Are Containerboard Producers Rebalancing or Retrenching in 2025?

Published: 2025-11-13

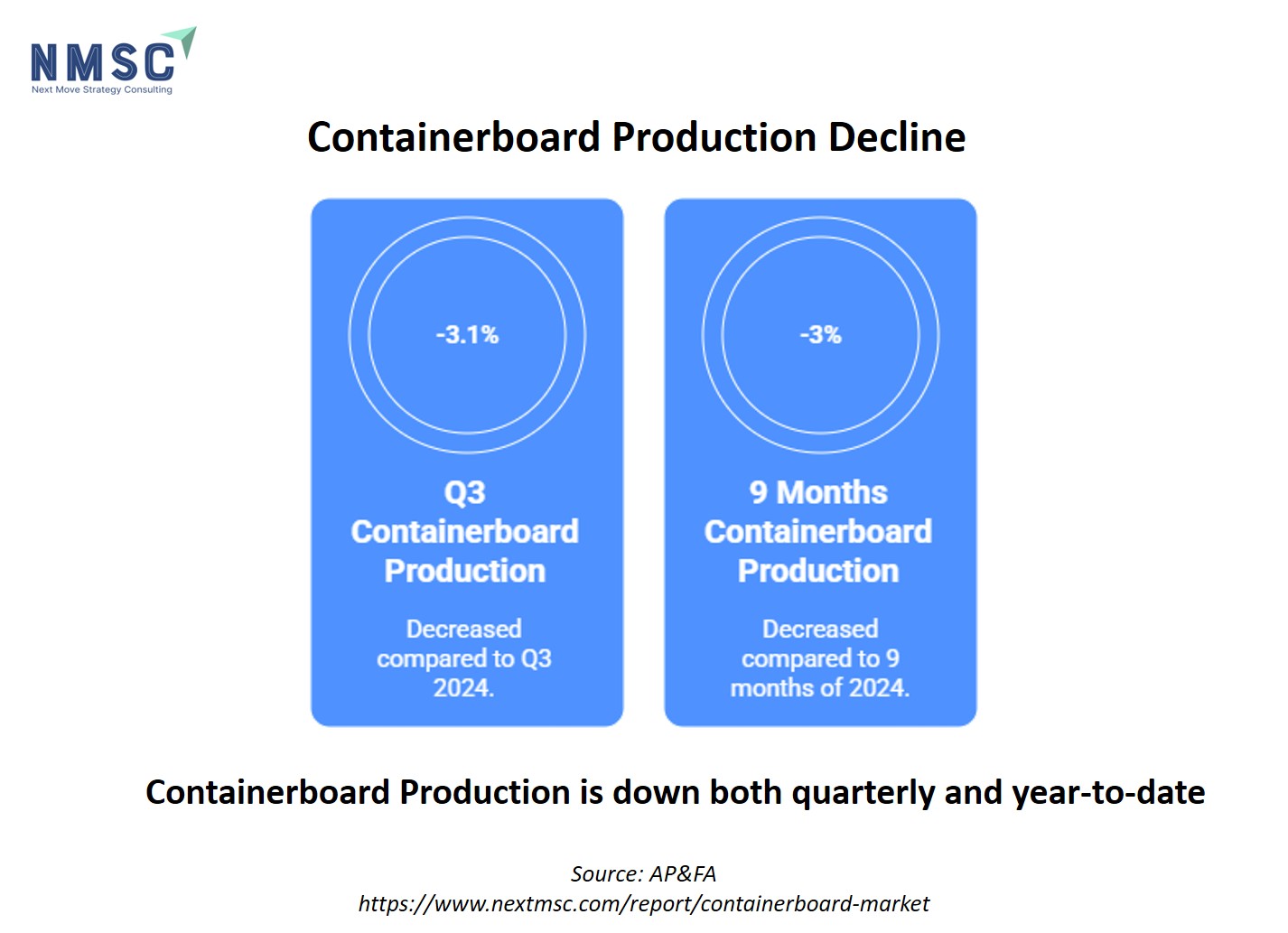

The global containerboard market witnessed a notable correction in the third quarter of 2025. As producers adjusted operations to reflect changing market dynamics, the quarter saw both capacity cuts and reduced output. According to industry data, containerboard production declined by over 3% compared to the same period last year, with overall capacity down by nearly 2% from the previous quarter. This trend highlights the sector’s ongoing efforts to rebalance after years of expansion and strong post-pandemic demand.

Industry Realignment Underway

Throughout 2025, leading containerboard manufacturers have taken decisive steps to manage oversupply and maintain price stability. Several mills have undergone extended downtime, while others have announced permanent closures to reduce high-cost or underutilized capacity. These strategic moves mark a shift from growth-driven expansion toward operational efficiency and cost optimization.

The reduction in active capacity is part of a broader adjustment cycle, as producers align output with a more tempered packaging demand environment. The focus has shifted from increasing volume to protecting margins and ensuring long-term sustainability.

Demand Softens Across Packaging Segments

The slowdown in box shipments, a key indicator of containerboard consumption has been a major driver behind the recent capacity cuts. After a period of robust growth fueled by e-commerce and consumer goods, demand has moderated in 2025. Factors such as slower retail sales, cautious inventory restocking, and normalization in online order volumes have all contributed to this softer demand landscape.

At the same time, industrial and export packaging segments have been affected by broader macroeconomic headwinds, including lower manufacturing output and trade uncertainties. Together, these elements have prompted mills to take a more conservative production approach to avoid oversupply pressures.

Balancing Supply, Pricing, and Profitability

With the market entering a new phase of adjustment, price dynamics have remained relatively stable despite fluctuations in operating rates. Strategic downtime and measured production levels have helped prevent steep declines in containerboard prices. While some regional tightness has been reported due to mill closures, overall pricing remains supported by the industry’s disciplined supply management.

For producers, this phase presents both challenges and opportunities. Short-term margins are under pressure due to reduced run rates, but the long-term benefit lies in achieving a healthier balance between supply and demand. The focus on efficiency, cost control, and selective investment will likely define operational strategies heading into 2026.

Implications for Stakeholders

For converters and packaging manufacturers, the evolving supply scenario emphasizes the importance of proactive procurement strategies. Securing consistent raw material supply and maintaining diversified sourcing will remain crucial in navigating potential disruptions caused by mill maintenance or closures.

From an investment standpoint, the current correction is positioning the market for a more stable growth trajectory in the coming years. Reduced excess capacity, coupled with gradual demand recovery, could lead to improved utilization rates and margin recovery across the sector.

Outlook and Insight

According to Next Move Strategy Consulting, the current slowdown should be viewed as a “necessary recalibration rather than a long-term decline.” With production cuts continuing through late 2025, the market is expected to reach a firmer equilibrium by mid-2026. Margins could begin to recover once inventory levels normalize and downstream demand for corrugated packaging begins to pick up, especially in the FMCG and e-commerce sectors.

Conclusion

Q3 2025 marked a turning point for the global containerboard industry. After a period of steady growth, producers are now recalibrating operations to adapt to a more moderate demand environment. While short-term pressures persist, these adjustments are likely to create a stronger foundation for future stability. The market’s current focus on efficiency, capacity discipline, and operational resilience will play a key role in shaping containerboard’s growth outlook beyond 2025.

About the Author

Joydeep Dey is a seasoned SEO Executive, Content Writer, and AI expert with over 2½ years of experience in digital marketing and artificial intelligence. He specializes in SEO strategy, impactful content creation, and developing data-driven, AI-powered solutions that enhance online visibility and engagement. With a strong foundation in natural language processing and emerging AI technologies, Joydeep is known for simplifying complex concepts into clear, actionable insights.

Joydeep Dey is a seasoned SEO Executive, Content Writer, and AI expert with over 2½ years of experience in digital marketing and artificial intelligence. He specializes in SEO strategy, impactful content creation, and developing data-driven, AI-powered solutions that enhance online visibility and engagement. With a strong foundation in natural language processing and emerging AI technologies, Joydeep is known for simplifying complex concepts into clear, actionable insights.

About the Reviewer

Sanyukta Deb is an accomplished Content Writer and Digital Marketing Strategist with extensive expertise in content strategy, SEO, and audience engagement. She specializes in building strong brand visibility through data-driven campaigns and impactful, value-added researched content. With a passion for creativity and innovation, she blends strategic thinking with design and communication to craft meaningful digital experiences. Over the years, she has contributed cross-functional marketing projects, driving measurable impact and audience engagement.

Sanyukta Deb is an accomplished Content Writer and Digital Marketing Strategist with extensive expertise in content strategy, SEO, and audience engagement. She specializes in building strong brand visibility through data-driven campaigns and impactful, value-added researched content. With a passion for creativity and innovation, she blends strategic thinking with design and communication to craft meaningful digital experiences. Over the years, she has contributed cross-functional marketing projects, driving measurable impact and audience engagement.

Add Comment