Sugar Polyol Market By Product Type (Sorbitol, Xylitol, Maltitol, Mannitol, Lactitol, Erythritol, Isomalt, and Other Polyols), By Form (Powder, Granules, Syrup, and Tablets), By Application (Food and Beverages, Pharmaceuticals, and Personal Care and Nutraceuticals), By End-User (Food Manufacturers, Pharmaceutical Companies, Personal Care and Nutraceutical Companies, and Home/Consumers) – Global Analysis & Forecast, 2025–2030

Industry Outlook

The global Sugar Polyol Market size was valued at USD 5.29 billion in 2024 and is expected to reach USD 5.65 billion by 2025. Looking ahead, the industry is projected to expand significantly, reaching USD 7.84 billion by 2030, registering a CAGR of 6.78% from 2025 to 2030.

The sugar polyol market today sits at the intersection of mainstream food manufacturing and health-driven reformulation. Widely used sugar alcohols such as sorbitol, xylitol, erythritol and others have become standard ingredients across confectionery, bakery, dairy alternatives, oral-care, pharmaceutical syrups and low-calorie beverages because they provide bulk, sweetness, texture and shelf-life benefits without the glycemic impact of sucrose. Manufacturers rely on polyols for clean-label sugar-reduction projects and to meet demand from diabetic and weight-conscious consumers, while oral-care formulators value certain polyols for dental benefits. The sector balances established food-industry uses with growing inclusion in nutraceuticals and functional foods.

Looking forward, the industry’s immediate prospects are shaped by reformulation trends, regulatory scrutiny around safe intake levels, and ingredient innovation that targets taste and digestive tolerance. Expect product developers to push polyol blends and process improvements that reduce the laxative effects associated with some types while preserving sensory performance, and to combine polyols with sweetener systems and fibres for better mouthfeel and reduced aftertaste. Sustainability and cost pressures will drive supply-chain optimization and alternative feedstocks, and oral-care, pharmaceutical and low-sugar packaged foods will remain key adoption pathways as manufacturers aim to meet both consumer health preferences and tighter nutrition labelling standards.

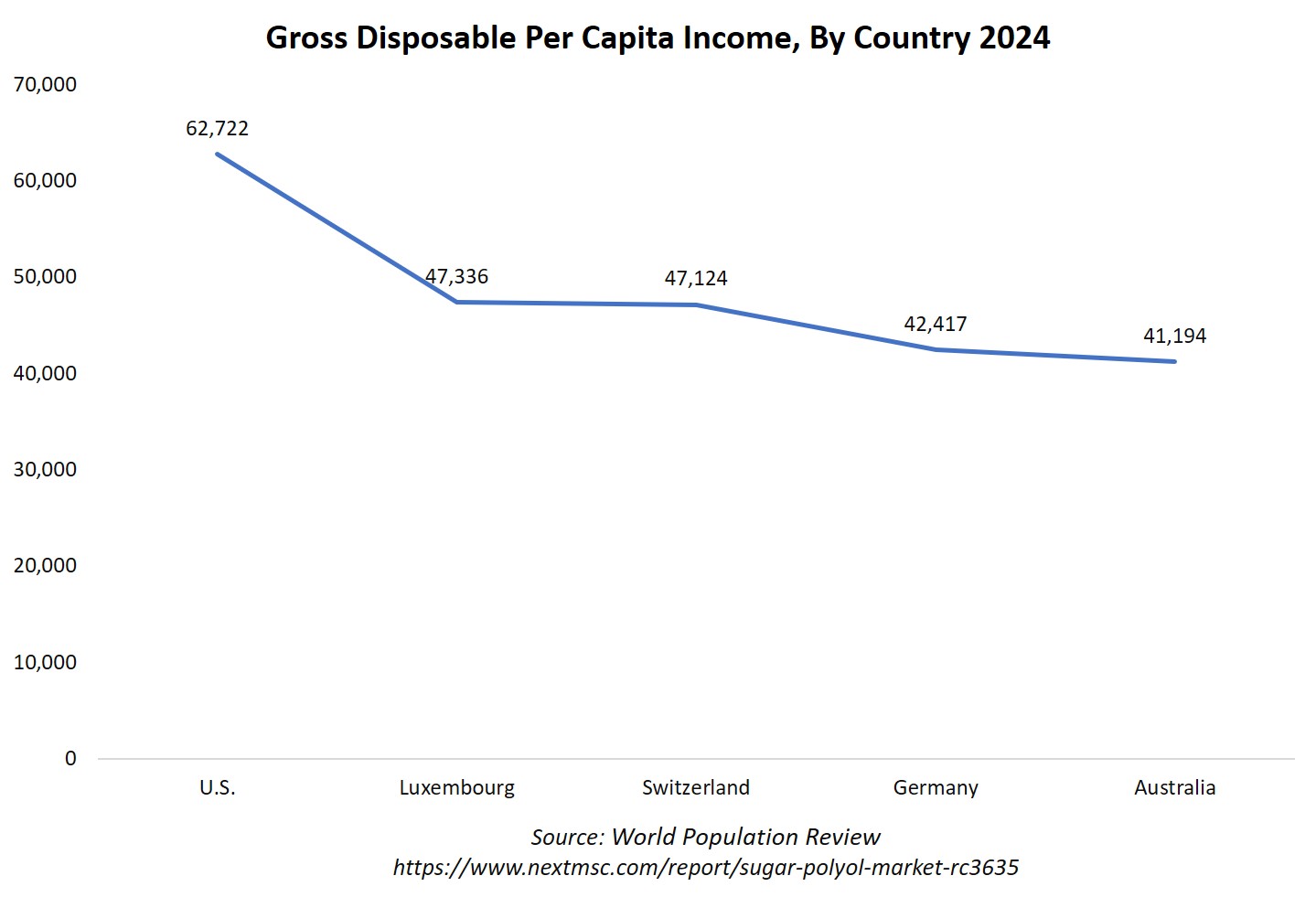

Also, rising disposable income is playing a pivotal role in boosting the sugar polyol market growth globally, especially in rapidly growing regions, where consumers are increasingly adopting healthier lifestyles and seeking premium, low-calorie food options. As disposable incomes climb, individuals have greater purchasing power to choose sugar-free alternatives and functional foods, driving robust demand for sugar polyol like sorbitol and xylitol.

The above chart shows that the U.S., Luxembourg, Switzerland, Germany, and Australia have high gross disposable incomes, which translates to greater consumer spending power. In these countries, strong disposable income directly drives demand for premium, healthier sugar alternatives like polyols, supporting faster market growth for low-calorie and sugar-free products as consumers opt for better dietary choices.

What are the Key Trends in the Sugar Polyol Industry?

How is the Sugar Polyol Market Responding to Safety Signals and Shifting Regulatory Attention?

Since mid-2024, the conversation around certain polyols, especially erythritol, has moved beyond sweetness and calories into safety and risk perception, with clinical and experimental studies prompting renewed scrutiny of cardiovascular and vascular-health effects. That discussion is already shaping buyer behaviour and R&D priorities, where formulators are flagging dose guidelines, marketers are reworking claims, and procurement teams are evaluating supplier transparency to avoid downstream reputational risk. For companies, this means treating safety evidence as a commercial variable accelerates sponsored clinical or tolerability studies for formulations, lowers single-serving polyol levels through blends, and prepares clear consumer guidance on portioning. Doing so preserves trust while keeping polyols in mainstream product lines rather than being relegated to niche replacement items.

How is the Sugar Polyol Market Solving Sensory and Digestive-tolerance Limits to Broaden Use?

A major technical trend is the move away from single-polyol solutions toward blended sweetener systems and process tweaks that target both mouthfeel and gastrointestinal tolerance. Manufacturers and co-packers are increasingly using erythritol + oligosaccharide or low-dose polyol blends to mimic sugar’s bulk and reduce laxative effects, while R&D in fractionation and crystalline grades improves texture and dissolution in confectionery and beverages. Practically, this translates into faster time-to-market for reformulated SKUs if ingredient teams pair sensory labs with pilot digestive-tolerance studies and work with ingredient suppliers on customized particle grades. Firms that invest now in sensory-science capability and pilot consumer tolerance testing converts more legacy recipes into low-sugar offerings with minimal sensory compromise.

How are Sustainability and Feedstock Choices Reshaping Sugar Polyol Supply Chains?

Supply concentration, notably feedstock and regional production footprints and pressure to reduce carbon and water intensity are pushing buyers to diversify suppliers and explore alternative feedstocks and circular production methods. Regions that dominate production, for example, large polyol volumes tied to commodity starches in Asia, remain strategic pinch points, prompting European and North American players to sign longer-term offtakes or invest in localised upstream capacity. For companies, mapping feedstock exposure end-to-end, qualifying at least one alternative supplier per major polyol, and starting small pilots with lower-impact feedstocks or co-products to hedge price and ESG risk reduces procurement volatility and supports customer sustainability claims.

What are the Key Market Drivers, Breakthroughs, and Investment Opportunities that will Shape the Sugar Polyol Market in the Next Decade?

The sugar polyol market today occupies a practical middle ground between traditional sweeteners and high-intensity alternatives. Polyols such as sorbitol, xylitol, erythritol and maltitol are widely used for bulk, humectancy and lower-glycaemic sweetness across confectionery, chewing gum, oral-care, pharmaceuticals and some beverage and bakery reformulations. Demand drivers include sustained consumer interest in reduced-sugar products and technical advantages in texture and shelf life, while regulation and public health guidance increasingly shape formulation choices. Regulatory re-evaluations and safety conversations, most notably EFSA’s re-assessment of erythritol have added scrutiny around tolerability and labelling, prompting ingredient innovation, blended sweetener systems and supply-chain risk management. At the same time, oral-care and pharma applications continue to offer higher-margin growth paths because of clinical and functional benefits.

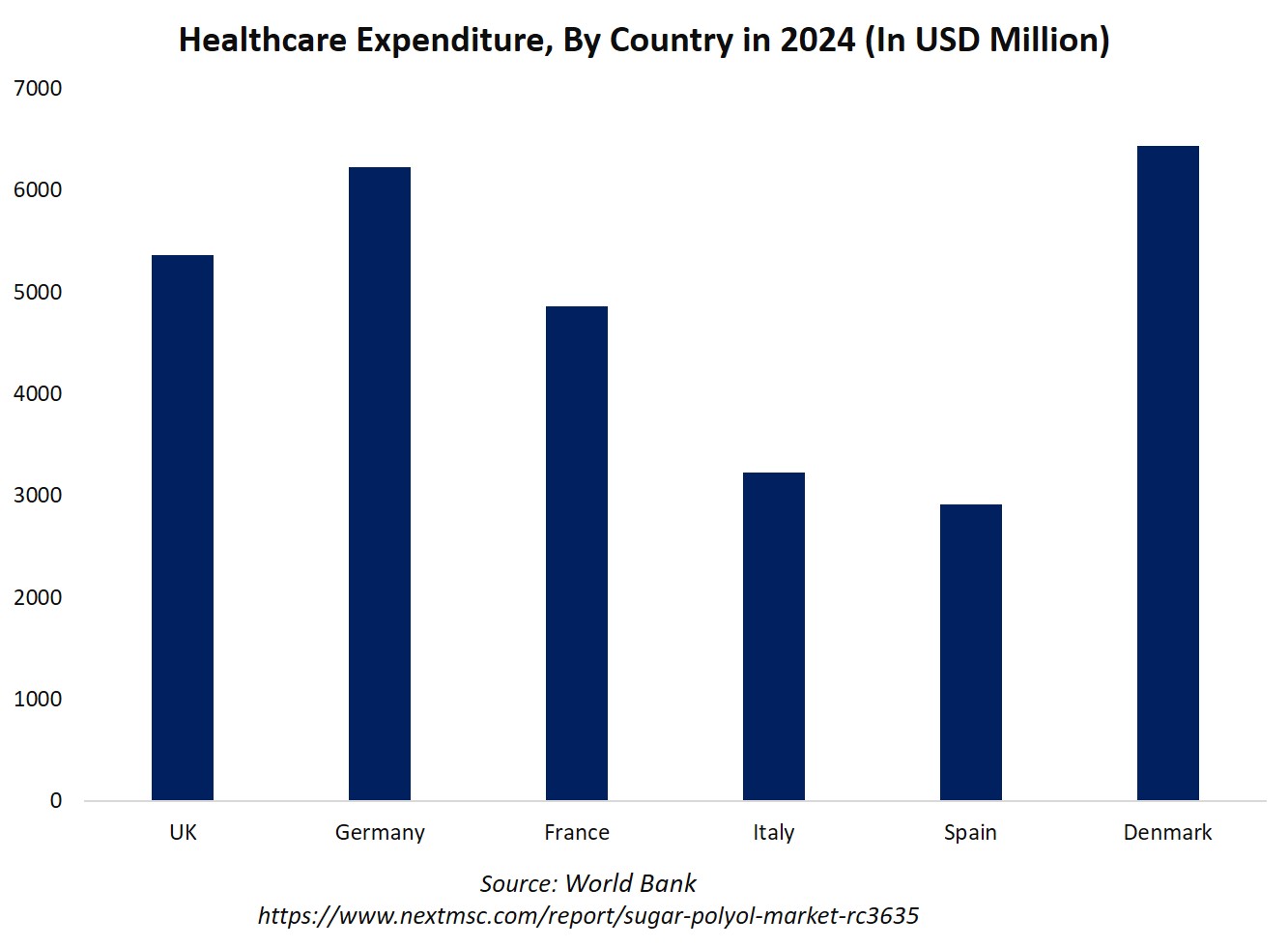

Moreover, health expenditure significantly impacts the sugar polyol market because higher health spending often reflects greater public and private investment in disease prevention, wellness, and healthier lifestyles. This increased expenditure boosts awareness and adoption of low-calorie and diabetic-friendly sweeteners like polyols, particularly as healthcare systems and policymakers promote sugar substitutes to address rising rates of diabetes, obesity, and other health concerns. As a result, countries that prioritize health spending tend to experience stronger growth in demand for sugar polyol across food, beverage, and pharmaceutical applications, driving further innovation and market expansion.

The chart displays healthcare expenditure by country in 2024. High healthcare expenditure in these countries signals greater investment in public health, disease prevention, and health-promoting products, all of which drive demand for healthier sugar alternatives such as polyols.

Growth Drivers:

How is Consumer Demand for Lower-sugar but Sugar-like Texture Driving Sugar Polyol Adoption?

Consumers still want the mouthfeel, bulk and cooking performance of sugar while lowering calories and glycaemic load. Polyols deliver this technical profile and are therefore preferred when brands avoid high-intensity sweetener aftertaste. Recent surveys show many consumers cite weight management and reduced sugar as motivators for switching sweeteners. That consumer preference translates into R&D priorities, where formulators are using polyol blends or partial replacements to retain texture. Practically, ingredient teams prioritise sensory panels and stability pilots when reformulating, and consider blends such as erythritol + a small fraction of bulk polyol or fibre to reduce digestive load while preserving functionality.

How are Regulatory Clarity and Safety Reassessments Influencing Scale-up and Reformulation Strategies?

Regulatory reviews and health advisories are actively shaping ingredient choice and permissible claims. EFSA’s re-evaluation of erythritol flagged tolerability limits, and WHO guidance on non-sugar sweeteners influences public messaging around sweeteners more broadly. These developments push manufacturers to quantify per-serving polyol levels, run tolerability or portioning guidance, and document safety dossiers for food and pharma customers. Companies that proactively invest in label transparency, clinical tolerability studies or conservative serving formulations are better positioned to maintain retailer listings and export to jurisdictions with strict re-evaluations.

Growth Inhibitors:

What Regulatory and Perception Headwinds Could Restrain the Sugar Polyol Market Expansion?

While polyols offer technical benefits, safety reassessments and consumer scepticism present material inhibitors. EFSA’s opinion noted erythritol’s potential for gastrointestinal effects at higher intakes and called for clear labelling and use-level awareness. Simultaneously, WHO guidance on non-sugar sweeteners shifts public-health messaging toward reducing overall sweetness rather than substituting it. Together, these signals can depress large-serving ready-to-consume formats or prompt retailers to demand lower per-serving polyol levels. For manufacturers, the immediate response is investing in portion-based testing, consumer education on safe intake, and alternative blends that maintain sensory profile while lowering single-serve polyol load.

Where Can investors and Ingredient Suppliers Capture Premium Returns in the Sugar Polyol Market Value Chain?

Opportunities lie in higher-specification grades, formulation partnerships and regionalised, lower-carbon production. Demand is increasing for pharma-grade polyols, speciality crystalline grades for confectionery and tailored blends that minimise digestive effects; investors who finance capacity for regulated-grade production or sensory-science co-development capture sticky, higher-margin contracts. Additionally, upstream investments that diversify away from single feedstocks or that adopt circular/low-impact processes win procurement mandates from large CPGs prioritising ESG. Credible public guidance and regulatory reassessments, such as EFSA, WHO, elevate the value of documented safety and quality systems. Companies that certify tolerability testing and provide technical dossiers for oral-care and pharma customers unlock premium pricing and longer-term supply agreements.

How Sugar Polyol Market Segmented in this Report, and What are the Key Insights from the Segmentation Analysis?

By Type Insights

Is the Type Mix Determining Sugar Polyol Market Trajectories in 2025?

Based on type, the sugar polyol market share is segmented into sorbitol, xylitol, maltitol, mannitol, lactitol, erythritol, isomalt, and other polyols.

Sorbitol remains the workhorse polyol for bulk, humectancy and texture in syrups, sugar-free confectionery and oral-care, its broad GRAS/approved use and low cost make it a default ingredient for many formulators. The FDA’s sugar-alcohol guidance lists sorbitol among the common polyols used in foods, reinforcing its entrenched regulatory acceptance and label familiarity for manufacturers. Because of its affordability and multifunctionality, companies are preserving sorbitol supply-chain resilience and pursuing improved crystalline grades to win confectionery and bakery reformulations that demand sugar-like bulk.

Maltitol is widely used where high-bulk sweetness and minimal aftertaste are required, especially in sugar-free confectionery and chocolate analogues, and has an established regulatory record as a food excipient and sweetener. Its functionality in liquid and solid formats makes it a preferred choice when texture and melting behaviour matter.

On the other hand, Erythritol’s popularity for low-calorie, sugar-like sweetness and near-zero calories is tempered by recent regulatory re-evaluations. Because erythritol is fully or largely absorbed and has distinctive digestive-tolerance characteristics, formulators are shifting to controlled per-serve inclusion and blends to avoid consumer GI complaints and regulatory flags. Suppliers respond by offering technical guidance on per-serving limits, blended systems and high-purity grades that ease labelling and tolerability concerns.

By Form Insights

How are Different Forms Shaping the Sugar Polyol Market Trends in 2025?

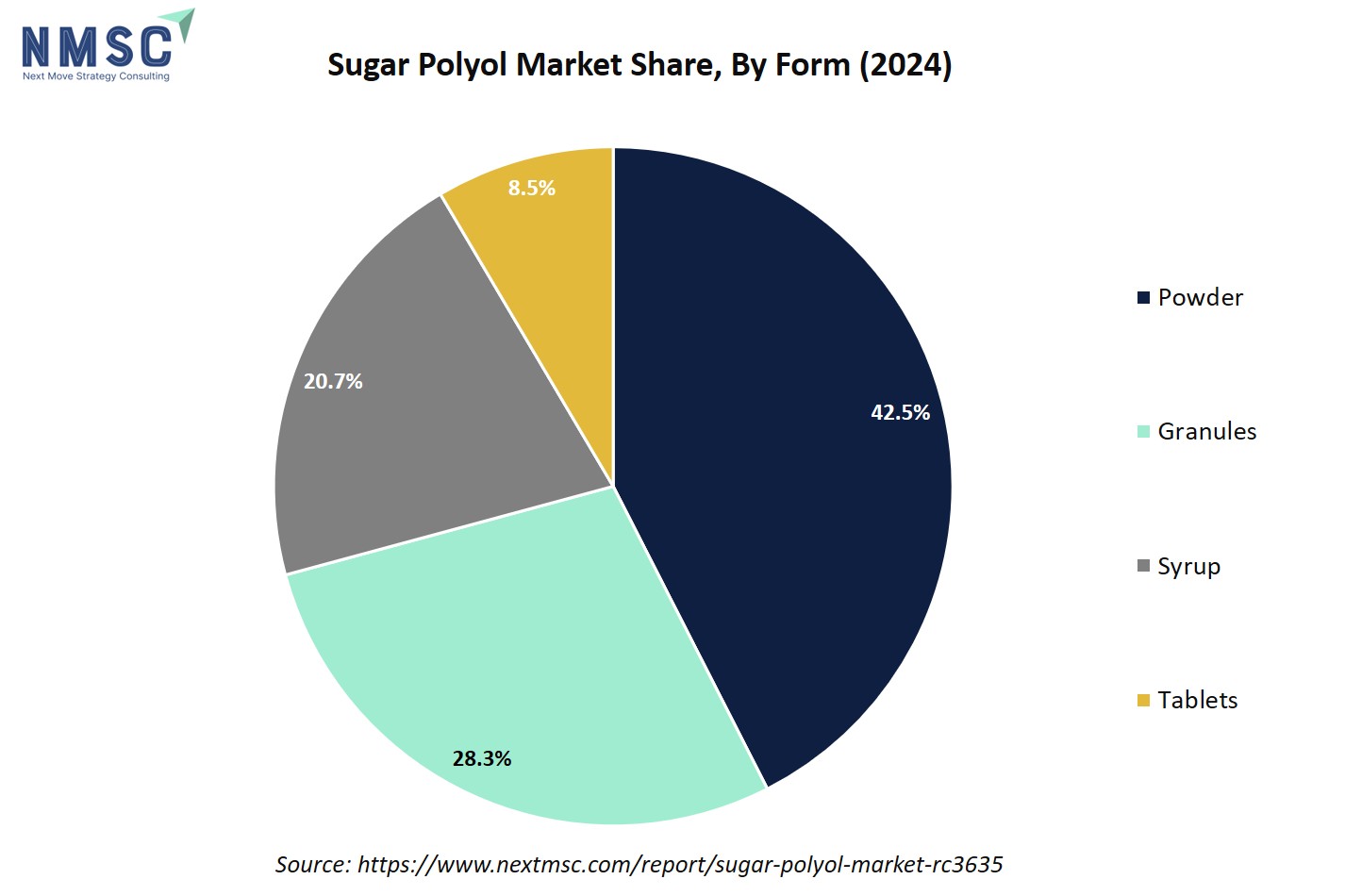

On the basis of form, the market is segmented into powder, granules, syrup, and tablets.

Powdered polyols remain the dominant form for confectionery, bakery, and tabletop sweeteners due to ease of blending, precise dosing, and fast dissolution. The FDA and EFSA recognise powdered forms for wide food applications, making them a default choice for R&D and industrial production. Suppliers that optimise particle size distribution, flowability, and anti-caking properties help manufacturers improve texture and uniformity in end products, giving a competitive edge in bulk and private-label markets.

Granular polyols are preferred in applications requiring slow dissolution, controlled sweetness release, or easy dosing in chewing gum, candies, and dry mixes. Regulatory agencies list granular polyols as safe for food and pharmaceutical use, supporting widespread adoption. Companies gain an advantage by offering consistent granule size, low dust formulations, and moisture-stable variants, which enable confectionery and beverage manufacturers to maintain product quality while reducing processing challenges

Syrup forms of polyols are widely used in beverages, liquid syrups, and certain baked goods for texture, humectancy, and sweetness uniformity. Syrups provide functional advantages over crystalline forms in controlling viscosity and enhancing moisture retention. Suppliers differentiate by providing high-purity, low-hygroscopicity syrups tailored for low-sugar drinks and sauces, helping brands achieve clean-label claims and smooth mouthfeel without compromising shelf life. Regulatory bodies recognise syrup-grade polyols as safe, supporting broad adoption in food and pharma formulations.

Meanwhile, tablet forms of sugar polyol are predominantly used in pharmaceuticals, nutraceuticals, and oral-care products like chewing gum and lozenges, where controlled release and precise dosing are critical. The FDA classifies polyols as safe excipients for chewable and oral formulations. Manufacturers capture high-value markets by providing pharmaceutical-grade polyols with tight particle size, compression properties, and consistent stability. Collaborating with pharma and oral-care developers ensures products meet efficacy, taste, and tolerability standards while commanding premium pricing.

By Application Insights

How are Applications Driving the Sugar Polyol Market in 2025?

On the basis of application, the market is segmented into food and beverages, pharmaceuticals, and personal care and nutraceuticals.

Food and beverage applications dominate the sugar polyol market, leveraging their sweetness, bulk, and humectancy for sugar-free confectionery, baked goods, dairy alternatives, and low-calorie beverages. Regulatory authorities recognise polyols as safe for broad food applications, enabling manufacturers to reformulate products for reduced sugar content without compromising taste or texture.

Pharmaceutical applications use polyols primarily as excipients in syrups, chewable tablets, and capsules for sweetness, bulking, and stability. Mannitol, lactitol, and erythritol are favoured for their GRAS/excipient status and compliance with pharmacopeial standards. Suppliers that provide pharmaceutical-grade polyols with precise particle size, low moisture, and controlled solubility support consistent dosing and patient-friendly formulations.

In personal care and nutraceuticals, polyols act as humectants, stabilizers, and sweeteners in oral-care products, protein bars, and functional foods. Xylitol and erythritol are particularly valued for dental benefits, while sorbitol enhances texture and moisture retention in creams and gels. Regulatory recognition by EFSA and FDA ensures safe use across these segments.

By End-User Insights

How are End-Users Shaping the Sugar Polyol Market in 2025?

On the basis of end-user, the market is segmented into food manufacturers, pharmaceutical companies, personal care and nutraceutical companies, and home/consumers.

Food manufacturers remain the largest end-users of sugar polyol, leveraging their sweetness, bulk, and humectancy in sugar-free confectionery, baked goods, dairy alternatives, and beverages. Regulatory agencies like the FDA recognise polyols as safe for general food applications, allowing manufacturers to reduce sugar content while maintaining texture and taste.

Pharmaceutical companies use polyols as excipients in chewable tablets, syrups, capsules, and oral solutions, where sweetness, bulking, and stability are critical. Mannitol, lactitol, and erythritol are preferred due to their GRAS/excipient status and compliance with pharmacopeial standards. In personal care and nutraceuticals, polyols are used as humectants, sweeteners, and stabilizers in oral-care products, protein bars, functional foods, and supplements. Xylitol and erythritol are valued for dental and health benefits, while sorbitol improves moisture retention and texture in creams and gels. Regulatory recognition by EFSA and FDA enables safe application in both food-adjacent and topical formulations.

At the consumer level, sugar polyol are used in tabletop sweeteners, DIY baking, and home-prepared sugar-free foods. Powdered and granular polyols dominate this segment due to ease of portioning and solubility. FDA guidance affirms their safe use for home consumption, but dosage awareness is important to avoid digestive discomfort. Ingredient suppliers capitalize on this segment by offering consumer-friendly packaging, portion-controlled sachets, and clear labelling, helping households adopt reduced-sugar diets safely while fostering brand loyalty.

Regional Outlook

The sugar polyol market is geographically studied across North America, Europe, Asia Pacific, Middle East & Africa, and Latin America and each region is further studied across countries.

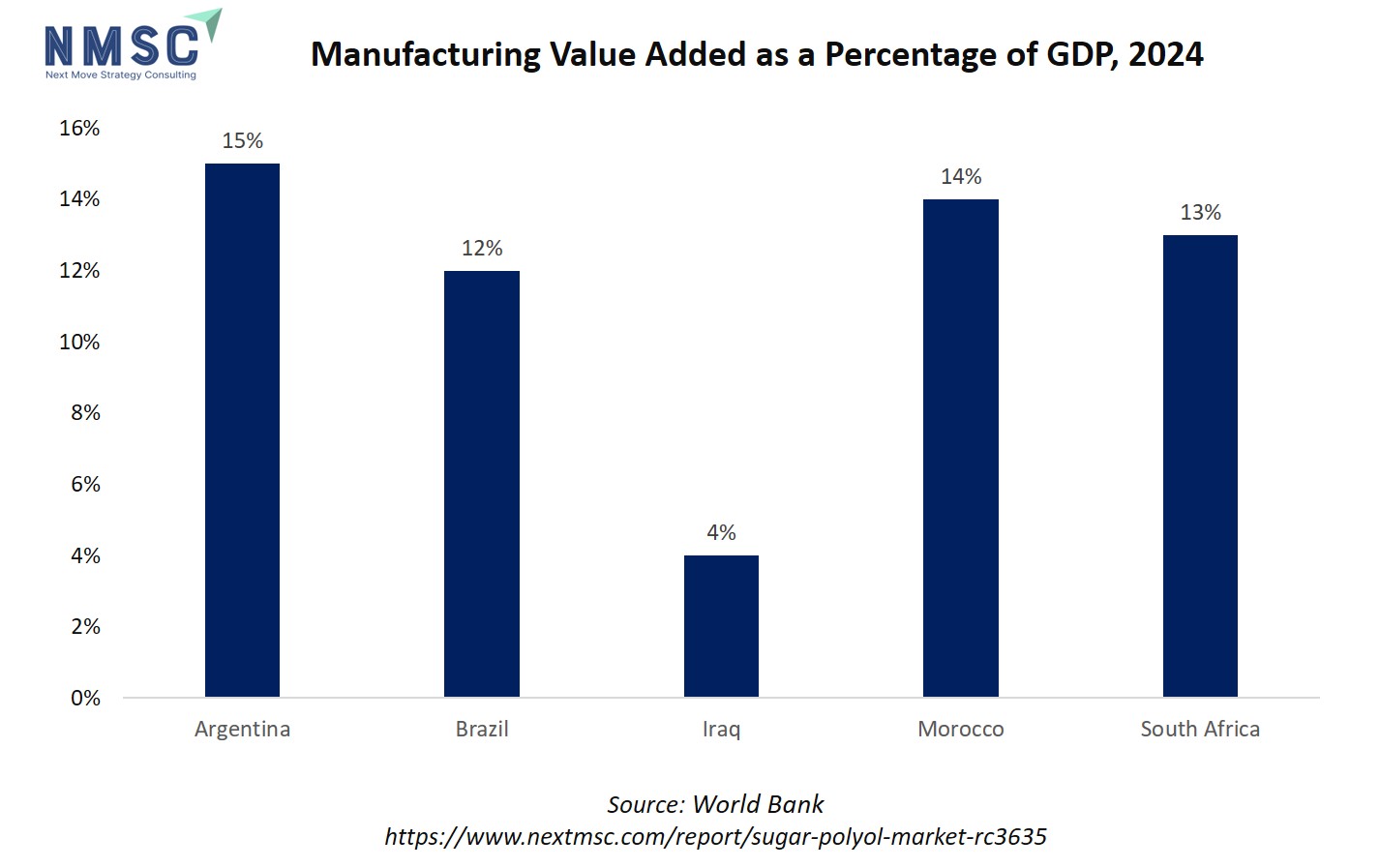

Manufacturing value impacts the sugar polyol market because a higher share typically signals a strong industrial base and better domestic production capabilities. Countries with a robust manufacturing sector can produce sugar polyol more efficiently, reduce reliance on imports, and support local innovation, making these sweeteners more available and affordable. This industrial strength drives market expansion by ensuring stable supply chains, cost efficiencies, and greater responsiveness to consumer demand for processed foods and low-calorie products that rely on sugar polyol as key ingredients.

The chart depicts manufacturing value added as a percentage of GDP for five countries in 2024. This information signals the relative strength of each country's manufacturing sector, which directly impacts the sugar polyol market demand by determining domestic production capacities and operational efficiencies. Countries with higher manufacturing value added are better positioned to support local production of sugar polyol, lower operational costs, and quickly respond to growing demand for sugar alternatives, making these markets more competitive and resilient in the expanding global polyol industry.

Sugar Polyol Market in North America

North America’s market is driven by sustained consumer demand for lower-sugar products, wide R&D adoption of sugar-replacement systems, and strong retail reformulation activity. Food manufacturers use polyols to preserve bulk and mouthfeel while cutting sugar; at the same time, public-health and labelling scrutiny pushes companies to manage per-serve sweetener levels and provide clearer portion guidance. The U.S. and Canada both have mature CPG channels that adopt polyol blends for tabletop sweeteners, confectionery and reduced-sugar bakery items, sustaining steady industrial demand while triggering innovation in tolerance-friendly blends.

Sugar Polyol Market in the United States

In the United States polyols are anchored in confectionery, sugar-free gum, and reformulations as brands respond to consumer interest in lower sugar and diabetic-friendly options. USDA Agricultural Research and ERS data show long-running monitoring of per-capita sweetener deliveries, and manufacturers rely on polyols for bulk and stability where high-intensity sweeteners fall short; this technical fit underpins demand even as overall sugar policy and health guidance encourage less sweetness overall. Expected formulation work, sensory testing and portion-based nutrition guidance are major levers for US manufacturers.

Sugar Polyol Market in Canada

Canada follows U.S. trends but with its own nutrition-label and front-of-pack policy environment encouraging reformulation. Canadian food manufacturers have been active in replacing sucrose in niche and mass SKUs, and retailers increasingly request ingredient transparency and portion guidance. Because Canada imports and adapts many North American product formats, polyol suppliers who offer regulatory support, application trials and clear labelling guidance find an easier path to multi-SKU adoption in Canadian retail and private label.

Sugar Polyol Market in Europe

Europe’s polyol market is highly influenced by regulatory reviews and consumer health guidance; EFSA’s re-evaluation of erythritol and active dialogue on non-sugar sweeteners have reshaped formulation risk assessments. European confectionery and oral-care sectors remain important adopters, but manufacturers now emphasize per-serving limits, blended systems and clearer labelling. Sustainability and local feedstock concern also prompt regional sourcing strategies. In short, Europe is a technically sophisticated market where regulatory signals translate quickly into procurement and R&D changes.

Sugar Polyol Market in the United Kingdom

The UK market has been a quick adopter of reduced-sugar innovation driven by active retailer reformulation targets and public-health campaigns. Polyols feature in sugar-reduced confectionery, gum and certain beverages, but post-Brexit regulatory alignment and label expectations require suppliers to support cross-border compliance. U.K. brands’ willingness to trial polyol blends and portion-controlled formats supports stable demand, though consumer sensitivity to digestive tolerance is monitored closely in marketing and product claims.

Sugar Polyol Market in Germany

Germany’s sizeable food-manufacturing base and strong confectionery tradition make it a major user of polyols for sugar-reduced chocolates, sugar-free confectionery and bakery. German brands prize product quality and sensory parity with sugar, so suppliers that provide tailored crystalline grades, melt-profile data and pilot support win reformulation projects. Regulatory vigilance and a conservative labeling culture also mean manufacturers prefer documented tolerability and conservative per-serve polyol use.

Sugar Polyol Market in France

France’s culinary and patisserie sectors demand high sensory fidelity, so polyol adoption in bakery and confectionery is selective and technically exacting. Food-service and premium artisanal producers test polyol blends carefully for texture and stability; meanwhile national public-health messaging around sugar reduction encourages food brands to create lower-sugar versions that preserve mouthfeel. Companies offering application trials and sensory-science support are best placed to convert premium recipes to reduced-sugar formats in France.

Sugar Polyol Market in Italy

Italy’s confectionery and traditional-sweets markets are selective but present opportunities for polyols when texture and flavour are preserved. Manufacturers experimenting with sugar-reduced desserts and gelato often require specific polyol grades to match crystalline structure and melting behaviour. Regional demand is therefore concentrated among artisanal and premium producers willing to co-develop tailored grades, while mainstream food manufacturers cautiously target mass-market reduced-sugar SKUs.

Sugar Polyol Market in Spain

Spain shows steady uptake of polyols in packaged sweets, baked goods and functional beverages as health-oriented consumption grows. Spanish CPG and bakery sectors are responsive to Mediterranean-diet positioning and offer low-sugar variants of traditional products; companies that provide stable, low-hygroscopic polyol syrups and powder grades find traction. Spain’s combination of industrial and artisanal producers means suppliers offer both bulk and pilot-scale flexibility to win business.

Sugar Polyol Market in the Nordics

Nordic countries emphasize clean-label, natural ingredients, and manufacturers in Sweden, Norway and Denmark favour polyol systems that can be paired with fibres or naturally-derived sweeteners. Public health initiatives and active retailer sustainability programs accelerate low-sugar product launches in beverages, dairy alternatives and snacks. The Nordics’ high regulatory awareness and sustainability focus reward suppliers with transparent sourcing, low-carbon footprints and high-purity documentation.

Sugar Polyol Market in the Asia-Pacific

APAC’s growth is driven by urbanization, rising disposable incomes and fast growth in ready-to-drink beverages and confectionery; many regional regulators are strengthening nutrition labelling, which boosts reformulation. Markets such as China, Japan, South Korea and India differ by consumption patterns but share rising demand for reduced-sugar formats and functional beverages, which benefits polyol suppliers capable of scaling syrup and crystalline supplies while addressing tolerance and labelling concerns. Regional regulatory pilots also influence product rollouts and marketing strategies.

Sugar Polyol Market in China

China’s beverage market surpassed an estimated USD 170 billion in 2024, driving strong ingredient demand for syrups and low-sugar formulations; this scale makes China one of the world’s most important growth markets for polyols. Local regulators are experimenting with front-of-pack Nutri-Grade pilots that could accelerate reformulation incentives, while beverage and tea brands push reduced-sugar SKUs for urban consumers, supporting demand for erythritol, sorbitol syrups and tailored blends. Suppliers who localise production and labelling support gain a strategic edge.

Sugar Polyol Market in Japan

Japan’s market is driven by aging demographics, strong oral-care penetration and a cultural preference for less overt sweetness, so polyols are widely used in chewing gum, oral-care and certain confectionery. Food manufacturers emphasise texture and high-quality mouthfeel, and nutraceutical producers often adopt polyols in chewables and lozenges. Japan’s rigorous regulatory and quality standards reward suppliers offering pharmaceutical-grade documentation and stable particle specs.

Sugar Polyol Market in India

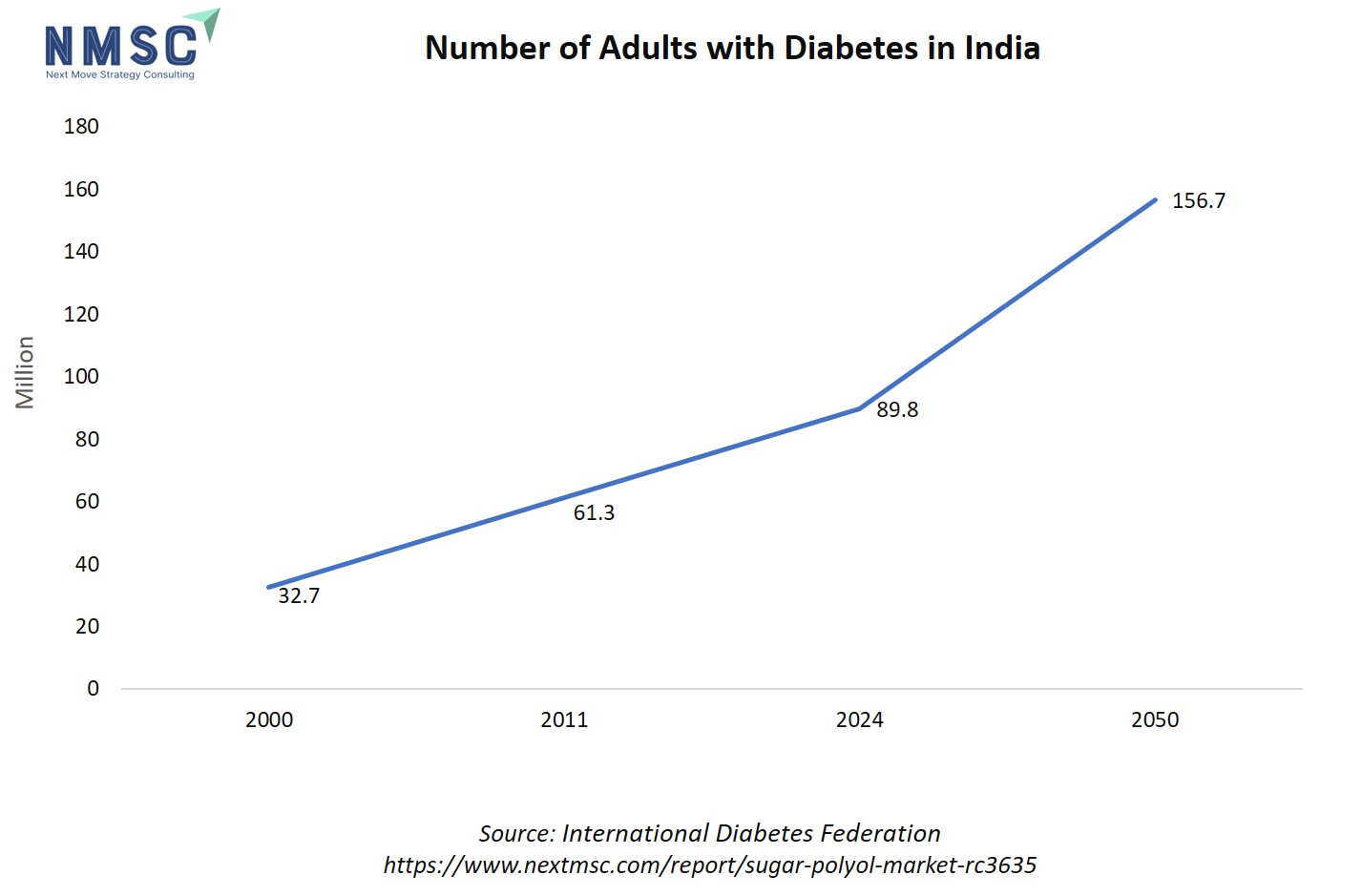

India’s rising diabetes prevalence and government emphasis on reducing sugar consumption create a large, evolving opportunity for polyols in packaged snacks, bakery and beverages. With IDF and national data indicating millions affected by diabetes, manufacturers are increasingly launching reduced-sugar products and investigating polyol blends for confectionery and beverages. Local cost sensitivity requires suppliers to balance price, availability and technical support; partnerships with regional co-packers and small-format sachets for consumers are effective go-to-market tactics.

The chart shows a dramatic rise in the number of adults with diabetes in India, increasing from 32.7 million in 2000 to a projected 156.7 million by 2050. This steep upward trend indicates a growing population seeking alternatives to traditional sugar, directly boosting demand for sugar polyol since these sweeteners are recognized as safe for diabetics and can help manage blood sugar levels. As a result, the spike in diabetes prevalence fuels robust market growth for sugar polyol in India, encouraging food and beverage manufacturers to develop more diabetic-friendly products and making polyols a preferred choice for health-conscious consumers.

Sugar Polyol Market in South Korea

South Korea’s fast-moving F&B innovation cycle and high consumer adoption of functional beverages support polyol use in ready-to-drink products, confectionery and nutraceutical gummies. Korean consumers value clean taste and texture, pushing R&D toward blends that reduce aftertaste and digestive effects. Suppliers who provide fast sample turnaround, sensory support and regionally compliant documentation can capture quick wins in Korea’s agile product development environment.

Sugar Polyol Market in Taiwan

Taiwan’s market mixes traditional confectionery and a dynamic beverage café culture; polyols are gaining traction in sugar-reduced teas, bottled drinks and tabletop sweeteners. Local brands often launch limited-edition low-sugar variants, creating demand for both syrup and powder grades. Suppliers enabling small-batch trials and providing local label guidance help Taiwanese brands experiment rapidly and scale successful reformulations.

Sugar Polyol Market in Indonesia

Indonesia’s large population and growing packaged-foods market create volume opportunities for polyols, particularly in confectionery and beverages. Price sensitivity means sorbitol and other lower-cost polyols often dominate, but expanding middle-class demand for reduced-sugar options creates space for higher-value blends. Regulatory focus on nutrition labelling and sugar reduction gradually encourage reformulation and create export/export-substitution prospects for local manufacturers.

Sugar Polyol Market in Australia

Australia’s market is shaped by strong regulatory scrutiny, active consumer health awareness and a sizeable oral-care sector; polyols are used across confectionery, functional beverages and oral-care. Retailer reformulation targets and demand for naturalistic ingredient claims favour suppliers who demonstrate safety, tolerability and sustainable sourcing. Australian manufacturers often mirror UK/Australia regulatory expectations, so internationally compliant documentation is valued.

Sugar Polyol Market in Latin America

In Latin America, public-health measures including sugar taxes and front-of-pack labelling in some countries have accelerated reformulation in beverages and snacks; this creates openings for polyols, especially in Mexico, Brazil and Chile. Price sensitivity and regional sugar supply dynamics mean sugar alternatives compete on cost and technical fit; however, policies that penalise high-sugar products make polyol-based reduced-sugar SKUs attractive for large beverage and confectionery producers.

Sugar Polyol Market in the Middle East & Africa

The Middle East & Africa region is heterogeneous: oil-wealth markets and urban centres adopt premium low-sugar products and functional beverages, while many African markets remain price sensitive and sugar-centric. Urbanisation, rising diabetes prevalence, and growth of modern retail channels are driving interest in reduced-sugar formats, but supply-chain constraints and higher-cost ingredients slow adoption. Suppliers who localize distribution, provide cost-effective sorbitol grades and support pilot reformulations find traction in urban MEA markets.

Competitive Landscape

Which Companies Dominate the Sugar Polyol Market and How do they Compete?

The sugar polyol market features a mix of global giants and regional specialists competing across product innovation, quality, and geographic reach. Roquette Frères focuses on plant-based and sustainable polyols, emphasizing eco-friendly production processes. Cargill leverages its integrated supply chain and research capabilities to develop functional sweeteners for diverse applications. Ingredion targets clean-label and health-driven solutions, while ADM emphasizes large-scale production efficiency and consistent global supply. Tate & Lyle differentiates itself through specialty sweeteners for reduced-calorie foods. Regional players like Gulshan Polyols and Shandong Bailong Chuangyuan compete on price and local customization, capturing niche segments in Asia and emerging markets.

Market Dominated by Sugar Polyol Giants and Specialists

The market is shaped by the dominance of multinational leaders and agile regional players. Global giants such as Roquette, Tate & Lyle, and Cargill control a substantial portion of the market through innovation and expansive distribution networks. In contrast, specialists like Jungbunzlauer and Sukhjit Starch & Chemicals focus on industrial and pharmaceutical applications in their respective regions. Hamburg Fructose GmbH and Zhejiang Huakang Pharmaceutical cater to niche high-purity polyol needs. This mix ensures competitive diversity: large firms drive global scale and standardization, while smaller players focus on product differentiation, tailored formulations, and local partnerships to capture specific market niches and respond quickly to consumer trends.

Innovation and Adaptability Drive Market Success

Companies succeed by continuously adapting to consumer demand and regulatory changes. BENEO has invested in functional ingredients that enhance digestive health while providing sweetening solutions. Similarly, Tereos has innovated in polyol syrups to improve solubility and flavor profiles for beverages. Nagase Viita focuses on customized polyol formulations for nutraceutical applications. Likewise, IFF (International Flavors & Fragrances) integrates polyols into flavor and texture solutions for confectionery and bakery products. Even Muby Chem and Zhejiang Huakang Pharmaceutical emphasize R&D to meet specialized pharmaceutical applications, demonstrating that innovation ranges from functional foods to high-value medical-grade polyols.

Market Players to Opt for Merger & Acquisition Strategies to Expand their Presence

M&A activity is a key strategy for growth and market penetration. Tate & Lyle’s acquisition of CP Kelco expanded its portfolio into natural and functional ingredients. Cargill strengthened its polyol-related supply chain through the purchase of SJC Bioenergia in Brazil. Roquette has pursued strategic acquisitions in Asia to secure raw material access and expand production capacity. Similarly, Ingredion has targeted specialty ingredient startups to diversify its offerings in health-focused and clean-label products. These deals allow companies to access new geographies, acquire novel technologies, and enhance their competitive positioning in a market increasingly driven by innovation, regulatory compliance, and evolving consumer preferences.

List of Key Sugar Polyol Companies

-

Cargill

-

Ingredion

-

Archer Daniels Midland Company

-

Shandong Bailong Chuangyuan

-

Gulshan Polyols Ltd

-

Tereos

-

Nagase Viita

-

Jungbunzlauer

-

Sukhjit Starch & Chemicals

-

IFF

-

Hamburg Fructose GmbH

-

Zhejiang Huakang Pharmaceutical Co., Ltd

What are the Latest Key Industry Developments?

February 2025- Cargill finalized the acquisition of the remaining 50% stake in SJC Bioenergia, enhancing its presence in Brazil's renewable energy market. This move supports Cargill's strategy to integrate bio-based feedstocks for polyol production, ensuring a sustainable supply chain.

January 2025- Following the sale of its sugar division in 2010, Tate & Lyle has focused on healthier food ingredients, including low-calorie sweeteners and fibres derived from corn, seaweed, and stevia. This strategic shift aligns with market trends favouring health-conscious products.

December 2024- Shandong Bailong Chuangyuan launched two major projects: a 30,000-ton/year soluble dietary fiber facility and a 15,000-ton/year crystalline sugar plant. These expansions enhance the company's ability to supply polyols and related ingredients, strengthening its market position.

February 2024- Roquette introduced four new functional pea proteins under its NUTRALYS range, targeting plant-based food and beverage applications. This innovation expands Roquette's portfolio, aligning with the growing demand for plant-based ingredients in the sugar polyol sector.

What are the Key Factors Influencing Investment Analysis & Opportunities in the Sugar Polyol Market?

Investment in the sugar polyol market is accelerating as global ingredient companies and private equity firms target the fast-growing sugar-reduction and clean-label space. Leading players such as Ingredion and Tate & Lyle have increased funding toward innovation centers, R&D partnerships, and new production facilities to meet reformulation demands in the food, beverage, and nutraceutical sectors. These moves reflect strong investor confidence in the long-term potential of low-calorie sweeteners as regulatory and consumer pressure to curb sugar intake rises globally.

Valuations and capital flows are also favouring Asia-Pacific, where countries like China and India are emerging as key manufacturing and consumption hotspots due to rapid urbanization and dietary shifts. Meanwhile, North America and Europe remain prime investment destinations for strategic partnerships and technology acquisitions focused on advanced polyol formulations and sustainable sourcing. These geographic spread signals a maturing market, where both scale efficiency and innovation capability are driving investment opportunities in the global sugar polyol landscape.

Key Benefits for Stakeholders:

Next Move Strategy Consulting (NMSC) presents a comprehensive analysis of the sugar polyol market, covering historical trends from 2020 through 2024 and offering detailed forecasts through 2030. Our study examines the market at regional and country levels, providing quantitative projections and insights into key growth drivers, challenges, and investment opportunities across all major sugar polyol segments.

The market offers distinct benefits to a wide range of stakeholders, creating a value chain that aligns health-conscious demand with sustainable business growth. For investors, the sector presents stable long-term returns driven by rising regulatory pressure to reduce sugar consumption and the growing demand for low-calorie ingredients across food, beverage, and pharmaceutical applications. Customers, both industrial and end consumers, gain access to healthier product options that maintain sweetness, texture, and taste without the negative metabolic effects of traditional sugars. Food and beverage manufacturers benefit from the versatility and functional properties of polyols, enabling them to innovate reformulated products that meet evolving consumer preferences and labelling requirements. Collectively, these dynamics make the sugar polyol market a cornerstone of the global shift toward health-driven, sustainable ingredient solutions.

Report Scope:

|

Parameters |

Details |

|

Market Size in 2025 |

USD 5.65 Billion |

|

Revenue Forecast in 2030 |

USD 7.84 Billion |

|

Growth Rate |

CAGR of 6.78% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Countries Covered |

33 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent to up to 80 analyst-working hours) after purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

|

Approach |

In-depth primary and secondary research; proprietary databases; rigorous quality control and validation measures. |

|

Analytical Tools |

Porter's Five Forces, SWOT, value chain, and Harvey ball analysis to assess competitive intensity, stakeholder roles, and relative impact of key factors. |

Key Market Segments

By Type

-

Sorbitol

-

Xylitol

-

Maltitol

-

Mannitol

-

Lactitol

-

Erythritol

-

Isomalt

-

Other Polyols

By Form

-

Powder

-

Granules

-

Syrup

-

Tablets

By Application

-

Food and Beverages

-

Confectionery

-

Bakery

-

Dairy

-

Beverages

-

Traditional Sweets

-

Other Food Products

-

-

Pharmaceuticals

-

Syrups

-

Chewable Tablets

-

Oral Care Products

-

-

Personal Care and Nutraceuticals

-

Toothpaste and Mouthwash

-

Nutritional Supplements

-

By End-User

-

Food Manufacturers

-

Pharmaceutical Companies

-

Personal Care and Nutraceutical Companies

-

Home/Consumers

Geographical Breakdown

-

North America: U.S., Canada, and Mexico.

-

Europe: U.K., Germany, France, Italy, Spain, Sweden, Denmark, Finland, Netherlands, and rest of Europe.

-

Asia Pacific: China, India, Japan, South Korea, Taiwan, Indonesia, Vietnam, Australia, Philippines, Malaysia and rest of APAC.

-

Middle East & Africa (MEA): Saudi Arabia, UAE, Egypt, Israel, Turkey, Nigeria, South Africa, and rest of MEA.

-

Latin America: Brazil, Argentina, Chile, Colombia, and rest of LATAM

Conclusion & Recommendations

Our report equips stakeholders, industry participants, investors, and consultants with actionable intelligence to capitalize on sugar polyol’s transformative potential. By combining robust data-driven analysis with strategic frameworks, NMSC’s Sugar Polyol Market Report serves as an indispensable resource for navigating the evolving landscape.

The strategic outlook for the market is marked by steady expansion, technological refinement, and increasing alignment with global health and sustainability goals. As consumers continue to demand reduced-sugar and functional products, manufacturers are prioritizing innovation in formulation, sensory optimization, and clean-label sourcing. Regional growth in Asia-Pacific and Latin America underscores the need for scalable, cost-efficient production, while mature markets in North America and Europe drive demand for premium, high-purity polyols. Continued investments in bio-based feedstocks and process efficiency further enhance the market’s resilience and profitability, positioning sugar polyol as essential components of the future low-sugar economy.

For executives and investors, the path forward lies in building strategic partnerships across the ingredient and food-tech ecosystem, integrating R&D with market intelligence to anticipate shifts in consumer behaviour and regulatory frameworks. Allocating capital toward sustainable production, localized supply chains, and novel formulation technologies deliver both competitive advantage and measurable ESG value, ensuring strong, future-ready portfolios in the evolving sweetener landscape

Speak to Our Analyst

Speak to Our Analyst