Battery Market by Type (Stationary, and Motive), by Battery Type (Primary Batteries,Secondary Batteries and Others), by Voltage Type (Low Voltage Batteries, Medium Voltage Batteries and Others), By Power Capacity (Low Capacity Batteries, Medium Capacity Batteries and Others), By Self-Discharge Rate (Low Self-Discharge Rate Batteries, Medium Self-Discharge Rate Batteries and Others), by Application (Residential and others) – Global Opportunity Analysis and Industry Forecast 2023-2030.

Industry: Energy & Power | Publish Date: 04-Nov-2025 | No of Pages: 442 | No. of Tables: 668 | No. of Figures: 613 | Format: PDF | Report Code : EP510

Battery Market Overview

The global Battery Market size was valued USD 151.48 billion in 2024, and it is projected to reach USD 378.53 billion by 2030, with a CAGR of 16.5% from 2025-2030.

The factors including expanding electric vehicle sector along with growing demand for consumer electronics and expansion of energy storage systems propels the growth of the market. However environmental concerns due to the use of toxic chemicals restrains the growth of the market.

On the contrary development of nuclear power batteries creates future growth opportunities for the market. Leading are taking various initiatives including collaboration along with business expansion and product launch to maintain their market dominance and enhance their overall product offerings. These efforts are expected to accelerate innovation along with improve energy efficiency and drive widespread adoption that is shaping the future of the industry.

Renewable Energy Expansion Supporting Grid-scale Battery Demand

The increasing adoption of renewable energy sources is creating robust demand for battery storage systems capable of managing grid intermittency and enhancing energy reliability. Countries with high solar and wind penetration—such as Germany, China, India, and Australia—are scaling up grid storage capacities to ensure stable power delivery. Public tenders, government-backed subsidies, and utility mandates are reinforcing this trend, with national and regional energy agencies recognizing storage as a cornerstone of future power infrastructure.

Accelerating Electrification in the Mobility Sector

The global shift toward electric mobility is a critical driver of battery demand. With electric vehicle (EV) mandates, fuel efficiency standards, and ICE phase-out deadlines gaining traction, automakers are rapidly scaling battery-powered vehicle production. Strategic investments in gigafactories, battery leasing models, and energy-dense chemistries are propelling growth. The adoption of battery-powered buses, two-wheelers, and commercial fleets in urban and regional markets is further expanding the market footprint across transportation sub-segments.

High Production Costs and Material Supply Volatility

Despite scaling benefits, the production of advanced batteries remains cost-intensive due to the complexity of manufacturing processes and the limited availability of key raw materials such as lithium, cobalt, and nickel. These materials are often mined in geopolitically sensitive regions and refined through resource-heavy operations, creating cost volatility and environmental concerns. This makes it difficult for manufacturers to offer affordable solutions in cost-sensitive sectors and developing regions, thus slowing down adoption in certain markets.

Growth Potential in Sustainable and Circular Battery Ecosystems

Emerging global standards on battery lifecycle management are unlocking significant growth opportunities in sustainable production, recycling, and second-life applications. Governments, particularly within the EU and Asia-Pacific, are introducing regulations mandating battery traceability, minimum recycled content, and extended producer responsibility. This regulatory push is fostering investment in closed-loop systems, AI-powered battery diagnostics, and green manufacturing processes. Companies that integrate circularity into product design and supply chain operations are well-positioned to benefit from evolving compliance and market expectations.

Development of Nuclear Power Batteries Creates Future Growth Opportunities for the Market

The development of nuclear power batteries creates future growth opportunities for the market as advancements in atomic energy technology pave the way for long-lasting, high-efficiency power sources. Unlike conventional batteries, nuclear power batteries offer extended operational lifespans, making them ideal for applications in space exploration, medical implants, remote infrastructure, and defense systems.

For example, in March 2024, Betavolt developed a nuclear battery with a lifespan of 50 years to electrify and decarbonize energy sources, as it offers a solution for sustainable and long-lasting energy storage. As research progresses in harnessing safe and compact nuclear energy for commercial use, these innovative batteries are expected to revolutionize energy storage by providing sustainable and maintenance-free power solutions.

By Type, Motive Holds the Dominating Share of the Battery Industry

Motive holds the dominating share in battery industry as it is used widely in electric vehicles, industrial equipment, and material handling systems. Increased demand for electric mobility, including passenger cars, commercial transport, and two-wheelers, generates strong demand for motive batteries.

Growth in warehouse automation and the use of battery-powered fork lifts and automated guided vehicles propel market size growth. Increased emphasis on sustainability and energy efficiency also drives the transition to advanced lithium-ion and solid-state batteries, enhancing performance and life in motive applications.

By Battery Type, Secondary Batteries (Rechargeable) Holds the Dominating Share of the Market

Secondary batteries hold the dominating share due to their widespread use across industries including consumer electronics along with electric vehicles and renewable energy storage. Demand for consumer electronics and electric vehicles generates need for high performance rechargeable batteries. The quest for cleaner energy sources and the transition to electric mobility provided a massive boost to the use of rechargeable batteries that leads to their market dominance in consumer and industrial markets.

Asia-Pacific Dominates Battery Market Share During the Forecast Period

The expanding electric vehicle industry drives the growth of the market in China with the demand for high performance and long-lasting batteries to fuel electric vehicles. With China remaining the world’s leading producer and consumer of electric vehicles firms are investing in future battery technologies including solid-state and lithium-ion batteries to enhance energy density along with decrease charging time and increase battery lifespan.

The latest report released by the International Energy Agency reported that new electric car registrations hit 8.1 million in 2023 that is a growth of 35% from the previous year. This sustained growth in EV adoption reinforces the demand for advanced battery innovation, driving more innovation and investment in the market.

Moreover, the government push towards the battery industry further drives the growth of the market in Korea as policymakers introduce supportive policies along with subsidies and research incentives to make the country a battery manufacturing powerhouse. The emphasis on clean energy and green technology resulted in huge investments in next-generation battery solutions such as solid-state and lithium-ion technologies.

For instance, in December 2024, the Korean Ministry of Land Infrastructure and Transport initiated a pilot program to enhance safety monitoring of electric vehicle batteries amid concerns of EV fires. The government support for local battery makers along with strategic partnerships and R&D investment is driving innovation and fueling the growth of Korea's battery industry.

Europe Exhibits the Highest CAGR of Battery Industry During the Forecast Period

The investment towards the battery sector fuels the growth of the market in the UK as increasing funding from both government and private entities accelerates advancements in battery technology, manufacturing, and infrastructure.

For Example, in May 2024, Faraday Battery Challenge invested USD 1.8 million to support small and medium-sized (SME) battery developers across the UK. The UK’s commitment to establishing a strong domestic battery supply chain, supported by these initiatives is driving market expansion and technological progress.

Furthermore, the surge in EV adoption propels the growth of the market in Germany as the increasing demand for electric vehicles drives the need for high-performance, energy-dense, and long-lasting battery solutions. The latest report published by the Electric Vehicles Technology Collaboration Programme stated that adoption of EVs in the country accounted for 1.3 million in 2023 compared to 1.1 million in 2021 that is a growth of around 22.9% within 2 years. The rising production of EVs by leading automakers and the establishment of battery manufacturing facilities further contribute to the expansion of the market, fostering innovation and technological advancements in battery development.

Competitive Landscape

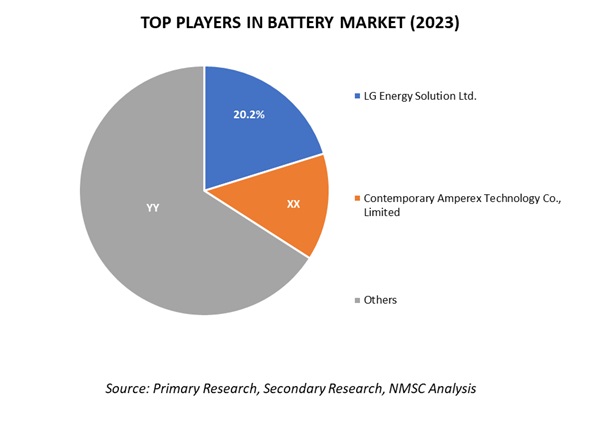

The battery industry comprises various key market players such as Contemporary Amperex Technology Co. Limited (CATL), LG Energy Solution, Panasonic Corporation (Energy Division), Samsung SDI Co., Ltd, BYD Company Ltd, Tesla, Inc. (Tesla Energy), SK On (formerly SK Innovation), Saft Groupe SAS (TotalEnergies), EnerSys, Inc, GS Yuasa Corporation, VARTA AG, Johnson Matthey Battery Systems Ltd, EVE Energy Co., Ltd, Leclanché SA, Toshiba Corporation (Energy Systems And Solutions), Exide Technologies / Exide Industries Ltd, Amara Raja Batteries Ltd. (Amaron), Northvolt AB, BMZ Group, AESC UK Ltd.

These market players are adopting various strategies including collaboration, product launch, and business expansion across various regions to maintain their dominance in battery industry.

|

DATE |

COMPANY |

RECENT DEVELOPMENTS |

|

November 2024 |

SK Innovation Co. Ltd. |

SK Innovation Co. Ltd. collaborated with POSCO Pilbara Lithium Solution to enhance raw material competitiveness by securing domestically produced lithium hydroxide for manufacturing nickel-cobalt-manganese (NCM) cathodes. |

|

November 2024 |

Samsung SDI Co., Ltd. |

Samsung SDI Co., Ltd. launched new LFP+ battery for commercial vehicles, at a tech showcase in Hanover to commercialize all-solid-state batteries by 2027. |

|

September 2024 |

Panasonic Corporation |

Panasonic Corporation collaborated with Subaru Corporation to focus on the supply of automotive lithium-ion batteries and the joint establishment of a new battery factory in Oizumi, Gunma Prefecture, Japan. |

|

July 2024 |

Contemporary Amperex Technology Co., Limited |

Contemporary Amperex Technology Co., Limited expanded their business and launched a new EV battery brand called CATL TIANXING to address key challenges in the new energy commercial vehicle industry, such as slow recharging, high ownership costs, and limited transport mileage. |

|

October 2023 |

LG Energy Solution Ltd |

LG Energy Solution collaborated with Toyota Motor North America in a long-term supply agreement for lithium-ion battery modules to power Toyota's battery electric vehicles (BEVs) assembled in the United States. |

Battery Market Key Segmentation

By Type

-

Stationary

-

Motive

By Battery Type

-

Primary Batteries (Non-rechargeable)

-

Alkaline Batteries

-

Zinc-Carbon Batteries

-

Lithium-Thionyl Chloride Batteries

-

-

Secondary Batteries (Rechargeable)

-

Lead-Acid Batteries

-

Nickel-Cadmium (NiCd) Batteries

-

Nickel-Metal Hydride (NiMH) Batteries

-

Lithium-ion Batteries

-

Lithium Nickel Manganese Cobalt (LI-NMC)

-

Lithium Iron Phosphate (LFP)

-

Lithium Cobalt Oxide (LCO)

-

Lithium Titanate Oxide (LTO)

-

Lithium Manganese Oxide (LMO)

-

Lithium Nickel Cobalt Aluminium Oxide (NCA)

-

-

Other Secondary Batteries

-

By Voltage Type

-

Low Voltage Batteries (1V - 12V)

-

Medium Voltage Batteries (24V - 100V)

-

High Voltage Batteries (200V - 1000V)

By Power Capacity

-

Low-Capacity Batteries (Up to 1,000 mAh)

-

Medium Capacity Batteries (1,000 mAh to 10,000 mAh)

-

High-Capacity Batteries (10,000 mAh to 100,000 mAh)

-

Ultra-High-Capacity Batteries (More than 100,000 mAh)

By Self-Discharge Rate

-

Low Self-Discharge Rate Batteries

-

Medium Self-Discharge Rate Batteries

-

High Self-Discharge Rate Batteries

By Application

-

Residential

-

Industrial

-

Automotive

-

ICE Engines

-

Passenger vehicles

-

Commercial vehicles

-

-

Electric vehicles

-

E-Bikes

-

E-Cars

-

E-Buses

-

E-Trucks

-

-

-

Medical

-

Telecom & IT

-

Consumer Electronics

-

Power & Utility

-

Aerospace & Defense

-

Marine

-

Other Industries

-

-

Commercial

By Region

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Taiwan

-

Thailand

-

Rest of Asia-Pacific

-

-

RoW

-

Latin America

-

Middle East

-

Africa

-

Key Players

-

Contemporary Amperex Technology Co. Limited (CATL)

-

LG Energy Solution

-

Panasonic Corporation (Energy Division)

-

Samsung SDI Co., Ltd.

-

BYD Company Ltd.

-

Tesla, Inc. (Tesla Energy)

-

SK On (formerly SK Innovation)

-

Saft Groupe SAS (TotalEnergies)

-

EnerSys, Inc.

-

GS Yuasa Corporation

-

VARTA AG

-

Johnson Matthey Battery Systems Ltd.

-

EVE Energy Co., Ltd.

-

Leclanché SA

-

Toshiba Corporation (Energy Systems And Solutions)

-

Exide Technologies / Exide Industries Ltd.

-

Amara Raja Batteries Ltd. (Amaron)

-

Northvolt AB

-

BMZ Group

-

AESC UK Ltd

Report Scope and Segmentation

|

Parameters |

Details |

|

Market Size in 2024 |

USD 151.48 Billion |

|

Revenue Forecast in 2030 |

USD 378.53 Billion |

|

Growth Rate |

CAGR of 16.5% from 2024 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

20 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst