Air Compressor Market by Technology Type (Positive-Displacement, and Dynamic-Displacement), by Drive-Power Source (Electric-Driven, and Engine-Driven), by Lubrication Type (Oil-Free, and Oil-Injected/Flooded), by Power Rating (0-100 kW, and Others), by Discharge Pressure (Low-Pressure, and others), by Mobility (Stationary, and Portable) by Speed Control (Fixed-Speed, and Others), by End-Use Industry (Manufacturing, and others)– Global Opportunity Analysis and Industry Forecast, 2025–2030.

Industry: Construction & Manufacturing | Publish Date: 04-Sep-2025 | No of Pages: 386 | No. of Tables: 686 | No. of Figures: 611 | Format: PDF | Report Code : CM17

Air Compressor Market Overview

The global Air Compressor Market size was valued at USD 25.94 billion in 2024 and is predicted to reach USD 35.34 billion by 2030, with a CAGR of 4.9% from 2025 to 2030. In terms of volume the market size was 11 million units in 2024 and is projected to reach 19 million units by 2030, with a CAGR of 8.3% from 2025 to 2030.

The air compressor market also known as compressed air system market encompasses devices designed to convert power into potential energy stored in compressed air, that is used across various industrial sectors. It functions by compressing air to increase its pressure, that can then be utilized for various applications such as powering pneumatic tools, inflating tires, and supporting industrial processes. These compressors provide numerous benefits across a wide range of industries and applications.

They efficiently convert power into pressurized air, enabling the operation of pneumatic tools and enhancing tasks in construction, manufacturing, and automotive repair with greater speed and precision. The versatility of compressed air system extends to inflating tires, powering spray guns for painting, and supplying compressed air systems for HVAC systems, thereby boosting productivity and performance.

Additionally, these compressors contribute to energy savings and environmental sustainability by offering a cleaner alternative to traditional power sources and reducing the reliance on disposable aerosol cans. These reliable and portable tools are indispensable in both industrial and residential settings, making them essential for a broad spectrum of tasks.

Expanding Construction Sector Accelerates Air Compressor Adoption

The construction industry is witnessing substantial growth worldwide, driven by infrastructure modernization, smart city initiatives, and residential and commercial development. This sector demands highly efficient tools for operations such as drilling, painting, sandblasting, and concrete spraying—all of which rely heavily on-air compressors. As construction methodologies advance, the demand for highperformance, durable, and energy-efficient air compressors continues to rise. Their role in powering pneumatic tools and supporting automated construction systems makes them indispensable across construction sites

Surge in Oil & Gas Activities Boosts Compressor Utilization

Air compressors are fundamental to the oil and gas industry, where they are used in exploration, drilling, refining, and distribution processes. These systems power pneumatic tools, drive gas compression in processing units, and support offshore operations. As global energy demand grows, the sector increasingly requires high-capacity, technologically advanced compressors to enhance operational efficiency, meet regulatory compliance, and ensure uninterrupted production cycles. The growing complexity and scale of oil and gas projects further solidify the need for robust air compressor systems.

Rising Demand In Mining Operations Fuels Market Expansion

The mining industry relies extensively on compressed air systems for critical operations such as material extraction, ventilation, drilling, and processing. Air compressors are used to power conveyors, rock drills, pneumatic pumps, and underground ventilation systems. With mining activities expanding to meet the global demand for minerals and metals, the requirement for reliable, high-output air compressors is intensifying. Their capability to withstand harsh environments and support continuous operations makes them vital to the mining value chain.

High Capital And Maintenance Costs Limit Market Penetration

Despite their benefits, the adoption of air compressors can be hindered by their high initial investment and ongoing maintenance requirements. Expenses related to equipment installation, energy consumption, and routine servicing—including filter replacements, oil changes, and performance checks— can burden end-users, particularly small and medium enterprises. This cost barrier can delay procurement decisions and limit market penetration, especially in price-sensitive regions.

Smart Technologies Unlock New Avenues For Growth

The integration of Internet of Things (IoT) sensors and cloud-based platforms is revolutionizing the air compressor landscape. These smart systems allow for real-time monitoring, predictive maintenance, and performance optimization. By capturing operational data such as temperature, vibration, and pressure, and analyzing it through cloud analytics, businesses can proactively address system inefficiencies, reduce downtime, and lower operational costs. This shift toward intelligent air compressor solutions is creating new growth avenues, especially in industries embracing digital transformation and Industry 4.0 standards.

By Type, Stationary Air Compressor Holds the Dominant Share in the Market

Stationary holds the dominant share of approximately 59.1% in the type segment of the market as it offers higher output capacities and prolonged duty cycles compared to portable models, making them ideal for continuous and heavy-duty applications in industrial settings.

