Aluminum in Construction Market by Product Type (Extrusions, Sheets and Plates, ACPs, Aluminum Castings), by Application (Architectural, Structural, Roofing and Cladding, Interior Finishes, Glass and Glazing Support, Balustrades and Handrails, Sunshades and Louvers, and others), and by End-User Industry (Residential Construction, Commercial Construction, Industrial Construction, Infrastructure and Transportation, and Others) – Global Opportunity Analysis and Industry Forecast, 2025–2030

Industry Outlook

The global Aluminum in Construction Market size was valued at USD 137.16 billion in 2024 and is expected to reach USD 144.56 billion by 2025. Looking ahead, the industry is projected to expand significantly, reaching USD 188.01 billion by 2030, registering a CAGR of 5.39% from 2025 to 2030.

The aluminum extrusion profiles is experiencing significant growth, driven by sustainability, technological innovation, and global urbanization. Aluminum’s recyclability, energy efficiency, and durability make it a preferred choice for eco-conscious and sustainable building practices. Advances in manufacturing, including 3D printing, automated roll forming, and smart panels, are enhancing precision, customization, and energy optimization. Additionally, rising urban populations are fueling demand for lightweight, durable, and versatile aluminum components in high-rise buildings, transportation hubs, and large-scale infrastructure projects, positioning the material as a key solution for modern, intelligent, and sustainable construction.

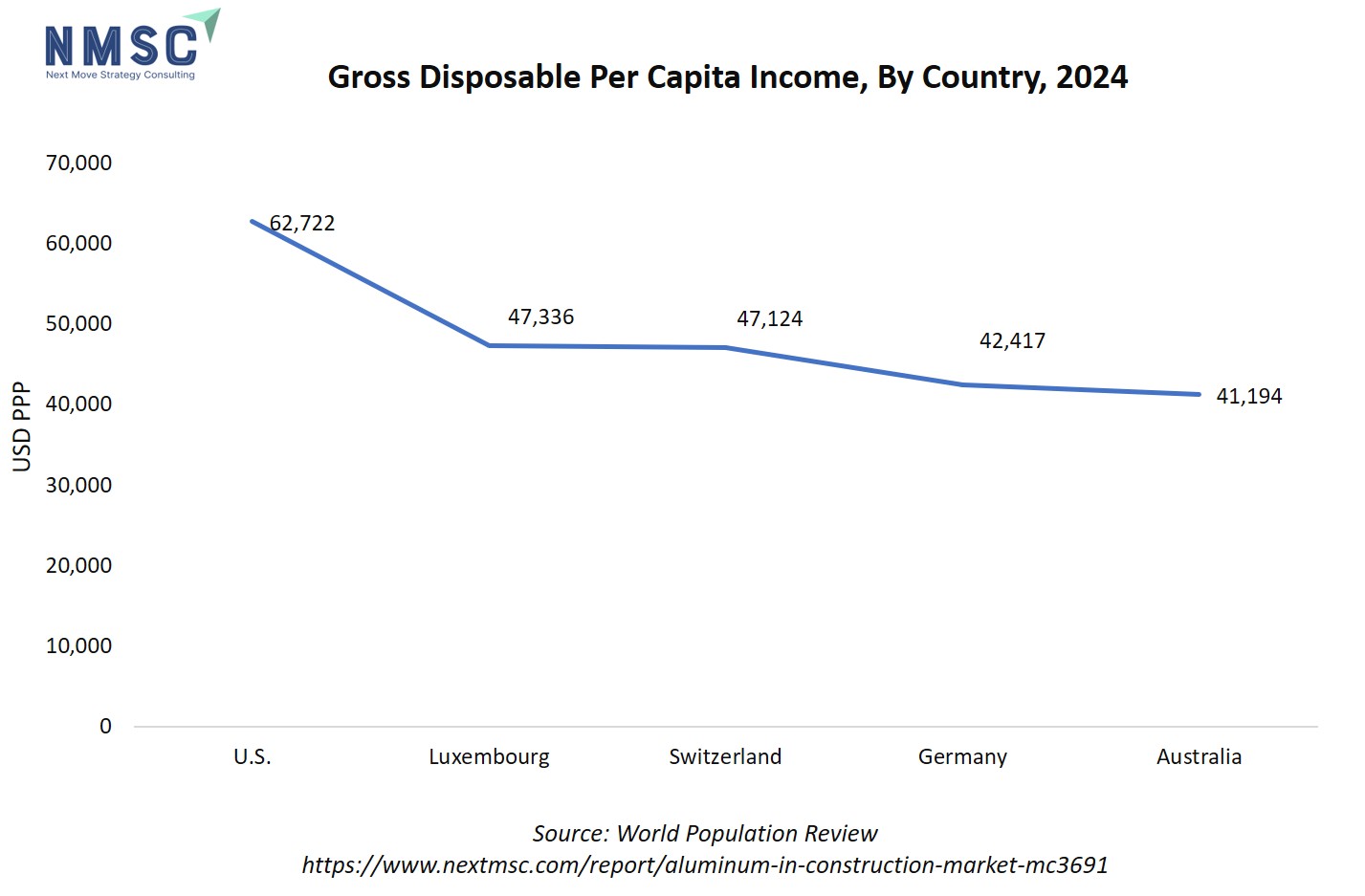

The above chart depicting gross disposable per capita income across countries highlights the purchasing power of key markets for aluminum in construction. Higher disposable income, such as in the U.S., Luxembourg, and Switzerland, supports greater investment in premium construction materials, including lightweight, durable, and sustainable aluminum solutions for commercial, residential, and infrastructure projects. Overall, these income patterns help industry players prioritize markets with strong spending capacity while tailoring product offerings to meet affordability, sustainability, and performance expectations, thereby influencing strategic expansion, adoption rates, and investment planning in the aluminum construction sector.

What are the Key Trends in the Aluminum in Construction Market?

What Role does Sustainability Play in Aluminum's Growing Popularity in Construction?

Sustainability is a pivotal factor driving the increased use of extruded aluminum building sections. Aluminum's recyclability and energy efficiency align with the growing emphasis on sustainable building practices. The growth is partly attributed to the material's role in reducing the environmental impact of construction projects. Aluminum's lightweight nature contributes to energy savings during transportation and installation, while its durability extends the lifespan of building components, reducing the need for frequent replacements. Moreover, the material's ability to be recycled without loss of quality supports circular economy principles, minimizing waste and conserving resources. Construction companies focusing on sustainable practices leverage aluminum's environmental benefits to meet green building standards and appeal to eco-conscious clients.

How are Technological Innovations Enhancing Aluminum's Applications in Construction?

Technological innovations are significantly enhancing aluminum's applications in the construction industry, leading to more efficient and versatile use of the material. Advancements in manufacturing technologies, such as automated roll forming and 3D printing, are improving the precision and customization of aluminum components. These innovations enable the production of complex designs and reduce material waste, contributing to cost savings and sustainability. Additionally, the development of smart aluminum panels embedded with sensors allows for real-time monitoring of building performance, facilitating predictive maintenance and optimizing energy usage. As the construction industry continues to embrace digitalization and smart technologies, aluminum's role is expanding beyond traditional applications, positioning it as a key material in the development of intelligent and sustainable buildings. Companies investing in these technological advancements enhance their product offerings and stay competitive in the evolving construction market.

What Impact does Global Urbanization have on Aluminum Demand in Construction?

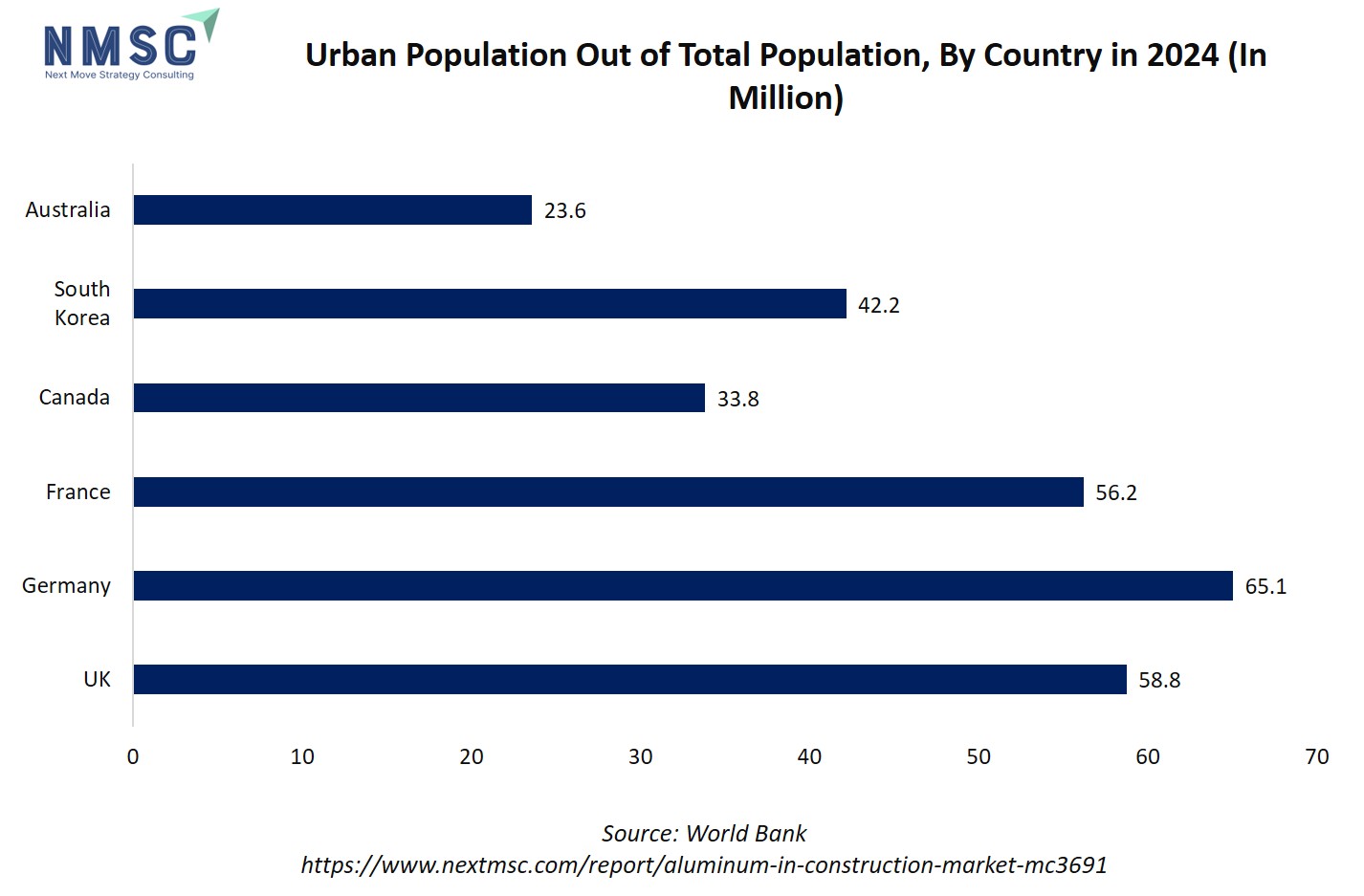

Global urbanization is a significant driver of aluminum demand in the construction industry. As urban populations grow, there is an increasing need for efficient, durable, and sustainable building materials to accommodate the expanding infrastructure requirements. Aluminum's lightweight and durable properties make it an ideal choice for high-rise buildings, transportation hubs, and other large-scale urban projects. Their growth is driven by the increasing adoption of aluminum in various construction applications, including structural components, facades, and interior elements. As urbanization accelerates, the demand for aluminum in construction is expected to rise, presenting opportunities for companies to expand their product offerings and cater to the evolving needs of urban development.

What are the Key Market Drivers, Breakthroughs, and Investment Opportunities that will Shape the Aluminum in Construction Market in the Next Decade?

The alloy-based construction materials is experiencing dynamic growth, propelled by technological advancements, sustainability imperatives, and evolving urban demands. Key drivers include the increasing adoption of aluminum in commercial buildings, clean energy applications like solar installations, and federal infrastructure spending. However, the industry faces challenges such as raw material price fluctuations and trade restrictions. Despite these hurdles, opportunities abound in areas like low-carbon aluminum production and smart building technologies.

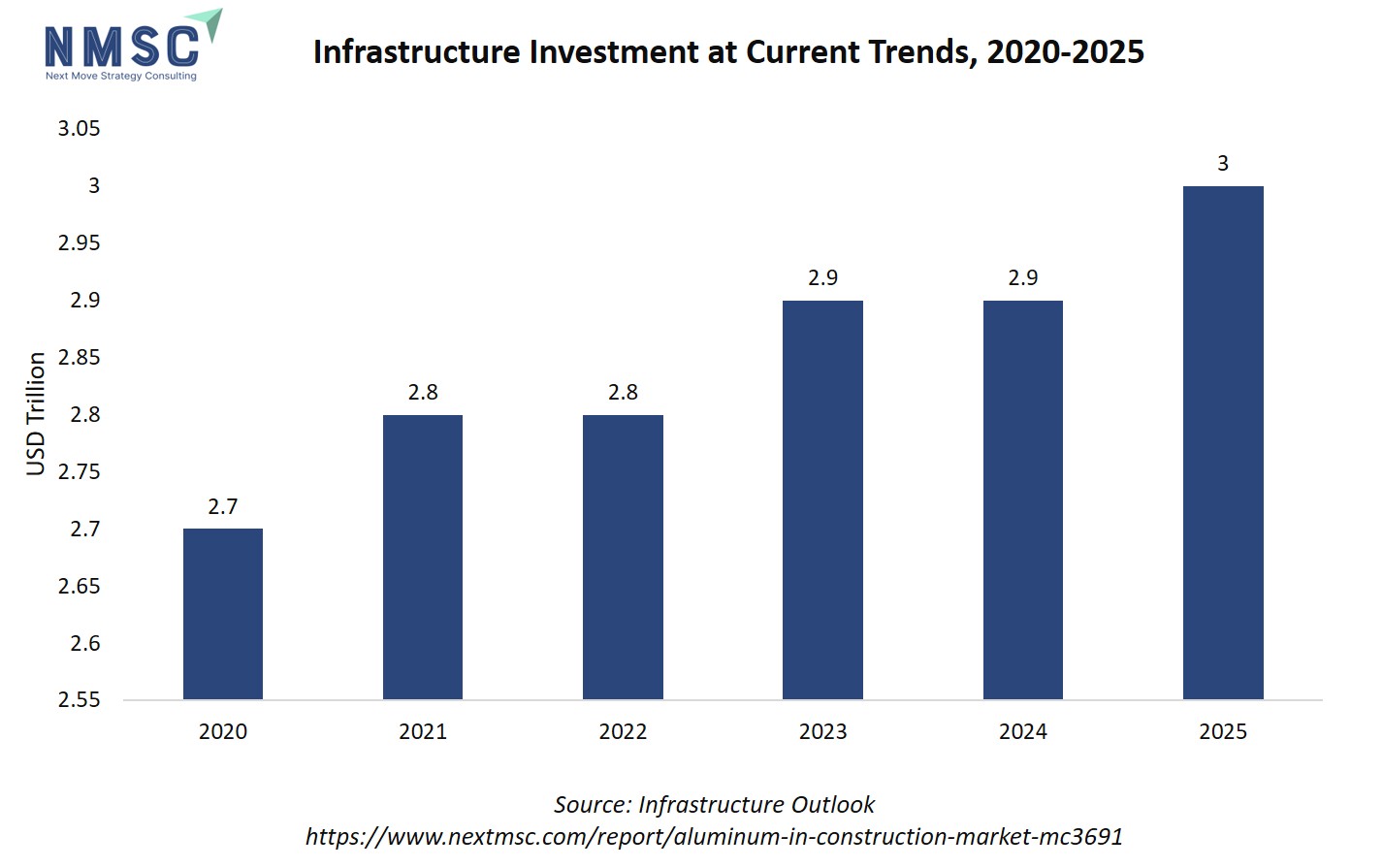

The projected rise in global infrastructure investment signals a significant positive impact on the aluminum in construction market, as this surge in public and private spending on projects like transportation networks, bridges, and public buildings will substantially increase demand for aluminum due to its essential role in modern structural frameworks, façades, and building systems prized for their strength, light weight, and corrosion resistance.

Growth Drivers:

How is the Shift Towards Clean Energy Influencing Aluminum Demand in Construction?

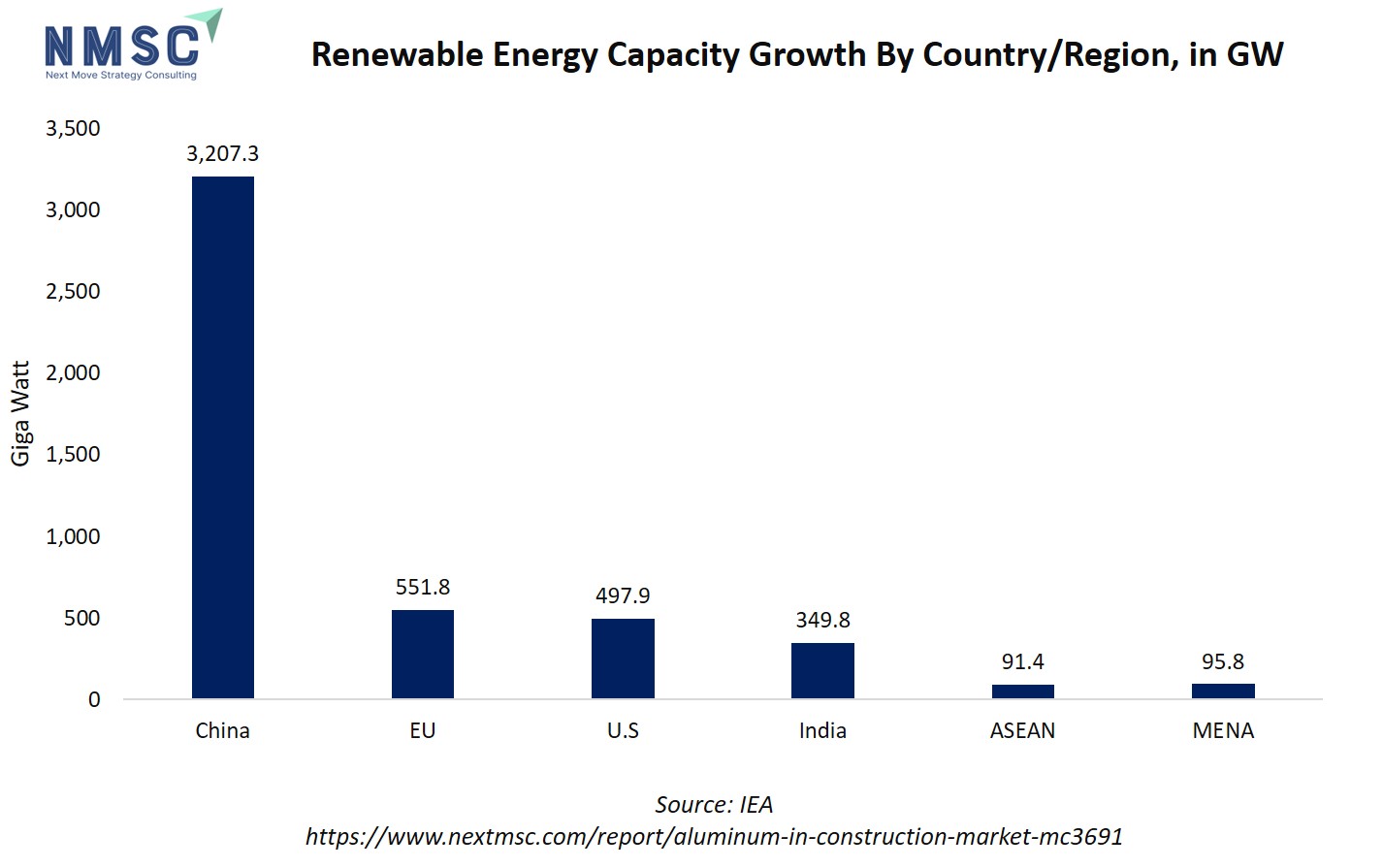

The transition to clean energy is significantly impacting aluminum demand, particularly in solar energy applications. Aluminum's role in solar panel frames and mounting systems is expanding as the world moves towards renewable energy sources. This shift is part of a broader trend where aluminum is increasingly utilized in clean energy projects, including electric vehicles and grid infrastructure. For industry stakeholders, aligning with clean energy initiatives and incorporating aluminum solutions position businesses at the forefront of the sustainable energy movement.

The explosive growth in renewable energy capacity depicted in the chart, led by China, the EU, and the U.S., directly fuels a parallel boom in the aluminum in construction market, as this expansion necessitates the massive deployment of solar farms, wind turbines, and upgraded grid infrastructure, all of which are heavily dependent on aluminum for the construction of durable, lightweight, and corrosion-resistant mounting systems, structural frames, and conductive transmission lines, making the metal a fundamental enabler of the global clean energy transition.

What Factors are Driving the Increased Use of Aluminum in Commercial Construction?

The demand for aluminum in commercial and non-residential construction continues to grow due to its lightweight, durable, and corrosion-resistant properties. In 2024, the U.S. non-residential construction sector is estimated to consume approximately 183 pounds of aluminum per USD 100,000 in construction spending. This demonstrates aluminum’s critical role in curtain walls, window and door frames, roofing, and cladding systems. The emphasis on energy efficiency, modern architectural designs, and sustainable building practices is further accelerating adoption. Construction firms leveraging aluminum for non-residential projects benefit from improved structural performance, reduced maintenance costs, and alignment with green building certifications, making it a strategic material choice for contemporary commercial projects.

Growth Inhibitors:

What are the Challenges Hindering Aluminum's Growth in Construction?

Aluminum faces challenges that could impede its growth in the construction sector. Fluctuating prices of raw materials like bauxite and alumina affect production costs and project budgets. Trade restrictions and tariffs, such as the 50% U.S. import tariff on aluminum, have led to higher prices and disrupted supply chains. Additionally, the energy-intensive nature of aluminum production raises environmental concerns and operational costs. Addressing these issues requires strategic planning and adaptation to maintain aluminum's competitiveness in the market.

What Investment Opportunities are Emerging in Low-carbon Aluminum Production?

The push for sustainability is opening investment avenues in low-carbon aluminum production. For instance, Rio Tinto has partnered with AMG Metals & Materials to explore a low-carbon aluminum project in India, aiming to produce up to 1 million tonnes per annum using renewable energy sources. Such initiatives highlight the growing interest in environmentally friendly aluminum production methods. Investors focusing on low-carbon technologies capitalize on this trend, supporting the development of sustainable aluminum solutions in the construction industry.

How is Aluminum in Construction Market Segmented in this Report, and What are the Key Insights from the Segmentation Analysis?

By Product Type Insights

Are extrusions, sheets & plates, ACPs, or castings dominating aluminum in construction in 2025?

The Metal extrusion industry is segmented into extrusions, sheets and plates, composite panels (ACPs), and aluminum castings.

Extruded aluminum profiles remain the backbone of building products because they combine low weight, design flexibility, and recyclability, the aluminum association reports extrusions make up the largest share of building-product shipments (windows, curtain walls, door frames). This sub-segment benefits from retrofit and non-residential construction activity and from policy-driven clean-energy installs, for example, window-mounted solar supports.

Sheets and plates are vital for weatherproofing and architectural cladding. At a national scale USGS shows building is a material-intensive end use of aluminum, and sheets are the primary semis used for cladding and roofing because of formability and corrosion resistance. On the other hand, ACPs have risen as a design-led sub-segment: they deliver high aesthetics, lightweight façade solutions, and thermal performance improvements. Global industry bodies and trade analyses note construction will absorb more aluminum to 2030, with urbanisation and commercial building activity pushing façade demand. ACP uptake is strongest where building codes emphasize fire-safe cores and insulation; manufacturers who certify fire ratings and supply high-recycle-content panels will win specification battles in large commercial projects.

Castings are a smaller but strategically important niche in construction for bespoke connectors, structural fittings, and some facade hardware. IAI and USGS material-flow data show cast and fabricated aluminum serve specialised applications where strength-to-weight and corrosion resistance matter; volumes are lower but technical barriers (tooling, alloys) protect margins. Growth depends on modular construction and prefabrication trends: as offsite building rises, demand for precision cast components and integrated joinery is likely to climb.

By Application Insights

Is Architectural or Structural Use Leading the Aluminum in Construction Market by Application in 2025?

Based on Application, the market is divided into Architectural, Structural, Roofing and Cladding, Interior Finishes, Glass and Glazing Support, Balustrades and Handrails, Sunshades and Louvers, Doors and Windows, Skylights and Canopies, and Staircases and Walkways.

Architectural applications dominate the aluminum in construction market in 2025, driven by growing demand for sustainable and modern design solutions. According to the International Aluminum Institute (IAI), buildings account for nearly 25% of global aluminum use, largely for architectural façades and decorative structures. Architects increasingly specify aluminum for its aesthetic flexibility, recyclability, and energy-efficient properties. Demand is particularly high in smart cities and commercial hubs prioritizing green-certified designs and low-carbon materials.

Structural use of aluminum is gaining prominence due to its strength-to-weight ratio and corrosion resistance. With the construction industry shifting toward offsite modularization and sustainable frameworks, structural aluminum is expected to see sustained adoption in 2025. This sub-segment benefits from government initiatives promoting lightweight infrastructure and recyclable materials in public projects.

Aluminum is increasingly used for interior design elements such as partitions, ceilings, and trims. The IAI notes that aluminum’s versatility and lightweight nature make it a favored choice for modern interior aesthetics, particularly in corporate and hospitality spaces. Demand is also supported by rising renovation projects and the use of anodized or powder-coated finishes that offer enhanced visual appeal and durability.

By End-User Insights

Which End-user Segment is Driving the Aluminum in Construction Market Growth in 2025?

On the basis of end-user, the market is segmented into residential construction, commercial construction, industrial construction, infrastructure and transportation, healthcare facilities, educational institutions, sports and recreation facilities, government and public buildings, agricultural and rural construction, and specialized construction.

The residential segment continues to be a leading consumer of aluminum in 2025, supported by the growing demand for energy-efficient homes and sustainable building materials. Residential buildings account for a significant portion of global aluminum use due to widespread application in doors, windows, roofing, and cladding. Rising urbanization and government-backed affordable housing programs, especially in Asia-Pacific and the Middle East are accelerating aluminum adoption for lightweight and low-maintenance housing solutions.

In industrial applications, aluminum’s corrosion resistance, durability, and recyclability make it a preferred material for factories, warehouses, and processing plants. Industrial infrastructure increasingly integrates aluminum roofing, partitions, and ventilation systems to optimize energy efficiency and reduce long-term maintenance costs. With global industrial expansion and the shift toward sustainable manufacturing, this segment continues to show steady growth in aluminum utilization.

On the other hand, schools and universities increasingly adopt aluminum in their building envelopes, roofing, and windows to meet sustainability and safety standards. Educational infrastructure projects worldwide are prioritizing materials that reduce lifecycle costs and improve energy efficiency. Lightweight aluminum structures enable faster construction timelines and are commonly used in modular classrooms and campus expansions.

Regional Outlook

The aluminum in construction market share is geographically studied across North America, Europe, Asia Pacific, Middle East & Africa, and Latin America and each region is further studied across countries.

Aluminum in Construction Market in North America

In North America, the aluminum in construction market is experiencing steady growth, driven by technological advancements and a focus on sustainability. The region's construction industry is increasingly adopting aluminum due to its lightweight, durability, and recyclability, aligning with green building standards. Technological innovations, such as the development of high-strength alloys and improved manufacturing processes, are enhancing the performance and versatility of aluminum in construction applications. Additionally, the integration of AI and automation in construction processes is optimizing material usage and reducing waste, further promoting aluminum's adoption. The U.S. market, in particular, is witnessing a surge in demand for aluminum in non-residential construction, with projections indicating a significant increase in consumption by 2027.

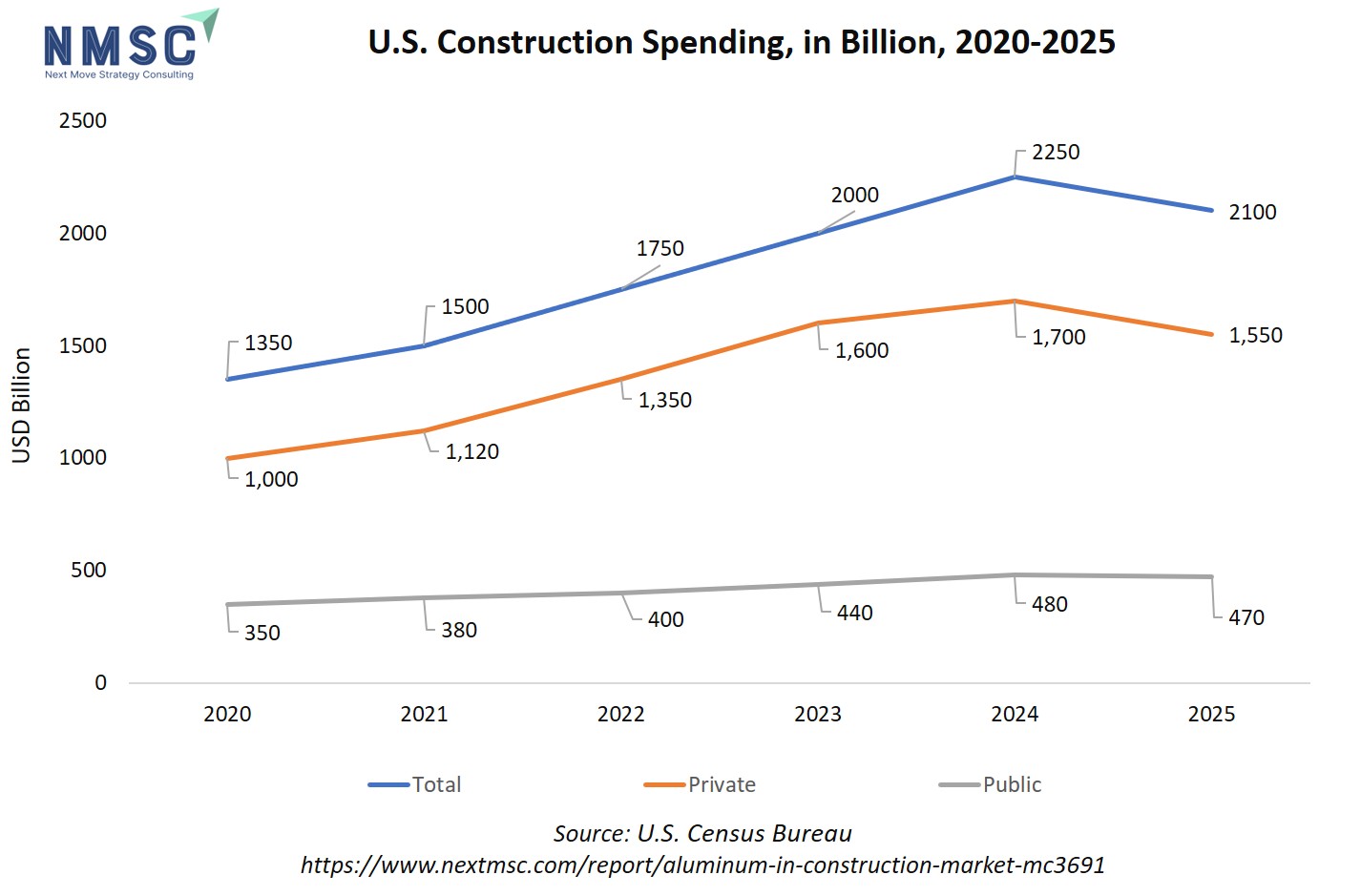

The chart depicting a substantial and consistent rise in U.S. construction spending from 2020 to 2025, driven by growth in both private and public sectors, directly stimulates the aluminum in construction market by creating robust demand for the metal across a wide range of projects, from commercial and residential buildings (private) to infrastructure and public facilities, where aluminum is extensively used for structural components, curtain walls, windows, and roofing due to its durability, design flexibility, and sustainability.

Aluminum in Construction Market in the United States

The United States is leading the charge in adopting aluminum for construction, particularly in non-residential sectors such as commercial buildings and infrastructure. In 2024, the U.S. non-residential construction sector consumed approximately 183 pounds of aluminum per USD 100,000 in construction spending. This trend is fueled by the growing emphasis on sustainable building materials and energy-efficient designs. Technological advancements, including the use of AI and Building Information Modeling (BIM), are streamlining construction processes and enhancing the efficiency of aluminum applications. Despite challenges like import tariffs, the demand for aluminum in construction remains robust, driven by its versatility and alignment with green building standards.

Aluminum in Construction Market in Canada

Canada's aluminum in construction market demand is experiencing steady growth, driven by a combination of economic factors and technological advancements. The country's construction industry is increasingly adopting aluminum due to its lightweight, durability, and recyclability, aligning with green building standards. Technological innovations, such as the development of high-strength alloys and improved manufacturing processes, are enhancing the performance and versatility of aluminum in construction applications. Additionally, the integration of AI and automation in construction processes is optimizing material usage and reducing waste, further promoting aluminum's adoption. The Canadian market is witnessing a rise in demand for aluminum in both residential and non-residential construction sectors, driven by urbanization and infrastructure development.

Aluminum in Construction Market in Europe

Europe's aluminum in construction market is characterized by a strong emphasis on sustainability and technological innovation. The region's construction industry is increasingly adopting aluminum due to its lightweight, durability, and recyclability, aligning with green building standards. Technological advancements, such as the development of high-strength alloys and improved manufacturing processes, are enhancing the performance and versatility of aluminum in construction applications. The integration of AI and automation in construction processes is optimizing material usage and reducing waste, further promoting aluminum's adoption. Countries like Germany and France are leading the way in incorporating aluminum into their construction projects, driven by government initiatives and a focus on energy-efficient buildings.

Aluminum in Construction Market in the United Kingdom

The United Kingdom's aluminum in construction market is experiencing growth, driven by sustainability initiatives and technological advancements. The country's construction industry is increasingly adopting aluminum due to its lightweight, durability, and recyclability, aligning with green building standards. Technological innovations, such as the development of high-strength alloys and improved manufacturing processes, are enhancing the performance and versatility of aluminum in construction applications. Additionally, the integration of AI and automation in construction processes is optimizing material usage and reducing waste, further promoting aluminum's adoption. The UK market is witnessing a rise in demand for aluminum in both residential and non-residential construction sectors, driven by urbanization and infrastructure development.

Aluminum in Construction Market in Germany

Germany's aluminum in construction market growth is robust, driven by a combination of economic factors and technological advancements. The country's construction industry is increasingly adopting aluminum due to its lightweight, durability, and recyclability, aligning with green building standards. Technological innovations, such as the development of high-strength alloys and improved manufacturing processes, are enhancing the performance and versatility of aluminum in construction applications. The integration of AI and automation in construction processes is optimizing material usage and reducing waste, further promoting aluminum's adoption. Germany's commitment to sustainability and energy-efficient buildings is further fueling the demand for aluminum in construction.

Aluminum in Construction Market in France

France's aluminum in construction market is experiencing growth, driven by sustainability initiatives and technological advancements. The country's construction industry is increasingly adopting aluminum due to its lightweight, durability, and recyclability, aligning with green building standards. Technological innovations, such as the development of high-strength alloys and improved manufacturing processes, are enhancing the performance and versatility of aluminum in construction applications. Additionally, the integration of AI and automation in construction processes is optimizing material usage and reducing waste, further promoting aluminum's adoption. France's focus on energy-efficient buildings and government incentives are contributing to the rise in aluminum usage in construction projects.

Aluminum in Construction Market in Italy

Italy's aluminum in construction market is characterized by a strong emphasis on design and innovation. The country's construction industry is increasingly adopting aluminum due to its lightweight, durability, and recyclability, aligning with green building standards. Technological advancements, such as the development of high-strength alloys and improved manufacturing processes, are enhancing the performance and versatility of aluminum in construction applications. The integration of AI and automation in construction processes is optimizing material usage and reducing waste, further promoting aluminum's adoption. Italy's rich architectural heritage and focus on sustainable design are driving the demand for aluminum in construction projects.

Aluminum in Construction Market in Spain

Spain's aluminum in construction market is experiencing growth, driven by urbanization and infrastructure development. The country's construction industry is increasingly adopting aluminum due to its lightweight, durability, and recyclability, aligning with green building standards. Technological innovations, such as the development of high-strength alloys and improved manufacturing processes, are enhancing the performance and versatility of aluminum in construction applications. Additionally, the integration of AI and automation in construction processes is optimizing material usage and reducing waste, further promoting aluminum's adoption. Spain's focus on sustainable construction practices and government initiatives are contributing to the rise in aluminum usage in the construction sector.

Aluminum in Construction Market in the Nordics

The Nordic countries' aluminum in construction market is characterized by a strong emphasis on sustainability and energy efficiency. The region's construction industry is increasingly adopting aluminum due to its lightweight, durability, and recyclability, aligning with green building standards. Technological advancements, such as the development of high-strength alloys and improved manufacturing processes, are enhancing the performance and versatility of aluminum in construction applications. The integration of AI and automation in construction processes is optimizing material usage and reducing waste, further promoting aluminum's adoption. Government policies and incentives supporting sustainable construction practices are driving the demand for aluminum in the Nordic construction market.

Aluminum in Construction Market in the Asia-Pacific

The Asia-Pacific region is witnessing rapid growth in the aluminum in construction market, driven by urbanization and infrastructure development. Countries like China and India are experiencing significant demand for aluminum in construction due to their booming economies and increasing urban populations. Technological advancements, such as the development of high-strength alloys and improved manufacturing processes, are enhancing the performance and versatility of aluminum in construction applications. The integration of AI and automation in construction processes is optimizing material usage and reducing waste, further promoting aluminum's adoption. Government initiatives and investments in infrastructure are contributing to the rise in aluminum usage in the construction sector across the Asia-Pacific region.

Aluminum in Construction Market in China

China's aluminum in construction market is the largest globally, driven by rapid urbanization and infrastructure development. The country's construction industry is increasingly adopting aluminum due to its lightweight, durability, and recyclability, aligning with green building standards. Technological innovations, such as the development of high-strength alloys and improved manufacturing processes, are enhancing the performance and versatility of aluminum in construction applications. Additionally, the integration of AI and automation in construction processes is optimizing material usage and reducing waste, further promoting aluminum's adoption. China's focus on sustainable construction practices and government policies supporting green building initiatives are contributing to the rise in aluminum usage in the construction sector.

Aluminum in Construction Market in Japan

Japan's aluminum in construction market is characterized by a strong emphasis on technological innovation and sustainability. The country's construction industry is increasingly adopting aluminum due to its lightweight, durability, and recyclability, aligning with green building standards. Technological advancements, such as the development of high-strength alloys and improved manufacturing processes, are enhancing the performance and versatility of aluminum in construction applications. The integration of AI and automation in construction processes is optimizing material usage and reducing waste, further promoting aluminum's adoption. Japan's commitment to energy-efficient buildings and government incentives supporting sustainable construction practices are driving the demand for aluminum in the construction sector.

Aluminum in Construction Market in India

India's aluminum in construction market is experiencing rapid growth, driven by urbanization and infrastructure development. The country's construction industry is increasingly adopting aluminum due to its lightweight, durability, and recyclability, aligning with green building standards. Technological innovations, such as the development of high-strength alloys and improved manufacturing processes, are enhancing the performance and versatility of aluminum in construction applications.

Aluminum in Construction Market in South Korea

South Korea’s construction industry increasingly relies on aluminum for high-rise buildings, airports, commercial complexes, and urban infrastructure. Aluminum’s lightweight, durable, and corrosion-resistant properties make it ideal for energy-efficient and sustainable construction. Technological innovations, including high-strength alloys, prefabricated panels, and modular systems, improve structural performance and accelerate project timelines. AI integration and digital construction tools enable predictive maintenance, optimized material allocation, and waste reduction. Architects and engineers use advanced design simulations and Building Information Modeling (BIM) to ensure precise execution of aluminum applications in façades, roofing, and window systems. Sustainability initiatives, energy-efficiency regulations, and urbanization trends further reinforce aluminum adoption, especially in metropolitan centers.

Aluminum in Construction Market in Taiwan

Taiwan’s urban construction sector heavily utilizes aluminum in commercial, residential, and infrastructure projects. Prefabricated aluminum panels, high-strength alloys, and corrosion-resistant coatings enhance design flexibility, durability, and energy efficiency. AI-enabled project management, predictive maintenance, and digital workflows optimize material use, construction sequencing, and long-term building performance. Lightweight aluminum is ideal for high-density urban areas, where modular construction techniques speed up project delivery. Sustainability initiatives, government policies promoting green buildings, and the push for energy-efficient architecture support aluminum adoption across both private and public projects.

Aluminum in Construction Market in Indonesia

Indonesia’s rapid urbanization and infrastructure expansion are driving aluminum usage in residential, commercial, and industrial construction. Aluminum is widely applied in roofing, façades, window systems, and modular building components due to its lightweight, corrosion-resistant, and durable properties. Technological advancements, such as prefabricated panels, high-strength alloys, and modular construction, improve build speed, structural performance, and design flexibility. AI-driven project planning, predictive maintenance, and digital workflows optimize material allocation, reduce waste, and enhance energy efficiency. Government-backed infrastructure projects and sustainability-focused urban development further encourage aluminum adoption. Its recyclability and adaptability to tropical climates make aluminum a preferred material for both high-rise urban complexes and large-scale infrastructure initiatives.

Aluminum in Construction Market in Australia

Australia’s aluminum adoption in construction is driven by urban development, sustainable architecture, and high-rise residential and commercial projects. Aluminum is commonly used in façades, roofing systems, window frames, and modular structures, providing durability, lightweight performance, and energy efficiency. Technological trends, including prefabrication, precision extrusion, and corrosion-resistant coatings, enhance structural integrity and design flexibility. AI-enabled design and project management tools, combined with predictive maintenance, optimize material usage, reduce waste, and improve construction efficiency. Green building initiatives, energy-efficiency regulations, and sustainability-focused infrastructure projects further reinforce aluminum usage across residential, commercial, and public sector buildings. Prefabricated and modular components allow faster construction while minimizing environmental impact.

Aluminum in Construction Market in Latin America

Latin America, including countries like Brazil, Mexico, and Chile, increasingly relies on aluminum for residential, commercial, and infrastructure projects. Aluminum is widely applied in roofing, façades, curtain walls, and modular structures due to its lightweight, durable, and recyclable properties. Technological advancements, such as high-strength alloys, prefabrication, and modular construction, enhance structural performance, accelerate timelines, and improve efficiency. AI and digital project management tools support optimized material allocation, predictive maintenance, and reduced construction waste. Sustainability initiatives, energy-efficient building policies, and urban development projects further reinforce aluminum adoption in major cities. Prefabricated panels and modern fabrication techniques enable cost-effective, resilient construction, while aluminum’s recyclability supports environmentally conscious urban development.

Aluminum in Construction Market in the Middle East & Africa

In the Middle East and Africa, aluminum is increasingly used in high-rise buildings, airports, commercial complexes, and large-scale infrastructure projects. Its lightweight, durable, and corrosion-resistant properties make it suitable for energy-efficient and sustainable construction in harsh climatic conditions. Technological innovations, including high-strength alloys, prefabrication, modular panels, and smart coatings, enhance structural performance and design flexibility. AI-assisted project management, predictive maintenance, and digital construction workflows optimize material use, reduce waste, and improve construction precision. Sustainability initiatives, green building certifications, and urban development projects encourage aluminum adoption across residential, commercial, and infrastructure sectors. Prefabrication and modular systems accelerate project timelines while reducing environmental impact.

Competitive Landscape

Which Companies Dominate the Aluminum in Construction Market and How do they Compete?

The global aluminum in construction market is characterized by a mix of industry giants and specialized players; each employing distinct strategies to maintain and grow their market share. Hindalco Industries Ltd., a prominent Indian player, has strengthened its position through strategic partnerships, such as its collaboration with Italy's Metra SpA to introduce advanced aluminum extrusion technology in India. This partnership focuses on producing large-scale, high-precision extrusions for high-speed rail coaches, a technology previously limited to Europe, China, and Japan. Similarly, Novelis, a subsidiary of Hindalco, is expanding its footprint in the aluminum construction sector by investing in new capacity and enhancing its recycling capabilities. The company's commitment to sustainability and circular economy principles positions it as a leader in providing sustainable aluminum solutions for construction applications. Other global players like Norsk Hydro ASA and Alcoa Corporation are also active in the market, focusing on innovation and sustainability to differentiate themselves.

Market Dominated by Aluminum in Construction Giants and Specialists

The aluminum construction market is predominantly dominated by a blend of global giants and specialized players, each carving out niches based on technological expertise, sustainability initiatives, and regional presence. Norsk Hydro ASA and Alcoa Corporation, for instance, have established themselves as key players in the European and North American markets, respectively. Norsk Hydro's focus on low-carbon aluminum production and Alcoa's extensive experience in aluminum manufacturing have enabled them to cater to the growing demand for sustainable construction materials. In contrast, companies like Vedanta Resources Limited and Shandong Xinfa Aluminum & Electricity Group Co., Ltd. are expanding their reach in emerging markets. Vedanta's significant investments in expanding its aluminum capacity in India underscore its commitment to meeting the rising demand in the Asian construction sector. These companies leverage their specialized expertise to offer tailored solutions that meet the specific needs of the construction industry.

Innovation and Adaptability Drive Market Success

Innovation and adaptability are central to the strategies of leading aluminum construction companies as they strive to meet the evolving demands of the market. Hindalco Industries Ltd. has demonstrated its commitment to innovation through its partnership with Metra SpA, focusing on producing high-precision aluminum extrusions for high-speed rail coaches. This collaboration brings advanced European technology to the Indian market, enhancing the quality and efficiency of aluminum products used in construction. Similarly, Novelis’ "Novelis 3x30" initiative sets ambitious goals to increase the recycled content in its products, reduce carbon emissions, and fuel future growth through sustainable practices. This focus on circular economy principles not only addresses environmental concerns but also aligns with the growing demand for eco-friendly construction materials.

Market Players to OPT for Merger & Acquisition Strategies to Expand their Presence

Merger and acquisition (M&A) strategies are increasingly being employed by aluminum construction companies to expand their market presence and capabilities. Vedanta Resources Limited's recent announcement of a significant investment to ramp up its aluminum capacity to 3.1 million tonnes per annum by FY28 is a strategic move to strengthen its position in the global market. This expansion is expected to enhance Vedanta's competitiveness and ability to meet the growing demand for aluminum in construction applications. Similarly, Norsk Hydro ASA's approach to M&A is evident in its strategic investments aimed at enhancing its position in the European market. By focusing on acquisitions that complement its existing operations, Norsk Hydro is expanding its capabilities in producing low-carbon aluminum products, aligning with the industry's shift towards sustainability. These strategic M&A activities reflect a broader trend in the aluminum construction market, where companies seek to enhance their technological capabilities, expand their product offerings, and strengthen their market presence to stay competitive in an increasingly globalized and sustainability-conscious industry.

List of Key Aluminum in Construction Companies

-

Hindalco Industries Ltd.

-

Rusal

-

Norsk Hydro ASA

-

Shandong Xinfa Aluminum & Electricity Group Co., Ltd.

-

Vedanta Resources Limited

-

Sumitomo Chemical Company, Limited

-

Norsk Hydro ASA

-

Constellium SE

-

Reliance Steel & Aluminum Co.

What are the Latest Key Industry Developments?

-

October 2025- Vedanta Ltd. announced plans to invest USD 18.3 million to expand its aluminum production capacity to 3.1 million tonnes per annum by FY28. This move aims to strengthen its position in the global aluminum market and meet increasing demand.

-

June 2025- Vedanta Ltd. revealed plans to invest USD 1.82 million in a mega aluminum project in Dhenkanal, Odisha, including a 3 MTPA smelter and a 4,900 MW captive power plant. This project is expected to create 30,000 jobs and significantly boost aluminum production capacity.

-

April 2025- Norsk Hydro signed a long-term agreement worth approximately USD 1.08 billion with Danish company NKT to supply low-carbon aluminum wire rods for enhancing Europe's grid infrastructure. This deal supports the EU's plan to modernize electricity grids for a cleaner energy transition.

-

December 2024- Hindalco Industries Ltd. partnered with Italy's Metra SpA to produce high-precision aluminum extrusions for India's Vande Bharat high-speed rail coaches. This collaboration involves a USD 228 million investment to enhance domestic manufacturing capabilities and reduce reliance on imports.

-

September 2024- Novelis introduced its 3x30 initiative, aiming to increase recycled content to 75%, reduce emissions to under 3 tonnes of CO2e per tonne of flat-rolled product, and lead the industry in circularity by 2030. This strategy underscores Novelis' commitment to sustainable practices in aluminum production.

What are the Key Factors Influencing Investment Analysis & Opportunities in the Aluminum in Construction Market?

The aluminum construction market is attracting significant investment interest due to its pivotal role in sustainable and modern infrastructure. Funding trends indicate that investors are prioritizing companies that focus on innovation, prefabrication technologies, and environmentally friendly aluminum solutions. Startups and established players alike are securing capital to expand production capabilities, adopt digital construction tools, and develop low-carbon materials. These investments are strategically targeted toward regions experiencing rapid urbanization and infrastructure growth, highlighting the market’s potential for long-term returns.

Valuations in the sector are influenced by technological adaptability, supply chain efficiency, and alignment with sustainability goals. Investment hotspots are emerging in urban centers and industrial hubs where construction activity is high, and green building practices are incentivized. Companies leveraging automation, AI-enabled design, and modular aluminum solutions are particularly attractive for investors, as these innovations enhance efficiency, reduce costs, and support environmentally conscious construction projects.

Key Benefits for Stakeholders:

Next Move Strategy Consulting (NMSC) presents a comprehensive analysis of the aluminum in construction market trends, covering historical trends from 2020 through 2024 and offering detailed forecasts through 2030. Our study examines the market at regional and country levels, providing quantitative projections and insights into key growth drivers, challenges, and investment opportunities across all major Aluminum in Construction segments.

The aluminum in construction market provides tangible benefits to a wide range of stakeholders, including investors, customers, and end-users. Investors gain from the sector’s consistent growth, driven by rising urbanization, infrastructure development, and increasing demand for sustainable building materials, offering strong long-term returns and portfolio diversification. Customers, such as construction companies and architects, benefit from aluminum’s lightweight, durable, and recyclable properties, which enable faster project timelines, reduced structural loads, and lower maintenance costs. Additionally, the adoption of advanced technologies, prefabrication, and modular solutions improves efficiency and design flexibility, allowing stakeholders to achieve high-quality, energy-efficient, and environmentally sustainable buildings, thereby aligning economic and environmental interests across the construction value chain.

Report Scope:

|

Parameters |

Details |

|

Market Size in 2025 |

USD 144.56 Billion |

|

Revenue Forecast in 2030 |

USD 188.01 Billion |

|

Growth Rate |

CAGR of 5.39% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Countries Covered |

33 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent to up to 80 analyst-working hours) after purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

|

Approach |

In-depth primary and secondary research; proprietary databases; rigorous quality control and validation measures. |

|

Analytical Tools |

Porter's Five Forces, SWOT, value chain, and Harvey ball analysis to assess competitive intensity, stakeholder roles, and relative impact of key factors. |

Key Market Segments

By Product Type

-

Extrusions

-

Sheets and Plates

-

Composite Panels (ACPs)

-

Aluminum Castings

By Application

-

Architectural

-

Structural

-

Roofing and Cladding

-

Interior Finishes

-

Glass and Glazing Support

-

Balustrades and Handrails

-

Sunshades and Louvers

-

Doors and Windows

-

Skylights and Canopies

-

Staircases and Walkways

By End-User Industry

-

Residential Construction

-

Commercial Construction

-

Industrial Construction

-

Infrastructure and Transportation

-

Healthcare Facilities

-

Educational Institutions

-

Sports and Recreation Facilities

-

Government and Public Buildings

-

Agricultural and Rural Construction

-

Specialized Construction

Geographical Breakdown

-

North America: U.S., Canada, and Mexico.

-

Europe: U.K., Germany, France, Italy, Spain, Sweden, Denmark, Finland, Netherlands, and rest of Europe.

-

Asia Pacific: China, India, Japan, South Korea, Taiwan, Indonesia, Vietnam, Australia, Philippines, Malaysia and rest of APAC.

-

Middle East & Africa (MEA): Saudi Arabia, UAE, Egypt, Israel, Turkey, Nigeria, South Africa, and rest of MEA.

-

Latin America: Brazil, Argentina, Chile, Colombia, and rest of LATAM

Conclusion & Recommendations

Our report equips stakeholders, industry participants, investors, and consultants with actionable intelligence to capitalize on market’s transformative potential. By combining robust data-driven analysis with strategic frameworks, NMSC’s Aluminum in Construction Market Report serves as an indispensable resource for navigating the evolving landscape.

The aluminum construction market is poised for sustained growth, driven by urbanization, infrastructure expansion, and a strong focus on sustainability and energy-efficient construction. Companies that embrace technological innovation, such as AI-assisted design, modular construction, and low-carbon aluminum production, are likely to strengthen their market position and capture emerging opportunities. Strategic partnerships, capacity expansions, and investments in recycling and sustainable practices are shaping a competitive landscape that rewards adaptability, efficiency, and forward-thinking initiatives.

Executives and investors capitalize on these trends by prioritizing investments in companies that demonstrate strong innovation capabilities, sustainable operations, and regional market expansion. Engaging in strategic partnerships, exploring merger and acquisition opportunities, and supporting sustainable aluminum solutions enhance competitiveness and long-term returns. By aligning decision-making with industry dynamics, stakeholders effectively leverage growth potential while contributing to environmentally responsible construction practices.

Speak to Our Analyst

Speak to Our Analyst