Hong Kong Home Insurance Market By Product Type (Building Coverage, Contents Coverage, Personal Liability, and Others), By Policy Type (Standard, Comprehensive, Digital), By Distribution Channel (Direct, Bancassurance, Brokers, Online), By Customer Type (Individual, Family, HNW), By Risk Coverage (Fire, Water Damage, Typhoon, Theft), By End User (Residential, Commercial, Mixed-Use) – Hong Kong Analysis & Forecast, 2024–2025

Hong Kong Home Insurance Industry Outlook

The Hong Kong Home Insurance Market was valued at USD 478 million in 2024 and is expected to reach USD 513 million by 2025. Looking ahead, the industry is projected to expand significantly, reaching USD 892 million by 2030, registering a CAGR of 7.5% from 2025 to 2030.

The Hong Kong home insurance market growth is being driven by rising property values, increasing urban density, and heightened awareness of climate-related risks such as typhoons and flooding. Investments in digital insurance platforms, AI-driven claims processing, and inclusive policy offerings are supporting innovation and customer engagement. Regulatory frameworks, including updates under the Mortgage Insurance Programme and the Risk-Based Capital (RBC) regime, are further shaping market dynamics, ensuring robust coverage standards and compliance.

The Hong Kong home insurance market is evolving with a strong focus on customizable policies, enhanced risk assessment models, and streamlined digital processes, reflecting Hong Kong’s modern housing landscape and the growing demand for comprehensive, tech-enabled home insurance solutions.

What are the key trends in Hong Kong home insurance industry?

Are Digital Platforms Drive a New Era of Home Insurance in Hong Kong?

The Hong Kong home insurance market is rapidly embracing digital-first solutions to meet the needs of tech-savvy homeowners, tenants, and landlords. A clear example is QBE Hong Kong’s launch of the Home Plus Protection Package (HPPP) in Macau in 2024; an all-in-one policy tailored for different residential needs. Its standout feature is full online accessibility, allowing customers to purchase coverage directly through QBE’s new platform.

This reflects a broader shift in Hong Kong where insurers are moving beyond traditional, paper-heavy distribution models and adopting convenient, customizable, and transparent online offerings. Consumers increasingly expect to manage policies digitally, from purchase and comparison to claims filing, making user-friendly platforms a critical differentiator in the Hong Kong home insurance market. For insurers, this transformation not only reduces operating costs but also opens opportunities to personalize products using customer data and strengthen long-term engagement. As digital adoption accelerates, online-first home insurance packages are set to become a cornerstone of growth and innovation in Hong Kong’s insurance sector.

Is Hong Kong’s Smart-Home Adoption Transforming the Home Insurance Market?

Yes, the growing use of smart-home technologies in Hong Kong is reshaping how insurers design and deliver home insurance products. Urban residents are increasingly adopting IoT-enabled devices such as leak detectors, smart locks, and energy monitoring systems, which not only enhance household safety but also lower the probability of costly claims. Insurers view these devices as risk-reducing tools, making them an attractive basis for offering discounted premiums or bundled protection plans.

The city’s broader push toward sustainability and green finance is also driving insurers to integrate eco-efficient and resilient home features into their coverage. This trend aligns with the government’s vision of creating safer and more sustainable living environments, where insurance acts as both a safety net and an incentive for proactive risk management.

Will AI-Powered Underwriting Redefine Home Insurance in Hong Kong?

Yes, AI-driven risk assessment systems are set to transform how insurers in Hong Kong evaluate and price home coverage. These systems leverage building-level data, historical claims records, and even weather forecasts to deliver more precise risk segmentation. The benefits are significant: reduced underwriting time, stronger fraud detection, and the ability to offer dynamic, usage-based pricing that aligns with individual household risk profiles.

For example, The Insurance Authority (IA) has launched its AI Cohort Programme in August 2024, to guide insurers in adopting artificial intelligence responsibly. According to an IA survey of over 110 insurers, 20% already have AI adoption strategies in place, more than half are running pilot projects, and about 40% plan to increase their AI investment over the next two years. This shows a strong momentum toward embedding AI across Hong Kong’s insurance value chain, making AI-powered underwriting a defining trend for the Hong Kong home insurance market in the coming decade.

What are the key market drivers, breakthroughs, and investment opportunities that will shape the Hong Kong home insurance industry in next decade?

The Hong Kong home insurance market is undergoing a period of transformation, fuelled by urban densification, climate-related risks, and the adoption of smart-home technologies. Rising high-rise housing developments, combined with an aging building stock, are increasing the demand for comprehensive and digitally enabled protection plans. At the same time, sustainability initiatives and government-backed green finance policies are pushing insurers to integrate eco-efficient and resilient features into home insurance offerings.

However, the Hong Kong home insurance market faces headwinds. Regulatory complexity, underinsurance culture, and low consumer awareness remain persistent barriers. Still, breakthroughs in AI-powered underwriting, IoT-based risk monitoring, and digital-first platforms are creating new growth opportunities. Companies that can align their solutions with evolving regulations, embrace automation, and design customer-centric, digital-first, and risk-preventive products will capture significant market share in the coming decade.

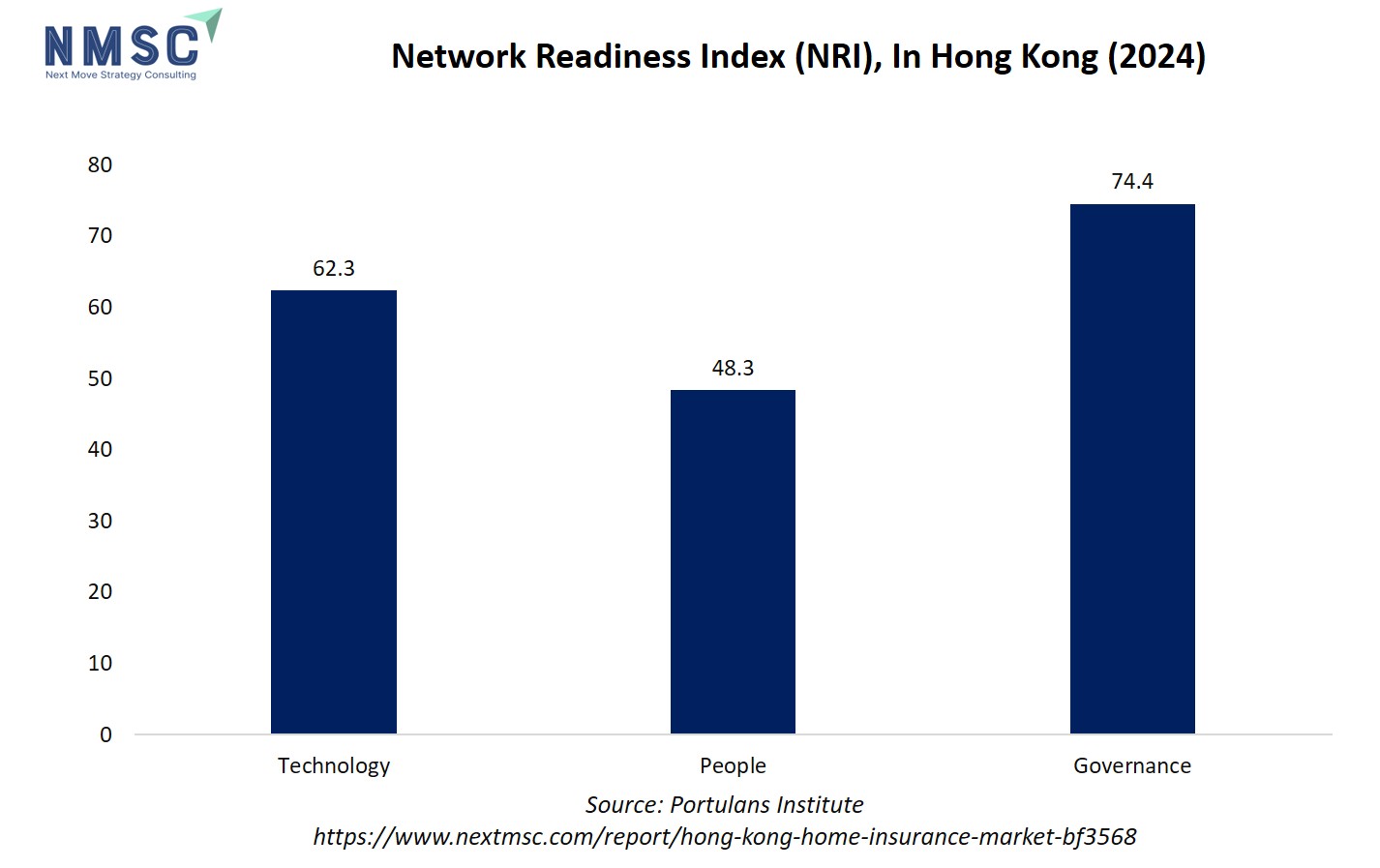

The bar chart illustrates Hong Kong’s Network Readiness Index (NRI) scores across four dimensions: Technology, People, Governance, and Impact. Hong Kong has a Technology score of 62.31, indicating strong ICT infrastructure and digital adoption. The People score is 48.33, reflecting moderate digital skills and usage among the population. Governance is the highest at 74.43, showing strong regulatory frameworks and effective policy enforcement. The Impact score, while not explicitly stated, reflects the socio-economic benefits derived from technology adoption.

This technological readiness has a direct connection to the Hong Kong home insurance market. High scores in Technology and Governance suggest that insurers can leverage digital platforms, smart-home integrations, and predictive analytics to offer more efficient and tailored insurance products. The moderate People score indicates the need for user-friendly digital tools to engage homeowners effectively. Strong governance ensures reliable policy enforcement and risk assessment, which increases consumer trust in home insurance products. Consequently, these factors collectively support the growth and modernization of the market, enabling insurers to innovate and meet the needs of urban residents in a technologically advanced environment.

Growth Drivers:

Is urban housing density driving demand for home insurance in Hong Kong?

Yes, according to the World Bank, Hong Kong’s entire population was urban in 2024 (100%), underscoring the city’s complete reliance on vertical living. With residents concentrated in high-rise apartments and dense residential complexes, risks such as fire, flooding, water leakage, and structural faults are magnified, often spreading across multiple units at once. This environment is fueling strong demand for multi-risk home insurance solutions that go beyond individual coverage to include shared facilities such as lifts, lobbies, and piping systems. Insurers are responding by designing comprehensive strata-titled and landlord-tenant policies that address both collective and unit-level risks, while also experimenting with innovations like parametric flood protection, modular policies for multi-family complexes, and partnerships with property managers to integrate AI-based monitoring. At the same time, modernization of Hong Kong’s aging building stock and rising adoption of smart-home technologies such as IoT water sensors and leak detectors are driving the bundling of insurance with preventive solutions, enabling insurers to reduce claims frequency while offering customers more resilient and convenient protection.

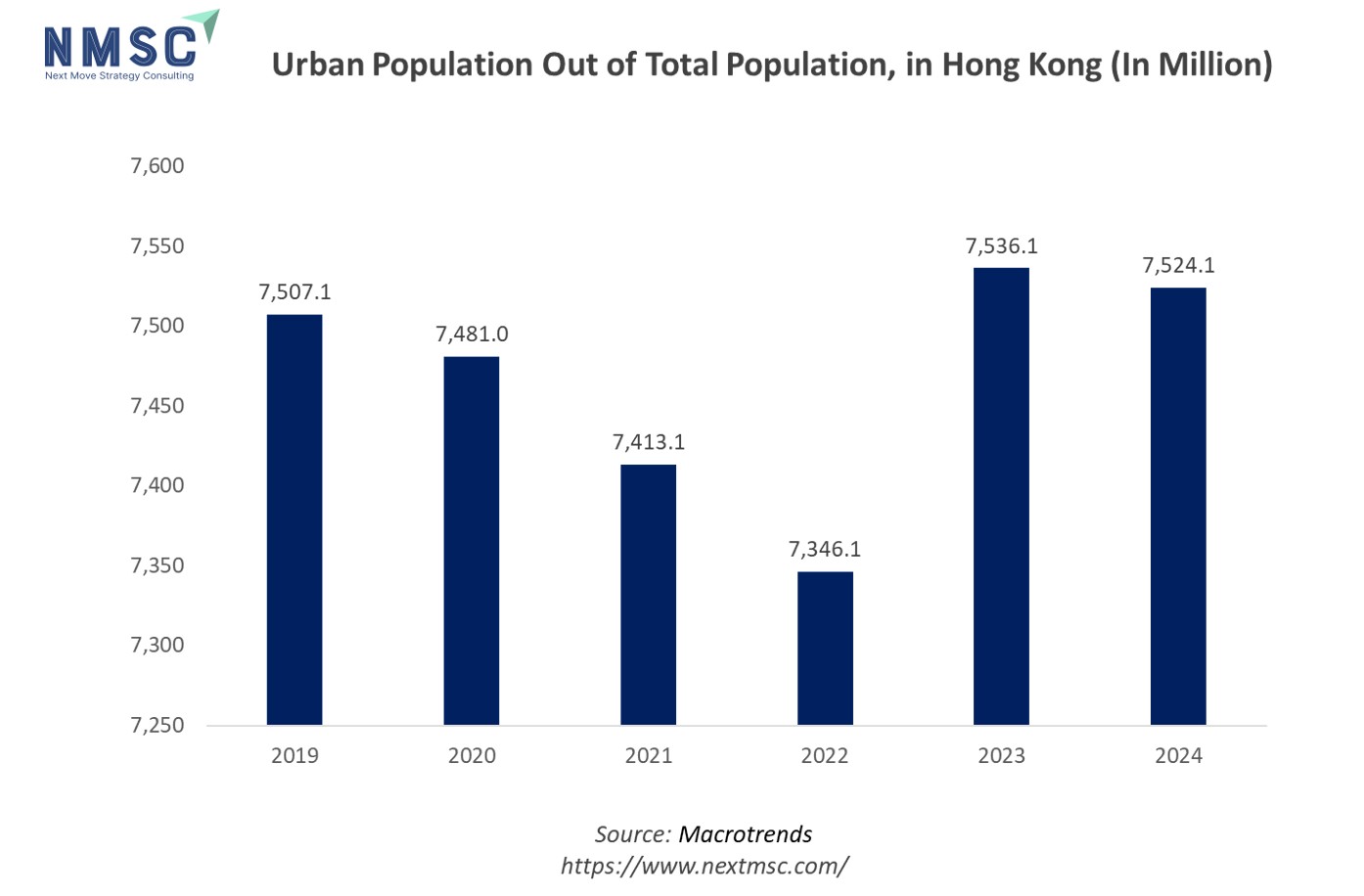

The chart illustrates Hong Kong’s urban population, measured in millions, from 2019 to 2024. In 2019, the urban population was 7.5079 million, which slightly declined to 7.481 million in 2020 and continued to decrease in 2021 (7.4131 million) and 2022 (7.3461 million). In 2023, the population rebounded to 7.5361 million, followed by a minor decline to 7.5241 million in 2024. Overall, the trend shows slight fluctuations, with a dip during 2020–2022 and recovery afterward.

The urban population trend has a direct influence on Hong Kong home insurance market demand. A larger urban population increases the number of households, which drives demand for home insurance products. The dip in urban population during 2020–2022 may have slightly slowed market growth, while the recovery in 2023–2024 supports renewed demand for residential insurance policies. Additionally, as urban populations grow in densely populated areas, homeowners increasingly seek comprehensive coverage against risks such as fire, natural disasters, and theft, prompting insurers to offer more tailored and technologically advanced home insurance solutions, including digital-first platforms and IoT-enabled monitoring services.

Is climate change accelerating demand for home insurance in Hong Kong?

Yes, climate change is becoming a critical driver of home insurance adoption in Hong Kong as the city faces rising exposure to typhoons, flash floods, and extreme rainfall. In recent years, insured losses from weather-related events have increased, highlighting vulnerabilities in both high-rise apartments and older housing infrastructure. This has pushed insurers to expand climate resilience coverage with flood protection add-ons, temporary relocation benefits, and emergency repair services. The heightened awareness of climate risk is not only reshaping consumer demand but also creating long-term opportunities for insurers to design innovative, catastrophe-ready products that align with evolving regulatory frameworks and Hong Kong’s broader push for resilient urban living

Growth Inhibitors:

Is low consumer awareness hindering insurance penetration?

Yes. Despite growing risks, a significant portion of Hong Kong households remain underinsured or uninsured, often relying solely on building management coverage that does not extend to contents or personal liability. This gap is limiting market expansion. Industry reports highlight that education and awareness campaigns will be critical in overcoming this barrier and boosting adoption.

Is regulatory complexity slowing product innovation?

Yes, Hong Kong’s insurance sector is tightly regulated by the Insurance Authority (IA), and compliance requirements can lengthen product development cycles. While necessary for protecting consumers, these rules add costs and reduce agility for insurers.

How Hong Kong home insurance market is segmented in this report, and what are the key insights from the segmentation analysis?

By Coverage Type Insights

Which coverage types dominate Hong Kong’s home insurance market?

On the basis of coverage type, the Hong Kong home insurance market share is segmented into dwelling coverage, content coverage, and liability coverage. Dwelling coverage leads the market, driven by Hong Kong’s dense high-rise housing landscape where risks of fire, smoke, natural disasters, and structural damage are heightened. The rising frequency of climate events such as typhoons and flash floods has made structural protection an essential component of home insurance policies. Content coverage is the second-largest segment, covering personal belongings, high-value items, and additional living expenses. With increasing affluence and adoption of smart-home devices, insurers are offering enhanced protection for electronics, jewelry, and luxury goods. Liability coverage, while smaller in share, is gaining traction as policies covering personal liability and medical payments to others become more relevant in shared living environments and rental properties.

By Policy Type Insights

Are packaged and parametric policies reshaping Hong Kong’s home insurance offerings?

Based on policy type, the Hong Kong home insurance market is segmented into named peril, open peril, parametric (index-triggered), and combined (packaged policies). Named peril policies remain common due to affordability, offering protection against specific risks such as fire and theft. However, demand for open peril policies is rising as consumers seek broader, all-risk coverage. A major growth driver is parametric insurance, particularly for flood and typhoon risks, where payouts are triggered by measurable weather indices. This approach ensures faster claims settlement and is gaining favor among urban homeowners. Combined packaged policies are also expanding, offering comprehensive protection by bundling dwelling, contents, and liability coverage into a single product—appealing to both landlords and tenants in Hong Kong’s rental-heavy housing market.

By Distributional Channel Insights

How are digital platforms and bancassurance transforming distribution in Hong Kong?

On the basis of distribution channel, the Hong Kong home insurance market is segmented into insurance companies (direct), banks (bancassurance), digital aggregators, and brokers/agents. Bancassurance dominates, reflecting Hong Kong’s strong financial sector integration, where banks partner with insurers to sell policies bundled with mortgages. Direct insurance channels are also growing, supported by insurers’ online platforms for fast and customizable policy purchase. Digital aggregators are gaining traction among younger, tech-savvy consumers who compare policies online before purchase. Brokers and agents remain important for high-value clients, offering advisory-led sales for customized coverage.

By End User Insights

Which end-user groups are driving demand for home insurance in Hong Kong?

Based on end-user, the Hong Kong home insurance market is segmented into owner-occupied, landlord (rental properties), tenant (renters), and vacant property. Tenants and landlords form the largest segment; driven by Hong Kong’s rental-heavy housing market where nearly half of the population lives in rented apartments. Landlords are increasingly purchasing protection against property damage and liability claims from tenants. Owner-occupied policies hold steady demand, especially in luxury and high-rise private residences. Coverage for vacant properties is a niche but growing segment, as property investors seek protection against vandalism, water damage, and natural disasters in unoccupied units.

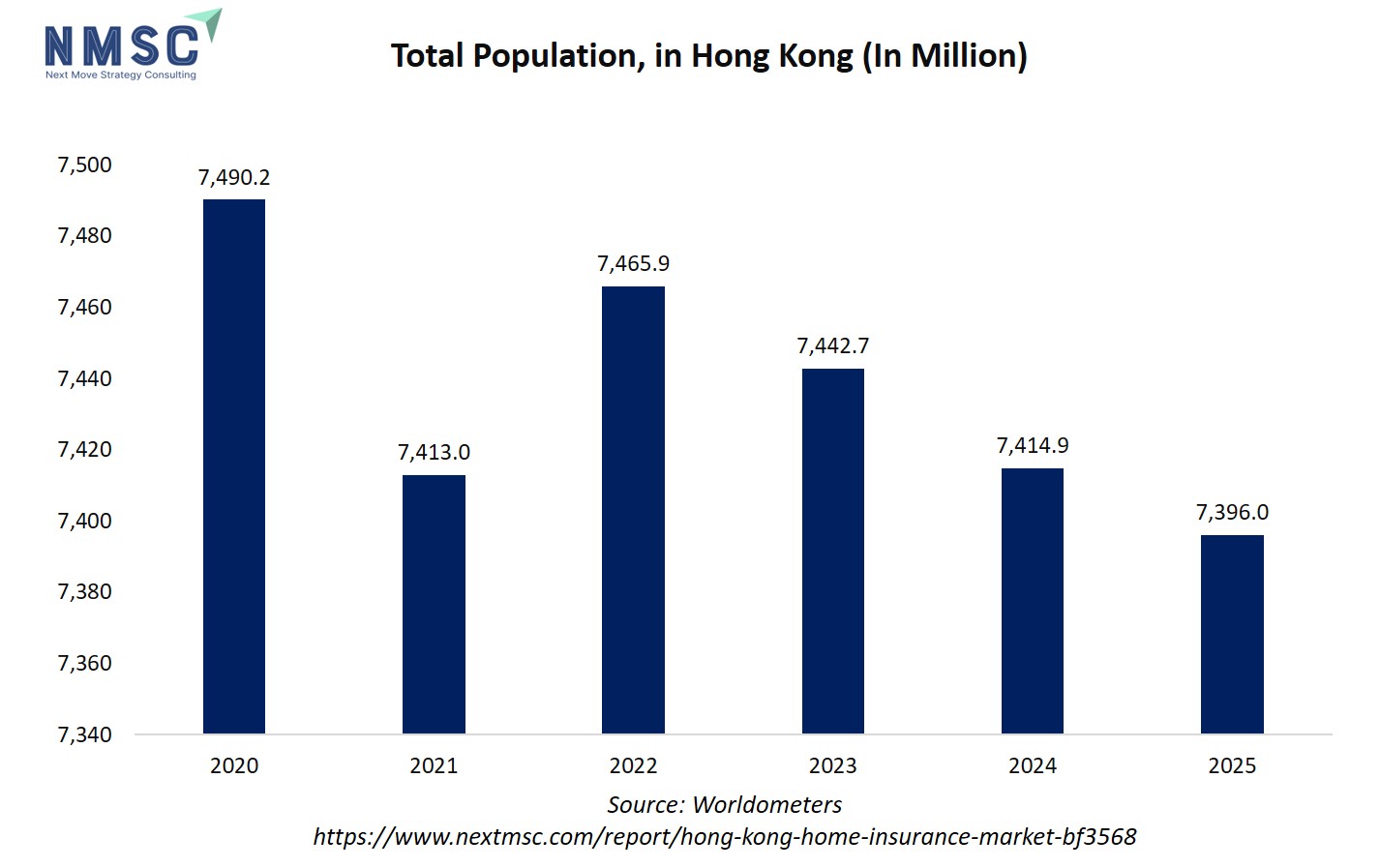

The line chart depicts the population of Hong Kong (in millions) from 2020 to 2025. In 2020, the population was approximately 7.490 million, which slightly decreased to 7.413 million in 2021. The trend of gradual decline continued with 7.466 million in 2022, 7.443 million in 2023, 7.415 million in 2024, and 7.396 million in 2025. Overall, the chart shows a steady decrease in Hong Kong’s urban population over this six-year period.

This population trend has a direct connection to the home insurance market. A declining population could slow the demand for new residential properties, which may impact the volume of home insurance policies sold. Nonetheless, Hong Kong still maintains a substantial urban population, sustaining demand for insurance coverage, particularly in high-density apartments and high-value residential areas. Insurers may also focus on products that address risks associated with aging buildings and urban living.

By Premium Structure Insights

Which premium payment structures are most preferred in Hong Kong?

On the basis of premium structure, the Hong Kong home insurance market is segmented into regular (annual/monthly) payments and single payment policies. Regular premium plans dominate, especially monthly payment models that offer affordability and flexibility for middle-income households and tenants. However, single-payment policies are increasingly popular among landlords and high-net-worth individuals seeking convenience and long-term coverage without recurring payments. The shift toward digital payment platforms and auto-renewal options is further driving adoption of flexible premium models in Hong Kong

Competitive Landscape

Which Companies Dominate the Home Insurance Industry in Hong Kong and How Do They Compete?

The Hong Kong home insurance market is led by major players such as AXA China Region Insurance Company (Bermuda) Ltd, MSIG Insurance (Hong Kong) Limited, Chubb Insurance Hong Kong Limited, QBE Hongkong & Shanghai Insurance Limited, Allianz Insurance (Hong Kong) Limited, AIG Insurance Hong Kong Limited, FWD General Insurance (Hong Kong) Company Limited, China Taiping Insurance (Hong Kong) Company Limited, China Ping An Insurance (Hong Kong) Company Limited, and Assicurazioni Generali S.p.A. These companies are driving growth by enhancing policy flexibility, digitizing claims processes, and introducing innovative add-ons such as climate risk coverage and smart-home integration. Their strategies increasingly focus on AI-driven underwriting, IoT-enabled risk detection, and mobile-first platforms to streamline customer experience. For instance, insurers are embedding predictive tools to assess water damage or fire risks in high-rise apartments, a critical factor in Hong Kong’s vertical housing landscape. To remain competitive, leading players are also collaborating with property developers, banks, and insurtech startups to co-create value-added offerings and bundled protection products.

Market Dominated by Established Global and Regional Insurers

Hong Kong home insurance market is primarily led by global giants like AXA, Allianz, AIG, and Chubb, alongside strong regional players such as China Ping An, China Taiping, and MSIG. These insurers compete by offering multi-risk policies designed for high-density living, strata-title buildings, and rental properties. Digital-native insurers like OneDegree Insurance Company Limited are disrupting the space with fully online distribution models, transparent pricing, and faster claims turnaround. Local players such as Blue Cross (Asia-Pacific) Insurance Limited, Liberty Insurance (Hong Kong) Limited, HSBC Insurance (Asia) Limited, and Zurich Assurance Ltd also maintain strong positions through bancassurance partnerships and customer proximity.

Innovation and Adaptability Drive Market Success

Recent years have seen competition fuelled by climate-resilient insurance solutions, AI-powered underwriting, and mobile app-based claims filing. For example, insurers are integrating IoT leak detectors and AI analytics to prevent water damage in apartments. Others are focusing on catastrophe-ready products in response to rising risks of typhoons and flooding. Firms are also leveraging blockchain and eKYC platforms to enhance transparency and security in policy issuance.

Market Players Embrace Innovative Offerings and Expansion Strategies

Industry players in Hong Kong home insurance market are increasingly focusing on strategic innovations and product expansion to strengthen their market presence. One Degree Insurance Company Limited recently launched it’s One Degree Home Insurance plan, designed to cater to a wide spectrum of households. The policy extends coverage to traditional families, opposite-sex cohabiting partners, as well as LGBTQ+ families, including same-sex married couples and cohabiting partners. This move reflects a growing trend among insurers to diversify offerings and address the evolving needs of Hong Kong’s modern households.

List of Key Hong Kong Home Insurance Companies

-

AXA China Region Insurance Company (Bermuda) Ltd

-

MSIG Insurance (Hong Kong) Limited

-

Allianz Insurance (Hong Kong) Limited

-

AIG Insurance Hong Kong Limited

-

FWD General Insurance (Hong Kong) Company Limited

-

China Taiping Insurance (Hong Kong) Company Limited

-

China Ping An Insurance (Hong Kong) Company Limited

-

Assicurazioni Generali S.p.A.

-

Liberty Insurance (Hong Kong) Limited

-

Blue Cross (Asia-Pacific) Insurance Limited

-

HSBC Insurance (Asia) Limited

-

Zurich Assurance Ltd

-

OneDegree Insurance Company Limited

What are the latest key industry developments?

-

August 2025 - AIG Hong Kong continued to invest in digital platforms to enhance customer experience and streamline insurance processes. The company's focus on digitalization aims to meet the evolving expectations of homeowners seeking convenient and accessible insurance solutions.

-

July 2025 - FWD Group made its Hong Kong trading debut, raising USD 442 million in an initial public offering. This move positioned FWD as a significant player in the Hong Kong insurance market, with potential implications for its home insurance offerings.

-

June 2025 - QBE Hong Kong has partnered with the International Finance Corporation (IFC) to develop insurance products with favourable underwriting terms for buildings with superior Building Resilience Index (BRI) ratings. This collaboration aims to promote resilience in the built environment, aligning with the growing demand for sustainable and disaster-resilient housing.

-

May 2025 - AXA has announced plans to relocate its Bermuda-based unit to Hong Kong under the new re-domiciliation regime. This move aligns AXA's operational base with its registration, aiming to enhance operational efficiency and support Hong Kong's status as a leading international financial center.

-

May 2025 - Allianz's global insurance operations experienced an 8.6% growth in 2024, surpassing the previous year's record growth. This expansion reflects the company's strong performance and increasing demand for insurance products, including home insurance, across various markets.

What are the key factors influencing investment analysis & opportunities in Hong Kong home insurance market?

Investment in Hong Kong’s home insurance sector is being shaped by several critical factors, reflecting both market dynamics and evolving consumer needs. Urban housing density, rising property values, and increasing exposure to climate-related risks—such as typhoons and flooding, have heightened the demand for comprehensive home insurance solutions. Funding trends indicate growing interest from venture capital and private equity in insurers that leverage digital platforms, InsurTech solutions, and AI-driven claims processing, which enhance efficiency and customer engagement. Insurers offering inclusive products that cater to traditional families, cohabiting partners, and LGBTQ+ households are particularly attractive, reflecting Hong Kong’s diverse demographic profile.

Valuations for home insurance providers are experiencing upward momentum due to the integration of advanced risk assessment models, real-time claims management systems, and customizable policy options. Regulatory support, such as enhancements to the Risk-Based Capital (RBC) framework and initiatives under the Mortgage Insurance Programme, further strengthen investor confidence.

The long-term outlook remains positive, with innovation, strategic partnerships, and digital transformation fostering growth opportunities in both individual homeowner coverage and broader property insurance solutions.

Key Benefits for Stakeholders:

Next Move Strategy Consulting presents a comprehensive analysis of the Hong Kong home insurance market, covering historical trends from 2020 through 2024 and offering detailed forecasts through 2030. Our study examines the market at global, regional, and country levels, providing quantitative projections and insights into key growth drivers, challenges, and investment opportunities across all major Home Insurance segments.

Report Scope:

|

Parameters |

Details |

|

Market Size in 2025 |

USD 513 million |

|

Revenue Forecast in 2030 |

USD 892 million |

|

Growth Rate |

CAGR of 7.5% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Million (USD) |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 analyst-working hours) after purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

|

Approach |

In-depth primary and secondary research; proprietary databases; rigorous quality control and validation measures. |

|

Analytical Tools |

Porter's Five Forces, SWOT, value chain, and Harvey ball analysis to assess competitive intensity, stakeholder roles, and relative impact of key factors. |

Key Hong Kong Home Insurance Market Segments

By Policy Structure

-

Coverage Type

-

Dwelling Coverage

-

Fire, Smoke & Explosion

-

Natural Disasters

-

Structural Damage

-

-

-

Content Coverage

-

Personal Belongings

-

High-value Items

-

Additional Living Expenses

-

-

Liability Coverage

-

Personal liability

-

Medical Payments to Others

-

-

Optional Add-ons

-

Home Emergency Assistance

-

Cyber Protection

-

Pet Damage Coverage

-

By Policy Type

-

Named Peril

-

Open Peril

-

Parametric (Index-Triggered)

-

Combined (Packaged Policies)

By Distribution Channel

-

Insurance Companies (Direct)

-

Banks (Bancassurance)

-

Digital Aggregators

-

Brokers/Agents

By End‑User

-

Owner-Occupied

-

Landlord (Rental properties)

-

Tenant (Renters)

-

Vacant Property

By Premium Structure

-

Regular (Annual/Monthly)

-

Single Payment

Conclusion & Recommendations

Our report equips stakeholders, industry participants, investors, policy-makers, and consultants with actionable intelligence to capitalize on Hong Kong Home Insurance’s transformative potential. By combining robust data-driven analysis with strategic frameworks, NMSC’s Hong Kong Home Insurance Market Report serves as an indispensable resource for navigating the evolving home Insurance landscape.

Speak to Our Analyst

Speak to Our Analyst