Halal Food Market by Product Type (Meat and Poultry, Seafood, Dairy Products, Bakery and Confectionery, Beverages), by Certification (Certified Halal, Non-Certified / Locally Recognized), by Distribution Channel (Supermarkets and Hypermarkets, Specialty Halal Stores, Online Retail, Food Service), by End User (Individual Consumers, Institutional Consumers – Hospitality Industry, Healthcare Facilities, Educational Institutions, Travel and Tourism) – Global Analysis & Forecast, 2025–2030

Industry Outlook

The global Halal Food Market size was valued at USD 3.33 trillion in 2024, and is expected to be valued at USD 3.66 trillion by the end of 2025. The industry is projected to grow, hitting USD 5.92 trillion by 2030, with a CAGR of 10.08% between 2025 and 2030.

The market is undergoing rapid transformation, driven by increasing consumer awareness, digitalization, brand differentiation, and growing demand for ethically sourced and certified products. Globally, demand for high-quality, safe, and traceable Halal food is rising sharply, fuelled by the surge in e-commerce, social media marketing, lifestyle-driven consumption, and international trade in Halal-certified products. Expansion of online retail platforms, food delivery services, and AI-powered supply chain management further intensifies the need for innovative product offerings, personalized marketing strategies, and transparent sourcing practices. Advancements in food technology, sustainable production methods, packaging innovations, and traceability solutions are reshaping industry workflows, enhancing consumer trust, and strengthening brand identity in an increasingly health-conscious and digital-first world.

What are the Key Halal Food Market Trends?

What are the Major Technological Trends Shaping the Market?

Technological advancements are transforming the halal food market by enhancing production efficiency, traceability, and consumer engagement. AI and machine learning are used for supply chain optimization, predictive demand analysis, and quality control of Halal-certified products. Cloud-based platforms enable real-time monitoring of sourcing, inventory, and certification compliance. AR/VR technologies enhance consumer experiences through virtual product trials and interactive branding campaigns. Additionally, innovations like smart packaging, 3D food printing, and sustainable production methods are helping brands meet rising demands for transparency, personalization, and eco-friendly solutions.

How is Demographic Change Influencing the Market?

Demographic shifts are reshaping consumption patterns in the market. Younger, digitally native consumers prefer convenient, ready-to-eat, and visually appealing Halal products, discovered via e-commerce and social media. Older consumers focus on authenticity, trust in Halal certification, and nutritional quality. Rapid urbanization, rising disposable incomes, and growing digital literacy are fueling demand for premium, ethically sourced, and traceable halal foods, particularly in emerging markets. Producers and retailers are adapting product designs, packaging, and marketing strategies to meet these diverse consumer needs.

What Role does Government Support Play in Driving Growth in the Market?

Government support is crucial in promoting market growth. Policies that strengthen Halal certification, food safety standards, and supply chain transparency enhance consumer trust and market credibility. Initiatives promoting digital transformation, startup incubation, and agri-food innovation encourage investment in Halal-compliant production and distribution technologies. Intellectual property protections, MSME support, and food export facilitation boost competitiveness. Public campaigns highlighting Halal standards and healthy consumption habits also drive consistent demand for Halal products.

How are Consumer Preferences Changing in the Market?

Consumer preferences are increasingly focused on health, authenticity, convenience, and sustainability. Modern consumers seek Halal-certified products that are traceable, ethically sourced, and produced sustainably. There is growing interest in innovative packaging, ready-to-eat meals, plant-based options, and functional foods. Visual branding, social media presence, and immersive digital experiences strongly influence purchasing decisions. Overall, the market is shifting toward personalized, trustworthy, and culturally aligned Halal food offerings that resonate with consumers’ lifestyles and values.

What are the Key Market Drivers, Breakthroughs, and Investment Opportunities that will Shape the Industry in Next Decade?

The market is witnessing robust growth, driven by rising disposable incomes, urbanization, and the expansion of e-commerce and online retail channels. Increasing purchasing power enables consumers to spend on premium, ready-to-eat, and imported Halal products, while digital platforms enhance accessibility and global reach, particularly in emerging and non-traditional markets. Countries like China and the USA dominate e-commerce activity, presenting significant opportunities for Halal food brands, while niche markets in Europe and other regions are gaining traction. Despite challenges from complex certification processes and varying regulatory standards, growing demand for convenient, ethically sourced, and high-quality Halal offerings is creating opportunities for product innovation, brand differentiation, and international market expansion.

Growth Drivers:

How is Expansion of E-commerce & Online Retail Driving the Halal Food Market Demand?

The rapid growth of e-commerce platforms and online retail channels is significantly driving the market by increasing accessibility and convenience for consumers worldwide. Online platforms enable consumers to browse, compare, and purchase Halal-certified products from both local and international brands, with home delivery. This expansion supports the distribution of niche and premium Halal products that be unavailable in traditional retail stores. Additionally, digital marketing, social media promotions, and app-based loyalty programs enhance brand visibility and consumer engagement. As a result, e-commerce not only broadens market reach but also accelerates sales growth and encourages innovation in packaging, product variety, and personalized offerings.

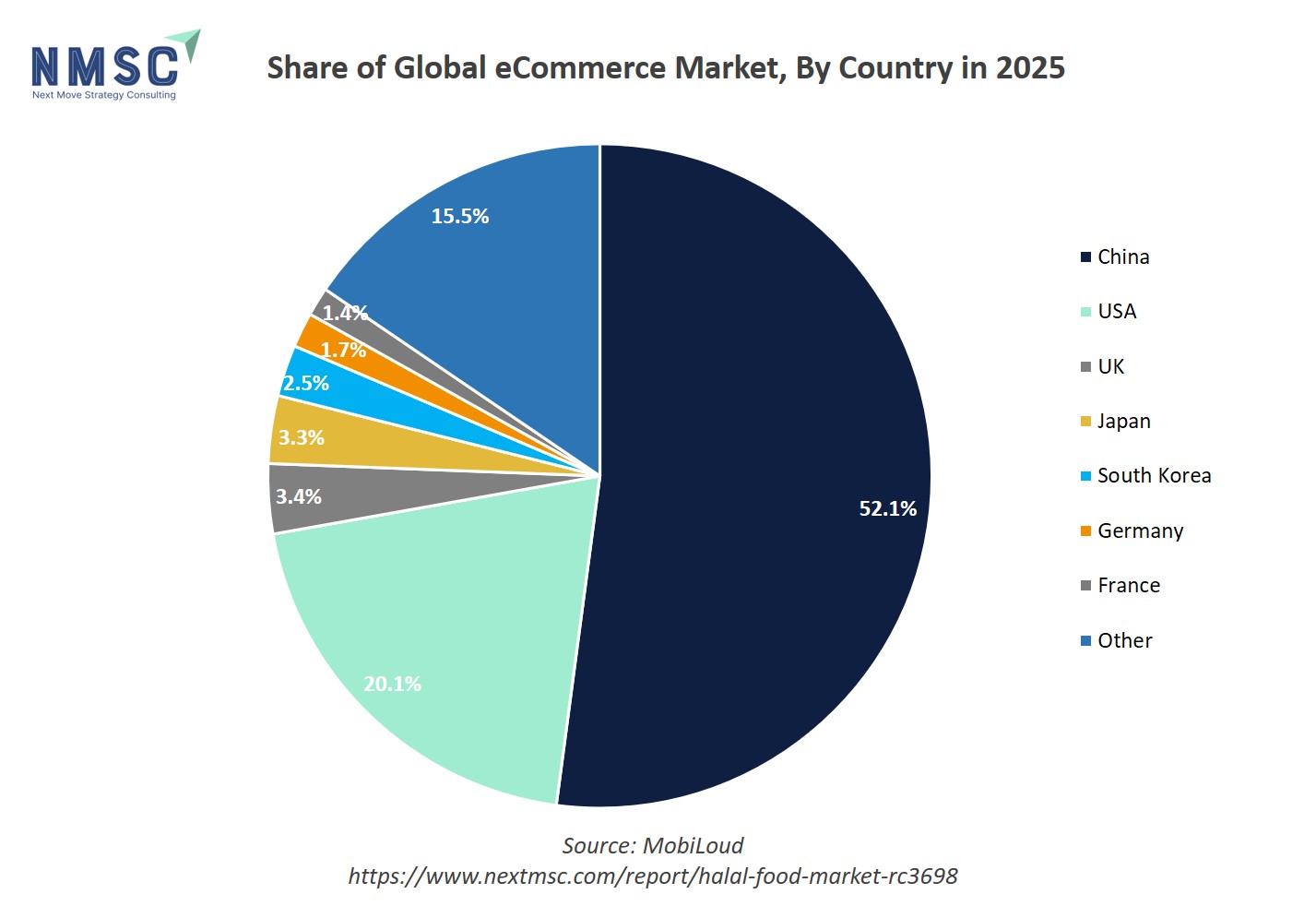

The pie chart depicts the global e-commerce market share by country in 2025. China dominates the market with a 52.1% share, accounting for over half of global e-commerce activity. The USA follows with 20.1%, while the UK and Japan contribute 3.4% and 3.3%, respectively. South Korea, Germany, and France hold smaller shares of 2.5%, 1.7%, and 1.4%, respectively. The remaining countries collectively represent 15.5% under the “Other” category. With the rapid growth of online retail, Halal food brands leverage these digital channels to reach a wider international audience, including non-traditional markets where demand for Halal products is emerging. Countries with smaller e-commerce shares, such as the UK, Japan, South Korea, Germany, and France, still represent niche markets with growing interest in specialty and ethically sourced foods. Overall, the expansion of e-commerce accelerates global market penetration, improves product accessibility, and enables Halal food brands to engage digitally savvy consumers across regions.

Is Rising Disposable Income Accelerating the Market Growth?

As incomes grow, especially in emerging economies and urban areas, consumers have greater purchasing power to spend on high-quality and premium Halal food products. Increased disposable income allows households to prioritize convenience, ready-to-eat meals, imported Halal products, and branded offerings over basic staples. This shift not only boosts demand for diversified Halal food options but also encourages innovation in product development, packaging, and marketing to cater to more affluent and quality-conscious consumers. Rising incomes, therefore, directly contribute to market expansion, higher sales volumes, and the growth of premium segments within the halal food market.

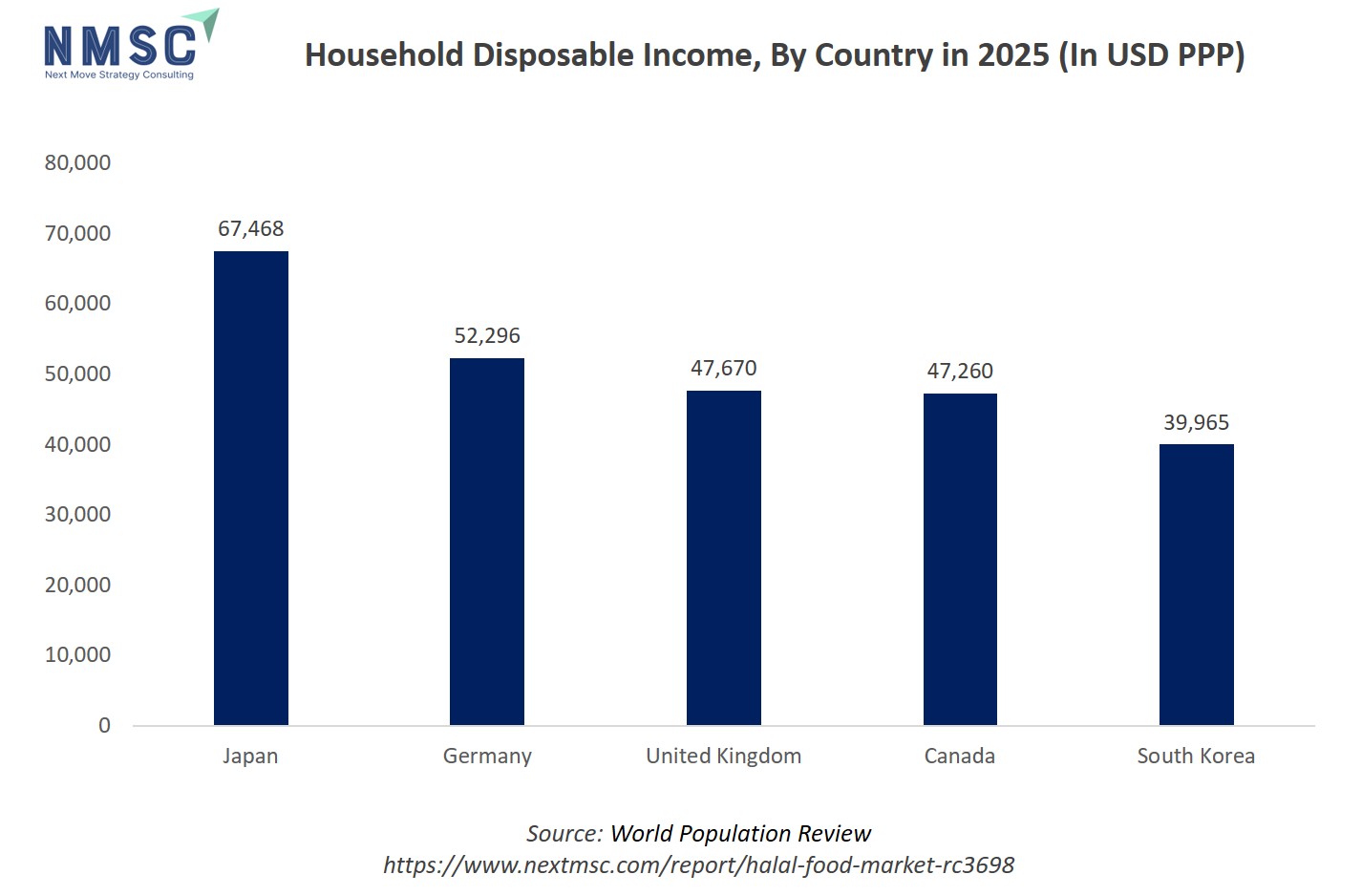

The bar chart illustrates the household disposable income in USD PPP for selected countries in 2024. Japan leads with USD 67,468, followed by Germany at USD 52,296, the United Kingdom at USD 47,670, Canada at USD 47,260, and South Korea at USD 39,965. Higher disposable income in countries like Japan and Germany indicates strong consumer purchasing power, creating opportunities for premium and imported Halal food products. In contrast, markets with moderate incomes, such as South Korea, favor affordable or ready-to-eat Halal offerings. Overall, variations in disposable income highlight where Halal food brands target premium segments versus mass-market products to maximize adoption and growth.

Growth Inhibitors:

How does Complex Certification and Regulatory Compliance Limit the Halal Food Market Growth?

The market faces challenges due to the stringent certification processes and varying regulatory standards across countries. Obtaining Halal certification requires adherence to specific religious, hygiene, and quality norms, which be time-consuming and costly for producers. Differences in certification authorities and compliance requirements between regions add further complexity, particularly for exporters. These challenges slow product launches, limit international expansion, and increase operational costs, acting as a key restraint to market growth.

How is Rising Demand for Ready-to-Eat and Premium Halal Products Creating Opportunity for the Market?

The growing preference for convenient, ready-to-eat, and premium Halal food products presents a significant market opportunity. Urbanization, busy lifestyles, and higher disposable incomes are driving demand for packaged meals, snacks, and gourmet Halal offerings. Brands that innovate in product variety, quality, and packaging capture this expanding segment. Additionally, leveraging e-commerce and digital marketing enables Halal food companies to reach a global consumer base, creating opportunities for international expansion and brand differentiation.

How Halal Food Market Share is Segmented in This Report, and What are the Key Insights from the Segmentation Analysis?

By Product Type Insights

Which Product Type Is Expected to Drive the Halal Food Market in 2025?

On the basis of product type, the market is segmented into meat and poultry, seafood, dairy products, bakery and confectionery, beverages, pantry and packaged food, and others. The market in 2025 is expected to be primarily driven by meat and poultry, as these are core Halal food staples with consistently high consumer demand across regions. Rising awareness of Halal certification, quality assurance, and traceability is further boosting consumption in this segment.

Other segments such as dairy products, bakery and confectionery, and beverages are also gaining significant traction due to urbanization, changing lifestyles, and growing demand for ready-to-eat, convenient, and premium Halal options. The pantry and packaged food category is emerging as a high-potential segment, driven by e-commerce expansion, online grocery adoption, and consumer preference for shelf-stable and easily accessible Halal products.

By Certification Insights

Which Certification Segment Is Expected to Drive the Halal Food Market in 2025?

On the basis of certification, the market is segmented into Certified Halal and Non-Certified / Locally Recognized products. The market in 2025 is expected to be primarily driven by Certified Halal products, as consumers increasingly prioritize authenticity, quality assurance, and compliance with Islamic dietary laws. Certified Halal labeling strengthens trust, encourages brand loyalty, and enables wider international market access.

While non-certified or locally recognized products serve regional and niche markets, the demand for certified Halal offerings is rising sharply due to global consumer awareness, export opportunities, and e-commerce expansion. Certification also plays a critical role in premium, ready-to-eat, and imported Halal product segments, making it a key growth driver in both mature and emerging markets.

By Distribution Channel Insights

Which Channels Are Likely to Lead Growth in the Halal Food Market in 2025?

On the basis of distribution channel, the market is segmented into supermarkets and hypermarkets, specialty Halal stores, online retail, and food service. The market in 2025 is expected to be primarily driven by supermarkets and hypermarkets, as they provide wide product variety, convenience, and easy accessibility for consumers seeking Halal-certified products. Large retail chains also enhance brand visibility and support promotional campaigns, boosting market reach.

Meanwhile, online retail and specialty Halal stores are witnessing rapid growth due to rising e-commerce adoption, digital marketing, and consumer demand for niche, premium, and convenient Halal products. The food service segment, including restaurants and catering, is emerging as a key growth area, fueled by urbanization, busy lifestyles, and preference for ready-to-eat and culturally authentic meals.

By End-User Insights

Which End Users Are Expected to Drive the Halal Food Market in 2025?

On the basis of end users, the market is segmented into individual consumers and institutional consumers, including the hospitality industry, healthcare facilities, educational institutions, and travel & tourism. The market in 2025 is expected to be primarily driven by individual consumers, as rising urbanization, disposable incomes, and awareness of Halal certification are boosting demand for premium, ready-to-eat, and convenience products.

Among institutional consumers, the hospitality and travel sectors are showing significant growth potential, driven by increasing Halal food offerings in hotels, airlines, and restaurants catering to Muslim travelers. Healthcare and educational institutions are also gradually adopting Halal-compliant meals to meet dietary requirements, creating additional opportunities for the halal food market expansion across both mainstream and specialized segments.

Regional Outlook

The market is geographically studied across North America, Europe, Asia Pacific, and the Middle East & Africa, and each region is further studied across countries.

Halal Food Market in North America

The North American market is driven by rising consumer awareness, digitalization of retail, and growing demand for convenient, high-quality, and ethically sourced products. Expansion of e-commerce platforms, food delivery apps, and online grocery channels is boosting accessibility and market reach. Companies are increasingly focusing on premium, ready-to-eat, and imported Halal food offerings to cater to diverse consumer preferences. Additionally, rising disposable incomes, urbanization, and health-conscious lifestyles are supporting growth, while digital marketing and social media engagement enable brands to connect with a tech-savvy audience and strengthen brand presence in the region.

Halal Food Market in the United States

In the U.S. market growth is primarily driven by the rising demand for Halal-certified foods, ready-to-eat meals, and premium imported products. Expansion of online retail and e-commerce platforms is facilitating greater accessibility to niche Halal products. Social media campaigns and digital marketing strategies are helping brands build awareness and attract younger, health-conscious, and ethically aware consumers. Additionally, rising disposable incomes and urbanization support the adoption of innovative and convenient Halal food offerings, while growing interest in plant-based and functional foods further fuels market expansion.

Halal Food Market in Canada

Canada’s market is growing due to increasing awareness of Halal certification, digitalization of retail, and the expansion of e-commerce channels. Consumers are seeking high-quality, convenient, and ready-to-eat Halal products, while social media and digital marketing campaigns help brands engage diverse ethnic and religious communities. Rising urbanization, disposable incomes, and health-conscious lifestyles are encouraging adoption of premium Halal foods. Furthermore, demand for sustainable sourcing and culturally relevant offerings is shaping product development and creating opportunities for innovative Halal food solutions across the country.

Halal Food Market in Europe

The European market is supported by rising consumer awareness, digital retail expansion, and increasing interest in ethically sourced and certified Halal foods. E-commerce platforms and online grocery services enhance accessibility, while digital marketing and social media engagement drive brand visibility. Urbanization, rising disposable incomes, and health-focused lifestyles are fueling demand for premium and ready-to-eat Halal offerings. Trends toward sustainable sourcing, functional foods, and culturally relevant products are shaping market innovations, creating opportunities for specialized and high-quality Halal food solutions across the region.

Halal Food Market in the United Kingdom

In the U.K., the market is primarily driven by growing consumer demand for certified, high-quality, and convenient Halal snacks. Expansion of e-commerce platforms, food delivery services, and online grocery channels improves accessibility and product variety. Social media campaigns and digital marketing initiatives are helping brands engage diverse populations and strengthen loyalty. Rising disposable incomes, urban lifestyles, and health-conscious consumption patterns are fueling demand for premium and ready-to-eat Halal foods. Sustainability, ethical sourcing, and product innovation further support market growth in the country.

Halal Food Market in Germany

Germany’s market is growing due to increasing consumer interest in Halal certification, convenience, and premium food products. E-commerce expansion and digital retail platforms enhance product availability and reach. Social media and digital marketing campaigns help brands engage diverse consumers, while urbanization and rising disposable incomes support adoption of high-quality Halal foods. Trends in sustainable production, ethical sourcing, and ready-to-eat meals are shaping product innovation, creating opportunities for companies to differentiate and capture market share in Germany’s growing Halal food sector.

Halal Food Market in France

In France, the market is driven by rising awareness of Halal certification, growing demand for convenience, and the popularity of ready-to-eat and premium food offerings. Expansion of e-commerce and online grocery channels improves accessibility, while digital marketing and social media engagement enhance brand visibility and consumer connection. Urbanization, rising disposable incomes, and health-conscious lifestyles are encouraging adoption of high-quality Halal foods. Additionally, trends toward sustainable sourcing, plant-based products, and culturally relevant offerings are shaping market innovation and supporting steady growth across the country.

Halal Food Market in Spain

Spain’s market is significantly influenced by the growth of e-commerce, social media, and digital content consumption. Urbanization and rising digital literacy are driving demand for convenient, premium, and culturally relevant Halal food products. Expansion of online retail and delivery platforms improves accessibility, while digital marketing and social campaigns enhance brand engagement. Rising consumer interest in ready-to-eat meals, plant-based options, and sustainable products, coupled with increasing health consciousness, is creating opportunities for innovation and growth across the Spanish Halal Food sector.

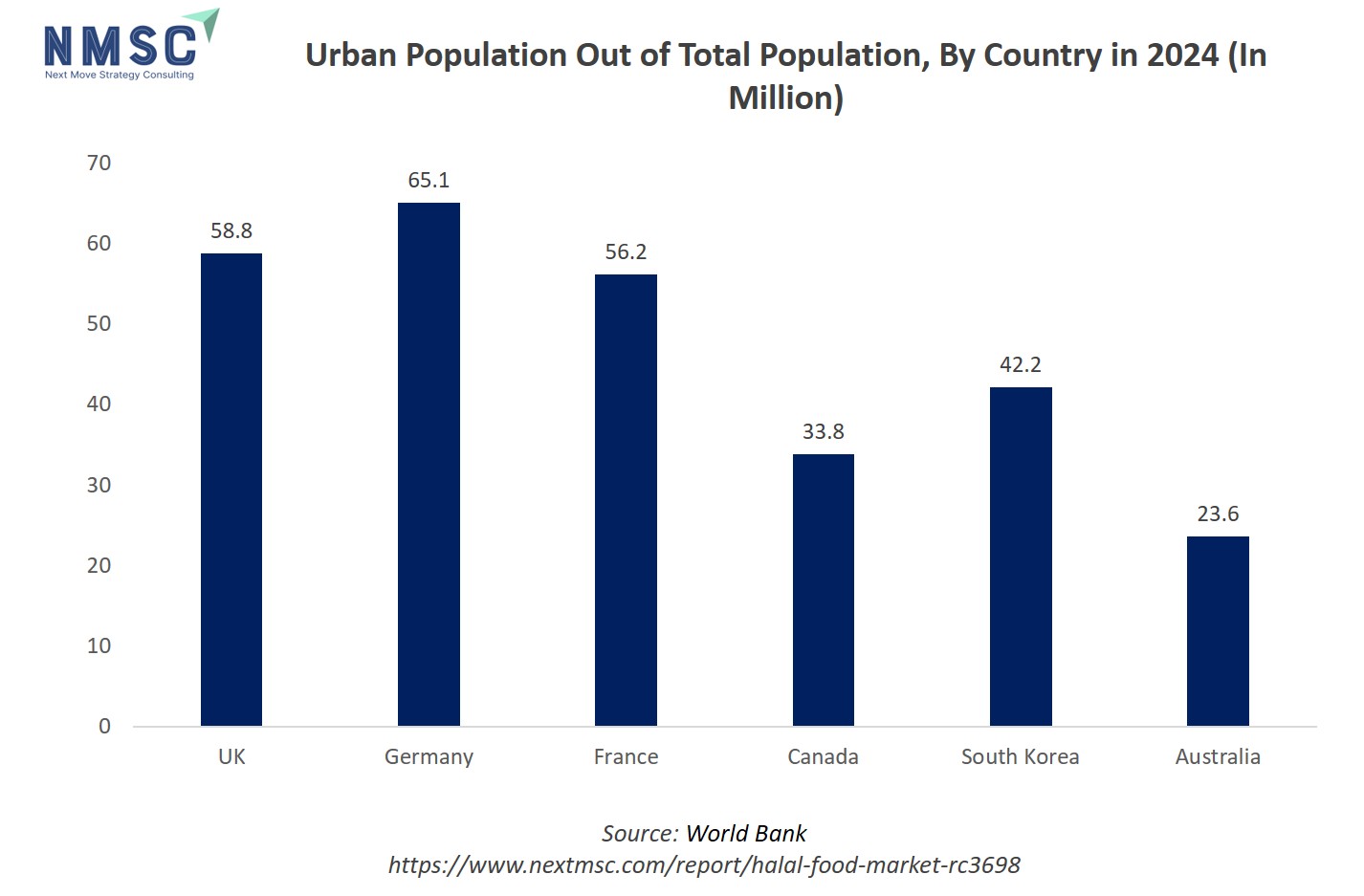

The bar chart illustrates the urban population (in millions) across selected countries in 2024. Germany records the highest urban population at 65.05 million, followed by the United Kingdom with 58.76 million, and France with 56.21 million. In the Asia-Pacific region, South Korea reports an urban population of 42.17 million, while Canada and Australia follow with 33.84 million and 23.60 million, respectively.

The growing urban population across these nations is a key driver for the halal food market, as urban consumers exhibit higher purchasing power, greater exposure to diverse cuisines, and stronger demand for convenient and packaged food products. Urbanization fosters the expansion of modern retail channels, including supermarkets, specialty Halal stores, and online platforms, improving product accessibility. Additionally, the multicultural composition of urban centers enhances awareness and acceptance of Halal-certified food, driving product innovation and market penetration across mainstream retail and food service sectors.

Halal Food Market in Italy

Italy’s market growth is supported by increasing digitalization, e-commerce expansion, and social media adoption. Rising demand for premium, ready-to-eat, and ethically sourced Halal food products is encouraging businesses to innovate in product variety, packaging, and marketing strategies. Urbanization, higher disposable incomes, and growing health awareness are driving adoption of convenient and quality Halal offerings. These trends, combined with online retail and digital marketing initiatives, are contributing to steady growth in Italy’s halal food market.

Halal Food Market in the Nordics

In the Nordic countries, the market is driven by urbanization, digital transformation, and high adoption of e-commerce and social media platforms. Consumers increasingly seek convenient, ready-to-eat, and high-quality Halal products, while sustainable sourcing and ethical production practices are gaining importance. Expansion of online grocery platforms and delivery services improves accessibility, and digital marketing campaigns help brands engage diverse, health-conscious, and tech-savvy audiences. These factors collectively support consistent market growth across the Nordic region.

Halal Food Market in Asia Pacific

The Asia Pacific market is fueled by rapid urbanization, rising disposable incomes, and digital adoption. Countries such as China, India, South Korea, and Indonesia are witnessing growing demand for premium, ready-to-eat, and plant-based Halal foods. E-commerce platforms, social media, and digital marketing initiatives are expanding accessibility and consumer engagement. Rising health consciousness, cultural awareness, and preference for convenient and innovative products are driving market expansion, while digital channels enable brands to target tech-savvy and urban populations effectively.

Halal Food Market in China

China’s market is primarily driven by rapid e-commerce growth, rising disposable incomes, and increasing urbanization. Consumers are increasingly seeking premium, ready-to-eat, and culturally authentic Halal food products. Expansion of online grocery platforms and food delivery services improves reach, while digital marketing and social media engagement enhance brand visibility. Growing demand for convenient, ethically sourced, and innovative offerings, coupled with platform-specific content and interactive digital campaigns, is supporting steady market growth in China.

Halal Food Market in Japan

Japan’s market growth is influenced by high digital adoption, urbanization, and health-conscious lifestyles. Consumers show increasing preference for premium, convenient, and ethically certified Halal products. E-commerce platforms and digital marketing channels enhance accessibility and brand engagement, while trends toward plant-based foods, ready-to-eat meals, and culturally relevant offerings support innovation. Rising disposable incomes and tech-savvy consumer behavior further contribute to market expansion.

Halal Food Market in India

India’s market is driven by rapid digitalization, urbanization, and increasing internet penetration. Growing consumer awareness of Halal certification and rising disposable incomes are boosting demand for premium, ready-to-eat, and ethically sourced Halal food products. Expansion of e-commerce, online grocery, and food delivery platforms is improving accessibility, while social media campaigns and digital marketing enable brands to engage tech-savvy, urban populations. Rising demand for innovative and culturally relevant offerings is creating strong growth opportunities.

Halal Food Market in South Korea

South Korea’s market is fueled by high digital adoption, social media penetration, and urbanization. Consumers are increasingly seeking convenient, premium, and ethically sourced Halal food products. E-commerce and modern retail platforms enhance accessibility, while digital marketing campaigns drive brand engagement. Rising interest in plant-based, ready-to-eat, and culturally relevant Halal foods, along with health-conscious lifestyles, is supporting sustained growth across the country.

Halal Food Market in Taiwan

Taiwan’s market growth is supported by digital transformation, social media adoption, and urbanization. Consumers are seeking premium, convenient, and culturally authentic Halal food products. Expansion of e-commerce platforms and online grocery services improves market reach, while innovative packaging, ready-to-eat options, and sustainable sourcing are gaining popularity. Digital marketing campaigns and interactive content enhance consumer engagement, driving growth in the Taiwanese halal food market.

Halal Food Market in Indonesia

Indonesia’s market is driven by rapid urbanization, growing disposable incomes, and increasing digital adoption. Consumers are demanding premium, ready-to-eat, and culturally relevant Halal foods. Expansion of e-commerce, online grocery, and food delivery services improves accessibility, while digital marketing and social media campaigns strengthen brand visibility. Rising health awareness, innovation in packaging and product variety, and emphasis on sustainability are further supporting market expansion across urban and semi-urban regions.

Halal Food Market in Australia

Australia’s halal food market is supported by digital transformation, growing e-commerce platforms, and high social media engagement. Consumers are increasingly seeking premium, ready-to-eat, and ethically sourced Halal products. Expansion of online grocery and food delivery channels improves accessibility, while digital marketing and interactive campaigns enhance brand visibility and consumer engagement. Rising urbanization, digital literacy, and health-conscious lifestyles are driving demand for convenient, innovative, and culturally relevant Halal food offerings. Additionally, trends toward sustainable sourcing and product innovation are further supporting market growth across the country.

Halal Food Market in Latin America

In Latin America, the market is driven by rapid digitalization, increasing internet penetration, and the expansion of e-commerce platforms. Countries such as Brazil, Mexico, and Argentina are witnessing growing demand for premium, convenient, and culturally authentic Halal foods. Businesses are leveraging social media, online marketing, and interactive campaigns to engage urban and tech-savvy consumers. Rising urbanization, disposable incomes, and awareness of Halal certification are supporting the adoption of ready-to-eat, plant-based, and ethically sourced products, fuelling steady market growth across metropolitan and semi-urban regions.

Halal Food Market in the Middle East & Africa

The market in the Middle East and Africa is supported by high digital adoption, social media engagement, and expanding e-commerce infrastructure. Consumers are increasingly seeking premium, ready-to-eat, and culturally compliant Halal foods. Businesses are investing in online retail, digital marketing, and interactive content to enhance visibility and brand engagement. Rising urbanization, growing disposable incomes, and emphasis on ethical and sustainable sourcing are driving demand. Combined with culturally tailored offerings and innovative product development, these factors are fostering consistent market growth across the region.

Competitive Landscape

Which Companies Dominate the Halal Food Market and How Do They Compete?

The global market is dominated by a mix of established multinational corporations, regional leaders, and specialized Halal food producers such as QL Foods Sdn Bhd, Saffron Road, DagangHalal Group, Kawan Foods Berhad, Prima Agri-Products Sdn Bhd, BRF S.A., Tahira Foods Ltd., American Foods Group, Unilever PLC, Al Islami Foods, Al Safa Foods Canada Ltd., Barry Callebaut AG, Crescent Foods, Al-Falah Halal Foods, and Nestlé Malaysia.

These companies compete by offering a wide range of Halal food products including meat and poultry, dairy, bakery, beverages, pantry items, and ready-to-eat solutions, catering to diverse consumer needs across regions. Market leaders differentiate themselves through product quality, Halal certification, innovation in flavors and packaging, and adoption of advanced production and supply chain technologies. Strategies also include expanding global and regional distribution networks, strengthening brand visibility, and diversifying product portfolios. Smaller or specialized companies focus on niche markets, premium offerings, or culturally tailored products to meet specific consumer preferences. Companies that combine quality, innovation, convenience, and strong operational efficiency are capturing significant market share and building strong consumer loyalty in the halal food market.

Market Dominated by Halal Food Market Giants and Specialists

The market is led by a mix of large multinational companies and regional or niche firms. Major players compete on scale, brand reputation, technological capabilities, and client networks, offering comprehensive services ranging from corporate branding to digital content and Halal product marketing solutions. Smaller or specialized firms focus on bespoke, culturally tailored, or premium offerings, catering to niche markets and specific consumer needs. This dual structure enables clients to choose between established agencies for reliability or specialized firms for innovative and highly customized solutions.

Innovation and Adaptability Drive Market Success

Leading companies invest heavily in technological innovation and creative tools to deliver engaging, high-quality, and interactive Halal food solutions. Adoption of motion graphics, 3D visualization, AR/VR integration, and AI-assisted technologies enhance efficiency and creativity. Firms that embrace trends like personalization, digital storytelling, sustainability, and platform-specific content strengthen brand presence, drive consumer engagement, and maintain a competitive edge.

Market Players to Opt for Merger & Acquisition Strategies to Expand Their Presence

M&A activities are increasingly used by Halal Food companies to expand services, enter new markets, and acquire specialized expertise. Leading firms are acquiring niche players to diversify offerings, scale operations efficiently, and integrate advanced digital and marketing technologies. These strategies allow companies to capture new client segments, respond to rising demand for innovative solutions, and enhance market positioning in both mainstream and specialized segments.

List of Key Halal Food Companies

-

QL Foods Sdn Bhd

-

DagangHalal Group

-

Kawan Foods Berhad

-

Prima Agri-Products Sdn Bhd

-

Tahira Foods Ltd.

-

American Foods Group

-

Unilever PLC

-

Al Islami Foods

-

Al Safa Foods Canada Ltd.

-

Barry Callebaut AG

-

Crescent Foods

-

Al-Falah Halal Foods

-

Nestlé Malaysia

What are the Latest Key Industry Developments?

-

May 2025 - QL Foods is actively contributing to the growth of the U.S. halal meat industry, valued at USD 20 billion. They are addressing challenges such as the lack of standardized halal certification and supply chain disruptions by diversifying their supply chain and partnering with local U.S. producers. Their strategic focus on e-commerce is enhancing accessibility to halal products in rural and suburban areas.

-

May 2025 - Saffron Road has successfully captured the U.S. halal food market, which is valued at USD 20 billion. Their products are now available in over 25,000 stores nationwide, including Whole Foods and Walmart, reflecting their widespread acceptance and growth.

-

May 2025 - Kawan Foods Berhad, a leading Malaysian frozen food manufacturer, has expanded its halal-certified products into the U.S. market. Their offerings include halal paratha, aiming to introduce Malaysian culinary delights to American consumers.

-

November 2024 - BRF S.A., a Brazilian pork and chicken processor, signed a binding agreement to acquire a processed foods factory in Henan province, China, for $43 million. This acquisition is part of their strategy to gain direct access to the Chinese market, one of the largest protein-consuming markets globally.

-

June 2024 - Saffron Road introduced four new frozen meals: Korean Fire-Roasted Chicken, Vegetable Bibimbap, Drunken Noodles, and Fire-Roasted Adobo Chicken. These additions aim to diversify their offerings and cater to a broader consumer base seeking global flavors.

What are the Key Factors Influencing Investment Analysis & Opportunities in the Halal Food Market?

The market is attracting substantial investor interest due to the rising global demand for high-quality, innovative, and diverse Halal food products. Key factors influencing investment decisions include a company’s ability to offer premium, ready-to-eat, and culturally compliant products, adoption of advanced production and supply chain technologies, and efficient distribution across regional and international markets. Firms demonstrating innovation, sustainability, and adaptability in meeting evolving consumer preferences, ranging from mainstream packaged foods to niche, specialty Halal offerings, are particularly appealing. Strategic initiatives such as mergers, acquisitions, and partnerships further signal growth potential, making companies with diversified product portfolios, strong technological capabilities, and established market presence prime targets for investment opportunities in the Halal food sector.

Key Benefits for Stakeholders:

Next Move Strategy Consulting (NMSC) presents a comprehensive analysis of the halal food market, covering historical trends from 2020 through 2024 and offering detailed forecasts through 2030. Our study examines the market at global, regional, and country levels, providing quantitative projections and insights into key growth drivers, challenges, and investment opportunities across all major market segments.

Report Scope:

|

Parameters |

Details |

|

Market Size in 2025 |

USD 3.66 Trillion |

|

Revenue Forecast in 2030 |

USD 5.92 Trillion |

|

Growth Rate |

CAGR of 10.08% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Countries Covered |

28 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent to up to 80 analyst-working hours) after purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

|

Approach |

In-depth primary and secondary research; proprietary databases; rigorous quality control and validation measures. |

|

Analytical Tools |

Porter's Five Forces, SWOT, value chain, and Harvey ball analysis to assess competitive intensity, stakeholder roles, and relative impact of key factors. |

Key Market Segments

By Product Type

-

Meat and Poultry

-

Beef

-

Lamb

-

Chicken

-

Processed Meat

-

-

Seafood

-

Fish

-

Shellfish

-

-

Dairy Products

-

Milk

-

Cheese

-

Yogurt

-

Butter

-

-

Bakery and Confectionery

-

Bread

-

Cakes and Pastries

-

Chocolates and Sweets

-

-

Beverages

-

Non-Alcoholic Beverages

-

Coffee

-

Tea

-

-

Pantry and Packaged Food

-

Grains and Pulses

-

Nuts and Dried Fruits

-

Sauces and Spices

-

Frozen Meals

-

Instant Meals

-

Snacks

-

-

Others

-

Food Enzymes

-

Food Flavors

-

By Certification

-

Certified Halal

-

Non-Certified / Locally Recognized

By Distribution Channel

-

Supermarkets and Hypermarkets

-

Specialty Halal Stores

-

Online Retail

-

Food Service

By End User

-

Individual Consumers

-

Institutional Consumers

-

Hospitality Industry

-

Healthcare Facilities

-

Educational Institutions

-

Travel and Tourism

-

Geographical Breakdown

-

North America: U.S., Canada, and Mexico.

-

Europe: U.K., Germany, France, Italy, Spain, Sweden, Denmark, Finland, Netherlands, and rest of Europe.

-

Asia Pacific: China, India, Japan, South Korea, Taiwan, Indonesia, Vietnam, Australia, Philippines, Malaysia and rest of APAC.

-

Middle East & Africa (MEA): Saudi Arabia, UAE, Egypt, Israel, Turkey, Nigeria, South Africa, and rest of MEA.

-

Latin America: Brazil, Argentina, Chile, Colombia, and rest of LATAM.

Conclusion & Recommendations

Our report equips stakeholders, industry participants, investors, policy-makers, and consultants with actionable intelligence to capitalize on the market transformative potential. By combining robust data-driven analysis with strategic frameworks, NMSC’s Halal Food Market Report serves as an indispensable resource for navigating the evolving landscape.

Speak to Our Analyst

Speak to Our Analyst