Disabled and Elderly Services Market by Service Type (Daily Living & Personal Care Services, Mobility & Transportation Services, Communication Support Services, Therapeutic & Clinical Services, Assistive Technology Services, Remote Support & Safety Services, Care & Case Management Services), by End-User (Home Care, Institutional Care, Hospitals & Clinics, Assisted-Living & Nursing Homes, Rehabilitation & Day-care Centers, Community & Outpatient, Other) – Global Analysis & Forecast, 2025–2030

Disabled and Elderly Services Industry Outlook

The global Disabled and Elderly Services Market size was valued at USD 515.53 billion in 2024, and is expected to be valued at USD 552.64 billion by the end of 2025. The industry is projected to grow, hitting USD 782.38 billion by 2030, with a CAGR of 7.2% between 2025 and 2030.

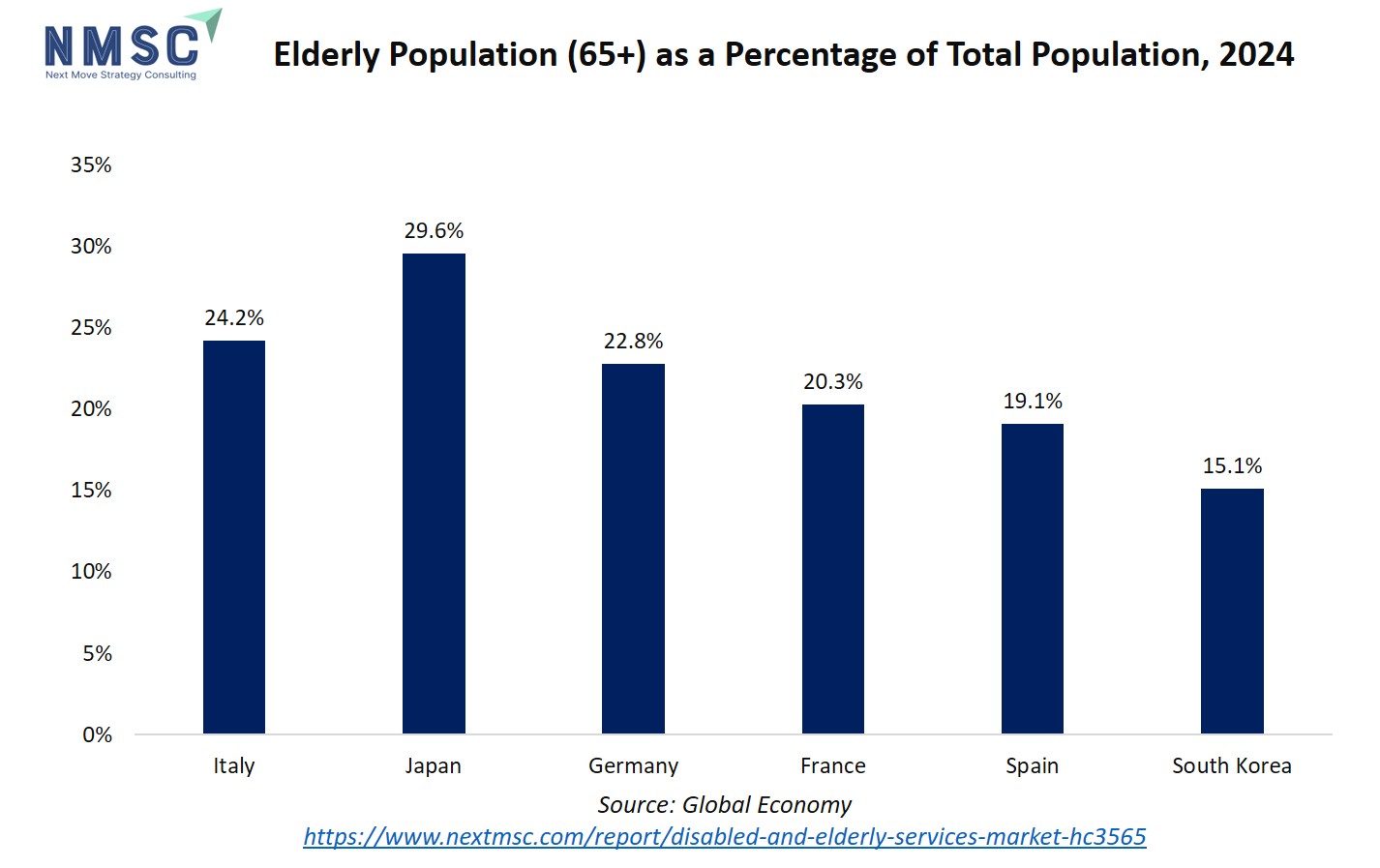

The market is undergoing rapid transformation, driven by demographic aging, rising chronic disease prevalence, and accelerating technology adoption. Globally, populations aged 65+ are increasing sharply, with Japan and European nations leading in elderly shares, fuelling demand for long-term care, assisted living, and in-home services. High chronic disease burdens in countries like the U.S. and U.K. further intensify the need for rehabilitation, monitoring, and specialized care. At the same time, advancements in telemedicine, AI, robotics, and smart home solutions are reshaping service delivery, enhancing independence, and addressing caregiver shortages. Urbanization and higher healthcare spending strengthen infrastructure readiness, while government support and digital adoption, especially in Asia Pacific, create strong growth opportunities for innovative, scalable care solutions.

At the same time, the market is diversifying in terms of adoption. Established providers such as Brookdale Senior Living, Bupa Care Services, Orpea, and Clariane SA continue to dominate through large-scale assisted living facilities and comprehensive care networks, while mid-sized and emerging players like Cera Care, ComForCare, and Senior Helpers are leveraging technology-driven home care and digital platforms to deliver cost-effective, personalized services. Companies including Home Instead, Right at Home, and Comfort Keepers are expanding franchise-based models, ensuring accessibility and scalability across geographies. Meanwhile, healthcare-focused operators such as Amedisys, BAYADA, Encompass Health, and LHC Group are integrating advanced rehabilitation, home health, and chronic disease management solutions. With increasing use of telehealth, remote monitoring, and AI-powered care coordination tools, alongside partnerships with technology firms like Tunstall Healthcare and Philips Lifeline, the sector is broadening its scope from traditional caregiving to technology-enabled, patient-centric models. As regulatory compliance, workforce training, and safety standards mature, the industry is evolving into a critical pillar of healthcare infrastructure, enabling both public and private organizations to meet rising demand while balancing affordability, quality, and long-term sustainability.

What are the key trends in Disabled and Elderly Services Industry?

What are the major technological trends shaping the disabled and elderly services market?

Technology is transforming the disabled and elderly services sector by enabling smarter, more efficient, and personalized care. Telemedicine platforms are allowing seniors and disabled individuals to consult doctors remotely, reducing the need for hospital visits. Remote patient monitoring devices and wearables, such as smartwatches and connected health trackers, are helping caregivers monitor vital signs, detect falls, and send alerts in emergencies. Artificial intelligence (AI) is being used for predictive health analytics, medication management, and even companionship through AI-enabled robots. Robotics and smart home systems, like voice-activated assistants, automated lighting, and mobility aids, are further improving independence and safety. These innovations not only reduce caregiver burden but also address staff shortages, making technology adoption one of the strongest growth trends in the industry.

How is demographic change influencing the disabled and elderly services industry?

Demographic shifts are emerging as the single most critical driver of the disabled and elderly services market. According to the World Health Organization (WHO) in 2024, by 2030, 1 in 6 people worldwide will be aged 60 years or older, with the elderly population increasing from 1 billion in 2020 to 1.4 billion. Looking further ahead, by 2050, the global population of people aged 60 years and above is projected to double to 2.1 billion, while the number of individuals aged 80 years and older is expected to triple to 426 million. This rapid aging is fuelling greater demand for assisted living, nursing care, and in-home support services. Longevity also brings a higher prevalence of age-related conditions such as dementia, Alzheimer’s, cardiovascular diseases, and mobility challenges. At the same time, nearly 1 in 6 people globally are already living with some form of disability, further intensifying the need for comprehensive care solutions. With smaller family sizes and increasingly urban lifestyles reducing informal caregiving options, reliance on professional elderly and disability care services is becoming essential, creating both challenges for healthcare systems and opportunities for private and public providers to expand services.

What role does government support play in driving industry growth?

Governments worldwide are playing a pivotal role in driving the growth of disability services by introducing funding initiatives, regulatory measures, and long-term care policies. Public authorities are increasingly prioritizing affordable access to healthcare, community-based support, and home care solutions to address the rising needs of aging populations and individuals with disabilities. Subsidies for in-home assistance, financial grants for local service providers, and incentives to establish specialized facilities are becoming more common. This proactive involvement not only enhances accessibility and affordability of care but also strengthens public confidence in the sector. At the same time, government support encourages private players to invest and innovate, creating a more sustainable and inclusive ecosystem for elderly and disability care.

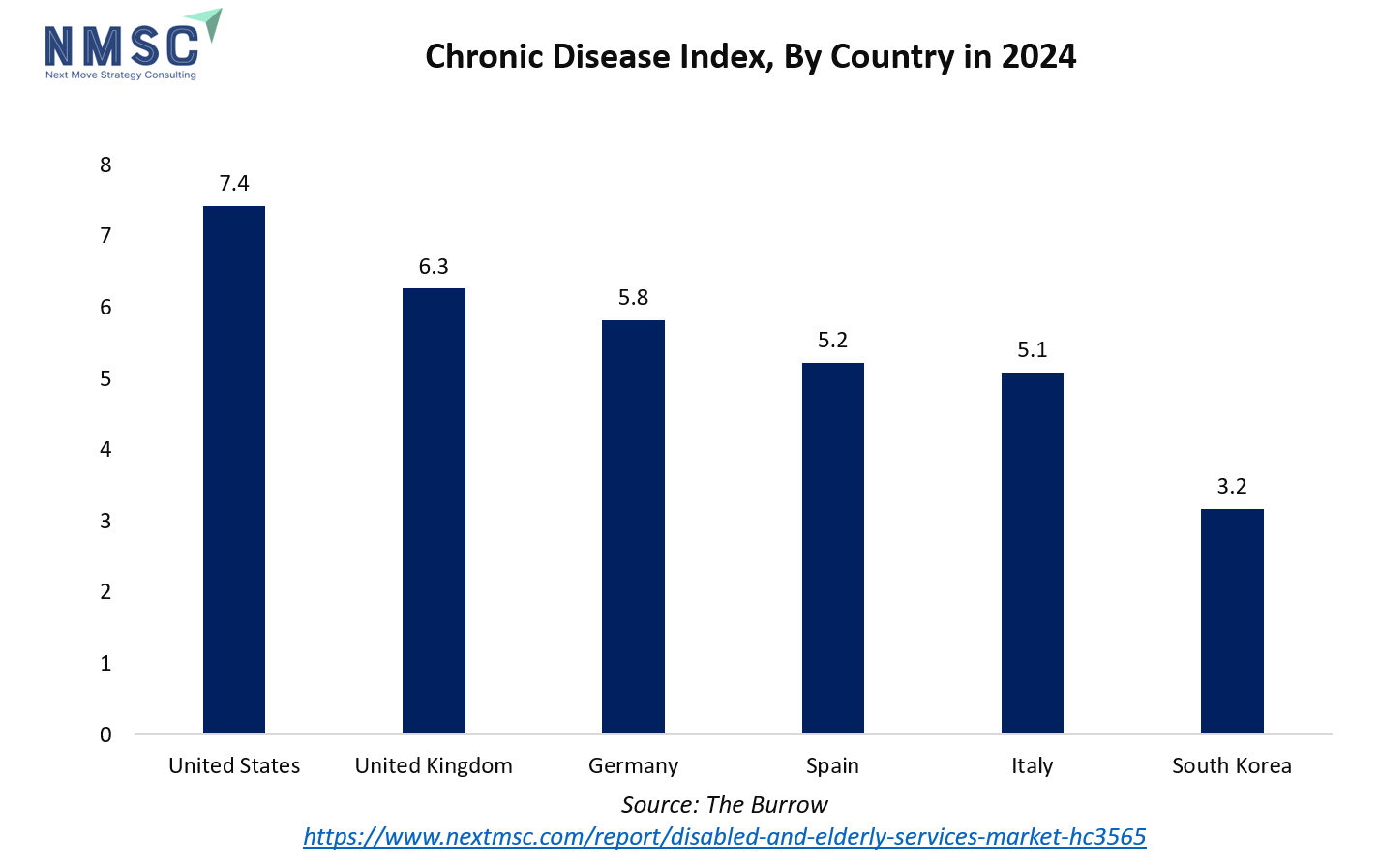

The chart illustrates the Chronic Diseases Index (CDI) scores of the top countries, with the United States leading at 7.42, followed by the United Kingdom (6.26), Germany (5.82), Spain (5.22), Italy (5.09), and South Korea (3.17). This ranking reflects the relative prevalence and healthcare burden of chronic diseases such as cardiovascular conditions, diabetes, and respiratory illnesses in these nations.

This sustained burden of chronic disease directly fuels the need for comprehensive disabled and elderly services, including home care, institutional care, therapeutic support, and remote monitoring. Service providers are responding by integrating advanced technologies such as telehealth, wearable devices, and AI-assisted care platforms to manage chronic conditions more effectively, improve patient outcomes, and reduce healthcare system strain. Consequently, the rising incidence of chronic diseases is both a key driver and a long-term growth opportunity for the market, positioning it as an essential component of modern healthcare infrastructure.

How is consumer preference changing in the disabled and elderly services market?

Consumer expectations are shifting from traditional institutionalized care such as nursing homes toward more personalized and dignified care solutions. Elderly individuals increasingly prefer to “age in place,” meaning they want to remain in their own homes for as long as possible. This preference fuels demand for home healthcare, visiting caregivers, adult day-care centers, and telehealth services. Families are also prioritizing holistic services that support not just medical needs, but also emotional well-being, social interaction, and independence. For people with disabilities, the demand is growing for services that enable employment, education, mobility, and community participation. As awareness rises, service providers are offering more flexible packages, ranging from part-time assistance to 24/7 specialized care, to cater to diverse needs. The emphasis on dignity, autonomy, and quality of life is reshaping how providers design and deliver services.

What are the key market drivers, breakthroughs, and investment opportunities that will shape the Disabled and Elderly Services Industry in next decade?

The disabled and elderly services market is experiencing robust growth driven by demographic and health trends. A rapidly aging population is increasing demand for long-term care, assisted living, and home-based support, as older adults face mobility, cognitive, and chronic health challenges. The rising prevalence of chronic and age-related illnesses further accelerates the need for specialized healthcare, rehabilitation, and palliative services. However, high costs of care, limited insurance coverage, and shortages of trained professionals pose significant growth restraints. At the same time, there is a strong opportunity in home-based and personalized care solutions, leveraging technology such as remote monitoring, telemedicine, and AI-driven tools to deliver efficient, scalable, and patient-centric services, enhancing both accessibility and quality of care.

The chart illustrates the percentage of elderly population aged 65 and above as a share of the total population in 2024 across selected countries. Japan records the highest proportion at 29.6%, followed by Italy at 24.2% and Germany at 22.8%, reflecting significant demographic aging. France and Spain show moderate levels at 20.3% and 19.1%, respectively, while South Korea, although lower at 15.1%, is also experiencing a notable rise in its elderly population. Overall, the chart highlights that developed economies, particularly Japan and European nations, are witnessing higher elderly population shares, which has important implications for healthcare systems, social support structures, and the disabled and elderly services market.

Growth Drivers:

How is Rapidly Aging Population Driving the Disabled and Elderly Services Market Demand?

The global rise in life expectancy and declining birth rates is leading to a rapidly aging population, which is one of the most significant drivers of the disabled and elderly services market growth. As the proportion of elderly individuals grows, so does the demand for long-term care, assisted living facilities, home healthcare, and specialized medical support. Aging populations are more prone to chronic illnesses, mobility limitations, and cognitive impairments, which require continuous healthcare and personal assistance. Furthermore, many older adults prefer to maintain independence and “age in place,” creating opportunities for service providers offering home-based solutions. This demographic shift is also straining traditional family caregiving structures, especially in urban areas, where smaller families and busy lifestyles reduce the availability of informal care. As a result, professional care services are becoming a necessity rather than an option, fuelling consistent growth in the market.

How is Increasing Prevalence of Chronic and Age-Related Illnesses Accelerating the Market Growth?

The rising prevalence of chronic diseases and age-related health conditions is a critical driver of the disabled and elderly services market trends. According to the Centers for Disease Control and Prevention (CDC) in 2024, six in ten Americans are living with at least one chronic disease, while four in ten have two or more, highlighting the widespread need for ongoing care and support. Conditions such as dementia, Alzheimer’s, cardiovascular disorders, arthritis, and diabetes are increasingly common as populations age, and they limit mobility, cognitive ability, and independence. This creates sustained demand for specialized healthcare services, rehabilitation, palliative care, and long-term treatment programs. Beyond physical health, chronic illnesses also contribute to emotional and social challenges, reinforcing the importance of holistic care that enhances both well-being and quality of life. As healthcare systems face rising pressure from long-term disease management, professional service providers are stepping in to address these gaps, making the growing burden of chronic and age-related illnesses a powerful driver of market growth.

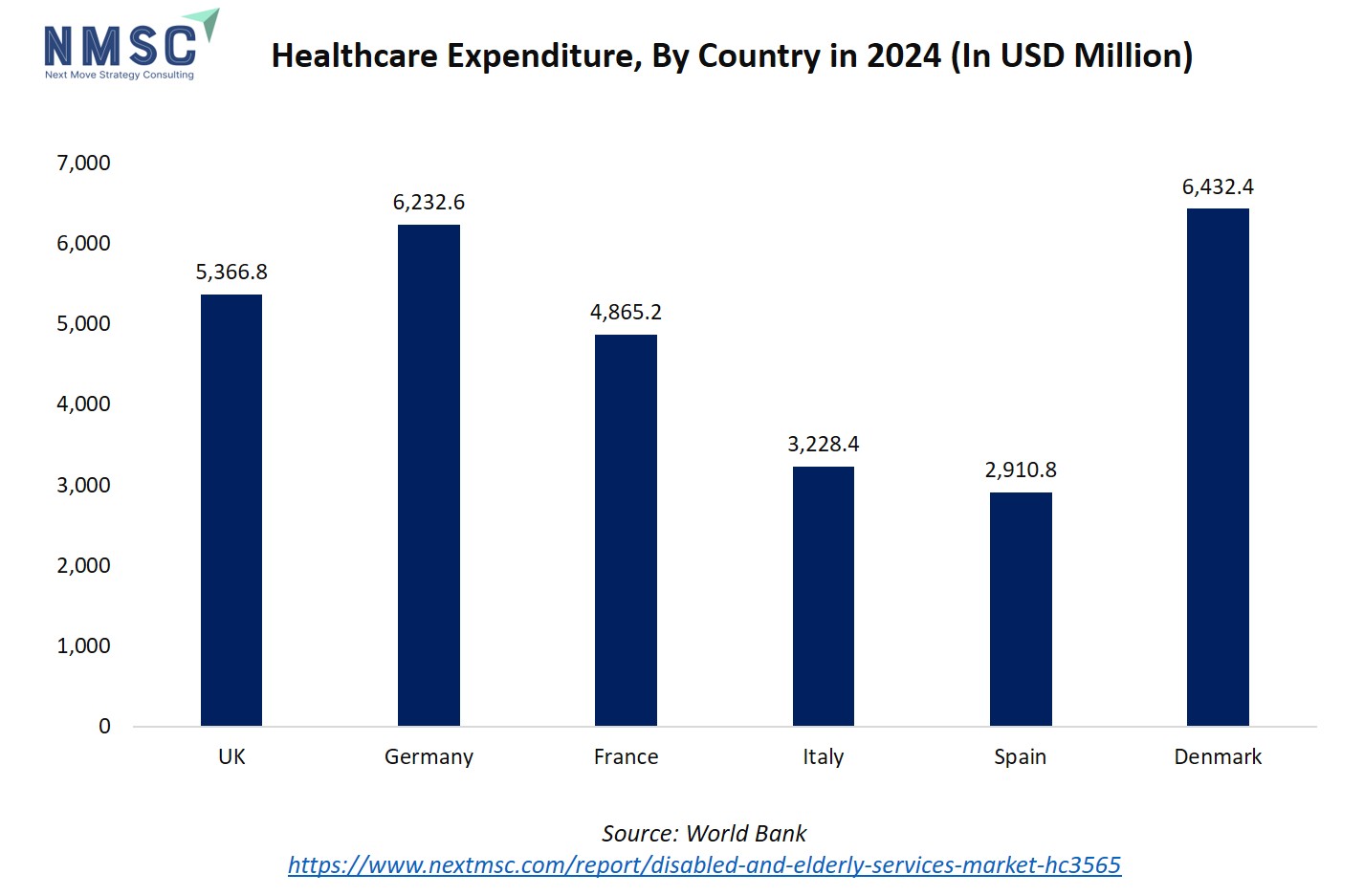

The chart illustrates the healthcare expenditure by country in 2024 (in USD million), highlighting significant variations across major European nations. Denmark records the highest spending at USD 6,432.4 million, followed closely by Germany at USD 6,232.6 million, while Spain and Italy show relatively lower expenditures at USD 2,910.8 million and USD 3,228.4 million respectively. These differences in healthcare investment directly influence the disabled and elderly services market, as higher expenditure reflects stronger government and institutional focus on healthcare infrastructure, elderly care programs, and long-term support services. Countries with higher spending are better positioned to adopt advanced care models, technology-driven solutions, and integrated support systems, thereby accelerating market growth. Conversely, nations with lower healthcare allocation face constraints in scaling such services, highlighting the critical link between healthcare expenditure and the overall expansion of the disabled and elderly services market.

Growth Inhibitors:

What Financial and Accessibility Challenges Limit the Growth of the Disabled and Elderly Services Market?

A significant challenge limiting the growth of the disabled and elderly services market is the expensive nature of long-term and specialized care. Services such as assisted living, nursing homes, in-home healthcare, and rehabilitation programs require substantial financial resources, which be unaffordable for a large section of the population. In many regions, insurance coverage and government funding are limited, leaving individuals and families to bear most of the expenses out-of-pocket. This financial barrier restricts access to quality care, especially in low- and middle-income countries, and delay or reduce service adoption even in developed markets. Additionally, the shortage of trained caregivers and healthcare professionals further drives up service costs, creating affordability challenges that hinder the overall growth potential of the market.

What Opportunities Exist in the Market for Home-Based and Personalized Elderly and Disability Care Services?

A major opportunity in the disabled and elderly services market lies in the growing demand for home-based and personalized care solutions. As elderly individuals and people with disabilities increasingly prefer to “age in place” or maintain independence, there is strong potential for services such as in-home healthcare, remote monitoring, telemedicine, and on-demand caregiver support. Personalized care plans that cater to medical, emotional, and social needs are gaining traction, providing a chance for service providers to differentiate themselves and capture niche segments. Additionally, the integration of technology, such as wearable devices, AI-driven health management tools, and smart home solutions, offers providers the ability to deliver efficient, scalable, and high-quality care. This shift toward individualized, home-centered care not only improves patient satisfaction but also opens new revenue streams for private players and community-based organizations, making it a significant growth opportunity for the market.

How Disabled and Elderly Services Market is segmented in this report, and what are the key insights from the segmentation analysis?

By Service Type Insights

Which Service Type Is Expected to Drive the Disabled and Elderly Services Market In 2025?

On the basis of service type, the market is segmented into daily living & personal care services, mobility & transportation services, communication support services, therapeutic & clinical services, assistive technology services, remote support & safety services and care & case management services.

The disabled and elderly services market is expected to be primarily driven by daily living and personal care services. This segment includes assistance with activities such as bathing, dressing, meal preparation, and hygiene management, which are essential for elderly and disabled individuals to maintain independence and quality of life. While other services like mobility & transportation, therapeutic & clinical services, and assistive technology provide critical support, daily living and personal care services see the highest and most consistent demand due to their direct impact on everyday functionality. Additionally, these services form the foundation for broader care ecosystems, with other segments, such as remote support, safety services, and case management, enhancing accessibility, monitoring, and overall care efficiency.

By Daily Living & Personal Care Services Insights

How Are Homemaking and Companionship Services Positioned in the Market in 2025?

Based on daily living & personal care services, the market is segmented into personal care, homemaking services and companionship & wellbeing.

Homemaking Services and Companionship & Wellbeing services are positioned as complementary yet essential segments in the Daily Living & Personal Care Services market. Homemaking services, including meal preparation, cleaning, and household management, support elderly and disabled individuals in maintaining a safe and organized living environment. Companionship and wellbeing services focus on social interaction, mental health, and emotional support, addressing isolation and enhancing overall quality of life. While these segments not drive the largest revenue compared to Personal Care, they play a crucial role in creating a holistic care ecosystem, ensuring that care is both functional and emotionally supportive.

By Therapeutic & Clinical Services Insights

What Is Driving the Growth of the Physical Therapy Segment in the Disabled and Elderly Services Market In 2025?

Based on therapeutic & clinical services, the market is divided into physical therapy, occupational therapy, speech & language therapy and cognitive & behavioral therapy.

The Physical Therapy segment is experiencing significant growth in 2025 due to the increasing need to improve mobility, manage pain, and support rehabilitation for elderly and disabled individuals. Age-related conditions, chronic illnesses, and post-injury care are driving demand for professional physical therapy services. Providers offering tailored therapy plans, home-based programs, and technology-assisted rehabilitation solutions are seeing higher adoption, as these services help maintain independence and enhance quality of life. The growing focus on preventive care and recovery also positions Physical Therapy as a key contributor to the overall expansion of the disabled and elderly services market share.

By End User Insights

Which End-User Segment is Expected to Lead the Disabled and Elderly Services Market in 2025?

Based on end user, the market is divided into home care, institutional care, community & outpatient and other.

In 2025, institutional care is expected to play a leading role in the disabled and elderly services market. This segment encompasses nursing homes, assisted living facilities, and long-term care institutions that provide structured medical and personal support to elderly and disabled individuals. While home care, community & outpatient, and other segments contribute to overall service delivery, institutional care experiences strong demand due to the availability of professional staff, comprehensive healthcare services, and 24/7 supervision. The segment’s ability to offer integrated therapeutic, clinical, and social support makes it a critical driver for the market, particularly for individuals with complex care needs or limited family support.

By Institutional Care Insights

What is Driving the Growth of the Assisted Living & Nursing Homes Segment in the Disabled and Elderly Services Market In 2025?

Based on institutional care, the market is divided into hospitals & clinics, assisted‑living & nursing homes and rehabilitation & day‑care centers.

The Assisted Living & Nursing Homes segment is witnessing strong growth in 2025 due to the increasing demand for long-term residential care and personal support among elderly and disabled individuals. These facilities provide 24/7 supervision, medical assistance, and daily living support, making them essential for individuals with chronic conditions, mobility limitations, or limited family caregiving options. The rising elderly population, coupled with a preference for structured care environments that ensure safety and consistent quality of service, is further fuelling adoption. Additionally, the integration of therapeutic and social programs within these facilities enhances residents’ overall quality of life, positioning Assisted Living & Nursing Homes as a key growth driver in the market.

Regional Outlook

The market is geographically studied across North America, Europe, Asia Pacific, and the Middle East & Africa, and each region is further studied across countries.

Disabled and Elderly Services Market in North America

The disabled and elderly services market in North America is being driven by a rapidly aging population and the rising prevalence of chronic illnesses. The growing proportion of elderly individuals is fuelling demand for assisted living, in-home care, and specialized healthcare services that help maintain independence, mobility, and quality of life. To meet these needs, service providers are increasingly leveraging technology-enabled solutions such as telehealth, remote monitoring, and AI-assisted care management, which enhance efficiency, scalability, and the overall quality of care. These trends are creating significant growth opportunities across the region, as providers focus on delivering accessible, patient-centered, and comprehensive care solutions for elderly and disabled populations.

Disabled and Elderly Services Market in the United States

In the U.S., the market is being driven by a rapidly aging population and the rising prevalence of chronic illnesses. According to the Population Reference Bureau (PRB) in 2024, the number of Americans aged 65 and older is projected to grow from 58 million in 2022 to 82 million by 2050, increasing their share of the total population from 17% to 23%. This demographic shift is fuelling demand for assisted living, in-home care, and specialized healthcare services that help maintain independence and quality of life. Technology-enabled solutions such as telehealth, remote monitoring, and AI-assisted care are increasingly being adopted to enhance efficiency, quality, and scalability of care.

Disabled and Elderly Services Market in Canada

In Canada, the disabled and elderly services market is primarily driven by a rapidly aging population and the increasing prevalence of chronic illnesses. According to Statistics Canada in 2024, there were approximately 7.8 million Canadians aged 65 and older, representing 18.9% of the total population. This demographic is projected to grow significantly in the coming decades, leading to higher demand for assisted living, in-home care, and specialized healthcare services. Service providers are increasingly adopting technology-enabled solutions such as telehealth, remote monitoring, and AI-assisted care management, which improve efficiency, quality, and accessibility of services.

Disabled and Elderly Services Market in Europe

The market in Europe is being driven by a combination of an aging population, rising prevalence of chronic diseases, and strong government support in several countries. As the proportion of elderly individuals grows, demand for assisted living, in-home care, rehabilitation, and specialized healthcare services is increasing to help maintain independence and quality of life. Chronic conditions such as cardiovascular disease, diabetes, respiratory disorders, and cancer are fuelling the need for long-term care and holistic support solutions. Additionally, technology-enabled services including telehealth, remote monitoring, and AI-assisted care management are being increasingly adopted across the region, enhancing efficiency, accessibility, and quality of care for elderly and disabled populations.

Disabled and Elderly Services Market in the United Kingdom

In the United Kingdom, the disabled and elderly services market is primarily driven by a rapidly aging population and the increasing prevalence of chronic illnesses. As of 2024, there are over 10 million people aged 65 and over in England, representing 18% of the population, and this number is projected to continue rising in the coming decades. This demographic shift is fuelling demand for assisted living, in-home care, and specialized healthcare services that help elderly and disabled individuals maintain independence and quality of life. Service providers are increasingly adopting technology-enabled solutions such as telehealth, remote monitoring, and AI-assisted care management, which improve efficiency, quality, and accessibility of care.

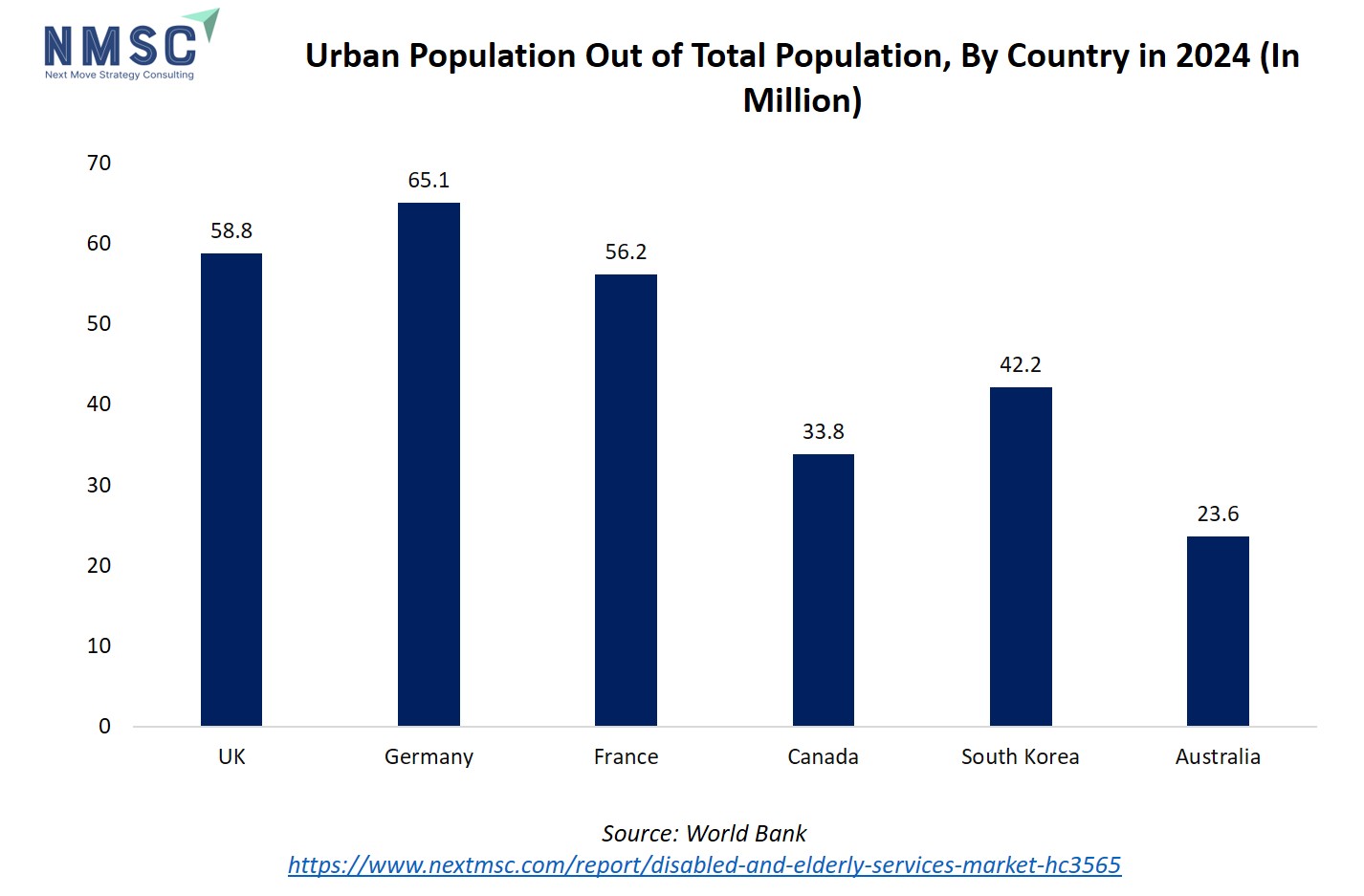

The chart illustrates the urban population (in millions) out of the total population in 2024 for selected countries. Germany leads with 65.05 million urban residents, followed by the United Kingdom at 58.76 million and France at 56.21 million. South Korea records 42.17 million, while Canada has 33.84 million, and Australia reports the lowest among the group at 23.60 million. This distribution highlights the concentration of populations in urban areas across advanced economies.

Urbanization drives the growth of the disabled and elderly services market by concentrating populations in cities, which increases demand for healthcare, assisted living, and rehabilitation services. Densely populated urban areas often face strained infrastructure and rising care costs, encouraging the adoption of technology-enabled solutions like telehealth, remote monitoring, and digital care platforms. Additionally, the shift toward nuclear families in urban societies heightens reliance on professional care, making urban environments crucial hubs for expanding and innovating elderly and disabled services.

Disabled and Elderly Services Market in Germany

In Germany, the industry is primarily driven by a rapidly aging population and the increasing prevalence of chronic illnesses. As of 2024, approximately 23.2% of Germany's population is aged 65 and older, and this demographic is projected to grow significantly in the coming decades. This shift is fuelling demand for assisted living, in-home care, and specialized healthcare services that help elderly and disabled individuals maintain independence and quality of life. Service providers are increasingly adopting technology-enabled solutions such as telehealth, remote monitoring, and AI-assisted care management, which improve efficiency, quality, and accessibility of services.

Disabled and Elderly Services Market in France

In France, the disabled and elderly services market is primarily driven by the increasing prevalence of chronic diseases among the aging population. Conditions such as cardiovascular diseases, diabetes, and respiratory disorders are becoming more prevalent, necessitating a higher demand for long-term care services, rehabilitation, and specialized medical support. This trend is further compounded by socioeconomic disparities, as individuals from lower-income backgrounds experience higher rates of chronic illnesses and face greater barriers to accessing healthcare services. These challenges underscore the need for comprehensive and equitable healthcare solutions to address the growing demands of the aging population.

Disabled and Elderly Services Market in Spain

In Spain, the disabled and elderly services market is primarily driven by the rising prevalence of chronic diseases, which significantly impact life expectancy and overall health outcomes. According to PubMed Central in 2024, conditions such as cardiovascular disease, diabetes, chronic obstructive pulmonary disease, and cancer are particularly common among individuals over 64 years of age, creating a substantial need for long-term care, rehabilitation, and specialized healthcare services. This growing burden of chronic illnesses is fuelling demand for comprehensive support solutions. Service providers are increasingly leveraging technology-enabled approaches, including telehealth, remote monitoring, and AI-assisted care management, to enhance the efficiency, quality, and accessibility of care for elderly and disabled populations.

Disabled and Elderly Services Market in Italy

In Italy, the disabled and elderly services market is primarily driven by the increasing prevalence of chronic diseases among the aging population. This trend is creating a growing demand for long-term care services, rehabilitation, and specialized healthcare support to help elderly and disabled individuals maintain independence and quality of life. Service providers are increasingly adopting technology-enabled solutions, including telehealth, remote monitoring, and AI-assisted care management, to improve the efficiency, accessibility, and overall quality of care. These innovations are helping address the evolving needs of Italy’s aging and disabled populations.

Disabled and Elderly Services Market in the Nordics

In the Nordic countries, the industry is primarily driven by strong government support and public funding for elderly and disability care. Robust healthcare infrastructure, well-established long-term care policies, and generous social welfare programs ensure widespread access to assisted living, home-based care, and rehabilitation services. This supportive regulatory environment encourages innovation and high-quality service delivery, allowing providers to adopt advanced solutions such as telehealth, remote monitoring, and AI-assisted care management. The combination of public-sector investment and advanced technology adoption is fuelling growth in the market across the Nordic region.

Disabled and Elderly Services Market in Asia Pacific

In Asia Pacific, the disabled and elderly services market is primarily driven by the region’s rapidly aging population and the growing prevalence of chronic conditions, which contribute significantly to mortality and long-term healthcare needs. Countries such as Japan, China, South Korea, and Australia are witnessing sharp demographic shifts, with rising proportions of elderly citizens placing increasing pressure on healthcare and social support systems. This trend is creating strong demand for long-term care services, rehabilitation, assistive living facilities, and community-based support to help elderly and disabled individuals maintain independence and quality of life. To address these needs, service providers across the region are adopting technology-enabled solutions such as telehealth platforms, remote monitoring systems, and AI-driven care management tools. These innovations are improving service accessibility, optimizing resource allocation, and enhancing overall care quality, making Asia Pacific a high-growth market for Disabled and Elderly Services.

Disabled and Elderly Services Market in China

In China, the disabled and elderly services market is primarily driven by the rapidly aging population and the high prevalence of chronic conditions, which are the leading cause of mortality in the country, accounting for over 80% of deaths annually, according to National Health Commission of the People’s Republic of China in 2024. This rising burden of chronic illnesses is increasing demand for long-term care services, rehabilitation, and specialized healthcare support to help elderly and disabled individuals maintain independence and quality of life. Service providers are increasingly adopting technology-enabled solutions, including telehealth, remote monitoring, and AI-assisted care management, to improve efficiency, accessibility, and overall quality of care.

Disabled and Elderly Services Market in Japan

In Japan, the disabled and elderly services market is primarily driven by strong government support and well-established long-term care policies. Generous public funding, robust healthcare infrastructure, and comprehensive social welfare programs ensure widespread access to assisted living, home-based care, and rehabilitation services. This supportive environment encourages innovation and high-quality service delivery, enabling providers to implement advanced solutions such as telehealth, remote monitoring, and AI-assisted care management. The combination of public-sector investment and a focus on accessibility and quality is fuelling growth in the market, helping meet the evolving needs of Japan’s aging and disabled population.

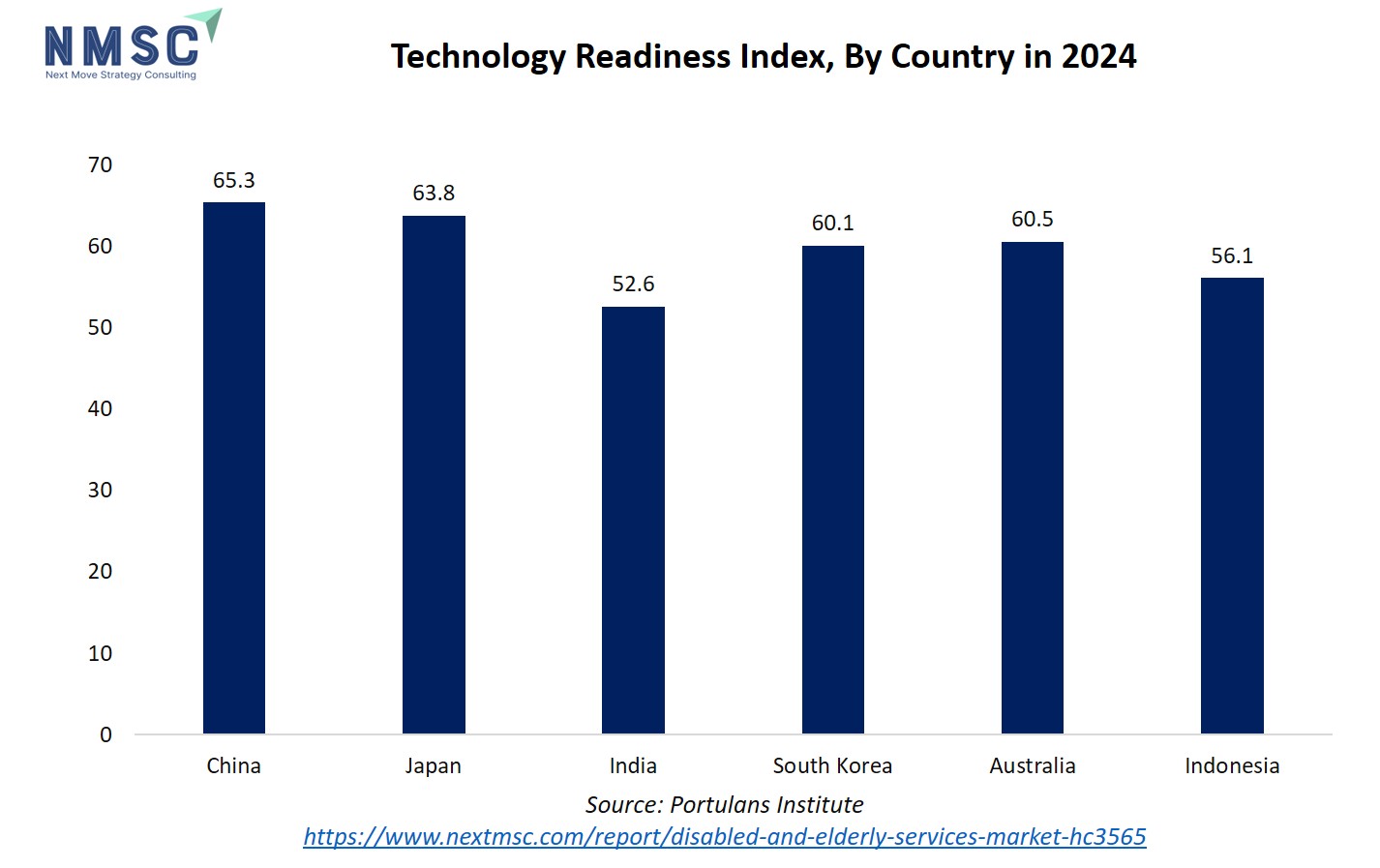

The chart illustrates the Technology Readiness Index (TRI) by country in 2024, showing how prepared different nations are to adopt and integrate emerging technologies. China (65.3) and Japan (63.8) lead the group with strong digital infrastructure and innovation ecosystems, followed by Australia (60.5) and South Korea (60.1), which also demonstrate high readiness through advanced technological adoption. Indonesia (56.1) shows moderate progress, while India (52.6) lags behind but continues to advance in digital transformation. In relation to the disabled and elderly services market, the TRI is a critical factor as higher readiness enables faster integration of assistive technologies, telehealth solutions, and AI-driven elderly care systems. Countries with stronger scores, such as China, Japan, and South Korea, are better positioned to scale innovative care solutions, while markets like India and Indonesia, despite lower readiness, represent high-growth opportunities as investments in digital infrastructure and healthcare innovation accelerate. Overall, the index highlights how technological preparedness directly drives the efficiency, scalability, and adoption of elderly and disability care services.

Disabled and Elderly Services Market in India

In India, the disabled and elderly services market is primarily driven by growing government initiatives, increasing public awareness, and innovations in assistive technologies. Startups like Neomotion, founded by IIT Madras alumni, are developing affordable and customizable wheelchairs, highlighting India’s growing role in the manufacturing of assistive devices, as per The Indian Express, The CSR Universe, 2024. Such advancements, combined with policies supporting long-term care and health awareness, are expanding access to assisted living, in-home care, rehabilitation, and specialized healthcare services. Service providers are also leveraging technology-enabled solutions, including telehealth, remote monitoring, and AI-assisted care management, to improve efficiency, accessibility, and quality of care for elderly and disabled populations.

Disabled and Elderly Services Market in South Korea

In South Korea, the disabled and elderly services market is primarily driven by increasing demand for home-based and personalized care solutions. As more elderly and disabled individuals seek to maintain independence and “age in place,” there is growing need for in-home healthcare, rehabilitation, and tailored support services. Providers are increasingly leveraging technology-enabled solutions, such as telehealth, remote monitoring, and AI-assisted care management, to deliver efficient, high-quality, and accessible care. The emphasis on personalized and home-centered services is creating new opportunities for service providers, while improving overall quality of life and addressing the evolving needs of South Korea’s aging and disabled population.

Disabled and Elderly Services Market in Taiwan

In Taiwan, the disabled and elderly services market is primarily driven by a rapidly aging population and the growing demand for community-based and home-centered care solutions. As more elderly and disabled individuals seek to maintain independence, there is increasing need for in-home healthcare, rehabilitation, and personalized support services. Service providers are adopting technology-enabled solutions such as telehealth, remote monitoring, and AI-assisted care management to improve the efficiency, accessibility, and quality of care. This focus on community and home-based care is creating opportunities for innovative service delivery models while addressing the evolving needs of Taiwan’s aging and disabled population.

Disabled and Elderly Services Market in Indonesia

In Indonesia, the disabled and elderly services market is primarily driven by rising private sector investment and the expansion of healthcare infrastructure. Increasing interest from private healthcare providers and investors is enhancing the availability and quality of assisted living, rehabilitation, and in-home care services. Alongside this, the adoption of technology-enabled solutions, including telehealth, remote monitoring, and AI-assisted care management, is improving service efficiency, accessibility, and overall quality of care. This combination of private investment and technological adoption is fuelling growth in the market, helping meet the evolving needs of Indonesia’s elderly and disabled population.

Disabled and Elderly Services Market in Australia

In Australia, the disabled and elderly services market is primarily driven by increasing government support and policy initiatives aimed at enhancing aged and disability care. Programs that fund home-based care, community services, and assisted living facilities are expanding access and improving the quality of services. Additionally, there is growing adoption of technology-enabled solutions such as telehealth, remote monitoring, and AI-assisted care management, which help providers deliver efficient, personalized, and high-quality care. These developments are addressing the needs of Australia’s aging and disabled population, supporting independence, improving quality of life, and creating opportunities for innovation in the care services sector.

Disabled and Elderly Services Market in Latin America

In Latin America, the disabled and elderly services market is primarily driven by rising urbanization and increasing public awareness of elderly and disability care needs. As more elderly and disabled individuals seek professional support, demand is growing for home-based care, assisted living, rehabilitation, and specialized healthcare services. Service providers are increasingly leveraging technology-enabled solutions such as telehealth, remote monitoring, and AI-assisted care management to improve efficiency, accessibility, and quality of care. The combination of growing awareness, urban population concentration, and adoption of innovative care solutions is fuelling market growth across the region, helping elderly and disabled individuals maintain independence and an improved quality of life.

Disabled and Elderly Services Market in the Middle East & Africa

In the Middle East and Africa, the disabled and elderly services market is primarily driven by increasing government initiatives and growing healthcare investments aimed at improving elderly and disability care. Rising awareness of the need for specialized support is fuelling demand for assisted living, home-based care, rehabilitation, and healthcare services tailored to the needs of elderly and disabled individuals. Service providers are adopting technology-enabled solutions, including telehealth, remote monitoring, and AI-assisted care management, to enhance the efficiency, accessibility, and quality of care. These developments are helping address gaps in traditional caregiving, supporting independence, and improving overall well-being across the region.

Competitive Landscape

Which Companies Dominate the Disabled and Elderly Services Market and How Do They Compete?

The global disabled and elderly services market is dominated by established care providers such as Home Instead, Inc., Right at Home International Ltd, Bupa Care Services Ltd, Clariane SA, Orpea SA, Sodexo Senior Living Services, Brookdale Senior Living, Inc., Sunrise Senior Living Management, Inc., Comfort Keepers, Senior Helpers Franchising LLC, Five Star Senior Living, Inc., Care UK Group, BAYADA Home Health Care, Amedisys, Inc., Encompass Health Corporation, LHC Group, Inc., Tunstall Healthcare Group Ltd, Lifeline by Philips, Cera Care Ltd, and ComForCare Home Care Services. These companies compete by offering comprehensive elderly and disability care solutions, including in-home care, assisted living, rehabilitation, and remote monitoring services.

Market leaders differentiate themselves through investments in technology-enabled care, such as telehealth, AI-assisted care management, wearable monitoring devices, and digital care platforms that enhance efficiency, quality, and accessibility. Strategies also focus on expanding service networks, improving caregiver training, and developing personalized care plans tailored to the unique needs of elderly and disabled populations. Regional innovators and specialized providers further intensify competition by addressing local market needs with flexible and cost-effective care solutions. As demand grows globally, companies that combine comprehensive service offerings with innovative technology adoption are capturing market share and positioning themselves at the forefront of the Disabled and Elderly Services sector.

Market dominated by Disabled and Elderly Services Giants and Specialists

The disabled and elderly services market is split between large multinational care providers, such as Home Instead, Inc., Brookdale Senior Living, Inc., Bupa Care Services Ltd, Sunrise Senior Living Management, Inc., and Orpea SA, which offer comprehensive, full-service care solutions, and specialist or regional providers, such as Cera Care Ltd, ComForCare Home Care Services, Comfort Keepers, and Senior Helpers Franchising LLC, which focus on niche services, personalized care, or specific geographic markets. Large providers compete on scale, extensive service networks, trained caregiver workforce, and technological integration, while specialist providers differentiate through tailored care plans, flexible home-based solutions, and targeted services for specific populations. This dynamic creates a two-tier market where clients choose either a broad full-service provider or a specialized, localized care solution depending on needs, accessibility, and personalization priorities.

Innovation and Adaptability Drive Market Success

Leaders in the disabled and elderly services market are increasingly investing in technology and service innovations to enhance care delivery and operational efficiency. Providers are embedding AI-assisted care management, remote monitoring tools, and telehealth platforms to deliver personalized and timely support. Recent initiatives show companies integrating wearable health devices, digital care coordination systems, and mobile-first care applications to streamline workflows, improve patient engagement, and reduce reliance on manual oversight. Firms that invest in scalable care platforms, interoperability with healthcare systems, and caregiver training programs are winning more clients, as families and institutions demand high-quality, reliable, and cost-effective care alongside accessibility and continuity of services.

Market Players to Opt for Merger & Acquisition Strategies to Expand Their Presence

Mergers and acquisitions have become a key strategy for Disabled and Elderly Services providers to expand capabilities and market presence. Leading care companies are acquiring smaller, specialized providers to enhance service offerings, enter new regions, and integrate advanced technologies. For example, large multinational providers acquire home-care startups or telehealth platforms to strengthen their in-home care and remote monitoring capabilities, while regional providers consolidate to scale operations and improve caregiver training programs. These M&A moves accelerate service rollouts, diversify care portfolios, and reinforce competitive positioning, enabling providers to meet growing demand, address evolving patient needs, and maintain a strong presence in increasingly competitive markets.

List of Key Disabled and Elderly Services Companies

-

Right at Home International Ltd

-

Clariane SA

-

Orpea SA

-

Sodexo Senior Living Services (Sodexo)

-

Brookdale Senior Living, Inc.

-

Sunrise Senior Living Management, Inc.

-

Comfort Keepers

-

Senior Helpers Franchising LLC

-

Five Star Senior Living, Inc.

-

Care UK Group

-

BAYADA Home Health Care

-

Amedisys, Inc.

-

Encompass Health Corporation

-

LHC Group, Inc.

-

Tunstall Healthcare Group Ltd

-

Lifeline by Philips (Philips Lifeline)

-

Cera Care Ltd (Cera Healthcare)

-

ComForCare Home Care Services

What are the Latest Key Industry Developments?

-

June 2025 - Clariane SA enrolled 7,200 employees in specialized qualification programs through its Clariane University, focusing on enhancing skills relevant to elderly and disabled care services. These programs cover areas such as personal care, clinical support, rehabilitation techniques, and safety protocols, ensuring that staff are well-equipped to meet the evolving needs of residents.

-

March 2025 - Bupa Care Services Ltd reported a significant USD 371.25 million increase in underlying profit, reflecting robust growth in its elderly and disability care service offerings. This financial boost was primarily driven by high demand for residential care, assisted living, and specialized healthcare services, highlighting the rising need for quality care among aging populations.

-

January 2025 - Home Instead, Inc. was recognized as the top provider of home care services for seniors and disabled individuals by Newsweek in its “America’s Best of the Best” rankings. This award highlights the company’s excellence in delivering personalized care, companionship, and support services that enable elderly and disabled clients to maintain independence and quality of life at home.

-

July 2024 - Sunrise Senior Living Management, Inc. expanded its footprint by adding 13 new senior living communities. This growth was achieved through a combination of strategic partnerships and acquisitions, allowing the company to rapidly scale its services without building new facilities from scratch.

-

April 2024- Sodexo Senior Living Services extended partnership with Ingleside to enhance dining and environmental services at Ingleside at Rock Creek in Washington D.C.

What are the Key Factors Influencing Investment Analysis & Opportunities in the Disabled and Elderly Services Market?

The market is attracting increasing investor attention as demand for elderly and disability care services continues to grow globally. Startups and service providers offering technology-enabled care solutions, such as telehealth, remote monitoring, AI-assisted care management, and personalized home-based services, are particularly attractive, with funding directed toward scalable and innovative care models. Investment activity is strong in North America, Europe, and Asia-Pacific, where aging populations and rising chronic disease prevalence are driving rapid service adoption. Strategic acquisitions and partnerships by larger care providers highlight consolidation as a key growth strategy. For investors, the most promising opportunities lie in providers that combine comprehensive service offerings with advanced technology, operational efficiency, and the ability to serve diverse and evolving care needs.

Key Benefits for Stakeholders:

Next Move Strategy Consulting (NMSC) presents a comprehensive analysis of the disabled and elderly services market, covering historical trends from 2020 through 2024 and offering detailed forecasts through 2030. Our study examines the market at global, regional, and country levels, providing quantitative projections and insights into key growth drivers, challenges, and investment opportunities across all major Disabled and Elderly Services segments.

Report Scope:

|

Parameters |

Details |

|

Market Size in 2025 |

USD 552.64 Billion |

|

Revenue Forecast in 2030 |

USD 782.38 Billion |

|

Growth Rate |

CAGR of 7.2% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Countries Covered |

28 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent to up to 80 analyst-working hours) after purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

|

Approach |

In-depth primary and secondary research; proprietary databases; rigorous quality control and validation measures. |

|

Analytical Tools |

Porter's Five Forces, SWOT, value chain, and Harvey ball analysis to assess competitive intensity, stakeholder roles, and relative impact of key factors. |

Key Market Segments

By Service Type

-

Daily Living & Personal Care Services

-

Personal Care

-

Homemaking Services

-

Companionship & Wellbeing

-

-

Mobility & Transportation Services

-

Paratransit & Personal Transport

-

Mobility Training

-

Escort & Assistance Services

-

-

Communication Support Services

-

Sign Language Interpretation

-

Captioning & Transcription

-

Communication Training

-

-

Therapeutic & Clinical Services

-

Physical Therapy

-

Occupational Therapy

-

Speech & Language Therapy

-

Cognitive & Behavioral Therapy

-

-

Assistive Technology Services

-

AT Assessment & Fitting

-

AT Training & Education

-

Maintenance & Repair

-

-

Remote Support & Safety Services

-

Personal Emergency Response Systems (PERS)

-

Remote Health Monitoring

-

Telehealth & Telecare

-

-

Care & Case Management Services

-

Geriatric Care Management

-

Service Navigation & Advocacy

-

Care Planning & Coordination

-

By End User

-

Home Care

-

Institutional Care

-

Hospitals & Clinics

-

Assisted‑Living & Nursing Homes

-

Rehabilitation & Day‑care Centers

-

-

Community & Outpatient

-

Other

Geographical Breakdown

-

North America: U.S., Canada, and Mexico.

-

Europe: U.K., Germany, France, Italy, Spain, Sweden, Denmark, Finland, Netherlands, and rest of Europe.

-

Asia Pacific: China, India, Japan, South Korea, Taiwan, Indonesia, Vietnam, Australia, Philippines, and rest of APAC.

-

Middle East & Africa (MENA): Saudi Arabia, UAE, Egypt, Israel, Turkey, Nigeria, South Africa, and rest of MENA.

-

Latin America: Brazil, Argentina, Chile, Colombia, and rest of LATAM

Conclusion & Recommendations

Our report equips stakeholders, industry participants, investors, policy-makers, and consultants with actionable intelligence to capitalize on Disabled and Elderly Services transformative potential. By combining robust data-driven analysis with strategic frameworks, NMSC’s Disabled and Elderly Services Market Report serves as an indispensable resource for navigating the evolving landscape.

Speak to Our Analyst

Speak to Our Analyst