Label Color Printing Market by Printer Type (Laser Printers, Inkjet Printers, & Others ), by Printing Technology (Digital Printing, Offset Printing, & Others), by Label Format (Pressure-Sensitive Labels, Shrink Sleeves, & Others), by Application (Food and Beverage Labels, Pharmaceutical Labels, Cosmetics & Others), and by End User (Fast-Moving Consumer Goods, Retail, Packaging, Personal Care, Pharmaceutical, Industrial, Others) – Global Opportunity Analysis and Industry Forecast, 2025–2030

Industry Outlook

The global Label Color Printing Market size was valued at USD 3.33 billion in 2024 and is expected to reach USD 3.53 billion by 2025. Looking ahead, the industry is projected to expand significantly, reaching USD 4.67 billion by 2030, registering a CAGR of 6.87% from 2025 to 2030.

The label color printing market is a dynamic and rapidly evolving sector, delivering high-quality, visually appealing, and functional labelling solutions across food and beverages, cosmetics, pharmaceuticals, electronics, and FMCG segments. With growing product variety, consumer demand for attractive packaging, and stringent regulatory requirements for traceability and brand protection, the Label Color Printing industry expanded across digital, flexographic, thermal, and hybrid printing platforms. Leading players including Avery Dennison Corporation, Multi-Color Corporation, Afinia Label, Epson Corporation, VIPColor Technologies Pte Ltd, Primera Technology, Inc, Addmaster Corporation, Canon Inc, Lexmark International Inc, Toshiba Corporation, Dell Inc., Brady Corporation, IMS Inc, UNINET Icolor, and OKI Data dominate both production and technology innovation worldwide. Label offerings range from pressure-sensitive and shrink-sleeve labels to in-mold, wet-glue, and linerless formats, with the industry increasingly leveraging automation, smart labels, and sustainable substrates to enhance efficiency, product differentiation, and consumer engagement. Despite challenges such as rising raw material costs, supply chain constraints, and regulatory compliance, growth prospects remain robust, driven by technological innovation, SKU proliferation, and the rising importance of brand identity and sustainable packaging.

What are the Key Trends in the Label Color Printing Market Growth?

How is Digital and Industrial Inkjet Adoption Reshaping Color Label Economics?

Digital and industrial inkjet printing is transitioning from a niche solution to a mainstream production method in the label industry. Seiko Epson reports rising inkjet printer and consumable revenues in FY2024. This evolution drives tangible benefits, lower minimum order quantities, faster time-to-market, and enhanced flexibility for brands to trade stockholding for agile SKUs and promotional campaigns. For converters, the implications are clear, investing in industrial inkjet platforms improves throughput, reduces cost per SKU for short- and medium-run jobs, and enables responsive production. Pilot deployments, coupled with co-developed color management workflows with ink and substrate suppliers, are critical to maintaining margins while scaling high-SKU portfolios.

Will Regulatory and Standards-Driven Traceability Accelerate Color Label Complexity?

Regulatory initiatives such as the EU Eco-design directive, the Digital Product Passport (DPP), and GS1’s December 2024 guidance are driving a transformation in packaging requirements, mandating richer, machine-readable content. Standards including QR codes, Data Matrix, NFC, and GS1 Digital Link are now foundational for interoperable traceability, product authentication, and enhanced consumer engagement. This evolution is increasing demand for color labels that combine high-resolution branding with embedded data carriers, requiring advanced printing, serialization, and smart material integration. Converters and label suppliers that implement verified GS1 Digital Link workflows, validate readability within production tolerances, and integrate serialization into high-throughput operations are well-positioned to capture premium contracts, particularly in regulated sectors such as pharmaceuticals, food, and high-value FMCG products.

How is Sustainability Influencing Venue Selection and Buyer Behaviour?

UFI and national convention bureaux report growing buyer and sponsor sensitivity to sustainability performance, with exhibitions increasingly quantifying environmental impacts in economic studies. Organizers now routinely include sustainability metrics in RFPs, and many venues publish carbon reduction and waste management targets post-2024. Sustainability considerations are shaping bidding and supplier selection, as buyers favour venues and organizers demonstrating measurable emissions reductions and circular waste programs. Actionable insights for event operators include publishing annual sustainability scorecards, pursuing recognized venue certifications, and offering low-emission solutions, such as local sourcing, digital collateral, and verified carbon offset programs, to maintain high-value corporate contracts and public sector tenders. Strong sustainability performance is becoming a key differentiator in competitive RFP processes.

How are Smart Labels and NFC/RFID Features Creating Premium Applications for Color Labels?

Smart and interactive labels, including NFC, RFID, and QR codes embedded with GS1 Digital Link, are moving from pilot projects to scaled commercial applications across authentication, after-sales engagement, and supply chain transparency. In 2024, companies such as Multi-Color and other leading label solution providers announced strategic initiatives, including targeted acquisitions in smart and sensor technologies, to strengthen their capabilities. This shift is creating a growing segment of color label demand where substrates, adhesives, and printed layers must be engineered for optimal RF performance, durability, and readable color contrast. Converters that provide end-to-end smart label solutions, including printing, encoding, and testing, achieve higher unit economics, capture premium contracts, and cultivate long-term, high-value customer relationships across regulated and technology-driven verticals.

What are the Key Market Drivers, Breakthroughs, and Investment Opportunities that Will Shape the Label Color Printing Market in the Next Decade?

Growth in label color printing is driven by better brand economics and regulatory complexity that requires richer information on pack, while technology shifts lower the cost of personalization and short runs. Large materials and print OEMs reported strategy shifts in 2024 toward labels and industrial printing, indicating capex and R&D tailwinds. However, raw material cost volatility and capital intensity for new presses are constraints for smaller converters. Strategic investors view smart and sustainable labels as adjacent high-growth opportunities attractive for M&A and partnership plays.

Growth Drivers:

How are Recent Printing Technology Advances Accelerating the Label Color Printing Market Demand?

Industrial inkjet and single-pass digital printing platforms have evolved from pilot applications to full-scale commercial deployment during 2024–2025, establishing new benchmarks for efficiency, speed, and operational flexibility in the label and packaging sectors. Leading OEMs are positioning these technologies as strategic growth drivers. Canon, through its LabelStream LS series and 2024 annual report, signalled a major expansion into industrial labels and packaging, while Seiko Epson reported increased unit shipments and strong IJP ink revenues in FY2024. These advancements significantly reduce minimum order quantities, enable rapid SKU versioning, and support localized production. Converters that implement targeted industrial inkjet pilots and collaborate on inkl, substrate workflows enhance throughput, improve margins, and strengthen competitive positioning in dynamic, high-mix label color printing market.

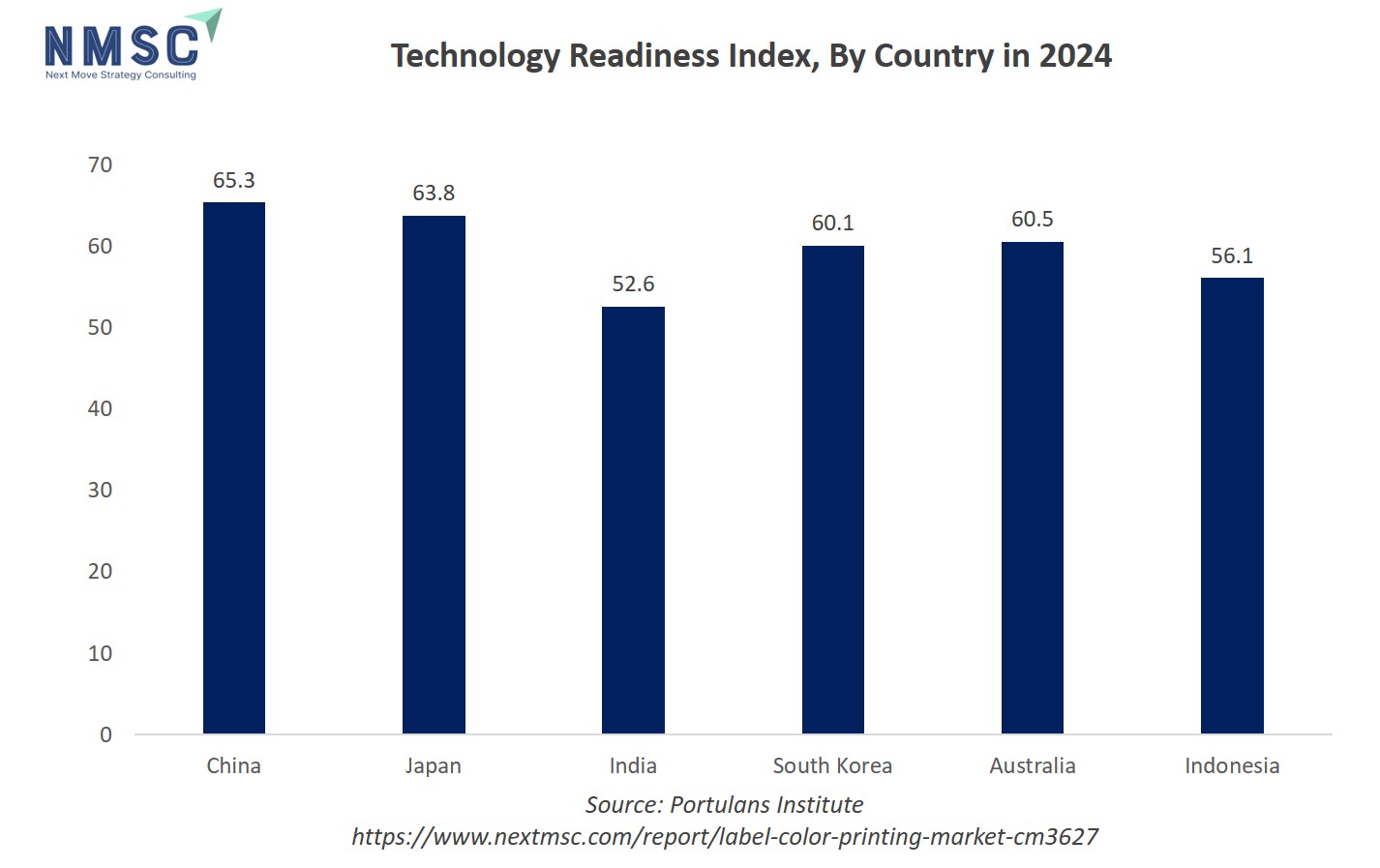

The chart shows the Technology Readiness Index for 2024 across leading Asia-Pacific countries, with China (65.3) and Japan (63.8) at the top, followed by Australia (60.5), South Korea (60.1), Indonesia (56.1), and India (52.6). In the context of the label color printing market, a higher technology readiness index indicates a stronger environment for the adoption of advanced digital and color printing technologies, integration of automation in label production, and swift shift toward smart labeling solutions. This means that countries like China and Japan are more likely to invest in and adopt cutting-edge label color printing equipment and solutions, driving market innovation and expansion, while lower readiness in India and Indonesia slow market development, limit capability upgrades, and delay adoption of world-class color printing standards.

How is Digital Printing Enabling Shorter Runs and Faster SKU Cycles?

Digital and industrial inkjet printing platforms have demonstrated significant commercial traction, enabling converters to efficiently manage shorter runs and faster SKU cycles. Technologies such as Canon’s LabelStream LS series and Seiko Epson’s ColorWorks on-demand label systems showcase the ability to deliver high-quality, short-run labels with minimal setup time. High-productivity presses like the HP Indigo 120K and 18K series further accelerate the transition from analog to digital production, reducing minimum order quantities and turnaround times. These capabilities allow brands to profitably produce regional variants, promotional editions, and personalized SKUs. Converters are advised to define SKU breakpoints, pilot industrial inkjet solutions for high-mix accounts, and scale based on throughput and cost per SKU.

Growth Inhibitors:

Will Cost and Capital Requirements Limit Small Converter Upgrades?

High-throughput digital label presses and automation platforms are designed for large-scale, centralized operations, making them capital-intensive and requiring significant upfront investment. OEM messaging emphasizes high-volume productivity and integrated automation, which limit rapid adoption among smaller and mid-sized converters. In addition, material costs, consumable availability, labour, and integration challenges further constrain smaller operators, particularly in lower-margin markets. To overcome these barriers, smaller converters explore equipment-as-a-service models, collaborative purchasing of inks and substrates, or strategic OEM financing. These approaches allow firms to test digital capabilities, manage capital outlay, and validate new workflows with a select set of high-value accounts before scaling operations.

Can AI (machine learning and automation) create new high-value services in label color printing?

AI adoption across the packaging value chain is becoming increasingly actionable, enabling converters and materials suppliers to automate workflows and unlock operational efficiencies. Applications span prepress correction, color management, defect detection, artwork versioning, and predictive maintenance, driving faster proof-to-print cycles, reduced waste, and improved quality control. AI also supports SKU optimisation and workflow governance, allowing companies to offer scalable, SaaS-style services to brands. Printers and converters should focus on integrating AI into prepress and quality-inspection processes with human oversight, while collaborating with specialist technology partners to implement AI-enabled tools effectively. Strategic adoption of AI enhances productivity, strengthen competitive positioning, and create new value streams across the packaging and labelling ecosystem.

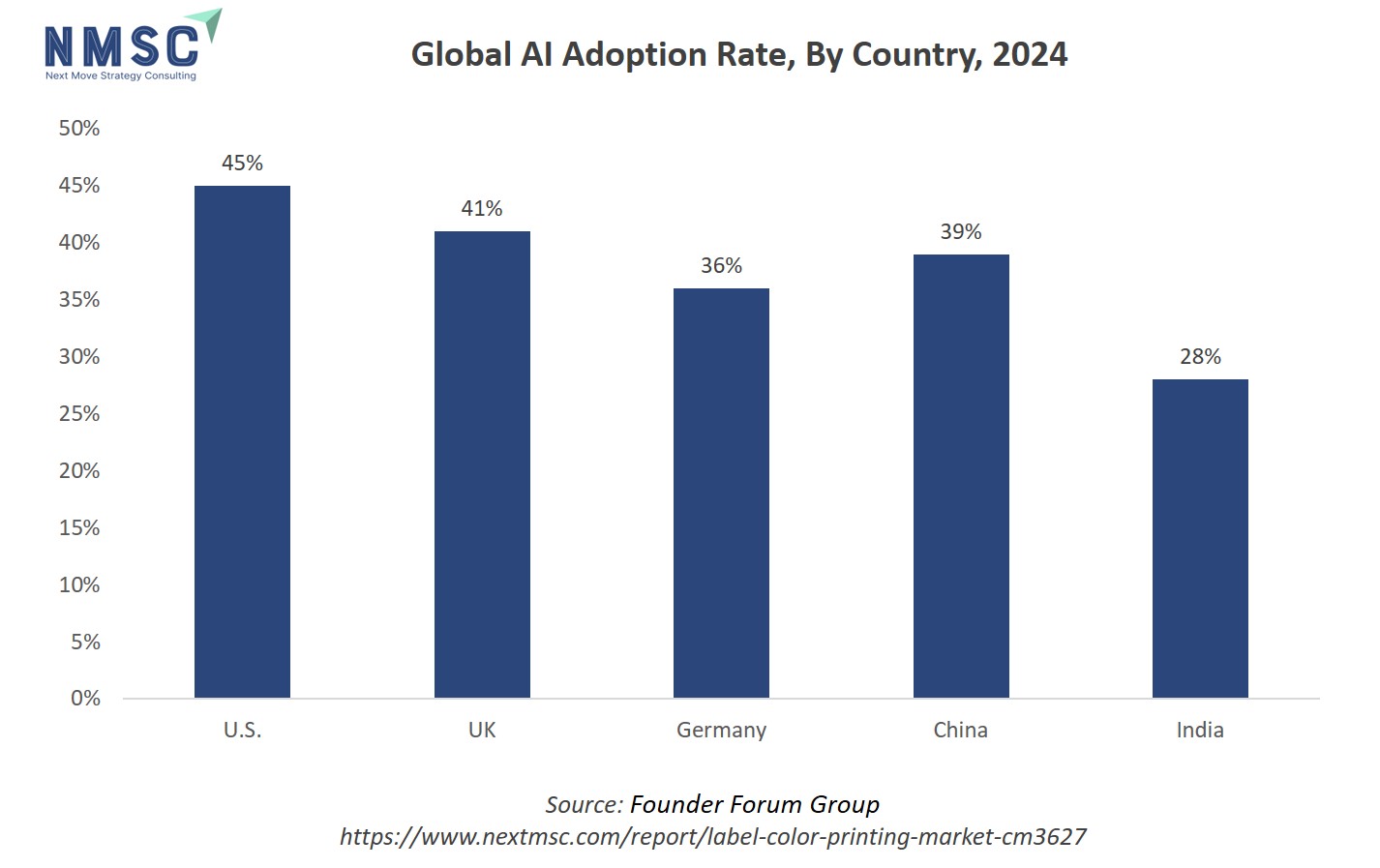

The chart illustrates the global AI adoption rate by country in 2024, with the U.S. leading at 45%, followed by the UK at 41%, China at 39%, Germany at 36%, and India at 28%. Higher AI adoption rates indicate a stronger integration of automation, advanced data analytics, and intelligent supply chain solutions in label color printing market. Countries with higher adoption, such as the U.S., UK, and China, are likely at the forefront of utilizing AI-driven printing technologies for improved efficiency, customization, and quality in label production, while lower adoption in India and Germany means more traditional processes are still prevalent, resulting in slower innovation and fewer competitive advantages in their printing industries.

How Label Color Printing Market segmented in this report, and what are the key insights from the segmentation analysis?

By Printer Type Insights

Is Inkjet Adoption Displacing Other Printer Types in 2025?

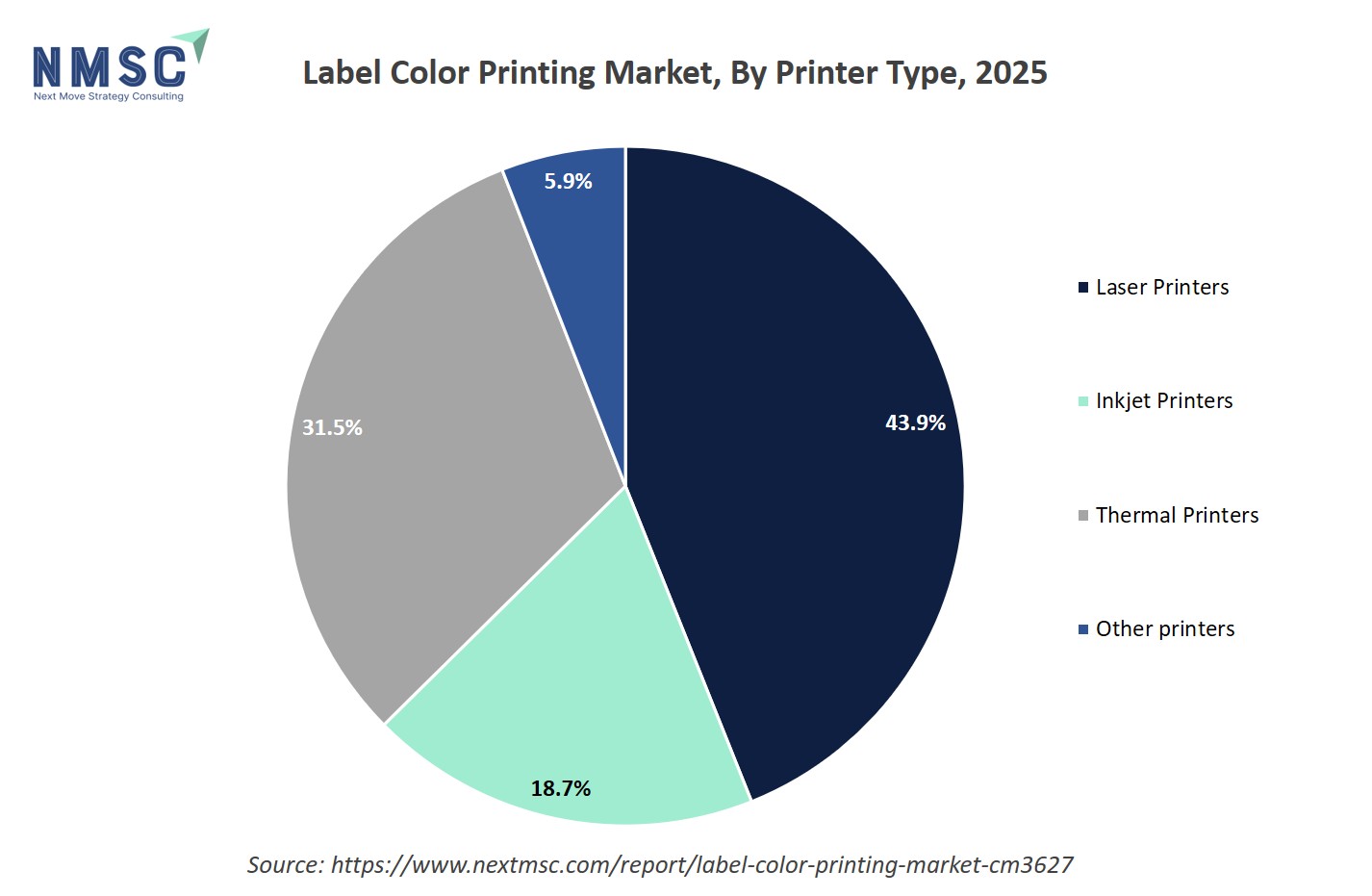

Based on printer type, the label color printing market share is segmented into laser printers, inkjet printers, thermal printers, and other printers.

Inkjet printers are increasingly capturing share for short- to mid-run color label production due to their flexibility, quick setup, and ability to produce high-quality full-color prints. While laser and thermal printers remain essential for on-demand or industrial coding applications, and gravure and flexo retain dominance for very high-volume, low-color-complexity runs, converters are optimizing their fleets strategically. Deploying inkjet for SKU variety and promotional runs, while using flexo/gravure for stable, large-volume production, allows maximum efficiency and profitability. OEMs are strategically emphasizing industrial inkjet platforms, reflecting strong revenue growth and signalling a gradual industry shift toward digital-first printing, driven by personalization, shorter lead times, and operational flexibility.

The chart illustrates the label color printing market segmentation by printer type for 2025, showing that laser printers dominate with a 43.9% share, followed by thermal printers at 31.5%, inkjet printers at 18.7%, and other printers at 5.9%. This indicates that while both thermal and inkjet technologies are widely used, laser printers are the preferred choice for label color printing applications globally, reflecting their efficiency, print quality, and reliability within this sector.

By Printing Technology Insights

Is Digital Printing the Fastest-Growing Technology?

Based on printing technology, the label color printing market is segmented into digital printing, flexographic printing, offset printing, gravure printing, and screen printing.

Digital printing technologies, including inkjet and electrophotographic solutions, are the fastest-growing segments for color label production due to their cost-effectiveness for short runs, personalization, and promotional campaigns. Traditional flexographic and offset processes remain indispensable for very high-volume production and specialized substrate requirements. Leading converters are blending flexo or gravure for base production runs with digital solutions for versioning, SKU proliferation, and marketing campaigns. This hybrid approach enhances operational efficiency, reduces lead times, and allows margin optimization. Investment by OEMs in industrial digital printing platforms highlights the strategic importance of these technologies, reinforcing their role in enabling innovation, rapid response to market trends, and competitive differentiation in color label printing.

By Label Format Insights

Are Pressure-Sensitive Labels Still Dominant in Color Applications?

Based on label format, the market is segmented into pressure-sensitive labels, shrink sleeves, in-mold labels, wet glue labels, linerless labels, and stretch sleeves.

Pressure-sensitive labels continue to dominate applications in food, beverage, and personal care sectors due to ease of application, wide substrate compatibility, and cost-effectiveness. Meanwhile, shrink sleeves and in-mold labels are growing faster in segments such as beverages, specialty packaging, and promotional products, where full-body decoration and vibrant color fidelity are critical. Converters are increasingly required to maintain multi-format capabilities, ensuring flexibility across client requirements and SKU variety. Efficient material sourcing strategies, combined with expertise in application-specific label formats, allow suppliers to capture cross-format opportunities. These trends underscore that pressure-sensitive labels will retain volume leadership, while growth in innovative formats will continue to accelerate as brand owners seek differentiation on shelf appeal and sustainability.

By Application Insights

Is Food and Beverage the Largest User of Color Labels?

Based on application, the market is segmented into food and beverage labels, pharmaceutical labels, cosmetics and personal care labels, retail product labels, industrial labels, logistics and e-commerce labels, and other applications.

The food and beverage sector remains the largest user of color labels, driven by rapid SKU proliferation, regulatory labeling requirements, and brand differentiation needs. Personal care and pharmaceutical industries follow closely, emphasizing traceability, compliance, and high-quality color reproduction. Growth in e-commerce channels further accelerates demand for visually appealing, information-dense labels capable of attracting online consumers and supporting fulfillment processes. Converters that focus on FMCG, personal care, and pharmaceutical categories are positioned to access the most consistent recurring demand. Aligning production strategies with regulatory standards, SKU complexity, and material innovation is increasingly crucial for maintaining competitive advantage and ensuring profitability in these high-volume, highly visible market segments.

By End User Insights

Are FMCG and Retail the Primary Drivers of Color Label Demand?

Based on end user, the market is segmented into fast-moving consumer goods, retail, packaging, personal care, pharmaceutical, industrial, and others.

FMCG and retail remain the primary end-user segments for color labels, driven by SKU churn, promotional activity, and ongoing product launches. Pharmaceutical, industrial, and other specialized sectors rely on color labels for traceability, serialization, and compliance purposes, pushing investments in high-contrast, durable, and high-fidelity printing solutions. Suppliers offering compliance-first, digitally adaptable, and customizable color label solutions gain preference in regulated verticals and high-value accounts. With increasing regulatory scrutiny and emphasis on product authenticity, converters that integrate digital tracking, AI-enabled personalization, and sustainable materials are better positioned to serve end-user demands, strengthen client relationships, and secure recurring contracts across multiple industry segments.

Regional Outlook

The label color printing market is geographically studied across North America, Europe, Asia Pacific, Middle East & Africa, and Latin America and each region is further studied across countries.

Label Color Printing Market in North America

North America benefits from a dense FMCG base, a sophisticated retail sector, and early adoption of smart labelling technologies. Converters and OEMs are increasingly investing in personalization, traceability, and supply chain compliance, including serialization and machine-readable labels, to meet the needs of CPG and pharmaceutical clients. The region also emphasizes sustainability and integration of digital engagement tools, creating opportunities for premium label formats and high-margin service offerings. U.S. and Canadian converters prioritizing hybrid workflows that combine digital, inkjet, and flexo production are positioned to capture higher yields and provide measurable sponsor and client outcomes, reinforcing North America’s position as a leading market for innovative label solutions.

Label Color Printing Market in the United States

The U.S. label market is defined by high per-capita packaged goods consumption and strict regulatory oversight, including FDA labelling standards and supply chain traceability requirements. This environment drives demand for high-quality, compliant color labels and specialized production capabilities such as serialization and anti-counterfeit features. Converters that integrate DPP-ready workflows, hybrid digital and analogue production, and automated quality control secure CPG and pharmaceutical contracts while improving operational efficiency. Regional adoption of sustainable substrates and eco-design initiatives further adds value, positioning U.S. converters to benefit from regulatory compliance, brand differentiation, and premium pricing opportunities in the color label printing market.

Label Color Printing Market in Canada

Canada largely mirrors U.S. market trends, albeit at smaller volumes. Converters that build cross-border supply partnerships and leverage sustainable substrate solutions secure premium contracts with multinational brands. Regional adoption of smart labelling, traceability, and DPP compliance is growing steadily, especially in FMCG, food, beverage, and personal care sectors. Companies that offer flexible production capabilities, multi-format label solutions, and localized service efficiently serve Canadian markets while maintaining profitability. Sustainability, material innovation, and workflow integration are increasingly important differentiators in the Canadian label color printing market, creating opportunities for converters to combine operational efficiency with regulatory and environmental compliance.

Label Color Printing Market in Europe

European demand for color labels is strongly influenced by regulatory frameworks, including the EU ESPR and Digital Product Passport initiatives, which accelerate adoption of machine-readable, traceable, and sustainable labels. Local recyclability rules, circular economy standards, and ESG-focused policies raise the bar for material selection and design. Converters with capabilities in hybrid digital and analog printing, multi-format production, and sustainable substrate sourcing are positioned to capture high-value contracts. Early adoption of digital workflows, IoT-enabled label tracking, and smart labeling solutions further enhances market competitiveness, as European brands increasingly prioritize compliance, environmental stewardship, and operational efficiency in their packaging strategies.

Label Color Printing Market in the United Kingdom

The U.K. label color printing market closely follows EU regulatory and sustainability trends, with strong adoption of digital engagement tools on labels to support traceability, consumer interaction, and brand communication. Retailers increasingly require sustainability certifications, recyclable substrates, and compliance with circular economy standards. Converters that focus on retailer compliance, multi-format production, and integration of smart labels with digital platforms gain market share. Additionally, investments in workflow automation, hybrid printing, and personalized labeling allow suppliers to serve high-volume FMCG and beverage sectors while maintaining operational efficiency and meeting evolving regulatory and environmental requirements.

Label Color Printing Market in Germany

Germany’s industrially advanced packaging sector is characterized by high innovation intensity, early adoption of digital printing technologies, and growing interest in smart labels. Converters and OEMs are investing in industrial inkjet and hybrid workflows to meet demands for premium beverage, food, and personal care packaging. Compliance with EU regulations, combined with strong sustainability initiatives, makes Germany a strategic hub for industrial label deployments in Europe. Companies capable of integrating digital platforms, automation, and multi-format production are best positioned to capture growth in both local and export-oriented packaging markets.

Label Color Printing Market in France

France emphasizes eco-design, recyclability, and mono-material label solutions, creating a strong market for sustainable packaging formats. Peelable and recyclable labels are increasingly required by large retailers, particularly in food, beverage, and personal care sectors. Converters that demonstrate material compliance, eco-certification, and digital workflow integration access leading retailer contracts. Multi-format capabilities, hybrid printing, and smart labelling are becoming key differentiators, supporting both regulatory compliance and brand visibility. Suppliers aligning sustainability initiatives with operational efficiency gain competitive advantage in the French label color printing market.

Label Color Printing Market in Spain

Spain shows consistent demand for color labels in beverages, packaged foods, and specialty products. Seasonal and tourism-linked SKUs contribute to demand fluctuations, requiring flexible production capabilities. Converters that combine hybrid workflows, digital personalization, and sustainable substrate sourcing optimize margins while meeting market demand. Investment in multi-format lines and efficient workflow integration supports growth opportunities, particularly for beverage and retail packaging segments, where shelf appeal, brand differentiation, and regulatory compliance are increasingly critical.

Label Color Printing Market in Italy

Italy’s strong food, wine, and specialty products sectors create high demand for premium color labels market, where color fidelity, substrate quality, and aesthetic design are critical. Converters serving these markets benefit from multi-format printing capabilities, hybrid digital/flexo workflows, and customised labelling solutions for artisanal and high-value products. Compliance with EU environmental standards and adoption of sustainable materials further enhance market positioning. Operational efficiency, coupled with innovation in design and material selection, enables converters to capture market share in Italy’s competitive packaging landscape.

Label Color Printing Market in the Nordics

Nordic label color printing market prioritize sustainability, circularity, and environmental transparency, with labels increasingly required to support recycling streams and provide verified product environmental data. Converters integrating eco-friendly substrates, hybrid printing technologies, and data-driven labelling solutions meet regulatory and retailer demands while strengthening brand partnerships. Demand is driven by FMCG, beverage, and personal care sectors, with multi-format production capabilities enabling suppliers to capture high-margin opportunities in premium and environmentally conscious product categories.

Label Color Printing Market in the Asia-Pacific

APAC is the fastest-growing region for color label printing due to rapid packaged goods expansion, SKU proliferation, and rising consumer demand. China and India represent priority label color printing market, with significant adoption of industrial inkjet and digital printing for FMCG, beverage, and personal care sectors. Converters and OEMs that offer hybrid workflows, multi-format printing, and sustainable substrates efficiently meet localized demand while scaling production for multinational clients. Investment in digital platforms, smart labeling, and workflow automation positions players to capture high-volume, high-value opportunities across the region.

Label Color Printing Market in China

China combines large-scale production with rapid adoption of digital and industrial inkjet printing for color labels. Domestic suppliers and global OEMs compete to serve high-volume FMCG, beverage, and personal care clients, with SKU proliferation driving demand for flexible, hybrid printing workflows. Compliance with traceability and serialization regulations is increasingly important. Converters adopting multi-format, digital-first production and integrating smart label technologies gain competitive advantage, capturing both local and export-oriented packaging demand.

Label Color Printing Market in Japan

Japan is a technology leader in industrial inkjet and hybrid printing, with strict quality and consistency requirements. OEMs invest heavily in R&D to develop inkjet solutions tailored to premium FMCG, beverage, and electronics packaging. Converters emphasizing digital workflows, hybrid printing, and multi-format production meet stringent client expectations, enhancing shelf appeal and brand perception. Sustainability and eco-design considerations are increasingly incorporated into material selection, supporting compliance with domestic and international standards while driving competitive differentiation.

Label Color Printing Market in India

India offers high-volume growth potential as packaged goods consumption rises, particularly in FMCG, food, and beverage sectors. Converters must balance cost sensitivity with digital printing capabilities and sustainable material offerings. Hybrid workflows, multi-format production, and adoption of smart labelling solutions enable converters to capture multinational brand contracts while supporting SKU proliferation. Operational efficiency, compliance with global standards, and flexibility in production capacity are critical to succeeding in India’s rapidly expanding label color printing market.

Label Color Printing Market in South Korea

South Korea’s strong electronics, cosmetics, and premium beverage sectors drive demand for high-fidelity color labels and serialized smart labels. Converters that adopt industrial inkjet and hybrid digital workflows, integrate data-driven tracking, and comply with sustainability requirements are well-positioned to serve these high-margin markets. Flexibility in multi-format production and adherence to stringent quality standards enhance competitiveness in South Korea’s rapidly evolving labelling industry.

Label Color Printing Market in Taiwan

Taiwan’s industrial and consumer goods sectors demand high-precision, premium-quality color labels to ensure product traceability, support promotional campaigns, and enable clear differentiation on crowded retail shelves. The adoption of digital and hybrid printing technologies allows converters to manage diverse SKUs efficiently, accommodate short-run production, and rapidly respond to evolving client needs. Companies that integrate automated workflows, smart label functionalities such as serialization and QR codes, and sustainable, recyclable substrates gain a competitive advantage in electronics, food, and cosmetic markets. These capabilities also support compliance with regulatory and environmental requirements while enhancing brand visibility and consumer engagement, positioning Taiwanese converters to capture both domestic and export-oriented opportunities in high-value sectors.

Label Color Printing Market in Indonesia

Indonesia represents a rapidly growing label color printing market, fuelled by expansion in beverages, packaged foods, and FMCG products. The country’s fragmented geography and seasonal product cycles necessitate converters to invest in flexible digital printing lines capable of handling short runs and diverse SKUs across islands. Multi-format capabilities, hybrid workflows combining digital and conventional printing, and sustainable substrate adoption are critical for balancing operational efficiency with cost-effectiveness. Companies that deliver consistent quality while meeting regulatory standards, market-specific branding needs, and sustainability expectations are well-positioned to capture emerging opportunities. Scalability, local distribution networks, and technological adaptability remain key factors for success in Indonesia’s dynamic labelling landscape.

Label Color Printing Market in Australia

Australia’s label color printing market shows moderate growth, primarily driven by packaged foods, beverages, and retail products. Retailers increasingly prioritize sustainability, recyclability, and compliance with environmental standards, placing pressure on converters to adopt eco-friendly substrates and circular-material strategies. Multi-format production and digital printing adoption enable converters to efficiently manage SKU diversity, short runs, and promotional campaigns. Companies that integrate smart label technologies, hybrid digital workflows, and sustainable materials secure high-value contracts and differentiate themselves in competitive sectors. Urban population density, retail expansion, and regulatory trends collectively support ongoing demand, while converters that combine technological innovation with operational efficiency are well-positioned to capture opportunities in Australia’s evolving market.

Label Color Printing Market in Latin America

Latin America is largely price-sensitive, but selective premiumization in beverages, personal care, and packaged foods is creating pockets of high-margin opportunity. Converters are leveraging cross-border partnerships, regional substrate sourcing, and multi-format hybrid printing to manage costs while meeting the complex requirements of global and local clients. Operational flexibility, scalability, and efficiency are critical, particularly when serving fragmented markets with varying regulatory standards. Sustainability trends, including recyclable and eco-friendly materials, are increasingly influencing client decisions. Companies that combine competitive pricing, compliance with local regulations, and sustainable practices gain market share, while investments in hybrid digital printing and smart label integration enhance responsiveness to evolving FMCG and beverage industry demands across the region.

Label Color Printing Market in the Middle East & Africa

Demand for color labels in the Middle East and Africa is uneven, with premium segments in beverages, cosmetics, and high-end FMCG driving growth in GCC countries, while other markets remain highly price-sensitive. Converters with regional distribution networks, low-capital-expenditure operations, and hybrid digital/analog workflows are better positioned to capture diverse opportunities. Adoption of smart label technologies, serialization, and sustainable substrates enhances competitiveness, particularly in premium segments where traceability, regulatory compliance, and brand differentiation are critical. Companies that combine operational efficiency, technological adaptability, and local market expertise successfully navigate this heterogeneous market, meeting client expectations while capitalizing on growth in high-value and emerging labelling opportunities across the region.

Competitive Landscape

Which Companies Dominate the Label Color Printing Market and How Do They Compete?

The global label color printing market is characterized by a moderately concentrated structure, dominated by a mix of multinational leaders alongside numerous regional and local firms. Major players such as Avery Dennison Corporation, Multi-Color Corporation, Afinia Label, Epson Corporation, VIPColor Technologies Pte Ltd, Primera Technology, Inc, Addmaster Corporation, Canon Inc, Lexmark International Inc, Toshiba Corporation, Dell Inc., Brady Corporation, IMS Inc, UNINET Icolor, and OKI Data collectively command a significant share of global label production and color printing solutions. These companies maintain extensive product and technology portfolios, emphasizing the importance of scale, reputation, and long-term client relationships in sustaining competitive advantage. Competition occurs across both geographic and niche dimensions, with global giants frequently vying for high-volume industrial, FMCG, and electronics contracts, while regional specialists cater to localized markets and custom labelling segments. The industry’s moderately oligopolistic nature means market share gains are typically achieved through innovation in printing technologies, automation, smart labels, hybrid workflows, and sustainable substrates. Ultimately, scale, technological expertise, and a robust operational network remain decisive differentiators, as clients increasingly prioritize vendors capable of delivering consistent, high-quality, and customizable label solutions across multiple sectors and geographies.

Label Color Printing Market Dominated by Giants and Specialists

Large materials and solutions groups and specialist converters continue to anchor the value chain: Avery Dennison reported FY24 net sales of USD 8.8 billion and highlights Intelligent Labels as a high-value growth area, underscoring the scale and margin advantage of materials incumbents. Materials players retain pricing power in engineered face stocks, adhesives and RFID-enabled substrates while global converters hold the customer relationships and service models brands require. This dual capture of value favours vertically integrated players and specialist converters able to bundle materials, printing and encoding services; smaller players should therefore pursue niche differentiation or alliance models to protect margin.

Innovation and Adaptability Drive Label Color Printing Market Success

OEMs and label specialists are explicitly tilting R&D and go-to-market effort toward labels and industrial printing, Canon’s 2024 reporting states a full-scale entry into industrial printing focused on labels and packaging as a growth priority, signalling stronger OEM competition and new technology supply to converters. Converters that combine hardware, consumables and software stacks, for color management, prepress automation and print-encode workflows, win longer contracts and higher lifetime value from brand customers. To capitalise, firms should accelerate pilots of integrated digital and smart-label systems and codify value propositions (speed, versioning, serialization) into tiered service offers.

Market Players to Opt for Merger & Acquisition Strategies to Expand Their Presence

M&A in 2024–2025 demonstrates a clear consolidation playbook: Multi-Color Corporation’s acquisitions of Starport Technologies (smart labels) and Eximpro (shrink sleeves) expanded both smart capability and geographic capacity, and MCC itself cites approximately USD 3 billion in annual revenue as context for scale. Private equity and strategic buyers continue to pursue roll-ups that deliver geographic reach, format breadth and the capital to invest in digital conversion and smart label rollouts. Converters and investors should prioritise M&A targets that either add adjacent technical capability (RFID/encoding, shrink sleeve) or accelerate entry into growth markets to achieve the scale required for modern automated production lines.

List of Key Label Color Printing Companies

-

Multi-Color Corporation

-

Afinia Label

-

Epson Corporation

-

VIPColor Technologies Pte Ltd

-

Primera Technology, Inc

-

Addmaster Corporation

-

Canon Inc

-

Lexmark International Inc

-

Toshiba Corporation

-

Dell Inc.

-

Brady Corporation

-

IMS Inc

-

UNINET Icolor

-

OKI Data

What Are The Latest Key Industry Developments?

-

October 2024- Multi-Color Corporation (MCC), one of the largest label companies in the world, announced the acquisition of Starport Technologies, a provider of smart label solutions based in Kansas City, Missouri.

-

December 2024- MCC announce the acquisition of Mexico-based Eximpro, a leading provider of shrink sleeve label (SSL) solutions.

-

September 2025 – Avery Dennison Corporation announces a series of product innovations that will launch at Labelexpo 2025, booth 3E61, beginning September 16 in Barcelona. With labels and packaging at the forefront of enabling circularity and connectivity

-

March 2024 – Cannon demonstrated new digital presses and label printing technologies including the water-based inkjet LabelStream 2000 at Drupa 2024.

What Are The Key Factors Influencing Investment Analysis & Opportunities In The Label Color Printing Market?

Investors should focus on assets demonstrating recurring revenue, strong order pipelines, and measurable ROI from high-value labelling solutions. Funding trends in 2024–2025 favour platform-enabled printing solutions, digital and hybrid printing technologies, smart label integration, and roll-up strategies targeting niche verticals within label color printing. Valuation multiples are increasingly linked to revenue visibility and recurring ARR from software-driven labelling platforms and automated workflows, with firms converting one-off production orders into subscription or service-based models commanding premium pricing. Key investment hotspots include Asia-Pacific for rapid industrial and FMCG growth, North America for scale and advanced technology adoption, and Europe for sustainable packaging and regulatory-driven labelling demand. Due diligence should prioritize proprietary technology, data-driven customization capabilities, long-term client contracts, and verified sustainability credentials.

Key Benefits for Stakeholders:

Next Move Strategy Consulting (NMSC) presents a comprehensive analysis of the label color printing market trends, covering historical trends from 2020 through 2024 and offering detailed forecasts through 2030. Our study examines the market at regional and country levels, providing quantitative projections and insights into key growth drivers, challenges, and investment opportunities across all major Label Color Printing segments.

Investors gain exposure to high-ROI segments, including digital and hybrid printing platforms, smart labels, automated workflows, and niche vertical roll-ups, offering recurring revenue and measurable growth. Policymakers benefit from verified industry impact data, supporting manufacturing standards, packaging regulations, and sustainability initiatives. Brand owners and customers see enhanced efficiency as producers adopt AI-enabled print analytics, data-driven customization, and sustainable substrates, improving quality, SKU management, and environmental impact. A robust digital printing ecosystem reduces operational and financial risk, enhances pricing transparency, and strengthens stakeholder confidence. These capabilities enable manufacturers to scale label color printing across geographies and product lines, transforming episodic production orders into durable, high-value business ecosystems.

Report Scope:

|

Parameters |

Details |

|

Market Size in 2025 |

USD 3.53 billion |

|

Revenue Forecast in 2030 |

USD 4.67 billion |

|

Growth Rate |

CAGR of 6.87% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Million (USD) |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Countries Covered |

33 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent to up to 80 analyst-working hours) after purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

|

Approach |

In-depth primary and secondary research; proprietary databases; rigorous quality control and validation measures. |

|

Analytical Tools |

Porter's Five Forces, SWOT, value chain, and Harvey ball analysis to assess competitive intensity, stakeholder roles, and relative impact of key factors. |

Key Market Segments

By Printer Type

-

Laser Printers

-

Inkjet Printers

-

Thermal Printers

-

Other Printers

By Printing Technology

-

Digital Printing

-

Flexographic Printing

-

Offset Printing

-

Gravure Printing

-

Screen Printing

By Label Format

-

Pressure-Sensitive Labels

-

Shrink Sleeves

-

In-Mold Labels

-

Wet Glue Labels

-

Linerless Labels

-

Stretch Sleeves

By Application

-

Food and Beverage Labels

-

Pharmaceutical Labels

-

Cosmetics and Personal Care Labels

-

Retail Product Labels

-

Industrial Labels

-

Logistics and E-commerce Labels

-

Other Applications

By End-User

-

Fast-Moving Consumer Goods (FMCG)

-

Retail

-

Packaging

-

Personal Care

-

Pharmaceutical

-

Industrial

-

Others

Geographical Breakdown

-

North America: U.S., Canada, and Mexico.

-

Europe: U.K., Germany, France, Italy, Spain, Sweden, Denmark, Finland, Netherlands, and rest of Europe.

-

Asia Pacific: China, India, Japan, South Korea, Taiwan, Indonesia, Vietnam, Australia, Philippines, Malaysia and rest of APAC.

-

Middle East & Africa (MEA): Saudi Arabia, UAE, Egypt, Israel, Turkey, Nigeria, South Africa, and rest of MEA.

-

Latin America: Brazil, Argentina, Chile, Colombia, and rest of LATAM

Conclusion & Recommendations

Our report equips stakeholders, industry participants, investors, and consultants with actionable intelligence to capitalize on label color printing’s transformative potential. By combining robust data-driven analysis with strategic frameworks, NMSC’s Label Color Printing Market Report serves as an indispensable resource for navigating the evolving landscape.

The label color printing market is shifting from volume-centred economics to value-driven solutions where digital printing, smart label integration and sustainability credentials determine winners. Corporate 2024 filings show incumbents investing in industrial inkjet, materials, and smart label capabilities, validating a medium-term growth path. Converters and investors should prioritize digital adoption, GS1/DPP readiness, and strategic M&A to scale smart and sustainable offerings.

Speak to Our Analyst

Speak to Our Analyst