Tank Trucking Market by Vehicle Type (Rigid Tank Trucks, Articulated Tank Trucks), by Tank Material (Stainless Steel, Aluminum, Carbon Steel), by Capacity (Small Capacity, Medium Capacity, Large Capacity), by Tank Type (Petroleum Tank, Chemicals Tank, Food and Beverages Tank, Water Tank, Gases Tank), by Drive Type, by Propulsion (Diesel, Natural Gas), by End-User (Food and Beverage Industry, Agriculture, Pharmaceuticals, Municipal Services) – Global Analysis & Forecast, 2025–2030.

Industry Outlook

The Tank Trucking Market size was valued at USD 163.61 billion in 2024, and is expected to be valued at USD 174.11 billion by the end of 2025. The industry is projected to grow, hitting USD 237.65 billion by 2030, with a CAGR of 6.42% between 2025 and 2030.

The tank trucking market is experiencing significant transformation, driven by technological advancements, regulatory compliance requirements, increasing demand for specialized transportation solutions, and growing emphasis on supply chain efficiency. Globally, demand for safe, reliable, and timely transportation of liquids and bulk materials is rising sharply, fueled by growth in the chemical, petroleum, food & beverage, and pharmaceutical industries. Expansion of digital fleet management, telematics, route optimization, and AI-powered logistics platforms further intensifies the need for operational efficiency, predictive maintenance, and real-time tracking solutions. Innovations in truck design, safety features, fuel efficiency, eco-friendly vehicles, and automated loading/unloading systems are reshaping industry workflows, enhancing service reliability, and strengthening competitiveness in an increasingly complex and regulated logistics landscape.

What are the Key Tank Trucking Market Trends?

What are the Major Technological Trends Shaping the Market?

Technological advancements are revolutionizing the Market, making operations safer, more efficient, and data-driven. The integration of AI and machine learning is optimizing route planning, predictive maintenance, fuel management, and fleet scheduling. Telematics and IoT sensors allow real-time monitoring of vehicle health, cargo conditions, and driver performance. Cloud-based fleet management platforms enable remote oversight, collaboration, and performance analytics, while autonomous driving technologies and semi-automated loading/unloading systems are beginning to redefine operational workflows. Additionally, innovations in fuel efficiency, eco-friendly vehicles, and carbon-emission monitoring are aligning the market with sustainability goals.

How is Demographic Change Influencing the Market?

Demographic shifts are indirectly shaping the Market through workforce dynamics, urbanization, and industrial demand. Younger, tech-savvy logistics professionals are driving adoption of digital fleet solutions, data analytics, and mobile monitoring systems. Rapid urbanization and industrial expansion are increasing demand for timely, reliable bulk transportation in both emerging and developed economies. Meanwhile, the aging workforce in some regions is creating opportunities for automation, safety innovations, and ergonomic vehicle design. Rising consumer expectations for faster delivery and high-quality product handling are also pressuring operators to invest in modernized fleets and technology-enabled solutions.

What Role does Government Support Play in Driving Tank Trucking Market Growth?

Government support plays a crucial role in expanding the market by promoting road safety, transportation infrastructure, and environmental compliance. Policies incentivizing clean fuel adoption, emissions reduction, and smart logistics technologies are encouraging fleet modernization. Regulatory frameworks for hazardous materials, cargo handling standards, and driver certification enhance operational safety and reliability. Additionally, infrastructure investments such as highways, industrial corridors, and smart transport hubs improve connectivity, reduce transit times, and boost market efficiency. Public-private partnerships and subsidies for sustainable fleet upgrades further accelerate industry growth.

How is Consumer Preference Changing in the Market?

Consumer and industrial clients are increasingly prioritizing reliability, safety, and sustainability in tank trucking services. Companies now prefer operators who provide real-time cargo tracking, timely delivery, and specialized transport solutions for hazardous or temperature-sensitive goods. Environmental responsibility, fuel efficiency, and transparent pricing are gaining importance. There is also a growing demand for digital interfaces and mobile apps that offer real-time updates, service customization, and predictive delivery schedules. Overall, the market is shifting from basic transportation services to technology-enabled, customer-centric, and sustainable logistics solutions that align with modern business and societal expectations.

What are the Key Market Drivers, Breakthroughs, And Investment Opportunities that will Shape the Industry in Next Decade?

The global Market is experiencing strong growth, driven by technological advancements, e-commerce expansion, and sustainability initiatives. Integration of IoT, telematics, AI-powered route optimization, and cloud-based fleet management is enhancing operational efficiency, safety, and reliability, while enabling predictive maintenance and cost optimization. The rise in demand for bulk liquid and temperature-sensitive product transportation is prompting operators to adopt specialized tank trucks and technology-enabled logistics solutions. Although high operational and maintenance costs pose challenges, opportunities from eco-friendly fleets, alternative fuels, and government incentives are encouraging modernization and sustainable practices, positioning the market for continued expansion in a technology-driven and environmentally conscious logistics landscape.

Growth Drivers:

How is Technological Advancements in Fleet Management Driving the Tank Trucking Market Demand?

Technological advancements are revolutionizing fleet management in the Market, driving efficiency, safety, and reliability. Integration of IoT sensors and telematics enables real-time monitoring of vehicle health, cargo conditions, and driver performance, supporting predictive maintenance and reducing operational downtime. AI-powered route optimization and advanced analytics improve fuel efficiency, delivery accuracy, and fleet utilization. Cloud-based platforms facilitate remote management, performance tracking, and collaborative planning across multiple regions. Automated reporting ensures compliance with safety and environmental regulations, while data-driven insights allow companies to anticipate demand and optimize resources. Together, these innovations enhance operational efficiency, reduce costs, and meet growing regulatory, sustainability, and customer expectations, making them a key driver of market growth.

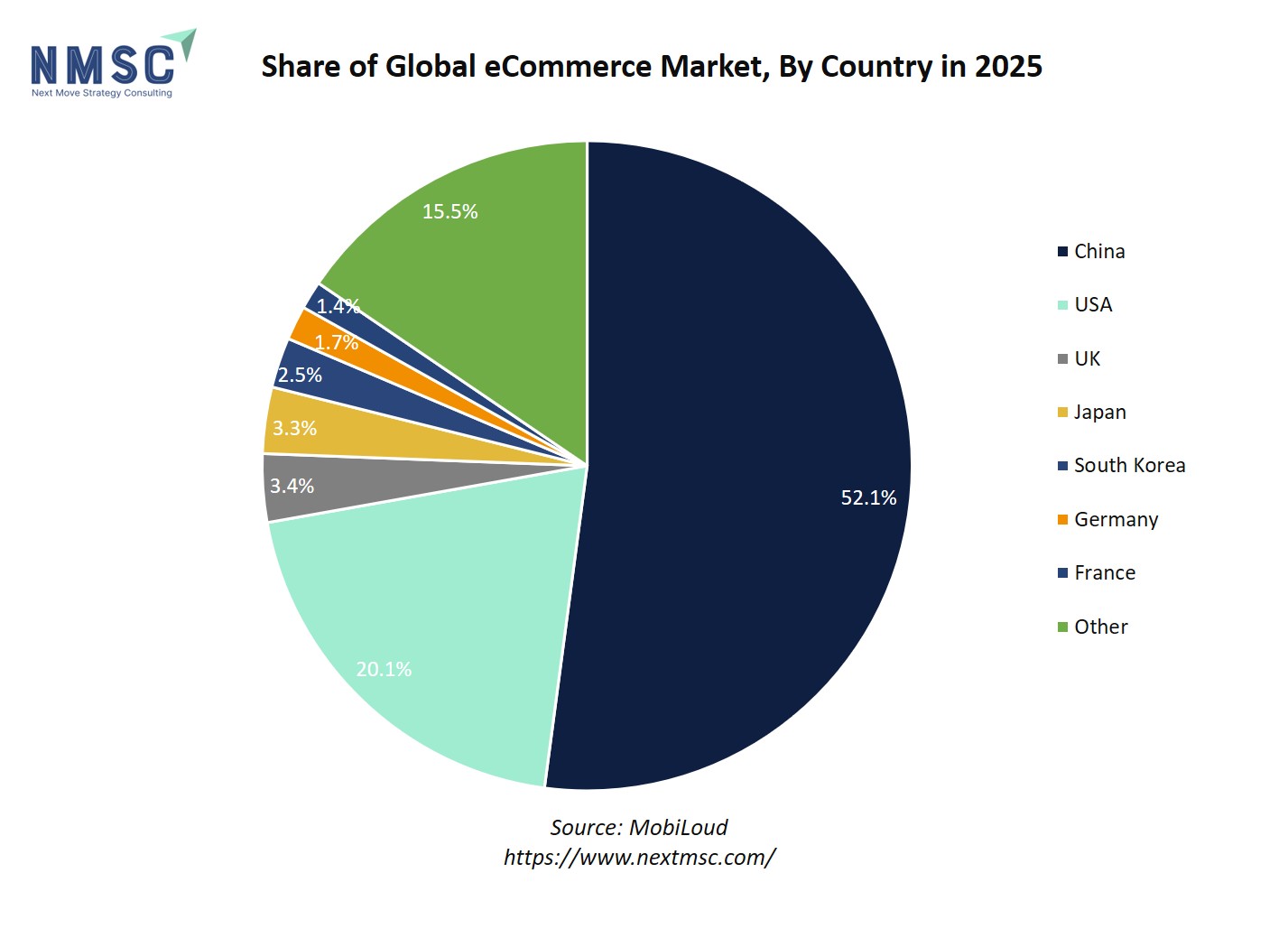

The pie chart depicts the global e-commerce market share by country in 2025. China dominates the market with a 52.1% share, accounting for over half of global e-commerce activity. The USA follows with 20.1%, while the UK and Japan contribute 3.4% and 3.3%, respectively. South Korea, Germany, and France hold smaller shares of 2.5%, 1.7%, and 1.4%, respectively. The remaining countries collectively represent 15.5% under the “Other” category.

The dominance of e-commerce in major markets is significantly influencing the tank trucking market. Countries with large e-commerce activity generate higher demand for timely and reliable transportation of bulk liquids, chemicals, and temperature-sensitive products, requiring specialized tank trucking solutions. For instance, markets with the largest e-commerce shares drive frequent shipments, pushing operators to adopt advanced fleet management technologies, route optimization, and real-time tracking systems to meet delivery expectations. Smaller but growing e-commerce regions also contribute to rising demand for flexible and scalable logistics services. Overall, the global expansion of e-commerce is accelerating the need for efficient, technology-enabled liquid bulk transport operations, supporting overall market growth.

Is E-commerce and Retail Sector Growth Accelerating the Market Expansion?

The rapid growth of e-commerce and the organized retail sector is significantly driving demand in the Market. Increasing consumption of bulk liquids, chemicals, food & beverages, and temperature-sensitive products requires specialized, timely, and reliable transportation solutions. Retailers and online platforms prioritize real-time delivery tracking, safe handling, and consistent supply chain performance, prompting fleet operators to adopt modern tank trucks and technology-enabled logistics services. Expansion of e-commerce in emerging markets and the rise of omni-channel retailing are further increasing shipment volumes and delivery frequency. This trend encourages investment in efficient fleet management systems, route optimization, and specialized tank truck designs, positioning e-commerce and retail growth as a crucial driver of market expansion.

Growth Inhibitors:

How does High Operational and Maintenance Costs Limit the Growth of the Tank Trucking Market?

The Market faces significant challenges due to high operational and maintenance costs. Specialized vehicles, advanced safety equipment, and compliance with regulatory standards require substantial investment. Additionally, fuel price volatility, driver wages, and ongoing maintenance of IoT-enabled or tech-integrated fleets further increase operational expenditures. Smaller operators struggle to absorb these costs, limiting market expansion and competitive pricing. These financial pressures slow fleet modernization and adoption of advanced technologies, acting as a key restraint for market growth, particularly in price-sensitive regions and emerging economies.

How is Adoption of Sustainable and Eco-Friendly Fleets Creating Opportunity for the Market?

Sustainability initiatives present a major growth opportunity in the Market. Increasing focus on low-emission vehicles, alternative fuels, and fuel-efficient technologies enables operators to reduce carbon footprints and comply with environmental regulations. Growing government incentives for clean transportation, along with rising customer preference for eco-conscious logistics partners, encourage investment in green fleets. Companies that adopt sustainable tank trucks and smart fuel management systems gain a competitive advantage, enhance brand reputation, and expand into environmentally regulated markets, making sustainability a key opportunity for market growth.

How Tank Trucking Market is Segmented in this Report, and What are the Key Insights from the Segmentation Analysis?

By Vehicle Type Insights

Which Vehicle Type is Expected to Drive the Tank Trucking Market in 2025?

On the basis of vehicle type, the market is segmented into rigid tank trucks, articulated tank trucks, and semi-tank trailers. The Market in 2025 is expected to be primarily driven by articulated tank trucks. These vehicles offer enhanced cargo capacity, flexibility, and efficiency for transporting large volumes of liquids, chemicals, and fuels, making them the preferred choice for large-scale industrial and commercial operations.

While other segments such as rigid tank trucks and semi-tank trailers are widely used for short-haul operations, regional deliveries, or specialized cargo, articulated tank trucks continue to hold the largest market share due to their versatility and ability to serve diverse industries. Additionally, semi-tank trailers are emerging as a high-potential category, driven by increasing demand for modular transport solutions, ease of loading/unloading, and compliance with evolving safety and regulatory standards in the logistics and chemical transportation sectors.

By Tank Material Insights

Which Tank Material is Expected to Drive the Tank Trucking Market in 2025?

On the basis of tank material, the market is segmented into stainless steel, aluminum, carbon steel, and composite materials. The Market in 2025 is expected to be primarily driven by stainless steel tanks. These tanks offer superior durability, corrosion resistance, and compatibility with a wide range of chemicals, food-grade liquids, and petroleum products, making them the preferred choice for both industrial and commercial transportation.

While other segments such as aluminum, carbon steel, and composite materials are used for specific applications like lightweight transport, cost-effective solutions, or specialized cargo, stainless steel tanks continue to hold the largest market share due to their versatility and long service life. Additionally, composite materials are emerging as a high-potential category, driven by growing demand for lightweight, high-strength, and environmentally friendly tank solutions in chemical and fuel transportation sectors.

By Capacity Insights

Which Tank Capacity Segment is Expected to Drive the Tank Trucking Market in 2025?

On the basis of capacity, the market is segmented into small capacity (up to 10,000 liters), medium capacity (10,001 to 25,000 liters), and large capacity (above 25,000 liters). The Market in 2025 is expected to be primarily driven by medium capacity tanks. These trucks strike a balance between operational efficiency and cargo volume, making them ideal for regional deliveries, industrial applications, and commercial liquid transport.

While small capacity tanks are widely used for local or specialized deliveries, and large capacity tanks cater to long-haul or bulk transport, medium capacity tanks continue to hold the largest share due to their versatility, cost-effectiveness, and suitability for a variety of industries. Additionally, large capacity tanks are emerging as a high-potential category, driven by increasing demand for bulk chemical, fuel, and food-grade liquid transportation that requires economies of scale and optimized logistics operations.

By Tank Type Insights

Which Tank Type is Expected to Drive the Tank Trucking Market in 2025?

On the basis of tank type, the market is segmented into petroleum tanks, chemicals tanks, food and beverages tanks, water tanks, gases tanks, and cryogenic liquids tanks. The Market in 2025 is expected to be primarily driven by chemicals tanks. These tanks are in high demand due to the growing need for safe, compliant, and efficient transportation of industrial chemicals, hazardous liquids, and specialty fluids across various sectors, including pharmaceuticals, petrochemicals, and manufacturing.

While petroleum tanks and food and beverages tanks are widely used in energy and FMCG sectors, chemicals tanks continue to hold the largest market share due to stringent safety regulations, rising industrial production, and the need for specialized corrosion-resistant materials. Additionally, cryogenic liquids tanks and gases tanks are emerging as high-potential categories, driven by increasing demand for liquefied gases, industrial refrigeration, and specialty medical and laboratory transport applications.

By Drive Type Insights

Which Drive Type is Expected to Drive the Tank Trucking Market in 2025?

On the basis of drive type, the market is segmented into 4x2, 6x2, 6x4, and 8x4. The Market in 2025 is expected to be primarily driven by 6x4 drive trucks. These trucks offer an optimal combination of power, load-carrying capacity, and maneuverability, making them suitable for long-haul operations, heavy liquid transport, and industrial deliveries.

While 4x2 drive trucks are commonly used for lighter loads and short-distance transport, and 8x4 trucks are specialized for extremely heavy or oversized cargo, 6x4 trucks continue to hold the largest market share due to their versatility across industries and road conditions. Additionally, 6x2 drive trucks are emerging as a high-potential segment, driven by growing demand for fuel-efficient, mid-capacity, and cost-effective transportation solutions in regional logistics and chemical transport sectors.

By Propulsion Insights

Which Propulsion Type is Expected to Drive the Tank Trucking Market in 2025?

On the basis of propulsion, the market is segmented into diesel, electric/hybrid, and natural gas. The Market in 2025 is expected to be primarily driven by diesel-powered trucks. Diesel engines continue to dominate due to their reliability, high torque, long driving range, and suitability for heavy-duty, long-haul tanker service operations across diverse terrains.

While electric/hybrid and natural gas trucks are gaining traction due to increasing focus on sustainability, emissions reduction, and government incentives, diesel trucks continue to hold the largest market share because of existing infrastructure, cost efficiency, and proven performance in transporting liquids, chemicals, and fuels. Additionally, electric/hybrid trucks are emerging as a high-potential segment, driven by growing environmental regulations, urban delivery needs, and investment in green logistics solutions.

By End-User Insights

Which End-User Segment is Expected to Drive the Tank Trucking Market in 2025?

On the basis of end-user, the market is segmented into oil and gas industry, chemical industry, food and beverage industry, agriculture, pharmaceuticals, and municipal services (water and waste management). The Market in 2025 is expected to be primarily driven by the oil and gas industry. This sector requires reliable, large-capacity tank trucks for the transportation of petroleum products, fuels, and other hydrocarbons, making it a major driver of demand in the tank trucking market.

While other segments such as the chemical industry and food and beverage industry are also witnessing strong growth due to regulatory compliance, hygiene standards, and specialized transport requirements, the oil and gas industry continues to hold the largest market share because of its high-volume operations, long-distance transportation needs, and critical supply chain requirements. Additionally, municipal services and pharmaceuticals are emerging as high-potential segments, driven by growing urbanization, demand for safe water supply, and temperature-controlled transport for sensitive medicinal products.

Regional Outlook

The market is geographically studied across North America, Europe, Asia Pacific, and the Middle East & Africa, and each region is further studied across countries.

Tank Trucking Market in North America

The North American market is driven by increasing industrial production, growth in e-commerce, and rising demand for safe and timely bulk liquid transportation. Expansion of chemical, petroleum, food & beverage, and pharmaceutical industries is boosting the need for specialized tank trucks. Adoption of IoT-enabled fleet management, route optimization, and predictive maintenance enhances operational efficiency and safety. Companies are also investing in sustainable vehicles and eco-friendly fuels to meet regulatory standards and customer expectations, supporting steady market growth across the region.

Tank Trucking Market in the United States

In the U.S. market growth is primarily fuelled by high demand for specialized and reliable bulk liquid transportation. Increasing adoption of digital fleet management, telematics, and AI-powered route optimization improves efficiency and reduces downtime. Growth in e-commerce, industrial manufacturing, and pharmaceuticals is driving demand for timely, secure, and temperature-controlled transport. Investments in eco-friendly trucks, automated monitoring systems, and predictive maintenance are further supporting market expansion.

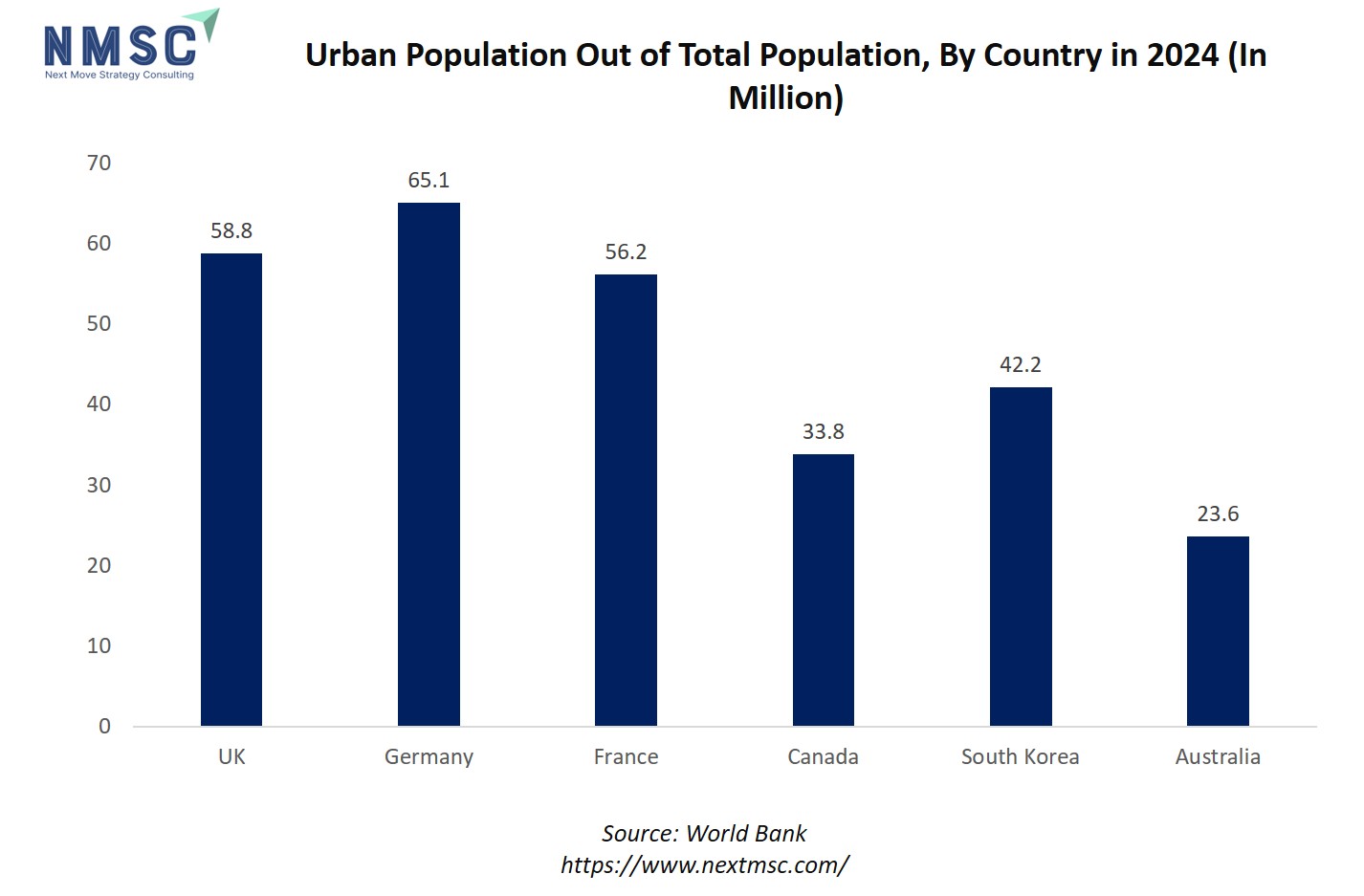

The bar chart illustrates the urban population (in millions) in 2024 across selected countries. Germany recorded the highest urban population at 65.05 million, followed by the United Kingdom with 58.76 million, and France with 56.21 million. Among the non-European nations, South Korea reported 42.17 million, Canada stood at 33.84 million, while Australia had the lowest urban population among the listed countries at 23.60 million.

The growing urban population across these regions significantly influences the tank trucking market, as urbanization drives higher consumption of fuels, chemicals, food-grade liquids, and essential resources that require efficient bulk transportation. Increased industrial activity, expanding logistics infrastructure, and rising demand for clean water and waste management services in densely populated urban centers are creating substantial opportunities for tank truck manufacturers and operators. This trend underscores the need for reliable, high-capacity, and environmentally sustainable tank trucking solutions to support the growing logistical and industrial needs of urban economies.

Tank Trucking Market in Canada

Canada’s market is growing due to the expansion of industrial hubs, chemical production, and food & beverage logistics. Rising adoption of digital fleet management, telematics, and predictive analytics is enhancing route planning, safety, and fuel efficiency. Demand for specialized tank trucks, including temperature-sensitive and hazardous material transport, is increasing. Sustainable fleet initiatives and compliance with environmental regulations are creating new opportunities for market growth.

Tank Trucking Market in Europe

The European market is supported by industrial growth, e-commerce expansion, and stringent regulatory requirements. Companies are investing in digital fleet management, IoT monitoring, and AI-based route optimization to improve delivery efficiency and safety. Rising focus on sustainable fleets, low-emission vehicles, and eco-friendly technologies is shaping market trends, while demand for bulk liquid and temperature-sensitive transport continues to grow across chemical, pharmaceutical, and food industries.

Tank Trucking Market in the United Kingdom

In the U.K., the market is driven by industrial production, e-commerce growth, and regulatory compliance for hazardous and bulk liquid transport. Adoption of digital fleet management, telematics, and route optimization technologies is improving delivery reliability and operational efficiency. Increasing awareness of sustainability and the shift toward fuel-efficient, low-emission vehicles are creating new opportunities for fleet modernization, supporting steady market growth.

Tank Trucking Market in Germany

Germany’s market is fuelled by industrial output, chemical and pharmaceutical production, and demand for safe, specialized tank transportation. Digitalization of fleet operations through IoT monitoring, AI-assisted logistics, and predictive maintenance is enhancing efficiency and reducing operational risks. Adoption of eco-friendly trucks and compliance with environmental standards further support market expansion, while high demand for bulk liquid and temperature-sensitive cargo ensures consistent growth.

Tank Trucking Market in France

In France, market growth is driven by industrial logistics, chemical and food & beverage transport, and e-commerce expansion. Companies are investing in digital fleet management, telematics, and AI-based route optimization to improve operational efficiency and safety. Rising focus on sustainable fleets, low-emission vehicles, and eco-friendly operations is encouraging fleet modernization, while demand for specialized tank trucks ensures steady market development across the country.

Tank Trucking Market in Spain

Spain’s market is driven by industrial growth, e-commerce expansion, and urbanization. Increasing demand for timely and safe transport of bulk liquids, chemicals, and temperature-sensitive products is encouraging fleet modernization. Adoption of digital fleet management, route optimization, and telematics enhances operational efficiency and delivery reliability. Investments in sustainable and low-emission vehicles are further supporting market expansion.

Tank Trucking Market in Italy

Italy’s market growth is supported by rising demand for specialized bulk liquid transport and chemical logistics. Companies are implementing AI-powered route optimization, predictive maintenance, and digital fleet monitoring to reduce operational costs and enhance safety. Growth in e-commerce, industrial production, and pharmaceuticals is driving steady demand for modernized tank trucking solutions.

Tank Trucking Market in the Nordics

In Nordic countries, the market is fueled by industrial expansion, high digital adoption, and regulatory compliance for hazardous and bulk liquid transport. Integration of IoT sensors, telematics, and predictive analytics improves fleet efficiency, safety, and delivery reliability. Emphasis on sustainable vehicles and low-emission technologies is shaping market trends and encouraging fleet modernization.

Tank Trucking Market in Asia Pacific

The Asia Pacific market is experiencing rapid growth due to industrialization, urbanization, and e-commerce expansion. Rising demand for specialized tank trucking for chemicals, food & beverages, and temperature-sensitive cargo is driving fleet upgrades. Adoption of digital fleet management, telematics, AI-assisted route planning, and sustainable vehicles is enhancing operational efficiency and safety, supporting market expansion across the region.

Tank Trucking Market in China

China’s market is driven by industrial growth, rapid e-commerce adoption, and high demand for specialized bulk liquid transport. Companies are leveraging AI-assisted fleet management, telematics, and predictive maintenance to improve delivery efficiency and safety. Investment in sustainable, low-emission trucks is increasing, supporting steady market growth.

Tank Trucking Market in Japan

Japan’s market growth is fueled by industrial logistics, e-commerce expansion, and the need for timely, safe, and specialized bulk liquid transport. Adoption of digital fleet management, telematics, and predictive maintenance is enhancing efficiency and safety, while investments in fuel-efficient and eco-friendly vehicles support sustainable growth.

Tank Trucking Market in India

India’s market is growing rapidly due to urbanization, industrialization, and rising e-commerce activity. Demand for specialized tank trucks for chemicals, food & beverages, and temperature-sensitive cargo, coupled with adoption of digital fleet management and predictive analytics, is driving efficiency and reliability. Sustainable and low-emission vehicles are increasingly being deployed to meet regulatory and environmental standards.

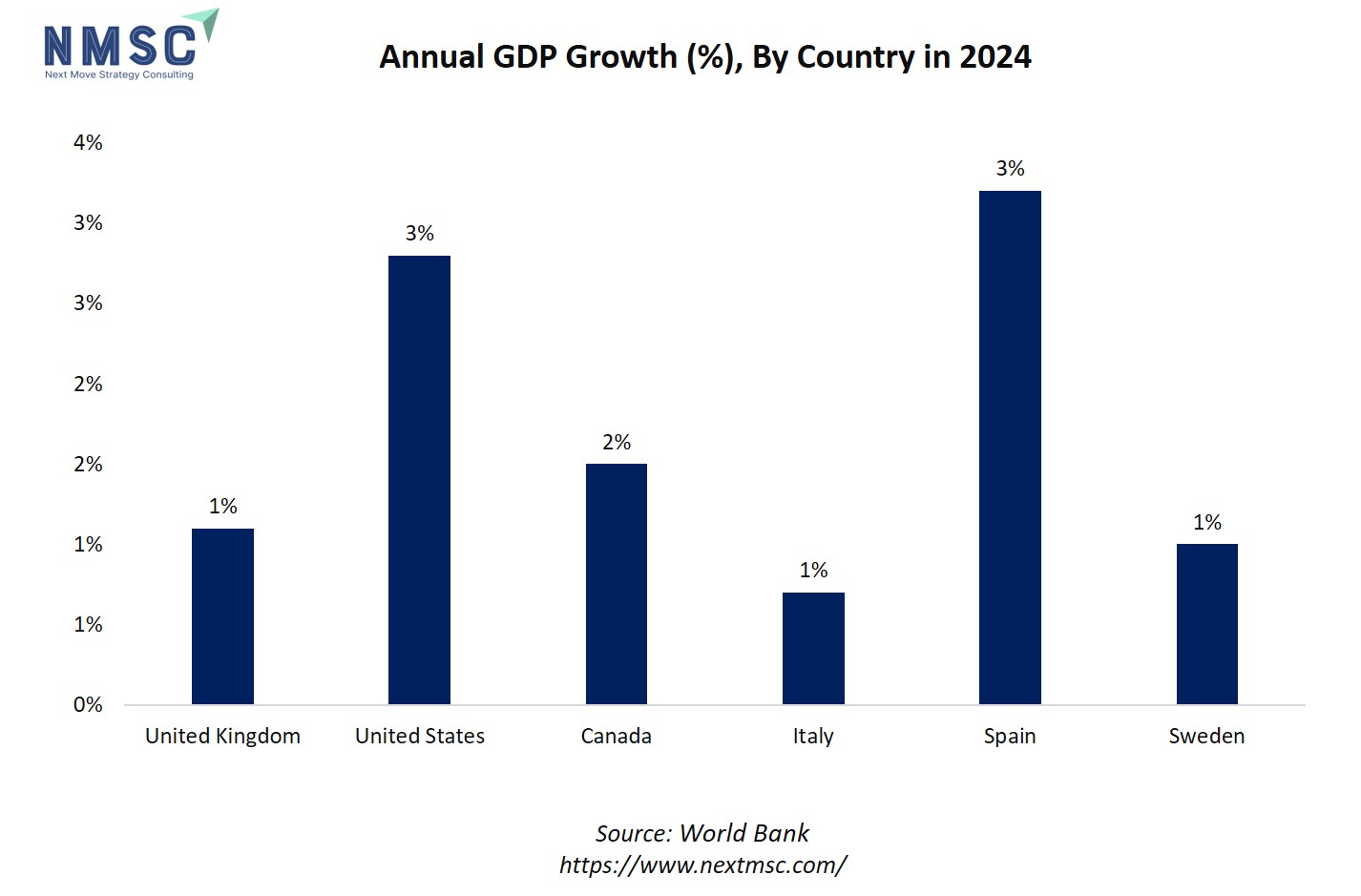

The bar chart illustrates the annual GDP growth rate (%) in 2024 across selected countries. Spain recorded the highest GDP growth at 3.20%, reflecting strong economic recovery and industrial expansion. The United States followed with 2.80%, supported by robust manufacturing, energy production, and logistics activities. Canada registered a moderate growth rate of 1.50%, while the United Kingdom and Sweden posted similar growth levels at 1.10% and 1.00%, respectively. Italy showed the slowest growth among the listed countries, at 0.70%, indicating a more stable but restrained industrial environment.

Higher GDP growth directly influences the market, as expanding economies generate increased demand for fuel, chemicals, food-grade liquids, and water transportation. Economic expansion drives manufacturing output, construction activities, and cross-border trade, all of which rely on efficient bulk transport solutions. Countries with stronger GDP growth, such as Spain and the United States, are therefore expected to witness higher fleet utilization rates, greater investments in modern tank trucks, and accelerated adoption of sustainable logistics practices, contributing to overall market growth and competitiveness.

Tank Trucking Market in South Korea

South Korea’s market is driven by high industrial activity, e-commerce expansion, and demand for reliable bulk liquid transport. Telematics, AI-powered route optimization, and predictive maintenance are being widely adopted to enhance operational efficiency and fleet safety. Sustainable fleet initiatives are supporting compliance with environmental regulations and market growth.

Tank Trucking Market in Taiwan

Taiwan’s market growth is fuelled by industrial logistics, e-commerce expansion, and demand for specialized bulk liquid and temperature-sensitive transport. Companies are adopting digital fleet management, telematics, and predictive maintenance to improve delivery reliability and reduce operational costs. Investments in eco-friendly and fuel-efficient trucks are driving sustainable market development.

Tank Trucking Market in Indonesia

Indonesia’s market is driven by rapid industrialization, urbanization, and expanding e-commerce activity. Increasing demand for bulk liquid, chemical, and temperature-sensitive transportation is prompting adoption of specialized tank trucks and technology-enabled fleet management. Integration of telemetry, route optimization, and predictive maintenance enhances operational efficiency and delivery reliability, while sustainable fleet initiatives support long-term growth across urban and semi-urban regions.

Tank Trucking Market in Australia

Australia’s market growth is supported by industrial expansion, e-commerce logistics, and the need for timely bulk liquid transport. Companies are increasingly adopting IoT-enabled fleet management, AI-assisted route optimization, and predictive maintenance to improve operational efficiency, reduce costs, and ensure safe delivery. Investments in low-emission and fuel-efficient tank trucks are further promoting sustainable market development.

Tank Trucking Market in Latin America

In Latin America, rapid industrialization, urbanization, and e-commerce growth are driving demand for reliable bulk liquid and chemical transport. Adoption of digital fleet management, real-time monitoring, and AI-powered route optimization enhances delivery accuracy and operational efficiency. Investments in sustainable, low-emission trucks and modernized fleets are supporting market expansion across Brazil, Mexico, Argentina, and other metropolitan regions.

Tank Trucking Market in the Middle East & Africa

The market in the Middle East & Africa is supported by industrial growth, e-commerce expansion, and rising demand for safe, specialized transportation of bulk liquids and chemicals. Companies are implementing telematics, predictive maintenance, and AI-assisted fleet management to improve efficiency and delivery reliability. Increasing investment in sustainable and fuel-efficient tank trucks is further driving growth across urban and industrial centers.

Competitive Landscape

Which Companies Dominate the Tank Trucking Market and How Do They Compete?

The global market is dominated by a combination of established logistics providers, regional specialists, and niche service operators such as Quality Carriers, Highway Transport Chemical, Groendyke Transport, Dupre Logistics LLC, Florida Rock and Tank Lines Inc., Martin Transport Inc., Shiny Shipping and Logistics Pvt. Ltd, Bulkmatic Transport Company, Liquid Trucking, SAR Logistics, Deccan Transcon, CKB Logistics, and Surabhi Transports Pvt. Ltd.

These companies compete by offering a wide range of tank trucking services, including bulk chemical transportation, food-grade liquid hauling, petroleum and fuel delivery, and temperature-controlled logistics. Market leaders differentiate themselves through fleet modernization, compliance with safety and environmental regulations, and technology-enabled operations, such as GPS tracking, telematics, and real-time logistics monitoring. Competitive strategies also include expanding regional and national service coverage, offering specialized equipment like ISO tanks or refrigerated trucks, and providing tailored solutions for hazardous or high-value cargo. Smaller or regional players focus on personalized client service, rapid response times, and specialized local routes, targeting industries like chemicals, food processing, and petrochemicals. With growing demand for efficient, safe, and environmentally responsible transportation, companies that integrate operational efficiency, regulatory compliance, and cust

Market dominated by Tank Trucking Market Giants and Specialists

The tank trucking market is characterized by a mix of large multinational fleet operators and regional or specialized trucking companies. Major players compete on fleet size, service reliability, technological capabilities, and extensive client networks, offering comprehensive transportation solutions for bulk liquids, chemicals, and temperature-sensitive cargo. Smaller or niche operators focus on specialized services, catering to specific industries, hazardous materials, or premium logistics requirements. This dual structure allows clients to choose between established operators for reliability and scale or specialized providers for customized, high-value, and innovative transportation solutions.

Innovation and Adaptability Drive Market Success

Leading firms in the tank trucking market invest heavily in digital fleet management, IoT sensors, AI-powered route optimization, and predictive maintenance to enhance operational efficiency, safety, and reliability. Adoption of telematics, cloud-based monitoring, and automated reporting enables real-time cargo tracking and regulatory compliance. Companies that adapt to trends such as sustainable and low-emission fleets, fuel efficiency, and customer-centric logistics solutions are strengthening market presence and client loyalty. Continuous innovation in fleet technology, operational efficiency, and service quality is crucial to maintaining a competitive edge.

Market Players to opt for Merger & Acquisition Strategies to Expand Their Presence

Mergers and acquisitions are increasingly used by tank trucking companies to expand geographic coverage, diversify fleet capabilities, and acquire specialized operational expertise. Leading operators acquire smaller or regional firms to increase market share, integrate advanced fleet technologies, and enter new industry verticals. These M&A activities allow companies to scale operations efficiently, enhance service offerings, and respond to rising demand for specialized, safe, and technology-enabled transportation solutions, strengthening competitive positioning in both mainstream and niche logistics segments.

List of Key Tank Trucking Companies

-

Quality carriers

-

Highway Transport Chemical

-

Groendyke Transport

-

Dupre Logistics LLC

-

Florida Rock and Tank Lines Inc.

-

Martin Transport Inc.

-

Shiny Shipping and Logistics Pvt. Ltd

-

Bulkmatic Transport Company

-

Liquid Trucking

-

SAR Logistics

-

Deccan Transcon

-

CKB Logistics

-

Surabhi Transports Pvt. Ltd.

What are the Latest Key Industry Developments?

-

September 2025 - Quality Carriers launched Quality Depot Solutions (QDS™), offering on-shore support for the international transportation of ISO tanks near major ports and rail terminals across North America.

-

May 2025 - Quality Carriers was honored as an AdvanSix Gold Carrier for the fourth consecutive year, highlighting its commitment to service excellence.

-

May 2025 - Highway Transport participated in National Human Trafficking Awareness Month, supporting Truckers Against Trafficking with over 500 tank truck drivers trained to recognize and report signs of human trafficking.

-

August 2024 - Groendyke Transport announced the acquisition of all tank truck assets from Linden Bulk Transportation, enhancing its service capabilities.

What are the Key Factors Influencing Investment Analysis & Opportunities in the Tank Trucking Market?

The tank trucking market is attracting significant investor interest due to rising global demand for safe, reliable, and technologically advanced bulk liquid and chemical transportation solutions. Key factors influencing investment decisions include a company’s ability to maintain operational efficiency, adopt digital fleet management, AI-powered route optimization, IoT monitoring, and predictive maintenance, and scale services across diverse geographic and industrial markets. Firms that demonstrate innovation, sustainability, and adaptability, through eco-friendly fleets, low-emission vehicles, and specialized transport services, are particularly attractive. Strategic initiatives such as mergers, acquisitions, and partnerships further signal growth potential, making companies with diversified fleets, advanced technological capabilities, and strong market presence prime targets for investment.

Key Benefits for Stakeholders:

Next Move Strategy Consulting (NMSC) presents a comprehensive analysis of the market, covering historical trends from 2020 through 2024 and offering detailed forecasts through 2030. Our study examines the market at global, regional, and country levels, providing quantitative projections and insights into key growth drivers, challenges, and investment opportunities across all major tank trucking market segments.

Report Scope:

|

Parameters |

Details |

|

Market Size in 2025 |

USD 174.11 Billion |

|

Revenue Forecast in 2030 |

USD 237.65 Billion |

|

Growth Rate |

CAGR of 6.42% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Countries Covered |

28 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent to up to 80 analyst-working hours) after purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

|

Approach |

In-depth primary and secondary research; proprietary databases; rigorous quality control and validation measures. |

|

Analytical Tools |

Porter's Five Forces, SWOT, value chain, and Harvey ball analysis to assess competitive intensity, stakeholder roles, and relative impact of key factors. |

Key Market Segments

By Vehicle Type

-

Rigid Tank Trucks

-

Articulated Tank Trucks

-

Semi-Tank Trailers

By Tank Material

-

Stainless Steel

-

Aluminum

-

Carbon Steel

-

Composite Materials

By Capacity

-

Small Capacity (Up to 10,000 Liters)

-

Medium Capacity (10,001 to 25,000 Liters)

-

Large Capacity (Above 25,000 Liters)

By Tank Type

-

Petroleum Tank

-

Chemicals Tank

-

Food and Beverages Tank

-

Water Tank

-

Gases Tank

-

Cryogenic Liquids Tank

By Drive Type

-

4x2

-

6x2

-

6x4

-

8x4

By Propulsion

-

Diesel

-

Electric/Hybrid

-

Natural Gas

By End User

-

Oil and Gas Industry

-

Chemical Industry

-

Food and Beverage Industry

-

Agriculture

-

Pharmaceuticals

-

Municipal Services (Water and Waste Management)

Geographical Breakdown

-

North America: U.S., Canada, and Mexico.

-

Europe: U.K., Germany, France, Italy, Spain, Sweden, Denmark, Finland, Netherlands, and rest of Europe.

-

Asia Pacific: China, India, Japan, South Korea, Taiwan, Indonesia, Vietnam, Australia, Philippines, Malaysia and rest of APAC.

-

Middle East & Africa (MEA): Saudi Arabia, UAE, Egypt, Israel, Turkey, Nigeria, South Africa, and rest of MEA.

-

Latin America: Brazil, Argentina, Chile, Colombia, and rest of LATAM.

Conclusion & Recommendations

Our report equips stakeholders, industry participants, investors, policy-makers, and consultants with actionable intelligence to capitalize on market transformative potential. By combining robust data-driven analysis with strategic frameworks, NMSC’s tank trucking market report serves as an indispensable resource for navigating the evolving landscape.

Speak to Our Analyst

Speak to Our Analyst