Home Insurance Market By Product Type (Building Coverage, Contents Coverage, Personal Liability, and Others), By Policy Type (Standard, Comprehensive, Digital), By Distribution Channel (Direct, Bancassurance, Brokers, Online), By Customer Type (Individual, Family, HNW), By Risk Coverage (Fire, Water Damage, Typhoon, Theft), End-User (Residential, Commercial, Mixed-Use) – Global Analysis & Forecast, 2024–2025

Industry Outlook

The global Home Insurance Market size was valued at USD 323.24 billion in 2024, and is expected to be valued at USD 354.33 billion by the end of 2025. The industry is projected to grow, hitting USD 560.87 billion by 2030, with a CAGR of 9.62% between 2025 and 2030.

The market has emerged as a cornerstone of the broader insurance industry, driven by rising awareness of property protection and the growing incidence of climate-related risks, natural disasters, and thefts. Homeownership rates, urbanization, and stricter regulatory frameworks in developed and emerging economies are contributing to steady demand. Insurers are increasingly diversifying their offerings with coverage for both physical structures and personal belongings, while also integrating liability protection. Moreover, rising mortgage penetration has made home insurance a mandatory requirement in many regions, further expanding the consumer base and supporting long-term industry resilience.

The market is undergoing rapid transformation with the integration of digital technologies such as AI, big data analytics, and IoT-enabled smart home devices. These innovations allow insurers to deliver personalized pricing, enhance risk assessment, and streamline claim settlement processes, creating a more customer-centric ecosystem.

Partnerships with real estate firms, banks, and insurtech companies are expanding distribution channels, while sustainability concerns are shaping policies that address eco-friendly homes. Although challenges such as premium affordability and fraud risks remain, the sector is well-positioned for growth, driven by technology adoption, regulatory support, and evolving consumer needs.

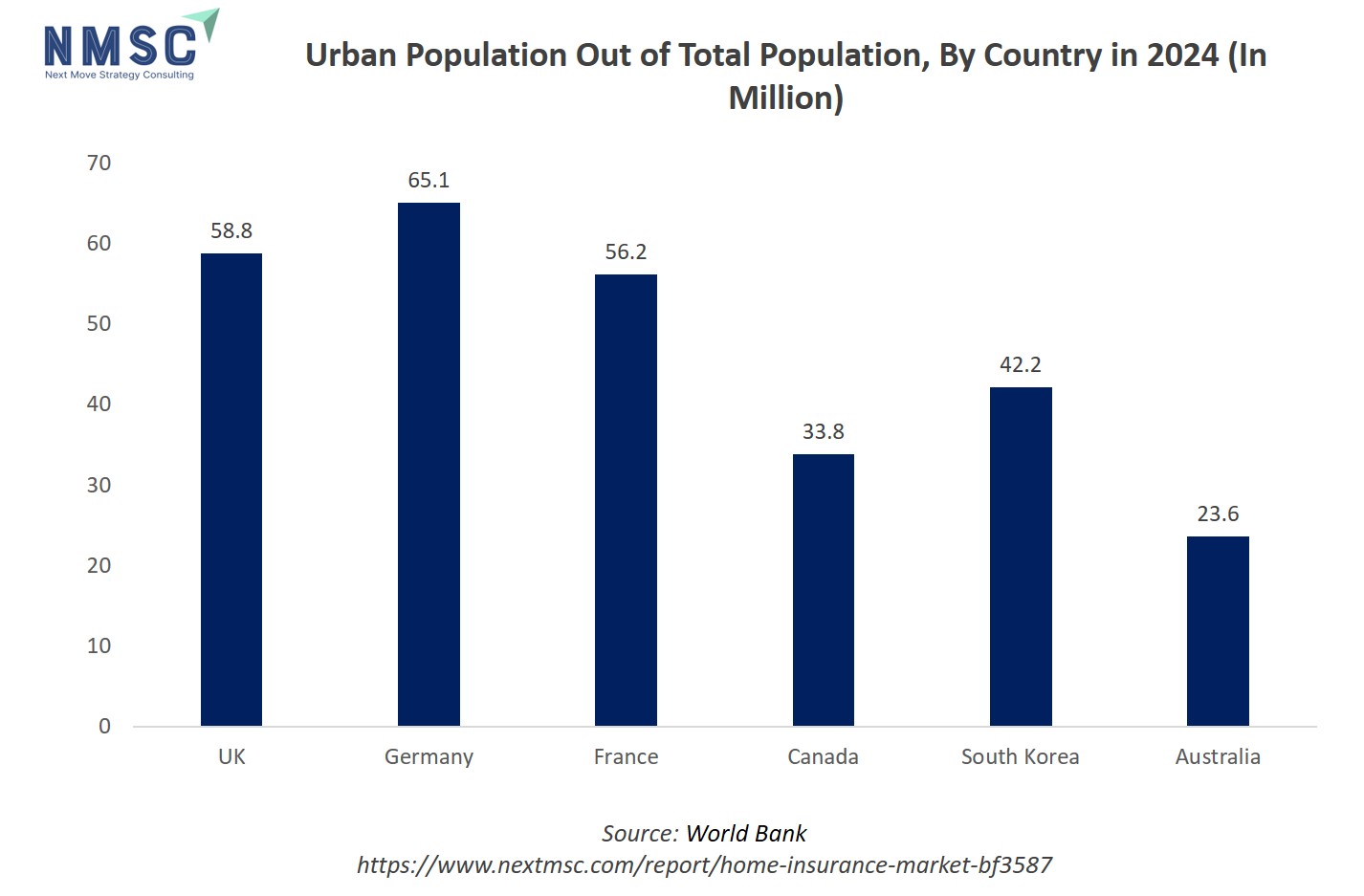

A large urban population is a powerful driver for the growth of the home insurance market. Higher urbanization typically leads to dense residential development, increased property ownership, and greater asset concentration, all of which fuel demand for home insurance products. Urban homeowners are generally more aware of insurance solutions and perceive higher risks from theft, fire, or natural disasters due to a crowded living environment. As cities expand, both individual and institutional investment in real estate rises, leading insurance companies to introduce tailored products and digital services that target urban markets. Consequently, ongoing urbanization directly accelerates market expansion by increasing the number of potential customers who seek financial protection for their homes and belongings.

The chart above presents the urban population figures for six countries in 2024, highlighting significant differences among them. These figures underline the substantial concentration of urban dwellers in major European economies compared to other developed nations. These disparities in urban population size have a direct and significant influence on the demand and scale of the home insurance market share in each country, with higher urban concentrations fueling greater uptake of insurance products as both risks and property values escalate in city environments.

What are the key trends in home insurance industry?

How is the home insurance market responding to accelerating climate and catastrophe losses?

The growing frequency and severity of climate events is reshaping underwriting and pricing across the market. Insured catastrophe losses jumped materially in 2024, forcing carriers to raise rates, restrict capacity in high-hazard zones, and push for resilience investments by homeowners. This pressure is changing product design; we now see more parametric and resilience-linked cover options alongside higher deductibles for wind and wildfire, and a shifting focus toward portfolio-level risk management rather than single-policy pricing. For companies, that means embedding forward-looking hazard models into pricing engines, testing scenario capital plans, and offering targeted retrofit discounts, for example roof upgrades or wildfire defensible space to reduce expected losses while keeping policies affordable.

How is smart home and IoT adoption changing loss prevention and customer engagement in the home insurance market?

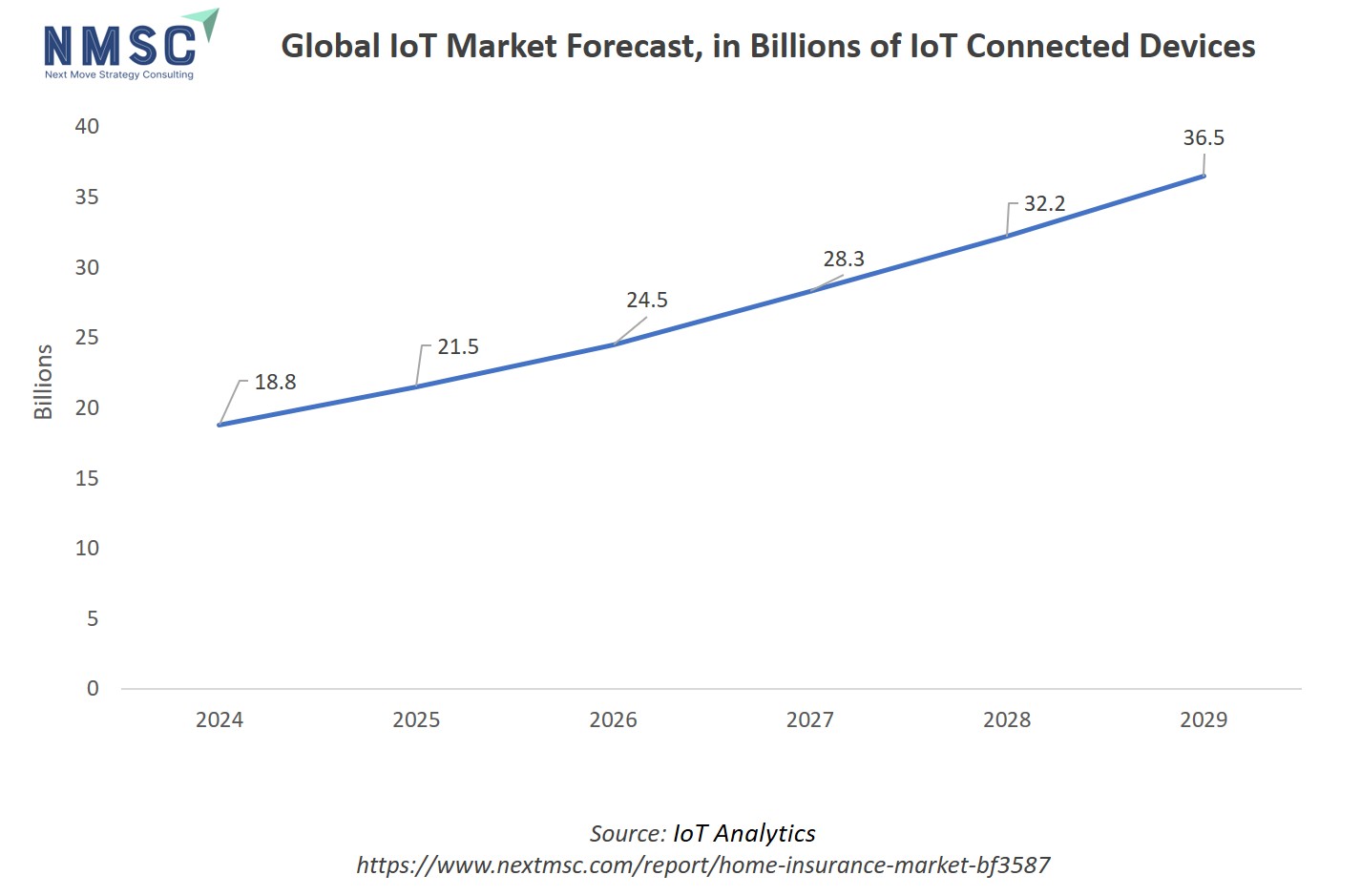

Connected sensors and smart home devices are starting to shift claims dynamics by detecting water leaks, fire risk, or HVAC failures before they become large losses; the broader IoT insurance ecosystem has seen rapid growth as carriers partner with device makers and platform providers to reduce the frequency and severity of small to mid-sized claims. Practically, insurers capture telemetry to refine risk pools and reward safer behaviour with dynamic discounts, while customers receive real-time alerts that prevent losses, a win for both retention and loss ratio. The analysis suggests that successful pilots move beyond simple discount nudges and integrate device-level insights into underwriting flow and claims triage so that alerts directly trigger loss-mitigation workflows.

The chart illustrates the global forecast for IoT-connected devices from 2024 to 2029, showcasing substantial and consistent growth over this period. In 2024, there are 18.8 billion IoT devices, which is expected to rise sharply year-on-year, reaching 21.5 billion in 2025, eventually peaking at 36.5 billion in 2029. This steep upward trend underlines the increasing adoption of IoT technology worldwide.

The exponential rise in IoT-connected devices significantly drives the market growth of the home insurance sector. As more households integrate smart sensors, connected alarms, and monitoring systems into their living spaces, insurers are able to offer dynamic, technology-enhanced products that improve risk assessment and prevention. IoT devices enable real-time data collection on home security, fire, water leaks, and other hazards, empowering insurance providers to develop personalized premiums and proactive services.

How is AI transforming claims automation and fraud detection in the home insurance market?

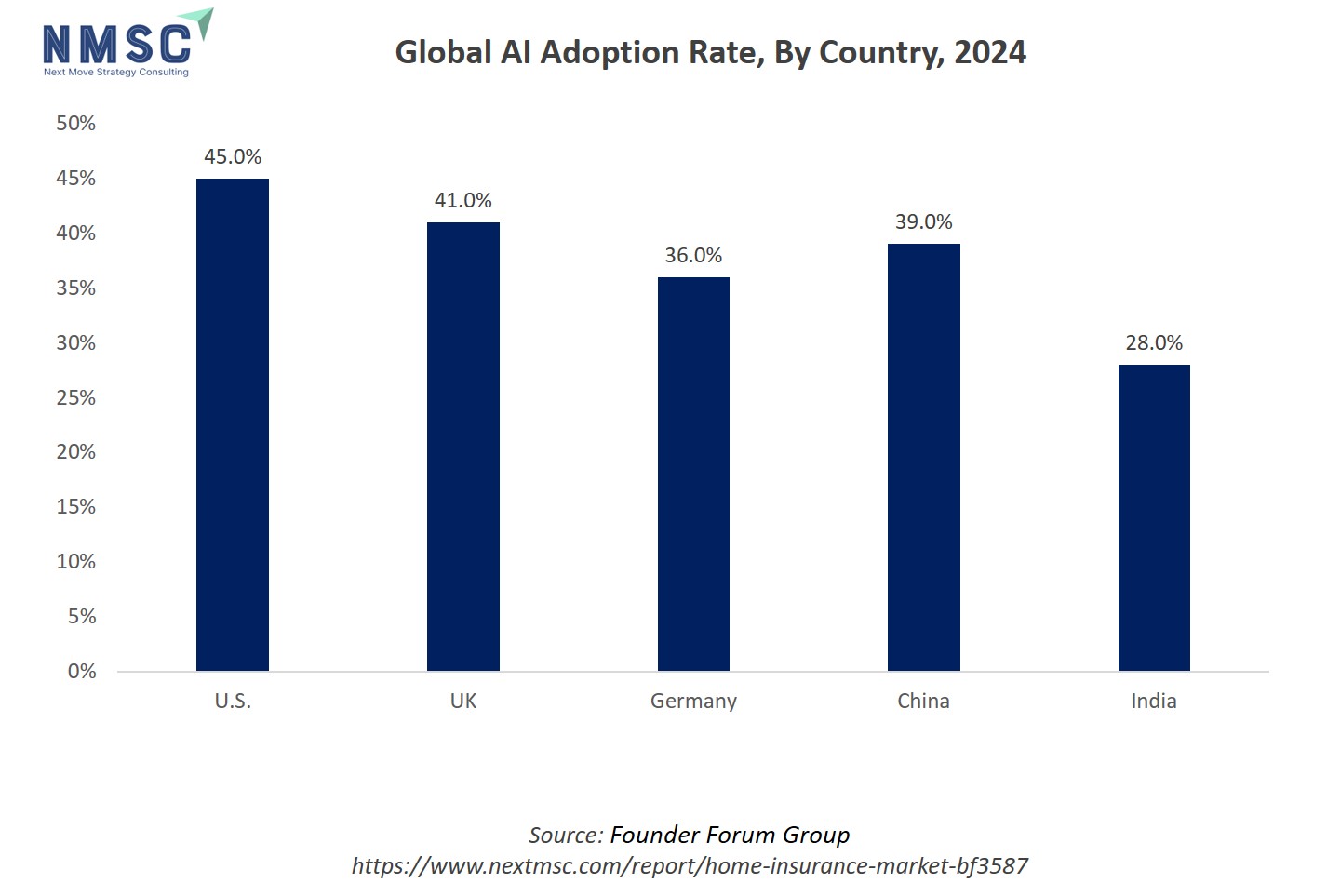

AI and machine learning are accelerating automation across first notice of loss, damage triage, and suspicious-claim detection. Lenders and carriers increasingly deploy models that flag anomalies, speed estimates, and route straightforward payments without manual review. Recent industry research shows insurers are prioritizing AI for fraud detection and claims efficiency as top investments.

The result is faster cycle times and lower operating cost, but also a new governance imperative: models must be explainable, auditable, and monitored for bias and degradation. In conversational terms, AI can act like a tireless claims investigator that screens out obvious fraud and accelerates genuine payments, but only if it is trained on representative data and tied to clear escalation rules.

The chart displays the global AI adoption rate by country for 2024, with the U.S. leading at 45%, followed by the UK at 41%. China and Germany exhibit adoption rates of 39% and 36%, respectively, while India lags behind the group at 28%. This data underscores the strong pace of AI integration in advanced economies compared to emerging markets, revealing disparities in technological readiness and digital transformation.

Higher AI adoption directly propels the home insurance market growth by enabling insurers to deploy advanced analytics, predictive modeling, and automated claims processing. AI tools enhance risk assessment, fraud detection, and personalized policy pricing, making insurance offerings more competitive and appealing to tech-savvy urbanites. The rise of AI-powered platforms supports tailored customer experiences, boosts operational efficiency, and creates innovative product tiers, resulting in increased consumer engagement and improved market penetration for home insurance providers.

How is embedded distribution and partnership-led insurance reshaping market access for homeowners?

Embedding home insurance into mortgage origination, real estate transactions, and smart-home retail checkouts is turning insurance from a separate purchase into a contextual, often instantaneous, element of buying a home or home product. The embedded insurance market has expanded rapidly post 2024 as platforms and insurers build APIs and white label products to capture purchase intent and reduce acquisition cost. The analysis indicates embedded approaches increase attachment rates and conversion while improving lifetime value through better onboarding and tailored cover at point of need. Practically, insurers should expose modular policy components via APIs, price micro cover add ons (for example temporary coverage during renovation), and craft partner economics that align incentives.

What are the key market drivers, breakthroughs, and investment opportunities that will shape the home insurance industry in the next decade?

The home insurance market trends is being reshaped by rising catastrophe frequency, inflation-driven construction costs, and supply chain challenges, which have driven loss costs higher and forced widespread premium repricing. Insured catastrophe losses in 2024 were materially elevated, straining reinsurance capacity and prompting carriers to re-underwrite geographic exposures and tighten availability in hazard-prone ZIP codes.

At the same time, digital data, IoT monitoring, and advances in AI/analytics are creating new growth avenues, while innovations such as parametric products and private flood solutions are expanding market depth. Regulatory reforms, including updates to the NFIP, continue to influence private participation, and insurers that combine disciplined underwriting with proactive risk-prevention services are positioned to expand profitable market share despite mounting volatility.

Growth Drivers:

How is rising climate risk awareness and regulatory focus driving home insurance demand?

Increasing climate-driven risk awareness and regulatory mandates are driving demand. Homeowners are more aware of threats from wildfires, floods, hurricanes, and increasingly frequent extreme weather, which in turn pushes them to seek stronger or more comprehensive coverage. Insurers and regulators are responding, where many jurisdictions now require disclosures, higher building standards, or resilience features, for example, flood mitigation, wildfire defensible space. This means insurers who can offer resilient product options and partner with regulators to reward risk mitigation will see lower loss ratios and gain trust.

How are technology and data-driven innovations fueling the home insurance market growth?

Technological integration and data-driven underwriting innovations are significantly expanding capacity and efficiency. The adoption of IoT devices (leak sensors, fire alarms, smart thermostat data), satellite imagery, AI, and predictive analytics is giving insurers better risk modelling, faster claim adjudication, and personalized pricing. These allow insurers to price policies more accurately, identify emerging risks, reduce fraud, and improve customer satisfaction. Firms that invest early in robust data pipelines, seamless customer interfaces, and transparent AI models stand to capture market share and maintain profitability amid rising loss costs.

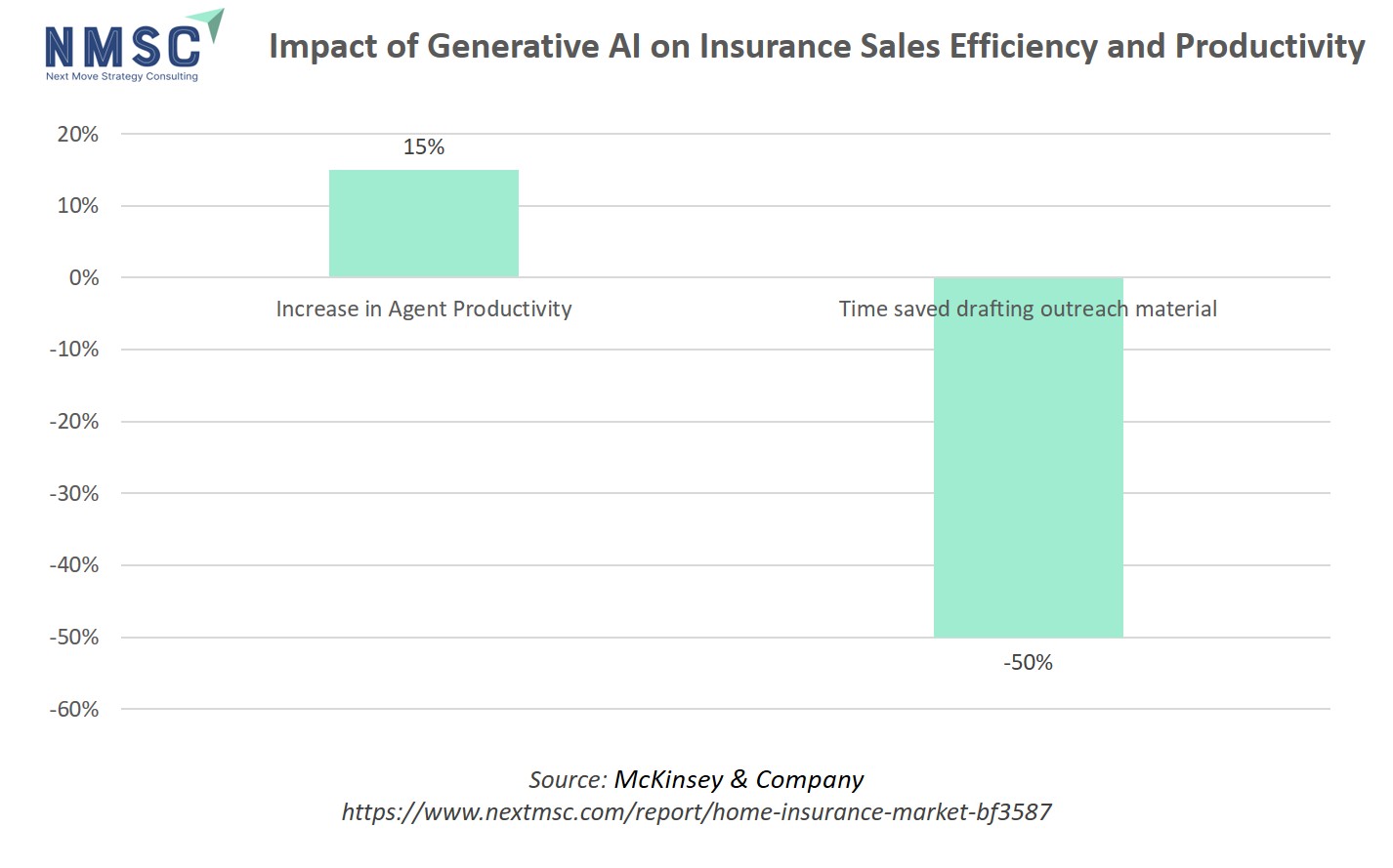

The chart demonstrates the positive impact of generative AI (Gen AI) on insurance sales operations, specifically highlighting two key metrics. First, Gen AI is shown to boost agent productivity by 15%, reflecting the capacity of AI tools to streamline tasks, automate repetitive processes, and augment decision-making. Second, there is a remarkable 50% reduction in the time agents spend drafting outreach materials, illustrating how AI-driven content generation significantly accelerates routine communication tasks in the insurance sector.

These enhancements in efficiency and productivity directly bolster the market growth of the home insurance sector. With less time spent on administrative work and more time available for customer engagement, insurance agents can focus on expanding their client base and delivering personalized services. The productivity gains and operational efficiencies achieved through Gen AI enable insurance providers to reach more potential homeowners, process more policies, and innovate rapidly, all of which lead to higher sales volumes and greater penetration of property insurance products in the market.

Growth Inhibitors:

Why are affordability and availability of home insurance becoming major challenges?

Affordability and availability of coverage in high-risk or disaster-prone areas constitute one major inhibitor. In places vulnerable to climate perils, premiums are rising steeply, for example, homeowners in high‐risk U.S. areas pay on average 82% more than those in lower-risk zones. As losses increase, insurers may withdraw from underwriting new policies in such areas, or impose restrictive deductibles and exclusions.

For many homeowners, even with strong risk awareness, surging premiums and shrinking insurer participation make coverage inaccessible. Without regulatory or public policy intervention (subsidies, zoning laws, resilience grants), the risk of uninsured exposure grows, threatening both consumers and the industry's ability to spread risk sustainably.

How are parametric and climate-risk-linked products creating new opportunities in the home insurance market?

An emerging opportunity lies in parametric and climate-risk-linked insurance products and services. Parametric structures, which pay out based on objective triggers, such as, wind speed, rainfall levels, flood gauges, etc. reduce assessment cost, speed payments, and offer transparency. Insurers and reinsurers can invest in better climate data infrastructure, partner with meteorological agencies, and underwrite parametric products, especially in emerging markets or for high-risk zones. Also, offering resilience upgrades or bonus discounts for mitigation retrofits can tie into these products. Innovators in this space have the potential to open new markets, improve loss predictability, and appeal to risk-conscious consumers and governments.

How the home insurance market is segmented in this report, and what are the key insights from the segmentation analysis?

By Product Type Insights

How do coverage, content, liability, and add-ons shape the future dynamics of the home insurance market?

Based on policy structure, the home insurance market report is divided into coverage type, content coverage, liability coverage, and optional add-ons.

Building coverage, which insures the physical structure, accounts for the bulk of premiums, particularly in regions with high homeownership. According to the Insurance Information Institute (III, 2025), about 97.3% of U.S. homeowners insurance policies include dwelling coverage as the primary component. Content coverage is more significant in Europe and Asia-Pacific markets where apartment living is dominant, while liability coverage is gaining traction globally due to rising legal awareness.

Liability coverage is gaining attention as homeowners face rising risks from accidents, third-party injuries, and legal claims. In the U.S., personal liability claims averaged USD 30,000 per incident in 2024, up 12% from 2022. This trend is pushing insurers to increase limits and integrate liability extensions into bundled home policies. As social and legal systems evolve, even emerging markets are adopting stronger liability components. Optional add-ons, ont the other hand, such as flood, earthquake, cyber, and identity theft coverage, are increasingly shaping product differentiation. With climate volatility, add-ons like flood coverage are in high demand.

By Policy Type Insights

How is the home insurance market segmented by policy type and what key insights emerge?

Based on the Policy type the market is divided into named peril, open peril parametric (index-triggered), and combined (packaged policies).

peril products still serve price-sensitive buyers and specific markets where customers accept trade-offs for lower premiums. Named peril uptake is higher in markets with limited product awareness or where consumers prefer targeted covers, for example, basic fire and theft only. Open peril policies, which cover all risks except listed exclusions, are increasingly attractive in developed markets as homeowners seek fewer surprises and broader protection; roughly 88% of U.S. homeowners carry some form of homeowners insurance, and many prefer broader dwelling protection amid rising per-risk losses. On the other hand, combined or packaged policies, bundling dwelling, contents, liability and optional add-ons into a single, modular product, drive higher attachment rates and simplify distribution, especially via agents and embedded channels. Evidence shows customers convert more readily when insurance is contextual (mortgage origination, home purchase checkout), and combined offers reduce acquisition friction while enabling tailored risk-based pricing.

By Distribution Channel Insights

Which distribution channels are shaping access to home insurance today?

Based on the distribution channel the home insurance market share is divided into insurance companies (direct), banks (bancassurance), digital aggregators, brokers/agents.

Direct sales through insurers’ own channels remain dominant in mature markets, as many homeowners trust established brands and prefer policy transparency. According to the NAIC, over 65% of U.S. homeowners’ policies in 2023 were written directly by insurance companies rather than intermediaries. This model lets insurers strengthen brand loyalty and cut intermediary costs, but it also requires heavy investment in customer service and claims tech.

Banks, however, are increasingly key distributors in Asia-Pacific, Europe, and Latin America, where customers often purchase home insurance alongside mortgages. For example, in India, the Insurance Regulatory and Development Authority (IRDAI) reported bancassurance contributing to nearly 30% of total insurance premiums across life and non-life segments. The advantage is embedded convenience: bundling cover with a home loan. However, product innovation is often limited compared to direct channels.

Aggregator platforms are rapidly expanding in markets like the UK and Europe, where nearly 70% of customers use aggregators to compare policies before purchase, according to the Association of British Insurers (2024). This channel empowers consumers with transparency but pushes insurers into a price-sensitive environment, eroding margins.

By Premium Structure Insights

How is the Home Insurance Market Structured by Premiums in 2025?

Based on the premium structure, the market is divided into regular (annual/monthly), single payment.

In 2025, home insurance premiums are primarily influenced by property value, geographic risk exposure, and the scope of coverage selected. Urban and high-value properties attract higher premiums compared to suburban or rural homes; while dwelling and liability coverage remain the key cost components. Optional add-ons such as cyber protection and home emergency assistance are also adding to premium variability, especially in developed markets. Insurers are increasingly leveraging climate risk models and IoT-enabled smart home data to create more personalized, risk-based pricing structures, helping them manage rising claims from natural disasters while offering fairer premiums to low-risk households.

By End-User Insights

How are end-user needs and premium structures shaping the evolution of the home insurance market in 2025?

Based on the premium structure the market is divided into owner-occupied, landlord (rental properties), tenant (renters), and vacant property.

The industry is increasingly tailoring products to diverse end-user groups, including owner-occupiers, landlords, tenants, and vacant property owners, each with distinct coverage requirements and risk exposures. To meet these needs, insurers are designing flexible coverage bundles that address property-specific risks, such as rental income protection for landlords or tailored renters’ policies for tenants. At the same time, premium structures are evolving beyond traditional annual or monthly payments to include single-payment options and innovative models tied to telematics or smart-home data, rewarding proactive risk management and preventive measures. This dual shift not only improves affordability and accessibility for households with varying budgets but also helps insurers achieve more precise risk-based pricing. By aligning product design with flexible payment models, insurers can expand market reach, retain profitability, and strengthen customer trust in a more volatile risk environment.

Regional Outlook

The market is geographically studied across North America, South America, Europe, the Middle East & Africa, and Asia Pacific, and each region is further studied across countries.

Home Insurance Market in North America

North America remains the largest and most mature market globally. Market dynamics are shaped by pronounced regional disparities in pricing and capacity, driven largely by exposure to natural calamities such as hurricanes, wildfires, and floods. Insurers are increasingly adopting advanced technologies like AI-driven underwriting, IoT-enabled smart home monitoring, and predictive analytics to improve risk assessment and reduce loss frequency. At the same time, variations in state-level regulation and affordability pressures continue to influence product availability across ZIP codes. To manage rising catastrophe risk, carriers are prioritizing data-driven underwriting, incentivizing policyholder mitigation measures, and securing optimized reinsurance placements, ensuring resilience while maintaining sustainable growth in this evolving market.

Home Insurance Market in the United States

The U.S. market shows double-digit homeowners’ premium growth in 2023–24 and improved underwriting outcomes, but availability remains constrained in wildfire and coastal flood zones. Federal analyses (FIO/NAIC filings) highlight ZIP-level price divergence and affordability concerns, motivating both state reform and private flood product growth.

Home Insurance Market in Canada

In Canada, the market is experiencing significant growth driven by rising claims from natural calamities such as floods, wildfires, hailstorms, and severe storms. Insured losses reached a record USD 6.21 billion in 2024, with approximately 228,000 claims during the summer alone, far exceeding historical averages. Premiums have risen nationally by about 4.8% year-over-year, with regional variations; Alberta up 11.6%, Saskatchewan 5.7%, and smaller increases in the Atlantic provinces. Escalating residential building and replacement costs are further fueling rate increases. Insurers are leveraging advanced risk-assessment tools, catastrophe modeling, and predictive analytics, while collaborating with provincial residual markets to maintain capacity and incentivize mitigation in high-risk areas, supporting sustainable growth amid climate-driven pressures.

Home Insurance Market in Europe

In Europe, the market exhibits regional disparities influenced by varying exposure to natural catastrophes and differing levels of insurance penetration. Northern and central European countries maintain robust insurance coverage, while southern regions face increasing risks from droughts, subsidence, and flooding. To address these challenges, insurers are leveraging advanced technologies such as AI-driven risk assessment tools, predictive analytics, and parametric insurance models to enhance underwriting accuracy and expedite claims processing. Additionally, initiatives like the European Commission's Climate Resilience Dialogue aim to bridge the insurance protection gap by promoting public-private partnerships and developing standardized risk metrics. These efforts are complemented by regulatory measures, including the European Insurance and Occupational Pensions Authority's recommendations for clearer consumer information on natural catastrophe coverage and increased capital reserve requirements for insurers to bolster financial resilience.

Home Insurance Market in the United Kingdom

The U.K. home insurance market is undergoing a significant transformation due to escalating climate-related risks and evolving distribution models. In 2024, insurers faced a record USD 0.737 billion in weather-related claims, including damage from 12 named storms; with subsidence claims rising 45% above average amid prolonged dry spells and high temperatures. This surge has contributed to an increase in average premiums. To manage these risks, insurers are adopting advanced technologies such as AI-driven risk assessment, predictive analytics, and smart-home monitoring to improve underwriting accuracy and loss prevention. Concurrently, market consolidation and strategic partnerships with digital platforms reflect a shift toward technology-enabled distribution, balancing efficiency, risk management, and customer engagement while adapting to a changing risk landscape.

Home Insurance Market in Germany

Germany’s home insurance market remains stable, underpinned by mature distribution channels and strong partnerships with reinsurers. To address rising exposures from floods and storms, insurers are increasingly investing in advanced climate risk modelling and predictive analytics, enabling more accurate underwriting and pricing of high-risk properties. In parallel, customer-facing risk mitigation programs, such as flood-proofing guidance, early-warning systems, and property resilience initiatives, are being deployed to reduce potential losses. These combined efforts allow insurers to maintain market stability, enhance resilience against natural calamities, and optimize capital allocation while safeguarding profitability in a changing climate landscape.

Home Insurance Market in France

The French home insurance market is heavily shaped by rising flood and storm risks, managed through a mix of pricing discipline, reinsurer analytics, and public mitigation schemes. According to home insurance, European insurers recorded bumper first-half profits in 2024 following premium hikes, driven in part by increased claims from natural catastrophes such as floods and storms. France’s CatNat system mandates a natural disaster surcharge on property policies, with the state reinsurer CCR providing financial backstop to insurers. Risk prevention programs like PAPI and zoning regulations such as PPRI guide underwriting and loss mitigation, while insurers increasingly adopt advanced technologies; satellite imagery, parametric products, predictive analytics; to enhance claims handling and risk assessment. These combined state and private sector efforts help maintain market resilience, capacity, and homeowner protection amidst growing weather-related exposure.

Home Insurance Market in Spain

Spain faces significant flood and drought issues in certain regions, prompting insurers to leverage improved catastrophe modelling, targeted underwriting, and a growing emphasis on mitigation and risk awareness. Growth is being driven by rising catastrophe losses such as the severe 2024 floods, inflation in rebuilding costs, and regulatory/public-private mechanisms like the CCS, which sustains market capacity and supports risk pricing. At the same time, insurers are investing in advanced risk modelling, digital distribution, and customer-focused resilience measures, although affordability pressures and regulatory limits may constrain upside growth in vulnerable regions.

Home Insurance Market in Italy

Italy’s home insurance market continues to face a wide protection gap, with only about 5.9% of households insured against natural catastrophes such as floods and earthquakes, leaving most homes financially vulnerable. To address this, Italy’s 2024 Budget Law introduced a mandate requiring companies, excluding agricultural businesses to purchase natural catastrophe insurance covering earthquakes, floods, and landslides, supported by a state-backed reinsurance scheme through SACE. Looking ahead, the Italian non-life market is projected to grow strongly, with overall non-life premiums and fire and natural perils premiums potentially climbing, driven by regulatory reforms and heightened risk awareness.

Home Insurance Market in the Nordics

In Sweden, the Property & Casualty insurance sector has seen rising losses tied to extreme weather. Insurers expect at least USD 7 billion in natural hazard-related insured losses for 2024 overall, up sharply from prior years, driven largely by floods, heavy rain, storm and hail damage. Meanwhile, Finland’s non-life insurance premiums grew, with claims paid under non-life policies increasing by about 9% year-over-year, reflecting higher payouts for weather and catastrophe events. Insurers in both countries are relying more on advanced risk modelling, catastrophe mapping, and climate adaptation tools to assess and price exposures.

Home Insurance Market in Asia Pacific

The Asia-Pacific (APAC) home insurance market is experiencing significant growth, driven by urbanization, rising property ownership, and heightened awareness of climate risks. Developed markets like Japan, Australia, and South Korea show high penetration and sophisticated underwriting, supported by reinsurer analytics for enhanced risk assessment and pricing. Meanwhile, emerging markets such as India, Southeast Asia, and China exhibit low insurance penetration but strong growth potential due to rising incomes and urban development. Flood insurance in APAC is also expanding rapidly, with a projected CAGR of 19.7% reflecting the region’s increasing climate-related exposures and the evolving home insurance landscape.

Home Insurance Market in China

China’s home insurance market is expanding rapidly, driven by urbanization, increasing property values, and heightened awareness of climate risks. In 2024, the property and casualty (P&C) insurance sector experienced significant growth, with online insurance purchases becoming increasingly popular, especially among younger demographics. The online insurance segment witnessed a notable surge, with a significant increase in the adoption of digital platforms for insurance transactions.

This digital transformation is further supported by the government's efforts to enhance oversight and mitigate risks in the insurance industry, including the implementation of comprehensive guidelines to improve the sector's overall quality. Additionally, the growing threat of floods and typhoons has led to product innovation and public-private risk-sharing initiatives, with reinsurers playing a crucial role in managing catastrophic losses. These developments underscore the evolving landscape of China's home insurance market, characterized by technological advancements and a proactive approach to climate-related challenges.

Home Insurance Market in Japan

Japan's home insurance market is characterized by high penetration and advanced catastrophe risk modelling, driven by frequent seismic and wind-related events. Insurers employ sophisticated loss modelling techniques and collaborate with partners to provide resilience financing. Additionally, parametric insurance products have been introduced to address gaps in coverage for weather-related damages. For instance, Mitsui Sumitomo Insurance launched a parametric weather insurance product designed to quickly settle claims and automatically provide payouts if key weather metrics reach above a certain threshold. These developments underscore Japan's proactive approach to enhancing its market's resilience and efficiency.

Home Insurance Market in India

India's home insurance market is experiencing rapid growth, driven by increasing property ownership, heightened risk awareness, and regulatory support. The expansion is supported by the Insurance Regulatory and Development Authority of India (IRDAI), which has implemented measures to enhance retail penetration and simplify product offerings. Additionally, the rise of digital platforms has facilitated greater access to affordable home insurance products, catering to the evolving needs of consumers.

Home Insurance Market in South Korea

South Korea’s home insurance market is mature and technologically advanced, with insurers leveraging data analytics for underwriting and distribution to enhance risk assessment and offer personalized policies. The market closely monitors typhoon and precipitation risks to inform pricing strategies, reflecting the country’s vulnerability to natural disasters. In 2024, the market was valued at approximately USD 130 billion. Growth is supported by increasing consumer demand for digital insurance products, following a market rebound of 2.6% in 2024. Overall, South Korea’s home insurance sector is evolving through technological integration, improved risk assessment, and expanding digital distribution, positioning the market for steady growth.

Home Insurance Market in Taiwan

Taiwan's home insurance market combines statutory earthquake coverage with voluntary property insurance, reflecting a dual-layered approach to disaster risk management. The Taiwan Residential Earthquake Insurance Fund (TREIF), established after the 1999 Chi-Chi earthquake, recorded NT USD 5.11 billion in reinsurance premium revenue in 2024, a 9.72% increase from the previous year. Despite this, only 38.6% of households have earthquake coverage. Reforms, such as raising the residential earthquake risk-spreading limit to NT USD 120 billion, aim to improve large-scale claim capacity, while policy uptake continues to rise. Overall, Taiwan’s sector is expanding, enhancing resilience against natural disasters.

Home Insurance Market in Indonesia

Indonesia home insurance market expansion faces significant protection gaps in home insurance, particularly concerning flood and typhoon risks. With low insurance penetration and high uninsured exposures, approximately 92% of properties remain unprotected, leaving millions vulnerable to natural disasters. Traditional insurance models often prove unaffordable or inaccessible for low-income households. In response, there is a growing emphasis on parametric and micro-insurance models, which offer affordable, scalable, and rapid-response coverage. These models are increasingly recognized as viable solutions to address the protection gap and enhance resilience against climate-related disasters.

Home Insurance Market in Australia

Australia’s home insurance market faces high climate-related risks, particularly in coastal and northern regions prone to storms and floods. The Insurance Council of Australia monitors availability, while smaller insurers have increased market share to 43% in 2024. Rising premiums, sometimes over 30% of household income, reflect affordability pressures, highlighting the need for resilient and sustainable insurance solutions.

Home Insurance Market in Latin America

Latin America's market faces significant challenges due to low penetration and high climate exposure, particularly in Mexico, Brazil, and parts of the Caribbean. Approximately 92% of properties in these regions remain uninsured, leaving them vulnerable to natural disasters. In response, innovative financial instruments such as catastrophe bonds and parametric insurance programs are gaining traction. These tools offer rapid payouts and affordable coverage, providing a means to bridge the protection gap where public resources are limited. For instance, in 2024, parametric insurance initiatives were highlighted as critical for building resilience and closing the protection gap in the Pacific, with similar applications in Latin America.

Home Insurance Market in the Middle East & Africa

The home insurance landscape in the Gulf Cooperation Council (GCC) countries and Africa shows contrasting dynamics. GCC markets have high asset values and strong insurance capacity, with robust underwriting and diverse products; for example, Gulf Insurance Group reported consolidated assets of USD 4.01 billion across multiple countries in 2024. In contrast, many African markets face low penetration and limited coverage, with natural disasters causing USD 0.5 billion in economic losses in H1 2024 while insurance uptake remains below 1%. To address these gaps, catastrophe bonds and parametric insurance are gaining traction; for instance, the African Risk Capacity issued USD 2.77 million to Lesotho in 2025 following a drought. These innovations are critical for bridging protection gaps and supporting resilience in high-risk, low-penetration markets.

Competitive Landscape

What are the Top Companies in Home Insurance Market and How They are Competing Against One Another?

Global home insurance is led by legacy giants and large diversified insurers such as State Farm, Allstate, Liberty Mutual, Chubb, Travelers and progressive regional players; market share reporting from regulatory filings and industry rankings shows these incumbents still dominate premium volumes and distribution networks. They compete on scale, agent and broker relationships, underwriting expertise and balance-sheet strength, while challenger insurtechs use direct digital channels, AI pricing, and fast claims to pressure margins. Incumbents defend share through scale economics, reinsurance programs, and selective rate increases in high-risk areas, whereas digital natives focus on customer experience and niche products to win younger segments.

Dominance of Home Insurance Industry Giants and Specialists

Competition is bifurcated between national full-service carriers and specialists focused on catastrophe, high-net-worth, or digital distribution. National giants use extensive agent networks and state-by-state underwriting to manage regulatory variation, while specialists and reinsurers concentrate on high-risk zones or niche products like flood and high value homeowners’ coverage. Regulators and rising catastrophe losses force carriers to refine territory appetite, creating pockets where fewer firms will underwrite. This opens margin opportunities for well-capitalized specialists and parametric providers to expand selectively

Innovation and Adaptability Drive Market Success

Top players are accelerating AI for claims triage, telematics, and IoT partnerships for proactive loss prevention, and data platforms for refined underwriting. Insurtechs like Lemonade emphasize rapid AI underwriting and claims automation to lower cost per policy while incumbents invest in data ingestion, catastrophe modelling and customer portals. Strategic playbooks include buying analytics capabilities, BPaaS partnerships with proptech, and piloting parametric covers. Those who combine robust capital, trusted distribution, and modular digital stacks are best placed to translate innovation into profitable growth amid rising loss costs.

Market Players to Opt for Merger & Acquisition Strategies to Expand their Presence

Mergers and acquisitions accelerate scale, distribution access and product breadth. Recent examples include Arch Insurance’s 2024 acquisition of Allianz’s U.S. MidCorp and Entertainment businesses to bolster middle market reach. Also, Ageas announced acquisition of UK home and auto insurer esure in 2025 to gain online and comparison-site strength. Similarly, Munich Re’s purchase of Next Insurance expanded direct underwriting capabilities in small commercial lines, illustrating how reinsurers and carriers use deals to add technology, customers and underwriting talent quickly. These strategic moves reflect a broader trend of consolidation in the industry, driven by the need for scale, technological advancement, and enhanced competitiveness.

