Spain Industrial Robotics Market By Type (Articulated Robots, SCARA Robots, Cylindrical Robots and Others), By Offering Hardware, and Services), By Payload Capacity (≤ 100 KG, 101-200 KG, 201-500 KG and Others), By Mobility (Stationary, and Mobile Robots), By Mounting Type (Floor mounted, and Others), By Application (Material Handling, Assembling & Disassembling, and Others), By Industry Vertical (Automotive, and Others) – Opportunity Analysis and Industry Forecast, 2025–2030

Industry: Semiconductor & Electronics | Publish Date: 25-Nov-2025 | No of Pages: 165 | No. of Tables: 192 | No. of Figures: 137 | Format: PDF | Report Code : SE3725

Industry Outlook

The Spain Industrial Robotics Market size was valued at USD 712.9 million in 2024 and is expected to reach USD 850.7 million by 2025. Looking ahead, the industry is projected to expand significantly, reaching USD 1616 million by 2030, registering a CAGR of 13.7% from 2025 to 2030. In terms of volume, the sector recorded 9 thousand units in 2024, with forecasts indicating growth to 12 thousand units by 2025 and further to 27 thousand units by 2030, reflecting a CAGR of 18.0% over the same period.

The industrial robotics market in Spain is witnessing significant growth, driven by the rapid expansion of the country’s manufacturing sector and a strong shift toward automation. Articulated robots are becoming integral to production across industries such as automotive, electronics, machinery, and food processing, enabling higher efficiency, precision, and quality.

Continuous vendor innovation, led by global players like ABB, Fanuc, KUKA, and Yaskawa, is accelerating the Spain industrial robotics market expansion through the development of flexible, AI-integrated, and collaborative robotic solutions that enhance productivity and operational agility. However, system complexity, high initial investment costs, and a shortage of skilled personnel continue to pose challenges, particularly for SMEs, limiting the pace of adoption.

Despite these barriers, the integration of IoT technology is unlocking new opportunities for data-driven manufacturing, enabling real-time monitoring, predictive maintenance, and optimized production processes. Overall, industrial robotics is playing a transformative role in modernizing Spain’s manufacturing landscape, fostering the rise of smart factories, and strengthening the nation’s global industrial competitiveness.

Expanding Manufacturing Sector is Driving Spain Industrial Robotics Market Growth

Spain’s growing manufacturing sector, particularly in automotive, aerospace, electronics, and food processing industries, is a major driver of multi-axis robotics adoption. Companies are increasingly turning to automation to maintain high-quality standards, improve production efficiency, and remain competitive in global supply chains.

Robotics allows for faster, precise, and consistent operations, enabling manufacturers to meet increasing domestic and export demand. This expansion of industrial activity is a primary factor supporting the Spain industrial robotics market growth.

Growing Adoption of Industry 4.0 and Digital Transformation is Driving Market Trends

The adoption of Industry 4.0 and digital manufacturing technologies is reshaping Spain’s industrial landscape. Robotics integration with AI, machine vision, IoT, and data analytics is enabling predictive maintenance, real-time monitoring, and flexible production processes.

Government incentives and modernization programs aimed at improving industrial efficiency are further promoting robotics deployment. These technological advancements are defining new market trends and encouraging Spanish manufacturers to adopt more intelligent, connected, and automated production systems.

High Implementation Costs and Skills Shortage is Limiting Market Expansion

Despite the benefits of automation, the high upfront costs of robotic systems remain a significant barrier, especially for small and medium-sized enterprises (SMEs). Additionally, a shortage of skilled personnel capable of programming, operating, and maintaining robots limits wider adoption. The combination of financial and technical challenges slows market expansion, particularly among traditional manufacturers who rely on manual processes or legacy machinery.

Increasing Adoption of Collaborative Robots Creates Future Opportunities

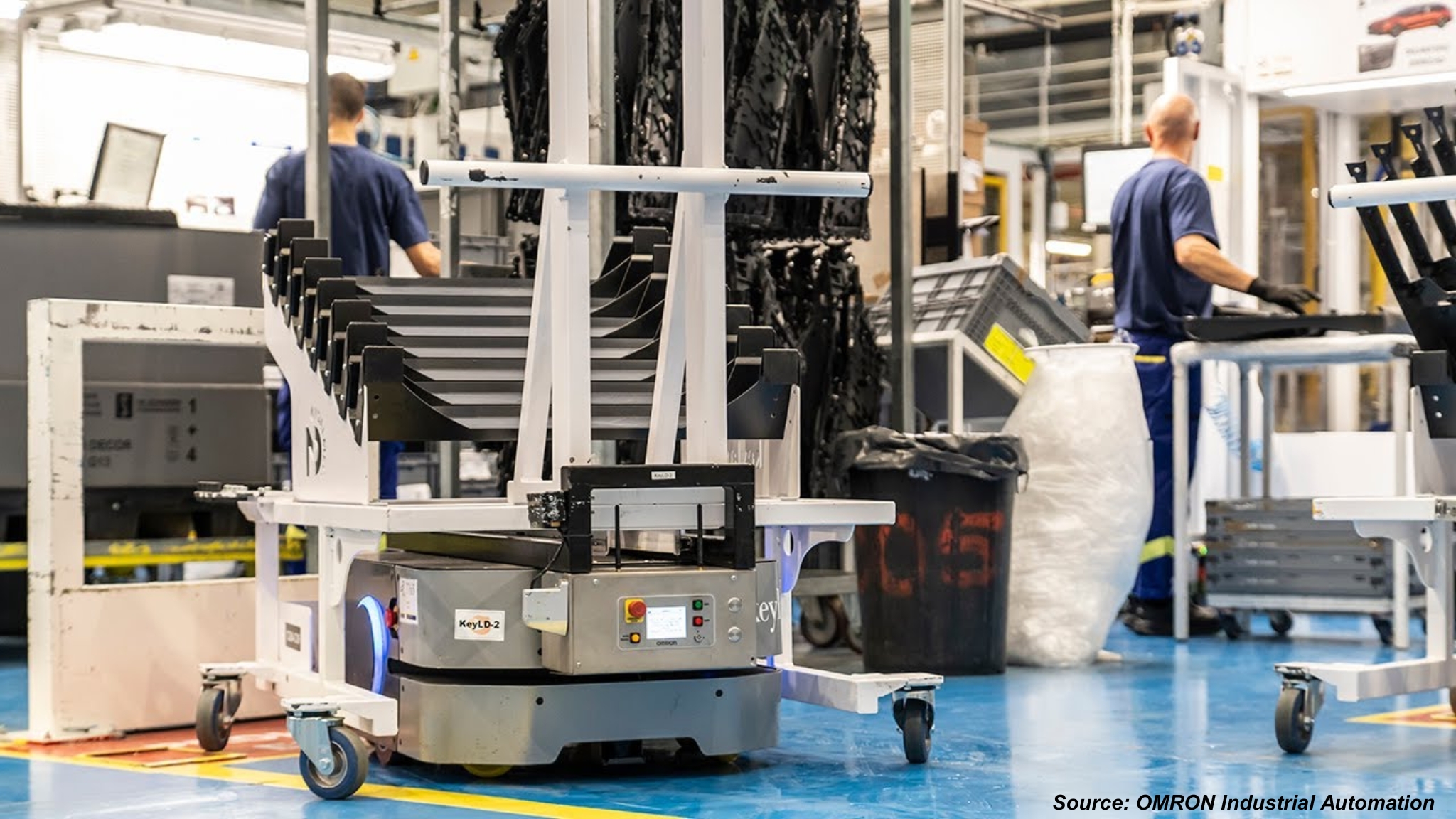

A growing opportunity in the Spain industrial robotics market trends lies in the rising use of collaborative robots (cobots) and modular retrofit solutions. Cobots, which can safely work alongside human operators, allow manufacturers to implement automation incrementally and cost-effectively.

Retrofit solutions for existing production lines provide an accessible way for companies to modernize without significant infrastructure changes. These innovations are expected to drive market demand and enable Spanish manufacturers to enhance productivity, operational efficiency, and competitiveness in both domestic and international markets.

Competitive Landscape

The Spain industrial robotics industry is highly competitive, with major global and domestic players driving technological advancement and automation adoption. Leading companies such as ABB Ltd., Fanuc Corporation, Yaskawa Electric Corporation, Mitsubishi Electric Corporation, KUKA AG, Kawasaki Heavy Industries, Yamaha Motor Co., Ltd., Robotnik Automation S.L., Panasonic Corporation, Carl Cloos Schweisstechnik GmbH, Omron Corporation, PAL Robotics, Stäubli International AG, Universal Robots, and INSER ROBÓTICA are at the forefront of innovation.

These vendors are introducing cutting-edge AI- and IoT-integrated robotic solutions, including collaborative robots, autonomous mobile robots (AMRs), and smart industrial automation systems, tailored to the evolving needs of Spain’s manufacturing sector. Their efforts are accelerating the integration of robotics across key industries such as automotive, electronics, machinery, and food processing, enhancing productivity, flexibility, and global competitiveness within Spain’s industrial landscape.

Spain Industrial Robotics Market Key Segments

By Type

-

Articulated Robots

-

SCARA Robots

-

Cylindrical Robots

-

Cartesian/Linear Robots

-

Parallel Robots

-

Collaborative Robots

-

Autonomous Mobile Robots (AMRs)

-

Automated Guided Vehicles (AGVs)

-

Other Robots

By Offering

-

Hardware

-

Software

-

Robot Control Software

-

Vision & Perception Software

-

Other Software

-

-

Services

By Payload Capacity

-

≤ 100 KG

-

101-200 KG

-

201-500 KG

-

501-1000 KG

-

1001-2000 KG

-

2001-5000KG

-

More than 5000 KG

By Mobility

-

Stationary Robots

-

Mobile Robots

-

By Mounting Type

-

Floor-mounted

-

Wall-mounted

-

Ceiling-mounted

-

Rail-mounted

By Application

-

Material Handling

-

Assembling & Disassembling

-

Processing

-

Cleanroom

-

Dispensing

-

Welding and Soldering

-

Pick and Place

-

Others

By Industry Vertical

-

Automotive

-

Semiconductor & Electronics

-

Plastic and Chemical Products

-

Metal and Machinery

-

Logistics

-

Food & Beverages

-

Healthcare & Pharmaceutical

Key Players

-

Yaskawa Electric Corporation

-

Mitsubishi Electric Corporation

-

KUKA AG

-

Kawasaki Heavy Industries

-

Yamaha Motor Co., Ltd

-

Robotnik Automation S.L.

-

Panasonic Corporation

-

Carl Cloos Schweisstechnik GmbH

-

Omron Corporation

-

PAL Robotics

-

Staubli International AG

-

Universal Robots

-

INSER ROBÓTICA

Report Scope and Segmentation

|

Parameters |

Details |

|

Market Size in 2025 |

USD 850.7 Million |

|

Revenue Forecast in 2030 |

USD 1616 Million |

|

Growth Rate |

CAGR of 13.7% from 2025 to 2030 |

|

Market Volume in 2025 |

12 thousand units |

|

Volume Forecast in 2030 |

27 thousand unit |

|

Growth Rate |

CAGR of 18.0% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Million (USD) |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Market Share |

Available for 9 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst