Outdoor Cabinets and Enclosure Market by Product Type (Equipment Cabinets, Utility Enclosures), by Material Type (Metal, Plastic), by Mounting/Installation Type (Floor-Mounted), by Size and Capacity (Compact <30″ H/W, Standard 30″–60″ H/W, Large >60″ H/W, Custom Dimensions), by Distribution Channel (Online Retailers), by Application (Telecommunications, Energy & Power, IT & Data Centers), by End-User (Residential Users, Commercial Enterprises) – Global Analysis & Forecast, 2025–2030.

Industry Outlook

The global Outdoor Cabinets and Enclosure Market size was valued at USD 3.76 billion in 2024, and is expected to be valued at USD 3.98 billion by the end of 2025. The industry is projected to grow, hitting USD 5.30 billion by 2030, with a CAGR of 5.9% between 2025 and 2030.

The sector is undergoing rapid transformation, driven by urbanization, expanding smart infrastructure, renewable energy adoption, and increasing digital connectivity across industries. Globally, demand for reliable, durable, and weather-resistant enclosures is rising sharply, fueled by growth in telecommunications networks, data centers, power distribution, industrial automation, and transportation infrastructure.

Expansion of EV charging stations, 5G networks, and smart city initiatives further intensifies the need for robust outdoor cabinets and enclosures capable of protecting sensitive equipment under harsh environmental conditions. Advancements in climate control, corrosion-resistant materials, modular designs, and IoT-enabled monitoring are reshaping product offerings, enhancing operational efficiency, and extending equipment lifespans.

At the same time, the outdoor cabinets and enclosure market share is diversifying in terms of adoption. Established providers such as Schneider Electric, Siemens, ABB, and Eaton continue to dominate through large-scale industrial and utility deployments, while mid-sized and regional players like Rittal, nVent, Hubbell, and Fibox are leveraging customized, application-specific, and modular solutions to serve niche markets.

Companies including Hammond Manufacturing, Chatsworth Products, DoHo Electric, and Conteg are expanding portfolios with climate-controlled, pole-mounted, and freestanding enclosures, ensuring flexibility across sectors. With increasing integration of smart monitoring systems, remote diagnostics, and IoT-enabled functionality, alongside partnerships with telecom, energy, and industrial technology firms, the sector is broadening from traditional protective enclosures to technology-enabled, resilient, and scalable infrastructure solutions.

As regulatory standards, environmental compliance, and safety certifications evolve, the outdoor cabinets and enclosure market is becoming a critical component of industrial and urban infrastructure, enabling organizations to meet growing connectivity, power, and automation demands while balancing reliability, durability, and long-term sustainability.

What are the key trends in the Outdoor Cabinets and Enclosure Market?

What are the Major Technological Trends Shaping the Outdoor Cabinets and Enclosure Market?

Technology is transforming the outdoor cabinets and enclosure market trends by enabling greater durability, intelligence, and efficiency. Innovations such as modular cabinet designs allow for easy scaling and integration across telecom, power, and transportation networks. Advanced thermal management systems (including liquid cooling, hybrid cooling, and heat exchangers) are being deployed to prevent equipment overheating as data demands rise.

The integration of IoT-enabled monitoring sensors in enclosures is gaining traction, providing real-time data on temperature, humidity, and security breaches. Materials science is also evolving, with corrosion-resistant alloys, composites, and UV-protected plastics enhancing outdoor performance. Furthermore, cyber-physical security solutions, like smart locks, remote access control, and tamper detection, are becoming standard as critical infrastructure protection becomes a top priority.

How is Demographic Change Influencing the Outdoor Cabinets and Enclosure Market?

Demographic and societal shifts, particularly urbanization and population growth, are shaping the outdoor cabinets and enclosure market demand. By 2030, the UN projects that nearly 60% of the global population will live in urban areas, driving large-scale investments in telecommunication networks, power distribution, and transportation infrastructure. The rise of younger, tech-savvy populations is accelerating adoption of high-speed internet, IoT devices, and EV charging stations, all of which depend on robust outdoor enclosure solutions.

At the same time, aging populations in developed regions are indirectly boosting demand for smart healthcare infrastructure and reliable connectivity, further requiring outdoor enclosures for telecom and monitoring systems. These demographic dynamics are intensifying the need for scalable, reliable, and weather-resistant enclosure systems.

What Role does Government Support Play in Driving Industry Growth?

Government initiatives are crucial in shaping the outdoor cabinets and enclosure market. National and regional authorities are investing heavily in 5G deployment, renewable energy, electrification of transport, and smart city projects, all of which rely on durable outdoor enclosures. Subsidies and incentives for green energy adoption, combined with stricter regulatory standards for equipment protection, safety, and sustainability, are accelerating adoption.

Public funding for critical infrastructure resilience, including power grids, defense, and emergency communication networks, further boosts demand. Additionally, policies promoting domestic manufacturing and standardization encourage competition and innovation among local and global players, creating a strong growth ecosystem.

How is Consumer Preference Changing in the Outdoor Cabinets and Enclosure Market?

Consumer preferences are shifting toward customized, scalable, and smart enclosure solutions. Telecom operators and data center providers demand enclosures that accommodate high-density equipment while offering efficient thermal management. Utility companies prefer modular and easy-to-install cabinets that reduce downtime and maintenance costs.

With growing emphasis on sustainability, buyers are increasingly choosing enclosures built from recyclable materials and designed for long service life. Customers also expect intelligent enclosures equipped with remote monitoring, real-time alerts, and predictive maintenance capabilities. The outdoor cabinets and enclosure market is moving away from one-size-fits-all products toward tailored solutions that meet specific environmental, operational, and technological requirements.

What are the Key Market Drivers, Breakthroughs, and Investment Opportunities that will Shape the Outdoor Cabinets and Enclosure Industry in Next Decade?

The outdoor cabinets and enclosure market growth is driven by rapid urbanization, infrastructure expansion, and the rise of smart cities and IoT adoption. Increasing demand for reliable connectivity, power distribution, and secure housing for sensitive electronics is pushing the use of advanced enclosures across telecom, utilities, transportation, and renewable energy sectors.

While high installation and maintenance costs remain a key challenge, the industry continues to benefit from large-scale investments in 5G networks, digital infrastructure, and edge computing. Moreover, the accelerating expansion of electric vehicle charging infrastructure presents a significant opportunity, positioning weatherproof cabinets as critical components in enabling resilient, secure, and future-ready infrastructure solutions.

Growth Drivers:

How is Urbanization & Infrastructure Growth Driving the Market Demand?

Urbanization is a key driver of the outdoor cabinets and enclosure market expansion, as expanding cities require advanced telecommunication, power distribution, transportation, and smart city infrastructure. With more people moving into urban areas, the demand for reliable connectivity, energy access, and digital services intensifies, creating the need for robust outdoor cabinets and enclosures to protect critical equipment.

According to the World Bank, the urban population accounts for 84% of the total population in the U.S. and 66% in China, highlighting how large urban centers are shaping infrastructure needs. As these regions continue to modernize and invest in 5G networks, renewable energy grids, EV charging stations, and IoT-enabled city solutions, outdoor cabinets and enclosures will remain essential for ensuring secure, weather-resistant, and uninterrupted operations.

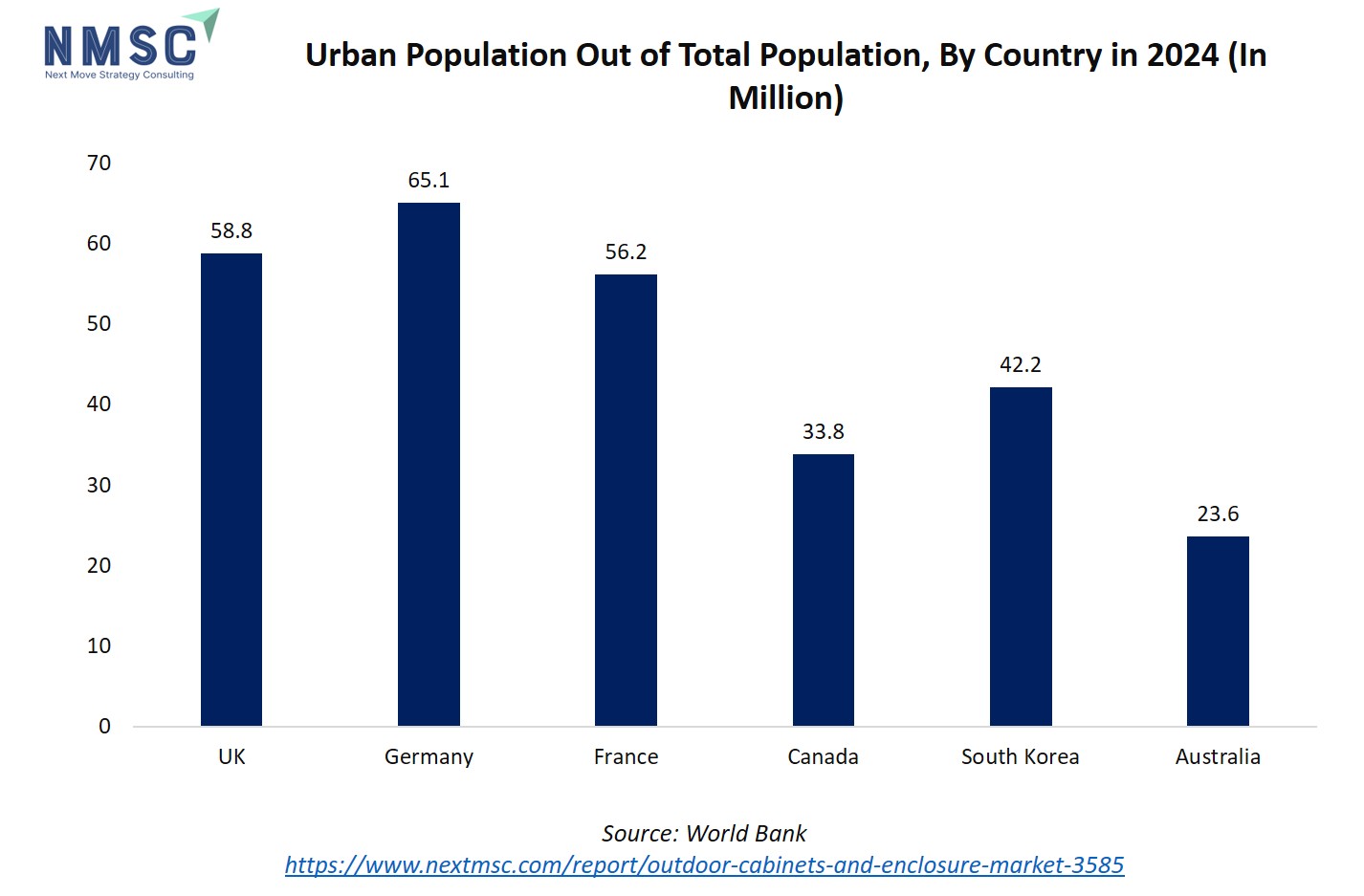

The bar chart illustrates the urban population (in millions) for six countries in 2024. Germany leads with the highest urban population of 65.1 million, followed closely by the UK (58.8 million) and France (56.2 million). South Korea has a moderately high urban population of 42.2 million, while Canada and Australia have lower urban populations of 33.8 million and 23.6 million, respectively. Each bar represents a country, clearly showing the concentration of people living in urban areas relative to others, with Germany, the UK, and France forming the top tier, and Australia at the lowest.

Urbanization is a key driver for the outdoor cabinets and enclosure market. Higher urban populations typically lead to increased infrastructure development, including telecommunications, electrical grids, and public utilities. This creates demand for outdoor cabinets, enclosures, and related protective housings to support equipment like data centers, power distribution units, and networking hardware.

For instance, Germany, the UK, and France, with their large urban populations, are likely to see strong demand due to dense city networks requiring advanced outdoor enclosure solutions. In contrast, Australia’s smaller urban population indicate slower but steady market growth, primarily concentrated in major cities.

How Growth of Smart Cities & IoT Accelerating the Market Growth?

The rapid development of smart cities and the widespread adoption of the Internet of Things (IoT) are significantly driving demand for outdoor telecom cabinets. Smart cities rely on interconnected systems such as traffic management, surveillance, environmental monitoring, public Wi-Fi, and smart lighting, all of which require secure and weatherproof enclosures to protect sensitive electronics in outdoor environments.

Similarly, IoT devices deployed across urban and industrial areas need reliable housing to ensure data accuracy, connectivity, and equipment longevity. As governments and municipalities worldwide invest heavily in smart infrastructure projects, the role of outdoor cabinets and enclosures becomes critical in enabling seamless integration, durability, and security of these technologies. This trend is expected to intensify as urban populations grow and cities become increasingly digitally connected and automated.

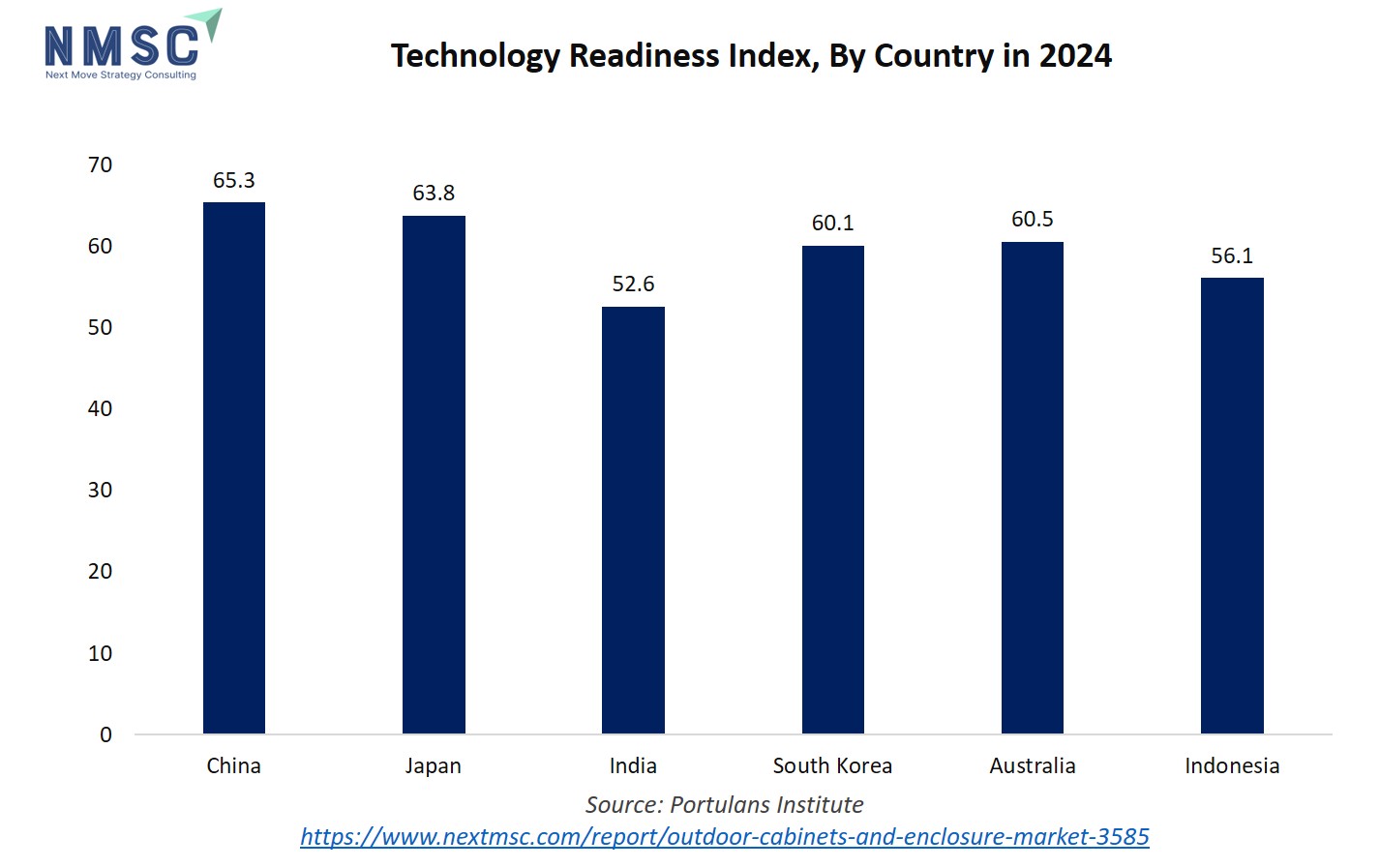

The bar chart shows the Technology Readiness Index (TRI) of six countries in 2024. China leads with a TRI of 65.3, followed by Japan (63.8). Australia (60.5) and South Korea (60.1) are moderately high, while Indonesia (56.1) and India (52.6) have lower TRI scores. The chart highlights differences in each country’s ability to adopt and implement advanced technologies, with taller bars indicating higher readiness.

Higher technology readiness directly drives demand for outdoor cabinets and enclosures. Countries like China, Japan, Australia, and South Korea, with higher TRI scores, are more likely to deploy advanced digital infrastructure, IoT systems, smart grids, and telecommunication networks. These systems require secure, durable, and weatherproof enclosures to house equipment such as servers, networking devices, and electrical components.

Conversely, countries with lower TRI, like India and Indonesia, adopt such infrastructure more gradually, leading to slower but growing industry demand. Overall, higher technology readiness accelerates the need for sophisticated waterproof cabinets, making it a key growth driver for the outdoor cabinets and enclosure market.

Growth Inhibitors:

How Does High Installation and Maintenance Costs Limit the Growth of the Outdoor Cabinets and Enclosure Market?

One of the major restraints in the outdoor cabinets and enclosure market growth is the high cost of installation and ongoing maintenance. Outdoor enclosures must be designed with advanced features such as thermal management, corrosion resistance, tamper-proof security, and weatherproofing, which increases their manufacturing and deployment costs compared to standard indoor cabinets.

In addition, regular maintenance is required to ensure performance in harsh environments, especially in regions with extreme temperatures, heavy rainfall, or high humidity. For smaller telecom operators, utility providers, and local municipalities, these expenses be a barrier to large-scale adoption. This cost challenge is particularly significant in emerging economies, where budget constraints slow down investment in infrastructure projects that rely on outdoor cabinets and enclosures.

How is Expansion of Electric Vehicle (EV) Charging Infrastructure Creating Opportunity for the Market?

The global shift toward sustainable transportation is creating a major opportunity for the outdoor cabinets and enclosure market. As countries accelerate the adoption of electric vehicles (EVs), there is a growing need for charging stations and supporting electrical infrastructure.

Electrical junction boxes play a critical role in housing power distribution units, batteries, converters, and control systems that keep EV charging networks secure and operational. With governments offering incentives for EV adoption and automakers investing in large-scale charging networks, demand for durable, weather-resistant, and tamper-proof enclosures is set to rise significantly. This opportunity is especially strong in regions like North America, Europe, and Asia-Pacific, where rapid EV rollout is supported by urbanization, environmental regulations, and consumer demand for clean energy solutions.

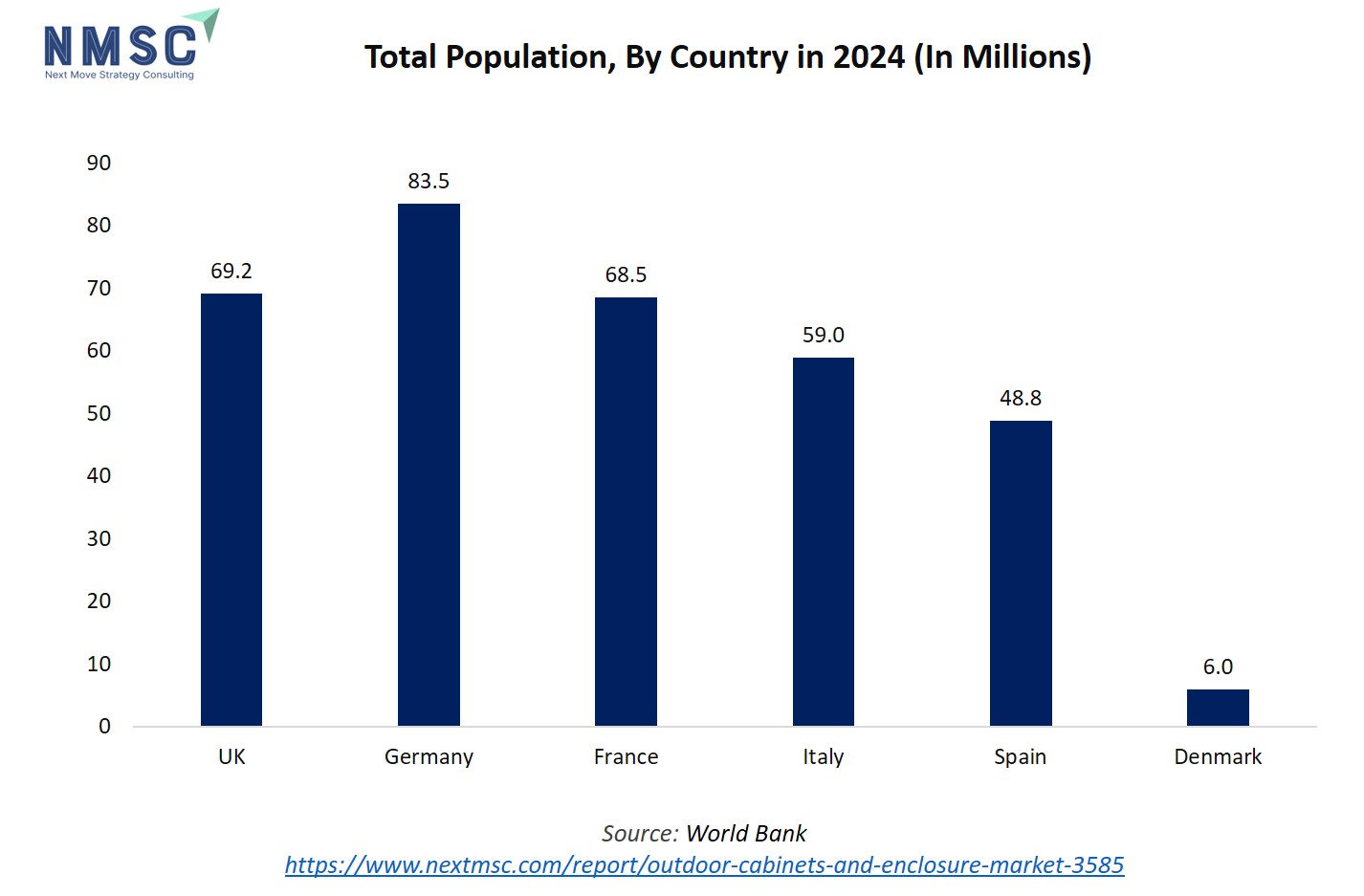

The bar chart depicts the total population (in millions) of six countries in 2024. Germany has the highest population at 83.5 million, followed by the United Kingdom (69.2 million) and France (68.5 million). Italy comes next with 59.0 million, Spain with 48.8 million, and Denmark has the smallest population among the group at 6.0 million. The bars clearly illustrate the population scale, with Germany’s bar being the tallest and Denmark’s the shortest.

Population size directly influences the demand for infrastructure, utilities, and telecommunications, which in turn drives the need for outdoor cabinets and enclosures. Countries with larger populations, like Germany, the UK, and France, typically require more extensive urban infrastructure to support residential, commercial, and industrial activities. This increases the demand for secure and durable outdoor enclosures to house power distribution units, networking equipment, and telecommunication systems.

Smaller populations, like Denmark, have lower overall demand, but urban centers and industrial hubs still require high-quality enclosures. Therefore, population size acts as a primary driver of the outdoor cabinets and enclosure market potential, as more people generally lead to higher infrastructure development and technology deployment, which are the key markets for outdoor cabinets and enclosures.

How Outdoor Cabinets and Enclosure Market is Segmented in this Report, and What are the Key Insights from the Segmentation Analysis?

By Product Type Insights

Which Product Type Is Expected to Drive the Outdoor Cabinets and Enclosure Market in 2025?

On the basis of product type, the market is segmented into equipment cabinets, utility enclosures, outdoor kitchen cabinets, hideaway enclosures, cooling/climate control cabinets, and custom enclosures.

The outdoor cabinets and enclosure market in 2025 is expected to be primarily driven by equipment cabinets. These enclosures are essential for housing telecommunication gear, networking devices, power supply units, and IT equipment, particularly as 5G, edge data centers, and smart city projects expand globally. Equipment cabinets provide robust protection against weather, vandalism, and environmental stress, making them indispensable for critical infrastructure.

While other segments such as utility enclosures and cooling/climate control cabinets are also gaining traction due to their role in power distribution and thermal management, equipment cabinets remain the backbone of the market. Additionally, custom enclosures are emerging as a high-potential segment, driven by rising demand for tailored solutions in renewable energy, EV charging, and industrial automation applications.

By Material Type Insights

Which Material Type Offers the Most Durability and Reliability in Outdoor Cabinets?

On the basis of material type, the market is segmented into metal, plastic, composite materials, wood, and hybrid.

Among materials such as metal, plastic, composite, wood, and hybrid, metal enclosures are expected to lead the market due to their superior strength, resistance to corrosion, and ability to withstand harsh weather conditions. Composite materials are gaining traction for lightweight and corrosion-resistant applications, while plastic and hybrid enclosures are chosen for cost efficiency and specialized environments. Wood is limited to decorative or residential outdoor applications.

By Mounting/Installation Type Insights

Which Mounting Type Is Most Preferred for Outdoor Enclosure Installations?

On the basis of mounting type, the market is segmented into floor-mounted, wall-mounted, pole-mounted, underground/vault-mounted, and freestanding.

The sector is expected to be primarily driven by pole-mounted enclosures, as they are highly suitable for telecom and smart city applications, including small cell 5G equipment, surveillance cameras, and environmental sensors in urban areas. Floor-mounted enclosures remain critical for housing large-scale telecom, IT, and power equipment in substations and industrial facilities. Wall-mounted units are popular in residential and commercial settings for space optimization, while underground/vault-mounted enclosures provide secure, weather-resistant installations for utilities and critical infrastructure. The trend toward urban densification and compact deployment of digital infrastructure is making pole-mounted and wall-mounted solutions increasingly significant.

By Size and Capacity Insights

What Size Segment is Most Widely Adopted in Outdoor Cabinet Applications?

On the basis of size, the market is segmented into compact (<30″ H/W), standard (30″–60″ H/W), large (>60″ H/W), and custom dimensions.

The market is expected to be primarily driven by standard-size enclosures (30″–60″ H/W), as they offer an optimal balance between equipment capacity, installation flexibility, and cost-efficiency. Standard enclosures are widely used across telecommunications, energy distribution, industrial automation, and smart city applications. Large enclosures are preferred for high-density installations such as data centers, substations, and industrial control systems, while compact and custom-size units are increasingly deployed for IoT devices, EV charging stations, and space-constrained urban environments. The versatility and adaptability of standard enclosures make them the most widely adopted segment in 2025.

By Distribution Channel Insights

Which Distribution Channel is Expected to Drive the Outdoor Cabinets and Enclosure Market in 2025?

On the basis of distribution, the market is segmented into online retailers, brick-and-mortar retail (home improvement stores, specialty electronics/electrical suppliers), direct sales (OEM/B2B), and wholesale/distributors.

The market is expected to be primarily driven by direct sales (OEM/B2B), as large-scale deployments for telecom, energy, and industrial clients require customized and high-volume orders. Online retail is growing for smaller-scale or modular solutions, while wholesale and brick-and-mortar channels serve regional installers and commercial buyers.

By Application Insights

Which Applications are Fueling Demand for Outdoor Cabinets and Enclosures?

On the basis of application, the market is segmented into telecommunications, energy & power, IT & data centers, industrial automation, transportation infrastructure, military and defense, commercial/public spaces, and residential.

The market is expected to be primarily driven by telecommunications, fueled by the global rollout of 5G networks, fiber optic expansions, and edge computing deployments that require secure, weather-resistant enclosures. Energy & power applications are also significant, supporting renewable energy installations, EV charging stations, and power distribution systems. Other applications, such as IT & data centers, industrial automation, and transportation infrastructure, contribute steadily to demand by requiring robust enclosures to protect critical equipment in outdoor and harsh environments. Increasing urbanization and smart city initiatives are further strengthening adoption across multiple applications.

By End User Insights

Who are the Key End-Users of Outdoor Cabinets and Enclosures?

On the basis of end-user, the market is segmented into residential users, commercial enterprises, industrial facilities, telecom/utility providers, government & municipalities, and contractors/installers.

The market is expected to be primarily driven by telecom and utility providers, as they deploy large-scale networks and infrastructure requiring secure, durable, and weather-resistant enclosures for equipment such as base stations, power distribution units, and fiber optic systems. Industrial facilities are significant end-users for automation, control, and energy management systems. Government and municipalities adopt outdoor enclosures for smart city projects, traffic management, and public safety applications, while residential and commercial users contribute to smaller-scale adoption through smart home and building automation solutions. Contractors and installers play a critical supporting role in implementing and maintaining these systems.

Regional Outlook

The market is geographically studied across North America, Europe, Asia Pacific, and the Middle East & Africa, and each region is further studied across countries.

Outdoor Cabinets and Enclosure Market in North America

The North American market for outdoor cabinets and enclosures is being driven by the rapid expansion of 5G networks and telecom infrastructure. Telecom operators are deploying advanced base stations, small cells, and fiber-optic networks across urban and rural areas, increasing demand for robust, weatherproof, and secure outdoor cabinets.

In addition, rising investments in smart city projects and IoT-enabled infrastructure are creating significant opportunities for enclosures that house sensors, traffic management systems, and public safety devices. The emphasis on network reliability, durability, and operational efficiency is a key factor fueling growth across the region.

Outdoor Cabinets and Enclosure Market in the United States

In the U.S., the market is primarily driven by renewable energy adoption and EV charging infrastructure. With federal and state incentives promoting solar, wind, and electric vehicle deployments, there is increasing demand for durable outdoor enclosures to protect power converters, inverters, batteries, and charging systems.

Utilities and commercial operators require climate-resistant and tamper-proof cabinets to ensure reliable energy distribution and safety. This focus on sustainable infrastructure and clean energy solutions is expected to accelerate the market growth significantly over the next decade.

Outdoor Cabinets and Enclosure Market in Canada

In Canada, the market is being fueled by industrial automation and transportation infrastructure projects. Outdoor enclosures are increasingly used to house control systems, monitoring devices, and power distribution equipment in manufacturing plants, railways, and urban transit systems.

Harsh weather conditions, including extreme cold and heavy precipitation, drive the need for highly durable, insulated, and weatherproof enclosures. As the country invests in modernizing industrial and transportation networks, demand for versatile outdoor cabinets that withstand environmental challenges continues to rise.

Outdoor Cabinets and Enclosure Market in Europe

The European market for outdoor cabinets and enclosures is being driven by the rapid deployment of smart city initiatives and urban digital infrastructure. Cities across Europe are investing heavily in IoT-enabled traffic management, surveillance systems, and environmental monitoring, increasing demand for secure, weather-resistant enclosures. The focus on connectivity, operational efficiency, and infrastructure modernization is creating growth opportunities across telecom, utilities, and municipal applications.

Outdoor Cabinets and Enclosure Market in the United Kingdom

In the U.K., the market is primarily driven by telecommunication network expansion, including 5G rollout and fiber optic deployments. Telecom operators require durable and tamper-proof outdoor cabinets to house base stations, small cells, and other network equipment in urban and rural areas. The increasing need for reliable, weatherproof enclosures in both dense cities and remote regions is fueling market growth, alongside government initiatives to improve broadband coverage nationwide.

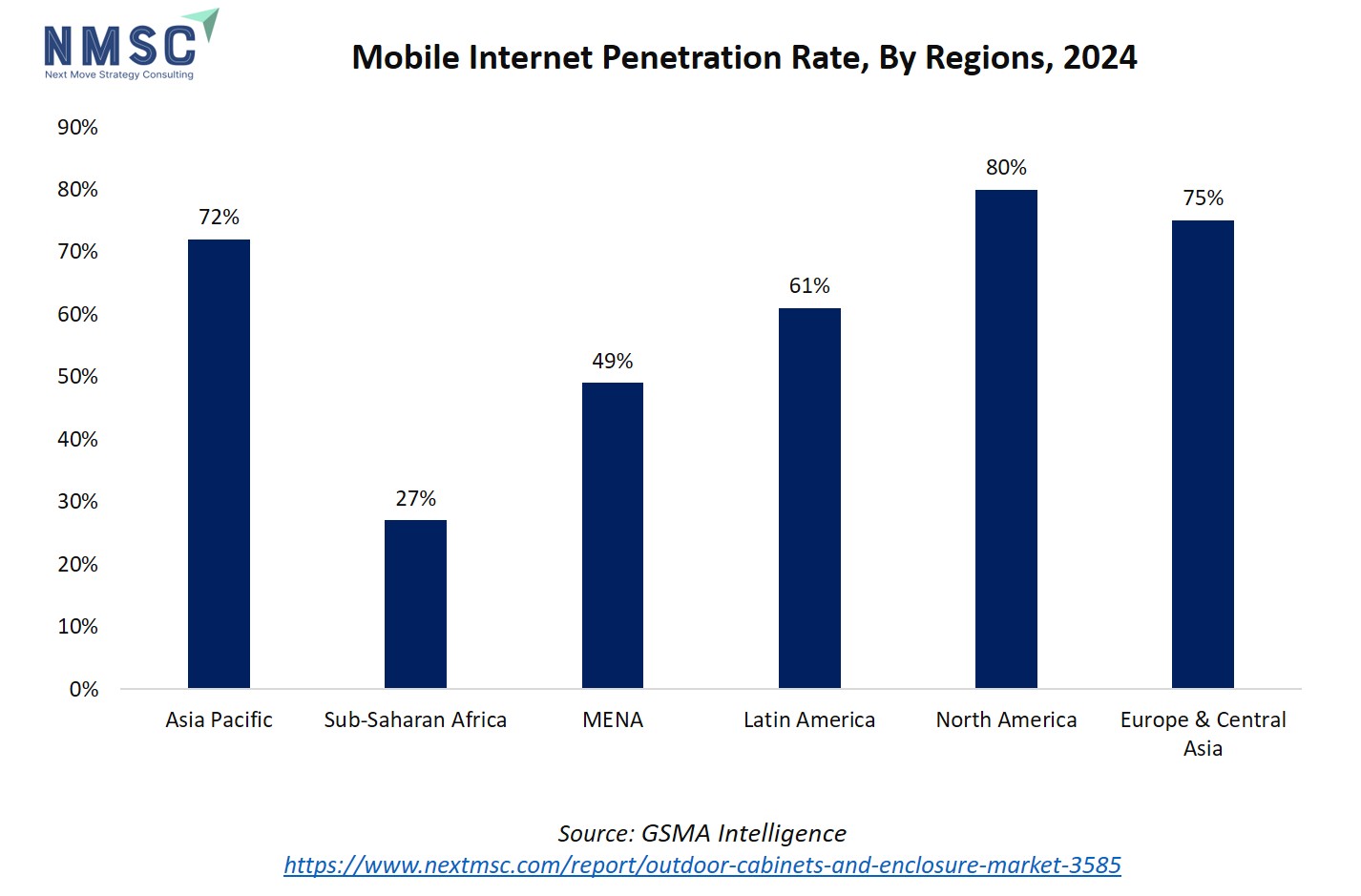

The bar chart illustrates the mobile internet penetration rate (%) in different regions in 2024. North America has the highest penetration at 80%, followed closely by Europe & Central Asia (75%) and Asia Pacific (72%). Latin America has a moderate rate of 61%, while the MENA region is at 49%, and Sub-Saharan Africa shows the lowest penetration at 27%. The bars clearly depict the digital connectivity gap across regions, with North America and Europe & Central Asia leading and Sub-Saharan Africa lagging.

Mobile internet penetration is a key driver for the market as higher penetration rates demand more extensive telecommunications and digital infrastructure. Regions with high mobile internet penetration, such as North America, Europe & Central Asia, and Asia Pacific, are likely to require greater deployment of outdoor cabinets and enclosures to house telecom equipment, 5G base stations, and networking devices.

Conversely, regions with lower mobile internet penetration, like Sub-Saharan Africa and MENA, experience slower demand growth, although expanding connectivity initiatives could gradually boost market opportunities. Overall, higher mobile internet penetration correlates with increased infrastructure needs, making it a significant growth driver for the outdoor cabinets and enclosures market.

Outdoor Cabinets and Enclosure Market in Germany

Germany’s market is being fueled by renewable energy projects and EV charging infrastructure. Outdoor enclosures are critical for protecting inverters, batteries, and control systems in solar, wind, and electric vehicle networks. The country’s commitment to energy transition and clean technology investment drives demand for climate-resistant and secure enclosures, making Germany a key growth region in Europe for the market.

Outdoor Cabinets and Enclosure Market in France

In France, the market is being driven by industrial automation and transportation infrastructure modernization. Outdoor cabinets are increasingly used in railways, highways, manufacturing plants, and urban transit systems to house control systems, monitoring devices, and power distribution units. Harsh weather conditions and the need for reliable, long-lasting enclosures in industrial and municipal applications are boosting adoption across the country.

Outdoor Cabinets and Enclosure Market in Spain

In Spain, the market is being significantly driven by urbanization and the expansion of smart city infrastructure. According to the World Bank, the urban population in Spain is approximately 39.92 million, highlighting the concentration of people in cities and the corresponding need for advanced urban infrastructure.

Municipalities are increasingly deploying traffic management systems, environmental sensors, and public safety networks, all of which require secure, weather-resistant outdoor cabinets and enclosures. The combination of rapid urban growth and the emphasis on connectivity, data reliability, and smart city modernization is creating strong demand for robust enclosures capable of protecting sensitive electronic equipment across urban and semi-urban areas.

Outdoor Cabinets and Enclosure Market in Italy

Italy’s market is being fueled by renewable energy and electric vehicle (EV) infrastructure growth. Outdoor cabinets and enclosures are essential for housing power inverters, battery systems, and charging stations, ensuring safe and reliable operation under varying weather conditions. Government incentives for clean energy adoption and EV rollout are encouraging large-scale installations, driving the demand for durable, tamper-proof, and climate-resistant enclosures across the country.

Outdoor Cabinets and Enclosure Market in the Nordics

In the Nordic countries, the market is driven by industrial automation and transportation infrastructure modernization. Outdoor enclosures are widely used in railway systems, ports, highways, and manufacturing plants to protect control systems, monitoring devices, and energy distribution equipment. The region’s harsh weather conditions, including cold temperatures, snow, and heavy precipitation, further emphasize the need for high-quality, weatherproof, and insulated cabinets, supporting market growth across commercial, industrial, and municipal applications.

Outdoor Cabinets and Enclosure Market in Asia Pacific

In Asia Pacific, the market is primarily driven by rapid urbanization and the expansion of smart city infrastructure. Growing urban populations in countries such as India, China, South Korea, and Australia are increasing demand for telecom networks, traffic management systems, environmental monitoring, and public safety networks, all of which require secure, weather-resistant outdoor cabinets and enclosures. The emphasis on connectivity, IoT deployment, and infrastructure modernization is creating strong demand for robust enclosures capable of protecting critical electronic equipment across urban and semi-urban areas.

Outdoor Cabinets and Enclosure Market in China

In China, the market is being fueled by telecommunication network expansion and 5G rollout. Rapid deployment of small cells, base stations, and fiber optic networks requires durable, climate-resistant, and tamper-proof outdoor cabinets to ensure reliable connectivity and network performance. Investments in smart city projects and IoT-enabled infrastructure are further boosting demand for secure enclosures to house sensors, traffic management systems, and public safety devices across urban centers.

Outdoor Cabinets and Enclosure Market in Japan

Japan’s market is primarily driven by industrial automation and transportation infrastructure modernization. Outdoor cabinets and enclosures are increasingly used to house control systems, monitoring devices, and power distribution units in manufacturing plants, railway networks, and urban transit systems. Harsh weather conditions, including heavy rainfall and typhoons, emphasize the need for high-quality, weatherproof, and insulated enclosures, supporting steady growth across commercial, municipal, and industrial applications.

Outdoor Cabinets and Enclosure Market in India

In India, the market is being significantly driven by rapid urbanization and infrastructure expansion. According to the World Bank, India’s urban population stands at approximately 534.91 million, reflecting the increasing concentration of people in cities and the corresponding demand for reliable urban infrastructure.

This growth is fueling the deployment of telecom networks, smart grids, EV charging stations, and IoT-enabled systems, all of which require secure, weather-resistant outdoor cabinets and enclosures to protect critical equipment. Combined with government initiatives supporting 5G rollout, smart city projects, and industrial modernization, the emphasis on urban infrastructure is creating strong opportunities for both modular and large-scale enclosure solutions across the country.

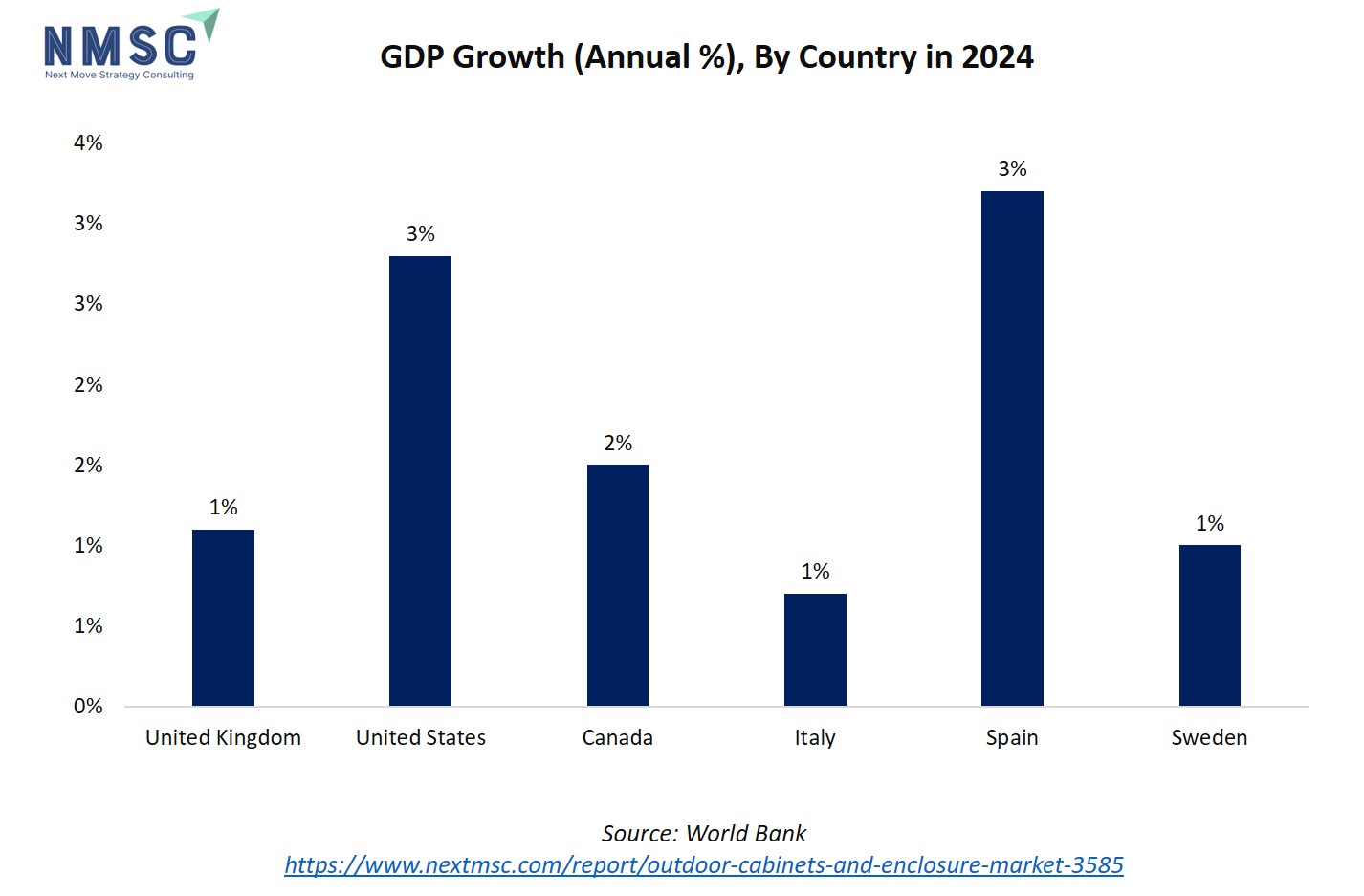

The bar chart illustrates the GDP growth rate (annual %) of six countries in 2024. Spain leads with the highest growth rate at 3.20%, followed by the United States at 2.80%. Canada shows moderate growth at 2%, while the United Kingdom (1.10%) and Sweden (1%) have lower rates. Italy has the lowest growth at 0.70%. Each bar represents a country’s economic expansion, with taller bars indicating stronger growth.

GDP growth is a key driver for the Outdoor Cabinets and Enclosures market. Countries with higher GDP growth, like Spain and the United States, typically invest more in infrastructure, urban development, and industrial projects. These developments increase demand for outdoor cabinets and enclosures to house electrical, telecommunication, and networking equipment.

In countries with moderate growth, such as Canada, the UK, and Sweden, demand is steady, driven by ongoing modernization and maintenance of existing infrastructure. Conversely, Italy’s lower GDP growth indicate slower expansion in infrastructure and industrial projects, resulting in more gradual market growth. Overall, stronger GDP growth supports higher investment in technology, urbanization, and industrialization, all of which directly boost the demand for outdoor cabinets and enclosures.

Outdoor Cabinets and Enclosure Market in South Korea

In South Korea, the market is primarily driven by the rapid expansion of smart city infrastructure and IoT deployment. Cities are increasingly implementing traffic management systems, environmental monitoring, public safety networks, and connected urban services, all of which require secure, weatherproof outdoor cabinets and enclosures. The emphasis on connectivity, data reliability, and infrastructure modernization is driving strong demand for durable enclosures capable of protecting sensitive equipment in both urban and semi-urban areas.

Outdoor Cabinets and Enclosure Market in Taiwan

Taiwan’s market is fueled by telecommunication network upgrades and 5G rollout. The deployment of small cells, base stations, and fiber-optic networks requires reliable, tamper-proof, and weather-resistant enclosures to ensure uninterrupted connectivity. Investments in smart city projects, IoT-enabled infrastructure, and public safety networks further enhance demand for outdoor cabinets, making Taiwan a key growth market in Asia Pacific for secure equipment housing solutions.

Outdoor Cabinets and Enclosure Market in Indonesia

In Indonesia, the market is being driven by industrial automation and urban infrastructure development. Outdoor cabinets and enclosures are increasingly used to house control systems, monitoring devices, and power distribution equipment in manufacturing plants, urban transit systems, and utility networks. Growing urbanization, coupled with rising investments in smart infrastructure and industrial modernization, is boosting demand for robust, weatherproof, and durable enclosure solutions across the country.

Outdoor Cabinets and Enclosure Market in Australia

In Australia, the market is being driven by urbanization, renewable energy projects, and EV charging infrastructure expansion. According to the World Bank, Australia’s urban population is approximately 23.60 million, highlighting the growing concentration of people in cities and the rising demand for modern infrastructure.

Outdoor enclosures are essential for protecting power inverters, battery systems, and EV charging equipment from harsh environmental conditions in both urban and suburban areas. Government incentives promoting clean energy adoption, smart grids, and sustainable transportation are accelerating the deployment of such infrastructure, creating strong growth opportunities for durable, climate-resistant, and secure outdoor cabinets and enclosures across the country.

Outdoor Cabinets and Enclosure Market in Latin America

In Latin America, the market is primarily driven by rapid urbanization and infrastructure modernization. Growing urban populations in countries such as Brazil, Mexico, and Argentina are increasing demand for telecom networks, power distribution systems, smart city applications, and public safety infrastructure, all of which require secure, weather-resistant outdoor cabinets and enclosures. The focus on connectivity, reliable equipment protection, and modernization of urban infrastructure is creating strong growth opportunities for durable and versatile enclosure solutions across both metropolitan and semi-urban areas.

Outdoor Cabinets and Enclosure Market in the Middle East & Africa

In the Middle East and Africa, the market is primarily driven by investment in renewable energy and industrial infrastructure expansion. Outdoor cabinets and enclosures are increasingly required to protect power distribution units, solar and wind energy systems, and industrial control equipment from harsh environmental conditions, including extreme heat, sand, and humidity. Government incentives, infrastructure projects, and private-sector adoption of smart grids and industrial automation solutions are fuelling demand for durable, weatherproof, and secure outdoor cabinets, supporting market growth across the region.

Competitive Landscape

Which Companies Dominate the Outdoor Cabinets and Enclosure Industry and How Do They Compete?

The global outdoor cabinets and enclosure industry is dominated by established manufacturers and suppliers such as Schneider Electric, Siemens, ABB, Eaton, Emerson Electric, Rittal, nVent, Hubbell Incorporated, CommScope, Panduit, Fibox, Hammond Manufacturing, Chatsworth Products (CPI), DoHo Electric, and Conteg. These companies compete by offering a wide range of outdoor cabinets and enclosures for applications in telecommunications, energy & power, IT & data centers, industrial automation, transportation infrastructure, and commercial and residential sectors.

Market leaders differentiate themselves through investments in advanced technologies and innovative designs, such as weatherproofing, corrosion-resistant coatings, climate control and cooling systems, modular and customizable enclosures, and smart monitoring features. Strategies also focus on expanding global distribution networks, enhancing product reliability and durability, and offering tailored solutions to meet specific customer or industry requirements.

Regional specialists and niche providers further intensify competition by offering customized, small-batch, or application-specific solutions. As demand grows across urbanization, smart infrastructure, and renewable energy projects, companies that combine comprehensive product portfolios with technological innovation are capturing market share and positioning themselves at the forefront of the Outdoor Cabinets and Enclosure Market.

Market dominated by Outdoor Cabinets and Enclosure Giants and Specialists

The outdoor cabinets and enclosure market is split between large multinational manufacturers and suppliers, which offer comprehensive, high-volume solutions, and specialist or regional providers, which focus on niche applications, customized enclosures, or local markets. Large providers compete on scale, global distribution networks, advanced product portfolios, and technological integration, while specialist providers differentiate through tailored designs, modular and customizable solutions, and responsive service for specific industries. This creates a two-tier market where clients choose either a broad, full-service supplier or a specialized, localized provider depending on project scale, application requirements, and customization needs.

Innovation and Adaptability Drive Market Success

Leaders in the outdoor cabinets and enclosure market share are investing heavily in technological innovation, materials engineering, and modular designs to enhance durability, performance, and usability. Companies are integrating climate control systems, IoT-enabled monitoring, smart locking mechanisms, and corrosion-resistant materials to provide weatherproof, secure, and connected solutions.

Providers that develop customizable and scalable enclosures, compatible with smart city applications, telecom networks, energy systems, and industrial automation, are winning contracts as clients demand reliable, long-lasting, and future-ready infrastructure solutions.

Market Players to Opt for Merger & Acquisition Strategies to Expand their Presence

Mergers and acquisitions have become a key strategy for sector’s providers to expand their capabilities and market reach. Leading manufacturers are acquiring regional or specialized enclosure companies to enhance product portfolios, enter new geographic markets, and integrate advanced technologies such as smart monitoring, climate control, and IoT compatibility.

These M&A activities accelerate deployment, diversify solutions, and strengthen competitive positioning, enabling providers to meet growing demand across telecom, energy, transportation, industrial, and urban infrastructure applications.

List of Key Outdoor Cabinets and Enclosure Companies

-

Siemens

-

ABB

-

Eaton

-

Rittal

-

NVent

-

Hubbell Incorporated

-

CommScope

-

Panduit

-

Fibox

-

Hammond Manufacturing

-

Chatsworth Products (CPI)

-

DoHo Electric

-

Conteg

What are the Latest Key Industry Developments?

-

July 2025 - Hubbell introduced the Hubbell-PRO Motor Disconnect Switches, housed in an IP67-rated thermoplastic enclosure, providing protection against dust and water, making them suitable for both indoor and outdoor applications.

-

May 2025 - Schneider Electric launched the Panel SeT SFN, the first decarbonized steel cabinet that reduces CO₂ emissions by 34%. This initiative is part of their broader strategy to enhance sustainability in electrical panels.

-

October 2024 - Siemens unveiled the RapidSBx switchboard, emphasizing flexibility, durability, and easy installation. Its minimal footprint and service entrance capabilities make it suitable for various applications.

-

June 2024 - ABB introduced a standard NEMA 4X enclosure for its 580 series drives, designed for outdoor use in HVAC and water/wastewater applications. The enclosure offers UV and weather resistance, providing superior protection against corrosion and extreme environments.

-

February 2024 - Rittal introduced the Wall Mount Vented (WMV) outdoor UL 3R Type Rated enclosure, featuring a durable design with integrated cooling, easy access for maintenance, and optimum corrosion protection.

What are the Key Factors Influencing Investment Analysis & Opportunities in the Outdoor Cabinets and Enclosure Market?

The outdoor cabinets and enclosure market is attracting increasing investor attention as global demand for robust, secure, and technology-enabled infrastructure grows across telecommunications, energy, industrial automation, and smart city projects. Companies offering modular, climate-resistant, IoT-enabled, and customizable enclosures are particularly attractive, with funding directed toward scalable and innovative solutions.

Investment activity is strong in North America, Europe, and Asia-Pacific, where urbanization, smart city development, renewable energy expansion, and industrial modernization are driving rapid adoption of outdoor enclosures. Strategic acquisitions and partnerships by leading manufacturers highlight consolidation as a key growth strategy.

For investors, the most promising opportunities lie in providers that combine comprehensive product portfolios, advanced technological features, operational efficiency, and the ability to cater to diverse and evolving infrastructure needs.

Key Benefits for Stakeholders:

Next Move Strategy Consulting (NMSC) presents a comprehensive analysis of the Outdoor Cabinets and Enclosure Market, covering historical trends from 2020 through 2024 and offering detailed forecasts through 2030. Our study examines the sector at global, regional, and country levels, providing quantitative projections and insights into key growth drivers, challenges, and investment opportunities across all major market segments.

Report Scope:

|

Parameters |

Details |

|

Market Size in 2025 |

USD 3.98 Billion |

|

Revenue Forecast in 2030 |

USD 5.30 Billion |

|

Growth Rate |

CAGR of 5.9% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Countries Covered |

28 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent to up to 80 analyst-working hours) after purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

|

Approach |

In-depth primary and secondary research; proprietary databases; rigorous quality control and validation measures. |

|

Analytical Tools |

Porter's Five Forces, SWOT, value chain, and Harvey ball analysis to assess competitive intensity, stakeholder roles, and relative impact of key factors. |

Key Market Segments

By Product Type

-

Equipment Cabinets

-

Utility Enclosures

-

Outdoor Kitchen Cabinets

-

Hideaway Enclosures

-

Cooling/Climate Control Cabinets

-

Custom Enclosures

By Material Type

-

Metal

-

Plastic

-

Composite Materials

-

Wood

-

Hybrid

By Mounting/Installation Type

-

Floor-Mounted

-

Wall-Mounted

-

Pole-Mounted

-

Underground/Vault-Mounted

-

Freestanding

By Size and Capacity

-

Compact (< 30″ H/W)

-

Standard (30″– 60″ H/W)

-

Large (> 60″ H/W)

-

Custom Dimensions

By Distribution Channel

-

Online Retailers

-

Brick-and-Mortar Retail

-

Home Improvement Stores

-

Specialty Electronics/Electrical Suppliers

-

Direct Sales (OEM/B2B)

-

Wholesale/Distributors

By Application

-

Telecommunications

-

Energy & Power

-

IT & Data Centers

-

Industrial Automation

-

Transportation Infrastructure

-

Military And Defense

-

Commercial/Public Spaces

-

Residential

By End-User

-

Residential Users

-

Commercial Enterprises

-

Industrial Facilities

-

Telecom/Utility Providers

-

Government & Municipalities

-

Contractors/Installers

Geographical Breakdown

-

North America: U.S., Canada, and Mexico.

-

Europe: U.K., Germany, France, Italy, Spain, Sweden, Denmark, Finland, Netherlands, and rest of Europe.

-

Asia Pacific: China, India, Japan, South Korea, Taiwan, Indonesia, Vietnam, Australia, Philippines, and rest of APAC.

-

Middle East & Africa (MENA): Saudi Arabia, UAE, Egypt, Israel, Turkey, Nigeria, South Africa, and rest of MENA.

-

Latin America: Brazil, Argentina, Chile, Colombia, and rest of LATAM

Conclusion & Recommendations

Our report equips stakeholders, industry participants, investors, policy-makers, and consultants with actionable intelligence to capitalize on the industry’s transformative potential. By combining robust data-driven analysis with strategic frameworks, NMSC’s Outdoor Cabinets and Enclosure Market Report serves as an indispensable resource for navigating the evolving landscape.

Speak to Our Analyst

Speak to Our Analyst