Interchip Optical Interconnect Market By Integration Level (Co-Packaged Optics, On-Board Optical Engines, and Optical Interposers), By Component (Light Sources, Modulators & Drivers, and Others), By Link Distance (Ultra-short, Short and Extended), By Performance Tier (Standard, Mid and High), By End-Users (HPC/Supercomputers, Data-Center Switch ASICs & Routers, AI/ML Accelerators and Others) – Global Interchip Optical Interconnect Analysis & Forecast, 2025–2030

Industry Outlook

The global Interchip Optical Interconnect Market size was valued at USD 15.99 billion in 2024, and is expected to be valued at USD 18.01 billion by the end of 2025. The industry is projected to grow, hitting USD 32.73 billion by 2030, with a CAGR of 12.7% between 2025 and 2030.

The industry is experiencing steady and significant growth, largely driven by the exponential rise in data demand, rapid advancements in artificial intelligence and machine learning, and the increasing need for high-speed, energy-efficient data transmission between chips in advanced computing systems. This growth is further supported by ongoing investments in next-generation data centres, high-performance computing infrastructure, and 5G networks that require ultra-low latency and high bandwidth communication.

The interchip optical interconnect market is evolving with a strong emphasis on co-packaged optics, silicon photonics, and chiplet-based architectures that enable greater scalability and lower power consumption compared to traditional electrical interconnects. Innovations are also focusing on improving performance for AI accelerators, optical interposer designs, and hybrid electro-optical packaging.

Regulatory trends, including energy efficiency mandates in data centers and standards for optical components in telecommunications, are also shaping the market ensuring that interconnect technologies meet stringent reliability, sustainability, and performance benchmarks.

The chart illustrates the interchip optical interconnect market revenue from 2024 to 2030, highlighting value (in billions). The value is expected to grow steadily from USD 15.99 billion in 2024 to USD 32.73 billion in 2030. This indicates a robust expansion in both the financial metrics of the industry.

What are the key trends in Interchip Optical Interconnect Industry?

How is silicon photonics integration reshaping the Interchip optical interconnect performance?

Silicon photonics has moved decisively from lab curiosity to industry staple. By 2028, roughly 44% of optical transceivers are expected to use silicon photonics, up from 24% in 2022, which is a clear sign of accelerating adoption. This shift translates into vastly higher link speeds and integration density, exemplified by Fudan University’s silicon photonics-based multiplexer achieving an on-chip bandwidth of 38 Tbps, with commercial viability projected within 3–5 years.

For companies, this signals the time to invest in silicon photonics R&D and foundry partnerships aligned with the AIM Photonics initiative, while actively advancing ASIC–SiPh co-integration; the actionable edge is to begin trials now and hedge on CMOS-friendly PICs and EDA flow support, or risk falling behind as others standardize around silicon-based optical I/O.

What energy and density gains will co packaged optics bring to AI and HPC data centres?

Co-packaged optics (CPO) is moving from concept to reality, with its first commercial integration into silicon expected by late 2025, led by major players like TSMC and Nvidia. Early implementations are already demonstrating impressive energy efficiency, with power savings ranging from 30% to 50%. A prime example is Broadcom’s Tomahawk-5 Ethernet switch, which delivers 70% lower power consumption while operating at a massive 51.2 Tbps, thanks to the use of integrated photonics.

The key advantage of co-packaging lies in its ability to drastically reduce electrical signal loss and parasitic effects, which are common in traditional pluggable optics. This results in far more efficient and compact interconnects especially crucial for AI and HPC workloads, where bandwidth and energy savings are top priorities.

For hyperscalers, chipmakers, and switch vendors, now is the time to begin prototyping with CPO technologies and build a foundation for widespread deployment by 2026–2027. Beyond performance, the move to CPO also allows companies to position themselves as leaders in green, high-efficiency infrastructure, a growing differentiator in the data centre space.

Could optical interposers and advanced packaging accelerate chiplet ecosystems?

Optical interposers are rapidly emerging as a disruptive force in chiplet architecture. Lightmatter’s upcoming interposer in 2025 and chiplet in 2026 bolstered by USD 850 million in funding signal strong industry momentum. At the same time, POET Technologies emphasizes that optical interposers can enable 800G to 1.6 Tbps links without demanding a major rethinking of system architecture.

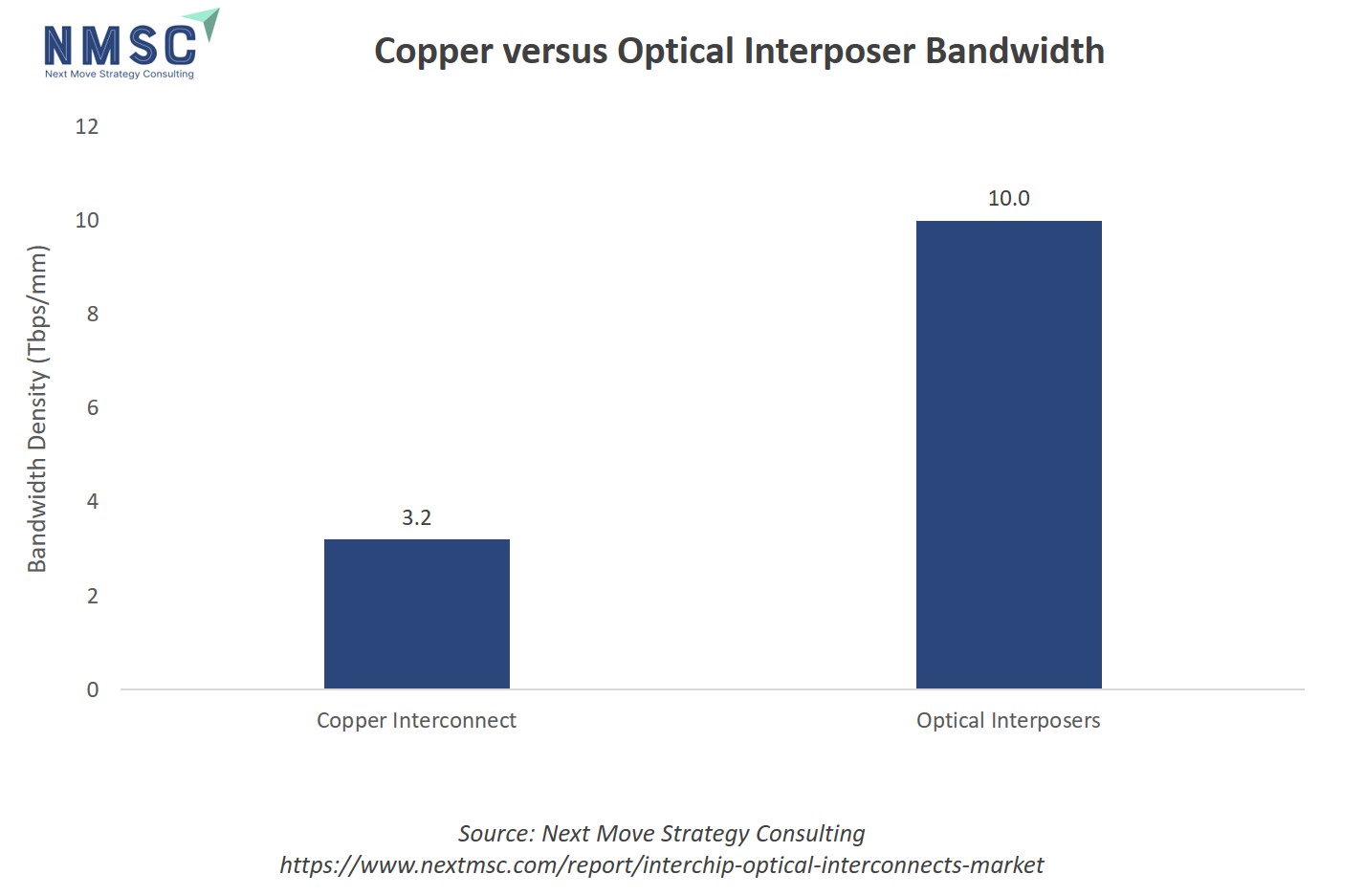

On the academic front, breakthroughs in polymer waveguide interfaces are demonstrating interconnect densities of up to 10 Tbps per millimeter an unprecedented leap. Collectively, these innovations point to a paradigm shift: the ability to design chiplet systems with photonic interconnect buses that vastly outperform today’s copper traces or pluggable modules. To seize this opportunity, semiconductor companies begin collaborating with optical interposer foundries, adopt photonics-ready chiplet designs in their 2025 plans, and aggressively roadmap optical bus integration by 2026.

The above chart highlights the significant performance advantage of optical interposers over traditional copper interconnects in terms of bandwidth density. While copper interconnects provide around 3 Tbps/mm, optical interposers achieve approximately 10 Tbps/mm, more than three times higher. This stark contrast demonstrates why the industry is increasingly shifting towards optical interconnect solutions for interchip communication. The growing demand for high-speed data transfer, driven by advanced computing, AI workloads, and data center requirements, makes optical interposers a more scalable and efficient alternative. Their ability to handle larger bandwidth while minimizing signal loss and power consumption positions them as a key enabler in the future growth of the interchip optical interconnect market.

What are the key market drivers, breakthroughs, and investment opportunities that will shape the Interchip Optical Interconnect industry in the next decade?

Interchip optical interconnect technology is emerging as a critical enabler for next-generation high-performance computing, data centers, and AI-driven systems. Recent breakthroughs in silicon photonics such as Intel’s co packaged optical I/O chiplet demonstrating ultra low energy per bit and advances in VCSEL, silicon, and hybrid photonic integration are driving higher bandwidth with lower latency and power. However, challenges like manufacturing complexity, integration with CMOS, and thermal management continue to limit mass deployment.

Despite existing challenges, the market outlook remains highly promising. Growth is being driven by hyperscale data center expansions, emerging 5G backhaul requirements, and the rising demand for AI accelerators. At the same time, increased investment in smart infrastructure and edge computing presents substantial long-term opportunities. However, to fully capitalize on this momentum, market players must skillfully address cost pressures and overcome standardization hurdles.

Growth Drivers:

Could hyperscale data center expansion and AI/ML demand accelerate adoption of interchip optical links?

The rapid growth of hyperscale data centers is fueling demand for high-speed, low-latency interconnects to support data-intensive AI and machine learning workloads. Optical links, particularly those using VCSELs and silicon photonic engines, are increasingly integrated into chiplets and co-packaged solutions. These technologies enable energy-efficient communication at speeds exceeding 400 Gb/s, making them well-suited for managing massive data flows and computational loads in modern AI-driven architectures.

Will the rollout of 5G and edge computing infrastructure continue to drive optical interconnect demand?

The fast-paced rollout of 5G networks, especially those utilizing millimeter-wave small cells, is driving the need for high-bandwidth, low-latency backhaul infrastructure. These dense, distributed network architectures place significant demands on data transport, which traditional copper-based connections struggle to meet.

Simultaneously, the rise of edge computing requires rapid data processing closer to end-users, further amplifying the need for efficient intra-system communication. Optical interconnects are emerging as a vital solution, offering energy-efficient, high-capacity data transfer across rack-to-rack and board-to-board connections. Their scalability and performance make them ideal for meeting the evolving demands of next-generation connectivity systems.

Growth Inhibitors:

Could integration hurdles and cost complexity constrain market growth?

Although demand for interchip optical interconnects is growing, several technical and economic challenges hinder widespread adoption. Integrating photonics with CMOS technology involves intricate processes such as precise die attachment, the use of hybrid materials, and advanced packaging, all of which complicate fabrication and affect yield. Moreover, components like VCSELs and micro ring resonators are thermally sensitive, making system-level design more complex. High capital investment required for silicon photonics manufacturing facilities, combined with a lack of industry-wide standards, further limits scalability. These issues are particularly restrictive for smaller companies lacking robust infrastructure or deep R&D capabilities.

Might chiplet-level optical die to die links unlock new investment avenues?

As multi-die architectures gain traction, die-to-die optical interconnects present a breakthrough opportunity. They allow ultra-low latency and high-speed data exchange between chiplets, solving bandwidth bottlenecks and reducing power consumption in modular chip designs. This approach benefits both advanced processors and specialized accelerators. The continued advancement of electronic–photonic design automation (EPDA) and integration tools further supports commercialization, offering a ripe field for R&D investment and ecosystem development.

How Interchip Optical Interconnect Market is segmented in this report, and what are the key insights from the segmentation analysis?

By Integration Level Insights

How are Integration Levels Shaping the Future of the Interchip Optical Interconnect Market?

On the basis of Integration Level, the market is segmented into Co-Packaged Optics, On-Board Optical Engines and Optical Interposers.

Co-Packaged Optics (CPO) is rapidly redefining the architecture of next-generation data centres and AI infrastructure. CPO eliminates traditional electrical bottlenecks by placing optical components adjacent to switching ASICs, thereby slashing energy per bit and enabling bandwidths up to 51.2 Tbps. However, its complexity in packaging and thermal management poses a significant barrier to widespread adoption in the near term.

On-Board Optical Engines offer a more modular and flexible approach, making them particularly attractive for scalable systems like AI servers, edge infrastructure, and modular data centres. These engines support high-speed links (up to 800 Gbps/lane) across PCBs, enabling efficient board-level optical communication. Startups are commercializing optical engines tailored for short-reach, chip-to-chip connectivity, addressing growing demand in both telecom and compute domains.

Optical Interposers are still in an emerging phase but hold promise for future chiplet-based computing systems. By embedding photonic waveguides within silicon interposers, this approach supports ultra-dense, high-bandwidth connections between chiplets, essential for advanced packaging strategies.

This chart above compares the energy per bit (pJ/bit) between Co-Packaged Optics (CPO) and Pluggable Optical Transceivers, highlighting the efficiency advantage of CPO. According to Intel data, CPO consumes around 5 picojoules per bit, while pluggable optics consume nearly 15 picojoules per bit for comparable high-speed interconnects. This significant threefold reduction in energy use underscores why CPO is gaining traction in next-generation data centers and high-performance computing systems, where reducing power consumption is critical for scalability and sustainability. The visual makes it clear that CPO delivers superior energy efficiency, positioning it as a transformative technology in the interchip optical interconnect market.

By Component Insights

Which Core Components are Powering the Growth of the Interchip Optical Interconnect Market?

Based on component, the market is segmented into Light Sources, Modulators & Drivers, Waveguides & Couplers, Photodetectors & Receivers and Packaging & Assembly ICs.

Light sources are the core of any optical interconnect system, enabling the generation of high-speed optical signals. VCSELs, edge-emitting lasers, and integrated silicon photonics-based lasers are widely used across applications from data centers to chiplet interconnects. With power efficiency becoming a top priority in AI and HPC systems, laser designs that consume <1 pJ/bit are increasingly adopted.

Modulators and driver ICs control the encoding and transmission of optical data signals. Silicon photonics-based Mach-Zehnder Interferometers (MZIs) and electro-absorption modulators are gaining traction for enabling modulation rates beyond 100 Gbps per lane. High-speed driver ICs, often co-packaged or integrated on the same die, are essential for maintaining signal fidelity and low power operation. As network speeds scale up, this segment is expected to grow rapidly, driven by innovations in monolithic integration and DSP-assisted modulation schemes.

Waveguides and couplers serve as the physical pathways and connection points for optical signals across interconnect layers. Silicon, silicon nitride, and polymer waveguides are widely deployed for their low loss and scalability. Efficient light coupling structures such as grating couplers and edge couplers are crucial for reducing optical loss and alignment complexity. This segment is growing steadily, with demand rising in multi-chiplet and co-packaged optics designs, where routing density and coupling efficiency are key to achieving performance at scale.

Photodetectors and receivers play a vital role in converting optical signals back into electrical form for further processing. Materials like germanium (Ge) and indium gallium arsenide (InGaAs) are favoured due to their responsiveness across telecom wavelengths. The growing need for high-speed, low-jitter receivers in machine learning accelerators and edge compute environments is pushing this segment toward faster response times and tighter integration with transimpedance amplifiers (TIAs). This segment is projected to maintain robust growth, fueled by rising interconnect densities and ultra-low latency computing needs.

Packaging and assembly technologies are becoming increasingly critical as photonic and electronic elements converge. Techniques like flip-chip bonding, wafer-level packaging, and heterogeneous integration are enabling compact, thermally managed, and high-yield IOI systems. As co-packaged optics and chiplet-based architectures become mainstream, the complexity and cost of packaging increase. Currently accounting for 30–35% of overall system cost, this segment is experiencing double-digit growth, with key innovation areas in 3D integration, thermal interface materials, and high-precision alignment.

By Link Distance Insights

How are Varying Link Distances—Ultra-Short, Short, and Extended—Shaping Use Cases and Growth in the Interchip Optical Interconnect Market?

Based on Link distance, the market is bifurcated into Ultra-short (≤1 cm, chip-to-chip), Short (1–10 cm, interposer/board) and Extended (>10 cm, board-to-board).

Ultra-short links (≤1 cm), primarily used for chip-to-chip communication, are crucial in advanced packaging architectures like chiplets and heterogeneous integration. These interconnects support extremely low latency and power consumption, making them vital for AI accelerators and HPC systems. Major players such as Intel and AMD are advancing 2.5D/3D integration, which heavily relies on ultra-short optical links for performance gains.

Short links (1–10 cm) bridge components across interposers or PCBs and are critical in modular computing systems and high-density boards. This segment is expected to dominate the market in the near term, holding a 35–40% revenue share by 2027. Short-reach optical links reduce signal degradation and EMI, enabling compact system layouts. Companies are focusing on targeting applications in AI servers, memory modules, and edge devices where traditional copper traces fall short.

Extended links (>10 cm) are deployed for board-to-board connectivity within systems such as data center servers and telecom switches. These links allow high-speed data transfer between boards without the signal losses associated with electrical interconnects. It represents a smaller share, driven by increasing compute disaggregation and demand for scalable I/O. As cloud and HPC infrastructures evolve, extended optical links will be essential to maintaining system throughput and energy efficiency across distributed hardware environments.

By Performance Tier Insights

How are Different Performance Tiers —Standard, Mid, and High-Speed Links—Shaping Adoption and Innovation in the Interchip Optical Interconnect Market?

On the basis of capacity, the market is segmented into Standard (<25 Gbps/lane), Mid (25–100 Gbps) and High (>100 Gbps).

Standard performance links (<25 Gbps/lane) cater to legacy systems and cost-sensitive applications such as industrial automation and consumer electronics. Though declining in relative share, this tier still holds relevance in regions with delayed high-speed infrastructure adoption. As of 2024, this segment accounts for roughly 20% of market revenue, but it is expected to shrink steadily. Its slower growth is due to increased preference for higher-speed solutions in AI, HPC, and advanced data center applications.

Mid-tier performance links (25–100 Gbps/lane) are the current workhorses of the interconnect market, balancing speed, power, and cost. Widely used in cloud computing, telecom, and enterprise servers, this segment makes up the largest share nearly 50% of the IOI market as of 2024. Demand is driven by the transition from 25G to 56G and 100G links, especially in AI workloads and switch-to-processor communication. Vendors like Broadcom and Cisco are prioritizing this tier for scalability and commercial availability.

High-performance links (>100 Gbps/lane) represent the cutting edge of interchip optical interconnects, essential for enabling petascale and exascale computing. Though currently niche, this segment is supported by emerging applications in GPU clusters, AI model training, and quantum computing. As 800G and 1.6T optical systems become commercially viable, demand for ultra-fast links will surge. Companies such as Nvidia, Lightmatter, and Ayar Labs are pushing this frontier to address latency-sensitive and bandwidth-intensive compute environments.

By End-User Insights

Which End-User Segments are Driving Demand in the Interchip Optical Interconnect Market—From HPC and AI to Automotive and 5G?

On the basis of end-user, the market is segmented into High-Performance Computing (HPC) / Supercomputers, Data-Center Switch ASICs & Routers, AI / ML Accelerators, Telecom / 5G Fronthaul, Consumer / Automotive SoCs and Other Industrial.

High-Performance Computing (HPC) and Supercomputers remain one of the primary end-user segments in the interchip optical interconnect market. These environments require the highest levels of bandwidth and lowest latency, making them early adopters of optical technologies. HPC systems drive innovation across packaging and interconnect design, often acting as testing grounds for next-generation optical platforms. This segment typically leads in technology sophistication and sets the performance benchmarks for other high-compute domains.

Data Center Switch ASICs and Routers represent the largest commercial application for interchip optical interconnects. As cloud infrastructure scales, the need for high-throughput, energy-efficient interconnects between switching elements grows significantly. This segment is central to mainstream adoption, offering the most consistent and broad deployment of optical links. Its position at the heart of hyperscale networking makes it foundational to the market’s overall growth and technological standardization.

AI and ML Accelerators are emerging as one of the fastest-growing segments in the optical interconnect space. The increasing size and complexity of AI models demand extremely high data exchange rates across processors and memory units. This segment is pushing the limits of interconnect performance and is expected to become a key driver of future innovation. It holds a strong position just behind data centers, with rising influence on design priorities across the ecosystem.

Telecom and 5G Fronthaul form a moderately growing segment, with demand driven by the ongoing transition to 5G and network densification. While traditionally focused on longer-distance optical links, telecom systems are beginning to incorporate interchip optics to support lower latency and improved signal integrity. Though not the dominant user, this segment plays a critical role in enabling high-speed data transfer in edge and metro environments, particularly as network architectures evolve.

Consumer and Automotive SoCs occupy a smaller but steadily expanding position in the market. While most consumer and automotive systems continue to rely on traditional electrical interconnects, emerging use cases such as autonomous driving and AR/VR are beginning to benefit from optical technologies. This segment is still in its early stages of adoption but shows promise for future growth as system complexity and data rates increase in embedded environments.

Other Industrial Applications such as aerospace, defense, medical, and industrial automation occupy a niche but strategic role. These environments value optical interconnects for their reliability, compactness, and resistance to interference. While this segment does not account for the highest volume, it often demands specialized and ruggedized optical solutions. It holds a stable position in the market, with adoption driven by specific mission-critical use cases across multiple industries.

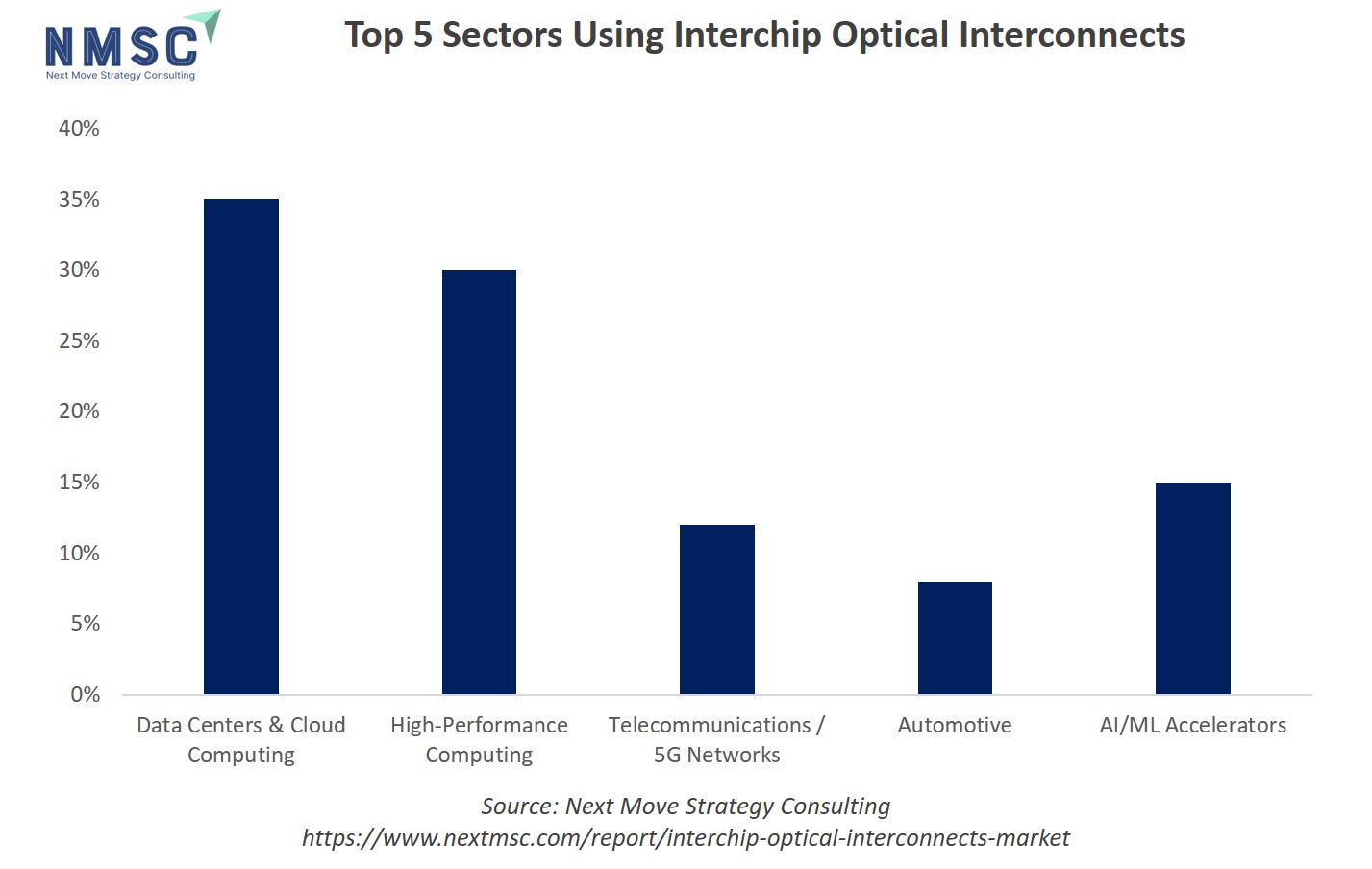

The above chart illustrates the estimated usage percentages of interchip optical interconnects across the top five sectors. Data centers and cloud computing lead the adoption with approximately 35%, highlighting their critical need for high-speed and high-bandwidth data communication. High-performance computing (HPC) follows closely at 30%, reflecting its reliance on low-latency interconnects for complex computational tasks.

Similarly, telecommunications and 5G networks adopt these technologies at around 12%, emphasizing the role of optical interconnects in enhancing network performance. The automotive sector, including autonomous vehicles, contributes 8% of usage, indicating emerging adoption in high-speed in-vehicle communication systems. Lastly, AI and ML accelerators demonstrates the growing importance of optical interconnects in managing large-scale data for training and inference. Overall, the infographic effectively conveys how interchip optical interconnects are distributed across industries, underscoring their significance in high-performance and data-intensive applications.

Regional Outlook

The interchip optical interconnect market share is geographically studied across North America, South America, Europe, the Middle East & Africa, and Asia Pacific, and each region is further studied across countries.

Interchip Optical Interconnect Market in North America

North America remains a global leader, driven by advanced data center operations, semiconductor innovation, and deep R&D investment. U.S. hyperscale cloud providers and national labs are particularly influential, accelerating deployment in HPC and AI/ML environments. Strong ecosystem support from startups to major chipmakers ensures rapid prototyping and commercialization of optical interconnect technologies across industries.

Interchip Optical Interconnect Market in U.S.

The United States, as the dominant market within North America, is propelled by aggressive 5G rollouts, hyperscaler expansion, and semiconductor innovation. Extensive research into optical interposers, engines, and co-packaged optics supports high-speed chip communication. Substantial public-private partnerships and infrastructure funding strengthen its position, sustaining leadership in chip‑level optical interconnect development.

Interchip Optical Interconnect Market in Canada

Canada contributes modestly to the inte growthrchip optical interconnect market, supported by academic research and collaboration with U.S. firms. Institutions like the University of Toronto and startups focused on photonics contribute to ongoing innovation. The Canadian government’s digital infrastructure investments and increased interest in data center optimization drive slow but steady demand for interchip optical solutions across cloud and AI computing environments.

Interchip Optical Interconnect Market in Europe

Europe is seeing significant traction in the interchip optical interconnect market trends due to large-scale HPC initiatives and AI investments. The EU’s drive for digital sovereignty and support for silicon photonics under Horizon Europe are fostering growth. Countries such as Germany, France, and the Netherlands are home to key R&D centers and collaborative projects in integrated photonics and advanced semiconductor packaging.

Interchip Optical Interconnect Market in U.K.

The U.K. interchip optical interconnect market demand is driven by academic research and partnerships between universities and tech companies. Institutions like the University of Cambridge play a pivotal role in developing photonic-electronic integration technologies. Government funding for digital infrastructure and emerging quantum computing startups further enhances adoption of optical interconnects in niche computing and communication environments.

Interchip Optical Interconnect Market in Germany

Germany leads in European manufacturing and industrial AI applications, driving demand for high-speed, low-power optical interconnects in edge AI and industrial automation. Key players in semiconductor manufacturing and automotive electronics are exploring integrated photonic solutions. Government-backed initiatives such as IPCEI (Important Projects of Common European Interest) further support domestic innovation in chip-to-chip optical communications.

Interchip Optical Interconnect Market in France

France shows growing interest in photonics through its national strategy for microelectronics and AI. The interchip optical interconnect market benefits from partnerships between French tech startups, research labs like CEA-Leti, and pan-European photonics projects. Demand from data centers and national supercomputing facilities fuels interest in energy-efficient optical data movement technologies.

Interchip Optical Interconnect Market in Italy

Italy is an emerging participant in the interchip optical interconnect ecosystem, primarily through academic involvement and participation in EU-led research projects. While local demand remains limited compared to larger markets, initiatives in AI infrastructure and green digital technologies are fostering moderate uptake of photonic interconnects, particularly for energy-efficient data handling in public sector HPC and research labs.

Interchip Optical Interconnect Market in Spain

Spain’s market is supported by a rising number of data centers and academic collaborations in integrated photonics. The government’s focus on digital transformation and EU recovery funding aids adoption in AI and big data applications. Though still early-stage, the interchip optical interconnect market here is poised to grow as regional data infrastructure scales and local startups explore photonics integration.

Interchip Optical Interconnect Market in Nordics

The Nordic countries are seeing rapid growth in energy-efficient data centers, a key driver for optical interconnect demand. Sweden and Finland, in particular, are investing in AI research and sustainable computing, creating favorable conditions for photonic-based chip communication. The strong presence of universities and high-tech startups supports early experimentation with co-packaged optics and photonic-electronic systems.

Interchip Optical Interconnect Market in Asia-Pacific

Asia-Pacific is a high-growth region for interchip optical interconnects, driven by massive investments in AI infrastructure, 5G, and semiconductor manufacturing. Countries like China, Japan, and South Korea are leading adopters, with tech giants and foundries pushing photonics integration. Government-backed chip initiatives and rising demand for low-latency, high-bandwidth computing further accelerate market penetration across the region.

Interchip Optical Interconnect Market in China

China is aggressively expanding its interchip optical interconnect capabilities, with domestic players investing heavily in silicon photonics R&D. State-backed programs support the development of indigenous chip technologies for AI, data centers, and HPC. Firms like Huawei and Alibaba Cloud are integrating optical IO to enhance processing performance, reduce thermal constraints, and secure a competitive edge in global chip markets.

Interchip Optical Interconnect Market in Japan

Japan’s legacy in electronics and precision manufacturing positions it well in the interchip optical interconnect space. Companies like NTT and Fujitsu are exploring optical-electrical integration for next-gen computing. Government support for quantum computing and advanced ICT infrastructure also encourages the development of chip-level optical communication systems, especially in research and national-scale computing projects.

Interchip Optical Interconnect Market in India

India’s interchip optical interconnect industry is still nascent but growing due to government initiatives like Digital India and the Semiconductor Mission. Increasing AI workloads and data center expansion drive interest in low-latency interconnects. Startups and academic institutions are gradually exploring photonic integration, though commercial adoption is limited by the current lack of domestic chip manufacturing infrastructure.

Interchip Optical Interconnect Market in South Korea

South Korea is an early adopter of interchip optical interconnects, supported by its leading semiconductor firms like Samsung and SK Hynix. These companies are investing in next-generation chip packaging and photonics integration to meet demands of AI and memory-intensive applications. National R&D funding and collaboration with U.S.-based tech leaders further position South Korea as a regional innovator in this domain.

Interchip Optical Interconnect Market in Indonesia

Indonesia represents an emerging market, where demand for interchip optical interconnects is driven by rising cloud adoption and data localization policies. While local development is limited, increasing investment in hyperscale data centers and digital economy infrastructure may eventually support adoption of energy-efficient, high-speed chip interconnects, particularly in collaborations with foreign technology providers and integrators.

Interchip Optical Interconnect Market in Australia

Australia’s interchip optical interconnect market is influenced by academic research, government-backed AI infrastructure, and defense-related computing projects. Growth is modest but steady, with universities and institutions like CSIRO exploring optical technologies. As high-performance computing gains momentum in public research and enterprise applications, optical IO may gain further relevance for boosting data center performance and energy efficiency.

Interchip Optical Interconnect Market in Latin America

Latin America is a developing region for interchip optical interconnects. Countries like Brazil and Mexico are investing in cloud infrastructure and AI labs, which could spur adoption in the long term. However, limited local chip production and R&D slow adoption. Partnerships with international firms and participation in open-source hardware initiatives could improve technology diffusion over time.

Interchip Optical Interconnect Market in Middle East and Africa

The interchip optical interconnect market in Middle East & Africa is in its infancy, with adoption mostly limited to government-backed smart city and AI infrastructure initiatives in Gulf countries. Data center expansions in UAE and Saudi Arabia may drive future uptake of interchip optical interconnects. Africa lags behind but could benefit from broader global efforts to support sustainable, scalable digital infrastructure.

Competitive Landscape

Which Companies Dominate the Interchip Optical Interconnect Industry and How Do They Compete?

The interchip optical interconnect industry is led by major players such as Intel, Broadcom, Ayar Labs, IBM, and Nvidia. These companies are driving growth through continuous innovation and significant investment in research and development. Their strategies focus on advancing photonic integration, enabling high-bandwidth, low-latency, and energy-efficient data transmission between chips. To maintain a competitive edge, these firms are adopting co-packaged optics, silicon photonics, and chiplet-based architectures that support modularity and scalability for AI, HPC, and data centre applications.

The competitive landscape is shaped by rapid technology cycles, with emphasis on bandwidth density, thermal efficiency, and integration with CMOS processes. Market leaders are strengthening their global and regional presence through strategic alliances, joint ventures, and venture capital investment in startups. They are also creating innovation ecosystems by collaborating with semiconductor foundries, research institutions, and hyperscale cloud providers to develop next-generation optical interconnects tailored for the explosive growth in AI and high-performance computing workloads.

Market Dominated by Interchip Optical Interconnect Giants and Specialists

The interchip optical interconnect industry is led by major firms like Intel, Broadcom, Cisco (via Luxtera), and Marvell—each leveraging unique strengths to compete across niches. Intel dominates with its silicon photonics chiplets and 100G/400G transceivers while Broadcom captures the merchant switch silicon segment with its Tomahawk ASICs and co-packaged optics. Cisco’s optical strategy centers on its acquisition of Luxtera to vertically integrate photonic solutions. Marvell challenges hyperscaler dominance with custom silicon-photonic solutions and AI-focused interconnect accelerators. Meanwhile, specialist component suppliers—3M, Sumitomo, TE Connectivity—bolster connectivity projects with high-speed modules.

Innovation and Adaptability Drive Market Success

Top players regularly launch advanced products and integrate optical tech into broader offerings. Intel introduced a fully integrated optical compute interconnect chiplet in June 2024 to boost inter-chip bandwidth and efficiency in AI applications. Broadcom’s “Bailly” 51.2 Tbps co packaged optics Ethernet switch delivers ~70% power savings while enhancing scalability. Marvell is scaling silicon photonics and AI custom compute, targeting ~30% of total revenue from AI by 2025. Cisco pushes deeper integration of Luxtera’s silicon photonics into data center stacks. These strategies underscore a competitive landscape shaped by continual refresh cycles and rapid optical-tech adoption embedded within broader platforms.

Market Players to Opt for Merger & Acquisition Strategies to Expand their Presence

Mergers and acquisitions are central to the interchip optical interconnect market expansion. Nokia’s acquisition of Infinera in June 2024 for USD 2.3 billion merged photonic integrated circuit capabilities with coherent line systems. AMD recently acquired Enosemi in May 2025 to enter silicon photonics, joining existing AI infrastructure efforts. Earlier, Lumentum acquired Neophotonics (2021) and Cloud Light (2023) to strengthen optical component competitiveness. These moves demonstrate aggressive consolidation and vertical integration, accelerating optical interconnect capabilities and tapping into broader AI and hyperscale data center demands.

List of Key Interchip Optical Interconnect Companies

-

Coherent Corp.

-

Lumentum Holdings, Inc.

-

Ayar Labs

-

Lightelligence

-

POET Technologies Inc.

-

Ranovus

-

Broadcom

-

Skorpios Technologies

-

Dustphotonics

-

Effectphotonics

-

Nubis Inc.

-

STMicroelectronics

-

Celestial AI

What are the Latest Key Industry Developments?

-

June, 2024 – Intel’s Integrated Photonics Solutions Group unveiled its Optical Compute Interconnect (OCI) chiplet co-packaged with an Intel CPU at OFC 2024. Supporting 64×32 Gbps bi directional links over 100 m fibre, this advance boost bandwidth and power efficiency for AI HPC infrastructure.

-

April, 2024 – At its 2024 North America Technology Symposium, TSMC introduced the Compact Universal Photonic Engine (COUPE) initiative. Featuring OSFP pluggable at 1.6 Tbps and CoWoS co-packaged optics targeting up to 12.8 Tbps, it significantly advances optical links for next-gen datacenters.

-

December, 2024 – Ayar Labs raised USD 155 million to ramp production of its TeraPHY optical interconnect chiplets, backed by AMD, Intel, Nvidia, GlobalFoundries, and TSMC. The funding underscores strong industry support for optical I/O to alleviate AI datacenter bottlenecks.

-

March, 2024 – MaxLinear and Jabil launched production of an 800 Gbps silicon photonics pluggable transceiver, based on Intel's silicon-photonics platform and MaxLinear’s 5 nm DSP. It targets high-speed optical I/O for AI/ML networking.

-

April, 2025 – Lightmatter introduced a silicon photonics interposer (2025) and chiplet (2026) designed to optically connect AI chips. Manufactured by GlobalFoundries and backed by USD 850 million in funding, it aims to overcome electrical I/O limits in AI accelerators.

What are the Key Factors Influencing Investment Analysis & Opportunities in Interchip Optical Interconnect Market?

Investment in the interchip optical interconnect market is driven by the exponential growth of AI workloads, demand for energy-efficient data centres, and the limitations of traditional electrical I/O at scale. Venture funding has surged since 2023, with startups like Ayar Labs securing over USD 150 million in Series D rounds backed by Nvidia, Intel, and GlobalFoundries. Strategic acquisitions and co-investments in silicon photonics also highlight growing confidence in this segment’s commercial viability.

Valuations are rising as interconnect performance becomes central to AI chip design, especially for applications in hyperscale computing, cloud infrastructure, and HPC. Investment hotspots include the U.S. (Silicon Valley, Boston), South Korea, Japan, and select European hubs like the Netherlands and Germany—where photonics and packaging innovation converge. Government-backed semiconductor missions in China and India are also fostering new opportunities for early-stage investment in integrated photonics and optical chiplet ecosystems.

Key Benefits for Stakeholders:

Next Move Strategy Consulting (NMSC) presents a comprehensive analysis of the interchip optical interconnect market, covering historical trends from 2020 through 2024 and offering detailed forecasts through 2030. Our study examines the market at global, regional, and country levels, providing quantitative projections and insights into key growth drivers, challenges, and investment opportunities across all major Interchip Optical Interconnect segments.

Report Scope:

|

Parameters |

Details |

|

Market Size in 2025 |

USD 18.01 billion |

|

Revenue Forecast in 2030 |

USD 32.73 billion |

|

Growth Rate |

CAGR of 12.7% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

30 |

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 analyst-working hours) after purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

|

Approach |

In-depth primary and secondary research; proprietary databases; rigorous quality control and validation measures. |

|

Analytical Tools |

Porter's Five Forces, SWOT, value chain, and Harvey ball analysis to assess competitive intensity, stakeholder roles, and relative impact of key factors. |

Key Market Segments

By Integration Level

-

Co-Packaged Optics (CPO)

-

On-Board Optical Engines

-

Optical Interposers

By Component

-

Light Sources

-

Modulators & Drivers

-

Waveguides & Couplers

-

Photodetectors & Receivers

-

Packaging & Assembly ICs

By Link Distance

-

Ultra-short (≤1 cm, chip-to-chip)

-

Short (1–10 cm, interposer/board)

-

Extended (>10 cm, board-to-board)

By Performance Tier

-

Standard (<25 Gbps/lane)

-

Mid (25–100 Gbps)

-

High (>100 Gbps)

By End-User

-

High-Performance Computing (HPC) / Supercomputers

-

Data-Centre Switch ASICs & Routers

-

AI / ML Accelerators

-

Telecom / 5G Fronthaul

-

Consumer / Automotive SoCs

-

Other Industrial

Geographical Breakdown

-

North America: U.S., Canada, and Mexico.

-

Europe: U.K., Germany, France, Italy, Spain, Sweden, Denmark, Finland, Netherlands, and rest of Europe.

-

Asia Pacific: China, India, Japan, South Korea, Taiwan, Indonesia, Vietnam, Australia, Philippines, and rest of APAC.

-

Middle East & Africa (MENA): Saudi Arabia, UAE, Egypt, Israel, Turkey, Nigeria, South Africa, and rest of MENA.

-

Latin America: Brazil, Argentina, Chile, Colombia, and rest of LATAM.

Conclusion & Recommendations

Our report equips stakeholders, industry participants, investors, policy-makers, and consultants, with actionable intelligence to capitalize on Interchip Optical Interconnect transformative potential. By combining robust data-driven analysis with strategic frameworks, NMSC’s Interchip Optical Interconnect Market Report serves as an indispensable resource for navigating the evolving Interchip Optical Interconnect landscape.

Speak to Our Analyst

Speak to Our Analyst