Plant Growth Regulators (PGRs) and Biostimulants Market By Product Type (PGRs (Auxins, Gibberellins and Others), Biostimulants (Microbial and Non microbial), By Formulation (Liquid concentrate, Water-soluble powder and Others), By Crop Type (Row Crops, Turfs and Ornamentals and Others), By Application Method (Foliar Spray, Soil Treatment and Others), By Mode of Action (Growth regulation, Stress Protection and Others), and By End-Users – Global Analysis & Forecast, 2025–2030

Industry Outlook

The global Plant Growth Regulators (PGRs) and Biostimulants Market size was valued at USD 7.33 billion in 2024, and is expected to be valued at USD 7.99 billion by the end of 2025. The industry is projected to grow, hitting USD 12.34 billion by 2030, with a CAGR of 9.08% between 2025 and 2030.

The PGRs and biostimulants market continues to witness steady growth in 2025, fueled by the convergence of hybrid work trends, and increased consumer focus on wellness and productivity. Urban hubs like New York, San Francisco, and Seattle are becoming key demand centers for smart office and home furniture, driven by rising adoption of ergonomic, connected, and multifunctional furniture solutions. Growth is further supported by increased corporate spending on hybrid-ready workspaces and residential tech integration.

The industry is rapidly innovating with AI-enabled features, sustainable materials, and modular, customizable designs that meet the evolving needs of both commercial and residential users. Demand for eco-conscious and health-enhancing furniture, such as smart sit-stand desks, climate-responsive beds, and app-controlled lighting is on the rise.

However, the PGRs and biostimulants market faces challenges like high upfront costs, tech integration complexity, and consumer data privacy concerns. Continued innovation, focus on user experience, and cross-industry collaboration will be key to shaping the future of the biostimulants ecosystem.

What are the Key Trends in PGRs and Biostimulants Industry?

How is the plant growth regulators and biostimulants market transforming precision and digital agriculture?

Adoption of precision tools is changing how growers’ dose of organic farming inputs. Dealers and agronomy services report rapidly rising use of variable-rate application (VRT) and prescription mapping, and recent precision-agriculture surveys show VRT is now common in dealer services rather than niche pilots. That means companies can no longer treat biostimulants/PGRs as spray-once commodities as growers expect data-backed, zone-specific recommendations that reduce waste and improve ROI.

Practically, this is shifting R&D toward products that perform reliably under targeted, sensor-driven regimes and toward partnerships with platform providers who supply prescription maps. For firms, the clear play is to instrument product trials with geotagged performance data and publish use-case dashboards so distributors can sell prescriptions, not just bottles and doing so shortens the path from trial to paid adoption and reduces farmer hesitation about variable results.

Why are Microbial and Marine (Seaweed) Biostimulants Becoming Dominant Choices in the PGRs and Biostimulants Market?

Research and product pipelines increasingly favour microbes and seaweed extracts because they deliver multi-modal stress resilience and nutrient-use efficiency that conventional inputs can’t match; recent reviews show a surge in studies on microbe- and microalgae-derived biostimulants and their mechanisms, and market analyses reports seaweed/acid-based segments capturing a large share of new product launches. That combination of science and supplier activity explains why farmers buying into sustainability premiums choose these classes, because they improve drought and salinity tolerance while fitting organic or reduced-chemical programs.

What will Regulatory Clarity Mean for the Plant Growth Regulators and Biostimulants Market?

Regulatory momentum, from EU updates to draft EPA guidance and recent U.S. legislative activity is crystallising what counts as a biostimulant or plant regulator, which reduces ambiguity for manufacturers and for customers who worry about claims and compliance. That clarity drives commercialization, i.e., once a product category has a predictable pathway (labelling, allowed claims, safety testing), investors, distributors, and big Ag players accelerate launches and shelf-space commitments.

At the same time, staggered timelines and national nuances mean companies must build a regulatory playbook rather than a single submission. Practically, firms should map each target market’s regulatory milestones and prioritize a compliance-first launch in one or two lead geographies, then reuse validated data for adjacent markets; this reduces rework and speeds commercial scale-up.

How are Formulation and Application Innovations Reshaping Efficacy and Commercialization in the PGRs and Biostimulants Market?

Aside from active ingredients, product form and delivery are fast becoming the value drivers. Seed coatings, encapsulation, nano-enabled slow release, and co-formulations that target microbiomes all show in recent R&D and patent reviews as the areas with the most technical momentum. That means a successful new biostimulant or PGR is as much about formulation science and application timing as about the active itself.

The practical takeaway is straightforward, companies that pair a validated active with a differentiated delivery system (e.g., seed treatment that survives storage, or foliar micro-encapsulation that resists UV breakdown) can charge a premium and reduce field variability.

What are the Key Market Drivers, Breakthroughs, and Investment Opportunities that will Shape the PGRs and Biostimulants Industry in Next Decade?

The plant growth regulators and biostimulants market demand is accelerating as growers and food companies push for higher yields with lower environmental footprint; some estimates put global industry value in the low-to-mid billions and project doubled or stronger growth over the next decade, driven by demand for improved nutrient-use efficiency and abiotic-stress resilience. This commercial tailwind is reinforced by clearer regulatory direction in major markets, which reduces investor and distributor uncertainty and helps scale validated products faster.

At the same time, scientific breakthroughs (notably in microbial consortia and seaweed extract modes of action) and formulation advances (encapsulation, seed coatings, and controlled-release systems) are making performance more predictable, but real-world variability across varieties/soils and fragmented national rules remain the practical hurdles. That mix creates clear opportunities in R&D-led product differentiation, supply-chain traceability, and application technology partnerships.

Growth Drivers:

How are plant growth regulators and biostimulants helping reduce fertilizer dependency and improve resilience?

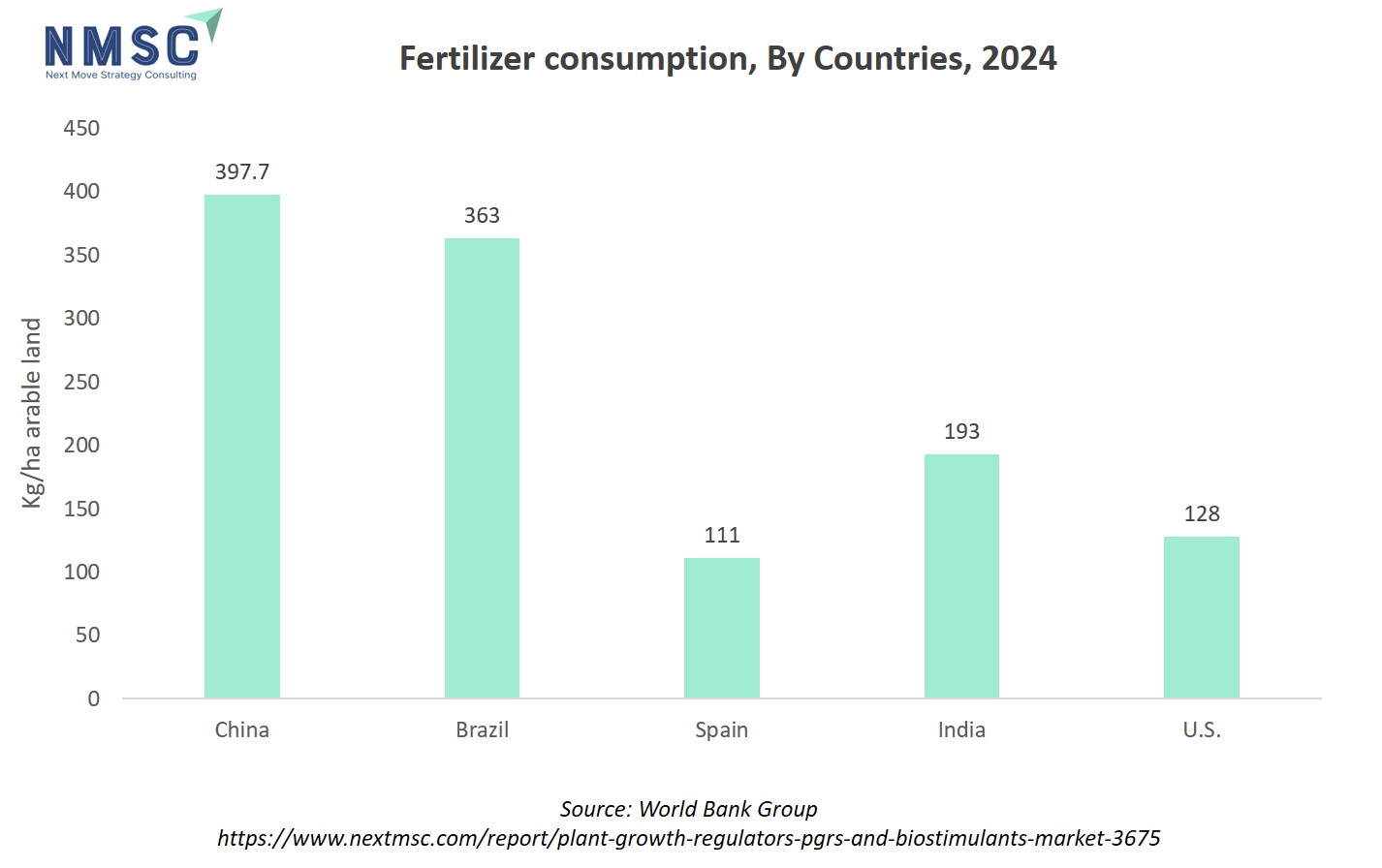

Farmers and advisors are increasingly testing biostimulants and plant growth regulators to boost nutrient-use efficiency and buffer crops against drought or salinity, backed by FAO guidance that highlights their role in abiotic-stress resilience and nutrient uptake. At the same time, global fertilizer volumes recovered in 2023-24, and IFA’s 2024 outlook shows nutrient consumption and production trending upward, while the World Bank’s 2024 fertilizer-price index fell sharply from 2023 peaks, a combination that makes fertilizer-sparing claims commercially relevant today. For companies, embedding kg-N saved per hectare and stress-trial data into trial reports is now a commercial must.

How is regulatory clarity and public research reshaping commercial risk for PGRs and biostimulants market?

Recent regulatory moves and public science have materially lowered commercialization uncertainty. The EU’s FPR implementation activity and harmonisation timetable through late-2024/2025 clarifies biostimulant standards, and the U.S. EPA issued updated draft guidance (Nov 2024) on when agrochemical alternatives may be treated as plant regulators, giving clearer claim-boundaries.

Parallel FAO and CGIAR events and projects in 2024 are advancing mechanism-level understanding. Together, these government and public-science signals shorten the prove-it window for efficacy and labelling, so firms that align dossiers and co-publish independent trials gain faster distributor and regulator acceptance.

Growth Inhibitors:

What is the key inhibitor slowing scaling of the PGRs and biostimulants market growth?

Inconsistent field performance (variety- and environment-dependent outcomes) combined with patchy national regulatory interpretations creates buyer hesitation and higher go-to-market costs. Where efficacy depends strongly on cultivar, soil or timing, adoption stalls; likewise, uneven regulatory rules force repeated local dossiers. The practical response is standardizing multi-season, multi-site trials and harmonizing dossiers for lead geographies to de-risk rollouts.

Where is the most attractive emerging investment opportunity in the PGRs and biostimulants market?

Formulation and delivery technology, such as, encapsulation, seed-applied biostimulants, and controlled-release matrices, plus application tech partnerships (seed companies, precision-ag platforms), offer the clearest route to premium pricing and repeatable outcomes. These innovations turn variable activities into reliable products and are easier to protect commercially (IP, co-developed services), making them high-leverage targets for R&D and M&A investment.

How is the PGRs and Biostimulants Market Segmented in this Report, and What are the Key Insights from the Segmentation Analysis?

By Product Type Insights

Is the combined PGRs & biostimulants market shifting toward a biostimulant-led, regulation-driven expansion in 2025?

On the basis of product type, the plant growth regulators and biostimulants market report is segmented into plant growth regulators (PGRs) and Biostimulants. PGRs are also classified into auxins, gibberellins, cytokinins, abscisic acid modulators, ethylene modulators and others biostimulants are also classified into microbial and non-microbial biostimulants.

Biostimulants are the faster-growing segment while plant growth regulators (PGRs) retain strategic, crop-specific value. Data from the European Biostimulants Industry Council (EBIC) and its market overview places the plant biostimulant market at ~USD 3+ billion in the early 2020s with forecasts to roughly triple toward ~USD 9+ billion by 2030, signalling strong demand driven by sustainability and nutrient-efficiency goals. By contrast, FAO research and AGRIS case studies show that PGRs remain indispensable where precise, short-term physiological control matters, for example, documented PGR applications increased wheat yields by ~5% and sharply reduced lodging in controlled trials, illustrating why PGRs keep strong footholds in horticulture, nurseries and high-value cropping systems where immediate ROI matters. By analysis, we understand that biostimulants’ growth is demand-led and enabled by regulatory recognition plus a growing evidence base from public research; microbial biostimulants promise compounding soil-health benefits but face field-consistency constraints, while non-microbial categories (seaweed extracts, humates, amino acids) scale faster because of easier standardization and reproducible short-term effects.

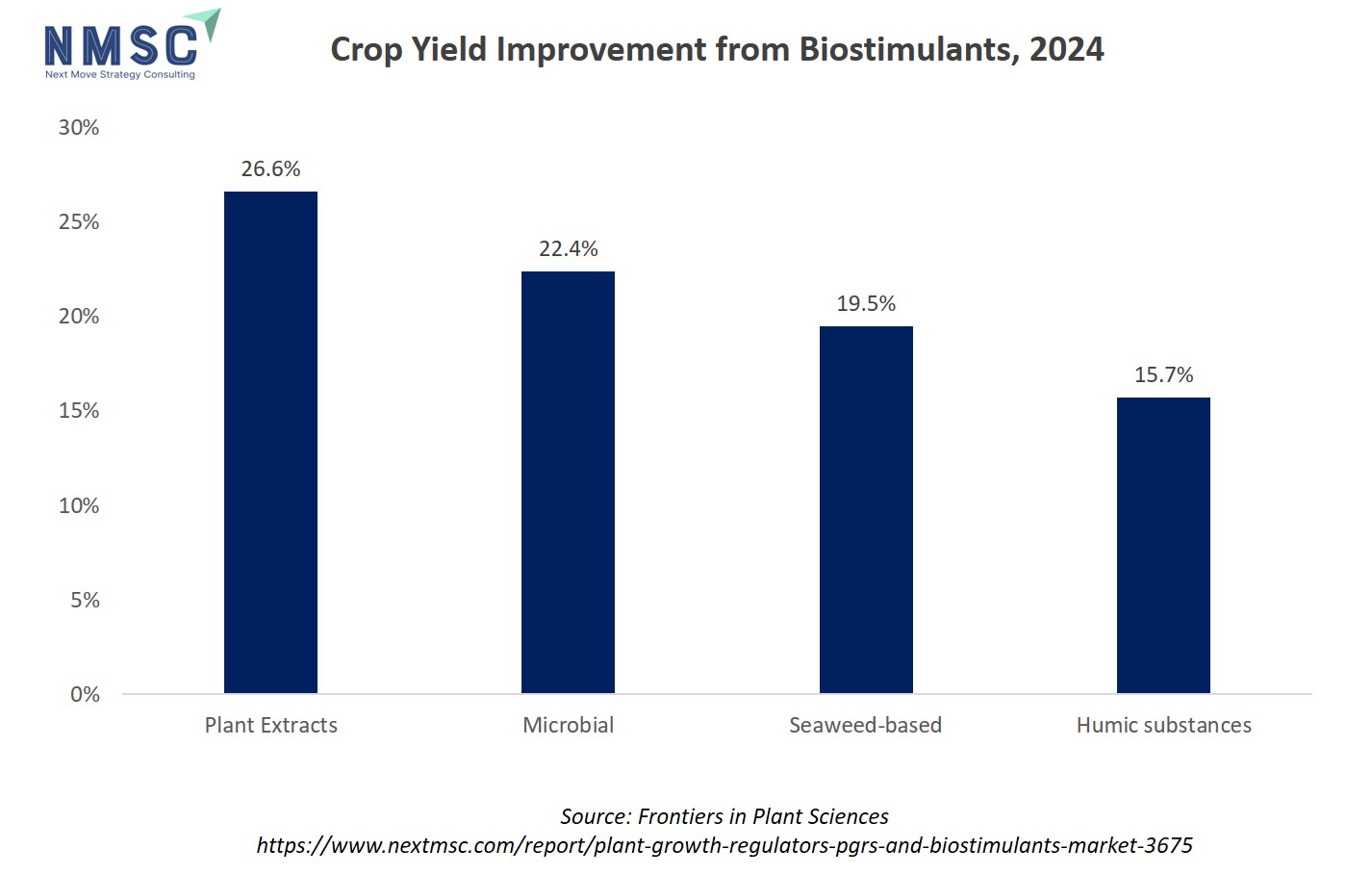

The infographic illustrates the comparative yield gains achieved through different types of biostimulants in agriculture. Plant extracts show the highest positive impact on crop yields at 26.6%, followed by microbial biostimulants with 22.4%. Seaweed-based formulations contribute a 19.5% increase, while humic substances deliver a 15.7% yield improvement. The data highlights how various biostimulant categories differ in effectiveness, underscoring their growing importance in enhancing crop productivity and sustainability by improving plant performance under diverse agricultural conditions.

By Formulation Insights

Are Liquid Concentrates, Powders, Granules, and Seed Coatings Shaping the PGRs & Biostimulants Market in 2025?

Based on formulation, the plant growth regulators and biostimulants market is segmented into liquid concentrate, water-soluble powder, suspension concentrates granule, seed coating formulation and others.

Each segment of formulation serves distinct agronomic needs. According to the FAO’s pesticide formulation manual, liquid and suspension concentrates dominate because they are easy to dilute, compatible with existing spraying systems, and widely suited for foliar and soil applications. Water-soluble powders and granules are valued for precise dosing and storage stability, making them popular for bulk distribution. While Seed-coating formulations, are gaining momentum as delivery systems for microbial biostimulants that enhance germination and early growth. This segmentation reflects a dual dynamic: liquids ensure scalability for large farms, while seed coatings and powders offer precision for high-value crops.

By Crop Type Insights

Are Row Crops, Fruits & Vegetables, and Turf & Ornamentals Driving Distinct Adoption in 2025?

Based on crop type, the plant growth regulators and biostimulants market is divided into row crops, fruits and vegetables, turf and ornamentals and others.

Each crop type shows unique adoption patterns. FAO highlights that row crops such as cereals and oilseeds are the largest acreage users, where biostimulants are increasingly applied to improve nutrient-use efficiency and mitigate drought stress at scale. Fruits and vegetables, by contrast, rely heavily on PGRs like auxins, gibberellins, and cytokinins to regulate flowering, fruit set, and post-harvest quality, making them a key driver of high-margin demand. While Turf and ornamentals represent a smaller but strategic segment, where cytokinins and specialized biostimulants are used to enhance aesthetics, stress tolerance, and shelf life. This segmentation shows a dual-market dynamic, where row crops drive volume through sustainability and efficiency, while fruits, vegetables, and ornamentals sustain value through quality enhancement and crop-specific precision.

By Application Method Insights

Are Foliar Sprays, Soil Treatments, Seed Treatments, and Fertigation Defining Application Choices in 2025?

Based on application method, the plant growth regulators and biostimulants market is divided into foliar spray, soil treatment, seed treatment, fertigation and others.

Each segment of application methods reflects a distinct agronomic strategy. Foliar sprays dominate because they enable rapid uptake and visible results in stress mitigation and crop quality enhancement. Soil treatments, on the other hand, are favored for improving root development and long-term soil–plant interactions, especially when microbial biostimulants are used to boost rhizosphere activity. Seed treatments are increasingly important for ensuring early vigor and uniform establishment, allowing farmers to reduce input dependency later in the season. Fertigation stands out in regions with advanced irrigation systems, delivering precise and efficient input use directly through water channels. This segmentation reflects a balanced adoption landscape where foliar sprays provide immediate impact, while soil and seed-based methods build resilience and long-term efficiency, with fertigation offering the highest precision in controlled environments.

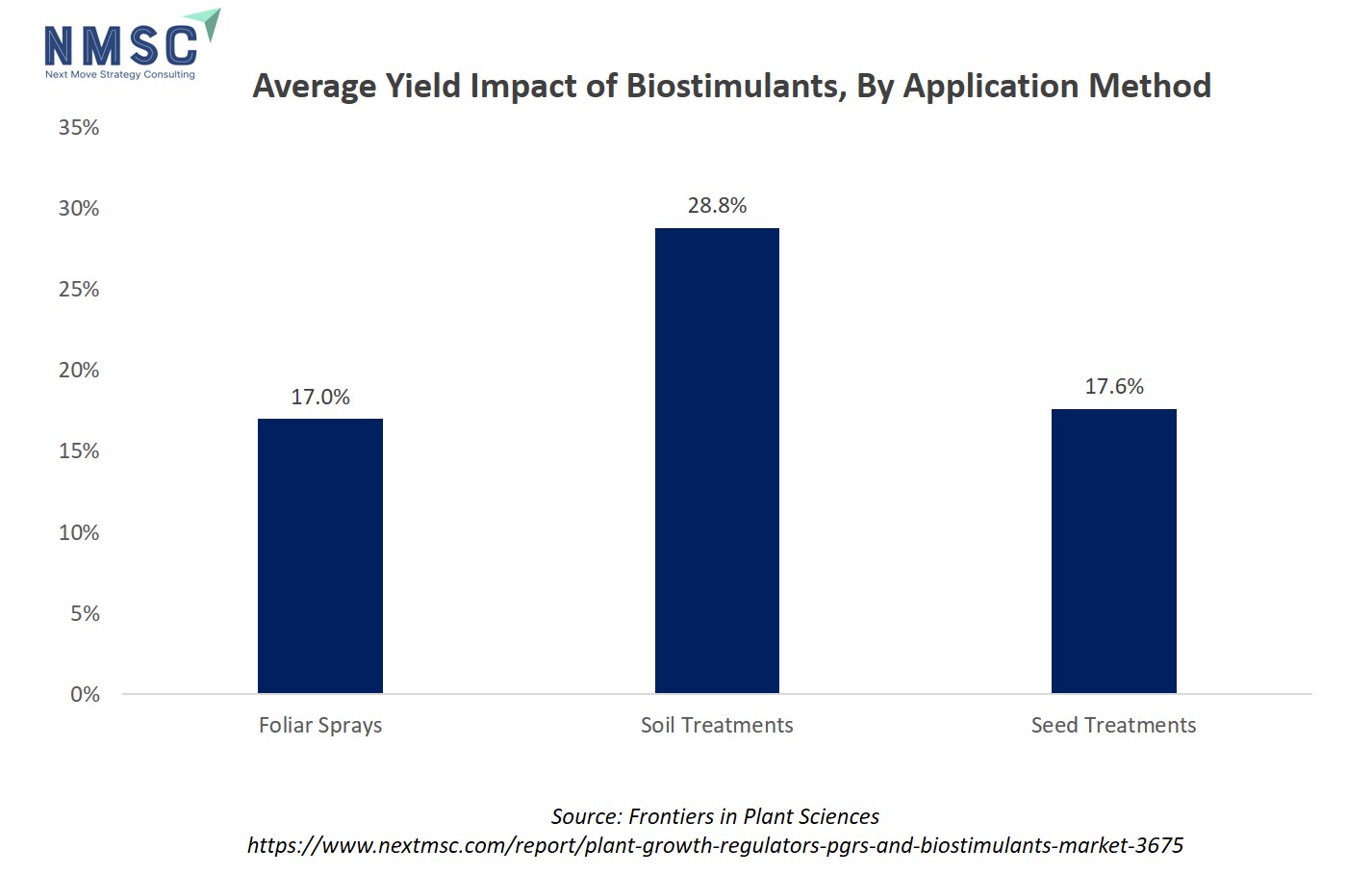

The given chart illustrates the average yield impact of biostimulants based on application method, highlighting that soil treatments deliver the highest yield increase at 28.8%, followed by seed treatments (17.6%) and foliar sprays (17.0%). The chart underscores the significant effectiveness of soil-applied biostimulants, which likely benefit from direct nutrient delivery and sustained availability to crops, while seed and foliar applications provide moderate but consistent improvements in early growth and overall productivity. Overall, this visual emphasizes that application method is a critical factor in optimizing crop yield outcomes with biostimulant use, guiding growers in strategic input selection

By Mode of Action or Purpose Insights

Are Growth Regulation, Stress Protection, Nutrient Use Efficiency, and Quality Enhancement Driving Market Adoption in 2025?

Based on mode of action or purpose, the plant growth regulators and biostimulants market is segmented into growth regulation, stress protection, nutrient use efficiency, root stimulation, flower and fruit set enhancement, yield enhancement and quality, post-harvest quality and shelf life.

Growth regulation remains core in high-value crops where auxins, gibberellins, and cytokinins shape canopy architecture, fruiting, and harvest timing. Stress protection is increasingly critical as climate variability intensifies, with biostimulants helping plants withstand drought, salinity, and temperature extremes. Nutrient use efficiency has become a policy-aligned driver, as farmers aim to reduce fertilizer dependency while maintaining yields. Root stimulation and early vigor support establishment in both row crops and horticulture, reducing downstream risks. Flower and fruit set enhancers are valued in orchards and vineyards where uniformity and size directly affect revenues. Yield enhancement and quality improvement are broad objectives across crops, while post-harvest quality and shelf-life interventions secure value along the supply chain. Together, this segmentation reflects how immediate physiological control from PGRs complements the resilience and efficiency focus of biostimulants, aligning market adoption with both farm-level productivity and sustainability priorities.

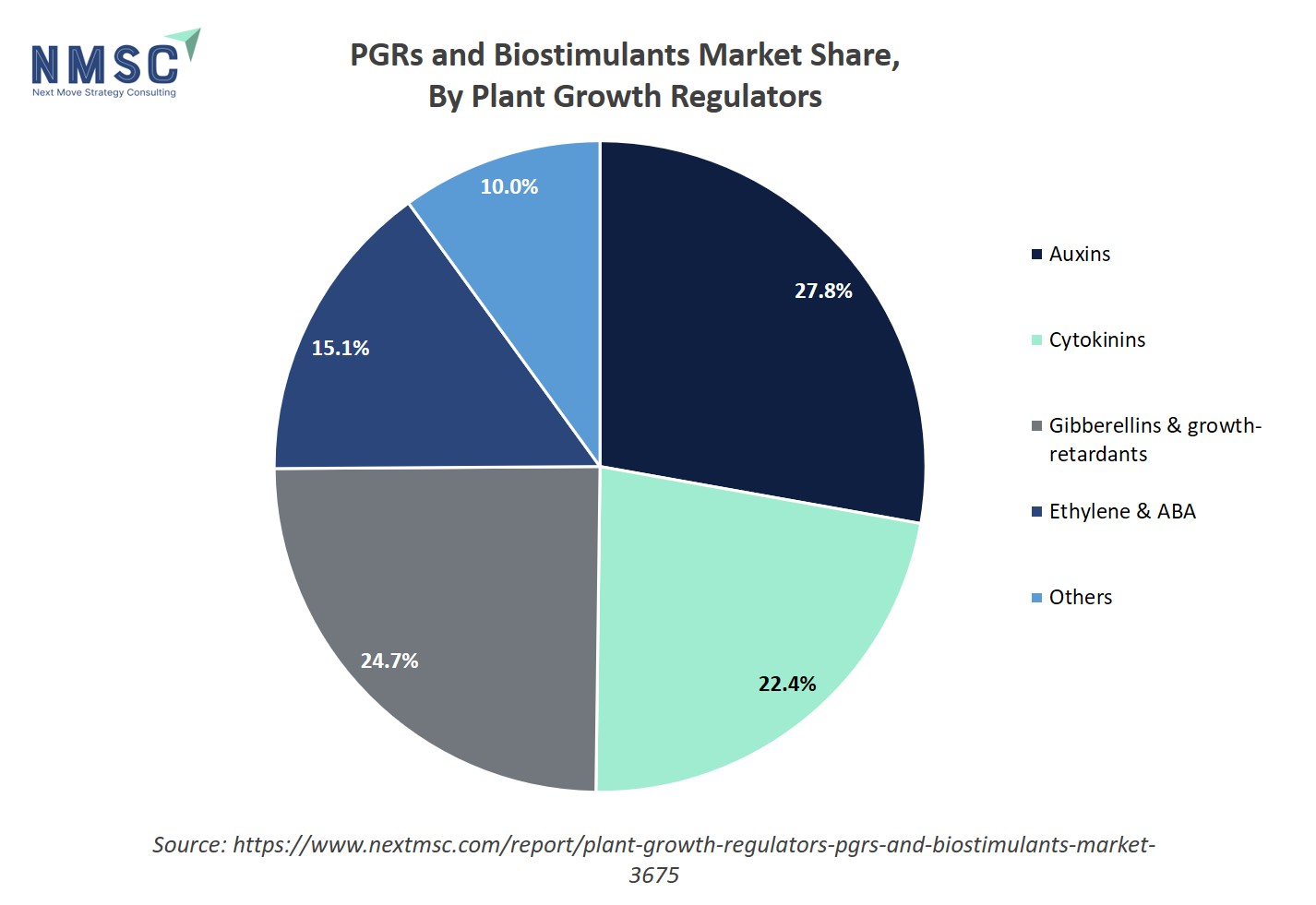

The above chart illustrates the market share by type, highlighting that auxins dominate with 27.8%, trailed by gibberellins & growth-retardants at 24.7%, cytokinins at 22.4%, ethylene & ABA at 15.1%, and other types making up 10%. This balanced market structure reflects both the importance and diverse utility of each category across agricultural practices. The substantial shares held by multiple regulator types indicate strong, widespread adoption, which drives ongoing product development, targeted crop solutions, and overall expansion of the sector, thanks to rising demand in sustainable and precision agriculture.

By End-User Insights

Are Large Farms, Smallholders, Greenhouses, and Institutional Buyers Shaping End-User Demand in 2025?

Based on end-user, the plant growth regulators and biostimulants industry is bifurcated into large commercial farms, smallholder farms, greenhouse commercial growers, nurseries and landscapers, seed companies, contract growers and processors, and institutional buyers and cooperatives.

Large commercial farms drive volume demand, adopting PGRs for growth regulation and biostimulants for nutrient efficiency and stress tolerance at scale. Smallholders, though resource-constrained, increasingly integrate affordable biostimulants to improve resilience under climate stress. Greenhouse growers and nurseries represent precision users, focusing on rooting, flowering, and uniformity for high-value crops and ornamentals. Seed companies employ coatings and microbial inoculants to boost germination and seedling vigour, embedding biostimulants early in the production chain. Contract growers and processors emphasize quality consistency to meet supply agreements, making post-harvest and fruit set solutions critical. Finally, institutional buyers and cooperatives influence collective adoption by promoting sustainable inputs across member networks. This segmentation highlights a dual dynamic: large-scale farms and institutions shape volume and policy-driven adoption, while specialized growers and seed companies sustain innovation and quality-driven demand.

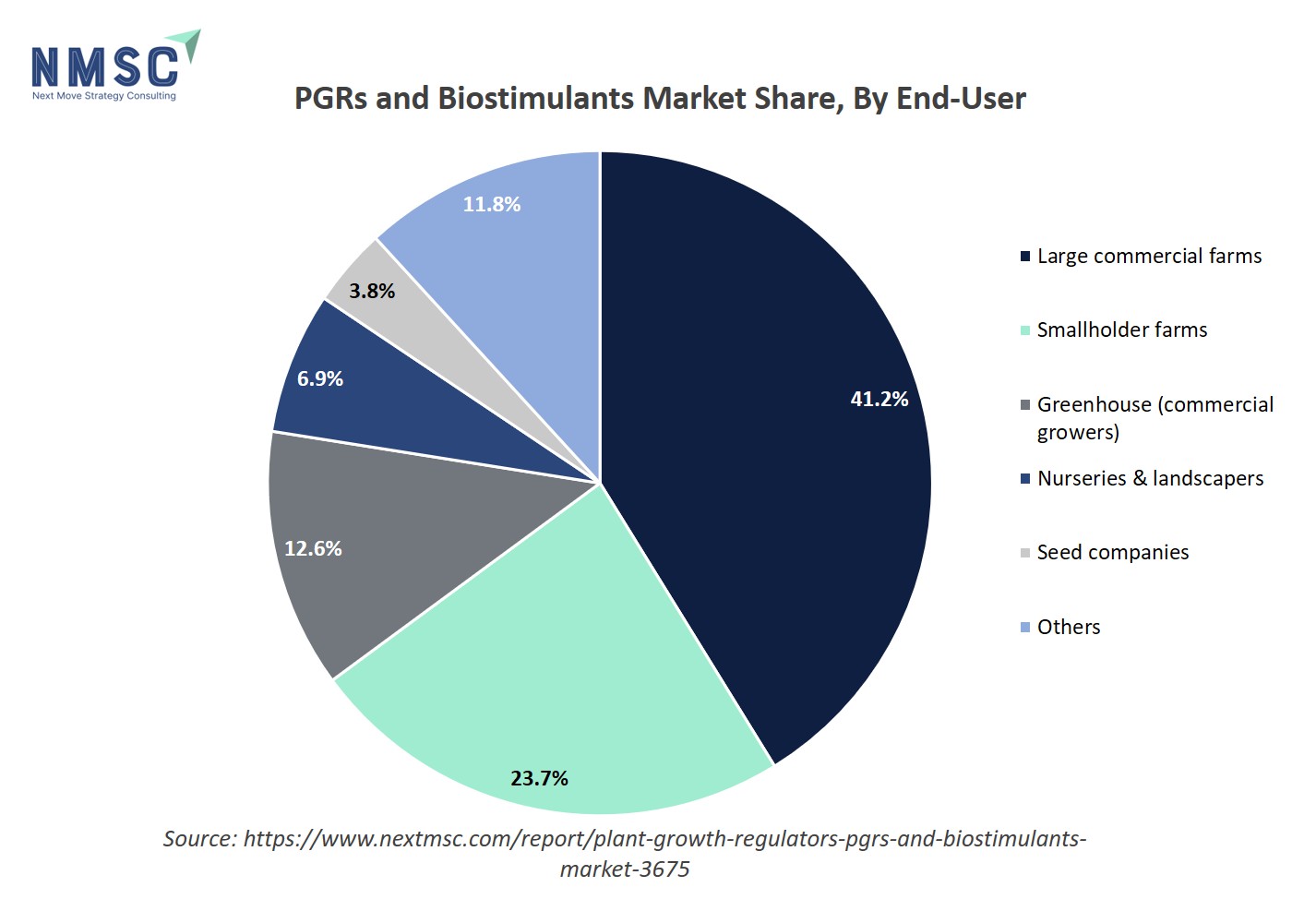

The above chart presents the market share by end-user segment, revealing that large commercial farms dominate with 41.2%, followed by smallholder farms at 23.7%, greenhouse commercial growers at 12.6%, others at 11.8%, nurseries & landscapers at 6.9%, and seed companies at 3.8%. This concentration in large-scale and smallholder farming highlights the sector’s pivotal role in driving demand and innovation for plant growth regulators, as these user groups seek enhanced yields and sustainability. The broad adoption across diverse end-users underpins a robust growth trajectory for the PGRs and biostimulants market, propelled by agricultural intensification, resource optimization, and evolving farming practices.

Regional Outlook

The plant growth regulators and biostimulants market share is geographically studied across North America, Europe, Asia Pacific, and the Middle East & Africa, and each region is further studied across countries.

PGRs and Biostimulants Market in North America

North America exhibits a mature, innovation-driven market where precision agriculture and integrated crop-management practices support steady adoption. Farmers and distributors favour proven ROI solutions such as foliar biostimulants and seed treatments. Regulatory clarity and private-sector R&D investments in the U.S. drive commercialisation, while Canada shows targeted uptake across horticulture and specialty crops, supporting incremental market expansion.

PGRs and Biostimulants Market in the United States

The U.S. market leads in product innovation, large-scale trials and channel partnerships with ag-retailers and farm services. Grower demand focuses on yield resilience, stress mitigation and input-efficiency, which benefits microbial and seaweed-based biostimulants as well as specific PGR formulations. Private investment and pilot programmes accelerate adoption across row crops and high-value horticulture, creating a mature but steadily growing market.

Government Policies and Initiatives Supporting Biostimulant Adoption by Region:

|

Region/Country |

Initiative / Policy |

Focus Area |

|

USA |

Farm Bill 2024 |

Specialty crops & sustainable ag |

|

EU |

Green Deal / Farm to Fork |

Reduce chemical use, promote Biostimulants |

|

India |

NMSA |

Organic inputs & Biostimulants |

|

China |

National Agricultural Tech Extension |

Promote PGRs & Biostimulants |

The table above provides an overview of how governments worldwide are supporting the adoption of sustainable agricultural practices through strategic initiatives. It reflects a broader trend of policy-driven efforts to enhance crop productivity, reduce reliance on chemical inputs, and encourage innovative solutions like PGRs and biostimulants.

By highlighting targeted programs across different regions, the table underscores the increasing role of government frameworks in shaping agricultural modernization, promoting environmental sustainability, and enabling farmers to implement advanced crop management techniques.

PGRs and Biostimulants Market in Canada

Canada’s market is influenced by regional cropping systems, canola, cereals and horticulture, and by sustainability-driven incentives. Adoption is concentrated where clear yield or quality benefits are demonstrated under local conditions. Cold-climate product formulations and targeted agronomy services help suppliers win trust. The pace of uptake is measured but consistent, with opportunities in controlled-environment agriculture and specialty crop.

PGRs and Biostimulants Market in Europe

Europe is a leading region for market adoption, propelled by regulatory frameworks such as the Fertilising Products Regulation that provide clearer market pathways. High farm-level adoption in specialty crops, horticulture, and some row crops is driven by sustainability targets and consumer demand for reduced residues. Suppliers emphasize scientific validation, traceability, and cross-border compliance within the EU single market. Innovation clusters, cooperative extension services, and grant-funded trials underpin commercialization. Robust demo plots, local extension support, and measurable ROI data attract growers.

PGRs and Biostimulants Market in the United Kingdom

The plant growth regulators and biostimulants market in the U.K. reflects post-Brexit regulatory shifts and a renewed focus on domestic agricultural priorities, with growers seeking inputs that improve crop quality, resilience, and resource efficiency. Horticulture, turf, and specialized producers show particular interest in products that offer traceable benefits and residue reductions for premium markets. Commercial channels emphasize demonstrable field trials, agronomy-backed claims, and strong distributor relationships to persuade conservative adopters and scale effective solutions. Local trials, agronomy services and ROI data are essential.

PGRs and Biostimulants Market in Germany

Germany blends strong agricultural research, an advanced ag-tech ecosystem, and sizable horticulture and vegetable sectors that are receptive to scientifically validated biostimulants and PGRs. Farmers and advisors seek products that align with environmental policy goals and demonstrate consistent outcomes under regional conditions. The market is competitive, and success depends on robust data, traceable sourcing, and effective agronomy support. Suppliers offering local trials, training, and clear ROI evidence win.

PGRs and Biostimulants Market in France

France’s diverse cropping landscape, spanning cereals, vineyards, fruits, and vegetables, creates broad demand for targeted PGRs and biostimulants that enhance quality, resilience, and yield stability. Cooperative advisory networks and local extension services are influential in disseminating trial data and agronomic recommendations, helping suppliers build credibility. Grower priorities often emphasize premium crop quality and disease resilience for domestic and export markets, which favors products with validated benefits and clear residue profiles. Suppliers that provide localized trials, agronomy support, and clear ROI messaging tend to succeed.

PGRs and Biostimulants Market in Spain

Spain leverages its substantial fruit, vegetable, and olive sectors to trial biostimulants and PGRs focused on drought resilience, water-use efficiency, and quality improvement. Distribution networks and regional agronomy services are critical to reach fragmented farms across diverse climates. Growers favor cost-effective, field-proven solutions that demonstrably reduce irrigation needs or improve crop grades. Collaborative trials with universities and cooperatives support product credibility, while export-oriented producers demand residue-conscious inputs. Locally tailored formulations plus trials, training and ROI evidence win.

PGRs and Biostimulants Market in Italy

Italy’s horticulture, fruit, and viticulture sectors present strong opportunities for the plant growth regulators and biostimulants market expansion that improve fruit set, quality, and stress tolerance. Regional cooperatives and consultants play a central role in technology transfer, helping suppliers prove local relevance through field trials and demonstrations. Growers prioritize solutions that enhance produce grades and meet export standards while supporting sustainable practices. Market uptake is focused in high-value regions, where an emphasis on quality and traceability drives purchasing decisions. Strong demo plots, local extension support, and clear ROI evidence build adoption.

PGRs and Biostimulants Market in the Nordics

Nordic countries emphasize sustainability, organic agriculture, and technological precision, creating niche demand for certified, eco-friendly biostimulants and PGRs that align with low-input systems and climate resilience goals. Controlled-environment production and high-value horticulture adopt innovative solutions faster, driven by traceability and strict environmental standards. The market is smaller but premium-oriented, favoring products with strong certification and scientific backing. Suppliers offering local trials, training, and clear ROI evidence win.

PGRs and Biostimulants Market in Asia Pacific

Asia-Pacific is the fastest-growing region in the plant growth regulators and biostimulants market, propelled by rising food demand, yield gaps, and the need for input-efficient agricultural practices across heterogeneous farming systems. Intensive horticulture, rice, plantation crops, and emerging commercial row-crop sectors create differentiated product needs. Local manufacturers and multinational suppliers compete on formulation relevance, price, and regional distribution reach. Government programmes, pilot projects, and expanded ag-retail networks accelerate adoption, while localized agronomy support remains critical. Suppliers that provide localized trials, agronomy support, and clear ROI messaging tend to succeed.

PGRs and Biostimulants Market in China

China’s biostimulants and PGR market is expanding rapidly, supported by government emphasis on productivity, quality, and reduced environmental impact. Domestic companies scale manufacturing and regional distribution while tailoring formulations to local cropping patterns. Large-scale horticulture and cash-crop sectors are early adopters, and commercial agronomy services facilitate product trials and farmer education. Regulatory pathways continue to evolve, and suppliers that can demonstrate localized efficacy and strong supply-chain traceability capture market share. Local trials, agronomy services and ROI data are essential.

PGRs and Biostimulants Market in Japan

Japan focuses on high-value horticulture, strict quality standards, and precision application, favoring biostimulants and PGRs that reliably enhance quality, shelf-life, and resource efficiency. Growers are conservative but willing to adopt products with robust trial data and clear economic benefits, especially in greenhouse and specialty crop systems. Traceability and compliance with stringent regulations are essential for market acceptance. Niche opportunities abound in urban and controlled-environment production where premium pricing offsets input costs. Locally tailored formulations, trials and agronomy support build trust.

PGRs and Biostimulants Market in India

India’s market is rapidly expanding due to yield gaps, diverse smallholder systems, and increased penetration of commercial agri-input channels. Seaweed extracts, microbial inoculants, and targeted PGRs gain traction for stress mitigation and productivity improvements across cereals, horticulture, and cash crops. Fragmented distribution and local agronomic variability demand tailored formulations and strong extension support. Local manufacturers and startups play a large role, while demonstration plots and agronomy partnerships are key to farmer adoption. Suppliers offering local trials, training, and clear ROI evidence win.

The above infographic illustrates fertilizer usage in key countries, measured in kilograms per hectare of arable land. China (397.7 kg/ha) and Brazil (363 kg/ha) lead in consumption, while India (193 kg/ha) shows moderate levels, and the U.S. (128 kg/ha) and Spain (111 kg/ha) remain relatively low. This heavy reliance on chemical fertilizers underscores the need for high crop yields but also raises sustainability concerns. Consequently, the PGRs and biostimulants market is closely linked, as these solutions enhance nutrient efficiency, reduce chemical dependency, and support more sustainable agricultural practices.

PGRs and Biostimulants Market in South Korea

South Korea’s plant growth regulators and biostimulants market is innovation-driven and focused on high-value horticulture, controlled-environment farming, and consistent quality for premium domestic and export markets. Strong R&D institutions and regulatory oversight ensure products are evidence-based and traceable, which builds grower confidence. Adoption rates are moderate given small domestic acreage, but controlled-environment producers and greenhouse operators are early adopters. Success depends on clear benefits for quality, shelf-life, and labour efficiency. Strong demo plots, local extension support, and clear ROI evidence build adoption.

PGRs and Biostimulants Market in Taiwan

Taiwan’s plant growth regulators and biostimulants market is driven by intensive, high-value horticulture, fruit crops, tea and greenhouse production where growers prioritise quality, shelf-life and residue control for export and domestic premium markets. Limited arable land and advanced controlled-environment farming promote precision application and early adoption of targeted PGRs and microbial biostimulants. Strong local R&D, university extension and specialty distributors help validate new products, while regulatory oversight and traceability demand favour scientifically backed formulations. Opportunities exist in urban farming, floriculture, post-harvest quality solutions and distributor-led demonstration programmes.

PGRs and Biostimulants Market in Indonesia

Indonesia’s tropical cropping systems and extensive plantation sectors, including palm, rubber, and rice, offer significant potential for biostimulants and PGRs that address stress management and productivity. Distribution challenges across islands and fragmented smallholder networks require localized agronomy expertise and robust supply chains. Palm and plantation companies may adopt at scale if cost-benefit is clear, while smallholders need affordable, easy-to-apply solutions. Partnerships with local distributors and extension services are essential. Suppliers that provide localized trials, agronomy support, and clear ROI messaging tend to succeed.

PGRs and Biostimulants Market in Australia

Australia prioritizes inputs that enhance water-use efficiency, salinity tolerance, and crop quality across diverse climates from horticulture to broadacre farming. Growers are pragmatic and adopt products that provide clear yield benefits or input savings, validated through regional trials and extension services. Export-oriented horticulture drives demand for residue-reduction and quality-enhancing inputs. The market favors well-documented results, strong agronomy support, and products adapted to local environmental constraints. Locally tailored formulations plus trials, training and ROI evidence win.

PGRs and Biostimulants Market in Latin America

Latin America blends large commercial row-crop production with a wide range of smallholder systems, creating demand for scalable, cost-effective biostimulants and PGRs. Brazil and Argentina lead adoption in soybean, maize, and specialty crops, with suppliers focusing on formulation robustness and supply-chain reach. Logistics, regulatory clarity, and agronomy support determine success across varied geographies. Large commercial farms can deploy at scale, while smallholders require tailored low-cost solutions and training. Suppliers that provide localized trials, agronomy support, and clear ROI messaging tend to succeed.

PGRs and Biostimulants Market in the Middle East & Africa

Middle East & Africa prioritize water-use efficiency, salinity management, and stress tolerance, making biostimulants and PGRs attractive for arid and semi-arid farming systems. Adoption is uneven: irrigated commercial farms and high-value horticulture lead uptake, while broad smallholder adoption is limited by distribution, cost, and awareness. Successful commercialization hinges on demonstration projects, government initiatives, and partnerships with agronomy providers to prove value under local conditions. Robust demo plots, local extension support, and measurable ROI data attract growers.

Competitive Landscape

Which Companies Dominate the PGRs and Biostimulants Market and How do they Compete?

The global plant growth regulators and biostimulants industry is led by established agribusiness leaders such as BASF SE, Bayer AG, Syngenta Group AG, Corteva Agriscience, UPL Ltd., FMC Corporation, Koppert Biological Systems B.V., Nufarm Limited, and others, alongside a growing base of regional innovators. These companies are fuelling market expansion through consistent investment in biological R&D, microbial technologies, and advanced formulations.

Their strategies focus on enhancing nutrient-use efficiency, boosting stress resilience, and aligning with sustainable farming standards. With rising pressure to reduce synthetic fertilizer dependency, leaders are launching integrated crop solutions that combine biostimulants, seed treatments, and precision application tools to deliver measurable yield gains.

The competitive landscape of the plant growth regulators and biostimulants market is being reshaped by regulatory clarity, sustainability agendas, and digital agriculture adoption. Major players are strengthening their positions via acquisitions of biotech specialists, partnerships with research institutes, and expansion into high-growth regions across Asia-Pacific and Latin America.

At the same time, innovators are embedding biostimulant portfolios into precision-farming platforms, leveraging data-driven prescriptions and adaptive formulations to tackle crop- and climate-specific needs. As agriculture transitions toward greener practices, companies that balance science-backed efficacy with scalability are capturing both regulatory trust and farmer loyalty, positioning themselves at the forefront of the biological input’s revolution.

Market dominated by PGRs and Biostimulants Giants and Specialists

Global agribusiness giants, such as, BASF, Bayer, Syngenta, Corteva compete with specialist biological firms, like, Koppert, Nufarm Limited, Valent BioSciences LLC and regional players such as UPL in a two-speed market. The multinationals bring scale, distribution and bundling with seed and crop-protection portfolios, while specialists supply differentiated biologics, niche actives, and faster innovation cycles that appeal to organic and premium channels. Regional formulators and seed houses then localize offerings for specific crops and soils, so market share is won via both broad-channel reach and regionally tuned product portfolios which is a dynamic that keeps both consolidation and partnership strategies active.

Innovation and Adaptability Drive Market Success

Winners are those pairing novel actives with delivery and digital agronomy. Bayer and Corteva are investing heavily in R&D pipelines and biologicals integration (Corteva’s biological revenues and targets highlight the strategy), while BASF leverages partnerships and co-development to add seaweed and microbial lines. Fast-moving specialists push mechanism-level science and trial data to shorten adoption cycles, and seed/precision-ag tie-ups (prescription dosing, seed treatments) improve repeatability, so technical depth plus go-to-market agility determines who converts trials into recurring sales.

Market Players to Opt for Merger & Acquisition Strategies to Expand Their Presence

Consolidation and alliances are busy levers. Larger firms use acquisitions and strategic deals to buy capabilities and feedstocks, such as BASF’s 2024 partnerships to broaden seaweed and biostimulant offerings, while regional acquirers and specialist consolidators also moved in 2024–25, such as PI Industries’ 2024 deal for Plant Health Care; similarly, Olmix and other biosourced groups completing bolt-on buys. Start-up buys (nutrient-efficiency or microbial tech) and co-development agreements speed market entry, reduce time-to-label and provide distribution scale, a playbook buyers and sellers repeat to de-risk biological product rollouts.

List of Key PGRs and Biostimulants Companies

-

Corteva Agriscience LLC

-

Syngenta Group AG

-

Nufarm Limited

-

Bayer AG

-

Valent BioSciences LLC

-

SICIT Group S.p.A.

-

UPL Limited

-

Sumitomo Chemical Co., Ltd.

-

Nippon Soda Co., Ltd.

-

CH Biotech R&D Co., Ltd.

-

Biolchim S.p.A.

-

Italpollina S.p.A. (Hello Nature group)

-

Rovensa Group (Rovensa Next / Tradecorp)

-

Koppert Biological Systems B.V.

-

Acadian Seaplants Limited (Acadian Plant Health / Kelpak)

-

Kemin Industries (Kemin Crop Technologies)

-

Mycorrhizal Applications LLC (MycoApply)

-

Novozymes A/S (BioAg)

What Are The Latest Key Industry Developments?

-

June 2025- Corteva, through its Catalyst platform, led Symbiomics’ Series A funding round, marking its first investment in Brazil to scale its microbial discovery platform for developing next-generation biostimulants. The funding will accelerate Symbiomics’ microbial discovery platform, aimed at developing next-generation biological solutions, and strengthens Corteva’s global push to expand innovation and leadership in the biologicals segment.

-

February 2025- UPL, in partnership with Novonesis, launched NIMAXXA in Brazil, the country’s first biostimulant bionematicide. The product provides both nematode protection and crop stimulation in a single, shelf-stable seed treatment, showcasing a major step forward in innovative formulation and dual-action biological solutions.

-

February 2025- BASF reported outcomes from its Pragati sustainable castor program in India, where certified farmers used integrated solutions, including biostimulants, to achieve higher yields and resilience.

-

November 2024- Corteva highlighted biologicals, including biostimulants and plant growth regulators, as a USD 1 billion growth engine through 2027, embedding them alongside digital tools and crop protection.

-

October 2024- BASF partnered with Acadian Plant Health to launch seaweed-based biostimulants, designed to improve stress resilience and crop performance. This move expands BASF’s biostimulant portfolio and strengthens its role in sustainable farming.

What Are The Key Factors Influencing Investment Analysis & Opportunities In The Pgrs And Biostimulants Market?

Investment activity in the PGRs and biostimulants market has accelerated in 2024-2025, with global agribusinesses and venture capital increasingly targeting biological inputs. Funding trends show strong support for startups advancing microbial biostimulants, seed treatments, and stress-resilience products, reflecting agriculture’s pivot toward sustainable intensification.

For instance, Corteva’s Catalyst investment arm and UPL’s partnerships highlight a growing appetite for early-stage innovation. Valuations in this segment remain robust, as investors view biologicals as essential to reducing fertilizer dependency and meeting carbon-neutral farming goals.

Emerging investment hotspots include Brazil, India, and Southeast Asia, where high crop diversity and government backing for low-chemical farming create scalable opportunities. European and North American markets remain attractive for premium, regulatory-approved products. For companies and investors, aligning portfolios with sustainability standards and climate-smart agriculture is proving to be a key differentiator in capturing long-term value.

Key Benefits for Stakeholders:

Next Move Strategy Consulting (NMSC) presents a comprehensive analysis of the worldwide Plant Growth Regulators (PGRs) and Biostimulants Market, covering historical trends from 2020 through 2024 and offering detailed forecasts through 2030. Our study examines the market at global, regional, and country levels, providing quantitative projections and insights into key growth drivers, challenges, and investment opportunities across all major market segments.

Report Scope:

|

Parameters |

Details |

|

Market Size in 2025 |

USD 7.99 Billion |

|

Revenue Forecast in 2030 |

USD 12.34 Billion |

|

Growth Rate |

CAGR of 9.08% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

28 |

|

Companies Profiled |

20 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent to up to 80 analyst-working hours) after purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

|

Approach |

In-depth primary and secondary research; proprietary databases; rigorous quality control and validation measures. |

|

Analytical Tools |

Porter's Five Forces, SWOT, value chain, and Harvey ball analysis to assess competitive intensity, stakeholder roles, and relative impact of key factors. |

PGRs & Biostimulants Market Key Segments

By Product Type

-

Plant growth regulators

-

Auxins

-

Gibberellins

-

Cytokinins

-

Abscisic acid modulators

-

Ethylene modulators

-

Other PGRs

-

-

Biostimulants

-

Microbial biostimulants

-

Plant growth promoting bacteria

-

Mycorrhizal fungi

-

Other microbial agents

-

-

Non microbial biostimulants

-

Seaweed extracts

-

Humic substances

-

Fulvic substances

-

Protein hydrolysates and amino acids

-

Plant extracts and metabolites

-

Chitosan and biopolymers

-

Inorganic stimulants

-

Others

-

-

By Formulation

-

Liquid concentrate

-

Water-soluble powder

-

Suspension concentrates

-

Granule

-

Seed coating formulation

-

Others

By Crop Type

-

Row Crops

-

Fruits and Vegetables

-

Turf and Ornamentals

-

Others

By Application Method

-

Foliar spray

-

Soil Treatment

-

Seed Treatment

-

Fertigation

-

Others

By Mode of Action or Purpose

-

Growth regulation

-

Stress protection

-

Nutrient use efficiency

-

Root stimulation

-

Flower and fruit set enhancement

-

Yield enhancement and quality

-

Post harvest quality and shelf life

By End-User

-

Large commercial farms

-

Smallholder farms

-

Greenhouse commercial growers

-

Nurseries and landscapers

-

Seed companies

-

Contract growers and processors

-

Institutional buyers and cooperatives

Geographical Breakdown

-

North America: U.S., Canada, and Mexico.

-

Europe: U.K., Germany, France, Italy, Spain, Sweden, Denmark, Finland, Netherlands, and rest of Europe.

-

Asia Pacific: China, India, Japan, South Korea, Taiwan, Indonesia, Vietnam, Australia, Philippines, and rest of APAC.

-

Middle East & Africa (MENA): Saudi Arabia, UAE, Egypt, Israel, Turkey, Nigeria, South Africa, and rest of MENA.

-

Latin America: Brazil, Argentina, Chile, Colombia, and rest of LATAM

Conclusion & Recommendations

Our report equips stakeholders, industry participants, investors, policy-makers, and consultants with actionable intelligence to capitalize on PGRs and Biostimulants’s transformative potential. By combining robust data-driven analysis with strategic frameworks, NMSC’s PGRs and Biostimulants Market Report serves as an indispensable resource for navigating the evolving landscape.

Speak to Our Analyst

Speak to Our Analyst