India EV Charging Market by Type of Charger [AC Chargers {Mode 1 (2.3 kW), Mode 2 (2.3 kW), & Mode 3 (3.7 kW to 22 kW)}, and DC Chargers], By Charging Speed (Level 1, Level 2, and Level 3), By Connector Type (Type 1, Type 2, CCS, CHAdeMO, and Others), by Installation (Fixed, and Portable), and by End-Users (Commercial, and Residential) – Opportunity Analysis and Industry Forecast, 2025–2030

Industry: Automotive & Transportation | Publish Date: 06-Nov-2025 | No of Pages: 180 | No. of Tables: 142 | No. of Figures: 87 | Format: PDF | Report Code : AT868

India EV Charging Market Overview

The India EV Charging Market size was valued at USD 348.50 million in 2024, and is expected to be valued at USD 487.10 million by the end of 2025. The industry is projected to grow further, hitting USD 1652.20 million by 2030, with a CAGR of 27.67% between 2025 and 2030. In terms of volume, the market size was 454 thousand units in 2024 and is projected to reach 2507 thousand units in 2030, with a CAGR of 30.87% from 2025 to 2030.

The India EV charging market is witnessing robust growth, driven by strong government initiatives such as PM E-DRIVE and FAME II, rising EV sales, and active private sector investments from players such as Tata Power and BPCL. However, challenges like lack of standardization and compatibility issues among charging systems pose barriers to seamless deployment. Despite this, the integration of renewable energy sources into charging networks presents a significant opportunity for sustainable growth, especially in urban and semi-urban areas.

Growing Adoption of EVs Across India Fuels the EV Charging Infrastructure Industry

The rising adoption of EVs in India is accelerating the growth of charging infrastructure, as increasing environmental awareness and demand for cleaner mobility drive the need for accessible and efficient charging solutions. According to the latest report published by the Indian Brand Equity Foundation in 2025, the electric vehicle sales in India saw a significant increase of 49.25%, reaching 1.52 million units in 2023. This upward trend in EV sales is expected to further accelerate the development of a strong and accessible charging infrastructure across India.The rising adoption of EVs in India is accelerating the growth of charging infrastructure, as increasing environmental awareness and demand for cleaner mobility drive the need for accessible and efficient charging solutions. According to the latest report published by the Indian Brand Equity Foundation in 2025, the electric vehicle sales in India saw a significant increase of 49.25%, reaching 1.52 million units in 2023. This upward trend in EV sales is expected to further accelerate the development of a strong and accessible charging infrastructure across India.

Increasing Government Initiatives and Policies Drives the India EV Charging Market Growth

Growing implementation of supportive government policies drives India’s EV charging market by lowering entry barriers and encouraging investment. Incentives, streamlined regulations, and focused schemes reduce setup complexity, attract private players, and increase charging station rollout. According to the latest report by the National Portal of India, the Indian government launched the PM Electric Drive Revolution in Innovative Vehicle Enhancement (PM E-DRIVE) scheme in October 2024, allocating about USD 237.8 billion specifically for the development of public charging stations across urban and rural areas. Therefore, such investments and strategic planning demonstrate the commitment to expanding EV infrastructure and facilitating the transition to electric mobility in the country.

Expansion of EV Charging Networks by Key Players Boosts the Market Growth

The expansion of EV charging networks by industry leaders drives market growth by reducing range anxiety and improving charging access. Leading manufacturers build widespread, reliable infrastructure, making EV use more practical and convenient. This improves user confidence, encourages adoption, and strengthens the overall EV ecosystem, accelerating India’s transition to electric mobility. For instance, TATA.ev to boost India’s Charging Infrastructure to 400,000 Charge Points by 2027. Furthermore, Hyundai Motor’s Indian division plans to establish around 600 public fast charging stations by 2031. This initiative aligns with their strategy to enhance the EV infrastructure, ensuring wider access to fast charging points, and further promoting electric vehicle adoption across the country.

Increasing Market Competition Hinders The Market Growth

The rapid influx of players into India’s electric vehicle (EV) charging infrastructure sector—ranging from large energy companies and global OEMs to startups and local service providers—has intensified market competition. While competition can drive innovation and cost reduction, the current pace of entry is leading to significant pricing pressure and declining profit margins, particularly for early-stage and regional charging point operators (CPOs).

This intensifying competitive landscape is challenging the financial sustainability of smaller or unorganized operators, many of whom struggle to recover capital expenditure due to slow initial utilization and underdeveloped monetization models. In several urban zones, the race to gain early market share is encouraging aggressive pricing strategies, sometimes resulting in service inconsistency or poorly maintained infrastructure.

Rising Adoption of Wireless Charging Systems is Expected to Create Ample Opportunity Growth for the Market Expansion

The adoption of wireless electric vehicle (EV) charging infrastructure in India presents a promising yet nascent growth avenue that can significantly enhance charging convenience and accelerate infrastructure innovation. Wireless charging—enabled via inductive technology—allows EVs to charge automatically when parked over a charging pad, eliminating the need for physical connectors. This hands-free, automated system is especially well-suited for India's dense urban settings, where conventional plug-in systems face practical limitations.

A notable example is Simactricals, a startup incubated at IIT Kanpur, which has developed an indigenous wireless charging system adaptable to a wide range of EV categories including two-wheelers, three-wheelers, and four-wheelers. Such innovation reflects the broader momentum in India’s clean mobility and deep-tech ecosystem, aligning well with the government's FAME-II policy, PLI schemes, and smart city initiatives.

Charger Type Analysis: AC Chargers Lead the Market

Regarding charger type, AC chargers currently dominate the India EV charging market share. This is primarily attributed to their greater affordability in terms of production, installation, and operational costs when compared to DC chargers.

Furthermore, AC EV chargers are more commonly used for charging at home and in workplaces due to their lower cost and suitability for longer charging sessions. The report by IESA and Customised Energy Solutions also supports this, stating that the ecosystem was dominated by type-2 AC chargers, which accounted for 82 % of the market in 2021-22, followed by AC001 type chargers at 12.5 %. This makes AC chargers a more accessible and practical option for a large segment of EV users who can charge their vehicles overnight or during work hours.

Additionally, the prevalence of slower chargers like Bharat AC-001 (typically rated at 3.3kW) and DC-001 (15kW) also contributes to the dominance of the AC segment, as AC-001 is a type of AC charger. These slower chargers, taking approximately 8-12 hours to fully charge a vehicle, are best suited for overnight charging at homes or workplaces and cater to a significant portion of the current EV sector, particularly the two-wheeler and four-wheeler segments. Projections suggest that even by 2030, with EVs expected to constitute 65% of the market, slow chargers are expected to continue dominating.

Application Segment: Commercial Use Leads with Fastest Growth

Concerning the application segment, the commercial application holds the highest CAGR of 41.7% in the India EV charging market. This rapid growth is largely due to the rapid electrification of commercial fleets, which includes vehicles such as taxis, delivery vans, and buses. The increasing adoption of electric vehicles in the commercial sector necessitates a robust charging infrastructure to support their daily operations and ensure minimal downtime.

Moreover, government policies such as FAME II and the National Electric Mobility Mission Plan primarily focus on public transport electrification, which directly boosts the demand for charging infrastructure at depots and transit hubs.

Initiatives aimed at electrifying public transport and commercial logistics actively drive the deployment of charging stations specifically designed for commercial use. The partnership between Montra Electric and Steam-A to enhance charging infrastructure reliability for electric small commercial vehicles further underscores this growing focus on the commercial segment.

Strategic Analysis of Companies in the India EV Charging Industry

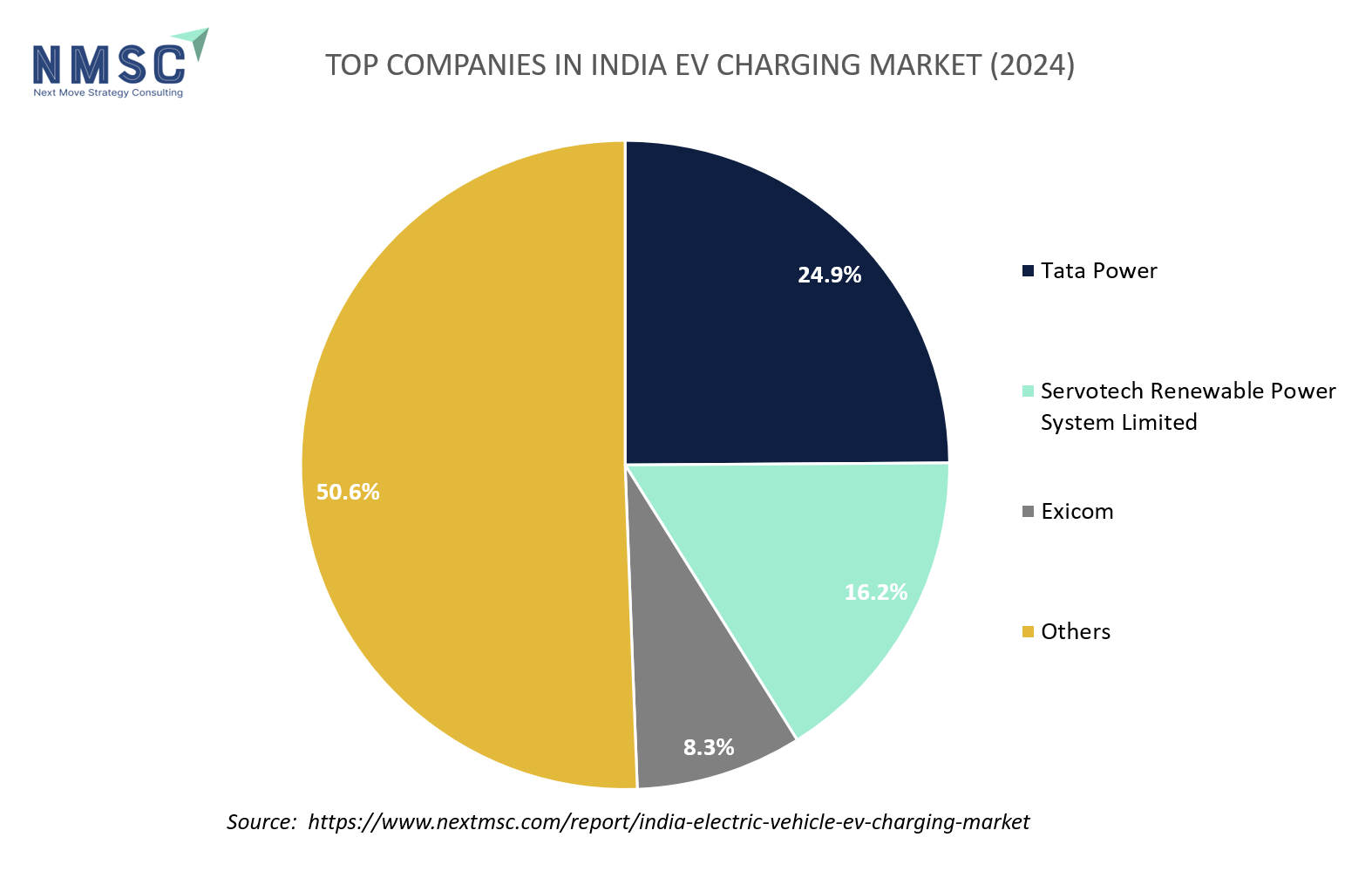

The India EV charging market demand is fueled by the strategic initiatives of key players committed to strengthening the country’s electric mobility ecosystem. Tata Power Company Limited leads the segment with over 60,000 charging points, including more than 1,000 public stations as of 2024.

The company emphasizes renewable energy integration and partnerships with oil firms to expand its presence across urban and highway corridors. Charge Zone, with 3,500 operational chargers, aims to scale to one million by 2030, prioritizing highway networks and smart app-based tracking solutions.

ChargePoint Holdings Inc., a global leader, is entering the Indian market with advanced solutions targeting fleet operators and businesses. Blink Charging Co. leverages its international expertise to establish stations in high-traffic urban zones. Exicom focuses on hardware innovation, managing over 65,000 chargers across 400+ cities, bolstered by strong collaborations with leading automakers.

Meanwhile, Ather Energy has crossed a landmark by achieving over 400 Ather Grid fast charging points across Maharashtra, spanning 35 cities. Its network is interoperable with HPCL and EV Dock stations. The company has also partnered with ThunderPlus to make 140 ThunderPlus fast-charging stations accessible to Ather users across 50 cities in 15 states. Ather will unveil its new EL scooter platform, Ather Stack 7.0 software, and next‑generation fast chargers at its Community Day event in August 2025

Ola Electric Mobility Ltd. develops integrated charging stations for its scooter users, directly accessible through its mobile app. Ather Energy has rolled out over 1,900 fast chargers and is expanding into tier-2 and tier-3 cities post-IPO with its proprietary LECCS (Light Electric Combined Charging System) standard. Servotech Power Systems Ltd. has deployed more than 5,600 chargers and is executing large-scale projects, including 1,800-charger rollout in partnership with BPCL.

Despite challenges like high infrastructure costs, inconsistent state-level policies, and limited rural grid reliability, the market holds vast potential. Strategic investments, public-private partnerships, and localized innovation continue to drive momentum across India’s dynamic EV charging landscape.

List of Self Manufactured VS Whitelabelled Charger Manufacturers

|

Supplier |

Own Manufacturing/Designing |

Primarily White-Label |

|

Servotech Power Systems |

Yes |

No |

|

Exicom Group |

Yes |

No |

|

Tata Power |

Partial |

No |

|

Ather Energy |

Yes |

No |

|

Delta Electronics India |

Yes |

No |

|

Mass-Tech Controls |

Yes |

No |

|

Okaya EV |

Yes |

No |

|

BrightBlu |

Yes |

No |

|

Charzer |

No |

Yes |

|

Magenta EV Solutions |

No |

Yes |

|

PlugNgo |

No |

Yes |

|

Adani Total Energies |

No |

Yes |

|

ABB India |

Partial |

Yes |

|

E-Fill Electric |

No |

Yes |

|

Fortum India |

No |

Yes |

|

Ola Electric |

No |

Yes |

|

ChargeZone |

No |

Yes |

|

ChargePoint |

No |

Yes |

|

Blink Charging |

No |

Yes |

|

Quench |

Yes |

No |

|

Sharify Services Private Limited |

Partial |

Partial |

|

Autel |

Yes |

No |

|

Schneider Electric |

Yes |

No |

|

Hitachi |

Yes |

No |

|

Shindengen |

Yes |

No |

Source: Primary Research, Secondary Research, NMSC Analysis

India EV Charging Market Key Segments

By Type Of Charger

-

AC Chargers

-

Mode 1 (2.3 kW)

-

Mode 2 (2.3 kW)

-

Mode 3 (3.7 kW to 22 kW)

-

-

DC Chargers (22 kW to 350 kW)

By Charging Speed

-

Level 1

-

Level 2

-

Level 3

By Connector Type

-

Type 1

-

Type 2

-

CCS

-

CHAdeMO

-

Others

By Installation

-

Fixed

-

Portable

By End User

-

Commercial

-

Commercial Public EV Charging Stations

-

Highway Charging Stations

-

Fleet Charging Stations

-

Workplace Charging Stations

-

-

Commercial Private EV Charging Stations

-

-

Residential

-

Private Homes

-

Apartments

-

Key Players

-

Tata Power

-

Servotech Renewable Power System Limited

-

Exicom

-

Okaya EV Pvt. Ltd.

-

Amara Raja Energy & Mobility Limited

-

Bolt.Earth

-

Kazam EV Tech Pvt. Ltd.

-

VVDN Technologies

-

Sharify Services Pvt. Ltd.

-

Amplify Mobility Pvt. Ltd.

-

ABB

-

ChargeZone

-

Delta Electronics, Inc.

-

Schneider Electric

-

Hitachi Industrial Products, Ltd.

Report Scope and Segmentation

|

Parameters |

Details |

|

Market Size in 2024 |

USD 348.50 Million |

|

Revenue Forecast in 2030 |

USD 1652.20 Million |

|

Growth Rate |

CAGR of 27.67% from 2025 to 2030 |

|

Market Volume in 2024 |

454Thousand Units |

|

Volume Forecast in 2030 |

2507 Thousand Units |

|

Growth Rate (Volume) |

CAGR of 30.87% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Million (USD) |

|

Market Value Estimation |

Thousand Units |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst