Tallow Market By Animal Source (Cattle, Sheep and Goat, Pig, and Others), By Product Type (Refined Tallow, Unrefined Tallow, and Tallow Fatty Acids), By Grade (Edible and Technical / Industrial), By Form (Solid and Liquid), By Distribution Channel (Hypermarkets and Supermarkets, Online Retail, Distributors and Wholesalers, and Direct Sales), By Application (Food and Beverage, Animal and Pet Feed, Personal Care and Cosmetics, and Others) – Global Analysis & Forecast, 2025–2030

Industry Outlook

The global Tallow Market size was valued at USD 10.41 billion in 2024 and is expected to reach USD 11.02 billion by 2025. Looking ahead, the industry is projected to expand significantly, reaching USD 14.65 billion by 2030, registering a CAGR of 5.87% from 2025 to 2030.

The tallow industry today stands as a mature, commodity-driven segment anchored to global meat and rendering supply chains. It functions as a versatile by-product market, where processors collect and render animal fats into tallow and refined derivatives that move into food processing, animal feed, oleochemicals, and industrial uses. Recent years have seen steady commercial demand from renewable fuels and oleochemical manufacturers, which has increased competition for available supplies and pushed larger processors toward integration and strategic offtake agreements. At the same time, buyers and regulators are pressing for clearer traceability and sustainability assurances, so supply-chain transparency and certification have become central commercial differentiators. Tallow’s practical applications are broad and evolving, culinary fats and frying, soap and personal-care emulsifiers, lubricants and surfactants, and feedstock for renewable diesel and aviation fuels, which keeps the product relevant across low- and high-value segments.

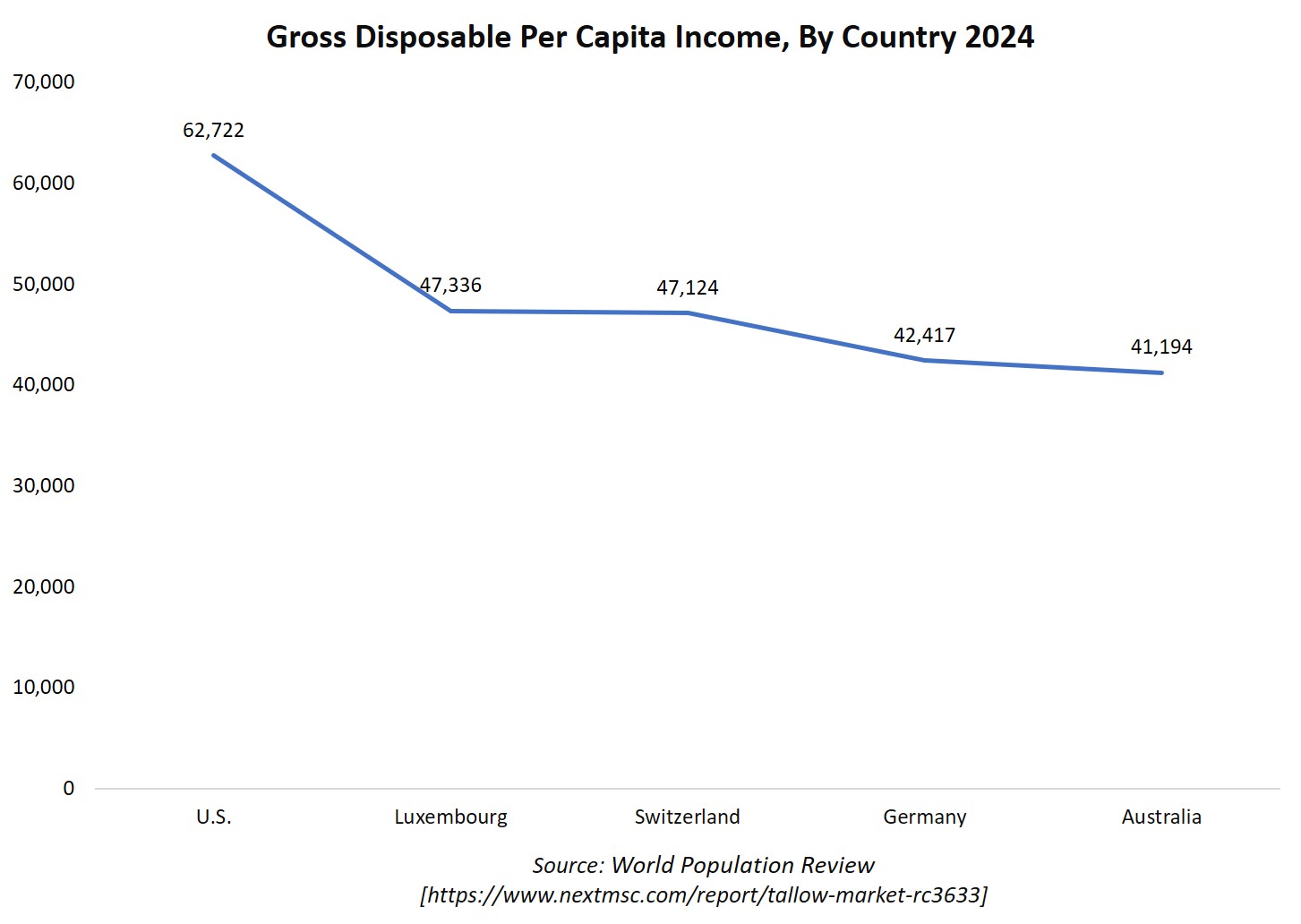

Additionally, gross disposable income significantly impacts the tallow market by influencing consumer purchasing power and demand patterns. As disposable income rises, especially in emerging economies, consumers tend to shift toward higher consumption of food products, personal care items, and other goods that utilise tallow as a raw material. This increased spending power boosts demand for tallow-based products in food processing, cosmetics, pharmaceuticals, and renewable energy sectors.

The chart illustrates the gross disposable per capita income across five countries. In regions with elevated disposable income, consumers are more likely to spend on products containing tallow, including processed foods, cosmetics, personal care, and biofuels. This increased demand pushes the market toward innovation, premiumization, and expansion. Conversely, countries with lower disposable income see less demand growth for such non-essential or value-added tallow products, keeping market growth more moderate compared to high-income economies.

What are the key trends in the tallow industry?

How is the Tallow market transforming renewable fuels demand?

Tallow’s role as a low-cost, high-yield feedstock for hydro processed esters and fatty acids (HEFA) pathways has become front-and-centre as renewable diesel and SAF scale up. Renewable diesel capacity more than quadrupled between 2020 and 2024 and imports of animal fats, including tallow used for biofuel production jumped sharply, reflecting that feedstock substitution is real and material. This has pushed many renderers and meat processors into longer-term supply arrangements and spurred traders to secure cross-border flows to meet refining contracts. The practical consequence is twofold; price linkages to fuel policy and refinery off-take give tallow new demand elasticity, but they also expose the market to policy and tax shifts. Companies are therefore stress-testing commercial models against biofuel policy scenarios, locking in diversified offtake partners, and investing in quality assurance to meet HEFA/SAF spec requirements.

Rising demand for renewable fuels, such as biodiesel and renewable diesel, has significantly impacted the tallow market by transforming tallow from a traditional by-product into a highly sought-after feedstock. As governments and industries prioritize sustainable, low-carbon fuel sources, tallow, owing to its high energy content and low carbon intensity, has become integral to producing renewable fuels that meet increasingly stringent environmental mandates. This surge in demand often outpaces available supply, driving up prices and intensifying competition for tallow among fuel producers and other users, such as the oleochemical and animal feed industries.

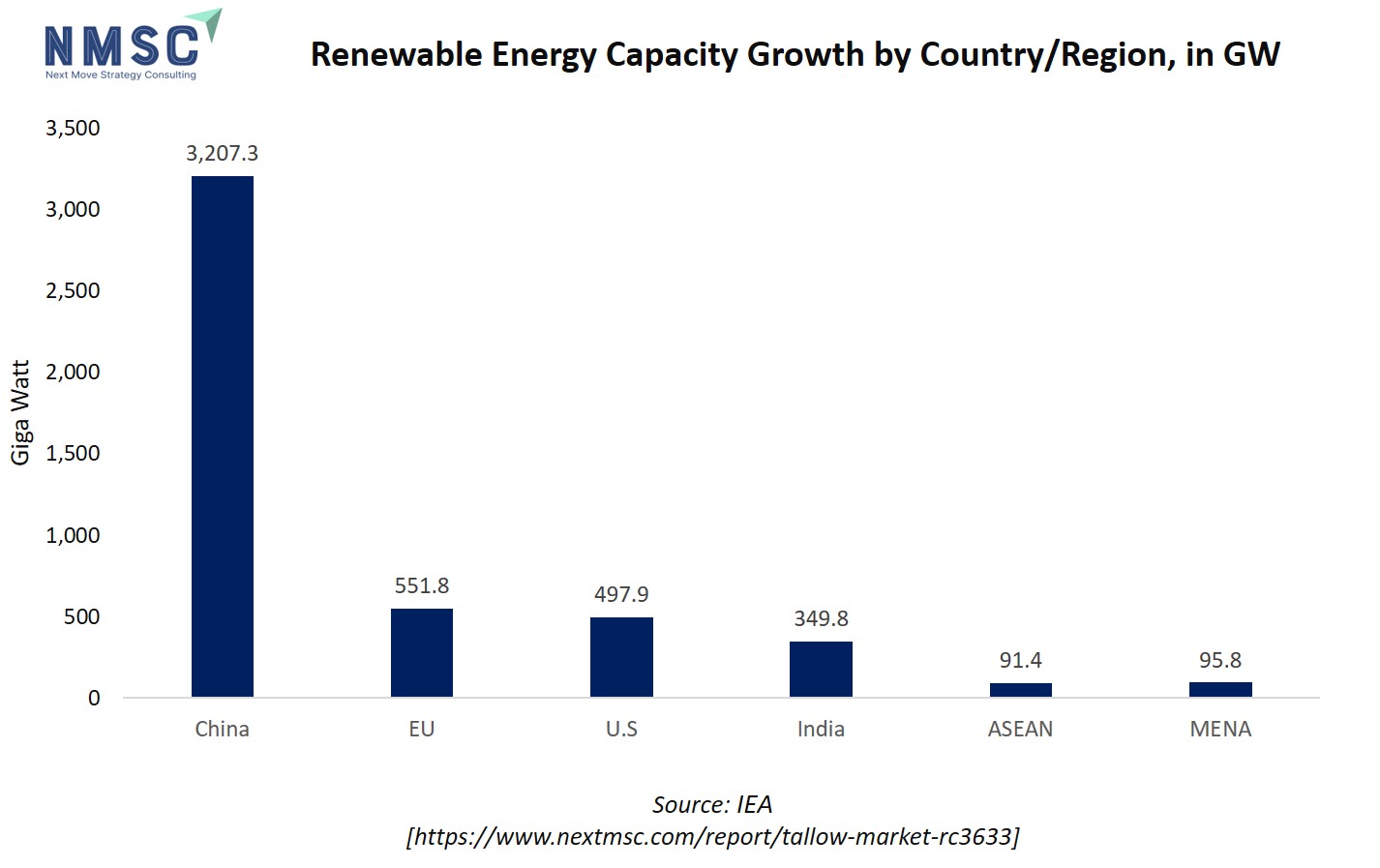

The rapid expansion of renewable energy, especially in countries like China, the EU, and the U.S., often includes an increased focus on renewable fuels such as biodiesel and renewable diesel, where tallow serves as a key feedstock. Countries making large investments in renewable energy typically adopt supportive policies and incentives for cleaner fuel production, directly driving the demand for tallow. As these regions increase their renewable energy output, the competition for feedstocks like tallow intensifies, pushing up prices and shaping global trade flows for tallow-based renewable fuels. Thus, mapping renewable energy capacity growth helps stakeholders in the tallow market anticipate shifts in demand and identify critical regions for expansion or sourcing.

How is the Tallow market sourcing changing under sustainability and traceability pressure?

Sustainability regulations and concerns over forest-related risks are reshaping how and where tallow is sourced. New measures, such as the EU’s anti-deforestation laws and various national due diligence requirements, are making traceable sourcing a key priority for buyers. While implementation timelines vary, the overall direction points toward stricter compliance expectations. As a result, tallow is no longer traded as a simple bulk commodity; buyers now expect clear supply-chain documentation, regular supplier audits, and third-party certifications to manage both regulatory and reputational risks. Producers that ensure transparency, traceability, and responsible sourcing practices are better positioned to secure long-term contracts and maintain stronger pricing stability.

How is feedstock competition and price volatility reshaping tallow value chains?

Rising demand from renewable fuel producers, combined with seasonal limits in rendering and fluctuations in vegetable oil markets, has led to greater short-term volatility in tallow prices. This tightening supply environment is driving consolidation across the value chain, with renderers increasingly partnering or integrating with packers and biodiesel producers. To protect margins, many companies are diversifying their feedstock mix, blending tallow with poultry fat or used cooking oil where regulations allow and adopting flexible procurement strategies with hedging and seasonal sourcing options. For traders and processors, maintaining small storage capacities and investing in quick quality testing help manage supply disruptions and reduce pricing risks.

How is upgrading tallow into speciality oleochemicals creating premium opportunities?

Beyond traditional bulk fat sales, the market is increasingly focusing on fractionation and chemical upgrading. Tallow is being converted into fatty acids, methyl esters, and other higher-value derivatives for use in cosmetics, lubricants, and surfactants, reflecting the growing preference for bio-based inputs in the oleochemical industry. Forecasts indicate rising demand for these tallow-derived products, offering higher margins for suppliers that move up the value chain. Companies now explore capital-efficient options such as tolling agreements with speciality processors, co-developing tallow fractions with formulators, or gradually investing in refining capabilities. Emphasising quality control, obtaining certifications, like ISCC, and providing transparent lifecycle information help secure access to these premium, high-margin markets.

What are the key market drivers, breakthroughs, and investment opportunities that will shape the tallow industry in the next decade?

The tallow market is experiencing significant growth, driven by increasing demand across various industries. This growth is fueled by the expanding use of tallow in biofuels, animal feed, and oleochemicals. However, the market faces challenges such as supply constraints and regulatory pressures. Addressing these issues presents opportunities for innovation and strategic investments. Key drivers include the rising demand for renewable fuels and the increasing emphasis on sustainability and traceability in sourcing. Conversely, challenges like feedstock competition and price volatility, along with the need for significant capital investment in refining capabilities, pose obstacles. Nonetheless, these challenges also open avenues for companies to invest in upgrading tallow into higher-value products, thereby capturing premium market segments.

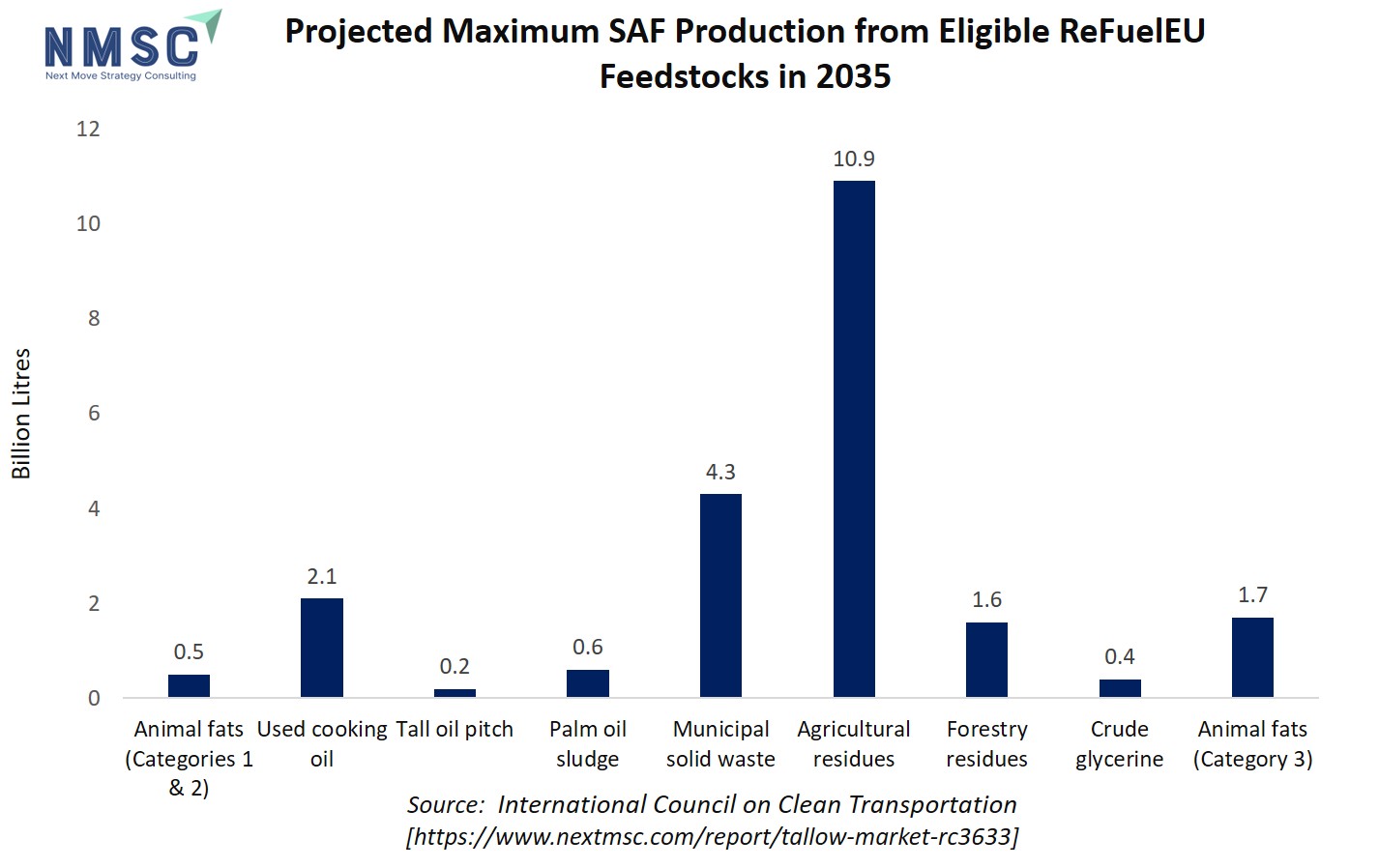

Additionally, maximum SAF production potential from eligible ReFuelEU feedstocks acts as a demand driver for the tallow (animal fats) market. Regulatory support and policy incentives like ReFuelEU compel the aviation sector to increase the use of sustainable aviation fuels, significantly boosting demand for eligible feedstocks, including animal fats (tallow). As these feedstocks become more essential in meeting aggressive decarbonization and SAF blending targets, their importance as a market driver grows. This policy-induced demand influences supply allocation, price dynamics, and investment in the market, making it a clear illustration of a demand-side driver stemming from sustainability mandates and future requirements for SAF production.

This chart reflects a strong demand-side driver for the tallow market growth, as regulations like the ReFuelEU initiative mandate increasing use of sustainable aviation fuels, thereby boosting demand for eligible feedstocks such as animal fats. Policy-induced demand from the aviation sector incentivises greater allocation of tallow for SAF production, raising its strategic value and price in the market while intensifying competition with other industries reliant on animal fats. As a result, regulatory pressure and the shift toward decarbonization in air transport are poised to make sustainable fuel demand a central force reshaping the market landscape.

Growth Drivers:

How is the tallow market benefiting from renewable fuel mandates?

The global push for renewable energy has significantly increased the demand for tallow as a feedstock for biofuels. Government mandates and incentives for renewable fuels are boosting demand for tallow as a feedstock. This surge in demand is attracting investments and driving innovation in the biofuel sector. Companies in the tallow supply chain capitalise on this trend by securing long-term contracts with biofuel producers and investing in infrastructure to meet the growing demand. Additionally, exploring partnerships with renewable energy firms provides stable revenue streams and enhances market positioning.

How is sustainability and traceability reshaping tallow sourcing?

Increasing regulatory requirements and consumer demand for sustainable products are pushing companies to adopt traceable and eco-friendly sourcing practices. Governments in North America, Europe, and the Asia Pacific are implementing stringent regulations on the use of animal by-products, waste management, and renewable fuels, creating both opportunities and challenges for tallow manufacturers. This shift is compelling tallow producers to enhance transparency and sustainability in their operations. To align with these expectations, companies invest in traceability technologies, obtain relevant certifications, and collaborate with stakeholders to ensure responsible sourcing practices. Adopting these measures improves brand reputation and opens access to premium markets that prioritise sustainability.

Growth Inhibitors:

What challenges arise from feedstock competition and price volatility?

The tallow market expansion faces challenges related to limited supply and price volatility, driven by competition from alternative feedstocks and shifts in demand across end-use sectors. These fluctuations impact operational margins and complicate procurement planning. Companies address these risks by diversifying their feedstock portfolio, maintaining flexible supply arrangements, and establishing robust storage and quality management systems. Strengthening relationships with suppliers and exploring alternative inputs help businesses maintain stability and reduce exposure to sudden market changes, ensuring continuity in both production and revenue streams.

What investment opportunities exist in upgrading tallow into higher-value products?

There is a clear opportunity for companies to increase margins by upgrading tallow into higher-value derivatives such as fatty acids, methyl esters, and speciality oleochemicals. These products are increasingly sought after in cosmetics, lubricants, and surfactants, where bio-based inputs are preferred. Businesses explore capital-efficient strategies such as tolling agreements with specialised processors, co-development with formulators, or gradual investment in refining capabilities. Focusing on quality assurance, obtaining sustainability certifications, and providing transparent lifecycle information helps secure access to these premium segments, positioning companies for long-term growth and higher profitability.

How is Tallow Market segmented in this report, and what are the key insights from the segmentation analysis?

By Animal Source Insights

Is Animal Source Defining the Tallow Market in 2025?

Based on animal source, the market is segmented into cattle, sheep and goat, pig, and others.

Cattle-derived tallow holds the largest share of the global market due to the widespread availability of beef and related byproducts. In regions like North America and Latin America, where beef production is high, bovine tallow is more readily accessible and cost-effective. This abundance makes it a preferred choice for industrial applications such as biodiesel production, soap manufacturing, and oleochemicals. Sheep and goat-derived tallow, while less prevalent, is valued for its unique properties. This type of tallow is used in high-end cosmetics, pharmaceuticals, and speciality soaps due to its distinct fatty acid composition. The limited supply and higher cost of sheep/goat tallow make it suitable for premium markets where quality and specificity are paramount. Its use is particularly prominent in regions with strong sheep and goat farming traditions, such as parts of Europe and the Middle East.

Pig-derived tallow is versatile and widely used across various industries, including animal feed, biodiesel production, and industrial lubricants. Its fatty acid profile makes it suitable for high-temperature applications and as a feedstock for renewable diesel. The pig segment's growth is driven by the extensive pork industry in countries like China and the European Union, where pork is a staple meat. The availability of pig tallow supports its use in diverse applications, balancing cost and performance.

The Others category encompasses tallow derived from animals like poultry and horses, as well as synthetic and plant-based alternatives. While these sources currently represent a smaller portion of the market, they are gaining attention due to innovations in rendering technologies and increasing demand for sustainable and ethical products.

By Product Type Insights

How Are Different Product Types Driving the Tallow Market Trends in 2025?

On the basis of product type, the market is segmented into refined tallow, unrefined tallow, and tallow fatty acids.

Refined tallow is processed to remove impurities, resulting in a high-quality product suitable for applications in food processing, cosmetics, and biodiesel production. Its purity and consistency make it a preferred choice for industries requiring stringent quality controls. The refining process enhances its stability and shelf life, making it ideal for use in products like soaps, candles, and lubricants. The demand for refined tallow is driven by the increasing consumer preference for natural and sustainable ingredients in personal care and food products.

Unrefined tallow retains its natural composition, making it suitable for various industrial applications, including animal feed and biodiesel production. Its versatility and cost-effectiveness make it an attractive option for industries seeking functional ingredients without the need for extensive processing. The use of unrefined tallow aligns with the growing trend towards utilising by-products in sustainable manufacturing processes. However, its application is limited to non-food and non-cosmetic uses due to the presence of impurities.

Tallow fatty acids are derived from the hydrolysis of tallow and are utilised in specialised applications such as soap manufacturing, rubber production, and as emulsifiers in various industries. These derivatives offer specific functional properties, including lubrication and emulsification, making them valuable in niche markets. The demand for tallow fatty acids is influenced by the growth of industries like personal care, pharmaceuticals, and automotive manufacturing, where specialised chemical properties are required. Advancements in processing technologies are expanding the range of applications for tallow fatty acids, further driving their market growth.

By Grade Insights

Is Grade Determining the Growth Trajectory of the Tallow Market?

On the basis of grade, the market is segmented into edible and technical/industrial.

Edible-grade tallow meets strict food safety and quality standards, making it suitable for applications in cooking fats, bakery products, and confectionery. Its purity, stability, and fatty acid profile ensure safe consumption and consistent performance in food processing. The demand for edible-grade tallow is growing with increased awareness of natural and traditional cooking fats, especially in regions with strong culinary preferences for animal-based fats.

Technical or industrial-grade tallow, on the other hand, is used in applications such as biodiesel production, lubricants, soaps, candles, and oleochemicals. This grade prioritises functional properties over food safety, allowing for broader industrial utility and cost-effective sourcing. Its versatility makes it a preferred choice for manufacturers seeking sustainable raw materials for non-food applications.

By Form Insights

Is Product Form Shaping the Tallow Market Dynamics in 2025?

On the basis of form, the market is segmented into solid and liquid.

Solid tallow, typically sold in blocks or pellets, is valued for its stability, ease of storage, and long shelf life. It is commonly used in soap and candle manufacturing, lubricants, and other industrial applications where handling convenience and consistent composition are essential. The solid form also facilitates transport and bulk storage, making it cost-effective for large-scale industrial consumers. However, liquid tallow, usually melted or rendered, offers flexibility for blending and further processing into biodiesel, oleochemicals, or other derivative products. Its ease of pumping and incorporation into production lines makes it ideal for continuous industrial processes and chemical manufacturing. The liquid form supports faster processing, enabling manufacturers to respond to fluctuating demand and streamline operations.

By Distribution Channel Insights

How Are Distribution Channels Influencing the Tallow Market in 2025?

On the basis of distribution channel, the market is segmented into hypermarkets and supermarkets, online retail, distributors and wholesalers, and direct sales.

Hypermarkets and supermarkets serve as primary points for edible-grade tallow, targeting households and small-scale food businesses. These retail channels emphasize convenience, brand visibility, and bulk availability. Their structured inventory and wide reach allow suppliers to cater to regions with high consumer demand, while promotional activities drive brand loyalty.

Online retail has emerged as a critical channel, providing convenient access to both edible and specialty tallow products. E-commerce platforms enable suppliers to reach niche markets, including health-conscious consumers and small-scale manufacturers, without relying on physical retail presence. Online channels also facilitate direct customer engagement, personalized offerings, and subscription-based models. Suppliers focusing on online retail enhance their market penetration by investing in digital marketing, robust logistics, and responsive customer service.

Distributors and wholesalers act as intermediaries between tallow producers and industrial consumers, including biodiesel manufacturers, soap makers, and oleochemical processors. They offer bulk purchasing, storage solutions, and streamlined logistics, ensuring consistent supply to large-scale buyers. By partnering with reliable distributors, companies expand their reach efficiently and respond quickly to regional demand fluctuations. This channel is especially valuable for technical-grade tallow and large-volume industrial applications.

By Application Insights

Which Applications Are Shaping the Growth of the Tallow Market Demand in 2025?

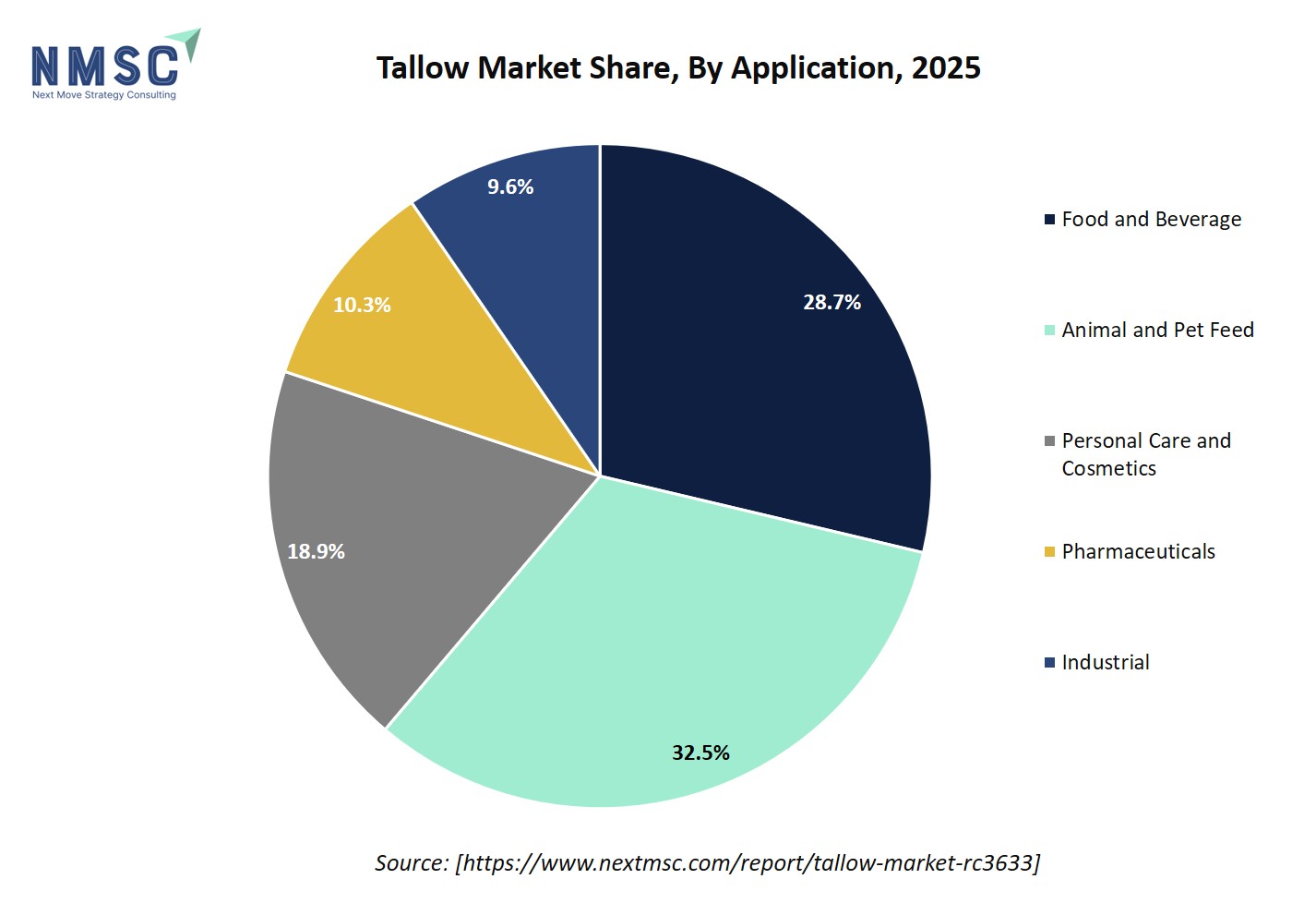

On the basis of application, the market is segmented into food and beverage, animal and pet feed, personal care and cosmetics, pharmaceuticals, and industrial.

Tallow in the food and beverage segment is widely used as cooking fat, a bakery ingredient, and in processed foods. Its stability at high temperatures and natural composition make it a preferred choice in traditional cuisines and industrial food preparation. Rising consumer awareness of natural fats and culinary trends favouring traditional cooking methods continue to drive demand. However, tallow serves as a high-energy ingredient in animal and pet feed, providing essential fatty acids and calories. Its cost-effectiveness and availability make it a key component in feed formulations for livestock, poultry, and pets. The growth of the global livestock and pet food industry supports consistent demand for tallow in this segment. Companies capitalise by ensuring quality consistency, reliable supply chains, and customised formulations to meet the nutritional needs of different animals.

Tallow is used in soaps, creams, and other personal care products due to its moisturising properties and emulsifying capabilities. Increasing consumer preference for natural and bio-based ingredients enhances demand in this segment. Suppliers gain a competitive edge by providing refined, high-purity tallow, obtaining sustainability certifications, and partnering with cosmetic manufacturers to develop innovative formulations that meet evolving consumer expectations.

Regional Outlook

The tallow market share is geographically studied across North America, Europe, Asia Pacific, Middle East & Africa, and Latin America and each region is further studied across countries.

Tallow Market in North America

In North America, particularly the United States, the market is experiencing growth driven by technological advancements and increased demand in the biofuel sector. The integration of AI and automation in rendering processes is enhancing efficiency and product quality. The U.S. has seen a significant increase in tallow imports, with imports more than doubling. This surge is attributed to rising demand for tallow-based biodiesel and sustainable sourcing practices. The Clean Fuels Alliance America's 2024 annual report highlights the importance of biofuels in the region's decarbonization strategy, emphasising the role of tallow as a renewable feedstock in biofuel production.

Tallow Market in the United States

The U.S. market is growing steadily, driven by rising demand in biofuel production, personal care, and food industries. The country has significantly increased tallow imports in recent years, sourcing from Australia, Canada, Brazil, and Argentina to meet industrial needs. AI and automation are being integrated into rendering and supply chain processes, improving efficiency, reducing waste, and ensuring consistent quality. The U.S. Environmental Protection Agency 2024 reports highlight that bio-based feedstocks, including tallow, are essential for renewable fuel programs, which directly support tallow demand in biodiesel and sustainable aviation fuel production. This combination of regulatory support, technological adoption, and industrial demand positions the U.S. as a central driver of the North American tallow market.

Tallow Market in Canada

Canada's market is characterised by a strong focus on sustainable practices and a growing export orientation. The country is leveraging its agricultural base to produce tallow for various applications, including biofuels and animal feed. Technological advancements in rendering processes are improving efficiency and reducing environmental impact. Canada's regulatory framework supports sustainable practices, further boosting the demand for tallow in international markets.

Tallow Market in Europe

In Europe, the market is influenced by sustainability initiatives and the integration of tallow into biofuel production. The European Union's biofuel mandates are driving the demand for tallow as a feedstock for biodiesel production. The availability of waste oil feedstocks, including tallow, is being assessed to meet the growing demand for sustainable aviation fuel. The potential of waste oils, such as tallow, in SAF production highlights the importance of these feedstocks in achieving emission reduction targets.

Tallow Market in the United Kingdom

The United Kingdom's market is experiencing a resurgence due to a renewed interest in traditional uses and modern applications. Tallow is being utilized in soap making, skincare products, and as a sustainable ingredient in various formulations. The demand for natural and bio-based ingredients is driving the growth of tallow-based products in the personal care sector. Technological advancements in rendering processes are improving the quality and consistency of tallow, supporting its use in diverse applications.

Tallow Market in Germany

Germany's market is primarily driven by its use in biofuel production and industrial applications. The country's commitment to renewable energy and sustainability is propelling the demand for tallow-based biodiesel. The industrial sector's demand for tallow in lubricants and oleochemicals is also contributing to market growth. AI and automation are being integrated into production processes to enhance efficiency and reduce environmental impact. Germany's strong regulatory framework supports sustainable practices, further encouraging the use of tallow in various applications.

Tallow Market in France

In France, the market is experiencing growth due to increased demand in the cosmetics and pharmaceutical industries. The country's strong focus on natural and sustainable ingredients is driving the use of tallow in skincare products, soaps, and ointments. Technological advancements in rendering processes are improving product quality and efficiency. France's regulatory environment supports the use of animal-derived ingredients in cosmetics, further boosting the demand for tallow-based products.

Tallow Market in Italy

Italy's market is influenced by its culinary traditions and industrial applications. Tallow is used in traditional cooking methods, particularly in deep-frying and pastry production. The industrial sector utilizes tallow in the production of lubricants and oleochemicals. Technological advancements in rendering processes are improving efficiency and product quality. Italy's regulatory framework encourages sustainable practices, supporting the use of tallow in various applications.

Tallow Market in Spain

Spain's market is driven by its use in renewable energy production and industrial applications. The country's commitment to renewable energy is propelling the demand for tallow-based biodiesel. The industrial sector's demand for tallow in lubricants and oleochemicals is also contributing to market growth. AI and automation are being integrated into production processes to enhance efficiency and reduce environmental impact. Spain's regulatory framework supports sustainable practices, further encouraging the use of tallow in various applications.

Tallow Market in the Nordics

The Nordic countries are at the forefront of integrating sustainable practices and technological advancements in tallow production. AI and automation are being utilized to improve efficiency and reduce environmental impact. The demand for tallow-based products in biofuel production, cosmetics, and animal feed is increasing, driven by consumer preferences for sustainable and natural ingredients. The Nordic regulatory environment supports sustainable practices, further boosting the demand for tallow in various industries.

Tallow Market in the Asia-Pacific

The Asia-Pacific region is experiencing rapid growth in the market, driven by advancements in rendering technology and increasing applications in personal care and cosmetics. Countries like China and India are leading in tallow production and consumption, supported by strong agricultural bases and growing industrial sectors. AI adoption is gradually increasing, enhancing production efficiency and supply chain management.

Tallow Market in China

China's market is expanding due to industrial growth and export potential. The country is increasing its tallow production to meet domestic demand and export requirements. Technological advancements in rendering processes are improving efficiency and product quality. China's regulatory environment is evolving to support sustainable practices in tallow production. The demand for tallow-based products in biofuel production, cosmetics, and animal feed is increasing, driven by both domestic and international markets.

Tallow Market in Japan

Japan's market is characterized by technological integration and market stability. The country is adopting AI and automation in tallow production to enhance efficiency and reduce costs. The demand for tallow-based products in personal care and cosmetics is stable, supported by consumer preferences for natural ingredients. Japan's regulatory framework encourages sustainable practices, further supporting the use of tallow in various applications.

Tallow Market in India

India's market is growing due to its strong agricultural base and emerging applications in various industries. The country is increasing its tallow production to meet domestic demand and export requirements. The demand for tallow-based products in biofuel production, cosmetics, and animal feed is rising, driven by both domestic consumption and international markets. AI adoption is gradually increasing, enhancing production efficiency and supply chain management.

Tallow Market in South Korea

South Korea's market is influenced by technological advancements and market expansion. The country is integrating AI and automation in tallow production to improve efficiency and reduce costs. The demand for tallow-based products in personal care and cosmetics is increasing, driven by consumer preferences for natural ingredients. South Korea's regulatory environment supports sustainable practices, further boosting the demand for tallow in various industries.

Tallow Market in Taiwan

Taiwan's market is driven by industrial applications and technological integration. The country utilizes tallow in the production of lubricants and oleochemicals. Technological advancements in rendering processes are improving efficiency and product quality. Taiwan's regulatory framework encourages sustainable practices, supporting the use of tallow in various applications.

Tallow Market in Indonesia

Indonesia's market is expanding due to its strong agricultural base and focus on sustainable practices. The country is increasing its tallow production to meet domestic demand and export requirements. The demand for tallow-based products in biofuel production, cosmetics, and animal feed is rising, driven by both domestic consumption and international markets. AI adoption is gradually increasing, enhancing production efficiency and supply chain management.

Tallow Market in Australia

Australia's market is characterized by export growth and technological advancements. The country is increasing its tallow production to meet export requirements, particularly to markets in North America and Asia. Technological advancements in rendering processes are improving efficiency and product quality. Australia's regulatory environment supports sustainable practices, further boosting the demand for tallow in various industries.

Tallow Market in Latin America

Latin America's market is influenced by its agricultural strength and emerging technologies. The region's strong agricultural base supports tallow production for domestic consumption and export. AI adoption is gradually increasing, enhancing production efficiency and supply chain management. The demand for tallow-based products in biofuel production, cosmetics, and animal feed is rising, driven by both domestic consumption and international markets.

Tallow Market in the Middle East & Africa

The Middle East and Africa's market is growing due to sustainable practices and market expansion. The region is focusing on sustainable rendering processes and adhering to environmental regulations, which appeal to international markets seeking sustainable raw materials. The demand for tallow-based products in biofuel production, cosmetics, and animal feed is increasing, driven by both domestic consumption and international markets. AI adoption is gradually increasing, enhancing production efficiency and supply chain management.

Competitive Landscape

Which Companies Dominate the Tallow Industry and How Do They Compete?

The tallow market is led by a mix of global giants and specialized players competing across industrial, food, and biofuel segments. Cargill, Incorporated leverages large-scale operations and sustainable energy projects to strengthen its foothold in renewable fuels. Wilmar International focuses on operational integration across origination, processing, and manufacturing, ensuring efficiency and wide market coverage. Meanwhile, Jacob Stern & Sons Inc and Baker Commodities target niche segments, emphasizing customized tallow solutions for specialty food and industrial uses. These varied strategies reflect how market leaders balance scale, diversification, and specialized offerings to capture both volume-driven and high-margin opportunities.

Market Dominated by Tallow Giants and Specialists

The tallow market structure reflects a clear division between large multinational giants and smaller specialised firms. Giants such as Cargill and JBS S.A. command global supply chains, driving scale economies in biofuel, personal care, and industrial markets. In contrast, specialists like Vantage Speciality Chemicals cater to high-value applications, including oleochemicals and cosmetics, where customisation and quality are critical. This competition shapes regional dynamics: giants dominate volume-heavy markets, while specialists capture niche demand through targeted innovation. Such segmentation ensures both types of players thrive, with giants focusing on global reach and specialists on tailored solutions.

Innovation and Adaptability Drive Market Success

Innovation is a central differentiator in the tallow market. Companies are adopting new processing technologies, sustainable rendering practices, and product differentiation to meet evolving demands. For instance, Wilmar International invests in integrated agribusiness operations to improve efficiency and reduce waste, while Cargill has reengineered its edible oils portfolio to comply with global health standards, removing trans fats and aligning with sustainability goals. Jacob Stern & Sons focuses on specialty fatty acids and niche industrial applications, demonstrating how adaptability in product offerings and operational processes enables firms to respond swiftly to market trends and regulatory changes, maintaining competitiveness.

Market Players to Opt for Merger & Acquisition Strategies to Expand Their Presence

Merger and acquisition (M&A) strategies are increasingly being employed by market players to expand their presence and enhance their capabilities in the industry. Bunge Limited's announced business combination with Viterra is a prime example of such a strategy. The merger aims to create a more resilient and diversified global agribusiness, enhancing Bunge's capabilities in the market by expanding its product offerings and market reach. Similarly, JBS S.A., the world's largest meat producer, has made strategic investments to strengthen its position in the market. In 2025, JBS announced a USD 70 million investment in Paraguay, including the acquisition of a local chicken brand's processing plant. This move is expected to enhance JBS's competitiveness and diversification, contributing to its growth in the tallow market. These M&A activities highlight the industry's trend towards consolidation, with companies seeking to leverage synergies, expand their product portfolios, and access new markets to drive growth and profitability.

List of Key Tallow Companies

-

Cargill, Incorporated

-

Ajinomoto Co., Inc.

-

Vantage Specialty Chemicals, Inc

-

Jacob Stern & Sons Inc

-

Baker Commodities Inc

-

Cailà & Parés

-

Wilmar International Limited

-

Bunge Limited

-

Tyson Foods Inc.

-

JBS S.A.

What are the Latest Key Industry Developments?

-

October 2025- JBS S.A. acquired Pollos Amanecer's processing plant and plans to expand production to 100,000 birds per day. Increased poultry processing generates more tallow as a by-product, boosting raw material availability for biodiesel, animal feed, and oleochemical industries, while supporting regional market growth.

-

July 2025- Bunge Limited’s USD 34 billion merger with Viterra strengthens its grain and oilseed processing operations, indirectly impacting the tallow market by enhancing integrated supply chains and distribution networks. Greater scale improves the sourcing and trade of tallow-derived feedstocks, especially for biodiesel and oleochemical applications.

What are the Key Factors Influencing Investment Analysis & Opportunities in the Tallow Market?

The tallow market is attracting increasing investor attention due to its versatility across biofuels, cosmetics, and animal feed industries. Growing emphasis on sustainability and renewable raw materials is driving interest from private equity and strategic investors seeking to capitalize on long-term demand. Funding trends show a preference for companies that integrate tallow into higher-value applications, such as oleochemicals and speciality personal care products.

Investment hotspots are emerging in regions with robust agricultural and livestock sectors, including North America, Europe, and parts of the Asia-Pacific. Companies with scalable processing capabilities, strong supply chain integration, and traceable sourcing are seen as more attractive for investment. The market’s adaptability to regulatory shifts, coupled with innovations in processing and product diversification, presents opportunities for investors to support expansion, vertical integration, and strategic partnerships, ensuring both growth and risk mitigation in a competitive landscape.

Key Benefits for Stakeholders:

Next Move Strategy Consulting (NMSC) presents a comprehensive analysis of the Tallow Market, covering historical trends from 2020 through 2024 and offering detailed forecasts through 2030. Our study examines the market at regional and country levels, providing quantitative projections and insights into key growth drivers, challenges, and investment opportunities across all major tallow segments.

The tallow industry offers distinct benefits to various stakeholders. Investors gain opportunities for stable returns and portfolio diversification due to tallow’s growing demand across biofuels, animal feed, and personal care sectors, coupled with the market’s adaptability to sustainability trends. Customers, including manufacturers and processors, benefit from a reliable and versatile raw material that are tailored for specific applications, such as biodiesel production, oleochemicals, and cosmetics, while meeting regulatory and environmental standards. Additionally, end-users benefit from innovative, high-quality products derived from tallow, such as natural skincare formulations and sustainable industrial inputs. This combination of reliable supply, product versatility, and alignment with global sustainability goals ensures value creation across the value chain.

Report Scope:

|

Parameters |

Details |

|

Market Size in 2025 |

USD 11.02 Billion |

|

Revenue Forecast in 2030 |

USD 14.65 Billion |

|

Growth Rate |

CAGR of 5.87% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

10 |

|

Countries Covered |

33 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customisation (equivalent to up to 80 analyst-working hours) after purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

|

Approach |

In-depth primary and secondary research; proprietary databases; rigorous quality control and validation measures. |

|

Analytical Tools |

Porter's Five Forces, SWOT, value chain, and Harvey ball analysis to assess competitive intensity, stakeholder roles, and relative impact of key factors. |

Key Market Segments

By Animal Source

-

Cattle

-

Sheep and Goat

-

Pig

-

Others

By Product Type

-

Refined Tallow

-

Unrefined Tallow

-

Tallow Fatty Acids

By Grade

-

Edible

-

Technical / Industrial

By Form

-

Solid

-

Liquid

By Distribution Channel

-

Hypermarkets and Supermarkets

-

Online Retail

-

Distributors and Wholesalers

-

Direct Sales

By Application

-

Food and Beverage

-

Animal and Pet Feed

-

Personal Care and Cosmetics

-

Skin Care Products

-

Soaps

-

Lip Care Products

-

-

Pharmaceuticals

-

Drug Formulations

-

Nutritional Supplements

-

-

Industrial

-

Biofuels

-

Lubricants

-

Candle Manufacturing

-

Others

-

Geographical Breakdown

-

North America: U.S., Canada, and Mexico.

-

Europe: U.K., Germany, France, Italy, Spain, Sweden, Denmark, Finland, Netherlands, and rest of Europe.

-

Asia Pacific: China, India, Japan, South Korea, Taiwan, Indonesia, Vietnam, Australia, Philippines, Malaysia and rest of APAC.

-

Middle East & Africa (MEA): Saudi Arabia, UAE, Egypt, Israel, Turkey, Nigeria, South Africa, and rest of MEA.

-

Latin America: Brazil, Argentina, Chile, Colombia, and rest of LATAM

Conclusion & Recommendations

Our report equips stakeholders, industry participants, investors, and consultants with actionable intelligence to capitalize on Tallow’s transformative potential. By combining robust data-driven analysis with strategic frameworks, NMSC’s Tallow Market Report serves as an indispensable resource for navigating the evolving landscape.

The market is poised for sustained growth, driven by rising demand in biofuels, oleochemicals, personal care, and animal feed, alongside increasing emphasis on sustainable sourcing and traceability. Strategic takeaways highlight the importance of innovation, vertical integration, and geographic diversification, as well as the value of targeting higher-margin applications like speciality fatty acids and bio-based products. Companies that embrace technological advancements, regulatory compliance, and agile supply chains are better positioned to capture emerging opportunities and mitigate risks.

For executives and investors, the path forward involves prioritising partnerships, M&A opportunities, and investments in processing or refining capabilities that enable value-added product offerings. Focusing on regions with robust livestock and renewable energy infrastructure, leveraging traceable supply chains, and exploring co-development with formulators or end-users maximise returns while aligning with sustainability trends shaping the tallow market.

Speak to Our Analyst

Speak to Our Analyst