Platinum Market by Product Form (Refined Platinum, Platinum Powder, Platinum Compounds, Platinum Alloys), by Source (Primary Mining, Secondary Recycling), by Grade (High Purity, Technical Grade), by Application (Automotive, Jewellery, Industrial Medical and Other Applications) – Global Analysis & Forecast, 2025–2030

Industry Outlook

The global Platinum Market size was valued at USD 7.97 billion in 2024 and is expected to reach USD 8.47 billion by 2025. Looking ahead, the industry is projected to expand significantly, reaching USD 11.44 billion by 2030, registering a CAGR of 6.2% from 2025 to 2030.

The sector for global platinum production trends is entering a new phase of growth as the global shift toward cleaner energy increasingly shapes demand patterns. Hydrogen is becoming a central part of this transition, and with it, platinum is gaining importance as a critical enabler of next-generation energy technologies.

As countries and industries move toward low-emission hydrogen and expand their use of fuel cells and advanced catalytic systems, platinum’s role is expanding beyond its traditional industrial applications. This change is gradually redefining the market, positioning platinum as a key material linked to the broader clean-energy ecosystem rather than only legacy sectors.

For companies operating in hydrogen, fuel-cell manufacturing or catalyst technology, the evolving platinum market landscape presents an opportunity to strengthen their future position by improving catalyst efficiency, forming long-term supply partnerships and embedding recycling into their material strategies.

At the same time, the rapid global expansion of water-electrolyser installations essential for producing green hydrogen is further reinforcing platinum’s long-term growth outlook. As more countries implement national hydrogen strategies and companies scale up clean-energy infrastructure, demand for high-performance catalytic materials used in several electrolyser technologies is rising. This is widening platinum’s relevance across energy, industrial and mobility applications, making it increasingly important in low-carbon systems.

For the platinum market trends, this momentum offers a structural opportunity: growing electrolyser deployment strengthens platinum demand and enhances its strategic role in the clean-energy transition. Companies that invest in advanced catalyst design, expand their participation in hydrogen value chains and explore innovative recovery or recycling solutions will be well-positioned to benefit from this shift.

What are the Key Trends in the Platinum Industry?

How is the platinum market evolving under a structural supply-deficit scenario?

The platinum market demand is entering a phase where demand is consistently outpacing what miners supply, creating a tighter and more competitive environment for industries that rely on the metal. Recent outlooks from the USGS indicate that global production capacity is unlikely to expand meaningfully before 2029, keeping supply nearly flat even as industrial and clean-energy applications continue to grow.

At the same time, WPIC projects an average annual shortfall of around 727 koz between 2025 and 2029, roughly 9% above available supply, which reinforces the expectation of prolonged deficits. For the market, this means greater price volatility and increased pressure on downstream users.

Companies dependent on platinum from automotive and hydrogen technologies to chemical and electronics sectors should prepare by securing long-term contracts, diversifying suppliers, investing in recycling loops and adopting material-efficient designs to safeguard operations against tightening supply conditions.

How are evolving automotive technologies influencing platinum’s demand profile across regions?

The automotive industry is moving in two directions at once electric vehicles are growing fast, but many countries still depend heavily on internal-combustion and hybrid vehicles, especially in developing regions. This mix is shaping how the market behaves, because certain vehicle types, such as heavy-duty trucks and some hybrid models, continue to need platinum-based catalysts to meet emission standards.

As a result, global platinum demand from the auto sector isn’t disappearing, instead it is becoming more uneven across regions but still stable overall, driven by stricter pollution rules and slower EV adoption in some markets. For the market, this means the auto industry will remain a key and steady demand source in the near to medium term. Automotive companies respond by improving catalyst efficiency, adjusting sourcing based on regional trends and aligning their production plans with how quickly each market is transitioning to cleaner mobility.

How is the rise of recycling and circular-material strategies influencing the future of the platinum market?

Many industries are now prioritizing sustainability and long-term material security, and this is pushing recycling to the forefront of the market. Instead of depending only on newly mined platinum, companies are increasingly adopting circular-use strategies to recover the metal from used automotive parts, industrial catalysts and other end-of-life products. This shift is encouraging better collection systems, improved recycling technologies and closer collaboration across manufacturers, recyclers and refiners.

For the platinum industry as a whole, this means recycled platinum is gradually becoming an important additional source of supply, helping ease pressure on mining and reducing exposure to price swings. Businesses that invest early in recycling partnerships or recovery programs secure more stable access to platinum, lower operational costs and stay aligned with global sustainability goals, all of which strengthen their competitive position as demand for the metal continues to grow.

What are the Key Market Drivers, Breakthroughs, and Investment Opportunities that will Shape the Platinum Industry in the Next Decade?

The platinum industry is undergoing a significant transformation as the global shift toward clean energy accelerates demand across emerging applications. Industries are increasingly exploring hydrogen technologies, fuel cells and advanced catalytic systems, all of which depend on platinum’s unique performance characteristics. This growing focus on low-carbon solutions is expanding platinum’s relevance beyond its traditional uses in automotive and industrial processes.

As companies and governments invest in next-generation energy infrastructure, platinum is becoming a strategic material within the broader clean-energy ecosystem, encouraging businesses to innovate in catalyst design, efficiency and long-term material planning. At the same time, the platinum market expansion faces challenges tied to supply constraints, high production costs and the need for efficient recycling to keep pace with rising demand.

Navigating these hurdles requires companies to strengthen supply-chain resilience, improve recovery of secondary materials and adopt sustainable sourcing practices. Yet these challenges also create room for strategic opportunity: businesses that invest early in advanced hydrogen technologies, build strong recycling partnerships and enhance transparency across the value chain position themselves as leaders in a rapidly evolving market. As clean-energy adoption speeds up, companies capable of balancing innovation with sustainability will be best placed to shape the future of the platinum industry.

Growth Drivers:

How is the surge in hydrogen production creating downstream demand for platinum?

The growing push toward cleaner energy is beginning to reshape how the market develops, and hydrogen is at the center of this shift. The International Energy Agency notes that global hydrogen demand has already passed 97 million tonnes and is on track to reach around 100 million tonnes in 2024, showing that hydrogen is becoming a much bigger part of the global energy system.

Although most of today’s hydrogen is still used in traditional industries, the steady rise of low-emission hydrogen and electrolyzer technologies, many of which rely on platinum-group catalysts signals a new future demand stream for platinum. For the market, this means platinum is increasingly tied to the global clean-energy transition rather than only industrial processes.

Companies involved in hydrogen, fuel cells or catalytic technologies should prepare for stronger long-term demand by improving catalyst efficiency, securing supply partnerships and exploring recycling options to stay competitive as hydrogen adoption expands.

How is the rapid expansion of global electrolyzer capacity driving the market?

The platinum market is getting a major boost from the rapid growth in water-electrolyser installations worldwide, which are essential for producing green hydrogen and rely on platinum-group catalysts in several electrolyser technologies.

The International Energy Agency reports that global electrolyser capacity rose to 1.4 GW in 2023 and is expected to reach around 5 GW in 2024, reflecting accelerating investments and government-backed hydrogen strategies. As electrolyser deployment expands, the need for high-performance catalysts grows as well, supporting additional demand for platinum beyond its traditional automotive and industrial uses.

For the market, this creates a strong driver by tying future demand to the long-term global shift toward green hydrogen, increasing the material’s strategic importance in clean-energy systems.

Growth Inhibitors:

Could rapid EV adoption curb platinum demand from autocatalysts?

One key restraint for the market comes from the rapid global shift toward battery-electric vehicles, which do not require platinum-based catalytic converters. According to the International Energy Agency, electric car sales reached about 14 million units in 2023 and climbed past 17 million in 2024, giving EVs over a 20% share of global car sales.

As more countries push zero-emission vehicle policies, this trend gradually reduces the number of combustion-engine vehicles on the road and with it, the long-standing demand for platinum in autocatalysts. Although hybrids and heavy-duty engines still rely on platinum, the overall direction of the market is clear: faster electrification will increasingly limit growth from this traditional segment.

For the platinum sector, this means planning for a future where automotive demand becomes smaller and shifting toward opportunities in hydrogen technologies, industrial uses and recycling to stay resilient.

How is the rise of advanced industrial applications opening new opportunities for the platinum market growth?

A promising opportunity for the market is emerging as more industries adopt advanced, high-performance manufacturing technologies that depend on reliable and efficient catalysts. Sectors like chemicals, petrochemicals, electronics and specialty materials are all shifting toward cleaner, more efficient production methods, and platinum’s unique durability and catalytic strength make it an ideal fit for these upgraded processes.

As a result, companies are increasingly using platinum in applications such as chemical synthesis, precision coatings and electronic component production. For the market, this means demand is expanding into new industrial areas that are driven by long-term innovation rather than short-term cycles.

Businesses take advantage of this by developing tailored platinum-based materials, partnering with industrial tech suppliers and improving catalyst efficiency to secure a strong position in these growing, high-value segments.

How is the Platinum Market Report Segmented, and What are the Key Insights from the Segmentation Analysis?

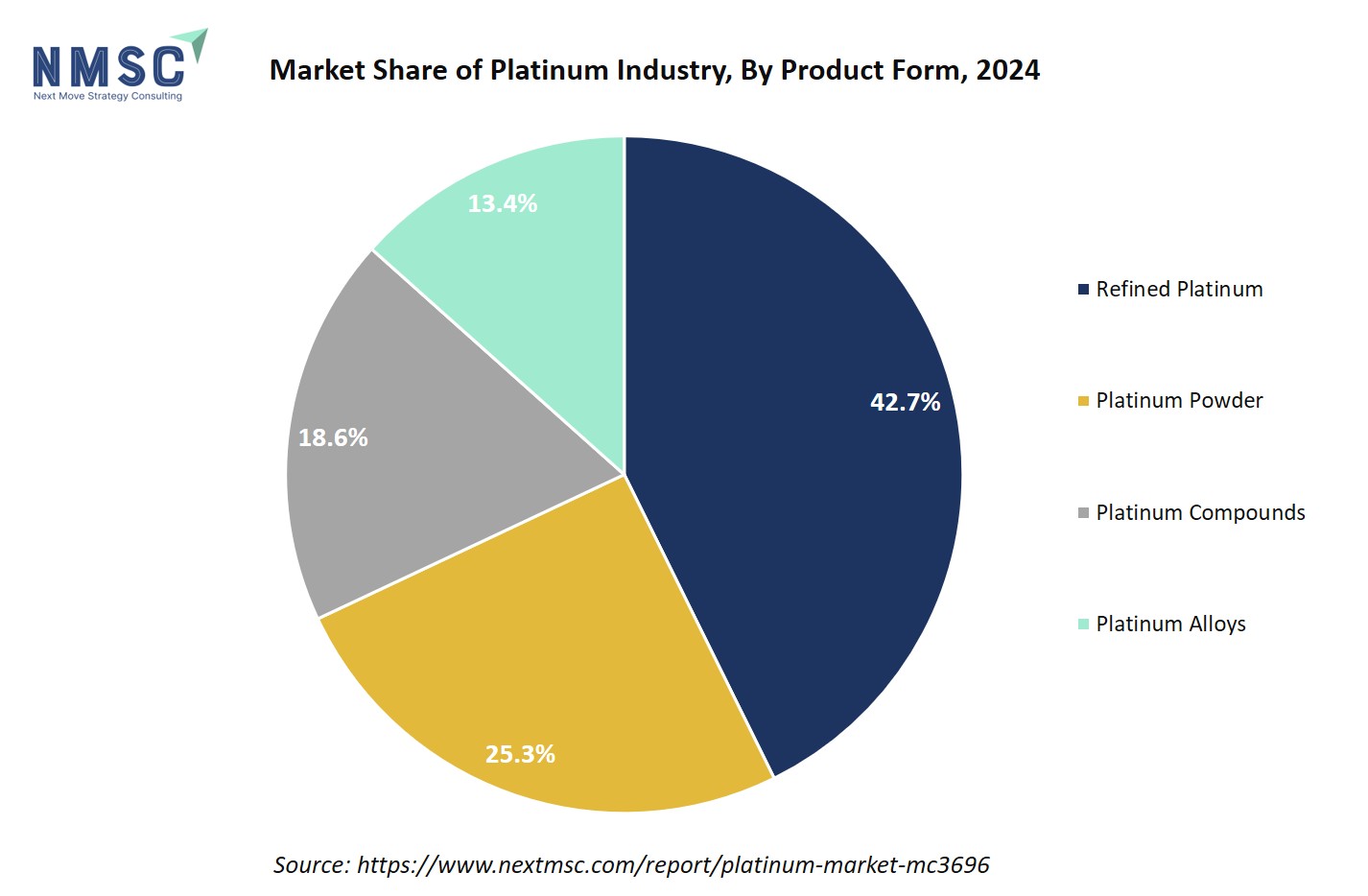

By Product Form Insights

Is the Platinum Industry in 2025 Shaped by Diverse Product Form?

Based on product form, the market is segmented into refined platinum, platinum powder, platinum compounds and platinum alloys.

Refined Platinum is the processed and purified form of platinum obtained from primary mining or recycled sources. It represents the highest purity metallic form, suitable for a wide range of industrial, automotive, jewelry, and investment applications. Refined platinum is typically produced as ingots, bars, or sheets and serves as the standard material for further processing into specialized products such as alloys, catalysts, and fine jewelry. This segment is distinguished by its high purity, uniformity, and versatility across multiple end-use industries.

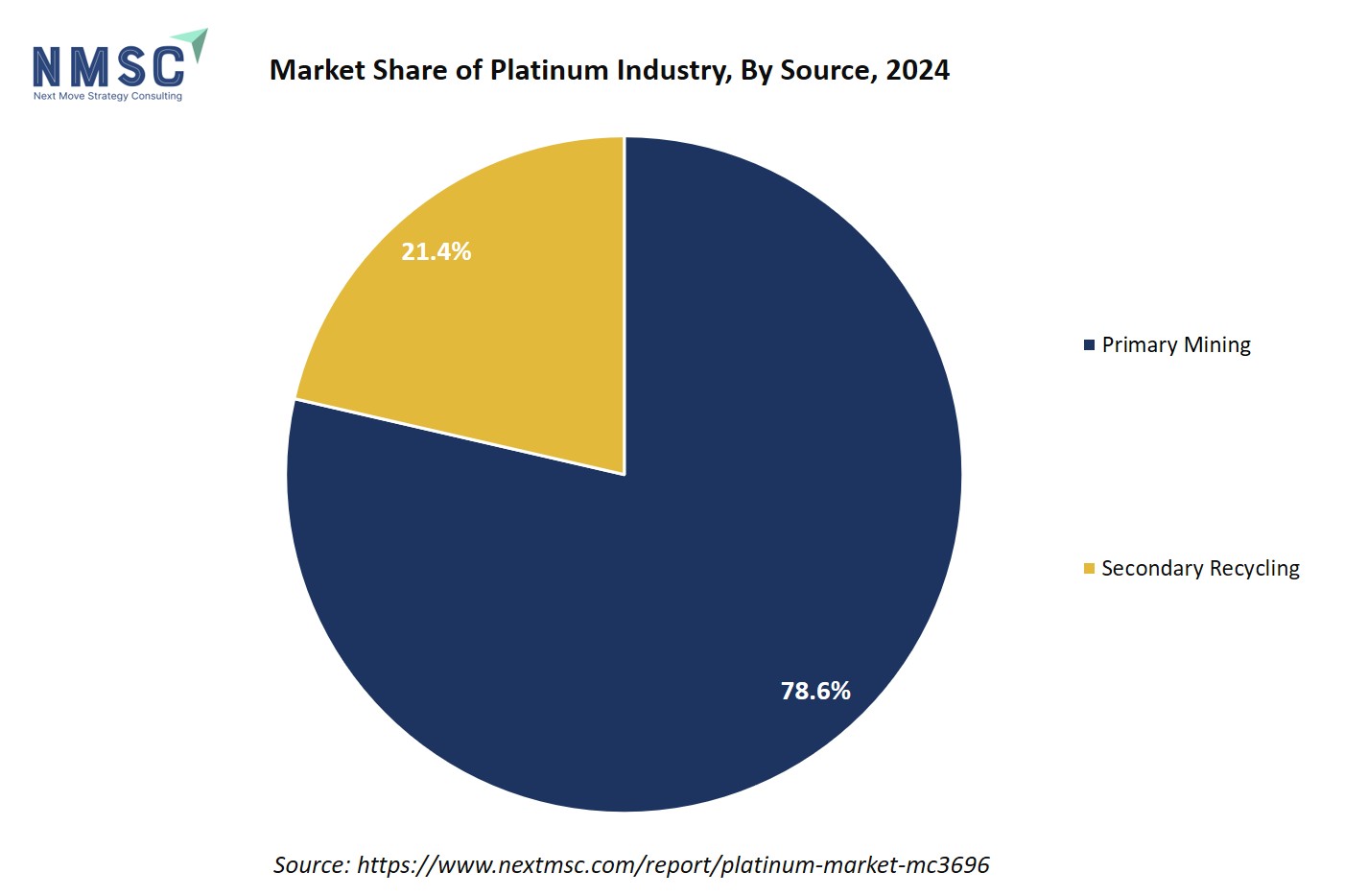

By Source Insights

Is the Platinum Market Trends in 2025 Being Shaped by Source?

On the basis of source, the market is segmented into primary mining and secondary recycling.

Primary mining refers to the extraction of platinum directly from naturally occurring mineral deposits. This involves mining ores from the earth, processing them to concentrate the platinum group metals, and then refining them into pure platinum. It represents the main source of fresh supply in the market.

Secondary recycling refers to the recovery of platinum from pre-used or waste materials, such as automotive catalytic converters, electronic scrap, jewelry, and industrial by-products. The recovered platinum is processed and refined to produce high-purity metal, contributing to sustainable supply and reducing dependence on primary mining.

By Grade Insights

How are Grade Driving the Platinum Industry in 2025?

On the basis of Grade, the market is segmented into high purity and technical grade.

High purity platinum refers to platinum that has been refined to contain a very high concentration of the metal, typically above 99.9 percent. It is used in applications that demand exceptional chemical stability, corrosion resistance, and performance, such as precision electronics, laboratory equipment, high-end jewelry, and specialized industrial catalysts.

Technical grade platinum is a lower-purity form of the metal, generally ranging from 95 to 99.9 percent purity. It is suitable for general industrial applications where absolute purity is not critical, such as bulk chemical catalysts, automotive components, and large-scale manufacturing processes.

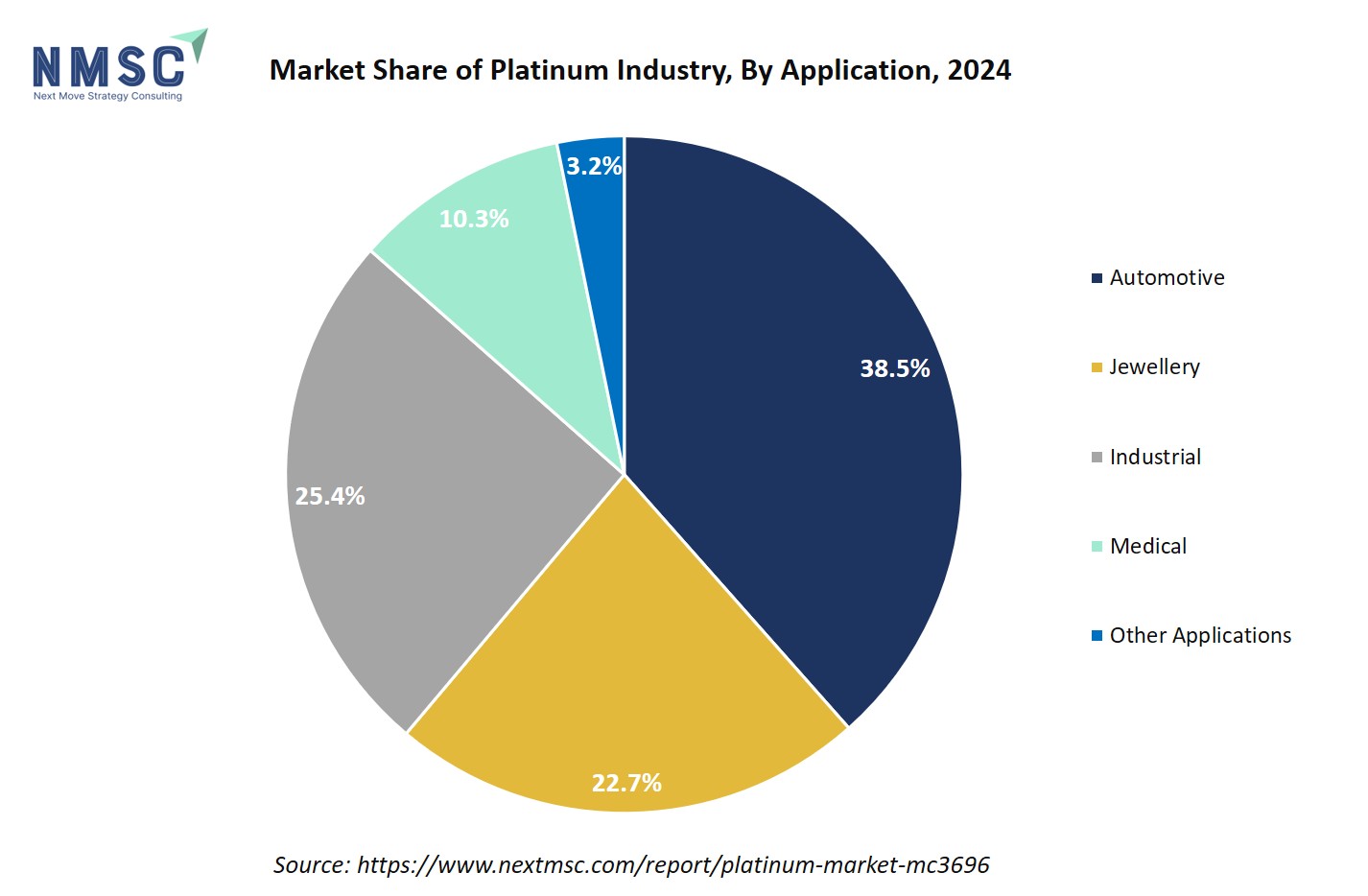

By Application Insights

Which Applications Are Driving the Platinum Market in 2025?

On the basis of application, the market is segmented into automotive, jewellery, industrial, medical and other applications.

Automotive refers to the use of platinum in vehicles, primarily for emission control and alternative energy solutions. The segment includes Catalytic Converters, which reduce harmful exhaust emissions from gasoline and diesel engines by facilitating chemical reactions that convert pollutants into less harmful gases. It also includes Hybrid and Fuel Cell Vehicles, where platinum acts as a key catalyst in fuel cells, enabling the efficient conversion of hydrogen into electricity to power the vehicle. This segment is a major driver of platinum demand due to regulatory requirements for cleaner emissions and the growing adoption of green mobility technologies.

Regional Outlook

The platinum market share is geographically studied across North America, Europe, Asia Pacific, Middle East & Africa, and Latin America and each region is further studied across countries.

Platinum Market in North America

The North American market is influenced by a steady industrial foundation and a gradual shift toward clean-energy applications. Core sectors such as chemicals, refining, and electronics continue to anchor demand, while emerging hydrogen and fuel-cell initiatives in the U.S. and Canada are creating new opportunities for platinum use.

Although rising EV adoption moderates some autocatalyst requirements, ongoing emissions standards for heavy-duty vehicles help maintain demand within the transport sector. With the region relying largely on imports and recycled supplies, market participants remain sensitive to global supply dynamics. Overall, the blend of stable industrial activity and expanding clean-energy projects positions North America for sustained, but evolving platinum demand.

Platinum Market in the United States

The U.S. market is shaped by strategic policy priorities, decarbonization goals, and established industrial uses. Platinum remains an essential material for sectors such as refining, aerospace, and emissions control, reinforcing its status as a strategic input. Growing national initiatives around hydrogen, clean fuels, and electrolyser deployment are opening a new avenue of catalyst demand, gradually shifting the sector’s focus toward clean-energy applications. While increasing EV adoption softens some autocatalyst requirements, demand from heavy-duty transport and industrial systems continues to provide stability. For market players, this environment underscores the need to manage limited domestic supply, strengthen recycling channels, and position procurement strategies to align with the expanding hydrogen economy.

Platinum Market in Canada

Canada’s market is increasingly supported by the country’s push toward a full hydrogen ecosystem, where platinum’s catalytic properties make it indispensable for next-generation energy technologies. According to Natural Resources Canada, the national hydrogen value chain spanning production, storage/distribution and end-use relies on platinum-group metals, including platinum, as critical materials for fuel cells and electrolysers. This integration of platinum into Canada’s clean-energy build-out strengthens its role in the emerging hydrogen economy and drives sustained demand in the Canadian market.

Platinum Market in Europe

Europe’s market is evolving under the weight of ambitious climate policies, tightening vehicle-emission norms, and accelerated investment in hydrogen technologies. Stricter standards for CO₂ and heavy-duty vehicles continue to sustain platinum use in advanced emission-control systems, even as parts of the transport sector transition away from combustion.

At the same time, the EU’s strong backing for electrolysers, hydrogen hubs, and clean-energy industrial projects directly strengthens the region’s reliance on platinum-based catalysts. Coupled with Europe’s emphasis on recycling and critical-mineral security, these policies support both primary and secondary platinum flows, reinforcing the region’s role as a key demand centre within the global market.

Platinum Market in the United Kingdom

The United Kingdom’s platinum market is being reshaped by its decarbonisation agenda, the shift toward zero-emission mobility, and growing interest in hydrogen and industrial clean-technology projects. Although increasing EV adoption softens traditional autocatalyst demand, national initiatives around hydrogen hubs, industrial decarbonisation, and advanced recycling are creating new pathways for platinum use in fuel-cell and industrial catalysts.

At the same time, the continued presence of combustion and hybrid vehicles maintains a base level of demand. Together, these trends signal a market moving away from a reliance on autocatalysts and toward a more diversified role for platinum within the UK’s clean-energy transition and circular-supply ambitions.

Platinum Market in Germany

A key driver for Germany’s market is the country’s advanced automotive and industrial technology base, which continues to rely on high-performance catalysts. Germany’s strong manufacturing ecosystem spanning chemicals, automotive engineering, and precision industrial processes creates steady demand for platinum in applications such as catalytic converters, specialty chemicals, and high-efficiency industrial systems.

As manufacturers pursue cleaner production methods and more efficient emission-control technologies, platinum remains central to meeting performance and regulatory requirements. This combination of technological leadership and stringent environmental standards positions Germany as a consistent and innovation-driven consumer of platinum within Europe.

Platinum Market in France

A key driver for France’s market is the country’s strong industrial and chemical-processing sector, which relies heavily on high-performance catalysts. France’s well-established refining, petrochemical, and specialty-chemical industries use platinum-based catalysts to support cleaner production, efficiency gains, and adherence to strict environmental standards.

As the nation continues to modernize industrial facilities and enhance sustainability within heavy manufacturing, demand for advanced catalytic materials such as platinum remains supported. This industrial backbone helps position France as a steady and strategically important market for platinum within Europe.

Platinum Market in Italy

Italy’s market is supported by long-standing industrial uses in catalysts, petrochemicals, and select automotive applications, while the country’s energy-transition initiatives are gradually opening space for hydrogen pilots that expand future catalyst demand. Intermittent jewellery consumption also adds a secondary layer of support.

Because Italy’s industrial and regulatory environment is closely aligned with wider European policies, shifts in EU emissions standards and hydrogen strategies directly influence domestic investment and platinum usage. As a result, the Italian sector is balancing its traditional industrial base with emerging opportunities in hydrogen technologies and growing interest in recycling and circular-supply approaches.

Platinum Market in Spain

Spain’s market is increasingly shaped by the country’s expanding renewable-energy foundation and its strong commitment to developing a competitive hydrogen economy. As Spain accelerates hydrogen production for industrial decarbonisation and future export potential, the role of platinum-based catalysts in electrolysers and fuel-cell systems becomes more prominent.

At the same time, Spain’s alignment with broader EU priorities on recycling and critical-material security encourages the growth of secondary platinum supply and catalyst recovery. Together, these factors position Spain as an emerging Southern European hub where renewable strength and hydrogen initiatives support a growing and strategically relevant market.

Platinum Market in the Nordics

The Nordic region’s market is reinforced by its strong decarbonisation agenda, extensive renewable-energy capacity, and early commitment to hydrogen and green-fuel development. As countries across the region advance hydrogen pilots and clean-industry projects, the use of platinum in fuel-cell and electrolyser technologies becomes increasingly important.

At the same time, the Nordics’ emphasis on circularity and high recycling standards supports a stable secondary supply of platinum. Together, these factors create a favourable environment for growing platinum demand tied to low-carbon industrial applications and emerging green-hydrogen opportunities across the region.

Platinum Market in the Asia-Pacific

Asia-Pacific has become one of the most dynamic regions shaping global platinum demand, driven by rapid shifts in mobility, large-scale hydrogen ambitions, and a broad base of industrial and consumer applications. While some markets are moving quickly toward electric mobility reducing traditional autocatalyst use, others are advancing hydrogen, fuel-cell, and industrial decarbonisation initiatives that increase the need for platinum-based catalysts. The region’s diverse pace of transition results in varied demand patterns, but collectively it creates significant long-term potential for platinum linked to clean-energy deployment and industrial expansion.

Platinum Market in China

China’s market is increasingly influenced by its advanced industrial and chemical-processing sectors, which rely on high-performance catalysts for efficiency and emissions control. Strong growth in specialty chemicals, refining, and heavy industry drives sustained platinum demand, while innovation in industrial processes and cleaner production technologies further reinforces its role. This industrial backbone positions China as a critical market for platinum, where technological advancement and modernization efforts continue to underpin steady and strategic demand.

Platinum Market in Japan

A key driver for Japan’s market is the country’s advanced industrial and electronics sector. Japan’s strong focus on high-tech manufacturing, including chemical processing, electronics, and precision machinery, relies heavily on platinum-based catalysts for efficiency, durability, and high-performance processes. Continuous innovation in industrial technologies and efforts to improve sustainability and energy efficiency further reinforce the need for platinum. This combination of technological leadership and industrial sophistication positions Japan as a steady and strategically important market for platinum demand.

Platinum Market in India

A key driver for India’s market is the country’s strong automotive production. According to the Society of Indian Automobile Manufacturers, India produced approximately 31 million vehicles in FY 2024 25 across passenger cars, commercial vehicles, two- and three-wheelers, and quadricycles.

Since platinum is a critical component in autocatalysts that reduce emissions in internal-combustion and hybrid vehicles, this high vehicle output directly supports steady demand for platinum. The scale of India’s automotive industry, together with ongoing emission regulations, makes autocatalyst-related platinum consumption a significant driver of the domestic market.

Platinum Market in South Korea

South Korea’s market is influenced by the country’s growing focus on fuel-cell and clean-energy mobility solutions. As South Korea invests in hydrogen-powered transport and industrial applications, platinum-based catalysts play a critical role in fuel-cell technologies. Government support for innovation, infrastructure development, and sustainable energy adoption further strengthens the need for platinum, positioning the country as an important regional market for the metal in emerging clean-energy technologies.

Platinum Market in Taiwan

Taiwan’s market is shaped by its high-tech electronics and semiconductor industries. Platinum is used in various industrial processes, including precision manufacturing and chemical applications critical to semiconductor production. As Taiwan continues to expand its semiconductor capacity and advanced electronics manufacturing, demand for platinum in catalysts and industrial processes is reinforced, making the country an important player in the regional platinum market.

Platinum Market in Indonesia

Indonesia’s market is shaped by its expanding automotive sector and increasing focus on emission control technologies. Platinum is a key component in autocatalysts, which help vehicles meet environmental and regulatory standards. As vehicle production grows and emission regulations tighten, demand for platinum in catalytic converters rises, making the automotive industry an important driver of the domestic market.

Platinum Market in Australia

Australia’s market is supported by its strong mining and metallurgical industries. Platinum is used in various industrial applications, including chemical processing, refining, and high-performance manufacturing. As Australia continues to expand its advanced industrial capabilities and focus on resource processing and technological innovation, demand for platinum in industrial catalysts and specialty applications remains significant, reinforcing the country’s role in the regional market.

Platinum Market in Latin America

Latin America’s market is influenced by its growing jewelry and luxury goods sector. Platinum is highly valued for high-end jewelry due to its durability, purity, and aesthetic appeal. As consumer demand for premium jewelry continues to rise across the region, this segment provides steady and significant support for platinum consumption, making the luxury and consumer goods market an important driver of regional platinum demand.

Platinum Market in the Middle East & Africa

This combined region presents two contrasting dynamics for the market. Africa, particularly South Africa, continues to dominate global supply due to its rich geological endowment and extensive mining operations, making production decisions there a key factor in worldwide platinum availability. Meanwhile, the Middle East is emerging as a potential growth area for platinum demand through its development of hydrogen clusters and fuel-cell projects.

The region’s reliance on concentrated supply from Africa, coupled with limited recycling, creates vulnerabilities in the global market. Overall, while Africa anchors platinum supply, demand growth is increasingly driven by the Middle East’s clean-energy ambitions and Africa’s opportunities for downstream industrial use, together shaping global platinum trends.

Competitive Landscape

Which Companies Dominate the Platinum Industry and How do they Compete?

Leading companies in the industry, including Johnson Matthey, Umicore, BASF, and TANAKA PRECIOUS METAL GROUP, have solidified their positions through innovation, strategic partnerships, and global expansion. Johnson Matthey leverages its expertise in catalysts and platinum-group metals to develop solutions for clean energy and industrial applications.

Umicore focuses on circular economy initiatives, producing recycled PGMs and sustainable materials that meet growing environmental standards. BASF invests in advanced R&D for platinum-based catalysts in hydrogen and industrial processes, while TANAKA drives innovation with high-performance platinum materials for industrial and medical applications. These companies differentiate themselves by combining technological leadership, sustainability, and product quality to strengthen their competitive edge.

Other key players such as Sibanye-Stillwater, NIPPON PGM, MKS PAMP GROUP, ARGOR-HERAEUS, CHIMET, VALCAMBI, Norilsk Nickel, Hindustan Platinum, Aida Chemical, Northam Platinum, and IMPLATS focus on strategic acquisitions, expanding production and recycling capabilities, and securing reliable platinum supply chains.

By investing in downstream applications, global partnerships, and circular economy solutions, these companies enhance their market reach while responding to rising demand in automotive, industrial, and clean-energy sectors. Collectively, the strategic initiatives of these market leaders highlight a competitive landscape driven by innovation, sustainability, and global expansion in the platinum industry.

Market Dominated by Platinum Giants and Specialists

The platinum industry is shaped by a mix of global leaders and specialized players, each establishing strengths across different regions and applications. Companies like Johnson Matthey, Umicore, and BASF lead the global landscape through innovation, broad portfolios, and advanced R&D capabilities, particularly in catalysts, hydrogen technologies, and industrial applications.

Meanwhile, specialized firms such as TANAKA, NIPPON PGM, and Aida Chemical focus on niche platinum products, high-performance materials, and tailored solutions for specific industrial or medical uses. This dual structure promotes dynamic competition, with major players leveraging scale, global reach, and technological leadership, while specialists drive innovation in targeted segments.

Regional and local companies further enhance competitiveness by understanding specific market needs and regulatory frameworks, enabling them to deliver customized solutions and strengthen their position in the platinum sector.

Innovation and Adaptability Drive Market Success

Innovation is a key driver of success in the platinum sector, with companies continually developing new products and applications to meet evolving consumer demands. Umicore’s launch of Nexyclus in April 2024, featuring fully recycled precious metals including platinum-group metals, exemplifies how innovation and adaptability are key drivers of market success.

By introducing a circular-sourcing product line, the company not only addresses supply constraints in the market but also aligns with the growing global emphasis on sustainability and resource efficiency. This proactive approach demonstrates that companies able to innovate by developing recycled, high-quality PGM materials secure a competitive advantage, meet evolving customer expectations, and enhance resilience against market volatility. Umicore’s strategy shows that adapting to environmental and economic pressures through technological and process innovation is critical for long-term growth in the platinum industry.

Market Players to Opt for Merger & Acquisition Strategies to Expand Their Presence

Merger and acquisition (M&A) strategies have become pivotal for companies aiming to strengthen their position in the market. In July 2025, Sibanye-Stillwater’s acquisition of Metallix Refining underscores a broader trend in the market where companies are leveraging mergers and acquisitions to expand their presence and capabilities.

By incorporating two U.S. recycling sites, Sibanye not only strengthens its PGM recycling capacity but also enhances supply chain security for platinum and other precious metals. This strategic move enables the company to better meet growing demand from industrial and clean-energy sectors while reinforcing its position in the circular economy. Such M&A initiatives reflect how market players are actively seeking growth, diversification, and competitive advantage in a landscape shaped by rising platinum demand and sustainability priorities.

Key Players

-

Johnson Matthey

-

TANAKA PRECIOUS METAL GROUP Co., Ltd.

-

NIPPON PGM Co., Ltd

-

MKS PAMP GROUP

-

ARGOR-HERAEUS SA

-

Sibanye‑Stillwater

-

CHIMET

-

VALCAMBI SA

-

Norilsk Nic

-

Hindustan Platinum Pvt. Ltd.

-

Aida chemical Industries Co., Ltd

-

Northam Platinum

-

IMPLATS

What are the Latest Key Industry Developments?

-

November 2024 - BASF ECMS opened a hydrogen R&D lab in Hannover to develop next-generation PGM catalysts for water electrolysis. This move strengthens BASF’s innovation in platinum-based technologies and positions the company to benefit from growing demand in the green hydrogen market, highlighting platinum’s key role in clean-energy solutions.

-

November 2024 - Tanaka unveiled a breakthrough nano grain platinum material with ultra-high hardness and nano-sized crystal grains, offering superior strength and durability. This innovation reinforces Tanaka’s leadership in platinum technologies and supports growing demand for high-performance platinum applications in industrial, medical, and clean-energy sectors.

What are the Key Factors Influencing Investment Analysis & Opportunities in the Platinum Market?

Investment in platinum is increasingly influenced by the growing global shift toward clean energy and low-emission technologies. Investors are focusing on companies that specialize in platinum-based catalysts for hydrogen production, fuel cells, and industrial decarbonisation solutions, as well as those involved in advanced recycling and supply-chain optimization.

Market confidence is stronger for businesses that prioritize efficiency, reliability, and sustainability in their platinum applications, as these factors help mitigate supply risks and position companies for long-term growth. The strategic importance of platinum in emerging energy technologies makes it an attractive segment for investors seeking exposure to both industrial and clean-energy markets.

Valuations in the platinum sector are shaped by technological innovation, intellectual property in catalyst design, and the ability to scale production and recycling operations effectively. Investment interest is particularly high in regions with robust industrial infrastructure and active clean-energy initiatives, including Europe, North America, and parts of Asia-Pacific.

Companies that integrate ethical sourcing, advanced catalyst technologies, and circular economy practices are likely to draw more investor attention, while strategic partnerships, joint ventures, and R&D collaborations strengthen their market positioning in a rapidly evolving industry.

Key Benefits for Stakeholders:

Next Move Strategy Consulting (NMSC) presents a comprehensive analysis of the Platinum Market, covering historical trends from 2020 through 2024 and offering detailed forecasts through 2030. Our study examines the market at regional and country levels, providing quantitative projections and insights into key growth drivers, challenges, and investment opportunities across all major segments.

The industry delivers significant value across multiple stakeholders by connecting economic opportunity with the global transition toward clean energy and industrial decarbonisation. Investors benefit from exposure to a strategically important commodity with growing demand in hydrogen, fuel-cell technologies, and industrial catalysts. Manufacturers and technology developers gain access to high-performance platinum-based materials that enable advanced energy solutions and industrial processes, while customers ranging from industrial users to energy providers benefit from reliable, efficient, and sustainable catalyst solutions.

Additionally, recyclers and suppliers play a critical role in maintaining supply continuity and supporting circular economy practices. Together, this ecosystem fosters mutual growth, where innovation, efficiency, and sustainability create value for both financial stakeholders and end users in a rapidly evolving market.

Report Scope:

|

Parameters |

Details |

|

Market Size in 2025 |

USD 8.47 Billion |

|

Revenue Forecast in 2030 |

USD 11.44 Billion |

|

Growth Rate |

CAGR of 6.2% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Countries Covered |

33 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent to up to 80 analyst-working hours) after purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

|

Approach |

In-depth primary and secondary research; proprietary databases; rigorous quality control and validation measures. |

|

Analytical Tools |

Porter's Five Forces, SWOT, value chain, and Harvey ball analysis to assess competitive intensity, stakeholder roles, and relative impact of key factors. |

Platinum Market Key Segments

By Product Form

-

Refined Platinum

-

Platinum Powder

-

Platinum Compounds

-

Platinum Alloys

By Source

-

Primary Mining

-

Secondary Recycling

By Grade

-

High Purity

-

Technical Grade

By Application

-

Automotive

-

Catalytic Converters

-

Hybrid and Fuel Cell Vehicles

-

-

Jewellery

-

Rings and Bands

-

Necklaces and Bracelets

-

Watches

-

-

Industrial

-

Chemical Catalysts

-

Glass Manufacturing

-

Electronics Components

-

Petroleum Refining

-

-

Medical

-

Diagnostic Equipment

-

Surgical Instruments

-

Laboratory Equipment

-

Biomedical Implants

-

Dental Materials

-

-

Other Applications

Geographical Breakdown

-

North America: U.S., Canada, and Mexico.

-

Europe: U.K., Germany, France, Italy, Spain, Sweden, Denmark, Finland, Netherlands, and rest of Europe.

-

Asia Pacific: China, India, Japan, South Korea, Taiwan, Indonesia, Vietnam, Australia, Philippines, Malaysia and rest of APAC.

-

Middle East & Africa (MEA): Saudi Arabia, UAE, Egypt, Israel, Turkey, Nigeria, South Africa, and rest of MEA.

-

Latin America: Brazil, Argentina, Chile, Colombia, and rest of LATAM.

Conclusion & Recommendations

Our report equips stakeholders, industry participants, investors, and consultants with actionable intelligence to capitalize on the transformative potential of the market. By combining robust data-driven analysis with strategic frameworks, NMSC’s Platinum Market Report serves as a vital resource for navigating the evolving landscape shaped by clean-energy adoption, hydrogen technologies, and industrial decarbonisation.

The sector is positioned for sustained growth, driven by rising demand for fuel-cell systems, hydrogen electrolysers, and advanced industrial catalysts. Strategic takeaways emphasize the importance of catalyst innovation, efficient recycling, and supply-chain resilience, as these factors enhance operational reliability and market competitiveness. Companies that focus on high-performance platinum-based solutions, diversify applications across energy and industrial sectors, and integrate circular-economy practices are best positioned to capture market share and strengthen long-term growth prospects.

For executives and investors, the key to capitalizing on these trends lies in identifying high-potential applications, investing in R&D for next-generation platinum catalysts, and fostering strategic partnerships to expand technological and geographic reach. Prioritizing regions with supportive policy frameworks, hydrogen infrastructure, and industrial innovation hubs optimizes deployment and sourcing strategies.

Additionally, emphasizing material efficiency, sustainable supply practices, and transparency in catalyst performance builds credibility and accelerates adoption, unlocking significant opportunities for value creation in the global market.

Speak to Our Analyst

Speak to Our Analyst