Ceramic Machinery Market by Type (Shaping Machines, Decorative and Glazing Machines, Kilns and Firing Machines, Raw Material Processing Machines, Storage and Handling Machines, and Others Machinery), by Product Type (Tile, Sanitary Ware, Tableware, Technical Ceramics, Refractories, and Abrasive), by End User (Construction, Automotive, Electronics, and Others)–Global Opportunity Analysis and Industry Forecast, 2024–2030

Industry: Construction & Manufacturing | Publish Date: 15-May-2025 | No of Pages: 337 | No. of Tables: 240 | No. of Figures: 205 | Format: PDF | Report Code : CM262

Ceramic Machinery Market Overview

The global Ceramic Machinery Market size was valued at USD 5.04 billion in 2023 and is predicted to reach USD 7.31 billion by 2030, with a CAGR of 5.0% from 2024 to 2030. The ceramic machinery market, also known as the ceramic manufacturing equipment market, encompasses the global industry dedicated to designing, manufacturing, and distributing machinery and equipment for producing and processing ceramic products such as tiles, sanitary ware, tableware, and advanced ceramics. This market includes a wide variety of machinery, such as crushers, grinding mills, kilns, dryers, and presses, which are utilized at different stages of ceramic production, from raw material preparation to the final product.

Ceramic machinery is characterized by high-precision equipment for shaping, glazing, drying, and manufacturing ceramics, ensuring exact product specifications and superior quality outcomes. The benefits of ceramic machinery include enhanced manufacturing speed, consistent product quality, reduced labor costs, and the ability to produce complex and customized ceramic items. This market is crucial for meeting the increasing demand for high-quality ceramic products in various industrial applications, fueled by advancements in manufacturing technology and growing investments in automation.

Surge in Construction Industry is Driving the Market

The rapid expansion of the construction industry is significantly driving the demand for ceramic products such as tiles, sanitary ware, and architectural elements, which in turn fuels the growth of the market. As global construction projects, including residential, commercial, and infrastructure developments, continue to rise, there is an increasing need for high-quality, durable, and aesthetically pleasing ceramic materials.

According to the latest World Bank report, the global construction industry generated approximately USD 27.81 trillion in revenue in 2023, up from USD 22.36 trillion, representing a growth of around 24.4%. This surge in demand compels manufacturers to invest in advanced ceramic machinery to enhance production efficiency, meet quality standards, and accommodate the rising volume of output, thereby driving the market growth for ceramic machinery.

The Rising Urbanization Across the Globe is Boosting the Demand for Ceramic Machinery

The rise in urbanization is further boosting the demand for ceramic machinery by accelerating the construction of new residential, commercial, and infrastructure projects. As cities and urban areas expand, there is an increased need for ceramic products such as tiles, facades, and sanitary ware to meet the aesthetic and functional demands of modern buildings. According to a 2022 report by the World Economic Forum, the proportion of the global population living in cities is expected to grow from 55% in 2022 to 80% by 2050. This surge in urbanization is boosting the adoption of advanced ceramic manufacturing equipment, which is necessary for efficiently producing high-quality, durable, and innovative ceramic materials.

Rise in Technological Innovations is Further Boosting the Growth of the Market

Technological advancements, such as automation, digital printing, and introduction of advanced materials, by key industry players, have significantly enhanced the capabilities of ceramic machinery, enabling the production of higher-quality and customized ceramic products. For example, in July 2022, Bosch introduced the world’s first 3D-printed ceramic microreactor, which combines advanced ceramic materials with 3D printing technology. This innovative microreactor offers precise control in chemical reactions, resulting in improved efficiency and safety compared to traditional reactors. These technological innovations boost the demand for ceramic machinery by facilitating more efficient, precise, and innovative production processes.

High Initial Investment Restrains the Growth of the Market

However, the high initial investment required for ceramic machinery poses a significant financial barrier, restraining market growth. This substantial capital expenditure needed for purchasing and installing advanced machinery can be particularly challenging for smaller companies and startups. The significant upfront costs limit the ability of these businesses to invest in new technologies, thereby hindering their competitiveness and innovation capabilities.

Additionally, the expenses associated with ongoing maintenance and technical support further exacerbate financial constraints. As a result, the overall growth of the market is impeded, as many potential market entrants and existing small-scale manufacturers struggle to afford these advanced production tools.

Integration of Inkjet Technology in Ceramic Machinery is Expected to Create Lucrative Opportunity for Market Expansion

The integration of inkjet technology in ceramic machinery is anticipated to create significant growth opportunities for the market by enabling high-resolution, customizable printing directly onto ceramic surfaces. This technology facilitates the creation of intricate designs, vibrant colors, and detailed patterns, enhancing the aesthetic appeal and personalization of ceramic products. Furthermore, the flexibility and efficiency of inkjet technology streamline production processes, reducing reliance on traditional, labor-intensive methods. This makes inkjet technology an attractive investment, expanding market opportunities and fostering innovation within the ceramic machinery sector.

By Type, Shaping Machines Holds the Dominant Share in the Market

Shaping machines dominate the ceramic machinery market share with 33.9% share and exhibit the second highest CAGR in the ceramic industry due to their crucial role in transforming raw materials into precise forms for various applications. The key types include extrusion machines, which produce uniform shapes such as tiles by pushing material through a die, and pressing machines, which compact ceramic powders into dense forms using high pressure. These machines ensure high efficiency, uniformity, and precision in production, serving industries that manufacture structural ceramics, tiles, and sanitary ware. Their ability to provide consistent and accurate shaping solutions is essential for meeting the demands of both large-scale ceramic production and specialized ceramic products.

By End User, Construction Holds the Dominant Share in the Ceramic Machinery Industry

The construction industry holds 49.2% share among end users in the ceramic industry, heavily relying on ceramic machinery to produce essential materials such as tiles, sanitary ware, refractories, and structural ceramics. High-quality ceramic products are crucial in construction due to their durability, aesthetic appeal, and functional properties.

Shaping machines, kilns, and glazing machines are extensively used to manufacture tiles that are not only strong and long-lasting but also visually appealing. Technical ceramics produced for construction applications include materials that provide thermal insulation and resistance to wear and corrosion. These advanced ceramic products enhance the structural integrity and longevity of buildings and infrastructure. The construction sector's demand for precision and efficiency in production drives continuous innovation and improvement in ceramic machinery.

Asia-Pacific Dominates the Ceramic Machinery Industry with 42% Market Share in 2023

The surge in exports of ceramic products, such as tableware and roofing tiles, is driving manufacturers in the Asia-Pacific region to invest in high-capacity and efficient ceramic machinery. The latest report published by the Observatory of Economic Complexity (OEC) states that South Korea exported USD 449 million of ceramic products, making it the 22nd largest exporter of ceramic products in the world.

As demand for these products grows internationally, manufacturers need to meet stringent quality and quantity standards set by global markets. Investing in advanced ceramic machinery allows them to produce large volumes of high-quality ceramic goods efficiently, ensuring them to compete effectively on the international stage. This trend is fuelling the growth of the ceramic machinery market trends in the region as manufacturers strive to enhance their production capabilities to meet export demands.

Also, the adoption of collaborative efforts among key players in the ceramic machinery sector drives ceramic machinery market expansion in the region by combining resources, expertise, and innovation. These partnerships facilitate the development of advanced technologies, such as 3D printing, that significantly enhance production efficiency and product quality.

For example, in February 2024, Lithoz joined forces with AS ONE, Mitsui Kinzoku, and Yugōkuen Ceramics to advance ceramic 3D printing technology in Japan. This collaboration aimed to utilize Lithoz's Lithography-based Ceramic Manufacturing (LCM) technology to build a robust technology network and enhance the country’s ceramic manufacturing capabilities.

By creating a shared technology hub, these partnerships help to develop advanced ceramic machinery and speed up the use of new production methods. This results in improved capabilities for shaping and manufacturing ceramic materials to achieve precise forms and properties, thereby driving the ceramic machinery market growth in the region.

North America is Expected to Show Steady Growth in the Ceramic Machinery Industry with a CAGR of 7.4% till 2030

The North America ceramic machinery market is significantly propelled by the growth of the residential and commercial construction sectors. As these sectors expand, fueled by increasing urbanization and population growth, the demand for ceramic materials such as tiles, sanitary ware, and architectural elements rises sharply. According to recent report published by the White House, the U.S. government in 2023, invested around USD 220 billion for over 32,000 construction infrastructure projects.

Also, as per the Canadian Real Estate Association report, home sales went up by 3.7% from May to June 2024. The number of new property listings also grew by 1.5% month-over-month, indicating a balanced market. This surge in demand necessitates the use of advanced machinery capable of efficiently producing high-quality ceramics to meet the needs of these construction projects, thus boosting the ceramic machinery market demand.

Furthermore, the rapid growth of urbanization across various region in the region further accelerates the demand for advanced ceramics machinery. As urban development progresses, there is a heightened need for large volumes of ceramic materials to support the increased construction activities in residential, commercial, and infrastructure projects.

According to the latest report published by the Central Intelligence Agency (CIA), 83.3% of the total population of U.S. resided in urban areas in 2023. Advanced ceramics machinery plays a crucial role in meeting this demand by enabling efficient, high-volume production of ceramic products. These machineries ensure manufacturers to produce the necessary quantities of high-quality tiles, sanitary ware, and other ceramic materials required for modern urban construction, that in turn fuels the market.

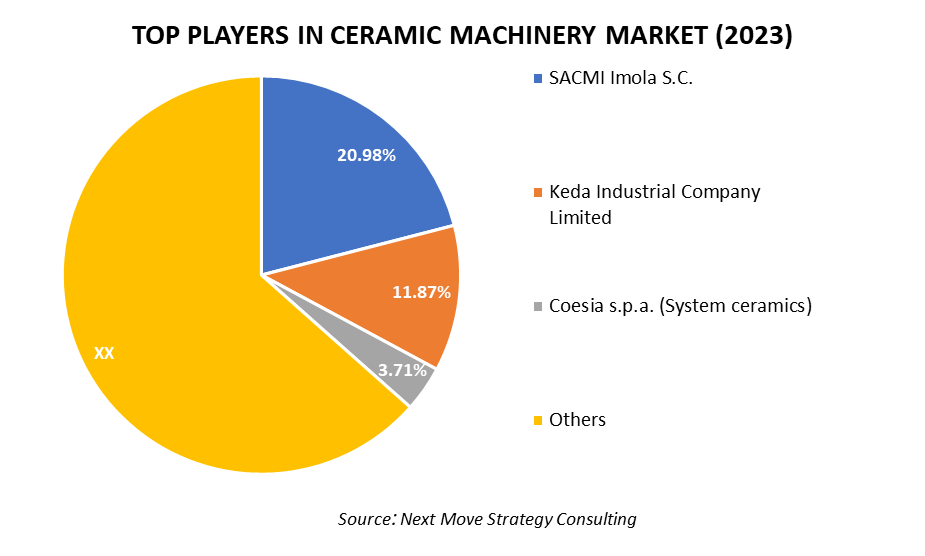

Competitive Landscape

The ceramic machinery industry comprises various market players, such as Keda Industrial Company Limited, SACMI Imola S.C., SITI B&T Group S.p.A., Air Power Group S.p.A., KERA jet S.A., Mectiles Italia S.R.L., Breton S.p.A., Coesia S.p.A. (System Ceramics), LB Technology, Handle Gmbh and among others.

These market players are adopting various strategies including partnership, business expansion, product launch, and acquisition across various regions to maintain their dominance in ceramic machinery industry. By continuously innovating and launching new offerings, they aim to meet the evolving demands of customers and also enables them to capture new opportunities and expand their market share.

|

DATE |

COMPANY |

RECENT DEVELOPMENTS |

|

|

May 2024 |

System Ceramics |

System Ceramics partnered with Qua Granite, emphasizing a shared commitment towards innovation and quality. This collaboration aims to integrate System Ceramic’s advanced technologies, known for their speed, quality, and precision, into Qua Granite's fleet of automatic machinery, enhancing their performance and capabilities. |

|

|

May 2024 |

SACMI |

SACMI expanded its business reach with the launch of a new Tiles Technical Hub in India to provide technical support and fast assistance to over 700 customers. This facility aims to enhance the company's support for the ceramic sector, particularly in tile production, by providing advanced technological solutions and services. |

|

|

October 2023 |

SITI B&T |

SITI B&T launched its BT Quartz, a new line of plant innovations designed to enhance the efficiency and quality of the manufacturing process. These innovations aim to provide manufacturers with a more efficient, reliable, and cost-effective production process, leveraging Gruppo BT's expertise in engineering and manufacturing. |

|

|

July 2023 |

KEDA Industrial Group |

KEDA Industrial Group acquired 70% equity stake in F.D.S. Ettmar S.r.l., an Italian mold manufacturing company, to enhance its presence in the ceramic machinery industry. This acquisition aims to deepen KEDA's overseas operations and improve its global value-added services by leveraging FDS's expertise in mold manufacturing, that is crucial for ceramic tile production. |

|

|

May 2023 |

KERAjet S.A. |

KERAjet S.A. launched KERAtex GIGA a digital printing solution specifically designed for ceramic tiles. It aims to enhance the printing process, offering high-quality results and versatility for manufacturers in the ceramics industry. |

|

|

April 2022 |

LB Technology |

LB Technology acquired Barcom, a company specializing in the production of ceramic slabs. The acquisition of Barcom aligns with LB Group's growth strategy, enabling the company to expand its production capabilities and tap into the growing demand for innovative ceramic solutions. |

|

Ceramic Machinery Market Key Market Segments

By Type

-

Shaping Machines

-

Decorative and Glazing Machines

-

Kilns and Firing Machines

-

Raw Material Processing Machines

-

Storage and Handling Machines

-

Others Machinery

By Product Type

-

Tile

-

Sanitary Ware

-

Tableware

-

Technical Ceramics

-

Refractories

-

Abrasive

By End User

-

Construction

-

Automotive

-

Electronics

-

Others

Key Players

-

Keda Industrial Company Limited

-

SACMI Imola S.C.

-

SITI B&T Group S.p.A.

-

Air Power Group S.p.A.

-

KERA jet S.A.

-

Mectiles Italia S.R.L.

-

Breton S.p.A.

-

Coesia S.p.A. (System Ceramics)

-

LB Technology

-

Handle Gmbh

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2023 |

USD 5.04 Billion |

|

Revenue Forecast in 2030 |

USD 7.31 Billion |

|

Growth Rate |

CAGR of 5.0% from 2024 to 2030 |

|

Analysis Period |

2023–2030 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

10 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst