France Co-Working Space Market by Space Type (Shared Open Spaces, Enclosed Private Suites, Virtual Office Solutions, Event/Meeting Facilities), by Membership Type (Hot Desks, Dedicated Desks, and Others), by Business Type (Standard Coworking, and Others), by Business Model (Direct Ownership/Operation, and Others), by End User (Freelancers/Remote Workers, and Others), by Industry Vertical (Technology & IT Services, and Others) - Opportunity Analysis and Industry Forecast, 2024–2030

Industry: ICT & Media | Publish Date: 07-Nov-2025 | No of Pages: 157 | No. of Tables: 120 | No. of Figures: 65 | Format: PDF | Report Code : IC2023

Industry Overview

The France Co-Working Space Market size was valued at USD 911.7 million in 2024, and is expected to be valued at USD 1178 million by the end of 2025. The industry is projected to grow, hitting USD 3158.2 million by 2030, with a CAGR of 21.8% between 2025 and 2030.

The France co-working space market is entering a more mature phase, driven by structural shifts in how businesses use offices. With over one in five employees teleworking at least occasionally in 2024, hybrid work has become the norm, pushing companies to seek flexible seat blocks, satellite hubs, and multi-location passes rather than long-term leases. This demand is no longer limited to freelancers and startups; SMEs and corporates are also adopting co-working to cut real estate costs while improving agility. Regional cities such as Lyon, Toulouse, and Nantes are emerging as strong growth hubs, supported by decentralization policies and lower rental costs, which make co-working a more profitable venture outside Paris.

On the supply side, operators are pivoting to asset-light models through management agreements, franchises, and joint ventures with landlords, reducing capital risk while enabling faster rollouts. Real estate groups are also more proactive in repurposing underused offices into flexible spaces, aligning with sustainability and urban renewal goals. At the same time, product differentiation is intensifying, such as premium managed offices, niche vertical spaces, and technology-enabled offerings are being developed to meet diverse client needs, from freelancers to Fortune 500 firms. While profitability remains uneven due to competition and high operating costs, operators that standardize fit-outs, leverage analytics, and focus on tier-2 expansion are best placed to capture sustainable growth.

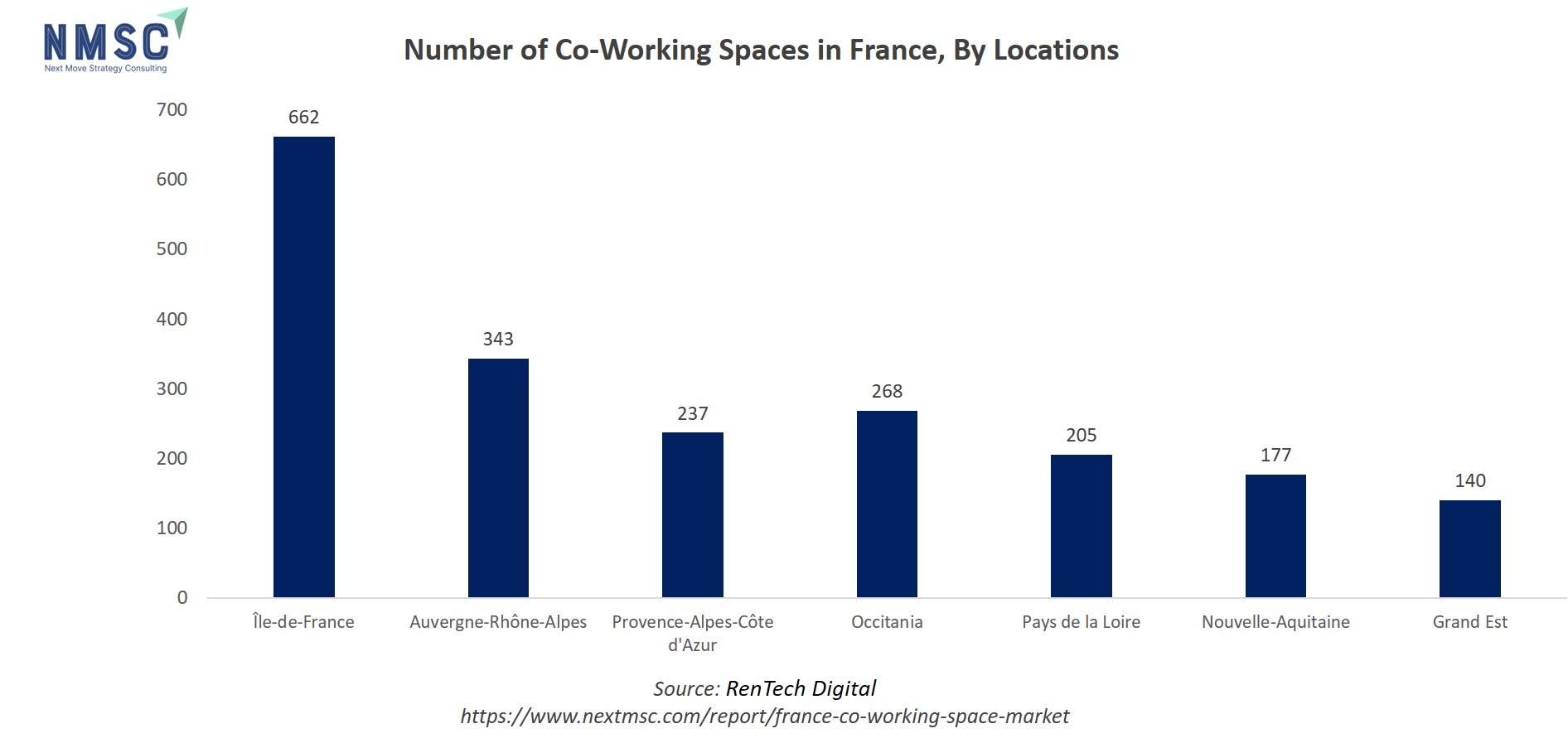

The above chart illustrates the distribution of co-working spaces across key regions in France, highlighting significant regional variations. Île-de-France leads by a wide margin with 662 co-working spaces, reflecting Paris’s dominance as the country’s primary business hub. Auvergne-Rhône-Alpes follows with 343 spaces, while Provence-Alpes-Côte d’Azur and Occitania record 237 and 268 spaces respectively, showcasing strong coworking adoption in southern France. Mid-tier regions include Pays de la Loire with 205 spaces and Nouvelle-Aquitaine with 177, whereas Grand Est hosts 140 spaces. Overall, the data emphasizes the central role of Île-de-France in coworking growth while also pointing to expanding regional hubs that contribute to France’s evolving flexible workspace market.

What are the key trends in France co-working space Industry?

How is Hybrid Work Continuing to Reshape Demand for Flexible Office Solutions in France?

Telework remains a structural influence on workspace demand. INSEE reports that in the first half of 2024 more than one in five private-sector employees teleworked at least occasionally, with hybrid patterns averaging about two days per week. This has turned flexible seat blocks; multi-site passes and satellite hubs from niche products into core offerings for corporates managing hybrid teams. Practically, operators must configure inventory for variable weekday peaks, balancing hot desks for adhoc users with bookable private suites for predictable team days. The insight is tactical: deploy dynamic pricing tied to weekday/lead-time patterns and offer enterprise flex passes with usage analytics to reduce no-shows and lift realized occupancy. Doing so captures hybrid demand while improving revenue per available seat and lowering churn.

Are Regionalisation and Secondary Cities Creating New Investment Hotspots Outside Paris?

France’s flexible workspace footprint is decentralising. Industry data indicates a sharp rise in regional supply in 2024, with one study estimating a 23% year-on-year increase in flexible locations and Paris representing roughly 37% of national supply. Regional hubs such as Lyon, Bordeaux, Marseille, Toulouse and Nantes are showing faster penetration growth as remote-first teams and talent dispersal reduce the premium for central Paris addresses. For investors this means two practical moves, first, prioritise smaller-ticket conversions in secondary downtowns where rents and capex are materially lower, and second, structure leases with step-up rent or revenue-share clauses to capture upside as demand matures.

Are Asset-light Models and Landlord Joint Ventures Becoming the Default Scaling Route?

Yes, asset-light models and landlord joint ventures are quickly becoming the main way for co-working operators in France and across Europe to grow. Instead of spending heavily to rent, design, and run every location themselves, many operators now prefer deals where landlords share the costs and risks. In these models, landlords provide the buildings, while operators handle the branding, services, and community management. This works well because landlords get to make better use of older office spaces, while operators expand faster without huge upfront expenses. For this to succeed, operators need standardized designs, clear processes, and tech systems that can be rolled out quickly across multiple sites. On the landlord side, offering a mix of fixed rent plus a share of the profits creates a fair balance.

What are the Key Market Drivers, Breakthroughs, and Investment Opportunities that will Shape the France Co-working Space Industry in Next Decade?

The France co-working space market is undergoing rapid transformation, fueled by evolving workplace models, digital adoption, and shifting employee expectations. With hybrid work now embedded across sectors, demand for flexible offices is accelerating, particularly in major urban centres like Paris, Lyon, and Marseille. Operators are diversifying offerings to attract freelancers, startups, SMEs, and large enterprises alike, tailoring services to both affordability and premium needs.

At the same time, rising real estate costs, sustainability regulations, and competition among providers are shaping strategic choices. The France co-working space market is seeing a surge in partnerships between operators and landlords, with asset-light models emerging as a preferred growth strategy. Breakthroughs in workspace technology, such as smart access, collaboration tools, and energy efficiency systems, are reshaping user experience. Despite these advances, challenges around profitability and market saturation remain, leaving room for innovative investment approaches.

Growth Drivers:

How is Hybrid Work Adoption Shaping Demand for Flexible Spaces?

Hybrid work has become one of the most influential drivers of France’s co-working sector, as enterprises rethink traditional office footprints to cut fixed costs and boost agility. Many firms now choose satellite hubs or flexible desk blocks rather than committing to expensive long-term leases. Co-working operators are responding with hybrid-friendly solutions such as multi-location passes, enterprise memberships, and technology-enabled booking systems that help corporates manage fluctuating workforce needs while maintaining collaboration and culture.

Why is Urbanization Creating a Surge in Co-working Demand?

Urbanization and startup clustering are major accelerators of co-working adoption in France. Cities such as Paris, Bordeaux, and Lille attract growing numbers of entrepreneurs and SMEs, creating dense ecosystems that thrive on collaboration, networking, and shared infrastructure. At the same time, rising real estate costs in prime urban districts make co-working more attractive than securing long-term commercial leases, especially for cost-sensitive businesses. This trend allows operators to fill demand for centrally located, well-connected spaces while diversifying into premium managed offices for corporates. As France’s urban hubs continue to drive talent and innovation, co-working spaces act as both affordable alternatives and strategic enablers of growth.

Growth Inhibitors:

Can Profitability be Sustained Amidst Rising Competition?

While demand is rising, profitability remains a critical challenge for French co-working operators. High rental liabilities, operational costs, and competitive pricing exert downward pressure on margins. In major hubs like Paris, the rapid expansion of players such as Wojo, Deskeo, and IWG has intensified price competition, leading to thinner spreads between costs and revenues. To remain viable, operators must differentiate through specialized services, premium amenities, or sector-focused environments rather than competing solely on price. Asset-light partnerships with landlords and flexible service-based revenue models are emerging as potential solutions, but scaling profitability in a crowded market remains difficult without consistent differentiation.

Why are Secondary Cities Becoming Co-working Investment Hotspots?

Beyond the capital, regional cities such as Nantes, Toulouse, Montpellier, and Strasbourg are becoming highly attractive investment hotspots for co-working providers. Driven by talent decentralization, improved transport infrastructure, and the rise of remote-first companies, demand for flexible workspaces outside Paris is accelerating. These locations benefit from lower real estate costs, which improve operator profitability while enabling affordable memberships for freelancers, SMEs, and corporates setting up satellite offices. Moreover, regional economic development policies in France encourage business activity outside the capital, further strengthening long-term demand. For investors and operators, secondary cities present a strategic opportunity to capture growth while avoiding the saturation and high overheads of Paris and other tier-one hubs.

How France Co-working Space Market is Segmented in this Report, and what are the Key Insights from the Segmentation Analysis?

By Space Type Insights

Which Space Types are Driving the France Co-working Market Growth in 2025?

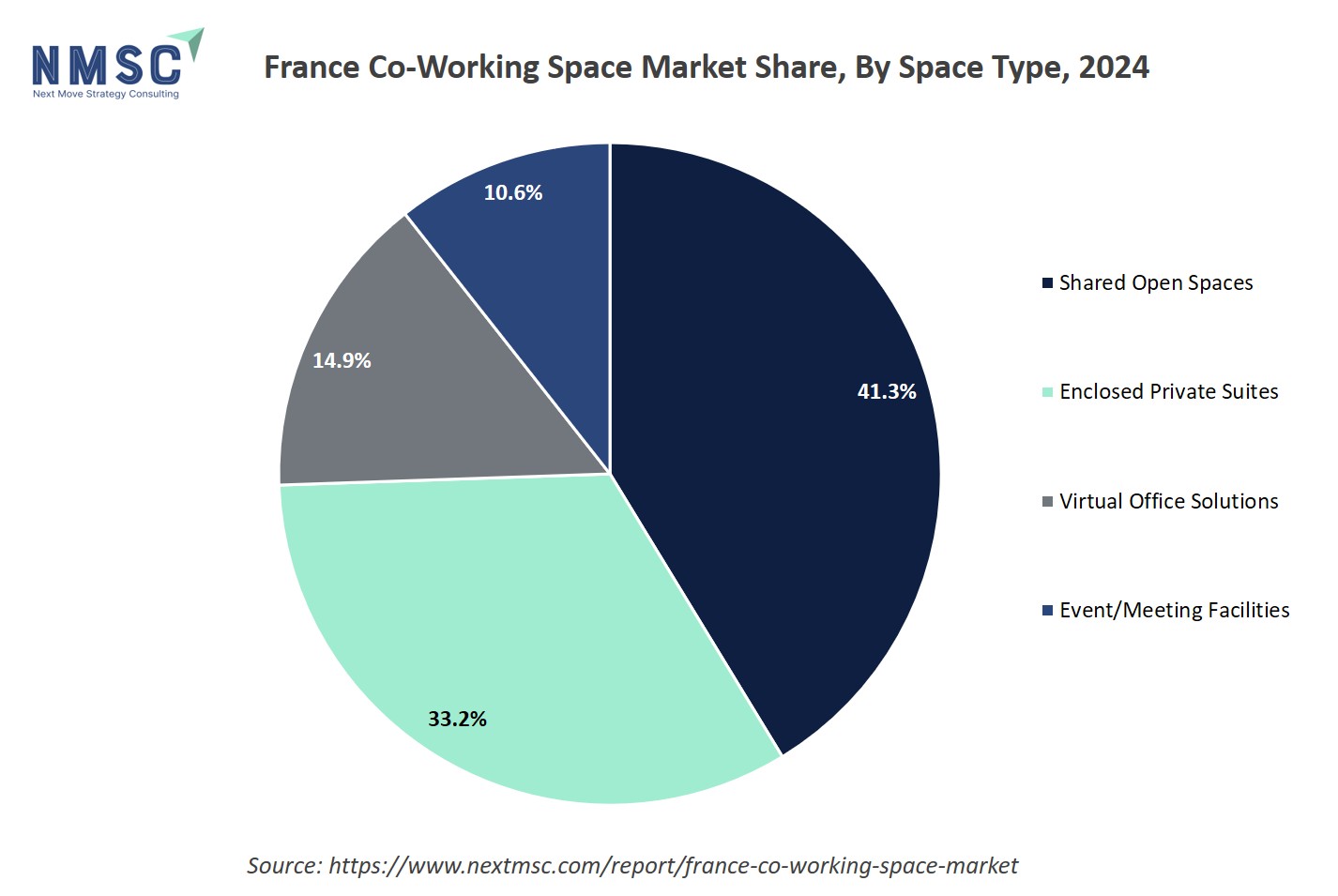

Based on space type, the market is segmented into shared open spaces, enclosed private suites, virtual office solutions, and event/meeting facilities.

Shared open desks remain the primary volume driver, with hot desks and day passes meeting demand from freelancers and hybrid professionals and enabling operators to maximise seat turnover. Enclosed private suites deliver the strongest revenue growth and longer tenures, attracting corporates and scaleups through predictable occupancy and premium pricing. Virtual office services function as a low-cost acquisition channel that converts domiciled entities into occasional users, while event and meeting facilities monetise off-peak hours and increase ancillary revenue. Collectively, these segments reward operators that combine yield management, integrated booking technology, hospitality-led fit-outs, and landlord joint ventures; investors are increasingly focused on suburban conversion opportunities and enterprise-grade management contracts.

The above chart illustrates highlights how space types preferences vary among users. Shared open spaces dominate with 41.3%, reflecting the continued appeal of affordable, community-driven environments for freelancers, startups, and small teams. Enclosed private suites account for 33.2%, showing strong demand from SMEs and corporates that prioritize privacy, security, and long-term operational stability while still valuing flexibility over traditional leases. Event and meeting facilities represent 14.9%, underscoring the importance of flexible venues for workshops, client meetings, and networking events. Virtual office solutions capture 10.6%, catering to remote businesses and entrepreneurs seeking professional addresses and administrative support without physical occupancy. This distribution reveals a balanced market where open and collaborative settings lead adoption, but private and specialized spaces are gaining traction as co-working becomes integral to enterprise strategies in France.

By Membership Type Insights

Which Membership Types are Shaping the France Co-working Market Demand?

On the basis of membership type, the market is segmented into hot desks, dedicated desks, private office leases and hybrid flex passes.

The France co-working space market can be viewed through four primary membership types, each reflecting the diverse needs of today’s workforce. Hot desks represent the most flexible and accessible option, attracting freelancers, digital nomads, and short-term users who value affordability and freedom over permanence. Dedicated desks, by contrast, cater to professionals who require a stable workstation with the added benefit of a consistent community environment, offering a sense of ownership within a shared setting. Private office leases are increasingly favoured by corporates, scaleups, and small enterprises seeking privacy, brand identity, and secure spaces that support longer-term strategic planning. Finally, hybrid flex passes have emerged as a dynamic solution for companies managing distributed teams and hybrid work schedules, enabling employees to access multiple locations with adaptable seat allocations. Together, these membership types create a balanced ecosystem where flexibility, stability, privacy, and scalability converge to meet the evolving demands of France’s modern workplace culture.

By Business Type Insights

How do Business Type Segments define Operator Positioning and Client Focus?

On the basis of business type, the France co-working space market is segmented into standard coworking, premium managed offices, and niche/specialized spaces.

The France co-working space market share also segments along business type, reflecting the varied positioning strategies operators adopt. Standard coworking spaces form the foundation of the market, offering accessible, community-driven environments where freelancers, startups, and small businesses benefit from flexible desks, shared amenities, and affordable memberships. Premium managed offices occupy the upper tier, targeting corporates and high-growth firms with turnkey solutions that combine private suites, branded fit-outs, and hospitality-inspired services, often backed by enterprise-grade infrastructure and long-term service agreements. Niche and specialized spaces add further depth, catering to specific communities such as creatives, tech startups, or social innovators, and differentiating through curated programming, unique design concepts, or sector-specific resources.

Together, these segments illustrate how the France co-working space market balances accessibility with exclusivity, scale with specialization, and affordability with high-touch experiences, shaping a diverse ecosystem that appeals to both individuals and enterprises across France.

By Business Model Insights

Which Business Models are Enabling Scale and De-risked Expansion?

Based on business model, the France co-working space market is divided into direct ownership/operation, franchise/partnership, and real estate collabs.

The France co-working space market, when segmented by business model, highlights three distinct approaches that shape growth and scalability. Direct ownership and operation remain the traditional model, where operators control assets, design, and service delivery end-to-end, allowing for strong brand consistency but requiring significant capital commitments. Franchise and partnership models are increasingly common, enabling operators to expand footprints quickly by leveraging local partners’ resources and networks while maintaining brand standards.

Real estate collaborations, often structured as management agreements or joint ventures with landlords and asset managers, are gaining prominence as they reduce operator risk, provide stable returns to property owners, and accelerate conversions of underutilized assets into flexible workspaces. Collectively, these models reveal a shift from capital-heavy expansion toward asset-light strategies, with collaboration and shared risk emerging as key enablers of sustainable growth in France’s co-working landscape.

By Industry Vertical Insights

Which Industry Verticals are Driving Sector Adoption and Tailored Offerings?

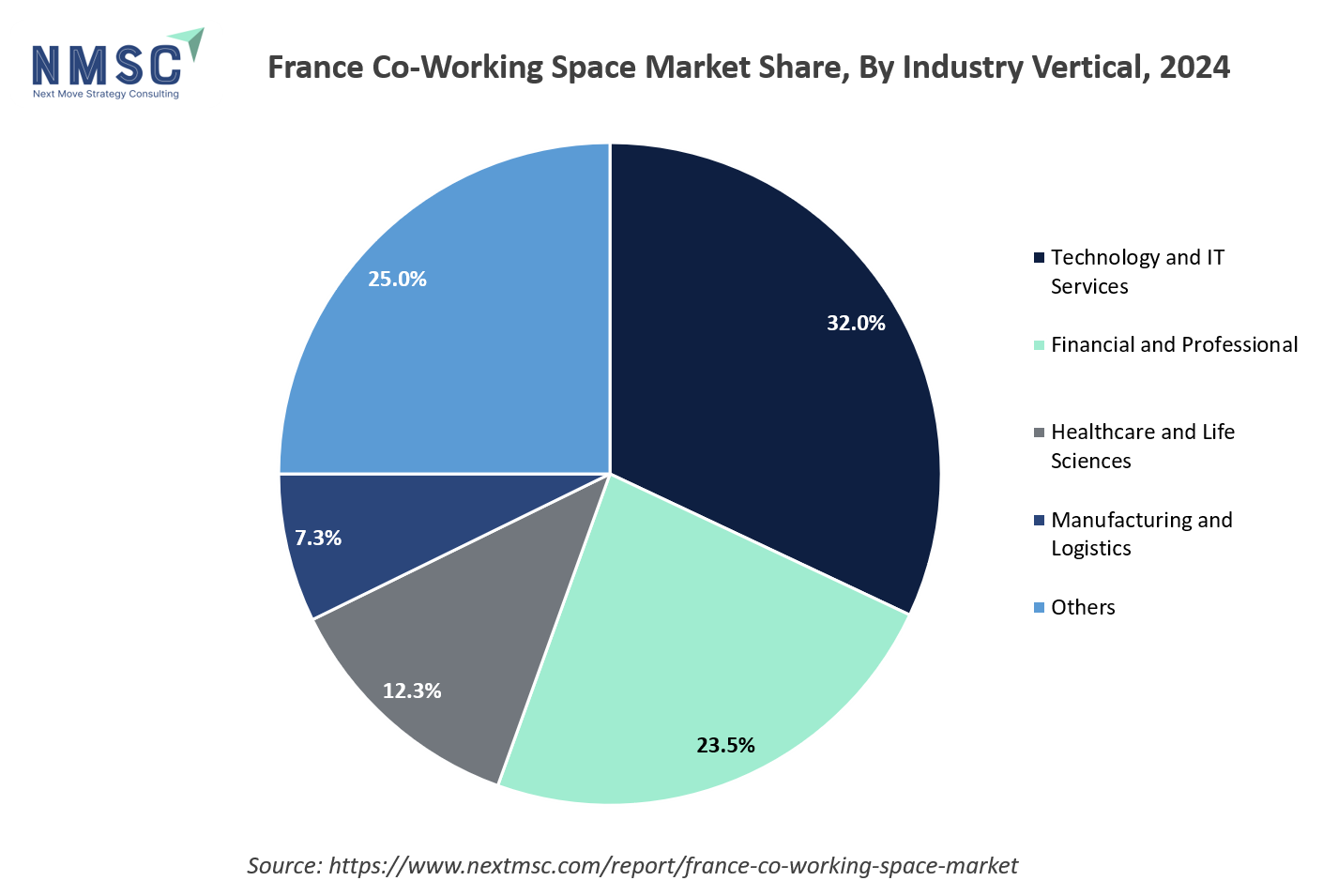

On the basis of industry vertical, the France co-working space market is segmented into technology and IT services, financial and professional, healthcare and life sciences, manufacturing and logistics, public sector and education, and others.

Technology and IT services remain the leading users, with startups, developers, and digital firms driving demand for agile, innovation-friendly environments. Financial and professional services increasingly rely on premium managed offices, using flexible hubs to host client-facing teams and satellite operations. Healthcare and life sciences firms adopt coworking for research support, administrative units, and cross-disciplinary collaboration, while manufacturing and logistics companies use suburban or regional sites to house project teams closer to operations.

Public sector bodies and education institutions leverage coworking to pilot innovation labs, training centres, and community programs. The “others” category, spanning creatives, nonprofits, and consultants, underscores coworking’s inclusivity. This segmentation reflects not only the diversity of end users but also the adaptability of France’s co-working model to sector-specific needs, from high-tech agility to public-sector experimentation.

The chart highlights how adoption varies across sectors in France Co-Working Space. Technology and IT services lead with 32.0%, reflecting the sector’s strong reliance on flexible, innovation-driven work environments that support startups, scale-ups, and remote teams. Similarly, the financial and professional services sector follows at 23.5%, driven by consulting firms, legal services, and agile finance teams seeking cost-efficient yet professional office solutions.

Healthcare and life sciences account for 12.3%, indicating growing demand from biotech startups, research groups, and health-focused entrepreneurs. Manufacturing and logistics occupy 7.3%, representing a smaller but emerging share as supply-chain-oriented firms adopt hybrid office models. Interestingly, the public sector and education contribute 25.0%, highlighting increasing government and institutional engagement with co-working to foster collaboration, training, and innovation hubs. The France co-working space industry spread shows how co-working has evolved from a startup-centric model to a mainstream workplace solution across diverse verticals in France.

By End-User Insights

Who are the Primary End Users and How do their Needs Differ?

Based on end-user, the France co-working space market is bifurcated into freelancers/remote workers, startups, SMEs, and large enterprises.

The France co-working space market when segmented by end-user, highlights how flexible work models cater to distinct organizational needs. Freelancers and remote workers form the foundation of demand, relying on hot desks and hybrid passes that provide affordability, community, and relief from isolation. Startups are heavy adopters of shared environments, leveraging co-working for networking opportunities, mentoring programs, and cost-efficient scaling. SMEs increasingly turn to dedicated desks and private suites as they mature, seeking stability while maintaining flexibility compared to traditional leases. Large enterprises represent the fastest-growing segment, driven by hybrid work strategies that prioritise satellite offices, scalable seat blocks, and premium managed spaces to enhance employee experience and reduce fixed overheads. Collectively, these user groups reflect a layered ecosystem where co-working supports individuals’ productivity, entrepreneurial growth, and corporate transformation alike.

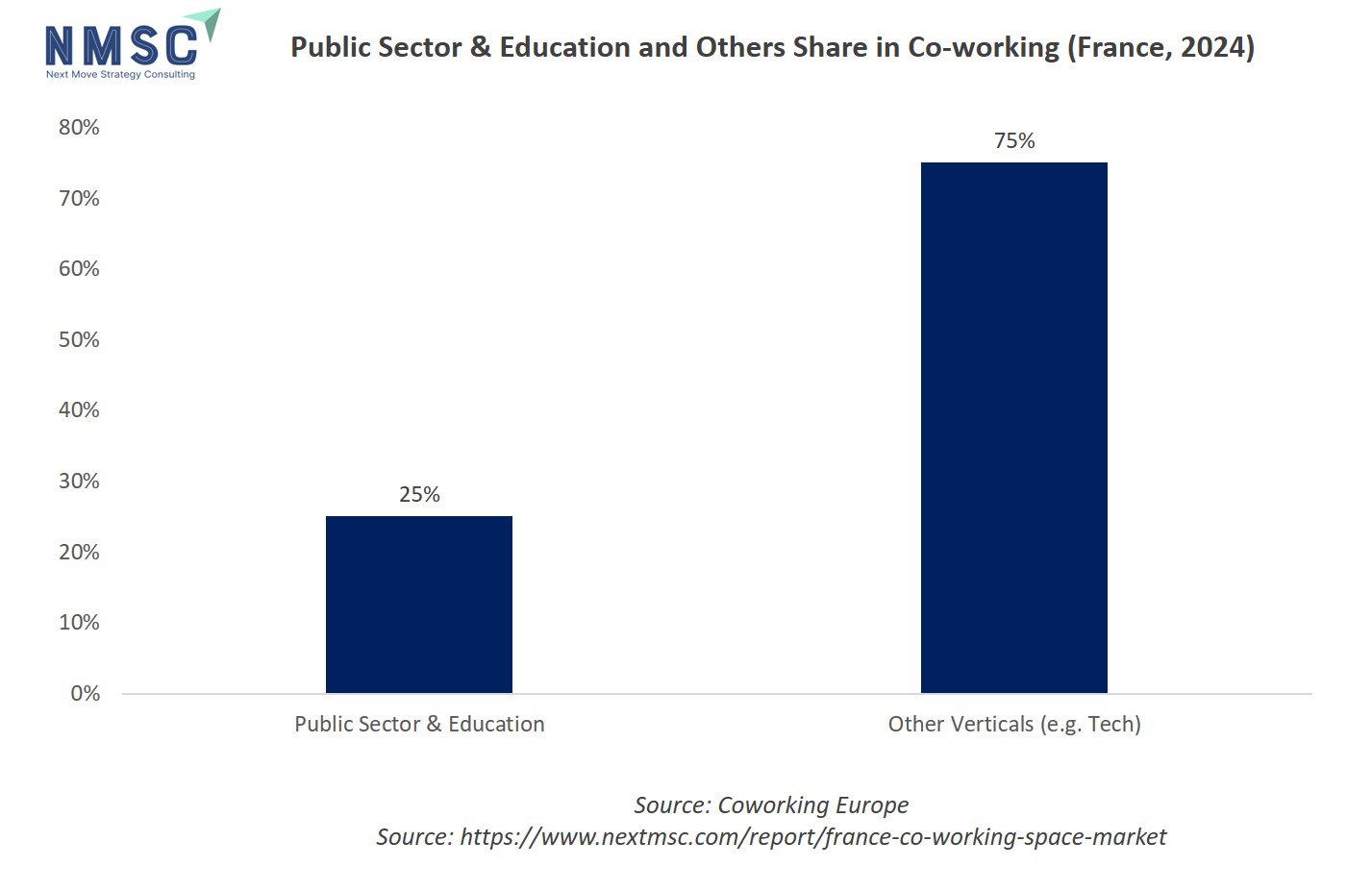

The above chart illustrates the share of Public Sector & Education versus other verticals in France’s co-working market in 2024. Public Sector & Education accounts for 25%, highlighting the growing institutional adoption of flexible workspaces as government bodies, universities, and training institutions increasingly use co-working environments to foster collaboration and innovation. In contrast, other verticals, including technology, represent 75%, showing that while co-working remains dominated by private-sector demand, the inclusion of the public sector is becoming a notable driver of diversification. This trend reflects a broader shift in France where co-working is no longer confined to startups and tech firms but is evolving into a mainstream workplace solution across multiple industries.

Competitive Landscape

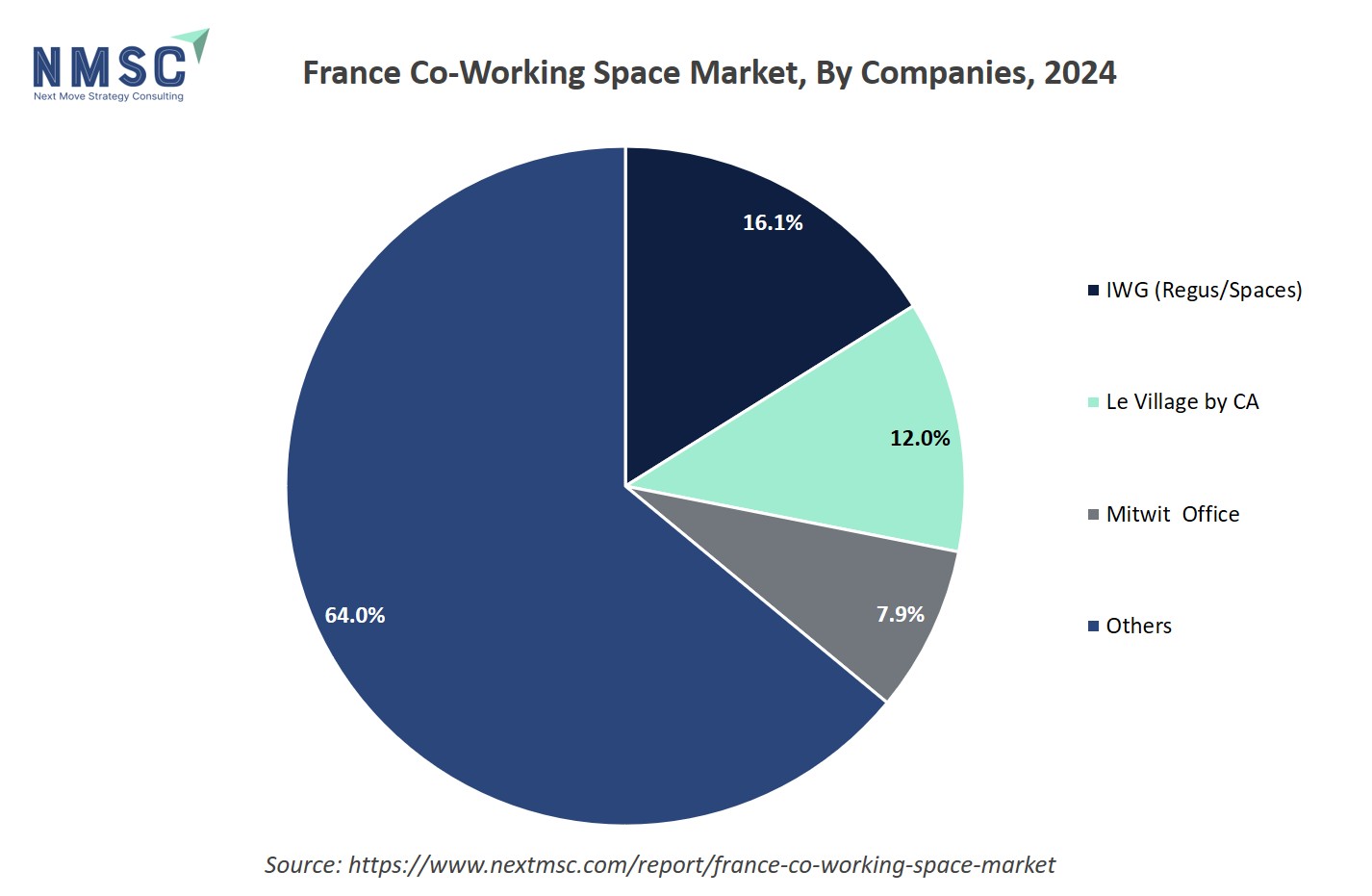

Which Companies Dominate the Co-working Space Industry in France and How do they Compete?

The France co-working space market is led by prominent operators such as IWG (Regus, Spaces), Wojo (Accor), Deskeo, Morning, WeWork, Now Coworking, Flex-O, and others. These players are fueling market growth through sustained investment in flexible design, hospitality-inspired services, and hybrid work integration. Their strategies focus on offering modular workspaces, tech-enabled booking systems, enterprise-grade amenities, and wellness-oriented environments that cater to both startups and large corporates. In response to shifting work preferences, companies are expanding regional hubs beyond Paris, introducing suburban satellite spaces, and developing premium boutique concepts that combine aesthetics with productivity-enhancing features.

The competitive landscape is being shaped by innovation and consolidation, with leading brands upgrading portfolios through acquisitions, landlord partnerships, and asset-light models. Operators are increasingly leveraging digital platforms, community-building programs, and ESG-aligned fit-outs to strengthen differentiation. Several are also exploring partnerships with real estate investors and corporations to accelerate expansion, positioning themselves at the forefront of France’s rapidly modernizing flexible workspace ecosystem.

Market Dominated by France Co-Working Space Giants and Specialists

Large global operators, such as, IWG/Spaces, WeWork uses dense urban footprints, standardized product lines, and enterprise sales teams to secure long, high-value corporate accounts and scale quickly via management agreements. National champions and design-led specialists, like, Morning, Deskeo, and Wojo counter by owning local relationships, premium or hospitality style products, and faster neighbourhood rollouts outside central Paris. The result is a two-tier market: internationals chase scale and corporate portfolios, while specialists target premium pricing, bespoke fit-outs and regional densification to defend margins and member loyalty.

Innovation and Adaptability Drive Market Success

Winning operators combine product innovation (hybrid meeting pods, private HQ suites), tech (enterprise booking, analytics, monthly seat management), and distribution partnerships to grow revenue per user. Accor’s move to make Wojo and Worklib bookable via the ALL-loyalty ecosystem is a textbook distribution and cross-sell play that instantly expands demand channels. At the same time, operators are adopting asset-light and management models that accelerate openings while limiting capex, IWG reported that most 2024 openings were capital-light management or partnership centres. These choices let operators scale faster and focus investment on experience, tech, and client success.

Market Players to Opt for Merger & Acquisition Strategies to Expand Their Presence

Consolidation and landlord partnerships are now commonplace. For example, Deskeo’s signing and operation of 145 Avenue Charles-de-Gaulle in Neuilly (a full building fit-out) shows operator expansion into premium addresses via direct asset deals; IWG’s Factories partnership with Perial AM demonstrates operator-asset manager JVs to convert suburban stock into hybrid hubs; similarly, Morning’s rapid growth under Nexity backing highlights how developer/propco ownership can fast-track rollouts. This deal types shorten go-to-market time and transfer certain development risks to owners.

List of Key France Co-Working Space Companies

-

Le Village by CA

-

Mitwit Office

-

WeWork

-

Deskeo

-

Wojo

-

Schoolab

-

Flex-O

-

Morning

-

Kwerk

-

Hiptown

-

Bureaux & Co

-

Now Coworking

-

Newton Offices

-

La Cordee

What are the Latest Key Industry Developments?

-

March 2025 - Morning Coworking opened its 50th location in the Paris region with a 3,000 square metre eight-story site in Boulogne-Billancourt. The move signals scaling of domestic operators, regional densification and competition with international brands for mid-market and corporate clients.

-

November 2024 - IWG and asset manager Perial AM announced three new Factories by Perial AM and IWG sites scheduled for Q1 2025 across the Paris region and beyond. Strategically, the project repurposes suburban office stock into hybrid hubs to capture commuter decentralisation.

-

June 2024 - Accor integrated workspace providers Wojo and Worklib into its ALL loyalty platform, allowing hotel guests and corporate customers to book coworking spaces and earn points. Strategically, this expands distribution channels for workspaces, boosts cross-selling and strengthens travel-to-workspace demand alignment.

-

May 2024 - WeWork announced that Shares, a French fintech startup, selected a WeWork location for its French headquarters. This highlights ongoing enterprise and scale client demand, validating flexible space as a viable HQ option for fast-growing startups and scaleups in France.

-

February 2024 - Deskeo expanded its portfolio by acquiring an office building at 145 Avenue Charles de Gaulle in Neuilly-sur-Seine, strengthening its presence in premium Paris-region addresses and supporting its growth strategy in high-value flexible workspace locations.

What are the Key Factors Influencing Investment Analysis & Opportunities in the France Co-working Space Market?

Funding in France’s flexible workspace sector is moving from early-stage venture bets toward institutional capital and landlord partnerships as operators scale and seek yield-stable models. 2024–25 saw higher M&A and asset-light deals, joint ventures between operators and asset managers, and growing corporate enterprise contracts that support stronger revenue multiples and re-rating of top operators.

Valuations and investor interest concentrate on Paris and fast-growing regional hubs such as Lyon, Bordeaux and Marseille, plus high-quality suburban decentralised assets that capture hybrid commuters. Premium and niche luxury coworking commands outsized pricing power in central Paris, while secondary cities offer yield-seeking opportunities for conversion plays and long-lease rollouts.

Key Benefits for Stakeholders:

Next Move Strategy Consulting (NMSC) presents a comprehensive analysis of the France co-working space market, covering historical trends from 2020 through 2024 and offering detailed forecasts through 2030. Our study examines the market at global, regional, and country levels, providing quantitative projections and insights into key growth drivers, challenges, and investment opportunities across all major France Co-Working Space segments.

Report Scope:

|

Parameters |

Details |

|

Market Size in 2025 |

USD 1178 Million |

|

Revenue Forecast in 2030 |

USD 3158.2 Million |

|

Growth Rate |

CAGR of 21.8% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Million (USD) |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent to up to 80 analyst-working hours) after purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

|

Approach |

In-depth primary and secondary research; proprietary databases; rigorous quality control and validation measures. |

|

Analytical Tools |

Porter's Five Forces, SWOT, value chain, and Harvey ball analysis to assess competitive intensity, stakeholder roles, and relative impact of key factors. |

Key Market Segments

By Space Type

-

Shared Open Spaces

-

Enclosed Private Suites

-

Virtual Office Solutions

-

Event/Meeting Facilities

By Membership Type

-

Hot Desks

-

Dedicated Desks

-

Private Office Leases

-

Hybrid Flex Passes

By Business Type

-

Standard Coworking

-

Premium Managed Offices

-

Niche/Specialized Spaces

By Business Model

-

Direct Ownership/Operation

-

Franchise/Partnership

-

Real Estate Collabs

By End-User

-

Freelancers/Remote Workers

-

Startups (Less Than 10 Employees)

-

SMEs (10-250 Employees)

-

Large Enterprises (More Than 250)

By Industry Vertical

-

Technology and IT Services

-

Financial and Professional

-

Healthcare and Life Sciences

-

Manufacturing and Logistics

-

Public Sector and Education

-

Others

Conclusion & Recommendations

Our report equips stakeholders, industry participants, investors, policy-makers, and consultants with actionable intelligence to capitalize on France Co-Working Space’s transformative potential. By combining robust data-driven analysis with strategic frameworks, NMSC’s France co-working space market report serves as an indispensable resource for navigating the evolving landscape.

Speak to Our Analyst

Speak to Our Analyst