France Warehouse Robotics Market by Type (Automated Guided Vehicles (AGVs), Autonomous Mobile Robots (AMRs), Articulated Robots, & Others), by Offering (Hardware, Software, and Services), by Payload Capacity (Less than 100 KG, 101-200 KG, 201-500 KG, and Others), by Application (Palletizing and Depalletizing, Sorting and Packaging, Picking and Placing, Transportation) and by End-User (E-commerce, Automotive, Food & Beverages, and Others) – Opportunity Analysis and Industry Forecast, 2025–2030

Industry: Semiconductor & Electronics | Publish Date: 07-Oct-2025 | No of Pages: 224 | No. of Tables: 182 | No. of Figures: 127 | Format: PDF | Report Code : SE3144

France Warehouse Robotics Market Overview

The France Warehouse Robotics Market size was valued at USD 188.9 million in 2024, and is projected to hit USD 321.1 million by 2030, with a CAGR of 8.1 %. In terms of volume, the market size was 6.23 thousand units in 2024 and is projected to reach 11.27 thousand units by 2030, with a CAGR of 9.1% from 2025 to 2030.

The rapid growth in the purchase of goods and services online in France is importantly fueling the warehouse robotics market. These robots show competence and results by performing tasks such as sorting, picking, and packing, reducing manual errors and improving workflows.

The application of robots in warehouse facilities across the region is significantly fueling the France warehouse robotics market growth. However, raises fears about the reduction of employment opportunities for human workers restrains the growth of Warehouse Robotics.

Rapid Growth in Purchase of Goods and Services Drives the Market

The fast growth in the acquisition of goods and services online in France is suggestively fueling the warehouse robotics market. The expansion of e-commerce sector, creates tests for businesses to manage larger volumes of inventory and fulfil orders faster and accurately.

As per the European E-Commerce Report 2024, the percentage of e-shoppers in France increased from 70% in 2019 to 77% in 2023. This cumulative trend of online shopping in this country along with consumer expectations of faster deliveries, drives the companies to invest in mechanization that forces the growth of the market.

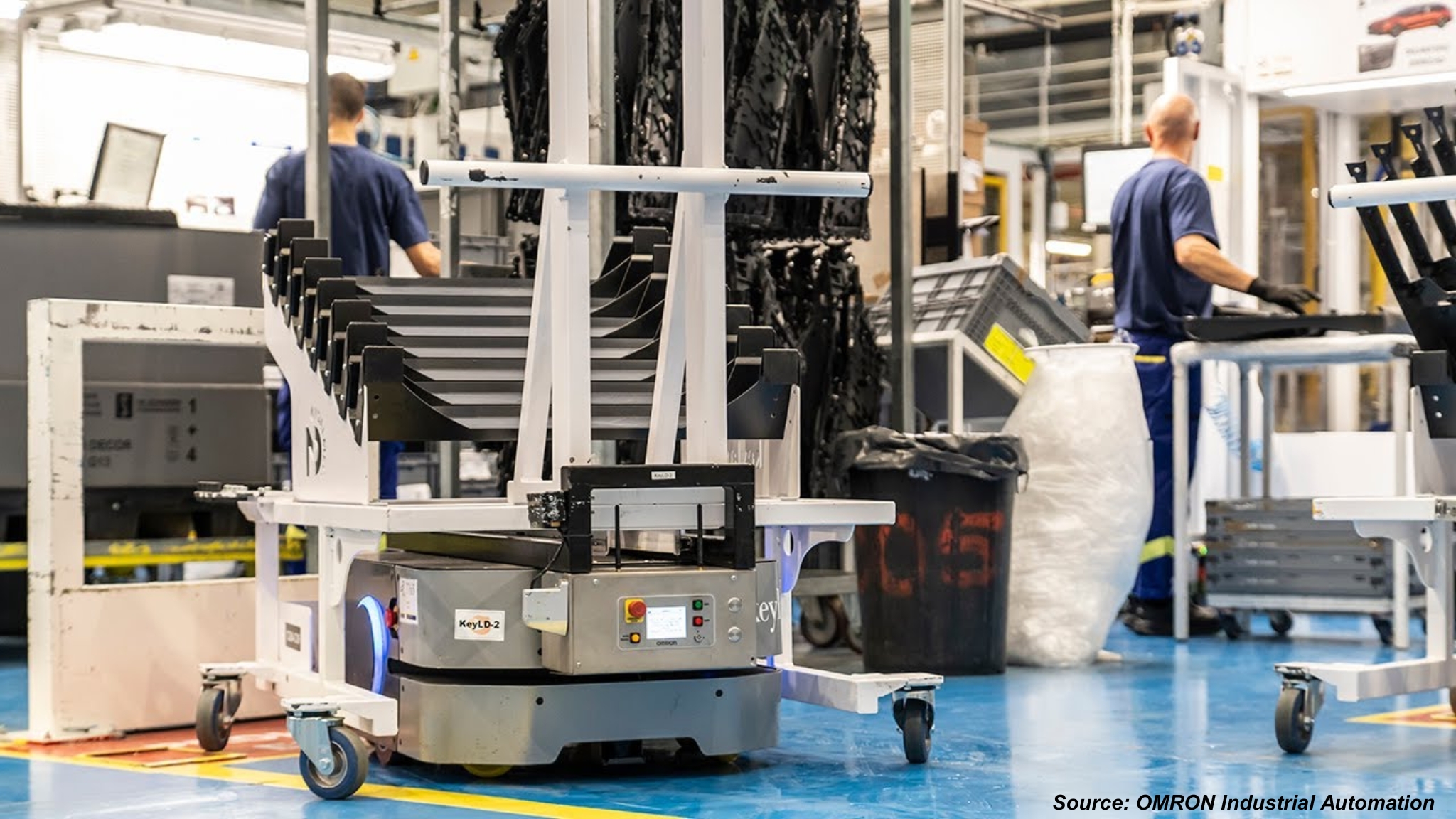

Implementation of Robots in Warehouse Fuels the Demand for Warehouse Robotics

With the application of robots in warehouse facilities is significantly fueling the France warehouse robotics market demand. The French companies striving to enhance operational efficiency, improve accuracy, and meet rising buyer expectations, turn to automation solutions.

For instance, in June 2024, Renault Group new logistic facility is equipped with Excotec’s Skypod robots that aims to reduce human error, lower lead times and improve efficiency across supply chains.

Therefore, as more companies in France adopt these advanced robotics solutions to improve productivity and stay competitive, the demand for smart warehouses continues to rise, further boosting the market growth.

Lower Employment Opportunities for Human Workers Restrain the Growth of the Market

There is a concern over job displacement are restraining the growth of the warehouse robotics market in France. The fear of job losses due to automation led to resistance from workers and labour unions, who are wary of the impact on employment opportunities.

This resistance can slow the adoption of robotics in warehouses, as companies face pressure to protect existing jobs. The apprehension surrounding workforce reduction creates a challenging environment for the widespread acceptance of automation solutions in the country.

Introduction of Artificial Intelligence Creates Future Option for the Market

The addition of artificial intelligence in automated warehouse systems is expected to play a major role allowing growth opportunity for the France warehouse robotics market trends in the future. AI induced solutions improves decision making, optimize inventory management and improve the accuracy and speed of operations that helps warehouses to become more accurate and adaptable.

As such in January 2025, Nvidia disclosed new AI development tools aimed at improving the potential of autonomous robots and vehicles. These models are mad to create synthetic data and simulate physical interactions, allowing developers to create designed templates for testing their AI systems before real-world. These progresses will focus on the transformative potential of AI in warehouse robotics, paving the way for smarter, more lively and highly efficient warehouse operations that meet the future demands of modern supply chain.

Competitive Landscape

The promising players operating in the France warehouse robotics industry includes ABB Ltd., Omron Corporation, KUKA AG, Fanuc Corporation, JBT Corporation, Teradyne Inc., Zebra Technologies, Dematic, Honeywell International Inc, Vanderlande Industries B.V., KNAPP AG, YASKAWA ELECTRIC CORPORATION, Amazon Robotics LLC, Toshiba Corporation, SSI Schaefer and others.

France Warehouse Robotics Market Key Segments

By Types

-

Automated Guided Vehicles (AGVs)

-

Laser Guidance

-

Magnetic Guidance

-

Optical Tape Guidance

-

Vision Guidance

-

Others

-

-

Autonomous Mobile Robots (AMRs)

-

Tow Vehicle

-

Tug Vehicle

-

Unit Load Vehicle

-

Pallet Truck

-

Forklift Vehicle

-

Other Type

-

-

Articulated Robots

-

Collaborative Robots

-

Scara Robots and Cylindrical Robots

-

Others

By Offering

-

Hardware

-

Software

-

Warehouse Management System (WMS)

-

Warehouse Execution System (WES)

-

Warehouse Control System (WCS)

-

-

Services

By Payload Capacity

-

≤ 100 KG

-

101-200 KG

-

201-500 KG

-

501-1000 KG

-

1001-2000 KG

-

2001-5000KMore than 5000 KG

By Application

-

Palletizing and depalletizing

-

Sorting and Packaging

-

Picking and Placing

-

Transportation

By End User

-

E-commerce

-

Automotive

-

Food & Beverages

-

Pharmaceutical

-

Chemical and Materials

-

Semiconductor and Electronics

-

Others

Key Players

-

ABB Ltd.

-

Omron Corporation

-

KUKA AG

-

Fanuc Corporation

-

JBT Corporation

-

Teradyne Inc.

-

Zebra Technologies

-

Dematic

-

Honeywell International Inc

-

Vanderlande Industries B.V.

-

KNAPP AG

-

YASKAWA ELECTRIC CORPORATION

-

Amazon Robotics LLC

-

Toshiba Corporation

-

SSI Schaefer

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size Value in 2024 |

USD 188.9 million |

|

Revenue Forecast in 2030 |

USD 321.1 million |

|

Value Growth Rate |

CAGR of 8.1% from 2025 to 2030 |

|

Market Volume in 2024 |

6.23 thousand units |

|

Unit Forecast in 2030 |

11.27 thousand units |

|

Volume Growth Rate |

CAGR of 9.1% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Million (USD) |

|

Market Volume Estimation |

Thousand units |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Countries Covered |

10 |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst