Virtual Fitness Market by Session Type (Group Classes and Solo Training), Streaming Type (Live Streaming, On-Demand Streaming), Program Type (Weight Loss, Muscle Gain and Others), Platform Type (Mobile-First Platforms, Web Platforms, Immersive Tech Platforms), Device Type (Smartphones, Others), Business Model (Subscription-Based, Pay-Per-Class and Others), and End User Segment (Individual Consumers, Professional Gyms and Others) – Global Opportunity Analysis and Industry Forecast, 2024–2030

Industry Overview

The global Virtual Fitness Market size was valued at USD 51.10 billion in 2024 and is predicted to reach USD 68.09 billion by the end of 2025. The industry is predicted to reach USD 286.04 billion by 2030 with a CAGR of 33.25% from 2025 to 2030.

The market is experiencing robust growth, driven by rapid technological advancements, rising health and wellness awareness, and widespread adoption of smart devices. Innovations such as artificial intelligence, augmented reality, and virtual reality are enhancing personalization, interactivity, and user engagement, while growing health consciousness is prompting more individuals to integrate virtual workouts into their daily routines.

High smartphone and wearable device penetration further facilitates seamless access to fitness platforms and real-time progress tracking, making the experience more engaging and accessible. However, market expansion is hindered by limited internet accessibility in rural and underdeveloped areas, which affects service quality and adoption.

Despite this challenge, opportunities remain strong, particularly in leveraging AI for tailored fitness solutions, enabling providers to differentiate offerings, increase retention, and tap into evolving consumer preferences for customized, flexible, and immersive fitness experiences.

Technological Advancements Enhancing Personalization and Engagement in Virtual Fitness

Technological advancements play a crucial role in driving the growth of the market. The incorporation of cutting-edge technologies like artificial intelligence (AI), augmented reality (AR), and virtual reality (VR) has significantly transformed how fitness services are delivered and experienced. AI enables personalized workout plans tailored to individual fitness levels and goals, improving effectiveness and user engagement.

Meanwhile, AR and VR create immersive and interactive workout environments that enhance motivation and make exercising more enjoyable. These innovations not only attract a wider range of users but also help retain them by offering a more engaging and customized fitness experience, thereby fuelling market expansion.

Increasing Health and Wellness Awareness Drives Demand for Virtual Fitness

Growing health and wellness awareness is a significant driver of the market. As more people recognize the importance of maintaining a healthy lifestyle to prevent chronic diseases and improve overall well-being, there is an increased demand for accessible and effective fitness solutions.

Virtual fitness platforms offer convenient options for users to engage in regular physical activity without the constraints of time or location. This rising consciousness about health encourages individuals to adopt virtual workouts as part of their daily routine, thereby boosting the market’s growth and expanding its user base.

Widespread Smart Device Adoption Boosts Engagement in Virtual Fitness

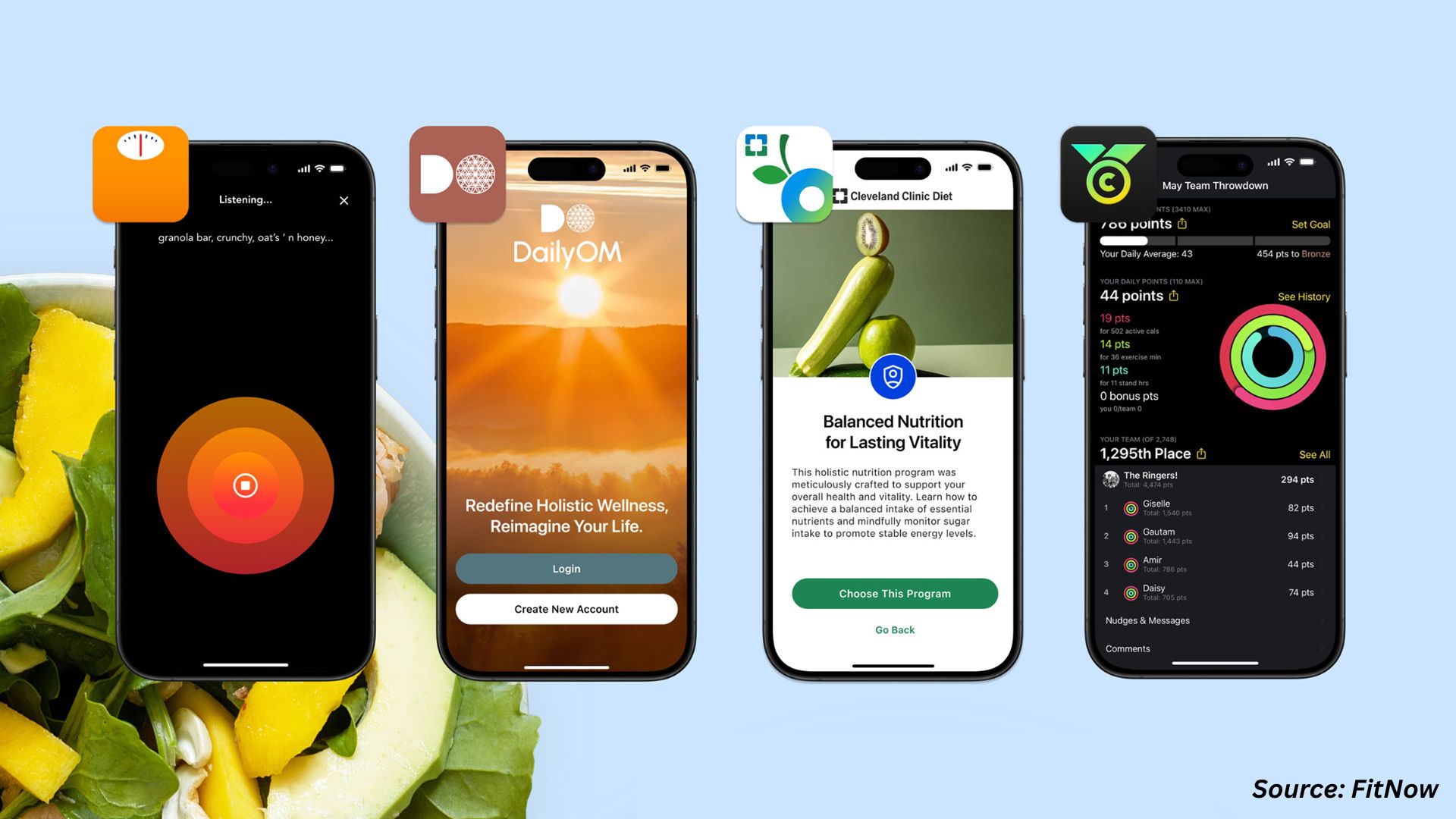

The widespread adoption of smart devices is a major driver of the virtual fitness market demand. According to Pew Research Center in 2024, 98% of Americans now own a cellphone, with 91% specifically using smartphones. This high smartphone penetration, along with the growing use of tablets and wearable fitness trackers, enables users to easily access virtual fitness platforms anytime and anywhere.

These devices allow for seamless integration of workouts into daily routines and provide real-time tracking of health metrics such as heart rate, calories burned, and activity levels. This continuous connectivity and data-driven feedback enhance the overall fitness experience, making virtual fitness more appealing and accessible to a wide audience, thereby driving market growth.

Limited Internet Accessibility and Connectivity Issues Hinders the Market Growth

A significant challenge hindering the growth of the market is the lack of reliable internet access in many regions, particularly in rural, remote, and underdeveloped areas. Virtual fitness platforms heavily rely on stable, high-speed internet connections to deliver live streaming, interactive sessions, and real-time feedback.

When connectivity is weak or inconsistent, users experience buffering, lag, or disconnections, which disrupts the workout experience and reduces engagement. This led to user frustration and decreased adoption rates in these areas.

Additionally, inadequate internet infrastructure limits the ability of virtual fitness providers to expand their services globally, particularly in emerging markets where there is strong potential demand. Overcoming this digital divide remains a key obstacle to fully unlocking the market’s growth potential.

Integration of AI and Personalized Fitness Solutions Creates New Growth Opportunities for the Market

The market has a significant opportunity to leverage advancements in artificial intelligence (AI) to offer highly personalized workout experiences. By using AI-driven data analytics, virtual fitness platforms tailor exercise routines, nutrition plans, and progress tracking to individual users’ needs, preferences, and performance levels.

This personalization increases user engagement, satisfaction, and long-term retention. As consumers increasingly seek customized fitness solutions, integrating AI technology presents a powerful growth avenue for virtual fitness providers to differentiate themselves and attract a broader audience.

Market Segmentations and Scope of the Study

The virtual fitness market report is divided on the basis of session type, streaming type, program type, platform, device type, business model, end user and region. On the basis of session type, the market is grouped into group classes and solo training. On the basis of streaming type, the market is categorized into live streaming and on-demand streaming. On the basis of program type, the market is grouped into weight loss, muscle gain, endurance training, and flexibility & balance. On the basis of platform, the market is categorized into mobile-first platforms, web platforms, and immersive tech. Regional breakdown and analysis of each of the aforesaid segments includes regions comprising of Asia-Pacific, North America, Europe, and RoW.

Geographical Analysis

In North America, the increasing acceptance and use of digital health and fitness technologies act as a key driver for the virtual fitness market share. Consumers are embracing mobile fitness apps, wearable devices, and online workout platforms that offer convenience, personalized training, and real-time health monitoring. This tech-savvy population’s preference for flexible and on-demand fitness solutions fuels the demand for virtual fitness services across the region, supporting sustained market growth.

In Europe, increasing health awareness among consumers is significantly driving the growth of the market. People are becoming more proactive about maintaining their physical and mental well-being, seeking convenient and flexible fitness solutions that fit their busy lifestyles.

At the same time, many European governments are actively promoting healthier living through public health campaigns, investments in digital health infrastructure, and policies encouraging physical activity. These initiatives include support for virtual fitness platforms as a scalable and accessible way to engage large populations in regular exercise. The combination of rising consumer health consciousness and strong governmental backing is creating a favorable environment for the expansion of virtual fitness services across the European market.

In the Asia-Pacific region, rapid urbanization and a growing middle-class population are major drivers of virtual fitness adoption. According to the World Bank in 2024, urban populations in China and India account for 66% and 37% of their total populations, respectively, reflecting significant urban concentration.

As more people move to cities, increasingly busy lifestyles create a higher demand for convenient and time-efficient fitness solutions. Alongside rising disposable incomes and increasing health awareness among the expanding middle class, improving internet infrastructure and smartphone penetration are enabling greater access to virtual fitness platforms. These combined factors are fuelling strong growth in the market across the Asia-Pacific region.

In the rest of the world, including Latin America, the Middle East, and Africa, the growing demand for flexible and accessible fitness options is driving the market. Consumers in these regions are increasingly seeking affordable and convenient ways to stay active amid busy schedules and limited access to traditional gym facilities.

Improvements in internet connectivity and rising smartphone adoption are also enabling wider access to virtual fitness platforms. As awareness of health and wellness continues to rise, these factors collectively present significant growth opportunities for virtual fitness providers in emerging markets outside the major regions.

Strategic Developments in the Virtual Fitness Industry

Key players in the industry are actively pursuing product innovation, strategic acquisitions, and international project expansion to strengthen their global footprint and meet evolving industrial demands.

-

In June 2025, Apple introduced the "Workout Buddy" feature within Apple Fitness+, leveraging its generative AI framework, Apple Intelligence. This innovative virtual trainer provides real-time, personalized audio coaching during workouts by analyzing user-specific data such as heart rate, pace, and fitness history. The integration of this AI-driven feature aims to offer a more immersive and tailored fitness experience, setting Apple Fitness+ apart in the competitive virtual fitness market.

-

In March 2025, BODi announced a strategic partnership with Hello Alpha, a virtual healthcare platform. This collaboration integrates BODi's fitness and nutrition programs with Hello Alpha's virtual healthcare services, creating a comprehensive solution for individuals seeking to improve their health and wellness through an integrated approach. The partnership emphasizes hormone health and weight management, offering personalized insights and support from licensed medical providers alongside BODi's programs.

-

In January 2025, Apple Fitness+ is receiving an exciting update within the Strava app. The two companies have teamed up to enhance the integration of Fitness+ with the widely-used fitness community, offering more detailed workout summaries, featuring Strava athletes in Fitness+ content, and providing Strava subscribers with a complimentary three-month trial of the service.

-

In August 2024, Peloton announced plans to launch select public-facing software beta tests, signaling a strategic shift towards broader wellness experiences beyond traditional cardio fitness.

-

In June 2024, We’re excited to introduce Zwift Ride, Zwift’s new smart bike! This all-in-one indoor cycling system features a smart frame combined with a trainer. It’s built for permanent setup, adjustable to accommodate any rider, and designed to deliver the complete Zwift experience.

-

In May 2024, the human performance company ships to 56 markets worldwide, with more expansions planned. The WHOOP app has also been launched in Italian and Latin American Spanish, alongside English, French, and German. To support this rapid growth, WHOOP has appointed new executives to its C-suite to advance its mission of helping individuals achieve their goals through top-tier wearable technology and personalized insights on recovery, sleep, strain, and health. Additionally, WHOOP continues to offer a one-month free trial, available at WHOOP.com, making it the only wearable brand to provide a “try before you buy” option.

Key Benefits

-

The report provides quantitative analysis and estimations of the sector from 2025 to 2030, which assists in identifying the prevailing industry opportunities.

-

The study comprises a deep-dive analysis of the current and future virtual fitness market trends to depict prevalent investment pockets in the sector.

-

Information related to key drivers, restraints, and opportunities and their impact on the market is provided in the report.

-

Competitive analysis of the key players, along with their market share is provided in the report.

-

SWOT analysis and Porters Five Forces model is elaborated in the study.

-

Value chain analysis in the market study provides a clear picture of roles of stakeholders.

Virtual Fitness Market Key Segments

By Session Type

-

Group Classes

-

Solo Training

By Streaming Type

-

Live Streaming

-

On-Demand Streaming

By Program Type

-

Weight Loss

-

Muscle Gain

-

Endurance Training

-

Flexibility & Balance

By Platform

-

Mobile-First Platforms

-

Web Platforms

-

Immersive Tech

By Device Type

-

Smartphones & Tablets

-

Smart TVs

-

VR/AR Devices

-

Laptops & Desktops

By Business Model

-

Subscription-Based

-

Pay-Per-Class

-

Advertisement

-

Hybrid

By End-User

-

Individual Consumers

-

Professional Gyms

-

Sports Institute

-

Defense Institute

-

Educational Institutes

-

Corporate Institution

-

Others

By Region

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Taiwan

-

Thailand

-

Rest of Asia-Pacific

-

-

RoW

-

Latin America

-

Middle East

-

Africa

-

Key Players

-

Peloton Interactive, Inc.

-

Apple Inc. (Apple Fitness+)

-

The Beachbody Company, Inc. (BODi)

-

Zwift Inc.

-

Strava, Inc.

-

WHOOP, Inc.

-

Tonal Systems, Inc.

-

iFIT Health & Fitness Inc.

-

Freeletics GmbH

-

FitOn Health, Inc.

-

Future (Future.co)

-

Aaptiv, Inc.

-

Trainerize Inc.

-

Myzone Holdings Ltd

-

Daily Burn (IAC)

Report Scope and Segmentation:

|

Parameters |

Details |

|

Market Size in 2025 |

USD 68.09 Billion |

|

Revenue Forecast in 2030 |

USD 286.04 Billion |

|

Growth Rate |

CAGR of 33.25% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

28 |

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst