Machine Customers Market By Acting Entity (Consumer Device, Enterprise Device, Software Agent, and Others), By Technology Enabler (IoT and Sensors, AI/ML, NLP, and Others), By Product and Service Mix (Hardware sales, Software license and subscriptions and Others), By Procurement Channel (Direct integration API, Embedded vendor portal, and Others), By End-User (IFSI, Retail and E-commerce, Telecommunications and IT, and Others) – Global Analysis & Forecast, 2025–2030

Industry Outlook

The global Machine Customers Market size was valued at USD 2.5 billion in 2024, and is expected to be valued at USD 2.73 billion by the end of 2025. The industry is projected to grow, hitting USD 4.19 billion by 2030, with a CAGR of 9.0% between 2025 and 2030.

The market is experiencing strong growth in 2025, powered by advances in artificial intelligence, Internet of things, and automation. Adoption is expanding across consumer and enterprise domains as connected devices, software agents, and autonomous systems increasingly make independent purchasing decisions. Key demand is coming from industries such as banking and financial services, retail, healthcare, manufacturing, and transportation.

Innovation is accelerating with AI decisioning, natural language processing, computer vision, and robotic process automation, enabling more complex and autonomous buying behaviors. Applications include procurement bots, predictive maintenance systems, personal health monitors, smart assistants, and autonomous mobility solutions.

Demand is particularly strong for machine-enabled procurement of digital services, consumables, maintenance, and logistics. Despite the rapid expansion, the market faces challenges including integration complexity, governance and compliance, cybersecurity risks, and data privacy concerns.

Ensuring trust in autonomous decision-making, improving interoperability across platforms, and developing regulatory standards will be critical. Continued innovation, ecosystem partnerships, and cross industry collaboration will define the future machine customers market outlook and its role in reshaping the global commerce.

What are the Key Trends in Machine Customers Industry?

How are Machine Customers Changing the Size and Direction of Commercial Spend?

Machine customers are already being sized as a macroeconomic force rather than a niche technology trend. Recent reporting highlights projections that AI buyers and machine agents will control extremely large volumes of commerce by the end of this decade, and senior executives expect machine-driven buying to be material to corporate revenue in the near term. This rapid shift means sellers must rethink addressable market definitions and revenue models now rather than later.

Practically speaking, that translates to ensuring product catalogues and pricing are machine-readable, offering programmatic pricing and flexible API payment flows, and modelling recurring flows that machines will prefer, such as replenishment subscriptions. For companies, the immediate action is to inventory how many SKUs and services are already machine accessible, convert core product metadata to standardized machine-readable formats, and run small pilot programs exposing APIs to procurement bots to learn behaviour and detect margin pressure early.

How are Machine Customers Reshaping Procurement and Supply Chain Operations?

Machine customers are accelerating the move from human-paced procurement to event-driven automated replenishment and algorithmic sourcing. During peak commerce periods, influenced interactions materially lifted online holiday sales in 2024, demonstrating that automated agents and conversational assistants already change purchase timing and volume in practice. Because machine buyers act deterministically and at scale, they expose different friction points than human buyers do.

For example, return rates, SLA expectations, and latency of fulfilment become central performance metrics. To adapt, companies should instrument real-time inventory and returns telemetry, provide machine-friendly order lead times, and create programmatic SLAs and refusal rules so bots can reason about trade-offs automatically.

A practical next step is to run a pilot that exposes an authenticated API to a small set of procurement agents or partners, measure response time to order events and return outcomes, then use that telemetry to tune logistics priorities and automated exception handling.

How are Machine Customers Enabled by Edge AI and Machine Data Changing Real-time Decisioning?

The increasing capability of edge computing and richer machine data streams is letting devices make purchase decisions with sub-second context rather than batch updates. Industry coverage across machine data and observability shows vendors pushing machine data and edge AI as the critical substrate for autonomous decisioning for devices and industrial systems. That means replenishment, energy procurement or micro services buying can happen where the sensor sits rather than via slow central processes, reducing latency and enabling local optimisation.

For product and platform companies the actionable move is to support lightweight edge friendly protocols and compact machine-readable contracts, plus instrument decision logs for explainability and debugging. Concretely firms should map which product lines have edge compute or high frequency telemetry, prioritize converting those lines to support machine decision hooks, and design throttles and safety constraints so local agents cannot unintentionally cascade high value purchases.

How are Machine Customers Forcing Governance Trust and Standards Across Commerce?

As machine agents take on more buying authority, governance, auditable decision trails, and interoperable standards become business critical rather than academic concerns. Coverage of CX and enterprise readiness highlights industry concerns around standard terminology, interoperability, and retaining a human touch while scaling autonomous interactions.

Companies will face stronger expectations for verifiable identity for agents, tamper-proof decision logs, and consent frameworks that map machine authorization to commercial liability. The immediate recommendation is to adopt robust agent identity and credentialing, add immutable audit trails for automated purchases, and align contracts and terms of sale to explicitly cover agent actions.

Piloting a signed agent certificate program with a handful of partners and instrumenting end-to-end audit logs produces both governance proof points and product learnings that reduce legal and compliance friction as adoption grows.

What are the Key Market Drivers, Breakthroughs, and Investment Opportunities that will Shape the Machine Customers Industry in the Next Decade?

The machine customers market trends is entering a decisive growth phase in 2025, propelled by the convergence of AI, Internet of Things (IoT) , and autonomous systems. Businesses are witnessing a paradigm shift where machines not only recommend but also purchase, negotiate, and optimize supply chains. This transformation is backed by corporate momentum in digital procurement, connected devices, and AI-enabled decisioning that reduce human intervention in routine buying cycles.

At the same time, the market faces structural challenges. Governance frameworks, interoperability standards, and data privacy guardrails remain nascent, slowing broader adoption. Yet, the breakthroughs in edge AI, machine data observability, and API-first commerce platforms are expanding investment opportunities. The balance between innovation and trust will define the trajectory, creating space for firms that can deliver both autonomous efficiency and transparent accountability.

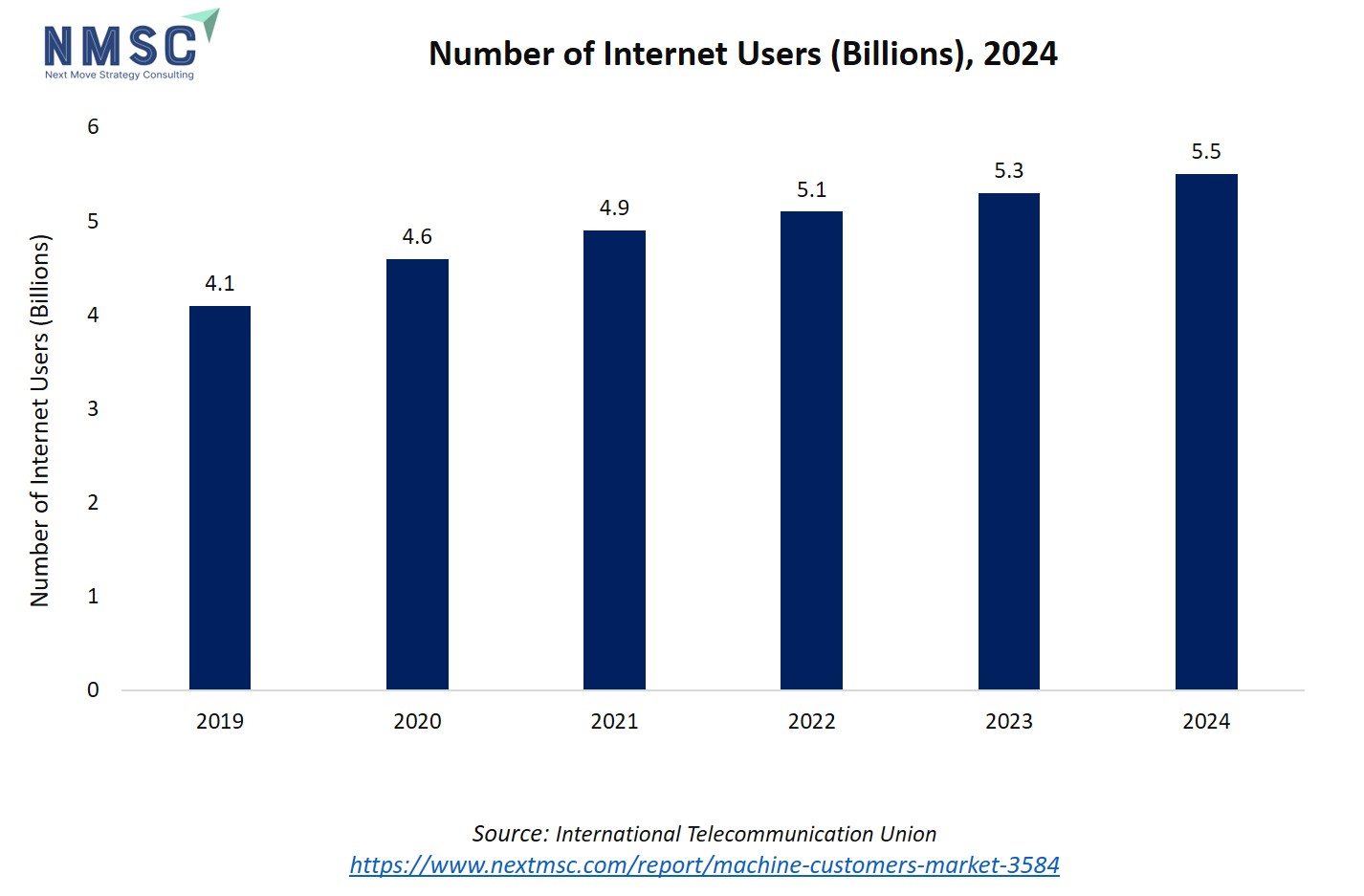

The above chart depicts the steady global growth in the number of internet users, rising from 4.1 billion in 2019 to 5.5 billion in 2024. The continued expansion in internet adoption directly expands the addressable customer base for the machine customers market, which depends on connectivity for both direct machine-to-machine (M2M) transactions and user-driven digital services. As internet penetration increases, more devices and automated systems become viable participants in digital ecosystems, driving greater adoption, upgrades, and innovation in machine customers solutions worldwide

Growth Drivers:

Will AI-powered Personalization Accelerate Machine Customer Adoption?

The demand for more personalized and predictive customer experiences is compelling businesses to deploy advanced AI-driven solutions that autonomously manage customer journeys and purchasing decisions. AI-driven personalization is emerging as a key differentiator, with 66% of global customer service managers using generative AI to tailor interactions in real time.

These systems analyse live behavioural data and sentiment, instantly adapting offers, recommendations, and support to match specific customer, human or machine needs. As a result, organizations adopting hyper-personalized machine customer interfaces are witnessing enhanced loyalty and revenue growth, pushing further investments and adoption in industries ranging from finance to retail.

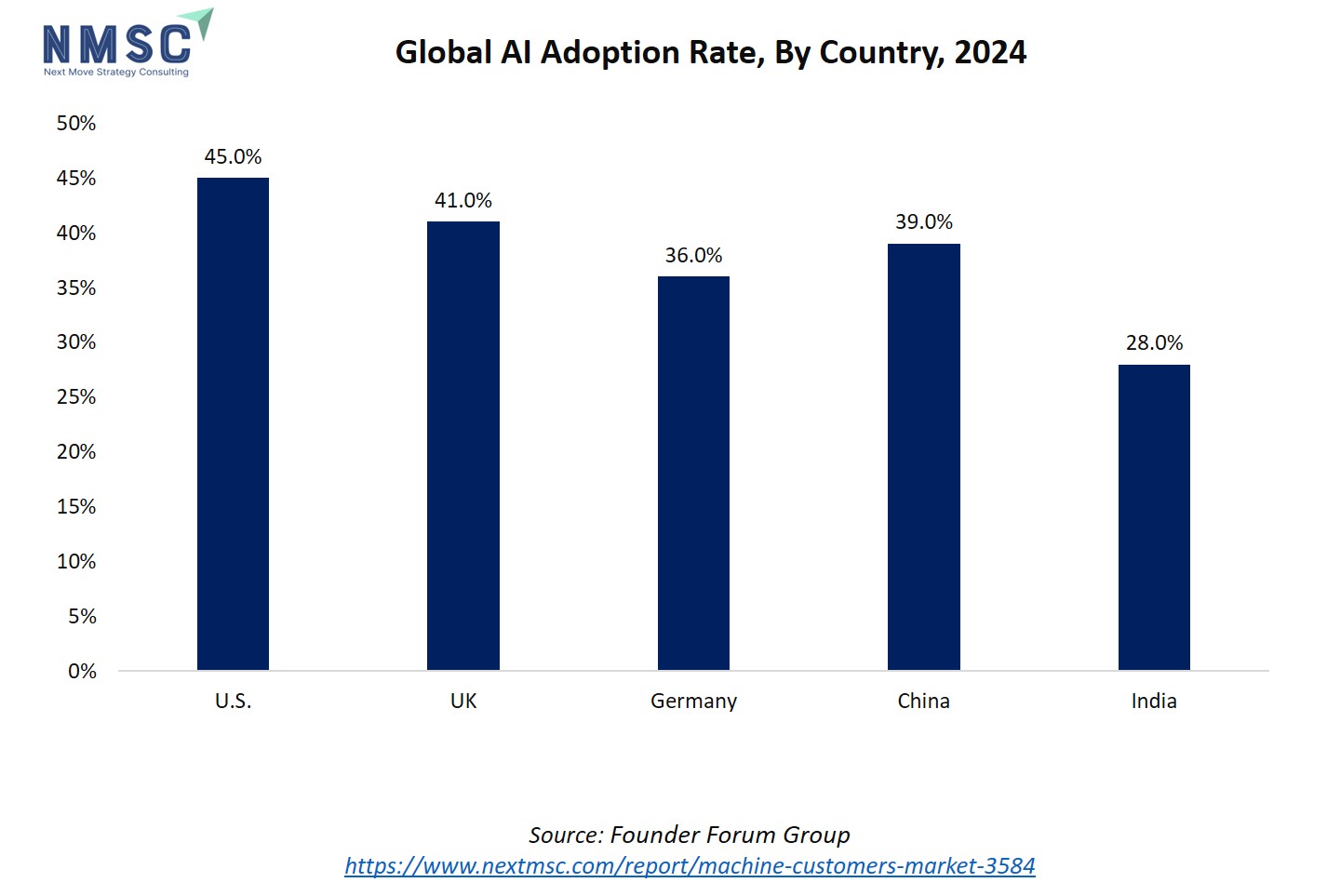

This chart above depicts the AI adoption rate by country in 2024, highlighting that the U.S. leads with 45%, followed by the UK (41%), China (39%), Germany (36%), and India (28%). Higher AI adoption rates indicate a greater prevalence of automated systems, machine learning applications, and intelligent decision-making tools.

For the machine customers market demand, this suggests that countries with higher adoption rates will have a more mature ecosystem of AI-enabled machines, advanced edge computing infrastructure, and real-time data-driven services, driving faster deployment, higher investment, and greater market growth opportunities

How will IoT and Autonomous Commerce Platforms Fuel the Expansion of Machine Customers?

The proliferation of connected devices, projected to surpass 15 billion globally by 2025, and the rise of autonomous commerce ecosystems are fueling the surge in machine-to-machine (M2M) transactional capabilities. These platforms enable smart devices, logistics systems, and industrial machines to autonomously negotiate, purchase, and replenish goods and services, optimizing operational efficiency.

As businesses turn to automated restocking systems, smart utilities management, and autonomous procurement, the real-time data streams and interoperability among IoT devices will accelerate the market’s growth trajectory while driving new value chains and efficiency gains.

Growth Inhibitors:

Can Privacy and Trust Barriers Slow the Adoption of Machine Customers?

A significant hurdle for the rapid expansion of machine customers is the prevailing scepticism around data privacy, security, and the lack of transparency in autonomous transactions. Many organizations and consumers are hesitant to trust non-human agents with sensitive purchasing, financial, or personal information, especially given concerns about algorithmic decision-making, data misuse, and regulatory uncertainty.

This lack of trust can lead to slower integration in high-stakes industries, such as healthcare or finance, where transparency and accountability are paramount. Robust legal and ethical frameworks are needed to build confidence and foster wider acceptance of machine customers in global commerce.

How will AI-driven Automation in Customer Service Create New Revenue Streams?

The convergence of generative AI, agentic AI, and real-time automation in customer service is creating substantial opportunities for new revenue models and operational efficiency. By autonomously handling complex workflows, such as billing, technical support, and proactive maintenance, AI-powered agents reduce the need for manual intervention, resulting in up to 23.5% lower costs per customer contact and a 4% increase in annual revenue on average.

Companies investing in these innovations stand to unlock new service offerings (e.g., AI-based managed customer support) and subscription-based models tailored to both human and machine clients, positioning themselves to capitalize on the next wave of digital transformation.

How Machine Customers Market is Segmented in this Report, and What are the Key Insights from the Segmentation Analysis?

By Acting Entity Insights

How Is the Machine Customers Market Report Segmented by Acting Entity?

On the basis of acting entity, the market is segmented into consumer device, enterprise device, mobile autonomous system, and software agents.

Consumer devices, such as smart appliances and personal assistants, are increasingly making autonomous purchasing decisions based on user preferences and usage patterns. Enterprise devices, including connected machinery and industrial sensors, facilitate automated procurement and maintenance tasks within organizational ecosystems. Mobile autonomous systems, like delivery drones and robotic vehicles, execute transactions related to logistics and service provisioning. Software agents, encompassing AI-driven applications and bots, perform tasks ranging from data analysis to financial transactions, often operating across various platforms. This segmentation reflects the diverse applications and functionalities of machine customers across different sectors and environments. As these entities evolve, they contribute to the broader trend of automation and digital transformation in commerce and industry.

By Technology Enabler Insights

Which Technology Enabler Leads the Machine Customers Market in 2025?

Based on technology enabler, the market is segmented into internet of things and sensors, artificial intelligence and machine learning, natural language processing, computer vision, robotic process automation, connectivity and network services and edge compute and cloud compute.

The sector relies on multiple technology enablers, including internet of things and sensors, artificial intelligence and machine learning, natural language processing, computer vision, robotic process automation, connectivity and network services, and edge and cloud compute. Among these, IoT and sensors dominate in 2025, as they provide the essential data streams that fuel autonomous decision-making and transactions. The Ericsson Mobility Report projects IoT connections to reach over 43 billion globally by 2030, up from 18.8 billion in 2024, highlighting the scale of machine-driven interactions. AI and machine learning are rapidly advancing, enabling predictive purchases and adaptive decision models, while NLP enhances voice-driven commerce and computer vision powers recognition-based transactions. Connectivity, cloud, and edge computing ensure low-latency, scalable infrastructure, and robotic process automation supports enterprise workflow automation, making them critical but secondary enablers compared to IoT.

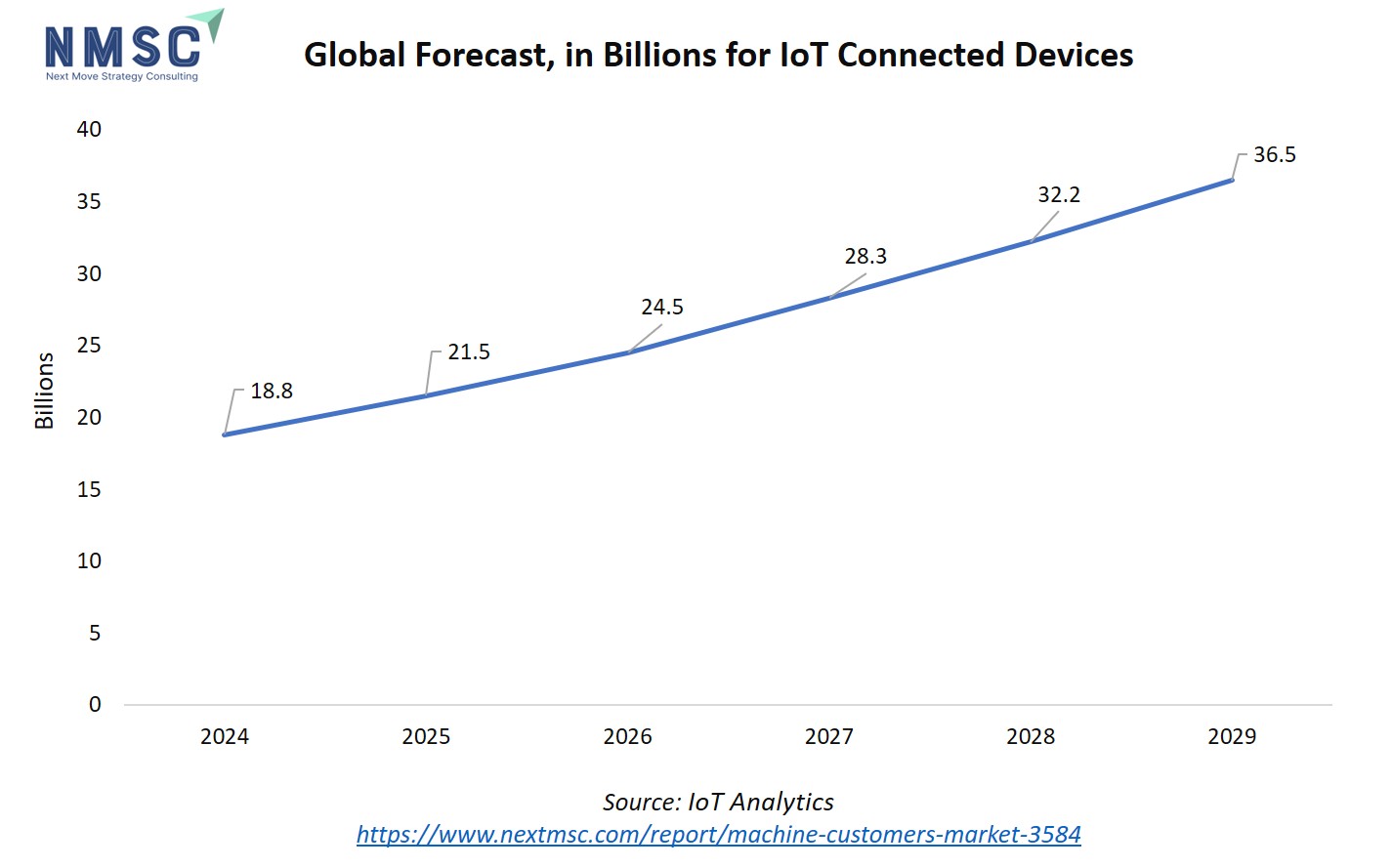

The rapid expansion of IoT endpoints indicates a significant rise in the number of connected machines that can autonomously interact, transact, and deliver services, effectively multiplying the scope of the machine customers market. As IoT adoption rises, businesses gain new opportunities to develop M2M-driven offerings, automate processes, and capitalize on data-rich, connected ecosystems. The chart above shows the accelerating growth in the number of IoT-connected devices globally, projecting an increase from 18.8 billion in 2024 to 36.5 billion by 2029 based on IoT Analytics data.

By Product and Service Mix Insights

Which Product and Service Segment Leads the Machine Customers Market in 2025?

Based on product and service mix, the market is divided into hardware sales, software license and subscriptions, managed services, maintenance and spare parts and data and analytics subscriptions.

In 2024, hardware sales lead the market, as IoT devices, sensors, and autonomous systems provide the physical foundation for machine-driven transactions. A report projects over 43 billion IoT connections by 2030, up from 18.8 billion in 2024, reflecting the hardware intensity of this ecosystem. Software licenses and subscriptions are rapidly growing as AI and automation platforms monetize recurring value streams, while managed services and maintenance ensure long-term device uptime. Data and analytics subscriptions, though smaller today, represent a high-value growth area as machine customers increasingly rely on real-time intelligence to execute predictive and adaptive purchasing.

By Autonomy Level Insights

Which Autonomy Level Holds the Greatest Influence in the Machine Customers Market?

Based on autonomy level, the market is divided into rule-based, assisted decision, semi-autonomous, and fully autonomous.

At present, rule-based and assisted decision systems dominate the market, as enterprises rely on pre-programmed instructions and human-in-the-loop oversight to ensure accuracy and compliance in procurement and transactions. Semi-autonomous systems are gaining adoption in sectors such as manufacturing, logistics, and utilities, where machines can execute repeatable purchasing tasks with minimal human intervention. However, the most transformative potential lies in fully autonomous systems, which integrate AI, IoT, and predictive analytics to make end-to-end purchasing and operational decisions without human input. Forecasts study show that by 2030, machine customers could account for 20% of all digital commerce transactions, signaling the rapid shift toward autonomy. While rule-based systems provide the foundation today, the long-term market expansion will be driven by the acceleration of semi-autonomous and fully autonomous models, creating new value pools across industries.

By Procurement Channel Insights

Are Growth Regulation, Stress Protection, Nutrient Use Efficiency, and Quality Enhancement Driving Market Adoption in 2025?

Based on procurement channel, the market is segmented into direct integration API, embedded vendor portal, marketplace and platform, broker or intermediary, and human-assisted procurement.

Direct integration APIs currently holds grip over the market, as they enable seamless, machine-to-machine purchasing by linking enterprise systems with suppliers in real time, reducing latency and errors. Embedded vendor portals and marketplaces are expanding as enterprises seek scalable catalog access and standardized workflows. Broker- or intermediary-led models remain important for industries with complex supply chains, while human-assisted procurement persists in high-value or regulated transactions where oversight is essential. According to the World Economic Forum, digital procurement models, particularly API-driven and marketplace-enabled approaches, are becoming critical in reshaping global trade efficiency. This highlights how automation-driven channels are laying the foundation for market expansion, while hybrid models balance efficiency with compliance.

By End-User Insights

Which End-User Segment is Leading Machine Customers Adoption in 2025?

Based on end-user, the market is bifurcated into banking financial services and insurance, retail and e-commerce, healthcare and life sciences, automotive and transportation, manufacturing and industrial, telecommunications and it, energy and utilities, consumer goods and services, and others.

End-user adoption of machine customers is unfolding across multiple industries, but financial services and retail are leading the curve due to their early embrace of AI-driven procurement and digital commerce systems. According to the World Economic Forum’s AI for TradeTech report, financial institutions are prioritizing autonomous systems to streamline payments, settlements, and compliance-heavy workflows, while retail and e-commerce companies are using automated agents to optimize purchasing and inventory flows. Healthcare and life sciences are increasingly deploying machine customers for precision supply chain management, while manufacturing and automotive sectors benefit from IoT-enabled, device-level procurement. Energy, utilities, and telecom operators are leveraging these systems to manage distributed networks more efficiently. Overall, BFSI and retail dominate today, but heavy industries and healthcare are quickly accelerating adoption, pointing to broader cross-sector expansion in the near future.

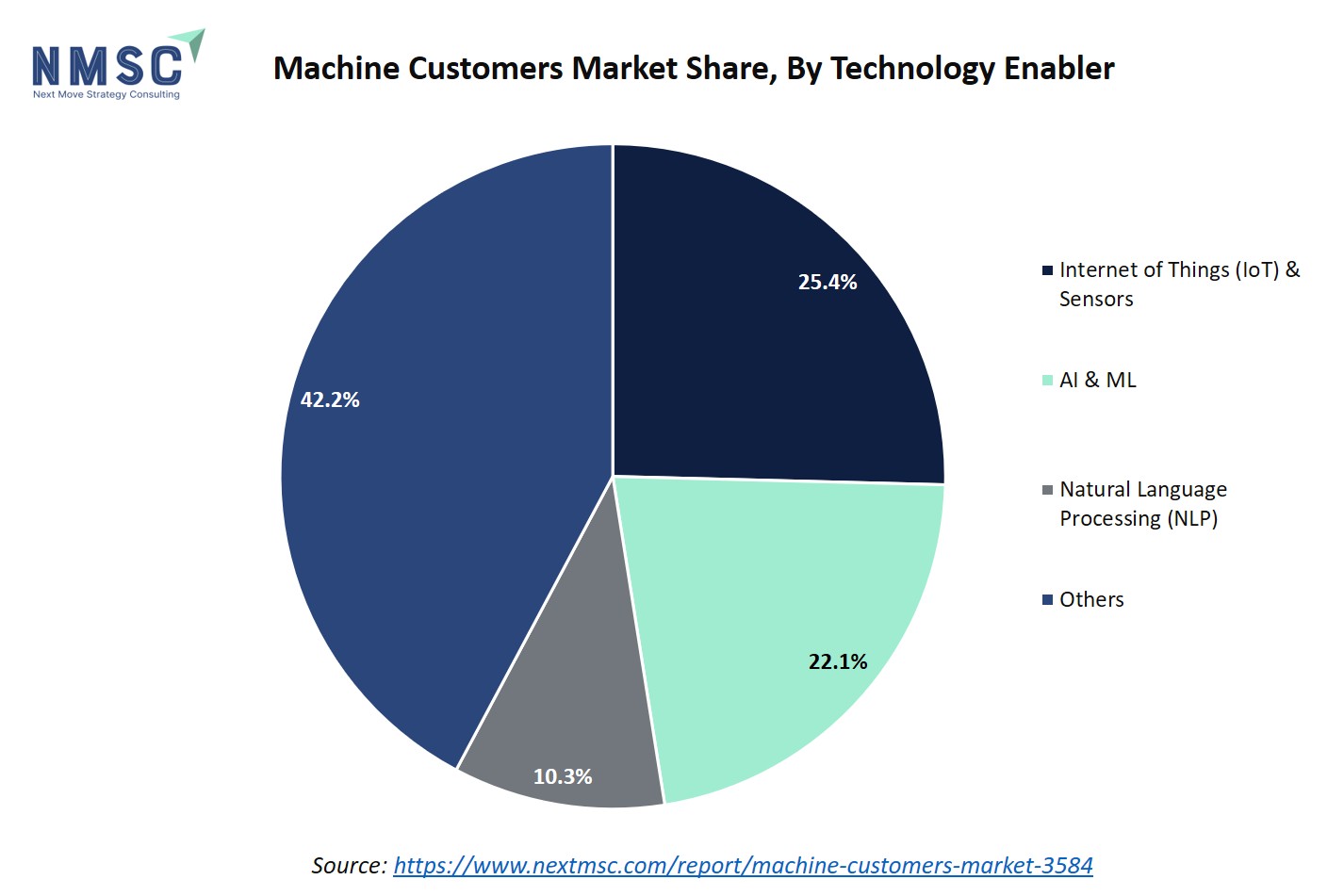

The dominance of IoT & AI highlights the foundational role of connected devices and intelligent automation in driving the machine customer market, while NLP and other emerging technologies are steadily growing their influence, enabling machines to seamlessly interact, transact, and make autonomous decisions across digital commerce and services. The chart illustrates the market share split of machine customers by technology enabler, with IoT & Sensors accounting for 25.4%, AI & ML at 22.1%, Natural Language Processing (NLP) at 10.3%, and the largest segment, Others, at 42.2%.

Regional Outlook

The market is geographically studied across North America, Europe, Asia Pacific, and the Middle East & Africa, and each region is further studied across countries.

Machine Customers Market in North America

North America leads with dense cloud infrastructure, rapid enterprise AI adoption and large scale IoT deployments that together create a fertile environment for machine buyers. Hyperscaler investment in data centers and enterprise AI projects drives low-latency compute and secure platforms that procurement bots and edge agents depend on, while strong enterprise IT budgets accelerate pilots and rollouts. The Bank of America Institute record data center investment as AI demand surges, which supports machine decisioning at scale. These infrastructure and AI investments mean faster adoption of procurement automation, predictive maintenance agents and programmatic commerce across US and Canadian firms.

Machine Customers Market in the United States

The United States combines deep cloud capacity, active AI research, and agile enterprise procurement modernization, enabling rapid machine customer adoption. Large corporate IT budgets and generative AI spending lift capabilities for autonomous decisioning, while strong developer ecosystems produce procurement bots and agent frameworks. Executive surveys show many US firms prioritizing AI-enabled procurement pilots, and hyperscaler infrastructure growth reduces friction for high-frequency automated transactions. The result is early mainstreaming of machine buyers in enterprise procurement and services buying, particularly in technology-intensive sectors such as finance, retail, and logistics.

Machine Customers Market in Canada

Canada’s AI research strength and growing cloud adoption foster machine customer pilots, particularly within public sector and regulated industries. Strong university and startup ecosystems in AI, combined with national AI strategy and data governance emphasis, encourage enterprises to test procurement bots under privacy aware frameworks. While market scale lags the United States, Canadian firms benefit from proximity to hyperscalers and international standards, enabling careful rollouts that balance autonomy and compliance. This translates into steady enterprise uptake of automated replenishment, analytics-driven maintenance, and SaaS procurement by machine agents across regulated industries.

Machine Customers Market in Europe

Europe shows varied traction shaped by strong regulatory focus and advanced industrial IoT usage. Widespread industrial automation in manufacturing and pronounced regulatory activity such as the EU AI Act influence how quickly organizations grant autonomous buying rights to agents.

The legislative emphasis increases demand for verifiable agent identities and auditable decision logs before wide scale adoption, but established industrial IoT installations and digitalization initiatives make enterprise use cases like predictive maintenance and programmatic procurement prominent. European firms thus progress cautiously with governance heavy pilots while scaling industrial machine buying where compliance frameworks are clearer.

The above chart shows the percentage of enterprises purchasing cloud services in 2024, with Finland leading at 78.3%, followed by Sweden (71.6%), Denmark (69.5%), Malta (66.7%), and the Netherlands (65.0%). The widespread cloud adoption in these countries underlines their advanced digital infrastructure, supporting efficient data management, scalability, and integration needed for next-generation solutions. High cloud usage accelerates digital transformation, creating fertile ground for deploying machine customers, automation platforms, and AI-driven services across Europe’s most digitally mature economies.

Machine Customers Market in the United Kingdom

The U.K. benefits from strong fintech and retail technology adoption that accelerates machine procurement pilots, especially for digital services and payments. London’s financial services and vibrant tech ecosystem foster early procurement bot experiments, while service providers are piloting machine-friendly APIs and programmatic pricing.

Regulatory clarity and emphasis on compliance shape cautious but pragmatic adoption among enterprises, and the U.K. technology landscape supports quick integration of agent authentication and audit trails needed for scaled adoption of machine buyers. This makes the U.K. a testing ground for financial and commerce-focused machine customer models.

Machine Customers Market in Germany

Germany’s strong industrial base and deep manufacturing digitization position it as an early adopter of industrial machine customers for maintenance and supply chain optimization. Large-scale industrial IoT deployments and Industry 4.0 programs create natural use cases for autonomous replenishment and spare parts ordering.

However, stringent enterprise governance and standards orientation mean companies focus on controlled authority limits and auditable agent behavior. That combination yields significant uptake in semi-autonomous purchasing for manufacturing operations, while full autonomy advances more slowly until interoperability and legal frameworks are standardized.

Machine Customers Market in France

France is promoting the integration of AI and machine customers mainly in manufacturing, retail, and public services. Regional technological hubs and public sector initiatives are stimulating both research and commercial adoption, while French Tech clusters facilitate collaboration between AI startups and traditional enterprises. The government’s digital transformation grants encourage businesses of all sizes to trial AI-powered transaction agents, promoting competitiveness and increasing France’s share in the European autonomous commerce ecosystem.

Machine Customers Market in Spain

Spain’s logistics and retail sectors show early use of machine-enabled replenishment and fleet management agents, supported by growing mobile connectivity and cloud adoption. Retailers and logistics operators pilot event-driven ordering and predictive maintenance for fleets and warehouses, while urban technology hubs foster experimentation with consumer-facing assistants. Regulatory and integration challenges slow full autonomy, but focused pilots in high-volume retail and transport use cases drive incremental adoption of programmatic procurement and automated replenishment.

Machine Customers Market in Italy

Italy’s manufacturing, logistics and mid-market industries are gradually adopting industrial IoT and asset monitoring, enabling machine customer scenarios for maintenance and parts procurement. Uptake is uneven regionally, with advanced manufacturing clusters experimenting with automated ordering for consumables and spares while smaller firms move more slowly due to integration costs.

Where digital transformation programs exist, machine agents are introduced with conservative authority limits and human approval gates. Over time, increasing IoT coverage and vendor API exposure will enlarge the addressable machine buyers in the Italian industry.

Machine Customers Market in the Nordics

The Nordic countries combine high digital maturity, strong public and private sector digitization, and rapid IoT adoption, making them fertile for machine customer adoption in smart cities, energy and industrial applications. High trust in institutions and advanced infrastructure ease deployment of authenticated agents and auditable purchase logs, while sustainability priorities create demand for programmatic procurement that optimizes energy and resource use. Nordic firms are thus early adopters of autonomous replenishment for sustainable operations and energy procurement use cases, supported by robust connectivity and edge compute initiatives.

Machine Customers Market in Asia Pacific

Asia-Pacific exhibits exponential growth in the machine customers market share, led by rapid industrialization, government-backed automation incentives, and a vast base of digitally native companies. Tech adoption is especially high in China, Japan, South Korea, and India, where national digitalization strategies, robust electronics sectors, and maturing AI talent pools are accelerating the use of autonomous purchasing agents, IoT-driven commerce platforms, and AI in both consumer and enterprise domains. The pattern is clear, aggressive policy support, a willingness to invest in cutting-edge technology, and regional competition are propelling APAC to the top of global rankings for machine customer capability and impact.

Machine Customers Market in China

China rapidly leads in AI adoption for commerce, with major investments in agentic AI, robotics, and autonomous supply chain systems. The government’s multi-billion-dollar AI 2030 plan has catalysed mass deployment of digital purchasing agents in industries such as e-commerce, logistics, and automotive manufacturing.

As of 2024, Chinese enterprises are accounting for a significant portion of the world’s machine-driven commercial transactions, fueled by a strong focus on self-reliant innovation and state-led digital infrastructure investments. The country’s AI industry and related sectors could grow into a market valued at USD 1.4 trillion by 2030, and also China’s AI investments may deliver a 52% return on invested capital by 2030, which will ultimately lead to the growth of machine customers industry.

Machine Customers Market in Japan

Japan’s market is shaped by the Society 5.0 vision and decades of expertise in robotics, leading to seamless machine customer adoption in sectors like logistics, healthcare, and retail. AI-powered agents support procurement, maintenance, and customer service functions in large enterprises as well as SMEs. National policies encourage investment in Industry 4.0 capabilities, and Japanese companies are integrating AI with IoT and robotics at an accelerated rate, cementing Japan’s status as a technological powerhouse in autonomous commerce.

Machine Customers Market in India

India is emerging as a major hub for digital commerce, with machine customers gaining ground in banking, telecom, and e-commerce sectors. Government initiatives such as Digital India and Make in India accelerate cloud, IoT, and AI adoption in supply chains and retail. According to recent data, India’s Smart Advanced Manufacturing and Rapid Transformation Hubs (SAMARTH) scheme is directly encouraging SMEs to upgrade digital infrastructure, laying strong foundations for the next generation of machine-driven commerce.

Machine Customers Market in South Korea

South Korea’s advanced digital infrastructure and government support for smart factories have made it a global leader in autonomous manufacturing and machine-driven commerce. South Korean companies are investing significantly in connected devices, AI platforms, and process automation, while the government’s Manufacturing Innovation 3.0 Roadmap allocates substantial resources to drive these transformations. This proactive strategy solidifies South Korea’s leadership position in machine customer applications and sets highly competitive standards in APAC.

Machine Customers Market in Taiwan

Taiwan’s semiconductor and electronics industries make it a concentrated hub for intelligent devices and industrial automation, which supports machine buyers' use cases in parts ordering and equipment maintenance. Strong manufacturing digitization and vendor ecosystems accelerate integrations for programmatic procurement, while proximity to broader Northeast Asia supply chains aids rapid scaling. As a result, Taiwan’s specialized industrial clusters are fertile ground for machine customers focused on high-volume component procurement and maintenance automation.

Machine Customers Market in Indonesia

Indonesia’s connectivity growth and expanding e-commerce logistics sector create practical machine customer entry points, such as fleet management and warehouse replenishment agents. Mobile and IoT adoption are rising, though enterprise digitization levels vary, so early machine customer use cases concentrate in logistics, retail distribution, and urban utilities. Improving connectivity and regional platform growth will gradually broaden potential for automated purchasing, especially as local platforms expose APIs and logistics providers instrument telemetry.

Machine Customers Market in Australia

Australia’s strong cloud adoption, energy transition projects and industrial IoT deployments support machine customer scenarios in utilities, mining and logistics. High enterprise IT spend and robust cloud connectivity allow pilot programs for autonomous procurement in maintenance and energy optimization, and government digital initiatives further encourage adoption. Australian firms are therefore positioned to scale semi-autonomous buying in industrial settings where predictable maintenance cycles and high asset value make automated procurement economically attractive.

Machine Customers Market in Latin America

Latin America shows emerging interest in machine buyers driven by logistics automation, retail modernization and growing IoT uptake, but slower enterprise cloud and AI spending tempers rapid scale. Regional pilots focus on fleet maintenance, automated replenishment for retail chains, and agriculture telemetry, with adoption skewed to larger enterprises and urban hubs. As cloud and connectivity investments increase and marketplaces expose programmatic APIs, Latin America is likely to see steady growth in machine customer use cases across logistics and large-scale retail.

Machine Customers Market in the Middle East & Africa

The Middle East & Africa region is witnessing differentiated adoption, in the Middle East, smart city projects, investments in AI and robotics, and proactive government ambitions (e.g., UAE’s AI 2031 strategy) push the envelope in autonomous commerce and machine customer models. From national visions like the UAE's AI Strategy 2031 to Saudi Arabia’s sweeping Vision 2030, the region is building not just smart cities, but smart service economies. In Africa, new entrants leverage mobile-first ecosystems, fintech, and e-commerce platforms to introduce AI-powered transactional agents, particularly in urban centers. Public and private partnerships, investment in education, and commitment to digitalization are collectively fostering a dynamic landscape for machine customer adoption, signalling high future growth potential.

Competitive Landscape

Which Companies Dominate the Machine Customers Industry and How do they Compete?

The global machine customers market is led by established connectivity, IoT, and infrastructure providers such as Vodafone Group, AT&T, Cisco Systems, IBM Corporation, Deutsche Telekom, Orange Business, Hewlett Packard Enterprise, Telit Cinterion, Sigfox, Particle Industries, and others, alongside a growing base of regional innovators.

These companies are driving market growth through continuous investment in IoT networks, cloud infrastructure, AI decisioning, and device management platforms. Their strategies focus on enabling autonomous procurement, real-time data processing, secure agent authentication, and seamless device-to-platform interactions that allow machines to transact efficiently and reliably.

The competitive landscape is being shaped by rapid AI adoption, advanced edge computing, and evolving enterprise automation requirements. Major players are expanding capabilities via acquisitions, strategic partnerships, and regional deployments in high-growth markets such as Asia-Pacific and Latin America.

Innovators are embedding machine-friendly APIs, programmatic commerce interfaces, and predictive analytics into enterprise systems to enable event-driven purchasing, predictive maintenance, and autonomous replenishment. Companies that combine scalable infrastructure, AI-enabled decision-making, and secure transaction capabilities are capturing both enterprise trust and market leadership, positioning themselves at the forefront of the machine customers ecosystem.

Market Dominated by Machine Customers Giants and Specialists

Competition is between major cloud providers and specialized procurement and automation vendors. Connectivity and network providers such as Vodafone, AT&T, Deutsche Telekom and Orange Business deliver wide area communications and IoT services, while networking and infrastructure firms like Cisco and Hewlett Packard Enterprise supply core infrastructure. Enterprise software and platform capabilities are provided by firms such as IBM, and IoT specialists including Sigfox, Wireless Logic, Telit Cinterion, 1oT, Particle, Exosite, PowerFleet and Itron enable device connectivity, management and telemetry that feed machine buyer workflows. Robotic process automation and automation vendors orchestrate agent behavior, and market power clusters around platform leaders that form cross-layer partnerships to control the end-to-end flow from machine buyer to vendor.

Innovation and Adaptability Drive Market Success

Winning firms move fast on API first commerce, machine-readable catalogs, and embedded AI decisioning to attract autonomous buyers. Vendors are layering NLP and predictive models into procurement flows and acquiring niche AI capabilities to speed product roadmaps. For example, automation platform vendors have bought NLP and optimization startups to extend agent decisioning into unstructured data and inventory optimization, demonstrating how tactical buys and product integration shorten time to market for machine-centric features. Rapid developer tooling and secure agent credentialing remain key differentiators.

Market Players to OPT for Merger & Acquisition Strategies to Expand their Presence

Several leading players in the machine customers industry have pursued mergers and acquisitions to expand their presence and capabilities. Telit completed the acquisition of Thales’ cellular IoT business to create Telit Cinterion, strengthening its position in connectivity and device management.

Vodafone has also scaled aggressively, reaching over 200 million IoT device connections, underlining how scale in connectivity underpins automated commerce growth. Similarly, IBM has strategically acquired firms like Red Hat in hybrid cloud to expand enterprise platforms, while Cisco has a long record of M&A to broaden networking and security services. These moves highlight how companies across telecom, infrastructure, and IoT layers rely on acquisitions to accelerate time to market, fill capability gaps, and secure enterprise adoption of machine customer ecosystems.

List of Key Machine Customers Companies

-

AT&T

-

Cisco Systems, Inc.

-

Deutsche Telekom AG

-

Sigfox

-

Wireless Logic

-

Telit Cinterion

-

Orange Business

-

Hewlett Packard Enterprise

-

PowerFleet

-

Itron Inc.

-

1oT

-

Particle Industries, Inc.

-

Exosite

What are the Latest Key Industry Developments?

-

April 2025- Vodafone announced its IoT network has surpassed 200 million active device connections, doubling its managed IoT base over five years. This scale enables more machine customers, as more devices generate data, trigger events, and potentially make autonomous or semi-autonomous purchase decisions.

-

January 2025- Telit has announced new modules supporting the GSMA’s eSIM/eUICC / SGP.22 & upcoming SGP.32 standards, integrating SIMs inside modules to enable dynamic profile selection, remote updates, and better device autonomy. These technical enablers reduce friction for device-driven purchasing and autonomous operations.

-

August 2024- Deutsche Telekom launched AI-powered conversational agents for logistics and customer service in August 2025. Their AI agent system digitizes delivery documentation and automates processes, driving operational efficiency and machine customer adoption in supply chain management.

-

June 2024- Cisco Systems showcased AI-driven innovations at Cisco Live 2024 in June, unveiling AI-powered chat assistants and introducing the Cisco Hypershield security platform for AI-scale data centers. These advancements enhance secure, autonomous machine interactions and customer service automation.

-

February 2024- IBM unveiled the LinuxONE 4 Express, extending AI performance and cyber-resilient hybrid cloud capabilities to SMBs. This launch supports scalable AI infrastructure vital for enabling machine customers across various sectors.

What are the Key Factors Influencing Investment Analysis & Opportunities in the Machine Customers Market?

The machine customers market demand is experiencing significant investment momentum. This surge is driven by advancements in AI, IoT connectivity, and automation technologies, positioning the market as a focal point for venture capital and corporate investments. Regions such as North America and Asia-Pacific are emerging as primary investment hotspots, attributed to their robust technological infrastructure and supportive regulatory environments. Notably, AI startups within this domain are commanding high valuations, with average revenue multiples reaching 17.8x, reflecting investor confidence in the transformative potential of machine-driven commerce.

Strategic investments are increasingly directed towards enhancing machine autonomy, data analytics capabilities, and secure transaction frameworks. Companies are focusing on integrating advanced AI models, edge computing solutions, and blockchain technologies to facilitate seamless and secure machine-to-machine interactions. This trend underscores the growing recognition of machine customers as pivotal components in the future of digital commerce, prompting stakeholders to allocate resources towards innovations that enable scalable and efficient autonomous purchasing systems.

Key Benefits for Stakeholders:

Next Move Strategy Consulting (NMSC) presents a comprehensive analysis of the Machine Customers Market, covering historical trends from 2020 through 2024 and offering detailed forecasts through 2030. Our study examines the industry at global, regional, and country levels, providing quantitative projections and insights into key growth drivers, challenges, and investment opportunities across all major market segments.

Report Scope:

|

Parameters |

Details |

|

Market Size in 2025 |

USD 2.73 Billion |

|

Revenue Forecast in 2030 |

USD 4.19 Billion |

|

Growth Rate |

CAGR of 9.0% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

28 |

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent to up to 80 analyst-working hours) after purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

|

Approach |

In-depth primary and secondary research; proprietary databases; rigorous quality control and validation measures. |

|

Analytical Tools |

Porter's Five Forces, SWOT, value chain, and Harvey ball analysis to assess competitive intensity, stakeholder roles, and relative impact of key factors. |

Key Market Segments

By Acting Entity

-

Consumer device

-

Smartphone agent

-

Home assistant device

-

Consumer appliance

-

Personal health monitor

-

Personal vehicle agent

-

-

Enterprise device

-

Enterprise system agent

-

Industrial sensor

-

Manufacturing robot

-

Fleet vehicle agent

-

-

Mobile autonomous system

-

Drone

-

Autonomous vehicle agent

-

Public space robot

-

-

Software agent

-

Robotic process automation bot

-

Procurement bot and marketplace agent

-

Independent autonomous agent

-

By Technology Enabler

-

Internet of things and sensors

-

Artificial intelligence and machine learning

-

Natural language processing

-

Computer vision

-

Robotic process automation

-

Connectivity and network services

-

Edge compute and cloud compute

-

Others

By Product and Service Mix

-

Hardware sales

-

Software license and subscriptions

-

Managed services

-

Maintenance and spare parts

-

Data and analytics subscriptions

-

Others

By Autonomy Level

-

Rule-based

-

Assisted decision

-

Semi-autonomous

-

Fully autonomous

By Procurement Channel

-

Direct integration API

-

Embedded vendor portal

-

Marketplace and platform

-

Broker or intermediary

-

Human-assisted procurement

-

Others

By End-User

-

Banking Financial Services and Insurance

-

Retail and E-commerce

-

Healthcare and Life Sciences

-

Automotive and Transportation

-

Manufacturing and Industrial

-

Telecommunications and IT

-

Energy and Utilities

-

Consumer Goods and Services

-

Others

Geographical Breakdown

-

North America: U.S., Canada, and Mexico.

-

Europe: U.K., Germany, France, Italy, Spain, Sweden, Denmark, Finland, Netherlands, and rest of Europe.

-

Asia Pacific: China, India, Japan, South Korea, Taiwan, Indonesia, Vietnam, Australia, Philippines, and rest of APAC.

-

Middle East & Africa (MENA): Saudi Arabia, UAE, Egypt, Israel, Turkey, Nigeria, South Africa, and rest of MENA.

-

Latin America: Brazil, Argentina, Chile, Colombia, and rest of LATAM

Conclusion & Recommendations

Our report equips stakeholders, industry participants, investors, policy-makers, and consultants with actionable intelligence to capitalize on Machine Customers’ transformative potential. By combining robust data-driven analysis with strategic frameworks, NMSC’s Machine Customers Market Report serves as an indispensable resource for navigating the evolving landscape.

Speak to Our Analyst

Speak to Our Analyst