Aluminum Composite Panels Market by Product (PVDF, Polyester, Laminating Coating, Oxide Film, Others), by Type (Fire Resistant, Anti-Bacterial, Antistatic), by Composition (Surface Coating, Metal Skin, Core Material, Rear Skin), and by End Use Application (Construction, Automotive [Doors, Hoods, Wings, Side Panels, Trailers, Others], Advertising Boards, Railways, and Other Applications) – Global Opportunity Analysis and Industry Forecast, 2025–2030

Industry Outlook

The global Aluminum Composite Panels Market size was valued at USD 9.08 billion in 2024 and is expected to reach USD 9.69 billion by 2025. Looking ahead, the industry is projected to expand significantly, reaching USD 13.34 billion by 2030, registering a CAGR of 6.70% from 2025 to 2030.

The sector has become a cornerstone in modern construction and industrial design. Comprising two thin aluminum sheets enclosing a non-aluminum core, ACPs offer a blend of durability, lightweight properties, and aesthetic flexibility. Their applications span building facades, interior cladding, signage, and transportation, where they contribute to energy efficiency, fire safety, and sound insulation.

The aluminum composite panels market is propelled by urbanization, infrastructure development, and a growing preference for sustainable materials. Technological advancements, such as the development of fire-resistant and anti-bacterial coatings, have further expanded their utility across various sectors.

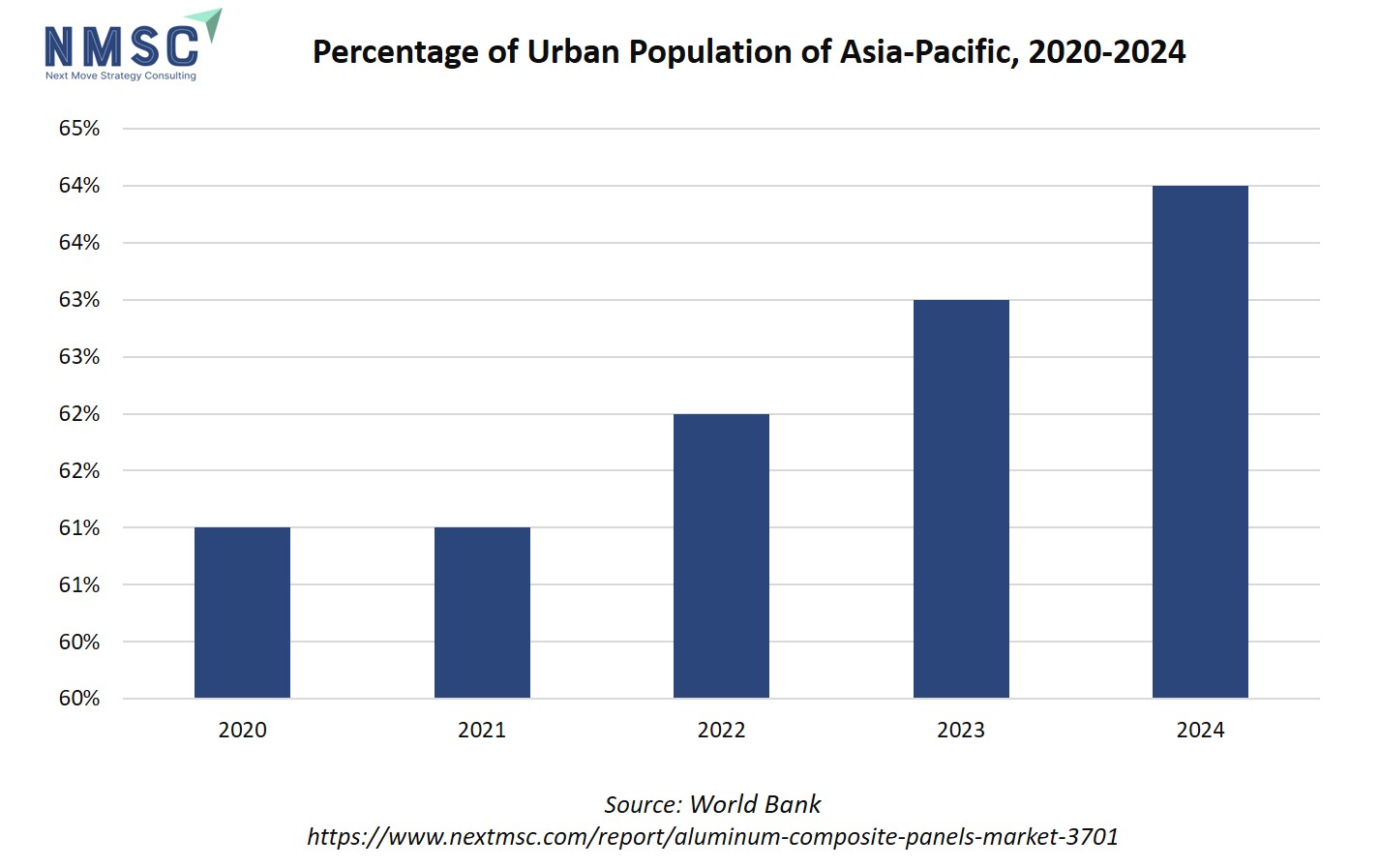

Looking ahead, the industry is poised for continued growth, driven by the global push for green buildings and energy-efficient solutions. In regions like Asia-Pacific, government initiatives and rapid urbanization are accelerating demand. The transportation sector is also emerging as a significant adopter, leveraging ACPs for vehicle exteriors and interiors due to their lightweight and durable nature.

However, challenges such as fire safety concerns and regulatory compliance remain, necessitating ongoing innovation and adherence to stringent standards. Despite these hurdles, the future of ACPs appears promising, with advancements in material science and manufacturing processes paving the way for more sustainable and versatile applications.

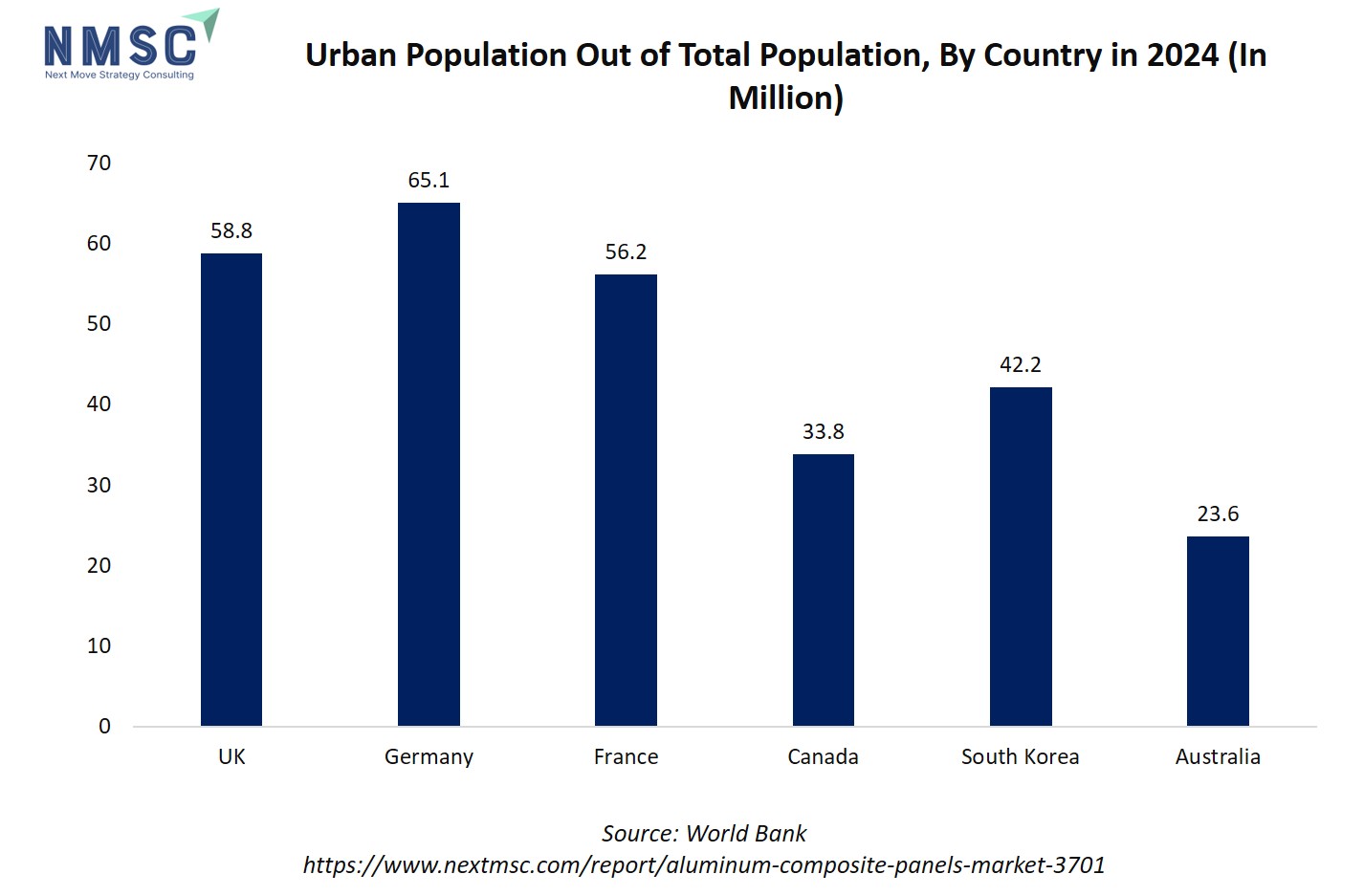

The chart presents the urban population figures for 2024 across several countries. The concentration of substantial urban populations in economically advanced nations highlights ongoing urbanization trends, which play a pivotal role in stimulating construction activity and the demand for modern infrastructure and high-performance building materials.

This dynamic directly impacts the global aluminum composite panels market by driving robust demand for lightweight, durable, and aesthetically versatile facade and cladding solutions in high-rise buildings, commercial complexes, and transit infrastructure within rapidly growing urban centers.

What are the Key Trends in the Aluminum Composite Panels Market?

How is the Market Enhancing Fire Safety Standards?

The aluminum composite panels market is increasingly focusing on fire-resistant materials to address safety concerns. In 2024, the fire-resistant ACP segment held the largest market share, driven by stringent building codes and heightened awareness of fire hazards. Manufacturers are innovating by incorporating mineral-filled cores and non-combustible facings to enhance fire resistance without compromising on aesthetics or structural integrity.

This shift is particularly evident in regions with rigorous safety regulations, such as Europe and North America. For companies, staying ahead in this trend means investing in R&D to develop compliant and superior fire-resistant ACPs. Collaborations with regulatory bodies and participation in standard-setting also position firms as leaders in fire safety innovation.

How is AI Transforming ACP Design and Manufacturing?

Artificial Intelligence (AI) is revolutionising the aluminum composite panels market demand by streamlining design processes and enhancing manufacturing precision. AI-driven tools enable architects and designers to create customised facades with optimal material performance, while predictive analytics improve production efficiency and reduce waste.

This technological integration is particularly beneficial in large-scale construction projects, where cost and time savings are critical. For companies, adopting AI technologies leads to more sustainable practices and a competitive edge in the sector. Investing in AI not only improves operational efficiency but also aligns with the growing demand for smart, eco-friendly building solutions.

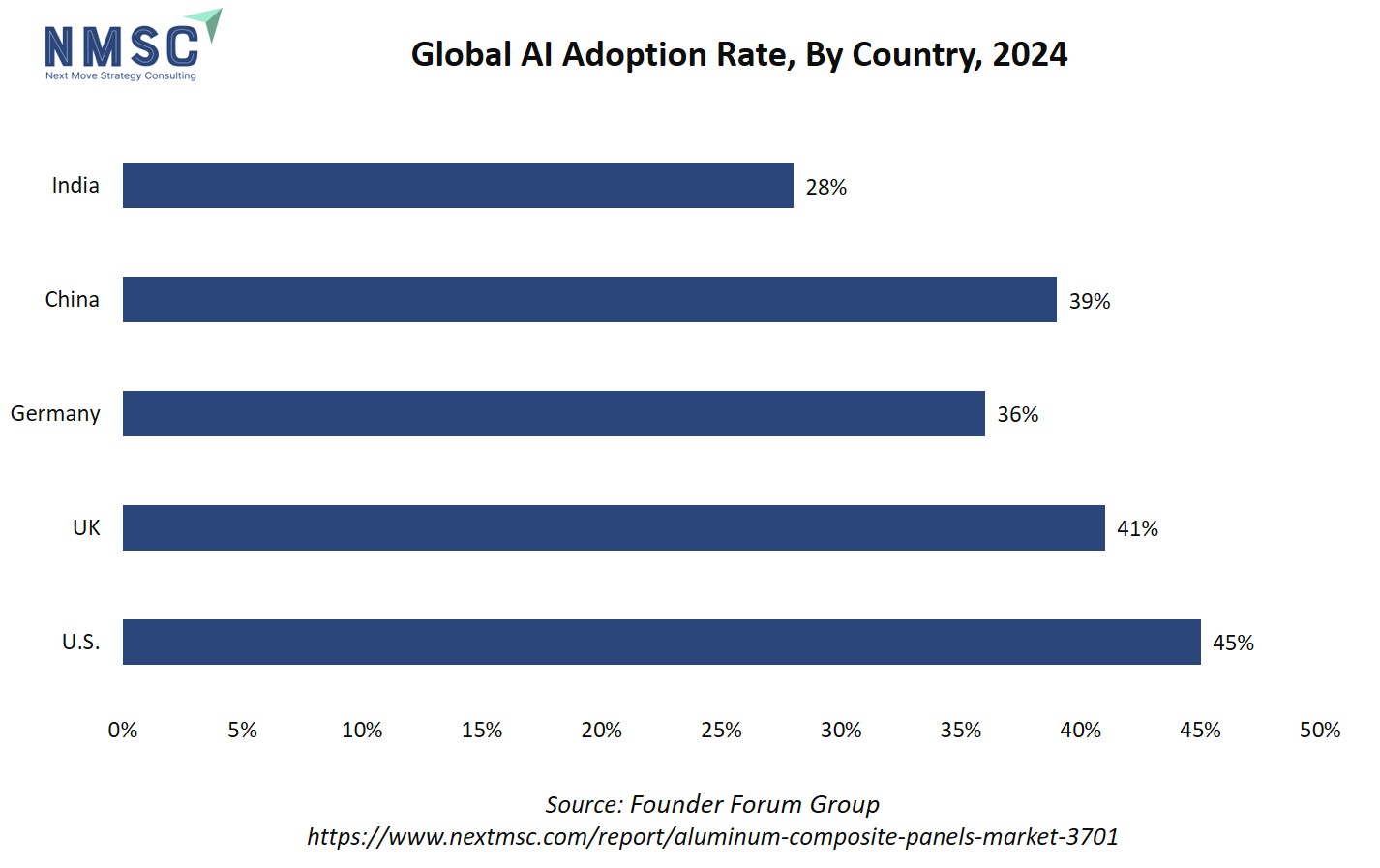

The above chart captures the global AI adoption rate across major countries. The prominent U.S. adoption rate reflects widespread integration of artificial intelligence in industries such as construction, architecture, and manufacturing, driving transformation in design, efficiency, and performance standards.

For the U.S. market, this high AI adoption accelerates smart manufacturing processes, fosters innovative product development, and optimizes supply chain management, resulting in advanced panel solutions that cater to evolving consumer and architectural demands for sustainability, energy efficiency, and personalization in the built environment.

How is ACP Contributing to Sustainable Construction Practices?

Sustainability is a key driver in the aluminum composite panels market growth, with increasing demand for eco-friendly materials in construction. The lightweight nature of ACPs reduces the overall carbon footprint of buildings, while their durability ensures longevity and minimal maintenance. Manufacturers are responding by developing ACPs with recyclable materials and energy-efficient coatings.

This trend aligns with global initiatives promoting green building standards and energy-efficient construction. For companies, embracing sustainability not only meets regulatory requirements but also appeals to environmentally conscious consumers and investors. By prioritizing sustainable practices, firms enhance their brand reputation and contribute to a more sustainable built environment.

How is ACP Innovation Shaping the Future of Building Facades?

Innovations in aluminum cladding panels are redefining building facades, offering architects and designers greater flexibility and creativity. Advancements such as self-cleaning surfaces, integrated photovoltaic cells, and enhanced thermal insulation are expanding the functional and aesthetic possibilities of ACPs.

These innovations are particularly relevant in urban areas, where building aesthetics and energy efficiency are paramount. For companies, staying at the forefront of these developments requires continuous investment in research and collaboration with design professionals. By offering cutting-edge ACP solutions, firms meets the evolving demands of the construction industry and differentiate themselves in a competitive market.

What are the Key Market Drivers, Breakthroughs, and Investment Opportunities that will Shape the Aluminum Composite Panels Market in the Next Decade?

The market is experiencing robust growth, fueled by urbanization, infrastructure development, and a heightened focus on energy-efficient and aesthetically appealing building materials. The expansion is driven by the increasing adoption of ACP sheets in construction, transportation, and signage applications, owing to their lightweight, durable, and versatile properties.

However, the industry faces challenges such as fire safety concerns, regulatory compliance, and fluctuating raw material prices. Addressing these issues presents opportunities for innovation and differentiation. Companies investing in fire-resistant materials, sustainable production processes, and cost-effective solutions capitalize on emerging market demands.

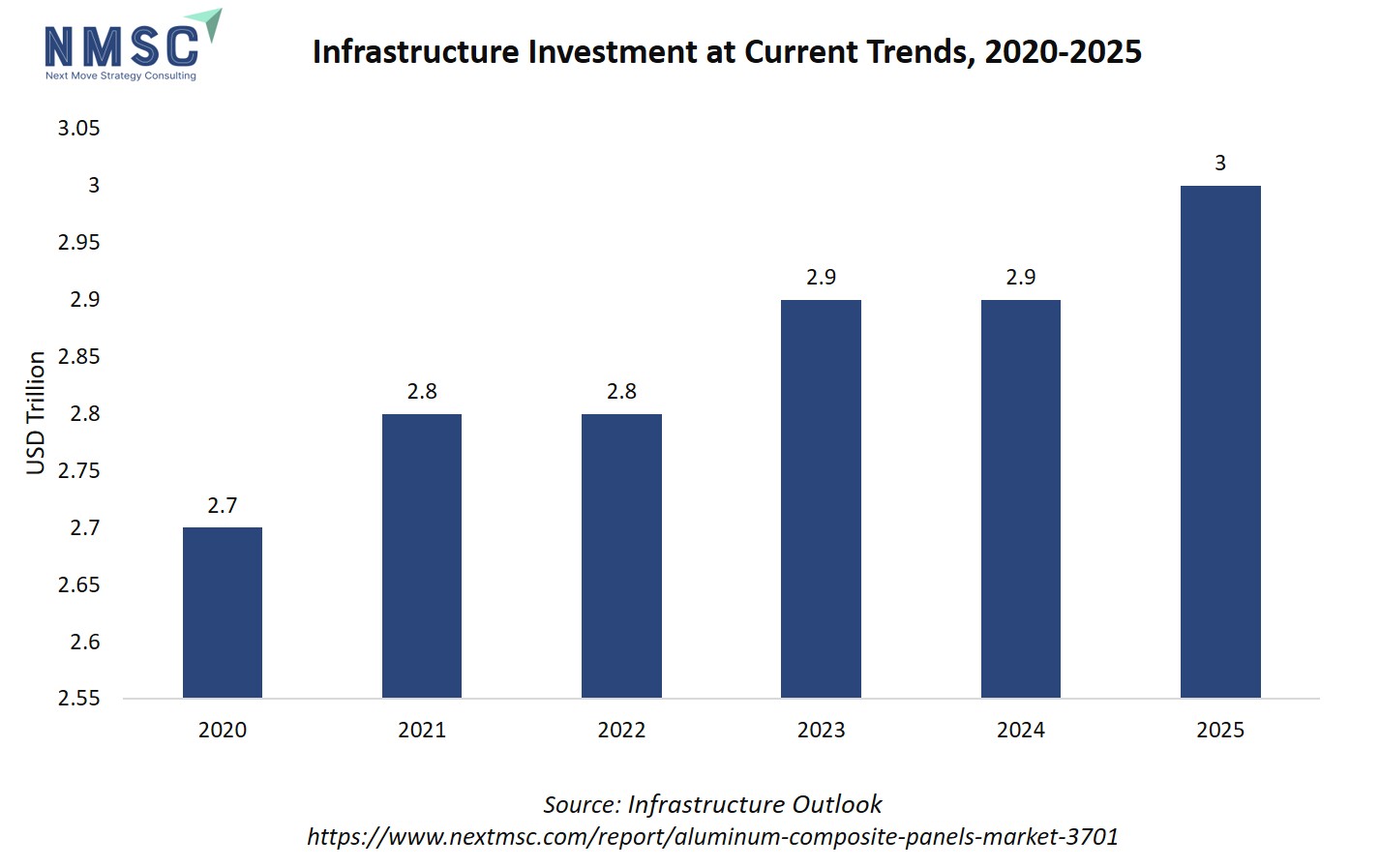

The future aluminum composite panels market trajectory hinges on balancing growth drivers with strategic investments and adherence to evolving industry standards. Also, infrastructure investment significantly boosts the market by stimulating demand for construction materials, creating jobs, and enhancing productivity across sectors.

Increased spending, especially in major projects like transportation, urban development, and public utilities, leads to greater consumption of critical materials such as aluminum composite panels, cement, steel, and advanced building products. In particular, the market for aluminum composite material (ACM) benefits as they are preferred for modern, energy-efficient buildings and large-scale infrastructure due to their durability, lightweight nature, and design versatility.

Growth Drivers:

How is the Growing Demand for Energy-Efficient Buildings Driving Market Expansion?

The increasing emphasis on energy-efficient buildings is a significant driver for the market. ACPs offer thermal insulation properties that contribute to energy conservation in buildings. Their lightweight nature reduces the overall load on structures, facilitating energy savings in heating and cooling systems.

As governments and organizations worldwide implement stricter energy efficiency regulations, the demand for materials like exterior wall panels that meet these standards is on the rise. For companies, aligning product offerings with energy-efficient solutions and obtaining relevant certifications enhances competitiveness and appeal to environmentally conscious consumers.

How is the Shift Towards Sustainable Construction Practices Influencing ACP Adoption?

Sustainability has become a cornerstone in modern construction, influencing material selection and design choices. ACPs, especially those with recyclable cores and low-VOC coatings, align with green building standards and certifications. This shift is evident in regions like Europe and North America, where sustainable construction practices are increasingly mandated.

Manufacturers focusing on eco-friendly ACPs tap into the growing market segment that prioritises environmental responsibility. By investing in sustainable production processes and transparent supply chains, companies enhance brand reputation and meet the evolving demands of the construction industry.

Growth Inhibitors:

What are the Implications of Fire Safety Regulations on Aluminum Composite Panels Market Dynamics?

Fire safety concerns have prompted stringent regulations in the market, particularly concerning the flammability of core materials. The adoption of fire-resistant ACPs is becoming essential to comply with building codes and ensure occupant safety. This trend is particularly pronounced in high-rise buildings and public infrastructure projects.

Manufacturers are investing in research and development to produce aluminum skin and core materials with enhanced fire-resistant properties, such as mineral-filled cores and non-combustible facings. For companies, staying ahead of regulatory changes and investing in fire-safe ACP technologies mitigate risks and open new industry opportunities.

How is Investment in Smart ACP Technologies Open New Market Opportunities?

The integration of smart technologies into ACPs is an emerging trend that presents new aluminum composite panels market opportunities. Smart ACPs with features like self-cleaning surfaces, integrated photovoltaic cells, and enhanced thermal insulation are gaining traction in the construction industry. These innovations cater to the growing demand for intelligent and energy-efficient building solutions.

Companies investing in smart ACP technologies differentiates themselves in a competitive market and meet the evolving needs of consumers and regulatory bodies. By embracing technological advancements, firms position themselves as leaders in the future of sustainable and intelligent construction materials.

How is the Aluminum Composite Panels Market Report Segmented, and What are the Key Insights from the Segmentation Analysis?

By Product Insights

Are PVDF, Polyester, Laminating Coatings, Oxide Film, or Other Coatings Dominating the Aluminum Composite Panels Market Share in 2025?

Based on product, the market is segmented into PVDF, polyester, laminating coating, oxide film, and others.

PVDF remains the specification leader for exterior ACPs because of its proven long-term colour and gloss retention, chemical and UV resistance, and rigorous architectural testing regimes, factors that make it the preferred top-coat for facades and high-end cladding. PVDF’s market strength is reinforced by architectural-grade performance standards and industry guidance on coil-coating processes.

Laminated surface finishes, including decorative films, textured laminates, and multi-layer protective skins, serve niche aesthetic and functional. These finishes let ACP manufacturers offer bespoke looks without expensive paint lines, enabling rapid customization for interior fit-outs, retail, and signage. Their market role is growing in retrofit and branding-heavy projects, but long-term weathering and recyclability concerns mean laminates are typically chosen for controlled-environment applications rather than exposed high-rise façades.

By Type Insights

Which Type is Driving the Aluminum Composite Panels Market in 2025?

On the basis of type, the market is segmented into fire-resistant, anti-bacterial, and antistatic.

Fire-resistant aluminum composite panels (FR-ACPs) continue to dominate the market in 2025 due to stricter global fire-safety regulations and increasing public awareness of façade safety. FR-ACPs use mineral-filled cores or A2-class compositions that delay flame spread while maintaining lightweight, aesthetic façades. Their adoption is particularly strong in commercial towers, airports, and institutional projects, making them the most preferred ACP type globally.

Anti-bacterial aluminum composite panels are gaining traction in healthcare, education, and hospitality sectors, driven by rising hygiene standards. These panels are coated with silver-ion or photocatalytic compounds that inhibit microbial growth on surfaces. The demand for such ACPs surged post-pandemic as developers prioritized infection control and cleaner indoor environments. Although smaller in volume than FR-ACPs, this segment is witnessing steady growth through hospital and laboratory construction.

Antistatic ACPs serve a more specialized role, primarily used in cleanrooms, semiconductor plants, and research facilities where static charge damage sensitive electronics. These panels are treated with conductive coatings or carbon-based additives to prevent electrostatic discharge. The segment remains niche but strategically important, with gradual adoption in high-tech industrial construction and data center infrastructure, especially across Asia and North America.

By Composition Insights

Which Composition is Dominating the Aluminum Composite Panels Market in 2025?

On the basis of composition, the market is segmented into surface coating, metal skin, core material, and rear skin.

Surface coatings remain the most visible and specification-critical component of ACPs, determining aesthetics, durability, UV resistance, and fire performance. High-performance coatings contribute significantly to façade longevity, color retention, and environmental compliance, driving demand for premium-grade materials in commercial and high-rise construction projects. Surface coatings also influence recyclability and maintenance cycles, making them a key differentiator in competitive bidding.

The aluminum metal skin provides structural support and protects the ACP core from mechanical damage, weathering, and corrosion. Thicker or anodized skins are preferred in high-traffic or exposed environments, while thin skins are used for decorative interiors. Metal skin innovation, including recycled content and alloy optimization, is increasingly influencing material selection in sustainable architecture.

Core material is critical in defining the fire, acoustic, and thermal performance of ACPs. Polyethylene cores dominate low-rise and budget projects due to cost-effectiveness. Core material composition directly affects regulatory compliance, safety certifications, and the adoption of ACPs in high-rise or public buildings, making it a central focus for manufacturers and architects. The rear skin provides structural balance, protects the core, and contributes to panel rigidity. While less visible than the surface skin, rear skins, coated or painted, prevent moisture ingress and improve panel flatness over time.

By End-Use Application Insights

Which End-Use Application is Steering Growth in the Aluminum Composite Panels Market in 2025?

Based on end-use application, the market is divided into construction, automotive, advertising boards, railways and others.

Construction remains the largest end-use segment for ACPs, accounting for the majority of global consumption. ACPs are widely used in façades, cladding, roofing, and interior partitioning due to their lightweight, durability, and design flexibility. Rising urbanization, high-rise developments, and green-building regulations, especially in Asia-Pacific and the Middle East, are driving demand for fire-resistant, energy-efficient, and aesthetically versatile panels in commercial and residential projects.

ACPs are widely used for outdoor signage, billboards, and display panels due to their flatness, printability, and weather resistance. Polyester or PVDF-coated ACPs dominate this segment, balancing cost and aesthetics. Growth is linked to urban commercial expansion, retail advertising demand, and large-format branding projects. Though the segment is niche in volume, it remains important for manufacturers targeting customization and design flexibility.

Railway applications are an emerging segment, with ACPs used in train exteriors, interiors, and station infrastructure. Demand is particularly strong in Europe and Asia, where high-speed rail networks and modern rolling-stock projects increasingly specify ACPs for façades, walls, and ceiling panels.

Regional Outlook

The aluminum composite panels market share is geographically studied across North America, Europe, Asia Pacific, Middle East & Africa, and Latin America and each region is further studied across countries.

Aluminum Composite Panels Market in North America

The market in North America is shaped by a blend of steady construction demand, rising retrofit activity and strict fire-safety and energy codes that push developers toward higher-performance cladding. Manufacturers are responding with fire-tested mineral cores, PVDF coatings and lightweight assemblies that simplify installation. AI-driven production scheduling and predictive maintenance are gradually improving yields and reducing scrap in North American plants, while modular façade systems accelerate adoption in commercial and institutional builds. Regional building-safety reforms have also raised demand for compliant ACP variants, making certification and testing a commercial differentiator.

Aluminum Composite Panels Market in the United States

In the U.S., ACP demand tracks commercial construction cycles and large-scale renovation projects; stringent local building codes and increased attention to façade fire performance after high-profile incidents have nudged specifiers toward non-combustible cores and tested systems. The U.S. construction sector’s multi-trillion-dollar scale sustains a base demand for cladding materials, but project-level emphasis on compliance and assurance has increased the value of tested, certified ACPs. U.S. manufacturers are deploying process automation and data telemetry to improve throughput and quality control, an operational edge when buyers prioritize certified performance.

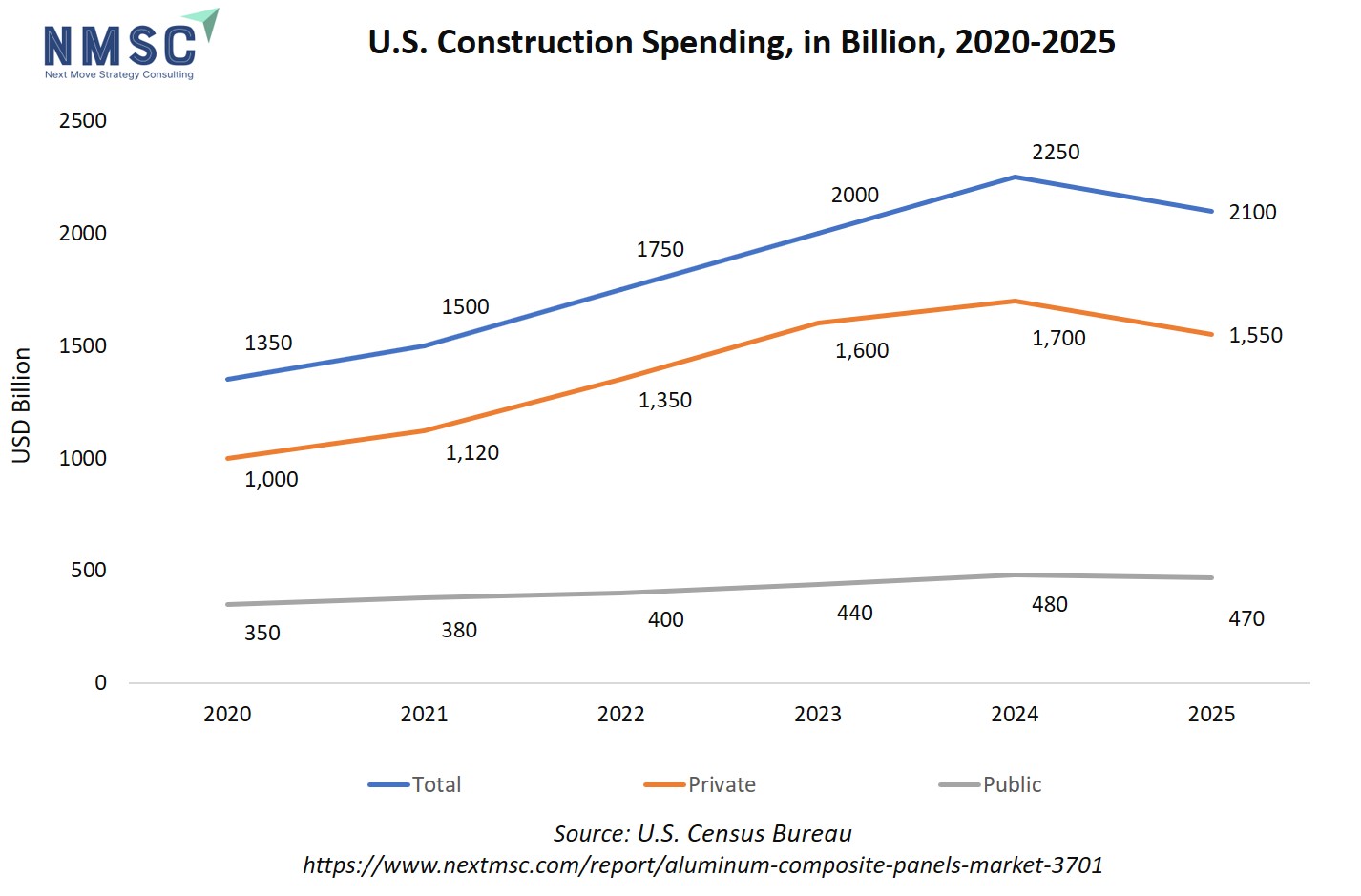

Also, construction spending directly influences the U.S. market by driving demand for both new builds and renovation projects. Higher investment in commercial, residential, and infrastructure projects increases the need for durable, lightweight, and aesthetically versatile façade solutions like ACPs. Construction expenditure acts as a primary barometer for the sector’s short- and medium-term performance.

The above chart illustrates the annual trend in U.S. construction spending across total, private, and public segments. The upward trajectory in overall construction investment underscores robust activity in both residential and commercial sectors, which directly drives demand for building materials such as aluminum composite panels. Increased spending signifies active new builds, renovations, and infrastructure projects, likely stimulating volume growth and technological innovation in the U.S. market.

Aluminum Composite Panels Market in Canada

Canada’s market is influenced by cold-climate performance requirements and a growing focus on energy efficiency in building envelopes. Provinces with active retrofit programs and urban infill projects use ACPs for lightweight façades that improve thermal performance while enabling contemporary aesthetics.

Supply chains emphasize corrosion resistance and moisture management for northern climates. Canadian fabricators are selectively adopting AI tools for thermal modelling and material optimization to meet passive-house and net-zero design goals, supporting ACPs that combine insulation-friendly cores and high-performance coatings.

Aluminum Composite Panels Market in Europe

Europe shows a two-speed landscape- strong adoption of high-spec, fire-resistant ACPs in Northern and Western Europe where stringent regulations and green building standards prevail, contrasted with mixed adoption in parts of Southern and Eastern Europe. Post-Grenfell regulatory tightening across the EU/UK has driven demand for non-combustible core technologies and retro-cladding programs in social and private housing. Advanced coatings for durability and recyclability, plus AI-led lifecycle analysis, are differentiators for suppliers targeting European projects that increasingly demand formal sustainability declarations (EPD) and compliance.

Aluminum Composite Panels Market in the United Kingdom

The U.K. market is defined by intense regulatory scrutiny since Grenfell, new Building Safety Regulator enforcement and bans on combustible external wall materials for many high-rise projects. That environment has accelerated demand for tested mineral-core and non-combustible ACP systems, and for third-party certification. Specifiers also prize whole-system compliance, such as, tested assemblies, fire barriers, and accredited installers. Manufacturers that supply verified, code-compliant solutions and support remediation programs finds a receptive market.

Aluminum Composite Panels Market in Germany

Germany’s emphasis on energy efficiency and durability steers architects to high-quality ACPs with excellent thermal and long-life coating performance. German projects value lifecycle analysis and recyclability; hence ACPs with reclaimed-Aluminum content and low-VOC finishes are increasingly specified. Industrialized façade manufacturing, BIM integration and process automation are common, and AI tools for design optimization and performance simulation are finding footholds among façade contractors pursuing certified green builds. The market rewards suppliers who demonstrates both technical compliance and sustainability credentials.

Aluminum Composite Panels Market in France

France balances aesthetics with performance. Contemporary urban projects favour ACP for its design flexibility, while national safety authorities and recent fire incidents have increased scrutiny of cladding systems. French building codes and local authorities require independent testing and transparent product declaration, encouraging suppliers to offer well-documented, fire-resistant ACP systems. Architects’ desire for novel finishes keeps demand alive for advanced coatings and textured panels, while manufacturers that combine tested safety performance with bespoke aesthetics gain an advantage.

Aluminum Composite Panels Market in Italy

Italy’s ACP demand is driven largely by commercial and renovation markets in dense urban centers where façade replacement and heritage-sensitive retrofits are common. Designers mix ACP with other cladding types for lightweight, ventilated façades that meet seismic and thermal constraints. Italian fabricators take advantage of advanced finishing techniques, and some are using digital tooling and AI-assisted patterning for complex façade geometries. The market rewards suppliers who deliver tailored aesthetics alongside reliable fire-performance data and rapid local fabrication.

Aluminum Composite Panels Market in Spain

Spain’s coastal urban projects and tourism-driven developments use ACP for façades that balance visual impact, corrosion resistance and maintainability. After recent apartment block fires that attracted scrutiny, regulators and clients are more focused on fire-safe material choices, accelerating interest in non-combustible cores for multi-storey residential projects. Suppliers combining durable coatings with certified fire performance and simple installation systems are better positioned to win work in Spain’s renovation and new-build segments.

Aluminum Composite Panels Market in the Nordics

The Nordic region prioritizes thermal performance, durability and sustainability, creating demand for ACP solutions that support net-zero goals and withstand harsh climates. High environmental standards and strong recycling targets make suppliers highlight aluminum recycling content and low embodied carbon in ACP offerings. Nordic contractors are early adopters of digital design tools and performance simulation; AI is used for optimising thermal breaks and fastening patterns to limit thermal bridging. Long lifecycles and maintainable finishes are selling points in Scandinavia’s facade market.

Aluminum Composite Panels Market in the Asia-Pacific

Asia-Pacific is the largest and most dynamic market due to rapid urbanization, massive new-build programs and infrastructure investment. China, India and Southeast Asia show divergent patterns. China’s property slowdowns weigh on some segments, yet infrastructure and public projects still demand ACPs for large façades; India’s urbanization and commercial growth fuel demand for lightweight, aesthetic cladding; Southeast Asia’s mixed regulatory regimes drive selective uptake of fire-resistant panels. Manufacturers scale local production and automation; AI-enabled plant control and design tools are increasingly used to meet massive volume and customization needs.

Aluminum Composite Panels Market in China

China historically accounts for a large share of ACP production and consumption, but property market weakness and a slowdown in residential starts reduced some demand in 2024. Still, public works, rail and urban renewal projects sustain ACP use for façades and station finishes. Domestic manufacturers focus on cost efficiency, while export opportunities exist where producers certify fire performance. Macro rebuilding strategies and regional economic stimulus re-ignite end-market demand, so suppliers watching policy shifts could time capacity and product launches.

Aluminum Composite Panels Market in Japan

Japan’s ACP usage is concentrated in commercial and urban façade applications where technical performance, corrosion resistance and seismic considerations matter. Japanese architects value precision, modular façades and longevity; suppliers emphasize high-durability coatings and meticulous installation standards. AI and digital manufacturing are applied in design for complex geometries and to optimize manufacturing tolerances. The market is stable and quality-driven, favoring suppliers with rigorous testing, long warranties, and strong local service networks.

Aluminum Composite Panels Market in India

India’s ACP adoption is rising rapidly with urban office parks, retail and metro infrastructure. Lightweight panels are attractive for fast building cycles and façade retrofits in dense cities. Local manufacturers are expanding capacity but face quality and compliance gaps compared with more regulated markets, creating opportunities for suppliers offering certified, fire-safe solutions. AI adoption is emerging in design optimization and plant automation, but addressing installation quality through accredited applicators remains a key market enabler. Economic growth and government infrastructure programs underpin sustained ACP demand.

Aluminum Composite Panels Market in South Korea

South Korea’s advanced construction sector and emphasis on high-quality finishes make ACP a regular choice for commercial façades and transport interiors. Korean manufacturers integrate high-performance coatings and precision fabrication; AI tools for CAD/CAM and production optimization are common. Urban redevelopment and high-speed rail infrastructure provide stable demand, and suppliers that offer proven fire performance and local technical support succeed in tendered projects. Market sophistication means compliance documentation and rapid local service are advantages.

Aluminum Composite Panels Market in Taiwan

Taiwan’s market emphasizes corrosion resistance and lightweight design for both commercial buildings and transportation applications. Given the island’s humidity and salt exposure, coatings and fastening solutions that resist degradation are important. Local fabricators increasingly use digital nesting and ERP systems to reduce waste, and AI-assisted quality inspection is emerging in higher-end plants. Strategic partnerships with coating suppliers and local façade contractors help ACP makers differentiate on longevity and maintenance performance.

Aluminum Composite Panels Market in Indonesia

Indonesia’s ACP demand is linked to commercial construction and tourism infrastructure. Regulatory attention to façade fire performance is growing but still uneven across regions, creating a fragmented market where imported, tested systems coexist with lower-cost local panels. Urban centres like Jakarta show stronger uptake of certified ACP products for malls and towers, while provincial markets favor cost and speed. Manufacturers that combine certified safety performance with cost-competitive local production capture market share as regulations and enforcement tighten.

Aluminum Composite Panels Market in Australia

Australia’s market balances aesthetic demand with strict building codes and recent reforms after cladding incidents, which stressed the need for non-combustible façade systems in certain building classes. State-level compliance and certification requirements favor suppliers who prove test results and provide system warranties. Australian contractors also value ease of installation and local technical support; manufacturers leveraging digital detailing and offsite prefabrication are winning larger façade packages.

Aluminum Composite Panels Market in Latin America

Latin America’s ACP adoption varies; major urban centres in Brazil, Mexico and Colombia are investing in commercial and retail projects that prefer ACP for fast façades and signage, while regulatory frameworks for fire performance remain mixed. Suppliers face logistics and import-duty considerations; local fabrication hubs exist but are smaller scale. Growth is tied to urban commercial development and refurbishment; companies that provide clear compliance documentation and climate-resistant finishes (for tropical zones) are better positioned for regional projects.

Aluminum Composite Panels Market in the Middle East & Africa

The Middle East uses ACP extensively for high-profile commercial, hospitality and mixed-use projects where aesthetics and large façade surfaces matter; hot climate durability and solar-reflective coatings are priorities. Wealthy Gulf markets favor high-end finishes and tested systems, while some African markets are price-sensitive and favor simpler ACPs. Large infrastructure programs in the Gulf and North Africa keep regional demand steady; suppliers that provide heat-resistant coatings and rapid local fabrication/installation support perform strongly.

Competitive Landscape

Which Companies Dominate the Aluminum Composite Panels Industry and How do they Compete?

The market is characterized by a diverse array of companies, each bringing unique strengths to the industry. Arconic, a leading manufacturer, offers a wide range of composite materials, including pre-painted heavy-gauge Aluminum and bonded sheets, catering to various architectural needs. Mitsubishi Engineering-Plastics Corporation focuses on providing engineering plastics, which complement ACP applications by enhancing material properties.

Fairfield Metal specializes in custom ACM panel fabrication, offering tailored solutions to meet specific project requirements. Similarly, Eurobond, based in India, offers high-quality ACPs known for their durability and aesthetic appeal. These companies compete by differentiating their product offerings, focusing on innovation, quality, and customer-specific solutions to capture market share.

Market Dominated by Aluminum Composite Panels Giants and Specialists

The market is shaped by a combination of industry giants and specialized manufacturers. Large-scale producers like Arconic and Alubond USA leverage their extensive manufacturing capabilities and global presence to dominate the market. Arconic, for instance, offers a broad range of composite materials and has a significant footprint in the architectural products sector. On the other hand, companies like Fairfield Metal and Yaret Technology focus on niche markets, providing customized solutions and specialized products to meet specific customer needs.

On the other hand, companies like Fairfield Metal and Yaret Technology focus on niche markets, providing customized solutions and specialized products to meet specific customer needs. This dynamic creates a competitive landscape where large players set industry standards, while specialists cater to unique requirements, driving innovation and diversity in the market.

Innovation and Adaptability Drive Market Success

Innovation plays a pivotal role in the success of ACP manufacturers. Companies are continuously developing new materials and technologies to meet evolving market demands. For instance, Yaret Technology has introduced nano self-cleaning ACPs, enhancing the durability and maintenance of building facades.

Similarly, Fairfield Metal offers a range of panel systems, including ECONECT-RS and ECONECT-Z, designed for faster fabrication and simplified installation. These innovations not only improve product performance but also address specific challenges in the construction industry, such as sustainability and efficiency. Manufacturers that prioritize research and development are better positioned to adapt to market changes and maintain a competitive edge.

Market Players to Opt for Merger & Acquisition Strategies to Expand their Presence

To expand their market presence and capabilities, several ACP manufacturers are pursuing merger and acquisition strategies. Alubond USA, for example, has established a significant manufacturing and processing capacity across multiple countries, including the USA, UAE, and China, positioning itself as a global leader in the market. Such strategic expansions enable companies to access new markets, enhance production capabilities, and diversify their product offerings. By acquiring or merging with other firms, ACP manufacturers leverage synergies, reduce operational costs, and strengthen their position in a competitive industry. These strategies are crucial for companies aiming for long-term growth and sustainability in the market.

Key Players

-

Arconic

-

Mitsubishi Engineering-Plastics Corporation

-

Fairfield Metal

-

Yaret Technlology

-

Eurobond

-

Aldeko Panels Private Limited

-

ALUBOND U.S.A

-

Aludecor

-

3A Composites

-

ALUMAX COMPOSITE MATERIAL

-

ALUMAX PANEL INC

-

Alstrong

-

Guangzhou Xinghe Co., Ltd

-

Multipanel

-

Viva ACP

What are the Latest Key Industry Developments?

-

October 2025- Arconic announced a USD 57.5 million investment to double its high-purity aluminum production capacity at the Davenport Works plant in Iowa. This expansion aims to meet the growing demand for aerospace and defence applications, enhancing Arconic's position in the high-performance materials sector.

-

April 2024- Mitsubishi Engineering-Plastics Corporation introduced new engineering plastic products at CHINAPLAS 2024, focusing on automotive, electronics, and medical markets. The company also unveiled a concept utilizing Circular Carbon Methanol to produce engineering plastics, highlighting its commitment to sustainability and innovation in material science.

-

March 2024- Eurobond ACP invested in cutting-edge coating technologies to enhance the durability and aesthetic appeal of its panels. Their panels now exhibit exceptional resistance to weathering, corrosion, and UV rays, making them suitable for high-rise facades and artistic installations, thereby strengthening Eurobond's market position.

What are the Key Factors Influencing Investment Analysis & Opportunities in the Aluminum Composite Panels Market?

Private capital is increasingly eyeing building-materials innovators that solve safety and sustainability problems, and ACP manufacturers that demonstrate tested, low-carbon products are commanding higher valuations. Growth-stage funding is skewing toward companies offering differentiated cores, recyclable aluminum sourcing, or smart façades (PV-integrated or sensor-enabled) because these reduce lifecycle costs and regulatory risk.

Valuations remain sensitive to aluminum feedstock volatility and margin pressure from commoditised panels, so investors favour vertically integrated players or firms with durable IP and certified fire-performance that de-risks deployment in regulated markets.

Investment hotspots cluster where construction activity and regulatory upgrades intersect: Asia–Pacific (India, Southeast Asian metros) for volume and retrofit demand, Gulf states for premium commercial projects, and Western Europe/Canada for high-spec, sustainable systems. Short-term opportunities include retro-cladding services and certified non-combustible panels; longer-term upside lies in scalable, automated fabrication and circular-recycling platforms that lower embodied carbon and boost margins.

Key Benefits for Stakeholders:

Next Move Strategy Consulting (NMSC) presents a comprehensive analysis of the aluminum composite panels market trends, covering historical trends from 2020 through 2024 and offering detailed forecasts through 2030. Our study examines the market at regional and country levels, providing quantitative projections and insights into key growth drivers, challenges, and investment opportunities across all major market segments.

The industry offers multifaceted benefits across its stakeholder ecosystem. For investors, it provides a resilient and expanding market backed by global urbanization, sustainable construction mandates, and ongoing innovation in materials and manufacturing technologies. These factors translate into steady returns and scalable growth potential, particularly as governments tighten energy-efficiency and fire-safety regulations.

For customers, including architects, developers, and contractors, ACPs deliver aesthetic flexibility, durability, and cost-effectiveness, allowing for rapid installation and reduced maintenance over building lifecycles. End users also benefit from improved building performance, including better insulation and safety. As technological advancements such as AI-driven design and recyclable cores mature, both investors and customers gain from enhanced product quality, regulatory compliance, and long-term environmental sustainability.

Report Scope:

|

Parameters |

Details |

|

Market Size in 2025 |

USD 9.69 Billion |

|

Revenue Forecast in 2030 |

USD 13.34 Billion |

|

Growth Rate |

CAGR of 6.70% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Countries Covered |

33 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent to up to 80 analyst-working hours) after purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

|

Approach |

In-depth primary and secondary research; proprietary databases; rigorous quality control and validation measures. |

|

Analytical Tools |

Porter's Five Forces, SWOT, value chain, and Harvey ball analysis to assess competitive intensity, stakeholder roles, and relative impact of key factors. |

Aluminum Composite Panels Market Key Segments

By Product

-

PVDF

-

Polyester

-

Laminating Coating

-

Oxide Film

-

Others

By Type

-

Fire Resistant

-

Anti-Bacterial

-

Antistatic

By Composition

-

Surface Coating

-

Metal Skin

-

Core Material

-

Rear Skin

By End Use Application

-

Construction

-

Automotive

-

Doors

-

Hoods

-

Wings

-

Side Panels

-

Trailers

-

Others

-

-

Advertising Boards

-

Railways

-

Other Applications

Geographical Breakdown

-

North America: U.S., Canada, and Mexico.

-

Europe: U.K., Germany, France, Italy, Spain, Sweden, Denmark, Finland, Netherlands, and rest of Europe.

-

Asia Pacific: China, India, Japan, South Korea, Taiwan, Indonesia, Vietnam, Australia, Philippines, Malaysia and rest of APAC.

-

Middle East & Africa (MEA): Saudi Arabia, UAE, Egypt, Israel, Turkey, Nigeria, South Africa, and rest of MEA.

-

Latin America: Brazil, Argentina, Chile, Colombia, and rest of LATAM.

Conclusion & Recommendations

Our report equips stakeholders, industry participants, investors, and consultants with actionable intelligence to capitalize on the transformative aluminum composite panels market potential. By combining robust data-driven analysis with strategic frameworks, NMSC’s Market Report serves as an indispensable resource for navigating the evolving landscape.

The market stands at a pivotal point where sustainability, innovation, and regulation are shaping its global trajectory. As cities modernise and environmental policies tighten, ACPs are evolving from simple aesthetic cladding to advanced, multifunctional building materials that enhance safety, energy efficiency, and design flexibility.

The fusion of AI-driven manufacturing, recyclable materials, and smart façades is redefining industry standards, ensuring steady growth across both mature and emerging economies. This transformation signals a shift toward high-performance, eco-conscious solutions that align with the future of construction.

For executives and investors, the path forward lies in strategic alignment with regulatory trends, green building certifications, and digital transformation. Investing in R&D for fire-resistant and sustainable ACP variants, forging partnerships with technology providers, and expanding local fabrication capabilities in high-growth markets will be critical. Stakeholders who embrace innovation, compliance, and sustainability today are best positioned to capture long-term value in the evolving global ACP landscape.

Speak to Our Analyst

Speak to Our Analyst