Toys Market By Material (Plastic Toys, Wooden Toys, Metal Toys, Fabric and Soft Toys, and Others), By Product Type (Action Figures, Building Sets, Dolls, Vehicles, Arts & Craft Toys, Games and Puzzles, Sports and Outdoor Toys, and Others), By Age Group (Age 1-4, Age 5-11, and Age 12+), By Distribution Channel (Online Retail, Offline Retail, Specialty Toy Stores, Department Stores, and Brand Stores), and By Price Tier (Budget, Mid-range, and Premium) – Global Analysis & Forecast, 2025–2030

Industry Outlook

The global Toys Market size was valued at USD 162.91 billion in 2024, and is expected to be valued at USD 173.98 billion by the end of 2025. The industry is projected to grow, hitting USD 241.75 billion by 2030, with a CAGR of 6.83% between 2025 and 2030.

This Market is undergoing a significant transformation driven by growing consumer demand for innovative, educational, and high-quality products. Consumers are increasingly seeking toys that combine learning, creativity, and interactive engagement, prompting manufacturers to focus on product innovation, technology integration, and educational value. The expansion of e-commerce and global distribution networks has made toys more accessible, further accelerating market growth and intensifying competition among companies.

Rising household incomes continue to boost demand for premium and diverse toys, enabling families to invest in products that enhance skill development, entertainment, and engagement. This trend encourages manufacturers to expand product lines, adopt eco-friendly materials, and incorporate digital or AI-driven features. By aligning with these evolving preferences, the toy industry supports continuous market growth, product diversification, and competitive differentiation across both established and emerging markets.

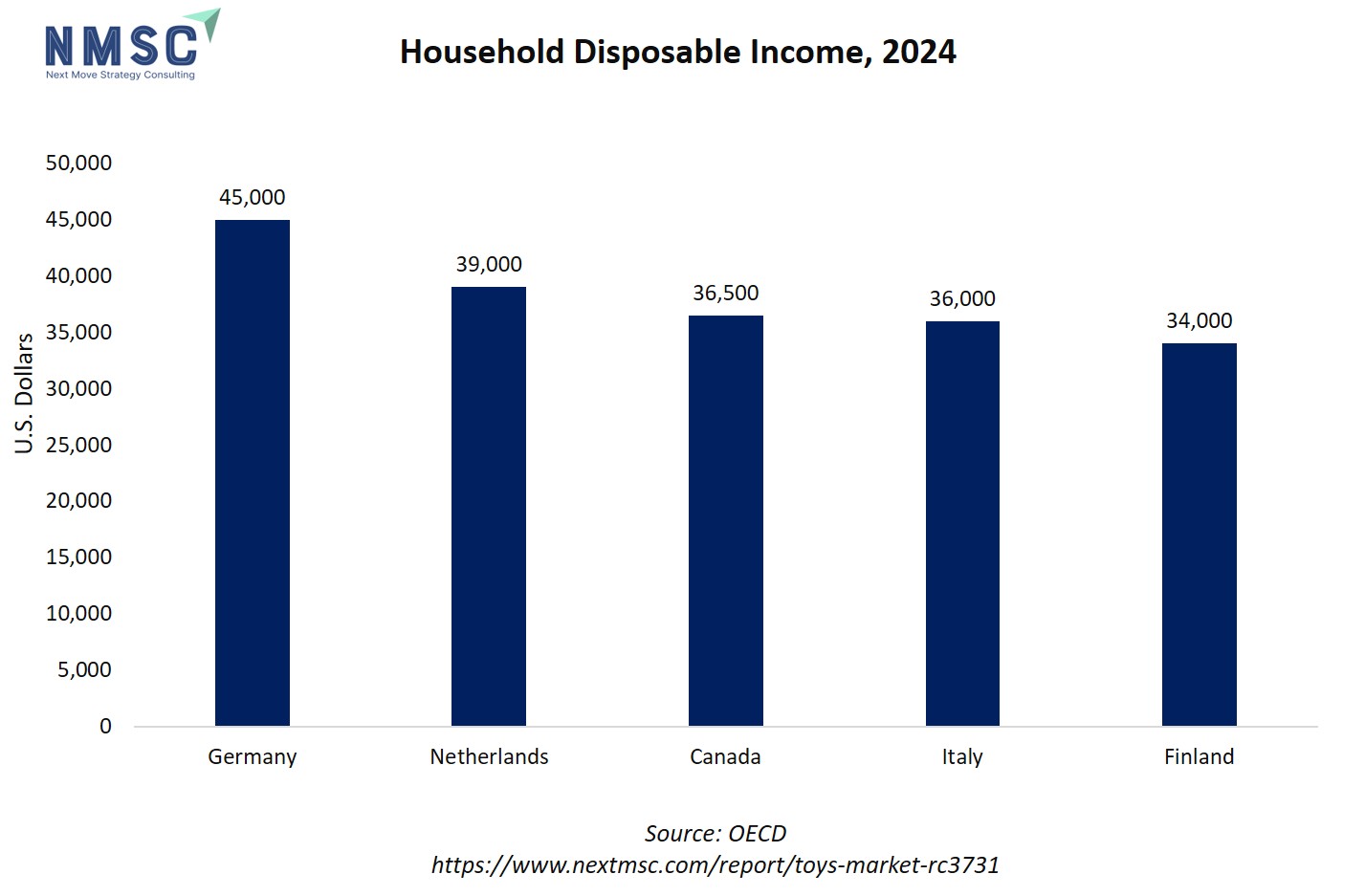

The chart showing household disposable income by country in 2024 highlights a clear correlation, as higher disposable income strongly aligns with increased spending on premium and educational products, including toys. Countries such as Germany, the Netherlands, and Canada, with higher household incomes, represent attractive markets for toy manufacturers, as consumers in these regions are more likely to invest in innovative, tech-enabled, and high-quality toys that cater to evolving preferences and educational or recreational trends.

What are the Key Trends in Toy Industry?

How are licensed toys fueling growth in the toys market?

Licensed toys have become a key driver in the toys market growth, fueled by the popularity of franchises such as Pokémon, Final Fantasy, and Minecraft, which also saw movie releases in 2025. These products appeal not only to children but also to adult collectors, reflecting the broader trend of “kidults” engaging with toys for nostalgia and leisure. During the first half of 2025, licensed toys accounted for 37% of all toy sales in the U.S. and experienced an 18% increase in dollar sales compared to the same period in 2024. This data underscores the significant impact of entertainment tie-ins on consumer behaviour and highlights the importance of strategic licensing for companies seeking to expand their market share. By aligning product offerings with current media trends, toy manufacturers capture both young and adult audiences, driving sustained growth in a competitive industry.

How is sustainability influencing toy purchases?

Sustainability is becoming a key factor shaping the market, as consumers increasingly favor products that are eco-friendly, safe, and built to last. The Toy Association’s 2025 Trend Spotting report indicates that parents and caregivers are gravitating toward toys made from responsibly sourced or recycled materials, reflecting a broader societal emphasis on environmental responsibility. Within the market, considerations such as product safety, non-toxic components, and reduced environmental impact are emerging as important drivers of purchasing decisions, influencing both product design and brand positioning across the industry.

How are digital and interactive toys transforming the toys market?

Digital and interactive toys are reshaping the toys market by blending physical play with technology-driven experiences. Toys that incorporate augmented reality (AR), virtual reality (VR), and app-based interactivity are becoming increasingly popular, offering immersive experiences that engage children in new ways. These toys not only entertain but also promote learning, problem-solving, and creativity, reflecting a growing consumer preference for products that combine education and play.

What are the key market drivers, breakthroughs, and investment opportunities that will shape the toy industry in next decade?

The global toy industry is experiencing strong growth driven by evolving consumer preferences, rising disposable incomes, and the increasing popularity of innovative products. Global toy sales reached USD 111.8 billion in 2024, marking a 3% increase from 2023, fueled by greater spending on recreational and educational toys, STEM-focused and tech-enabled products, as well as licensed collectibles. Higher household disposable incomes allow consumers, particularly in countries like the U.S., Germany, and Canada, to invest in premium and innovative toys, supporting market expansion and encouraging the development of diverse, value-added offerings.

At the same time, the rapid rise of e-commerce and widespread global distribution networks has made toys more accessible, enabling consumers to explore a broad range of products conveniently. Manufacturers are increasingly focusing on interactive, educational, and tech-integrated toys to meet shifting preferences, while incorporating sustainable materials and eco-friendly packaging to appeal to conscious consumers. These trends collectively drive technological innovation, product diversification, and competitive growth in the global market.

Growth Drivers:

How is the Growth in Global Toy Sales Driving the Toys Market Expansion?

The global toys market is strongly supported by increasing consumer demand, as evidenced by global toy sales reaching USD 111.8 billion in 2024, a 3% rise from 2023. This growth is driven by higher disposable incomes, greater spending on recreational and educational products, and the popularity of innovative offerings such as STEM-focused, tech-enabled, and licensed collectible toys. Moreover, the rise of e-commerce and global distribution networks has made toys more widely accessible, further accelerating market growth. The consistent increase in sales highlights the market’s strong potential and positions it as a key driver for ongoing investment and product innovation.

How does Rising Household Disposable Income Influence Toy Demand?

The growth of household disposable income is a significant driver of the global toys market, as higher earnings enable consumers to spend more on toys, including educational, STEM-focused, and tech-enabled products. Data from the FAO indicates that countries with greater disposable incomes, such as the U.S., Germany, and Canada, experience higher spending on leisure and recreational items, including toys. This rising purchasing power fuels demand for premium and innovative toys, supporting overall toys market expansion and creating opportunities for manufacturers to introduce diverse and value-added products.

Growth Inhibitors:

What Impact do Regulatory Challenges have on the Global Toys Market Trends?

Regulatory challenges remain a critical factor influencing the growth and stability of the global toys market. Stringent safety standards, differing regulations across regions, and complex compliance requirements elevate production costs and extend time-to-market for toy manufacturers. In the United States, for example, the Consumer Product Safety Commission (CPSC) enforces rigorous safety guidelines that manufacturers must adhere to, demanding substantial resources and careful oversight. Beyond domestic regulations, international trade policies and tariffs add further complexity, affecting market access and profitability. Navigating these regulatory landscapes requires toy companies to implement robust compliance strategies and continuously adapt to evolving legal frameworks, ensuring both market presence and consumer trust are maintained.

How Is the Focus on Sustainability Creating Investment Opportunities in the Toy Industry?

The growing focus on sustainability in the toy industry presents a significant investment opportunity, as companies increasingly prioritize eco-friendly materials and practices. Mattel’s initiative to use 100% recycled or bio-based plastics in its products by 2030, exemplified by the 'Barbie Loves the Ocean' series made from ocean-bound plastics, highlights how major players are responding to consumer demand for environmentally responsible toys. This shift not only positions companies as leaders in sustainability but also opens avenues for investors to support innovative, eco-conscious product lines. As consumers continue to favour green products, investing in sustainable toy initiatives offers both market growth potential and alignment with broader environmental goals.

How is the toys market is segmented in this report, and what are the key insights from segmentation analysis?

By Material Insights

How is the Toys Market Shaped by Plastic Toys, Wooden Toys and Others?

Based on material type, the market is segmented into plastic toys, wooden toys and others.

Plastic toys are one of the most common segments in the market due to their versatility and durability. They be easily molded into a wide range of shapes and designs, making them suitable for children of different age groups. This segment includes products such as action figures, building blocks, and interactive toys, offering manufacturers flexibility in design and mass production. Plastic toys remain popular for their affordability and ability to incorporate interactive or electronic features, making them a staple in the global toy industry.

Wooden toys are valued for their durability, safety, and eco-friendly appeal. They include puzzles, building blocks, and traditional educational toys. Wooden toys are especially popular among parents seeking sustainable and long-lasting alternatives. Their natural aesthetic and sturdy construction make them ideal for developmental and educational play, supporting both imaginative and STEM-focused activities.

Other materials such as metal, fabric, and soft toys serve specialized purposes within the market. Metal toys, like miniature vehicles or mechanical sets, are durable and collectible. Fabric and soft toys, including plush dolls and stuffed animals, focus on comfort, emotional connection, and early childhood development. Together, these “other” materials complement the plastic and wooden segments, providing diversity in play experiences and catering to niche consumer preferences.

By Product Type Insights

Which product is emerging as the most flexible in the toys market?

Based on product type, the market is segmented into action figures, building sets, dolls and others.

Action figures are toys that represent characters from movies, comics, or popular media. They are designed to encourage imaginative play, storytelling, and role-playing among children. This segment appeals to fans of specific franchises and includes features like movable joints, accessories, and collectible editions. Action figures also attract older demographics who collect for nostalgia or display purposes, making them a versatile segment in the market.

Building sets include construction toys such as blocks, interlocking bricks, and modular kits that allow children to create structures and objects. They promote creativity, problem-solving, and fine motor skills. These creative toys cater to a wide age range and are popular among both educational and recreational markets. Building sets range from simple designs for younger children to complex, STEM-oriented kits for older children and teens.

Dolls are toys that represent human or fantasy characters and come with clothing, accessories, and interactive features. They encourage imaginative play, social role-playing, and emotional development. Dolls are popular across multiple age groups, with some designed for young children, while collectible or themed dolls attract older audiences.

Others include vehicles like toy cars, trains, and planes; arts and craft toys that encourage creativity and hands-on skills; games and puzzles that focus on cognitive development and social interaction; and sports and outdoor toys that promote physical activity. These “others” provide variety in play experiences and cater to diverse interests and developmental needs across different age groups.

By Age Group Insights

How is the Toys Market Shaped by Age Group Segmentation?

Based on age group, the toys market share is segmented into Age below 1, 1-4, Age 5-11 and Age 12+

Toys for infants below 1 year are primarily focused on sensory stimulation, safety, and early developmental support. These include rattles, teething toys, soft plush toys, and activity gyms designed to engage babies’ senses through colours, textures, sounds, and movement. Safety is the top priority in this segment, with products made from non-toxic, soft, and durable materials that are easy for infants to handle. The aim is to encourage motor skills, hand-eye coordination, and early cognitive development while ensuring a safe play environment.

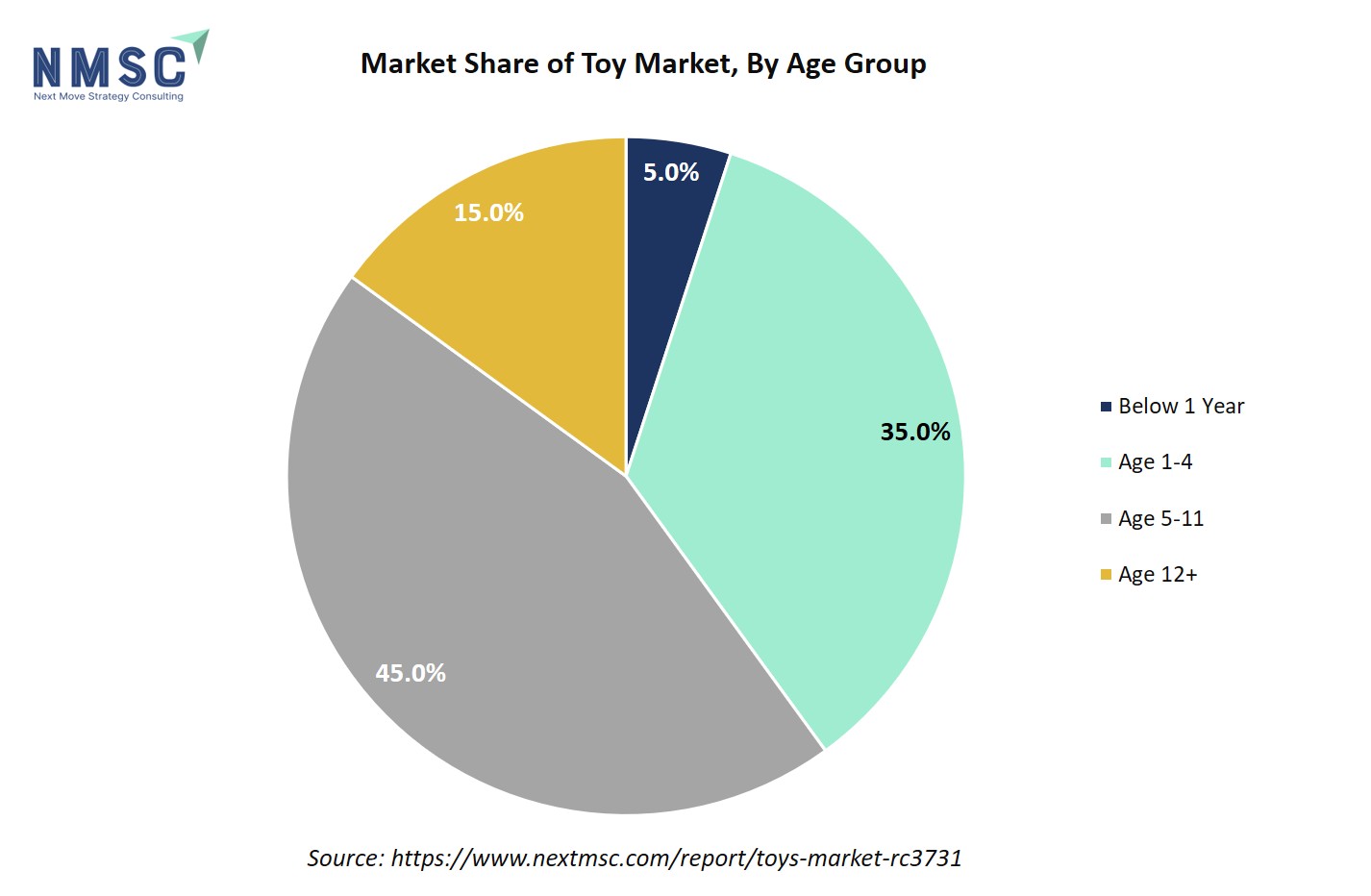

The chart shows the market share of the market by age group, with children aged 5–11 years leading at 45%, followed by 1–4 years at 35%, 12+ years at 15%, and below 1 year at 5%. This distribution highlights that the core demand for toys is driven by school-age children, who represent the largest and most diverse consumer group, purchasing everything from dolls and action figures to board games and STEM kits. The preschool segment also maintains a strong position, reflecting the importance of early learning and interactive toys for developmental growth. While the share of infants is relatively small, this category remains important for essentials such as rattles and plush toys. Meanwhile, the 12+ years group, though smaller, demonstrates steady growth, driven by the rising “kidult” trend, hobby kits, and collectibles. Together, these varied age segments ensure the toys market caters to a wide spectrum of consumers, supporting innovation and growth across traditional, educational, and tech-enabled categories worldwide.

By Distribution Channel Insights

How are Distribution Channels Driving the Toys Market?

Based on distribution channel, the market is segmented into online retail, offline retail and others.

Online retail is a key channel for children-toys, offering convenience, easy comparison, and global reach. Consumers browse, read reviews, and make purchases from home, while brands benefit from direct-to-consumer sales, personalized recommendations, and exclusive launches.

Offline retail remains important, allowing customers to see, touch, and try products before buying. Local toy shops, supermarkets, and retail chains provide immediate availability, in-store promotions, and hands-on experiences that enhance consumer confidence.

Others include specialty stores, department stores, and brand-exclusive stores, offering curated selections, premium products, and in-store experiences that complement online and general offline retail channels.

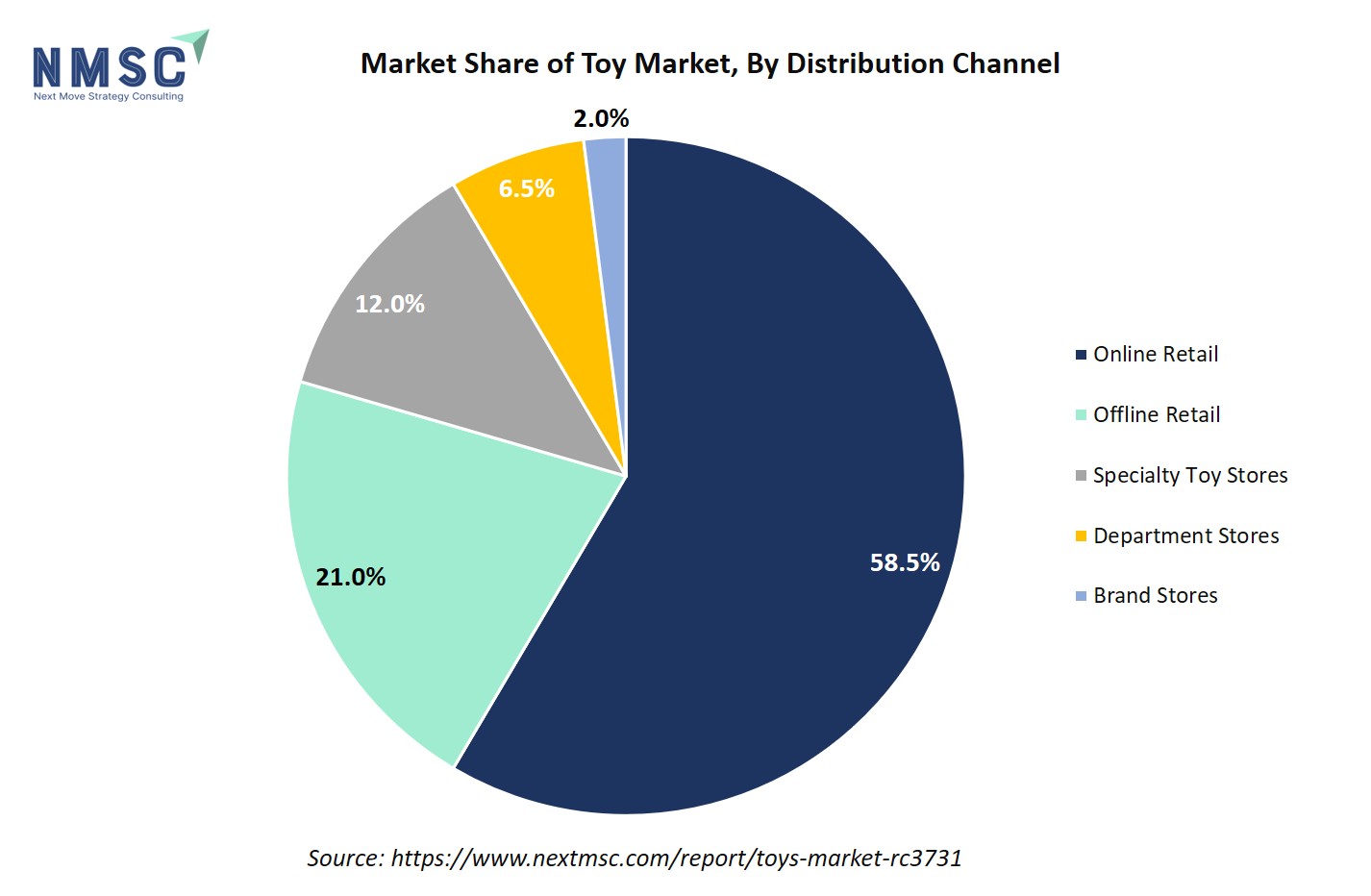

The chart shows the market share of the market by distribution channel, with Online Retail leading at 58.5%, followed by Offline Retail at 21%, Specialty Toy Stores at 12%, Department Stores at 6.5%, and Brand Stores at 2%. This distribution highlights that while traditional retail channels remain important, the majority of sales are now driven by online platforms, offering convenience, wider product variety, and access to tech-enabled and educational toys. Offline channels, including specialty and department stores, continue to attract consumers seeking hands-on interaction, personalized service, and the ability to experience products before purchase. The combination of digital and physical channels ensures broad market reach and supports the growing adoption of innovative, interactive, and premium toys across global markets.

Regional Outlook

The market is geographically studied across North America, Europe, Asia Pacific, Latin America and the Middle East & Africa and each region is further studied across countries.

Toys Market in North America

The North American toys market is experiencing growing influence from education-focused initiatives that promote hands-on learning and skill development. The U.S. Department of Education’s “YOU Belong in STEM” program highlights the importance of inclusive STEM opportunities, encouraging coding, robotics, and maker activities in classrooms and communities. This emphasis on interactive learning is steadily shaping consumer preferences, as parents and schools look for toys that combine entertainment with educational value. In response, toy companies are increasingly innovating with STEM-based products that align with national priorities, reinforcing the market’s shift toward technology-driven play.

Toys Market in the United States

In the U.S., the market is increasingly influenced by a shift toward educational and skill-based play. Consumers, including parents and educators, are seeking toys that go beyond entertainment to foster cognitive development, creativity, and problem-solving abilities. This has led manufacturers to innovate with STEM-focused products, coding kits, and interactive learning toys that blend fun with educational value. Consequently, the demand for tech-enabled, hands-on, and learning-oriented toys is shaping product offerings, marketing approaches, and overall market growth, positioning the U.S. toy industry as a hub for purposeful, development-driven play experiences.

Toys Market in Canada

In Canada, the toys Market is increasingly shaped by the rapid growth of e-commerce as a preferred retail channel. The Government of Canada’s Trade Commissioner Service notes that online shopping is the fastest-growing segment in the consumer products sector, including toys. This trend is driving manufacturers and retailers to strengthen their digital presence, enhance online sales platforms, and adopt targeted digital marketing strategies. As a result, the Canadian market is evolving toward greater accessibility, convenience, and consumer engagement, with online channels playing a central role in shaping purchasing patterns and overall market growth.

Toys Market in Europe

In Europe, the market is increasingly influenced by the EU’s push for digital product safety and traceability. As of 2025, regulations require that all toys sold within the EU, both online and offline, include a Digital Product Passport, providing transparent information on origin, materials, and compliance with safety standards. This initiative is driving manufacturers and retailers to adopt robust product information systems and ensure greater transparency. Consumers are responding by favouring toys that meet strict safety and environmental standards, prompting companies to invest in technology-enabled compliance, which strengthens trust and supports growth in the European market.

Toys Market in the United Kingdom

In the United Kingdom, the market is being shaped by the rapid growth of online retail, which offers consumers greater convenience and variety. According to the Office for National Statistics, total retail sales rose 3.3% in May 2024, with non-store retailers, primarily online platforms, experiencing a 5.9% increase, the largest monthly rise since April 2022. This trend is driving toy retailers to strengthen their digital presence, optimize marketing strategies, and provide competitive offerings, making the UK market more dynamic, accessible, and responsive to consumer demand.

Toys Market in Germany

In Germany, the toys market is being shaped by a strong emphasis on sustainability and eco-friendly products. Consumers are increasingly seeking toys made from recyclable or responsibly sourced materials, reflecting broader societal concerns about the environment. This shift is prompting manufacturers to innovate with sustainable production methods, durable designs, and environmentally conscious packaging. As a result, the market is evolving to reward companies that integrate eco-friendly practices, appealing to environmentally aware parents and caregivers while supporting long-term growth in Germany’s toy industry.

Toys Market in France

In France, the toys market is experiencing significant growth, particularly in categories such as games and puzzles, construction toys, and stuffed animals. According to a report by CreditNews, these segments have shown remarkable increases: games and puzzles up by 35%, construction games by 31%, and stuffed animals by 12%. This surge is attributed to several factors, including increased consumer spending, a growing interest in family-oriented activities, and a shift towards toys that promote cognitive development and creativity. Manufacturers are responding to this demand by innovating and expanding their product offerings in these categories, contributing to the overall growth of the French market.

Toys Market in Spain

In Spain, the market is increasingly influenced by the rise of adult consumers, or “kidults,” who are engaging with products traditionally aimed at children. This shift is driving demand for board games, construction sets, and collectibles, prompting retailers and manufacturers to diversify offerings and marketing strategies. By catering to both nostalgia and leisure interests, the market is expanding beyond its traditional youth base, reflecting a broader trend where toys serve as entertainment and collectibles for all ages, ultimately boosting growth and innovation within the Spanish toy industry.

Toys Market in Asia Pacific

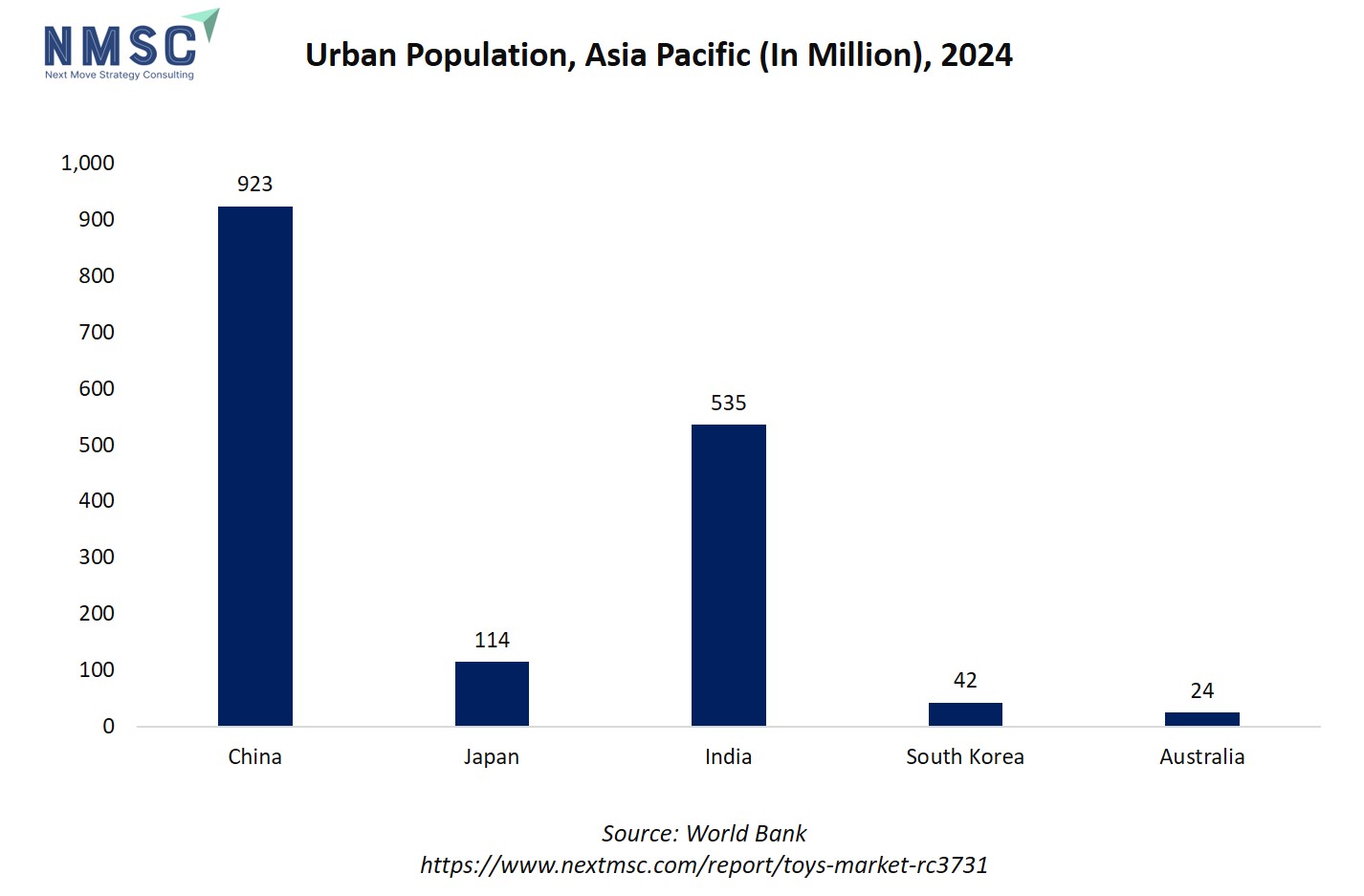

Rapid urbanization is a key driver of growth in the Asia Pacific market. As populations increasingly move to cities, higher disposable incomes and an expanding middle class are boosting demand for toys. Urban living also improves access to both retail outlets and online platforms, making a diverse range of toys more readily available to consumers. Countries such as China and India are experiencing significant market growth, driven by urban development and evolving consumer preferences. This shift is fueling the expansion of the Asia Pacific market, creating opportunities for traditional manufacturers and innovators to cater to a broader, more dynamic customer base.

The chart highlights the urban population across key Asia Pacific countries, illustrating a strong connection to the market. China leads with 923 million, followed by India at 535 million, indicating vast urban consumer bases with growing disposable incomes and access to retail and e-commerce platforms. Japan (114 million), South Korea (42 million), and Australia (24 million) also represent important urban markets. Higher urban populations drive demand for toys, including educational, tech-enabled, and interactive products, as city-dwelling families increasingly seek diverse and innovative play experiences. This trend makes urbanization a key factor in the expansion and adoption of toys across the Asia Pacific region.

Toys Market in China

In China, a significant factor influencing the market is the growing emphasis on early childhood education. As the government and parents increasingly recognize the importance of early learning, there is a rising demand for educational toys that promote cognitive development, creativity, and problem-solving skills in young children. This shift is encouraging toy manufacturers to innovate and design products that align with educational goals, integrating elements of science, technology, engineering, and mathematics (STEM) into play. Consequently, the Chinese market is evolving to meet the needs of a more education-focused consumer base, fostering growth and diversification within the industry.

Toys Market in Japan

In Japan, the market is being reshaped by the growing influence of adult-oriented demand and nostalgia-driven consumption. The Ministry of Economy, Trade and Industry (METI) highlighted in its 2025 interim report on the “Value of Toys” that, even with the challenges of a declining birth rate, the sector continues to expand by catering to adult consumers. This has encouraged manufacturers to introduce collector’s editions, premium sets, and high-end figurines designed for enthusiasts and fans, effectively broadening the market beyond children and reinforcing toys as a cultural and lifestyle product in Japan.

Toys Market in India

In India, the toys market is gaining momentum through the government’s “Vocal for Local” initiative, which is boosting domestic manufacturing while expanding global reach. Backed by toy clusters under MSME schemes and strict quality standards, Indian toys are now exported to 153 countries, reflecting growing international competitiveness. These efforts are encouraging local manufacturers to invest in better design, branding, and innovation, reducing reliance on imports while positioning India as a stronger global supplier. This transformation is directly shaping the Indian market by enhancing both its domestic growth and export potential.

Toys Market in South Korea

In South Korea, the sector is being reshaped by the country’s strong digital and gaming culture, where consumers are drawn to toys that integrate physical play with digital experiences. Hybrid products that connect with apps, consoles, or popular gaming franchises are gaining popularity, reflecting a shift toward more immersive and interactive forms of play. This trend is encouraging toy makers to innovate by blending technology with traditional toys, positioning the South Korean market at the intersection of entertainment, technology, and play.

Toys Market in Australia

In Australia, the market is being driven by the increasing demand for interactive and tech-enabled toys. Consumers are seeking products that blend traditional play with digital features, such as augmented reality, app connectivity, or smart functionalities. This trend encourages manufacturers to innovate with hybrid toys that offer immersive and engaging experiences, appealing to both children and parents. As a result, the Australian market is evolving to incorporate technology-driven entertainment, expanding product variety and enhancing consumer engagement across both physical and digital play experiences.

Toys Market in Latin America

In Latin America, the toys market is being shaped by the rapid growth of e-commerce, which is transforming how consumers discover and purchase products. Government initiatives to improve digital infrastructure and support online retail are enabling wider access to toys across the region. This trend is prompting manufacturers and retailers to optimize their online presence, adapt marketing strategies, and develop products suited for digital sales channels. As a result, the Latin American market is expanding, driven by the convenience and reach of online platforms, which connect brands with a broader and more diverse consumer base.

Toys Market in the Middle East & Africa

In the Middle East and Africa, the market is increasingly influenced by the growing focus on outdoor and sports-oriented play. Governments and local authorities are promoting physical activity and youth engagement, which has heightened demand for toys that support active, outdoor recreation. This trend encourages manufacturers to develop products such as sports equipment, ride-on toys, and interactive outdoor games that cater to children’s physical development and social interaction. By aligning with these preferences, the MEA market is evolving to emphasize both fun and fitness, expanding beyond traditional indoor play and fostering a more dynamic and diverse product landscape.

Competitive Landscape

Who are the Leading Companies in the Toys Market and How are they Competing?

The global toys industry competition is shaped by a mix of long-established industry giants and agile, niche-focused challengers. Leading corporations like The LEGO Group, Mattel, Hasbro, Bandai Namco, and Spin Master dominate through extensive global distribution networks, iconic brands, and decades of consumer trust. These companies leverage strong R&D, broad product portfolios, and economies of scale to maintain leadership across mass-market and premium segments. Their ability to adapt to evolving trends, such as STEM-focused toys, tech-integrated play, and sustainability initiatives, helps them retain market share while appealing to changing consumer preferences.

At the same time, specialized and digitally native brands such as MGA Entertainment, VTech, TOMY, Schleich, and Playmobil compete by emphasizing innovation, immersive experiences, and fast product development. These companies thrive through limited-edition collections, collaborations with popular IPs, and interactive or app-integrated products that resonate with younger, tech-savvy audiences. Their agility in responding to trends and consumer demands allows them to carve out niche markets, putting competitive pressure on established giants to continuously innovate and diversify their offerings.

Market Dominated by Toy Giants and Specialists

The global toys industry is primarily led by major corporations such as The LEGO Group, Mattel, Hasbro, Bandai Namco, and Spin Master. These industry giants maintain dominance through a combination of strong brand recognition, extensive distribution networks, and diverse product portfolios. Specialized companies like MGA Entertainment, TOMY, and Schleich also carve out significant niches by focusing on specific categories, such as dolls, educational toys, and collectibles, respectively. This segmentation allows for targeted marketing and product development, catering to specific consumer preferences and age groups. The competition among these companies is fierce, with each striving to innovate and capture market share across various regions and demographics.

Innovation and Adaptability Drive Market Success

Innovation is a key factor in maintaining competitiveness within the toy industry. Companies like LEGO have embraced digital integration, collaborating with platforms like Epic Games to create virtual experiences that complement their physical products. Similarly, Mattel and Hasbro leverage their iconic brands, such as Barbie and Transformers, by expanding into digital media and entertainment, thereby enhancing brand engagement and consumer loyalty. Adaptability is also crucial; for instance, Spin Master acquired Melissa & Doug to strengthen its position in the early childhood development segment, responding to the growing demand for educational and screen-free play options. These strategies highlight the industry's shift towards blending traditional play with modern technology and educational value.

Market Players to Opt for Merger & Acquisition Strategies to Expand their Presence

Mergers and acquisitions have become a strategic avenue for toy companies to diversify their portfolios and enter new markets. In 2024, Spin Master acquired Melissa & Doug, a move that allowed the company to tap into the early childhood development sector, known for its emphasis on educational and screen-free play. This acquisition not only broadened Spin Master's product offerings but also strengthened its position in a growing market segment. Similarly, LEGO's acquisition of 29 indoor entertainment centers from Merlin Entertainments for USD 270 million underscores its strategy to enhance consumer engagement through immersive brand experiences. These strategic acquisitions enable companies to expand their market presence, access new consumer bases, and integrate complementary product lines, thereby fostering growth and innovation within the competitive toy industry.

List of Key Toy Companies

-

The LEGO Group

-

Mattel, Inc.

-

Bandai Namco Toys & Hobby Inc.

-

Hasbro, Inc.

-

Spin Master Corp.

-

VTech Holdings Limited

-

TOMY Company, Ltd.

-

MGA Entertainment, Inc.

-

Simba Dickie Group

-

Ravensburger AG

-

JAKKS Pacific, Inc.

-

PLAYMOBIL

-

Moose Toys Pty Ltd

-

Schleich GmbH

-

Playmates Toys Limited

What are the Latest Key Industry Developments?

June 2025 - Mattel’s partnership with OpenAI reflects a growing trend in the toys market toward AI-driven and interactive play. By integrating technology into age-appropriate toys, Mattel enhances engagement and innovation, highlighting how the industry is blending traditional play with digital features to meet evolving consumer expectations.

WHAT ARE THE KEY FACTORS INFLUENCING INVESTMENT ANALYSIS & OPPORTUNITIES IN TOYS MARKET?

Investment dynamics in the toys industry are increasingly guided by funding patterns, company valuations, and regional growth prospects. Investors are focusing on tech-enabled, educational, and sustainable toy segments, driving higher valuations for startups that develop AI-powered, interactive, or eco-friendly products. Key investment hubs include North America, Europe, and Asia-Pacific, supported by high disposable incomes, expanding e-commerce, and favorable regulatory environments. Emerging markets such as India, Latin America, and the Middle East are gaining attention due to growing middle-class populations and rising demand for innovative toys. Overall, the market presents strong opportunities for strategic acquisitions and funding of inventive brands, with success hinging on innovation, brand strength, and alignment with shifting consumer preferences.

Key Benefits for Stakeholders:

Next Move Strategy Consulting (NMSC) presents a comprehensive analysis of the global toys market trends, covering historical trends from 2020 through 2024 and offering detailed forecasts through 2030. Our study examines the market at global, regional, and country levels, providing quantitative projections and insights into key growth drivers, challenges, and investment opportunities across all major toy segments.

The toy industry generates value for a wide range of stakeholders. Investors benefit from strong growth potential and attractive returns driven by trends in tech-enabled, educational, and sustainable toys. Customers enjoy a diverse array of products that enhance creativity, learning, and entertainment, ranging from interactive AI-powered toys to STEM-focused and eco-friendly options. By addressing the needs of these groups simultaneously, the industry fosters innovation, market expansion, and consumer satisfaction, creating a mutually beneficial ecosystem that supports long-term growth and engagement across the global market.

REPORT SCOPE:

Key Market Segments

By Material

Plastic Toys

Wooden Toys

Metal Toys

Fabric and Soft Toys

Others

By Product Type

Action Figures

Building Sets

Dolls

Vehicles

Arts & Craft Toys

Games and Puzzles

Sports and Outdoor Toys

Others

By Age Group

Below 1 Yrs

Age 1-4

Age 5-11

Age 12+

By Distribution Channel

Online Retail

Offline Retail

Specialty Toy Stores

Department Stores

Brand Stores

By Price Tier

Budget

Mid-range

Premium

Geographical Breakdown

North America: U.S., Canada, and Mexico.

Europe: U.K., Germany, France, Italy, Spain, Sweden, Denmark, Finland, Netherlands, and rest of Europe.

Asia Pacific: China, India, Japan, South Korea, Taiwan, Indonesia, Vietnam, Australia, Philippines, and rest of APAC.

Middle East & Africa (MENA): Saudi Arabia, UAE, Egypt, Israel, Turkey, Nigeria, South Africa, and rest of MENA.

Latin America: Brazil, Argentina, Chile, Colombia, and rest of LATAM.

Conclusion & Recommendations

The future of the toys market depends on its ability to integrate innovation, sustainability, and personalized play experiences while capturing rising global demand for educational, tech-enabled, and eco-friendly toys. Strategic initiatives such as expanding into emerging markets, adopting environmentally responsible materials, and leveraging digital and AI-driven interactive products will shape the next phase of market leadership. For investors, the sector offers strong growth potential and opportunities for brand-value appreciation, while customers benefit from diverse, engaging, and educational offerings. Executives must focus on product innovation, strategic collaborations, and digital engagement to stay competitive in a rapidly evolving and increasingly discerning global Market.

Speak to Our Analyst

Speak to Our Analyst