South Korea Elevator Safety Equipment Market by Offering (Hardware, Software & Platforms, Services), by Procurement Type (New Installations, SaaS Subscriptions & Recurring Monitoring Contracts), by Distribution Channel (OEM, System Integrator/Specialist Installer, Distributor & Wholesaler, Direct to FM/Building Owner, Managed Service Provider), by End-Use Vertical (Residential High-Rises, Healthcare Facilities, Industrial Plants, Transportation Hubs) – Global Analysis & Forecast, 2025–2030

Industry Outlook

The South Korea Elevator Safety Equipment Market was valued at USD 155 million in 2024 and is expected to reach USD 169.1 million by 2025. Looking ahead, the industry is projected to expand significantly, reaching USD 261.4 million by 2030, registering a CAGR of 9.1% from 2025 to 2030.

The market is experiencing robust growth driven by rapid urbanization, strict safety regulations, and increasing adoption of smart and IoT-enabled elevators. With an urban population of over 42 million concentrated in metropolitan areas, demand for high-rise residential, commercial, and healthcare buildings continues to rise, intensifying reliance on elevators and advanced safety systems.

Key market drivers include government-mandated safety standards, modernization and retrofit projects for aging infrastructure, and integration with smart city and green building initiatives. AI-powered predictive maintenance, IoT monitoring, and energy-efficient solutions are shaping innovation, while high installation costs remain a challenge. Overall, the market is poised for sustained growth, technological advancement, and investment opportunities across multiple verticals.

Advanced technologies, including emergency brakes, overload sensors, seismic detectors, and real-time monitoring platforms, are becoming standard in new installations and retrofits. OEMs, system integrators, and manufacturers are increasingly focusing on offering end-to-end solutions, combining hardware reliability with smart software platforms to enhance operational efficiency and passenger safety.

Growing demand from healthcare facilities, commercial offices, and high-rise residential towers, coupled with regulatory compliance and smart-city initiatives, ensures long-term adoption of modern elevator safety solutions. This convergence of technology, regulation, and urban development positions South Korea as a dynamic and lucrative market for elevator safety equipment manufacturers.

What are the key trends in the South Korea Elevator Safety Equipment Industry?

Are Smart and IoT-Enabled Elevators Driving Growth in South Korea Elevator Safety Equipment Market?

Yes, South Korea’s elevator safety equipment market is witnessing strong momentum from the integration of smart and IoT-enabled systems. With the country’s advanced digital infrastructure and urban density, demand for intelligent elevators equipped with real-time monitoring, predictive maintenance, and automatic safety alerts is rising rapidly.

IoT sensors detect abnormalities such as cable tension issues or brake wear before they lead to accidents, thereby reducing risks and downtime. For manufacturers and operators, these technologies also support cost-efficient maintenance models, enhancing both safety and reliability.

Is Government Regulation Accelerating Safety Equipment Innovation in South Korea?

Yes, government regulations and strict building safety codes are major drivers in shaping South Korea elevator safety equipment market trends. Authorities mandate rigorous safety standards in high-rise apartments, office complexes, and commercial spaces, requiring elevators to be equipped with advanced emergency communication systems, seismic sensors, and fire-resistant features.

Recent regulatory updates emphasize preventive safety measures, pushing manufacturers to innovate and adopt globally recognized safety certifications. This compliance-driven innovation not only boosts safety but also strengthens consumer trust in technologically advanced elevator systems.

Will AI and Data Analytics Redefine South Korea Elevator Safety Equipment Market?

Yes, AI-powered analytics are emerging as a transformative force in South Korea’s elevator safety landscape. By leveraging operational data, historical incident records, and building usage patterns, AI systems predict potential failures and optimize maintenance schedules. This enhances both passenger safety and operational efficiency, reducing costly breakdowns.

South Korea’s growing adoption of AI in smart-city projects and high-tech buildings makes elevators an ideal use case for predictive safety solutions. Over the next decade, AI integration is expected to be a defining trend, creating safer, more efficient, and future-ready elevator systems in the country.

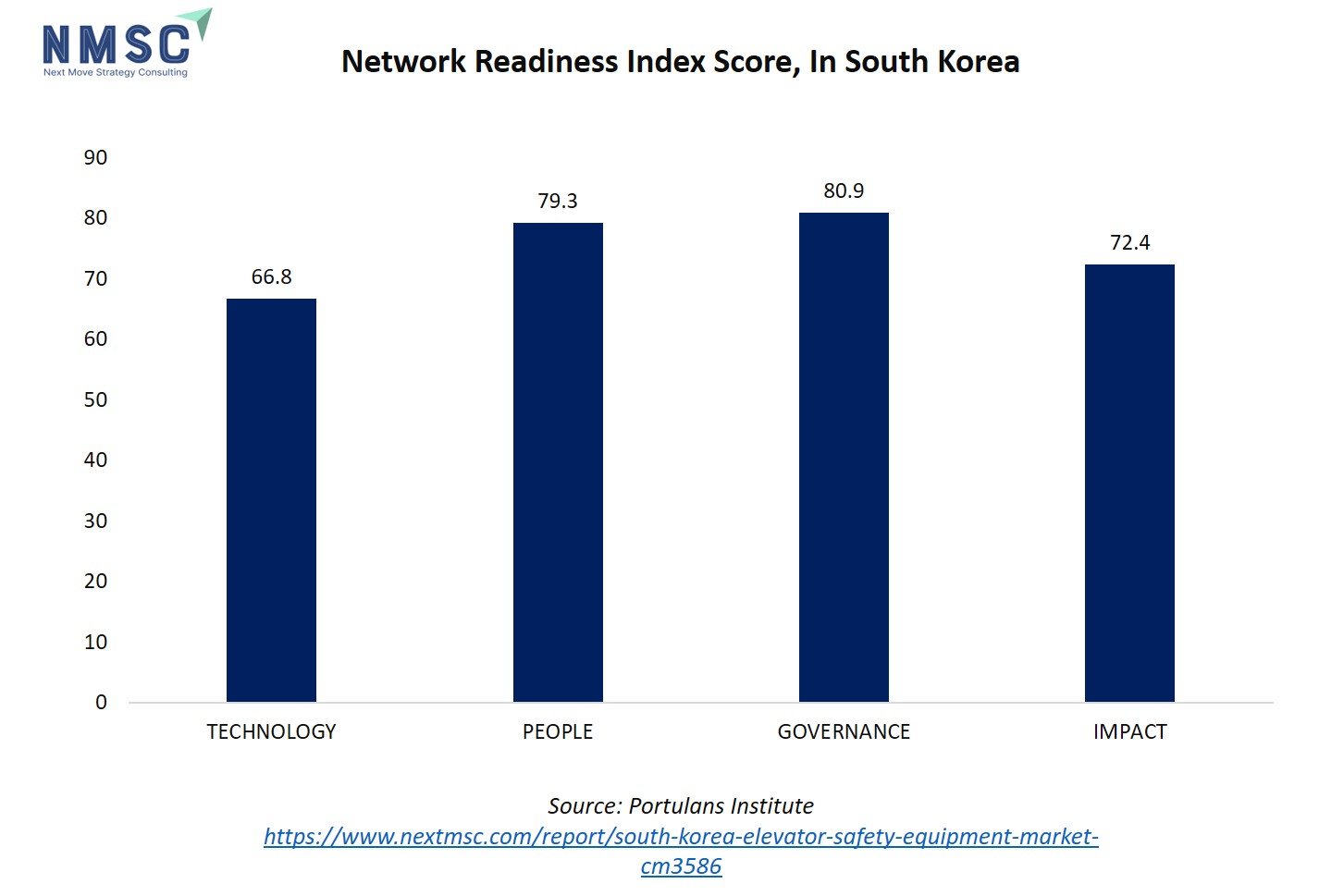

The bar chart illustrates South Korea’s overall score and pillar-wise performance in technology, people, governance, and impact, highlighting the country’s strong foundation for innovation and regulatory compliance. The Technology pillar, scoring 66.78, indicates a high level of technological readiness, supporting the adoption of IoT-enabled, AI-driven elevator safety systems, predictive maintenance tools, and smart monitoring platforms. The People pillar, with the highest score of 79.28, underscores the availability of a skilled workforce and public awareness, ensuring effective installation, maintenance, and compliance. Governance, scoring 80.93, highlights the presence of strict regulatory frameworks and safety standards that drive demand for modern elevator safety equipment. Lastly, the Impact pillar, with a score of 72.4, reflects the importance of reliable vertical transportation in urban high-rises, commercial complexes, and public infrastructure. Collectively, these scores emphasize South Korea’s readiness to adopt advanced elevator safety solutions, positioning the market for sustained growth and innovation.

What are the Key Market Drivers, Breakthroughs, and Investment Opportunities that will Shape the South Korea Elevator Safety Equipment Market in Next Decade?

The South Korea elevator safety equipment market share is witnessing strong growth driven by rapid urbanization, strict safety regulations, and the country’s push toward smart infrastructure. With a highly urbanized population concentrated in metropolitan hubs, the demand for high-rise residential, commercial, and mixed-use buildings continues to rise, increasing reliance on elevators and advanced safety technologies. Regulatory mandates requiring emergency braking systems, overload sensors, and seismic detection devices further fuel adoption, ensuring passenger protection and compliance.

However, high installation and maintenance costs remain a challenge, particularly for smaller developers and retrofitted projects. At the same time, integration with smart building and smart city initiatives offers significant opportunities, positioning South Korea as a dynamic market for innovative elevator safety solutions.

Growth Drivers:

How Urbanization Fuels Growth in South Korea Elevator Safety Equipment Market?

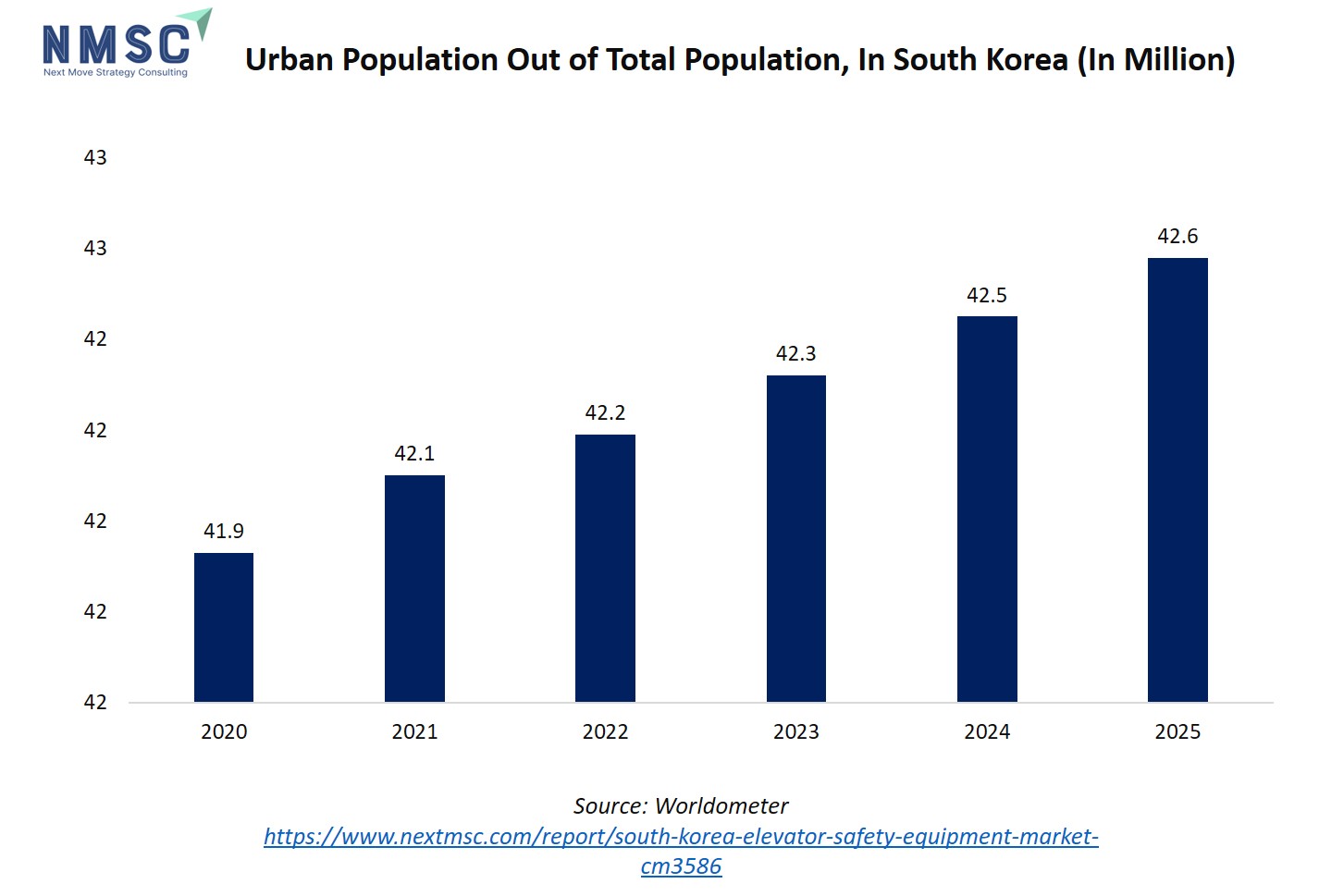

South Korea is one of the most urbanized countries in Asia, with the majority of its people living in metropolitan areas such as Seoul, Busan, and Incheon. According to the World Bank, the country’s urban population stands at 42.17 million, highlighting how densely concentrated the population is in cities. This high level of urbanization fuels continuous construction of high-rise apartments, commercial towers, and mixed-use buildings, where elevators are a necessity for daily mobility.

As elevator usage intensifies, the need for advanced safety equipment, such as overload sensors, seismic detectors, and emergency braking systems, grows significantly. Therefore, urban population concentration is a key driver boosting the South Korea elevator safety equipment market demand.

The bar chart illustrates the year-on-year urban population of South Korea, measured in millions, from 2020 to 2025. The data shows a steady upward trend, rising from 41.9 million in 2020 to 42.6 million in 2025, reflecting gradual urbanization across the country. Each successive year records a modest increase, indicating consistent migration to metropolitan areas and expansion of city boundaries. This growing urban population directly impacts the elevator safety equipment market in South Korea.

As more residents live in high-rise apartments, commercial complexes, and mixed-use buildings, the reliance on elevators intensifies. Consequently, there is a rising demand for advanced safety solutions, including emergency brakes, overload sensors, seismic detectors, and IoT-enabled monitoring systems, to ensure passenger safety and compliance with strict building regulations. The steady urban population growth thus serves as a key driver supporting sustained South Korea elevator safety equipment market expansion.

How Stringent Safety Regulations Powers Elevator Safety Equipment in South Korea?

South Korea has established strict building and elevator safety standards to protect its urban population living in high-rise apartments, office complexes, and commercial spaces. The government mandates the installation of advanced safety mechanisms such as emergency braking systems, overload detection devices, seismic sensors, and fire-resistant materials in elevators.

Regular inspections, certification requirements, and compliance audits ensure that both newly installed and existing elevators meet these regulations. This strict regulatory environment compels manufacturers and building owners to continuously invest in upgraded safety equipment. As a result, stringent safety regulations not only safeguard passengers but also act as a strong market driver, pushing innovation and boosting demand for advanced elevator safety technologies in South Korea.

Growth Inhibitors:

How High Installation and Maintenance Costs Hinders the Market Growth in South Korea?

One of the key restraints in South Korea’s elevator safety equipment market is the high cost associated with installing and maintaining advanced safety systems. Modern technologies such as IoT-enabled sensors, AI-driven monitoring platforms, and seismic detection equipment require significant upfront investment. In addition, periodic inspections, compliance testing, and system upgrades add to long-term maintenance expenses.

For smaller property developers, residential complexes with limited budgets, or older buildings requiring retrofits, these costs act as a barrier to adoption. While large commercial projects in major cities absorb the expense, the financial burden slow down widespread implementation of advanced safety solutions across all building types, thereby restraining market growth.

How is Integration with Smart Building and Smart City Projects Enhancing Opportunities in the South Korea Elevator Safety Equipment Market Expansion?

The aggressive push toward smart cities and intelligent infrastructure present a major opportunity for the South Korea elevator safety equipment market. With government-backed initiatives in cities like Seoul, Busan, and Songdo, buildings are increasingly adopting IoT-enabled, AI-driven, and energy-efficient systems to improve safety and sustainability.

Elevator safety equipment integrated into these smart ecosystems, such as real-time monitoring dashboards, predictive maintenance platforms, and connected emergency response systems, deliver both enhanced safety and operational efficiency. As urban developers prioritize smart and green buildings, elevator safety equipment manufacturers have a strong opportunity to align their offerings with these next-generation projects, opening new avenues for growth and long-term adoption.

How South Korea Elevator Safety Equipment Market is Segmented in this Report, and What are the Key Insights from the Segmentation Analysis?

By Offering Insights

How Does Hardware in Elevator Safety Equipment Enhance Passenger Safety and System Reliability in South Korea?

On the basis of offering, the South Korea elevator safety equipment market is segmented into hardware, software & platforms, and services. Among these, hardware forms the backbone of elevator safety systems, with critical components such as emergency brakes, door sensors, overspeed governors, and seismic detectors ensuring passenger protection and reliable operation.

In South Korea, where urban density and high-rise construction are extensive, these hardware solutions are essential for addressing both everyday safety and region-specific risks like seismic activity. Properly installed and maintained safety hardware prevents uncontrolled movement, door malfunctions, and accident risks, ensuring elevators remain compliant with the country’s stringent safety regulations.

Furthermore, advancements in precision engineering and durability extend the service life of hardware components while reducing maintenance frequency, which is vital for high-traffic buildings across metropolitan areas. This makes hardware a foundational and indispensable segment driving safety and reliability in South Korea’s elevator systems.

By Procurement Type Insights

How Do New Installations (OEM Bundles) Strengthen Safety Standards in South Korea Elevator Safety Equipment Market?

Based on procurement type, the South Korea elevator safety equipment market report is segmented into new installations (OEM bundles), modernization/retrofit (aftermarket upgrades), replacement/spare parts, and SaaS subscriptions & recurring monitoring contracts.

In the case of new installations (OEM bundles), elevators are equipped with advanced safety equipment from the very beginning, including overspeed governors, seismic detectors, door sensors, emergency brakes, and AI-enabled monitoring systems. This ensures that safety and compliance with South Korea’s stringent building codes are built into the core design of high-rise residential and commercial projects. The country’s continuous urban development and large-scale construction of smart buildings, OEM bundles allow property developers to integrate the latest safety technologies upfront, minimizing future retrofitting costs. Additionally, these factory-installed solutions deliver seamless compatibility, higher reliability, and improved efficiency, making new installations a key driver of safety and performance in South Korea elevator safety equipment market.

By Distribution Channel Insights

How Do OEMs (Elevator Manufacturers) Ensure Built-In Safety and Regulatory Compliance in South Korea?

Based on distribution channel, the South Korea elevator safety equipment market is bifurcated into OEM (elevator manufacturer), system integrator/specialist installer, distributor & wholesaler, direct to FM/building owner, and managed service provider

In the case of OEMs (elevator manufacturers), safety equipment is integrated directly into new elevator systems during production. This ensures that advanced components such as overspeed governors, seismic detectors, emergency brakes, and smart monitoring devices are seamlessly built into the elevator design, rather than added as aftermarket upgrades. In South Korea, where high-rise construction is extensive and safety regulations are stringent, OEM-installed solutions guarantee compliance from day one. Moreover, OEMs collaborate with regulators and industry bodies to update their safety features in line with evolving standards. By delivering factory-tested, pre-certified equipment, OEMs minimize installation risks and deliver higher reliability, making them a cornerstone of safe and efficient vertical mobility in South Korea’s rapidly urbanizing landscape.

By End-use vertical Insights

How Do Elevator Safety Solutions Enhance Reliability in Healthcare Facilities in South Korea?

Based on end-use vertical, the South Korea elevator safety equipment market is bifurcated into residential high-rises, commercial offices, retail/hospitality, healthcare facilities, industrial plants, transportation hubs, and public infrastructure.

In healthcare facilities, elevator safety equipment plays a vital role in ensuring safe and uninterrupted vertical transportation for patients, medical staff, and critical supplies. Advanced safety systems such as emergency brakes, load sensors, backup power integration, and IoT-enabled monitoring help maintain reliable operation even during emergencies. In South Korea, where hospitals operate in high-rise structures and handle heavy patient traffic, compliance with stringent safety regulations is essential.

Additionally, predictive maintenance and smart monitoring reduce downtime, ensuring that elevators remain available for critical situations such as patient transfers or emergency evacuations. By enhancing reliability and safety, modern elevator safety equipment supports operational efficiency and safeguards lives, making it a crucial investment for healthcare infrastructure across South Korea.

Competitive Landscape

Which Companies Dominate the South Korea Elevator Safety Equipment Industry and How Do They Compete?

The market is led by major players such as Hyundai Elevator Co., Ltd., Otis Elevator Company (Otis Korea), TK Elevator (TK Elevator Korea), Mitsubishi Elevator (Mitsubishi Electric — KMEC), FUJITEC KOREA Co., Ltd. (Fujitec), Schindler Group (Schindler Korea), Toshiba Elevator and Building Systems, KONE Corporation (Korea operations), Hitachi (Elevator business) — Korea presence, GYG Elevator Co., Ltd. (Gum Young/ GYG), CANNY Elevator Co., Ltd., SILVER Elevator Korea Co., Ltd., Schmersal Korea Ltd. (Schmersal Group), Shin Han Elevator Co., Ltd., and MODEUN (Modeun) Elevator Co., Ltd.

These companies are driving growth by focusing on technological innovation, smart integration, and compliance with South Korea’s stringent safety regulations. Competition centers on deploying advanced safety equipment, such as seismic detectors, emergency brakes, overload sensors, and IoT-enabled monitoring systems, designed to support the country’s dense high-rise infrastructure. Many players are embedding AI-powered predictive maintenance tools, cloud-based monitoring, and energy-efficient components to meet the needs of smart city and green building projects.

For instance, leading manufacturers are rolling out IoT-enabled safety platforms that track elevator health in real time, reducing downtime in high-traffic environments like residential towers and commercial offices. To stay competitive, these companies also collaborate with property developers, facility managers, and government regulators to align with evolving safety standards while offering customized solutions.

Partnerships with technology providers and smart building integrators further allow them to deliver end-to-end safety ecosystems, making innovation, reliability, and compliance the core of competition in the South Korea elevator safety equipment market.

Market Dominated by Established Global and Regional Manufacturers

The South Korea elevator safety equipment market share is primarily led by global giants such as Otis Elevator Company (Otis Korea), Schindler Group (Schindler Korea), TK Elevator, KONE Corporation (Korea operations), Mitsubishi Electric (KMEC), Hitachi, Toshiba Elevator and Building Systems, and Fujitec Korea, alongside strong regional players like Hyundai Elevator Co., Ltd., GYG Elevator Co., Ltd. (Gum Young/ GYG), SILVER Elevator Korea Co., Ltd., Shin Han Elevator Co., Ltd., and MODEUN Elevator Co., Ltd. These companies compete by supplying end-to-end elevator systems bundled with advanced safety technologies, specifically designed for high-rise residential towers, commercial offices, and large-scale infrastructure projects.

Emerging local players and niche specialists, including Schmersal Korea Ltd., strengthen their market presence by focusing on component-level expertise such as emergency braking systems, door interlocks, and seismic safety sensors. Competition is also intensifying around modernization and retrofit projects, where companies offer tailored safety upgrades for South Korea’s aging building stock.

Innovation and Adaptability Drive Market Success

Recent years have seen competition fuelled by IoT-enabled monitoring platforms, AI-powered predictive maintenance, and eco-efficient safety systems. For example, manufacturers are embedding real-time sensors and AI analytics to detect abnormal vibrations, brake wear, or door malfunctions before accidents occur. Others are focusing on seismic safety features and disaster-ready systems, in response to growing awareness of earthquake resilience in vertical transportation. Firms are also leveraging digital twin simulations, smart city integrations, and cloud-based remote monitoring to enhance operational transparency and reliability. By combining hardware durability with smart software platforms, South Korea’s elevator safety equipment providers are redefining safety as not only a regulatory requirement but also a key differentiator in the country’s highly urbanized, high-rise-driven South Korea elevator safety equipment market.

Market Players Embrace Innovative Offerings and Expansion Strategies

Industry players in the South Korea elevator safety equipment market are increasingly focusing on strategic innovations and product expansion to strengthen their market presence. For example, Hyundai Elevator Co., Ltd. has been expanding its smart elevator portfolio with IoT-enabled monitoring systems and AI-driven predictive maintenance tools that enhance passenger safety and reduce downtime. Similarly, Otis Korea and Schindler Korea are rolling out modernization solutions tailored for aging building stock, integrating advanced safety components such as overspeed governors, seismic detectors, and smart door interlocks to meet South Korea’s stringent safety standards. This reflects a growing trend among manufacturers to diversify offerings and adapt to South Korea’s urban, high-rise-driven environment. Companies are not only competing on hardware reliability but also on digital platforms, energy efficiency, and integration with smart city projects. By aligning with the evolving needs of residential high-rises, commercial offices, and healthcare facilities, leading players are reinforcing their market leadership while tapping into the rising demand for safer, more intelligent elevator systems.

List of Key South Korea Elevator Safety Equipment Companies

-

Hyundai Elevator Co., Ltd.

-

TK Elevator (TK Elevator Korea)

-

Mitsubishi Elevator (Mitsubishi Electric — KMEC)

-

FUJITEC KOREA Co., Ltd. (Fujitec)

-

Schindler Group (Schindler Korea)

-

Toshiba Elevator and Building Systems

-

Hitachi (Elevator business) — Korea presence

-

GYG Elevator Co., Ltd. (Gum Young / GYG)

-

CANNY Elevator Co., Ltd.

-

SILVER Elevator Korea Co., Ltd.

-

Schmersal Korea Ltd. (Schmersal Group)

-

Shin Han Elevator Co., Ltd.

-

MODEUN (Modeun) Elevator Co., Ltd.

What are the Latest Key Industry Developments?

-

September 2025 - KONE Corporation provided a guide on planning elevator modernization projects, focusing on enhancing safety, energy efficiency, and future-readiness.

-

July 2025 - Hyundai Elevator launched a promotion featuring a flood detection system package to minimize safety risks during monsoon seasons.

-

April 2025 - TK Elevator Korea's futuristic curved concept design for its unique TWIN elevators was recognized in the iF Design Award 2025 under the 'Product Concepts' category.

-

April 2025 - South Korea's Ministry of the Interior and Safety plans to conduct elevator safety surveys, with Schindler Korea expected to participate, ensuring compliance with national safety standards.

-

November 2024 - Hyundai Elevator announced a program offering free inspections for elevators over 10 years old, regardless of manufacturer. This initiative aims to enhance safety and reduce risks associated with aging infrastructure.

What are the Key Factors Influencing Investment Analysis & Opportunities in the South Korea Elevator Safety Equipment Market?

Investment in South Korea elevator safety equipment market is being shaped by several critical factors, reflecting both market dynamics and evolving infrastructure needs. High urban density, rapid construction of residential high-rises, and stringent government safety regulations have heightened the demand for advanced safety solutions such as overspeed governors, seismic detectors, and IoT-enabled monitoring systems.

Funding trends indicate growing interest from private equity, venture capital, and strategic investors in manufacturers that leverage AI-driven predictive maintenance, digital twin simulations, and smart-building integration, which enhance efficiency and compliance. Companies offering modernization and retrofit solutions for aging infrastructure are particularly attractive, given South Korea’s large stock of older buildings requiring upgrades to meet modern safety standards.

Valuations for elevator safety equipment providers are experiencing upward momentum due to the integration of advanced technologies, expansion into smart city projects, and rising demand for energy-efficient, eco-compliant systems. Regulatory support, such as the enforcement of strict inspection regimes and elevator safety codes by the Korea Elevator Safety Agency (KoELSA), further strengthens investor confidence. The long-term outlook remains positive, with innovation, strategic partnerships, and digital transformation fostering growth opportunities across residential, commercial, and healthcare verticals. As South Korea continues to urbanize and digitize its infrastructure, the elevator safety equipment market is well-positioned to attract sustained investment and deliver strong returns.

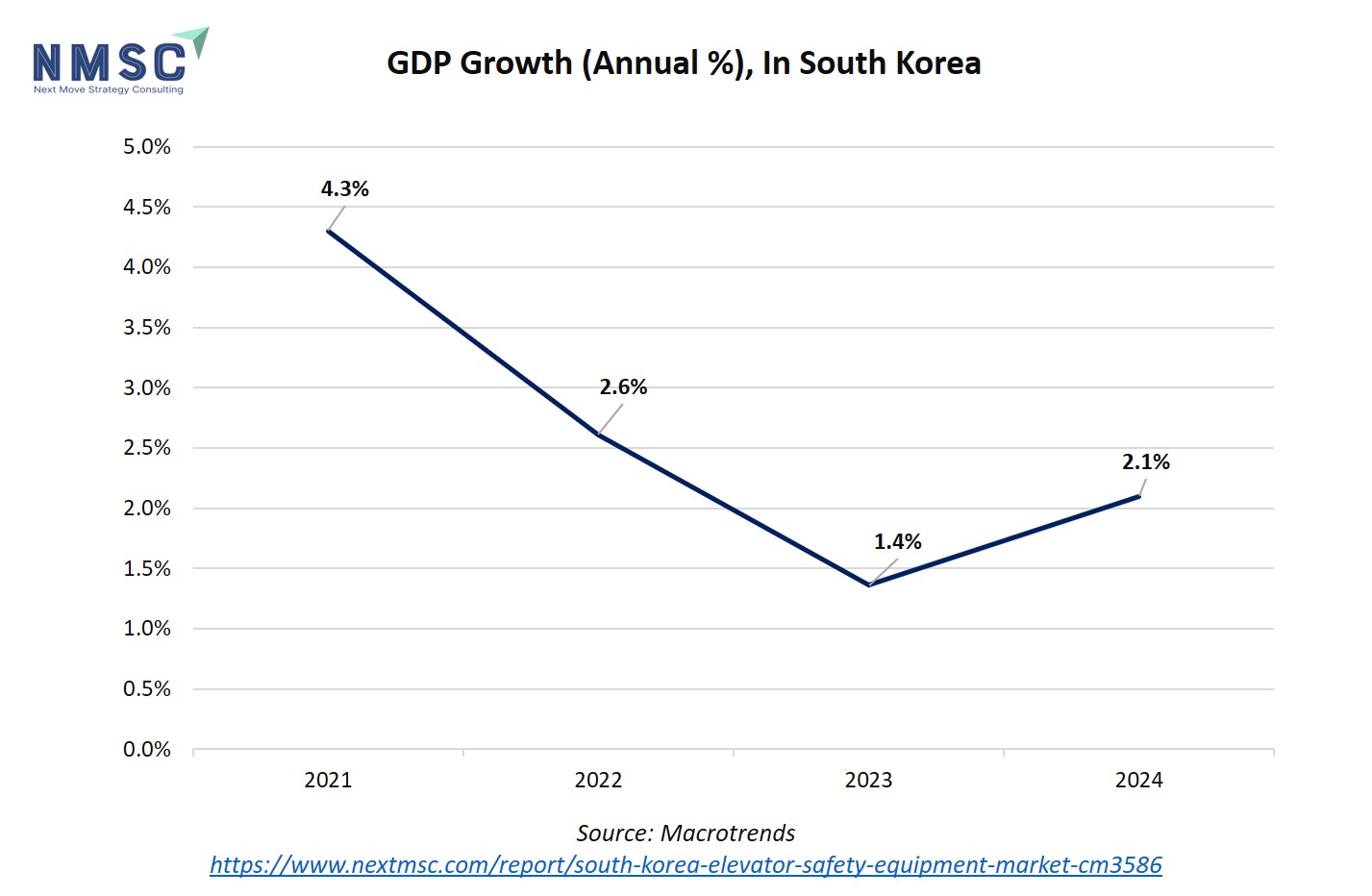

The line graph depicts the annual GDP growth rate (%) of South Korea from 2021 to 2024. After a strong rebound of 4.3% in 2021, following the pandemic-induced slowdown, growth moderated to 2.6% in 2022 and further slowed to 1.4% in 2023, before slightly recovering to 2.1% in 2024. The trend reflects fluctuations in domestic demand, global trade, and macroeconomic conditions impacting the country’s economy.

Economic growth in South Korea directly influences the elevator safety equipment market. Higher GDP growth supports urban development, commercial construction, and high-rise residential projects, which increase the demand for elevators and advanced safety solutions. Even during periods of slower growth, regulatory requirements and modernization needs sustain steady investment in emergency brakes, overload sensors, seismic detectors, and IoT-enabled monitoring systems. Thus, South Korea’s GDP trajectory is a key macroeconomic factor shaping the growth and adoption of elevator safety equipment in the country.

Key Benefits for Stakeholders:

Next Move Strategy Consulting presents a comprehensive analysis of the South Korea elevator safety equipment market, covering historical trends from 2020 through 2024 and offering detailed forecasts through 2030. Our study examines the market at global, regional, and country levels, providing quantitative projections and insights into key growth drivers, challenges, and investment opportunities across all major Elevator Safety Equipment segments.

Report Scope:

|

Parameters |

Details |

|

Market Size in 2025 |

USD 169.1 million |

|

Revenue Forecast in 2030 |

USD 261.4 million |

|

Growth Rate |

CAGR of 9.1% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Million (USD) |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 analyst-working hours) after purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

|

Approach |

In-depth primary and secondary research; proprietary databases; rigorous quality control and validation measures. |

|

Analytical Tools |

Porter's Five Forces, SWOT, value chain, and Harvey ball analysis to assess competitive intensity, stakeholder roles, and relative impact of key factors. |

Key South Korea Elevator Safety Equipment Market Segments

By Offering

-

Hardware

-

Mechanical Safety Systems

-

Braking Systems

-

Overspeed Governors

-

Door Interlocks & Locks

-

Safety Gear & Buffers

-

-

Control & Operation

-

Main controllers / ECUs

-

Door operators (motors/controllers)

-

Emergency operation / manual override panels

-

-

Monitoring & Recording

-

Cameras

-

Recorders & edge devices

-

Networking & power accessories

-

Cabin sensors for monitoring

-

-

Communication & Alarms

-

Intercom / two-way voice

-

Panic / SOS buttons

-

Telemetry / cellular gateways / modems

-

-

Power & Support

-

Backup power / UPS (for safety devices)

-

Emergency lighting / alarm bells / strobes

-

-

Accessories & Spare Parts

-

-

Software & Platforms

-

Video Management Systems (VMS)

-

Cloud Storage, SaaS Retention & Portals

-

Analytics Modules

-

Integration Middleware

-

-

Services

-

Installation & Integration

-

Monitoring & Alarm Response

-

Maintenance & Spare-part Contracts

-

Managed Video Services

-

Inspection, Certification, Warranty & Training

-

By Procurement Type

-

New Installations (OEM bundles)

-

Modernization / Retrofit (aftermarket upgrades)

-

Replacement / Spare Parts

-

SaaS Subscriptions & Recurring Monitoring Contracts

By Distribution Channel

-

OEM (elevator manufacturer)

-

System Integrator / Specialist Installer

-

Distributor & Wholesaler

-

Direct to FM / Building Owner

-

Managed Service Provider

By End-Use vertical

-

Residential high-rises

-

Commercial offices

-

Retail/Hospitality

-

Healthcare facilities

-

Industrial plants

-

Transportation hubs

-

Public infrastructure

Conclusion & Recommendations

Our report equips stakeholders, industry participants, investors, policy-makers, and consultants with actionable intelligence to capitalize on South Korea Elevator Safety Equipment’s transformative potential. By combining robust data-driven analysis with strategic frameworks, NMSC’s South Korea Elevator Safety Equipment Market Report serves as an indispensable resource for navigating the evolving elevator safety equipment landscape.

Speak to Our Analyst

Speak to Our Analyst