Self-Loading Concrete Mixer Market by Type (Mini Self-loading Mixer, & others), by Water Tank Capacity (Up to 300 L, & others), by Bucket Capacity (Up to 250 L, & others), by Engine Power (<50 HP, & others), by Drum Rotation (0–10 RPM, & others), by Engine Type (Diesel Engines, Electric), by Ownership (Private Fleets, Rental Fleets), by Application (Road Construction, & Others), and by End-User (Construction Industry, & others) – Global Opportunity Analysis and Industry Forecast, 2025–2030

Industry Outlook

The global Self-Loading Concrete Mixer Market size was valued at USD 5.77 billion in 2024 and is expected to reach USD 6.18 billion by 2025. Looking ahead, the industry is projected to expand significantly, reaching USD 8.66 billion by 2030, registering a CAGR of 6.65% from 2025 to 2030.

The market has witnessed significant growth, driven by the increasing demand for efficient and versatile construction equipment. These machines, which combine the functions of a concrete mixer and a loader, offer enhanced mobility and productivity on construction sites. Their ability to mix and transport concrete on-site reduces the need for additional equipment, leading to cost savings and improved project timelines. Applications span across various sectors, including residential, commercial, and infrastructure development, where quick and efficient concrete delivery is essential.

Looking ahead, the future prospects of the self-loading concrete mixer industry appears promising. Advancements in technology, such as the integration of artificial intelligence and Internet of Things (IoT) capabilities, are expected to further enhance the performance and efficiency of these machines.

Additionally, the growing emphasis on sustainable construction practices is driving the adoption of eco-friendly models, including battery-electric versions. As urbanization continues and infrastructure projects expand, the demand for automatic concrete mixers is anticipated to rise, offering opportunities for innovation and growth within the industry.

Additionally, rising infrastructure investment drives the self-loading concrete mixer market growth significantly, by increasing the volume and scale of development projects, such as roads, bridges, ports, and urban real estate, which require fast and efficient concrete production solutions. As capital flows into infrastructure, demand for versatile and technologically advanced concrete mixers rises, fostering innovation and expanding market opportunities for equipment manufacturers.

The chart highlights the steady rise in global infrastructure investment from USD 2.7 trillion in 2020 to an expected USD 3 trillion in 2025, signifying robust financing and development activity across sectors such as transportation, utilities, and urban projects. This increasing investment directly benefits the self-loading concrete mixer market share, as more infrastructure projects translate into higher demand for advanced and efficient construction machinery. Concrete batching equipment, valued for their mobility, automation, and cost-efficiency, become increasingly essential on large-scale and time-sensitive infrastructure sites, driving growth opportunities and technology innovation within the segment as infrastructure spending intensifies.

What are the Key Trends in the Self-Loading Concrete Mixer Market?

How is Artificial Intelligence (AI) Enhancing Operational Efficiency in Self-Loading Concrete Mixers?

Artificial Intelligence (AI) is revolutionizing the self-loading concrete mixer market by automating the concrete mixing and delivery process. AI algorithms enable precise control over ingredient proportions, ensuring consistent concrete quality. Additionally, AI-powered systems predict maintenance needs based on usage patterns, reducing downtime and extending equipment lifespan. This technological advancement not only improves operational efficiency but also contributes to cost savings for construction companies.

For instance, AI integration allows for real-time monitoring of fuel consumption and emissions, aiding in sustainability efforts. Companies investing in AI-driven self-loading concrete mixers gain a competitive edge by offering faster, more reliable, and eco-friendly solutions to their clients.

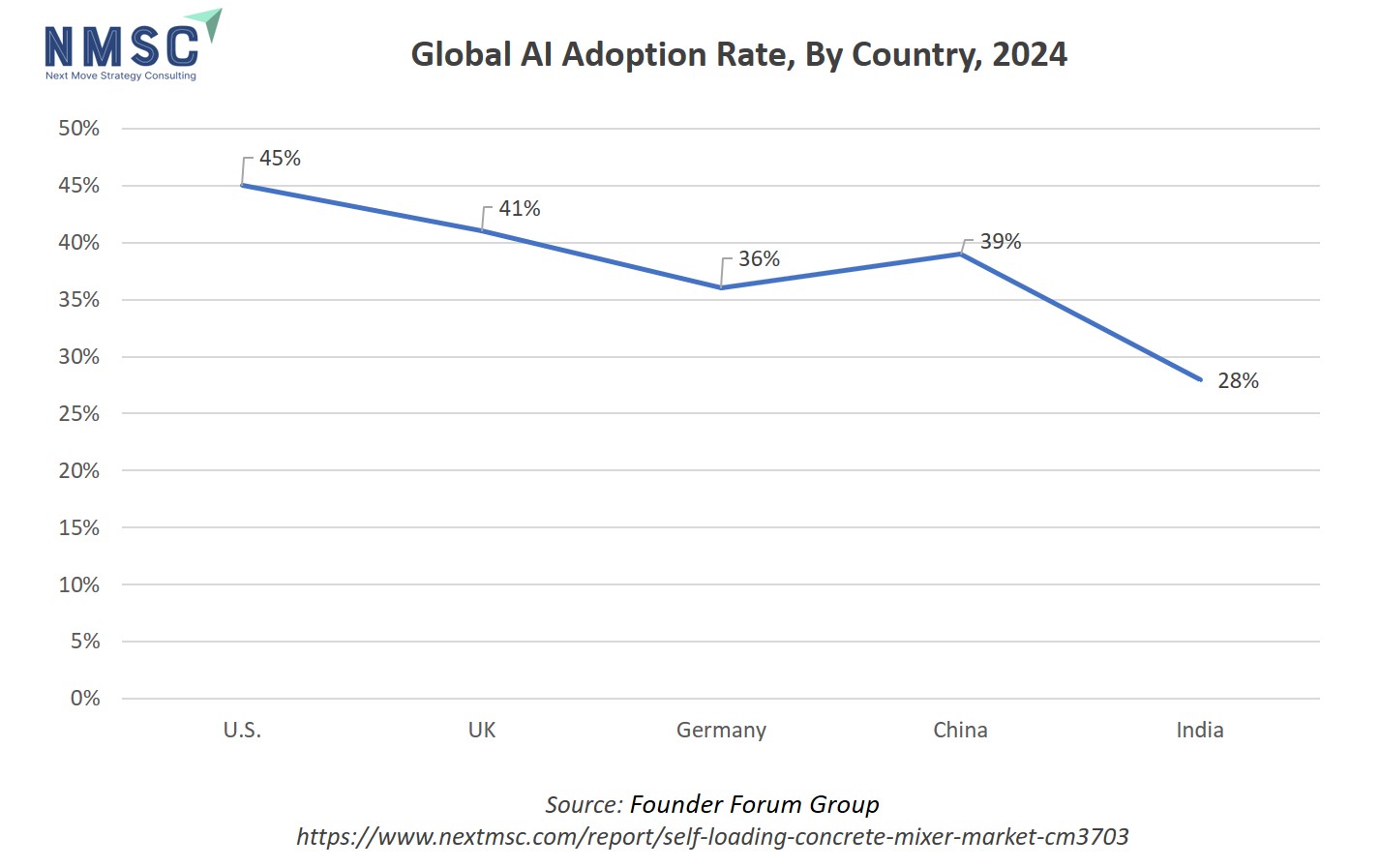

The chart illustrates the global AI adoption rate by country for 2024. This disparity in AI adoption rates has significant implications for the self-loading concrete mixer market, as higher AI integration typically correlates with increased automation, efficiency, and competitiveness in construction technology sectors.

Countries with higher AI adoption, such as the US and UK, are likely to pioneer advancements in smart concrete mixer designs, incorporating predictive maintenance, real-time analytics, and autonomous operation features, while lower adoption rates in regions slow the penetration of such innovations, impacting overall self-loading concrete mixer market growth, technology readiness, and operational productivity within the self-loading concrete mixer segment.

What Role Does Urbanization Play in Driving the Demand for Self-Loading Concrete Mixers?

Rapid urbanization is a significant driver of the self-loading concrete mixer market demand. As cities expand and infrastructure projects increase, the demand for efficient and flexible concrete mixing solutions rises. Compact concrete mixers, with their ability to mix and transport concrete on-site, reduce the need for additional equipment and labour, leading to cost savings and faster project completion. This trend is particularly evident in emerging economies where urban development is accelerating.

Construction companies operating in these regions are increasingly adopting self-loading concrete mixers to meet the growing demand for infrastructure development. Therefore, businesses looking to capitalise on this trend consider investing in self-loading concrete mixers to enhance their operational capabilities and stay competitive in the evolving market.

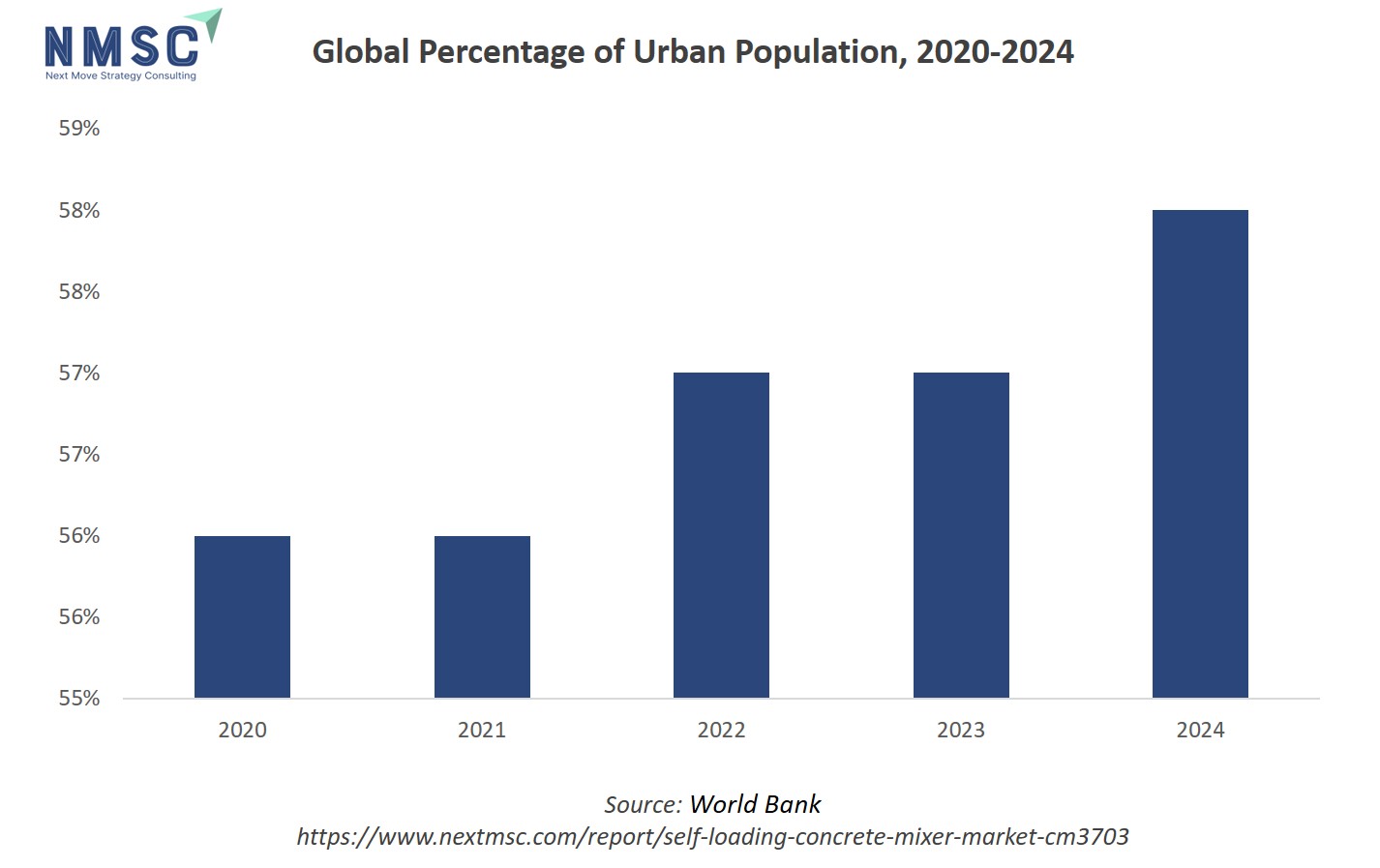

The chart shows a steady increase in the global percentage of urban population from 2020 to 2024. This trend towards greater urbanization significantly impacts the self-loading concrete mixer market expansion, as increasing urban populations drive higher demand for infrastructure development, housing projects, and urban construction activities.

As cities expand and new urban projects emerge, construction companies are likely to seek more efficient, flexible, and cost-effective equipment, such as concrete machinery, to meet project timelines and quality standards, ultimately fueling the self-loading concrete mixer market trends and technological advancements within the sector.

How are Sustainability and Eco-Friendly Innovations Shaping the Future of Self-Loading Concrete Mixers?

Sustainability is becoming a central focus in the self-loading concrete mixer market, with manufacturers developing eco-friendly models to meet environmental regulations and consumer preferences. These innovations include battery-electric mixers that produce zero emissions during operation, reducing the carbon footprint of construction projects.

Additionally, advancements in fuel efficiency and noise reduction technologies contribute to more sustainable construction practices. The growing emphasis on environmental responsibility is influencing purchasing decisions, with clients increasingly favouring companies prioritise sustainability.

For businesses in the construction industry, adopting eco-friendly self-loading concrete mixers not only improve their environmental impact but also enhance their reputation and appeal to environmentally conscious clients.

What Impact Does Technological Integration Have on the Productivity of Self-Loading Concrete Mixers?

The integration of advanced technologies into self-loading concrete mixers is significantly boosting their productivity. Features such as GPS tracking, telematics, and automated mixing systems allow for precise control and monitoring of concrete production, leading to consistent quality and reduced material waste. Moreover, these technologies enable real-time data collection, facilitating better decision-making and project management.

Construction companies utilising technologically advanced self-loading concrete mixers achieve faster turnaround times and improved efficiency on job sites. To remain competitive, businesses invest in these technological advancements to enhance their operational capabilities and meet the increasing demands of modern construction projects.

What are the Key Market Drivers, Breakthroughs, and Investment Opportunities that Will Shape the Self-Loading Concrete Mixer Market in the Next Decade?

The self-loading concrete mixer segment sits at the intersection of growing on-site productivity needs and tighter timelines across construction, infrastructure and remote-site projects. These units, prized for combining loading, mixing and transport in one machine, are widely used by small-to-mid contractors, road and bridge crews, and remote or urban infill jobs where access and speed matter. Recent construction momentum, supported by urban expansion and renewed infrastructure programs, keeps demand steady even where macro growth is uneven; global construction fundamentals remain constructive according to industry outlooks.

Growth Drivers:

How is Urbanization and Construction Activity Propelling the Self-Loading Concrete Mixer Market?

As cities densify and smaller, faster civil works multiply, demand for agile on-site concrete solutions grows, self-loading mixers remove double-handling and shorten lead times, making them ideal for urban infill, municipal works and remote infrastructure. Urban population share has risen steadily and global construction output showed continued recovery and expansion in recent outlooks, underpinning machinery demand.

For manufacturers and fleet operators this suggests prioritizing compact, low-emission units and urban configuration options (noise, manoeuvrability) while partnering with rental houses that serve city projects to capture higher utilization and faster replacement cycles

How is Technological Integration (Telematics, Predictive Maintenance) Driving Adoption of Self-Loading Concrete Mixer Market?

Owners seek machines that lower downtime and operational cost; telematics and AI-based maintenance forecasting reduce unexpected failures and optimize fuel or battery usage. Industry reports highlight accelerating adoption of connected equipment and electrification pathways in heavy-duty sectors, implying similar gains for self-loading mixers.

Practically, OEMs create subscription-style telematics services and aftermarket analytics to monetize data, while contractors use remote diagnostics to plan preventive service windows, reducing idle time and total cost of ownership, a clear commercial lever in tendered, time-sensitive projects.

Growth in electricity demand strongly influences the market by stimulating investment in power infrastructure, such as new plants, transmission lines, substations, and renewable energy projects, all of which require substantial concrete work for foundations and structural supports. As utilities and governments expand generation capacity and modernize grids to meet rising electricity needs, construction contractors increasingly turn to efficient, mobile concrete solutions like self-loading mixers to handle large volumes, tight schedules, and remote locations.

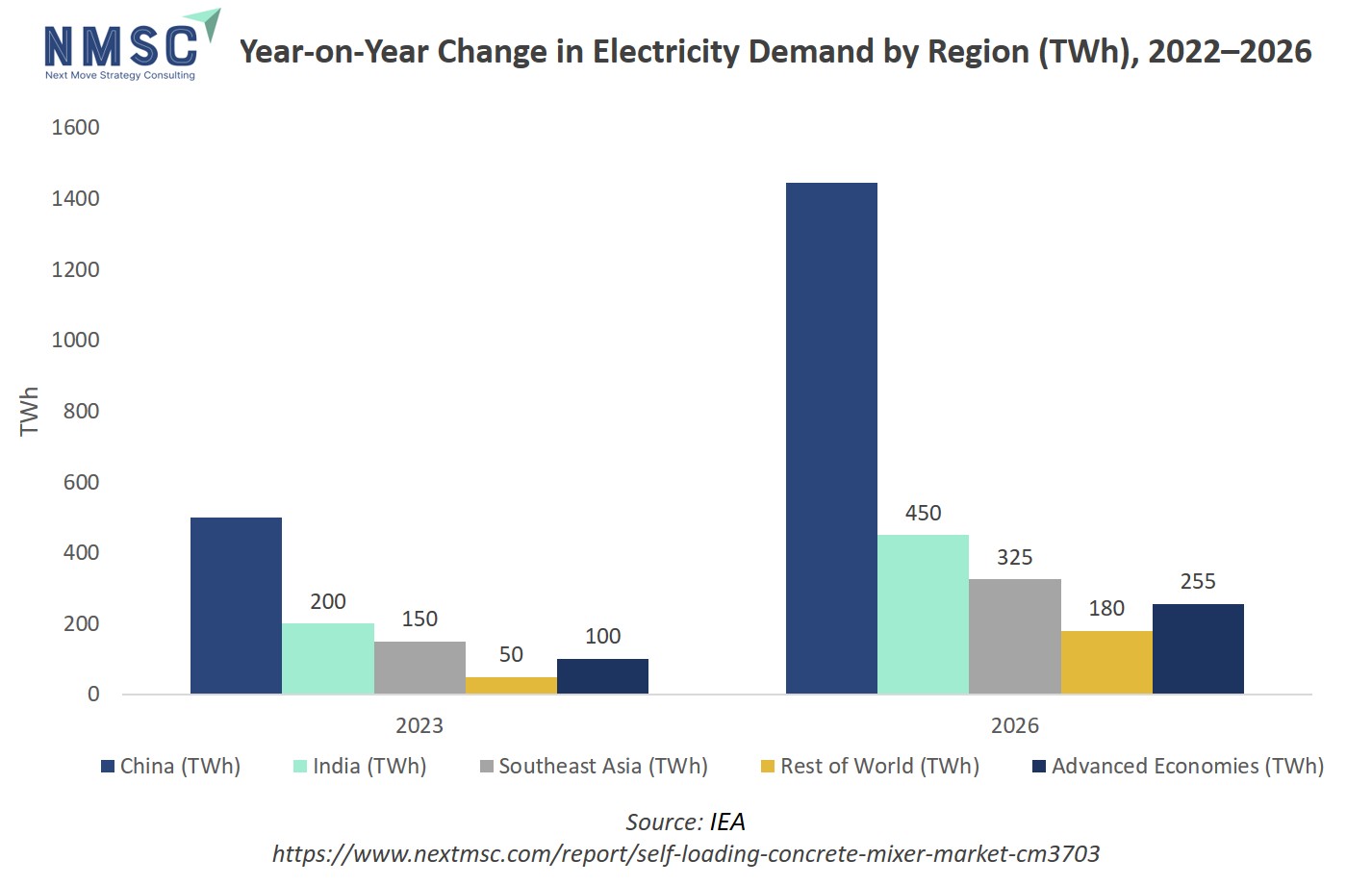

The chart depicts the projected year-on-year increase in electricity demand by region from 2023 to 2026, with China exhibiting the highest growth followed by India, Southeast Asia, advanced economies, and the Rest of the World. This rising electricity demand directly impacts the self-loading concrete mixer market by driving significant infrastructure development, particularly in energy generation, transmission, and distribution projects.

As power infrastructure expands to accommodate surging demand, the need for efficient, versatile concrete mixing equipment increases to meet construction deadlines and ensure quality. Self-loading concrete mixers, with their mobility and operational efficiency, are positioned to benefit from these construction activities, expanding self-loading concrete mixer market demand especially in high-growth regions like China and India.

Growth Inhibitors:

What is Holding Back Faster Fleet Renewal to Modern Self-Loading Concrete Mixers?

The principal drag is upfront capital cost combined with skilled-operator and technician shortages; many small contractors delay replacements despite efficiency gains because of capex pressure. Construction labor shortages remain acute in multiple markets, complicating adoption of machines that require trained operators or specialized maintenance.

Additionally, inconsistent charging infrastructure and regulatory clarity for electric mobile plant in some regions raises buyer caution. To overcome this, manufacturers and financiers scale rental, lease-to-own, and integrated service packages that lower entry cost and provide operator training, reducing the behavioral and financial barriers to fleet modernization.

Where is the Strongest Emerging Investment Opportunity Within the Self-Loading Concrete Mixer Value Chain?

A rapid-payback opportunity lies in electrified self-loading mixers and associated on-site charging and battery-swap services for urban and regulated markets. As electricity grids decarbonise and construction clients push for lower-emission fleets, electric mobile plant becomes commercially attractive, backed by broader electricity and technology roadmaps.

Investors target integrated solutions: e-mixer hardware, standardised battery modules, charging infra for rental depots, and telematics-enabled energy management. Pilot projects with municipalities or green-infrastructure contractors de-risk technology, create reference cases and speed procurement approvals, positioning entrants ahead of regulatory and client demand curves.

How is the Self-Loading Concrete Mixer Market Report Segmented, and What are the Key Insights from the Segmentation Analysis?

By Type Insights

Which Self-Loading Concrete Mixer Type is Dominating the Market in 2025?

Based on type, the market is segmented into mini self-loading concrete mixer, standard self-loading concrete mixer, and heavy-duty self-loading concrete mixer.

Mini self-loading concrete mixers are compact machines designed for small-scale construction projects. Their manoeuvrability and ability to operate in confined spaces make them ideal for residential buildings and urban infrastructure. The demand for mini mixers is increasing due to the growth of small-scale construction activities and the need for cost-effective solutions. These mixers offer flexibility and efficiency, contributing to their rising popularity in the market.

Standard self-loading concrete mixers are versatile machines suitable for a wide range of construction projects. They offer a balance between capacity and manoeuvrability, making them suitable for both urban and rural construction sites. The adoption of standard mixers is driven by their ability to handle medium-scale projects efficiently. Their versatility and reliability make them a preferred choice for contractors seeking a balance between performance and cost.

Heavy-duty self-loading concrete mixers are designed for large-scale construction projects requiring high capacity and durability. These mixers handle large volumes of concrete, making them suitable for infrastructure projects such as highways, bridges, and industrial facilities. The demand for heavy-duty mixers is driven by the increasing scale of construction projects and the need for efficient concrete mixing and transportation solutions. Their robust design ensures reliability and performance in demanding environments.

By Water Tank Capacity Insights

Which Water Tank Capacities are Driving the Self-Loading Concrete Mixer Market in 2025?

On the basis of water tank capacity, the market is segmented into up to 300 Ltrs, 301-600 Ltrs, 601-800 Ltrs, and above 800 Ltrs.

Mixers with water tanks up to 300 liters are ideal for small-scale projects and urban construction sites with limited space. Their compact design allows for easier maneuverability and faster setup. These mixers are cost-effective and suitable for contractors handling residential buildings or small civil works, where concrete volumes are moderate. The smaller water capacity supports short-duration mixing operations efficiently while reducing water wastage. Water tanks in the 301–600 liter range are standard for medium-scale construction projects. These mixers balance water capacity with mobility, allowing consistent concrete quality over longer mixing cycles. They are commonly deployed for multi-story residential buildings, small commercial complexes, and road maintenance projects. The segment is growing due to its adaptability to varied project sizes and moderate operational efficiency.

Mixers with 601–800 liter water tanks cater to large-scale construction sites where continuous concrete production is required. The higher water capacity supports larger batch sizes, maintaining work efficiency and consistent concrete quality. These mixers are preferred for infrastructure projects, such as bridges, highways, and industrial facilities, where moderate to high-volume concrete delivery is necessary. Self-loading mixers with tanks above 800 liters are designed for heavy-duty and high-volume applications. Their capacity ensures minimal refilling and uninterrupted operations on large-scale infrastructure projects. This segment is driven by major civil and industrial construction, where time efficiency and high output are critical. The robust design ensures reliability and long-term performance under demanding conditions.

By Bucket Capacity Insights

Which Bucket Capacities are Driving the Self-Loading Concrete Mixer Market in 2025?

On the basis of bucket capacity, the market is segmented into up to 250 Ltrs, 250-500 Ltrs, 500-750 Ltrs, and above 750 Ltrs.

Mixers with bucket capacities up to 250 liters are ideal for small-scale residential and urban projects. Their compact design allows easy maneuvering in confined spaces and quick on-site mixing. These mixers are cost-effective, making them attractive to small contractors and construction sites with moderate concrete requirements. Their limited capacity ensures minimal wastage and efficient operations for short-duration tasks.

Bucket capacities in the 250–500 liter range serve medium-scale construction projects, offering a balance between mobility and output. They are commonly deployed for commercial buildings, small infrastructure projects, and urban road maintenance. This segment is preferred due to its versatility, allowing consistent concrete quality across moderate batch sizes and extended mixing cycles.

By Engine Power Insights

Which Engine Power Ranges are Dominating the Self-Loading Concrete Mixer Market in 2025?

Based on engine power, the market is divided into less than 50 HP, 50–80 HP, 80–120 HP, and above 120 HP.

Mixers with engine power below 50 HP are primarily used for small-scale construction projects and residential buildings. Their compact engines allow for maneuverability in tight urban sites while maintaining adequate performance for moderate concrete volumes. This segment is popular among small contractors and projects with lower operational demands due to cost-effectiveness and ease of maintenance.

Engine power in the 50–80 HP range serves medium-scale construction projects, offering a balance of performance and fuel efficiency. These mixers handle larger batch sizes and moderate workloads efficiently, making them suitable for multi-story buildings, small commercial complexes, and urban infrastructure works. The segment is preferred for its reliability and adaptability across different site conditions. Mixers with 80–120 HP engines are designed for large-scale construction projects that require higher output and continuous operations. These machines provide the necessary torque and power to handle heavy loads, ensuring consistent concrete mixing for highways, bridges, and industrial facilities. They are chosen for their ability to sustain high-volume operations with minimal downtime.

High-power mixers with engines above 120 HP are intended for very large, heavy-duty infrastructure projects. They support maximum concrete output, high operational efficiency, and prolonged usage under demanding conditions. This segment is critical for major industrial, highway, and large civil engineering projects where time efficiency and performance are paramount.

By Drum Rotation Insights

Which Drum Rotation Speeds are Influencing the Self-Loading Concrete Mixer Market in 2025?

Based on drum rotation, the market is divided into 0-10 Rpm and 10-20 Rpm.

Mixers with drum rotation speeds of 0–10 RPM are typically used for small-scale construction projects or sites with moderate concrete volume requirements. The lower speed ensures gentle mixing, reducing wear on the drum and mechanical components. This segment is favored in residential and urban construction projects where operational efficiency and cost-effectiveness are key, and where extremely high mixing speeds are not required.

Mixers operating at 10–20 RPM are designed for medium- to large-scale projects requiring faster mixing and higher throughput. Higher drum speeds enhance concrete homogeneity and reduce mixing cycle times, making these mixers suitable for commercial buildings, infrastructure works, and industrial projects. This segment is preferred for projects demanding consistent concrete quality and faster operational cycles to meet tight schedules.

By Engine Type Insights

Are Diesel or Electric/Hybrid Engines Dominating the Self-Loading Concrete Mixer Market in 2025?

Based on engine type, the market is divided into diesel engines, and electric/hybrid units.

Diesel-powered self-loading concrete mixers remain the most widely used due to their reliability, high torque, and ability to operate in remote construction sites without access to electricity. They are suitable for small to heavy-duty mixers and are preferred for medium- to large-scale infrastructure projects. Diesel engines provide consistent performance in challenging environments, making them the backbone of the market, especially in regions with extensive road and industrial construction activities.

Electric and hybrid mixers are gaining traction due to increasing emphasis on sustainability, reduced emissions, and lower operating costs. These units are particularly suited for urban construction projects and regions with stringent environmental regulations. While adoption is still smaller compared to diesel engines, growth is accelerating as manufacturers invest in battery technology and hybrid solutions that combine the efficiency of diesel with the eco-friendliness of electric power.

By Ownership/Deployment Insights

Are Contractor-Owned or Rental Fleets Driving the Self-Loading Concrete Mixer Market in 2025?

Based on ownership/deployment, the market is divided into contractor-owned/private fleets and rental fleets.

Contractor-owned self-loading concrete mixers dominate the market, as construction companies prefer to maintain control over their equipment for ongoing projects. Owning mixers allows contractors to optimize operations, ensure consistent availability, and reduce long-term rental costs. This approach is particularly common for medium- to large-scale projects where frequent use and reliability are critical. Private ownership also enables customization and integration of fleet maintenance practices.

Rental fleets are gaining traction in urban and small-scale construction projects where ownership costs are high or demand is intermittent. Renting mixers provides flexibility, reduces capital investment, and allows contractors to scale their fleet based on project requirements. Rental services are especially useful for short-term projects, seasonal demands, or regions where storage and maintenance of private equipment are challenging.

By Application Insights

Which Construction Applications are Driving the Self-Loading Concrete Mixer Market in 2025?

Based on application, the market is divided into road construction, building construction, bridge construction, dam construction, and others.

In building construction, mixers are essential for residential, commercial, and multi-story projects. Their ability to mix and transport concrete directly to floors or tight spaces improves operational efficiency, reduces labor requirements, and ensures consistent concrete quality. Standard and mini mixers dominate this segment due to their manoeuvrability.

On the other hand, Bridge construction requires large volumes of high-quality concrete, making heavy-duty self-loading mixers a preferred choice. These mixers provide uninterrupted supply, consistent mixing, and efficient transportation for piers, decks, and other structural components. The segment is driven by infrastructure expansion and modernization projects globally.

By End-User Insights

Which End-Users are Driving the Self-Loading Concrete Mixer Market in 2025?

On the basis of end-user, the market is segmented into construction industry, infrastructure development, residential projects, commercial projects, and industrial projects.

The broader construction industry is the largest end-user of self-loading concrete mixers, using them across various civil engineering projects. Mixers provide on-site concrete production, reducing dependency on centralized batching plants and improving operational efficiency. Adoption is driven by both small-scale contractors and large construction companies seeking reliable and mobile mixing solutions.

On the other hand, Infrastructure projects, including highways, bridges, airports, and ports, require high-capacity, heavy-duty mixers. The segment demands consistent concrete supply and high-volume output for long-duration projects. Self-loading mixers streamline operations, reduce labor, and ensure timely project completion, making them essential for large-scale infrastructure development.

Residential construction favors mini and standard mixers for urban housing and multi-story buildings. Their compact size, maneuverability, and cost-effectiveness make them ideal for confined spaces and small-volume concrete requirements. Growing urbanization and housing demand are driving adoption in this segment. Industrial projects, including factories, warehouses, and manufacturing facilities, utilize mixers for high-volume, high-quality concrete. Large-capacity heavy-duty mixers are preferred to meet the demands of extensive structural components, ensuring operational efficiency and minimal downtime.

Regional Outlook

The market is geographically studied across North America, Europe, Asia Pacific, Middle East & Africa, and Latin America and each region is further studied across countries.

Self-Loading Concrete Mixer Market in North America

North America’s market is shaped by mixed construction momentum, fleet renewal needs and a clear tilt toward telematics and emissions reduction. Contractors value self-loading mixers for on-site speed and reduced labor in remote and urban projects; telematics, predictive maintenance and battery-pathways are winning attention as owners seek lower total cost of ownership. U.S. construction spending trends and tight labor pools influence replacement cycles and rental demand, slowing capex but accelerating service-based uptake. The region’s push for electrification and connected equipment supports higher-spec, data-enabled mixers that reduce downtime and operating costs.

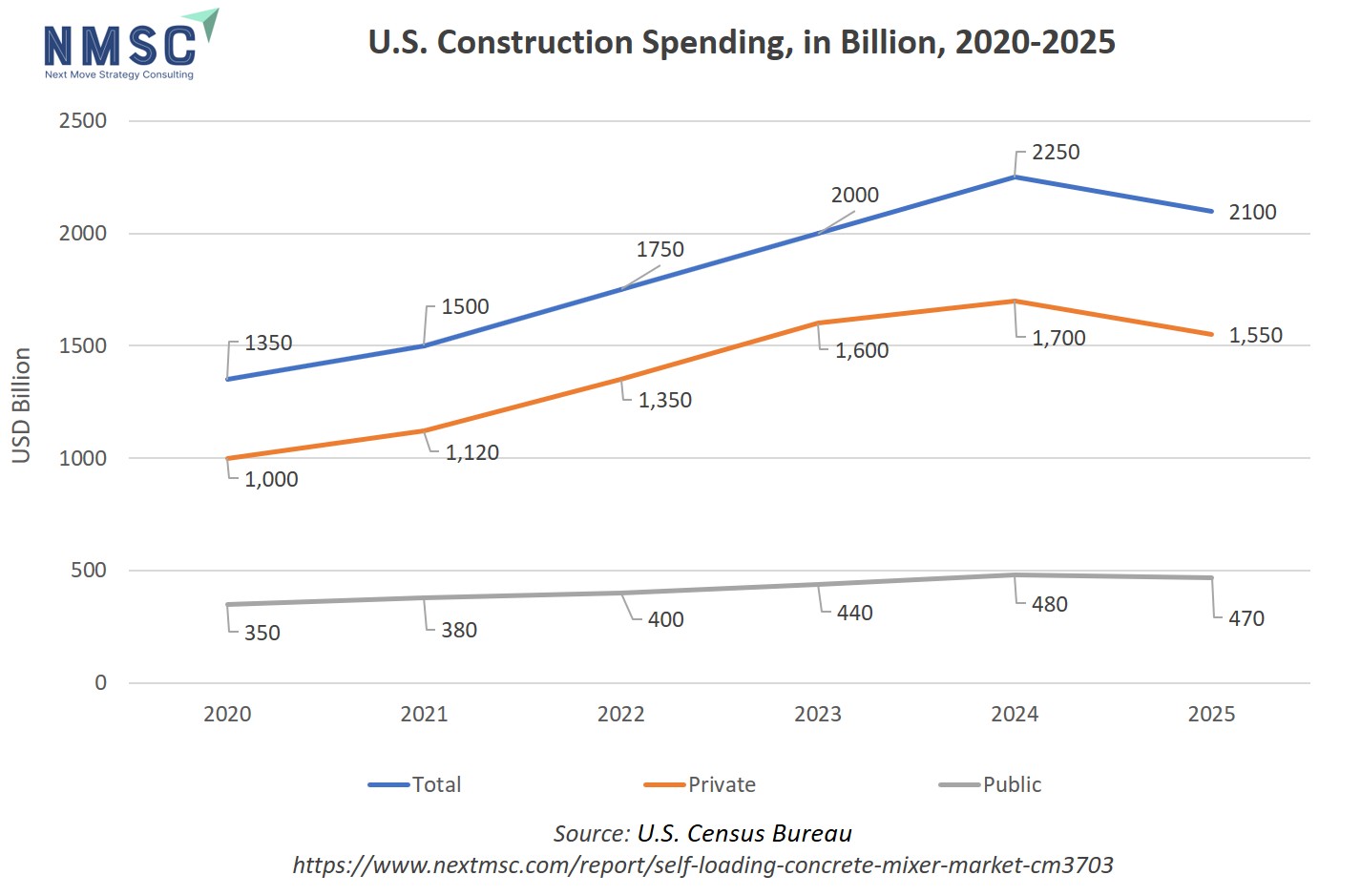

The above chart illustrates the growth trajectory of U.S. construction spending from 2020 to 2025, with total expenditure rising from USD 1,350 billion in 2020 and peaking at USD 2,250 billion in 2024 before a slight dip to USD 2,100 billion in 2025; it also shows consistent increases in private/public and a third segment across the same period.

The upward trend in construction investment directly drives demand for advanced construction equipment, making the market for self-loading concrete mixers more robust as contractors seek greater efficiency, mobility, and labor savings in large-scale building projects. Elevated spending means more infrastructure and development projects, in turn boosting technological adoption and market opportunities for self-loading concrete mixers, particularly in a highly competitive U.S. sector where automation and productivity gains are valued.

Self-Loading Concrete Mixer Market in the United States

In the U.S., procurement choices are driven by project velocity, contractor labor shortages and growing interest in electrified jobsite equipment. Monthly construction spending and public infrastructure programs set near-term demand while telematics and AI-enabled diagnostics reduce firms’ risk of breakdowns on tight schedules. Investors and rental firms are responding with financing and subscription models that lower initial cost barriers, a key lever when firms defer capex. Contractors in highways, utilities and remote works increasingly favor self-loading mixers for their single-operator convenience and reduced double-handling, and adoption rises where telematics demonstrably cuts downtime.

Self-Loading Concrete Mixer Market in Canada

Canada’s market follows large infrastructure and resource-driven projects; equipment must tolerate long hauls and cold-climate operations. Statistics Canada’s construction data and federal infrastructure commitments stabilize demand though provincial cycles vary. Fleet owners in remote regions favor self-loading mixers for logistic simplicity and reduced labor; telematics and remote diagnostics are valuable given long service distances. Electrification is nascent but attractive for urban jobs where emissions rules tighten. Rental adoption and aftermarket services (training, remote support) materially increase utilisation, making Canada fertile for companies offering integrated service-plus-hardware models.

Self-Loading Concrete Mixer Market in Europe

European demand is heterogeneous but technology-forward. Urban retrofits, renewable-energy projects and stricter emissions policies push buyers to low-emission, telematics-enabled equipment. Eurostat’s construction production shows modest growth in many EU markets, yet macro caution slows pure capex purchases; instead, rental and retrofit markets expand. Germany’s machinery softness contrasts with pockets of robust infrastructure spending elsewhere, so manufacturers prioritise flexible product specs (compact, low-noise, electric-ready) and digital services to win municipal and rental-house customers. Telematics and predictive maintenance are now value propositions rather than luxuries.

Self-Loading Concrete Mixer Market in the United Kingdom

The U.K. construction picture is patchy, with private housing and repair/maintenance driving near-term activity while new large projects face budget scrutiny. The Office for National Statistics data shows modest ups and downs, but urban refurbishment and constrained site access favor agile self-loading mixers that reduce waiting for ready-mix deliveries. Policymakers’ net-zero goals and rising energy costs also make low-emission and efficient machines attractive for municipal tenders. Consequently, rental houses and contractors are more likely to opt for service-backed, telematics-equipped units to mitigate capex risk and meet sustainability clauses.

Self-Loading Concrete Mixer Market in Germany

Germany’s machinery sector has faced export and production softness, prompting OEMs to focus on value-added digital services and efficiency features. The VDMA and industry commentary point to slower equipment sales but stronger interest in high-quality, durable machines with advanced diagnostics. Municipal and infrastructure projects still demand robust mixers, and noise/emissions rules in urban zones favour electric or low-emission variants. German rental markets and contractors value lifecycle services and parts availability; firms that bundle telematics, predictive maintenance and retrofit kits gain an advantage amid muted new-equipment spending.

Self-Loading Concrete Mixer Market in France

France’s construction sector is governed by urban renewal and social housing programs which favour compact, low-emission machinery. Contractors in dense urban areas prefer self-loading mixers to avoid congestion and waiting times for central ready-mix plants. National and EU sustainability targets push procurement toward electrified or fuel-efficient models, and telematics helps firms demonstrate compliance and optimise fleet use. OEMs that provide financing, depot-charging solutions and local service networks will find demand in France’s municipal and renovation-heavy projects.

Self-Loading Concrete Mixer Market in Italy

Italy’s construction sector, driven by renovation and seismic retrofitting programs, values versatility and maneuverability; self-loading mixers reduce on-site handling and sit well in narrow urban streets. Italian public works and EU-funded resilience projects provide intermittent demand peaks, making rental and lease models popular. Technology adoption is increasing, where telematics for utilisation tracking and predictive service reduces downtime for dispersed contractors. Companies offering compact, low-noise, and low-emission models with easy serviceability are positioned to capitalise on Italy’s renovation-led market.

Self-Loading Concrete Mixer Market in Spain

Spain’s market is shaped by residential rebounds and tourism infrastructure maintenance; urban infill projects and coastal works benefit from the mobility and speed of self-loading mixers. Regional funding for infrastructure upgrades and rising interest in low-carbon construction support electrified or fuel-efficient models. Spanish contractors frequently favour rentals to manage seasonal demand, so OEMs with strong rental partnerships and on-site training programs boost utilization. Telematics adoption is growing as firms seek to track machine use across islands and remote coastal projects.

Self-Loading Concrete Mixer Market in the Nordics

Nordic markets combine strong environmental policy with high labour costs, making low-emission, automated and quiet equipment commercially attractive. Municipal green procurement rules and dense urban centres encourage battery-electric or hybrid mixers, while telematics and fleet energy management help sites meet strict emissions reporting. Harsh climates push demand for ruggedised designs and reliable remote-diagnostics. Manufacturers that support depot-charging, battery-service networks, and turnkey energy management (charging + telematics) capture premium segments in Sweden, Norway, Denmark and Finland.

Self-Loading Concrete Mixer Market in the Asia-Pacific

Asia-Pacific is the most heterogenous and fastest-growing market, with booming urbanization and infrastructure programs driving demand for efficient, mobile concrete solutions. China’s urban projects and Africa-facing infrastructure in Southeast Asia increase need for self-loading mixers, while technology uptake (telematics, remote service) rises as operators seek reliability. Electrification is uneven, as China and Australia move faster on battery pathways than many ASEAN markets. Reports’ electrification analysis indicate that digital and electric transitions will disproportionately benefit markets with strong grid investments and green procurement rules.

Self-Loading Concrete Mixer Market in China

China’s construction and equipment market remains pivotal. Domestic manufacturers scale self-loading mixers rapidly for both internal urban projects and export markets. China’s drive for industrial digitisation and electrified equipment supports rapid telematics adoption; government incentives for low-emission machinery in urban cores accelerate battery and hybrid trials. Local supply chains and component affordability shorten development cycles for new models. As contractors increasingly demand machines with built-in diagnostics and energy management, Chinese OEMs are practical leaders in value-priced, connected mixers.

Self-Loading Concrete Mixer Market in Japan

Japan’s construction market emphasizes precision, compact equipment and automation for constrained urban sites and disaster-resilience projects. Local contractors accept higher-specification machines that incorporate telematics, remote-control features and low-noise electric operation. Japan’s technology adoption curve and strict emissions/noise standards make electric or hybrid self-loading mixers attractive for municipal tenders. Manufacturers that embed advanced diagnostics and ergonomics obtain premium pricing, while rental and service models that guarantee uptime are particularly valued, given Japan’s emphasis on schedule certainty.

Self-Loading Concrete Mixer Market in India

India’s vast and fragmented market shows strong demand for rugged, cost-effective self-loading mixers for rural roads, small civil works and rapid urbanization projects. Infrastructure programs and housing initiatives keep base demand high, but capex sensitivity and operator skill gaps shape buying behaviour. Telematics adoption is growing among larger contractors and rental operators to manage utilisation and maintenance across dispersed sites. Electrification is early-stage due to grid and charging constraints in many regions, but urban municipal projects and sustainability-linked tenders prompt pilots for battery or hybrid units.

Self-Loading Concrete Mixer Market in South Korea

South Korea’s advanced manufacturing base and dense urban projects favour high-tech, low-emission and telematics-equipped mixers. Contractors expect integrated data (telemetry + jobsite planning) and electrified options align with national carbon targets. Local OEMs and tech providers co-develop battery and energy-management solutions for rental depots and municipal clients. Given Korea’s strong digital infrastructure, AI-enabled predictive maintenance and fleet optimisation are commercially valuable and are being trialled in heavy equipment segments. This pushes adoption faster than in markets where digital infrastructure lags.

Self-Loading Concrete Mixer Market in Taiwan

Taiwan favors compact, reliable equipment for constrained urban and island projects; manufacturers that offer rugged, high-uptime machines with telematics and local support win. Taiwanese contractors value quick-response aftersales and compact electric-ready platforms for city works. Given close industrial ties with larger OEM hubs, Taiwan adopts proven telematics and battery technologies quickly when municipal procurement emphasises low emissions and noise. Integration with regional spare-parts networks is a competitive advantage.

Self-Loading Concrete Mixer Market in Indonesia

Indonesia’s market is transportation and infrastructure-led, with heavy demand for flexible, low-logistics concrete solutions in remote and island projects. Self-loading mixers reduce double-handling and are popular where ready-mix supply is fragmented. Adoption of telematics is growing among larger contractors, while electrification remains limited by grid and depot constraints. Rental houses and local distributors that provide training, parts and service networks accelerate uptake. Infrastructure spending and urbanization trends support steady demand, especially for robust, low-maintenance models.

Self-Loading Concrete Mixer Market in Australia

Australia’s dispersed projects, mining support works and strict emissions expectations in some jurisdictions make self-loading mixers a pragmatic solution for remote and regional jobs. Telematics for utilisation tracking and diesel-to-hybrid pilots are increasingly relevant, especially where long on-road times raise fuel costs. Strong rental markets and well-developed service networks allow contractors to choose asset-light models, helping fleets modernise without heavy capex. Clean-energy and electrification roadmaps make coastal urban projects early adopters of low-emission units.

Self-Loading Concrete Mixer Market in Latin America

Latin America displays elevated demand for rugged, cost-efficient self-loading mixers for road upgrades, rural housing and municipal works; logistics challenges make on-site mixing very attractive. Country-level volatility and capex constraints push rental and financing models; telematics adoption is nascent but growing among larger fleets that need utilisation data. Urbanization and government infrastructure programs (roads, social housing) create recurring demand, but intermittent funding and currency risks shape procurement timing. OEMs with local service networks, adaptable financing and low-maintenance designs find better market traction.

Self-Loading Concrete Mixer Market in the Middle East & Africa

In the Middle East & Africa, heavy infrastructure, rapid urban expansion and remote-site construction (mining, pipelines) spur demand for self-loading mixers that cut transport cost and labour needs. Oil-rich Gulf markets and large African infrastructure programs differ, where Gulf states prioritise high-spec, low-emission solutions for urban projects while many African countries prioritise rugged, low-cost units. Telematics adoption is mixed but rising where fleets are larger; electrification is slower due to grid constraints, though pilot programs exist in wealthier GCC cities. Companies combining rugged hardware with remote-diagnostic services and flexible finance succeed.

Competitive Landscape

Which Companies Dominate the Self-Loading Concrete Mixer Industry and How do they Compete?

Schwing Stetter India, Ajax Engineering, Fiori Group, CARMIX, Xuzhou Construction Machinery Group (XCMG) and Apollo Carmix are widely recognised as top players in the self-loading concrete mixer segment, with strong regional footprints and model breadth. Schwing-Stetter and Ajax compete on industrial-grade reliability and dense dealer/service networks in South Asia, while Fiori and Carmix (Italy) focus on premium build, off-road capability and operator ergonomics for Europe and export markets.

XCMG and several Chinese makers press on price-performance and rapid product iterations for larger APAC and export markets, and Apollo Carmix leverages a local JV to combine Italian design with Indian manufacturing. Manufacturers differentiate through specs, service networks, rental partnerships and embedded telematics.

Market Dominated by Self-Loading Concrete Mixer Giants and Specialists

Competition today looks like a two-track race between global giants and regional specialists, where machinery quality, aftersales and finance options matter as much as headline specs. Global brands bring R&D, product variants and trade-fair visibility; regional specialists win on local adaptation, spare parts availability and lower total cost of ownership.

Rental houses and dealer networks are decisive in markets with capex sensitivity, effectively becoming distribution and service arms that influence buyers. Telematics, emission compliance and electric-ready architectures are now table stakes for premium segments; meanwhile price-sensitive buyers still prioritise ruggedness and simple serviceability, creating niche windows for focused manufacturers.

Innovation and Adaptability Drive Market Success

Innovation and adaptability are central to market leadership, where companies push telematics, automated batching, low-noise cabs and electric/hybrid drive trials to meet urban procurement and emissions rules. Fiori recently expanded its presence in the Americas, signalling geographic play and product adaptation for articulated chassis requirements.

Schwing-Stetter and Ajax highlight product launches and dealer expansions aimed at urban and infrastructure projects, while Carmix and Apollo Carmix emphasise robust 4×4 mixer designs and local assembly to lower costs and improve service lead times. Across the board, embedded sensors, remote diagnostics and operator-friendly controls are being used to reduce downtime and support premium service contracts.

Market Players to Opt for Merger & Acquisition Strategies to Expand Their Presence

Mergers, JVs and strategic partnerships are logical routes to scale distribution, localise production and add complementary capabilities. A clear real-world example is Apollo Carmix, a JV combining Apollo Inffratech’s local manufacturing and Metalgalante/Carmix’s Italian design and IP to fast-track market share in India.

Manufacturers also expand via dealer tie-ups and regional subsidiaries (Fiori America’s expansion is a recent strategic move). Beyond pure mixers, consolidation in adjacent construction technology (e.g., recent acquisitions in construction chemicals) shows buyers and suppliers seeking vertically integrated offerings to win tenders; such moves illustrate why M&A and partnerships are attractive for quicker geography and capability play.

Key Players

-

Schwing Stetter India

-

Ajax Engineering Pvt. Ltd.

-

Fiori Group S.p.A.

-

CARMIX

-

Xuzhou Construction Machinery Group Co., Ltd.

-

Luton Group

-

HAMAC Machinery

-

Dieci S.r.l.

-

KATO IMER S.p.A.

-

M. Lorenzana S.L.

-

Piquersa Maquinaria, S.A.

-

AddForce

-

Apollo Carmix

-

Shandong Toros Machinery Co., Ltd.

-

Shengmao Machinery

What are the Latest Key Industry Developments?

-

April 2025- SCHWING Stetter India partners with MAX Truder GmbH to expand precast concrete production in India. This collaboration combines SSI’s local presence with extrusion-technology expertise, expanding the addressable market beyond mixers into precast elements.

-

Dec 2024- At Bauma Conexpo 2024, Fiori displayed new self-loading mixers (DBS 2800/4300 & DBX 2500/5000) and initiated expansion of its Indian dealership network, boosting local market penetration and showcasing tech for Indian job-sites.

-

December 2024- XCMG displayed over 100 flagship machines, demonstrating its push toward intelligent, new-energy construction equipment and reflecting pressure on concrete-equipment makers (including mixers) to adopt digital and green features.

-

May 2024- AJAX became the first Indian concrete equipment manufacturer to export its in-house slip-form paver to Russia and Africa, signalling its internationalisation and technological capability beyond self-loading mixers.

What are the Key Factors Influencing Investment Analysis & Opportunities in the Self-Loading Concrete Mixer Market?

Investment in the self-loading concrete mixer market is being shaped by a combination of technological innovation, operational efficiency, and growing infrastructure demand. Funding trends indicate increasing interest from both strategic investors and private equity players seeking exposure to construction equipment that combines productivity with adaptability. Valuations are influenced by a company’s technological capabilities, service network strength, and geographic reach, with firms offering telematics, AI-driven maintenance, and eco-friendly solutions commanding premium attention from investors.

Investment hotspots are concentrated in regions with rapid urbanization and infrastructure expansion, such as Asia-Pacific, parts of the Middle East, and emerging Latin American self-loading concrete mixer market. Companies operating in these areas, particularly those with local partnerships or rental-based business models, present attractive opportunities for expansion. The convergence of smart machinery adoption, sustainability initiatives, and demand for flexible equipment creates a compelling environment for strategic investments and portfolio diversification.

Key Benefits for Stakeholders:

Next Move Strategy Consulting (NMSC) presents a comprehensive analysis of the Self-Loading Concrete Mixer Market, covering historical trends from 2020 through 2024 and offering detailed forecasts through 2030. Our study examines the market at regional and country levels, providing quantitative projections and insights into key growth drivers, challenges, and investment opportunities across all major market segments.

Stakeholders across the self-loading concrete mixer market derive multiple benefits from its growth and technological advancements. Investors gain from robust returns driven by increasing demand for efficient, versatile construction equipment and the adoption of premium, technology-enabled models that command higher margins.

Customers, including contractors, rental houses, and infrastructure developers, benefit from faster on-site concrete mixing, reduced labour requirements, and enhanced project efficiency, especially in urban or remote sites where logistics are challenging. The integration of telematics, predictive maintenance, and eco-friendly solutions further ensures lower operating costs, improved uptime, and compliance with environmental regulations, creating a win-win scenario where both financial and operational stakeholders capture tangible value.

Report Scope:

|

Parameters |

Details |

|

Market Size in 2025 |

USD 6.18 Billion |

|

Revenue Forecast in 2030 |

USD 8.66 Billion |

|

Growth Rate |

CAGR of 6.65% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Countries Covered |

33 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent to up to 80 analyst-working hours) after purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

|

Approach |

In-depth primary and secondary research; proprietary databases; rigorous quality control and validation measures. |

|

Analytical Tools |

Porter's Five Forces, SWOT, value chain, and Harvey ball analysis to assess competitive intensity, stakeholder roles, and relative impact of key factors. |

Self-Loading Concrete Mixer Market Key Segments

By Type

-

Mini Self-loading Concrete Mixer

-

Standard Self-loading Concrete Mixer

-

Heavy-duty Self-loading Concrete Mixer

By Water Tank Capacity

-

Up to 300 L

-

301–600 L

-

601–800 L

-

Above 800 L

By Bucket Capacity

-

Up to 250 L

-

250–500 L

-

500–750 L

-

Above 750 L

By Engine Power

-

Less than 50 HP

-

50–80 HP

-

80–120 HP

-

Above 120 HP

By Drum Rotation

-

0–10 RPM

-

10–20 RPM

By Engine Type

-

Diesel Engines

-

Electric/Hybrid Units

By Ownership/Deployment

-

Contractor-owned/Private Fleets

-

Rental Fleets

By Application

-

Road Construction

-

Building Construction

-

Bridge Construction

-

Dam Construction

-

Others

By End-User

-

Construction Industry

-

Infrastructure Development

-

Residential Projects

-

Commercial Projects

-

Industrial Projects

Geographical Breakdown

-

North America: U.S., Canada, and Mexico.

-

Europe: U.K., Germany, France, Italy, Spain, Sweden, Denmark, Finland, Netherlands, and rest of Europe.

-

Asia Pacific: China, India, Japan, South Korea, Taiwan, Indonesia, Vietnam, Australia, Philippines, Malaysia and rest of APAC.

-

Middle East & Africa (MEA): Saudi Arabia, UAE, Egypt, Israel, Turkey, Nigeria, South Africa, and rest of MEA.

-

Latin America: Brazil, Argentina, Chile, Colombia, and rest of LATAM.

Conclusion & Recommendations

Our report equips stakeholders, industry participants, investors, and consultants with actionable intelligence to capitalize on the transformative self-loading concrete mixer market potential. By combining robust data-driven analysis with strategic frameworks, NMSC’s Market Report serves as an indispensable resource for navigating the evolving landscape.

The market is poised for continued growth, driven by urbanization, infrastructure expansion, and the adoption of advanced technologies such as telematics, AI-driven predictive maintenance, and eco-friendly powertrains. Companies that prioritize innovation, operational efficiency, and sustainability are likely to strengthen their competitive position, while flexible business models, including rental and service-based offerings, are emerging as key differentiators. The convergence of technological adoption and global infrastructure demand underscores a market that is both resilient and ripe for strategic expansion.

Executives and investors capitalize on these trends by focusing on regions with rapid urbanization and strong infrastructure pipelines, investing in companies that offer smart, low-emission, and high-efficiency machinery, and exploring strategic partnerships or acquisitions to expand geographic reach. Prioritizing innovation-led firms and service-oriented models will ensure higher returns, reduced risk, and long-term market relevance.

Speak to Our Analyst

Speak to Our Analyst