Ice Cream Market By Product Type (Cup and Tub, Cone, Bar and Stick and Others), By Ingredient Base (Dairy, Non-Dairy, Frozen Dessert), By Category (Impulse, Take Home, Artisanal), By Flavor (Classic Flavors, Fruit-Based Flavors and Others), By Packaging Format (Single Serve, Multi Serve, Bulk Pack), By Distribution Channel (Supermarket and Hypermarket, Convenience and Retail Store and Others), & By End User (Children, Adults, Families, Institutional Users) – Global Analysis & Forecast, 2025–2030

Industry Outlook

The global Ice Cream Market size was valued at USD 107.23 billion in 2024, and is expected to be valued at USD 114.52 billion by the end of 2025. The industry is projected to grow, hitting USD 159.12 billion by 2030, with a CAGR of 6.8% between 2025 and 2030.

The ice cream market is undergoing a transformation driven by growing consumer demand for safer, sustainable, and high-quality products. Consumers are increasingly seeking dairy-free, plant-based, and ethically produced ice cream, prompting brands to reformulate offerings to replicate the creaminess and indulgence of traditional products while meeting health and environmental expectations. This shift is influencing product development, flavor innovation, and packaging strategies, as companies aim to differentiate themselves in a competitive market and align with evolving consumer preferences for sustainability and wellness.

Technological advancements are also playing a key role in shaping the ice cream industry, enabling brands to enhance both product quality and nutritional value. Improvements in production processes, such as texture stabilization, controlled fat crystallization, and the addition of functional ingredients like probiotics, fiber, and plant-based proteins, are allowing manufacturers to respond to rising demand for healthier, premium, and indulgent ice cream products. By adopting such innovations, companies expand their market presence, attract health-conscious and eco-aware consumers, and strengthen brand loyalty in an increasingly competitive landscape.

What are the Key Trends in the Ice Cream Industry?

How is the Ice Cream Market Being Reshaped by Non-Dairy and Plant-Based Demand?

Plant-based alternatives have transitioned from a niche offering to a core growth driver within the global market, particularly in regions where climate awareness and sustainability policies are reshaping consumer preferences. Post-2023 reports from leading plant-based organizations and NGOs highlight a rapid expansion of dairy-free ice cream product lines, underscoring growing consumer demand for indulgent yet lower-carbon dessert options. This shift is not merely about dietary preferences, it reflects a structural change in how brands are innovating, sourcing ingredients, and positioning themselves in a market increasingly influenced by environmental considerations.

How is the Market Responding to Shifting Global Trade and Regional Production Nodes?

Global trade dynamics are redefining the competitive landscape of the market, as shifting production hubs, evolving export patterns, and changing tariff structures reshape how brands manage their supply chains and margins. For example, Europe produced 3.3 billion litres of ice cream in 2024, underscoring how established regions continue to influence global trade flows even as new exporter entrants emerge and redistribute market power. This evolving scenario demands sharper strategic responses from multinational ice cream companies. Reassessing tariff exposure through HS-2/HS-6 trade data from UN Comtrade reveal hidden cost pressures and new opportunities, while setting up near-market production for premium SKUs helps minimize frozen shipping expenses and lead times. Additionally, leveraging bonded cold storage or cross-docking optimize distribution in regions with complex tariff or shelf-life challenges. By aligning trade strategies with these shifting supply patterns, ice cream brands build more resilient networks, control costs, and strengthen their positioning in an increasingly interconnected global market.

What are the Key Market Drivers, Breakthroughs, and Investment Opportunities that will Shape the Ice Cream Industry in Next Decade?

The ice cream industry is rapidly evolving as consumer preferences shift toward healthier, plant-based, and ethically produced options. Rising demand for dairy-free and vegan-friendly ice cream is prompting brands to innovate with formulations that replicate the indulgence and creaminess of traditional products while meeting sustainability and dietary expectations. Manufacturers are introducing clean-label, functional, and eco-friendly offerings, allowing them to capture a growing segment of health-conscious and environmentally aware consumers. These innovations not only differentiate brands in a competitive landscape but also help expand market presence across diverse consumer segments.

At the same time, operational challenges such as supply chain disruptions, rising input costs, and logistical bottlenecks are influencing production and profitability. Ice cream companies are responding by optimizing supply chains, exploring alternative sourcing, and improving production efficiency. The focus on plant-based and specialty products presents a significant growth opportunity, enabling brands to offer unique flavors, sustainable packaging, and innovative formats. By aligning with evolving consumer expectations for indulgence, health, and sustainability, ice cream manufacturers strengthen brand loyalty, drive market expansion, and maintain a competitive edge in a dynamic industry.

Growth Drivers:

How is the Demand for Plant-Based Ice Cream Influencing Ice Cream Market Trends?

The rising consumer preference for plant-based diets is increasingly shaping the market. While the 2024 global retail sales of plant-based dairy, meat, and other alternatives collectively reached USD 28.6 billion, the ice cream segment is emerging as a key growth area within this broader trend. This shift is fueled by health-conscious consumers and those with dietary restrictions seeking dairy-free, vegan-friendly desserts. In response, ice cream manufacturers are innovating with plant-based formulations, introducing products that replicate the creaminess and indulgence of traditional ice cream while meeting the demand for sustainable and health-oriented options. These developments are helping the ice cream sector capture a growing share of the expanding plant-based market.

What Role does Technological Innovation Play in Enhancing Product Offerings?

Technological advancements are increasingly shaping the market, driving both product innovation and ice cream market growth. Research from PMC highlights that improvements in production processes, such as better texture stabilization, controlled fat crystallization, and the addition of functional ingredients like probiotics, fiber, and plant-based proteins are enhancing the sensory quality and nutritional value of ice cream. These innovations allow manufacturers to respond to the rising consumer demand for healthier, functional, and premium ice cream products. By adopting such technologies, ice cream brands differentiate their offerings, attract health-conscious and indulgence-seeking consumers, expand their market presence, and ultimately increase profitability in an increasingly competitive landscape.

Growth Inhibitors:

How are Rising Input Costs and Supply Chain Disruptions Affecting the Ice Cream Industry?

The global market faced a turbulent year in 2024 as escalating input costs and widespread supply chain disruptions shook the industry’s stability. Kerry Group, for instance, reported an 8.6% decline in revenues, highlighting how constrained supply conditions and rising raw material expenses directly impacted production and market demand. These challenges extend across the sector, with soaring prices for dairy, sugar, and packaging, coupled with logistical bottlenecks, putting additional pressure on manufacturers. For ice cream companies, this has meant higher operational costs, delayed product launches, and shrinking profit margins. To remain competitive, brands are now focusing on building supply chain resilience, exploring alternative sourcing options, and implementing cost-optimization strategies, critical steps to ensure continuity, meet consumer expectations, and sustain growth in a volatile market environment.

What Investment Opportunities Does the Plant-Based and Dairy-Free Ice Cream Segment Offer?

The plant-based and dairy-free ice cream segment is emerging as a key growth avenue in the market, driven by increasing consumer focus on health, sustainability, and ethical choices. Rising demand for vegan, lactose-free, and environmentally friendly ice cream is encouraging brands to innovate with plant-based milks, natural sweeteners, and functional ingredients that appeal to a broader range of consumers, including those with dietary restrictions. By offering clean-label products, unique flavors, and eco-friendly packaging, ice cream companies differentiate themselves in a competitive market and foster strong brand loyalty. Investing in this segment enables stakeholders to tap into the expanding plant-based trend while meeting consumer expectations for healthier, sustainable, and indulgent ice cream options.

How is the Ice Cream Market is Segmented in this Report, and What are the Key Insights from Segmentation Analysis?

By Type Insights

How is the Ice Cream Market Shaped by Cup and Tub, Cone and Others?

Based on type, the market is segmented into cup and tub, cone and others.

The cup and tub segment represents one of the most popular and versatile formats in the ice cream market. These products are typically sold in individual servings (cups) or family-sized containers (tubs), catering to both on-the-go consumers and households. Their convenience, portion control, and ease of storage make them highly appealing, particularly for retail and e-commerce channels. Additionally, cups and tubs offer brands the flexibility to experiment with flavors, mix-ins, and premium ingredients without significant changes to packaging or production lines. This segment also aligns well with health-conscious trends, as smaller portions and customizable options allow consumers to indulge responsibly. For manufacturers, the cup and tub format provides opportunities to innovate, target diverse consumer preferences, and expand market reach across both traditional supermarkets and online platforms.

By Ingredient Base Insights

Which Ingredient Base is Emerging as the Most Flexible in the Ice Cream Market?

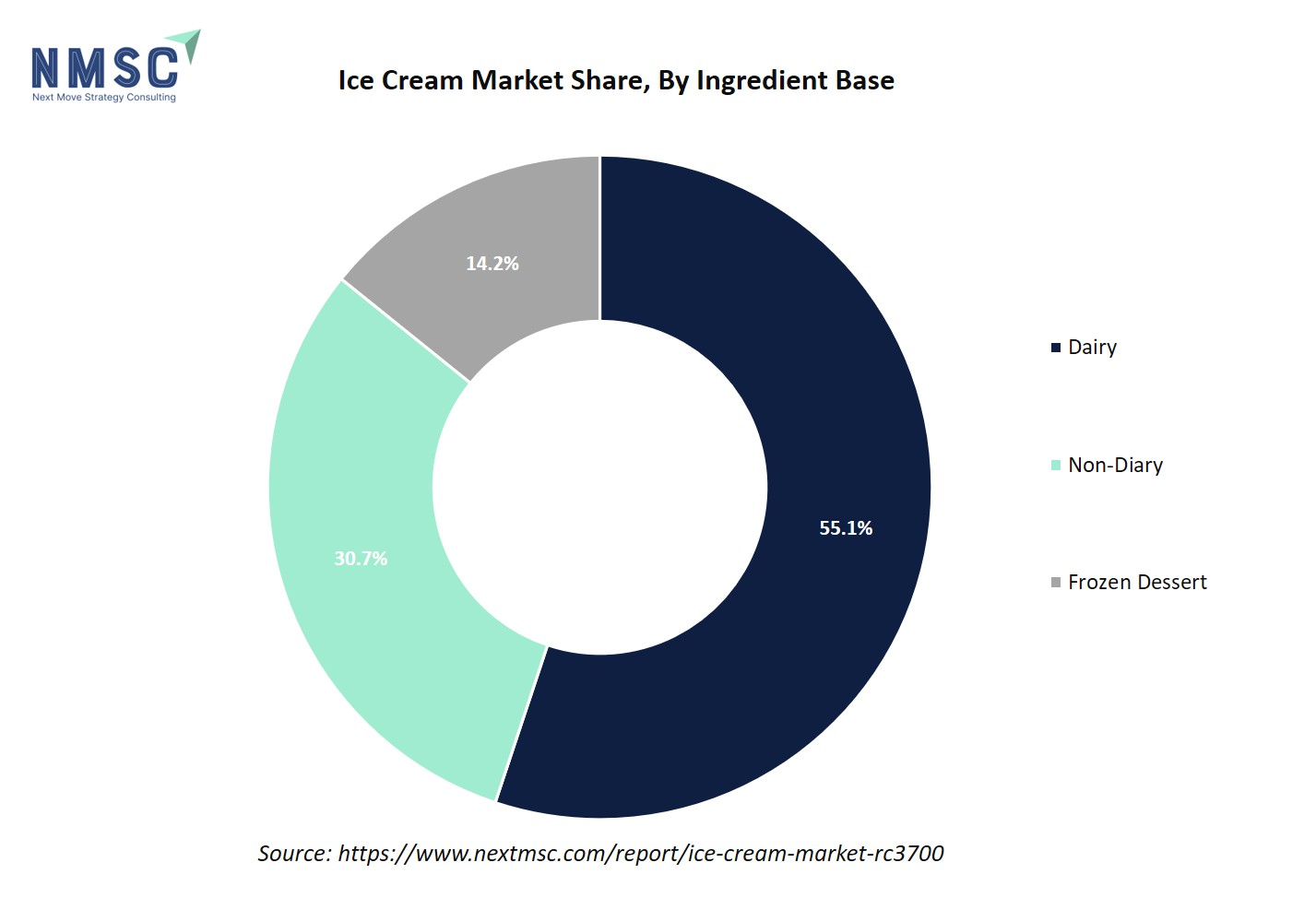

Based on ingredient base, the market is segmented into dairy, non-diary and frozen dessert.

Dairy-based ice cream is the traditional and most widely consumed segment in the global market. Made primarily from milk, cream, sugar, and natural flavorings, it is prized for its rich, creamy texture and indulgent taste. This segment caters to consumers seeking classic ice cream experiences and remains a staple in households, retail outlets, and foodservice channels. Dairy-based ice cream also provides a strong platform for innovation, allowing brands to introduce premium flavors, mix-ins, and limited-edition variants while maintaining the familiar taste profile that consumers love. For manufacturers, this segment offers opportunities to target both mass-market and premium segments, leverage branding around quality and creaminess, and expand presence across traditional and modern retail channels.

The chart represents the market by ingredient base, showing Dairy (55.1%) as the largest segment, followed by Non-Dairy (30.7%) and Frozen Dessert/Other (14.2%). It highlights the dominance of traditional dairy ice cream while illustrating the growing demand for plant-based alternatives and the presence of specialty frozen desserts in the market.

By Category Insights

How is the Ice Cream Market Shaped by Category Segmentation?

Based on category, the market is segmented into impulse, take home and artisanal.

Impulse ice cream refers to products designed for immediate consumption and spontaneous purchase, typically sold at points of sale such as convenience stores, kiosks, vending machines, and ice cream carts. This category includes single-serve items like cones, bars, sticks, and small cups that are convenient, affordable, and visually appealing to attract quick, on-the-go purchases. Impulse ice cream is marketed with eye-catching packaging and innovative flavors to entice consumers, particularly children and young adults. For manufacturers, this category offers opportunities to drive volume sales, experiment with seasonal or limited-edition flavors, and build brand visibility. Its high turnover and frequent repeat purchases make impulse ice cream a crucial segment for capturing everyday consumer demand in the market.

By Flavor Insights

How Flavors are Driving the Ice Cream Market Demand?

Based on flavors, the market is segmented into classic flavors, fruit-based flavors and others.

Classic flavors such as vanilla, chocolate, and strawberry form the cornerstone of the global market. These flavors are widely recognized and consistently popular across all age groups and regions, providing a reliable choice for consumers seeking familiar and comforting tastes. Vanilla, in particular, serves as a versatile base for mix-ins, toppings, and specialty variants, while chocolate and strawberry continue to attract both traditionalists and indulgence seekers. Classic flavors also offer manufacturers a platform for innovation, such as incorporating premium ingredients, natural extracts, or artisanal techniques, without straying from the recognizable taste profile. For brands, this segment remains essential for driving consistent sales, maintaining brand loyalty, and appealing to a broad consumer base across retail, foodservice, and on-the-go channels.

By Distribution Channel Insights

How are Different Distribution Channels Driving the Ice Cream Market?

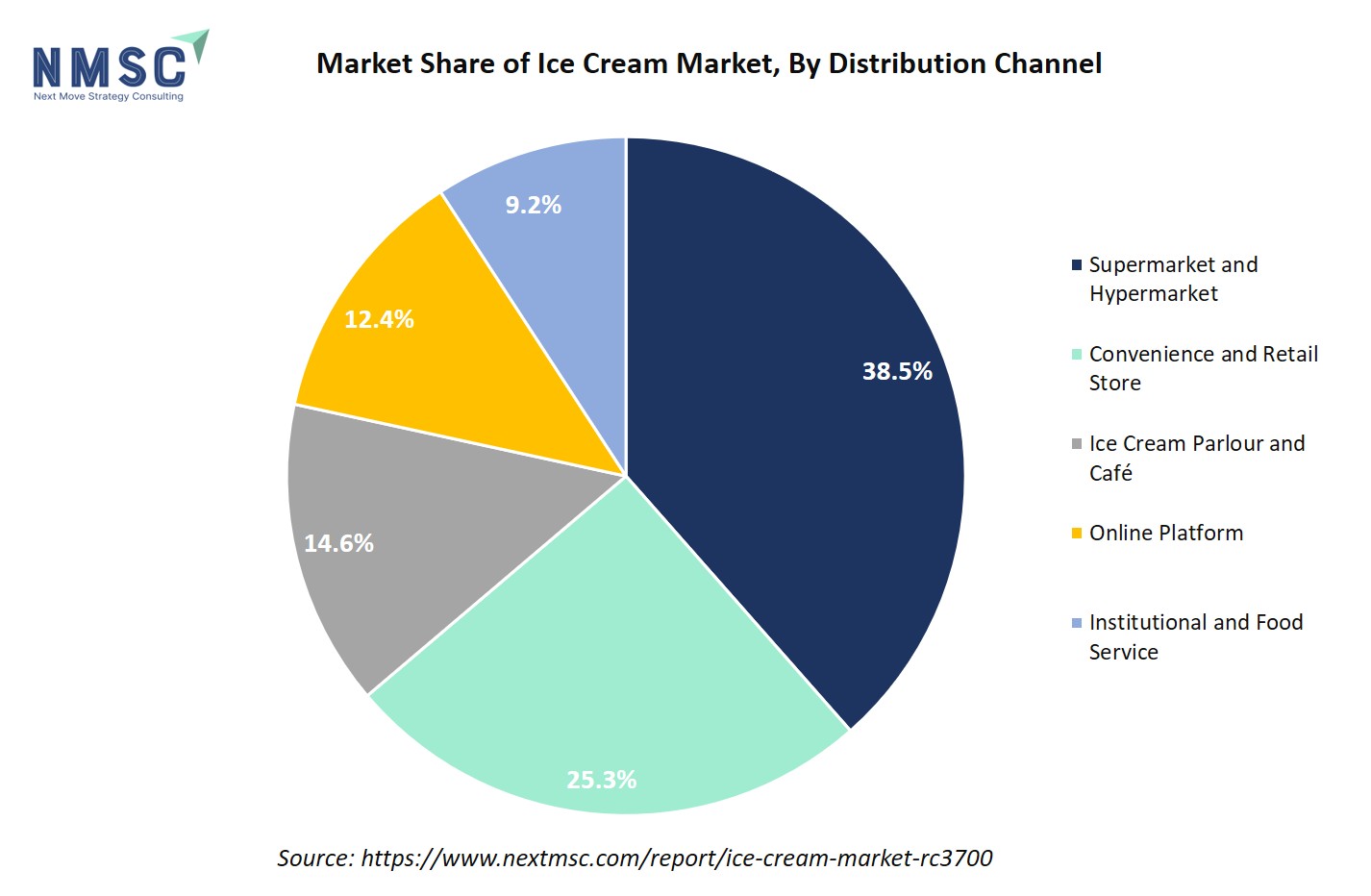

Based on distribution channel, the market is segmented into supermarket and hypermarket, convenience and retail store and others.

The supermarket and hypermarket channel is one of the primary distribution avenues for ice cream products, offering extensive reach and visibility to a wide consumer base. These stores provide a variety of ice cream formats, including cups, tubs, bars, and novelty items, catering to both individual and family-sized purchases. The organized retail environment allows brands to showcase premium, classic, and innovative flavors, leverage in-store promotions, and benefit from high foot traffic. For manufacturers, supermarkets and hypermarkets are crucial for building brand recognition, driving volume sales, and accessing diverse demographic segments. Additionally, this channel supports bulk purchasing and repeat consumption, making it a cornerstone of the market’s retail strategy.

The chart represents the global ice cream market by distribution channel, showing the relative contribution of different retail and service outlets. Supermarkets and hypermarkets (38.5%) hold the largest share due to their wide product range and accessibility. Convenience and retail stores (25.3%) provide quick-purchase options, while ice cream parlours and cafés (14.6%) cater to premium and artisanal experiences. Online platforms (12.4%) are growing as e-commerce adoption increases, and institutional and food service channels (9.2%) serve bulk and specialized needs. Overall, the chart highlights the dominance of traditional retail channels while emphasizing emerging opportunities in online and specialty segments.

By End User Insights

How End Users are Fueling Growth in the Ice Cream Market?

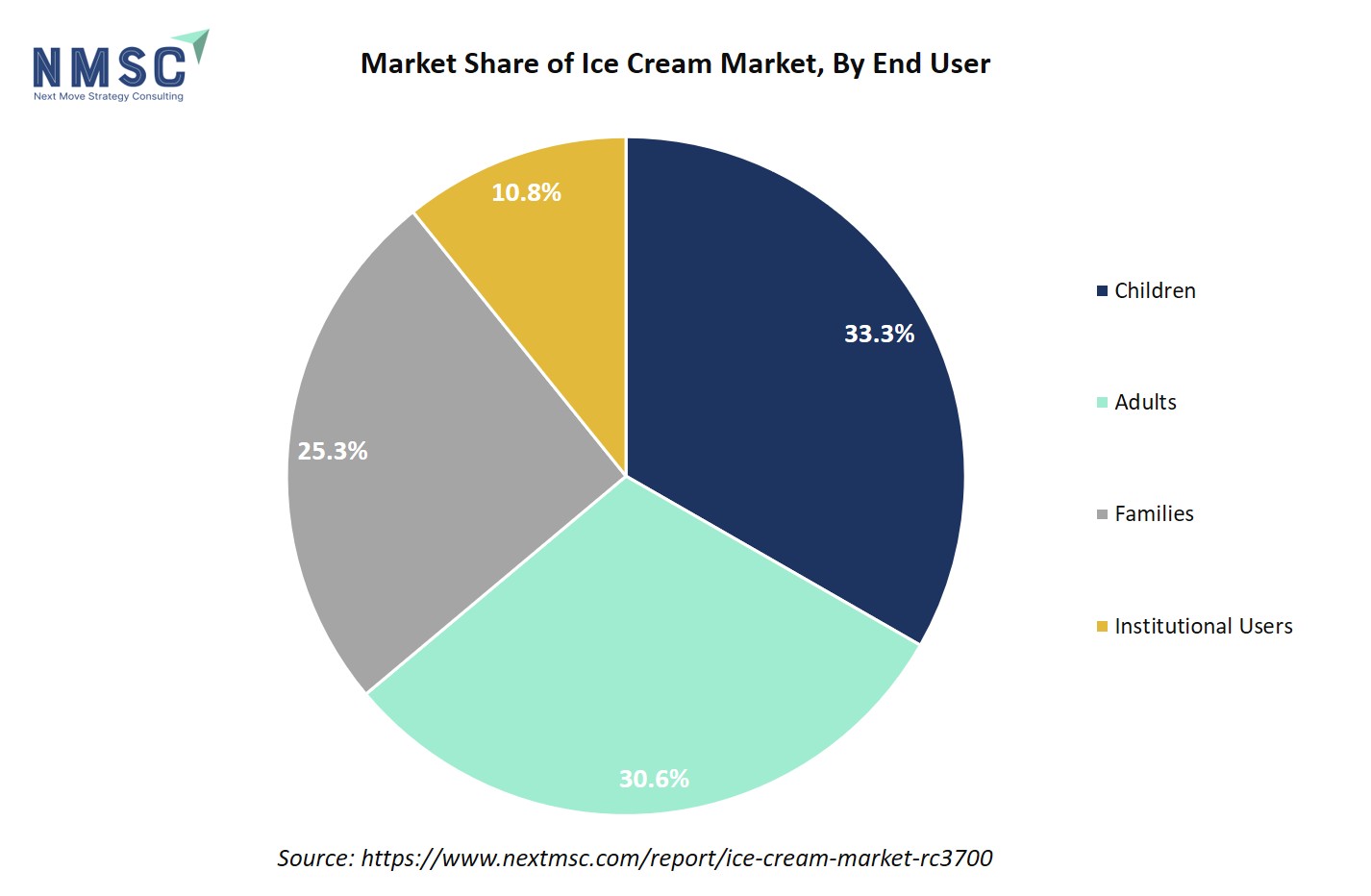

Based on end user, the market is segmented into children and others.

The children segment represents a key end-user category in the market, driven by their strong preference for sweet, colorful, and fun-to-eat products. Ice creams targeted at children feature playful shapes, vibrant colors, popular cartoon or character branding, and bite-sized portions, making them highly appealing to young consumers. This segment also encourages brand loyalty from an early age, as children influence household purchases and develop long-term preferences. For manufacturers, catering to children provides opportunities to innovate with flavors, packaging, and novelty formats while promoting limited-edition or seasonal offerings. By focusing on safety, nutritional considerations, and engaging designs, brands effectively capture this influential and growing consumer group within the market.

The chart represents the global ice cream market by end user, highlighting the consumption patterns across different consumer groups. Children (33.3%) account for the largest share, reflecting their high preference for ice cream products. Adults (30.6%) also contribute significantly, driven by indulgence and premium offerings. Families (25.3%) represent collective household consumption, while institutional users (10.8%) cover bulk purchases for schools, offices, and other establishments. Overall, the chart illustrates that while children remain the primary consumers, adults and families play a substantial role, and institutional demand provides additional but smaller market support.

Regional Outlook

The market is geographically studied across North America, Europe, Asia Pacific, Latin America and the Middle East & Africa and each region is further studied across countries.

Ice Cream Market in North America

The North American market is being propelled by a powerful shift toward premium and indulgent products, as consumers increasingly seek high-quality, artisanal, and innovative ice cream experiences. According to the National Frozen & Refrigerated Foods Association (NFRA), 78% of consumers are willing to pay more for premium ice cream, underscoring a robust demand for superior offerings. This trend is driving manufacturers to prioritize premium ingredients, unique flavors, and eye-catching packaging, enabling brands to stand out in a competitive landscape while satisfying the growing appetite for luxurious and memorable dessert experiences.

Ice Cream Market in the United States

A major driver of the U.S. ice cream market is the rising consumer demand for organic and higher-quality ice cream options. Data from the USDA’s Dairy Market News Weekly Report shows that organic ice cream advertisements have surged by 32%, with 14–16-ounce containers appearing in 680% more ads compared to conventional products. The average price for these organic ice creams is USD 6.08 versus USD 3.83 for standard varieties, reflecting a clear USD 2.25 premium. This increase in promotion highlights a growing preference among U.S. consumers for premium, organic ice cream, encouraging manufacturers to innovate with high-quality ingredients and capitalize on the expanding market for indulgent yet health-conscious dessert options.

Ice Cream Market in Canada

A major driver of the Canadian market is the growing consumer preference for premium and artisanal ice cream offerings. Shoppers are increasingly looking for unique flavors, high-quality ingredients, and indulgent experiences that go beyond traditional ice cream. This trend is supported by rising interest in gourmet desserts and personalized culinary experiences, prompting brands to experiment with small-batch production, seasonal flavors, and eye-catching packaging. By emphasizing premium quality and artisanal craftsmanship, ice cream manufacturers in Canada differentiate their products, appeal to discerning consumers, and capitalize on the expanding demand for luxury and specialty ice cream in the market.

Ice Cream Market in Europe

The rising demand for convenient, on-the-go ice cream options is driving growth in the European market. With consumers leading increasingly busy lifestyles, there is a strong preference for quick, portable, and easy-to-enjoy desserts, boosting popularity of single-serve cups, bars, sticks, and other ready-to-eat formats available in supermarkets, convenience stores, and vending outlets. This shift motivates ice cream manufacturers to innovate in packaging, portion sizes, and flavor offerings, helping brands capture impulse purchases, improve accessibility, and expand their presence among time-conscious consumers across Europe.

Ice Cream Market in the United Kingdom

The growing emphasis on health and wellness is driving the UK market, with consumers increasingly seeking lower-sugar and nutritious ice cream options. Rising awareness of dietary impacts, coupled with public health initiatives, has led to a shift toward products featuring reduced sugar, natural ingredients, and functional benefits. Government-led reformulation programs targeting calories, sugar, saturated fat, and salt in foods including ice cream support this trend. Manufacturers are responding by creating ice cream variants that align with healthier preferences, helping brands attract health-conscious consumers, expand their market presence, and remain competitive in the UK ice cream sector.

Ice Cream Market in Germany

A major driver of the German ice cream market is its strong production capacity and well-established manufacturing infrastructure. As reported by Eurostat, Germany remained the EU’s top ice cream producer in 2024, with 607 million litres, underscoring its leading position in both domestic consumption and exports. This solid production foundation allows manufacturers to innovate with a wide range of flavors, premium products, and value-added variants that cater to evolving consumer tastes. Coupled with efficient distribution networks and high consumer spending on indulgent and specialty desserts, Germany’s market benefits from both volume-driven growth and opportunities in the premium segment.

Ice Cream Market in France

The growing popularity of artisanal and regionally inspired ice cream is driving growth in the French market. Consumers are increasingly drawn to unique, high-quality flavors that showcase local ingredients, traditional recipes, and seasonal specialties. This shift encourages manufacturers to adopt small-batch production, premium ingredients, and packaging that emphasizes craftsmanship and authenticity. By catering to consumers seeking indulgent and culturally rich dessert experiences, ice cream brands differentiate their offerings, build stronger brand loyalty, and expand their share in the premium and specialty segments of the French market.

Ice Cream Market in Spain

A major driver of the Spanish market is the rising consumer demand for innovative and experiential flavors. Shoppers are increasingly drawn to unique taste combinations, limited-edition varieties, and immersive dessert experiences that go beyond traditional options. This trend motivates ice cream manufacturers to explore fusion flavors, seasonal ingredients, and visually appealing presentations that elevate the overall consumption experience. By prioritizing creativity and flavor innovation, brands attract adventurous consumers, stand out in a competitive market, and expand their presence in Spain’s evolving ice cream sector.

Ice Cream Market in Asia Pacific

The rising popularity of plant-based and dairy-free ice cream is driving growth in the Asia Pacific ice cream market. In 2024, global retail sales of plant-based dairy products including ice cream reached USD 22.4 billion, with the Asia Pacific region accounting for over a third of this total, largely driven by plant-based milk products. Government initiatives promoting plant-based diets and environmentally sustainable consumption further reinforce this trend. In response, ice cream manufacturers are developing innovative plant-based formulations, natural sweeteners, and functional ingredients, allowing them to meet the preferences of health-conscious and eco-aware consumers while expanding their footprint in the region’s growing plant-based ice cream segment.

Ice Cream Market in China

The growth of China’s ice cream market in 2024 is being driven by the country’s strong dairy production, which provides the essential raw material for ice cream manufacturing. With dairy output reaching 42.81 million tonnes in 2023, a 6.3% increase from the previous year, manufacturers have access to a larger and more consistent supply of high-quality milk. This abundance of raw material enables ice cream producers to expand their product offerings, introduce new flavors, and meet rising consumer demand, making dairy production a key driver of the country’s market growth.

Ice Cream Market in Japan

A significant driver contributing to the growth of Japan's market between 2024 and 2025 is the expansion of e-commerce, particularly through omnichannel shopping strategies. According to a report by Japan Up Close, the swift expansion of e-commerce in Japan has given rise to new consumer patterns, extending beyond mere transactions to multifaceted avenues that cater to diverse consumer preferences.

Ice Cream Market in India

The growth of India’s ice cream market in 2024–2025 is being fueled by the country’s strong milk production, the primary ingredient in ice cream. With India producing 239.30 million tonnes of milk in 2023–24, a 63.56% increase since 2014–15, ice cream manufacturers have access to a larger and more consistent supply of high-quality milk. This enables the production of a wider variety of ice cream products, supports the expansion of both premium and mass-market offerings, and helps meet the rising consumer demand for indulgent and innovative frozen desserts across the country.

Ice Cream Market in South Korea

The growth of South Korea’s market is being driven by changing consumer preferences and evolving lifestyle trends. With a rising interest in premium, innovative, and healthier dessert options, consumers are increasingly seeking ice cream products that offer unique flavors, textures, and functional benefits, such as low-sugar or high-protein variants. In response, manufacturers are diversifying their offerings and introducing creative product lines to cater to these demands. Additionally, the expansion of modern retail channels, including supermarkets, convenience stores, and online delivery platforms, has made ice cream more accessible to a wider audience. This combination of evolving tastes, product innovation, and improved availability is fueling the continued growth and dynamism of South Korea’s market.

Ice Cream Market in Australia

The growth of the Australian market is being increasingly driven by the rise of experiential and social consumption. Ice cream is evolving beyond a simple dessert to become a social and lifestyle experience, with consumers seeking interactive and customizable offerings such as sundae bars, unique toppings, and visually appealing presentations. Seasonal events, festivals, and pop-up concepts further encourage group enjoyment and social sharing of ice cream. This trend is motivating manufacturers and retailers to innovate not only in flavors and product formats but also in presentation and in-store experiences, thereby enhancing consumer engagement and contributing to the overall expansion of the Australian market.

Ice Cream Market in Latin America

The expansion of Latin America’s ice cream market is being propelled by the region’s vibrant street food and informal retail culture, where ice cream is widely available through kiosks, food trucks, and small local vendors. These accessible and affordable channels encourage frequent, spontaneous consumption among consumers of all ages. At the same time, ice cream products featuring tropical fruits, traditional desserts, and culturally significant flavors are resonating with local tastes, blending familiarity with indulgence. This synergy of easy accessibility, culturally relevant flavors, and innovative offerings is driving the steady growth of the market across Latin America.

Ice Cream Market in the Middle East & Africa

The growth of the Middle East’s ice cream market is being driven by the rapid expansion of the region’s food retail sector. In Saudi Arabia, for example, the food retail market reached over USD 50 billion in 2024 and is projected to grow at more than 5% annually, reflecting rising disposable incomes, increasing urbanization, and a growing demand for convenient food options. As supermarkets, hypermarkets, and online platforms become more widespread, consumers gain easier access to a broader variety of ice cream products, catering to diverse tastes and preferences. This combination of a strong retail infrastructure and evolving consumer habits is supporting the steady expansion of the market across the Middle East.

Competitive Landscape

Who are the Leading Companies in the Ice Cream Market and How are they Competing?

Global ice cream competition is shaped by a mix of established multinational corporations and innovative regional or digital-first brands. Legacy players such as Unilever, Nestlé, General Mills, and Lactalis dominate through extensive distribution networks, strong brand portfolios, and long-standing consumer trust. These companies leverage economies of scale, advanced R&D capabilities, and recognizable brands to maintain their presence across both mass-market and premium segments. Their ability to adapt to evolving consumer trends, such as plant-based options, healthier formulations, and sustainable packaging helps them secure consistent market share while appealing to a wide range of tastes and preferences.

On the other hand, specialty and niche ice cream brands, including Amul, Meiji, Vadilal, Bulla Dairy Foods, Blue Bell, and boutique artisanal brands, compete by emphasizing product innovation, unique flavors, and experiential offerings. These players focus on limited-edition releases, creative collaborations, and social media-driven marketing to connect with younger and more adventurous consumers. Their agility in responding to trends, coupled with direct-to-consumer and regional strategies, allows them to build strong brand loyalty while challenging the dominance of global giants in key markets.

Market Dominated by Ice Cream Giants and Specialists

The global ice cream market is largely dominated by leading multinational companies such as Unilever, Nestlé, and General Mills, which hold substantial market shares worldwide. These players capitalize on their strong distribution networks and well-known brand portfolios, such as Unilever’s Magnum and Ben & Jerry’s, Nestlé’s Häagen-Dazs, and General Mills’ Häagen-Dazs to strengthen their market presence. At the same time, regional ice cream producers like Amul in India and Meiji in Japan focus on catering to local flavors and consumer preferences, creating products that resonate within their domestic markets. The competition in the ice cream sector is intensifying, with both global giants and regional specialists constantly innovating to capture consumer attention and expand their reach across various market segments.

Innovation and Adaptability Drive Market Success

Innovation is a critical differentiator in the ice cream market. Leading ice cream companies are increasingly relying on innovation and adaptability to stay ahead in a competitive market. Unilever, for example, introduced a wide range of new ice cream products in 2025, including plant-based options, bakery-style gelato, s'mores treats, and character-themed novelties. These launches span its popular brands like Talenti, Breyers, Popsicle, Good Humor, Magnum, and Klondike, demonstrating the company’s ability to respond quickly to evolving consumer tastes. By continuously refreshing product portfolios and experimenting with new formats and flavors, ice cream manufacturers meet shifting preferences, maintain customer engagement, and strengthen their market position, reflecting a broader industry trend toward innovation-driven growth.

Market Players to OPT for Investment to Expand their Presence

Investments are playing a pivotal role in shaping the growth and evolution of the global market, as illustrated by Lactalis USA’s USD 75 million upgrades to its Walton and Buffalo facilities. By significantly expanding production capacity and optimizing operational efficiency, the company is positioned to meet the rising consumer demand for diverse, high-quality, and specialty ice cream products. These enhancements not only allow for increased production volumes but also facilitate faster turnaround times, superior quality control, and the introduction of innovative flavors, formats, and packaging. In a market where consumer preferences are rapidly evolving toward premium, indulgent, and unique offerings, such strategic investments enable Lactalis to stay competitive, strengthen its market presence, and broaden its distribution footprint. Ultimately, facility expansions like these contribute to overall market growth by improving accessibility, diversifying product portfolios, and fostering innovation across the ice cream sector.

List of Key Ice Cream Companies

-

Unilever PLC

-

AMUL

-

Vinamilk

-

Nestlé S.A.

-

General Mills, Inc.

-

Lactalis Group

-

Meiji Co., Ltd.

-

Wells Enterprises, Inc.

-

Blue Bell Creameries

-

Vadilal Industries Ltd.

-

Mother Dairy Fruit & Vegetable Pvt. Ltd.

-

Lotte Corporation

-

Baskin-Robbins

-

DMK Ice Cream

-

Bulla Dairy Foods

What are the Latest Key Industry Developments?

-

October 2025 - Baskin-Robbins unveiled its October Flavor of the Month, "Galactic Brownie," inspired by nostalgic candy and snack treats. The flavor features brownie batter ice cream, gooey brownie bits, creamy chocolate icing swirls, and colorful rainbow chips. It is available in various forms, including scoops, cones, shakes, sundaes, and Polar Pizzas.

-

May 2025 - Lotte Corporation, in collaboration with Meiji Co., Ltd., has introduced a new Greek Yogurt Ice Cream to the market. The product combines health-conscious ingredients with indulgent flavors, targeting the increasing consumer demand for healthier dessert options. The launch marks a significant step for the joint venture in expanding its ice cream portfolio and catering to evolving preferences in the global ice cream market. By leveraging the strengths of both companies, the collaboration aims to drive innovation and diversify product offerings across key regions.

What are the Key Factors Influencing Investment Analysis & Opportunities in Ice Cream Market?

Investment activity in the global ice cream market is being shaped by strong consumer demand, evolving taste preferences, and the growing popularity of premium, plant-based, and health-focused products. Funding trends indicate that private equity and venture capital are increasingly targeting innovative and specialty ice cream brands, particularly those offering functional ingredients, clean-label formulations, or sustainable production practices. High valuations for established multinational players and fast-growing regional brands reflect investor confidence in long-term market growth and resilience, making mergers, acquisitions, and joint ventures attractive strategies to consolidate market share and expand geographic reach.

Investment hotspots include North America and Europe, driven by premium and indulgent product trends, as well as Asia-Pacific, where rising disposable incomes and urbanization are fueling demand for both traditional and novel ice cream offerings. Investors are increasingly looking for opportunities in product innovation, niche artisanal segments, and partnerships that enhance distribution and operational efficiency, positioning these markets as key growth engines in the global ice cream landscape.

Key Benefits for Stakeholders:

Next Move Strategy Consulting (NMSC) presents a comprehensive analysis of the global ice cream market, covering historical trends from 2020 through 2024 and offering detailed forecasts through 2030. Our study examines the market at global, regional, and country levels, providing quantitative projections and insights into key growth drivers, challenges, and investment opportunities across all major ice cream segments.

The global ice cream industry creates significant value for a wide range of stakeholders. Investors benefit from strong growth potential, attractive returns, and opportunities in both premium and niche segments, including plant-based and artisanal products. Customers gain from an expanding variety of flavors, healthier formulations, and innovative product formats that cater to evolving tastes and lifestyles. Additionally, suppliers and distributors benefit from increased demand for raw materials, packaging, and logistics services, while brands strengthen their market presence through strategic collaborations and product innovations. Overall, the industry fosters a mutually beneficial ecosystem where investment, consumption, and operational efficiencies drive growth and satisfaction for all participants.

Report Scope:

|

Parameters |

Details |

|

Market Size in 2025 |

USD 114.52 Billion |

|

Revenue Forecast in 2030 |

USD 159.12 Billion |

|

Growth Rate |

CAGR of 6.8% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

33 |

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 analyst-working hours) after purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

|

Approach |

In-depth primary and secondary research; proprietary databases; rigorous quality control and validation measures. |

|

Analytical Tools |

Porter's Five Forces, SWOT, value chain, and Harvey ball analysis to assess competitive intensity, stakeholder roles, and relative impact of key factors. |

Key Market Segments

By Type

-

Cup and Tub

-

Cone

-

Bar and Stick

-

Sandwich

-

Cake and Cassata

-

Novelty and Specialty

-

Others

By Ingredient Base

-

Dairy

-

Non-Dairy

-

Frozen Dessert

By Category

-

Impulse

-

Take Home

-

Artisanal

By Flavor

-

Classic Flavors

-

Vanilla

-

Chocolate

-

Strawberry

-

Others

-

-

Fruit Based Flavors

-

Mango

-

Berry

-

Citrus

-

Tropical

-

Mixed Fruit

-

Others

-

-

Beverage Inspired Flavors

-

Coffee

-

Tea and Matcha

-

Chocolate Drinks

-

Alcohol Infused

-

Others

-

-

Specialty and Innovative Flavors

-

Seasonal Limited Edition

-

Fusion and Experimental

-

Functional and Fortified

-

By Packaging Format

-

Single Serve

-

Multi Serve

-

Bulk Pack

By Distribution Channel

-

Supermarket and Hypermarket

-

Convenience and Retail Store

-

Ice Cream Parlour and Café

-

Online Platform

-

Institutional and Food Service

By End User

-

Children

-

Adults

-

Families

-

Institutional Users

Geographical Breakdown

-

North America: U.S., Canada, and Mexico.

-

Europe: U.K., Germany, France, Italy, Spain, Sweden, Denmark, Finland, Netherlands, and rest of Europe.

-

Asia Pacific: China, India, Japan, South Korea, Taiwan, Indonesia, Vietnam, Australia, Philippines, Malaysia and rest of APAC.

-

Middle East & Africa (MEA): Saudi Arabia, UAE, Egypt, Israel, Turkey, Nigeria, South Africa, and rest of MEA.

-

Latin America: Brazil, Argentina, Chile, Colombia, and rest of LATAM.

Conclusion & Recommendations

The future of the ice cream market depends on its ability to blend innovation, sustainability, and consumer personalization while meeting the rising global demand for diverse and indulgent products. Strategic initiatives such as expanding into emerging regions, introducing healthier and plant-based formulations, and offering unique flavors and formats will shape the next phase of market leadership. For investors, the sector provides strong growth potential, attractive returns, and opportunities in premium, niche, and functional product segments. Policymakers support the industry by promoting food safety standards, sustainable sourcing, and local manufacturing. Meanwhile, company executives must prioritize product innovation, strategic partnerships, and operational efficiency to maintain competitiveness in an evolving market that increasingly values quality, variety, and ethical practices.

Speak to Our Analyst

Speak to Our Analyst