The high capacity and continuous operation capabilities of stationery compressed air system allows its application in various industries such as manufacturing, construction, and mining extensively utilize stationary air compressors for tasks such as powering assembly lines, operating heavy machinery, and running pneumatic tools.

By Industry Vertical, Construction, holds the highest CAGR of 6.9%

The construction industry boasts the highest CAGR of 6.9%, driven by the critical role air compressors play in various tasks. In painting and finishing, compressed air system provide consistent air pressure for spray painting, achieving smooth, professional finishes. They are also essential for sandblasting, offering the necessary force to clean surfaces effectively.

Furthermore, compressed air system is integral to the operation of pneumatic systems, such as air brakes in heavy machinery and equipment. Their reliability and power make them indispensable assets in the construction industry, enhancing productivity and efficiency across a spectrum of applications.

Asia-Pacific Region Dominates the Market and is Expected to Show Steady Growth with a CAGR of 6.1%

The Asia-Pacific dominates the air compressor market share due to the substantial presence of the oil and gas industry in the region. With increasing oil and gas exploration and production activities in the region, there's a heightened demand for air compressors to power essential operations such as gas compression, processing facilities, and pneumatic tools. According to the International Energy Agency report, Asia Pacific supply 24% of the oil in the total energy supply at a 61% of increasing trend from 2000-2022, 35% of the global share that accounts for 644 million terajoule (TJ).

This demand surge is directly fueled by the industry's need to optimize production efficiency, minimize downtime, and ensure compliance with safety regulations. As a result, manufacturers are ramping up production to meet these specific requirements, thereby driving growth of the market across the Asia Pacific region.

Moreover, the escalating consumption of electricity in countries such as China and India is fueling the demand for compressed air system, especially within power generation facilities. These compressors play a crucial role in turbine control and the operation of pneumatic equipment essential for power generation processes.

As per the findings of the International Energy Agency report, Asia Pacific contributed approximately 14,030,721 gigawatt-hours (GWh) of electricity in 2022, representing a substantial 49% of the global share. This significant contribution underscores the region's reliance on compressed air system to maintain efficient operations and meet the growing demand for electricity.

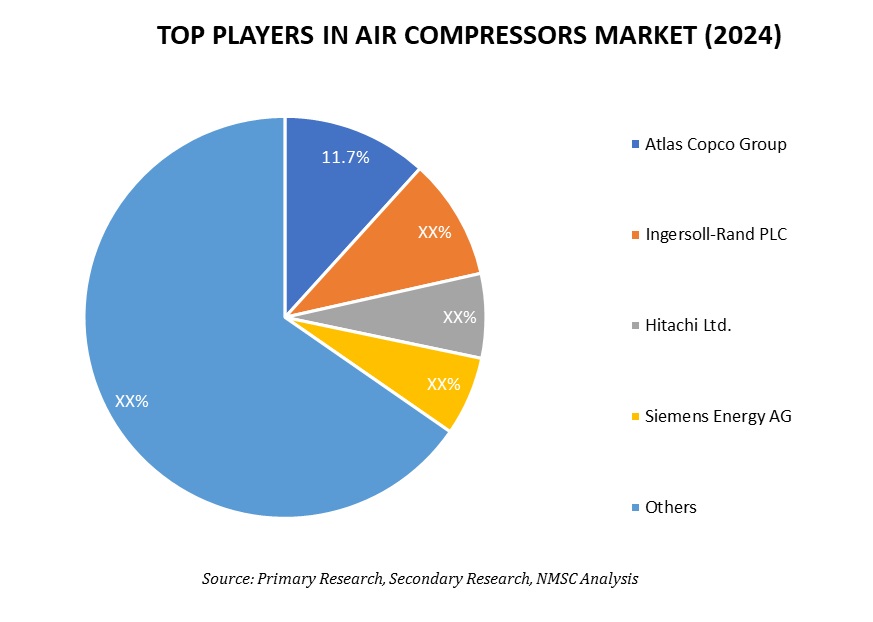

Competitive Landscape

Several key players operating in the air compressor industry includes Atlas Copco, Ingersoll Rand Inc., Kaeser Kompressoren SE, Hitachi Industrial Equipment Systems Co., Ltd., Mitsubishi Heavy Industries, BOGE Kompressoren GmbH, Doosan Portable Power (Bobcat), ELGi Equipments, Hanwha Power Systems Co., Ltd., Aerzener Maschinenfabrik, Fusheng Group, Kobelco Compressors, Hanbell Precise Machinery Co., Ltd., Kirloskar Pneumatic, ALMiG Kompressoren GmbH, Frank Technologies, CompAir, Anest Iwata, Bauer Kompressoren GmbH, Mattei Compressors., and others.

These market players are adopting various strategies, including product launches, acquisition, and partnership across various regions to maintain their dominance in the market.

|

DATE |

COMPANY |

RECENT DEVELOPMENTS |

|

|

Apr-2024 |

Ingersoll Rand |

Ingersoll Rand launched the Evolution range of air compressors, specifically designed for the Indian market. This new brand of contact cooled rotary screw air compressors includes the N-Series 4-75 kW rotary screw air-compressor that offers advanced features tailored to meet industry requirements. |

|

|

Apr-2024 |

Hitachi |

Hitachi acquired Mountain Air Compressor Incorporated to provide the sales and service of compressed air system, air treatment products, accessories, and related equipment. This acquisition is part of Hitachi Global Air Power's strategy to serve its customers and establish a presence in the Tennessee valley that caters the mining, lumber, pharmaceutical, and chemical industry customers. |

|

|

Mar-2024 |

Atlas Copco |

Atlas Copco Industrial Air launched the GA 11-30 FLX, their first dual-speed compressor, that is also their most energy-efficient fixed-speed compressor. This innovative product uses up to 20% less energy compared to traditional fixed-speed compressors that significantly reduces start-up peak, unload power, and transient losses. |

|

|

Feb-2024 |

ELGi Equipment |

ELGi Equipment launched its PG 550-215 trolley-mounted portable screw air compressor in India. The PG 550-215 is designed to enhance performance, reliability, and profitability for customers in construction and mining, featuring a 3-stage air filtration system and an integrated control panel for optimal performance, safety, and driller-friendly operations. |

|

|

Dec-2023 |

Kaeser |

Kaeser launched a new oil-free compression rotary screw compressor, the CSG.1 series, tailored for specialized engineering applications such as pharmaceuticals and chemical manufacturing. These compressors offer air flow rates from 4 to 15 cubic meters per minute and pressures up to 11 bar. |

|

|

Nov-2023 |

Siemens Energy |

Siemens Energy collaborated with Corre Energy for the deployment of multiday Compressed Air Energy Storage (CAES) technology in North America. This partnership builds on an existing strong relationship between the companies and support Corre Energy's expansion into North America, including a 280-megawatt CAES project in West Texas. |

|

|

June 2023 |

Atlas Copco |

Atlas Copco launched its first battery-driven portable screw compressor, the B-Air 185-12, that is a significant development towards a low carbon future in the global industrial marketplace. The B-Air 185-12 features 5-12 bar of pressure, a stable flow rate of 5.4-3.7 m3/min, and a 55-kWh battery storage capacity. |

Air Compressor Market Key Segments

By Technology Type

-

Positive-Displacement

-

Reciprocating (Piston)

-

Rotary

-

Screw

-

Scroll

-

Others (Vane, Lobe)

-

-

-

Dynamic-Displacement

-

Centrifugal

-

Axial

-

By Drive-Power Source

-

Electric-Driven

-

Engine-Driven (Diesel / Gas)

By Lubrication type

-

Oil-Free

-

Oil-Injected/Flooded

By Power Rating

-

0-100 kW

-

101-300 kW

-

301-500 kW

-

501 kW & Above

By Discharge Pressure

-

Low-Pressure (≤ 8 bar)

-

Medium-Pressure (8–16 bar)

-

High-Pressure (> 16 bar)

By Mobility

-

Stationary

-

Portable

By Speed Control

-

Fixed-Speed

-

Variable-Speed (VSD)

By End-Use Industry

-

Manufacturing

-

Oil & Gas

-

Energy & Power

-

Transportation & Automotive

-

Pharma & Food

-

Construction & Mining

-

Others

By Region

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Taiwan

-

Thailand

-

Rest of Asia-Pacific

-

-

RoW

-

Latin America

-

Middle East

-

Africa

-

Key Players

-

Atlas Copco

-

Ingersoll Rand Inc.

-

Kaeser Kompressoren SE

-

Hitachi Industrial Equipment Systems Co., Ltd.

-

Mitsubishi Heavy Industries

-

BOGE Kompressoren GmbH

-

Doosan Portable Power (Bobcat)

-

ELGi Equipments

-

Hanwha Power Systems Co., Ltd.

-

Aerzener Maschinenfabrik

-

Fusheng Group

-

Kobelco Compressors

-

Hanbell Precise Machinery Co., Ltd.

-

Kirloskar Pneumatic

-

ALMiG Kompressoren GmbH

-

Frank Technologies

-

CompAir

-

Anest Iwata

-

Bauer Kompressoren GmbH

-

Mattei Compressors

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2024 |

USD 25.94 Billion |

|

Revenue Forecast in 2030 |

USD 35.34 Billion |

|

Growth Rate |

CAGR of 4.9% from 2025 to 2030 |

|

Market Volume in 2024 |

11 Million Units |

|

Volume Forecast in 2030 |

19 Million Units |

|

Volume Growth Rate |

CAGR of 8.3% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

28 |

|

Companies Profiled |

20 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst