India Data Center Power Solution Market By Power Infrastructure Components (Power Conversion & Backup, On-Site Generation, and Others), By IT Load (< 500 kW, 500 kW–2 MW, and Others), By Redundancy Level (N, N+1, and Others), By Power Source & Sustainability (Grid-Tied, On-Site Conventional, and Others), By Project Maturity Stage (Concept & Feasibility, Under Construction, and Others), By End-User (IT & Cloud Service Providers, Financial Services, and Others)– India Analysis & Forecast,2025–2030

Industry Outlook

The India Data Center Power Solution Market size was valued at USD 1.18 billion in 2024, and is expected to be valued at USD 1.39 billion by the end of 2025. The industry is projected to grow, hitting USD 3.16 billion by 2030, with a CAGR of 17.9% between 2025 and 2030.

The India data center power solution market is witnessing robust growth in 2025, driven by surging digital transformation, cloud adoption, and the expansion of hyperscale facilities. Rising demand for AI workloads, Internet of Things applications, and 5G-enabled services is fueling the need for reliable, scalable, and energy-efficient power infrastructure. Key adoption is emerging across sectors such as banking and financial services, e-commerce, healthcare, IT & telecom, and manufacturing, as enterprises modernize their data operations and strengthen business continuity.

Innovation is accelerating with the integration of renewable energy sources, modular UPS systems, advanced power distribution units, and AI-driven energy management tools, enhancing both resilience and sustainability. Applications include mission-critical backup systems, intelligent load balancing, predictive equipment monitoring, and green power solutions tailored for high-density computing environments. Demand is particularly strong for solutions that optimize energy efficiency, reduce carbon footprints, and support government-led sustainability mandates under initiatives like Digital India and the National Data Center Policy.

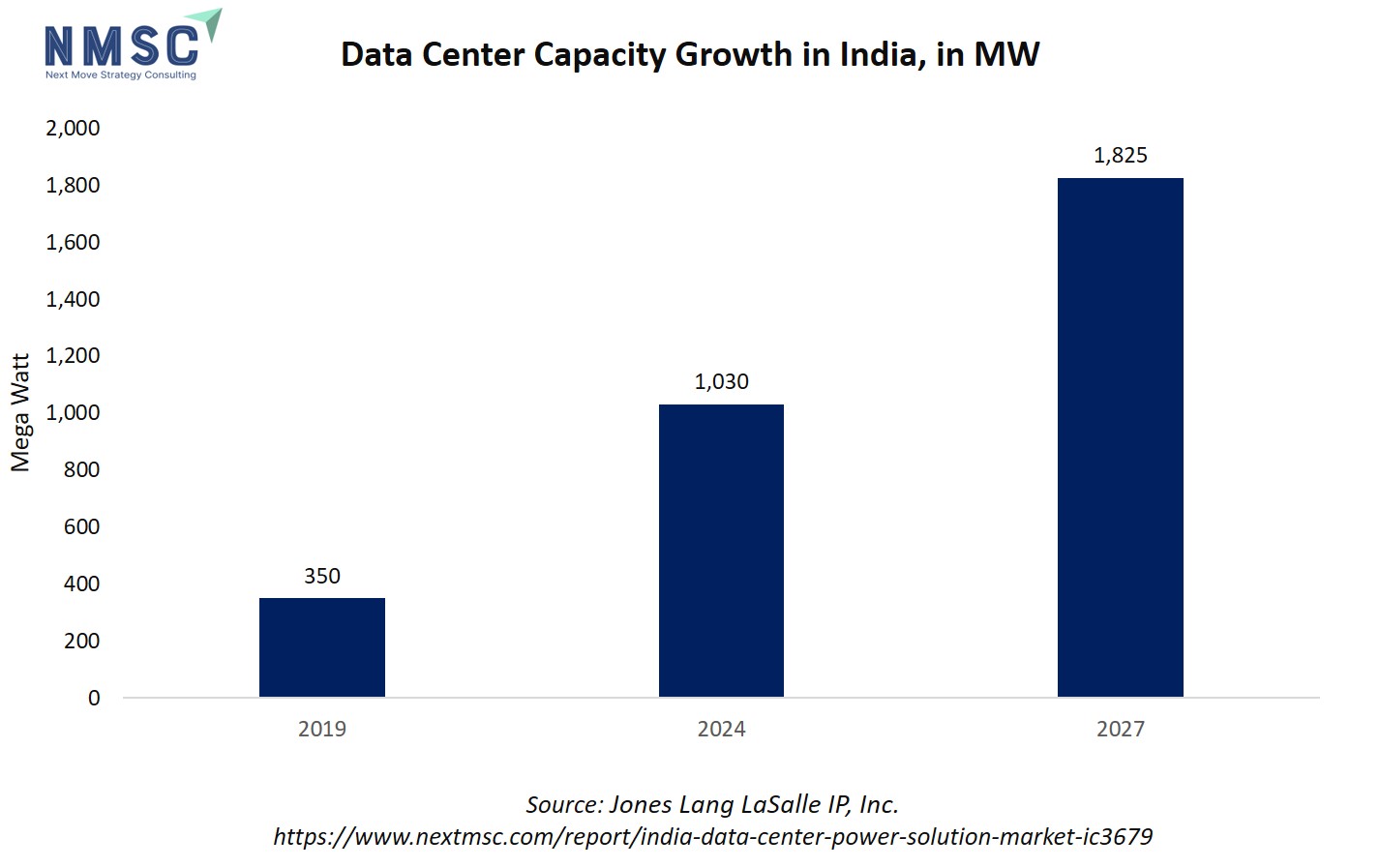

The above chart accurately reflects the major expansion of India’s data center capacity, rising from 350 MW in 2019 to 1,030 MW in 2024 and projected to reach 1,825 MW by 2027. This rapid increase underscores the surging demand for digital infrastructure driven by cloud, AI, and hyperscale workloads, compelling data center solution vendors to innovate in power architecture, higher capacity UPS systems, modular PDUs, and advanced cooling technologies to efficiently scale operations and capture market share in this high-growth environment.

What are the Key Trends in India Data Center Power Solution Industry?

How is the India Data Center Power Solution Market Decarbonizing Through Renewables and Storage Integration?

India’s data center power ecosystem is increasingly pivoting toward clean energy, aligning with the country’s broader sustainability goals. According to the Centre for Research on Energy and Clean Air (CREA), India added 25.1 GW of non-fossil capacity in 2025, a record increase that underscores the country’s momentum in renewable integration. For data centers, this rapid expansion provides a larger pool of renewable electricity and hybrid procurement models, enabling operators to replace conventional diesel backups with cleaner, more reliable alternatives. The integration of battery energy storage systems (BESS) is also gaining ground, allowing facilities to stabilize supply for AI-heavy workloads that demand uninterrupted power. This trend suggests that power solution vendors must design equipment compatible with inverter-based resources rather than treating renewables as auxiliary inputs.

How are AI and High-Density Workloads Reshaping Power Architecture and Cooling Requirements for India Data Center Power Solution Vendors?

The surge in generative AI and large-model training is forcing India’s data centers to rethink power density and thermal design. Traditional racks drawing 3–5 kW are being replaced by GPU-driven clusters consuming 30–50+ kW per cabinet, requiring liquid cooling readiness, denser power distribution units, and modular UPS topologies that can scale with demand. According to JLL, India’s data center capacity grew from 350 MW in 2019 to over 1,030 MW by 2024, with most of the new supply already pre-committed by hyperscalers and cloud service providers, an indicator that AI-intensive workloads are driving accelerated leasing and power demand. This pattern not only shortens procurement cycles but also compels operators to specify higher-density, GPU-ready infrastructure at the planning stage. For power solution vendors, this shift represents both a challenge and an opportunity. Companies should prioritize modular, liquid-cooling-compatible PDUs, scalable UPS modules, and validated test environments capable of handling higher input currents.

How are Modular, Prefabricated Power Solutions and Microgrids Accelerating Deployment in the India Data Center Power Solution Market?

Time-to-market has become a critical differentiator in India’s data center expansion. JLL reports that in just the second half of 2024, 114 MW of new capacity was delivered nationwide, with Mumbai alone accounting for nearly half, highlighting both the scale of growth and its concentration in key metros. Such demand pressures have accelerated adoption of modular, prefabricated power solutions like containerized UPS, pre-tested switchgear rooms, and plug-and-play distribution units. These solutions enable operators to bypass lengthy onsite construction, reducing project risks tied to grid readiness or permitting delays. For vendors, the lesson is clear: modular SKUs with proven interoperability and localized assembly are essential to winning projects where speed and reliability are paramount. Operators, meanwhile, benefit by aligning with suppliers offering turnkey packages, including microgrids that combine solar, BESS, and advanced control systems to maintain uptime during grid instability. By embedding mod

How will Grid Capacity, Regulatory Push, and Energy Policy Shape Procurement Strategies in The India Data Center Power Solution Market?

The interplay of grid reliability and policy direction is increasingly influencing procurement decisions in India’s data center sector. Demand has surged to the point where much of the new capacity is pre-committed, intensifying stress on local transmission networks and reinforcing the importance of long-term procurement strategies. Government initiatives like the National Data Center Policy and state-level renewable energy mandates are pushing operators to adopt greener, more reliable sourcing models, while grid bottlenecks in metros such as Mumbai are prompting the use of captive renewable parks and wheeling agreements. For power solution providers, this evolving regulatory environment creates opportunities to offer advisory services alongside hardware, helping clients model procurement risks and regulatory compliance scenarios. Operators, in turn, should prioritize sites with favorable policy frameworks and proactively partner with independent power producers to lock in bankable capacity. By aligning proc

Government Initiatives to Boost India Data Center Power Solution Market Growth:

|

Initiatives |

Focus Area |

|

Draft Data Centre Policy |

Grants data centers infrastructure status for easier project financing and clearances |

|

Renewable Energy Push |

Policies encouraging solar, wind, and green power integration in data centers |

|

Digital Personal Data Protection Act |

Data localization rules driving demand for local data center infrastructure |

|

Green Data Center Mandates |

States like Maharashtra mandate 100% renewable energy supply at new data center campuses |

Source: Draft Data Centre Policy, IEEFA, MeitY

Next Move Strategy Consulting

What are the Key Market Drivers, Breakthroughs, and Investment Opportunities that will Shape the India Data Center Power Solution Industry in the Next Decade?

The India data center power solution market is experiencing significant growth, driven by the country's expanding digital economy, increased adoption of cloud computing, and the rise of artificial intelligence (AI) workloads. This growth is further fueled by favorable government policies and substantial investments in infrastructure development. However, the industry faces challenges such as power infrastructure limitations, regulatory complexities, and the need for skilled manpower. Despite these challenges, there are emerging opportunities, particularly in renewable energy integration and the development of AI-centric data centers.

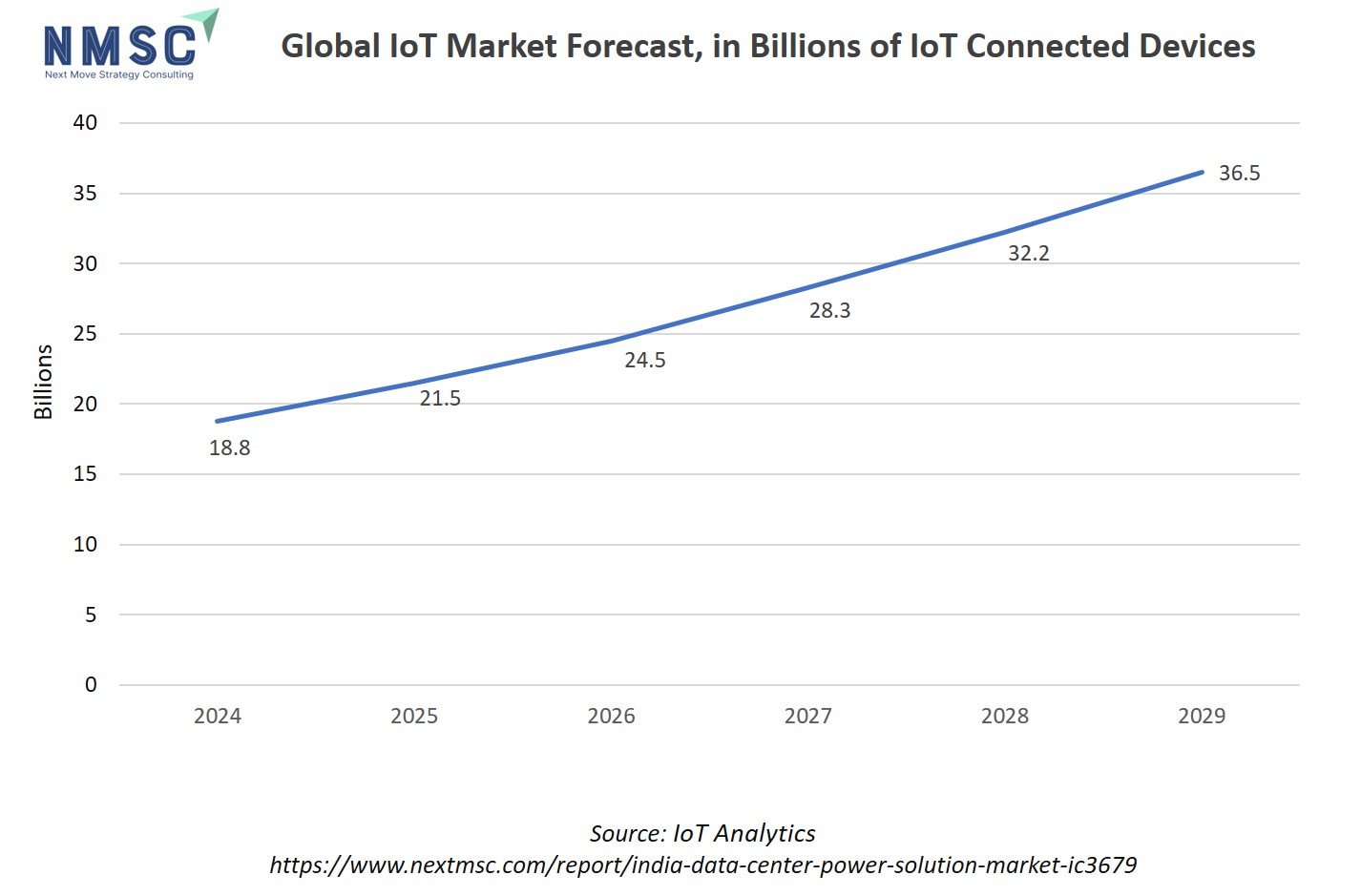

Also, the surging number of IoT connected devices globally directly amplifies data generation, network traffic, and storage requirements. This exponential rise in IoT connections fuels the need for larger, more advanced data centers in India, demanding highly reliable, scalable, and energy-efficient power infrastructure.

The above chart depicts a steady growth trajectory in the global Internet of Things (IoT) market, with the number of connected IoT devices expected to nearly double from 18.8 billion in 2024 to 36.5 billion by 2029. As IoT adoption accelerates, data centers must handle significantly higher workloads, intensifying requirements for robust UPS systems, modular power architecture, and advanced cooling solutions to ensure uninterrupted service and support the data deluge generated by these devices. This macro growth context underpins the strong investment and technological upgrade cycles for data center power solutions in the Indian market.

Growth Drivers:

How is the Expansion of AI Workloads Influencing Power Infrastructure Requirements?

The surge in AI workloads is significantly impacting power infrastructure requirements in India's data centers. AI-intensive applications demand higher computational power, leading to increased energy consumption. To meet these demands, data centers are adopting high-density computing systems and advanced cooling solutions. For instance, the inauguration of Equinix's AI-ready data center in Chennai, with plans to scale from 800 to 4,250 cabinets, highlights the industry's response to AI-driven power needs. This trend underscores the necessity for power solutions that can support high-performance computing and ensure efficient energy usage.

How are Government Initiatives and Investments Accelerating Data Center Infrastructure Development?

Government initiatives and investments are playing a pivotal role in accelerating data center infrastructure development in India. The establishment of AI-centric Special Economic Zones (SEZs), such as the one in Chhattisgarh with an investment of USD 120.4 million, demonstrates the commitment to fostering a conducive environment for data center growth. These initiatives aim to attract global tech giants and promote the development of high-performance computing systems. Additionally, investments in renewable energy projects, like Gujarat's addition of 6,632 MW of green power in 2025, are supporting the sustainability goals of data centers.

Growth Inhibitors:

What Challenges are Posed by Power Infrastructure Limitations in Data Center Operations?

Power infrastructure limitations pose significant challenges to data center operations in India. The rapid expansion of data centers has led to increased demand for electricity, straining existing power grids. This strain can result in power outages and unreliable supply, affecting the performance and reliability of data centers. Addressing these infrastructure limitations is crucial to ensure the seamless operation of data centers and meet the growing energy demands. For example, the establishment of a 3 GW solar cell and ecosystem hub by the RP-Sanjiv Goenka (RPSG) Group in Uttar Pradesh aims to mitigate such challenges by providing a dedicated renewable energy source for data centers.

How is the Integration of Renewable Energy Sources Creating Investment Opportunities in Data Center Power Solutions?

The integration of renewable energy sources is creating significant investment opportunities in data center power solutions. With states like Gujarat adding substantial renewable energy capacity, data centers are increasingly adopting solar and wind energy to meet their power needs. This shift not only supports sustainability goals but also offers cost advantages in the long term. Investors are recognizing the potential of renewable energy-powered data centers, leading to increased funding and development in this sector. For instance, the RPSG Group's proposed solar park in Uttar Pradesh, featuring a 60-MW captive solar and storage plant, exemplifies such investments.

How India Data Center Power Solution Market is Segmented in this Report, and What are the Key Insights from the Segmentation Analysis?

By Power Infrastructure Components Insights

How Do Power Infrastructure Components Shape the India Data Center Power Solution Market Trends?

On the basis of power infrastructure components, the India data center power solution market share is segmented into power conversion & backup, on-site generation, power distribution hardware, monitoring & management and professional services.

Power conversion and backup solutions, including UPS systems and battery storage, account for the largest share of the India data center power solution market. With increasing AI and high-density workloads, data centers demand reliable uninterrupted power supply to ensure zero downtime.

For example, Schneider Electric’s AI-ready UPS offerings are being widely adopted across hyperscale and enterprise data centers. This segment’s dominance highlights the India data center power solution market’s focus on operational continuity and risk mitigation.

On-site generation, including diesel generators and hybrid renewable setups, is becoming critical due to grid limitations in some metro regions. Adoption is driven by energy resiliency needs and sustainability goals. Operators integrating hybrid renewable-diesel solutions benefit from lower operational costs, compliance with ESG mandates, and enhanced uptime, making on-site generation an attractive segment for investors and data center developers.

Power distribution hardware, including switchgear, transformers, and PDUs is essential for efficient energy delivery within data centers. As AI workloads and high-density racks increase energy demand, proper distribution ensures minimal losses and operational efficiency. Companies like ABB and Eaton are innovating modular, compact, and high-capacity distribution systems to accommodate scalable deployments.

By IT Load Insights

How is the India Data Center Power Solution Market Segmented by IT Load and What Insights Can Be Drawn?

Based on IT load, the India data center power solution market is segmented into edge & micro (< 500 kW), medium (500 kW–2 MW), large (2–5 MW), and hyperscale (> 5 MW).

Edge and micro data centers, with IT loads under 500 kW, are increasingly deployed near end-users to reduce latency for applications like IoT, autonomous systems, and AI-driven analytics. Their smaller footprint allows rapid deployment and lower upfront costs, attracting telecom operators and localized enterprise applications.

Medium-sized data centers (500 kW–2 MW) cater to SMEs, cloud service providers, and regional enterprises. They balance cost-efficiency and computational capability, making them ideal for growing cities outside major metro hubs. Adoption of hybrid UPS and on-site generation solutions ensures reliability. India data center power solution market expansion in this segment is driven by digitalization mandates, AI adoption, and demand for resilient local infrastructure.

Large data centers with IT loads of 2–5 MW serve major enterprises, BFSI, and mid-sized hyperscalers. Their infrastructure requires high-density UPS, advanced cooling, and sophisticated power distribution networks.

Hyperscale data centers (>5 MW) represent the fastest-growing segment due to AI workloads, cloud services, and global hyperscalers entering India. These facilities demand high-density power, redundant on-site generation, and advanced monitoring & management platforms. India data center power solution market growth is fueled by government incentives, data localization requirements, and renewable energy integration.

By Power Capacity Band Insights

How Does Power Capacity Influence Market Dynamics and Growth Opportunities?

Based on power capacity band, the India data center power solution market is divided into < 0.05 GW, 0.05–0.1 GW, 0.1–0.2 GW, 0.2–0.5 GW and > 0.5 GW.

Smaller capacity projects (<0.05 GW) are typically edge or micro data centers, allowing rapid deployment and localized low-latency solutions, ideal for SMEs and IoT applications. Mid-tier capacities (0.05–0.5 GW) serve medium to large data centers, balancing scalability, cost-efficiency, and resilience with hybrid UPS and on-site generation. The >0.5 GW segment, including hyperscale facilities, demands high-density power, redundant generation, advanced monitoring, and renewable integration to support cloud, AI, and hyperscale enterprise workloads. Providers offering modular, energy-efficient, and scalable solutions can capture growth across all bands, especially in metro hubs like Mumbai, Bengaluru, and Chennai.

By Redundancy Level Insights

How Are Redundancy Levels Shaping Reliability and Investment Decisions in the Market?

Based on redundancy level, the India data center power solution market is divided into N (no redundancy), N+1 (single‐fault tolerant), N+2 (dual‐fault tolerant), 2N (full duplication), 2N+1 (concurrent maintain + extra spare), and 3N / 2N+2 (multi-backup fault tolerant)

N and N+1 configurations are typically deployed in edge and micro data centers where cost-efficiency is crucial, providing basic protection against outages. N+2 and 2N setups dominate medium to large facilities, offering dual-fault tolerance and high reliability for enterprise workloads. High-end configurations like 2N+1 and 3N are standard in hyperscale data centers, supporting critical AI, cloud, and BFSI operations where downtime is unacceptable. India data center power solution market demand is driven by increasing AI and high-density workloads, demanding resilient power infrastructure. Providers offering flexible, scalable redundancy options are well-positioned to capture opportunities by balancing CAPEX, OPEX, and operational reliability.

By Rack Power Density Insights

How are Different Rack Power Densities Shaping Opportunities in India’s Data Center Power Solution Market?

Based on rack power density, the India data center power solution market is segmented into < 10 kW/Rack, 10–30 kW/Rack, and > 30 kW/Rack.

Low-density racks (<10 kW/Rack) are commonly deployed in edge and micro data centers, SMEs, and regional enterprise facilities. Their lower power requirements allow simpler UPS and cooling solutions, reducing upfront CAPEX and operational complexity. This segment supports localized AI, IoT, and latency-sensitive applications, enabling rapid deployment and flexible scaling.

Medium-density racks (10–30 kW/Rack) are deployed in medium to large data centers, balancing computational capacity with manageable power and cooling demands. They accommodate enterprise workloads, BFSI operations, and cloud services requiring reliable energy delivery without excessive infrastructure investment. Adoption of hybrid UPS, on-site generation, and modular PDUs ensures uptime and energy efficiency.

High-density racks (>30 kW/Rack) are primarily deployed in hyperscale facilities supporting cloud providers, AI workloads, and large enterprise operations. These racks demand advanced UPS systems, redundant on-site generation, high-capacity cooling, and AI-enabled monitoring to maintain uptime and optimize energy efficiency.

By Power Source & Sustainability Insights

How are Power Sources and Sustainability Trends Driving the India Data Center Power Solution Market?

Based on power source & sustainability, the India data center power solution market is segmented into grid-tied, on-site conventional, low-carbon & renewables, and emerging tech.

Grid-tied solutions remain the most widely adopted, leveraging the national electricity grid for continuous power supply. They are cost-effective for most data centers but may face reliability challenges in regions with unstable grids. On-site conventional power, whereas includes diesel and gas generators, often used for backup or primary power in areas with unreliable grid access. These systems provide high reliability and flexibility but have higher operational costs and carbon emissions.

Low-carbon & renewable solutions, such as solar, wind, and hybrid renewable-diesel systems, are rapidly gaining traction due to government incentives and corporate ESG mandates. Integration of renewables reduces carbon footprint, lowers OPEX, and enhances sustainability. Emerging technologies include fuel cells, energy storage systems, and AI-optimized microgrids. These solutions promise higher efficiency, lower emissions, and resilience for future high-density, AI-driven workloads.

By End-User Insights

How are End-User Segments Driving Growth in the India Data Center Power Solution Market?

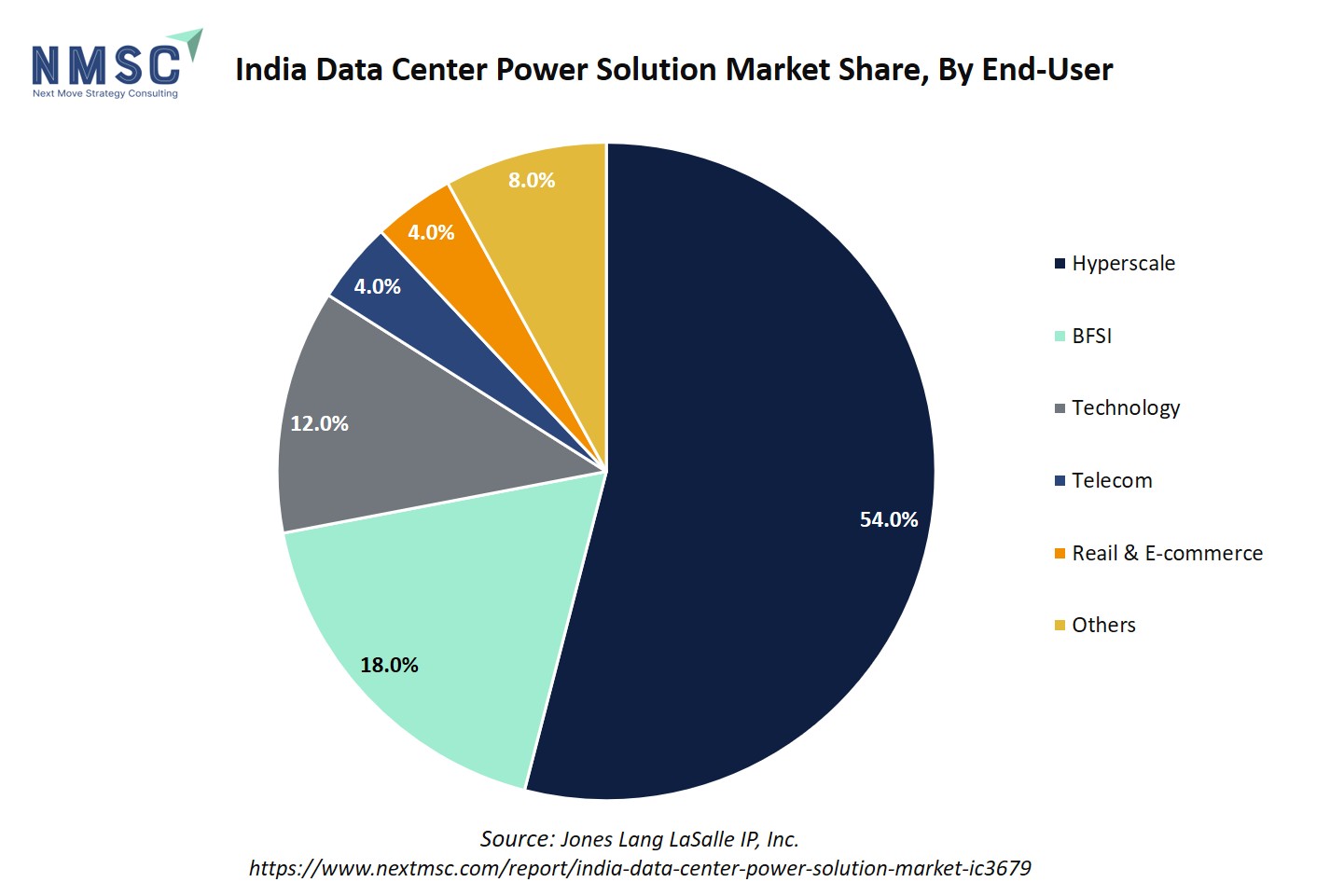

Based on end-user, the India data center power solution market is bifurcated into it & cloud service providers, financial services (BFSI), healthcare & life sciences, government & defence, telecom & media, manufacturing & energy, retail & E-commerce, and others.

IT & Cloud Service Providers dominate demand, driven by hyperscale data centers, AI workloads, and digital services expansion. They require high-density racks, redundant power systems, and advanced monitoring to maintain uptime and energy efficiency. Financial Services (BFSI) require highly reliable, low-latency infrastructure to support online banking, trading platforms, and regulatory compliance. Redundant power systems and predictive energy management are critical for operational continuity. Adoption of hybrid power solutions and AI-based monitoring enhances efficiency and uptime. Similarly, Government & Defence facilities demand robust and secure power infrastructure to support mission-critical applications, cybersecurity requirements, and national data storage needs. Redundant and fault-tolerant systems are preferred for risk mitigation and continuity.

Manufacturing & Energy data centers support industrial automation, IoT, and process control systems. Providers offering hybrid and renewable-integrated solutions can help reduce costs while ensuring uptime for critical operations. Retail & E-commerce rely on robust data centers for online transactions, supply chain management, and AI-driven analytics. Redundant power, efficient cooling, and predictive maintenance platforms are increasingly adopted to support peak demand periods.

The Indian data centre industry is poised for substantial growth, driven by both global technological advancements and domestic regulatory developments. As the country continues its digital transformation, the demand for data centre services is expected to surge, presenting both challenges and opportunities for industry players. The composition of user demand in the above chart across sectors influences the India data center power solution market by driving diverse and evolving infrastructure requirements. Dominance of hyperscale customers accelerates adoption of high-density, scalable power and cooling solutions as these facilities handle massive AI and large model training workloads. BFSI and technology sectors emphasize reliability, security, and compliance, increasing the need for robust, modular UPS and power distribution units with advanced monitoring. This dynamic demand landscape compels power solution providers to continuously enhance capacity, modularity, and cooling compatibility to sustain India’s rapidly growing data center ecosystem.

Competitive Landscape

Which Companies Dominate the India Data Center Power Solution Market and How do they Compete?

The India data center power solution market is dominated by a mix of global leaders and specialized domestic players. Global giants such as Schneider Electric, ABB, Eaton, and Vertiv provide comprehensive solutions, including UPS systems, backup generators, and advanced energy management platforms. At the same time, domestic companies like CtrlS, ESDS, and Sify Technologies leverage local expertise to offer cost-effective, regionally optimized solutions. Competition is particularly strong across metro hubs like Mumbai, Bengaluru, and Hyderabad, where high-density data center clusters demand reliability, scalability, and sustainable energy solutions. The interplay of global experience and local specialization drives innovation, operational efficiency, and service differentiation.

Market Dominated by India Data Center Power Solution Giants and Specialists

The India data center power solution market is characterized by a blend of global giants and specialized local players. Companies like Schneider Electric, ABB, Eaton, and Vertiv lead the market, offering a range of power management solutions including uninterruptible power supplies (UPS), backup generators, and energy-efficient cooling systems.

Local firms such as CtrlS, ESDS, and Sify Technologies leverage their deep understanding of the Indian regulatory environment and cost structures to cater to the unique needs of the India data center power solution market. This dual presence of global and local players fosters healthy competition, driving innovation and service differentiation across various regions, including Bengaluru, Hyderabad, and Mumbai.

Innovation and Adaptability Drive Market Success

In the rapidly evolving India data center power solution market, innovation and adaptability are key to maintaining a competitive edge. Schneider Electric exemplifies this approach by acquiring the remaining 35% stake in its Indian joint venture from Temasek for USD 6.4 billion in cash.

This move aims to accelerate decision-making and enhance its strategic focus on India, its third-largest market. The company plans to expand its Indian operations by 2.5 to 3 times and anticipates double-digit organic sales growth annually. Such strategic initiatives underscore the importance of localized innovation and operational agility in capturing the India data center power solution market share.

Market Players to Opt for Merger & Acquisition Strategies to Expand Their Presence

Mergers and acquisitions have become a strategic avenue for companies to enhance their capabilities and market presence in the India data center power solution sector. For instance, R Systems, backed by Blackstone, acquired Mangaluru-based Novigo Solutions for approximately USD 48 million, with the total deal potentially reaching USD 114 million, including stock-based performance milestones. This acquisition enables R Systems to bolster its digital transformation offerings, particularly in low-code/no-code development and intelligent automation. Such strategic acquisitions allow companies to diversify their service portfolios and tap into new customer segments, thereby strengthening their position in a competitive market.

List of Key India Data Center Power Solution Companies

-

ABB Ltd.

-

Caterpillar Inc.

-

Cummins Inc.

-

Vertiv Holdings Co.

-

Siemens

-

Delta Electronics, Inc.

-

Mitsubishi Electric Corporation

-

Legrand SA

-

Toshiba Energy Systems & Solutions Corp.

-

L&T Electrical & Automation Ltd.

-

Socomec Group SA

-

Kirloskar Oil Engines Ltd.

-

Hitachi Hi-Rel Power Electronics Pvt. Ltd.

What are the Latest Key Industry Developments?

-

July 2025- Schneider Electric announced the acquisition of the remaining 35% stake in its Indian joint venture from Temasek for USD 6.4 billion. This move aims to accelerate decision-making and enhance its strategic focus on India, its third-largest market and one of its four global hubs. The company plans to expand its Indian operations by 2.5 to 3 times and anticipates double-digit organic sales growth annually.

-

June 2025- ABB and Applied Digital introduced the HiPerGuard Medium Voltage Static Uninterruptible Power Supply for AI data centers. This industry-first technology increases power density, reduces electrical plant footprints, and enhances energy efficiency, catering to the high demands of AI workloads.

-

July 2024- Siemens opened a 6,000-meter square Center of Competence for Data Centers at the Global Infocity Park in Chennai, India. This facility serves as a regional innovation hub, uniting a team of over 200 professionals and enabling co-creation with partners and customers across the Asia Pacific region.

-

June 2024- Eaton completed a significant strategic investment in NordicEPOD AS, a European firm specializing in standardized power modules for data centers. This partnership aims to expand modular data center solutions, enhancing Eaton's offerings in the rapidly growing Indian market.

-

January 2024- Vertiv inaugurated a new manufacturing and test lab in India to support global and regional thermal management demands. This facility manufactures thermal management products tailored for colocation, cloud, telecom, and enterprise data centers, strengthening Vertiv's presence in the Indian market.

What are the Key Factors Influencing Investment Analysis & Opportunities in the India Data Center Power Solution Market?

The India data center power market is experiencing robust growth. This expansion is driven by factors such as hyperscale capital expenditure, data-localization mandates under the Digital Personal Data Protection Act, and sovereign AI initiatives requiring enhanced electrical resiliency. Notably, Schneider Electric's acquisition of the remaining 35% stake in its Indian joint venture from Temasek for USD 6.4 billion underscores the growing confidence in the Indian market's potential.

Key regions attracting investment include Mumbai, Bengaluru, and Chennai. Mumbai remains India's largest data center market, with a total capacity of approximately 670 MW, driven by strong demand from cloud, BFSI, and large tech companies. Chennai is emerging as a significant hub, with Equinix inaugurating a USD 69 million AI-ready data center in Siruseri. Additionally, Techno Electric & Engineering Company Ltd plans to build a 36 MW data center in Chennai as part of its USD 1 billion digital infrastructure initiative.

Key Benefits for Stakeholders:

Next Move Strategy Consulting (NMSC) presents a comprehensive analysis of the India data center power solution market, covering historical trends from 2020 through 2024 and offering detailed forecasts through 2030. Our study examines the market at global, regional, and country levels, providing quantitative projections and insights into key growth drivers, challenges, and investment opportunities across all major India data center power solution segments.

The India data center power solution market creates multifaceted benefits for diverse stakeholders. Investors gain access to a high-growth, high-demand sector fueled by AI, cloud adoption, and data localization mandates, offering attractive returns through infrastructure development and M&A opportunities. Policymakers benefit from accelerated digitalization and energy-efficient practices that align with national sustainability and renewable energy targets, while also strengthening India’s data sovereignty and cybersecurity resilience. Customers, including hyperscalers, telecom operators, and enterprises, enjoy reliable, scalable, and energy-optimized power solutions, ensuring uninterrupted operations and reduced total cost of ownership. Collectively, these stakeholders are empowered by a market that drives technological innovation, supports economic growth, and fosters a robust, future-ready digital infrastructure ecosystem.

Report Scope

|

Parameters |

Details |

|

Market Size in 2025 |

USD 1.39 Billion |

|

Revenue Forecast in 2030 |

USD 3.16 Billion |

|

Growth Rate |

CAGR of 17.9% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent to up to 80 analyst-working hours) after purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

|

Approach |

In-depth primary and secondary research; proprietary databases; rigorous quality control and validation measures. |

|

Analytical Tools |

Porter's Five Forces, SWOT, value chain, and Harvey ball analysis to assess competitive intensity, stakeholder roles, and relative impact of key factors. |

Key Market Segments

By Power Infrastructure Components

-

Power Conversion & Backup

-

Uninterruptible Power Supplies (UPS)

-

Energy Storage Systems

-

Lithium-ion Batteries

-

VRLA Lead-acid Batteries

-

Flywheels

-

-

On-Site Generation

-

Diesel & HVO-capable Generators

-

Natural-Gas Turbines

-

Fuel Cells (H₂, biogas)

-

-

Power Distribution Hardware

-

MV/LV Switchgear & Transformers

-

Busways & Intelligent PDUs

-

Automatic Transfer Switches

-

Panel boards & Breakers

-

-

Monitoring & Management

-

DCIM & Energy-Management Software

-

AI-Analytics & PUE-Optimization

-

-

Professional Services

-

Design & Integration

-

Maintenance & Managed Services

-

Consulting & Audit

-

By IT Load

-

Edge & Micro (< 500 kW)

-

Medium (500 kW–2 MW)

-

Large (2–5 MW)

-

Hyperscale (> 5 MW)

By Power Capacity Band

-

< 0.05 GW

-

0.05–0.1 GW

-

0.1–0.2 GW

-

0.2–0.5 GW

-

> 0.5 GW

By Redundancy Level

-

N (No Redundancy)

-

N+1 (Single‐fault tolerant)

-

N+2 (Dual‐fault tolerant)

-

2N (Full duplication)

-

2N+1 (Concurrent maintain + extra spare)

-

3N / 2N+2 (multi-backup fault tolerant)

By Rack Power Density

-

< 10 kW/Rack

-

10–30 kW/Rack

-

> 30 kW/Rack

By Power Source & Sustainability

-

Grid-Tied

-

On-Site Conventional

-

Diesel

-

Gas

-

-

Low-Carbon & Renewables

-

Emerging Tech

-

Hydrogen Fuel Cells

-

Microturbines

-

By End User Vertical

-

IT & Cloud Service Providers

-

Financial Services (BFSI)

-

Healthcare & Life Sciences

-

Government & Defense

-

Telecom & Media

-

Manufacturing & Energy

-

Retail & E-commerce

-

Others

Conclusion & Recommendations

Our report equips stakeholders, industry participants, investors, policy-makers, and consultants with actionable intelligence to capitalize on India data center power solution transformative potential. By combining robust data-driven analysis with strategic frameworks, NMSC’s India data center power solution market report serves as an indispensable resource for navigating the evolving landscape.

The India data center power solution market presents a dynamic landscape driven by AI adoption, cloud expansion, and renewable energy integration. Strategic takeaways highlight the importance of modular, high-density, and energy-efficient power systems, proactive government engagement, and M&A-driven growth to capture emerging opportunities. Companies that innovate while aligning with regional regulatory frameworks and sustainability goals are poised to gain competitive advantage.

Looking ahead, investment hotspots in Mumbai, Bengaluru, and Chennai, coupled with rising demand for AI-ready and hybrid energy solutions, indicate robust market expansion. Continued technological advancement, strategic partnerships, and cross-industry collaboration will define the India data center power solution market’s trajectory, positioning India as a critical hub for global data center power infrastructure.

Speak to Our Analyst

Speak to Our Analyst