The UK AI CCTV Market by Component (Hardware and Software), by Camera Type (Dome Cameras, Bullet Cameras, and Box Cameras), by Deployment (Cloud-Based and On-Premise), and End User (Commercial, Residential, and Industrial) – Opportunity Analysis and Industry Forecast, 2025 – 2030

Industry: ICT & Media | Publish Date: 05-Aug-2025 | No of Pages: 143 | No. of Tables: 109 | No. of Figures: 54 | Format: PDF | Report Code : IC1183

The UK AI CCTV Market Overview

The UK AI CCTV market size was valued at USD 428.76 million in 2024 and is predicted to reach USD 1366.40 million by 2030, with a CAGR of 21.8% from 2025 to 2030.

The market is growing at a high speed due to rising emphasis on security and surveillance in both public and private sector. Moreover, growing smart cities initiative by the government of the UK propels the market growth. However, high cost associated with the AI CCTV restrain the market growth.

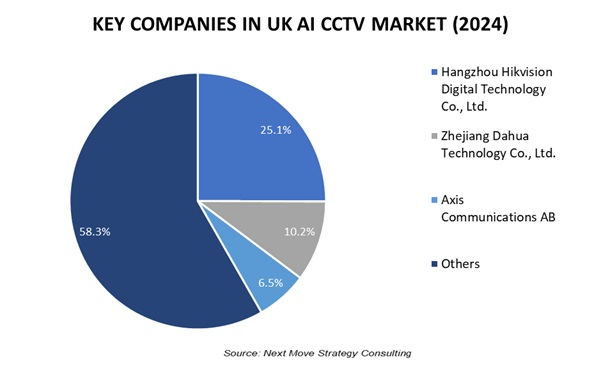

Nether less, the key companies such as Hangzhou Hikvision Digital Technology Co., Ltd., Zhejiang Dahua Technology Co., Ltd., Axis Communications AB, and others are revolutionizing the industry by launching various advanced AI CCTV which in turn creates future opportunities for the upcoming years.

Rising Emphasis on Security and Surveillance in Private and Public Sectors

The AI CCTV market continues to witness growth significantly in the UK, due to the increased integration of AI surveillance solutions in security and surveillance systems. The Public Policy Exchange Ltd. suggests that the UK is widely known for its wide application of CCTV nearly about 7.2 million cameras have been put into operation as of 2022, which is close to having nearly one camera for every nine people. This vast surveillance infrastructure puts the United Kingdom at one of the most surveilled societies in the world.

Smart City Initiatives Drives the Market Growth of the AI CCTV in the UK

The utilization of AI-powered CCTV systems in Smart City projects is the main factor that is fueling the UK AI CCTV market growth. The UK launched Smart Cities Council in November 2022 reflects a major step toward the development of smart cities. This project enables the integration of AI-based CCTV through a harmonious strategy that incorporates safety and sustainable measures as well as inclusivity.

High Installation Cost and Maintenance Restrict the Adoption of AI CCTV

The high costs associated with both the initial installation and maintenance of AI-powered CCTV systems serve as significant obstacles to the market's growth. These expenses limit the accessibility of advanced security solutions to a broader audience and also pose challenges for small businesses and homeowners looking to bolster their security measures.

Thereby, small businesses and individuals face considerable hurdles in embracing cutting-edge surveillance solutions, which in turn hinders the market growth.

Convergence of 5G connectivity and Edge computing with AI CCTV Creates Future Opportunity

The convergence of AI-powered CCTV systems with 5G connectivity and Edge Computing holds a transformative era in the surveillance industry, offering future opportunities in the UK AI CCTV market. The potential for real-time processing at the Edge, empowered by 5G's super-fast connectivity, will allow these systems to quickly scan video feeds and address security threats. This convergence of technologies is poised to drive widespread adoption and foster innovation in the surveillance industry thus paving the way for enhanced security solutions and safer environments in the years ahead.

By Component, Hardware Holds the Dominant Share in the UK AI CCTV Market

Hardware constitutes about 70% of AI CCTV Market. The hardware of an AI CCTV system comprises sophisticated cameras, sensors, edge processors, and storage units that are specifically created to increase surveillance and monitoring capabilities.

By Camera Type, Dome Cameras, Holds the Highest CAGR of 22.0%

Dome cameras in AI-powered CCTV systems contribute significantly to security and operational efficiency in the intralogistics market. Equipped with enhanced AI technology, these cameras allow for live tracking, face identification, and anomaly detection in the protection of assets and personnel. The slender design of a dome camera provides for 360-degree vision-a vital feature in keeping tabs on the movement of inventories and tracking the entry of various persons in high-traffic areas.

Competitive Landscape

The UK AI CCTV industry comprises various key players, such as Hangzhou Hikvision Digital Technology Co., Ltd., Zhejiang Dahua Technology Co., Ltd., Axis Communications AB, Motorola Solutions, Inc., Hanwha Vision Co., Ltd., Tiandy Technologies, Zhejiang Uniview Technologies Co., Ltd., IDIS Ltd., Arlo Technologies, Inc., Vivotek Inc., Entelec Inc., AMCO Security Ltd., Clearway Group Holdings Limited, Viseum Inc., Honeywell International Inc. and others.

These companies are adopting various strategies including product launches across various regions to maintain their dominance in the market. By continuously innovating and launching new offerings, they aim to meet the evolving UK AI CCTV market demands of customers and also enables them to capture new opportunities and expand their market share.

|

DATE |

COMPANY |

RECENT DEVELOPMENTS |

|

Oct-24

|

Hangzhou Hikvision Digital Technology Co., Ltd. |

Hikvision launched its latest network cameras featuring ColorVu 3.0 technology, marking a significant advancement in their EasyIP 4.0 Plus series. This new technology enhances low-light performance, enabling the cameras to capture full-color images even in dark environments. |

|

Feb-24 |

IDIS Ltd |

IDIS launched Edge AI camera with nine new models that cater to a wide range of surveillance applications. These cameras are designed with advanced features such as the ability to distinguish between vehicles, humans, and other objects, reducing false alarms and enhancing operational efficiency. |

|

Nov-23 |

Axis Communications |

Axis Communications launched its range of CCTV cameras including multidirectional panoramic cameras, high-performance bullet cameras, and stainless-steel dome camera. |

|

Sep-23 |

Arlo Technologies, Inc. |

Arlo Technologies, Inc. launched the essential cameras to provide an affordable smart home security solution. This camera is integrated with AI to enhance the smart home security solutions with features such as night vision and motion detection. |

|

Apr-23 |

Hangzhou Hikvision Digital Technology Co., Ltd. |

Hikvision launched ColorVu cameras including an LPR (License Plate Recognition) dome and camera/DVR (Digital Video Recorder) kits. These cameras are integrated with AI technology to enhance night vision capabilities and provide details in various settings. |

|

Mar-23 |

Vivotek Inc. |

Vivotek launched facial recognition camera with edge processing technology. This innovative camera integrates facial recognition technology directly into the camera itself, providing efficient and accurate recognition capabilities at the edge. |

The UK AI CCTV Market Key Segments

By Component

-

Hardware

-

Cameras

-

Storage Devices

-

Others

-

-

Software

-

Video Analytics Software

-

Video Management Software

-

By Camera Type

-

Dome Cameras

-

Bullet Cameras

-

Box Cameras

By Deployment

-

Cloud-Based

-

On-Premise

By End User

-

Commercial

-

Residential

-

Industrial

Key Player

-

Hangzhou Hikvision Digital Technology Co., Ltd.

-

Zhejiang Dahua Technology Co., Ltd.

-

Axis Communications AB

-

Motorola Solutions, Inc.

-

Hanwha Vision Co., Ltd.

-

Tiandy Technologies

-

Zhejiang Uniview Technologies Co., Ltd.

-

IDIS Ltd.

-

Arlo Technologies, Inc.

-

Vivotek Inc.

-

Entelec Inc.

-

AMCO Security Ltd.

-

Clearway Group Holdings Limited

-

Viseum Inc.

-

Honeywell International Inc.

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2024 |

USD 428.76 Million |

|

Revenue Forecast in 2030 |

USD 1366.4 Million |

|

Growth Rate |

CAGR of 19.1% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Million (USD) |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst