Events Market by Event Type (Social Events, Entertainment Events, Cultural Events, Educational Events, & Others), by Service (Event Planning, Venue Management, Audio-Visual Services, Catering Services, Security Services, & others), by Event Format (Physical Events, Virtual Events, Hybrid Events), by Distribution Channel (Direct Booking, Online Platforms, & Others), and by End User (Corporations, Government Organizations, & Others ) – Global Opportunity Analysis and Industry Forecast, 2025–2030

Industry Outlook

The global Events Market size was valued at USD 1382.1 million in 2024 and is expected to reach USD 1462 million by 2025. Looking ahead, the industry is projected to expand significantly, reaching USD 1936.3 million by 2030, registering a CAGR of 5.78% from 2025 to 2030.

The events market is a dynamic and rapidly evolving sector, delivering immersive, experiential, and corporate engagement solutions across social, entertainment, cultural, educational, and corporate segments. With rising urbanization, digital connectivity, and increasing corporate and consumer demand for memorable experiences, the market has expanded across venues such as convention centers, stadiums, hotels, and virtual platforms. Leading players including AEG, CL Events, Cvent Holding Corp, Live Nation, Access Destination Services, BCD Group International BV, DRPG Group, ATPI Ltd., Entertaining Asia, Reed Exhibitions, Questex LLC, The Freeman Company, Penguins Limited, Versatile Event Management, and ALIVE dominate both event planning and management services worldwide. Event offerings range from large-scale concerts, exhibitions, and conferences to specialized corporate activations, with the industry increasingly leveraging digital technologies, hybrid formats, and data-driven engagement strategies to enhance attendee experience, operational efficiency, and ROI. Despite challenges such as economic uncertainties, regulatory constraints, and logistical complexities, the market’s growth prospects remain robust, driven by innovation, personalization, and the rising importance of brand and experiential marketing.

What are the key trends in the events industry?

How is Data and AI Changing Event Personalization and Operations?

Primary sources from leading public companies in the events and meeting technology sector highlight substantial investment in data platforms and analytics to drive content personalization and measure event outcomes. Large event operators reported double-digit revenue growth in their 2025 half-year results, driven by enhanced digital monetization and the strong resurgence of live events. AI-enabled solutions, including matchmaking, session recommendations, and on-site operations optimization, are reducing attendee churn and improving exhibitor conversion by transforming passive leads into qualified pipelines. Key actionable insights include prioritizing identity-centric data stacks, consented attendee profiling, and AI-driven lead scoring. Vendors are advised to adopt revenue-share models tied to conversion rather than lead volume, shifting pricing power toward platforms capable of delivering demonstrable, attributable outcomes.

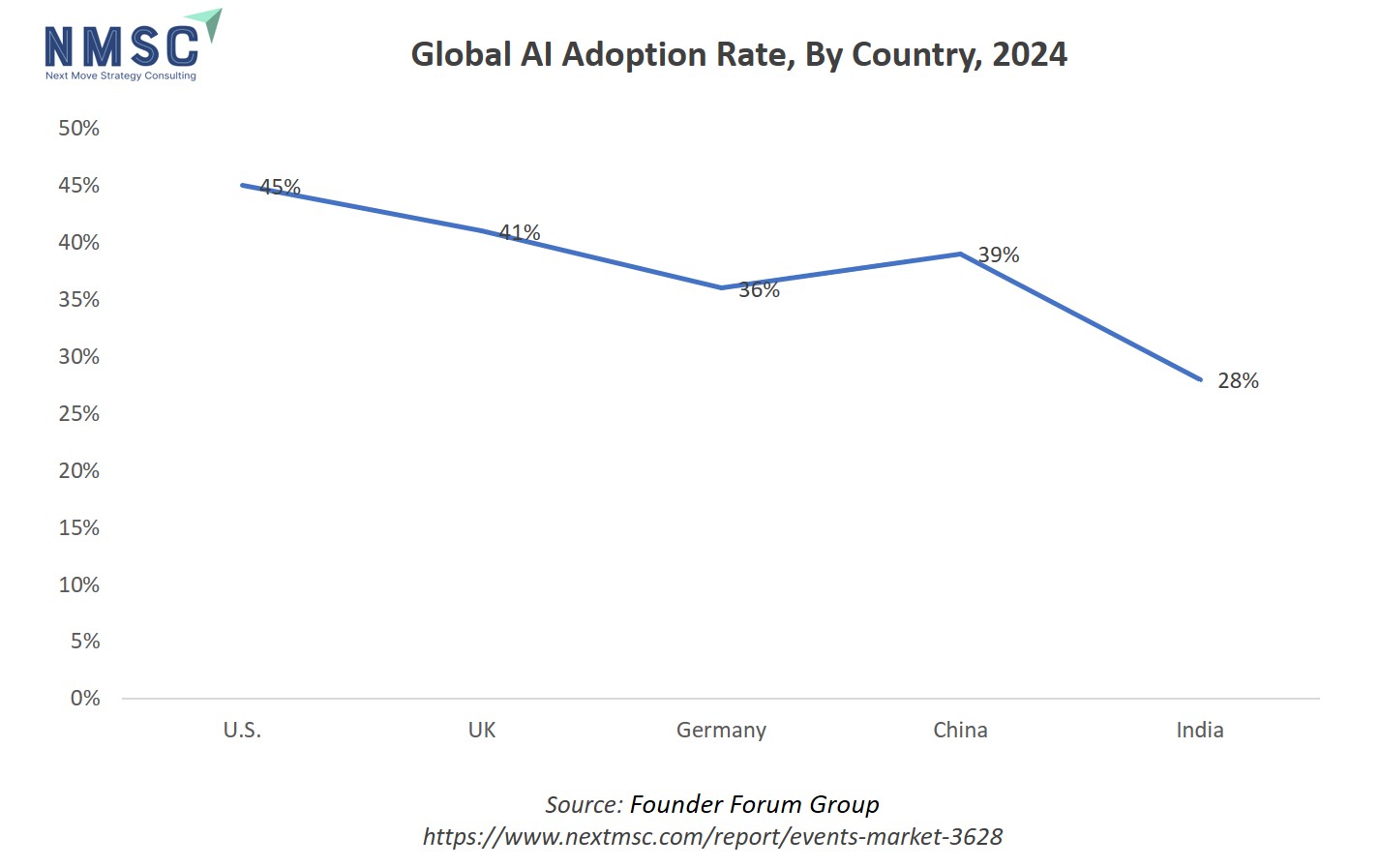

The chart presents the global AI adoption rate by country for 2024, showing the U.S. leading at 45%, followed by the UK at 41%, China at 39%, Germany at 36%, and India lagging behind at 28%. This data highlights notable regional differences, with Western countries demonstrating higher AI adoption rates compared to India, indicating advanced integration of artificial intelligence in their industries and economies

How is Hybrid Delivery Reshaping Attendee Reach and Sponsor ROI?

Several surveys and industry reports indicate that exhibition revenues and space uptake rose strongly in 2024 and are projected to grow further in 2025, driven by the expansion of hybrid formats that integrate physical presence with virtual content and networking. Hybrid events extend audience reach beyond venue capacity, support tiered sponsorship packages, enable year-round lead generation, and reduce marginal attendee costs. Actionable insights for organizers include formalizing hybrid ticketing strategies, deploying unified identity and analytics across physical and virtual touchpoints, and pricing sponsorships based on multi-channel reach rather than square metres alone to maximize ROI and retention. Integrating CRM systems and measurement dashboards transform episodic events into durable demand-generation funnels.

How is Sustainability Influencing Venue Selection and Buyer Behaviour?

UFI and national convention bureaux report growing buyer and sponsor sensitivity to sustainability performance, with exhibitions increasingly quantifying environmental impacts in economic studies. Organizers now routinely include sustainability metrics in RFPs, and many venues publish carbon reduction and waste management targets post-2024. Sustainability considerations are shaping bidding and supplier selection, as buyers favour venues and organizers demonstrating measurable emissions reductions and circular waste programs. Actionable insights for event operators include publishing annual sustainability scorecards, pursuing recognized venue certifications, and offering low-emission solutions, such as local sourcing, digital collateral, and verified carbon offset programs, to maintain high-value corporate contracts and public sector tenders. Strong sustainability performance is becoming a key differentiator in competitive RFP processes.

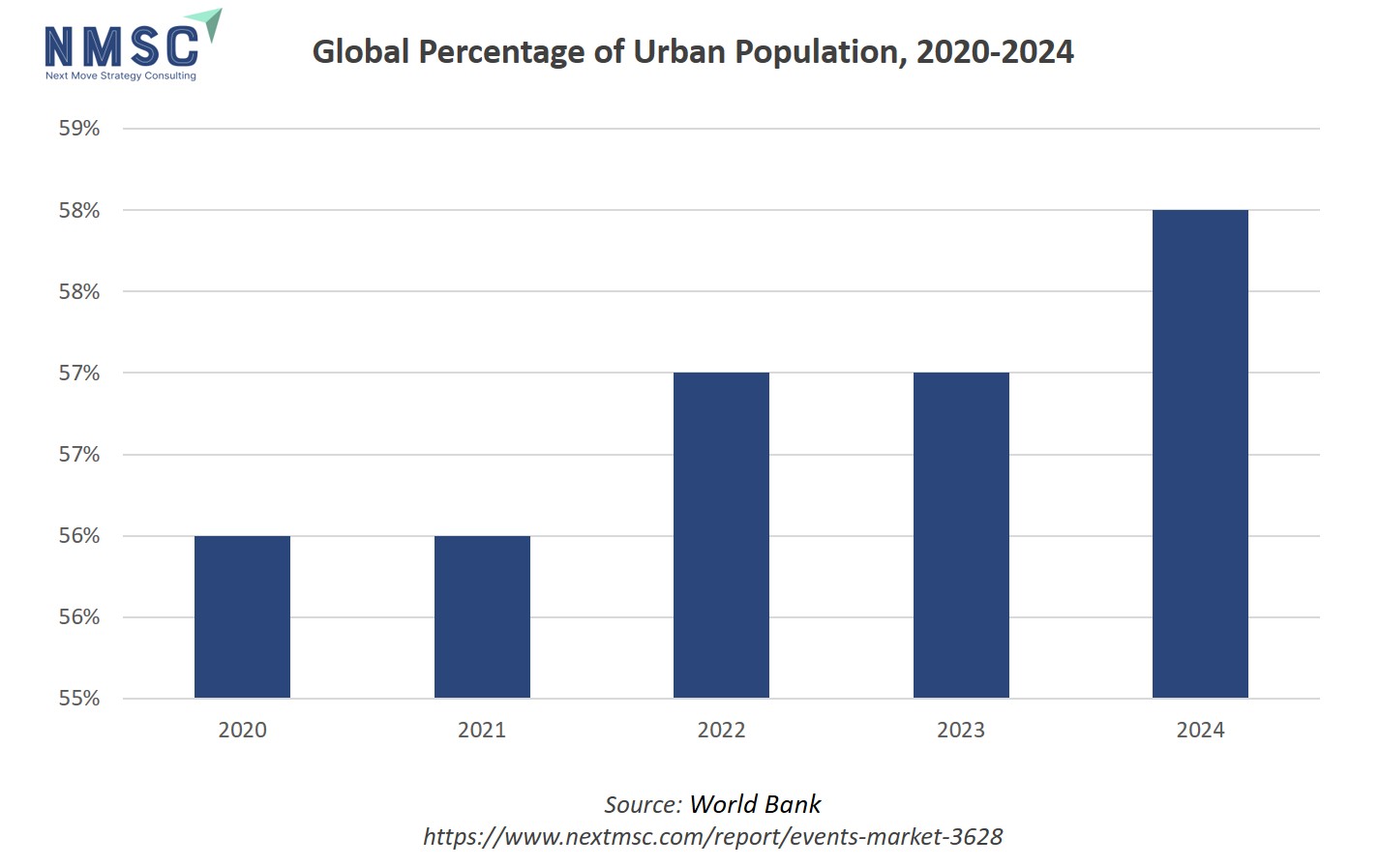

The chart indicates a rising global percentage of urban population from 56% in 2020 to 58% in 2024, underscoring the trend of increasing urbanization. As more people live in urban areas, demand for events, including entertainment, social gatherings, corporate seminars, and cultural activities, typically rises due to greater population density, better infrastructure, and higher disposable incomes. This demographic shift supports and accelerates the growth of the events market demand by creating a larger customer base and enabling a wider variety of event offerings in urban centers.

How is Rapid Urban Population Growth Influencing the Demand and Development of the Events Market?

The rapid growth of urban populations is a key driver of the events market growth, as increasing numbers of city dwellers create higher demand for cultural festivals, business conferences, and live entertainment. Expanding urban infrastructure, including improved transportation and communication networks, facilitates the hosting of large-scale events by enhancing accessibility and connectivity. Urbanization also encourages the development of specialized venues and facilities designed to accommodate diverse event formats, supporting sustained market growth. While this trend offers significant opportunities, it requires strategic planning to manage rising demand for event spaces, services, and logistical support, ensuring high-quality experiences for attendees.

What are the Key Market Drivers, Breakthroughs, and Investment Opportunities that Will Shape the Events Industry in the Next Decade?

The events industry’s post-pandemic resurgence is underpinned by the recovery of business travel, robust corporate marketing spends, and strategic investments by major platform players to monetise year-round digital engagement. Public sector and multilateral institutions continue to leverage events as forums for policy discussion and investment convening, with UFI and exhibitors reporting growth in both space and revenue across 2024–2025. These opportunities coexist with operational challenges, including rising venue and labour costs and the complexity of consistently measuring hybrid ROI. Companies that effectively capture attendee identity data and link event outcomes to sales pipelines are well-positioned to generate recurring revenue streams, enhance exhibitor and sponsor value, and achieve higher enterprise valuations.

Growth Drivers:

How is Corporate Marketing Spend Accelerating Events Demand?

Corporate marketing budgets are increasingly prioritizing live events and face-to-face interactions to boost client engagement, accelerate deal closures, and retain high-value accounts. According to 2025 Event Industry News, B2B exhibitions and sector-specific conferences have experienced rising demand throughout 2024–2025, highlighting the tangible impact of physical presence on conversion rates. It also underscores the exhibition industry’s robust global growth, with revenues projected to increase by approximately 18% year-on-year.

Organizers maximise this trend by aligning performance metrics with pipeline attribution, allowing clients to clearly quantify ROI. Furthermore, leveraging data-driven insights enables the customization of sponsorship packages, optimization of session schedules, and enhancement of overall attendee experiences. This approach not only strengthens exhibitor ROI but also fosters repeat participation and builds enduring relationships among organizers, sponsors, and attendees.

How is Technology Integration Enhancing Attendee Experience and Monetisation in the Events Market?

The integration of event technology platforms, analytics, CRM systems, and engagement tools has become a cornerstone for enhancing attendee experiences and driving monetization in the events industry. These platforms enable organizers to collect and analyse attendee data, providing insights that inform content delivery, personalize experiences, and optimize event strategies. Tools such as Cvent and Swapcard offer features including lead management, engagement scoring, and attendee feedback collection, facilitating real-time adjustments and post-event analysis. Additionally, cloud-based solutions streamline operations, integrate seamlessly with other business systems, and improve overall efficiency. Such technological advancements not only elevate attendee satisfaction but also create new revenue opportunities through data-driven sponsorships and tiered content offerings, making integrated tech stacks increasingly essential for competitive advantage.

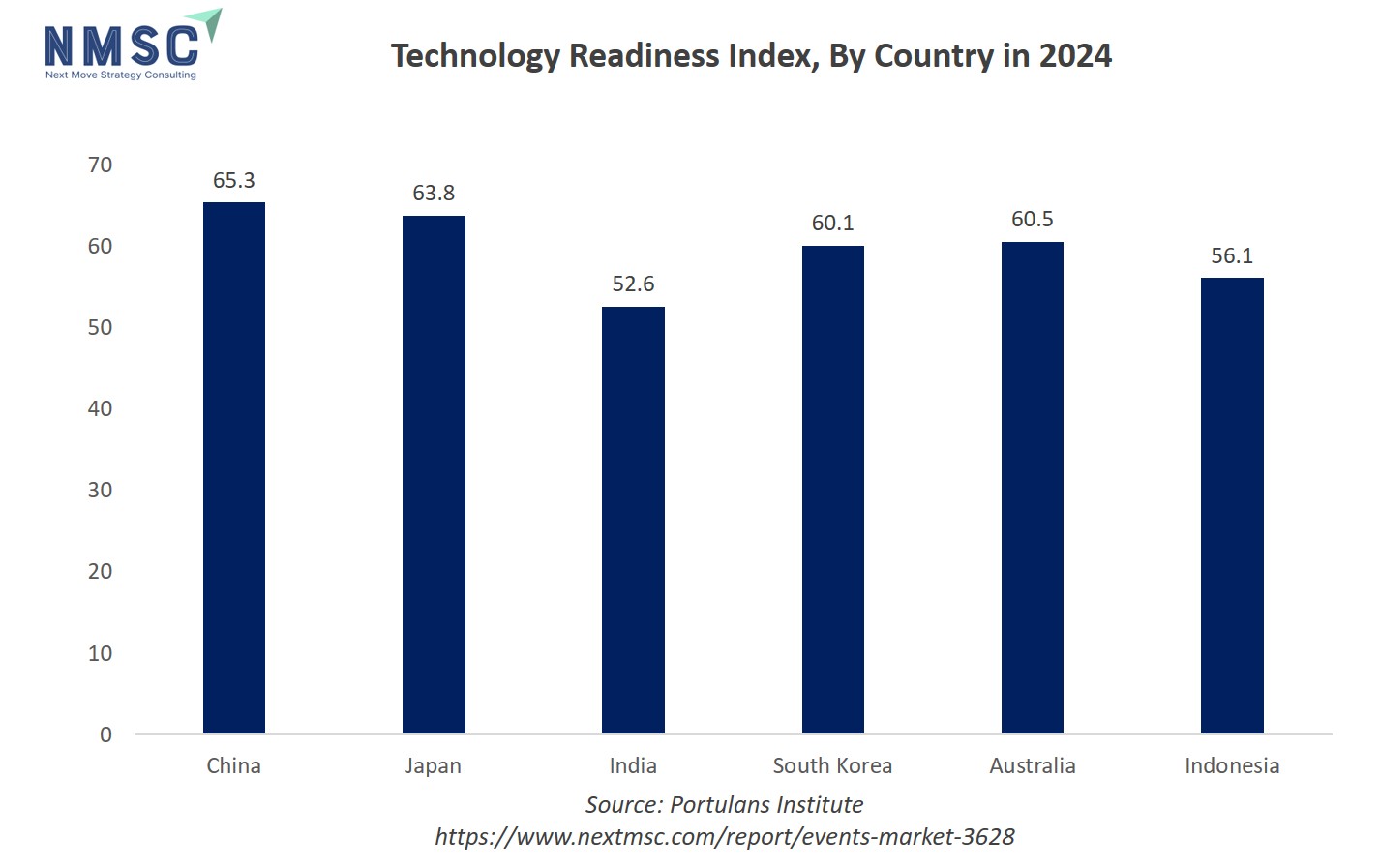

The chart shows the Technology Readiness Index by country for 2024, with China leading at 65.3, followed by Japan at 63.8, Australia at 60.5, South Korea at 60.1, Indonesia at 56.1, and India at 52.6. This indicates that China and Japan are the most prepared among these countries to implement advanced technologies, while India and Indonesia have lower readiness levels, potentially facing more challenges in rapid tech adoption

Growth Inhibitors:

How do Macro-Economic Pressures Constrain Event Budgets?

Macroeconomic factors such as rising inflation, elevated interest rates, and tighter corporate spending are directly constraining sponsorship allocations and travel budgets, particularly in mature markets. According to BLS.gov in 2025, these pressures increase operational costs, including venue hire, staffing, and logistics, compressing profit margins for organisers. Scenario planning and flexible pricing strategies are critical to navigating these challenges. Companies implement modular packages, early-bird discounts, or dynamic pricing to maintain attendance and sponsorship levels. Additionally, diversifying revenue through digital and hybrid offerings mitigates exposure to cyclical budget constraints, ensuring financial stability while preserving the quality and scale of events under shifting economic conditions.

What Emerging Investment Opportunities Exist in the Events Sector?

Investors are increasingly targeting integrated event technology platforms and venue modernisation projects that enhance operational efficiency and revenue per attendee. Platforms offering end-to-end identity management, attendee tracking, and measurable conversion metrics enable organisers to monetise data effectively. Similarly, venue upgrades focused on sustainability retrofits, flexible modular spaces, and hybrid event readiness provide long-term competitive advantages. Early-stage investments in subscription-based content, hybrid platforms, and modular venue designs offer high upside as organisers seek to optimise yields per square metre and attendee engagement. Investors should prioritise assets with clear revenue attribution and scalability to capitalise on evolving trends in hybrid and technology-driven event delivery.

How events market segmented in this report, and what are the key insights from the segmentation analysis?

By Event Type Insights

Is Corporate Events the Dominant Event Type in 2025?

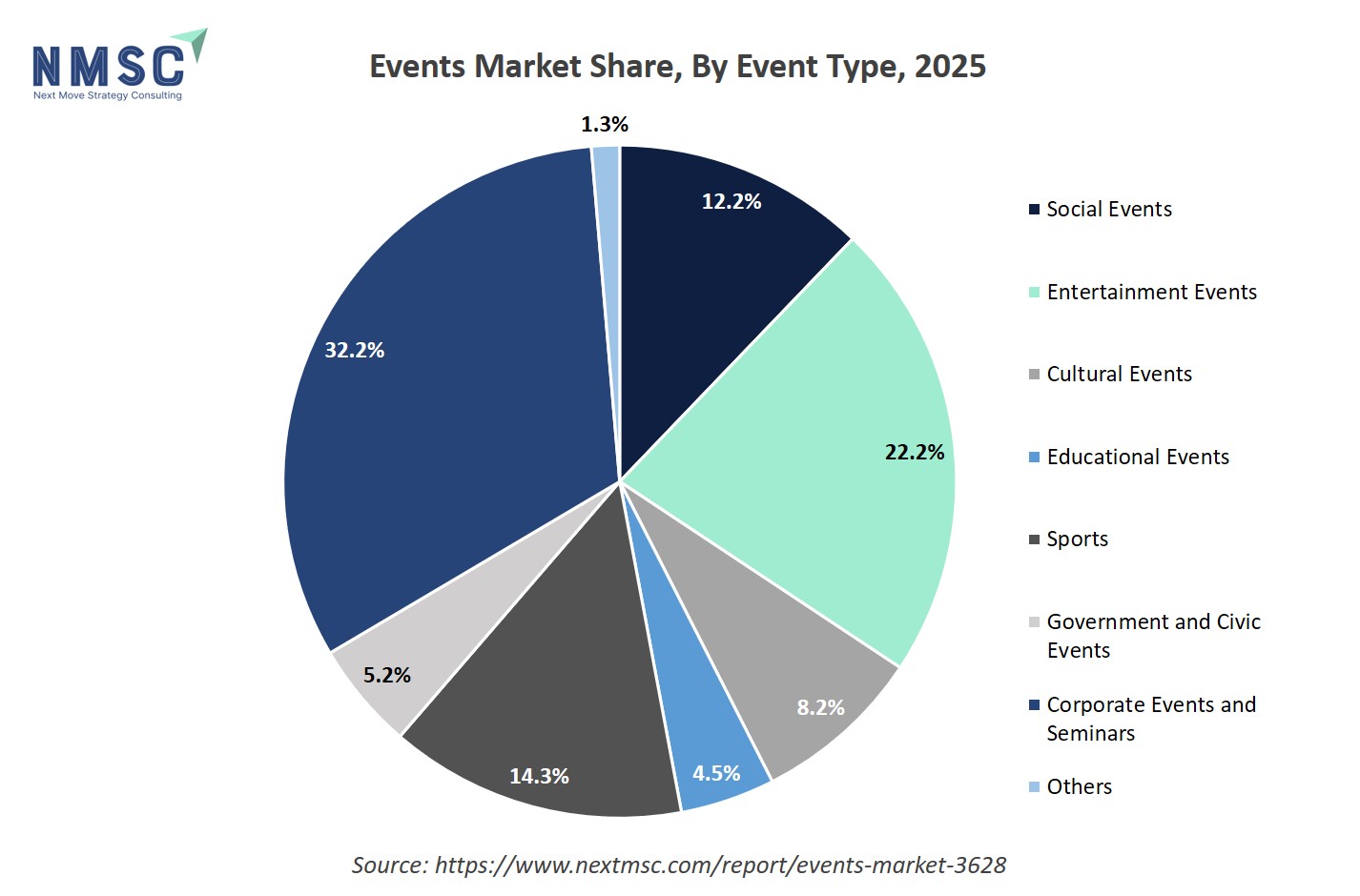

Based on event type, the market is segmented into social events, entertainment events, cultural events, educational events, sports, government and civic events, corporate events and seminars, and others.

Corporate events, including conferences, trade shows, and seminars, remain the dominant commercial segment by spend and exhibitor investment. UFI data shows B2B exhibitions capture a high share of professional visitors and exhibitor revenues globally, driven by procurement cycles and product launches. Organizers focusing on verticalized, industry-specific content maximize sponsor value and encourage repeat attendance. Product owners should deepen sector expertise and buyer intelligence to improve yield.

The chart displays the events market segmentation by event type for 2025, revealing that corporate events and seminars comprise the largest share at 32.2%, followed by entertainment events at 22.2%, sports at 14.3%, and social events at 12.2%. Other segments such as cultural events (8.2%), government and civic events (5.2%), educational events (4.5%), and a small "others" category (1.3%) contribute smaller shares. This distribution highlights the predominance of corporate, entertainment, and sports events as the central drivers of growth and activity in the global market.

By Service Insights

Is Event Planning the Largest Service Subsegment in 2025?

Based on service, the market is segmented into event planning, venue management, audio-visual services, catering services, security services, ticketing and registration, and marketing and promotion.

Event planning and full-service production continue to account for the largest share of service spend, as organizers outsource logistics, attendee experience, and content curation. The professionalisation of planning, including integrated digital registration, security, and compliance, leads clients to favour bundled service providers. Firms should modularize offerings to allow clients to scale quality services by event complexity while controlling costs. Primary industry reports indicate strong growth in full-service bookings in 2024–2025.

By Event Format Insights

Are Hybrid Events the Prevailing Event Format in 2025?

Based on event format, the market is segmented into physical events, virtual events, and hybrid events.

Hybrid events combining physical and virtual components are becoming the default format for large B2B and association events. UFI barometer data indicates significant adoption, with organizers reporting improved audience reach and sponsor engagement. Actionable insight: price hybrid packages to reflect extended exposure and invest in cross-channel analytics to measure engagement across both formats.

By Distribution Channel Insights

Are Online Platforms the Fastest Growing Distribution Channel in 2025?

Based on distribution channel, the market is segmented into direct booking, online platforms, event management companies, and third-party vendors.

Online platforms, including marketplaces, direct bookings, and virtual platforms, are growing faster than traditional channels, driven by searchability and lower friction. Organizers should invest in SEO, platform partnerships, and developer APIs to integrate registration, CRM, and lead export workflows. Investor reports show increasing digital product revenues in 2025.

By End User Insights

Which End User Leads Spend, Corporations or Government?

Based on end user, the market is segmented into corporations, government organizations, educational institutions, private individuals, and non-governmental organizations (NGOs).

Corporations remain the largest end user of trade shows and conferences by commercial spend. Government and civic events are important for public procurement and tourism promotion, but corporate budgets drive most sponsorship and exhibitor revenue. Strategies that tie event outcomes to measurable business results are most effective in capturing larger shares of corporate spend.

Regional Outlook

The events market is geographically studied across North America, Europe, Asia Pacific, Middle East & Africa, and Latin America and each region is further studied across countries.

Events Market in North America

North America continues to lead the global events market share, driven by substantial corporate marketing spend, mature venue infrastructure, and advanced technology adoption. Both live and hybrid formats are expanding, with organizers increasingly leveraging analytics to demonstrate measurable ROI to sponsors. Corporate and trade events dominate by spend, supported by robust procurement cycles and product launches. Public sector events also contribute to market activity. Investment in event technology platforms and integrated analytics solutions is rising, enabling identity-driven engagement and recurring revenue streams. Organizers are prioritizing sustainability and compliance standards, as well as digital transformation, to meet evolving attendee and sponsor expectations.

Events Market in the United States

The U.S. events market remains robust, fueled by strong corporate budgets and growing demand for hybrid formats. BLS projections indicate meeting planner employment will grow 5% from 2024–2034, reflecting sustained activity. Large-scale conferences, trade shows, and corporate seminars dominate commercial spend, while government and civic events support policy and tourism objectives. Organizers are focusing on advanced analytics, cross-channel engagement measurement, and digital integration to optimize sponsor ROI. Hybrid events and AI-driven attendee personalization are key trends. Sustainability initiatives and venue modernization continue to influence procurement decisions, ensuring that the U.S. remains a high-value market for both domestic and international event operators.

Events Market in Canada

Canada’s events and exhibitions sector is recovering steadily, supported by regional convention bureaus promoting business events to boost trade and tourism. Corporate and B2B events drive the majority of commercial spend, with hybrid and in-person formats expanding. Sustainability is increasingly central, with venues and organizers adopting green practices, such as carbon reduction targets and digital collateral. Organizers are leveraging local talent and infrastructure to enhance attendee experience while managing costs. Domestic demand, particularly in healthcare, technology, and manufacturing sectors, is growing. Investments in venue modernization, analytics-driven engagement, and hybrid platforms are enabling organizers to improve sponsor ROI and cultivate repeat participation.

Events Market in Europe

Europe’s events industry benefits from a mature and diversified calendar, attracting high visitor volumes across exhibitions, trade shows, and corporate conferences. Germany, the U.K., and France are leading hubs for professional events, while Southern European markets such as Italy, Spain, and France host both cultural and commercial shows. Hybrid adoption is accelerating, allowing organizers to extend reach and sponsor value. Sustainability and venue modernization are central to RFP success, with carbon and waste reduction initiatives influencing supplier selection. Organizers are increasingly leveraging integrated analytics, AI-driven personalization, and multi-channel engagement to optimize outcomes and drive repeat attendance across the region.

Events Market in the United Kingdom

The U.K. events market remains a key European hub, with London and major regional centers hosting significant corporate, trade, and cultural events. Hybrid formats and experiential elements are increasingly integrated to maximize engagement and extend reach. Corporate events, especially in finance, technology, and healthcare, dominate by spend, supported by sophisticated analytics and audience measurement capabilities. Sustainability is a critical procurement factor, with venues and organizers adopting certifications and green practices. Organizers are focusing on data-driven sponsorship offerings, pipeline attribution, and attendee personalization. Investments in digital platforms and multi-channel engagement are enhancing ROI, reinforcing the U.K.’s position as a strategic market for global organizers.

Events Market in Germany

Germany hosts a strong exhibition and corporate event ecosystem, led by cities such as Frankfurt, Berlin, and Munich. Trade shows and B2B conferences dominate spend, supported by well-developed venue infrastructure and high international participation. Hybrid events are increasingly standard, enabling organizers to expand audience reach and improve sponsor outcomes. Sustainability initiatives, including energy efficiency and certification programs, are central to venue selection and RFP success. Organizers are leveraging data analytics, CRM integration, and digital engagement tools to convert attendees into long-term pipelines. Sector-specific verticals such as automotive, technology, and healthcare continue to drive demand and investment in Germany’s events market.

Events Market in France

France maintains a robust events market, with Paris, Lyon, and Marseille hosting both corporate and cultural exhibitions. B2B trade shows and conferences are dominant, while hybrid formats are growing to extend reach beyond physical venues. Sustainability and venue modernization influence procurement decisions, with organizers reporting increased focus on carbon reduction and digital engagement. Corporate marketing spend continues to drive demand, particularly in technology, healthcare, and consumer goods sectors. Organizers are deploying analytics and AI tools to optimize session recommendations, sponsorship packages, and attendee experience. The integration of digital platforms and hybrid strategies is strengthening exhibitor ROI and repeat participation.

Events Market in Spain

Spain’s events market benefits from a combination of cultural, trade, and corporate events, led by Barcelona, Madrid, and Valencia. Hybrid adoption is rising, enabling extended reach and year-round engagement. Corporate events, particularly in tourism, technology, and manufacturing, drive commercial spend, supported by sponsorship and exhibitor investment. Sustainability practices, including venue certification and low-carbon initiatives, increasingly influence procurement. Organizers are focusing on data-driven attendee insights, integrated CRM, and AI-powered personalization to enhance engagement and conversion. Investments in modular venues, hybrid technology, and analytics platforms are helping Spanish organizers improve ROI, strengthen repeat participation, and attract international audiences .

Events Market in Italy

Italy hosts a diverse range of exhibitions, trade shows, and corporate events across Milan, Rome, and Florence. Hybrid formats are expanding, with organizers offering digital access to complement in-person participation. Corporate and sector-specific events, particularly in fashion, manufacturing, and technology, drive revenue. Sustainability and venue modernization are key differentiators for RFP success, as clients increasingly demand measurable emissions reductions. Organizers are leveraging analytics, identity-based data, and AI-driven attendee engagement to optimize sponsor ROI and foster repeat attendance. Investments in modular spaces and hybrid platforms support flexible event delivery, ensuring Italy remains a competitive market for both domestic and international organizers.

Events Market in the Nordics

Nordic countries, including Sweden, Denmark, Norway, and Finland, emphasize sustainability and digital innovation in events. Hybrid and experiential formats dominate, with corporate conferences and trade shows accounting for most commercial spend. Venue modernization and green certifications influence procurement decisions, while AI-driven personalization enhances engagement and conversion. Organizers are leveraging analytics and integrated platforms to optimize attendee experiences, sponsorship ROI, and pipeline attribution. Strong government support for business events and regional conferences supports market growth. Focus on low-emission venues, modular event design, and hybrid access enables organizers to balance attendee experience with cost efficiency across Nordic markets.

Events Market in the Asia-Pacific

Asia-Pacific is the fastest-growing global events region, driven by rapid urbanization, corporate expansion, and increased cross-border trade shows. China, India, and Australia lead in capacity growth, with hybrid and digital formats expanding reach and sponsor value. Corporate and B2B events dominate spend, particularly in technology, manufacturing, and healthcare sectors. Organizers are investing in regional partnerships, digital translation tools, and AI-driven attendee engagement to optimize conversion. Sustainability, modular venues, and modernized infrastructure are key drivers for procurement. Data-driven sponsorship models, pipeline attribution, and multi-channel analytics are enabling organizers to strengthen ROI and encourage repeat participation in APAC markets.

Events Market in China

China’s events sector is expanding rapidly, led by Beijing, Shanghai, and Shenzhen. Trade shows and B2B exhibitions dominate spend, supported by government-backed infrastructure projects and corporate marketing budgets. Hybrid and digital formats are increasingly adopted to extend reach and deliver measurable sponsor outcomes. Organizers leverage analytics, AI personalization, and multi-channel engagement to optimize attendee experience and conversion. Sustainability and energy efficiency standards influence venue selection, while modular, flexible spaces support diverse event requirements. Rapid urbanization, strong corporate demand, and technology integration position China as the leading APAC market for exhibitions, conferences, and hybrid events.

Events Market in Japan

Japan’s events market, anchored in Tokyo, Osaka, and Nagoya, combines strong corporate demand with cultural exhibitions. Trade shows, sector-specific conferences, and corporate events dominate spend, while hybrid formats enhance reach and engagement. Organizers are increasingly leveraging analytics, CRM, and AI-powered personalization to optimize sponsorship value and attendee experience. Sustainability and venue modernization are central to procurement decisions, including energy efficiency, waste reduction, and digital integration. Corporate marketing spend in technology, manufacturing, and healthcare sectors supports continued growth. Digital platforms, hybrid access, and multi-channel engagement tools are enabling organizers to convert attendees into long-term pipelines.

Events Market in India

India’s events market is experiencing rapid growth, driven by urban infrastructure expansion, corporate investment, and increasing adoption of hybrid formats. Cities such as Mumbai, Delhi, and Bengaluru host major trade shows, B2B exhibitions, and corporate conferences. Organizers are investing in digital platforms, AI-driven attendee engagement, and analytics to optimize sponsor ROI and event outcomes. Sustainability and modular venue solutions are gaining importance for procurement decisions. Corporate marketing budgets and government-backed initiatives in trade and tourism are fueling demand. Focus on hybrid accessibility, data-driven sponsorship models, and identity-based insights allows organizers to capture higher revenue and enhance repeat participation in India.

Events Market in South Korea

South Korea’s events market, centered in Seoul and Busan, is characterized by technology-driven exhibitions, corporate conferences, and trade shows. Hybrid formats dominate, enabling extended reach and enhanced sponsor engagement. Organizers are leveraging AI, analytics, and CRM integration to personalize attendee experiences, optimize pipeline attribution, and improve ROI. Sustainability initiatives and venue modernization influence procurement decisions, with green certifications increasingly required. Corporate spend, particularly in technology, manufacturing, and automotive sectors, drives growth. Investments in modular venues, digital translation, and hybrid platforms support flexibility, cost efficiency, and measurable outcomes across South Korea’s dynamic events ecosystem. .

Events Market in Taiwan

Taiwan’s events sector is expanding across Taipei and Kaohsiung, with trade shows, corporate conferences, and technology exhibitions leading commercial activity. Hybrid formats enable organizers to reach wider audiences and provide measurable sponsor exposure. Corporate marketing spend is focused on technology, electronics, and manufacturing sectors. Organizers are increasingly adopting AI-driven personalization, analytics dashboards, and integrated CRM solutions to optimize attendee engagement, sponsorship ROI, and pipeline attribution. Sustainability practices, modular venue design, and digital engagement tools are influencing venue selection and event planning. Taiwan’s market is driven by strong regional demand, technology adoption, and hybrid integration to enhance long-term event impact.

Events Market in Indonesia

Indonesia’s events sector is centered in Jakarta, Bali, and Surabaya, combining corporate, trade, and cultural events. Hybrid and digital adoption is growing, driven by increasing corporate marketing spend and tourism initiatives. Organizers are integrating AI-powered analytics, CRM, and attendee personalization to improve engagement and sponsor conversion. Sustainability practices, modular venue design, and energy-efficient infrastructure are influencing procurement decisions. Government-backed investment summits and PPPs support event growth, particularly in trade and FDI promotion. Corporate B2B events remain the largest revenue driver, while hybrid and experiential strategies enable organizers to extend reach, optimize ROI, and cultivate repeat attendance.

Events Market in Australia

Australia’s events market spans Sydney, Melbourne, Brisbane, and Perth, with corporate conferences, trade shows, and exhibitions dominating commercial spend. Hybrid adoption is increasing, allowing organizers to expand reach while maintaining engagement. Corporate and government events drive demand, supported by strong infrastructure and professional event services. Sustainability is a central procurement criterion, with low-emission venues, carbon reduction targets, and modular design favoured. Organizers are leveraging analytics, AI-driven personalization, and integrated platforms to improve pipeline attribution and sponsor ROI. Regional planning considers population growth, urban development, and venue capacity to ensure events meet local and national demand.

Events Market in Latin America

Latin America’s events market is expanding across Brazil, Mexico, Argentina, and Chile, driven by trade shows, cultural exhibitions, and investment summits. Corporate spend dominates, though public sector and PPP-backed events support economic development and FDI promotion. Hybrid and digital adoption is rising to extend audience reach and sponsor exposure. Organizers are investing in analytics, CRM integration, and AI personalization to optimize attendee engagement and conversion. Sustainability practices, modular venue design, and regional partnerships are increasingly important. Growth opportunities exist in trade, tourism, and infrastructure sectors, with hybrid and technology-enabled models driving efficiency, ROI, and repeat participation across the region.

Events Market in the Middle East & Africa

The Middle East, led by the UAE and Saudi Arabia, is investing heavily in convention infrastructure to host mega events, exhibitions, and trade shows. Africa shows selective growth, concentrated in major capitals and business hubs. Hybrid formats, AI-driven personalization, and analytics platforms are increasingly deployed to optimize engagement and sponsorship outcomes. Sustainability, venue modernization, and security requirements are critical for procurement and operations. Corporate and public sector events drive revenue, particularly in energy, technology, and finance sectors. Organizers are leveraging modular spaces, digital integration, and cross-channel analytics to enhance ROI, repeat participation, and long-term growth across the region.

Competitive Landscape

Which Companies Dominate the Events Industry and How Do They Compete?

The global events market is characterized by a moderately concentrated structure, dominated by a mix of multinational leaders alongside numerous regional and local firms. Major players such as AEG, CL Events, Cvent Holding Corp, Live Nation, Access Destination Services, BCD Group International BV, DRPG Group, ATPI Ltd., Entertaining Asia, Reed Exhibitions, Questex LLC, The Freeman Company, Penguins Limited, Versatile Event Management, and ALIVE collectively command a significant share of global event planning, management, and experiential services. These companies maintain extensive service portfolios, emphasizing the importance of scale, reputation, and long-term client relationships in sustaining competitive advantage. Competition occurs across both geographic and niche dimensions, with global giants frequently vying for large-scale corporate, entertainment, and exhibition contracts, while regional specialists cater to localized markets and niche experiential segments. The industry’s moderately oligopolistic nature means market share gains are typically achieved through innovation in event formats, technology-driven engagement, hybrid and digital solutions, and the ability to execute large, complex programs reliably. Ultimately, scale, creativity, and a robust operational network remain decisive differentiators, as clients increasingly prioritize vendors capable of delivering seamless, consistent experiences across multiple locations and formats.

Market Dominated by Events Giants and Specialists

The global events market continues to be dominated by large exhibition organisers such as Informa and Reed Exhibitions (RX), whose scale and international footprint position them as the primary drivers of B2B shows. Complementing these organisers, specialist technology vendors, including Cvent, Bizzabo, and Eventbrite, provide critical platforms for registration, matchmaking, engagement analytics, and virtual extensions. Their combined influence shapes commercial terms for venues and sponsors while defining industry standards. Investors should monitor partnerships between organisers and tech providers that integrate content, data monetisation, and year-round community engagement, as these alliances increasingly deliver measurable ROI and provide sustainable competitive advantage in both live and hybrid event segments.

Innovation and Adaptability Drive Market Success

Organisers and technology providers that embed AI-driven matchmaking, hybrid streaming solutions, and advanced analytics demonstrate higher resilience and revenue growth. Informa’s 2025 half-year results highlight how digital and live synergies contributed to double-digit growth, showcasing the financial benefits of integrated strategies. Companies that productise digital communities, extend sponsorship visibility beyond single-event windows, and offer personalised attendee journeys capture recurring revenue while strengthening brand loyalty. For event executives, the actionable takeaway is to leverage data-driven insights, invest in digital extensions of physical events, and continuously innovate event formats to secure both operational efficiency and monetisation of multi-channel engagement.

Market Players to Opt for Merger & Acquisition Strategies to Expand Their Presence

Private equity firms and strategic buyers are actively pursuing consolidation in the events space, targeting portfolios of vertical-specific exhibitions and hybrid platforms. Clarion and Hyve reported multiple M&A transactions across 2024–2025, highlighting a trend toward scaling operations, increasing global footprint, and leveraging cross-market synergies. Consolidation enables organisers to optimise scale economies, aggregate audience and sponsor data, and replicate successful vertical brands across geographies. Analysts expect further roll-ups and strategic carve-outs in 2025–2026 as competition intensifies, making M&A a critical lever for growth. Investors and organisers should prioritise opportunities where operational integration, data monetisation, and vertical expertise are combined to maximise long-term profitability.

List of Key Events Companies

-

CL Events

-

Cvent Holding Corp

-

Access Destination Services

-

BCD Group International BV

-

DRPG Group

-

ATPI Ltd.

-

Entertaining Asia

-

Reed Exhibitions

-

Questex LLC

-

The Freeman Company

-

Penguins Limited

-

Versatile Event Management

-

ALIVE

What Are The Latest Key Industry Developments?

-

August 2025- AEG renewed and expanded its decades-long alliance with American Express in August 2025, covering 40+ properties across four continents in venues, touring, festivals, and ticketing.

-

April 2025- Live Nation acquired Hayashi International Promotions (HIP), strengthening its presence in Japan’s concert promotion market by joining forces with a leading domestic promoter.

-

June 2025 – BCD Travel expanded its collaboration with Conferma to enhance virtual payment automation solutions in the meetings and travel event space.

-

January, 2025 –DRPG Group accelerated its North American expansion with acquisitions of The Special Event Company and UK agency OWB, expanding creative event production capabilities.

-

September, 2025 – Direct Travel finalized its acquisition of ATPI, forming a USD 6 billion global travel and event management powerhouse, while ATPI retains its brand identity.

What Are The Key Factors Influencing Investment Analysis & Opportunities In The Events Market?

Investors should focus on assets demonstrating recurring revenue, robust data capture, and measurable sponsor attribution. Funding trends in 2024–2025 favour platform plays, SaaS solutions for registration, matchmaking, and analytics, venue modernization with sustainability retrofits, and roll-up strategies targeting niche vertical events. Valuation multiples are increasingly linked to revenue visibility and recurring ARR from digital products, with organizers converting episodic revenues into subscription models commanding premium pricing. Key investment hotspots include Asia-Pacific for rapid space growth, the U.S. for scale and strong sponsor budgets, and the Gulf region for mega events and infrastructure investment. Diligence should prioritize identity and data assets, long-term sponsor contracts, and verified sustainability credentials.

Key Benefits for Stakeholders:

Next Move Strategy Consulting (NMSC) presents a comprehensive analysis of the events market trends, covering historical trends from 2020 through 2024 and offering detailed forecasts through 2030. Our study examines the market at regional and country levels, providing quantitative projections and insights into key growth drivers, challenges, and investment opportunities across all major events segments.

Investors gain exposure to high-ROI segments, including venue modernization, platform SaaS solutions, hybrid and digital event subscriptions, and niche vertical roll-ups, which provide recurring revenue streams and measurable growth potential. Policymakers benefit from verified economic impact data, supporting tourism, infrastructure, and urban development initiatives, while enabling informed allocation of public funds. Customers, sponsors, and exhibitors enjoy improved measurement and outcomes as organizers increasingly adopt data-driven attribution, AI-enabled analytics, and sustainability reporting, providing clarity on engagement, lead conversion, and carbon impact. A robust and integrated data stack reduces operational and financial risk, enhances pricing transparency, supports public-private investment in venues and city-level strategies, and strengthens long-term stakeholder confidence. Additionally, these capabilities enable organizers to optimize sponsorship ROI, scale events across geographies, and create year-round engagement pipelines, turning episodic events into durable, high-value business ecosystems.

Report Scope:

|

Parameters |

Details |

|

Market Size in 2025 |

USD 1462 million |

|

Revenue Forecast in 2030 |

USD 1936.3 million |

|

Growth Rate |

CAGR of 5.78% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Million (USD) |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Countries Covered |

33 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent to up to 80 analyst-working hours) after purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

|

Approach |

In-depth primary and secondary research; proprietary databases; rigorous quality control and validation measures. |

|

Analytical Tools |

Porter's Five Forces, SWOT, value chain, and Harvey ball analysis to assess competitive intensity, stakeholder roles, and relative impact of key factors. |

Key Market Segments

By Event Type

-

Social Events

-

Entertainment Events

-

Cultural Events

-

Educational Events

-

Sports

-

Government and Civic Events

-

Corporate Events and Seminars

-

Others

By Service

-

Event Planning

-

Venue Management

-

Audio-Visual Services

-

Catering Services

-

Security Services

-

Ticketing and Registration

-

Marketing and Promotion

By Event Format

-

Physical Events

-

Virtual Events

-

Hybrid Events

By Distribution Channel

-

Direct Booking

-

Online Platforms

-

Event Management Companies

-

Third-Party Vendors

By End User

-

Corporations

-

Government Organizations

-

Educational Institutions

-

Private Individuals

-

Non-Governmental Organizations (NGOs)

Geographical Breakdown

-

North America: U.S., Canada, and Mexico.

-

Europe: U.K., Germany, France, Italy, Spain, Sweden, Denmark, Finland, Netherlands, and rest of Europe.

-

Asia Pacific: China, India, Japan, South Korea, Taiwan, Indonesia, Vietnam, Australia, Philippines, Malaysia and rest of APAC.

-

Middle East & Africa (MEA): Saudi Arabia, UAE, Egypt, Israel, Turkey, Nigeria, South Africa, and rest of MEA.

-

Latin America: Brazil, Argentina, Chile, Colombia, and rest of LATAM

Conclusion & Recommendations

Our report equips stakeholders, industry participants, investors, and consultants with actionable intelligence to capitalize on the market’s transformative potential. By combining robust data-driven analysis with strategic frameworks, NMSC’s Events Market Report serves as an indispensable resource for navigating the evolving landscape.

The events market is in a recovery and structural growth phase, fuelled by rising corporate spend, hybrid productization, and platform monetization. Data from UFI and public company results in 2024–2025 show organizers capturing higher yields while investing in data-driven insights, sustainability, and flexible venue formats. Execu

tives should prioritize measurable sponsor outcomes, AI-enabled analytics, and subscription-based digital products; investors should target platform SaaS, hybrid community subscriptions, and venue modernization projects with recurring revenue potential, policymakers leverage verified economic impact studies to justify public investment in venues and city-level strategies, supporting measurable returns, sustainable infrastructure, and long-term ecosystem growth.

Speak to Our Analyst

Speak to Our Analyst