Australia ERP Software Market by Component (Software and Service), by Deployment (On Premise, Cloud, and Hybrid), by Business Function (Enterprise Asset Management (EAM), Financial Management System, Human Capital Management (HCM), Manufacturing and Operations, Supply Chain Management (SCM), Others), by Application (Manufacturing, BFSI, Healthcare, Retail & Distribution, Government, IT & Telecom, Construction, and Other)-Opportunity Analysis and Industry Forecast, 2025–2030

Industry: ICT & Media | Publish Date: 15-Oct-2025 | No of Pages: 79 | No. of Tables: 88 | No. of Figures: 53 | Format: PDF | Report Code : IC3007

Australia ERP Software Market Overview

The Australia ERP Software Market size was valued at 930.2 million in 2024 and is predicted to reach USD 1170.6 million by 2030, with a CAGR of 3.6% from 2025 to 2030.

The factors such as the rising adoption of digitalization, increase service industry and growing initiatives by the key market players drives the growth of the market. However, the complexity in integrating these devices with existing system restrains the growth of the market. On the contrary, advancement in AI based ERP software creates future growth opportunities. Moreover, the top players such as Microsoft Corporation and SAP SE among others are adopting various strategies in order to enhance their market expansion.

Increasing Expenditure In It Sector Propels The Growth Of The Market In The Country

The increase in IT spending across enterprises in the country fuels the demand for ERP software as organizations prioritize digital transformation to enhance operational efficiency and competitiveness. Higher IT budgets enable companies to invest in advanced ERP solutions that integrate business processes, automate workflows, and provide real-time insights for better decision-making. As per the latest report published by the Gartner, IT spending in Australia is projected to reach USD 95.6 billion by 2025, reflecting around 8.7% increase from the previous year. This surge in IT investments encourages organizations to adopt advanced technologies including ERP to streamline operations, enhance business strategies, and improve productivity, thereby propelling market expansion.

The Expansion In Service Industry Boosts The Erp Software Market In Australia

The rapid expansion of the service industry in Australia is accelerating the demand for ERP software as businesses seek integrated solutions to manage operations, enhance customer service, and streamline workflows. As service sector such as healthcare, finance, and real estate become complex, ERP systems are essential for organizing data, automating processes, and enhancing decision-making capabilities to remain competitive and efficient. According to the latest report published by the World Bank Group, Australia’s service sector accounted for 64.2% of the country's GDP in 2024. This significant contribution of the service sector highlights the growing need for ERP software to support business efficiency and scalability, further boosting market growth.

The Growing Initiative By Local Key Players Drives Erp Software Market Growth In Australia

The rising initiative by key players such as Pronto Software drives significant growth in the Australian ERP software market by providing customized solutions that address specific regional business needs. These companies offer ERP systems designed for Australian businesses, offering features such as supply chain management, resource planning, and business intelligence to meet industry-specific requirements. For example, Pronto Software, an Australian software & development company launched its new ERP solution, Pronto Xi 780, aimed to enhance operational efficiency for businesses. Its key features include an improved user experience, enhanced analytics capabilities, and increased automation to streamline processes and optimize workflows. Such innovation caters to the growing demand for ERP solutions that support operational efficiency and data-driven decision-making in Australian businesses.

Integration Of Erp With Existing Systems Hinder Market Growth In Australia

The integration of ERP solutions with existing systems presents a significant barrier to the growth of the ERP software market in Australia. Many organizations rely on older, legacy systems that are not compatible with newer ERP solutions. The complex, time-consuming integration process requires substantial resources and expert support that disrupt daily operations. These challenges discourage businesses from adopting new ERP systems, slowing down the market's growth and hindering the transition to more efficient, modernized business operations.

Integration Of Artificial Intelligence (ai) In Erp Software Creates Significant Future Growth Opportunities In The Market

The integration of artificial intelligence (AI) in ERP software presents significant future opportunities in the market. AI-powered ERP solutions enhance decision-making by providing real-time data insights, automating processes, and improving resource allocation. These systems streamline operations, reduce manual errors, and optimize supply chain management, driving efficiency across business functions. Additionally, AI’s predictive capabilities enable better demand forecasting, inventory management, and customer service, leading to cost savings and improved productivity.

Competitive Landscape

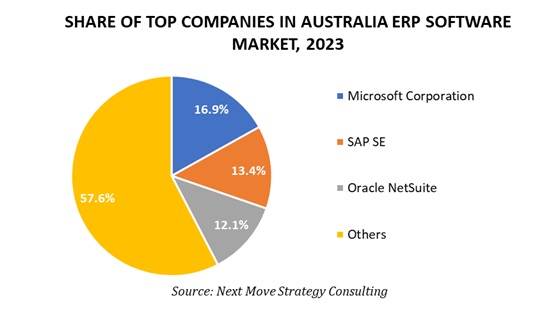

Several key players operating in the Australia ERP Software industry include Microsoft Corporation, SAP SE, Oracle NetSuite, Salesforce, Inc., Xero Limited, Sage Group, MYOB Australia Pty Ltd, Workday, Inc., ECI Software Solutions, Odoo, and others.

Note: For the latest market share analysis and in-depth Australia ERP Software industry insights, you can reach out to us at: Proceed to Checkout

These companies are adopting various strategies including product launch and partnerships to remain dominant in the market.

|

DATE |

COMPANY |

RECENT DEVELOPMENTS |

|

April 2025 |

Microsoft Corporation |

Official opening of Microsoft’s new North Sydney Innovation Hub was announced, marking Australia’s first such facility for AI and digital transformation |

|

July, 2024 |

MYOB |

MYOB partnered with Acumatica launch its cloud ERP solutions in Australia and New Zealand. This collaboration aims to enhance medium sized companies with advanaced ERP software, enhancing their operational efficiency. |

|

May 2025 |

Xero Limited |

Released product updates including onboarding enhancements, invoice improvements, and app setup streamlining |

Australia ERP Software Market Key Segment

By Component

-

Software

-

Service

By Deployment

-

On Premise

-

Cloud

-

Hybrid

By Business Function

-

Enterprise Asset Management (EAM)

-

Record Assets (Asset Mgmt)

-

Analytics & BI

-

Disposal of Assets

-

Others

-

-

Financial Management System

-

Core Financials

-

Corporate Performance Mgmt (CPM)

-

Financial Consolidation

-

Others

-

-

Human Capital Management (HCM)

-

Talent Management

-

Administrative HR

-

Workforce Management

-

Others

-

-

Manufacturing and Operations

-

Production Planning and Scheduling Products

-

Production Ops and Control Products

-

Manufacturing Information Mgmt Products

-

Others

-

-

Supply Chain Management (SCM)

-

Inventory management

-

Warehouse management

-

Transportation management

-

Procurement

-

Contract Management

-

-

Others

By Application

-

Manufacturing

-

BFSI

-

Healthcare

-

Retail & Distribution

-

Government

-

IT & Telecom

-

Construction

-

Aerospace Defense

-

Other Industries

By End User

-

Small and Medium Sized Enterprise

-

Large Enterprise

Key Market Players

-

Microsoft Corporation

-

SAP SE

-

Oracle NetSuite

-

Salesforce, Inc

-

Xero Limited

-

Sage Group

-

MYOB Australia Pty Ltd

-

Workday, Inc

-

ECI Software Solutions

-

Odoo

Report Scope and Segmentation

|

Parameters |

Details |

|

Market Size in 2024 |

USD 930.2 Million |

|

Revenue Forecast in 2030 |

USD 1170.6 Million |

|

Growth Rate (Value) |

CAGR of 3.6% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Million (USD) |

|

Growth Factors |

|

|

Companies Profiled |

10 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst