Brazil Intralogistics Software Market by Component {Software (WMS, TMS, YMS, Inventory Management Software, Labor Management Software and Others), and Services}, Technology (Internet of Things, Artificial Intelligence, Big Data Analytics, Cloud Security, Digital Twins and Others), Deployment Mode (On-Premises, and Cloud-Based), and End-User (Retail and E-commerce, Automotive, Food and Beverage, Pharmaceuticals, Aviation, Logistics, and Others) – Global Industry Trends and Forecast, 2025–2030

Industry: ICT & Media | Publish Date: 15-Nov-2025 | No of Pages: 188 | No. of Tables: 149 | No. of Figures: 74 | Format: PDF | Report Code : IC3408

Industry Overview

The Brazil Intralogistics Software Market size was valued at USD 123.56 billion in 2024, and is expected to be valued at USD 147.53 billion by the end of 2025. The industry is projected to grow, reaching USD 270.35 billion by 2030, with a CAGR of 12.9% between 2025 and 2030.

The market is experiencing rapid growth, fueled by the expansion of e-commerce, increased industrial automation, and the integration of Industry 4.0 technologies. Sectors such as retail, automotive, and manufacturing are modernizing their logistics operations, adopting AI-driven, cloud-based, and IoT-integrated systems to boost warehouse efficiency, inventory accuracy, and real-time visibility. These smart solutions are essential for managing complex supply chains and enabling data-driven decisions.

Despite this momentum, small and medium-sized businesses struggle with high implementation costs and regulatory challenges. However, the rise of modular and scalable platforms is helping to ease adoption across a broader base.

Key software such as Warehouse Management Systems (WMS), Transportation Management Systems (TMS), and inventory management software are playing a vital role. Enhanced by technologies like AI, big data, and cloud computing, these tools are transforming Brazil’s logistics landscape and supporting its long-term growth.

Explosive E-Commerce Growth Fuels Surge in Brazil Intralogistics Software Market Growth

Brazil’s rapidly growing e-commerce sector is driving widespread adoption of intralogistics software. With online shopping on the rise, warehouses and distribution centers are turning to automation and robotics to handle increasing order volumes efficiently.

As Latin America’s largest economy, Brazil is experiencing 14.3% annual e-commerce growth, with the market projected to exceed US$200 billion by 2026. This surge is fueled by greater smartphone and internet access, a tech-savvy population, and evolving digital payment systems.

Consumers are attracted to convenience, personalized offers, and online exclusives, prompting retailers to invest in digital infrastructure. To scale efficiently and remain competitive, businesses are adopting intralogistics tools that enhance order fulfillment, inventory management, and delivery accuracy.

Brazil’s Automotive Boom is Accelerating Intralogistics Innovation

Brazil’s dynamic automotive sector plays a key role in boosting the Brazil intralogistics software market demand. As the world’s 8th largest vehicle producer and Latin America’s top manufacturer, Brazil produced over 2.3 million vehicles in 2023, according to the latest data published by International Organization of Motor Vehicle Manufacturers (OICA). This level of production requires precise coordination across complex supply chains.

Automotive companies are deploying intralogistics solutions such as intelligent warehouse systems, automated guided vehicles (AGVs), and real-time tracking tools to streamline operations and maintain quality. Continued investments from industry leaders like Stellantis, Volkswagen, and Toyota are reinforcing the sector’s output and sustaining demand for automation in logistics.

Industry 4.0 Transformation Accelerates Smart Intralogistics Adoption

Brazil’s industrial ecosystem is undergoing digital transformation as manufacturers adopt Industry 4.0 technologies to improve efficiency and competitiveness. The key industries including food and beverage, electronics, consumer goods, and pharmaceuticals are integrating automation and smart systems to enhance productivity and reduce downtime. Intralogistics software forms the core of these initiatives, supporting real-time material tracking, predictive maintenance, and seamless machine integration.

Brazil invested R$ 186.6 billion toward digital transformation initiatives, including Industry 4.0, as part of the Missão 4 da Nova Indústria Brasileira plan. This initiative aims for 25 % of industrial companies digitally transformed by 2026, reaching 50 % by 2033, thereby expanding the market potential. As businesses look to scale without significantly increasing labor costs, the demand for intelligent, data-driven intralogistics solutions is set to grow.

Lack of Skilled Workforce Restrains Market Demand and Expansion

The Brazil intralogistics software market expansion faces a critical obstacle due to a shortage of qualified professionals adept at managing and maintaining sophisticated automation systems. This skills gap impedes the successful deployment of intralogistics solutions, resulting in underutilized technological investments. Consequently, businesses experience reduced operational efficiency and diminished returns on investment, which slows the industry's overall growth.

AI and Next-Gen Technologies Align with Market Trends to Drive Growth

Brazil’s intralogistics software market is poised to grow due to the increasing adoption of artificial intelligence (AI) and cutting-edge technologies. AI-driven tools, including predictive analytics, real-time inventory monitoring, and intelligent route optimization, enhance automation and minimize inefficiencies.

Innovations such as augmented/mixed reality, edge computing, and Industrial IoT create interactive digital twins, improving warehouse decision-making and safety. These advancements drive operational efficiency, reduce costs, and support scalability, positioning Brazil’s logistics sector for robust expansion as it embraces digital transformation and integrates these technologies to meet the demands of a modernizing market.

By Software, Transportation Management Systems (TMS) Hold a Highest CAGR of 17.8%

Transportation Management Systems (TMS) are experiencing the highest growth within the Brazil intralogistics software market trends, playing a pivotal role in streamlining freight operations across the country’s heavily road-reliant logistics network. Increasing demand for automation in freight billing, carrier selection, and load optimization is fueling rapid TMS adoption, enhancing operational efficiency and lowering logistics costs.

TMS is expected to lead the segment with a robust CAGR of 17.8%, driven by regulatory requirements such as the mandatory implementation of electronic freight invoicing (CT-e) and the rising adoption of telematics integration. With the continued surge in e-commerce and industrial production, companies are prioritizing flexible, AI-driven TMS platforms to effectively manage logistical complexities, remain compliant, and stay competitive in a dynamic supply chain environment.

By Deployment Mode, Cloud-Based Deployment Dominates the Market

Cloud based intralogistics solutions dominate Brazil's logistics software arena due to unmatched scalability, faster deployment, and cost efficiency. With a share of more than 50% in 2024 and growing at 13.6% CAGR, cloud-based remains dominant and the fastest-growing deployment mode. SMEs particularly benefit from lower upfront investment, while larger firms gain agility and rapid scalability.

The government’s strong push for digital transformation, including data localization and cloud friendly regulations, further accelerates adoption. Cloud TMS and WMS platforms enable real-time visibility, AI-driven optimization, and seamless integration with APIs and telematics addressing Brazil’s fragmented infrastructure and demanding logistics needs. These trends collectively position cloud deployment not just as an option, but as the strategic standard for modern intralogistics in Brazil.

Strategic Analysis of Companies of Brazil Intralogistics Software Industry

Between 2024 and mid 2025, major intralogistics software players in Brazil have significantly bolstered their positioning through targeted launches, partnerships, and regional growth initiatives.

-

TIBA Group’s strategic partnership with local player, SMX Logistics in March 2025 which marked a critical move to augment operations and access within Brazil, bringing in seven offices and ~150 employees, and raising TIBA’s service capacity across Latin America.

-

Another company named, DP World, a global logistics integrator, is expanding its inland logistics reach with four new freight forwarding offices launching in Campinas, Curitiba, Rio de Janeiro, and Porto Alegre throughout 2025—positioning for full end to end supply chain integration in Brazil.

-

Globally, software automation stalwarts like Dematic and viastore showcased enhanced WMS and AI-driven warehouse management systems at LogiMAT 2025, signaling innovation trends likely to influence their Brazilian offerings.

Collectively, these moves—ranging from M&A to regional expansion and product showcases—are sharpening competitive dynamics, with each player reinforcing capabilities in warehousing, software integration, and local-market relevance, promising sustainable market share gains and long term growth.

Brazil Intralogistics Software Market Key Segments

By Component

-

Software

-

Warehouse Management Software (WMS)

-

Transportation Management Software (TMS)

-

Yard Management Software

-

Inventory Management Software

-

Labor Management Software

-

Others

-

-

Services

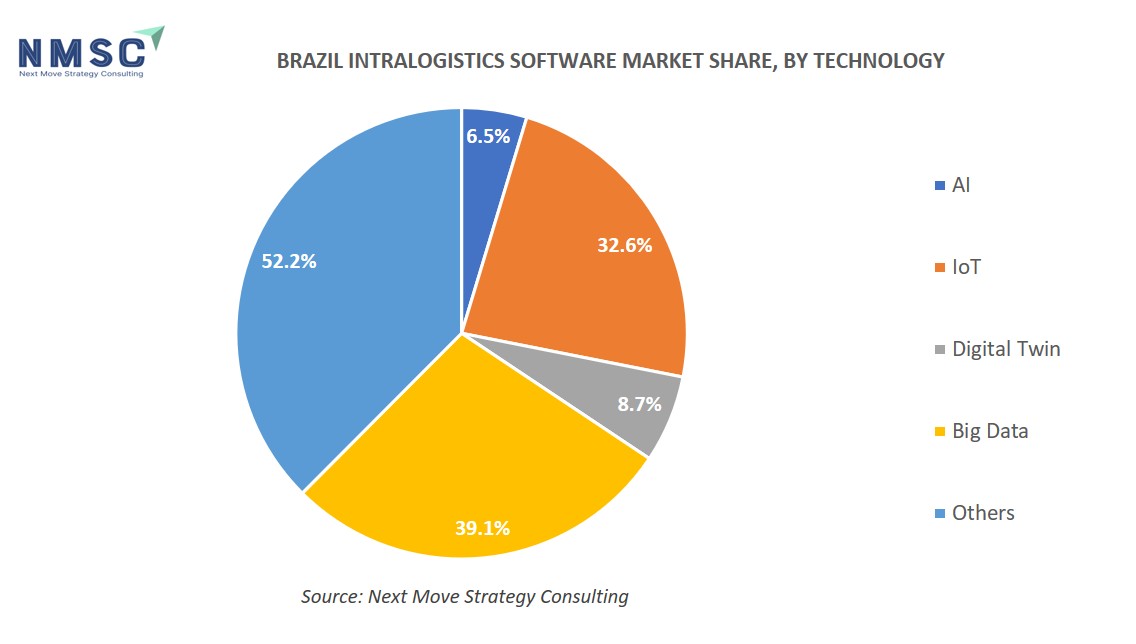

By Technology

-

Internet of Things (IoT)

-

Artificial Intelligence (AI)

-

Big Data Analytics

-

Cloud Security

-

Digital Twins

-

Others

By Deployment Mode

-

On-Premises

-

Cloud-Based

By End-User

-

Retail and E-commerce

-

Automotive

-

Food and Beverage

-

Pharmaceuticals

-

Aviation

-

Logistics

-

Semiconductor and Electronics

-

Consumer Goods

-

Others

Key Players

-

Jungheinrich AG

-

KNAPP

-

SSI SCHAEFER

-

Vanderlande

-

ULMA Handling Systems

-

Honeywell

-

LogPyx

-

Viastore Systems

-

Swisslog

-

i9 Supply

-

Dematic

-

AutoStore

-

Manhattan Associates

-

Generix Group

-

Oracle Corporation

-

Siemens AG

-

SAP SE

-

ABB

-

Beumer Group

-

Tecsys Inc.

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2025 |

USD 147.53 Billion |

|

Revenue Forecast in 2030 |

USD 270.35 Billion |

|

Growth Rate |

CAGR of 12.9% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

20 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent to up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst