Elevator Safety Equipment Market by Offering (Hardware, Software & Platforms, Services), by Procurement Type (New Installations, SaaS Subscriptions & Recurring Monitoring Contracts), by Distribution Channel (OEM, System Integrator/Specialist Installer, Distributor & Wholesaler, Direct to FM/Building Owner, Managed Service Provider), by End-Use Vertical (Residential High-Rises, Healthcare Facilities, Industrial Plants, Transportation Hubs) – Global Analysis & Forecast, 2025–2030

Elevator Safety Equipment Industry Outlook

The global Elevator Safety Equipment Market size was valued at USD 9.12 billion in 2024, and is expected to be valued at USD 9.95 billion by the end of 2025. The industry is projected to grow, hitting USD 15.38 billion by 2030, with a CAGR of 9.1% between 2025 and 2030.

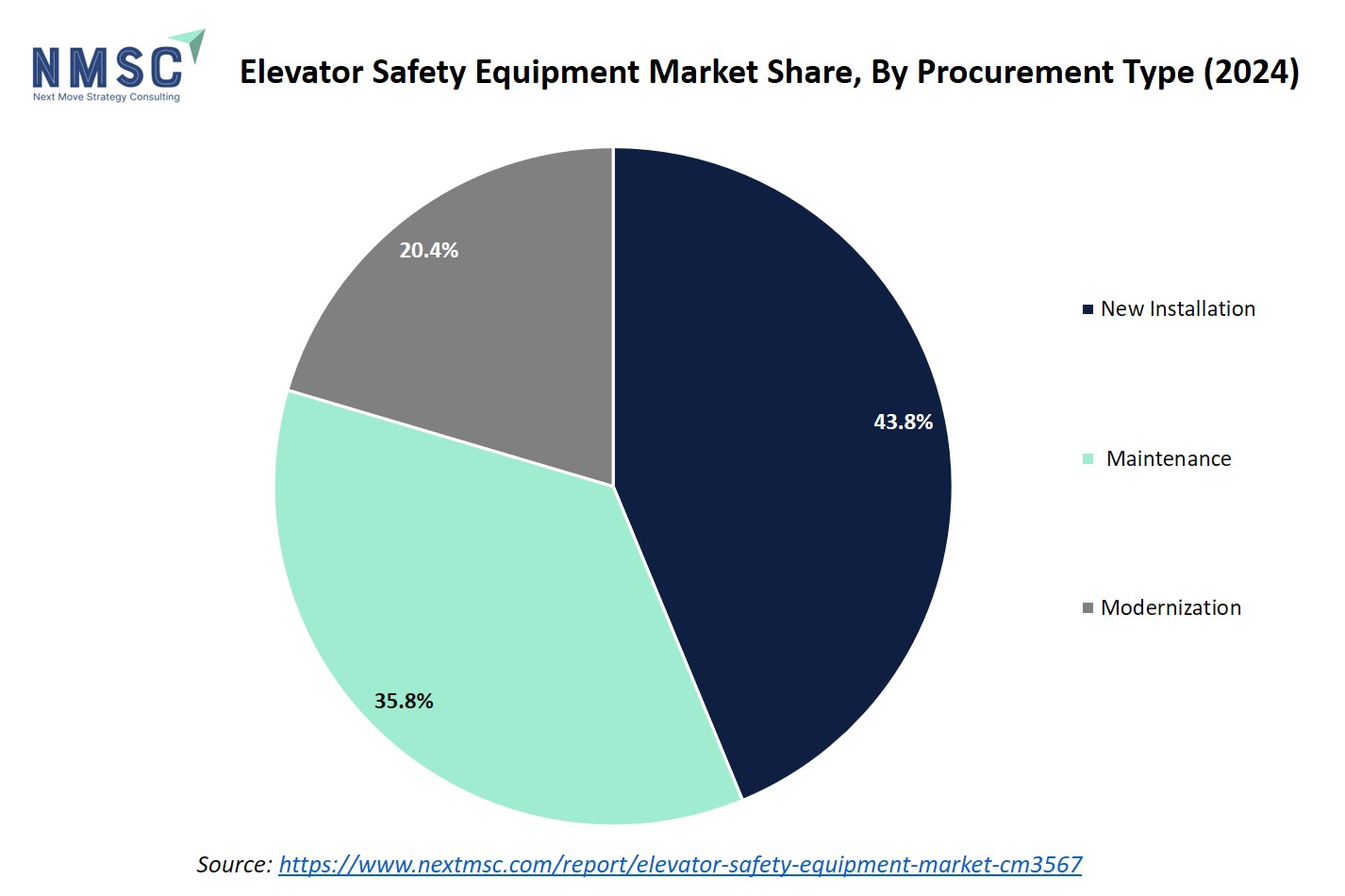

The elevator safety equipment market is expanding steadily, driven by rapid urbanization, rising high-rise construction, and growing emphasis on compliance with safety regulations. New installations account for the largest share, reflecting demand from residential and commercial projects, while modernization and maintenance ensure long-term system reliability and regulatory alignment. The integration of smart and IoT-enabled technologies is transforming the industry, with real-time monitoring, predictive maintenance, and cloud-based analytics enhancing passenger safety and operational efficiency. Emergency and rescue solutions, such as Automatic Rescue Devices (ARDs), seismic sensors, and fire-rated systems, are also gaining traction as building owners prioritize occupant safety in dense urban environments.

At the same time, high installation and maintenance costs remain a key challenge, especially in cost-sensitive markets. However, modernization and retrofitting offer cost-effective alternatives to full replacements, extending elevator lifecycles while supporting sustainability and compliance goals. Growing investment in smart infrastructure and smart city projects across Asia-Pacific, the Middle East, and Africa further fuels adoption of advanced safety systems. Overall, the market is shifting toward connected, regulation-driven, and sustainable solutions, making IoT-enabled elevators and modernization projects critical growth opportunities for the next decade.

What are the key trends in Elevator Safety Equipment Industry?

Is Smart and IoT-Enabled Safety Equipment Becoming More Common?

Smart technologies are increasingly shaping the market, with IoT sensors and AI-driven platforms providing continuous monitoring of elevator components. These systems detect abnormal vibrations, cable tension issues, or braking irregularities before they cause failures, allowing preventive action. Real-time data collection also supports predictive maintenance, minimizing downtime and reducing operating costs for building owners. In addition, cloud-based analytics and remote diagnostics help ensure elevators meet compliance standards while boosting passenger safety. As cities invest in smart building infrastructure and connected ecosystems, demand for IoT-enabled safety equipment is accelerating, making it a vital element of next-generation elevators.

Are Modernization and Retrofitting Driving Demand?

Many elevators in high-rise buildings worldwide were installed decades ago, and a large portion no longer meet today’s stringent safety standards. Instead of full replacements, modernization projects are becoming more cost-effective and sustainable, as they allow retrofitting of advanced safety solutions such as overspeed governors, advanced door sensors, and energy-efficient braking systems. This trend is particularly strong in Europe and North America, where strict regulations require property owners to maintain elevators at the highest safety levels. Furthermore, modernization extends elevator life cycles, reduces energy use, and provides compliance with evolving safety codes, creating a strong long-term growth driver for the market.

The pie chart illustrates the elevator safety equipment market share by Procurement Type in 2024. The new installation segment leads the market, accounting for 43.8%, highlighting strong demand from new construction projects and the increasing adoption of elevators in both residential and commercial high-rise buildings. The maintenance segment follows with 35.8%, reflecting the essential need for regular inspection, servicing, and compliance with safety standards to ensure passenger safety and equipment longevity. Meanwhile, the modernization segment holds 20.4%, driven by the replacement of aging systems and upgrades to meet advanced safety regulations and smart building requirements. Overall, the chart emphasizes that while new installations dominate, maintenance and modernization are critical to sustaining long-term market growth.

Is Emergency and Rescue Equipment Gaining Attention?

With increasing reliance on high-rise buildings, passenger safety during emergencies has become a top priority. Automatic Rescue Devices (ARDs), for example, ensure elevators move to the nearest floor and open doors safely during power outages, minimizing panic and risk. Backup power supplies and emergency communication systems, including two-way voice lines and alarm buttons, are also being widely adopted. In regions prone to earthquakes or fire hazards, specialized safety systems such as seismic detectors and fire-rated doors are becoming standard installations. This heightened focus on emergency preparedness is driving significant growth in this segment, as property owners seek to protect occupants in all situations.

Is Regulatory Compliance Shaping Market Growth?

Elevator safety is heavily regulated, and compliance with government-mandated safety codes is one of the strongest market drivers. In emerging economies such as China and India, stricter safety regulations are being enforced alongside rapid urban development, pushing developers to install advanced safety equipment in new projects. Meanwhile, in mature markets like North America and Europe, modernization is largely driven by compliance requirements, as older elevators must be updated to meet evolving safety norms. This regulatory environment ensures steady demand for advanced safety solutions, ranging from braking systems to smart monitoring tools, making compliance not just a legal necessity but also a competitive advantage for manufacturers.

What are the key market drivers, breakthroughs, and investment opportunities that will shape the Elevator Safety Equipment Industry in next decade?

The market is witnessing steady growth driven by the increasing construction of high-rise buildings and rapid urbanization in cities worldwide. Rising populations and vertical infrastructure development are fueling demand for advanced elevator systems equipped with emergency braking mechanisms, door sensors, and IoT-enabled monitoring technologies. At the same time, adoption of smart and connected elevators presents opportunities for predictive maintenance, enhanced passenger safety, and integration with building management systems. However, high installation and maintenance costs remain a key restraint, particularly in emerging economies. Overall, the market is expanding as building owners and developers prioritize passenger safety, regulatory compliance, and efficiency in modern and smart urban infrastructures.

Growth Drivers:

How High-Rise Construction Powers Elevator Safety Equipment ?

The rapid expansion of high-rise construction is a key driver of the market, as urban centers continue to grow vertically to accommodate rising populations. According to Civil Engineer (2024), the construction industry recorded a 10% increase in nominal value added and a 12% rise in gross output, reflecting strong momentum in new building projects. This surge directly fuels demand for advanced elevator systems, particularly in skyscrapers and large-scale developments where safety requirements are more stringent. As a result, equipment such as overspeed governors, emergency braking systems, and seismic sensors is increasingly essential to ensure passenger protection and regulatory compliance in modern high-rise infrastructure.

How Urbanization Fuels the Elevator Safety Equipment Market Growth?

Rapid urbanization is significantly driving the growth of the market, as rising populations in cities increase the demand for vertical infrastructure, including residential towers, commercial complexes, and public buildings. According to the World Bank (2024), 37% of India’s population and 84% of the U.S. population live in urban areas, highlighting the concentration of people in cities where high-rise developments are essential. This trend boosts elevator installations and, consequently, the need for advanced safety equipment such as door sensors, emergency rescue devices, and IoT-enabled monitoring systems. Urban policies promoting smart and sustainable infrastructure further encourage the adoption of state-of-the-art elevator safety technologies, supporting market expansion.

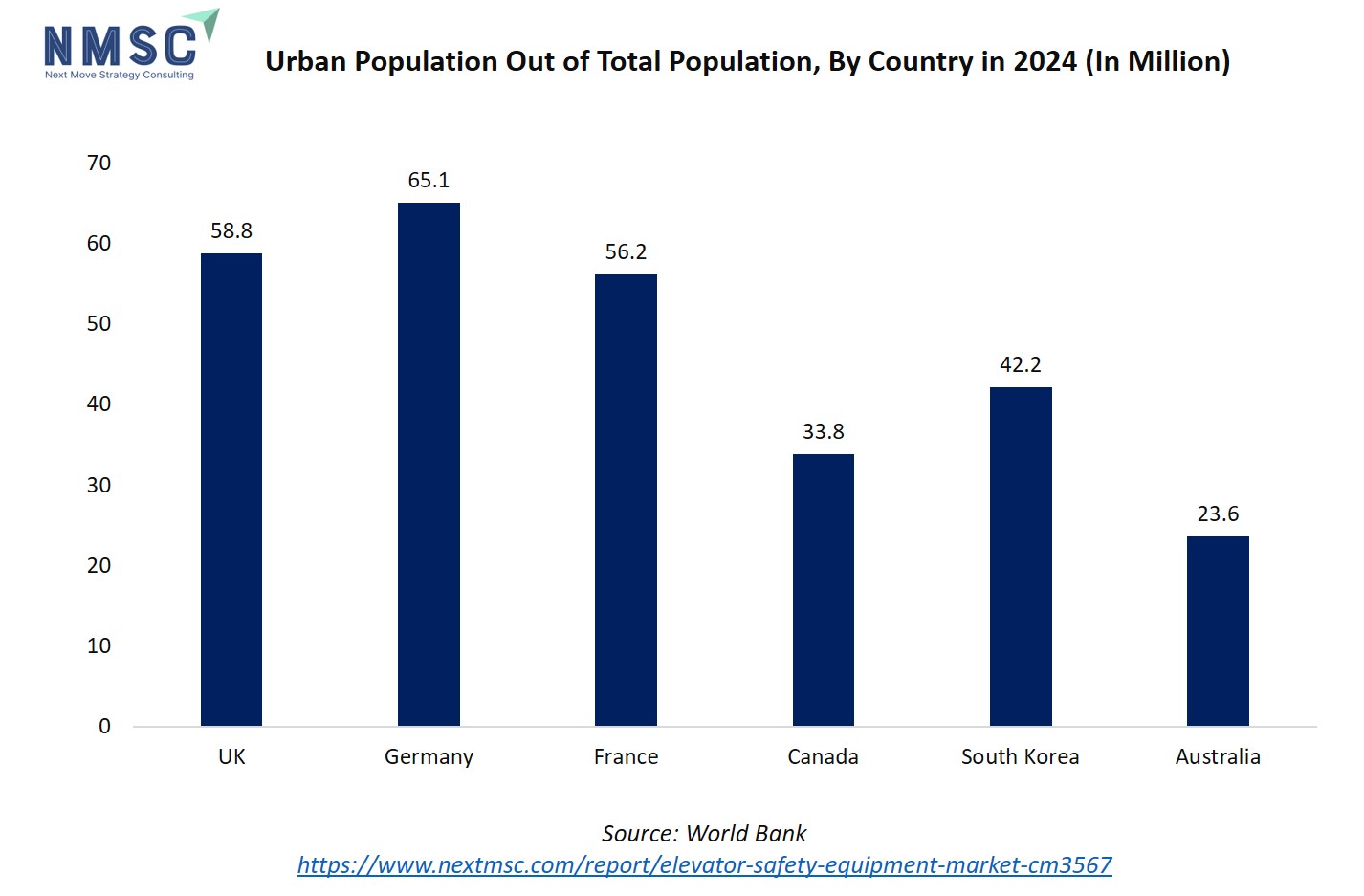

In 2024, countries such as Australia, the UK, Canada, France, Germany, and South Korea show significant urban populations, with Australia at 23.6 million (90.8% urbanized), the UK at 58.76 million (86.4%), Canada at 33.84 million (84.6%), France at 56.21 million (83.9%), South Korea at 42.17 million (81.1%), and Germany at 65.05 million (77.4%). High urbanization reflects a dense concentration of people living and working in high-rise buildings, commercial complexes, shopping centers, hotels, and healthcare facilities, all of which depend heavily on elevators for daily mobility. This creates a pressing need for robust safety systems, digital monitoring technologies, and predictive maintenance solutions to ensure reliable and secure elevator operations in busy urban environments. As urban populations continue to rise, the demand for advanced elevator safety equipment is expected to grow, making highly urbanized countries critical markets for the global elevator safety equipment industry.

Growth Inhibitors:

How High Installation and Maintenance Costs Hinders the Elevator Safety Equipment Market Expansion?

The high costs associated with installing and maintaining advanced elevator safety systems pose a significant challenge to market growth. Incorporating technologies such as automatic rescue devices, IoT-enabled monitoring, and seismic or fire safety sensors requires significant capital investment, which be a barrier for small- and medium-sized building owners or developers in emerging economies. Additionally, maintaining these sophisticated systems demands skilled technicians and regular servicing, further increasing operational expenses. As a result, while demand for safety and compliance is rising, the substantial financial burden slows adoption in cost-sensitive markets, restricting overall market growth.

How is Artificial Intelligence Enhancing Opportunities in the Elevator Safety Equipment Market?

The integration of Artificial Intelligence (AI) in smart and IoT-enabled elevators is creating significant growth opportunities in the market. AI algorithms analyze real-time data from IoT sensors to detect anomalies, predict component failures, and optimize maintenance schedules, reducing downtime and enhancing passenger safety. Smart elevators, connected to building management systems, allow AI to learn usage patterns, improve traffic flow, and adjust operations for peak efficiency and comfort. This combination of AI, IoT, and smart elevator technologies provides actionable insights for facility managers, ensures compliance with stringent safety standards, and supports the development of intelligent, self-monitoring urban infrastructure, particularly in rapidly urbanizing regions and smart city projects.

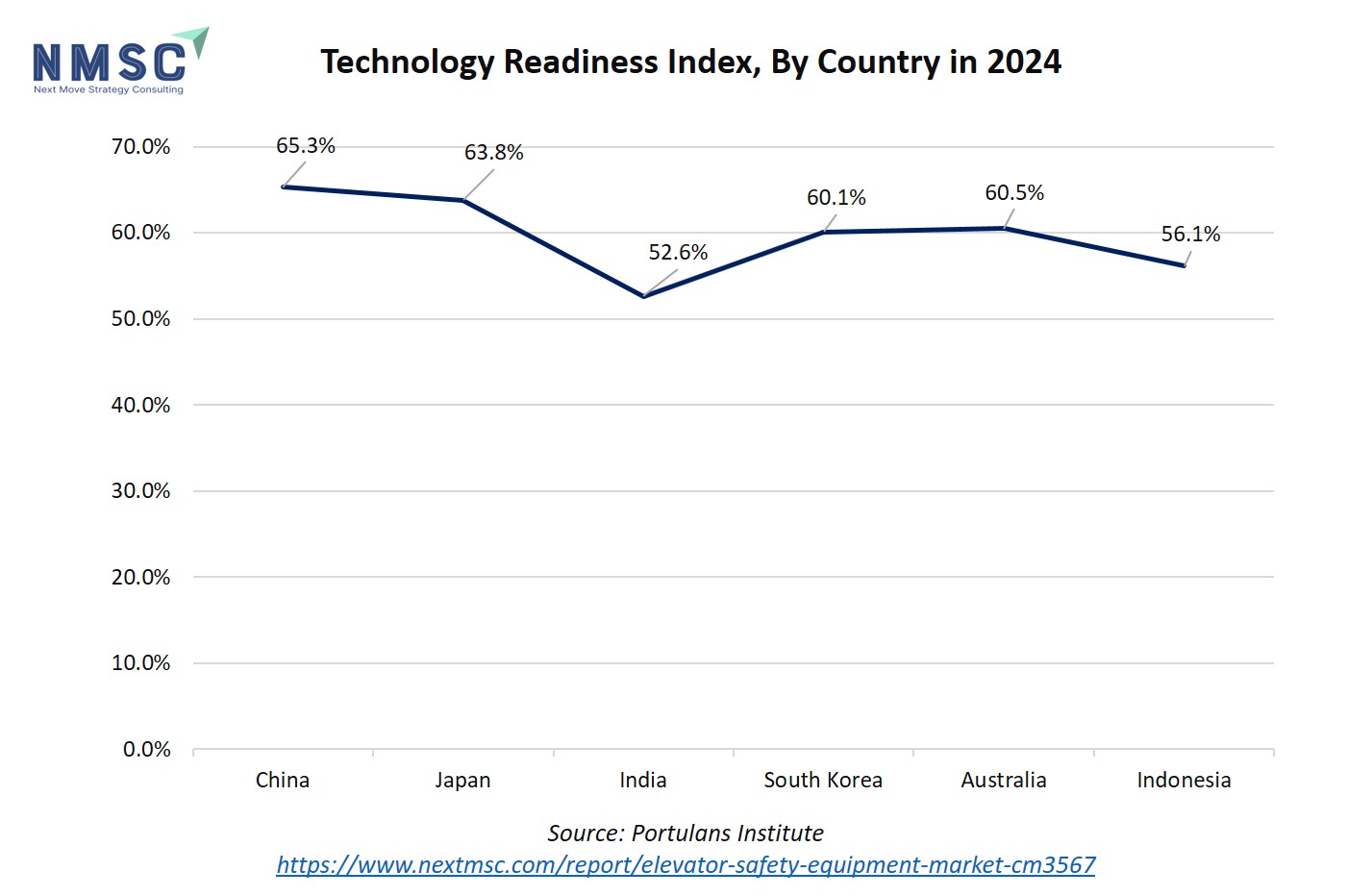

The line chart depicts the Technological Readiness Index (TRI) across six Asia-Pacific countries in 2024. China leads with a TRI of 65.3%, followed by Japan at 63.8%, Australia at 60.5%, South Korea at 60.1%, Indonesia at 56.1%, and India at 52.6%. The chart highlights a clear trend where more technologically advanced countries show higher readiness to adopt and implement smart systems.

In relation to the elevator safety equipment market, countries with higher TRI scores are better positioned to integrate IoT-enabled and AI-driven elevator safety solutions. For instance, China and Japan’s high technological readiness suggests strong adoption potential for smart elevators, predictive maintenance systems, and automated safety monitoring, whereas markets like India and Indonesia, with lower TRI, present growth opportunities as their technological infrastructure improves.

How the Elevator Safety Equipment market is segmented in this report, and what are the key insights from the segmentation analysis?

By Offering Insights

How Does Hardware in Elevator Safety Equipment Enhance Passenger Safety and System Reliability?

On the basis of offering, the market is segmented into hardware, software & platforms and services.

Elevator safety hardware, including emergency brakes, door sensors, overspeed governors, and seismic detectors, plays a critical role in ensuring passenger protection and operational reliability. High-quality hardware components provide real-time mechanical safeguards, preventing accidents caused by uncontrolled movement, door malfunctions, or environmental hazards. When installed and maintained correctly, these devices offer consistent performance even in high-traffic or high-rise environments, reducing downtime and enhancing compliance with safety regulations. Additionally, advancements in hardware durability and precision contribute to longer service life and lower maintenance frequency, making it a foundational and indispensable element of modern elevator safety systems.

By Procurement Type Insights

How Does Modernization and Retrofit Drive Safety and Efficiency in Existing Elevator Systems?

Based on procurement type, the market is segmented into new installations (oem bundles), modernization / retrofit (aftermarket upgrades), replacement / spare parts and saas subscriptions & recurring monitoring contracts.

Modernization and retrofit solutions allow older elevators to be upgraded with advanced safety equipment, such as emergency brakes, door sensors, IoT-enabled monitoring, and predictive maintenance tools. These upgrades improve passenger safety, enhance reliability, and ensure compliance with current safety regulations without the need for full elevator replacement. Retrofitting also extends the operational life of existing elevators, reduces energy consumption, and minimizes downtime through smarter, connected components. For building owners and facility managers, modernization offers a cost-effective alternative to new installations while bringing aging infrastructure up to modern safety and performance standards, supporting safer and more efficient vertical transportation.

By Distribution Channel Insights

How do System Integrators and Specialist Installers Enhance the Deployment of Elevator Safety Equipment?

Based on distribution channel, the market is bifurcated into oem (elevator manufacturer), system integrator / specialist installer, distributor & wholesaler, direct to fm / building owner and managed service provider.

System integrators and specialist installers play a crucial role in ensuring that elevator safety equipment is correctly installed, calibrated, and integrated with existing elevator systems. Their expertise ensures that components such as emergency brakes, door sensors, IoT-enabled monitoring devices, and predictive maintenance tools function seamlessly and meet regulatory compliance. By providing tailored solutions for complex or large-scale buildings, they help reduce installation errors, minimize downtime, and optimize overall elevator performance. Additionally, these professionals offer post-installation support, training, and troubleshooting, making them indispensable partners for building owners seeking reliable, high-quality safety solutions.

By End-use vertical Insights

How do Elevator Safety Solutions Support Commercial Office Buildings?

Based on end-use vertical, the market is bifurcated into residential high-rises, commercial offices, retail/hospitality, healthcare facilities, industrial plants, transportation hubs and public infrastructure.

In commercial office buildings, elevator safety equipment ensures smooth, reliable, and secure vertical transportation for employees, visitors, and service personnel. Advanced systems, such as emergency brakes, door interlocks, load sensors, and IoT-enabled monitoring, prevent accidents and reduce downtime, which is critical in high-traffic office environments. Safety compliance is particularly important in corporate spaces, where liability risks and regulatory standards are stringent. Additionally, predictive maintenance and remote monitoring offered by modern safety solutions optimize operational efficiency, lower repair costs, and enhance user confidence. Overall, deploying advanced elevator safety equipment in commercial offices supports building reliability, employee safety, and regulatory adherence.

Regional Outlook

The market is geographically studied across North America, South America, Europe, the Middle East & Africa, and Asia Pacific, and each region is further studied across countries.

Elevator Safety Equipment Market in North America

The North American elevator safety equipment market is experiencing steady growth, fueled by the region’s extensive urban infrastructure and focus on building modernization. Elevators in commercial towers, residential complexes, shopping malls, and healthcare facilities serve as key environments for implementing advanced safety solutions. A primary driver of the market is the increasing emphasis on smart and energy-efficient building initiatives, which promotes the integration of digital monitoring systems, predictive maintenance technologies, and modern safety equipment, strengthening the adoption of elevator safety solutions across major cities in North America.

Elevator Safety Equipment Market in the United States

The United States holds a leading position in the regional elevator safety equipment market due to its extensive elevator infrastructure and increasing focus on building digital transformation. Elevators in office towers, residential complexes, shopping malls, and healthcare facilities serve as high-frequency, captive environments, making them critical points for implementing safety systems and monitoring technologies. As of 2024, approximately 284.04 million people, or 84% of the U.S. population, reside in urban areas, according to the World Bank. This high level of urbanization drives vertical development and accelerates the demand for advanced elevator safety solutions. Furthermore, the integration of digital and energy-efficient technologies in new constructions and retrofitted buildings supports the expansion of Elevator Safety Equipment, reinforcing safety standards and smart infrastructure adoption across major U.S. cities.

Elevator Safety Equipment Market in Canada

Canada’s market is expanding steadily, driven by the country’s growing urban infrastructure and emphasis on modern, safe, and energy-efficient buildings. Elevators in commercial towers, residential complexes, healthcare facilities, and shopping centers represent critical environments for implementing advanced safety systems and monitoring technologies. As of 2024, approximately 33.84 million people, or 81% of Canada’s population, reside in urban areas, according to the World Bank. This high urbanization level fuels vertical development, increasing the adoption of elevator safety equipment in both new constructions and retrofitted buildings. Integration with smart building technologies and energy-efficient solutions further strengthens the market presence of Elevator Safety Equipment across major Canadian cities.

Elevator Safety Equipment Market in Europe

The European elevator safety equipment market is growing steadily, supported by the region’s mature urban infrastructure and strong focus on building safety and modernization. Elevators in commercial buildings, residential complexes, healthcare facilities, and shopping centers are critical environments for deploying advanced safety systems. A major driver of the market is the stringent safety regulations and compliance standards across European countries, which encourage the adoption of modern safety equipment, digital monitoring solutions, and predictive maintenance technologies, enhancing the overall safety and efficiency of elevator systems throughout the region.

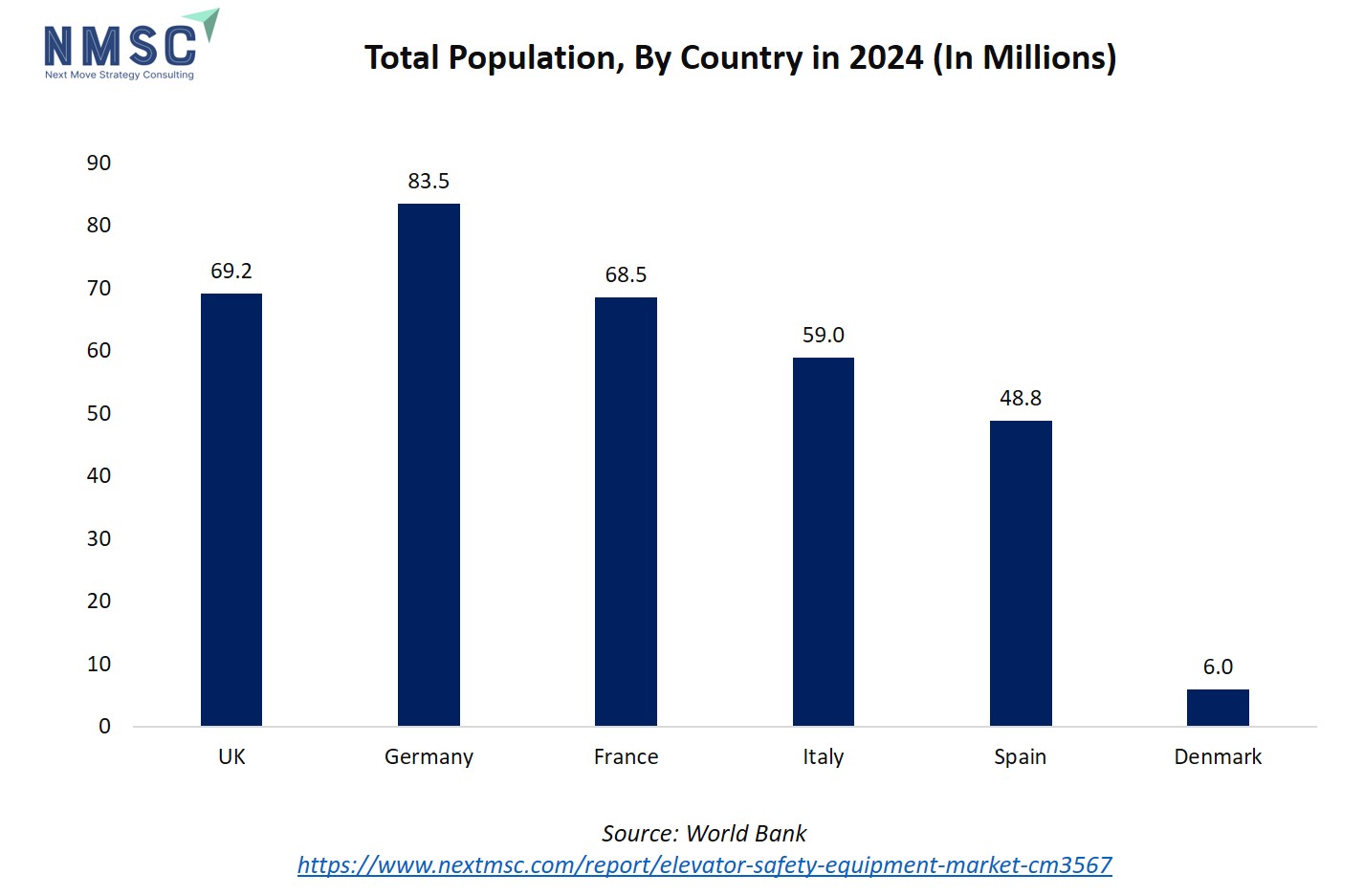

The bar chart above illustrates the total population (in millions) across countries in 2024, including Germany (83.51 Mn), the UK (69.22 Mn), France (68.51 Mn), Italy (58.98 Mn), Spain (48.80 Mn), and Denmark (5.97 Mn). These countries feature substantial populations, much of which is concentrated in urban centers where reliance on vertical mobility is high. Growing populations, especially in highly urbanized nations like Germany, the UK, and France, are driving increased demand for safe and reliable elevator systems in residential complexes, offices, shopping centers, hotels, and healthcare facilities. As population growth places greater pressure on urban infrastructure, the adoption of advanced elevator safety equipment, digital monitoring solutions, and predictive maintenance systems becomes essential, positioning these countries as strategic markets for the global elevator safety equipment industry.

Elevator Safety Equipment Market in the United Kingdom

The United Kingdom’s elevator safety equipment market is expanding, driven by urban development and the modernization of commercial and residential buildings. Elevators in office towers, shopping centers, healthcare facilities, and residential complexes serve as critical environments for implementing advanced safety systems. As of 2024, approximately 58.76 million people, or 83% of the U.K. population, reside in urban areas, according to the World Bank. This high urbanization supports vertical construction and accelerates the adoption of modern elevator safety solutions. Additionally, strict safety regulations and the growing emphasis on smart, energy-efficient building infrastructure act as key drivers, promoting the integration of digital monitoring systems and advanced safety technologies across major cities in the United Kingdom.

Elevator Safety Equipment Market in Germany

Germany’s elevator safety equipment market is witnessing steady growth, supported by the country’s well-developed urban infrastructure and emphasis on building modernization. Elevators in commercial towers, residential complexes, healthcare facilities, and shopping centers serve as essential environments for deploying advanced safety solutions. As of 2024, Germany has a total population of approximately 83.51 million, with a significant portion residing in urban areas, according to the World Bank. This high urban concentration drives vertical construction and increases demand for modern elevator safety systems. Moreover, stringent safety regulations and the focus on smart, energy-efficient building initiatives act as key market drivers, encouraging the adoption of digital monitoring systems, predictive maintenance solutions, and advanced safety equipment across German cities.

Elevator Safety Equipment Market in France

The elevator safety equipment market in France is growing steadily, supported by the country’s dense urban infrastructure and modernization of residential and commercial buildings. Elevators in office complexes, healthcare facilities, shopping centers, and high-rise apartments are critical environments for implementing safety systems. A key driver of this market is the increasing renovation of aging building stock, which requires the upgrading of elevators with advanced safety equipment and monitoring technologies. This trend is further reinforced by urban densification, which continues to boost demand for reliable and modern elevator safety solutions across major French cities.

Elevator Safety Equipment Market in Spain

The market in Spain is expanding as the country experiences rising demand for modernization of existing buildings and infrastructure. Elevators in residential complexes, commercial centers, and healthcare facilities are key environments for integrating advanced safety technologies. A major driver of the Spanish market is the rapid growth of the tourism and hospitality sector, which encourages the upgrading of hotels, resorts, and public buildings with modern safety systems to ensure reliability and compliance, particularly in high-traffic urban areas.

Elevator Safety Equipment Market in Italy

Italy’s elevator safety equipment market is witnessing steady growth, supported by the country’s urban concentration and the presence of numerous mid- and high-rise buildings. Elevators in residential complexes, offices, and historical buildings undergoing renovation are critical areas for safety system deployment. A primary driver in Italy is the government’s emphasis on building renovation incentives and infrastructure modernization programs, which stimulate demand for upgrading elevators with advanced safety technologies across both modern and heritage structures.

Elevator Safety Equipment Market in the Nordics

The elevator safety equipment market in the Nordics is evolving, supported by the region’s strong focus on sustainable urban development and technologically advanced infrastructure. Elevators in residential towers, commercial hubs, and healthcare institutions play a vital role in maintaining safety and accessibility. A key driver in the Nordic countries is the commitment to green and sustainable building practices, which accelerates the adoption of energy-efficient elevators equipped with advanced safety solutions and digital monitoring systems, aligning with the region’s environmental goals.

Elevator Safety Equipment Market in Asia Pacific

The elevator safety equipment market in Asia-Pacific is experiencing rapid growth, fueled by large-scale urbanization, population growth, and the rise of megacities across the region. Elevators in high-rise residential complexes, commercial towers, shopping malls, and healthcare facilities are central to meeting the mobility needs of densely populated urban centers. A key driver of the market is the massive investment in infrastructure and smart city projects, particularly in countries such as China, India, and Southeast Asian nations. These initiatives are accelerating the demand for modern elevators equipped with advanced safety systems, digital monitoring, and predictive maintenance technologies, ensuring reliability and compliance across both new and retrofitted buildings in the region.

Elevator Safety Equipment Market in China

China dominates the Asia-Pacific market, driven by its massive urban population, rapid vertical development, and strong focus on modern infrastructure. Elevators in high-rise residential complexes, commercial towers, metro stations, and healthcare facilities are vital for ensuring safe and efficient mobility in densely populated cities. As of 2024, approximately 923.49 million people reside in urban areas in China, according to the World Bank, making it the largest urban population globally. This immense urbanization fuels demand for advanced elevator safety systems. A key driver of the Chinese market is the government’s large-scale investment in smart city initiatives and infrastructure modernization, which is accelerating the adoption of cutting-edge safety technologies, predictive maintenance systems, and digital monitoring solutions across both new and retrofitted buildings.

Elevator Safety Equipment Market in Japan

Japan’s market is shaped by its advanced urban infrastructure, an aging population, and strong safety standards in buildings. Elevators in high-rise apartments, hospitals, and commercial complexes are essential for accessibility and reliability. In 2024, the country recorded a GDP growth rate of just 0.1%, highlighting its slow economic expansion. However, this modest growth reinforces the importance of renovation and modernization of existing infrastructure rather than new large-scale construction, driving demand for upgrading aging elevator systems with advanced safety equipment. Coupled with Japan’s focus on energy efficiency and smart technologies, the need to retrofit older buildings with modern safety solutions remains a central driver of the market.

Elevator Safety Equipment Market in India

India’s elevator safety equipment market is expanding rapidly, driven by accelerating urbanization, infrastructure development, and the rise of high-rise construction in major cities. As of 2024, approximately 534.91 million people reside in urban areas, according to the World Bank, reflecting a significant share of the population living in dense metropolitan regions. This surge in urban population directly fuels demand for vertical mobility solutions, making elevators indispensable in residential towers, commercial complexes, shopping malls, and healthcare facilities. A key driver of the Indian market is the government’s large-scale investment in smart city initiatives and affordable housing projects, which is creating a strong need for reliable elevator safety equipment, predictive maintenance systems, and advanced monitoring technologies across both new and retrofitted buildings.

Elevator Safety Equipment Market in South Korea

South Korea’s elevator safety equipment market is growing steadily, supported by its highly urbanized landscape, dense high-rise development, and strong technological adoption. Elevators in residential towers, commercial complexes, shopping centers, and healthcare facilities are critical for ensuring safe and efficient mobility in crowded urban environments. In 2024, South Korea’s total population stood at 51.75 million, according to the World Bank, with the majority concentrated in metropolitan regions such as Seoul, Busan, and Incheon. This high population density drives demand for advanced elevator safety systems. A key market driver is the country’s rapid adoption of smart building technologies and IoT-enabled monitoring solutions, which are enhancing safety, efficiency, and predictive maintenance in both newly constructed and retrofitted elevators across South Korea.

Elevator Safety Equipment Market in Taiwan

The market in Taiwan is advancing steadily, supported by the country’s concentration of high-rise residential and commercial buildings. Elevators in urban complexes, technology parks, and healthcare facilities are central to mobility and safety needs. A key driver of the market is the strong emphasis on earthquake resilience, which encourages the adoption of advanced safety equipment and monitoring systems to ensure elevator reliability and occupant protection in seismic-prone environments.

Elevator Safety Equipment Market in Indonesia

Indonesia’s elevator safety equipment market is growing rapidly, fueled by large-scale urban development and increasing high-rise construction across cities like Jakarta and Surabaya. Elevators in office towers, residential complexes, malls, and transport hubs are becoming critical to handle urban population growth. A major driver of the market is the expansion of commercial real estate and rapid growth of shopping and mixed-use developments, which is accelerating the integration of modern safety systems and digital monitoring solutions in both new and retrofitted buildings.

Elevator Safety Equipment Market in Australia

Australia’s market is expanding, supported by urban growth, infrastructure upgrades, and increasing adoption of smart building technologies. Elevators in residential towers, commercial complexes, hospitals, and shopping centers are vital for safe and efficient urban mobility. In 2024, Australia recorded a GDP growth rate of 1.4%, reflecting moderate economic expansion. This growth underpins continued investment in real estate and infrastructure projects, driving demand for modern elevator safety systems. A key market driver is the focus on sustainability and energy efficiency in new and retrofitted buildings, which encourages the integration of advanced safety technologies, digital monitoring solutions, and predictive maintenance across major Australian cities.

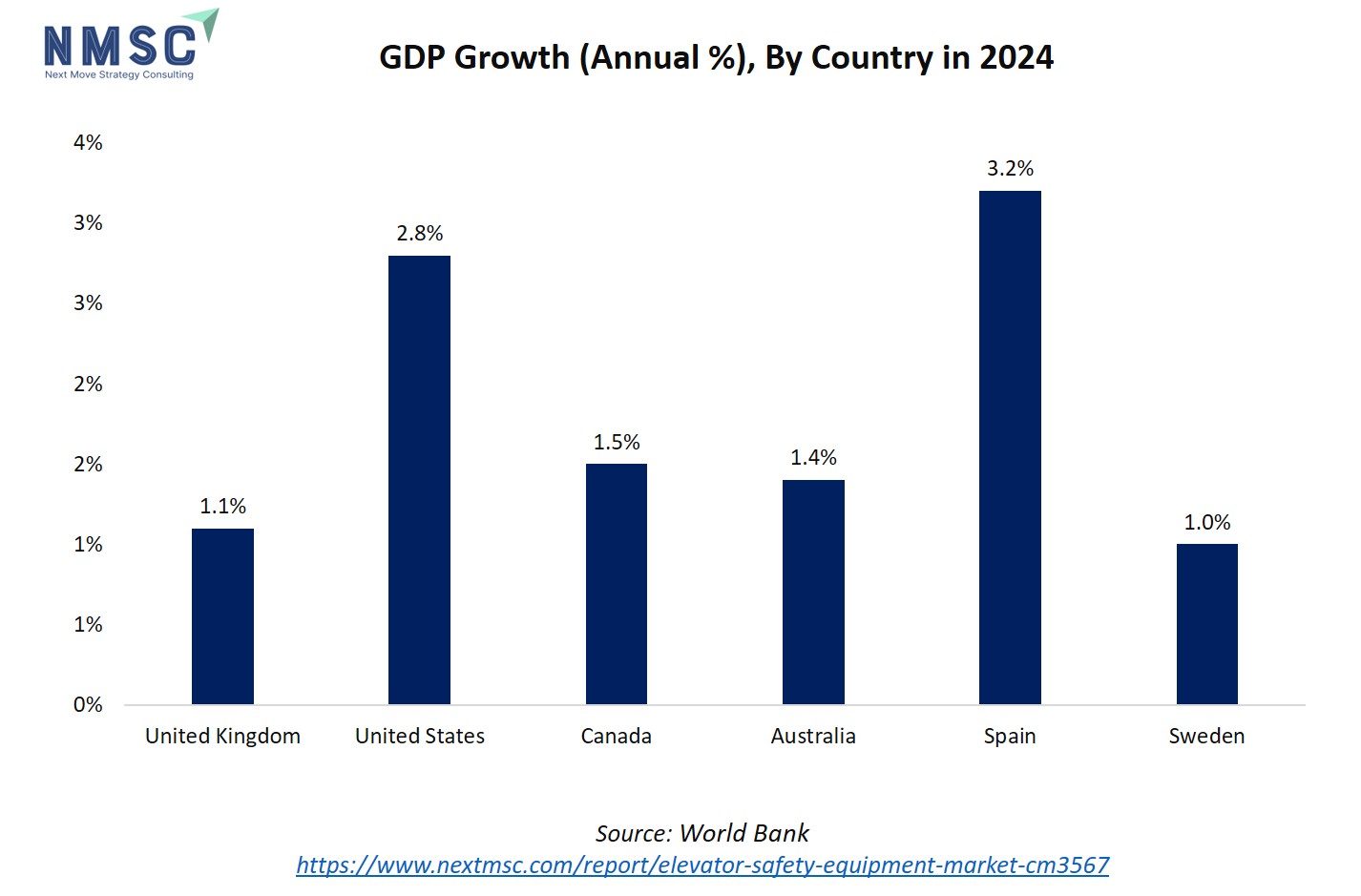

The bar chart illustrates GDP growth (annual %) by country in 2024, with Spain leading at 3.2%, followed by the United States (2.8%), Canada (1.5%), Australia (1.4%), the United Kingdom (1.1%), and Sweden (1.0%). Higher GDP growth rates, as seen in Spain and the U.S., signal stronger economic activity and increased investment in infrastructure, urban development, and real estate projects. This creates greater demand for elevators in commercial, residential, and public buildings, directly boosting the need for advanced elevator safety equipment. Meanwhile, countries with modest growth, such as the UK and Sweden, continue to focus on modernization and upgrading of existing infrastructure, which sustains demand for retrofitted safety systems. Overall, GDP growth acts as a critical driver, as economic expansion translates into larger-scale construction and modernization projects, strengthening opportunities in the global elevator safety equipment market.

Elevator Safety Equipment Market in Latin America

The elevator safety equipment market in Latin America is gaining momentum, driven by rapid urbanization, rising construction of high-rise residential and commercial buildings, and modernization of existing infrastructure. Elevators in shopping malls, office complexes, healthcare facilities, and residential towers are increasingly equipped with advanced safety systems to meet growing mobility needs in densely populated cities. A key driver of the market is the increasing investment in real estate and urban redevelopment projects, which is boosting demand for modern elevator safety technologies, digital monitoring solutions, and predictive maintenance across the region.

Elevator Safety Equipment Market in the Middle East & Africa

The elevator safety equipment market in the Middle East and Africa is expanding, supported by rapid urban development, infrastructure investments, and the growing presence of high-rise projects across major cities. Elevators in commercial towers, luxury residential complexes, shopping malls, and healthcare facilities are increasingly being equipped with advanced safety systems to ensure reliability and compliance. A key driver of the market is the boom in mega infrastructure and smart city projects, particularly in Gulf countries and emerging African economies, which is accelerating the adoption of modern elevator safety equipment, digital monitoring technologies, and predictive maintenance solutions across the region.

Competitive Landscape

What are the Top Companies in Elevator Safety Equipment Market and How they are Competing Against One Another?

Leading players in the elevator safety equipment market, including Hyundai Elevator Co., Ltd., Otis Elevator Company, TK Elevator, Mitsubishi Elevator (Mitsubishi Electric — KMEC), FUJITEC KOREA Co., Ltd., Schindler Group, Toshiba Elevator and Building Systems, KONE Corporation, Hitachi, Xinda Elevator, Sautter Lift Components GmbH (SLC), McDonough Elevator, Adams Elevator Equipment Company, Quad City Safety, and Panda Elevator Parts, are competing through product innovation, technological upgrades, and strategic partnerships. Companies like Otis and KONE focus on IoT-enabled monitoring, predictive maintenance, and smart building integration to enhance safety and operational efficiency. Schindler Group and TK Elevator are expanding their modernization and retrofit services to capture growth in aging infrastructure markets. FUJITEC and Mitsubishi Elevator emphasize advanced mechanical safety systems and emergency rescue solutions, while regional players such as Xinda Elevator and SLC are strengthening their presence through targeted local projects and spare parts distribution. Across the market, technology adoption, compliance with regulatory standards, and integration with connected building systems remain key competitive drivers, with companies leveraging innovation, global reach, and strategic collaborations to differentiate themselves.

Market Dominated by Tech Giants and Specialists

The elevator safety equipment market exhibits a moderately fragmented competitive structure, where major global elevator manufacturers and specialized safety solution providers compete alongside niche technology firms. Established players leverage their strong brand reputation, extensive distribution networks, and proprietary hardware and software solutions to maintain dominant positions across residential high-rises, commercial offices, healthcare facilities, and transportation hubs. While large manufacturers focus on scale, reliability, and regulatory compliance, specialized providers differentiate through IoT-enabled monitoring, predictive maintenance platforms, and advanced emergency safety devices. Companies such as Otis, Schindler, KONE, and Thyssenkrupp are emphasizing innovation in smart elevators, connected safety systems, and integration with building management platforms.

The market is also shaped by partnerships, acquisitions, and regional expansion.

Collaborations between elevator manufacturers, system integrators, and IoT software providers help accelerate deployment of advanced safety solutions, while regional players in Asia-Pacific, the Middle East, and Latin America leverage local construction trends, regulatory requirements, and urban growth to strengthen market presence. This evolving competitive landscape is increasingly driven by digital transformation, smart building initiatives, and the growing demand for reliable, connected, and compliant elevator safety solutions in high-rise and high-traffic infrastructures.

Innovation and Adaptability Drive Market Success

Success in the elevator safety equipment market depends on continuous innovation, adaptability to building requirements, and strategic positioning within high-rise and high-traffic environments. Leading players must invest in advanced hardware, IoT-enabled monitoring systems, predictive maintenance platforms, and smart emergency devices to stay ahead of evolving safety standards and regulatory expectations. Solutions need to be tailored to diverse end-use segments, ranging from residential towers and commercial offices to healthcare facilities and transportation hubs, ensuring compliance, reliability, and enhanced passenger safety. Building strong partnerships with elevator manufacturers, system integrators, facility managers, and technology providers is critical for securing large-scale installations and expanding market reach.

For emerging players and new entrants, opportunities exist in niche segments such as retrofitting aging elevators, smart city projects, or high-security facilities, where demand for connected safety solutions is growing. Differentiation be achieved through innovative features like real-time fault diagnostics, automated rescue devices, or AI-driven predictive maintenance. While customer retention is generally high due to regulatory compliance and long-term service contracts, firms must remain agile to respond to evolving safety codes, urban development trends, and smart building integration requirements. As vertical living increases and infrastructure becomes more connected, the ability to deliver reliable, data-driven, and context-aware elevator safety solutions will be key to long-term competitiveness.

Market Players to Opt for Merger & Acquisition Strategies to Expand their Presence

Leaders in the elevator safety equipment market are continuously enhancing their offerings to address evolving safety standards, smart building integration, and technological advancements. To strengthen capabilities and expand geographic reach, key players are actively pursuing strategic partnerships, mergers, and acquisitions. By combining their expertise in advanced hardware, IoT-enabled monitoring, and predictive maintenance with the local knowledge, distribution networks, or technology platforms of acquired firms, companies deliver more integrated and scalable safety solutions. This approach accelerates innovation, improves operational efficiency, and enables providers to serve a wider range of end-users, from residential high-rises and commercial offices to healthcare facilities and transportation hubs.

List of Key Elevator Safety Equipment Companies

-

Hyundai Elevator Co., Ltd.

-

TK Elevator

-

Mitsubishi Elevator (Mitsubishi Electric — KMEC)

-

FUJITEC KOREA Co., Ltd. (Fujitec)

-

Schindler Group

-

Toshiba Elevator and Building Systems

-

Hitachi

-

Xinda Elevator

-

Sautter Lift Components GmbH (SLC)

-

McDonough Elevator

-

Adams Elevator Equipment Company

-

Quad City Safety

-

Panda Elevator Parts

What Are The Latest Key Industry Developments?

-

August 2025 - Hyundai Elevator emphasizes cutting-edge technology to ensure safety and reliability in its products.

-

July 2025 - TK Elevator highlighted the completion of over 50,000 safety training modules, with more than 16,000 technicians participating in the Safety Transformation curriculum.

-

February 2025 - KONE's 2024 Annual Review highlighted the company's efforts in moving two billion people daily safely and reliably, with a focus on smart and sustainable People Flow solutions.

-

February 2025 - Schindler's Annual Report emphasized the company's commitment to safety and quality, with 44% of its equipment meeting ISO Class A standards.

-

December 2024 - Mitsubishi Electric conducted the Elevator and Escalator Safety Campaign, which includes user briefings to promote awareness of proper and safe elevator and escalator usage.

What are the Key Factors Influencing Investment Analysis & Opportunities In Elevator Safety Equipment Market?

Several small- to mid-sized companies in the elevator safety equipment market are attracting investment to scale their product offerings, enhance IoT-enabled monitoring, and expand modernization and retrofit services. Growing investor interest is driven by the increasing adoption of smart and connected elevators, predictive maintenance solutions, and compliance-focused safety upgrades across residential, commercial, and public infrastructure. Unlike conventional mechanical systems, advanced elevator safety solutions offer data-driven insights, real-time diagnostics, and integration with building management platforms, making them attractive for venture capital and private equity. Investment momentum is particularly strong for companies developing AI-based predictive maintenance, automated rescue devices, and smart city-aligned safety systems. As the market evolves, strategic capital is being directed toward scalable, technology-driven solutions that enhance passenger safety, regulatory compliance, and operational efficiency, reinforcing long-term growth potential in high-rise and urban environments.

Key Benefits for Stakeholders:

Next Move Strategy Consulting (NMSC) presents a comprehensive analysis of the global elevator safety equipment market, covering historical trends from 2020 through 2024 and offering detailed forecasts through 2030. Our study examines the market at global, regional, and country levels, providing quantitative projections and insights into key growth drivers, challenges, and investment opportunities across all major segments.

Report Scope:

|

Parameters |

Details |

|

Market Size in 2025 |

USD 9.95 Billion |

|

Revenue Forecast in 2030 |

USD 15.38 Billion |

|

Growth Rate |

CAGR of 9.1% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

30 |

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 analyst-working hours) after purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

|

Approach |

In-depth primary and secondary research; proprietary databases; rigorous quality control and validation measures. |

|

Analytical Tools |

Porter's Five Forces, SWOT, value chain, and Harvey ball analysis to assess competitive intensity, stakeholder roles, and relative impact of key factors. |

Key Market Segments

By Offering

-

Hardware

-

Mechanical Safety Systems

-

Braking Systems

-

Overspeed Governors

-

Door Interlocks & Locks

-

Safety Gear & Buffers

-

-

Control & Operation

-

Main controllers / ECUs

-

Door operators (motors/controllers)

-

Emergency operation / manual override panels

-

-

Monitoring & Recording

-

Cameras

-

Recorders & edge devices

-

Networking & power accessories

-

Cabin sensors for monitoring

-

-

Communication & Alarms

-

Intercom / two-way voice

-

Panic / SOS buttons

-

Telemetry / cellular gateways / modems

-

-

Power & Support

-

Backup power / UPS (for safety devices)

-

Emergency lighting / alarm bells / strobes

-

-

Accessories & Spare Parts

-

-

Software & Platforms

-

Video Management Systems (VMS)

-

Cloud Storage, SaaS Retention & Portals

-

Analytics Modules

-

Integration Middleware

-

-

Services

-

Installation & Integration

-

Monitoring & Alarm Response

-

Maintenance & Spare-part Contracts

-

Managed Video Services

-

Inspection, Certification, Warranty & Training

-

By Procurement Type

-

New Installations (OEM bundles)

-

Modernization / Retrofit (aftermarket upgrades)

-

Replacement / Spare Parts

-

SaaS Subscriptions & Recurring Monitoring Contracts

By Distribution Channel

-

OEM (elevator manufacturer)

-

System Integrator / Specialist Installer

-

Distributor & Wholesaler

-

Direct to FM / Building Owner

-

Managed Service Provider

By End-use vertical

-

Residential high-rises

-

Commercial offices

-

Retail/Hospitality

-

Healthcare facilities

-

Industrial plants

-

Transportation hubs

-

Public infrastructure

Geographical Breakdown

-

North America: U.S., Canada, and Mexico.

-

Europe: U.K., Germany, France, Italy, Spain, Sweden, Denmark, Finland, Netherlands, and rest of Europe.

-

Asia Pacific: China, India, Japan, South Korea, Taiwan, Indonesia, Vietnam, Australia, Philippines, and rest of APAC.

-

Middle East & Africa (MENA): Saudi Arabia, UAE, Egypt, Israel, Turkey, Nigeria, South Africa, and rest of MENA.

-

Latin America: Brazil, Argentina, Chile, Colombia, and rest of LATAM.

Conclusion & Recommendations

Our report equips stakeholders, industry participants, investors, policy-makers, and consultants, with actionable intelligence to capitalize on the markets transformative potential. By combining robust data-driven analysis with strategic frameworks, nmsc’s elevator safety equipment market report serves as an indispensable resource for navigating the evolving landscape.

Speak to Our Analyst

Speak to Our Analyst