Pincer Market By Material (Carbon Steel, Alloy Steel, Stainless Steel, and Specialty Metal Catalysts), By Product Type (Hand Tools, Chemical Ligands and Biological Claws), By Distribution Channel (Direct Sales, Industrial Distributors, and Others), By Application (Construction and Carpentry, Electronics and Electricals, Jewelry and Craft, and Others), and By End User (Industrial Users, Household Users, Research Institutions, and Others) – Global Analysis & Forecast, 2025–2030

Industry Outlook

The global Pincer Market size was valued at USD 383.2 million in 2024 and is expected to reach USD 403.1 million by 2025. Looking ahead, the industry is projected to expand significantly, reaching USD 519.4 million by 2030, registering a CAGR of 5.2% from 2025 to 2030.

The global surge in infrastructure development and construction activity continues to serve as a major catalyst for the pincer market, as these tools remain essential for reinforcement, assembly, and maintenance operations. With governments and private players investing in large-scale urban development, transportation, and housing projects, the requirement for reliable, high-performance hand tools is on the rise. Pincers, being a core part of every construction toolkit, benefit from recurring demand tied to both new projects and ongoing maintenance work. Manufacturers leverage this sustained momentum by designing products tailored for heavy-duty field use offering improved grip comfort, rust resistance, and enhanced cutting strength. Additionally, aligning production with industry-grade standards and offering customized tool sets for contractors and engineers help companies capture procurement-driven opportunities in fast-growing infrastructure markets.

At the same time, the continued expansion of the global industrial workforce is reinforcing demand for high-quality pincers used across factories, repair workshops, and maintenance facilities. As manufacturing operations scale in emerging economies, the reliance on versatile hand tools for assembly, installation, and upkeep tasks grows stronger. Pincer producers respond to this trend by developing ergonomically optimized designs suitable for repetitive industrial use, ensuring durability and worker comfort. Establishing supply partnerships with OEMs, tool distributors, and maintenance service providers further secure long-term contracts. By focusing on industrial-grade product innovation and efficient supply chain integration, manufacturers strengthen their market presence and benefit from the steady growth in global production and maintenance activity.

What are the Key Trends in the Pincer Industry?

How is Sustainability Policy and Single Use Scrutiny Changing the Pincer Market?

Growing environmental awareness and evolving sustainability regulations in Europe are reshaping how healthcare institutions purchase medical instruments, including pincers. Hospitals are now under pressure to reduce single-use plastic waste and demonstrate greener procurement practices, which directly impacts the types of pincers they choose. Manufacturers are therefore caught between meeting the clinical preference for sterile, disposable instruments and addressing policy-driven shifts toward reusable or recyclable alternatives. This transition is prompting pincer makers to rethink design and material choices, favoring durable metals or eco-friendly polymers that align with hospital sustainability goals. The opportunity lies in developing products with validated reprocessing guidelines, clear environmental benefits, and transparent lifecycle documentation. By offering pincers that combine clinical reliability with measurable sustainability value, manufacturers strengthen their appeal to procurement teams se

How is Advanced and Localised Manufacturing Changing Competitive Dynamics in the Market?

Advanced manufacturing technologies such as additive manufacturing and localized production are beginning to redefine competitive dynamics within the market. As regulators formalize frameworks for 3D printing and near-site medical device production, manufacturers are finding new opportunities to shorten supply chains and respond faster to specialized surgical demands. This shift is particularly relevant in a market where customization, precision, and reliability are critical differentiators. By integrating advanced manufacturing, pincer producers offer tailored designs, such as specific tip geometries or ergonomic enhancements with reduced lead times and lower logistical risk. Moreover, localized production supports resilience during global supply disruptions and enables faster compliance with regional quality standards. For the market, this evolution signals a gradual move away from purely volume-based competition toward agility and innovation-led growth. Companies that strategically combine large-scale offmicrofactories for bespoke variants capture both mass-market efficiency and premium niche opportunities.

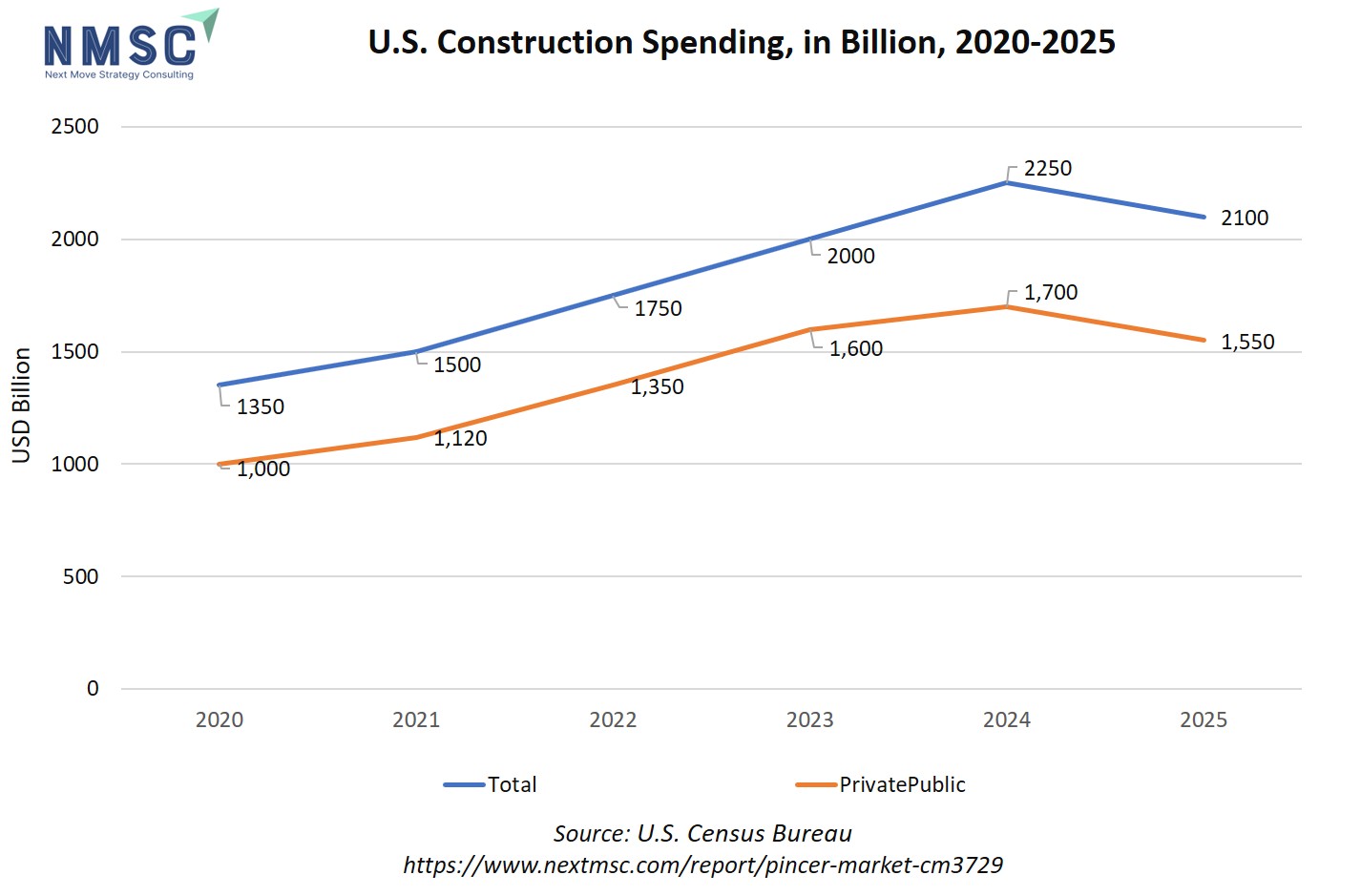

How is the Growth of Infrastructure and Manufacturing Spending Boosting Demand in the Market?

The global surge in infrastructure, manufacturing, and construction investments is directly stimulating growth in the market, as these tools remain essential for assembly, repair, and heavy-duty applications across industries. According to the Press Information Bureau and NITI Aayog, the global hand tools segment of which pincers form a key part was valued at about USD 34 billion in 2022 and is projected to reach nearly USD 60 billion by 2035, reflecting the expanding industrial and construction activity worldwide. This accelerating demand highlights the opportunity for pincer manufacturers to scale production and innovate around durability, ergonomics, and corrosion resistance to meet the needs of both developing economies and mature markets focused on replacement cycles. With infrastructure projects requiring reliable, high-strength tools, and industrial modernization emphasizing cost-effective yet robust hand instruments, the market is set to benefit from consistent, long-term growth. Companies that adopt

What are the Key Market Drivers, Breakthroughs, and Investment Opportunities that will Shape the Pincer Industry in the Next Decade?

The market is witnessing steady expansion, supported by the growing momentum in global infrastructure development, construction, and industrial activity. As these tools are fundamental to tasks such as assembly, reinforcement, repair, and maintenance, their demand remains consistent across both public and private projects. The increasing pace of urbanization and modernization has made reliable, high-strength hand tools a necessity on construction sites and in manufacturing facilities. Pincer manufacturers are responding by enhancing product durability, ergonomics, and corrosion resistance to meet the rigorous demands of professional users. By offering customized tool kits, industrial-grade finishes, and integrated maintenance services, companies are positioning themselves as key partners in large-scale infrastructure and industrial supply chains, ensuring recurring business through replacement and long-term procurement cycles.

Despite the strong growth trajectory, the market faces headwinds from slowing industrial output and tightening global economic conditions, which temporarily dampen investment and tool replacement activity. However, this challenge is offset by emerging opportunities tied to global energy-efficiency and building retrofit initiatives, which demand extensive use of hand tools for repair and refurbishment tasks. Pincer producers that innovate for these new applications developing versatile, lightweight, and durable designs suited for modern retrofitting and energy-efficient construction stand to gain a competitive edge. In this evolving industrial landscape, companies that balance cost efficiency with performance innovation and sustainability are best positioned to maintain resilience and capture long-term growth in the global market.

Growth Drivers:

How will Infrastructure and Construction Investment Accelerate Growth for the Market?

The steady rise in global infrastructure and construction spending is directly propelling growth in the market, as these tools remain indispensable for on-site assembly, reinforcement work, and general maintenance. According to the World Bank Infrastructure Monitor 2024, ongoing investments across transport, housing, and industrial development projects are creating continuous demand for durable and cost-efficient hand tools. For the market, this translates into recurring replacement cycles and bulk procurement opportunities from contractors and public works departments. Manufacturers capitalize on this momentum by producing heavy-duty pincers designed for rugged field use, featuring rust-resistant coatings, high-tensile steel jaws, and ergonomic grips to meet professional construction standards. Furthermore, by aligning their product lines with infrastructure-grade specifications and offering value-added packages like tool kits or maintenance services, pincer producers secure long-term supply contracts and s

How is the Rebound in Manufacturing Employment Fuelling Demand for Hand-tools Like Pincers?

The steady rebound in global industrial employment is directly reinforcing growth in the market, as expanding manufacturing and maintenance operations rely heavily on reliable hand tools for daily use. According to World Bank Open Data based on ILO modelled estimates, around 23.7% of the global workforce was employed in the industrial sector in 2023, reflecting a strong and sustained industrial base. This growing labor force translates into consistent demand for tools like pincers, which are vital for assembly, repair, and production-line maintenance. As factories and workshops scale operations especially in emerging economies, the need for durable, ergonomic, and corrosion-resistant pincers is rising. For manufacturers, this trend highlights the importance of designing products that meet industrial-grade performance standards and integrating with supply chains serving OEMs, maintenance contractors, and service workshops. By targeting this expanding industrial workforce, pincer producers secure long-term, vo

Growth Inhibitors:

How does Slowing Global Manufacturing Growth and Trade Uncertainty Act as a Restraint on the Market?

A key inhibitor for the global market is the deceleration in manufacturing growth and weakening industrial investment, which directly dampens demand for hand tools. According to the OECD Economic Outlook, global GDP growth is expected to decline from 3.3 % in 2024 to 2.9 % over 2025, reflecting slower output and reduced capital spending across major economies. Manufacturing activity, in particular, has softened amid rising input costs, tightening credit conditions, and cautious corporate spending. For pincer manufacturers, who depend on steady industrial and construction activity for sales, this slowdown translates into delayed procurement, fewer new projects, and pressure on pricing. Moreover, trade uncertainty and supply chain realignments raise sourcing costs and logistics complexity, further constraining margins. In such an environment, producers must focus on cost efficiency, supply resilience, and niche industrial applications to sustain growth momentum.

How is the Global Energy-efficiency Drive Unlocking New Opportunities for the Market?

The accelerating global focus on energy-efficiency and retrofitting is creating a promising growth channel for the market. According to the International Energy Agency (IEA), global investment in energy-efficiency initiatives surpassed USD 1 trillion, with governments channeling around USD 250 billion annually between 2020 and 2023 toward retrofit projects, efficient infrastructure, and building upgrades. These initiatives require extensive tool use for electrical, mechanical, and structural maintenance areas where pincers are indispensable for fastening, gripping, cutting, and repair work. This shift broadens the market beyond new construction into long-term retrofit cycles across residential, commercial, and industrial facilities. Manufacturers strategically align their product portfolios by introducing retrofit-optimized pincer designs with enhanced durability and ergonomic features. Partnering with HVAC, insulation, and retrofit service providers to bundle specialized hand-tools into efficiency projects

How Pincer Market Segmented in this Report, and What are the Key Insights from the Segmentation Analysis?

By Material Insights

Is the Pincer Industry in 2025 Shaped by Diverse Material?

Based on material, the market is segmented into carbon steel, alloy steel and others.

Carbon steel pincers represent one of the most widely used material segments in the market, valued for their durability, affordability, and high tensile strength. These pincers are preferred in general construction, carpentry, and mechanical repair applications due to their ability to withstand repeated mechanical stress and deliver reliable grip performance. The hardness and edge retention of carbon steel make it ideal for heavy-duty tasks such as cutting, pulling, and bending, while its cost-effectiveness supports large-scale procurement in industrial and commercial environments. However, carbon steel requires proper surface treatment or coating to prevent corrosion, which encourages manufacturers to apply protective finishes such as black oxide or nickel plating. This balance of strength, performance, and value positions carbon steel pincers as a foundational category across both professional and consumer tool markets.

By Product Type Insights

Is the Pincer Market in 2025 Being Shaped by Product Type?

On the basis of product type, the market is segmented into hand tools, chemical ligands and others.

Hand tools form the core commercial segment, encompassing varieties such as Nail Pulling Pincers, End Cutting Pincers, Crimping Pincers, and Precision Pincers. These are essential in construction, carpentry, electrical work, and precision engineering, where gripping, cutting, and fastening operations require mechanical efficiency and ergonomic design.

Chemical ligands include Tridentate Pincer Ligands and Metal Complex Pincer Ligands, which play a vital role in catalysis and chemical synthesis. They are used extensively in advanced materials research, energy production, and green chemistry for stabilizing metal centers and promoting efficient reactions.

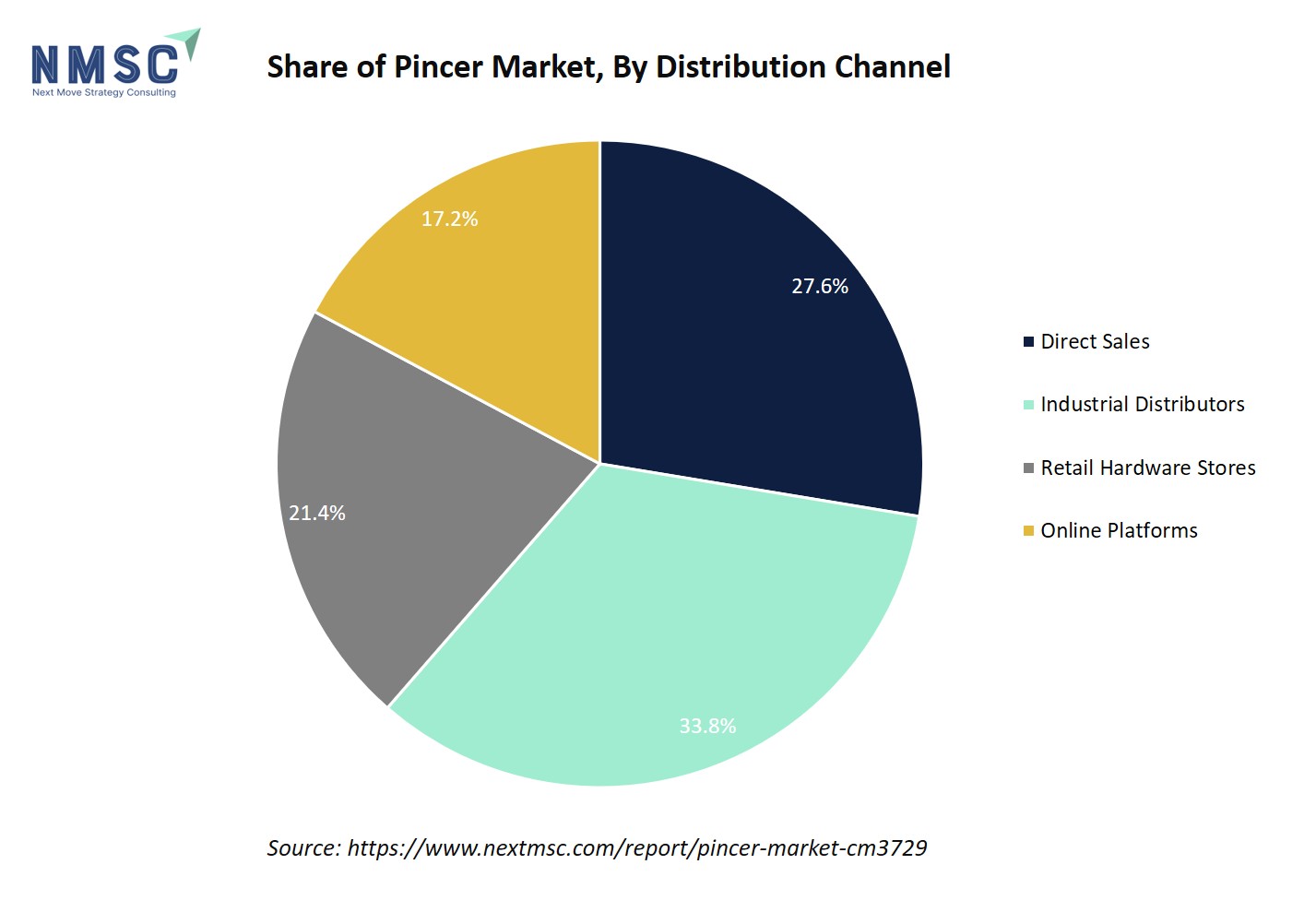

By Distribution Channel Insights

How are Distribution Channel Driving the Pincer Industry in 2025?

On the basis of distribution channel, the market is segmented into direct sales, industrial distributors and others.

The Direct Sales channel in the market involves manufacturers or producers selling products directly to end users without intermediaries. This model is especially effective for industrial clients, large construction firms, and institutional buyers who require bulk quantities or customized specifications. Direct engagement allows manufacturers to offer tailored solutions, such as specialized coatings, ergonomic designs, or branded tool sets while maintaining control over pricing, product quality, and delivery schedules. It also strengthens customer relationships through dedicated after-sales service, technical support, and training. For premium or professional-grade pincers, direct sales enable close collaboration between producers and clients, ensuring the tools meet exact performance standards and compliance requirements. This approach enhances brand loyalty and allows companies to capture higher margins by bypassing distributor markups.

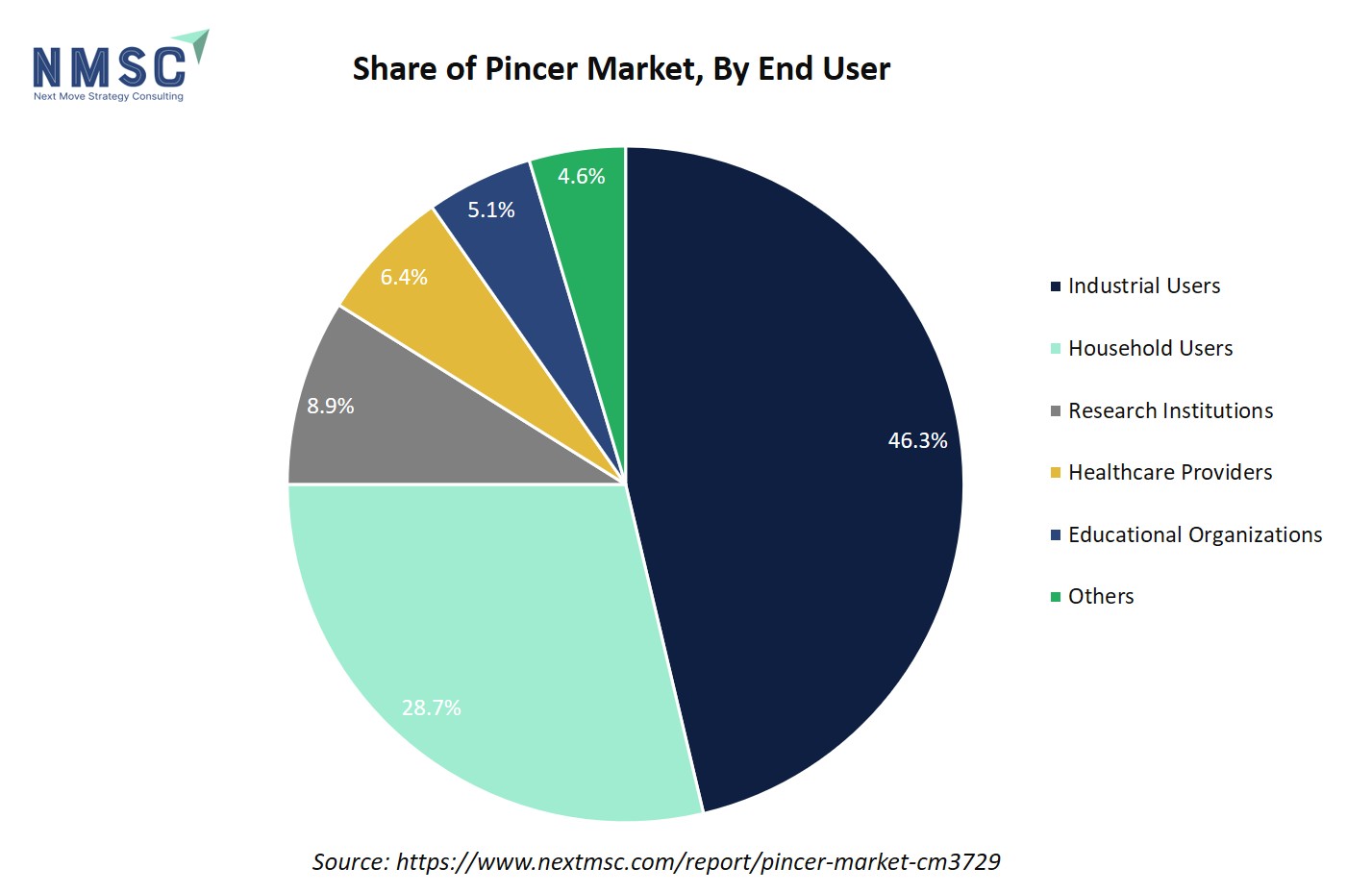

By End User Insights

Are End User Shaping the Pincer Market Trends in 2025?

On the basis of end user, the market is segmented into industrial users, household users and others.

Industrial Users form a core end-user segment in the market, representing factories, manufacturing units, construction companies, and maintenance service providers that rely on durable and high-performance tools for daily operations. In industrial environments, pincers are used extensively for cutting, gripping, fastening, bending, and assembly tasks across sectors such as automotive, electronics, metalworking, and heavy machinery. These users prioritize strength, precision, and longevity, demanding carbon steel or alloy steel pincers with ergonomic handles and corrosion-resistant finishes. Industrial buyers typically procure tools in bulk through direct contracts or authorized distributors, emphasizing reliability and compliance with safety standards. For manufacturers, catering to this segment means focusing on productivity-enhancing designs, customized tool kits, and after-sales service to ensure operational continuity and long-term client partnerships.

Regional Outlook

The pincer market share is geographically studied across North America, Europe, Asia Pacific, Middle East & Africa, and Latin America and each region is further studied across countries.

Pincer Market in North America

In North America, the market benefits from consistent demand driven by ongoing infrastructure development, industrial maintenance, and a strong manufacturing base across the United States and Canada. The steady flow of construction and repair projects fuels the need for reliable, high-quality hand tools, making this region a key consumer hub for pincer tool manufacturers. Companies that ensure product durability, efficient distribution, and strong partnerships with industrial suppliers or rental networks are well-positioned to succeed. Additionally, offering innovative features such as corrosion resistance and ergonomic designs help brands stand out in competitive procurement processes. However, manufacturers must also remain agile, as shifts in construction activity influence buying patterns, underscoring the importance of maintaining cost-effective product lines and responsive supply chains.

Pincer Market in the United States

In the United States, the market closely follows the rhythm of the construction industry, where large-scale public infrastructure, housing, and commercial projects create steady and predictable demand for high-quality hand tools. As construction activity expands, contractors and builders require reliable industrial pincers for various on-site applications, from wiring and metalwork to general assembly. This environment favors manufacturers and distributors that ensure consistent product availability, compliance with safety and procurement standards, and timely delivery to job sites. Therefore, success in the U.S. pincer market demand, depends on strong relationships with tool rental networks, contractor supply chains, and retail distributors. By offering durable, compliant, and trade-specific tool kits, suppliers effectively align with construction cycles and establish recurring sales opportunities in this highly regulated and competitive space.

Pincer Market in Canada

In Canada, this sector is supported by a balanced mix of industrial manufacturing and ongoing construction activity. Manufacturing hubs across key provinces sustain steady demand as production facilities and maintenance teams rely on durable hand tools for daily operations. Regions with stronger industrial bases naturally generate higher consumption of multi-functional pincers, emphasizing the importance of localized supply and service networks. For manufacturers and suppliers, success in the Canadian market depends on building close partnerships with industrial distributors, maintaining regional inventories, and providing responsive after-sales support. By aligning their operations with provincial industrial clusters and trade-driven manufacturing zones, companies secure consistent demand and strengthen their foothold in this stable yet regionally diverse market.

Pincer Market in Europe

In Europe, the market is influenced by the region’s advanced manufacturing ecosystem, focus on sustainability, and strong tradition of skilled trades. Industrial sectors such as automotive, aerospace, electronics, and precision engineering rely heavily on reliable hand tools, creating continuous demand for high-quality pincers suited to technical assembly and maintenance tasks. European buyers increasingly look for tools that meet strict performance, safety, and environmental standards, favoring products with certified materials and long service life. For suppliers, success depends on maintaining CE-compliant production, offering ergonomic and corrosion-resistant designs, and providing lifecycle documentation that aligns with EU sustainability goals. As industries modernize through automation and green manufacturing initiatives, opportunities are expanding for pincer brands that combine durability with eco-friendly materials and efficient distribution across the single market.

Pincer Market in the United Kingdom

In the United Kingdom, the market is driven by a combination of professional trade demand and a vibrant do-it-yourself culture. Skilled contractors, repair professionals, and home renovators consistently rely on reliable hand tools, keeping both heavy-duty and consumer-grade pincers in steady circulation. The country’s well-established network of distributors and hardware retailers provides strong sales channels, while product quality, compliance with British Standards, and reliable local availability remain key purchasing factors. For manufacturers, blending professional trade relationships with a strong retail presence is essential to reach the full spectrum of users. By offering durable, ergonomically designed pincers that suit both professional and home applications, suppliers effectively tap into the UK’s dual market structure and maintain consistent growth.

Pincer Market in Germany

In Germany, the market benefits from the country’s strong industrial base and disciplined approach to engineering and manufacturing. Demand is driven by precision-oriented sectors such as automotive, machinery, and industrial maintenance, where reliability and adherence to technical standards are essential. German buyers place high value on tool quality, durability, and compliance with DIN specifications, sourcing through structured procurement systems that emphasize long-term partnerships. For pincer manufacturers, success depends on maintaining consistent product standards, providing detailed technical documentation, and ensuring reliable delivery to support just-in-time production and maintenance needs. Germany’s strong export and engineering activities also boost demand for professional-grade pincers used in workshops, assembly lines, and field service operations both domestically and abroad.

Pincer Market in France

In France, the market is supported by ongoing renovation projects, public works programs, and a strong network of skilled trades. Even when new construction slows, consistent maintenance and urban refurbishment activities sustain steady demand for durable and compliant hand tools. French buyers, from contractors to public agencies expect pincers that meet national quality standards and demonstrate long service life. For manufacturers, aligning with local regulations, partnering with regional distributors, and ensuring French-language technical support are key to building trust and visibility. As sustainability gains importance in procurement decisions, suppliers that emphasize repairability, recyclable materials, and lifecycle performance are well-positioned to strengthen their presence in France’s quality-conscious and steadily active market.

Pincer Market in Italy

In Italy, the market is driven by the country’s strong base of small and medium-sized enterprises in sectors such as metalworking, automotive components, and artisanal manufacturing. These workshops and family-owned production units place high value on reliable, precision tools that support hands-on craftsmanship and everyday maintenance work. The culture of technical skill and attention to detail common in Italian industry sustains consistent demand for well-engineered pincers that combine functionality with ergonomic design. For suppliers, tailoring products to the needs of specialized trades, such as mechanics, electricians, and fabricators. and offering localized distribution through trusted regional tool retailers unlock steady growth in this craftsmanship-driven market.

Pincer Market in Spain

Spain’s robust recovery in construction activity is emerging as a key growth driver for the market. According to Eurostat, Spain recorded one of the strongest construction rebounds in the EU, with production rising by 22.8% in July 2025 compared with July 2024. This surge is fueling higher demand for durable hand tools like pincers, which are essential in renovation, infrastructure, and hospitality maintenance work. The country’s extensive tourism infrastructure and coastal construction projects create ongoing needs for corrosion-resistant, heavy-duty pincers suited to frequent field use. Manufacturers that tailor product lines to Spain’s environment, emphasizing durability, ergonomic design, and availability through regional distributors are well-positioned to capture steady demand from contractors and maintenance firms riding the construction rebound.

Pincer Market in the Nordics

In the Nordic region, the market is shaped by a strong emphasis on quality, safety, and sustainability. High labor costs and strict occupational safety standards drive demand for tools that are durable, ergonomic, and designed to minimize user fatigue. Professionals across industries such as construction, energy, and manufacturing prefer premium pincers that deliver long-term performance and reliability. For manufacturers, success depends on offering products that combine superior build quality with compliance to regional safety requirements and sustainability expectations. Providing long warranties, local after-sales service, and clear certification help suppliers stand out and appeal to both institutional buyers and professional users who value dependable, high-performance tools.

Pincer Market in the Asia-Pacific

The Asia-Pacific region serves as a major growth hub for the industry, supported by rapid industrialization, expanding manufacturing sectors, and ongoing infrastructure development. As factories, workshops, and urban projects multiply, the need for reliable and affordable hand tools continues to rise. In emerging economies, demand centers on cost-effective and durable pincers suited for heavy daily use, while more advanced markets in the region increasingly prioritize quality, ergonomics, and brand reliability. For manufacturers, success lies in balancing high-volume production with localized customization, efficient distribution, and strong after-sales support. Establishing regional assembly or partnerships further enhance responsiveness, reduce delivery times, and strengthen competitiveness in this fast-evolving market landscape.

Pincer Market in China

In China, the market is fueled by the country’s vast industrial ecosystem, expanding manufacturing base, and growing demand for repair and maintenance tools. The rise of advanced manufacturing, alongside widespread activity in construction and consumer goods servicing, creates strong and continuous need for reliable hand tools. Local producers dominate much of the market, making competition intense and price sensitivity high. To succeed, suppliers must focus on cost-efficient production, fast regional distribution, and compliance with domestic quality and certification standards. Building partnerships with local distributors and aligning with regional industrial priorities also help manufacturers strengthen their foothold. As China continues to modernize its industries, the appetite for durable, high-performance pincers remains a key opportunity within its dynamic industrial landscape.

Pincer Market in Japan

Japan’s pincer market is anchored by sophisticated manufacturing, high safety standards and an emphasis on quality; METI’s industrial production surveys indicate stable but sometimes fluctuating output in manufacturing sectors that use hand tools. Japanese buyers favour precision, longevity and ergonomic design, and procurement is channelled through established industrial distributors and in-house maintenance departments. For suppliers, winning in Japan means offering precision-engineered pincers with tight tolerances, reliable after-sales parts, and localized technical documentation. Even modest market share be profitable because of willingness to pay for premium, high-quality instruments used in automotive, electronics and precision engineering workshops.

Pincer Market in India

This market is expanding rapidly with manufacturing growth, rising construction activity and a government push to scale hand and power tool exports, NITI Aayog and PIB work underscore a national strategy to capture larger global market shares. The domestic opportunity is supported by large infrastructure and housing programmes and MSME clusters that drive steady demand for affordable, rugged pincers. For suppliers, India represents both a manufacturing base and a growing domestic market: local production reduces cost and supports export ambitions, while supplier partnerships with state tool clusters and vocational programs help reach trade buyers and large civil projects. Tailoring SKUs for both professional and retail DIY segments is strategic.

Pincer Market in South Korea

In South Korea, the pincer market is supported by a strong industrial base and continuous investment in advanced manufacturing and maintenance operations. Sectors such as automotive, electronics, and heavy machinery rely on precision-engineered, corrosion-resistant tools to support production and repair activities. Korean buyers value high performance, reliability, and adherence to local industrial standards, making quality and certification key factors in purchasing decisions. For manufacturers, ensuring quick delivery, local distribution partnerships, and compatibility with domestic equipment needs are essential to securing repeat business. Suppliers that align with Korea’s focus on efficiency, technology, and product excellence are well-positioned to capture steady demand in this competitive, quality-driven market.

Pincer Market in Taiwan

In Taiwan, the pincer market is closely tied to the country’s strong electronics and precision manufacturing industries. The need for accurate, reliable hand tools is constant across assembly lines, repair centers, and component workshops, where precision pincers play a vital role in handling delicate parts. Manufacturers that offer finely crafted, anti-static, and ergonomically designed pincers are well-positioned to meet the needs of these high-tech operations. Success in the Taiwanese market depends on forming strong relationships with contract manufacturers and distributors that supply electronics and PCB assembly facilities. By providing consistent quality, small-batch availability, and reliable local support, suppliers establish a steady presence within Taiwan’s export-driven industrial ecosystem.

Pincer Market in Indonesia

In Indonesia, the market is driven by the rapid growth of small-scale industries, workshops, and local repair services that form the backbone of the country’s informal and manufacturing economy. From automotive garages and metal fabrication units to household repair shops, there is steady demand for affordable and durable hand tools that withstand heavy daily use. The country’s expanding vocational training programs and rising focus on technical education also contribute to higher tool adoption among skilled workers and apprentices. For suppliers, offering cost-effective yet reliable pincers and building strong distribution networks across key islands help capture the growing demand from Indonesia’s diverse base of tradespeople and small manufacturers.

Pincer Market in Australia

In Australia, the pincer market is gaining momentum due to a notable rise in engineering construction activity, which increased by 6.1% in the June 2025 quarter according to the Australian Bureau of Statistics. This surge reflects expanded infrastructure and industrial projects that require durable, high-performance hand tools for installation, repair, and maintenance work. As construction and engineering activity remain strong, demand grows for robust, corrosion-resistant pincers suited for heavy-duty use on job sites. Manufacturers and distributors that focus on supplying reliable, industrial-grade tools and maintain efficient delivery to contractors and project suppliers are well-positioned to benefit from this sustained wave of infrastructure-driven demand.

Pincer Market in Latin America

In Latin America, the pincer market is driven by the region’s expanding manufacturing and repair ecosystem, particularly in automotive, electronics assembly, and metalworking sectors. A growing base of small and mid-sized workshops, along with a strong culture of equipment maintenance and local fabrication, sustains steady demand for affordable yet durable hand tools. The rise of vocational training programs and the formalization of skilled trades are also increasing awareness of quality standards and ergonomics in tool selection. For manufacturers, opportunities lie in offering value-focused, long-lasting pincers adapted to local working conditions, supported by broad distribution networks and after-sales service that reach both urban industrial centers and smaller regional markets.

Pincer Market in Middle East & Africa

The Middle East and Africa region offers significant yet uneven opportunities for the pincer market, closely tied to infrastructure expansion and industrial activity. Major Gulf economies such as Saudi Arabia, the UAE, and Qatar continue to drive large-scale construction and industrial projects under national transformation plans, supported by World Bank and African Development Bank (AfDB) financing for transport and energy infrastructure. These initiatives sustain high demand for robust, corrosion-resistant pincers suited for on-site assembly, maintenance, and mechanical repairs. In contrast, sub-Saharan Africa presents a more fragmented but growing market, where donor-funded infrastructure and local manufacturing projects stimulate steady tool consumption. Pincer manufacturers that establish regional partnerships, adapt pricing models, and ensure supply continuity effectively tap into this blend of premium GCC demand and value-driven African markets.

Competitive Landscape

Which Companies Dominate the Pincer Industry and How do they Compete?

Leading companies in the global pincer market, such as Robert Bosch GmbH, DeWalt, Irwin Tools, Klein Tools, and Channellock, Inc., have established strong market positions through innovation, product reliability, and extensive distribution networks. These brands are known for their professional-grade hand tools that cater to industrial, construction, and household applications. They continually refine product designs to improve ergonomics, durability, and corrosion resistance, ensuring superior performance in demanding environments. Bosch and DeWalt, in particular, focus on integrating precision engineering and advanced materials into their tool lines, while Klein Tools and Channellock maintain a legacy of craftsmanship and made-for-professionals manufacturing standards. Collectively, these players enhance competitiveness through brand trust, warranty programs, and direct engagement with contractors and industrial buyers.

Emerging and regional manufacturers such as Wiha Tools, Bahco, Proto Industrial Tools, Gedore Tools, Knipex-Werk C. Gustav Putsch KG, Eastman IMPEX, MK Forgings, Ajay Industries, Zhangjiagang Jianquan Tools Co., Ltd., and Hamco Ispat Pvt. Ltd. are expanding their presence through specialization and cost-efficient production. European brands like Knipex and Gedore emphasize precision and sustainability in design, while Indian and Chinese manufacturers focus on scalable production and export-oriented growth. These companies increasingly adopt automation and advanced forging techniques to ensure consistency and competitiveness in global supply chains. By offering a balance of affordability and quality, they are bridging the gap between premium Western brands and mass-market demand, thereby shaping a diverse and evolving global pincer industry.

Market Dominated by Pincer Giants and Specialists

The pincer market features a diverse competitive landscape shaped by the presence of established global brands and emerging regional manufacturers, each contributing to the industry’s evolution. Global leaders such as Robert Bosch GmbH, DeWalt, Irwin Tools, Klein Tools, and Channellock, Inc. dominate through innovation, product reliability, and strong distribution networks, catering to both professional and industrial users. In parallel, specialized European players like Knipex-Werk C. Gustav Putsch KG, Gedore Tools, Wiha Tools, and Bahco focus on precision engineering, ergonomic design, and craftsmanship, appealing to high-end markets. Meanwhile, manufacturers such as Eastman IMPEX, MK Forgings, Ajay Industries, Zhangjiagang Jianquan Tools Co., Ltd., and Hamco Ispat Pvt. Ltd. strengthen the market with cost-effective, scalable production that meets regional and export demands. This blend of global scale and localized expertise fosters competitive diversity, driving innovation, product differentiation, and accessibility across multiple price segments worldwide.

Innovation and Adaptability Drive Market Success

Innovation is a key driver of success in the pincer market, with companies continually developing new products and applications to meet evolving consumer demands. Bosch Power Tools’ announcement in October 2024 of over 30 new product launches, including an expanded range of hand tools and cordless systems highlights how innovation and adaptability continue to drive success in the market. By continually upgrading its product portfolio with ergonomic designs, enhanced durability, and compatibility with evolving cordless ecosystems, Bosch demonstrates its ability to respond to changing user needs and technological trends. This focus on continuous innovation not only strengthens its competitive edge in the global hand-tool segment but also reinforces the broader market’s transition toward more efficient, user-friendly, and versatile pincer solutions across industrial and professional applications.

List of Key Pincer Companies

-

DeWalt

-

Irwin Tools

-

Channellock, Inc

-

Wiha Tools

-

Bahco

-

Proto Industrial Tools

-

Gedore Tools

-

Knipex-Werk C. Gustav Putsch KG

-

Eastman IMPEX

-

MK Forgings

-

Ajay Industries

-

Zhangjiagang Jianquan Tools Co., Ltd.

-

Hamco Ispat Pvt. Ltd.

What are the Latest Key Industry Developments?

-

In July 2025, Knipex-Werk C. Gustav Putsch KG expanded its product line with the launch of an improved Cobra® ES pliers variant in North America, featuring a new 7¼″ size designed for enhanced maneuverability in tight spaces. This development highlights Knipex’s continuous innovation in precision hand tools, addressing the evolving needs of professionals in mechanical, electrical, and construction fields. While pliers and pincers serve distinct yet complementary functions, such advancements in ergonomic design, grip optimization, and compact usability signal the company’s broader focus on refining manual tool performance. The launch reinforces Knipex’s reputation for engineering excellence and directly contributes to the growth of the global pincer and hand-tool market by promoting efficiency and adaptability in demanding work environments.

-

In April 2025, DeWalt expanded its professional-grade tool portfolio with the launch of new hand tools and worksite systems, including the 20V MAX XR® 12-In. Double Bevel Sliding Miter Saw. This move underscores DeWalt’s ongoing commitment to innovation and performance across its tool lineup, reinforcing its position as a leader in the professional hand-tool segment. While primarily focused on power tools, such product introductions reflect the brand’s broader strategy to enhance efficiency and precision in construction and maintenance tasks key areas that also drive demand for high-quality pincers and complementary hand tools. DeWalt’s consistent investment in durable, ergonomically designed products continue to support overall market growth by setting new standards for reliability and user experience in manual and powered tool applications.

What are the Key Factors Influencing Investment Analysis & Opportunities in the Pincer Market?

Investment in the pincer market is increasingly driven by the rising global demand for durable, high-performance hand tools and precision-engineered metal components. Investors are particularly drawn to companies that demonstrate innovation in design, material enhancement, and ergonomic functionality. With industrial modernization, automation support tools, and infrastructure development accelerating globally, manufacturers that offer versatile and reliable pincers for both industrial and household applications are gaining traction. Investment appeal also stems from firms focusing on process efficiency, advanced metallurgy, and eco-friendly production methods, as these factors align with broader sustainability and productivity goals across industries such as construction, electronics, and manufacturing.

Valuations in the pincer sector are influenced by product innovation, brand reputation, and the ability to diversify across multiple end-user segments. Regions with strong industrial and construction bases, such as North America, Europe, and emerging Asia-Pacific economies serve as key investment hubs, supported by established manufacturing ecosystems and skilled labor availability. Companies that expand through strategic partnerships, localized production, and product customization are better positioned to attract investor confidence. Additionally, the integration of digital tools in supply chain management and smart manufacturing practices enhances operational efficiency, making the pincer market a promising domain for long-term, value-driven investment.

Key Benefits for Stakeholders:

Next Move Strategy Consulting (NMSC) presents a comprehensive analysis of the pincer market, covering historical trends from 2020 through 2024 and offering detailed forecasts through 2030. Our study examines the market at regional and country levels, providing quantitative projections and insights into key growth drivers, challenges, and investment opportunities across all major pincer segments.

The pincer market creates value across its entire ecosystem by combining precision engineering, durability, and usability to meet the diverse needs of industrial, professional, and household users. Investors benefit from the sector’s steady growth and recurring demand driven by infrastructure development and industrial maintenance, while manufacturers and distributors gain from continuous product innovation, ergonomic design improvements, and material advancements. End users enjoy enhanced efficiency, safety, and comfort from high-quality tools built for reliability and long service life. Meanwhile, suppliers of metals and components benefit from sustained production requirements. Together, these dynamics form a resilient and collaborative value chain where innovation, quality, and practicality drive consistent returns and customer satisfaction across the global pincer industry.

Report Scope:

|

Parameters |

Details |

|

Market Size in 2025 |

USD 403.1 Million |

|

Revenue Forecast in 2030 |

USD 519.4 Million |

|

Growth Rate |

CAGR of 5.2% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Countries Covered |

33 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent to up to 80 analyst-working hours) after purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

|

Approach |

In-depth primary and secondary research; proprietary databases; rigorous quality control and validation measures. |

|

Analytical Tools |

Porter's Five Forces, SWOT, value chain, and Harvey ball analysis to assess competitive intensity, stakeholder roles, and relative impact of key factors. |

Key Market Segments

By Material

-

Carbon Steel

-

Alloy Steel

-

Stainless Steel

-

Specialty Metal Catalysts

By Product Type

-

Hand Tools

-

Nail Pulling Pincers

-

End Cutting Pincers

-

Crimping Pincers

-

Precision Pincers

-

-

Chemical Ligands

-

Tridentate Pincer Ligands

-

Metal Complex Pincer Ligands

-

-

Biological Claws

-

Crab Claws

-

Lobster Claws

-

Other Species Claws

-

By Distribution Channel

-

Direct Sales

-

Industrial Distributors

-

Retail Hardware Stores

-

Online Platforms

By Application

-

Construction and Carpentry

-

Electronics and Electricals

-

Jewelry and Craft

-

Chemical Catalysis

-

Healthcare and Medication Safety

-

Food Processing and Aquaculture

-

Education and Defense Training

By End User

-

Industrial Users

-

Household Users

-

Research Institutions

-

Healthcare Providers

-

Educational Organizations

-

Others

Geographical Breakdown

-

North America: U.S., Canada, and Mexico.

-

Europe: U.K., Germany, France, Italy, Spain, Sweden, Denmark, Finland, Netherlands, and rest of Europe.

-

Asia Pacific: China, India, Japan, South Korea, Taiwan, Indonesia, Vietnam, Australia, Philippines, Malaysia and rest of APAC.

-

Middle East & Africa (MEA): Saudi Arabia, UAE, Egypt, Israel, Turkey, Nigeria, South Africa, and rest of MEA.

-

Latin America: Brazil, Argentina, Chile, Colombia, and rest of LATAM

Conclusion & Recommendations

Our report equips stakeholders, manufacturers, investors, and industry consultants with actionable intelligence to capitalize on the market’s evolving potential. By integrating data-driven insights with strategic market frameworks, NMSC’s Pincer Market Report serves as an essential resource for navigating this dynamic industry. The market is poised for sustained expansion, driven by rising industrialization, infrastructure growth, and advancements in tool design and materials. Strategic insights highlight the importance of continuous product innovation, ergonomic engineering, and quality assurance factors that strengthen brand credibility and competitiveness. Companies focusing on high-performance hand tools, specialized alloys, and tailored solutions for professional and industrial users are best positioned to capture growing market share and secure long-term success in a competitive global environment.

For executives and investors, capitalizing on these trends requires identifying emerging demand hubs, investing in R&D for advanced materials and manufacturing precision, and fostering partnerships with distributors and industrial suppliers to expand global reach. Emphasizing sustainability through durable, long-lasting tool designs and efficient production methods aligns with both regulatory standards and customer expectations. Moreover, building robust after-sales support, training initiatives, and smart tool integration strategies enhance user loyalty and operational efficiency. Together, these actions unlock significant opportunities for growth, value creation, and leadership in the rapidly modernizing global pincer market.

Speak to Our Analyst

Speak to Our Analyst