Optical Interconnect Market By Product (Fiber & Cable Assemblies, Active Optical Cables, and Others), By Interconnect Level (On-Chip, Inter-Chip, Board-Level, and Others), By Component (Light Sources, Modulation Systems and Others), By Fiber Mode (Single, and Multimode), By Data-Rate (<10 Gbps, 10–50 Gbps and Others), By Application (Data-Center Interconnect/Cloud Computing, Telecom Backbone, HPC/Supercomputing, and Others) – Global Optical Interconnect Analysis & Forecast, 2025–2030

Optical Interconnect Industry Outlook

The global Optical Interconnect Market size was valued at USD 18.25 Billion in 2024, and is expected to be valued at USD 20.92 billion by the end of 2025. The industry is projected to grow, hitting USD 41.36 billion by 2030, with a CAGR of 14.6% between 2025 and 2030.

The optical interconnect market is gaining traction as hyperscale computing, cloud services, and AI training workloads push traditional copper interconnects to their limits. Electrical connections struggle with signal degradation, bandwidth bottlenecks, and high energy use over longer distances and higher data rates, creating urgency for more efficient solutions. Optical links deliver low-latency, high-bandwidth communication across servers, switches, accelerators, and memory systems—making them indispensable for modern data centers, telecommunications networks, and high-performance computing clusters. Their ability to combine speed with energy efficiency positions them as a critical enabler of the digital economy’s next phase.

The industry is being reshaped by advances in silicon photonics, co-packaged optics, pluggable coherent modules, and chiplet-based optical I/O. These innovations are extending throughput, cutting power consumption, and improving scalability while aligning with industry priorities around sustainable design. Growing adoption is evident not only in data centers and telecom backbones but also in 5G fronthaul, cloud-edge integration, and AI system architectures. As a result, technology leaders, component suppliers, and start-ups are investing heavily in R&D, manufacturing partnerships, and acquisitions to capture market share and set the standards for future-proof interconnect solutions.

What are the key trends in Optical Interconnect Industry?

How rapidly will co-packaged optics (CPO) move from pilots to production?

CPO is the headline growth story. Specialist analysts forecast explosive expansion from a tiny base. Estimates show that the CPO market at about 0.046 billion USD in 2024 and projects it could reach a multi-billion-dollar scale by 2030. This matters because placing optics next to switch silicon slashes power-per-bit and multiplies density, turning an engineering demo into an operational efficiency lever for hyperscalers. Practically, network architects and board vendors should treat CPO as a near-term product roadmap item: prioritize thermal-aware board designs, qualify passive optical interfaces now, and form early packaging partnerships so they can pilot CPO modules when vendors move from lab demos to qualified wafer/lid supply.

Will silicon photonics become the default fabric for high-speed links?

Silicon photonics is transitioning from specialty PICs to broader deployment, with market estimates pointing to multi-billion USD growth, driven by demand for integrated laser, modulator and waveguide arrays that fit standard CMOS flows. The practical implication is clear: firms that invest in PIC design flows, test automation, and wafer-scale supply chains will lower unit cost faster than those relying on discrete optics. Suppliers should lock foundry/test capacity and invest in design kits and automated test protocols now, because silicon photonics' advantages compound once volume ramps and design re-use accelerate.

How decisive is energy-per-bit for adoption across data centers and edge networks?

Energy economics are a primary driver across data centers and edge networks. Independent research shows optical approaches, when pushed to board and chip scale, can reduce energy per bit dramatically. IBM and other studies report orders-of-magnitude cuts moving from electrical to optical links under certain architectures, with published examples noting reductions from several picojoules/bit toward sub-1 pJ/bit goals for integrated optics. That delta translates directly into lower rack PUE and lower operational cost for AI clusters where interconnects dominate power draw. For operators and vendors this means prioritizing power-per-bit as a procurement metric.

How are policy and advanced-packaging investments changing who wins the supply chain?

Government programs and packaging investments, such as CHIPS-era grants, national advanced-packaging initiatives, and new domestic photonics fabs, are actively reshaping manufacturing footprints and lowering supply risk. US programs and private expansions are already underwriting photonics fabs and test/pack centers. C Companies with secured advanced packaging capacity and local incentives can offer shorter lead times and preferred qualification lanes to hyperscalers. The practical insight for executives is to pair technology bets with strategic capacity deals, secure OSAT/foundry slots or public-private funding partnerships now, and build dual-sourcing strategies that blend domestic qualified packaging with Asia-based volume suppliers to balance cost, speed, and geopolitical risk.

What are the key market drivers, breakthroughs, and investment opportunities that will shape the Optical Interconnect industry in next decade?

The optical interconnect market is at a pivotal stage as data-intensive applications, hyperscale AI training, and next-generation telecom networks drive an urgent need for faster, more efficient communication technologies. Traditional copper-based systems are increasingly constrained by bandwidth ceilings, latency, and energy inefficiency, creating a strong case for optical solutions. Advancements in silicon photonics, co-packaged optics, and high-speed pluggables are expanding both technological capabilities and adoption momentum.

At the same time, challenges such as high packaging costs, supply-chain complexity, and standardization hurdles remain pressing. Yet, global investments, government incentives, and hyperscaler-driven R&D funding are opening new opportunities for innovation and scaling. This dual reality makes the market dynamic: companies must balance solving near-term engineering bottlenecks with positioning for long-term opportunities in emerging domains like chip-to-chip optics and AI-focused interconnect fabrics.

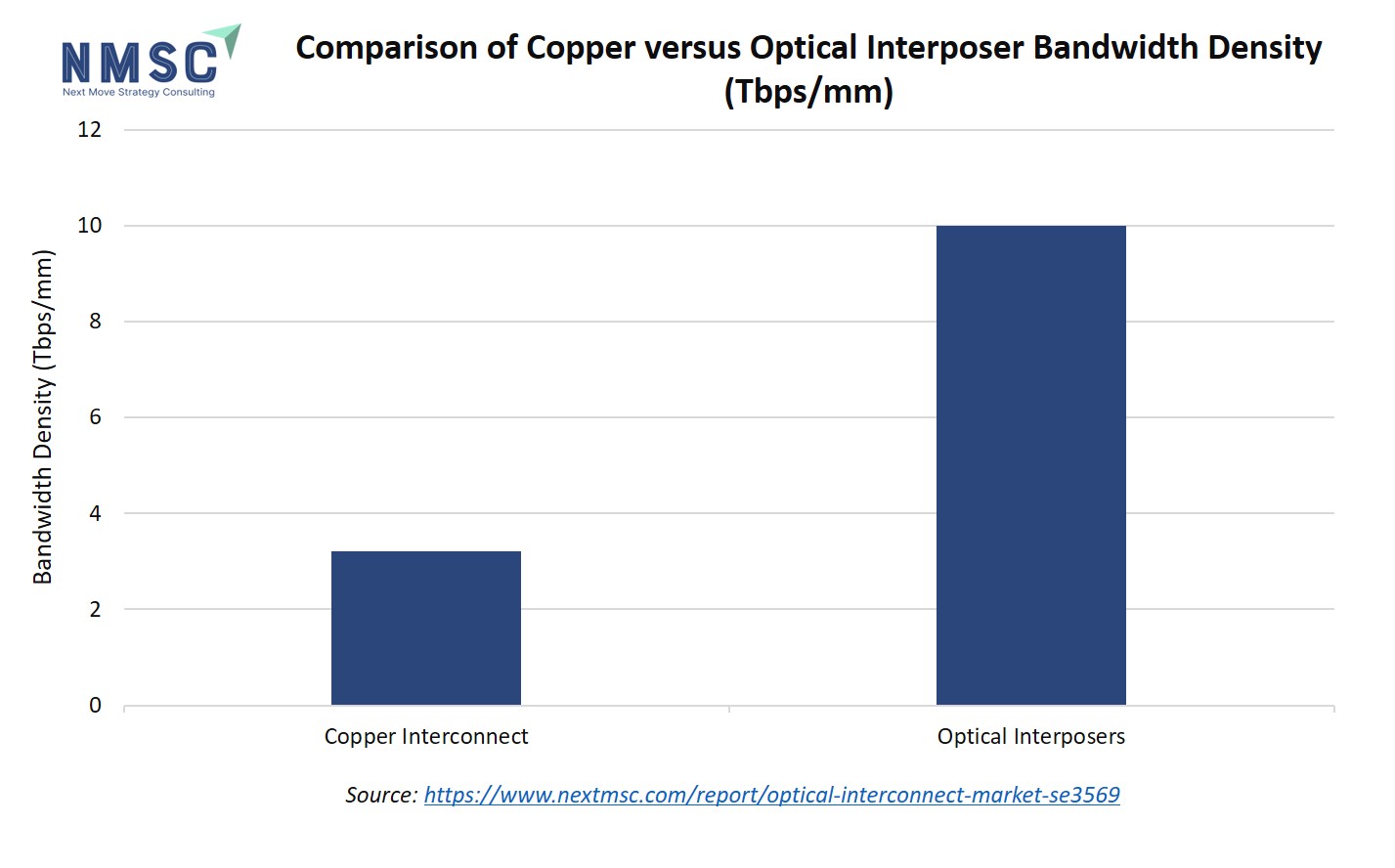

The chart above illustrates the advantage of optical interposers over traditional copper interconnects in terms of bandwidth density, with optical solutions reaching up to 10 Tbps/mm compared to just 3 Tbps/mm for copper. This significant leap in bandwidth density underscores why the market is rapidly shifting toward optical interconnects, especially for AI-intensive and high-performance data center environments where massive data throughput and low latency are essential for scaling next-generation computing workloads. Such compelling efficiency gains are directly driving industry investment, technological innovation, and the stronger adoption trajectory of optical interconnect technologies across global digital infrastructure.

Growth Drivers:

How does AI-driven data center growth fuel optical interconnect demand?

Hyperscale data centers powering artificial intelligence workloads are pushing traditional interconnects beyond their performance limits. For example, training a frontier AI model can require thousands of GPUs exchanging data at terabit-scale, and optical links reduce latency while dramatically improving energy-per-bit efficiency. Coherent pluggables and 800G/1.6T optical modules are already being deployed by leading hyperscalers to alleviate switch-to-switch and GPU-to-GPU bottlenecks. The trend indicates that as AI accelerates, the share of interconnect cost and power within data centers will rise, making optics an essential enabler.

Why is the shift toward silicon photonics accelerating adoption?

Silicon photonics is redefining optical integration by enabling lasers, modulators, and detectors to be manufactured at scale on CMOS-compatible platforms. Analysts project this segment to grow at double-digit CAGRs through the decade, supported by its ability to reduce cost per bit and integrate seamlessly into switch ASICs and accelerators. The technology also allows for co-packaged optics, a major breakthrough expected to drive long-term adoption across data centers and edge networks. For companies, the strategic move is to invest in design automation, packaging innovation, and foundry partnerships to accelerate time-to-market. Those who master integration at scale will gain an early lead.

Growth Inhibitors:

What packaging and cost barriers inhibit wider market adoption?

Despite strong momentum, advanced packaging remains a critical bottleneck. Co-packaged optics and chiplet-based photonics require highly specialized assembly processes, precise thermal management, and intensive testing protocols, all of which raise costs. This makes deployment challenging for operators outside hyperscaler budgets. Standardization gaps further slow adoption, as interoperable solutions are still being defined. Companies must also balance investments in R&D against uncertain near-term volumes. Unless cost structures improve, widespread deployment could lag demand. To overcome this, ecosystem collaboration is needed—vendors should co-invest in shared packaging R&D centers or align with public-private initiatives to reduce per-unit costs and scale adoption.

Where do emerging investment opportunities lie in optical interconnects?

One of the most promising opportunities lies in chip-to-chip and board-to-board optical I/O, particularly for AI accelerators and heterogeneous compute architectures. With electrical interconnects facing sharp limits at advanced nodes, optical I/O promises order-of-magnitude improvements in bandwidth density and energy efficiency. Start-ups like Ayar Labs have already attracted funding from Intel, Nvidia, and GlobalFoundries to scale optical chiplets, signalling strong ecosystem belief. For investors and suppliers, the actionable path is clear: engage in early-stage partnerships with chip designers, support IP development, and back ecosystem scaling. Those who secure positions in this emerging optical I/O segment will capture long-term strategic value.

How Optical Interconnect Market share is segmented in this report, and what are the key insights from the segmentation analysis?

By Product Insights

How are Fiber & Cable Assemblies, AOCs, Connectors & Adapters and Others Shaping the Optical Interconnect Market?

On the basis of product, the market is segmented into fiber & cable assemblies, active optical cables (AOCs), connectors & adapters, optical transceivers & modules and photonic engines & PICs.

Fiber and cable assemblies remain the physical backbone of any optical deployment because new fiber builds directly create demand for pre-terminated assemblies, splices, and passive infrastructure. For example, U.S. federal middle-mile investments supported the construction of over 12,500 miles of new middle-mile fiber. That buildout profile makes cable assemblies a steady, high-volume product category: lower unit ASPs but large, recurring volumes tied to broadband and backbone projects.

AOCs function as a pragmatic, short-to-medium reach bridge between copper and fully integrated photonics. They bundle optics and fiber into plug-and-play harnesses that accelerate upgrades inside racks and between top-of-rack/leaf switches. Government R&D and funding programs focused on photonic integration and data-center efficiency, such as DOE / ARPA-E projects explicitly position packaged/embedded photonic approaches as the next wave which implicitly elevates AOCs as an interim high-adoption solution while co-packaged optics and PICs mature.

Connectors and adapters are the standardized interfaces that make optical networks serviceable and scalable; demand here directly follows fiber rollouts and equipment refresh cycles. Because large public programs are expanding physical fiber infrastructure, connector volumes rise with deployment activity even if per-unit margins are modest.

CPO optical transceivers and modules are today the single largest revenue-driving product class in short-to-medium reach networking because they perform the essential electrical-optical conversion for switches, routers and servers. U.S. and programmatic research (DOE / NITRD / ARPA-E) highlight that while conventional pluggables currently dominate, the industry is actively funding co-packaged and socket-level photonic I/O research to cut power per bit and latency, a structural trend that will reshape transceiver demand over the next 3–7 years.

Photonic engines and PICs are the strategic, high-value disruptor. National labs and agencies (NIST, NSF, AIM Photonics) are funding foundry access, integration research, and novel PIC device work because silicon photonics promises better energy efficiency and far higher bandwidth density when tightly integrated with electronics. For instance, NSF programs explicitly promote AIM Photonics foundry access for PIC R&D, and NIST publications document silicon photonics advances that support monolithic and heterogeneous integration pathways.

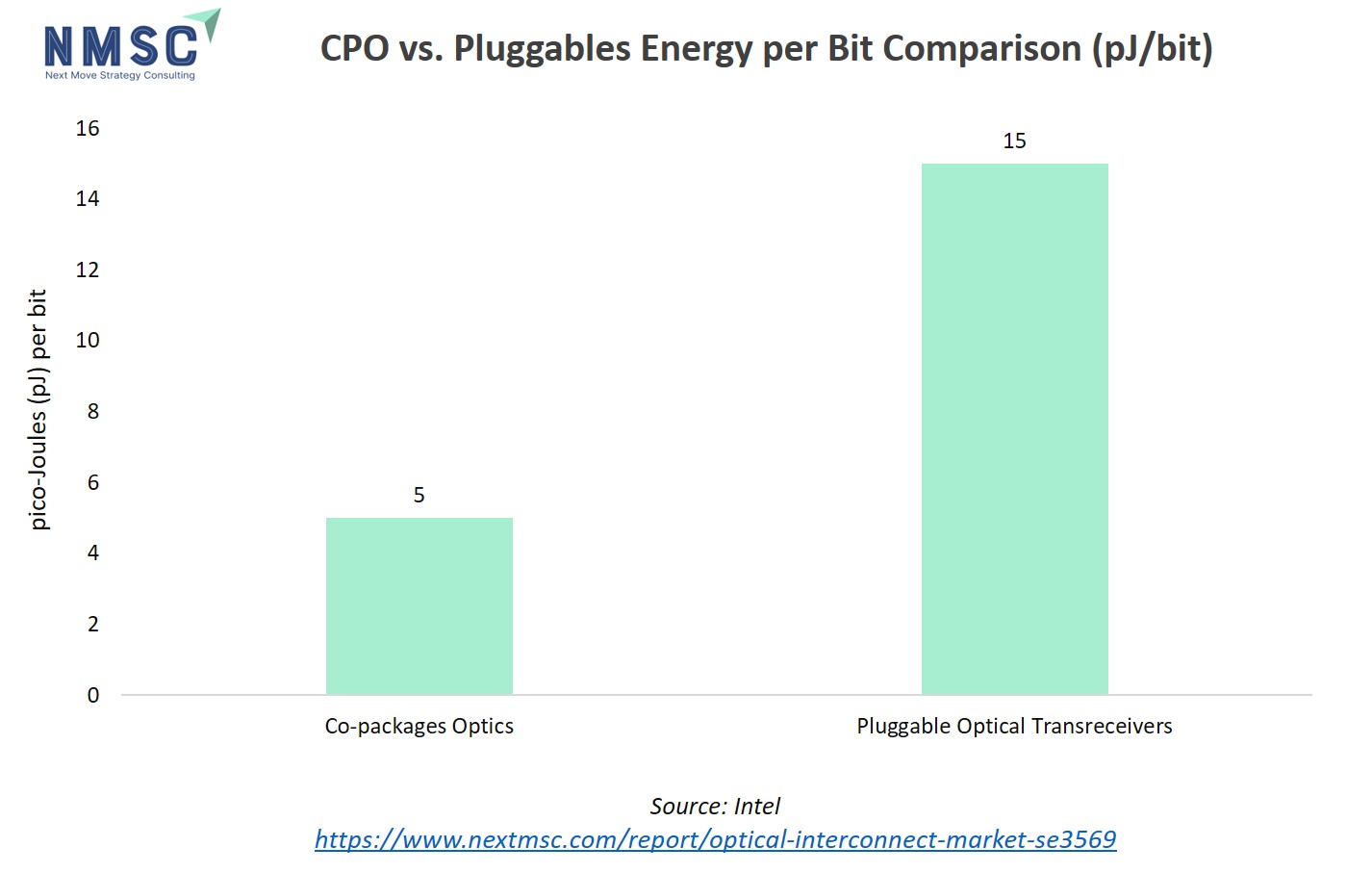

The above chart highlights the substantial energy efficiency advantage of co-packaged optics (CPO) over traditional pluggable optical transceivers, with CPO consuming just 5 picojoules per bit compared to 15 picojoules per bit for pluggables. This threefold reduction in energy per bit illustrates why data center operators and hyperscalers are increasingly prioritizing CPO technology to drive down total power usage and operational costs, especially as AI and high-performance workloads push network traffic to new extremes. As energy becomes a critical constraint in scaling digital infrastructure, such efficiency gains are accelerating the adoption of optical interconnect innovations across the global market.

By Interconnect Level Insights

Are On-Chip to Metro/Long-Haul Interconnect Levels Driving Different Optical Market Trends in 2025?

Based on interconnect level, the market is segmented into on-chip, inter-chip, board-level, rack-level and metro & long-haul optical interconnect.

On-chip optics, which route light signals directly across a single chip or a closely bonded photonic layer, provide the fastest and highest-bandwidth connections inside processors and AI accelerators. By replacing traditional electrical traces, they cut power use and signal loss. National labs and standards organizations are actively researching integrated photonics and advanced packaging to make these on-chip optical links more efficient and avoid the limitations of standard PCB wiring.

Inter-chip links are benefiting from silicon-photonics advances that deliver high bandwidth density and enable new chiplet ecosystems; peer-reviewed surveys note silicon photonics’ key metrics (modulation speed, energy/bit, footprint) as catalysts for shifting short-reach die-to-die fabrics toward optics. As designers adopt chiplet-based architectures, inter-chip optics provide modular, upgradeable bandwidth without a full fab retooling.

At the PCB/board level, optical waveguides, embedded fibers, and free-space coupling approaches reduce EMI and enable multi-Gb/s per lane across short board distances; technical treatments dating back decades document practical methods for integrating optics on printed circuit boards to support multi-Gb/s onboard communication. For modular, high-density systems, for example, NICs and accelerator cards, board-level optics lower signal integrity risk and simplify high-speed routing.

Metro and long-haul systems are architected for distance, capacity and survivability. DWDM coherent transmission, optical amplification, and transport-class ROADMs remain the backbone technologies to connect sites over 10s–1000s of kilometers. Standards and ITU descriptions distinguish metro (short/medium spans, denser grooming) from long-haul (fewer regenerations, very high capacity), and these segments grow on traffic aggregation and backbone expansions rather than the rapid adoption cycles seen in intra-data-center links.

By Component Insights

How are Light Sources, Modulation Systems, Waveguides, Detectors, and Control ASICs Driving the Optical Interconnect Market Growth?

Based on component, the market is bifurcated into light sources, modulation systems, waveguide networks, detection systems and control ASICs.

Light sources, such as lasers and VCSELs, generate the optical signals that drive all interconnect links. Their efficiency, power stability, and wavelength precision directly impact bandwidth and energy consumption. National labs and government programs, such as, NIST photonics research emphasize developing high-speed, low-power lasers suitable for data centers and AI accelerators.

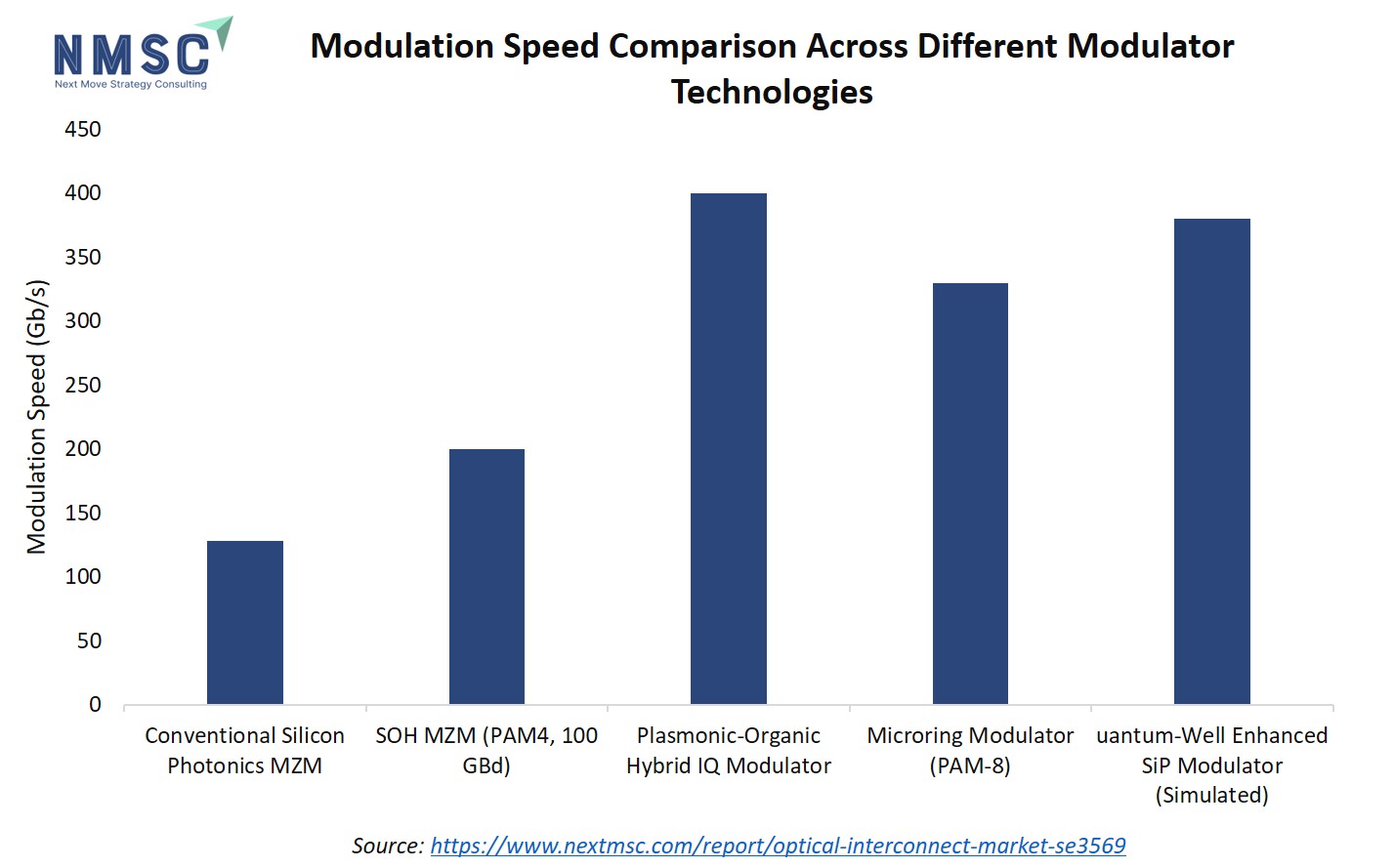

Modulation systems encode electrical signals onto light for transmission across optical interconnects. Advanced modulators, including Mach-Zehnder and electro-absorption modulators, improve data rate, signal integrity, and energy efficiency. U.S. DOE and NSF initiatives fund research into high-speed modulators for next-generation HPC and AI networking.

Detection systems, such as photodiodes and APDs, convert optical signals back to electrical form. Their sensitivity and speed determine the overall link performance. Government-funded photonics labs emphasize improving responsivity, reducing noise, and integrating detectors with CMOS for on-chip and board-level applications.

Control ASICs manage signal routing, modulation, and error correction in optical interconnects. They coordinate the interface between photonics and electronic systems, optimizing performance and power. DOE and NSF reports highlight the importance of integrating control logic with photonic engines for high-speed AI and data center fabrics.

Higher modulation speeds, as shown by the varied modulator technologies from conventional silicon photonics MZM to advanced plasmonic-organic and quantum-well enhanced modulators, directly impact the bandwidth and data transmission capacity crucial for meeting the exponentially growing demands of hyperscale data centers, 5G networks, and AI workloads. This comparison highlights the technological innovations driving future advancements in optical interconnect performance, providing valuable insights into which technologies might dominate or disrupt the market. Together, these factors reflect how surging cloud adoption, hyperscale data centers, and AI-driven workloads are primary growth catalysts, shaping investment priorities and innovation trajectories across the optical interconnect industry.

By Fiber Mode Insights

Are Single-Mode and Multimode Fibers Shaping the Optical Interconnect Market Demand Differently?

On the basis of fiber mode, the market is segmented into single-mode and multimode.

Single-mode fibers are the workhorses of long-distance, high-capacity networks. By allowing light to travel along a single path, they minimize dispersion and signal loss, making them indispensable for metro and long-haul deployments. U.S. broadband expansion programs rely heavily on single-mode fiber for middle-mile and backbone networks, reflecting its critical role in supporting high-speed internet and emerging 5G infrastructure. Their long reach and reliability make them the choice for hyperscalers and telecom operators who cannot compromise on performance.

Multimode fibers shine in short-reach environments like intra-rack and intra-data-center connections. By carrying multiple light paths simultaneously, they enable high throughput over tens to hundreds of meters without the cost and complexity of single-mode optics. Their affordability and ease of deployment make them ideal for enterprise networks and campus infrastructures, where rapid installation and scalability are key. As AI and HPC workloads grow inside data centers, multimode fibers are often the first stop for operators seeking high-density, cost-effective links.

By Data-Rate Insights

Are Different Data Rates Defining Distinct Growth Paths in the Optical Interconnect Market Trends?

On the basis of data-rate, the market is segmented into <10 Gbps, 10–50 Gbps, 50–100 Gbps and >100 Gbps.

Data rates below 10 Gbps still play a role in older enterprise networks and industrial applications. While these links are far from cutting-edge, their reliability and low cost ensure steady demand for maintenance, upgrades, and small-scale deployments. Government-backed broadband and campus network programs often rely on such links in transitional infrastructure, making them a consistent, if modest, revenue source.

This range dominates mid-tier enterprise and campus applications where cost-effectiveness meets reasonable performance. It is the sweet spot for multimode fibers, AOCs, and MPO cabling that power intra-data-center communication or regional campus connectivity. Operators favor this tier for deployments where speed requirements are growing, but ultra-high bandwidth is not yet necessary.

The 50–100 Gbps range represents the sweet spot for data centers upgrading to handle AI workloads, HPC clusters, and latency-sensitive applications. Pluggable optics like 100G transceivers and short-reach AOCs dominate this tier, enabling dense rack-to-rack interconnects without radical infrastructure overhauls.

Links above 100 Gbps, including 400G, 800G, and beyond, are the fastest-growing segment. They serve hyperscale cloud providers, AI training clusters, and HPC fabrics, where every nanosecond and watt of power counts. This tier drives innovation in co-packaged optics, photonic engines, and silicon photonics. Market demand here is fueled by AI, HPC, and hyperscale data center expansion, making it both a high-value and technically challenging segment.

By Distance Insights

Are <10 km, 10–100 km, and >100 km Optical Interconnects Shaping Market Growth Differently?

On the basis of distance, the market is segmented into <10 km, 10–100 km and >100 km.

Short-distance links dominate intra-rack, board-to-board, and rack-to-rack connectivity in data centers and enterprise campuses. Technologies such as multimode fiber, AOCs, and MPO-based high-density cabling thrive here because they balance cost, ease of deployment, and high bandwidth. The rapid adoption of AI and HPC within hyperscale facilities further amplifies demand for reliable short-reach optical solutions that can be deployed immediately.

Medium-distance links serve metro-area networks, interconnecting multiple campuses, data centers, or regional cloud nodes. Single-mode fibers and pluggable optics are preferred here due to the need for higher signal integrity over longer spans. Government and public infrastructure projects, including metro broadband initiatives, are steadily increasing the adoption of medium-reach optical interconnects to enhance regional connectivity.

Long-haul optical interconnects are the backbone of national and international communications, leveraging DWDM, coherent optics, and optical amplification. These links handle aggregated traffic across cities, regions, and countries, making them critical for telecom operators and hyperscale cloud providers expanding their global reach. Deployment here is slower but capital-intensive, reflecting the strategic importance of high-capacity, long-distance networks.

By Application Insights

How are Different Applications Driving Optical Interconnect Market Growth in 2025?

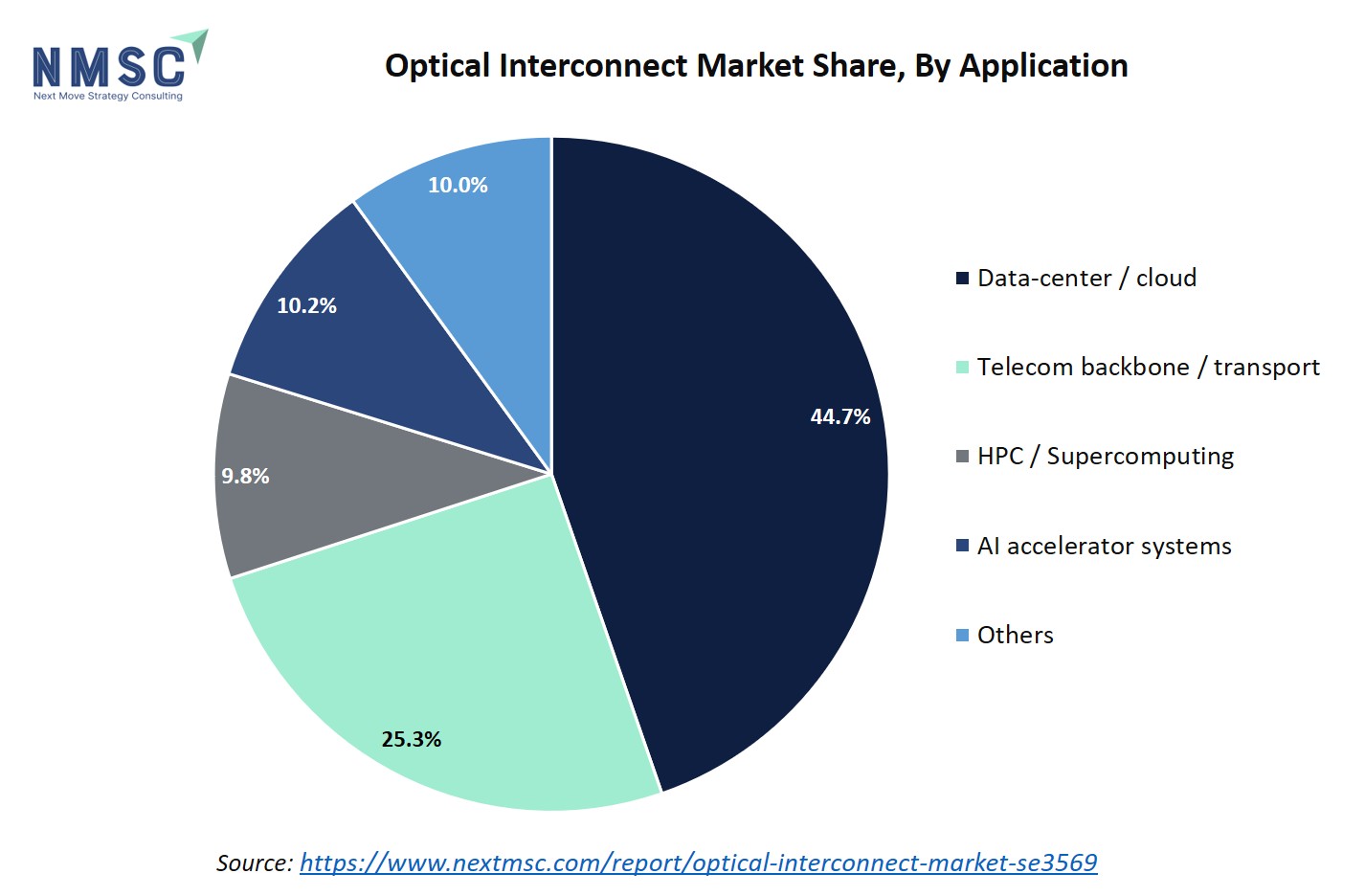

On the basis of application, the market is segmented data-center interconnect/cloud computing, telecom backbone, HPC/supercomputing, ai accelerator systems, automotive/industrial, military & defense and others.

Data-center and cloud applications are the primary demand engine for optical interconnects. Hyperscale cloud operators adopt high-speed optics, AOCs, and dense fiber assemblies to handle AI workloads, real-time analytics, and massive east-west traffic inside and between data centers. Research emphasizes energy-efficient interconnects for cloud fabrics, highlighting this segment as both high-volume and innovation-driven.

Telecom operators drive demand for single-mode fibers, DWDM systems, and long-haul optics to connect cities, regions, and countries. Backbone infrastructure upgrades, including 5G fronthaul and metro aggregation, fuel steady investment. Public funding programs like the NTIA’s broadband initiatives often include backbone buildouts, sustaining growth in this segment.

High-performance computing clusters rely on low-latency, high-bandwidth interconnects between nodes. Optical transceivers, co-packaged optics, and emerging photonic engines are critical here to reduce energy per bit and interconnect bottlenecks.

AI accelerators demand ultra-high-speed, low-latency optical interconnects to handle massive data movement between GPUs and memory modules. Silicon photonics and 3D-stacked optical engines are increasingly deployed in these systems to maximize bandwidth density while minimizing power consumption. This segment is the fastest-growing in terms of adoption and technical innovation.

Optical interconnects are finding niche applications in automotive and industrial automation, where high-speed data links support LiDAR, autonomous vehicle systems, and factory-floor sensor networks. Multimode fibers and short-reach optical modules provide reliable, interference-resistant connectivity in these environments.

The distribution in the above chart highlights how surging cloud adoption, hyperscale data centers, and AI-driven workloads are the primary catalysts for current market growth, shaping technology investments and innovation across the entire optical interconnect industry. The chart demonstrates that data-center and cloud applications overwhelmingly lead the optical interconnect market share, accounting for 44.7% of total market share, followed by telecom backbone/transport at 25.3%. High-performance computing (HPC) and supercomputing, AI accelerator systems, and other segments each represent about 10% or less, underscoring the dominance of massive data throughput requirements in digital infrastructure.

Regional Outlook

The market is geographically studied across North America, South America, Europe, the Middle East & Africa, and Asia Pacific, and each region is further studied across countries.

Optical Interconnect Market in North America

North America remains the innovation and early-adopter heartland for optical interconnects because hyperscalers and cloud providers drive demand for ultra-high bandwidth and energy efficiency; co-packaged optics (CPO) and silicon-photonics pilots are concentrated here, and public funding (CHIPS Act + advanced packaging grants) accelerates domestic packaging and pilot lines, reducing supply-chain risk while pulling system vendors toward optical I/O to solve power-per-bit limits in AI clusters.

Optical Interconnect Market in U.S.

In the U.S., hyperscaler capex, CHIPS Act incentives, and an ecosystem of foundries, OSATs and photonics start-ups create a virtuous cycle for optical interconnect investment. Government programs underwrite advanced packaging and pilot lines while Google, Meta, Microsoft and AWS fund production validation and long-haul fiber assets, together forcing faster commercialization of silicon photonics, coherent DSPs and co-packaged optics to meet AI-era scale and efficiency goals. Policy and private capital combined make the U.S. the leading commercialization engine for optical I/O.

Optical Interconnect Market in Canada

Canada’s optical-photonics activity is smaller but fast-growing, with a healthy mix of academic research, foundry collaborations and niche PIC startups; government R&D and cluster support plus rising data-center buildouts are pushing silicon-photonics and ultra-short-reach interconnect projects, particularly in Montreal and Toronto ecosystems. Market analysis cites double-digit growth rates for Canadian photonic integrated circuits, suggesting the country will increasingly supply specialized PICs and packaging services to North American hyperscalers and telecoms.

Optical Interconnect Market in Europe

Europe’s optical-interconnect landscape is shaped by strong research output but a commercialization gap: the EU Chips/Chips-JU initiatives and Photonics21 action calls aim to build pilot production and packaging capacity, while national programs in the Netherlands, Germany and France fund pilot fabs and photonics pilot lines; this funding plus demand for energy-efficient data centers pushes Europe toward silicon-photonics and coherent optics for metro and DCI applications, but scale and cost competitiveness versus Asia remain the primary constraints.

Optical Interconnect Market in U.K.

The UK combines strong academic photonics research, focused government funding, namely, National Semiconductor Strategy and Innovate UK programs, and a growing silicon-photonics SME base, which together speed translation from labs to pluggable modules and prototype CPO. With fibre rollout and data-sovereignty interest, the UK is positioning to supply specialized PIC components and system integration expertise rather than compete on low-cost, high-volume manufacturing. It is estimated that the UK Photonics industry is set to grow over USD 54 billion by 2035, which will boost the optical interconnect market.

Optical Interconnect Market in Germany

Germany’s strength is applied research and industrialization through Fraunhofer institutes, automotive and telecom demand, and a push for advanced packaging and pilot lines; the country focuses on robust, industrial-grade photonics and packaging to serve automotive, industrial and data-center customers, while EU funding and IP commitments aim to close the gap with Asian contract manufacturers. This emphasis on reliable, scalable photonics manufacturing supports Europe's strategic autonomy in optical interconnect supply chains.

Optical Interconnect Market in France

France leverages public R&D and industrial programs to back photonics pilot lines and coherent optics development, particularly for transportation, defense and telecom uses; Photonics21 and national funding channel resources toward prototype fabs and commercialization pathways, encouraging domestic suppliers to partner with European system integrators for metro/DCI applications where power efficiency matters. Policy-led support seeks to move French photonics from lab strength to production readiness.

Optical Interconnect Market in Italy

Italy’s optical-interconnect activity is more niche but anchored in research institutions and regional clusters that focus on optical packaging, component testing and specialized sensors; EU Chips/Photonics initiatives broaden access to pilot lines and collaborative R&D, making Italy a complementary supply partner in Europe for packaging and application-specific optics rather than a primary high-volume manufacturer. EU pilot funding helps scale regional capabilities.

Optical Interconnect Market in Spain

Spain’s optical interconnect market is gaining momentum as telecom upgrades, fibre-to-the-home rollouts, and surging data-center investment reshape digital infrastructure. The Vodafone Spain–MasOrange joint venture to launch a nationwide fibre network company significantly accelerates FTTH penetration, boosting traffic loads that require high-capacity coherent optics, pluggable transceivers, and data-center interconnect (DCI) solutions. Backed by EU and government digital funds, Spain is positioned as a strong demand hub for advanced optical modules and metro/long-haul connectivity. However, while consumption of next-gen optics will rise sharply, high-volume manufacturing of components remains concentrated in Asia, meaning Spain’s role is primarily as a high-growth deployment market rather than a production base.

Optical Interconnect Market in Nordics

The Nordics represent a unique pocket of strength in the optical interconnect market, blending world-class telecom vendors like Ericsson and Nokia with strong academic and industrial research networks. With some of the highest fibre penetration rates globally and early adoption of 5G, the region generates consistent demand for high-speed optical interconnects across both edge and core networks. According to Fraunhofer HHI, Nordic research collaborations are advancing photonic integration and testing environments, making the region especially attractive for trialing co-packaged optics, coherent modules, and photonics-enabled carrier solutions. Rather than focusing on mass production of pluggables, the Nordics position themselves as a hub for innovation, system integration, and early deployment of next-generation optical technologies.

Optical Interconnect Market in Asia-Pacific

Asia-Pacific mixes enormous manufacturing capacity, government industrial policy, and hyperscaler demand, creating both high-volume optical module supply (China/Taiwan) and advanced silicon-photonics packaging ambitions (Taiwan, Japan, Korea); the region’s push for AI infrastructure, foundry expansions and vertical integration accelerates silicon-photonics adoption and scale-up of 800G/1.6T modules, making APAC simultaneously the largest demand center and a manufacturing hub for optics.

Optical Interconnect Market in China

China is a high-volume producer of optical modules and transceivers (Accelink, Eoptolink, Innolight) and is aggressively scaling coherent optics and 800G/1.6T capabilities to serve domestic hyperscalers and telcos, buoyed by government support for semiconductor and photonics supply chains; analysts report very strong 800G demand and increasing local supply readiness, which tightens competition on price and scale for global suppliers.

Optical Interconnect Market in Japan

Japan’s optical-interconnect approach emphasizes systems R&D, carrier trials and integration. NTT and industrial partners push photonics-electronics convergence (in-package optics and IOWN/APN demos) to serve telco backbones and DCI needs, while strong domestic OSAT and materials capabilities support advanced packaging efforts that align with regional AI and telecom upgrades. Japan often leads in reliable, operator-grade photonics deployments.

Optical Interconnect Market in India

India’s optical-interconnect market is nascent but fast-growing, driven by rapid data-center expansion, cloud zone builds and government digital infrastructure programs; domestic demand for high-capacity pluggables and fiber backhaul is rising, and local manufacturing ambitions are beginning to attract investment—market reports show a multi-billion-dollar growth trajectory, though high-end silicon-photonics supply still depends on imports.

Optical Interconnect Market in South Korea

South Korea’s advanced telecom and cloud ecosystems (with rising hyperscaler and enterprise AI workloads) are increasing demand for low-latency, high-density optical interconnects, while local integrators and data-center builders push for 400G/800G deployments; growing hyperscale data-center capacity and R&D investment mean Korea is both a strong buyer and a testbed for optical I/O and CPO pilots.

Optical Interconnect Market in Indonesia

Indonesia’s optical-interconnect story is demand-led: rapid internet growth, undersea cable projects and regional cloud expansion increase demand for fiber backbone upgrades and higher-capacity DCI links; while local manufacturing is limited, the country’s infrastructure buildouts and regional connectivity projects, including trans-Pacific cable investment in the region push service providers to procure modern coherent and pluggable optics.

Optical Interconnect Market in Australia

The investable universe of the Australian data centre sector is forecast to nearly double to USD 26 billion in the next four years. Australia’s accelerating data-center investment and dark-fiber expansion support stronger uptake of high-speed optics for DCI and edge computing; rising institutional investment in data-center real estate and fibre upgrades creates a commercial environment for 400G+ optics, while geography and undersea cables make optical resilience and long-haul coherent links particularly important.

Optical Interconnect Market in Latin America

Latin America is moving from niche to scale. Big data-sovereignty projects, hyperscaler investments (AWS, Google) and fiber upgrades fuel demand for higher-capacity transceivers and DCI solutions, even as much of the region focuses on edge and metro links rather than co-packaged optics; Brazil’s active investment pipeline and Mexico’s optical trials show the region’s appetite for modern optics and subsea connectivity.

Optical Interconnect Market in Middle East and Africa

The Middle East and Africa are emerging as fast-growing markets for optical interconnects, driven by large-scale digital infrastructure projects and expanding connectivity needs. In the Middle East, mega projects like Saudi Arabia’s NEOM are investing heavily in greenfield data centers, AI campuses, and high-capacity networks, which directly boost demand for advanced optical interconnects to ensure low latency and energy efficiency. Sovereign cloud strategies and net-zero data campus initiatives further accelerate adoption of photonics-based solutions. Meanwhile, across Africa, improving fiber penetration and metro upgrades are increasing uptake of pluggables and coherent optics for regional backbones. According to NEOM, its tech-driven smart city project is designed around future-ready digital and connectivity infrastructure, underscoring how visionary national investments are creating fertile ground for optical interconnect growth across the wider region.

Competitive Landscape

Which Companies Dominate the Optical Interconnect Industry and How Do They Compete?

The Optical Interconnect market is led by large diversified semiconductor and photonics firms, such as, Broadcom, Intel, Marvell, Lumentum, Ciena, Coherent/II-VI while smaller specialists like, Lightmatter, Source Photonics, InnoLight, Accelink, Gigalight push focused innovations and low-cost modules. Giants compete on scale, integration (ASIC + photonics), and customer relationships with hyperscalers and carriers; specialists compete on niche performance, cost and speed-to-market. Together they create a two-tier landscape where platform incumbents aim to own end-to-end stacks while startups and specialists supply differentiated components and rapid innovation.

Market Dominated by Optical Interconnect Giants and Specialists

Competition splits by scope in the optical interconnect market. Giants pursue vertical integration and system wins like ASICs, DSPs, CPO to lock in hyperscalers and network operators, while specialists focus on single components, such as, lasers, transceivers, pluggable optics and volume manufacturing for cloud and telecom supply chains. Geographic footprints matter, where North American hyperscaler demand drives silicon-photonics and CPO designs, while Asian contract manufacturers and module vendors drive cost competition and scale. These dynamic forces incumbents to marry R&D muscle with manufacturing partnerships, and incentivizes specialists to form supply or technology alliances to compete on price and lead time.

Innovation and Adaptability Drive Market Success

Winners combine product innovation (silicon photonics, coherent DSPs, low-power 800G PAM4 engines), packaging advances (co-packaged optics, photonic interposers) and ecosystem play (pluggable optics standards, interoperability demos). Faster time-to-market and flexible integration with AI/HPC platforms are critical where companies that rapidly convert lab demos into pluggable modules or CPO solutions capture early hyperscaler deployments. Strategic collaborations (foundries, OSATs, cloud partners) and demonstrable power-per-bit gains are the practical differentiators that push adoption from trials into production. Continuous innovation is central to company strategies, where recent advances include Ciena’s 1.6T Coherent-Lite, Marvell’s 200G/lane pluggables, and Broadcom’s high-density co-packaged optics, all showcased at OFC 2025.These breakthroughs target data center efficiency, power savings, and AI–readiness.

Market Players to Opt for Merger & Acquisition Strategies to Expand their Presence

Mergers and acquisitions accelerate capability builds and extend addressable markets. Marvell’s acquisition of Inphi strengthened its coherent DSP and high-speed optics portfolio. II-VI’s acquisition of Coherent consolidated laser, materials and photonics capabilities to broaden product scope and scale. Similarly, Broadcom’s large software/stack acquisition of VMware illustrates how platform leaders consolidate adjacent ecosystems to secure enterprise and cloud relationships showing that strategic deals can be both horizontal (capability) and vertical (customer access). These examples show M&A remains a fast route to fill technology gaps, secure supply chains, and win hyperscaler contracts.

List of Key Optical Interconnect Companies

-

Lumentum Operations LLC

-

Broadcom

-

Marvell

-

Applied Optoelectronics, Inc.

-

InnoLight

-

Ciena Corporation

-

Eoptolink Technology Inc., Ltd.

-

Source Photonics

-

Lightmatter

-

Celestial AI

-

Intel Corporation

-

Accelink Technology Co. Ltd

-

Gigalight

What are the Latest Key Industry Developments?

-

July, 2025 – Broadcom launched its third-generation 200G/lane co-packaged optics (CPO) product line for high-density AI networks. Building on earlier CPO tech, this product minimizes optical interconnect power requirements, providing foundational scalability for AI cluster and cloud data center expansion.

-

March, 2025 – Lightmatter unveiled new Passage photonic interposer/chiplet products (and announced significant funding) to commercialize photonic chip-to-chip interconnects for AI systems; strategic relevance, advances practical photonic interconnect hardware and signals investor/hyperscaler confidence in photonic-first architectures.

-

September, 2024 – At ECOC 2024, Lumentum demonstrated its latest 800G ZR+ coherent pluggable transceivers, designed to support long-reach, high-capacity inter-data center use cases for AI. Leveraging hybrid photonic ICs and in-house indium phosphide tech, these modules increase reach and power, crucial for AI-driven cloud infrastructure.

-

June, 2024 – Intel demonstrated the first fully integrated optical I/O (OCI) chiplet co-packaged with a CPU, proving optical I/O at chiplet scale for AI/HPC; strategic relevance: accelerates co-packaged optics adoption and eases electrical I/O bottlenecks in AI data centers.

-

March, 2024 – Marvell announced Spica Gen2-T, the industry’s first 5nm transmit-only 800G PAM4 optical DSP, claiming >40% power reduction for 800G modules; strategic relevance: enables lower-power, denser 800G pluggables for AI/cloud interconnects.

What are the Key Factors Influencing Investment Analysis & Opportunities in Optical Interconnect Market?

Over the past year, there has been significant venture funding flowing into optical interconnect and chiplet/photonic I/O startups. For example, Ayar Labs raised about USD 155 million to scale production of its TeraPHY optical chiplets, backed by major players like Intel, Nvidia, and GlobalFoundries. Also, governments, especially in the U.S. are using policies like the CHIPS Act to fund expansion of photonics semiconductor fabrication and packaging, as seen with Infinera securing ~USD 93 million in incentives to boost domestic capacity by ten-fold.

Valuations are being pushed up as performance of optical interconnect becomes a central differentiator in AI, HPC, and data-center infrastructure. Products that reduce power, improve latency, or enable co-packaged optics (CPO) are especially prized. Regions with strong foundry and photonics ecosystems, North America (because of hyperscalers, government backing), China & East Asia (due to national photonics efforts), plus Taiwan & Singapore in manufacturing are emerging as key investment hotspots.

Key Benefits for Stakeholders:

Next Move Strategy Consulting (NMSC) presents a comprehensive analysis of the optical interconnect market, covering historical trends from 2020 through 2024 and offering detailed forecasts through 2030. Our study examines the market at global, regional, and country levels, providing quantitative projections and insights into key growth drivers, challenges, and investment opportunities across all major Optical Interconnect segments.

The optical interconnect industry creates value for multiple stakeholders in distinct ways. Investors benefit from strong growth prospects driven by AI, cloud, and high-performance computing demand, with rising valuations for companies developing co-packaged optics and silicon photonics. Policymakers see strategic advantages in funding optical interconnects, as the technology reduces energy use in data centers, supports domestic semiconductor ecosystems, and strengthens national digital infrastructure resilience. Customers, particularly hyperscalers, telecom operators, and enterprises gain from higher bandwidth, lower latency, and improved scalability, enabling them to support AI workloads and next-gen connectivity. Together, these dynamics make the industry both economically rewarding and strategically critical.

Report Scope:

|

Parameters |

Details |

|

Market Size in 2025 |

USD 20.92 Billion |

|

Revenue Forecast in 2030 |

USD 41.36 Billion |

|

Growth Rate |

CAGR of 14.6% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

28 |

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 analyst-working hours) after purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

|

Approach |

In-depth primary and secondary research; proprietary databases; rigorous quality control and validation measures. |

|

Analytical Tools |

Porter's Five Forces, SWOT, value chain, and Harvey ball analysis to assess competitive intensity, stakeholder roles, and relative impact of key factors. |

Key Market Segments

By Product

-

Fiber & Cable Assemblies

-

Active Optical Cables (AOCs)

-

Connectors & Adapters

-

Optical Transceivers & Modules

-

Photonic Engines & PICs

By Interconnect Level

-

On-Chip Optical Interconnect

-

Monolithic Integration

-

Heterogeneous Integration

-

3D-Stacked Photonics

-

-

Inter-Chip Optical Interconnect

-

Co-Packaged Optics (CPO)

-

On-Board Optical Engines

-

Optical Interposers

-

-

Board-Level Optical Interconnect

-

Rack-Level Optical Interconnect

-

Metro & Long-Haul Optical Interconnect

By Component

-

Light Sources

-

Modulation Systems

-

Waveguide Networks

-

Detection Systems

-

Control ASICs

By Fiber Mode

-

Single-Mode

-

Multimode

By Data-Rate

-

<10 Gbps

-

10–50 Gbps

-

50–100 Gbps

-

>100 Gbps

By Distance

-

<10 km

-

10–100 km

-

>100 km

By Application

-

Data-Center Interconnect/Cloud Computing

-

Telecom Backbone

-

HPC/Supercomputing

-

AI Accelerator Systems

-

Automotive/Industrial

-

Military & Defense

-

Others

Geographical Breakdown

-

North America: U.S., Canada, and Mexico.

-

Europe: U.K., Germany, France, Italy, Spain, Sweden, Denmark, Finland, Netherlands, and rest of Europe.

-

Asia Pacific: China, India, Japan, South Korea, Taiwan, Indonesia, Vietnam, Australia, Philippines, and rest of APAC.

-

Middle East & Africa (MENA): Saudi Arabia, UAE, Egypt, Israel, Turkey, Nigeria, South Africa, and rest of MENA.

-

Latin America: Brazil, Argentina, Chile, Colombia, and rest of LATAM.

Conclusion & Recommendations

Our report equips stakeholders, industry participants, investors, policy-makers, and consultants, with actionable intelligence to capitalize on Optical Interconnect transformative potential. By combining robust data-driven analysis with strategic frameworks, NMSC’s Optical Interconnect Market Report serves as an indispensable resource for navigating the evolving landscape.

Speak to Our Analyst

Speak to Our Analyst