List of Key Home Insurance Companies

-

Allianz Insurance plc

-

Zurich

-

Chubb

-

Travelers

-

USAA

-

Progressive Casualty Insurance Company

-

Nationwide Mutual Insurance Company

-

Aviva

-

Tokio Marine Group

-

American International Group, Inc.

-

Generali Hellas S.A

What are the Latest Key Industry Developments?

-

February 2025- Aon, Swiss Re Corporate Solutions and parametric specialist Floodbase created a parametric insurance solution targeting storm surge risk along U.S. coasts. It’s meant to help bridge protection gaps in traditional policies for coastal and natural disaster exposures.

-

September 2024- New Zealand insurer Tower partnered with CelsiusPro to launch a parametric insurance platform, introducing a Cyclone Response Cover for Fiji and Tonga. Real-time cyclone intensity triggers (using Joint Typhoon Warning Center data) aim to speed payouts in affected areas.

-

August 2024- AXA announced its market-first Heatwave Parametric Insurance product to protect outdoor workers during extreme heat. Climatic data showing rising average temperature trends helped motivate this product.

-

August 2024- Cayman Islands National Insurance Company (CINICO) launched a home insurance product with first-in-market parametric coverage. This policy pays pre-agreed amounts automatically in the event of a Category 3+ hurricane passing nearby, helping homeowners with incidental costs even if there’s no physical damage.

-

May 2024- First Central Insurance & Technology Group launched its new home insurance line in the UK, offering buildings & contents cover direct-online and via comparison sites, applying a data-first pricing strategy similar to its motor insurance business.

What are the Key Factors Influencing Investment Analysis & Opportunities in Home Insurance Market?

Investor appetite has rebounded in insurtech, especially among breakout-stage companies (Series B/C), after a cooling post-pandemic. Global insurtech funding in Q3 2024 hit USD 1.38 billion, led by larger rounds; mega-deals (>USD 100 million) made up over half of that total. Valuations have also shown mixed trends. While some early-stage firms retain high revenue multiples, the average valuation multiple for insurtechs in 2024 is around 9.7× revenue, reflecting increased investor caution.

Asia-Pacific, especially India and Southeast Asia, are becoming major investment hotspots, driven by rapid urbanization, rising homeownership, and low insurance penetration. Renewbuy in India raised USD 10 million in mid-2025 to fuel growth, showing strong local investor interest. Meanwhile, established hubs in the U.S. and Europe continue to draw capital for mature models, embedded insurance, and AI-based risk tools. The combination of growing risk exposure (e.g. climate) plus technological innovation is pushing investors toward regions and niches where both upside is high and competitive differentiation is possible.

Key Benefits for Stakeholders:

Next Move Strategy Consulting (NMSC) presents a comprehensive analysis of the home insurance market, covering historical trends from 2020 through 2024 and offering detailed forecasts through 2030. Our study examines the market at country levels, providing quantitative projections and insights into key growth drivers, challenges, and investment opportunities across all major home insurance segments.

The home insurance industry delivers distinct value to multiple stakeholders. Investors benefit from a resilient sector with recurring premium flows, growing insurtech innovation, and attractive opportunities in climate-linked and parametric products that can diversify portfolios. Policymakers gain by promoting financial stability, as broad insurance coverage reduces post-disaster fiscal burdens while supporting resilience goals through incentives for safer housing. Customers benefit most directly through financial protection of their homes and belongings, peace of mind against natural or man-made risks, and increasingly personalized, technology-driven services such as IoT-based loss prevention and faster AI-enabled claims. Together, these synergies create a sustainable, growth-oriented ecosystem.

Report Scope:

|

Parameters |

Details |

|

Market Size in 2025 |

USD 354.33 Billion |

|

Revenue Forecast in 2030 |

USD 560.87 Billion |

|

Growth Rate |

CAGR of 9.62% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

30 |

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 analyst-working hours) after purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

|

Approach |

In-depth primary and secondary research; proprietary databases; rigorous quality control and validation measures. |

|

Analytical Tools |

Porter's Five Forces, SWOT, value chain, and Harvey ball analysis to assess competitive intensity, stakeholder roles, and relative impact of key factors. |

Key Market Segments

By Policy Structure

-

Coverage Type

-

Dwelling Coverage

-

Fire, Smoke & Explosion

-

Natural Disasters

-

Structural Damage

-

-

-

Content Coverage

-

Personal Belongings

-

High-value Items

-

Additional Living Expenses

-

-

Liability Coverage

-

Personal liability

-

Medical Payments to Others

-

-

Optional Add-ons

-

Home Emergency Assistance

-

Cyber Protection

-

Pet Damage Coverage

-

By Policy Type

-

Named Peril

-

Open Peril

-

Parametric (Index-Triggered)

-

Combined (Packaged Policies)

By Distribution Channel

-

Insurance Companies (Direct)

-

Banks (Bancassurance)

-

Digital Aggregators

-

Brokers/Agents

By Premium Structure

-

Regular (Annual/Monthly)

-

Single Payment

By End‑User

-

Owner-Occupied

-

Landlord (Rental properties)

-

Tenant (Renters)

-

Vacant Property

Geographical Breakdown

-

North America: U.S., Canada, and Mexico.

-

Europe: U.K., Germany, France, Italy, Spain, Sweden, Denmark, Finland, Netherlands, and rest of Europe.

-

Asia Pacific: China, India, Japan, South Korea, Taiwan, Indonesia, Vietnam, Australia, Philippines, and rest of APAC.

-

Middle East & Africa (MENA): Saudi Arabia, UAE, Egypt, Israel, Turkey, Nigeria, South Africa, and rest of MENA.

- Latin America: Brazil, Argentina, Chile, Colombia, and rest of LATAM.

Conclusion & Recommendations

Our report equips stakeholders, industry participants, investors, policy-makers, and consultants, with actionable intelligence to capitalize on the market’s transformative potential. By combining robust data-driven analysis with strategic frameworks, NMSC’s Home Insurance Market Report serves as an indispensable resource for navigating the evolving landscape.

The future of the global home insurance market lies in balancing risk, affordability, and innovation. Rising climate-related losses will continue to challenge traditional models, but advances in data analytics, AI-driven claims, and parametric solutions present opportunities for insurers to enhance resilience and customer trust. Strategic collaborations with technology providers, real estate ecosystems, and policymakers will be critical for expanding access and mitigating systemic risks. Investors should watch for growth in emerging markets where insurance penetration is low but demand is rising. Overall, the industry’s outlook remains strong, anchored by innovation, regulatory evolution, and evolving consumer needs.

Speak to Our Analyst

Speak to Our Analyst