Africa Industrial Robotics Market by Type (Articulated Robots, SCARA Robots, and Others), by Offering Hardware, Software, and Services), by Payload Capacity (≤ 100 KG, 101-200 KG, 201-500 KG and Others), by Mobility (Stationary, and Mobile Robots), by Mounting Type (Floor mounted, Wall-mounted, and Others), by Application (Material Handling, Assembling & Disassembling, and Others), by Industry Vertical (Automotive, and Others) – Opportunity Analysis and Industry Forecast, 2025–2030

Industry: Semiconductor & Electronics | Publish Date: 25-Nov-2025 | No of Pages: 204 | No. of Tables: 191 | No. of Figures: 136 | Format: PDF | Report Code : SE3706

Industry Outlook

The Africa Industrial Robotics Market size was valued at USD 232.2 million in 2024 and is expected to reach USD 270.9 million by 2025. Looking ahead, the industry is projected to expand significantly, reaching USD 457.8 million by 2030, registering a CAGR of 11.1% from 2025 to 2030. In terms of volume, the market recorded 3 thousand units in 2024, with forecasts indicating growth to 4 thousand units by 2025 and further to 7 thousand units by 2030, reflecting a CAGR of 13.8% over the same period.

The market is experiencing steady growth, driven by the rapid expansion of manufacturing and automotive sectors, particularly in countries like South Africa, Egypt, and Morocco. Industrial robots are increasingly deployed for assembly, welding, painting, and material handling, helping manufacturers enhance productivity, reduce errors, and optimize operations. The adoption of advanced technologies such as AI, IoT, and collaborative robotics, alongside Industry 4.0 initiatives, is further accelerating robotics integration by enabling real-time monitoring, predictive maintenance, and data-driven decision-making. However, high implementation costs and a shortage of skilled personnel remain key restraints, limiting the scalability of industrial robots. At the same time, IoT integration presents a significant growth opportunity by improving efficiency, reducing downtime, and supporting Africa’s transition toward smart manufacturing and enhanced competitiveness.

Growing Adoption of Robots in Manufacturing and Automotive Sectors are Driving Industrial Robotics Adoption

The industrial robotics market in Africa is being driven by the rapid expansion of manufacturing industries, particularly in automotive, electronics, and consumer goods sectors. Countries such as South Africa, Egypt, and Morocco are investing in modern production facilities to improve efficiency, reduce labor costs, and maintain product quality. Industrial robots are increasingly used for tasks such as assembly, welding, painting, and material handling, helping manufacturers streamline operations, reduce errors, and enhance overall productivity. The rising demand for automation in high-volume and precision-driven industries is making industrial robots a critical part of Africa’s industrial development.

Increasing Focus on Advanced Technologies and Industry 4.0 Initiatives are Accelerating Robotics Market Growth

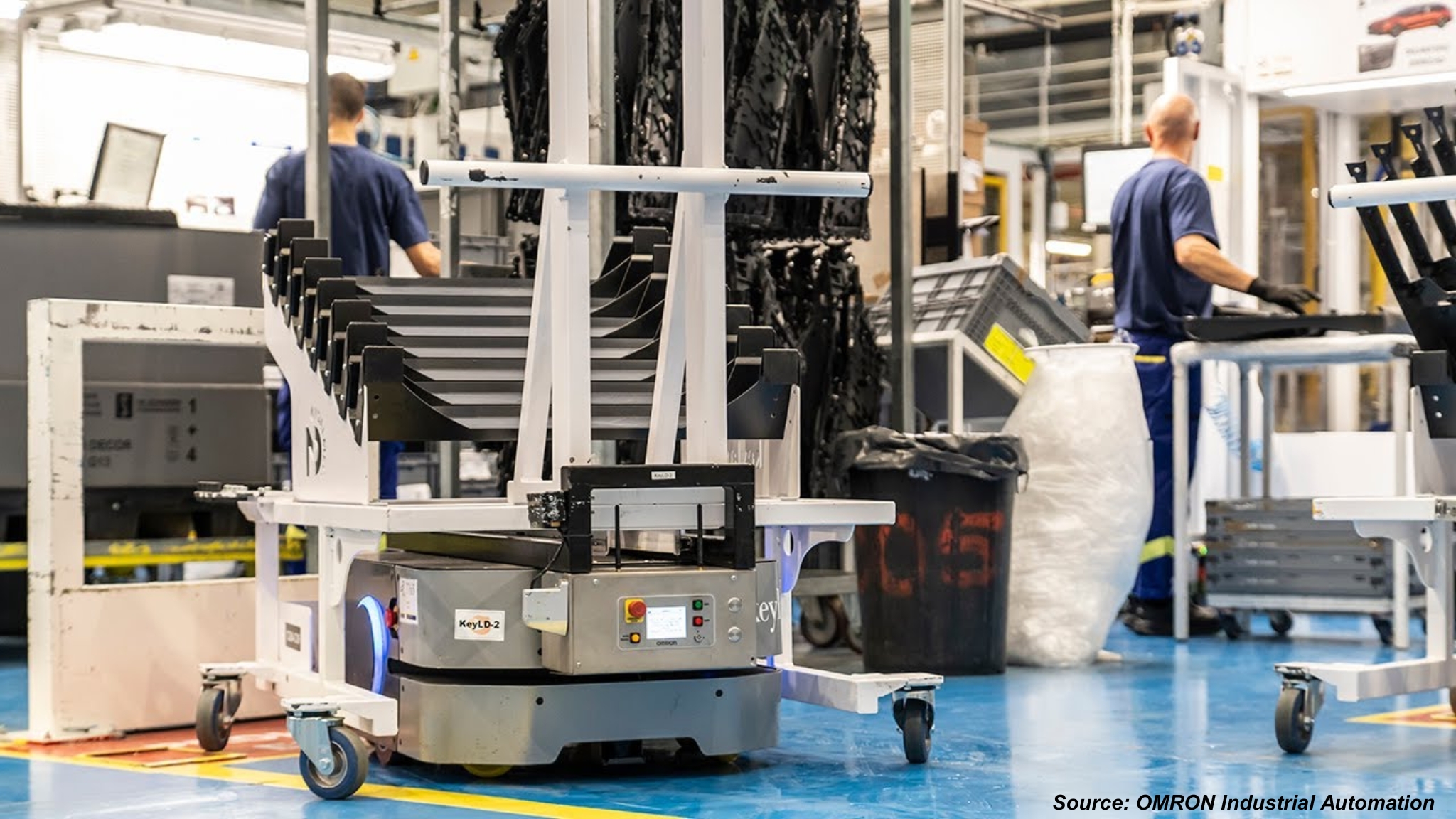

The integration of advanced technologies, including artificial intelligence (AI), the Internet of Things (IoT), and collaborative robotics, is accelerating robotics adoption in Africa. IoT-enabled industrial robots enable real-time monitoring, predictive maintenance, and data-driven decision-making, optimizing operational efficiency and reducing downtime. Government policies and private sector initiatives promoting Industry 4.0 and smart manufacturing practices are further boosting robotics deployment across key industries. These advancements help manufacturers improve productivity, reduce costs, and enhance competitiveness, driving the growth of industrial robotics in the region.

High Implementation Costs and Limited Technical Expertise are Hindering Robotics Adoption

The growth of the market is constrained by high implementation costs and a shortage of skilled personnel. Advanced industrial robots, including collaborative robots (cobots) and AI-enabled systems, require significant upfront investment, which can be a barrier for small and medium-sized enterprises (SMEs). Additionally, operating and maintaining these systems demands specialized technical expertise, which is limited across the region. These financial and workforce challenges can slow adoption and limit the scalability of industrial robots despite rising demand for automation.

Integration of IoT in Robots Creates Future Opportunity for the Market

The integration of Internet of Things (IoT) technology is a key opportunity for the Africa industrial robotics market demand. IoT-enabled industrial robots allow real-time monitoring, predictive maintenance, and intelligent process control, helping manufacturers optimize production workflows, track equipment performance, and reduce downtime. By leveraging these capabilities, African manufacturers can improve productivity, enhance energy efficiency, and make data-driven decisions, accelerating the adoption of industrial robots and supporting the region’s transition toward smart manufacturing.

Competitive Landscape

The Africa industrial robotics industry is highly competitive, led by key players such as ABB Ltd., Fanuc Corporation, Yamaha Motor Co., Ltd, Mitsubishi Electric Corporation, KUKA AG, Rockwell Automation, Siemens AG, Panasonic Corporation, Omron Corporation, Seiko Epson Corporation, Staubli International AG, SMARTSHIFT Robotics, and EVS TECH Co., Ltd. These companies are driving technological advancements by introducing AI- and IoT-enabled industrial robots, including collaborative robots (cobots) and autonomous mobile robots (AMRs). Their innovations are accelerating automation adoption across Africa’s manufacturing, automotive, electronics, and machinery industries, enhancing production efficiency, operational agility, and strengthening the region’s competitiveness in smart manufacturing and Industry 4.0.

Africa Industrial Robotics Market Key Segments

By Type

-

Articulated Robots

-

SCARA Robots

-

Cylindrical Robots

-

Cartesian/Linear Robots

-

Parallel Robots

-

Collaborative Robots

-

Autonomous Mobile Robots (AMRs)

-

Automated Guided Vehicles (AGVs)

-

Other Robots

By Offering

-

Hardware

-

Software

-

Robot Control Software

-

Vision & Perception Software

-

Other Software

-

-

Services

By Payload Capacity

-

≤ 100 KG

-

101-200 KG

-

201-500 KG

-

501-1000 KG

-

1001-2000 KG

-

2001-5000KG

-

More than 5000 KG

By Mobility

-

Stationary Robots

-

Mobile Robots

By Mounting Type

-

Floor-mounted

-

Wall-mounted

-

Ceiling-mounted

-

Rail-mounted

By Application

-

Material Handling

-

Assembling & Disassembling

-

Processing

-

Cleanroom

-

Dispensing

-

Welding and Soldering

-

Pick and Place

-

Others

By Industry Vertical

-

Automotive

-

Semiconductor & Electronics

-

Plastic and Chemical Products

-

Metal and Machinery

-

Logistics

-

Food & Beverages

-

Healthcare & Pharmaceutical

-

Others

Key Players

-

ABB Ltd.

-

Fanuc Corporation

-

Yaskawa Electric Corporation

-

Mitsubishi Electric Corporation

-

Seimens AG

-

Yamaha Motor Co., Ltd

-

Rockwell Automation

-

Denso Wave Inc.

-

Panasonic Corporation

-

Shibaura Machine CO., LTD

-

Omron Corporation

-

Seiko Epson Corporation

-

Staubli International AG

-

Honeywell International Inc

Report Scope and Segmentation

|

Parameters |

Details |

|

Market Size in 2025 |

USD 270.9 Million |

|

Revenue Forecast in 2030 |

USD 457.8 Million |

|

Growth Rate |

CAGR of 11.1% from 2025 to 2030 |

|

Market Volume in 2025 |

4 thousand units |

|

Volume Forecast in 2030 |

7 thousand units |

|

Growth Rate |

CAGR of 13.8% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Million (USD) |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst