Organic Food Market: 2024–25 — Growth, Regions and Strategic Moves

Published: 2025-09-08

The organic food market returned to clear growth in 2024 and into 2025 as consumers rebalanced spending toward health, retailers expanded private-label organic assortments, and large food groups reshaped portfolios via divestments and acquisitions. This piece summarises verified 2024–25 developments, cross-industry applications, core components, region-by-region dynamics, recent corporate deals, and near-term prospects — with data and primary quotes to verify every major claim.

1) Latest developments (2024–25)

-

U.S. retail momentum accelerated in 2024: “Dollar sales for organic also reached a new high of $71.6 billon in 2024.”

-

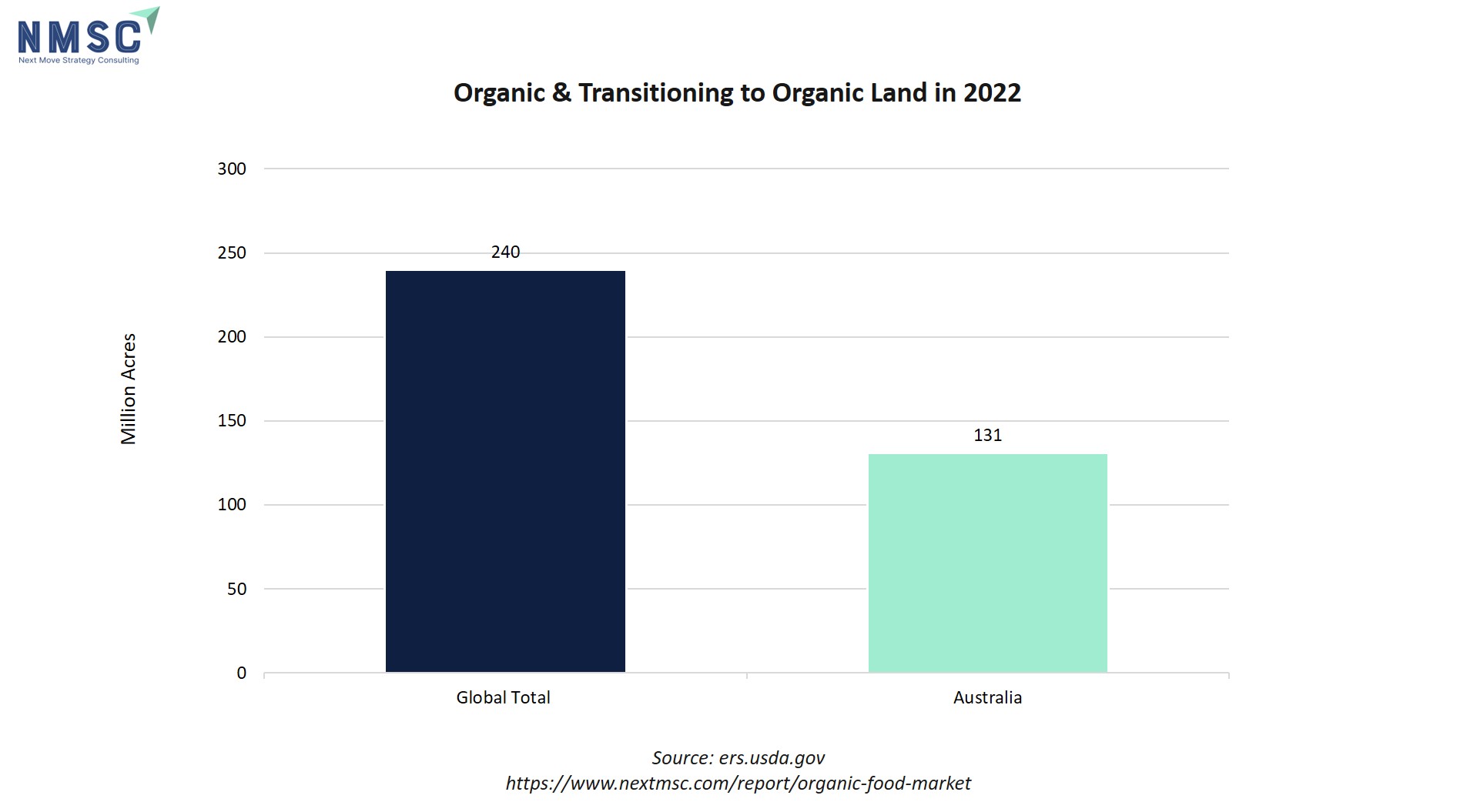

Global organic farmland continued to expand: “In 2022, global organic and transitioning to organic land comprised almost 240 million acres. Australia has the most organic and transitioning to organic acreage (131 million acres).”

-

Corporate portfolio moves: Danone divested some U.S. organic dairy brands and then pursued complementary organic acquisitions — “Danone announces the sale of Horizon Organic and Wallaby businesses in the U.S.” (Jan 2, 2024).

2) Applications across industries

Organic certification and ingredients matter beyond grocery aisles:

-

Food & Beverage: fresh produce, dairy, baby foods and beverages (functional and plant-based). OTA data shows produce led organic food sales in 2024.

-

Retail & Private label: grocers scale organic private labels to hold margins and traffic (see Kroger’s expansion of its Simple Truth organic line).

-

Hospitality & Food Service: organic supply contracts for premium and wellness menus.

-

Personal care & textiles: growth in organic textiles and personal-care segments is reported alongside food growth.

-

Nutrition & Medical Foods: acquisitions such as Danone → Kate Farms underline demand for certified organic medical nutrition and adult/paediatric formulas.

3) Components of the organic food market

Primary production: certified crops, livestock (dairy, eggs), and pasture/rangeland. USDA notes a concentration of Australia’s organic land in extensive grazing.

Processing & certification: regulatory regimes (USDA NOP, EU Organic Regulation) and third-party certifiers. Regulatory change and equivalence agreements drive trade flows.

Retail & distribution: supermarkets, specialist stores, online platforms, and private labels (e.g., Simple Truth, Great Value, retail organic lines).

Innovation: plant-based formulations, cleaner-label functional beverages, organic-ready medical nutrition and traceability tools (databases and organic-specific HS codes).

4) Regional analysis — dominating vs fastest-growing regions

Dominating regions (by retail value and market maturity)

-

United States (dominant retail market): OTA reports U.S. organic retail sales hit $71.6B in 2024, with produce the largest category. “U.S. sales of certified organic products accelerated in 2024... $71.6 billon in 2024.”

-

European Union (large, diversified market): EU is the second largest regional market (FiBL/EU statistics), and the European Commission set a strategic target of 25% organic farmland by 2030. “The Commission considers it a key tool... set the target of having 25 % of the EU's agricultural land organically farmed by 2030.”

Fastest-growing regions (by acreage and growth rates)

-

Asia-Pacific (notably China and Australia): China has become third largest market by growth; FiBL/industry sources show rapid expansion and rising retail demand. Australia leads in organic land area by a wide margin — 131M acres of certified and transitioning land in 2022. “Australia has the most organic and transitioning to organic acreage (131 million acres).”

Top countries to watch (by region):

-

North America: United States — highest retail value ($71.6B in 2024).

-

Asia-Pacific: China and Australia — China as a fast-emerging retail market; Australia as largest organic land holder (131M acres).

5) Key players and recent strategies / deals

Leading & emerging companies (with product/innovation links):

-

Danone — Danone will retain a non-consolidated minority stake in the business. The closing of the transaction is subject to customary conditions.

-

General Mills (Annie’s) — product innovation and brand-level organic offerings under its Accelerate strategy. “General Mills is executing its Accelerate strategy to drive sustainable, profitable growth...”

-

Kroger — expanding Simple Truth Organic private label and fresh organic assortments to capture value-seeking shoppers.

6) Future prospects

-

Near term (next 3–5 years): OTA projects a steady CAGR of 5.1% for organic through 2029; retailers will continue to widen organic private labels while regulated markets (EU, US) will refine equivalence and trade codes to improve traceability.

-

According to the study of Next Move Strategy Consulting, the global organic food market is projected to reach USD 604.83 million by 2030, growing at a CAGR of 13.48% from 2023 to 2030. Organic food includes agricultural products produced with minimal use of synthetic chemicals such as pesticides, fertilizers, and genetically modified organisms (GMOs).

About Next Move Strategy Consulting:

Next Move Strategy Consulting is a premier market research and management consulting firm that has been committed to provide strategically analysed well documented latest research reports to its clients. The research industry is flooded with many firms to choose from, what makes Next Move different from the rest is its top-quality research and the obsession of turning data into knowledge by dissecting every bit of it and providing fact-based research recommendation that is supported by information collected from over 500 million websites, paid databases, industry journals and one on one consultations with industry experts across a diverse range of industry sectors. The high-quality customized research reports with actionable insights and excellent end-to-end customer service help our clients to take critical business decisions that enables them to move beyond time and have competitive edge in the industry.

We have been servicing over 1000 customers globally that includes 90% of the Fortune 500 companies over a decade. Our analysts are constantly tracking various high growth markets and identifying hidden opportunities in each sector or the industry. We provide one of the industry’s best quality syndicate as well as custom research reports across 10 different industry verticals. We are committed to deliver high quality research solutions in accordance to your business needs. Our industry standard delivery solutions that ranges from the pre consultation to after-sales services, provide an excellent client experience and ensure right strategic decision making for businesses.

For more information please contact:

Next Move Strategy Consulting

5th Floor 867

Boylston St, STE 500,

Boston, MA 02116, U.S.

E-Mail: [email protected]

Direct: +18577585017

Website: www.nextmsc.com

Add Comment