Asia-Pacific Industrial Robotics Market by Type (Articulated Robots, SCARA Robots, and Others), by Offering Hardware, Software, and Services), by Payload Capacity (≤ 100 KG, 101-200 KG, 201-500 KG and Others), by Mobility (Stationary, and Mobile Robots), by Mounting Type (Floor mounted, Wall-mounted, and Others), by Application (Material Handling, Assembling & Disassembling, and Others), by Industry Vertical (Automotive, and Others) – Opportunity Analysis and Industry Forecast, 2025–2030

Industry: Semiconductor & Electronics | Publish Date: 24-Nov-2025 | No of Pages: N/A | No. of Tables: N/A | No. of Figures: N/A | Format: PDF | Report Code : SE3710

Industry Outlook

The Asia-Pacific Industrial Robotics Market size was valued at USD 26.36 billion in 2024 and is expected to reach USD 31.10 billion by 2025. Looking ahead, the industry is projected to expand significantly, reaching USD 55.89 billion by 2030, registering a CAGR of 12.4% from 2025 to 2030. In terms of volume, the market recorded 346 thousand units in 2024, with forecasts indicating growth to 409 thousand units by 2025 and further to 720 thousand units by 2030, reflecting a CAGR of 12% over the same period.

The Asia-Pacific industrial robotics market is witnessing robust growth, driven by rapid industrialization, technological advancements, and rising demand for automation across multiple sectors. Countries such as China, Japan, South Korea, India, and Southeast Asian nations are at the forefront of adopting robotics to enhance productivity, reduce operational costs, and maintain high-quality standards. The automotive, electronics, and logistics sectors are leading consumers of industrial robots, leveraging them for precision, speed, and efficiency. Additionally, the region is embracing Industry 4.0 practices, including AI, IoT, and smart factory solutions, which allow manufacturers to optimize production, enable predictive maintenance, and integrate flexible automation. Governments across the region are also playing a key role, offering incentives, subsidies, and supportive policies to encourage the adoption of robotic technologies, which further strengthens the market outlook.

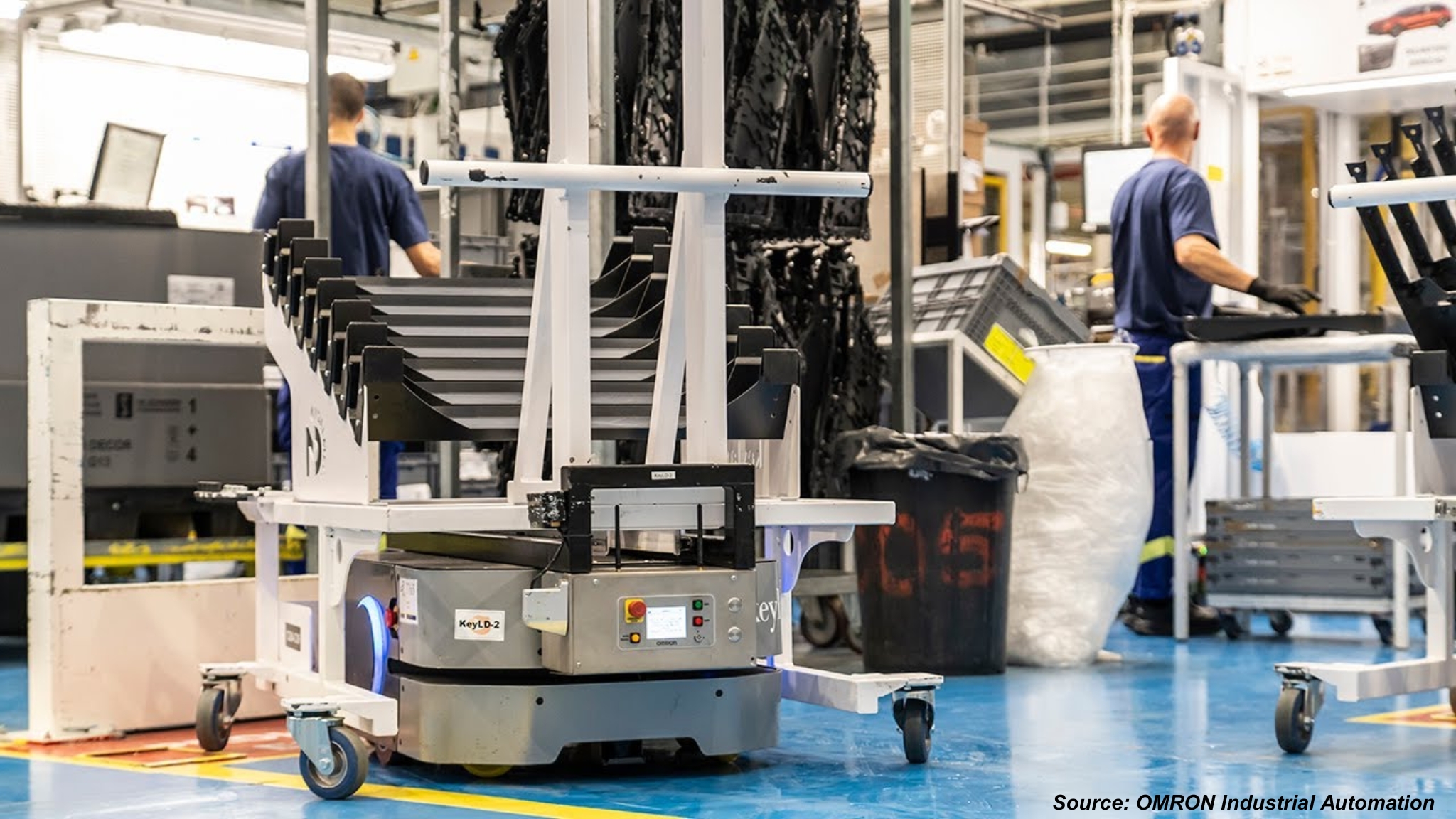

Technological innovations, particularly in collaborative robots (cobots) and autonomous mobile robots (AMRs), are significantly influencing the market landscape. Cobots allow safe interaction with human workers, improving flexibility and operational efficiency, while AI-enabled robots enhance decision-making and adaptability on production lines. Moreover, the e-commerce boom and expansion of logistics and warehousing operations are driving demand for automation beyond traditional manufacturing. Despite challenges such as high initial investment, integration complexities, and the need for skilled personnel, the Asia-Pacific region presents tremendous growth opportunities, making it a critical market for industrial robotics globally.

Rising Technological Innovation and AI Adoption are Driving Market Growth

Asia-Pacific is home to major robotics and automation technology developers, particularly in Japan, South Korea, and China. Continuous innovation in AI, machine learning, and smart sensors is enabling robots to perform more complex tasks, adapt to dynamic production lines, and operate autonomously with minimal human intervention. This technology adoption is crucial for industries such as electronics and automotive, where precision and high-speed production are essential. The development of collaborative robots (cobots) in the region is also helping manufacturers increase flexibility and safety in operations.

Growing Industrialization and Labor Challenges are Driving the Market

The region’s fast-paced industrial expansion, combined with rising labor costs and workforce shortages in aging economies like Japan and South Korea, is pushing companies to automate operations. Automation addresses the shortage of skilled labor, reduces dependency on manual work for repetitive or hazardous tasks, and ensures consistent production quality. In developing nations such as India, Vietnam, and Thailand, rapid industrialization and foreign investment in manufacturing hubs are driving demand for affordable and flexible robotic solutions to enhance efficiency and competitiveness.

High Initial Costs and Integration Complexity are Limiting Asia-Pacific Industrial Robotics Market Expansion

Despite the advantages, the adoption of industrial robots in Asia-Pacific is restrained by high upfront costs, especially for small and medium-sized manufacturers. Integrating robotics into existing production lines can be technically complex, requiring specialized knowledge and workforce training. Maintenance costs and potential downtime further challenge ROI, and the shortage of skilled operators and engineers limits the scalability of automation in several countries across the region.

E-commerce Growth and Cobots Adoption are Creating Future Opportunities in APAC

The booming e-commerce and logistics sectors across Asia-Pacific are creating strong opportunities for factory automation systems beyond traditional manufacturing. Robots are increasingly used for warehouse automation, packaging, and material handling, allowing faster fulfillment and operational efficiency. Additionally, collaborative robots (cobots), which are safer and easier to deploy alongside humans, offer SMEs a low-barrier entry into automation. This trend provides manufacturers with scalable and flexible solutions, supporting the expansion of robotics adoption across emerging and developed economies in the region.

China Holds the Dominant Market Share in the Asia-Pacific Region

China dominates the Asia-Pacific industrial robotics market share due to its massive manufacturing base, rapid industrialisation, and aggressive adoption of automation technologies. As the world’s largest producer of automobiles, electronics, and consumer goods, China has a high demand for industrial robots to maintain production efficiency, ensure precision, and reduce operational costs. The country has heavily invested in smart manufacturing initiatives under its Made in China 2025 plan, which encourages the integration of robotics, AI, and Industry 4.0 technologies across factories. China is also home to leading robotics manufacturers and solution providers, producing both high-end industrial robots and cost-effective collaborative robots (cobots) tailored for small and medium-sized enterprises. Rising labor costs, workforce shortages, and a need for higher productivity further drive robotics adoption, allowing China to maintain its dominant market share in the Asia-Pacific region while attracting significant domestic and international investment in automation technologies.

India to Witness Substantial Growth in the Asia-Pacific Industrial Robotics Market

India is poised to experience significant growth in the Asia-Pacific industrial robotics market demand, driven by rapid industrialization, expanding manufacturing sectors, and rising adoption of automation technologies. The country’s automotive, electronics, and consumer goods industries are increasingly investing in industrial robots to improve production efficiency, reduce human error, and maintain high-quality standards.

Government initiatives such as “Make in India” and Digital India are promoting Industry 4.0 adoption, offering incentives and support for automation, smart manufacturing, and technology-driven productivity improvements. Additionally, the rise of e-commerce and logistics sectors is fueling demand for warehouse automation, packaging, and material handling solutions. With labor costs gradually rising and a need to enhance operational efficiency, Indian manufacturers are increasingly turning to collaborative robots (cobots) and AI-enabled industrial robots, positioning India as one of the fastest-growing markets in the industrial robotics landscape.

Competitive Landscape

The Asia-Pacific industrial robotics industry is highly competitive, driven by the presence of both established global players and emerging regional companies. Leading companies such as Fanuc Corporation, Yaskawa Electric Corporation, KUKA AG, ABB Ltd., Kawasaki Heavy Industries, Mitsubishi Electric Corporation, Denso Corporation, and others are at the forefront of the market. These companies are leveraging technological advancements, including AI, IoT, and machine learning, to develop smarter, more efficient robots capable of performing complex manufacturing tasks. They are introducing collaborative robots (cobots), autonomous mobile robots (AMRs), and high-precision industrial robots that cater to automotive, electronics, logistics, and consumer goods sectors.

Major players are also pursuing strategic initiatives such as acquisitions, partnerships, and regional expansions to strengthen their market positions. For example, SoftBank’s acquisition of ABB’s robotics division underscores the emphasis on AI-driven robotics and highlights the competitive nature of the industry. Continuous product innovation and investment in R&D allow these companies to offer flexible, reliable, and scalable automation solutions, meeting the evolving demands of manufacturers in the region. Additionally, government initiatives such as China’s “Made in China 2025,” Japan’s “Society 5.0,” and various smart manufacturing programs in Southeast Asia are supporting these companies’ growth by fostering an ecosystem conducive to robotics adoption. Overall, the competitive landscape in Asia-Pacific is defined by technological leadership, strategic collaborations, and the drive to capture opportunities in rapidly industrialising markets.

Asia-Pacific Industrial Robotics Market Key Segments

By Type

-

Articulated Robots

-

SCARA Robots

-

Cylindrical Robots

-

Cartesian/Linear Robots

-

Parallel Robots

-

Collaborative Robots

-

Autonomous Mobile Robots (AMRs)

-

Automated Guided Vehicles (AGVs)

-

Other Robots

By Offering

-

Hardware

-

Software

-

Robot Control Software

-

Vision & Perception Software

-

Other Software

-

-

Services

By Payload Capacity

-

≤ 100 KG

-

101-200 KG

-

201-500 KG

-

501-1000 KG

-

1001-2000 KG

-

2001-5000KG

-

More than 5000 KG

By Mobility

-

Stationary Robots

-

Mobile Robots

By Mounting Type

-

Floor-mounted

-

Wall-mounted

-

Ceiling-mounted

-

Rail-mounted

By Application

-

Material Handling

-

Assembling & Disassembling

-

Processing

-

Cleanroom

-

Dispensing

-

Welding and Soldering

-

Pick and Place

-

Others

By Industry Vertical

-

Automotive

-

Semiconductor & Electronics

-

Plastic and Chemical Products

-

Metal and Machinery

-

Logistics

-

Food & Beverages

-

Healthcare & Pharmaceutical

-

Others

By Region

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Taiwan

-

Indonesia

-

Vietnam

-

Australia

-

Philippines

-

Malaysia

-

Rest of APAC

Key Players

-

Fanuc Corporation

-

Yaskawa Electric Corporation

-

Mitsubishi Electric Corporation

-

KUKA AG

-

Kawasaki Heavy Industries

-

Seimens AG

-

Denso Wave Inc.

-

Panasonic Corporation

-

Shibaura Machine CO., LTD

-

Omron Corporation

-

Seiko Epson Corporation

-

Staubli International AG

-

Universal Robots

-

Comau S.p.A.

Report Scope and Segmentation

|

Parameters |

Details |

|

Market Size in 2025 |

USD 31.10 Billion |

|

Revenue Forecast in 2030 |

USD 55.89 Billion |

|

Growth Rate |

CAGR of 12.4% from 2025 to 2030 |

|

Market Volume in 2025 |

409 thousand units |

|

Volume Forecast in 2030 |

720 thousand units |

|

Growth Rate |

CAGR of 12% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

Rising technological innovation and AI adoption are driving market growth Growing industrialization and labor challenges are driving market growth |

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst