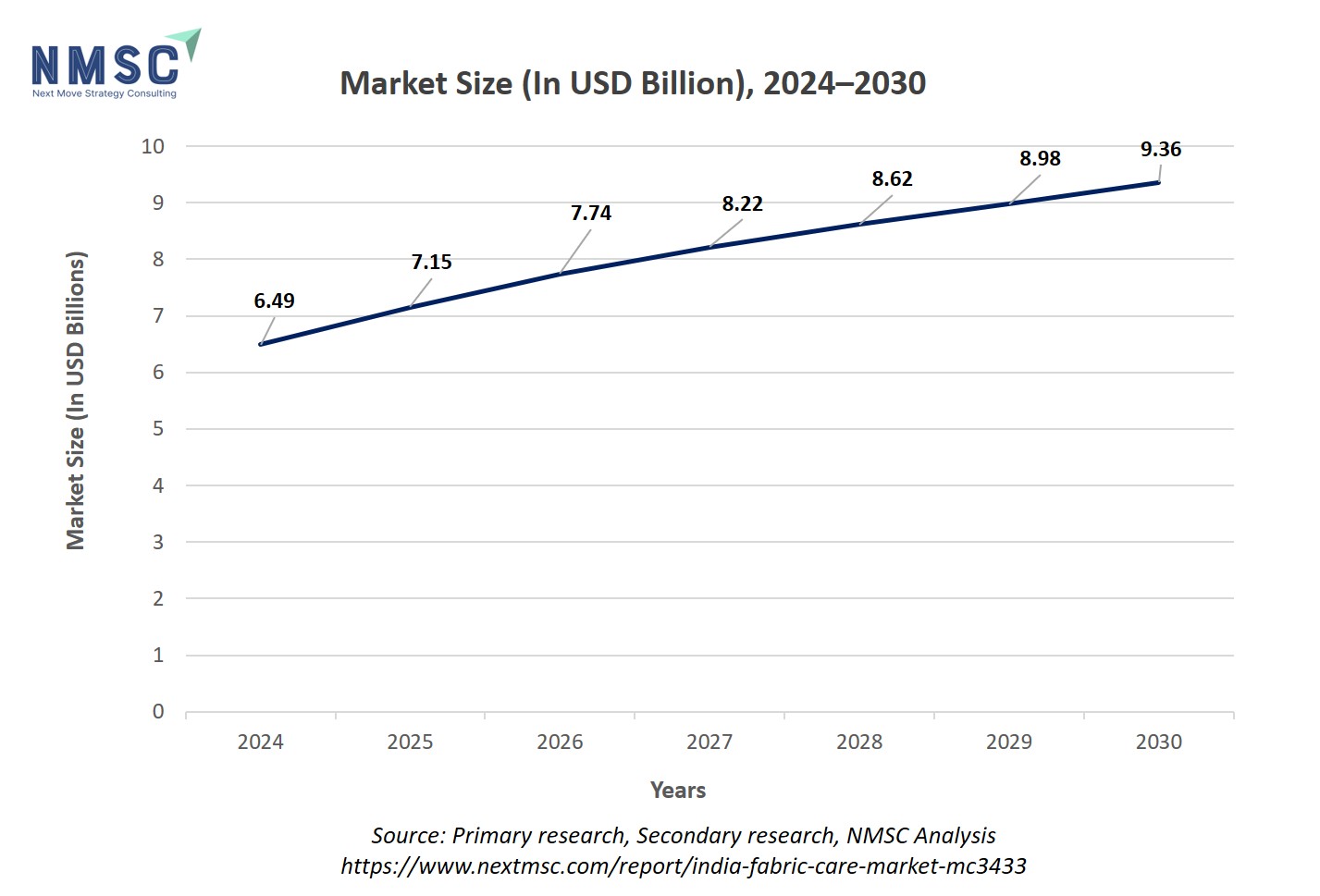

The India Fabric Care Market size was valued at USD 6.49 billion in 2024, and is expected to be valued at USD 7.15 billion by the end of 2025. The industry is projected to grow, hitting USD 9.36 billion by 2030, with a CAGR of 5.51% between 2025 and 2030.

India’s fabric care industry is rapidly evolving, shaped by changing lifestyles, demand for convenience, and a growing preference for eco-friendly and premium products. Consumers are shifting from traditional powders to liquid detergents, pods, sprays, and softeners, seeking solutions that are not only effective but also gentle on fabrics and the environment. Innovation is also driving product differentiation, with brands offering specialized variants for different fabric types, skin sensitivity, and fragrance preferences.

From automated manufacturing and AI-powered logistics to smart packaging and e-commerce penetration, technology is revolutionizing how fabric care products are produced, distributed, and consumed. As sustainability, functionality, and ease of use become central to consumer choices, the fabric care market in India is poised to become a benchmark of innovation and growth in the broader home and personal care sector shaping how Indian households care for their clothes in a modern, conscious era.

What are the Key Trends in the Fabric Care Industry?

How Rising MPCE and Digital Commerce are Reshaping the Industry?

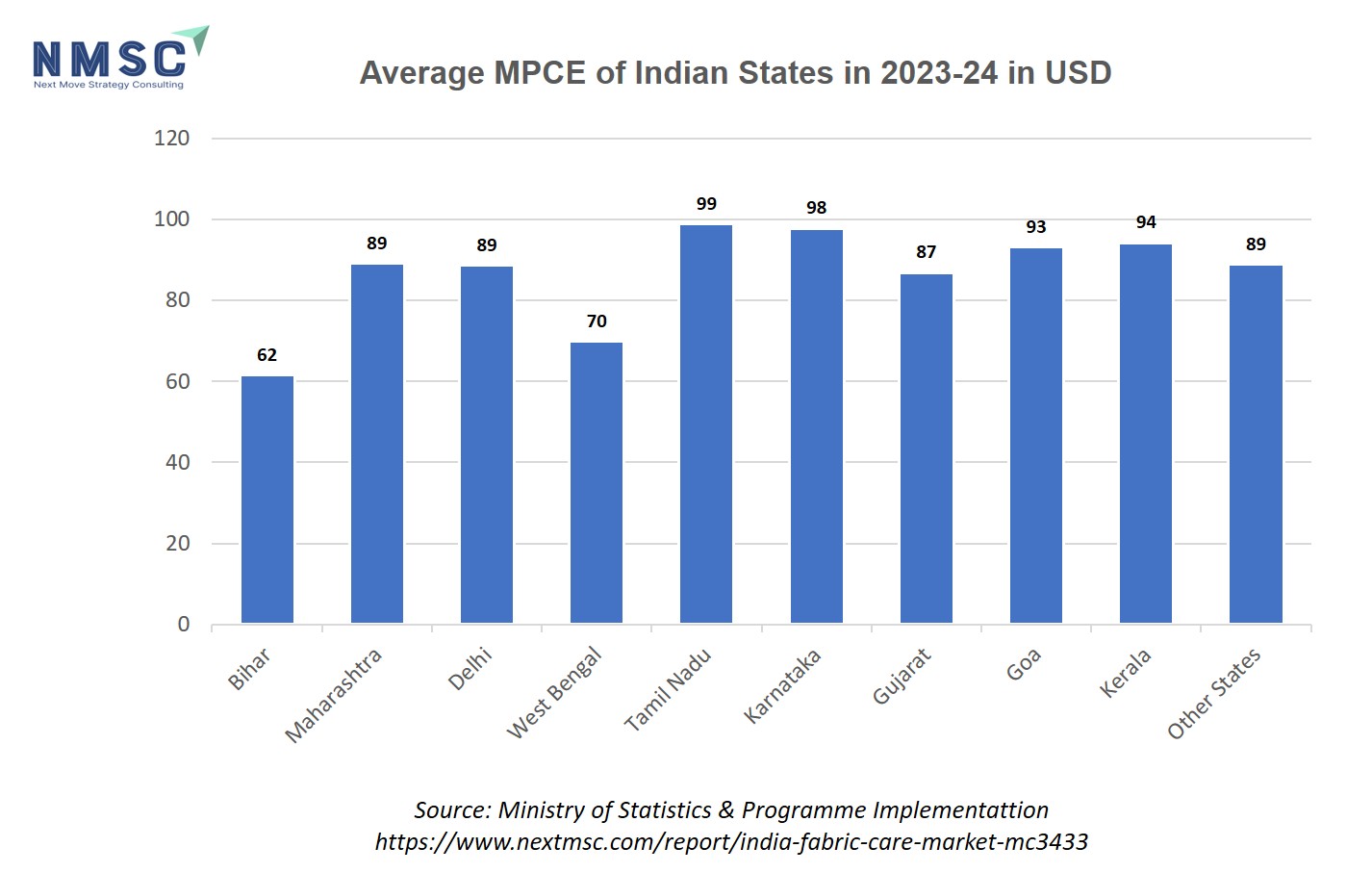

The surge in MPCE (Monthly Per Capita Expenditure) in India is directly boosting the demand for premium and specialized fabric care products, especially in tier II and III cities. With higher disposable incomes, consumers are more willing to explore eco-friendly, fragrance-rich, and convenience-oriented products. Coupled with the surge in digital commerce, this has accelerated online sales of fabric care products from 9% in 2022 to 12% in 2024. Improved logistics, targeted digital promotions, and seamless fulfillment are enabling brands to tap into emerging urban markets. As MPCE continues to rise, fabric care brands that invest in personalized digital experiences, subscription models, and responsive delivery will capture greater market share and long-term consumer loyalty.

What Role Does Sustainability Play in Shaping Product Innovation?

Growing environmental consciousness and stricter regulations have pushed fabric care companies to reimagine product design around eco friendly principles. Brands are developing biodegradable formulations, concentrated refills, and reusable packaging to reduce waste and appeal to discerning consumers.

For instance, eco friendly fabric care represents 25 % of new product launches in 2024, up from 18 % in 2022, as per company disclosures. Retailers are piloting in store bulk dispensers and collaborating with recycled material suppliers to reinforce circular-economy stories. Although sustainable lines require higher upfront investment, they yield stronger brand loyalty and differentiation. Smaller players can accelerate innovation by partnering with green chemistry specialists to share R&D risk and speed market entry.

What are the Key Market Drivers, Breakthroughs, and Investment Opportunities that will Shape the Industry in the Next Decade?

The India fabric care market growth is propelled by an expanding middle class, rising urban disposable incomes, and an evolving hygiene consciousness that emerged post pandemic. Consumers seek products that not only clean effectively but also care for fabric longevity and skin sensitivity, prompting manufacturers to invest in advanced surfactant technologies and dermatologically tested formulations.

Concurrently, rapid digital transformation in retail has unlocked tier II and III city markets via e commerce platforms, enabling both established and niche brands to scale without heavy distribution capex. Yet the market faces intense price sensitivity, especially in rural and lower income segments, where value offerings dominate purchase decisions. Regulatory imperatives on effluent treatment and plastic waste are introducing compliance costs, while competition from regional players compresses margins.

On the upside, government initiatives such as the Mega Integrated Textile Region and Apparel (MITRA) parks and National Policy on Textiles are fostering circular economy practices and infrastructure upgrades, laying the groundwork for sustainable, high growth opportunities.

Growth Drivers:

How are rising disposable incomes and urbanization driving growth in the fabric care market demand?

Higher income levels are prompting consumers to shift from basic powders to premium liquid detergents, fabric conditioners, and eco-friendly variants, reflecting a willingness to spend more on elevated value and convenience. In FY 2024, India’s per capita disposable income increased by 8%, following a 13.3% rise in FY 2023. This upward trend is closely linked to greater urbanization, rapid expansion of nuclear families, and elevated living standards.

Brands are amplifying their mass premium liquid SKUs with added features like long lasting fragrance, fabric protection, and convenience formats (e.g., pods) to match the evolving consumer profile. These macro shifts have encouraged consumers to trade up from low-cost powders to premium liquid formats and value-added solutions like pods and fabric softeners.

The desire for superior fragrance, stain-removal efficiency, and machine compatibility further accelerates the trend. To capitalize on this shift, brands should strengthen their mass-premium offerings with long-lasting fragrances, fabric protection, and differentiated formats to meet the expectations of India’s increasingly discerning middle class.

How are urbanization and evolving lifestyle trends driving the expansion of the industry?

The market is undergoing a significant transformation, largely influenced by rapid urbanization and shifting lifestyle preferences. As more Indian households embrace modern appliances and time-efficient domestic practices, the demand for convenient and specialized laundry products continues to rise.

According to the 2024 World Bank report, India’s urban population is projected to reach around 600 million by 2036 approximately 40% of the total population up from 31% in 2011. Additionally, these urban areas are expected to contribute nearly 70% of India's GDP. This demographic and economic shift has led to increased adoption of washing machines and a growing preference for machine-friendly, time-saving fabric care solutions such as liquid detergents, laundry capsules, and fabric conditioners. These evolving preferences not only promote product diversification and innovation but also significantly expand the market potential for fabric care, particularly across metropolitan and Tier 1 cities.

Growth Inhibitors:

How Do Environmental Concerns and Regulatory Pressures Restrain the Market?

The India fabric care market expansion is increasingly constrained by environmental and regulatory pressures. Traditional detergent powders contain phosphates, which contribute significantly to water pollution and eutrophication. For instance, phosphate concentrations in the Yamuna River a key concern for regulators, reach up to 13.4 mg/L at Khajoori Paltan, far exceeding the permissible limit of 5 mg/L set for dissolved phosphates. The Central Pollution Control Board (CPCB) is intensifying oversight, urging manufacturers to limit phosphate use and increase clarity on ingredient disclosure.

Meanwhile, Indian consumers are becoming more environmentally conscious, raising scrutiny over plastic packaging, water use, and residual chemicals. As a result, fabric care companies in India are under growing pressure to innovate, replacing phosphates with biodegradable alternatives, reducing plastics, and improving overall sustainability, not only to comply with evolving regulations but also to align with consumer expectations.

How do eco-friendly and sustainable innovations create significant growth opportunities in the industry?

One of the most promising growth avenues for the Indian fabric care sector is the surging demand for eco friendly and sustainable innovations. As environmental awareness reshapes consumer behaviour, brands pioneering green initiatives such as refillable liquid detergents, phosphate free concentrated formulas, biodegradable ingredients, and minimal or plastic free packaging are building loyal customer bases.

For instance, Hindustan Unilever Limited (HUL) introduced concentrated liquid detergents under its Surf Excel Matic brand, specifically formulated for front- and top-load washing machines. These products are phosphate-free, use less water, and come in refill pouches clearly reflecting a shift toward more sustainable, high-performance solutions that align with consumer expectations.

Moreover, the increasing focus on water-efficient, low-residue detergents not only supports environmental goals but also meets modern household needs for convenience and health safety. Ultimately, embracing sustainability is no longer just a value-added proposition it is emerging as a critical strategy for long-term relevance and success in the Indian fabric care market

How the Indian Fabric Care Market is Segmented in this Report, and what are the Key insights from the Segmentation Analysis?

By Product Insights

How is the growing consumer demand for specialized and eco-friendly products influencing the growth of specific product segments within the market?

The increasing consumer focus on sustainability, skin sensitivity, and fabric-specific needs is significantly shaping the growth trajectory of various product segments in the Indian fabric care market. On the basis of product, the market is segmented into Fabric Detergents (General Purpose, Baby Laundry Detergent, Delicate Laundry Detergent for wool/undergarments), Fabric Softeners/Conditioners, Stain Removers/Bleach, Sanitizer, and Other Products. As consumers increasingly seek multi-functional products that combine freshness, disinfection, and fabric care in one solution. Fabric softeners/conditioners are witnessing steady growth among middle and upper-income households, driven by premiumization and awareness campaigns, although rural uptake remains low. Stain removers and bleach serve specific urban needs and niche sectors like healthcare and hospitality, while fabric sanitizers surged during the pandemic and continue to hold relevance due to lasting hygiene concerns.other products While it currently represents the smallest share of the market, it signals a rising consumer inclination toward personalized and sustainable fabric care solutions.

By Form Insights

How is the Indian fabric care market segmented by form?

Based on form, the market is segmented into Liquid, powder, Unit Dose (Pods,Sachets), Sheet&Wipe, Spray.

Powder detergents continue to dominate in terms of volume, especially in rural and cost-sensitive segments, due to their affordability and widespread familiarity. However, liquid detergents are rapidly gaining market share in urban areas, driven by rising washing machine usage, convenience, and a growing preference for fabric-friendly and residue-free cleaning. Unit Dose formats, such as pods and sachets, though still niche, appeal to premium consumers seeking mess-free and precise usage. Sheet & Wipe products, representing innovative and eco-conscious solutions, cater to on-the-go and sustainability-focused users, while fabric sprays are carving out a niche among urban households for quick refreshment, deodorization, and specialty care. Each of these forms reflects distinct consumer behaviors and offers unique value propositions, collectively driving the diversification and premiumization of the Indian fabric care market.By Enterprise Type Insights’.

By Nature Insights

How is the increasing consumer preference for eco-friendly and specialty fabric care products influencing the market segmentation by nature in the industry?

Based on Nature, the market is bifurcated into conventional, eco-friendly / organic, specialty.

The market, when segmented by nature into Conventional, Eco-friendly/Organic, and Specialty products. While conventional products continue to dominate due to affordability and mass-market appeal, there is a marked rise in demand for eco-friendly and specialty offerings, especially among urban, environmentally conscious consumers. Eco-friendly products, made with biodegradable ingredients and minimal chemical usage, are increasingly favored for their lower environmental impact and perceived health benefits. Specialty products, such as fabric softeners, color protectors, and premium stain removers, cater to niche needs and premium lifestyles, reflecting a broader trend of product personalization and premiumization. The surge in sustainability awareness, government promotion of green products, and the proliferation of e-commerce platforms have further accelerated the adoption of these categories. As a result, manufacturers are expanding their organic and specialty product lines, which is reshaping the market structure and driving innovation across the nature-based segments.

By Distribution Channel Insights

How are quick commerce platforms influencing impulse purchases and brand trials in the urban fabric care consumer segment in India?

Based on Distribution Channel, the market is categorized into Online(Marketplaces, Brand e com, Quick Commerce), Offline(Supermarkets, Hypermarkets, Department Stores).

Quick commerce platforms, driven by app-based delivery under initiatives like ONDC by DPIIT are reshaping impulse buying and brand trials in India’s urban fabric care market. Their convenience appeals to young, time-constrained consumers who seek instant access to essentials like detergents, fabric softeners, and stain removers, particularly when running low unexpectedly. This immediacy has opened the door for new and niche eco-friendly or premium fabric care brands to gain traction through low-risk trial purchases. The quick commerce market is anticipated to reach between US$ 25 billion and US$ 55 billion by 2030, driven by an increase in high-frequency, high-value usersThe urban segment (accounts for a revenue share of around 65%) is the largest contributor to the overall revenue generated by the FMCG sector in India. However, in the last few years, the FMCG market has grown at a faster pace in rural India compared to urban India.

By Price Tier Insights

How is rising disposable income in urban India influencing the shift from value-tier to mid-range and premium fabric care products?

Based on price tier the market is categorised into Value, Mid-range, Premium.

The rise in disposable income, especially in urban India, is playing a pivotal role in reshaping consumer preferences across the fabric care market’s value, mid-range, and premium price tiers. Traditionally, the value-tier dominated the Indian market due to its affordability and mass accessibility. Products in this category, such as economy laundry powders and basic detergents, continue to serve price-sensitive rural and lower-income urban segments. The steady rise in disposable income across urban India is significantly reshaping consumer behavior in the fabric care market, influencing a transition across the value, mid-range, and premium price tiers. Historically, the value-tier has held dominance due to its affordability and widespread appeal among rural households and lower-income urban consumers. This segment, comprising budget-friendly laundry powders and basic detergents, remains essential for price-sensitive buyers. Premium brands are also leveraging digital platforms and D2C (direct-to-consumer) models, capitalizing on the 78% rise in e-commerce adoption in Tier I and Tier II cities as per Invest India. However, as urban incomes increase and lifestyle aspirations evolve, there's a visible shift toward mid-range and premium offerings.This economic upliftment is fueling demand for mid-range products like liquid detergents and stain removers, while also opening opportunities for premium categories featuring specialty cleaners, fabric conditioners, and eco-conscious formulations. Thus, rising urban affluence is not only sustaining value-tier demand but is also accelerating premiumization in India's fabric care landscape.

By End User Insights

How are shifting consumer preferences in the residential segment and the operational demands of commercial and institutional users collectively influencing innovation and product diversification in India’s fabric care sector?

Based on End User the market is categorised into Residential, Others.

The end-user landscape of the market is predominantly driven by residential consumers.This segment spans a wide range from rural households reliant on handwashing and low-cost detergent bars or powders, to urban families using semi- or fully automatic washing machines and preferring liquid detergents, pods, softeners, and antibacterial products for added convenience and fabric care. the increasing penetration of washing machines and rising hygiene awareness among Indian households are transforming fabric care preferences, particularly in urban areas. The commercial segment holds the second-largest share, driven by demand from laundromats, hospitality chains, hospitals, and institutional laundry services that require bulk packaging, concentrated formulas, and high-performance products for large-scale operations. The Others segment, though comparatively smaller, includes applications in the military, transportation (such as railways and airlines), and industrial uniforms, where fabric care solutions must meet stringent standards for hygiene, durability, and efficiency.

Regional Outlook

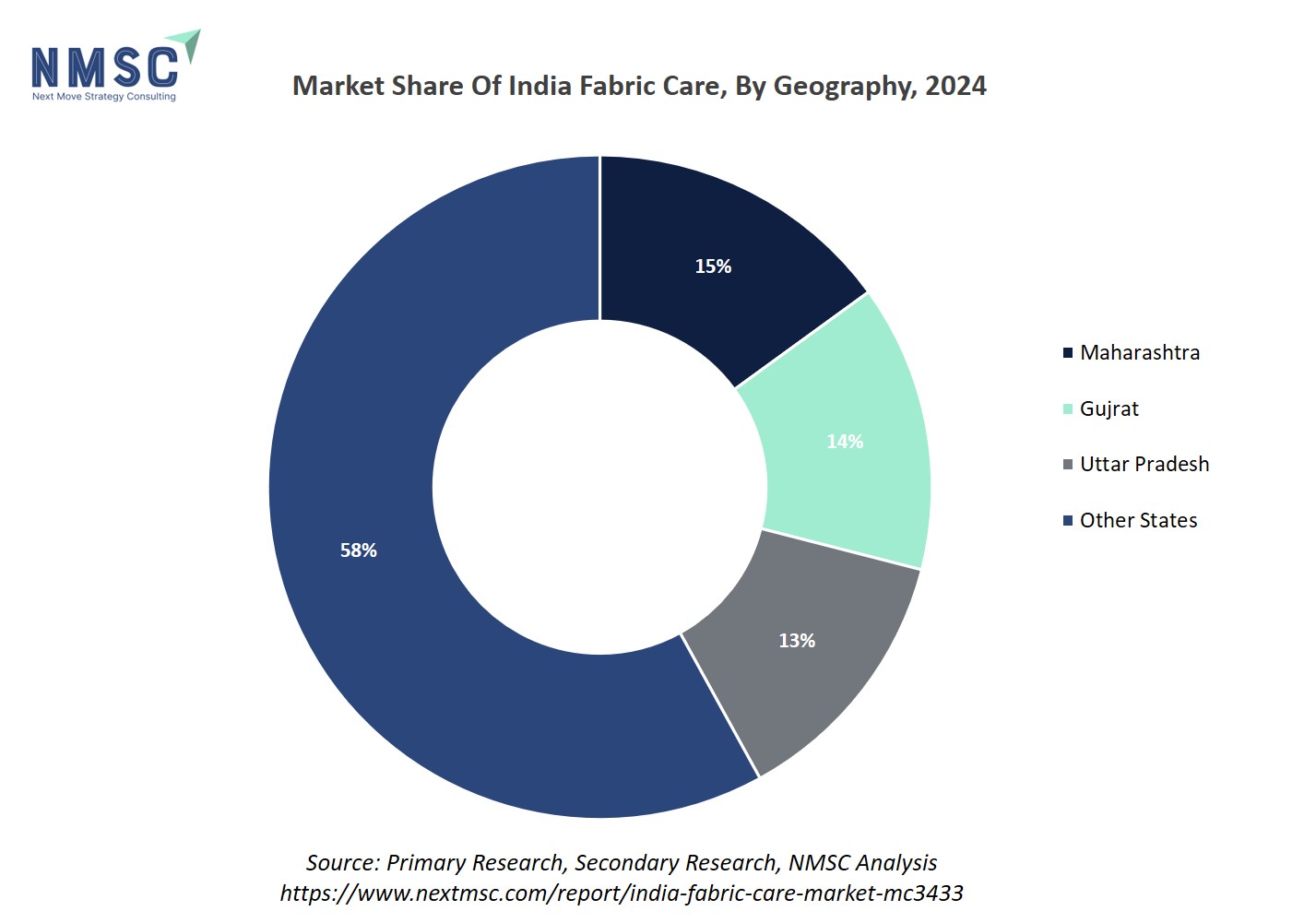

The market is geographically studied acrossvarious states of india such as Uttar Pradesh , Bihar, Maharashtra, Delhi, West Bengal, Tamil Nadu, Karnataka, Gujarat, Goa, Kerala, Other States.

India Fabric Care Market in Uttar Pradesh

The market size in Uttar Pradesh was valued at USD 848.3 million in 2024, and is expected to be valued at USD 934.9 million by the end of 2025. The industry is projected to grow, hitting USD 1217.6 million by 2030, with a CAGR of 5.43% between 2025 and 2030.

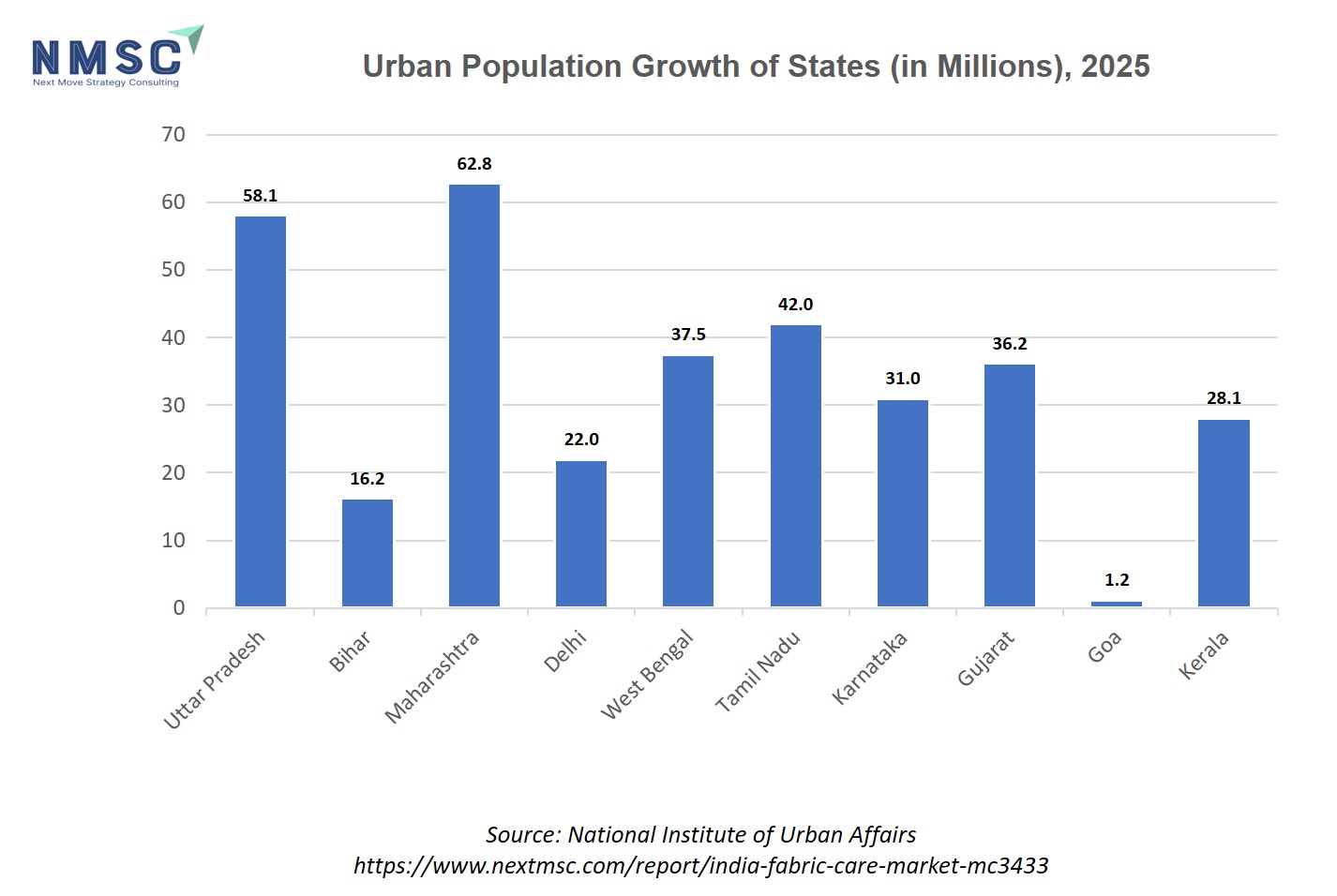

Uttar Pradesh, India’s most populous state, with an urban population of 57.3 million in 2024, represents a key growth market for the fabric care industry. As one of the fastest-urbanizing states, UP contributes significantly to the country's consumption-driven economy, fueled by rising household incomes and an expanding middle class.

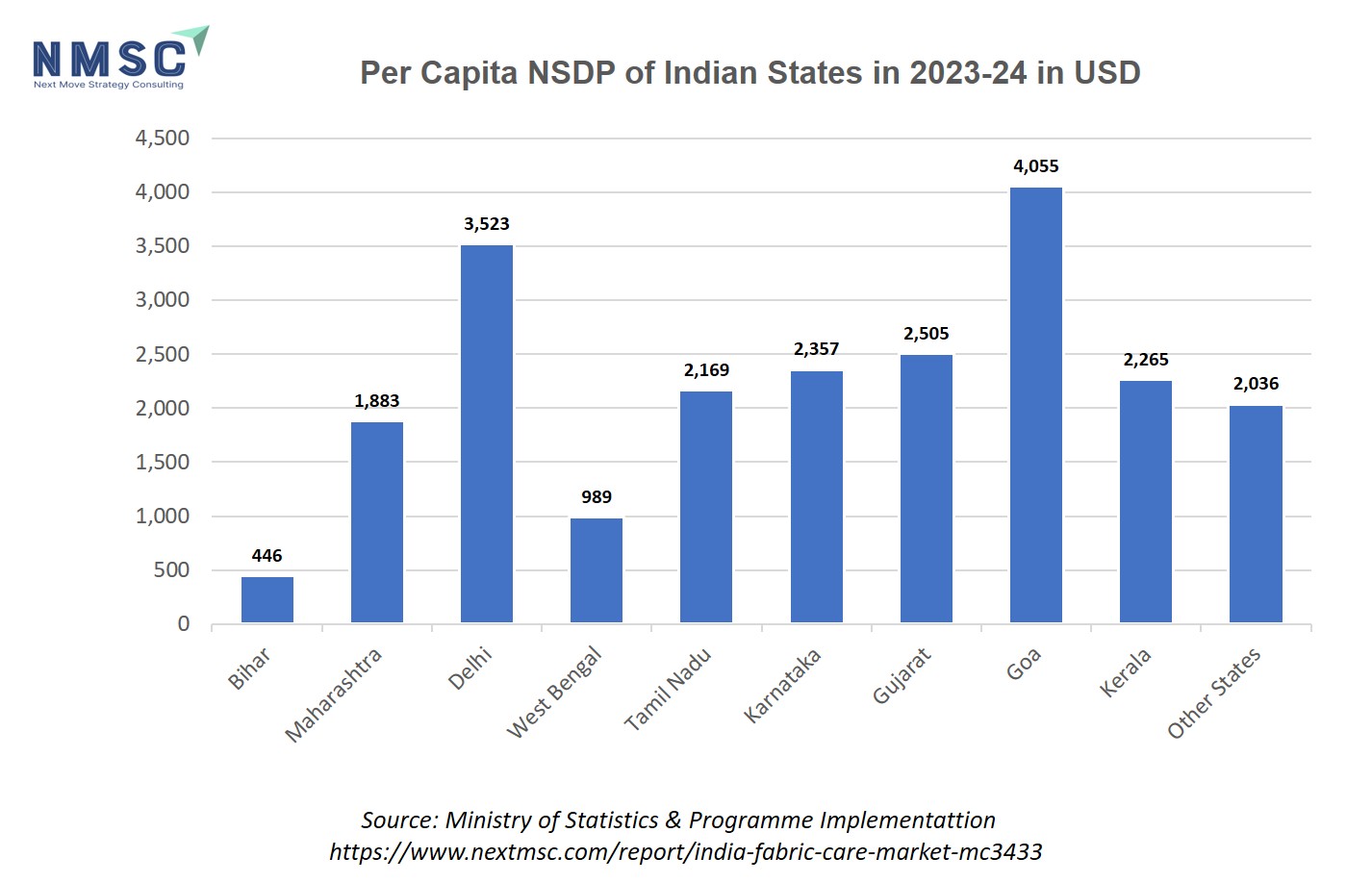

The state's average Monthly Per Capita Expenditure (MPCE) reached USD 65.32 in 2023–24, reflecting increased consumer purchasing power across both essential and premium home care categories. This urban expansion, along with heightened awareness around hygiene and fabric care is driving strong demand for detergents, fabric softeners, and stain removers, particularly in densely populated cities like Lucknow, Kanpur, Ghaziabad, and Noida.

Additionally, growing retail and e-commerce penetration in UP's non-food FMCG sector is broadening access to branded and sustainable fabric care products. The state’s development is further supported by investments in industrial corridors, smart city projects, and urban housing under schemes like PMAY, which are improving infrastructure and household conditions.

Together, these factors position Uttar Pradesh as a strategic target for fabric care brands seeking to scale in Tier 2 and Tier 3 urban markets as part of India’s broader shift toward premium daily-use consumer goods.

India Fabric Care Market in the Bihar

The market revenue in Bihar was valued at USD 406.4 million in 2024, and is expected to be valued at USD 444.9 million by the end of 2025. The industry is projected to grow, hitting USD 559.9 million by 2030, with a CAGR of 4.71% between 2025 and 2030.

Bihar, with an estimated urban population of 16.2 million in 2025 and an average Monthly Per Capita Expenditure (MPCE) of USD 60.9 in 2023–24, is emerging as a promising consumer base within India’s evolving fabric care market. The state’s gradual transition from rural to urban living is fostering increased aspirations for improved hygiene, cleanliness, and overall quality of life key drivers of demand for fabric detergents, softeners, and related care products. While historically industrially underdeveloped, urban hubs such as Patna, Gaya, Bhagalpur, and Muzaffarpur are witnessing growing market engagement, supported by enhancements in infrastructure and retail accessibility.

Additionally, Bihar’s young demographic and expanding digital connectivity are boosting consumer awareness and the adoption of branded fabric care solutions, particularly within the affordable and mid-range segments. Complementing these trends, ongoing government-led urban development efforts, including housing initiatives and smart city programs, are progressively improving urban living standards. Collectively, these dynamics position Bihar as an underpenetrated yet high-potential market, offering fabric care brands significant opportunities to drive volume-led growth and attract first-time consumers across both traditional and modern trade channels.

India Fabric Care Market in Maharastra

The Maharastra market size was valued at USD 961.2 million in 2024, and is expected to be valued at USD 1063.8 million by the end of 2025. The industry is projected to grow, hitting USD 1414.4 million by 2030, with a CAGR of 5.86% between 2025 and 2030.Maharashtra, with an estimated urban population of 62.0 million in 2024 and a high average MPCE of USD 89.15, is a key driver of India’s fabric care market.

As one of the country’s most industrialized and economically advanced states, it accounts for significant consumption across detergents, softeners, stain removers, and eco-friendly products. Urban centers like Mumbai, Pune, Nagpur, Nashik, and Thane are seeing rising numbers of nuclear families and dual-income households, boosting demand for premium, time-saving fabric care solutions.

A strong retail and e-commerce network ensures broad accessibility to both mass and niche brands. Ongoing urban development through initiatives such as the Mumbai Urban Transport Project, PMAY-Urban, and the Smart Cities Mission is further enhancing infrastructure and housing, reinforcing Maharashtra’s position as a strategic market for innovation, scale, and long-term growth in the household care sector.

India Fabric Care Market in Delhi

The market in Delhi was valued at USD 256.4 million in 2024, and is expected to be valued at USD 279.7 million by the end of 2025. The industry is projected to grow, hitting USD 345.4 million by 2030, with a CAGR of 4.31% between 2025 and 2030.

Delhi,the national capital of India holds an urban population of 21.6 million in 2024 and a high average MPCE of USD 88.63 represents a mature and premium market within India’s fabric care segment. As one of the most urbanized and densely populated regions, Delhi exhibits strong demand for advanced fabric care solutions such as liquid detergents, fabric conditioners, and eco-friendly products, driven by rising disposable incomes, higher education levels, and fast-paced lifestyles.

The widespread adoption of e-commerce has further enhanced access to branded and niche offerings. Additionally, urban development initiatives like the Delhi Master Plan 2041 and Smart City projects are modernizing infrastructure and housing, reinforcing Delhi’s status as a strategic hub for innovation and consumption in the home care industry.

India Fabric Care Market in the West Bengal

The market in West Bengal was valued at USD 455.3 million in 2024, and is expected to be valued at USD 499.4 million by the end of 2025. The industry is projected to grow, hitting USD 635.1 million by 2030, with a CAGR of 4.92% between 2025 and 2030.

West Bengal is emerging as a dynamic market for fabric care products, driven by increasing urbanization, rising hygiene awareness, and shifting consumer preferences toward branded solutions. With an urban population of 36.9 million in 2024 and a moderate average MPCE of USD 69.9 in 2023–24, the state presents substantial growth potential, particularly in key cities like Kolkata, Howrah, Durgapur, and Siliguri. These urban hubs are witnessing increased demand for detergents, fabric conditioners, and stain care products, fueled by the rise of nuclear families and lifestyle upgrades. The rapid growth of e-commerce amplified by influencer marketing, promotional pricing, and convenience has broadened consumer access to specialty fabric care offerings, especially among middle- and upper-income segments. Infrastructure initiatives such as the Bengal Silicon Valley tech hub and expansion of digital public service centers are further modernizing urban living and retail ecosystems. Together, these factors position West Bengal as a strategic market for fabric care manufacturers and premium brands aiming to scale operations across Eastern India’s evolving urban landscape.

India Fabric Care Market in Tamil Nadu

The market in Tamil Nadu was valued at USD 615.3 million in 2024, and is expected to be valued at USD 677.4 million by the end of 2025. The industry is projected to grow, hitting USD 878.1 million by 2030, with a CAGR of 5.32% between 2025 and 2030.

Tamil Nadu, with an urban population of 41.6 million in 2024 and one of the highest average MPCE at USD 98.8 (2023–24), stands out as a key consumption hub in India’s fabric care market. This strong purchasing power is translating into growing demand for premium, performance-driven products such as liquid detergents, fragrance-rich conditioners, and eco-friendly wash solutions. Urban centers like Chennai, Coimbatore, Madurai, and Tiruchirappalli are leading this shift, supported by rising hygiene awareness, modern lifestyles, and widespread digital adoption. Tamil Nadu also ranks among the top states in online FMCG retail penetration, driven by high smartphone usage, efficient logistics, and tech-savvy urban consumers. Post-pandemic health concerns have further accelerated the adoption of multifunctional and time-saving fabric care options. Infrastructure initiatives, including PMAY-Urban housing projects, metro rail expansions, and smart city developments, are enhancing urban living standards and household utility access. These combined trends position Tamil Nadu as a strategically vital market for fabric care brands aiming to scale across South India’s increasingly sophisticated home care segment.

India Fabric Care Market in Karnataka

The market in Karnataka was valued at USD 482.3 million in 2024, and is expected to be valued at USD 530.4 million by the end of 2025. The industry is projected to grow, hitting USD 683.4 million by 2030, with a CAGR of 5.20% between 2025 and 2030.

With an urban population of 30.5 million and a strong MPCE of USD 93.62, Karnataka is emerging as one of India’s most progressive and digitally advanced markets for fabric care. The state’s economic strength, reflected in its per capita NSDP of USD 2255.37 in 2023–24, supports rising consumer spending on premium home and laundry care solutions.

Urban centers like Bengaluru, Mysuru, Mangaluru, and Hubballi are at the forefront of this transformation, driven by tech-savvy populations, organized retail expansion, and a thriving digital commerce ecosystem. Karnataka has one of the highest online purchase rates in South India, fueling demand for liquid detergents, specialty softeners, and eco-friendly laundry care products.

Infrastructure advancements—including smart city initiatives, metro rail expansion, and high-density housing developments, particularly in Bengaluru—are accelerating the need for convenient, fast-acting, and high-performance fabric care solutions. With growing emphasis on hygiene, fragrance, and sustainability, Karnataka presents a key strategic market for brands targeting innovation-driven urban consumers in southern India.

India Fabric Care Market in Gujarat

The Gujarat market size was valued at USD 877.5 million in 2024, and is expected to be valued at USD 969 million by the end of 2025. The industry is projected to grow, hitting USD 1275 million by 2030, with a CAGR of 5.64% between 2025 and 2030.

As one of India’s most industrialized and urbanized states, Gujarat’s urban population of over 35.5 million is driving increased demand for fabric care products across major cities such as Ahmedabad, Surat, Vadodara, and Rajkot.The state’s rapid urbanization, rising hygiene awareness, and smart infrastructure development have significantly boosted the consumption of detergents, fabric softeners, and specialty stain removers.

With a strong focus on sanitation under national and state-led housing and cleanliness programs, coupled with expanding digital and retail networks, Gujarat represents a key strategic market for India’s fabric care brands aiming to innovate and scale in a hygiene-focused consumer environment.

India Fabric Care Market in Goa

The market in Goa was valued at USD 51.3 million in 2024, and is expected to be valued at USD 55.9 million by the end of 2025. The industry is projected to grow, hitting USD 68.8 million by 2030, with a CAGR of 4.24% between 2025 and 2030.

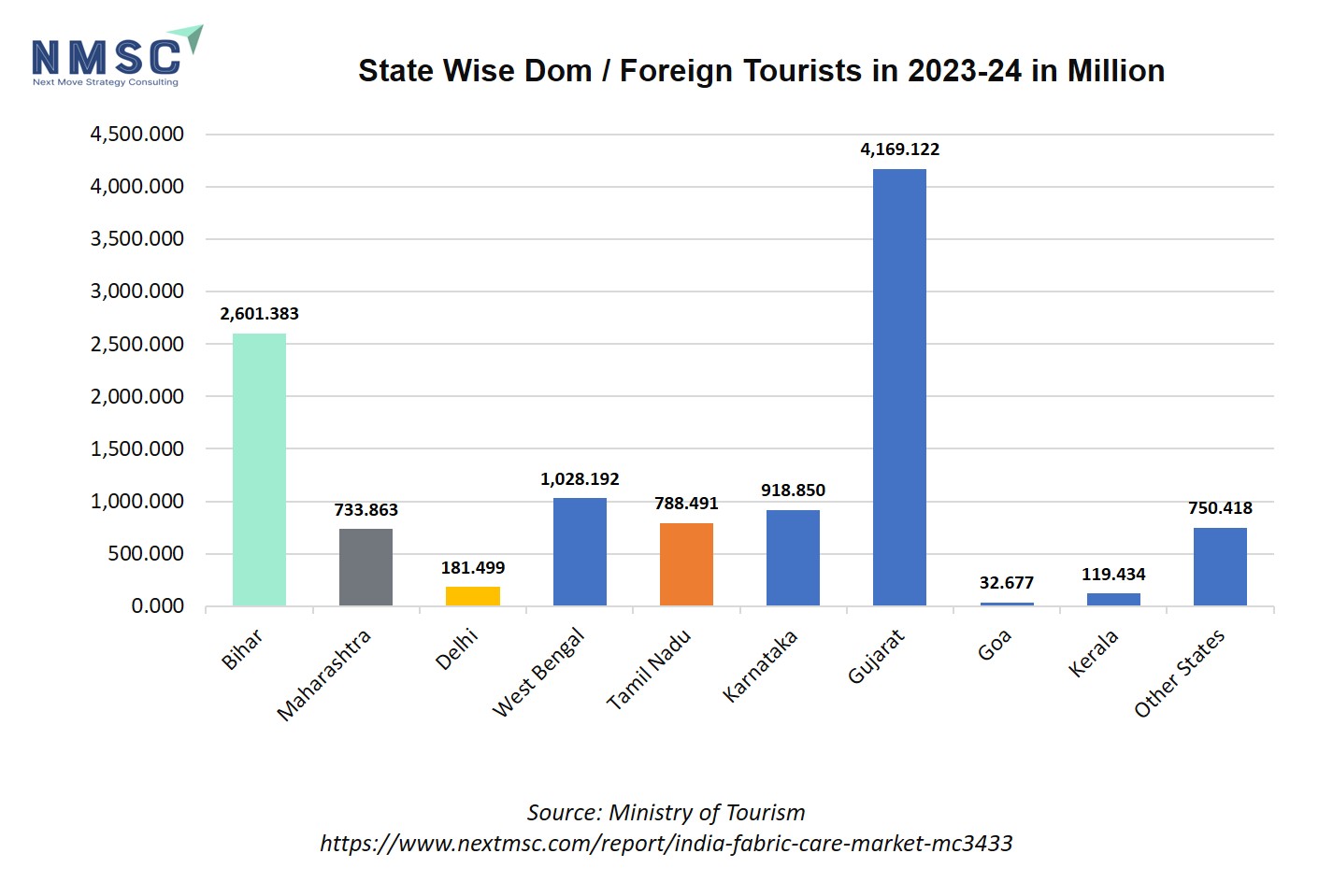

Despite its smaller population, Goa stands out as a premium fabric care market, shaped by lifestyle-driven, brand-conscious, and sustainability-aware consumers. Urban hubs such as Panaji, Margao, Vasco da Gama, and Mapusa are witnessing strong demand for liquid detergents, fabric conditioners, and eco-friendly laundry products tailored to convenience and quality. Moreover, the state’s robust hospitality and tourism industry drives institutional demand for high-performance commercial laundry solutions.With rising internet penetration and e-commerce adoption, Goa presents a niche yet lucrative market for fabric care brands looking to tap into affluent households and early adopters seeking sustainable, premium, and tech-enabled solutions. Moreover, the steady rise in tourist arrivals is further amplifying demand for professional-grade laundry care in hotels, resorts, and homestays, cementing Goa’s position as a niche but strategically important market in India’s evolving fabric care landscape.

The above graph illustrates the total number of domestic and foreign tourists visiting each state in India between 2023-24. This increasing influx of travelers has a significant positive impact on the growth of the fabric care market in the country, as higher tourist activity leads to greater demand for laundry and garment maintenance services across hotels, guesthouses, and local households.

India Fabric Care Market in Kerala

The market in Kerala was valued at USD 351.8 million in 2024, and is expected to be valued at USD 384.4 million by the end of 2025. The industry is projected to grow, hitting USD 479.3 million by 2030, with a CAGR of 4.51% between 2025 and 2030.

With an urban population of 27.3 million, Kerala presents a strong demand base driven by highly educated, health-conscious, and brand-aware consumers. The state is witnessing early adoption of liquid detergents, antibacterial fabric washes, and allergen-free softeners, reflecting a preference for performance, safety, and environmental responsibility.

Kerala’s high internet and smartphone penetration, among the highest in India, has fueled rapid growth in e-commerce, enabling access to a wide range of home care and fabric care products. Additionally, the state's deep-rooted environmental consciousness and supportive policies are pushing demand for biodegradable and low-chemical formulations. Together, these factors position Kerala as a strategic market for premium, health-driven, and sustainable fabric care brands seeking growth in southern India.

India Fabric Care Market in Other states

The other states market size was valued at USD 1184.6 million in 2024, and is expected to be valued at USD 1318.8 million by the end of 2025. The industry is projected to grow, hitting USD 1804 million by 2030, with a CAGR of 6.47% between 2025 and 2030.

States such as Rajasthan, Telangana, Andhra Pradesh, Madhya Pradesh, and Haryana are becoming increasingly important in India’s fabric care market due to expanding urbanization and rising consumption. Rajasthan and Madhya Pradesh are seeing steady urban growth through housing and infrastructure development, boosting access to branded fabric care products in cities like Jaipur and Indore. Telangana and Andhra Pradesh benefit from higher per capita incomes and growing e-commerce in urban centers like Hyderabad and Visakhapatnam. Haryana, with a high MPCE of USD 101.26 shows strong demand for premium fabric care in cities such as Gurugram and Faridabad, driven by modern lifestyles and disposable income. Moreover, the rise of smart cities, improved logistics, and greater hygiene awareness across these regions is accelerating demand for both mass-market and premium fabric care solutions, positioning them as key Tier 1 and Tier 2 consumption hubs for brands aiming to expand and diversify in India’s home care sector.

Competitive Landscape

What are the Top Companies in the India Fabric Care Industry and How they are Competing Against One Another?

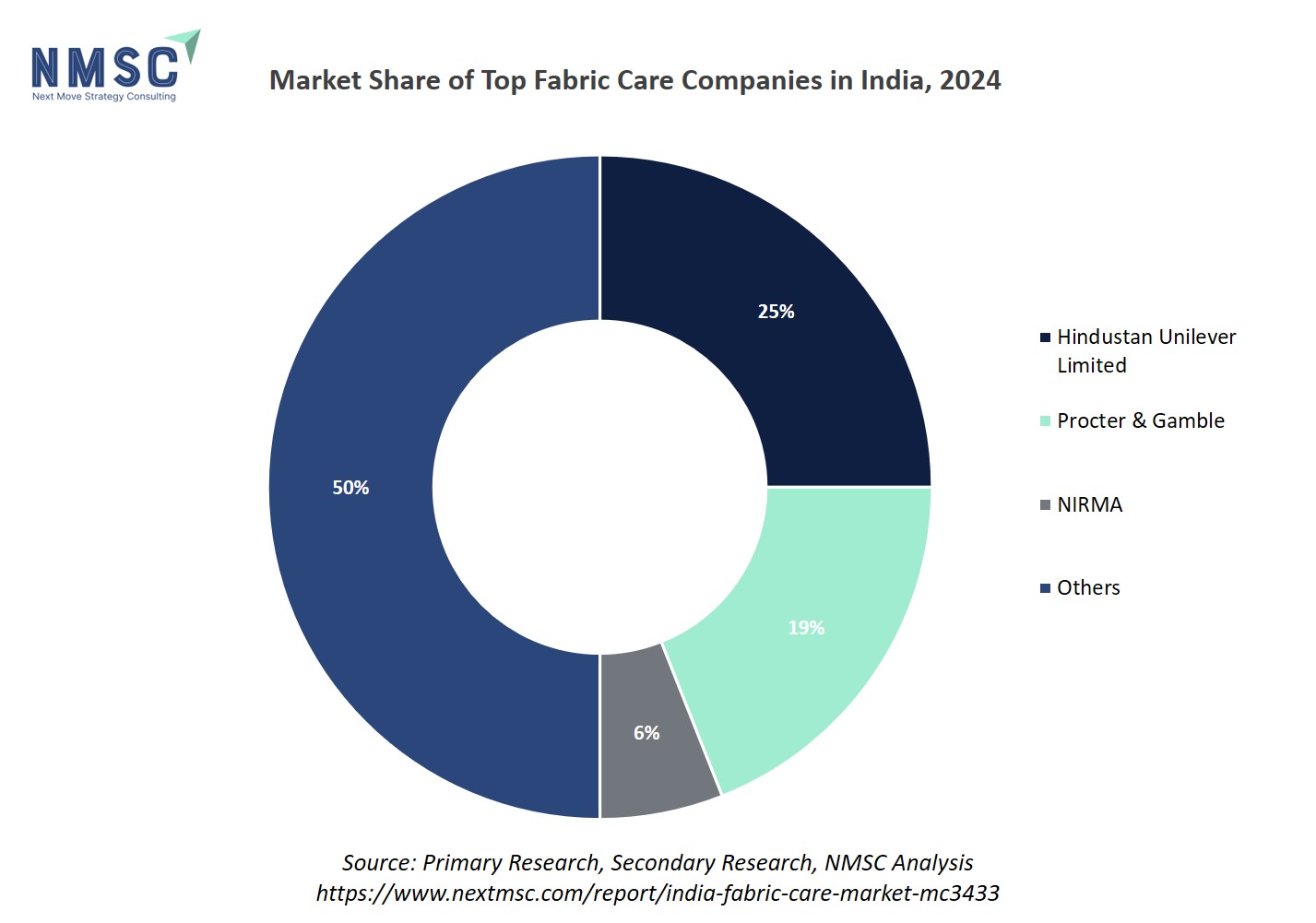

The fabric care industry in India is dominated by leading consumer goods companies such as Procter & Gamble, Reckitt Benckiser India, Godrej Consumer Products Limited, NIRMA, Jyothy Laboratories Ltd., Wipro Consumer Care & Lighting Ltd., RSPL Group, Patanjali Ayurved, Marico Limited, and others.

These market leaders are driving innovation through sustained investments in R&D, new product development, and sustainability initiatives. The competitive landscape is increasingly dynamic, characterized by continuous product launches in segments like eco-friendly detergents, fabric conditioners, stain removers, and machine-specific formulations.

Major players such as P&G and HUL are focused on enhancing their product portfolios with premium, liquid-based, and machine-wash-compatible solutions, while homegrown brands like NIRMA, Patanjali, and RSPL (makers of Ghari detergent) continue to dominate the value-for-money segment with mass appeal. Emerging brands like Born Good, Koparo Clean, and Ayur Gen Herbals are making strategic inroads into the eco-conscious consumer base by offering plant-based, biodegradable, and toxin-free fabric care alternatives.

To stay competitive, these companies are adopting digitally driven marketing strategies, expanding omnichannel retail footprints, and strengthening logistics and distribution networks across urban and rural markets. Strategic collaborations, celebrity endorsements, pricing innovations, and investment in sustainable packaging and supply chains are further shaping the competitive edge. With a focus on consumer-centric innovation, product diversification, and brand repositioning, the Indian fabric care market continues to evolve rapidly amidst growing awareness, rising disposable incomes, and shifting lifestyle preferences.

Innovation and Adaptability Drive Market Success

Success in the India fabric care sector hinges on a blend of product innovation, consumer responsiveness, and strategic agility. Established players like Procter & Gamble, Godrej Consumer Products, Reckitt Benckiser, and Marico must consistently invest in formulation R&D, packaging innovation, and sustainable product lines to maintain relevance and competitive edge.

This involves addressing evolving consumer needs such as eco-consciousness, machine-specific usage, stain-resistance, and fabric softness, while also strengthening retail and e-commerce partnerships to ensure broad and agile market reach. As consumer awareness around environmental impact and health safety grows, leading brands are also expected to align with evolving regulatory norms related to biodegradable ingredients and packaging waste.

For emerging players like Koparo Clean, Born Good, Soft & Fresh, and Ayur Gen Herbals, success lies in targeting niche segments such as green cleaning, plant-based formulations, and hypoallergenic products. These players are leveraging digital-first approaches, influencer marketing, and regional customization to carve space in a market traditionally dominated by legacy brands.

However, high brand loyalty and price sensitivity in certain demographics, particularly rural and semi-urban India, pose challenges. Nevertheless, the increasing shift towards premiumization, hygiene, and sustainable living creates significant opportunity for innovation-driven and purpose-led fabric care brands to disrupt the market and gain consumer trust.

Market Players to Opt for Merger & Acquisition Strategies to Expand their Presence

In the market, leading companies are increasingly turning to mergers, acquisitions, and strategic partnerships to strengthen their market position and expand product portfolios. Established players like P&G, Reckitt Benckiser, Marico, and Godrej Consumer Products are actively acquiring or collaborating with niche and eco-conscious brands to tap into emerging consumer preferences for sustainable and innovative fabric care solutions.

This trend allows companies to blend their existing manufacturing and distribution capabilities with the specialized formulations, digital agility, or regional strengths of acquired firms. The strategy not only accelerates innovation but also enhances their ability to serve diverse consumer needs across India’s value, mid-tier, and premium fabric care segments, while staying competitive in a rapidly evolving and sustainability-driven market.

List of Key India Fabric Care Companies

-

Hindustan Unilever Limited

-

Procter & Gamble

-

Reckitt Benckiser India

-

Godrej Consumer Products Limited

-

NIRMA

-

Jyothy Laboratories Ltd.

-

Wipro Consumer Care & Lighting Ltd.

-

RSPL Group

-

Patanjali Ayurved Limited

-

Fena Private Limited (INDIA)

-

Marico Limited

-

Amway India Enterprises Pvt. Ltd.

-

The Clorox Company

-

Modicare

-

Born Good

-

Koparo Clean

-

Abh Biochem Pvt. Ltd.

-

Ayur Gen Herbals

-

Soft & Fresh

-

Zimmer Aufraumen

-

Swift Brite Industries Inc.

What Are The Latest Key Industry Developments?

-

March 2025 – HUL relaunched Surf Excel Smart Shots, featuring enhanced formulation and upgraded benefits, targeting premium fabric care consumers to further strengthen their offering in the premium portfolio.

-

March 2025 – Jyothy Labs Limited announced the launch of new products under its Fabric Care and Household Insecticide categories. The company introduced Ujala Young & Fresh in the fabric care segment.

-

December 2024 – Rin bar was re-launched by Hindustan Unilever Limited, incorporating product-enhancing superior technology, and Comfort fabric conditioner underwent a comprehensive re-launch aimed at further elevating brand superiority.

-

May 2024 – Godrej Consumer Products expands e-commerce business, launches three new digital native products under Godrej Ezee, Godrej Protekt, and Goodknight.

-

January 2024 – Godrej Consumer Products Limited (GCPL) is reshaping the Indian laundry care category with the introduction of Godrej Fab. The product is a high-performance liquid detergent here to redefine the laundry experience.

What are the Key Factors Influencing Investment Analysis & Opportunities in India Market for Fabric Care?

India’s fabric care market offers compelling investment potential driven by a large, fast growing consumer base and high margin subsegments like liquids, unit dose formats, and eco friendly products. Rising disposable incomes and urbanization are boosting demand for premium, convenient solutions, while e commerce growth and modern retail channels enable rapid scaling and cost effective customer acquisition.

Regulatory pressures on packaging and wastewater treatment, coupled with strong R&D in advanced enzymes and IoT enabled dispensing, create barriers to entry and favor well capitalized players. Key opportunities lie in premium portfolio expansion in urban and Tier II markets, sustainable “green” innovations, digital first DTC models, and rural penetration via low cost SKUs. Additionally, value added services and strategic co branding with appliance manufacturers can further enhance margins and consumer loyalty.

Key Benefits for Stakeholders:

Next Move Strategy Consulting (NMSC) presents a comprehensive analysis of the global India Fabric Care market, covering historical trends from 2020 through 2024 and offering detailed forecasts through 2030. Our study examines the market at global, regional, and country levels, providing quantitative projections and insights into key growth drivers, challenges, and investment opportunities across all major fabric care segments.

India Fabric Care Market Key Segments

By Product Type

-

Fabric Detergents

-

General Purpose

-

Baby Laundry Detergent

-

Delicate Laundry Detergent (for wool/undergarments)

-

-

Fabric Softeners/Conditioners

-

Stain Removers/Bleach

-

Sanitizer

-

Other Products

By Form

-

Liquid

-

Powder

-

Unit Dose

-

Pods

-

Sachets

-

-

Sheet&Wipe

-

Spray

By Nature

-

Conventional

-

Eco-friendly / Organic

-

Specialty

By Distribution Channel

-

Online

-

Marketplaces

-

Brand e com

-

Quick Commerce

-

-

Offline

-

Supermarkets

-

Hypermarkets

-

Department Stores

-

By Price tier

-

Value

-

Mid-range

-

Premium

By End User

-

Residential

-

Commercial

-

Others

Geographical Breakdown

-

Uttar Pradesh

-

Bihar

-

Maharashtra

-

Delhi

-

West Bengal

-

Tamil Nadu

-

Karnataka

-

Gujarat

-

Goa

-

Kerala

-

Other States

Conclusion & Recommendations

Our report equips stakeholders, industry participants, investors, policy makers, and consultants with actionable intelligence to capitalize on the dynamic growth of India’s fabric care market. By combining comprehensive, data driven analysis with strategic insights and market frameworks, NMSC’s India Fabric Care Market Report serves as an indispensable resource for navigating evolving consumer preferences, regulatory shifts, and competitive dynamics.

Report Scope and Segmentation:

|

Parameters |

Details |

|

Market Size in 2025 |

USD 7.15 Billion |

|

Revenue Forecast in 2030 |

USD 9.36 Billion |

|

Growth Rate |

CAGR of 5.51% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

States Covered |

10 |

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 analyst-working hours) after purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

|

Approach |

In-depth primary and secondary research; proprietary databases; rigorous quality control and validation measures. |

|

Analytical Tools |

Porter's Five Forces, SWOT, value chain, and Harvey ball analysis to assess competitive intensity, stakeholder roles, and relative impact of key factors. |

Speak to Our Analyst

Speak to Our Analyst