AI-Enabled EW Solutions Market By Product (EW Equipment (Jammers, Receivers and ESM and Others), and EWOS (Training and Simulation Services, Mission Planning and Support, and Others), By Capability (Electronic Support, Electronic Protection, and Electronic Attack), By Platform (Airborne, Naval, Ground, and Space), By Technology (AI and ML, Software Defined Radio (SDR), Edge Compute and Accelerators and Other Enabling Technologies) – Global Analysis & Forecast, 2025–2030

AI-Enabled EW Solutions Industry Outlook

The AI-Enabled EW Solutions Market size was valued at USD 4.58 billion in 2024, and is expected to be valued at USD 5.18 billion by the end of 2025. The industry is projected to grow, hitting USD 9.54 billion by 2030, with a CAGR of 13.6% between 2025 and 2030.

The AI-enabled electronic warfare (EW) solutions market is emerging as a transformative segment within the global defense industry, driven by the increasing reliance on artificial intelligence and machine learning for battlefield dominance. Traditional EW systems, which focus on detecting, intercepting, and disrupting enemy communications and radar signals, are rapidly evolving with AI capabilities that enable autonomous threat detection, adaptive jamming, and real-time decision-making. Governments and defense organizations worldwide are investing heavily in AI-enabled EW to maintain a strategic edge, with applications spanning airborne platforms, naval vessels, ground vehicles, and integrated defense networks. Rising geopolitical tensions, increasing modernization of armed forces, and growing defense budgets are further accelerating the adoption of AI-enhanced EW systems, positioning the market for robust growth over the next decade.

The AI-enabled EW solutions market growth is also fueled by technological innovations in sensor fusion, cognitive computing, and high-speed data analytics, which allow EW systems to process complex electromagnetic signals with unprecedented accuracy and speed. Vendors are increasingly integrating AI into software-defined radios, radar warning receivers, and electronic countermeasure platforms, enabling predictive threat analysis and dynamic countermeasure deployment. The proliferation of unmanned systems and advanced surveillance technologies further amplifies the demand for intelligent EW solutions capable of autonomous operation and rapid response. Moreover, the availability of large-scale operational data from modern battlefields supports continuous AI model training, enhancing system effectiveness. As nations prioritize spectrum dominance and networked defense capabilities, the AI-enabled EW solutions market is expected to experience significant adoption, with North America, Europe, and Asia-Pacific leading the expansion due to advanced defense programs and strategic investments.

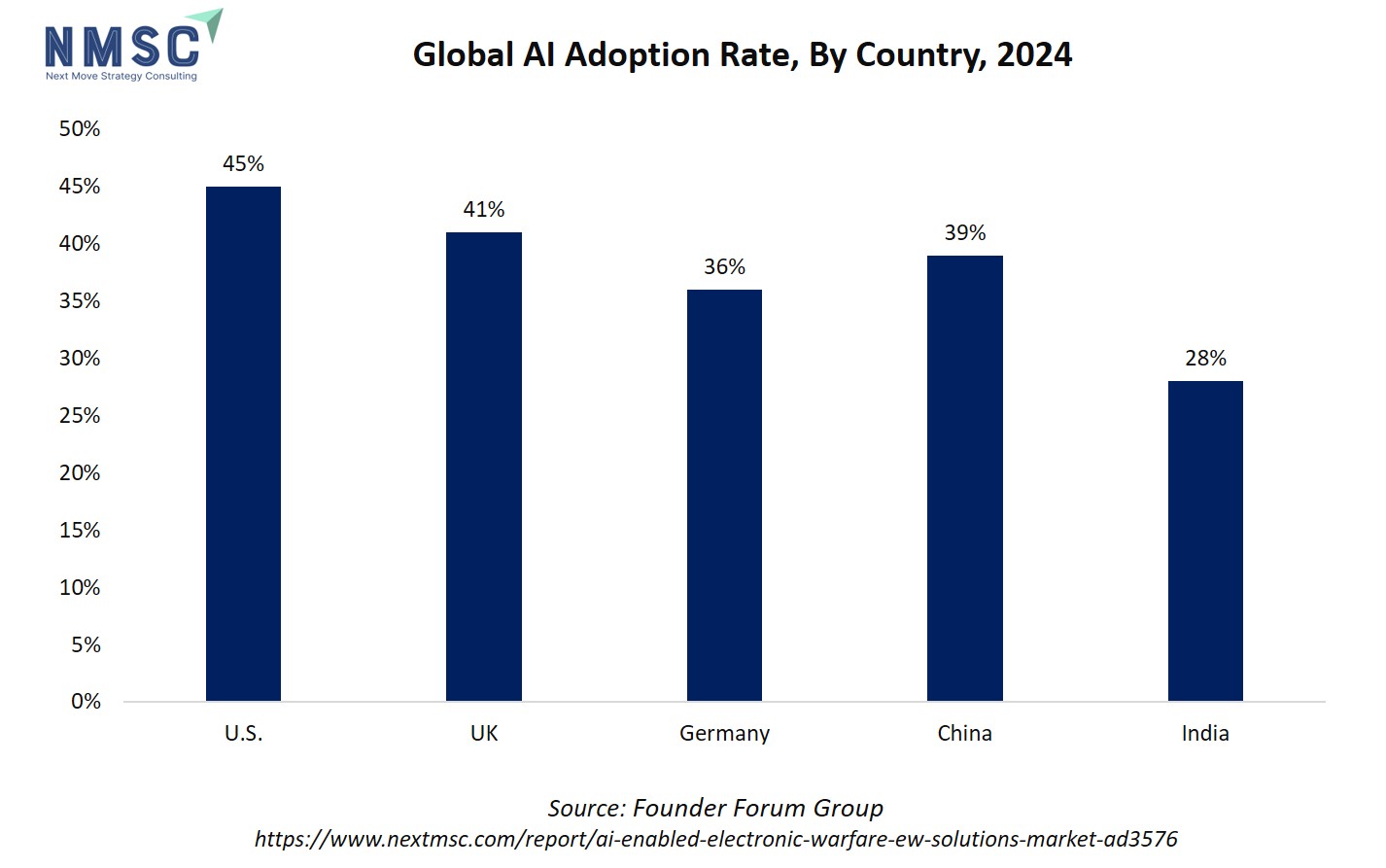

The chart illustrates the 2024 AI adoption rates by country, showing the U.S. at the forefront with 45%, followed by the UK (41%), China (39%), Germany (36%), and India at 28%. This differential adoption landscape strongly influences the growth trajectory of the AI-enabled electronic warfare (EW) solutions market, where countries with higher AI adoption like the U.S., UK, China, and Germany are positioned to lead in developing and deploying advanced AI-powered EW systems. These systems, critical for real-time threat detection, signal intelligence, cybersecurity, and autonomous decision-making, benefit from mature AI ecosystems that speed up innovation and procurement. Conversely, India's lower AI adoption rate suggests a more gradual uptake of AI-enabled EW capabilities, potentially delayed by technological and infrastructural constraints but also opening opportunities for targeted growth and investment.

What are the key trends in AI-Enabled EW Solutions Industry?

How Are AI-Powered Drone Swarms Enhancing Electronic Warfare Capabilities?

AI-driven drone swarms are revolutionizing modern warfare by enabling autonomous, coordinated attacks that can overwhelm enemy defenses. Companies like Auterion and Ukrainian firms have developed software that allows individual drones to operate as a unified strike force. For instance, Ukraine has integrated AI systems into its drones, enabling them to penetrate areas protected by signal jamming and enhancing their strike accuracy. This shift towards AI-powered swarming technologies is expected to significantly impact the EW landscape by introducing new challenges and opportunities in electronic countermeasures.

What Role Does Cognitive Electronic Warfare Play in Modern Defense Strategies?

Cognitive Electronic Warfare (EW) systems, powered by AI and machine learning, offer adaptive and autonomous capabilities that enable real-time threat detection, analysis, and response. As adversaries deploy advanced jamming, spoofing, and cyber-electronic attacks, traditional EW systems struggle to sustain market alignment. Cognitive EW systems provide enhanced agility, making them crucial for maintaining electromagnetic superiority on the battlefield. This evolution is prompting defense organizations worldwide to prioritize the adoption of cognitive EW technologies.

How Is AI Integration Transforming Electronic Warfare Systems?

The integration of AI into electronic warfare systems is transforming their capabilities, enabling more precise and efficient operations. AI enhances the ability to process and analyze vast amounts of data for real-time situational awareness, allowing military forces to counter emerging threats such as cyber warfare and anti-satellite weapons. This technological advancement is driving the demand for next-generation EW solutions that provide seamless interoperability across platforms.

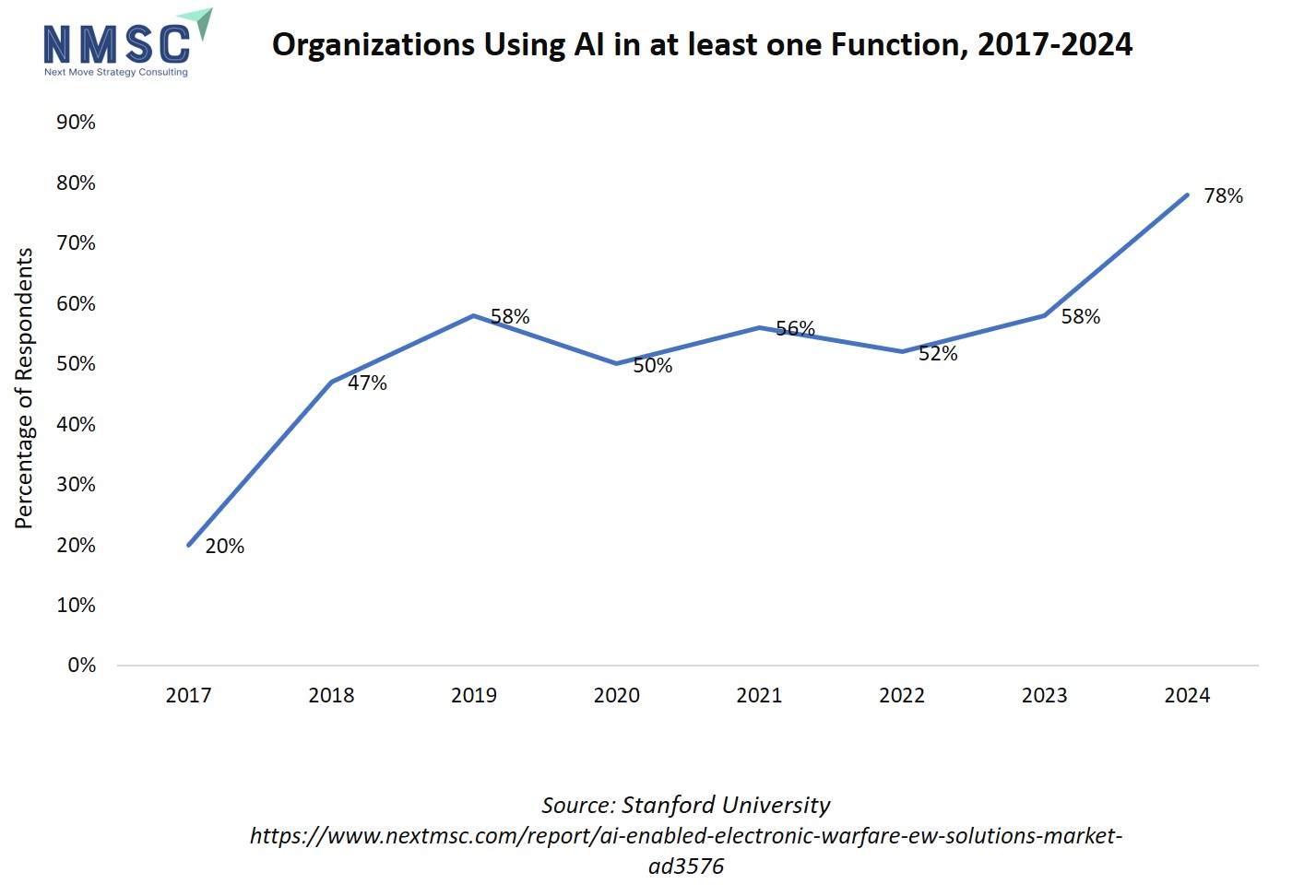

The chart shows that the percentage of organizations using AI in at least one function surged from 20% in 2017 to 78% in 2024, indicating a rapid and broad-based integration of AI solutions across industries. This accelerated adoption directly boosts the growth potential of the AI-enabled electronic warfare (EW) solutions market, as increased organizational familiarity with AI technology translates into greater demand, capability development, and willingness to invest in advanced AI-powered defense applications. As industries become more adept at leveraging AI, the defense sector benefits from cross-industry expertise, improved commercial-off-the-shelf AI tools, and heightened innovation, which collectively fuel the evolution, deployment, and uptake of sophisticated AI-enabled EW systems for real-time threat management, signal intelligence, and autonomous decision-making

What Impact Does AI-Driven Automation Have on Electronic Warfare Operations?

AI-driven automation is streamlining electronic warfare operations by reducing the need for human intervention and increasing the speed and accuracy of responses. Automated systems can swiftly analyze and respond to electronic threats, enhancing the effectiveness of countermeasures. This shift towards automation is prompting defense organizations to invest in AI technologies that can autonomously manage and mitigate electronic threats, thereby improving operational efficiency and reducing the risk of human error.

What are the key market drivers, breakthroughs, and investment opportunities that will shape the Ai-Enabled Ew Solutions Industry in the next decade?

The AI-enabled electronic warfare (EW) solutions market is experiencing rapid growth, driven by advancements in artificial intelligence and the increasing complexity of modern warfare. Governments and defense organizations worldwide are investing heavily in AI-powered EW systems to enhance their capabilities in threat detection, signal processing, and autonomous decision-making. This technological evolution is reshaping the landscape of electronic warfare, presenting new opportunities and challenges for defense contractors and military strategists alike.

As nations strive to maintain a technological edge, the integration of AI into EW systems is becoming a strategic imperative. The convergence of AI, machine learning, and electronic warfare is fostering innovation in areas such as cognitive electronic warfare, autonomous drones, and advanced jamming techniques. However, this transformation also introduces complexities related to system integration, ethical considerations, and the need for robust cybersecurity measures. Understanding the drivers, inhibitors, and emerging opportunities within this market is crucial for stakeholders aiming to navigate the evolving defense technology landscape.

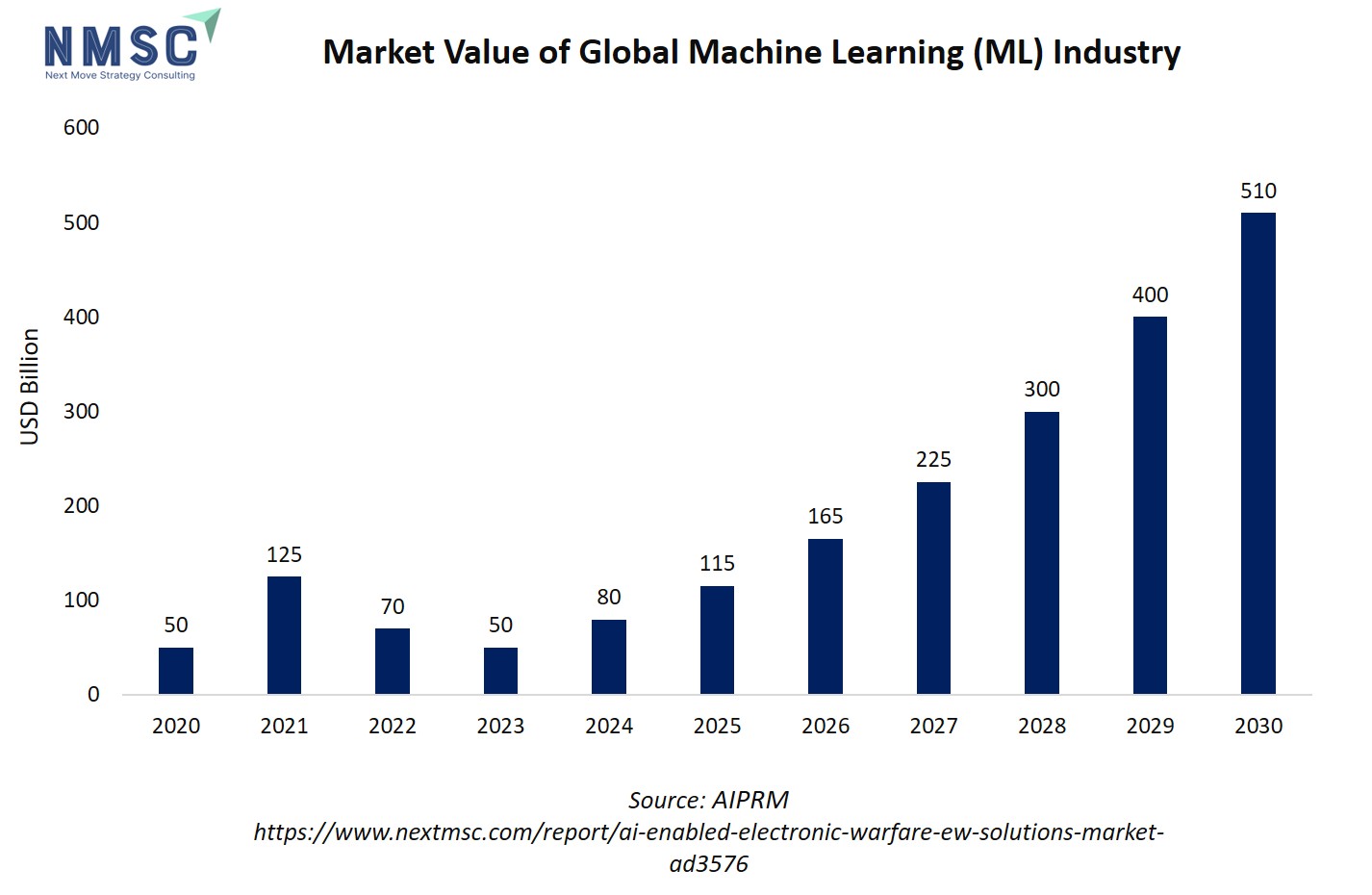

The chart shows a dramatic growth expected in the global machine learning market, underlining both recent volatility and a long-term surge in investment and capability expansion. This robust expansion in the underlying machine learning ecosystem directly fuels the advancement and adoption of AI-enabled Electronic Warfare (EW) solutions, as increasing market size accelerates R&D, enhances computational resources, and produces a greater volume of mature, scalable AI models suitable for defence applications. As the machine learning sector grows, defence organizations benefit from rapid innovation cycles, broader supplier ecosystems, and improved cost efficiencies that support the integration of AI-driven capabilities, such as real-time threat identification, adaptive responses, and autonomous EW operations, thereby driving hyper-growth and technological sophistication in the global AI-enabled EW solutions market.

Growth Drivers:

How Are Increasing Electronic Threats Driving AI-Enabled EW Adoption?

The expansion of the AI-enabled EW solutions market is significantly influenced by the increasing complexity of electronic threats and the need for advanced countermeasures. Traditional EW systems often struggle to adapt to sophisticated adversarial tactics, such as advanced jamming and spoofing. AI-powered systems offer enhanced adaptability and real-time decision-making capabilities, enabling more effective responses to dynamic threats. For instance, the integration of AI allows for predictive analytics and autonomous threat mitigation, improving the overall effectiveness of EW operations. This shift towards AI-driven solutions is prompting defense organizations to prioritize the adoption of cognitive EW technologies, thereby accelerating market growth.

How Is the Integration of AI-Powered UAVs Revolutionizing EW Operations?

The integration of Unmanned Aerial Vehicles (UAVs) equipped with AI capabilities is revolutionizing electronic warfare operations by providing enhanced surveillance, reconnaissance, and strike capabilities. AI-powered UAVs can autonomously navigate complex environments, identify and classify targets, and execute missions with minimal human intervention. This autonomy reduces the risk to personnel and increases operational efficiency. Additionally, AI enables UAVs to adapt to changing battlefield conditions, making them more resilient to electronic countermeasures. The widespread adoption of AI-integrated UAVs is driving significant investments in research and development, further propelling the growth of the AI-enabled EW solutions market.

Growth Inhibitors:

How Are Integration and Legacy System Issues Restricting AI-Enabled EW Growth?

Despite the promising advantages, the adoption of AI-enabled EW systems faces several challenges that hinder their widespread implementation. One of the primary concerns is the complexity of integrating AI technologies into existing EW infrastructures. Many legacy systems are not compatible with modern AI algorithms, necessitating costly and time-consuming upgrades. Additionally, there are concerns related to the reliability and robustness of AI systems in critical defense applications. Ensuring that AI algorithms can operate effectively in contested and degraded environments is crucial for their success. Overcoming these integration and reliability challenges is essential for the seamless deployment of AI-enabled EW systems.

How Can Strategic Investments Unlock New Opportunities in AI-Enabled EW Solutions?

The rapid advancement of AI technologies presents numerous investment opportunities within the AI-enabled EW solutions market. Companies specializing in AI-driven cognitive EW systems, autonomous UAVs, and advanced signal processing technologies are attracting significant interest from venture capitalists and defense contractors. For example, firms developing AI algorithms for real-time threat analysis and mitigation are poised for growth as defense organizations seek to enhance their electronic warfare capabilities. Additionally, partnerships between AI technology providers and defense agencies are fostering innovation and accelerating the development of next-generation EW solutions. Investors focusing on these areas can capitalize on the burgeoning demand for AI-powered defense technologies.

How AI-Enabled EW Solutions Market is segmented in this report, and what are the key insights from the segmentation analysis?

By Product Insights

How Do Product Segments in AI-Enabled EW Solutions Differ Between Equipment and Operational Support?

On the basis of product, the market is segmented into EW equipment, and electronic warfare operational support (EWOS).

AI-enabled EW equipment remains the largest contributor to market revenues, primarily due to high investments in radar jammers, sensors, and electromagnetic countermeasure systems. A NATO briefing (2024) highlighted that member states are allocating electronic defense modernization budgets toward AI-upgraded EW equipment. The reason is clear; hardware forms the first line of defense in detecting, disrupting, and neutralizing enemy signals. With increasing geopolitical conflicts and contested electromagnetic environments, militaries cannot rely solely on legacy platforms.

While EW equipment leads in revenue today, EWOS is emerging as the fastest-growing segment, driven by the demand for AI-powered cognitive analysis and threat prediction tools. Reports by the U.S. Department of Defense (DoD) (2024) suggest that EW-related R&D spending is directed toward AI-driven EWOS platforms, which enable forces to process complex electromagnetic data in real time. This shift highlights the growing reliance on software-defined capabilities to deliver situational awareness, reduce decision-making timelines, and optimize battlefield strategies.

By Capability Insights

How is the AI-Enabled EW Solutions Market Evolving Across ES, EP, and EA Capabilities?

Based on capability, the market is segmented into electronic support (ES), electronic protection (EP), and electronic attack (EA).

ES, which focuses on detecting, intercepting, and analyzing electromagnetic signals, is currently the most prominent segment due to rising investments in AI-powered spectrum monitoring and signal intelligence programs. U.S. DoD budget priorities for FY2024 emphasize strengthening electronic warfare, signals intelligence, and spectrum dominance through multiple RDT&E allocations, reflecting the growing importance of ES in modern conflicts.

Meanwhile, Electronic Protection (EP) is becoming increasingly vital as adversaries develop advanced jamming and spoofing techniques. AI-enabled adaptive EP frameworks are being designed to safeguard communications and mission-critical systems, with NATO highlighting EP as a key enabler for coalition interoperability. Finally, Electronic Attack (EA) is advancing rapidly through AI-driven systems that deploy precision-targeted jamming and deception. Research published by IEEE in 2024 emphasizes how AI enhances EA by enabling cognitive attacks that adapt to dynamic threat environments. Together, ES leads in adoption today, but EP and EA are projected to experience faster growth, suggesting that companies investing in flexible, cross-capability AI solutions will be best positioned for long-term success.

By Platform Insights

How is the AI-Enabled EW Solutions Market Segmented Across Airborne, Naval, Ground, and Space Platforms?

Based on platform, the AI-enabled EW solutions market is divided into airborne, naval, ground and space.

Airborne platforms, including fighter jets, UAVs, and surveillance aircraft, are currently the largest adopters due to the critical need for real-time spectrum dominance and threat detection in contested airspace. Programs such as the U.S. Air Force’s Next-Generation Electronic Warfare initiatives emphasize AI integration for advanced situational awareness, adaptive jamming, and cognitive threat response.

Naval platforms are increasingly integrating AI-enabled EW systems to safeguard ships and submarines against electronic attacks, with AI-driven solutions enhancing radar countermeasures and signal interception in maritime domains. Ground platforms, including armored vehicles and mobile command posts, benefit from AI-enabled EW systems that provide tactical spectrum management, electronic protection, and rapid threat neutralization in battlefield environments. Finally, space-based EW platforms are emerging as a strategic frontier, with AI playing a crucial role in satellite signal intelligence, orbital jamming, and secure communications.

By Technology Insights

How is the AI-Enabled EW Solutions Market Evolving Across Key Technology Segments?

Based on technology, the AI-enabled EW solutions market is divided into ai and ml, software defined radio (SDR), Edge compute and accelerators and other enabling technologies.

The AI-enabled EW solutions market is increasingly defined by the underlying technology platforms that drive its capabilities. Among these, AI and machine learning (ML) form the backbone of cognitive EW, enabling real-time threat detection, autonomous decision-making, and adaptive electronic countermeasures. The growing adoption of AI/ML is supported by defense R&D initiatives worldwide, including U.S. DoD and European defense programs, which emphasize AI integration for advanced signal processing and predictive analytics.

Software Defined Radio (SDR) technology provides flexibility by allowing EW systems to dynamically tune and respond across a wide spectrum, supporting both legacy and next-generation communication networks. Edge computing and accelerators are becoming critical to process vast volumes of electromagnetic data locally, reducing latency and ensuring rapid responses in contested environments. Finally, other enabling technologies, including secure communication modules, photonic sensors, and high-speed data links, are complementing AI/ML, SDR, and edge computing to enhance overall EW effectiveness.

Regional Outlook

The AI-enabled EW solutions market is geographically studied across North America, Europe, the Middle East & Africa, and Asia Pacific, and each region is further studied across countries.

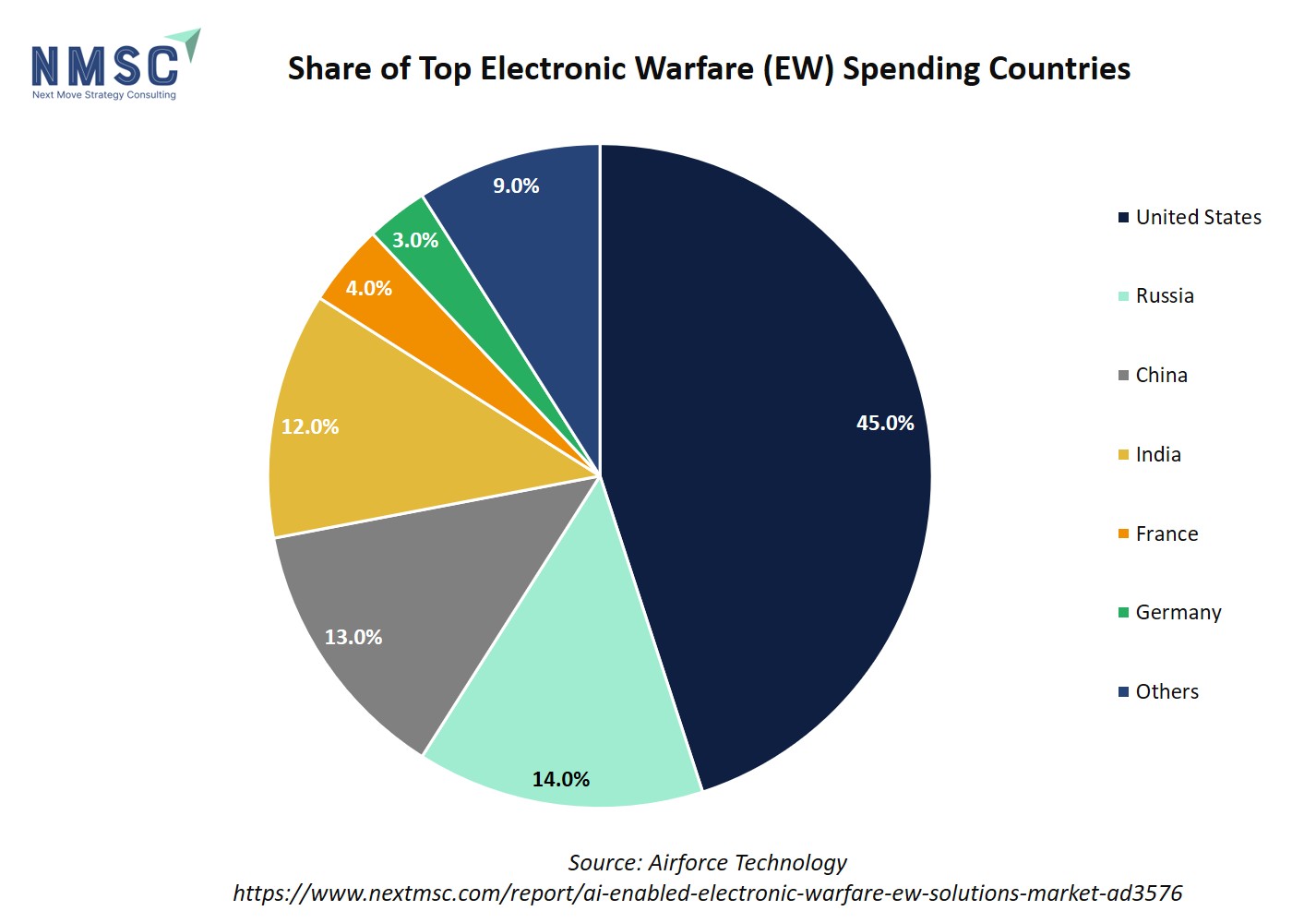

The chart above displays the share of top Electronic Warfare (EW) spending countries, with the United States dominating at 45%, followed by Russia (14%), China (13%), India (12%), France (4%), Germany (3%), and others (9%). This spending concentration underscores that the U.S. and its major global peers are driving the bulk of investments in EW technology and solutions, which incentivizes rapid R&D, procurement, and implementation of advanced AI-enabled EW platforms in these markets. As the bulk of capital allocation is focused here, industry innovation, vendor competition, and early adoption of AI-powered signal analysis, threat detection, and autonomous defense capabilities are expected to flourish most robustly in these nations, accelerating global market growth for AI-enabled EW solutions, while other regions may see slower uptake and innovation.

AI-Enabled EW Solutions Market in North America

The North American market is the global pace-setter. Large defence budgets, rapid R&D (especially in the U.S.), and strong civil-to-military AI transfer are accelerating AI-enabled EW adoption across platforms and services. Demand is driven by spectrum-dominance needs vs. cheap autonomous threats (swarming UAS), rapid procurement of cognitive jammers, and growing private-sector startups feeding the DoD innovation pipeline. That combination keeps the region’s share of next-gen EW procurement above other regions and underpins vendor consolidation and strategic partnerships.

AI-Enabled EW Solutions Market in the United States

The United States is investing heavily in EW modernization and AI-enabled autonomy. DoD FY budgets and DARPA programs explicitly fund cognitive jammers, digital RF sensing, and surrogate AI models to speed EW testing and fielding. The U.S. approach couples large program-of-record buys (airborne and vehicle jammers) with fast, prototype-driven experiments and commercial tech transition pathways. That mix shortens timelines for AI-assisted sensing, target/intent inference, and adaptive jamming, and it pushes the global vendor community to prioritize interoperability and secure AI model supply chains.

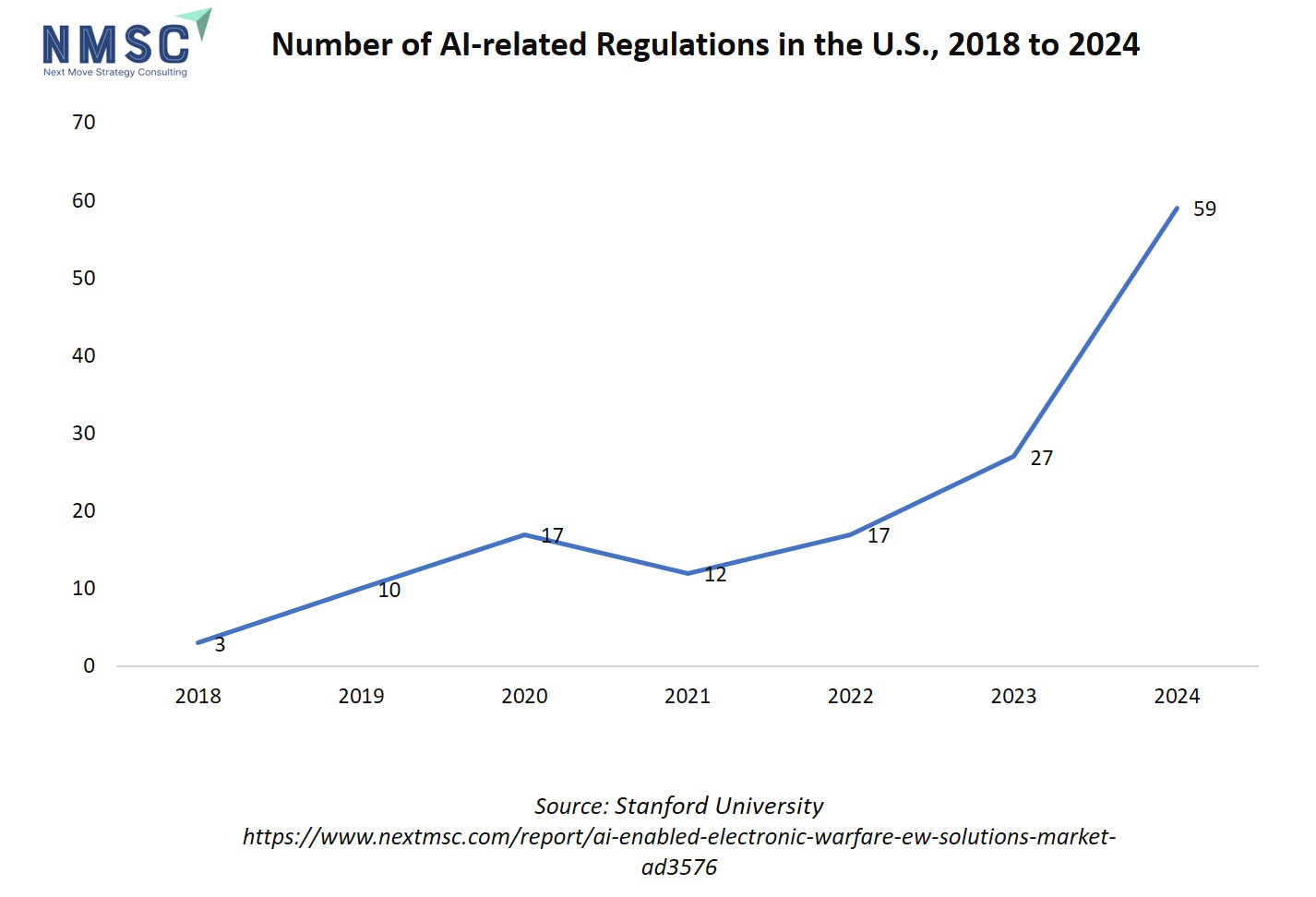

The chart highlights a sharp increase in the number of AI-related regulations in the U.S., rising from just 3 in 2018 to 59 in 2024, signaling heightened legislative oversight as AI technologies proliferate. This expanding regulatory environment has a dual impact on the AI-enabled electronic warfare (EW) solutions market: while regulations can provide clarity, safety standards, and foster public trust, they may also introduce compliance complexities and slow the pace of innovation by requiring stricter oversight of defense AI applications. As AI in EW gains strategic importance, robust regulatory frameworks could accelerate defense procurement and deployment for compliant providers, but may also create barriers to entry and increase costs for emerging players, ultimately influencing the speed, direction, and competitive dynamics of market growth.

AI-Enabled EW Solutions Market in Canada

Canada’s EW posture is modernization-focused but scaled to coalition needs. The Canadian Forces Land Electronic Warfare Modernization program and Inflection Point 2025 emphasize digital, data and AI capabilities for spectrum management and expeditionary operations. Adoption is slower than the U.S. but shaped by interoperability with NATO partners, prioritized procurement for deployable EW suites, and investment in dual-use AI research. For suppliers, Canada represents a market where sovereign-capability development, industry partnerships, and acquisition of interoperable AI-enhanced EW tools are the main growth drivers.

AI-Enabled EW Solutions Market in Europe

Europe is increasingly investing in AI for EW as part of a broader modernization effort, with NATO and EU programs pushing innovation in spectrum warfare, cyber-electronic defense, and AI-assisted decision support. The European Parliament identifies AI, Quantum, Cyber, and EW as priority areas to strengthen defense and reduce technological dependency. Countries like Germany, France, and the U.K. are pursuing dual-use technologies to combine civilian AI advances with military EW platforms, enabling smarter signal analysis, autonomous countermeasures, and faster deployment.

AI-Enabled EW Solutions Market in the United Kingdom

The U.K. is actively integrating AI into EW systems to enhance operational efficiency and strategic capabilities. Defense programs focus on autonomous platforms, advanced signal processing, and machine learning algorithms for detecting and countering electronic threats. Source data shows how U.K. investments align with broader European defense modernization, demonstrating commitment to technological innovation. This focus ensures the U.K. can respond rapidly to evolving threats, support NATO operations, and maintain its competitive edge in AI-enabled EW, combining policy-driven guidance with cutting-edge technology implementation.

AI-Enabled EW Solutions Market in Germany

Germany incorporates AI to strengthen EW and align with EU defense priorities. Investments focus on AI-driven surveillance, jamming, and cyber-defense platforms. The source confirms the alignment of national initiatives with European policy objectives. AI adoption enables faster threat detection, operational readiness, and improved electronic countermeasures. Germany’s approach reflects a combination of modernization, interoperability, and technological sophistication, enhancing its strategic positioning and facilitating collaboration with NATO allies for AI-enabled EW solutions.

AI-Enabled EW Solutions Market in France

France prioritizes AI for EW modernization, developing autonomous platforms, advanced signal processing, and intelligent countermeasure systems. Reports underscores France’s commitment to integrating AI into military applications to maintain competitiveness in modern warfare. By focusing on AI-driven electronic attack and surveillance systems, France strengthens operational effectiveness. The government’s strategy fosters R&D collaboration with the private sector, accelerating adoption and innovation, and providing Europe-wide benchmarks for AI-enabled EW capabilities

AI-Enabled EW Solutions Market in Spain

Spain invests in AI to enhance EW capabilities, focusing on signal intelligence, electronic surveillance, and countermeasure systems. Certain data validates Spain’s commitment to technological modernization. AI adoption improves operational efficiency, threat detection, and rapid response capabilities. Collaborative efforts with EU and NATO allies ensure interoperability, enabling Spain to deploy effective AI-enabled EW systems while contributing to regional security. These investments signal Spain’s growing role in Europe’s AI-driven defense landscape.

AI-Enabled EW Solutions Market in Italy

Italy’s defense sector explores AI in EW to modernize operations and improve responsiveness. AI-driven radar jamming, electronic countermeasures, and cyber defense systems enhance operational efficiency. Italy is aligning with broader European defense strategies. AI integration ensures faster threat analysis, improved situational awareness, and interoperability with NATO allies. This approach strengthens Italy’s position in the regional EW market while supporting broader technological advancement and fostering collaboration between government, academia, and private defense vendors.

AI-Enabled EW Solutions Market in Asia Pacific

The Asia-Pacific region is experiencing significant growth in the electronic warfare (EW) sector, driven by advancements in artificial intelligence (AI) and increased defense spending. The radar simulator market in the region is projected to grow USD 470.5 million by 2028, reflecting a compound annual growth rate (CAGR) of 6.3%. This growth is attributed to the adoption of AI, deep learning, and big data analytics across various military applications. Countries like China, Japan, and South Korea are at the forefront of integrating AI into their defense systems, enhancing capabilities in signal processing, threat detection, and autonomous operations. The region's focus on technological innovation and modernization positions it as a key player in the global EW landscape.

AI-Enabled EW Solutions Market in China

China is intensifying its AI-driven electronic warfare (EW) capabilities, focusing on cognitive radar systems and advanced jamming technologies. Recent flight tests of AI-powered airborne radar demonstrated 99% tracking accuracy under heavy electronic jamming, showcasing significant advancements in EW resilience. Additionally, the development of AI systems capable of detecting even the quietest nuclear submarines indicates a strategic push towards enhancing maritime EW capabilities. These developments underscore China's commitment to achieving technological self-sufficiency and strengthening its position in the global EW landscape.

AI-Enabled EW Solutions Market in Japan

Japan is strategically integrating AI into its defense systems to bolster electronic warfare capabilities. The Acquisition, Technology & Logistics Agency has established guidelines for the responsible use of AI in defense equipment R&D, ensuring ethical and effective implementation. Collaborations with international partners, such as the SAMURAI initiative with the United States, aim to advance AI safety in unmanned aerial vehicles, reflecting Japan's commitment to enhancing its EW capabilities through innovation and international cooperation.

AI-Enabled EW Solutions Market in India

India is rapidly advancing in the field of electronic warfare, emphasizing the integration of artificial intelligence to enhance defense capabilities. The country's defense sector has engaged over 632 startups and innovators, leading to the completion of 452 contracts focused on AI and machine learning applications in defense. These initiatives aim to bolster indigenous development of EW systems, reducing dependency on foreign technologies. Additionally, the Indian Navy's recent contract with Coratia Technologies for underwater robotics underscores the nation's commitment to modernizing its defense infrastructure. India's strategic focus on AI-driven EW systems enhances its position in regional security dynamics.

AI-Enabled EW Solutions Market in South Korea

South Korea is actively developing advanced electronic warfare aircraft to strengthen its defense posture. The Korea Aerospace Industries has unveiled the design of a new electronic warfare aircraft, emphasizing the nation's focus on enhancing its EW capabilities through indigenous development. Furthermore, collaborations with allies are fostering a robust innovation ecosystem, aiming to integrate autonomous systems and advanced EW technologies into South Korea's defense infrastructure.

AI-Enabled EW Solutions Market in Taiwan

Taiwan is experiencing a surge in demand for AI-related technologies, reflecting its growing emphasis on integrating artificial intelligence into defense systems. In August 2025, Taiwan's export orders increased by 19.5% year-on-year, driven by strong demand for AI and high-performance computing products. This trend suggests a strategic focus on enhancing electronic warfare capabilities through AI integration, aligning with regional security priorities and technological advancements.

AI-Enabled EW Solutions Market in Australia

Australia is enhancing its electronic warfare capabilities through strategic partnerships and technological advancements. The expansion of DroneShield's U.S. research and development operations underscores Australia's commitment to addressing rising counter-drone challenges through AI and software development. Furthermore, the development of a new electronic warfare suite for Growlers and Super Hornets demonstrates Australia's focus on integrating advanced EW systems into its defense infrastructure.

AI-Enabled EW Solutions Market in Latin America

Latin America is witnessing a surge in cyber threats, with organizations experiencing 39% more weekly incidents than the global average. This escalating risk has prompted several countries in the region to explore the integration of artificial intelligence into their electronic warfare strategies. While large-scale deployments are limited due to cost and infrastructure challenges, nations like Brazil and Argentina are investing in AI-driven technologies to enhance their defense capabilities. Collaborations with international partners and the development of localized AI solutions are key to strengthening the region's resilience against emerging threats.

AI-Enabled EW Solutions Market in the Middle East & Africa

The Middle East and Africa (MEA) region is experiencing rapid growth in the cognitive electronic warfare market. Countries like the United Arab Emirates and Saudi Arabia are leading investments in AI and robotics, with initiatives such as the joint AI and robotics lab launched by Nvidia and the Abu Dhabi Technology Innovation Institute. These developments aim to enhance capabilities in autonomous systems, radar technologies, and electronic warfare applications. The region's strategic focus on technological innovation and defense modernization positions it as a significant player in the global EW arena.

Competitive Landscape

Which Companies Dominate the AI-Enabled EW Solutions Market and How Do They Compete?

Leading players in the AI-enabled electronic warfare (EW) solutions market include Lockheed Martin, Northrop Grumman, Raytheon Technologies, L3Harris Technologies, and BAE Systems. These companies are leveraging artificial intelligence to enhance capabilities such as adaptive jamming, cognitive radar systems, and autonomous threat detection. Their competition centers around technological innovation, speed of deployment, and integration with existing defense infrastructures. For instance, Lockheed Martin's Skunk Works division unveiled the Vectis drone, an autonomous wingman designed for surveillance and EW roles. Such advancements underscore the industry's emphasis on rapid technological development to maintain a competitive edge.

Market dominated by AI-Enabled EW Solutions Giants and Specialists

The AI-enabled EW solutions market is characterized by a blend of industry giants and specialized firms. While large corporations like Lockheed Martin and Raytheon Technologies offer comprehensive defense solutions, specialized companies such as Anduril Industries and Shield AI focus on niche AI-driven EW technologies. This dual approach fosters innovation and caters to diverse defense needs. For example, Anduril's Pulsar system is designed for autonomous electronic warfare, highlighting the trend towards specialized, AI-powered solutions in modern defense strategies. The competition between these entities drives advancements in AI integration, system adaptability, and operational efficiency within the EW sector.

Innovation and Adaptability Drive Market Success

Innovation is a cornerstone of success in the AI-enabled EW solutions market. Companies are investing in research and development to create adaptive systems capable of responding to dynamic electronic threats. For instance, Raytheon Technologies has been at the forefront of developing AI algorithms that enable real-time signal processing and threat identification. Additionally, collaborations between defense contractors and AI startups are accelerating the development of next-generation EW systems. These innovations not only enhance the effectiveness of electronic warfare but also ensure that systems remain adaptable to evolving technological landscapes and adversarial tactics.

Market Players to Opt for Merger & Acquisition Strategies to Expand Their Presence

In response to the growing demand for AI-enabled EW solutions, companies are increasingly turning to mergers and acquisitions (M&A) to bolster their technological capabilities. For example, in the first half of 2025, aerospace and defense M&A activity rose by 11%, with companies acquiring AI-enabled defense systems and drone technologies. Such strategic acquisitions allow firms to integrate advanced AI technologies, expand their product portfolios, and enhance their competitive positioning in the rapidly evolving EW market. Also, L3Harris Technologies has partnered with Shield AI to integrate advanced artificial intelligence into electronic warfare operations. This collaboration aims to develop AI-enabled unmanned systems capable of autonomous threat detection and response in the electromagnetic spectrum. These trends underscore the importance of technological integration and innovation in maintaining a leadership stance within the industry.

List of Key AI-Enabled EW Solutions Companies

-

Raytheon Technologies Corporation (RTX)

-

BAE Systems plc

-

Thales Group

-

Leonardo S.p.A.

-

L3Harris Technologies Inc.

-

Airbus Defence and Space (Airbus SE)

-

Saab AB

-

Elbit Systems Ltd.

-

Rafael Advanced Defense Systems Ltd.

-

HENSOLDT AG

-

Rohde & Schwarz GmbH & Co KG

-

QinetiQ Group plc

-

Kratos Defense & Security Solutions, Inc.

What are the Latest Key Industry Developments?

-

September 2025- L3Harris Technologies and Shield AI showcased an AI-enabled electronic warfare system capable of autonomously detecting and countering unmanned threats. The demonstration highlighted the integration of AI in enhancing the effectiveness of electronic warfare operations.

-

September 2025- Lockheed Martin's Skunk Works division unveiled Vectis, a supersonic stealth drone designed to operate as a loyal wingman to manned aircraft. Capable of electronic warfare, surveillance, and precision strikes, Vectis aims to enhance combat capabilities while reducing risks to human pilots.

-

February 2025- Raytheon, a business unit of RTX, completed flight testing of the first AI/ML-powered Radar Warning Receiver for fourth-generation aircraft. This technology aims to enhance aircrew survivability by providing advanced threat detection and response capabilities.

-

September 2024- BAE Systems acquired Kirintec, a UK-based company specializing in counter-IED and electronic warfare technologies. This acquisition aims to bolster BAE's electronic warfare portfolio and expand its capabilities in electromagnetic activities.

-

May 2024- Anduril Industries introduced Pulsar, a modular, AI-driven electronic warfare system capable of autonomously detecting, jamming, and countering electromagnetic threats. The system enhances rapid response to evolving threats and is already operational with U.S. forces.

What are the Key Factors Influencing Investment Analysis & Opportunities in the AI-Enabled EW Solutions Market?

The AI-enabled electronic warfare (EW) solutions market is experiencing significant investment momentum, driven by escalating global defense budgets and the rapid adoption of artificial intelligence technologies. In 2024, the U.S. allocated approximately USD 5 billion to enhance its EW capabilities, underscoring the prioritization of next-generation warfare technologies. Simultaneously, venture capital funding in European defense and security tech surged to a record USD 5.2 billion, with a notable 41% increase in investments for defense startups, reflecting heightened geopolitical tensions and a strategic focus on AI-driven defense solutions.

Investment hotspots are emerging in North America, Europe, and Israel, where governments and private investors are channeling resources into AI-powered EW systems. In Israel, Glilot Capital raised USD 500 million for early-stage investments in AI and cybersecurity, aiming to bolster defense technologies against AI-driven threats. These funding trends indicate a robust market trajectory for cognitive EW solutions from 2025 to 2035.

Key Benefits for Stakeholders:

Next Move Strategy Consulting (NMSC) presents a comprehensive analysis of the AI-enabled EW solutions market, covering historical trends from 2020 through 2024 and offering detailed forecasts through 2030. Our study examines the market at global, regional, and country levels, providing quantitative projections and insights into key growth drivers, challenges, and investment opportunities across all major AI-Enabled EW Solutions segments.

The AI-enabled electronic warfare (EW) solutions industry provides significant value to multiple stakeholders. Investors benefit from high-growth opportunities, as escalating defense budgets and AI adoption drive strong returns, particularly in startups and tech-specialized firms developing autonomous EW systems. Policymakers gain strategic advantages by supporting technologies that enhance national security, improve battlefield decision-making, and maintain technological superiority over adversaries. Customers, primarily military and defense agencies, receive cutting-edge solutions that increase operational efficiency, situational awareness, and threat mitigation capabilities. The convergence of AI innovation, government backing, and operational demand ensures that all stakeholders profit, financially, strategically, and operationally, while fostering the rapid evolution of the EW market.

Report Scope:

|

Parameters |

Details |

|

Market Size in 2025 |

USD 5.18 Billion |

|

Revenue Forecast in 2030 |

USD 9.54 Billion |

|

Growth Rate |

CAGR of 13.6% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

28 |

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent to up to 80 analyst-working hours) after purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

|

Approach |

In-depth primary and secondary research; proprietary databases; rigorous quality control and validation measures. |

|

Analytical Tools |

Porter's Five Forces, SWOT, value chain, and Harvey ball analysis to assess competitive intensity, stakeholder roles, and relative impact of key factors. |

Key Market Segments

By Product

-

EW Equipment

-

Jammers

-

Receivers and ESM

-

Countermeasure Systems

-

Directed Energy Weapons

-

Decoys

-

-

Electronic Warfare Operational Support (EWOS)

-

Training and Simulation Services

-

Mission Planning and Support

-

ISR Support

-

Maintenance and Logistics Support

-

By Capability

-

Electronic Support (ES)

-

Signal Intelligence (SIGINT)

-

Threat Detection and Identification

-

Emitter Geolocation

-

-

Electronic Protection (EP)

-

Counter IED Protection

-

Signal Hardening and Anti Jam

-

Counter Countermeasure Systems

-

-

Electronic Attack (EA)

-

Jamming Capabilities

-

Anti-Radiation Systems

-

Cyber Electromagnetic Activities (CEMA)

-

By Platform

-

Airborne

-

Combat Aircraft Systems

-

UAV Payloads

-

Rotary Wing Systems

-

-

Naval

-

Surface Ship Systems

-

Submarine Systems

-

UMV Payloads

-

-

Ground

-

Vehicle Mounted Systems

-

Fixed Site Systems

-

Man Portable Systems

-

-

Space

-

Satellite Payloads

-

Space based EW Systems

-

By Technology

-

AI and ML

-

Software Defined Radio (SDR)

-

Edge Compute and Accelerators

-

Other Enabling Technologies

Conclusion & Recommendations

Our report equips stakeholders, industry participants, investors, policy-makers, and consultants with actionable intelligence to capitalize on AI-Enabled EW Solutions transformative potential. By combining robust data-driven analysis with strategic frameworks, NMSC’s AI-enabled EW solutions market report serves as an indispensable resource for navigating the evolving landscape.

The AI-enabled electronic warfare (EW) solutions market is poised for robust growth, driven by rapid technological advancements, rising defense budgets, and increasing adoption of AI across global defense sectors. Strategic takeaways indicate that companies investing in innovation, AI integration, and partnerships are best positioned to lead the market. Mergers, acquisitions, and international collaborations are accelerating capability development and market expansion. Looking ahead, the industry is expected to witness continued investment in autonomous systems, cognitive EW, and real-time threat mitigation technologies, with North America, Europe, and Asia-Pacific emerging as key growth hubs. Overall, sustained innovation and strategic investments will define competitive advantage and shape the future of AI-enabled EW solutions.

Speak to Our Analyst

Speak to Our Analyst